UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-6727

Dominion Funds, Inc.

(Exact name of registrant as specified in charter)

1613 Duke Street, Alexandria, VA 22314

(Address of principal executive offices)(Zip code)

Paul Dietrich, 1613 Duke Street, Alexandria, VA 22314

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 416-2053

Date of fiscal year end: June 30

Date of reporting period: 07/01/07 --- 6/30/08

Item 1. Reports to Stockholders.

ANNUAL REPORT

JUNE 30, 2008

SHEPHERD LARGE CAP GROWTH FUND

A SERIES OF DOMINION FUNDS, INC.

AUGUST 31, 2008

SHEPHERD LARGE CAP GROWTH FUND

Dear Fund Shareholders,

For the year ended June 30, 2008, the Shepherd Large Cap Growth Fund increased 1.20% compared to the S&P 500 Index (total return), which decreased -13.12% for the same period. Given the difficult stock market I am very pleased with our performance. Our performance for the first six months of 2008 was -0.59% compared to the S&P 500 Index (total return) losses of -11.91 for the same period.

ECONOMIC FORECAST FOR 2008 AND EARLY 2009

I believe that we will continue to experience a bear market for the rest of this year and well into 2009.

My investment strategy is DEFENSIVE and most of the Shepherd Fund portfolio is currently in bonds in order to protect your principal in these tough economic times.

I will continue a DEFENSIVE investment strategy focused mainly on bonds until the end of this bear market.

Until then….

Patience!

Paul Dietrich

President & Chief Investment Officer

Opinions expressed are those of Foxhall Capital Management, Inc. and are subject to change, are not guaranteed and should not be considered a recommendation to buy or sell any security.

Mutual fund investing involves risk; loss of principal is possible. This report is intended for shareholder use only and must be preceded or accompanied by a prospectus. Read it carefully before investing or sending money.

Automatic investment plans do not assure a profit and do not protect against a loss in declining markets.

TABLE OF CONTENTS

| | Page |

| | |

| INVESTMENT HIGHLIGHTS | 3 |

| EXPENSE EXAMPLE | 6 |

| Schedule of Investments | 7 |

| Statement of Assets and Liabilities | 9 |

| Statement of Operations | 10 |

| Statements of Changes in Net Assets | 11 |

| Financial Highlights | 12 |

| Notes to Financial Statements | 13 |

| REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 17 |

| ADDITIONAL INFORMATION | 18 |

INVESTMENT HIGHLIGHTS

For the fiscal year, July 1, 2007 to June 30, 2008, the Fund out-performed the S&P 500 Index by 1.20% to -13.12%. During this period, it has been a challenging investment environment for the stock market, with high oil prices, the housing and credit crisis along with a slowing economy.

Foxhall Capital’s investment strategies actively attempt to manage the risks posed by these volatilities by increasing the cash in the Fund’s portfolio when the market is going down and by selling stocks if they hit their “stop-loss target prices.” The Fund also manages risk by being globally diversified.

Also, Foxhall Capital has always believed that in uncertain markets, it is always more prudent to have the avoidance of severe losses in your Fund as your first investment goal, rather than striving for exceptional gains. In the end, that is always the key to success over a full market cycle.

The fact that we held at some times a significant percentage of the Fund in cash, bonds and other conservative defensive stocks during the year for risk management purposes accounts for our out-performing the stock indices for the period July 1, 2007 to June 30, 2008.

Investment Objective; Principal Investment Strategy and Policies

The Fund is a mutual fund whose only investment objective is growth of capital. The Fund invests in a diversified portfolio of common stocks of companies that meet the Fund’s investment and social criteria. Under normal circumstances, the Fund will invest at approximately 70% of its assets in common stocks of large cap companies that the Fund’s investment advisor believes have a good potential for capital growth. The Fund defines “large cap” companies as those whose market capitalization falls within the range of the S&P 500, which at the time of this report was approximately $5 billion to $285 billion.

The Fund includes U.S. stocks and international stocks. The Fund’s investment advisor manages risk in the Fund by increasing the allocation of the money market securities when the stock market is going thru a recession or major correction. The investment advisor also manages risks and limits losses by internationally diversifying the overall investment portfolio, so individual country risk (including country risk in the US), is minimized.

The Fund invests with the philosophy that long-term rewards to investors will come from those organizations whose products, services, and methods enhance traditional American values. To that end, the Fund’s advisor uses a “values-based” non-financial investment analysis intended to specifically seek out companies that support positive values.

Top Ten Holdings and Asset Allocation |

June 30, 2008 |

Top Ten Holdings | (% of Net Assets) | | Asset Allocation by Sector | (% of Net Assets) |

| iShares Lehman TIPS Bond | 11.11% | | Exchange Traded Funds | 36.57% |

| PowerShares DB Commodity Indrx Trking Fund | 8.71% | | Industrial Materials | 22.70% |

| PowerShares DB US Dollar Index Bearish | 7.10% | | Energy | 11.08% |

| CurrencyShares Swedish Krona Trust | 5.00% | | Health Care | 10.54% |

| CurrencyShares Australian Dollar Trust | 4.66% | | Business Services | 8.04% |

| Sociedad Quimica y Minera de Chile SA | 2.52% | | Industrials | 5.05% |

| James River Coal Company | 2.36% | | Consumer Goods | 4.90% |

| BPZ Resources, Inc. | 2.36% | | Software | 2.36% |

| Potash Corp. of Saskatchewan | 2.16% | | Computer Hardware | 1.37% |

| Chart Industries, Inc. | 2.00% | | Liabilities in excess of other assets | (2.61)% |

| | 47.98% | | | 100.00% |

Fund Performance

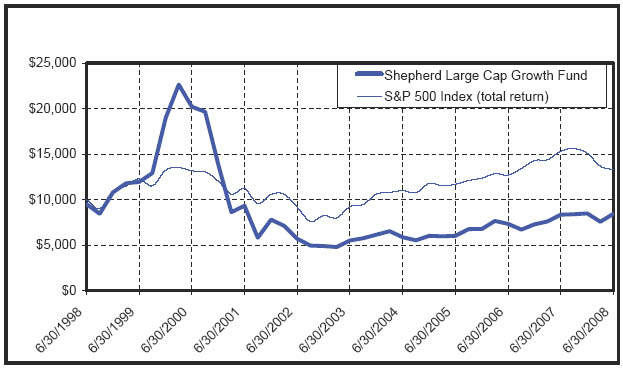

The line graph below compares the initial account value and subsequent account values for the Fund at the end of each of the periods indicated to the same investment over the same periods in the S&P 500 Index (total return). The graph assumes an initial $10,000 investment at the beginning of the first fiscal year and, in the case of the investment in the Fund, net of the Fund's sales load.

The S&P 500 is used for comparison to reflect the Fund’s strategy of investing primarily in large cap stocks. The S&P 500 Index includes 500 common stocks, most of which are listed on the New York Stock Exchange. The Index is a market capitalization-weighted index representing approximately two-thirds of the total market value of all domestic common stocks. One cannot invest directly in an index. Sector allocations are subject to change.

Past performance does not predict future performance. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Current performance of the Fund may be lower or higher than the performance quoted. The graph above and table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Average annual total return of the Fund as of 6/30/08 |

| 1 Year | 5 Years | 10 Years |

| -3.61% | 7.80% | -1.68% |

EXPENSE EXAMPLE

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments; and (2) ongoing costs, including advisory fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (January 1, 2008 through June 30, 2008).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. In addition to the sales load, you will be assessed fees for outgoing wire transfers, returned checks and stop payment orders at prevailing rates charged by Fund Services, Inc., the Funds' transfer agent. Redemption proceeds can be sent via overnight “express” mail (such as Federal Express), if requested, for a $20.00 service charge, or can be sent by wire transfer for a $15.00 fee. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if this transactional cost were included, your costs would have been higher.

| | Beginning Account Value January 1, 2008 | Ending Account Value June 30, 2008 | Expenses Paid During Period* January 1, 2008 to June 30, 2008 |

| Actual | $1,000.00 | $994.11 | $11.25 |

Hypothetical (5% return before expenses) | $1,000.00 | $1,013.58 | $11.36 |

* Expenses are equal to the Fund’s annualized expense ratio of 2.27%, multiplied by the average account value over the period, multiplied by 182/366 (to reflect the one-half year period).

DOMINION FUNDS, INC.

SHEPHERD LARGE CAP GROWTH FUND

Schedule of Investments

June 30, 2008

| | | Shares | | Value | |

COMMON STOCKS - 66.04% | | | | | | | |

Business Services - 8.04% | | | | | | | |

| Chart Industries, Inc. | | | 3,840 | | $ | 186,778 | |

| CSX Corp. | | | 2,210 | | | 138,810 | |

| Clean Harbors, Inc. * | | | 2,070 | | | 147,094 | |

| FTI Consulting Inc. * | | | 2,165 | | | 148,216 | |

| Union PAC Corp. | | | 1,700 | | | 128,350 | |

| | | | | | | 749,248 | |

| | | | | | | | |

Computer Hardware - 1.37% | | | | | | | |

| Western Digital Corp. * | | | 3,700 | | | 127,761 | |

| | | | | | | | |

Consumer Goods - 4.90% | | | | | | | |

| Coca Cola Femsa S.A.B. de CV (ADR) | | | 2,670 | | | 150,561 | |

| Darling International Inc. * | | | 9,275 | | | 153,223 | |

| Flowers Foods Inc. | | | 5,400 | | | 153,036 | |

| | | | | | | 456,820 | |

Energy - 11.08% | | | | | | | |

| Alpha Natural Resources Inc. * | | | 1,500 | | | 156,435 | |

| Contango Oil and Gas Co. * | | | 1,845 | | | 171,437 | |

| Continental Resources Inc. * | | | 2,285 | | | 158,396 | |

| Fording CDN Coal | | | 1,800 | | | 172,098 | |

| James River Coal Company * | | | 3,755 | | | 220,381 | |

| Transocean. Inc. * | | | 1,009 | | | 153,761 | |

| | | | | | | 1,032,508 | |

Health Care - 10.54% | | | | | | | |

| Gilead Sciences Inc. * | | | 2,500 | | | 132,375 | |

| Icon PLC (ADR) * | | | 1,950 | | | 147,264 | |

| Illumina Inc. * | | | 1,790 | | | 155,927 | |

| Martek Biosciences Corp. * | | | 3,995 | | | 134,671 | |

| Novo Nordisk (ADR) | | | 2,054 | | | 135,564 | |

| Parexel International * | | | 5,525 | | | 145,363 | |

| Techne Corp. * | | | 1,700 | | | 131,563 | |

| | | | | | | 982,727 | |

The accompanying notes are an integral part of these financial statements.

DOMINION FUNDS, INC.

SHEPHERD LARGE CAP GROWTH FUND

Schedule of Investments (Continued)

June 30, 2008

| | | Shares | | Value | |

Industrial Materials - 22.70% | | | | | | | |

| Bucyrus International, Inc. | | | 2,240 | | $ | 163,565 | |

| Cal-Maine Foods, Inc. | | | 4,735 | | | 156,208 | |

| CF Industries Holdings, Inc. | | | 1,095 | | | 167,316 | |

| Compania deMinas Buenaventura SA (ADR) | | | 2,310 | | | 151,005 | |

| Companhia Siderurgica Nacional (ADR) | | | 3,265 | | | 144,999 | |

| FMC Corp. | | | 2,265 | | | 175,402 | |

| Joy Global Inc. | | | 1,905 | | | 144,456 | |

| Mosaic Company * | | | 1,200 | | | 173,640 | |

| Nordson Corporation | | | 2,000 | | | 145,780 | |

| Sociedad Quimica y Minera de Chile SA (ADR) | | | 5,035 | | | 234,631 | |

| SPX Corporation | | | 1,150 | | | 151,490 | |

| Syngenta AG ADS (ADR) | | | 2,430 | | | 157,221 | |

| Wabtec Corp. | | | 3,100 | | | 150,722 | |

| | | | | | | 2,116,435 | |

Industrials - 5.05% | | | | | | | |

| Arcelor Mittal Class A (ADR) | | | 1,650 | | | 163,465 | |

| Owens Illinois Inc. * | | | 2,545 | | | 106,101 | |

| Potash Corp. of Saskatchewan (Canada) | | | 880 | | | 201,142 | |

| | | | | | | 470,708 | |

Software - 2.36% | | | | | | | |

| BPZ Resources, Inc. * | | | 7,485 | | | 220,059 | |

| TOTAL COMMON STOCKS (Cost $5,072,214) - 66.04% | | | | | | 6,156,266 | |

| | | | | | | | |

EXCHANGE TRADED FUNDS - 36.57% | | | | | | | |

| CurrencyShares Australian Dollar Trust | | | 4,500 | | | 434,115 | |

| CurrencyShares Swedish Krona Trust | | | 2,800 | | | 466,060 | |

| iShares Lehman TIPS Bond | | | 9,605 | | | 1,035,899 | |

| PowerShares DB Commodity Index Trking Fund | | | 18,100 | | | 811,785 | |

| PowerShares DB US Dollar Index Bearish | | | 22,645 | | | 661,594 | |

| TOTAL EXCHANGE TRADED FUNDS (Cost $3,199,602) | | | | | | 3,409,453 | |

| | | | | | | | |

| TOTAL INVESTMENTS (Cost $8,271,816) - 102.61% | | | | | | 9,565,719 | |

| Liabilities in excess of other assets - Net - (2.61%) | | | | | | (243,787 | ) |

| NET ASSETS - 100% | | | | | $ | 9,321,932 | |

*Non income producing during period; ADR = American Depository Receipts

The accompanying notes are an integral part of these financial statements.

DOMINION FUNDS, INC.

SHEPHERD LARGE CAP GROWTH FUND

Statement of Assets and Liabilities

June 30, 2008

ASSETS | | | | |

| Investments in securities, at value | | | | |

| (cost of $8,271,816) | | $ | 9,565,719 | |

| Dividends receivable | | | 4,996 | |

| | | | | |

| Total Assets | | | 9,570,715 | |

| | | | | |

| | | | | |

LIABILITIES | | | | |

| Payable to custodian | | | 225,158 | |

| Payable for fund shares redeemed | | | 7,132 | |

| Payable to advisor | | | 9,882 | |

| Payable to administrator | | | 6,611 | |

| | | | | |

| Total Liabilities | | | 248,783 | |

| | | | | |

NET ASSETS | | $ | 9,321,932 | |

| | | | | |

| | | | | |

NET ASSETS CONSIST OF: | | | | |

| Capital stock - par value | | $ | 1,844 | |

| Paid in capital | | | 11,825,801 | |

| Accumulated net realized loss | | | (3,799,616 | ) |

| Net unrealized appreciation | | | 1,293,903 | |

| | | | | |

NET ASSETS | | $ | 9,321,932 | |

| | | | | |

CAPITAL SHARES OUTSTANDING | | | | |

| (200,000,000 authorized shares; $.001 par value) | | | 1,843,570 | |

| | | | | |

NET ASSET VALUE PER SHARE | | $ | 5.06 | |

| | | | | |

OFFERING PRICE PER SHARE (net asset value plus sales charge of 4.75% of the offering price) | | $ | 5.31 | |

The accompanying notes are an integral part of these financial statements.

DOMINION FUNDS, INC.

SHEPHERD LARGE CAP GROWTH FUND

Statement of Operations

For the Year Ended June 30, 2008

Investment Income | | | | |

| Dividends (net of foreign taxes withheld of $5,974) | | $ | 104,614 | |

| Interest | | | 27,910 | |

| | | | | |

| Total investment income | | | 132,524 | |

| | | | | |

Expenses | | | | |

| Advisory and management fees (Note 2) | | | 93,726 | |

| Administrative expenses (Note 2) | | | 115,702 | |

| Interest expense | | | 3,162 | |

| | | | | |

| Total expenses | | | 212,590 | |

| | | | | |

Net Investment Loss | | | (80,066 | ) |

| | | | | |

Realized and Unrealized Gain | | | | |

on Investments (Note 4) | | | | |

| Net realized gain on investments | | | 40,524 | |

| Net change in unrealized appreciation on investments | | | 119,906 | |

| Net realized and unrealized gain on | | | | |

| Investments | | | 160,430 | |

| | | | | |

Net Increase in Net Assets Resulting from Operations | | $ | 80,364 | |

The accompanying notes are an integral part of these financial statements.

DOMINION FUNDS, INC. |

SHEPHERD LARGE CAP GROWTH FUND |

Statements of Changes in Net Assets |

For the Years Ended June 30, 2008 and 2007 |

| | | 2008 | | 2007 | |

| | | | | | |

Increase in Net Assets from Operations | | | | | | | |

| Net investment loss | | $ | (80,066 | ) | $ | (6,941 | ) |

| Net realized gain on investments | | | 40,524 | | | 1,060,808 | |

| Capital gain distributions from underlying fund | | | - | | | 1,385 | |

| Net change in unrealized appreciation/(depreciation) | | | | | | | |

| on investments | | | 119,906 | | | 160,207 | |

| | | | | | | | |

| Net increase in net assets resulting from | | | | | | | |

| Operations | | | 80,364 | | | 1,215,459 | |

| | | | | | | | |

| Distributions to shareholders | | | - | | | - | |

| Capital Share Transactions (Note 5) | | | 145,307 | | | 701,811 | |

| | | | | | | | |

Total Increase | | | 225,671 | | | 1,917,270 | |

| | | | | | | | |

Net Assets | | | | | | | |

| Beginning of year | | | 9,096,261 | | | 7,178,991 | |

| | | | | | | | |

| End of year (includes undistributed net investment loss - $0 and $0, respectively) | | $ | 9,321,932 | | $ | 9,096,261 | |

The accompanying notes are an integral part of these financial statements.

DOMINION FUNDS, INC. |

SHEPHERD LARGE CAP GROWTH FUND |

Financial Highlights |

For a share of capital stock outstanding throughout the period |

| | | For the years ended June 30, | |

| | | | | | | | | | | | |

| | | 2008 | | 2007 | | 2006 | | 2005 | | 2004 | |

PER SHARE DATA | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 5.00 | | $ | 4.40 | | $ | 3.61 | | $ | 3.52 | | $ | 3.31 | |

| | | | | | | | | | | | | | | | | |

Income from investment operations: | | | | | | | | | | | | | | | | |

| Net investment loss (a) | | | (0.04 | ) | | (0.00 | ) | | (0.06 | ) | | (0.04 | ) | | ( 0.05 | ) |

| Net realized and unrealized | | | | | | | | | | | | | | | | |

| gain (loss) on investments | | | 0.10 | | | 0.60 | | | 0.85 | | | 0.13 | | | 0.26 | |

Total from investment operations | | | 0.06 | | | 0.60 | | | 0.79 | | | 0.09 | | | 0.21 | |

| | | | | | | | | | | | | | | | | |

Less distributions | | | - | | | - | | | - | | | - | | | - | |

| | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 5.06 | | $ | 5.00 | | $ | 4.40 | | $ | 3.61 | | $ | 3.52 | |

| | | | | | | | | | | | | | | | | |

Total Return (b) | | | 1.20 | % | | 13.64 | % | | 21.88 | % | | 2.56 | % | | 6.34 | % |

| | | | | | | | | | | | | | | | | |

Ratios and Supplemental Data: | | | | | | | | | | | | | | | | |

| Net assets, end of period (000’s) | | $ | 9,322 | | $ | 9,096 | | $ | 7,179 | | $ | 6,380 | | $ | 4,990 | |

Ratio of expenses, excluding interest expense, to average net assets | | | 2.25 | % | | 2.25 | % | | 2.25 | % | | 2.25 | % | | 2.25 | % |

Ratio of expenses, including interest expense to average net assets | | | 2.27 | % | | - | | | - | | | - | | | - | |

| Ratio of net investment loss to average | | | | | | | | | | | | | | | | |

| net assets | | | (0.86 | )% | | (0.09 | )% | | (1.33 | )% | | (1.28 | )% | | ( 1.37 | )% |

| Portfolio turnover rate | | | 309.01 | % | | 382.33 | % | | 190.31 | % | | 487.33 | % | | 258.84 | % |

(a) Per share net investment loss has been determined on the basis of average number of shares outstanding during the period.

(b) Sales load is not reflected in total return

The accompanying notes are an integral part of these financial statements.

DOMINION FUNDS, INC.

SHEPHERD LARGE CAP GROWTH FUND

Notes to Financial Statements

June 30, 2008

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES |

| | Organization: Dominion Funds, Inc. (the “Company”) is a diversified regulated investment company and was incorporated in the State of Texas on June 5, 1992. The Company may designate one or more series of common stock; however, at this time the Shepherd Large Cap Growth Fund (the “Fund”) is the only series of the Company. The primary investment objective of the Fund is growth of capital. The Fund will invest in a diversified portfolio of common stock of companies that meet the Fund’s investment and social criteria. The following is a summary of the Fund’s significant accounting policies. |

| | Security Valuations: Equity securities generally are valued by using market quotations, but may be valued on the basis of prices furnished by a pricing service when the Advisor believes such prices accurately reflect the fair market value of such securities. Securities that are traded on any stock exchange or on the NASDAQ over-the-counter market are generally valued by the pricing service at the last quoted sale price. Lacking a last sale price, an equity security is generally valued by the pricing service at its last bid price. When market quotations are not readily available, when the Advisor determines that the market quotation or the price provided by the pricing service does not accurately reflect the current market value, or when restricted or illiquid securities are being valued, such securities are valued as determined in good faith by the Board of Directors. The Board has adopted guidelines for good faith pricing, and has delegated to the Advisor the responsibility for determining fair value prices, subject to review by the Board of Directors. |

| | Fixed income securities generally are valued by using market quotations, but may be valued on the basis of prices furnished by a pricing service when the Advisor believes such prices accurately reflect the fair market value of such securities. A pricing service utilizes electronic data processing techniques based on yield spreads relating to securities with similar characteristics to determine prices for normal institutional-size trading units of debt securities without regard to sale or bid prices. If the Advisor decides that a price provided by the pricing service does not accurately reflect the fair market value of the securities, when prices are not readily available from a pricing service, or when restricted or illiquid securities are being valued, securities are valued at fair value as determined in good faith by the Advisor, subject to review by the Board of Directors. Short term investments in fixed income securities with maturities of less than 60 days when acquired, or which subsequently are within 60 days of maturity, are valued by using the amortized cost method of valuation, which the Board has determined will represent fair value. |

| | Foreign currency: Investment securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollar amounts at the date of valuation. Purchases and sales of investment securities and income and expense items denominated in foreign currencies are translated into U.S. dollar amounts on the respective dates of such transactions. |

The Fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss from investments.

Reported net realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions, and the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on the Fund's books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the fair values of assets and liabilities, other than investments in securities at fiscal period end, resulting from changes in exchange rates.

DOMINION FUNDS, INC.

SHEPHERD LARGE CAP GROWTH FUND

Notes to Financial Statements (continued)

June 30, 2008

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (Continued) |

| | Federal Income Taxes: The Fund’s policy is to comply with the requirements of the Internal Revenue Code that are applicable to regulated investment companies and to distribute all its taxable income to its shareholders. Therefore, no federal income tax provision is required. |

New Accounting Pronouncements- The Fund adopted Financial Accounting Standards Board (FASB) Interpretation No. 48 - Accounting for Uncertainty in Income Taxes on July1, 2007. FASB Interpretation No. 48 requires the tax effects of certain tax positions to be recognized. These tax positions must meet a “more likely than not” standard that based on their technical merits, have a more than fifty percent likelihood of being sustained upon examination. At adoption, the financial statements must be adjusted to reflect only those tax positions that are more likely than not of being sustained. Management of the Fund does not believe that any adjustments were necessary to the financial statements at adoption.

In September 2006, the Financial Accounting Standards Board issued Statement of Financial Accounting Standards No. 157, “Fair Value Measurements” (“FAS 157”). FAS 157 defines fair value, establishes a framework for measuring fair value in generally accepted accounting principles, and expands disclosures about fair value measurements. FAS 157 establishes a fair value hierarchy that distinguishes between (1) market participant assumptions developed based on market data obtained from sources independent of the reporting entity (observable inputs) and (2) the reporting entity’s own assumptions about market participant assumptions developed based on the best information available in the circumstances (unobservable inputs). FAS 157 is effective for financial statements issued for fiscal years beginning after November 15, 2007, and is to be applied prospectively as of the beginning of the fiscal year in which FAS 157 is initially applied. Management is currently evaluating the application of FAS 157 to the Fund and will provide additional information in relation to FAS 157 on the Fund’s semi-annual financial statements for the period ending December 31, 2008.

Distributions to Shareholders: The Fund intends to distribute to its shareholders substantially all of its net realized capital gains and net investment income, if any, at year-end. Distributions will be recorded on ex-dividend date.

Other: The Fund follows industry practice and records security transactions on the trade date. The specific identification method is used for determining gains or losses for financial statements and income tax purposes. Dividend income is recorded on the ex-dividend date and interest income is recorded on an accrual basis. Discounts and premiums are amortized over the useful lives of the respective securities. Withholding taxes on foreign dividends will be provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates.

Reclassifications: In accordance with SOP-93-2, the Fund has recorded a reclassification in the capital accounts. As of June 30, 2008 the Fund has recorded a permanent book/tax difference of $80,066 from net investment loss to paid-in-capital. This reclassification has no impact on the net asset value of the Fund and is designed generally to present undistributed income and net realized gains on a tax basis, which is considered to be more informative to shareholders.

DOMINION FUNDS, INC.

SHEPHERD LARGE CAP GROWTH FUND

Notes to Financial Statements (continued)

June 30, 2008

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) |

Use of Estimates: The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the year. Actual results could differ from these estimates

| 2. | INVESTMENT ADVISORY AGREEMENT AND ADMINISTRATION AGREEMENT |

The Fund has an investment advisory agreement (the “agreement”) with Foxhall Capital Management (the “Advisor”), formerly Nye, Parnell & Emerson Capital Management, Inc. The Advisor provides the Fund with investment advice and recommendations for investments. Under the terms of the agreement, the Fund will pay the Advisor a monthly fee based on the Fund’s average daily net assets at the annual rate of 1.00%. For the fiscal year ended June 30, 2008 the Advisor earned advisory fees of $93,726. At June 30, 2008 the Fund owed the Advisor $9,882 in advisory fees.

The Fund has an administration agreement with Foundation Management, Inc., an affiliate of the Advisor, (the “Administrator”). The Administrator is responsible for the administration of the Fund and overall management of the Fund’s business affairs. Under the terms of the administrative agreement, the Fund will pay the Administrator a monthly fee based on the Fund’s average daily net assets at the annual rate of 1.25%. For the fiscal year ended June 30, 2008 the Administrator earned fees of $115,702. At June 30, 2008 the Fund owed the Administrator $6,611 in administrative fees.

The Fund has adopted a distribution plan (the “Plan”). Under the Plan, if the payment of administration fees by the Fund to the Administrator is deemed to be indirect financing by the Fund of the distribution of its shares, such payment is authorized by the Plan. The Plan specifically recognizes that the Administrator may use its administration fee, to pay for expenses incurred in connection with providing services intended to result in the sale of Fund shares and/or shareholder support services. For the fiscal year ended June 30, 2008 no such payments were made.

Certain directors and officers of the Fund are also directors and officers of the Advisor and Administrator.

| 3. | INVESTMENT TRANSACTIONS |

Investment transactions, excluding short-term investments, for the year ended June 30, 2008 were as follows:

| Purchases | $ | 27,992,279 |

| Proceeds from sales | $ | 26,446,069 |

DOMINION FUNDS, INC.

SHEPHERD LARGE CAP GROWTH FUND

Notes to Financial Statements (continued)

June 30, 2008

Income and long-term capital gain distributions are determined in accordance with Federal income tax regulations, which may differ from accounting principles generally accepted in the United States.

| Federal tax cost of investments, including short | | | | |

| term investments | | $ | 8,271,816 | |

| Gross tax appreciation of investments | | $ | 1,375,216 | |

| Gross tax depreciation of investments | | | (81,313 | ) |

| Net tax appreciation | | $ | 1,293,903 | |

| Undistributed ordinary income | | $ | - | |

| Undistributed capital gain income | | $ | - | |

| Accumulated capital losses | | $ | 3,807,592 | |

The accumulated capital loss carryovers listed above expire as follows:

| | | Amount | |

| 2009 | | $ | 2,928,034 | |

| 2010 | | $ | 879,558 | |

| 5. | CAPITAL SHARE TRANSACTIONS |

As of June 30, 2008 there were 1,000,000,000 shares of $.001 par value capital stock authorized, of which 200,000,000 shares are classified as the Fund’s series; the balance is unclassified. The total par value and paid-in capital totaled $11,827,645. Transactions in capital stock were as follows:

| | | June 30, 2008 | | June 30, 2007 | |

| | | Shares | | Amount | | Shares | | Amount | |

| Shares sold | | | 551,143 | | $ | 2,696,688 | | | 980,246 | | $ | 4,240,041 | |

| Shares issued in Reinvestment of dividends | | | - | | | - | | | - | | | - | |

| Shares redeemed | | | (527,189 | ) | | (2,551,381 | ) | | (793,763 | ) | | (3,538,230 | ) |

| Net increase (decrease) | | | 23,954 | | $ | 145,307 | | | 186,483 | | $ | 701,811 | |

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a fund creates a presumption of control of the fund, under Section 2(a)(9) of the Investment Company Act of 1940. As of June 30, 2008, FTC & CO. owned approximately 52% of the Fund, for the benefit of others.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders and Board of Directors

of the Dominion Funds, Inc.

We have audited the accompanying statement of assets and liabilities of Shepherd Large Cap Growth Fund (the “Fund”), the Fund comprising the Dominion Funds, Inc., including the schedule of investments, as of June 30, 2008 and the related statements of operations for the year then ended, changes in net assets for each of the two years in the period then ended and financial highlights for each of the four years in the period then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits. The financial highlights for the year ended June 30, 2004, were audited by other auditors whose report dated August 5, 2004 expressed an unqualified opinion on the financial highlights.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of June 30, 2008, by correspondence with the custodian and brokers. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of the Fund as of June 30, 2008, the results of its operations for the year then ended, the changes in its net assets and the financial highlights for the period indicated therein, in conformity with accounting principles generally accepted in the United States of America.

Abington, