1 Q2 2024 EARNINGS RELEASE July 30, 2024

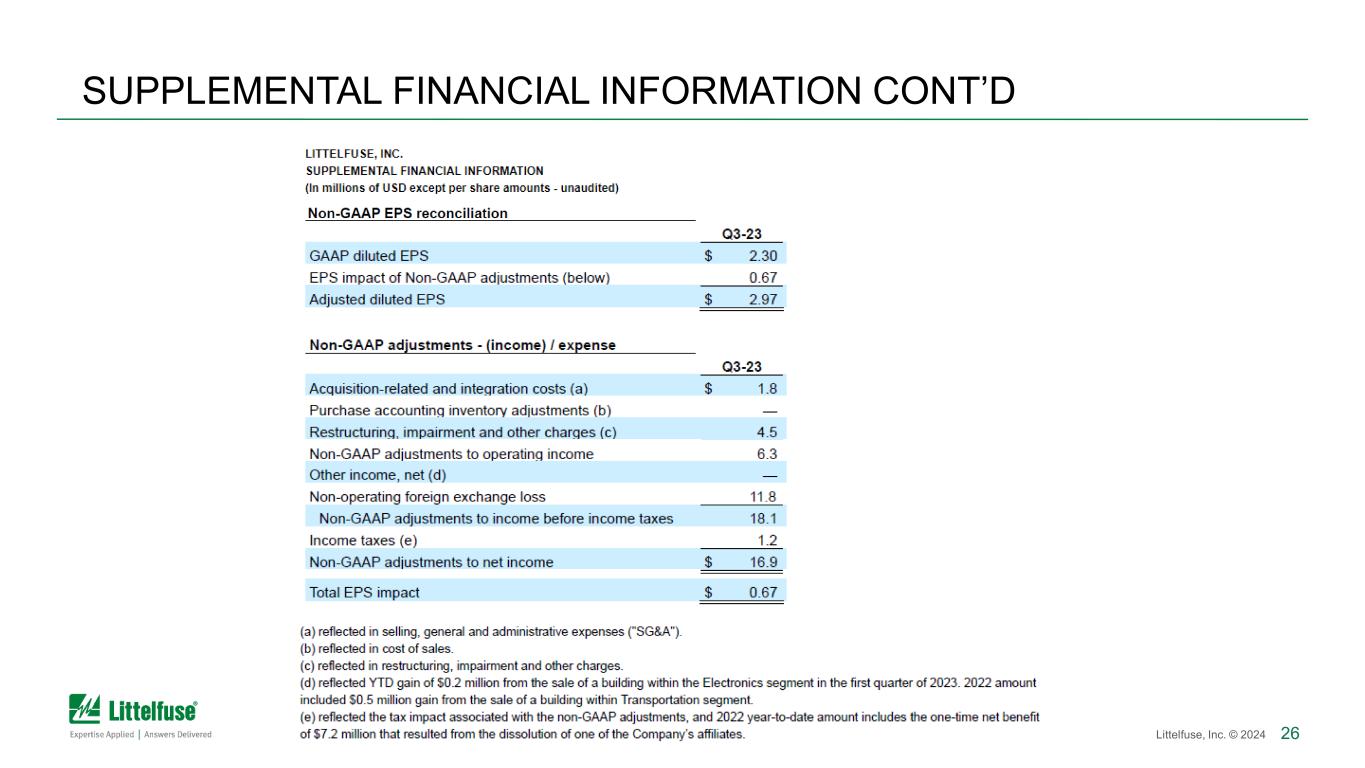

2Littelfuse, Inc. © 2024 Important Information About Littelfuse, Inc. This presentation does not constitute or form part of, and should not be construed as, an offer or solicitation to purchase or sell securities of Littelfuse, Inc. and no investment decision should be made based upon the information provided herein. Littelfuse strongly urges you to review its filings with the Securities and Exchange Commission, which can be found at investor.littelfuse.com. This website also provides additional information about Littelfuse. “Safe Harbor” Statement Under the Private Securities Litigation Reform Act of 1995. The statements in this presentation that are not historical facts are intended to constitute "forward-looking statements" entitled to the safe-harbor provisions of the Private Securities Litigation Reform Act. Such statements are based on Littelfuse, Inc.’s ("Littelfuse" or the "Company") current expectations and are subject to a number of factors and uncertainties, which could cause actual results to differ materially from those described in the forward- looking statements. These risks and uncertainties, include, but are not limited to, risks and uncertainties relating to general economic conditions; product demand and market acceptance; the impact of competitive products and pricing; product quality problems or product recalls; capacity and supply difficulties or constraints; coal mining exposures reserves; cybersecurity matters; failure of an indemnification for environmental liability; exchange rate fluctuations; commodity and other raw material price fluctuations; the effect of Littelfuse accounting policies; labor disputes; restructuring costs in excess of expectations; pension plan asset returns less than assumed; integration of acquisitions; uncertainties related to political or regulatory changes; and other risks which may be detailed in the company's Securities and Exchange Commission filings. Should one or more of these risks or uncertainties materialize or should the underlying assumptions prove incorrect, actual results and outcomes may differ materially from those indicated or implied in the forward-looking statements. This presentation should be read in conjunction with information provided in the financial statements appearing in the company's Annual Report on Form 10-K for the year ended December 30, 2023. Further discussion of the risk factors of the company can be found under the caption "Risk Factors" in the company's Annual Report on Form 10-K for the year ended December 30, 2023, and in other filings and submissions with the SEC, each of which are available free of charge on the company’s investor relations website at investor.littelfuse.com and on the SEC’s website at http://www.sec.gov. These forward-looking statements are made as of the date hereof. The company does not undertake any obligation to update, amend or clarify these forward-looking statements to reflect events or circumstances after the date hereof or to reflect the availability of new information. Non-GAAP Financial Measures. The information included in this presentation includes the non-GAAP financial measures of organic net sales (decline) growth, adjusted operating margin, adjusted EBITDA margin, adjusted diluted earnings per share, adjusted effective tax rate, free cash flow, and consolidated net leverage ratio (as defined in the credit agreement). A reconciliation of these non-GAAP financial measures to the most directly comparable GAAP financial measures are set forth in the appendix. The company believes that these non-GAAP financial measures provide useful information to investors regarding its operational performance because they enhance an investor’s overall understanding of our core financial performance and facilitate comparisons to historical results of operations, by excluding items that are not related directly to the underlying performance of our fundamental business operations or were not part of our business operations during a comparable period. The company believes that free cash flow is a useful measure of its ability to generate cash. The company believes that consolidated net leverage ratio is a useful measure of its credit position. Management additionally uses these measures when assessing the performance of the business and for business planning purposes. Note that our definitions of these non-GAAP financial measures may differ from those terms as defined or used by other companies. DISCLAIMERS

BUSINESS UPDATE Dave Heinzmann, President & CEO

4Littelfuse, Inc. © 2024 EXECUTIVE SUMMARY Strong Q2 performance; disciplined execution supports long-term growth strategy Solid Q2 execution & performance Q2 Sales & Adjusted EPS exceed the high end of guidance Solid YTD cash generation, flexible balance sheet Meaningful design-in activity, momentum with customers Portfolio optimization initiatives driving margin traction Sequential Electronics & Industrials segment margin expansion Continued progress with Transportation actions Confidence in expected return to growth in the fourth quarter Believe passive Electronics destocking is largely behind us, well positioned to support customers in rebound Ongoing soft industrial demand, executing through cycles

