1 Q3 2022 EARNINGS RELEASE November 1, 2022

2Littelfuse, Inc. © 2022 Important Information About Littelfuse, Inc. This presentation does not constitute or form part of, and should not be construed as, an offer or solicitation to purchase or sell securities of Littelfuse, Inc. and no investment decision should be made based upon the information provided herein. Littelfuse strongly urges you to review its filings with the Securities and Exchange Commission, which can be found at investor.littelfuse.com. This website also provides additional information about Littelfuse. “Safe Harbor” Statement Under the Private Securities Litigation Reform Act of 1995. The statements in this presentation that are not historical facts are intended to constitute "forward-looking statements" entitled to the safe-harbor provisions of the Private Securities Litigation Reform Act. Such statements are based on Littelfuse, Inc.’s ("Littelfuse" or the "Company") current expectations and are subject to a number of factors and uncertainties, which could cause actual results to differ materially from those described in the forward- looking statements. These risks and uncertainties, include, but are not limited to, risks and uncertainties relating to general economic conditions; the severity and duration of the COVID-19 pandemic and the measures taken in response thereto and the effects of those items on the company’s business; product demand and market acceptance; the impact of competitive products and pricing; product quality problems or product recalls; capacity and supply difficulties or constraints; coal mining exposures reserves; cybersecurity matters; failure of an indemnification for environmental liability; exchange rate fluctuations; commodity and other raw material price fluctuations; the effect of Littelfuse accounting policies; labor disputes; restructuring costs in excess of expectations; pension plan asset returns less than assumed; integration of acquisitions; uncertainties related to political or regulatory changes; and other risks which may be detailed in the company's Securities and Exchange Commission filings. Should one or more of these risks or uncertainties materialize or should the underlying assumptions prove incorrect, actual results and outcomes may differ materially from those indicated or implied in the forward-looking statements. This presentation should be read in conjunction with information provided in the financial statements appearing in the company's Annual Report on Form 10-K for the year ended January 1, 2022. Further discussion of the risk factors of the company can be found under the caption "Risk Factors" in the company's Annual Report on Form 10-K for the year ended January 1, 2022, and in other filings and submissions with the SEC, each of which are available free of charge on the company’s investor relations website at investor.littelfuse.com and on the SEC’s website at http://www.sec.gov. These forward-looking statements are made as of the date hereof. The company does not undertake any obligation to update, amend or clarify these forward-looking statements to reflect events or circumstances after the date hereof or to reflect the availability of new information. Non-GAAP Financial Measures. The information included in this presentation includes the non-GAAP financial measures of organic net sales growth, adjusted operating margin, adjusted EBITDA margin, adjusted diluted earnings per share, adjusted effective tax rate, and free cash flow. A reconciliation of these non-GAAP financial measures to the most directly comparable GAAP financial measures are set forth in the appendix. The company believes that these non-GAAP financial measures provide useful information to investors regarding its operational performance and ability to generate cash enhancing an investor’s overall understanding of its core financial performance. The company believes that these non-GAAP financial measures are commonly used by financial analysts and provide useful information to analysts. Management uses these measures when assessing the performance of the business and for business planning purposes. Note that the definitions of these non-GAAP financial measures may differ from those terms as defined or used by other companies. DISCLAIMERS

BUSINESS UPDATE Dave Heinzmann, President & CEO

4Littelfuse, Inc. © 2022 Q3 2022 & RECENT HIGHLIGHTS Continued outperformance, driven by global business wins, acquisitions & operational execution Q3: Delivered strong results above expectations YoY: Revenue +22%; Organic +8% despite FX headwinds Delivered margins & earnings growth above strategic long-term targets Adjusted Operating Margin 21% Adjusted Diluted EPS +8% Record performance year-to-date YoY: Revenue +24%; Adjusted Diluted EPS +35% Published 2021 Sustainability Report

5Littelfuse, Inc. © 2022 Structural Growth Themes Sustainability Connectivity Safety 2021 – 2025 GROWTH STRATEGY EMPOWERING A SUSTAINABLE, CONNECTED, AND SAFER WORLD Our Growth Drivers Content & Share Gains Strategic Acquisitions High-Growth Markets & Geographies Outcomes Double-Digit Revenue Growth Best-in-Class Profitability Top-Tier Shareholder Returns

