A Premier Supplier of Aircraft Structure NYSE MKT: CVU Roth Capital: 26th Annual Growth Stock Conference Investor Presentation: March 11, 2014

Forward Looking Statements 2 This presentation contains forward - looking statements that involve risks and uncertainties . All statements, other than statements of historical fact, included in this presentation, including without limitation, statements regarding projections, future financing needs, and statements regarding future plans and objectives of the Company, are forward - looking statements . Words such as "believes," "expects," "anticipates," "intends," "plans," "estimates" and similar expressions are intended to identify forward - looking statements . These forward - looking statements are based upon the current expectations of management and certain assumptions that are subject to risks and uncertainties . Accordingly, there can be no assurance that such risks and uncertainties will not affect the accuracy of the forward - looking statements contained herein or that our actual results will not differ materially from the results anticipated in such forward - looking statements . Such factors include, but are not limited to, the following : the cyclicality of the aerospace market, the level of U . S . defense spending, production rates for commercial and military aircraft programs, competitive pricing pressures, start - up costs for new programs, technology and product development risks and uncertainties, product performance, increasing consolidation of customers and suppliers in the aerospace industry and costs resulting from changes to and compliance with applicable regulatory requirements . The information contained in this presentation is qualified in its entirety by cautionary statements and risk factors disclosed in the Company's Securities and Exchange Commission filings, including its Annual Report on Form 10 - K filed on March 13 , 2013 , available at http : //www . sec . gov . We caution readers not to place undue reliance on any forward - looking statements, which speak only as of the date hereof and for which the Company assumes no obligation to update or revise the forward - looking statements herein . CPI AERO is a registered trademark of CPI Aerostructures, Inc . All other trademarks referenced herein are the property of their respective owners .

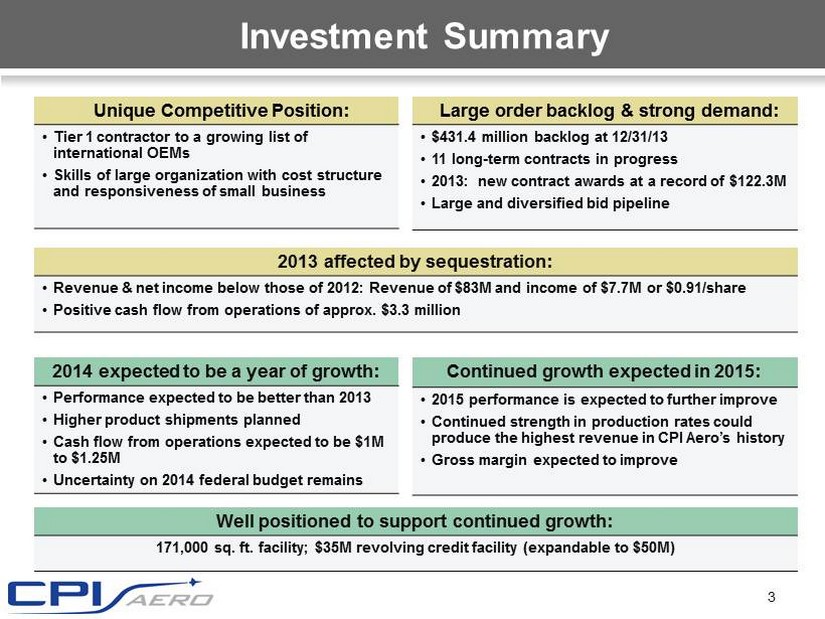

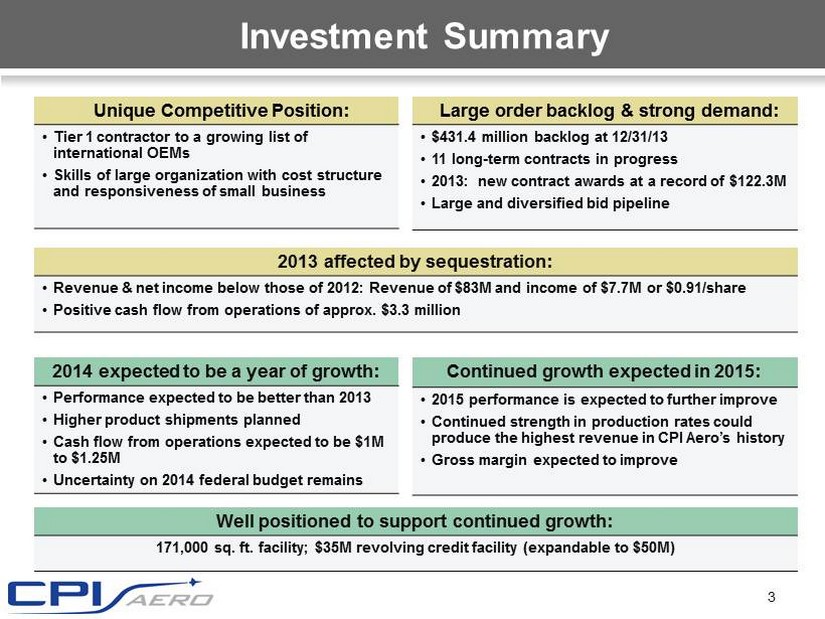

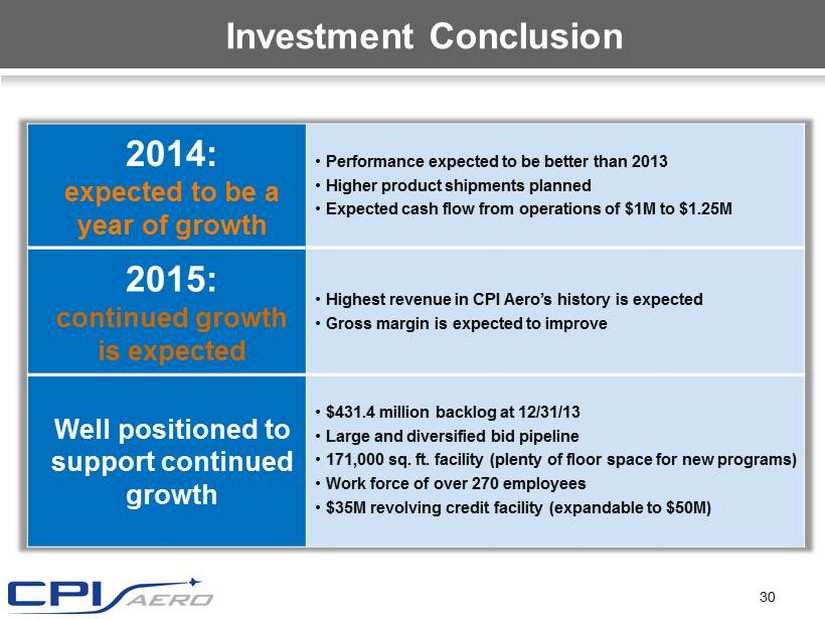

Investment Summary 3 Unique Competitive Position: • Tier 1 contractor to a growing list of international OEMs • Skills of large organization with cost structure and responsiveness of small business 2014 expected to be a year of growth : • Performance expected to be better than 2013 • Higher product shipments planned • Cash flow from operations expected to be $1M to $1.25M • Uncertainty on 2014 federal budget remains Well positioned to support continued growth: 171,000 sq. ft. facility; $35M revolving credit facility (expandable to $50M) Large order backlog & strong demand: • $431.4 million backlog at 12/31/13 • 11 long - term contracts in progress • 2013: new contract awards at a record of $122.3M • Large and diversified bid pipeline 2013 affected by sequestration: • Revenue & net income below those of 2012: Revenue of $83M and income of $7.7M or $0.91/share • Positive cash flow from operations of approx. $3.3 million Continued growth e xpected in 2015: • 2015 performance is expected to further improve • Continued strength in production rates could produce the highest revenue in CPI Aero’s history • Gross margin expected to improve

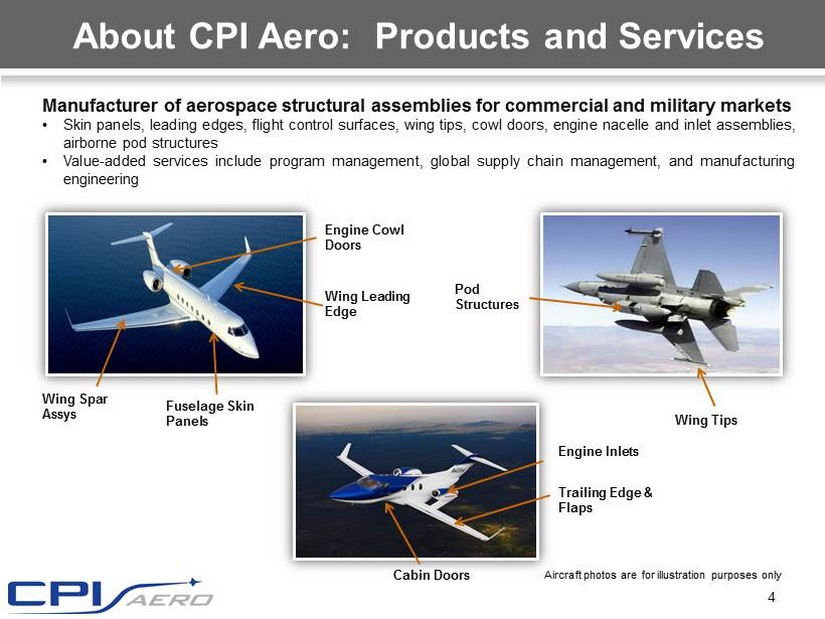

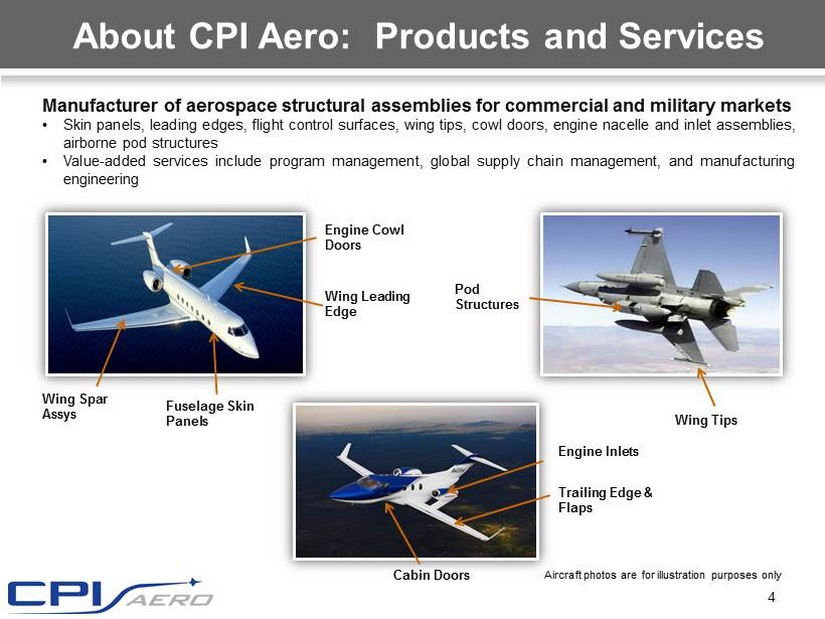

About CPI Aero: Products and Services Manufacturer of aerospace structural assemblies for commercial and military markets • Skin panels, leading edges, flight control surfaces, wing tips, cowl doors, engine nacelle and inlet assemblies, airborne pod structures • Value - added services include program management, global supply chain management, and manufacturing engineering 4 Fuselage Skin Panels Wing Spar Assys Pod Structures Wing Tips Engine Inlets Trailing Edge & Flaps Engine Cowl Doors Cabin Doors Wing Leading Edge Aircraft photos are for illustration purposes only

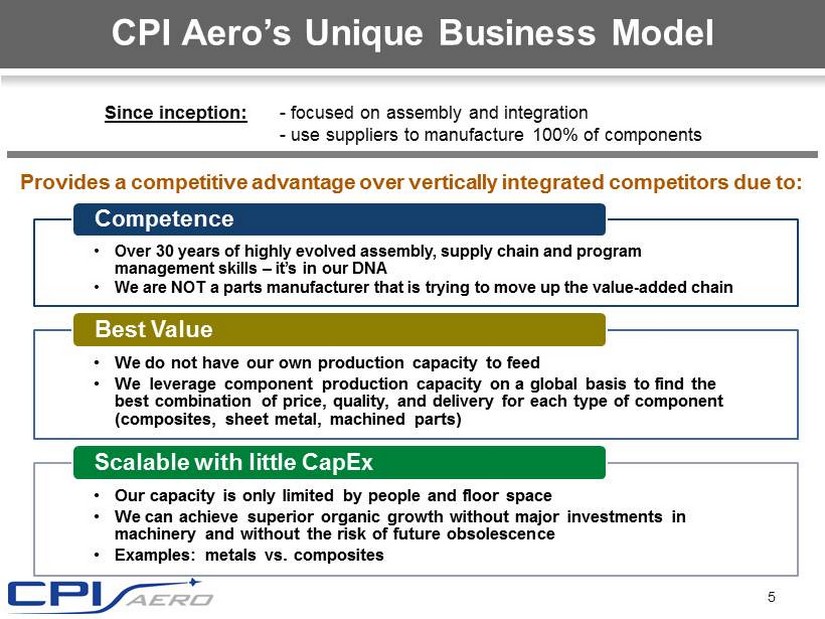

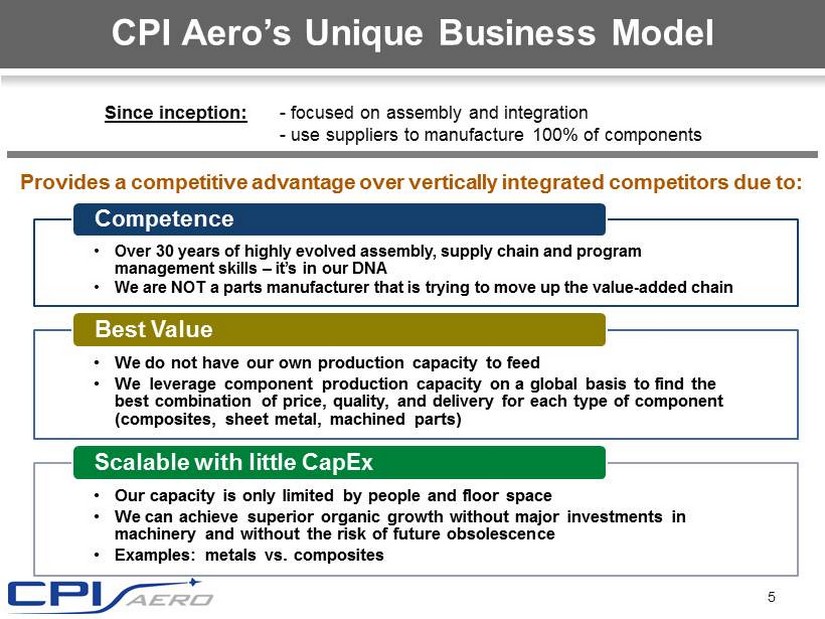

CPI Aero’s Unique Business Model Since inception: - focused on assembly and integration - use suppliers to manufacture 100% of components Provides a competitive advantage over vertically integrated competitors due to: • Over 30 years of highly evolved assembly, supply chain and program management skills – it’s in our DNA • We are NOT a parts manufacturer that is trying to move up the value - added chain Competence • We do not have our own production capacity to feed • We leverage component production capacity on a global basis to find the best combination of price, quality, and delivery for each type of component (composites, sheet metal, machined parts) Best Value • Our capacity is only limited by people and floor space • We can achieve superior organic growth without major investments in machinery and without the risk of future obsolescence • Examples: metals vs. composites Scalable with little CapEx 5

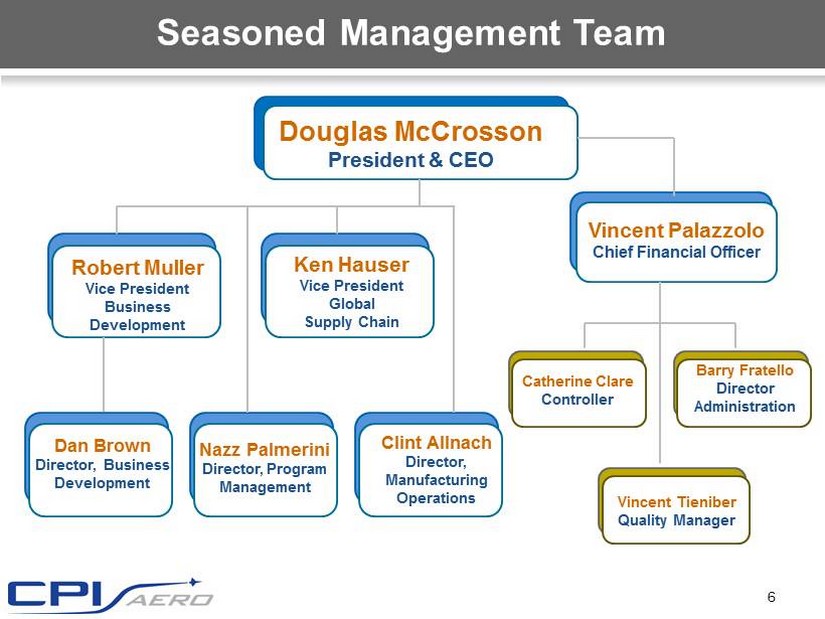

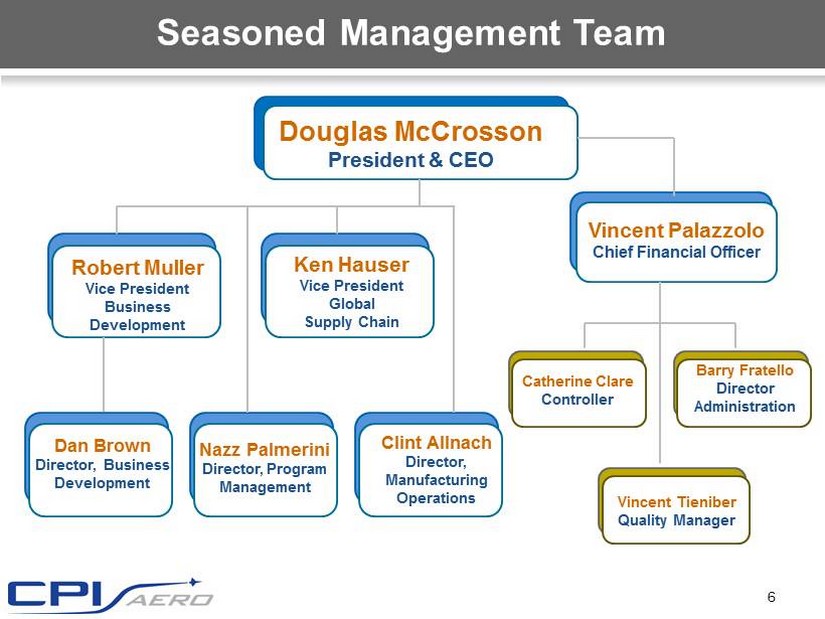

Seasoned Management Team 6 Douglas McCrosson President & CEO Robert Muller Vice President Business Development Ken Hauser Vice President Global Supply Chain Dan Brown Director, Business Development Nazz Palmerini Director, Program Management Clint Allnach Director, Manufacturing Operations Vincent Palazzolo Chief Financial Officer Catherine Clare Controller Barry Fratello Director Administration Vincent Tieniber Quality Manager

CPI Aero’s 171,000 Sq. Ft. Facility 7

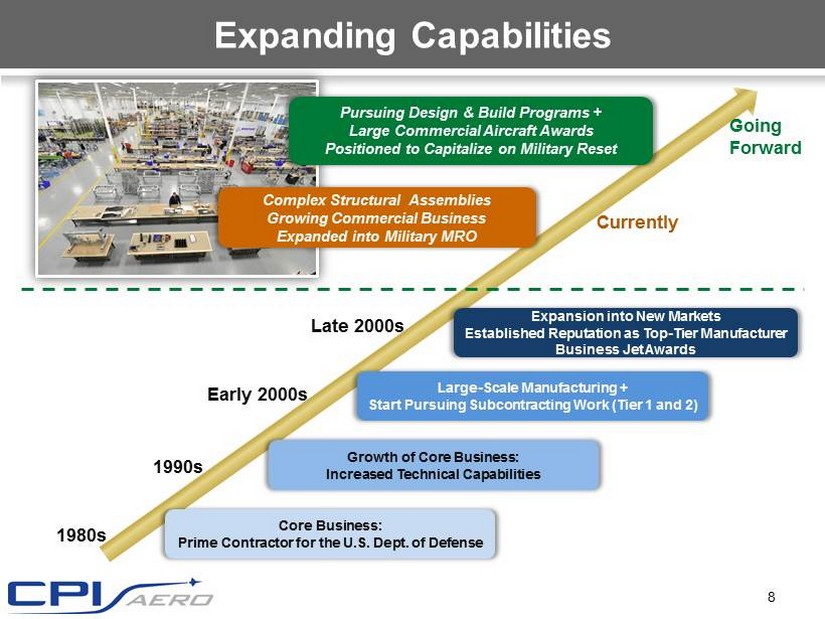

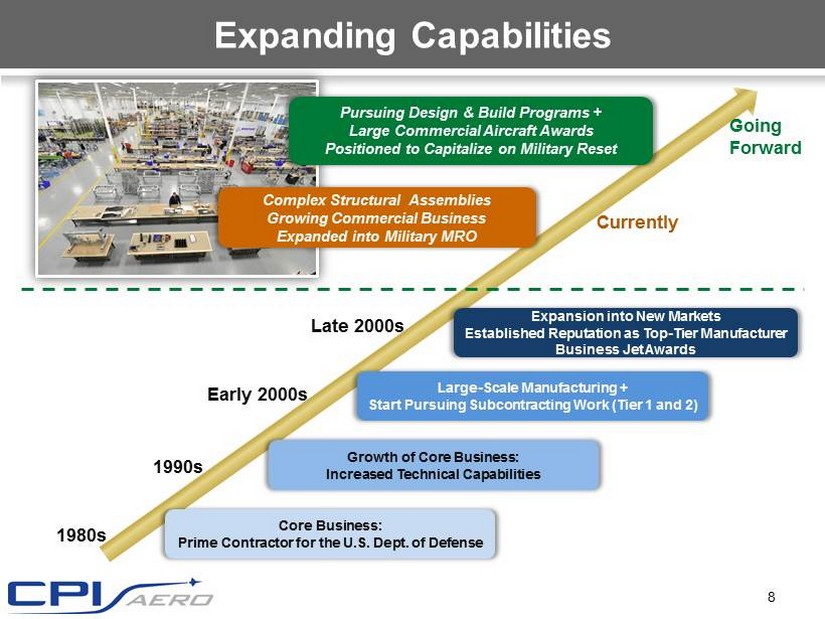

Expanding Capabilities 1980s 1990s Early 2000s Late 2000s Currently Going Forward Core Business: Prime Contractor for the U.S. Dept. of Defense Growth of Core Business: Increased Technical Capabilities Large - Scale Manufacturing + Start Pursuing Subcontracting Work (Tier 1 and 2) Expansion into New Markets Established Reputation as Top - Tier Manufacturer Business Jet Awards Complex Structural Assemblies Growing Commercial Business Expanded into Military MRO Pursuing Design & Build Programs + Large Commercial Aircraft Awards Positioned to Capitalize on Military Reset 8

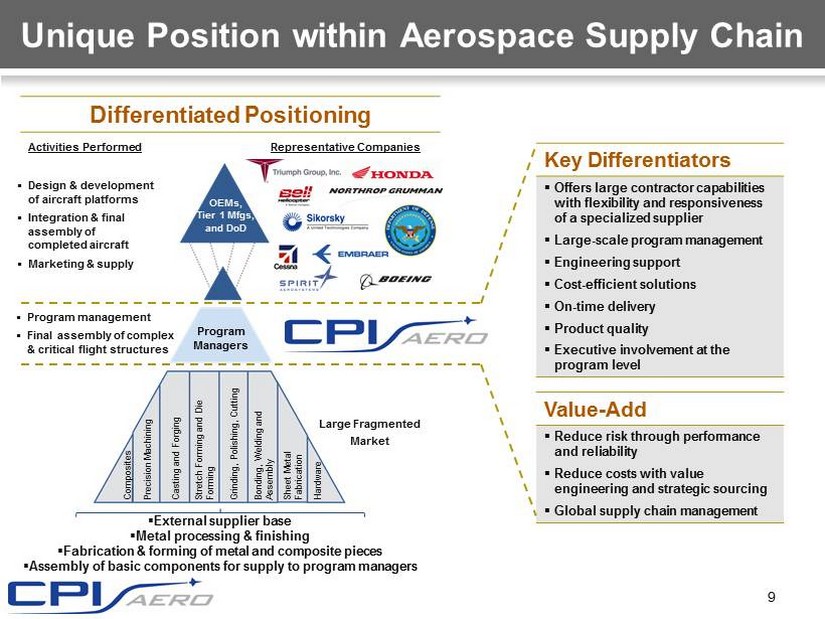

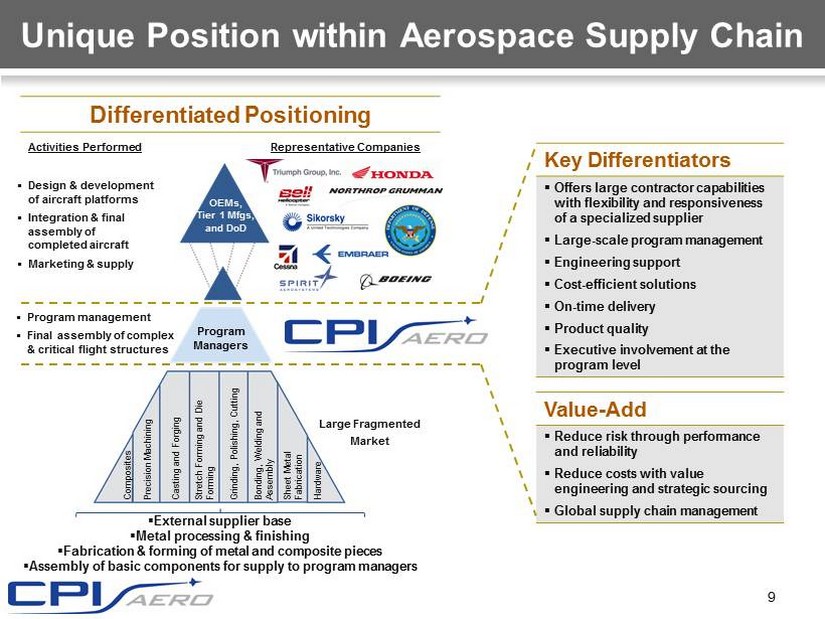

Unique Position within Aerospace Supply Chain Activities Performed Representative Companies ▪ Design & development of aircraft platforms ▪ Integration & final assembly of completed aircraft ▪ Marketing & supply ▪ Program management ▪ Final assembly of complex & critical flight structures ▪ External supplier base ▪ Metal processing & finishing ▪ Fabrication & forming of metal and composite pieces ▪ Assembly of basic components for supply to program managers Composites Precision Machining Casting and Forging Stretch Forming and Die Forming Grinding, Polishing, Cutting Bonding, Welding and Assembly Sheet Metal Fabrication Hardware Large Fragmented Market Program Managers OEMs, Tier 1 Mfgs, and DoD Key Differentiators ▪ Offers large contractor capabilities with flexibility and responsiveness of a specialized supplier ▪ Large - scale program management ▪ Engineering support ▪ Cost - efficient solutions ▪ On - time delivery ▪ Product quality ▪ Executive involvement at the program level Value - Add ▪ Reduce risk through performance and reliability ▪ Reduce costs with value engineering and strategic sourcing ▪ Global supply chain management Differentiated Positioning 9

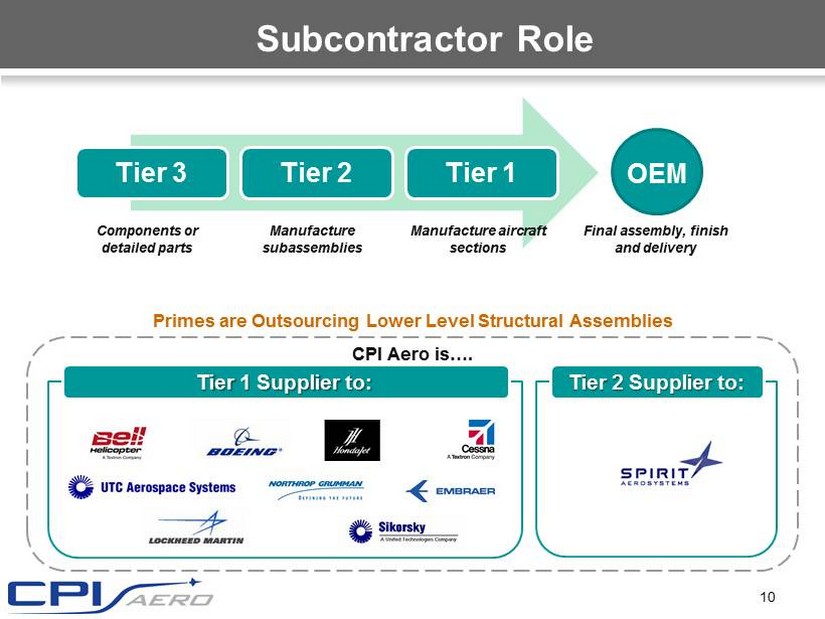

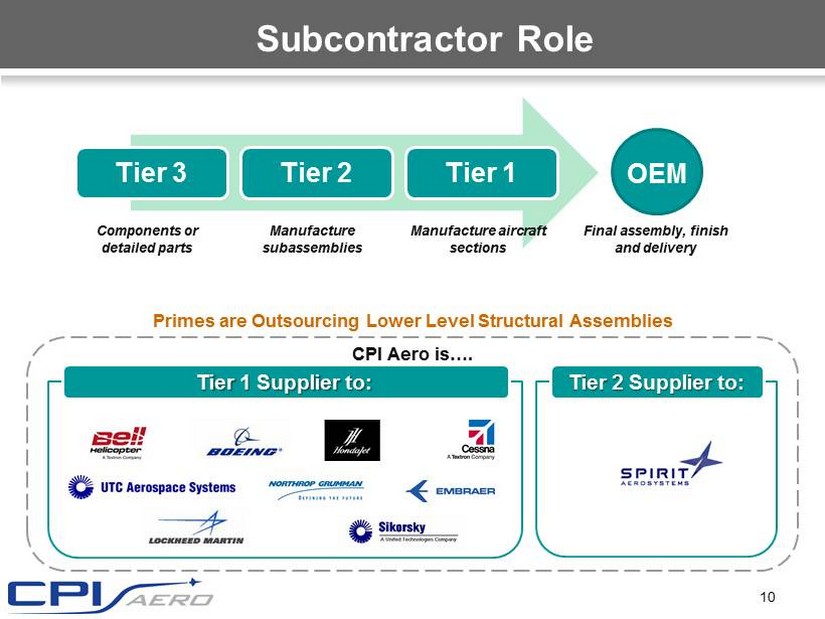

Subcontractor Role Primes are Outsourcing Lower Level Structural Assemblies CPI Aero is…. 10 Tier 3 Tier 1 Tier 2 OEM Components or detailed parts Manufacture subassemblies Manufacture aircraft sections Final assembly, finish and delivery Tier 1 Supplier to: Tier 2 Supplier to:

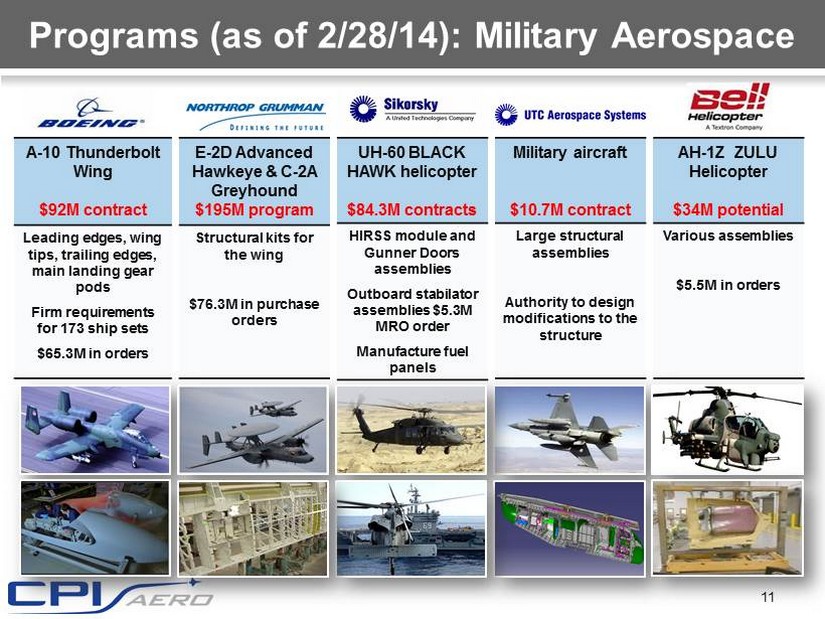

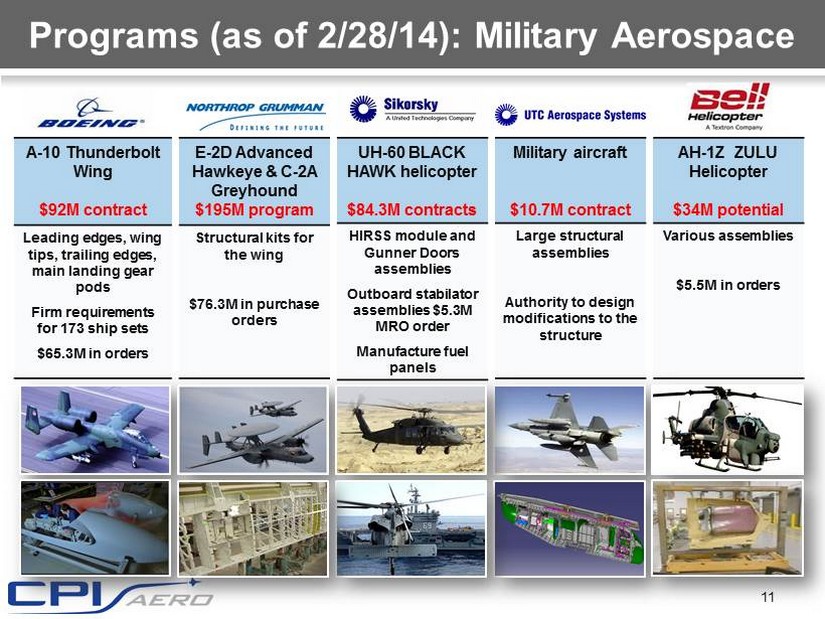

Programs (as of 2/28/14): Military Aerospace A - 10 Thunderbolt Wing $92M contract Leading edges, wing tips, trailing edges, main landing gear pods Firm requirements for 173 ship sets $65.3M in orders E - 2D Advanced Hawkeye & C - 2A Greyhound $195M program Structural kits for the wing $76.3M in purchase orders UH - 60 BLACK HAWK helicopter $84.3M contracts HIRSS module and Gunner Doors assemblies Outboard stabilator assemblies $5.3M MRO order Manufacture fuel panels Military aircraft $10.7M contract Large structural assemblies Authority to design modifications to the structure AH - 1Z ZULU Helicopter $34M potential Various assemblies $5.5M in orders 11

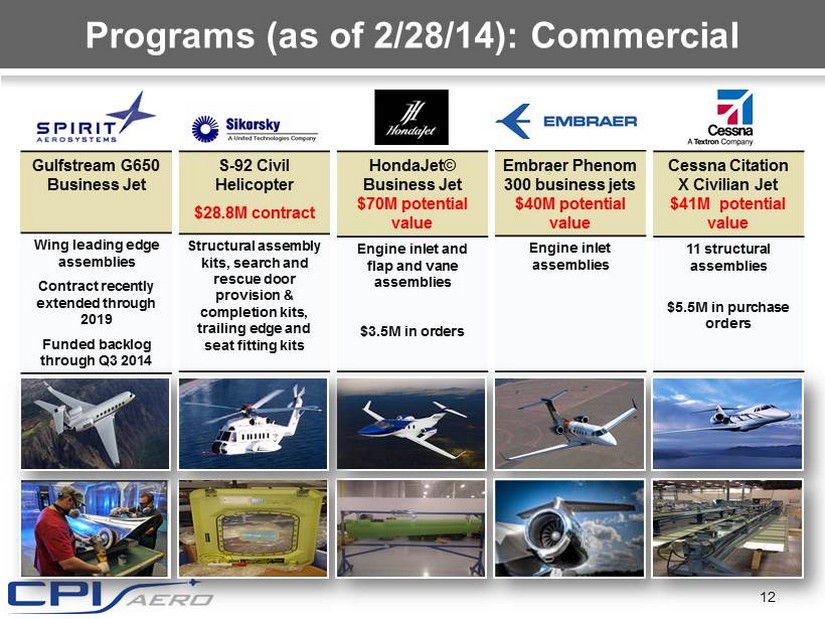

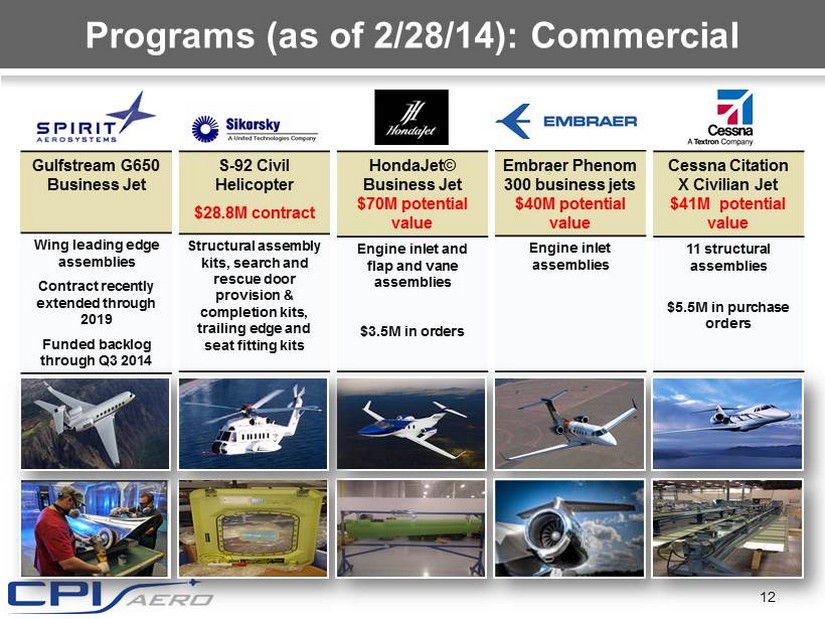

Programs (as of 2/28/14): Commercial Gulfstream G650 Business Jet Wing leading edge assemblies Contract recently extended through 2019 Funded backlog through Q3 2014 S - 92 Civil Helicopter $28.8M contract Structural assembly kits, search and rescue door provision & completion kits, trailing edge and seat fitting kits HondaJet © Business Jet $70M potential value Engine inlet and flap and vane assemblies $3.5M in orders Embraer Phenom 300 business jets $40M potential value Engine inlet assemblies Cessna Citation X Civilian Jet $41M potential value 11 structural assemblies $5.5M in purchase orders 12

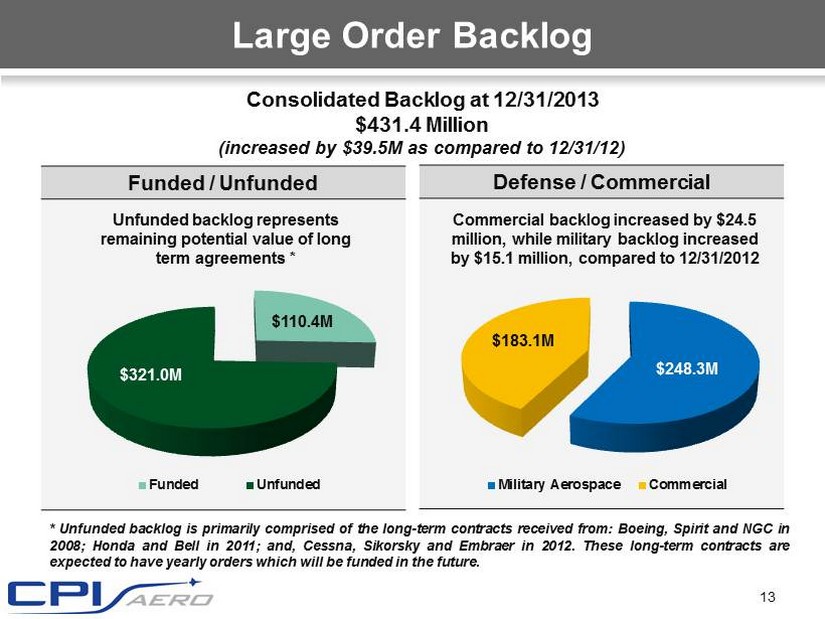

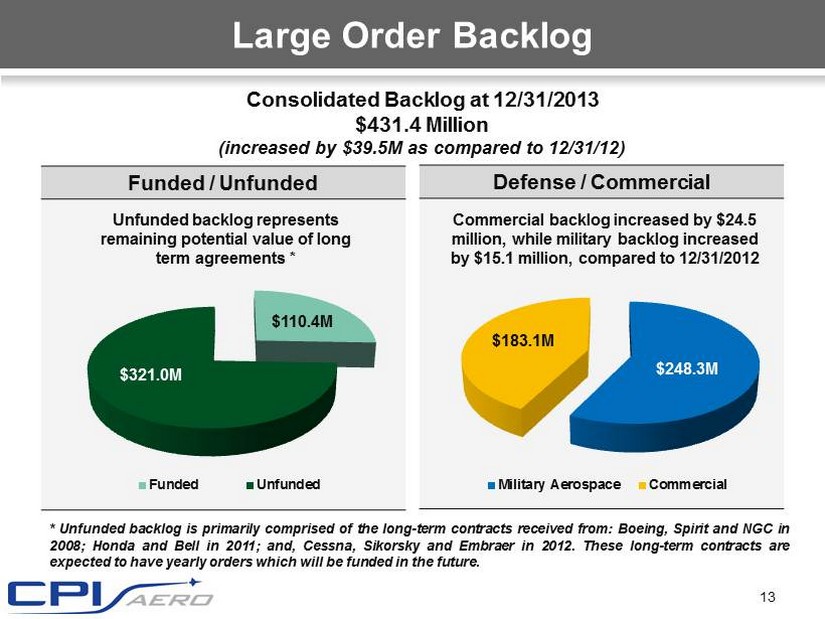

Large Order Backlog Funded / Unfunded $110.4M $ 321.0M Funded Unfunded Unfunded backlog represents remaining potential value of long term agreements * Defense / Commercial Consolidated Backlog at 12/31/2013 $431.4 Million (increased by $39.5M as compared to 12/31/12) $248.3M $183.1M Military Aerospace Commercial Commercial backlog i ncreased by $24.5 million, while military backlog increased by $15.1 million, compared to 12/31/2012 13 * Unfunded backlog is primarily comprised of the long - term contracts received from : Boeing, Spirit and NGC in 2008 ; Honda and Bell in 2011 ; and, Cessna, Sikorsky and Embraer in 2012 . These long - term contracts are expected to have yearly orders which will be funded in the future .

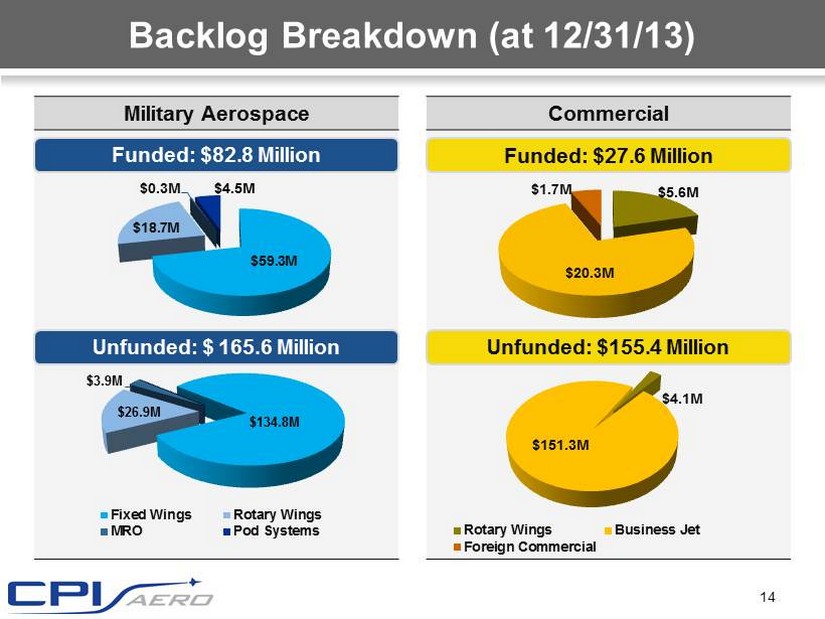

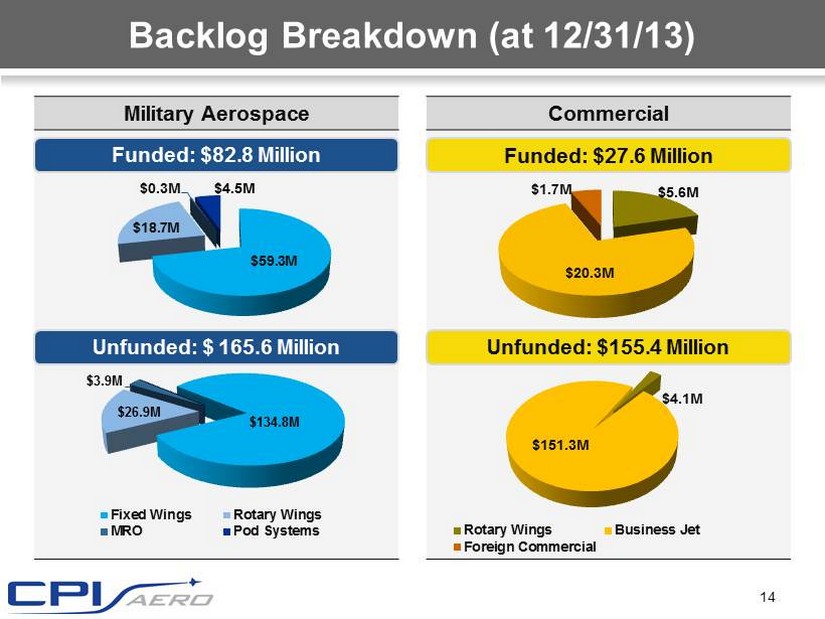

Backlog Breakdown (at 12/31/13) Military Aerospace Commercial $59.3M $18.7M $ 0.3M $4.5M $ 134.8M $26.9M $3.9M Fixed Wings Rotary Wings MRO Pod Systems $5.6M $20.3M $ 1.7M $4.1M $ 151.3M Rotary Wings Business Jet Foreign Commercial 14 Funded: $82.8 Million Unfunded: $ 165.6 Million Funded: $27.6 Million Unfunded: $155.4 Million

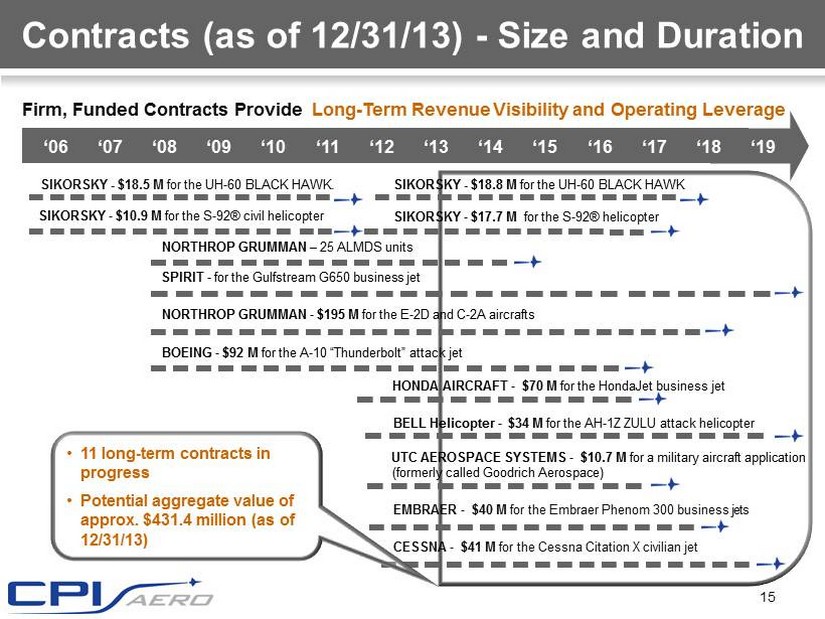

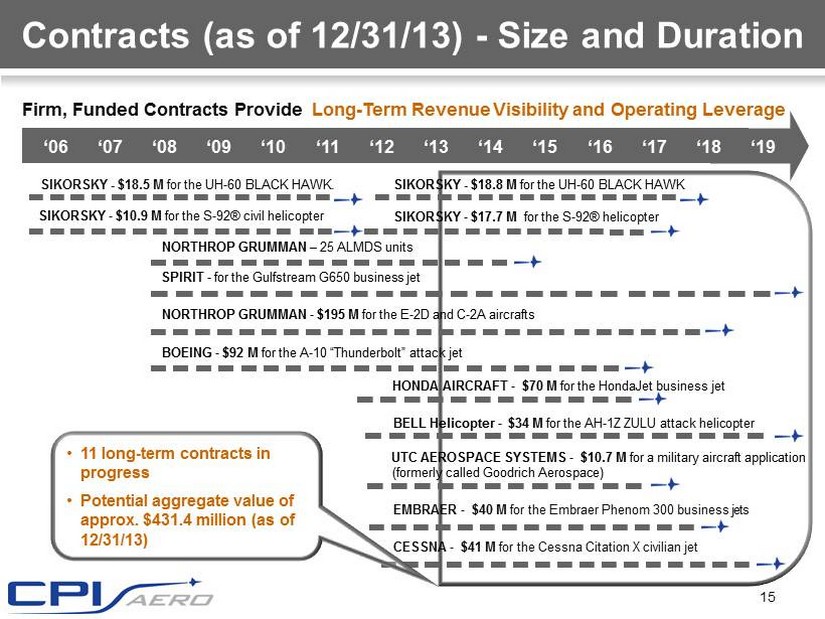

Contracts (as of 12/31/13) - Size and Duration Firm, Funded Contracts Provide Long - Term Revenue Visibility and Operating Leverage ‘06 ‘07 ‘08 ‘09 ‘10 ‘11 ‘12 ‘13 ‘14 ‘15 ‘16 ‘17 ‘18 ‘19 NORTHROP GRUMMAN – 25 ALMDS units NORTHROP GRUMMAN - $195 M for the E - 2D and C - 2A aircrafts SPIRIT - for the Gulfstream G650 business jet BOEING - $92 M for the A - 10 “Thunderbolt” attack jet SIKORSKY - $18.5 M for the UH - 60 BLACK HAWK. SIKORSKY - $10.9 M for the S - 92® civil helicopter SIKORSKY - $17.7 M for the S - 92® helicopter HONDA AIRCRAFT - $70 M for the HondaJet business jet BELL Helicopter - $34 M for the AH - 1Z ZULU attack helicopter UTC AEROSPACE SYSTEMS - $10.7 M for a military aircraft application EMBRAER - $40 M for the Embraer Phenom 300 business jets SIKORSKY - $ 18.8 M for the UH - 60 BLACK HAWK CESSNA - $41 M for the Cessna Citation X civilian jet • 11 long - term contracts in progress • Potential aggregate value of approx. $431.4 million (as of 12/31/13) (formerly called Goodrich Aerospace) 15

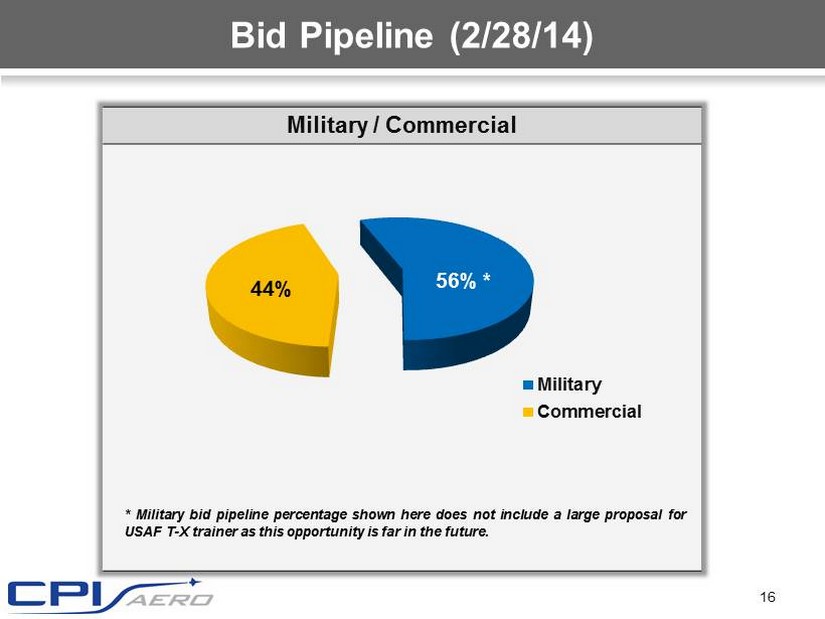

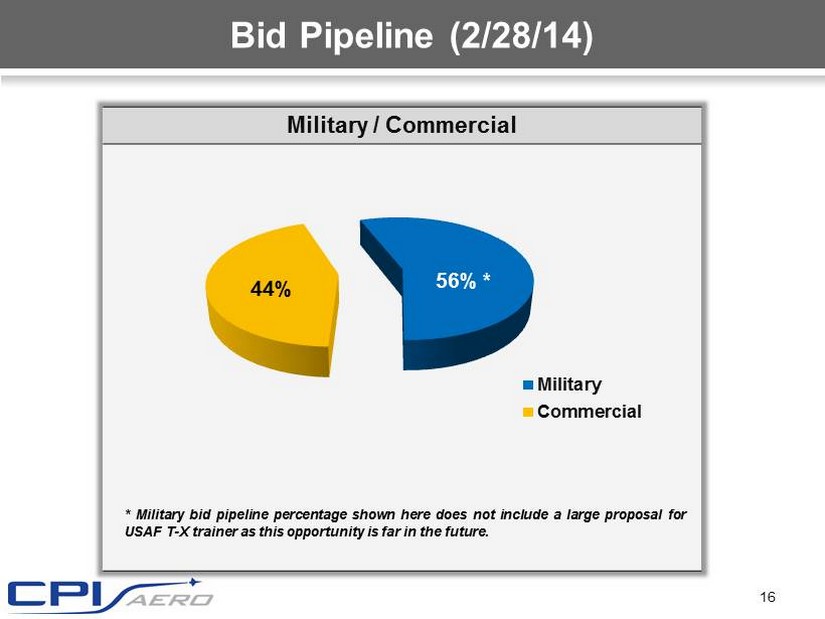

Bid Pipeline (2/28/14) 16 Military / Commercial * Military bid pipeline percentage shown here does not include a large proposal for USAF T - X trainer as this opportunity is far in the future . 56% * 44% Military Commercial

Military Bid Pipeline: Breakdown (2/28/14) 17 Fixed Wing 62% Rotary Wing 26% Pod Systems 7% MRO 5% Fixed Wing Rotary Wing Pod Systems MRO Commercial Light Bizjet 28% Rotary 14% Large Business 31% LCA 27% Light Bizjet Rotary Large Business LCA

Pursue Subcontracts on Large Commercial Aircraft Expand Relationship with Existing Customers (new program opportunities) Additional Growth Opportunities Embraer Boeing Airbus Pursue Subcontracts on Future Defense Programs 18 Future Light Helicopter New USAF Trainer New Presidential Helicopter

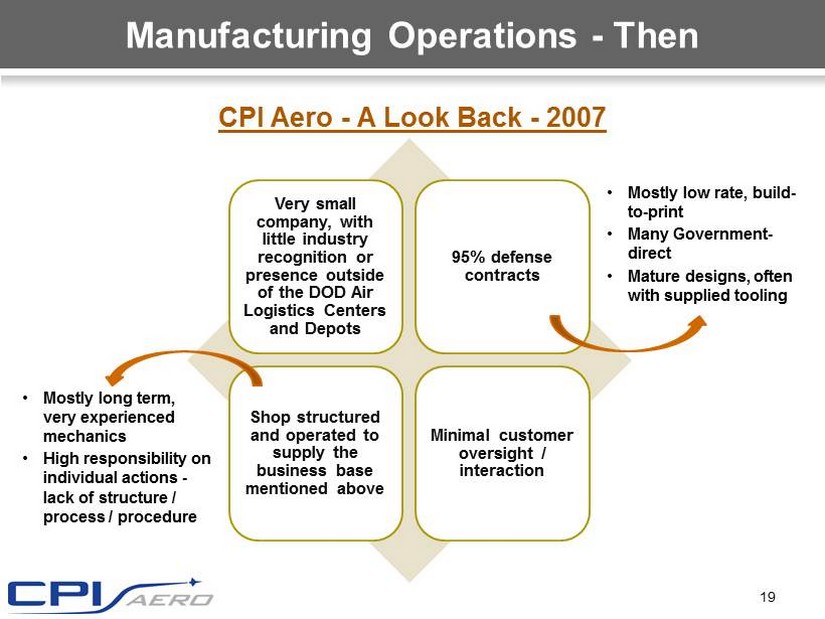

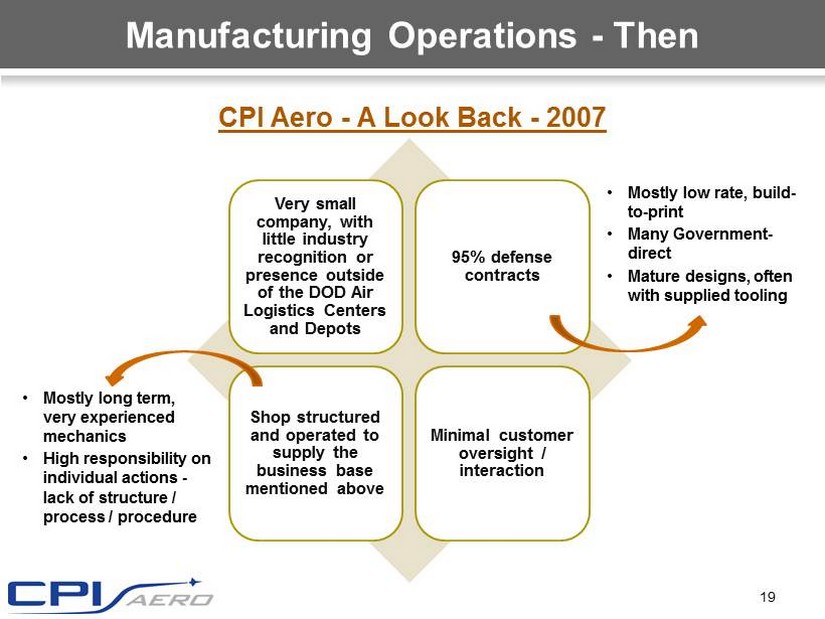

Manufacturing Operations - Then 19 CPI Aero - A Look Back - 2007 Very small company, with little industry recognition or presence outside of the DOD Air Logistics Centers and Depots 95% defense contracts Shop structured and operated to supply the business base mentioned above Minimal customer oversight / interaction • Mostly low rate, build - to - print • Many Government - direct • Mature designs, often with supplied tooling • Mostly long term, very experienced mechanics • High responsibility on individual actions - lack of structure / process / procedure

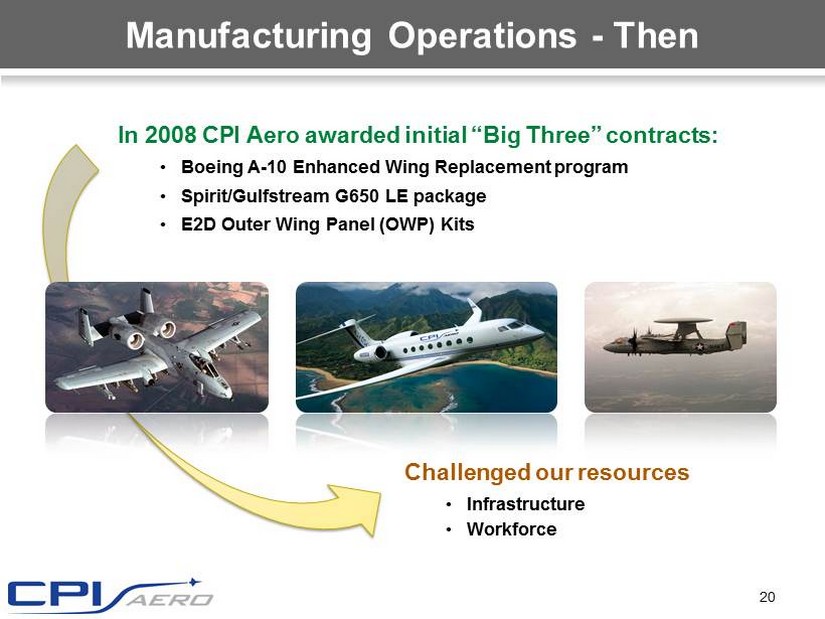

In 2008 CPI Aero awarded initial “Big Three” contracts: • Boeing A - 10 Enhanced Wing Replacement program • Spirit/Gulfstream G650 LE package • E2D Outer Wing Panel (OWP) Kits Manufacturing Operations - Then 20 Challenged our resources • Infrastructure • Workforce

21 Expanded into Military MRO Growing Commercial Business Complex Structural Assemblies Manufacturing Operations - Today Today 1. Engineering Capabilities 2. Tooling Department 3. Manufacturing and Integration

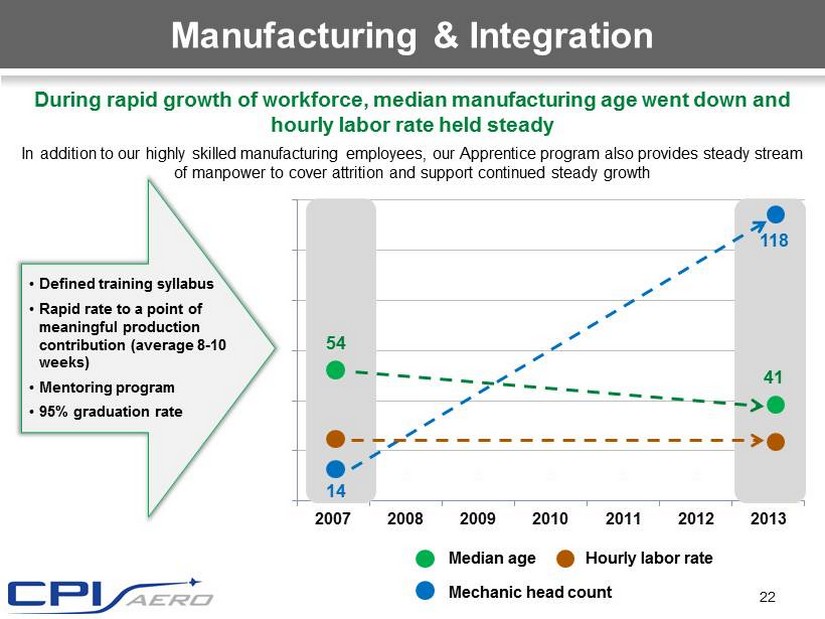

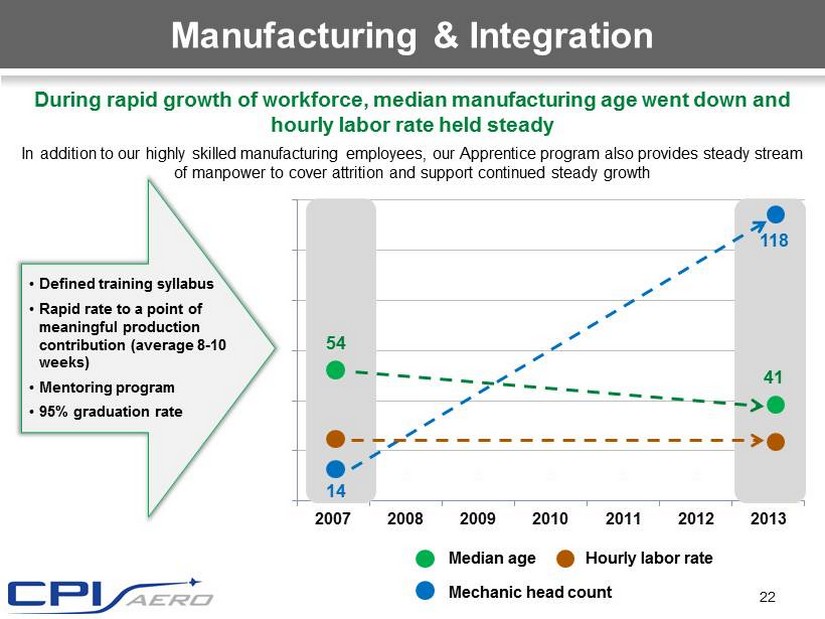

0 20 40 60 80 100 120 2007 2008 2009 2010 2011 2012 2013 During rapid growth of workforce, median manufacturing age went down and hourly labor rate held steady In addition to our highly skilled manufacturing employees, our Apprentice program also provides steady stream of manpower to cover attrition and support continued steady growth Manufacturing & Integration Mechanic head count Median age Hourly labor rate 54 41 14 118 22 • Defined training syllabus • Rapid rate to a point of meaningful production contribution (average 8 - 10 weeks) • Mentoring program • 95% graduation rate

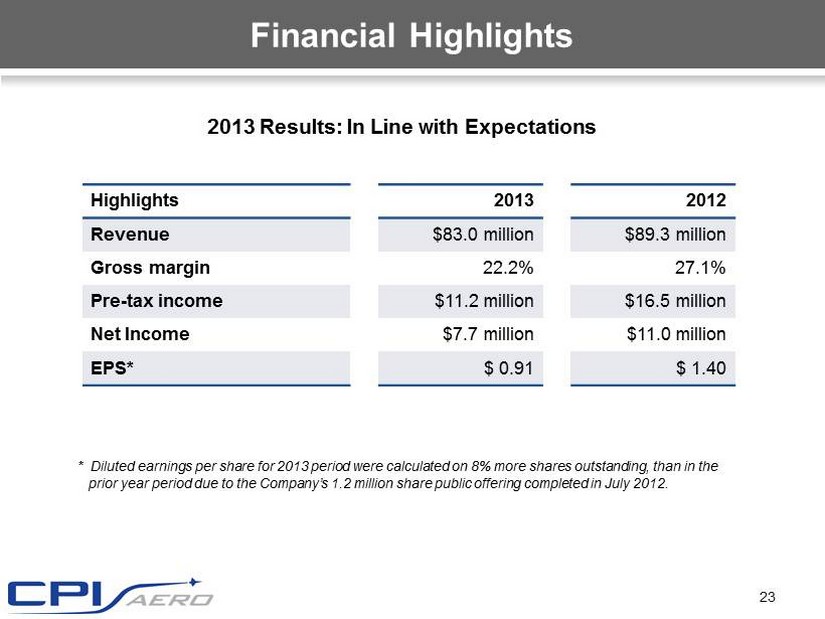

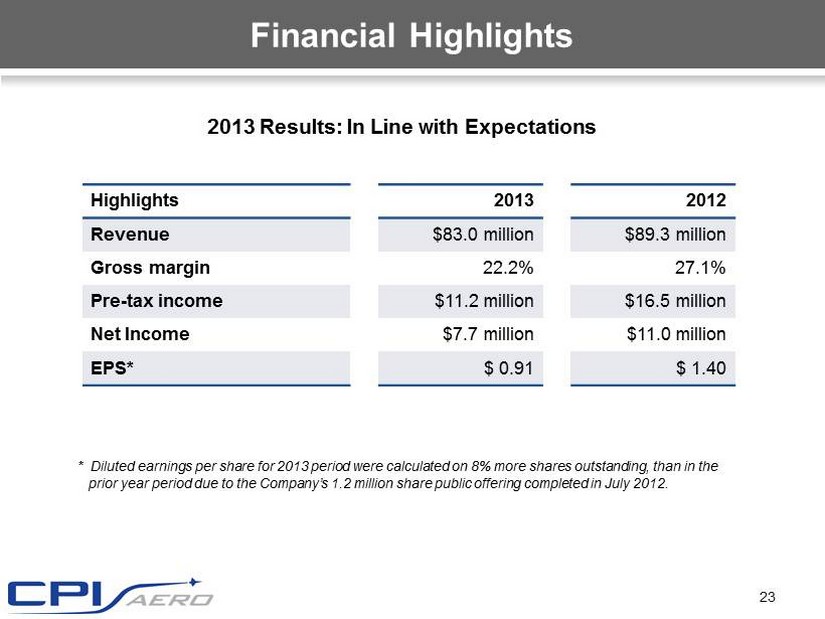

Financial Highlights 23 Highlights Revenue Gross margin Pre - tax income Net Income EPS* 2013 $83.0 million 22.2% $11.2 million $7.7 million $ 0.91 2012 $89.3 million 27.1% $16.5 million $11.0 million $ 1.40 * Diluted earnings per share for 2013 period were calculated on 8% more shares outstanding, than in the prior year period due to the Company’s 1.2 million share public offering completed in July 2012. 2013 Results: In Line with Expectations

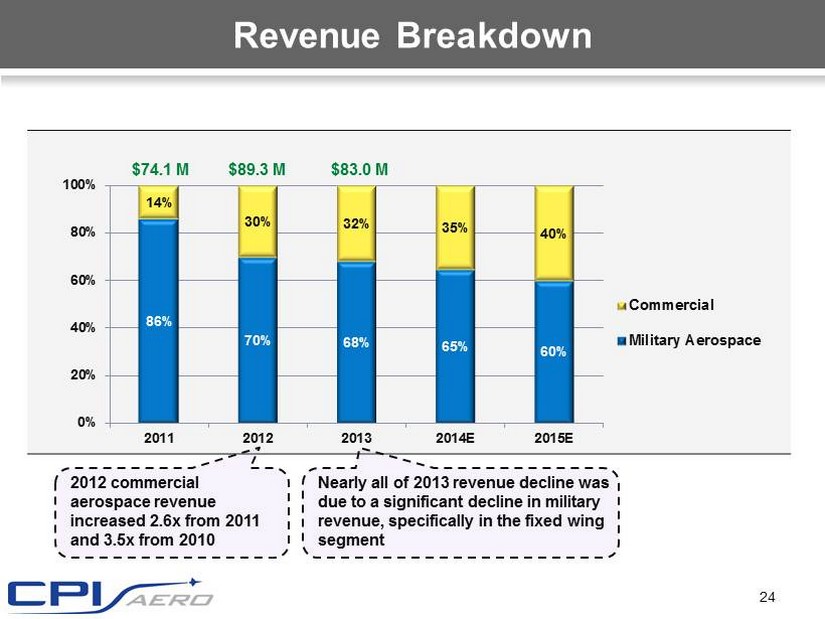

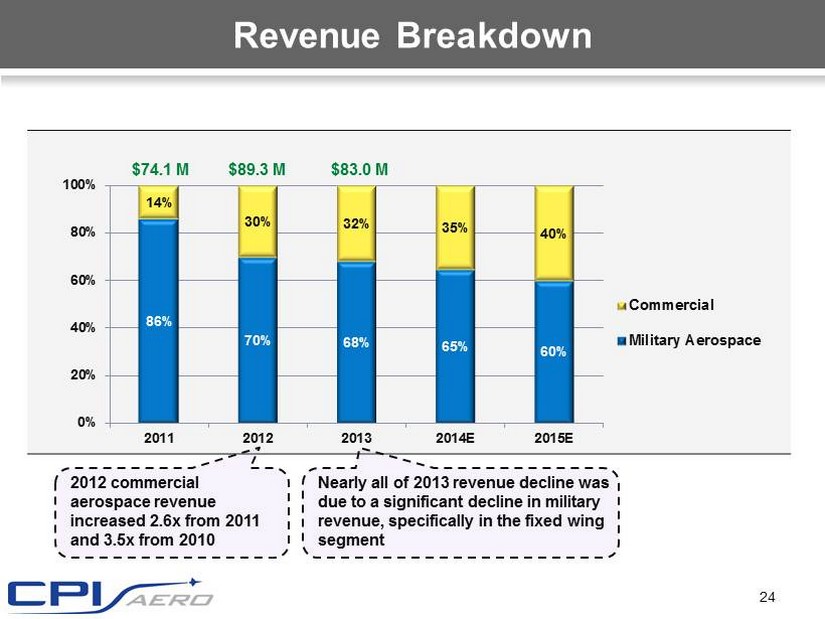

Revenue Breakdown 24 2012 commercial aerospace revenue increased 2.6x from 2011 and 3.5x from 2010 Nearly all of 2013 revenue decline was due to a significant decline in military revenue, specifically in the fixed wing segment 86% 70% 68% 65% 60% 14% 30% 32% 35% 40% 0% 20% 40% 60% 80% 100% 2011 2012 2013 2014E 2015E Commercial Military Aerospace $74.1 M $89.3 M $83.0 M

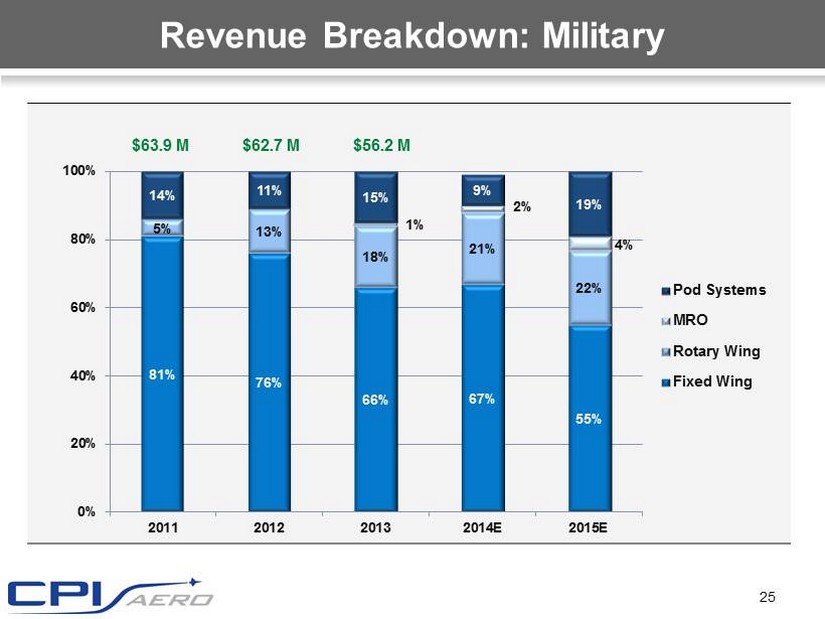

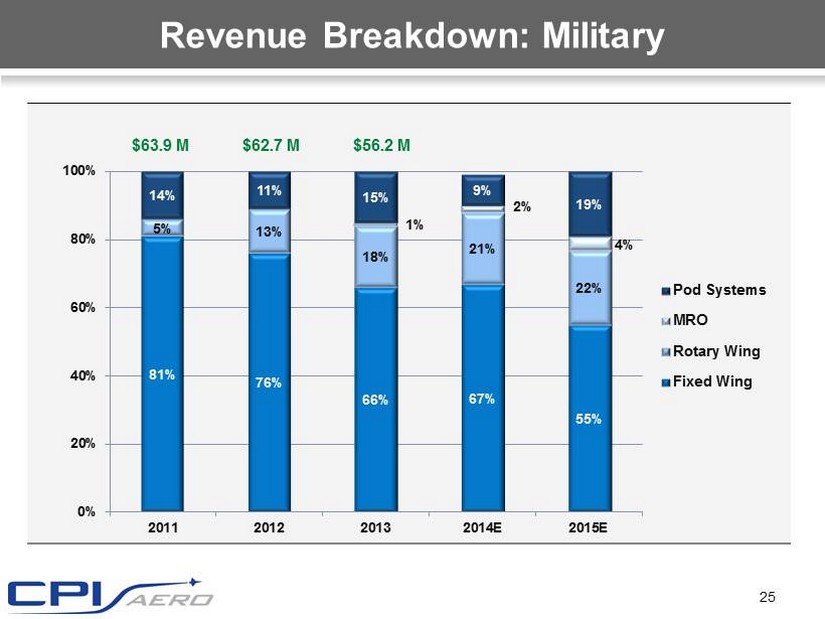

Revenue Breakdown: Military 25 81% 76% 66% 67% 55% 5% 13% 18% 21% 22% 1% 2% 4% 14% 11% 15% 9% 19% 0% 20% 40% 60% 80% 100% 2011 2012 2013 2014E 2015E Pod Systems MRO Rotary Wing Fixed Wing $63.9 M $62.7 M $56.2 M

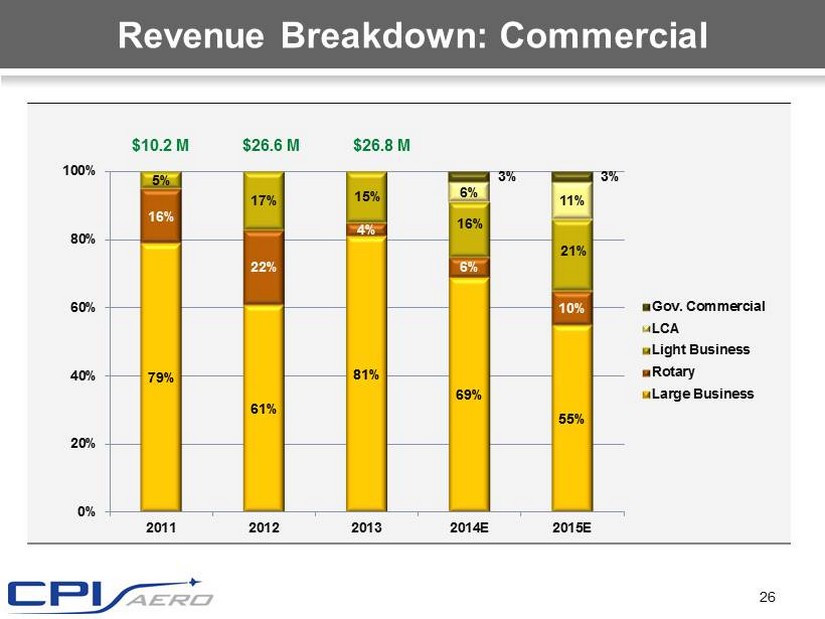

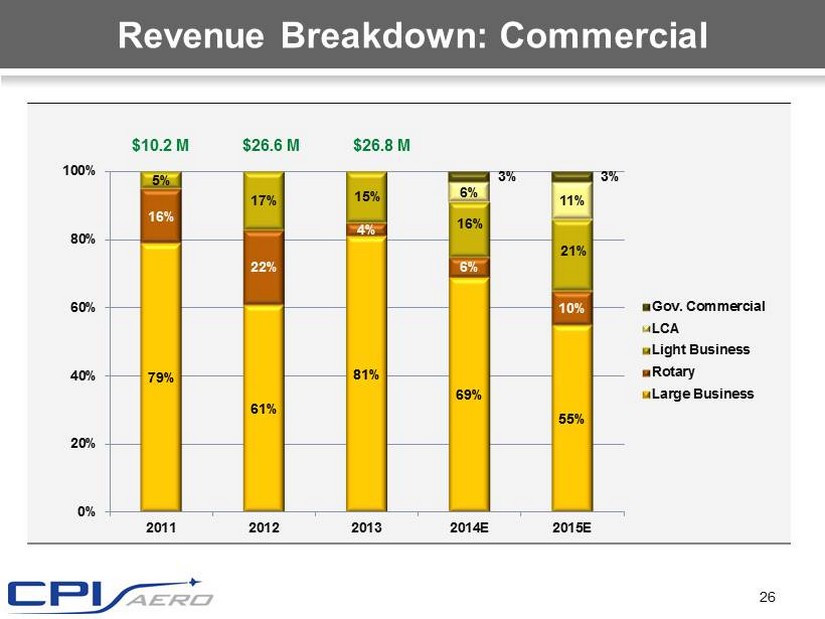

Revenue Breakdown: Commercial 26 79% 61% 81% 69% 55% 16% 22% 4% 6% 10% 5% 17% 15% 16% 21% 6% 11% 3% 3% 0% 20% 40% 60% 80% 100% 2011 2012 2013 2014E 2015E Gov. Commercial LCA Light Business Rotary Large Business $10.2 M $26.6 M $26.8 M

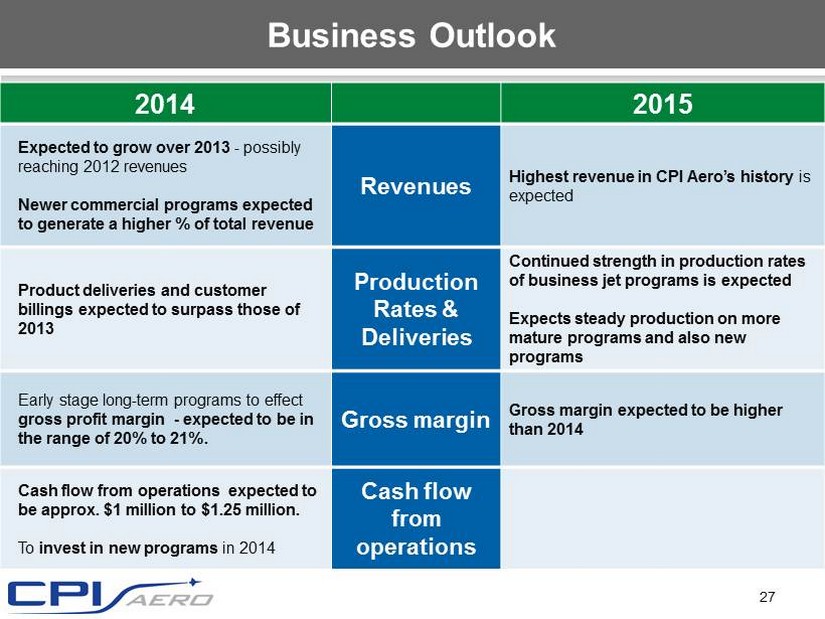

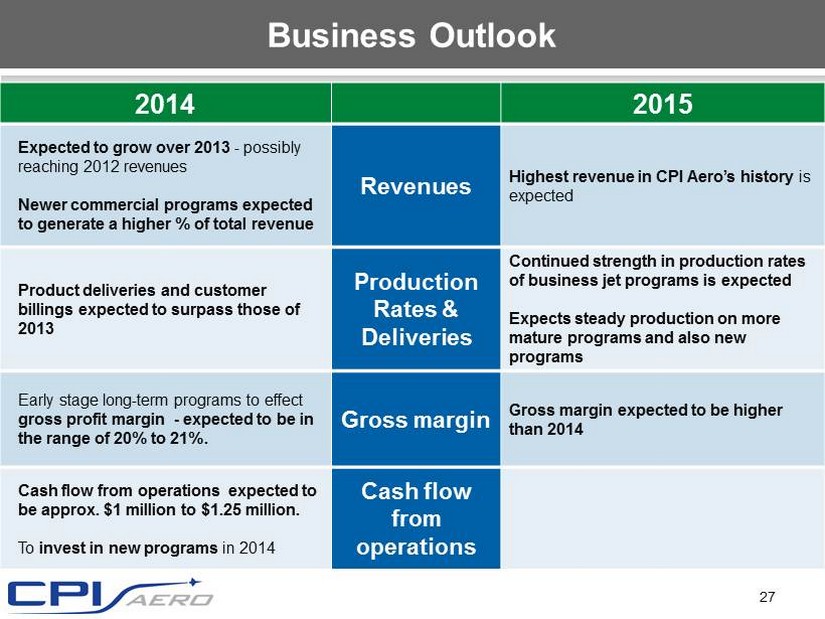

Business Outlook 27 2014 2015 Expected to grow over 2013 - possibly reaching 2012 revenues Newer commercial programs expected to generate a higher % of total revenue Revenues Highest revenue in CPI Aero’s history is expected Product deliveries and customer billings expected to surpass those of 2013 Production Rates & Deliveries Continued strength in production rates of business jet programs is expected Expects s teady production on more mature programs and also new programs Early stage long - term programs to effect gross profit margin - expected to be in the range of 20% to 21%. Gross margin Gross margin expected to be higher than 2014 Cash flow from operations expected to be approx. $1 million to $1.25 million. To invest in new programs in 2014 Cash flow from operations

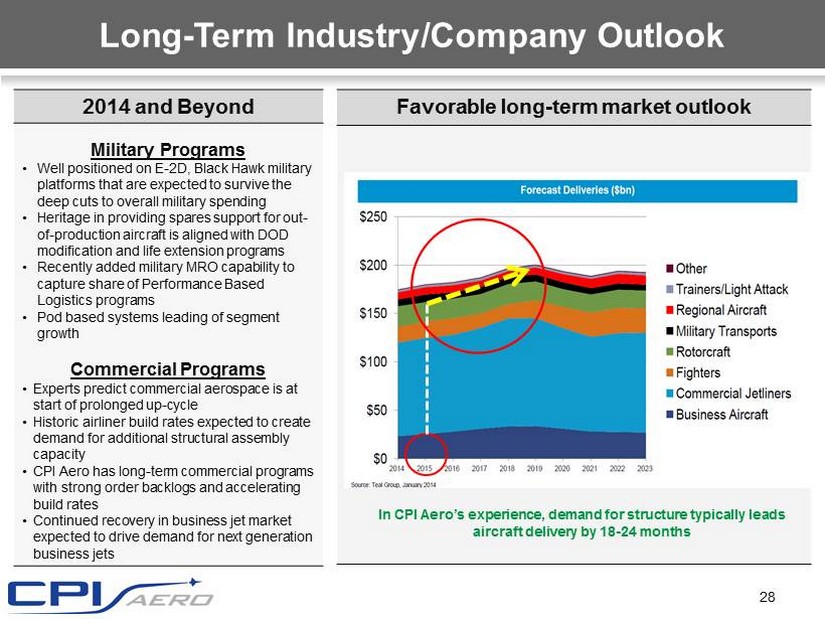

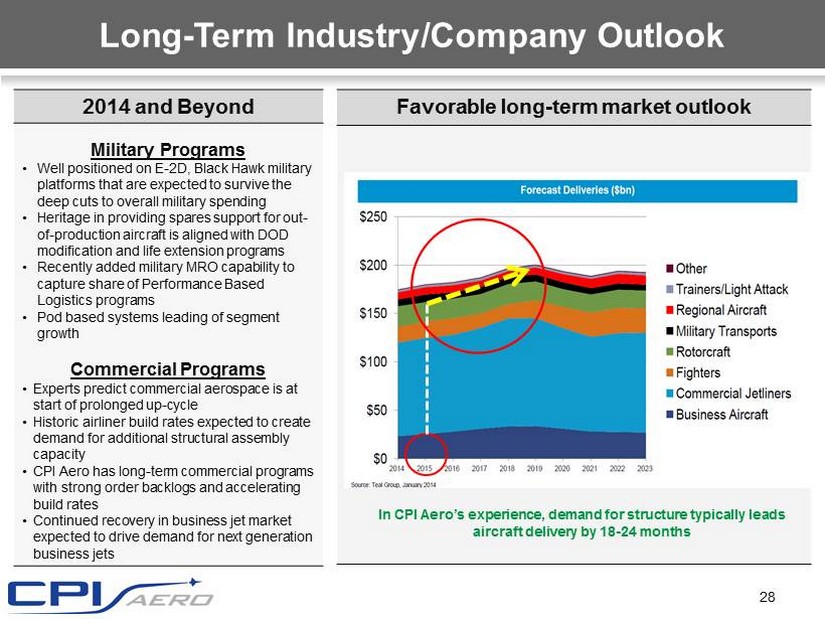

Favorable long - term market outlook Long - Term Industry/Company Outlook 2014 and Beyond Military Programs • Well positioned on E - 2D, Black Hawk military platforms that are expected to survive the deep cuts to overall military spending • Heritage in providing spares support for out - of - production aircraft is aligned with DOD modification and life extension programs • Recently added military MRO capability to capture share of Performance Based Logistics programs • Pod based systems leading of segment growth Commercial Programs • Experts predict commercial aerospace is at start of prolonged up - cycle • Historic airliner build rates expected to create demand for additional structural assembly capacity • CPI Aero has long - term commercial programs with strong order backlogs and accelerating build rates • Continued recovery in business jet market expected to drive demand for next generation business jets 28 In CPI Aero’s experience, demand for structure typically leads aircraft delivery by 18 - 24 months

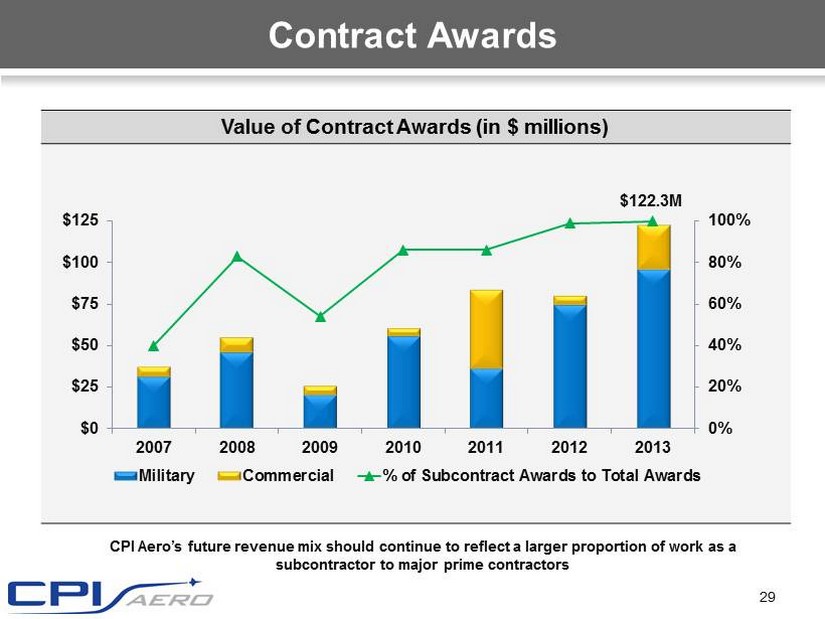

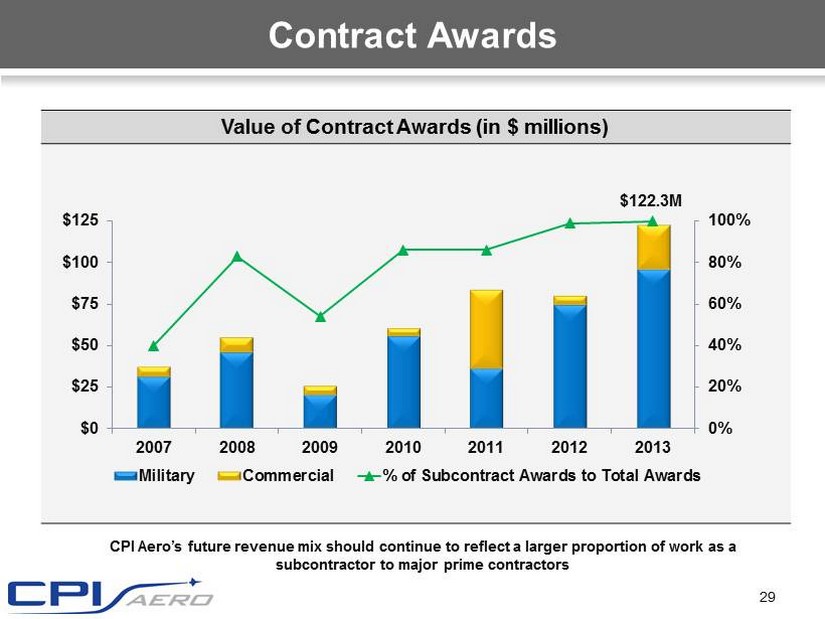

Contract Awards 29 Value of Contract Awards (in $ millions) CPI Aero’s future revenue mix should continue to reflect a larger proportion of work as a subcontractor to major prime contractors 0% 20% 40% 60% 80% 100% $0 $25 $50 $75 $100 $125 2007 2008 2009 2010 2011 2012 2013 Military Commercial % of Subcontract Awards to Total Awards $122.3M

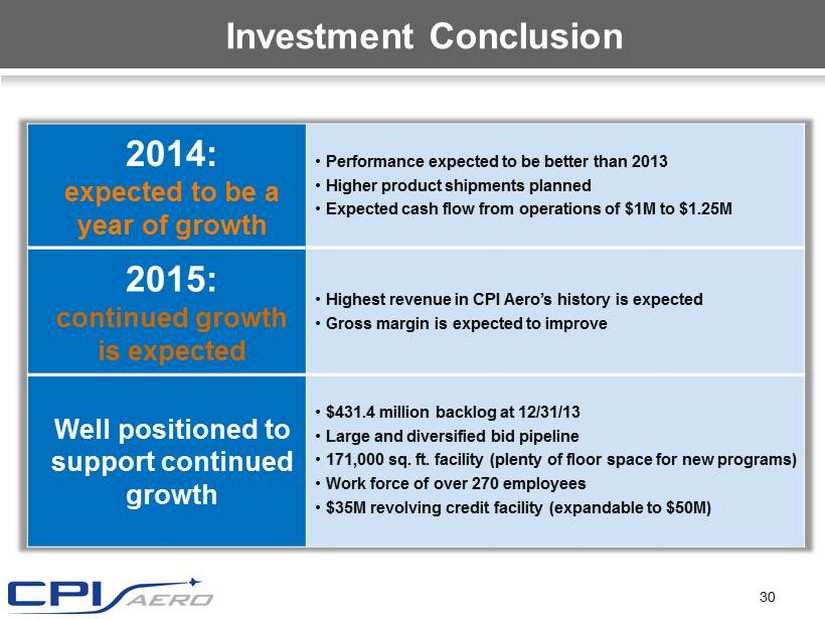

Investment Conclusion 30 2014: expected to be a year of growth • Performance expected to be better than 2013 • Higher product shipments planned • Expected cash flow from operations of $1M to $1.25M 2015: continued growth is e xpected • Highest revenue in CPI Aero’s history is expected • Gross margin is expected to improve Well positioned to support continued growth • $431.4 million backlog at 12/31/13 • Large and diversified bid pipeline • 171,000 sq. ft. facility (plenty of floor space for new programs) • Work force of over 270 employees • $35M revolving credit facility (expandable to $50M)

Contact us CPI Aerostructures Vincent Palazzolo, CFO (631) 586 - 5200 www.cpiaero.com Investor Relations Counsel Lena Cati (212) 836 - 961 www.theequitygroup.com lcati@equityny.com 31