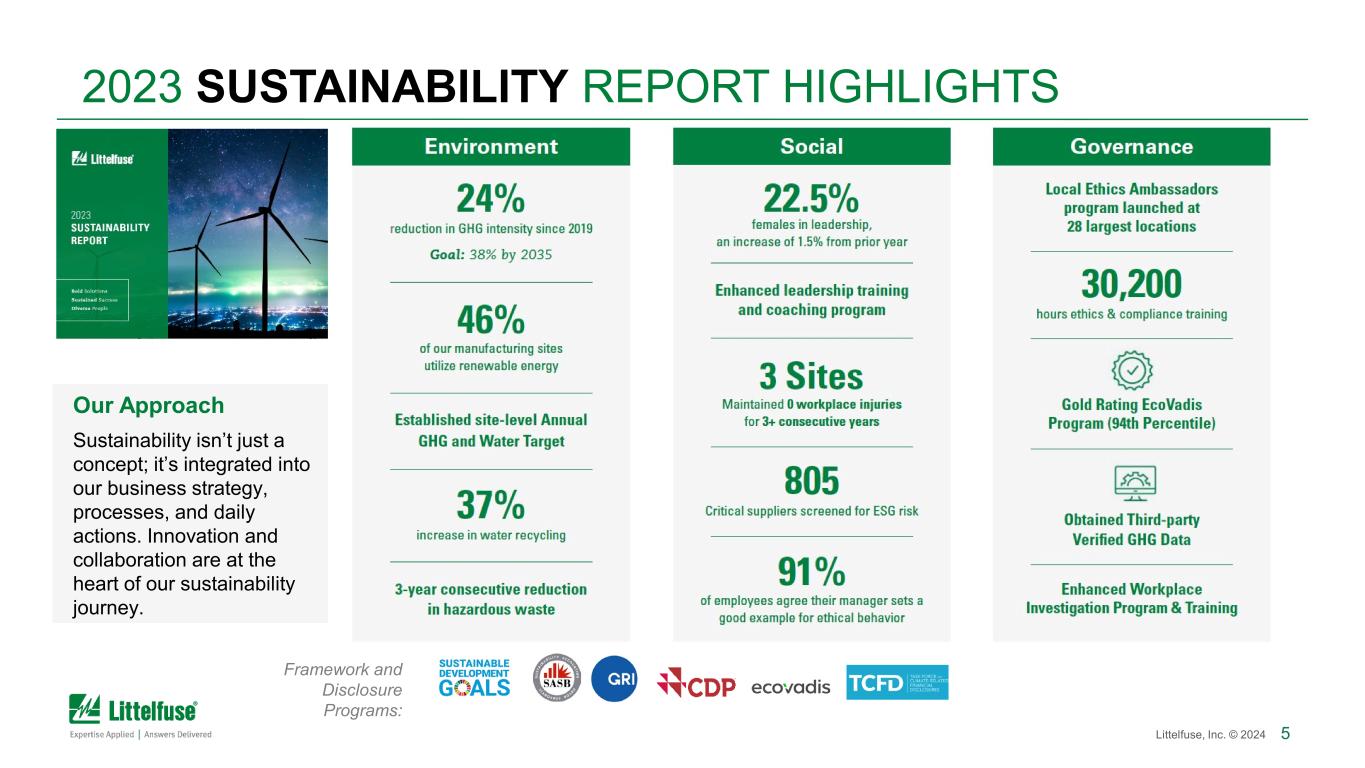

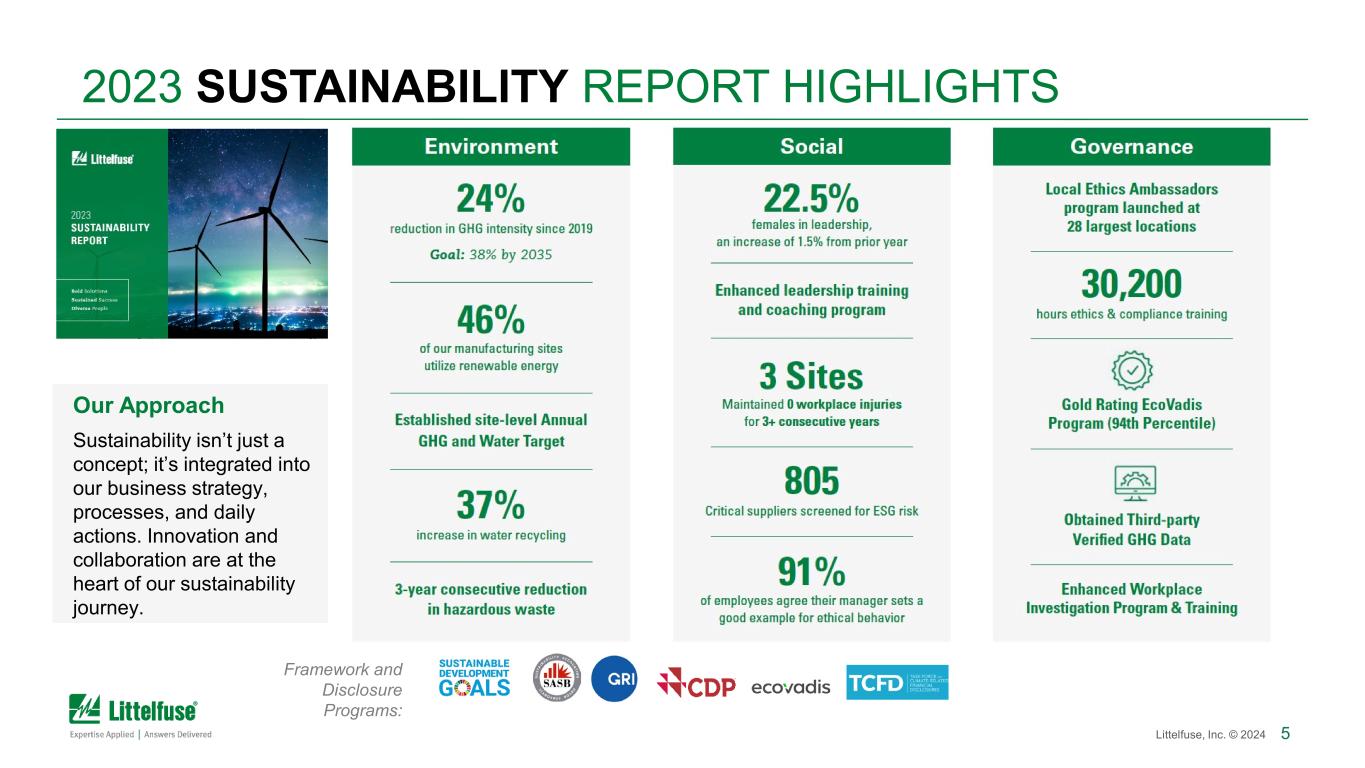

5Littelfuse, Inc. © 2024 2023 SUSTAINABILITY REPORT HIGHLIGHTS Framework and Disclosure Programs: Our Approach Sustainability isn’t just a concept; it’s integrated into our business strategy, processes, and daily actions. Innovation and collaboration are at the heart of our sustainability journey.