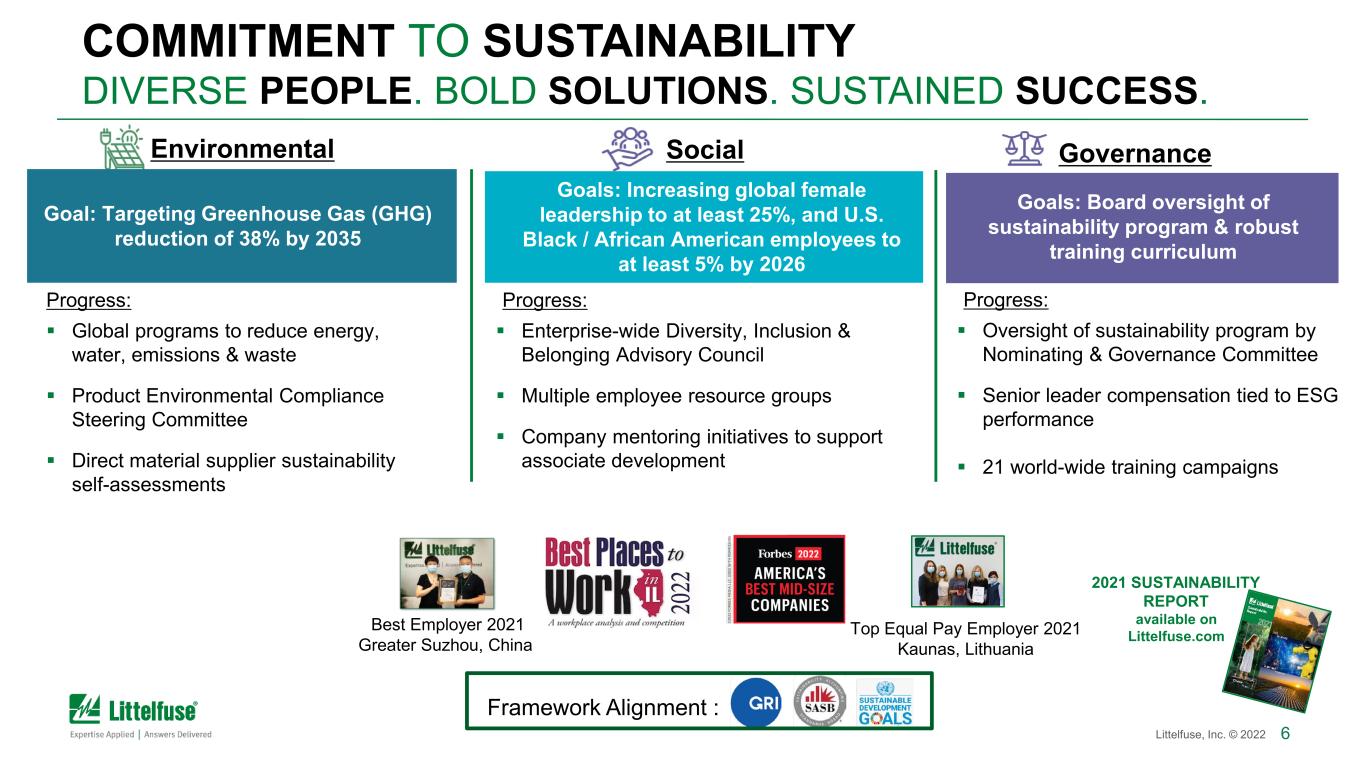

6Littelfuse, Inc. © 2022 Progress: Enterprise-wide Diversity, Inclusion & Belonging Advisory Council Multiple employee resource groups Company mentoring initiatives to support associate development COMMITMENT TO SUSTAINABILITY DIVERSE PEOPLE. BOLD SOLUTIONS. SUSTAINED SUCCESS. Environmental Social Governance Progress: Global programs to reduce energy, water, emissions & waste Product Environmental Compliance Steering Committee Direct material supplier sustainability self-assessments 2021 SUSTAINABILITY REPORT Goal: Targeting Greenhouse Gas (GHG) reduction of 38% by 2035 Goals: Increasing global female leadership to at least 25%, and U.S. Black / African American employees to at least 5% by 2026 Goals: Board oversight of sustainability program & robust training curriculum Top Equal Pay Employer 2021 Kaunas, Lithuania Best Employer 2021 Greater Suzhou, China available on Littelfuse.com Progress: Oversight of sustainability program by Nominating & Governance Committee Senior leader compensation tied to ESG performance 21 world-wide training campaigns Framework Alignment :

7Littelfuse, Inc. © 2022 INDUSTRIAL END MARKETS POSITIONED FOR CONTINUED GROWTH Expanding leadership with customers' focus on intensifying sustainability & safety Technical expertise & portfolio breadth secures significant new business in: Energy storage Alternative energy Commercial kitchens Industrial motor drives HVAC Automated test equipment Growth driven by engineering capabilities & differentiated innovation Q3 2022 Highlights

8Littelfuse, Inc. © 2022 TRANSPORTATION END MARKETS EXTENDING OUR LEADERSHIP POSITION Q3 2022 Highlights Leveraging company-wide automotive technology portfolio & market trends to increase passenger vehicle leadership & content Double-digit content outgrowth* Increased average content across vehicles to ~$7.00 New business pipeline & expanding portfolio support continued double-digit outgrowth Enabling customers' transition to electrification Passenger vehicles - on & off-board charging, BMS** Commercial vehicles – electrification of trucks, 2 & 3 wheelers in Asia Product innovation & electronification driving content opportunities - ADAS, infotainment, comfort & convenience *2019-2022 **BMS = Battery management system

9Littelfuse, Inc. © 2022 ELECTRONICS END MARKETS LEVERAGING OUR LEADERSHIP Q3 2022 Highlights Broader solutions & increased design-in activity within connectivity, sustainability & safety themes driving new business wins in: Data centers Building automation systems Battery power for power tools & e-bicycles Medical infusion pump C&K Switches expands technology portfolio, enhances market presence & strengthens distribution partnerships

FINANCIAL UPDATE Meenal Sethna, EVP & CFO

11Littelfuse, Inc. © 2022 Highlights Financial performance above high end of guidance on sales & earnings Revenue +22% vs PY, +8% organic GAAP operating margin 18.5%; Adjusted operating margin 21% Continuation of positive price/cost Margins solidly above strategic long-term target Adjusted EPS +8% vs PY Effective tax rate: GAAP 21.4%; Adjusted 18.0% Operating cash flow $148m; Free cash flow $127m, 41% growth over PY Q3 2022 FINANCIAL PERFORMANCE FINANCIAL PERFORMANCE GAAP EPS $3.69 $3.02 Adj. EPS $3.95 $4.28 Adj. EBITDA% 27.3% 25.9% $540 $659 Q3-21 Q3-22 Revenue (in millions) See appendix for GAAP to non-GAAP reconciliation

12Littelfuse, Inc. © 2022 Highlights Revenue growth +15% / organic +7% Ongoing robust operating margins Positive price/cost, volume, productivity initiatives POS / end market demand solid across breadth of markets Softness in consumer-oriented markets & ChinaOp Margin 28.9% 28.5% Adj. EBITDA% 33.4% 33.3% $347 $398 Q3-21 Q3-22 (in millions) Q3 2022 ELECTRONICS SEGMENT FINANCIAL PERFORMANCE Revenue See appendix for GAAP to non-GAAP reconciliation

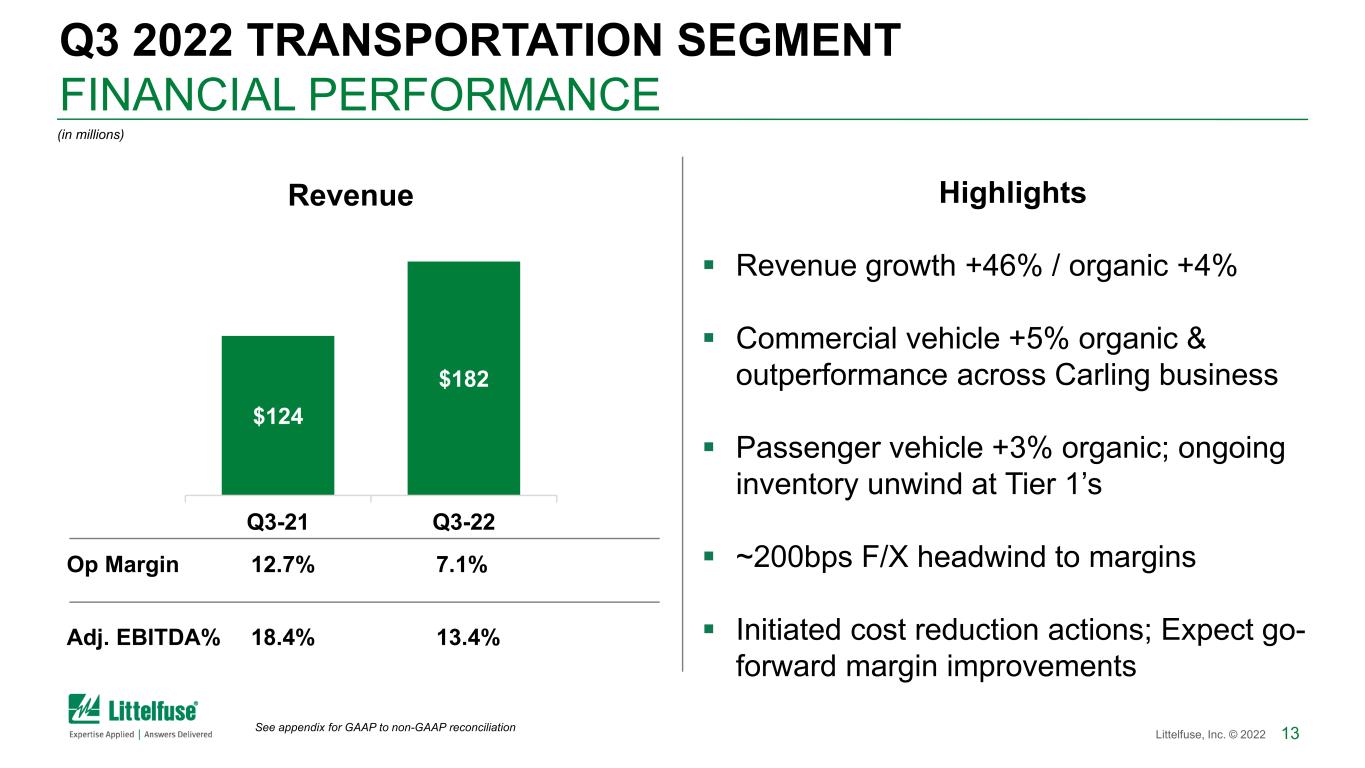

13Littelfuse, Inc. © 2022 Highlights Revenue growth +46% / organic +4% Commercial vehicle +5% organic & outperformance across Carling business Passenger vehicle +3% organic; ongoing inventory unwind at Tier 1’s ~200bps F/X headwind to margins Initiated cost reduction actions; Expect go- forward margin improvements Op Margin 12.7% 7.1% Adj. EBITDA% 18.4% 13.4% $124 $182 Q3-21 Q3-22 (in millions) Q3 2022 TRANSPORTATION SEGMENT FINANCIAL PERFORMANCE Revenue See appendix for GAAP to non-GAAP reconciliation

14Littelfuse, Inc. © 2022 Highlights Revenue growth +17% / organic +18% YTD revenue growth +27% Broad-based end market strength >500bps margin expansion Price realization, manufacturing & supply chain improvements, faster than expected recovery from China COVID shutdowns Op Margin 9.7% 15.3% Adj. EBITDA% 12.7% 18.1% $68 $80 Q3-21 Q3-22 (in millions) Q3 2022 INDUSTRIAL SEGMENT FINANCIAL PERFORMANCE Revenue See appendix for GAAP to non-GAAP reconciliation

15Littelfuse, Inc. © 2022 Q4 2022 GUIDANCE Highlights Q4 sales typically sequentially down mid-single Sales +11% vs PY / +4% organic (-7%) f/x & PY 14th week EPS +11% vs PY, excl. $0.25 of PY one-time benefits (tax holiday & 14th week) ~(150) bps operating margin dilution from recent acquisitions Recent Electronics book to bill below 1.0x Some channel inventory rebalancing Continuation of Tier 1 auto inventory unwind $553 Q4-21 Q4-22 Revenue $603 - $623 (in millions) See appendix for GAAP to non-GAAP reconciliation GAAP EPS $2.08 * Adj. EPS $3.16 $3.14 - $3.34

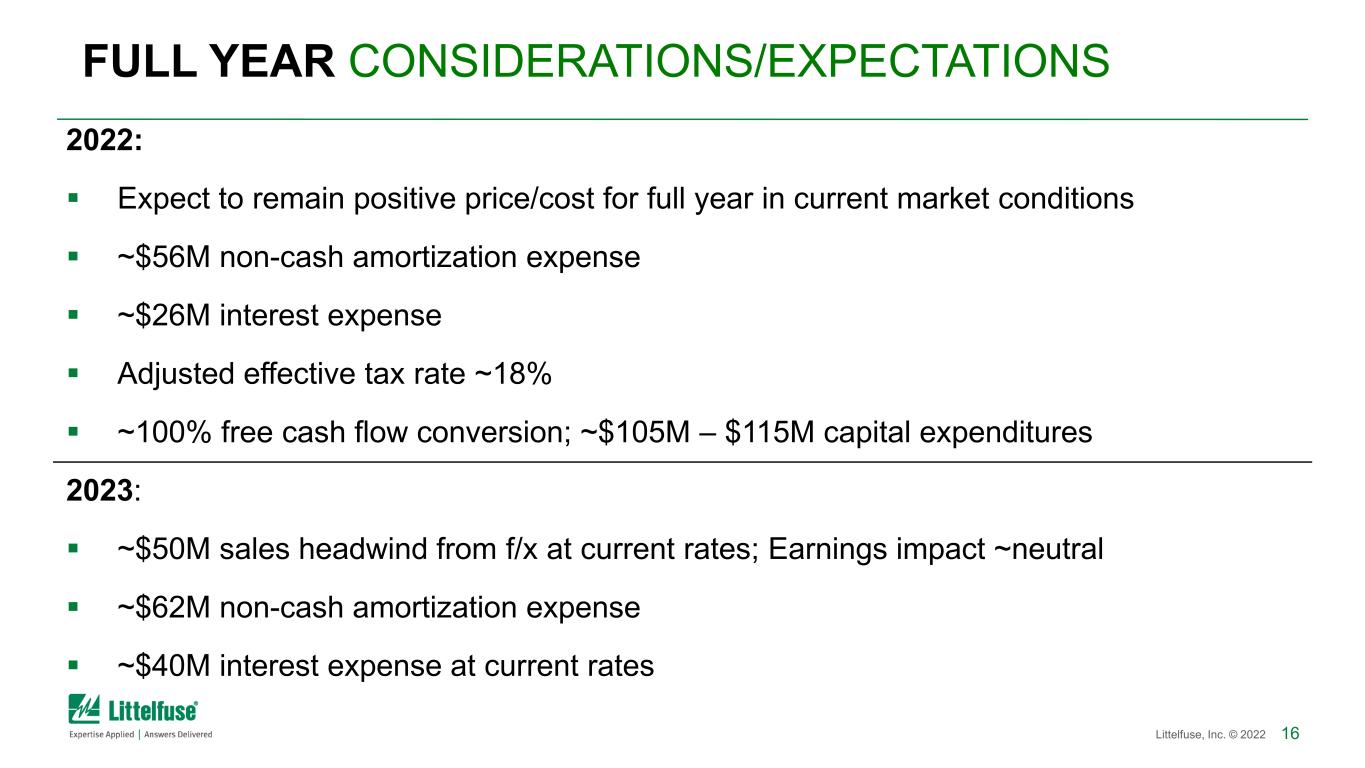

16Littelfuse, Inc. © 2022 FULL YEAR CONSIDERATIONS/EXPECTATIONS 2022: Expect to remain positive price/cost for full year in current market conditions ~$56M non-cash amortization expense ~$26M interest expense Adjusted effective tax rate ~18% ~100% free cash flow conversion; ~$105M – $115M capital expenditures 2023: ~$50M sales headwind from f/x at current rates; Earnings impact ~neutral ~$62M non-cash amortization expense ~$40M interest expense at current rates

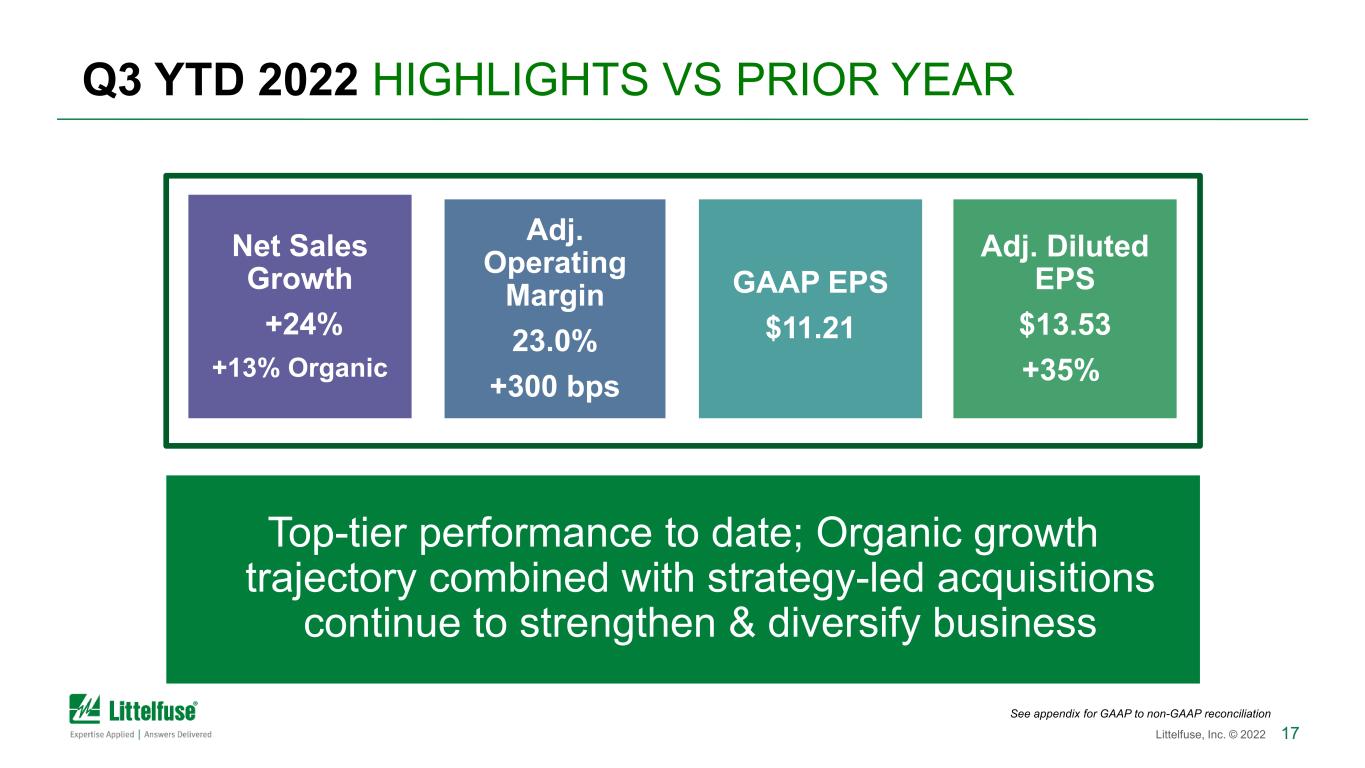

17Littelfuse, Inc. © 2022 Top-tier performance to date; Organic growth trajectory combined with strategy-led acquisitions continue to strengthen & diversify business Net Sales Growth +24% +13% Organic Adj. Operating Margin 23.0% +300 bps GAAP EPS $11.21 Adj. Diluted EPS $13.53 +35% Q3 YTD 2022 HIGHLIGHTS VS PRIOR YEAR See appendix for GAAP to non-GAAP reconciliation

18Littelfuse, Inc. © 2022 RESILIENT GROWTH STRATEGY & BUSINESS MODEL $0.00 $2.00 $4.00 $6.00 $8.00 $10.00 $12.00 $14.00 $16.00 $18.00 $0 $250 $500 $750 $1,000 $1,250 $1,500 $1,750 $2,000 $2,250 $2,500 '07 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '18 '19 '20 '21 '22F EP S Sa le s Revenue (M$) Adjusted EPS Sustained Double-Digit Sales & Earnings Growth Expanded market leadership & profitability Playbook to successfully manage through dynamic environments Prioritizing long-term strategic investments & managing cost structure 10-yr CAGR* Sales +14% Adj EPS +17% 15-yr CAGR* Sales +11% Adj EPS +17% 5-yr CAGR* Sales +16% Adj EPS +17% *15-yr: 2007 - 2022F; 10-yr: 2012 - 2022F; 5-yr: 2017 - 2022F

19Littelfuse, Inc. © 2021 Q&A

20Littelfuse, Inc. © 2021 APPENDIX

21Littelfuse, Inc. © 2022 SUPPLEMENTAL FINANCIAL INFORMATION

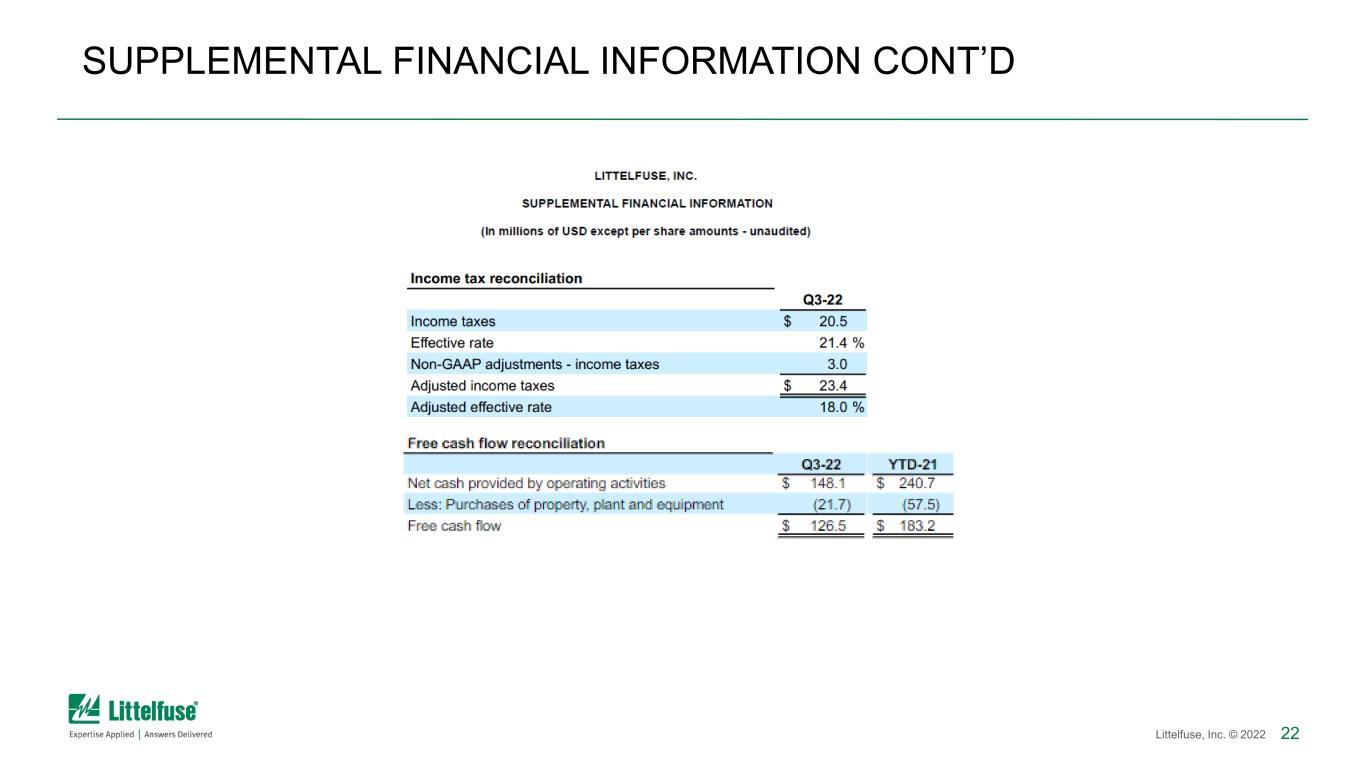

22Littelfuse, Inc. © 2022 SUPPLEMENTAL FINANCIAL INFORMATION CONT’D

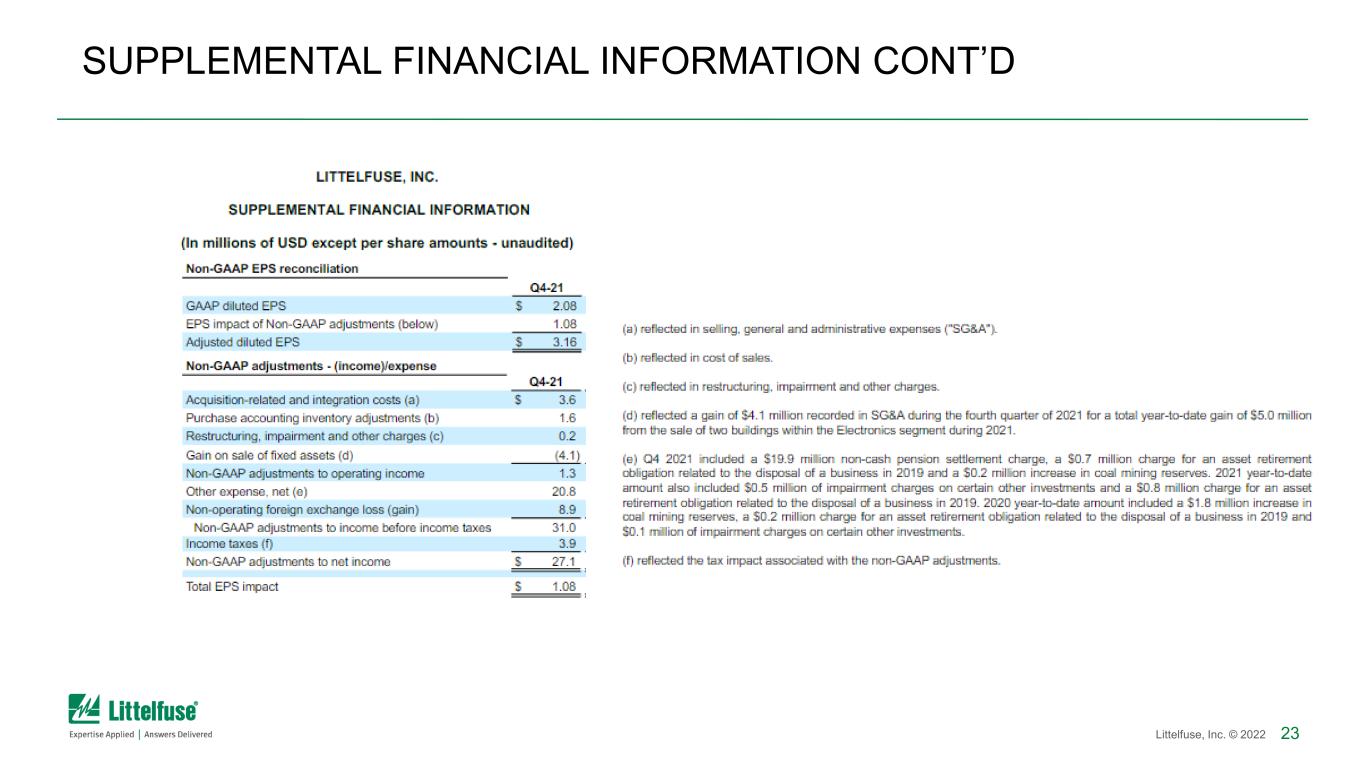

23Littelfuse, Inc. © 2022 SUPPLEMENTAL FINANCIAL INFORMATION CONT’D

24Littelfuse, Inc. © 2022 SUPPLEMENTAL FINANCIAL INFORMATION CONT’D