1 Q3 2021 EARNINGS RELEASE October 26, 2021

2Littelfuse, Inc. © 2021 DISCLAIMERS Important Information About Interfuse, Inc. This presentation does not constitute or form part of, and should not be construed as, an offer or solicitation to purchase or sell securities of Interfuse, Inc. and no investment decision should be made based upon the information provided herein. Interfuse strongly urges you to review its filings with the Securities and Exchange Commission, which can be found at investor.littelfuse.com/sec.cfm. This website also provides additional information about Interfuse. “Safe Harbor” Statement Under the Private Securities Litigation Reform Act of 1995. The statements in this presentation that are not historical facts are intended to constitute "forward-looking statements" entitled to the safe-harbor provisions of the Private Securities Litigation Reform Act. These statements may involve risks and uncertainties, including, but not limited to, risks and uncertainties relating to general economic conditions; the severity and duration of the COVID- 19 pandemic and the measures taken in response thereto and the effects of those items on the company’s business; product demand and market acceptance; the impact of competitive products and pricing; product quality problems or product recalls; capacity and supply difficulties or constraints; coal mining exposures reserves; cybersecurity matters; failure of an indemnification for environmental liability; exchange rate fluctuations; commodity and other raw material price fluctuations; the effect of Interfuse, Inc.'s ("Interfuse" or the "Company") accounting policies; labor disputes; restructuring costs in excess of expectations; pension plan asset returns less than assumed; integration of acquisitions; uncertainties related to political or regulatory changes; and other risks which may be detailed in the company's Securities and Exchange Commission filings. Should one or more of these risks or uncertainties materialize or should the underlying assumptions prove incorrect, actual results and outcomes may differ materially from those indicated or implied in the forward-looking statements. This presentation should be read in conjunction with information provided in the financial statements appearing in the company's Annual Report on Form 10-K for the year ended December 26, 2020. Further discussion of the risk factors of the company can be found under the caption "Risk Factors" in the company's Annual Report on Form 10-K for the year ended December 26, 2020, and in other filings and submissions with the SEC, each of which are available free of charge on the company’s investor relations website at investor.littelfuse.com and on the SEC’s website at www.sec.gov. These forward-looking statements are made as of the date hereof. The company does not undertake any obligation to update, amend or clarify these forward-looking statements to reflect events or circumstances after the date hereof or to reflect the availability of new information. Non-GAAP Financial Measures. The information included in this presentation includes the non-GAAP financial measures of organic net sales growth, adjusted operating margin, adjusted diluted earnings per share, adjusted effective tax rate, and free cash flow. A reconciliation of these non-GAAP financial measures to the most directly comparable GAAP financial measures are set forth in the appendix. The company believes that these non-GAAP financial measures provide useful information to investors regarding its operational performance and ability to generate cash enhancing an investor’s overall understanding of its core financial performance. The company believes that these non-GAAP financial measures are commonly used by financial analysts and provide useful information to analysts. Management uses these measures when assessing the performance of the business and for business planning purposes. Note that the definitions of these non- GAAP financial measures may differ from those terms as defined or used by other companies.

BUSINESS UPDATE Dave Heinzmann, President & CEO

4Littelfuse, Inc. © 2021 Q3-21 KEY THEMES Record revenue & earnings for the quarter Outstanding performance within challenging supply chain environment Ongoing, effective operational execution Continuous improvements to support customers Reflects global teams' commitment & hard work Broad-based strength across electronics segment end- markets, tempered by supply constraints in passenger car markets