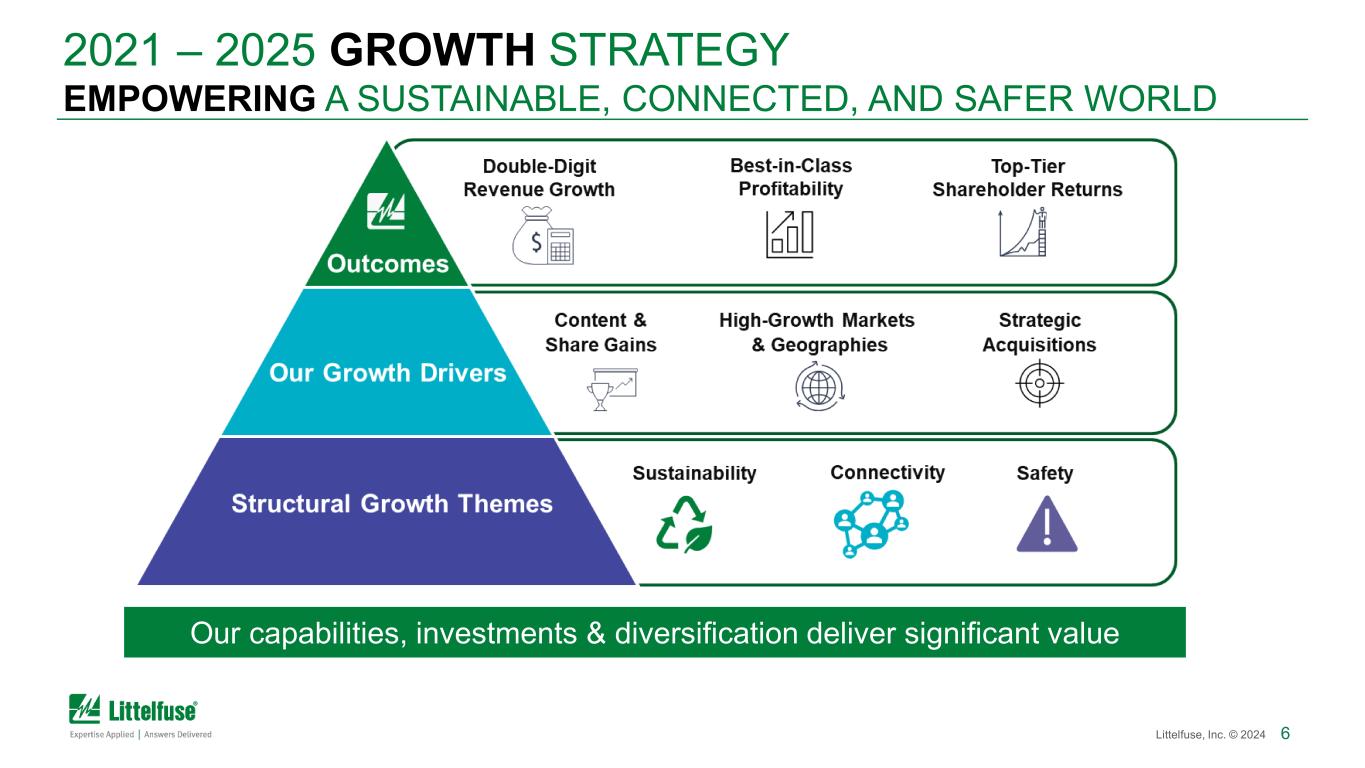

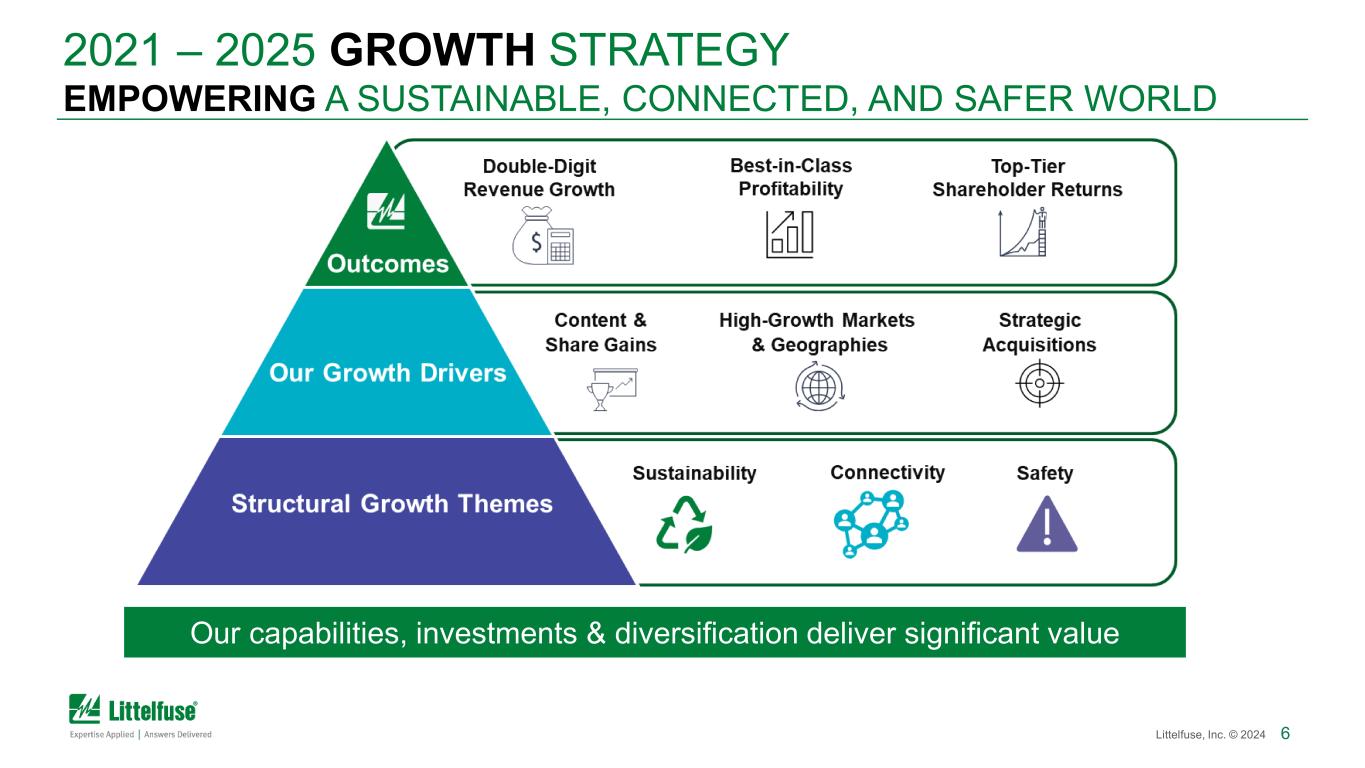

6Littelfuse, Inc. © 2024 2021 – 2025 GROWTH STRATEGY EMPOWERING A SUSTAINABLE, CONNECTED, AND SAFER WORLD Our capabilities, investments & diversification deliver significant value

7Littelfuse, Inc. © 2024 ELECTRONICS END MARKETS BROAD TECHNOLOGY CAPABILITIES, DIVERSE EXPOSURE Diverse end market dynamics: Strong 2Q data center volumes led by AI driven applications; broad demand softness Initial pockets of demand recovery; strong & persistent design-in activity through cycle Technologically diverse design win momentum across our global customer base Asia & NA data center wins across broad set of technologies & applications Multi-technology medical wins across Europe, Asia & NA Europe & Asia appliance wins spanning our diverse technology portfolio Q2 2024 Highlights

8Littelfuse, Inc. © 2024 TRANSPORTATION END MARKETS PRODUCT LEADERSHIP FOR A GLOBAL CUSTOMER BASE Benefiting from broad & balanced technology capabilities & global customer reach Core passenger vehicle product leadership, long- standing customer relationships Continued traction with commercial vehicle profitability initiatives amid ongoing soft end market dynamics Delivering meaningful wins across extensive range of transportation applications Multiple wins within battery management systems for key customers Continued wins across high & low voltage architectures Global commercial vehicle wins for a diverse range of applications Q2 2024 Highlights

9Littelfuse, Inc. © 2024 INDUSTRIAL END MARKETS EXECUTING WHILE DRIVING INNOVATIONS Disciplined execution while delivering innovative solutions Continued end demand softness, more pronounced impact to power semiconductor portfolio Supporting ongoing industry advancements toward next generation applications Diverse renewable wins for solar & wind customers HVAC evolutions for broad NA customer base Multi-technology wins for global EV charging infrastructure build out Q2 2024 Highlights

FINANCIAL UPDATE Meenal Sethna, EVP & CFO

11Littelfuse, Inc. © 2024 Q2 2024 TOTAL COMPANY FINANCIAL PERFORMANCE GAAP EPS $2.79 $1.82 Adj. EPS $3.12 $1.97 Adj. EBITDA% 22.5% 18.6% $612 $558 Q2-23 Q2-24 Revenue (in millions) See appendix for GAAP to non-GAAP reconciliation Highlights Revenue (-9%) vs PY / organic (-8%) ~2% portfolio pruning headwind GAAP op margin 11.7%; Adjusted op margin 12.7% F/X & Commodities: (-80bps) margin headwind vs. PY Effective tax rate: GAAP 26.0%; Adj. 25.0% Operating cash flow $69m; Free cash flow $50m YTD: Free cash flow $92m, 98% conversion rate

12Littelfuse, Inc. © 2024 CASH GENERATION & CAPITAL DEPLOYMENT Well-positioned business model & execution drive robust long- term cash generation Disciplined approach to working capital management Strong balance sheet supports capital deployment strategy Consolidated net leverage ratio ~1.6x Prioritizing growth investments YTD capital deployment - returned $73m to shareholders $41m via share repurchase $32m dividend payout; Board approved +8% increase Consistent prioritization of capital deployment Organic investments Strategic acquisitions Dividends and share repurchases See appendix for GAAP to non-GAAP reconciliation Driving long-term shareholder value

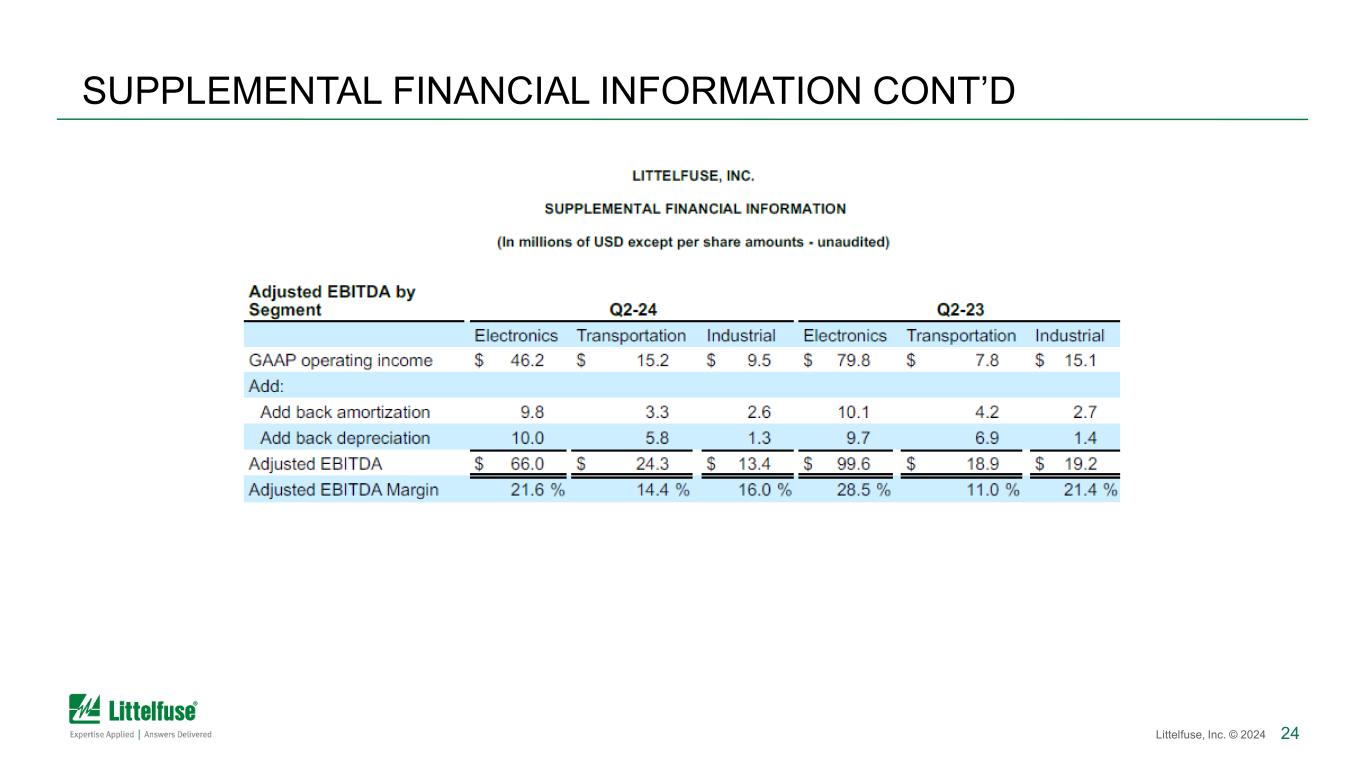

13Littelfuse, Inc. © 2024 $350 $306 Q2-23 Q2-24 Q2 2024 ELECTRONICS SEGMENT FINANCIAL PERFORMANCE Revenue (in millions) Op Margin 22.8% 15.1% Adj. EBITDA% 28.5% 21.6% Highlights See appendix for GAAP to non-GAAP reconciliation Revenue (-13%) vs PY / organic (-12%) Passive products (-4%) Semiconductor (-19%) Moderating passive inventory reductions, channel inventory levels have normalized into 2H; continued industrial softness & destock impacting semiconductor products Portfolio diversification efforts, execution driving margin resiliency

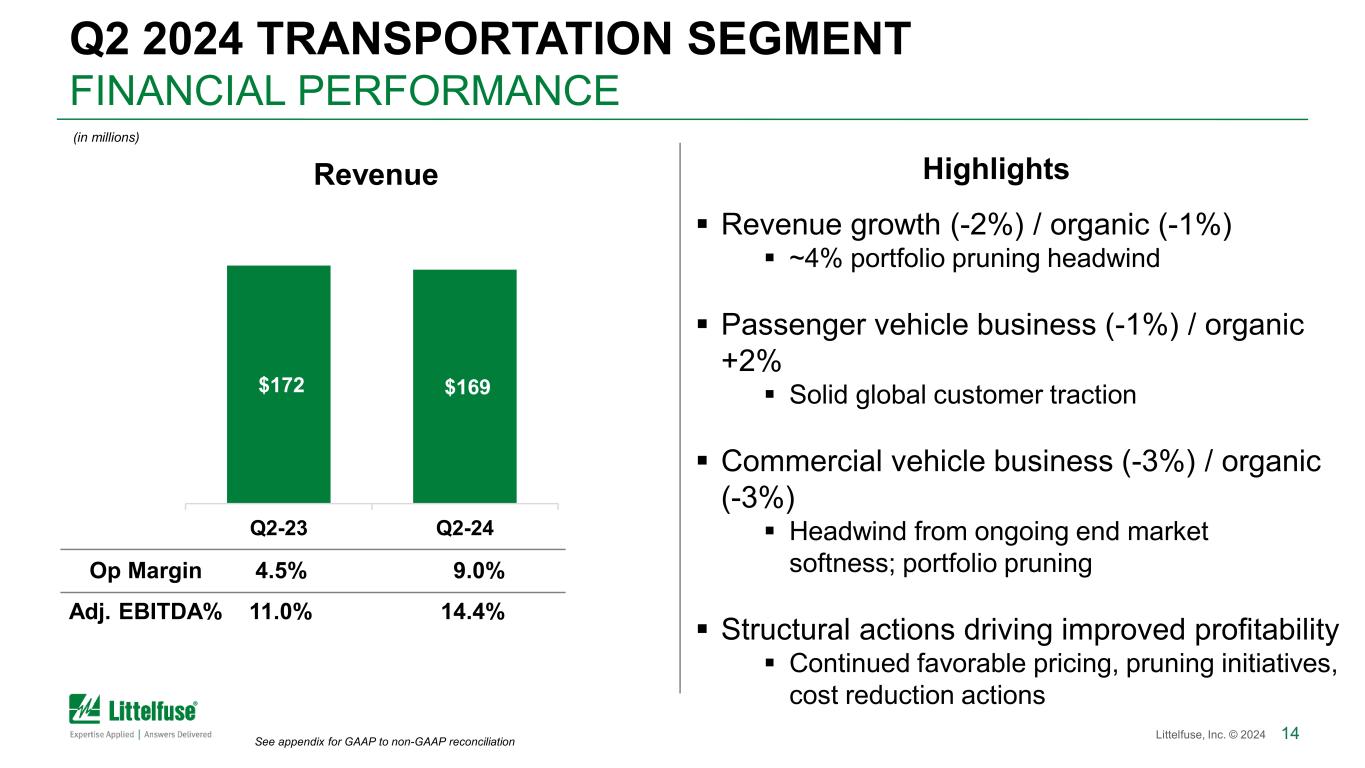

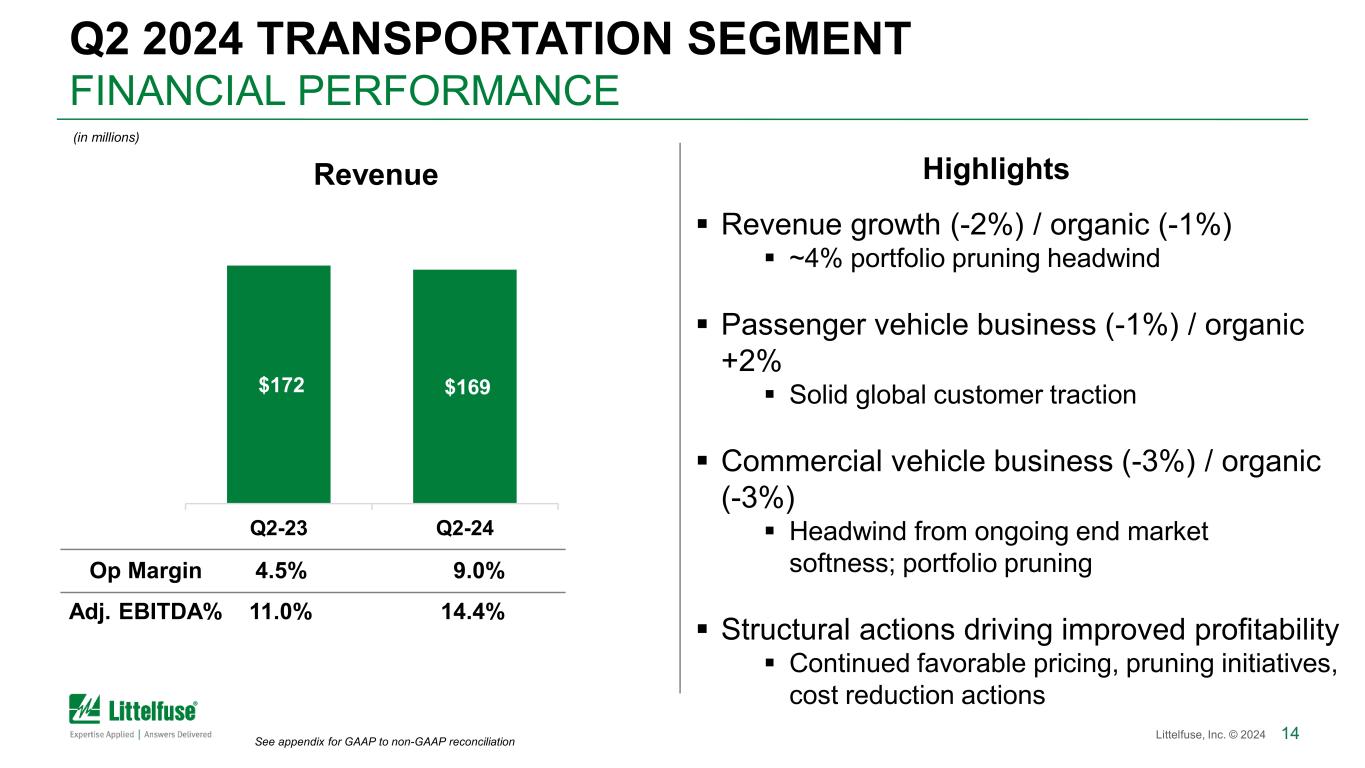

14Littelfuse, Inc. © 2024 $172 $169 Q2-23 Q2-24 Q2 2024 TRANSPORTATION SEGMENT FINANCIAL PERFORMANCE Revenue (in millions) Op Margin 4.5% 9.0% Adj. EBITDA% 11.0% 14.4% See appendix for GAAP to non-GAAP reconciliation Highlights Revenue growth (-2%) / organic (-1%) ~4% portfolio pruning headwind Passenger vehicle business (-1%) / organic +2% Solid global customer traction Commercial vehicle business (-3%) / organic (-3%) Headwind from ongoing end market softness; portfolio pruning Structural actions driving improved profitability Continued favorable pricing, pruning initiatives, cost reduction actions

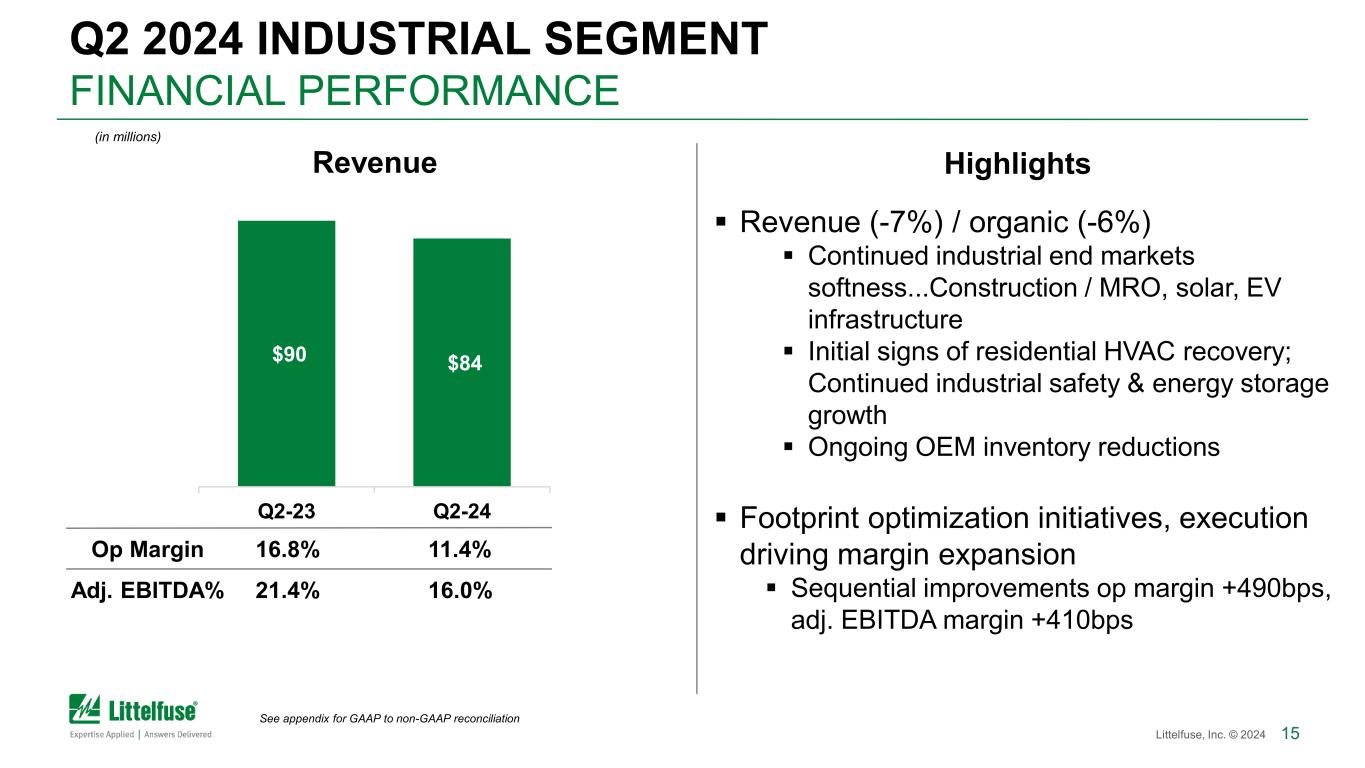

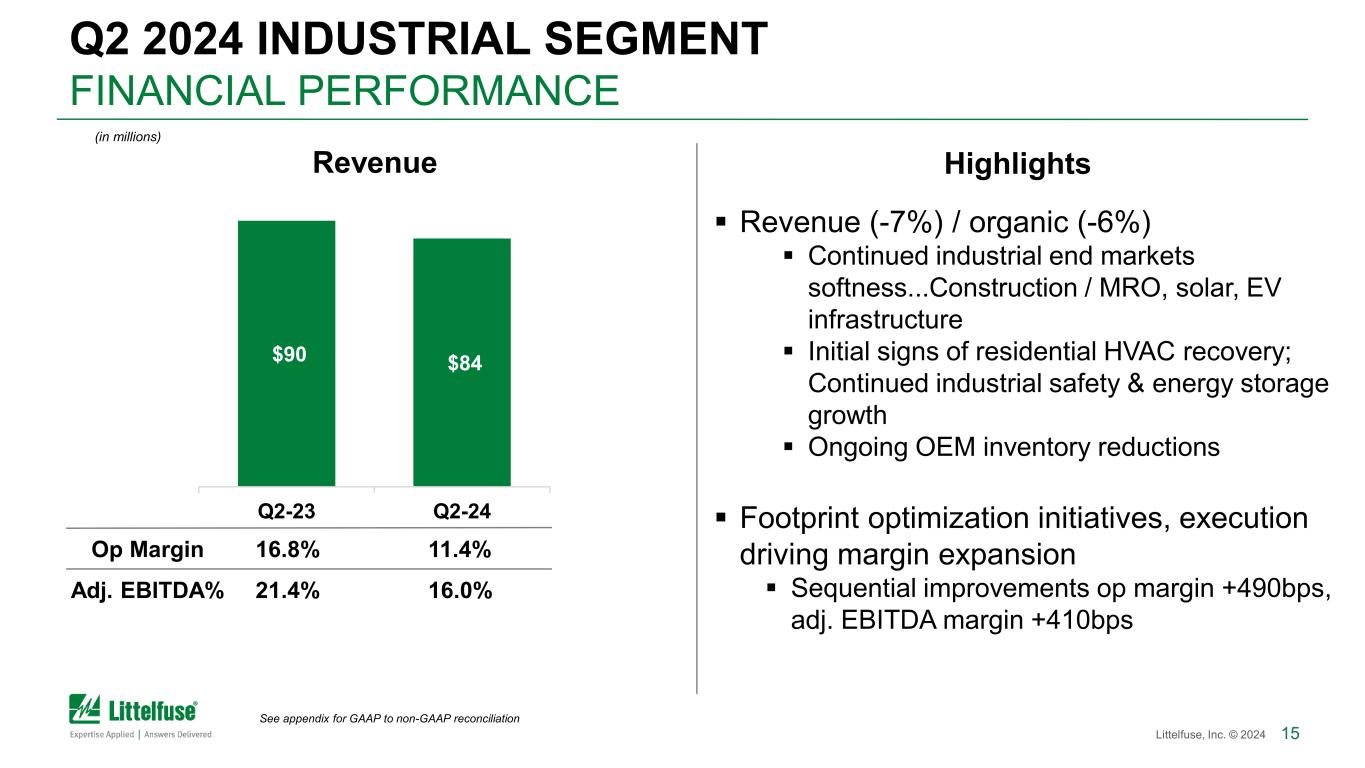

15Littelfuse, Inc. © 2024 $90 $84 Q2-23 Q2-24 Q2 2024 INDUSTRIAL SEGMENT FINANCIAL PERFORMANCE Revenue Revenue (-7%) / organic (-6%) Continued industrial end markets softness...Construction / MRO, solar, EV infrastructure Initial signs of residential HVAC recovery; Continued industrial safety & energy storage growth Ongoing OEM inventory reductions Footprint optimization initiatives, execution driving margin expansion Sequential improvements op margin +490bps, adj. EBITDA margin +410bps (in millions) Op Margin 16.8% 11.4% Adj. EBITDA% 21.4% 16.0% See appendix for GAAP to non-GAAP reconciliation Highlights

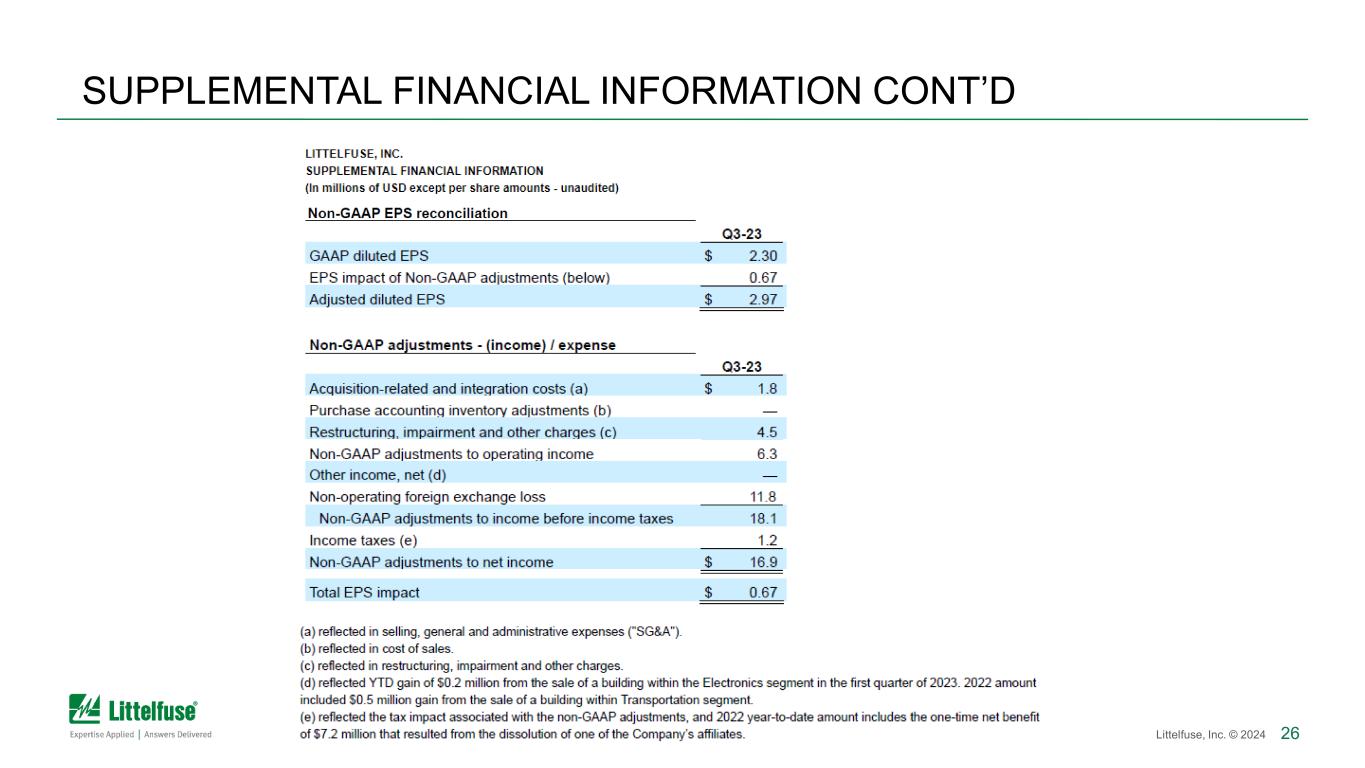

16Littelfuse, Inc. © 2024 Q3 2024 GUIDANCE Macro view…continued dynamic environment but some positive signs Passive electronics destocking largely complete in 1H; some ongoing cautious order patterns Initial pockets of demand recovery Continued soft industrial end markets Persistent commodity headwinds Sales $540 - $570m Essentially flat relative to Q2 (-1%) F/X headwind vs. PY Adj. EPS $1.95 - $2.15 Expected adj. effective tax rate ~26% Headwinds vs. PY: F/X, Commodities and Tax rate ($0.25) EPS; (-50bps) margin (in millions) See appendix for GAAP to non-GAAP reconciliation $607 $558 $540 - $570 Q3-23 Q2-24 Q3-24 Revenue Adj. EPS $2.97 $1.97 $1.95 - $2.15 GAAP EPS $2.30 $1.82 - Highlights

17Littelfuse, Inc. © 2024 FULL YEAR 2024 CONSIDERATIONS / EXPECTATIONS Expect return to sales growth in the fourth quarter, net of portfolio initiatives headwind FY: Pruning impact…(-2%) Company, (-6%) Transportation Segment (heavier Comm. Vehicle) Full year ’24 margin expectations impacted by elongated inventory destocking cycle & end market weakness Company adj. operating margin ~12-14% By segment…Electronics mid-teens; Industrial low-teens; Transportation continued improvement, high single-digits at year end F/X & Commodities: (-1%) headwind to sales; ~($0.40) EPS, (-50bps) margin headwind at current rates Other Assumptions $63m amortization expense $39m interest expense; expect to offset ~2/3 with interest income from cash investment strategies Adj. effective tax rate ~23% Expect ~100% free cash flow conversion Projecting ~$100m investment in capital expenditures

18Littelfuse, Inc. © 2024 DIVERSIFICATION OF TECHNOLOGIES, END MARKETS & GEOGRAPHIES DELIVERS DOUBLE-DIGIT REVENUE & EARNINGS CAGR '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '18 '19 '20 '21 '22 '23 Revenue (M$) Adjusted EPS 15-year* CAGR: Sales +10% EPS +18% Strong track record of top tier financial performance Expanding leadership in core markets while prioritizing strategic investments to bolster diversified portfolio Flexible cost structure drives improved profitability through cycles Proven team with history of successfully executing through dynamic environments *2008 - 2023

19Littelfuse, Inc. © 2024 APPENDIX

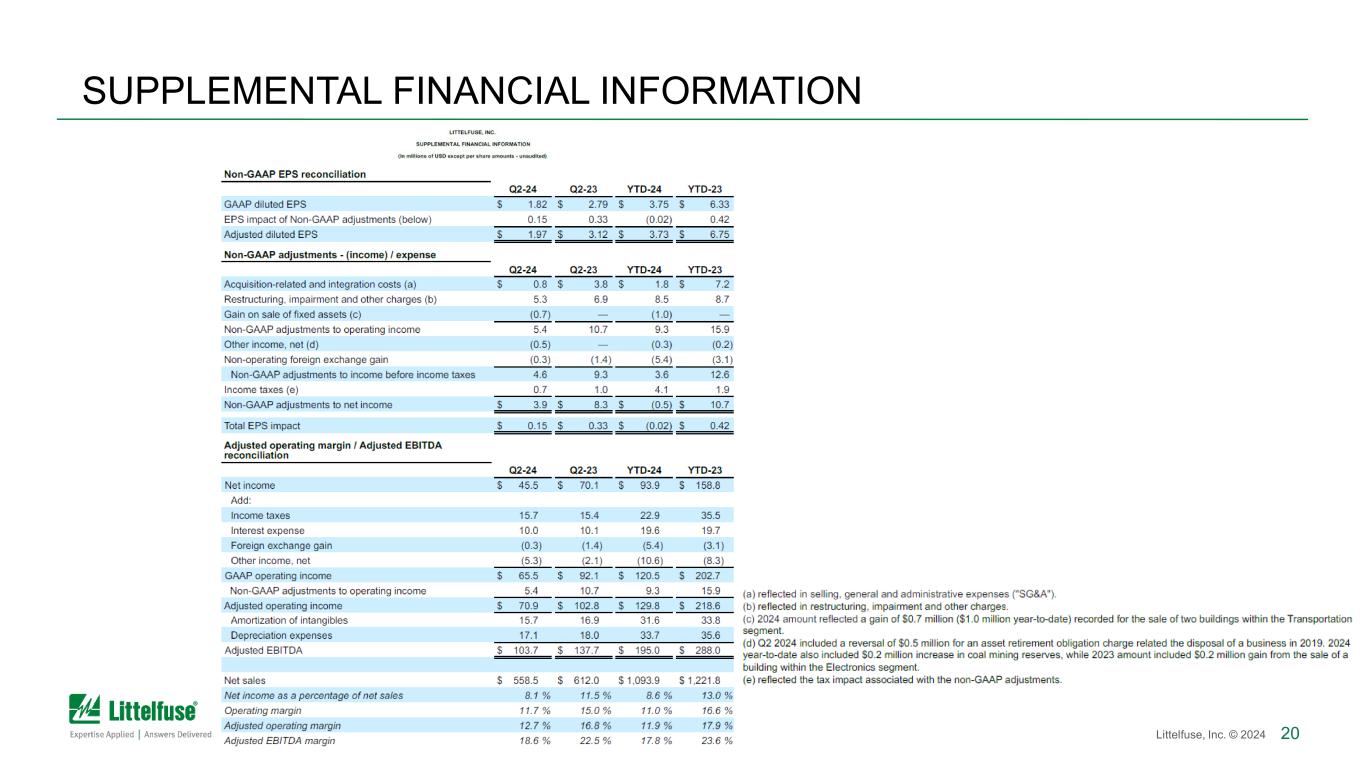

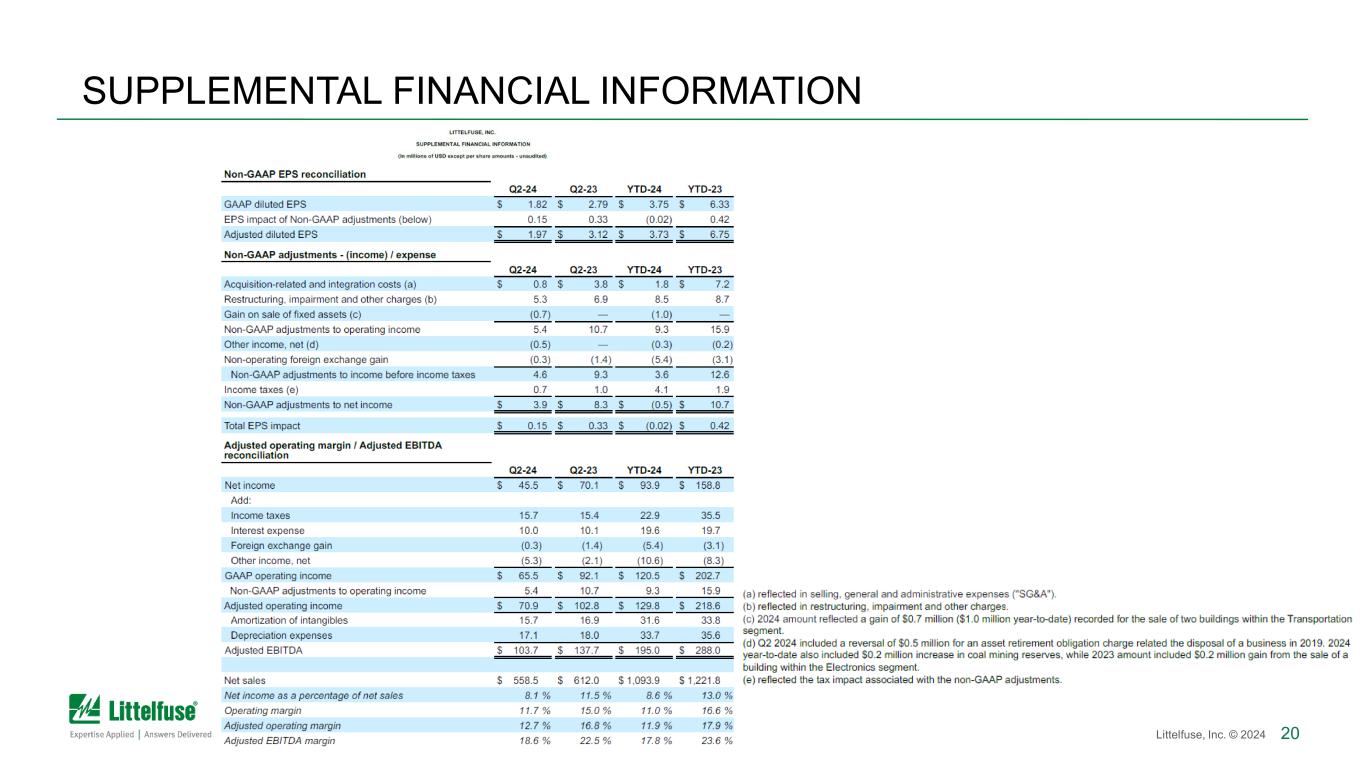

20Littelfuse, Inc. © 2024 SUPPLEMENTAL FINANCIAL INFORMATION

21Littelfuse, Inc. © 2024 SUPPLEMENTAL FINANCIAL INFORMATION CONT’D

22Littelfuse, Inc. © 2024 SUPPLEMENTAL FINANCIAL INFORMATION CONT’D

23Littelfuse, Inc. © 2024 SUPPLEMENTAL FINANCIAL INFORMATION CONT’D

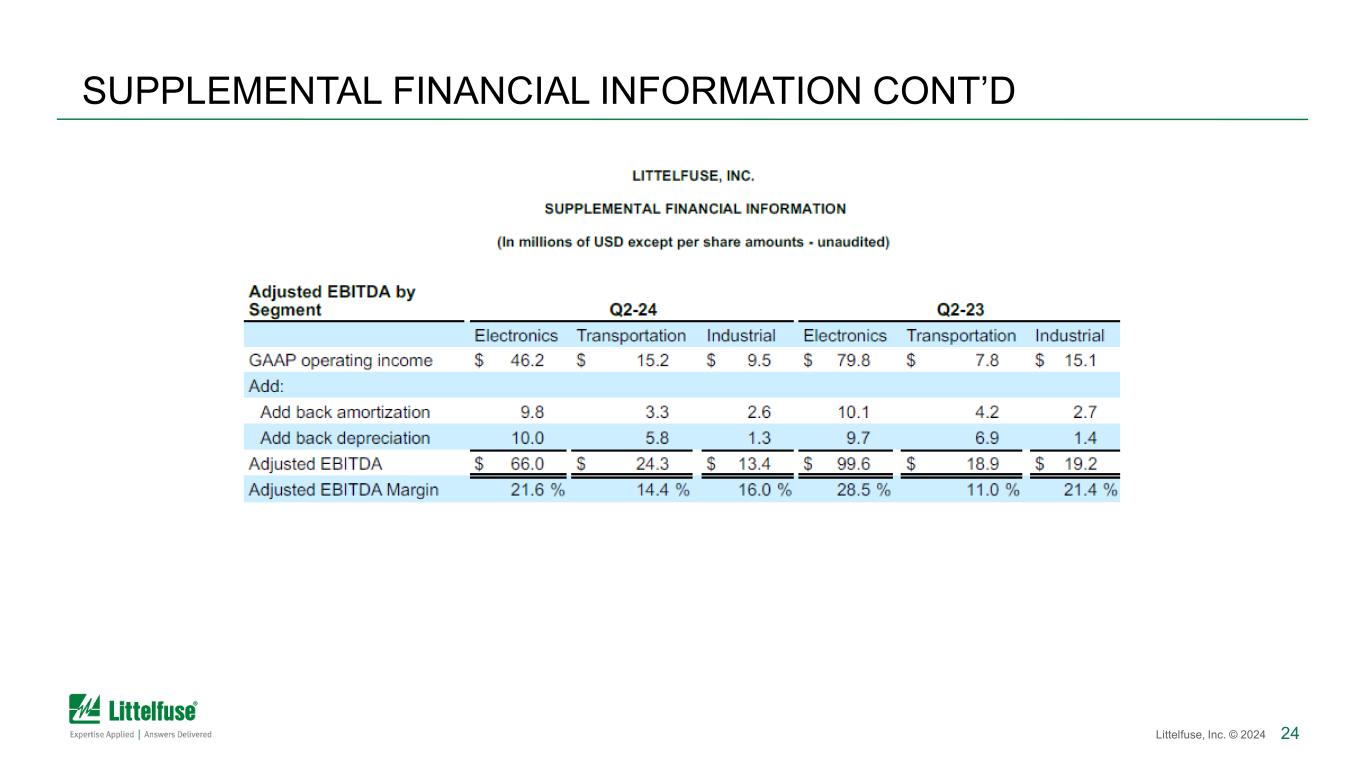

24Littelfuse, Inc. © 2024 SUPPLEMENTAL FINANCIAL INFORMATION CONT’D

25Littelfuse, Inc. © 2024 SUPPLEMENTAL FINANCIAL INFORMATION CONT’D

26Littelfuse, Inc. © 2024 SUPPLEMENTAL FINANCIAL INFORMATION CONT’D