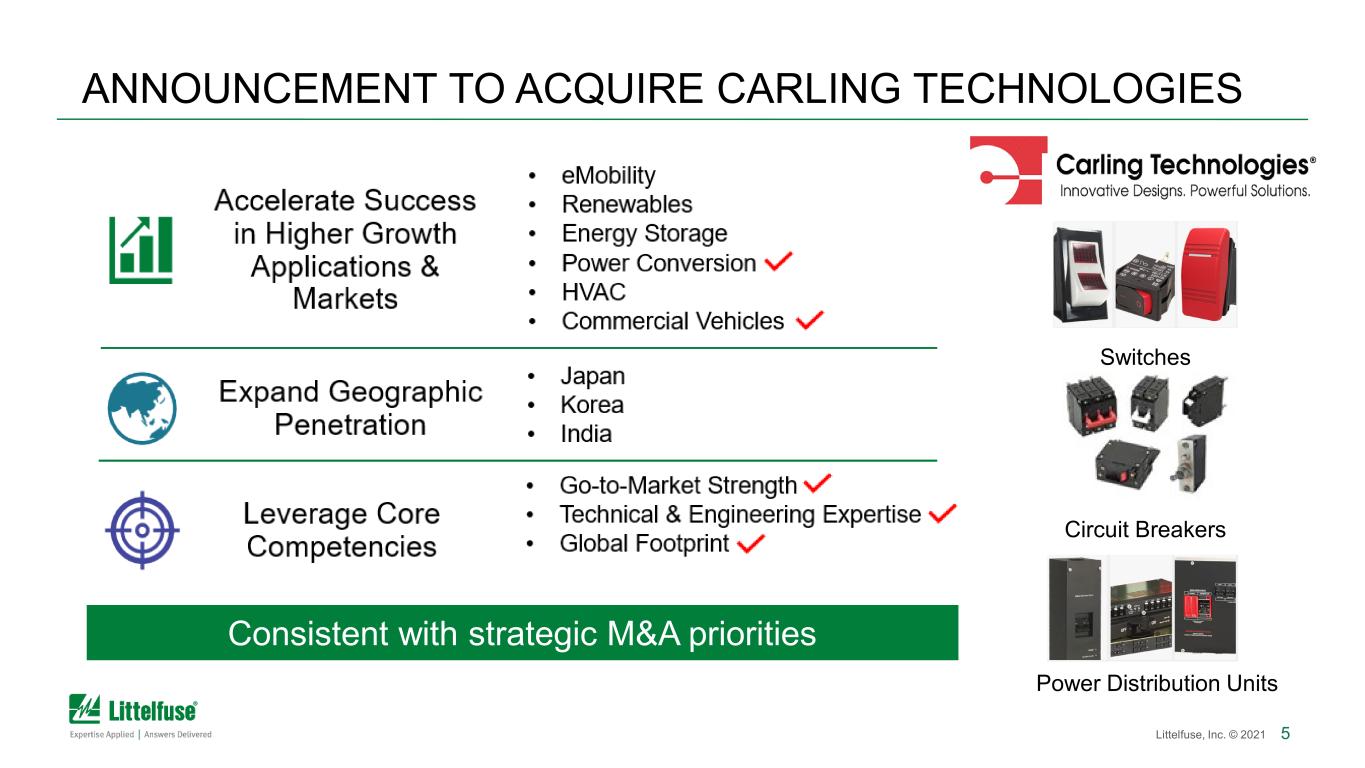

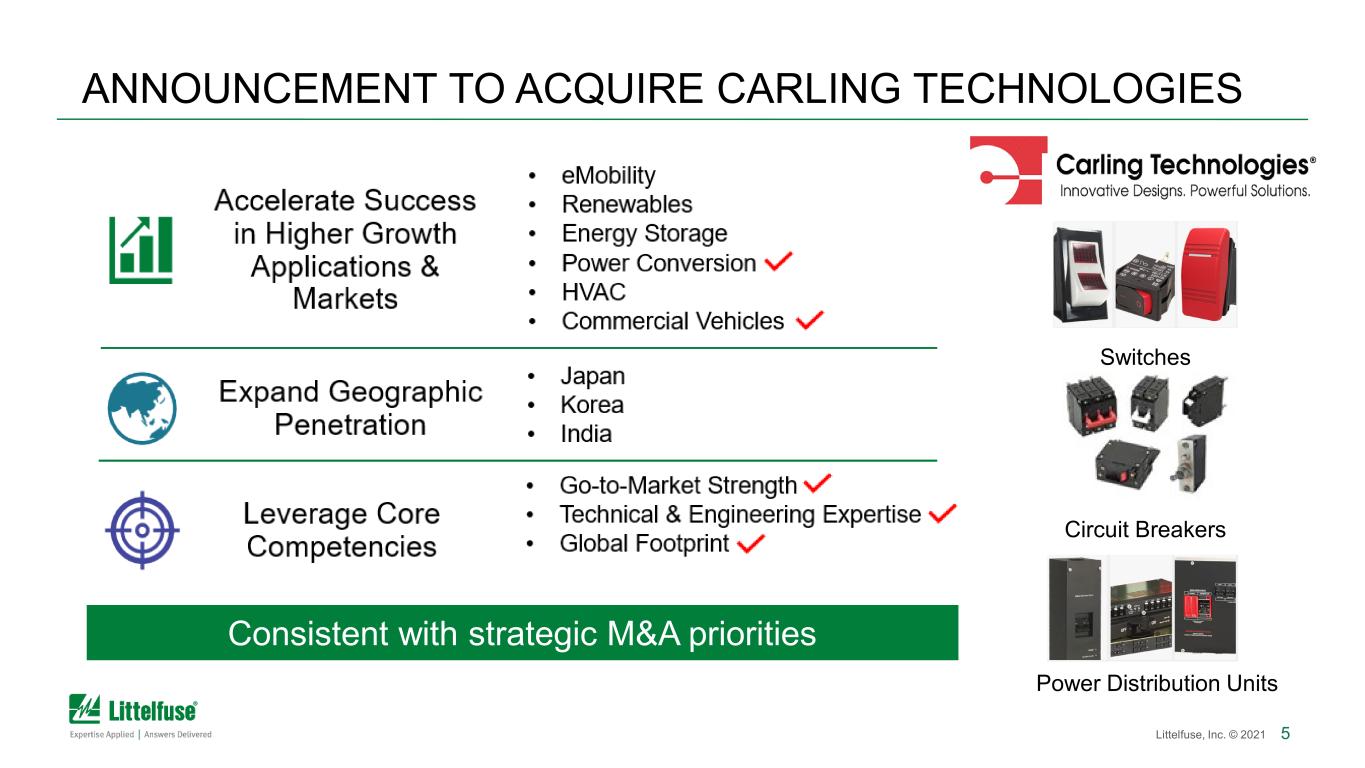

5Littelfuse, Inc. © 2021 ANNOUNCEMENT TO ACQUIRE CARLING TECHNOLOGIES Switches Power Distribution Units Circuit Breakers Consistent with strategic M&A priorities

6Littelfuse, Inc. © 2021 INDUSTRIAL END MARKETS POSITIONED FOR CONTINUED GROWTH Alternative energy, smart industry & safety continues to expand opportunities Strength across core markets Leveraging Hartland Controls product portfolio to capture design wins New business across Asia, Europe & North America Q3-21 Highlights Q3-21 Key Design Wins HVAC (Industrial Refrigeration) Renewable Energy & Energy Storage Industrial Safety

7Littelfuse, Inc. © 2021 TRANSPORTATION END MARKETS EXTENDING OUR LEADERSHIP POSITION Q3-21 Key Design WinsQ3-21 Highlights Sustainability & safety increasing product content opportunities Electric vehicle ramp driving robust design activity & several strategic gains Content outgrowth with wide range of passenger car wins Captured commercial vehicle business across China, Europe & North America xEV & EV Charging Applications EV Bus High-Current modules for passenger vehicles Automotive Electronics

8Littelfuse, Inc. © 2021 ELECTRONICS END MARKETS LEVERAGING OUR LEADERSHIP Q3-21 Highlights Q3-21 Key Design Wins Ongoing trend towards a more connected & electrified world expands new business pipeline Rapid technical support driving design wins Speed of service is differentiator, especially in current landscape Increasing presence across a wide spectrum of applications... from renewables to factory & building automation to manufacturing tools Data Center Appliances & Building Solutions Lawn & Garden Tools Manufacturing Tools

FINANCIAL UPDATE Meenal Sethna, EVP & CFO

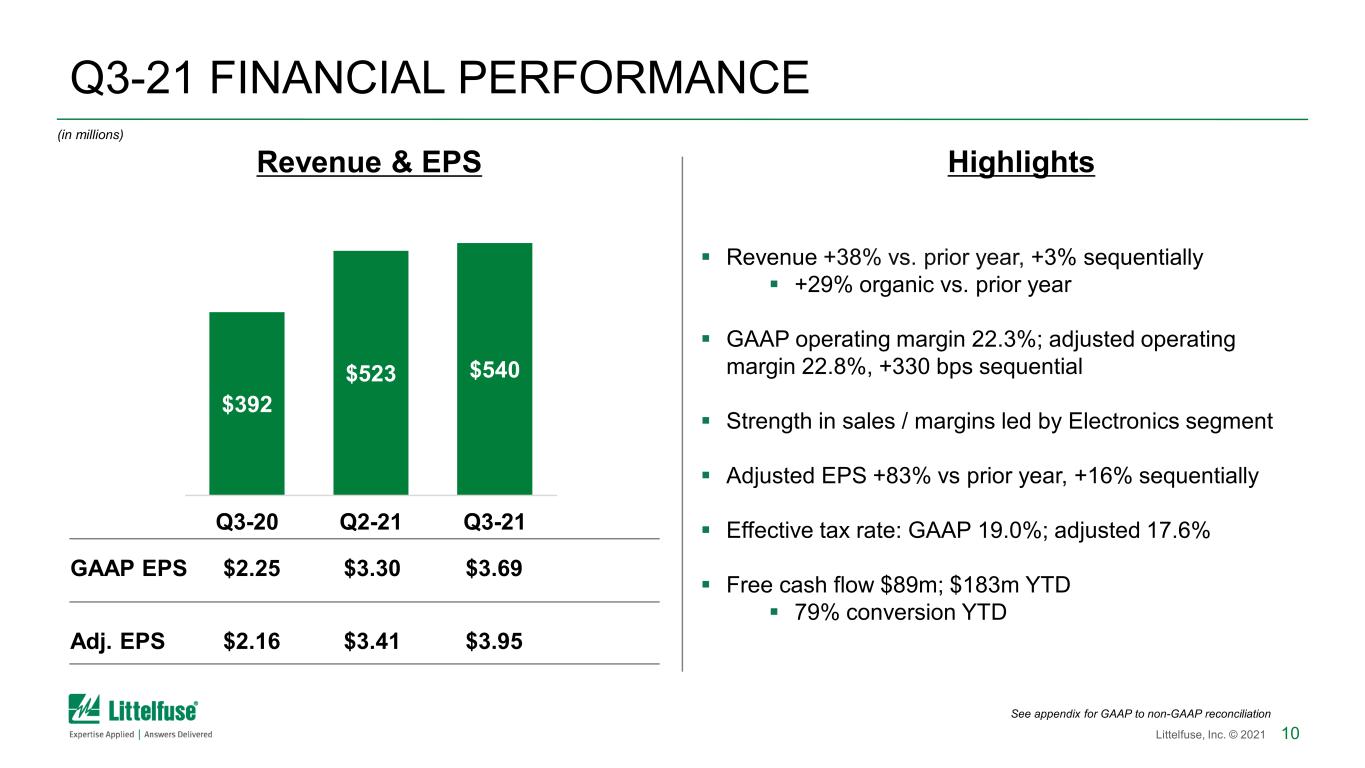

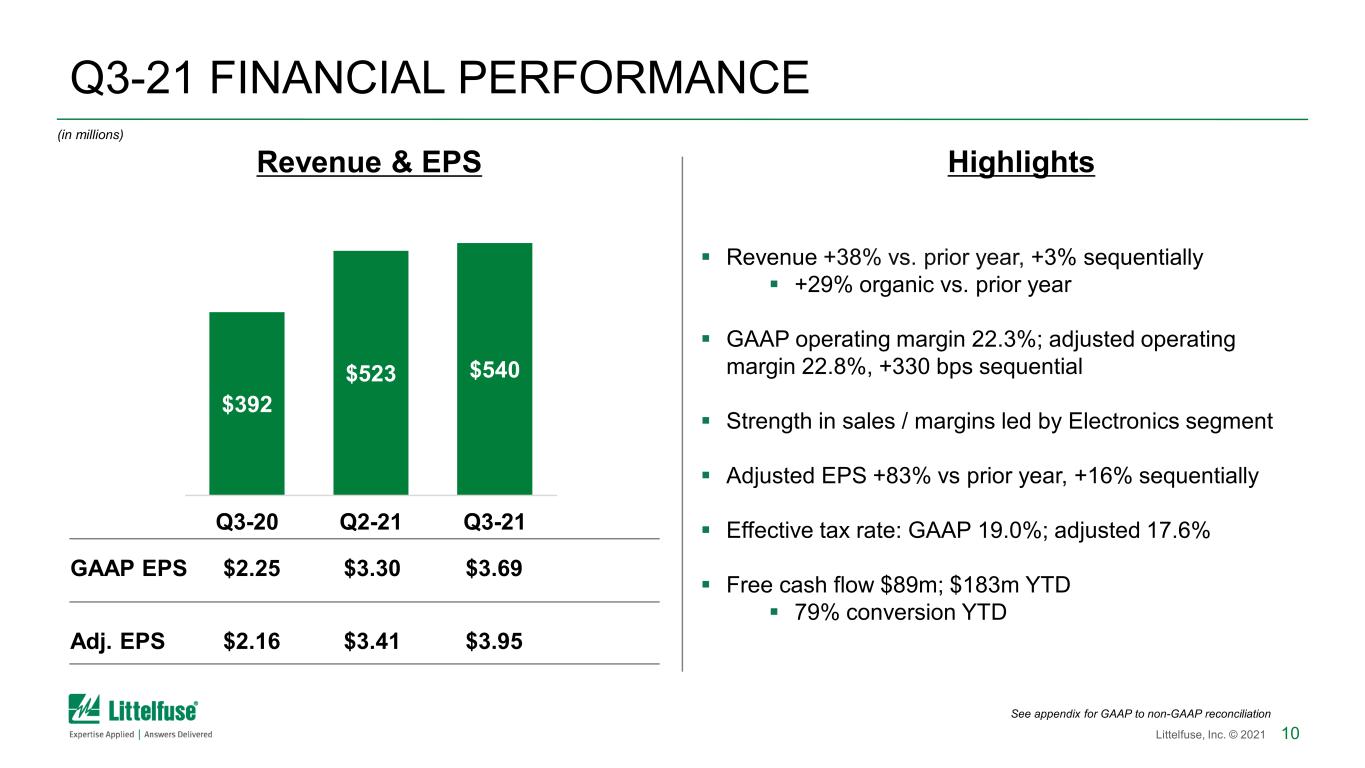

10Littelfuse, Inc. © 2021 See appendix for GAAP to non-GAAP reconciliation Highlights Revenue +38% vs. prior year, +3% sequentially +29% organic vs. prior year GAAP operating margin 22.3%; adjusted operating margin 22.8%, +330 bps sequential Strength in sales / margins led by Electronics segment Adjusted EPS +83% vs prior year, +16% sequentially Effective tax rate: GAAP 19.0%; adjusted 17.6% Free cash flow $89m; $183m YTD 79% conversion YTD GAAP EPS $2.25 $3.30 $3.69 Adj. EPS $2.16 $3.41 $3.95 $392 $523 $540 Q3-20 Q2-21 Q3-21 (in millions) Q3-21 FINANCIAL PERFORMANCE Revenue & EPS

11Littelfuse, Inc. © 2021 $31 $65 $68 Q3-20 Q2-21 Q3-21 Revenue $105 $133 $124 Q3-20 Q2-21 Q3-21 Revenue Q3-21 SEGMENT PERFORMANCE Electronics Segment Automotive Segment Industrial Segment Revenue +36%, +7% sequential Sales stronger than expected, working through backlog and content growth (in millions) Op Margin 18.0% 22.8% 28.9% $255 $325 $347 Q3-20 Q2-21 Q3-21 Revenue Revenue +19%, (-7%) sequential; Versus prior year: comm. vehicle +38%, pass. vehicle +13% Chip shortages impacting passenger car build / customer production Segment affected most by higher commodity prices Revenue +116%, +5% sequential Continued strength across HVAC, renewables, energy storage Segment margins impacted by supply disruptions and lower Hartland (acquisition) margins Op Margin 14.7% 14.4% 12.7% Op Margin 15.6% 12.9% 9.7% Record operating margins from favorable geographic/product mix, record volumes & price realization See appendix for GAAP to non-GAAP reconciliation

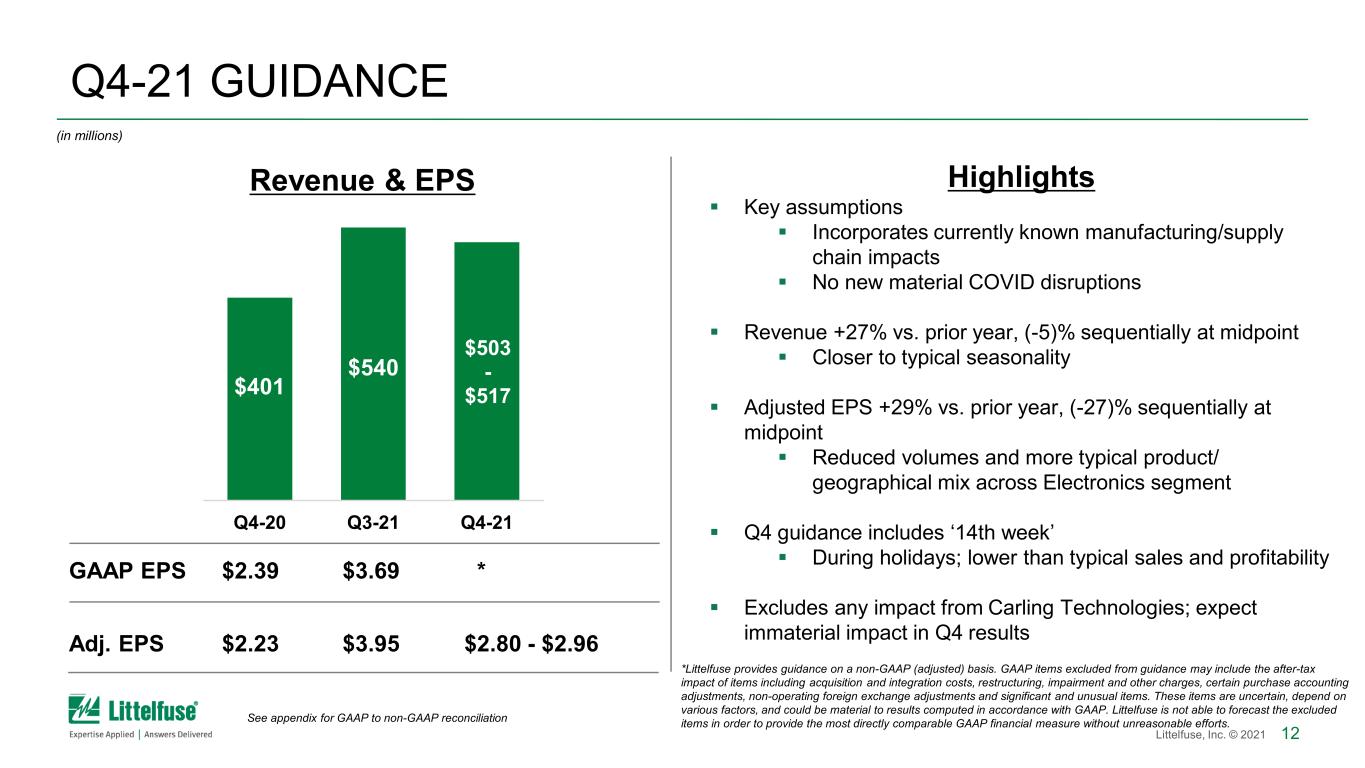

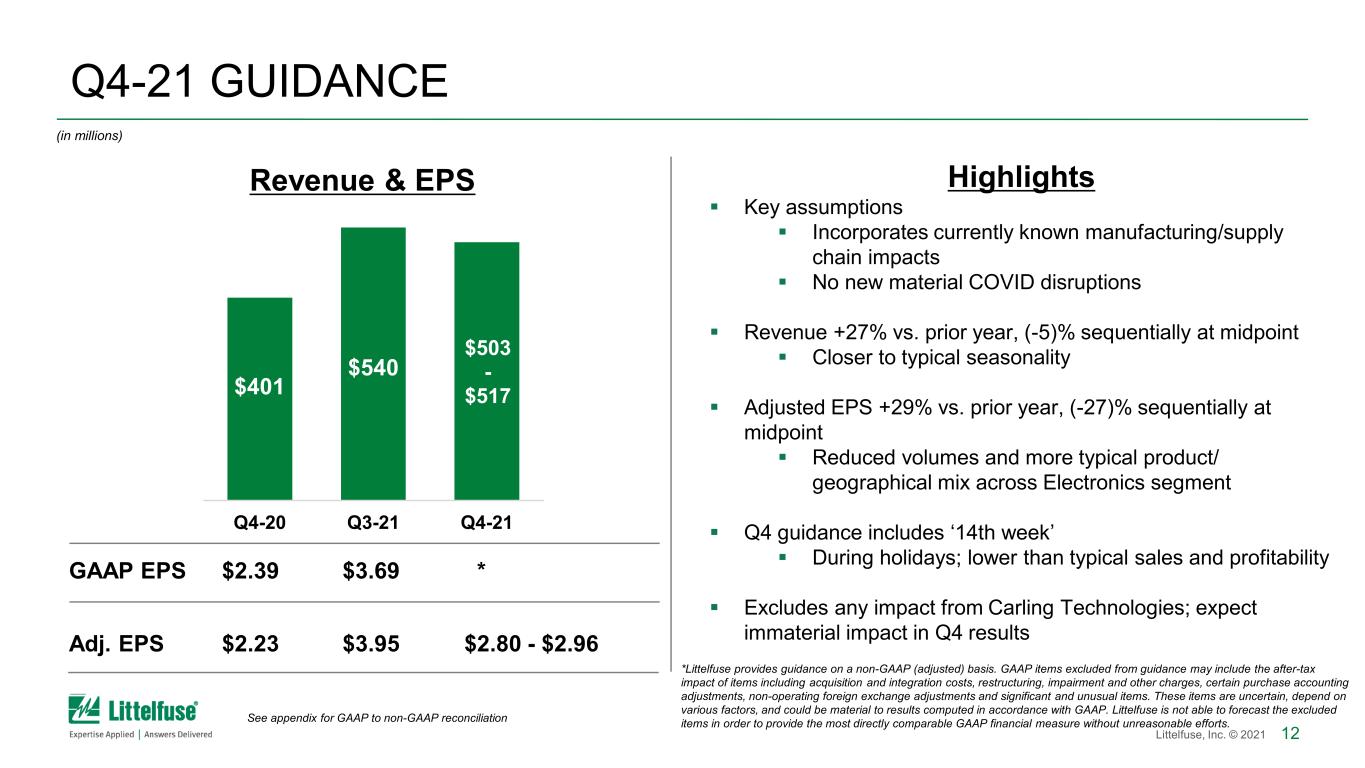

12Littelfuse, Inc. © 2021 Q4-21 GUIDANCE Highlights Key assumptions Incorporates currently known manufacturing/supply chain impacts No new material COVID disruptions Revenue +27% vs. prior year, (-5)% sequentially at midpoint Closer to typical seasonality Adjusted EPS +29% vs. prior year, (-27)% sequentially at midpoint Reduced volumes and more typical product/ geographical mix across Electronics segment Q4 guidance includes ‘14th week’ During holidays; lower than typical sales and profitability Excludes any impact from Carling Technologies; expect immaterial impact in Q4 results $401 $540 $503 - $517 Q4-20 Q3-21 Q4-21 Revenue & EPS (in millions) See appendix for GAAP to non-GAAP reconciliation GAAP EPS $2.39 $3.69 * Adj. EPS $2.23 $3.95 $2.80 - $2.96 *Littelfuse provides guidance on a non-GAAP (adjusted) basis. GAAP items excluded from guidance may include the after-tax impact of items including acquisition and integration costs, restructuring, impairment and other charges, certain purchase accounting adjustments, non-operating foreign exchange adjustments and significant and unusual items. These items are uncertain, depend on various factors, and could be material to results computed in accordance with GAAP. Littelfuse is not able to forecast the excluded items in order to provide the most directly comparable GAAP financial measure without unreasonable efforts.

13Littelfuse, Inc. © 2021 Highlights commitment to environmental, social, and governance (ESG) initiatives Focused on creating a solid foundation for sustainability program to ensure future success Communicates progress towards goals on sustainability journey To learn more, read the 2020 Sustainability Report and visit new Sustainability pages on corporate website 2020 SUSTAINABILITY REPORT

14Littelfuse, Inc. © 2021 Year-to-date, exceptional performance within ongoing challenging environment Continue to closely monitor supply chain challenges across suppliers & customers Proven sound business fundamentals Poised to achieve significant sales and earnings growth this year Remain well-positioned to deliver ongoing superior value for all stakeholders KEY TAKEAWAYS

15Littelfuse, Inc. © 2021 Q&A

16Littelfuse, Inc. © 2021 APPENDIX

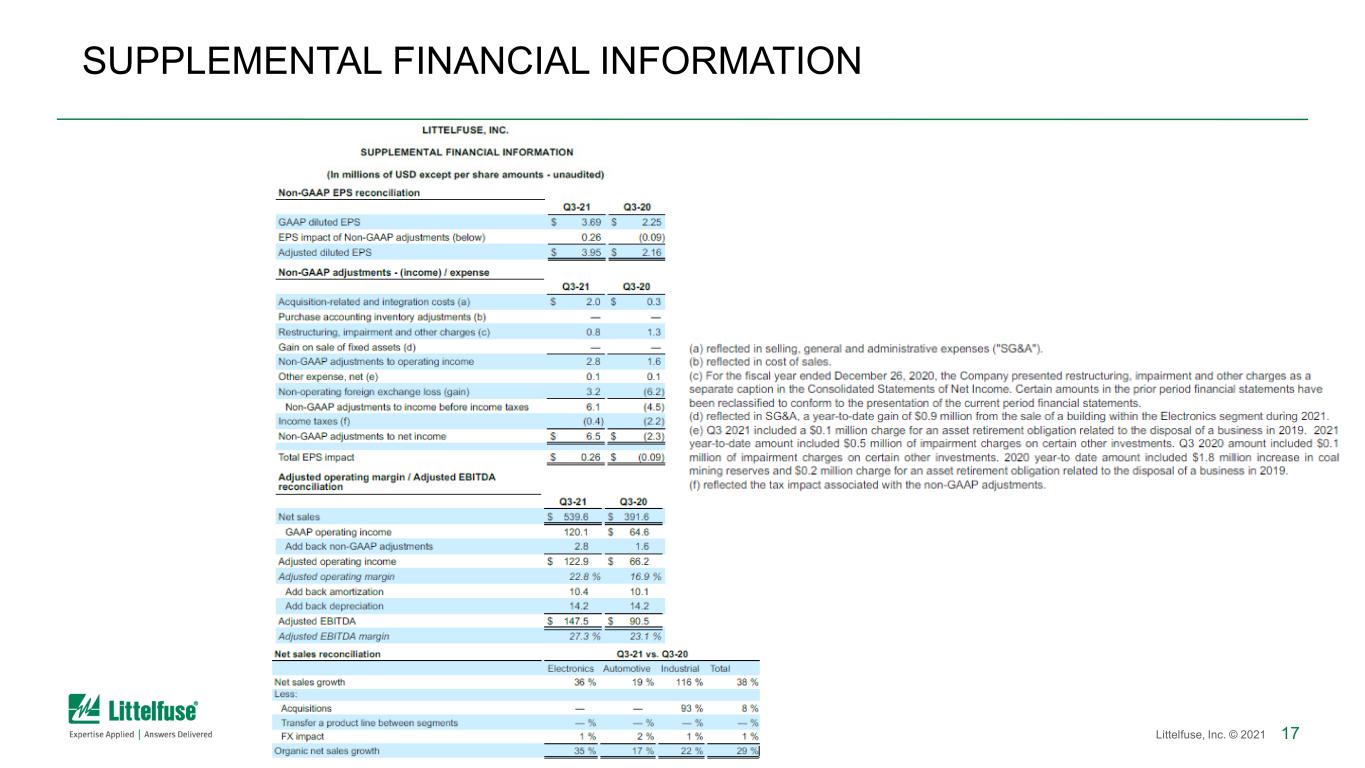

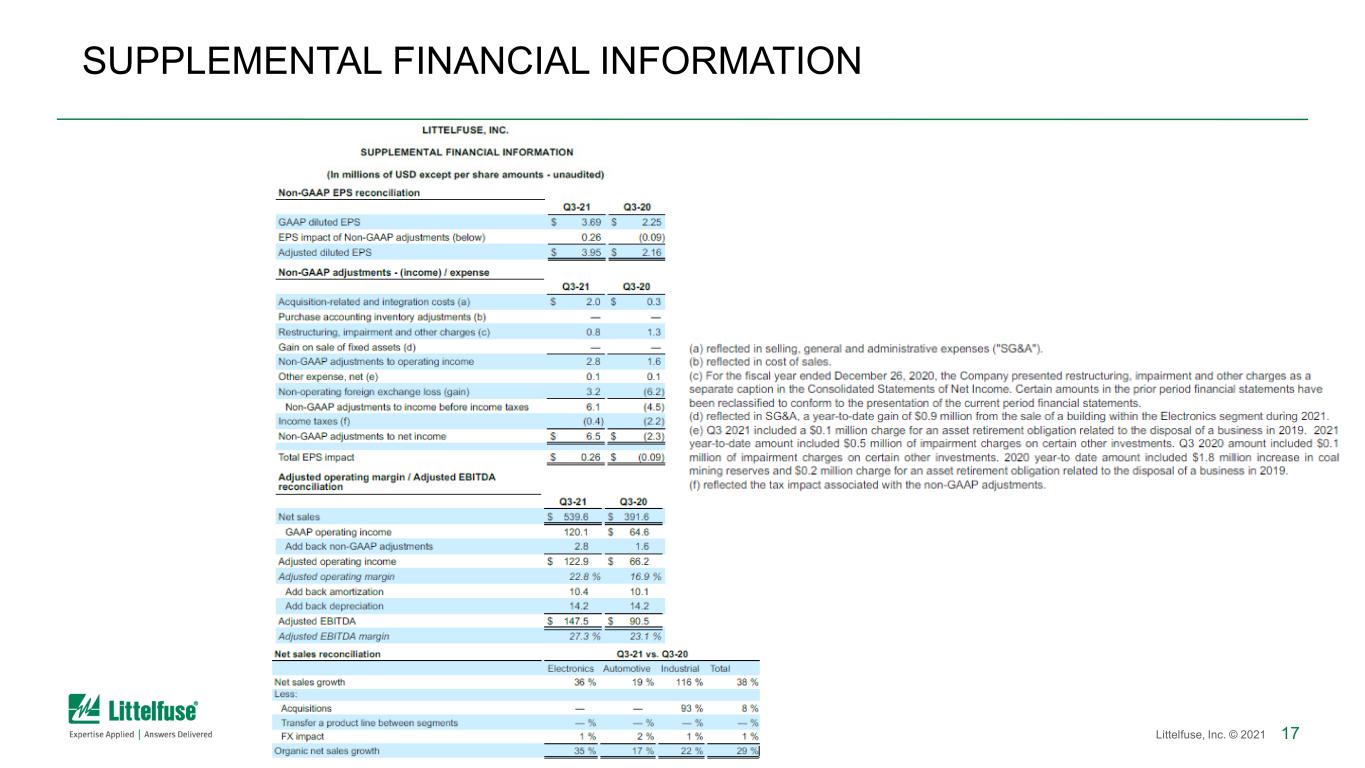

17Littelfuse, Inc. © 2021 SUPPLEMENTAL FINANCIAL INFORMATION

18Littelfuse, Inc. © 2021 SUPPLEMENTAL FINANCIAL INFORMATION CONT’D

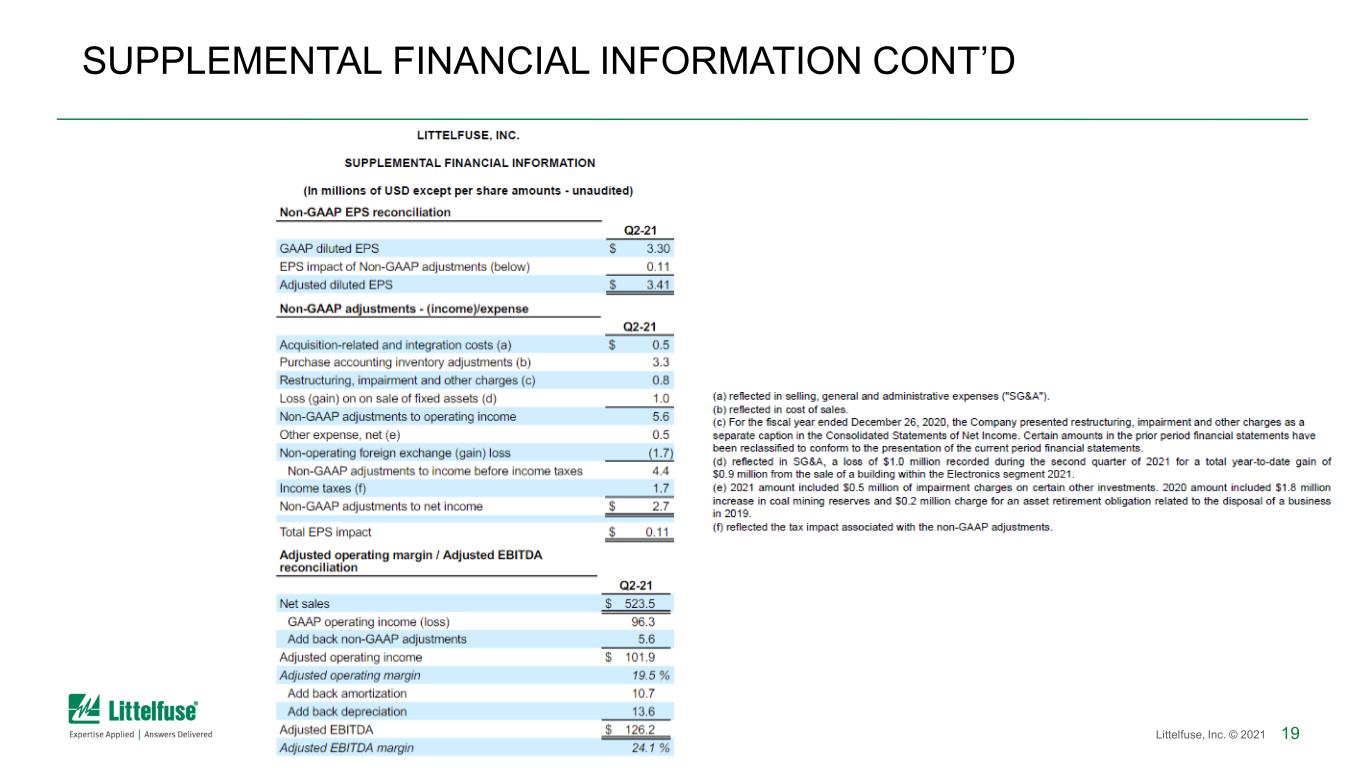

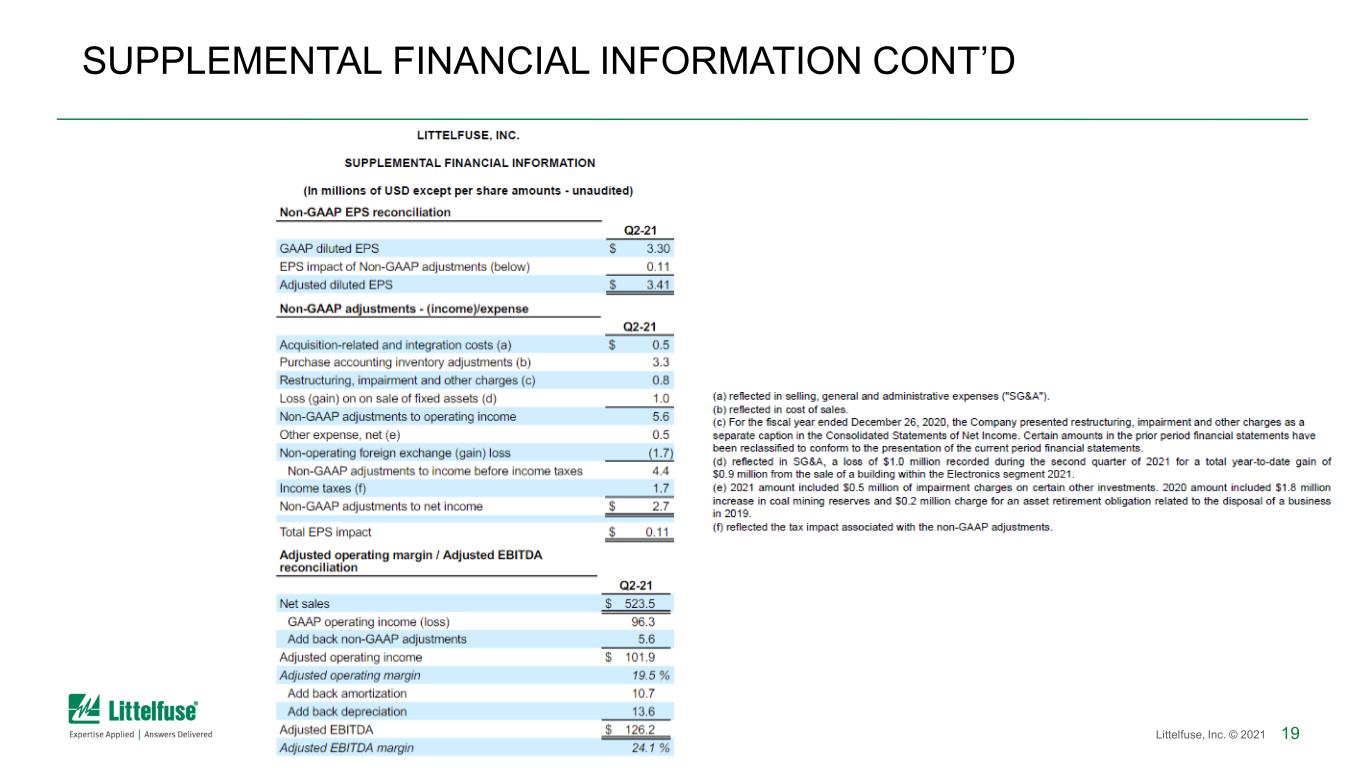

19Littelfuse, Inc. © 2021 SUPPLEMENTAL FINANCIAL INFORMATION CONT’D

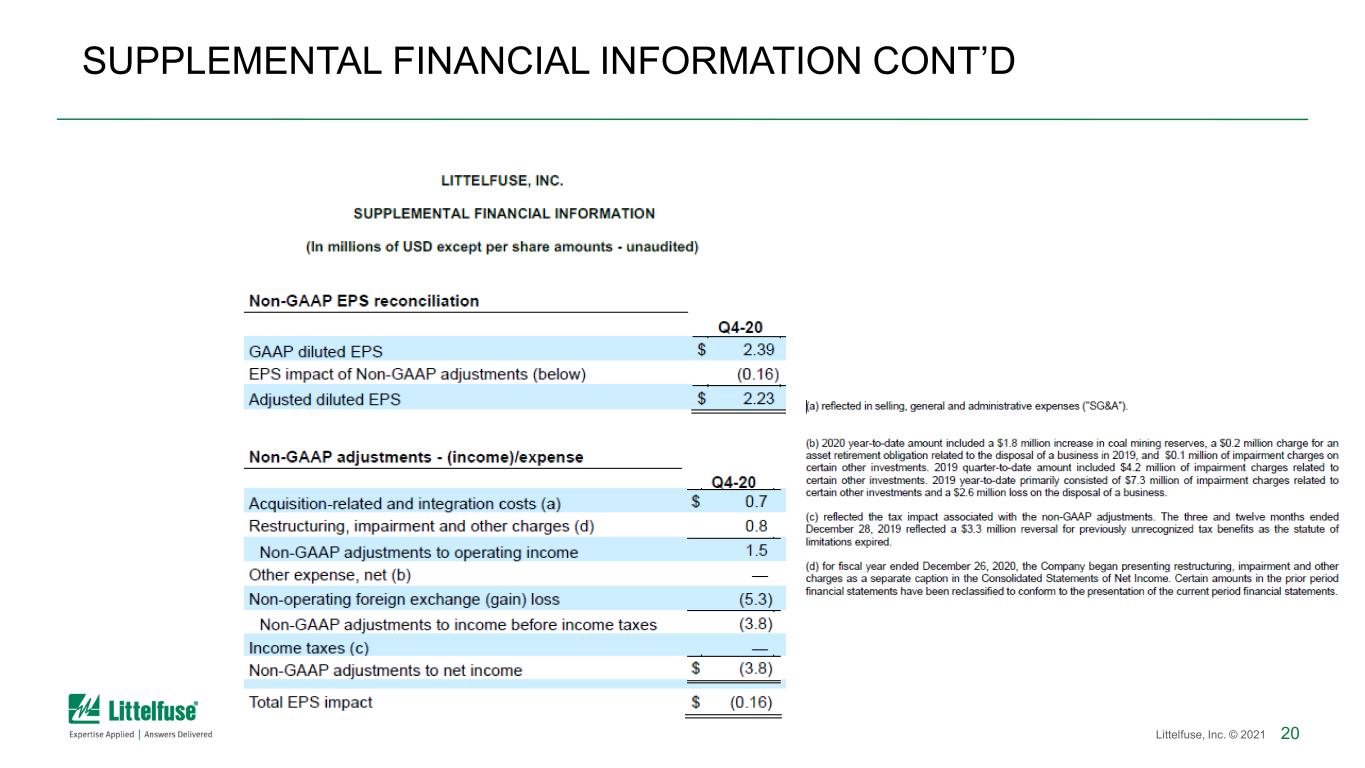

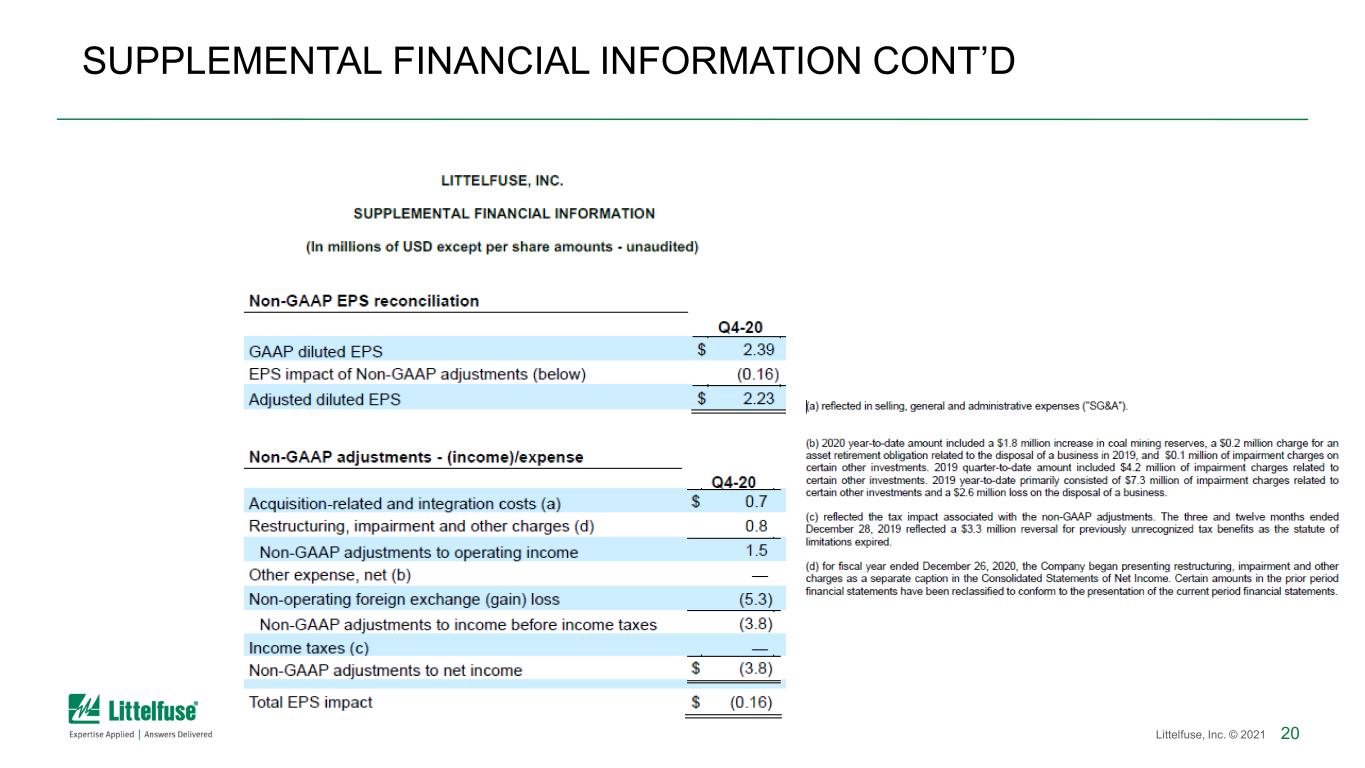

20Littelfuse, Inc. © 2021 SUPPLEMENTAL FINANCIAL INFORMATION CONT’D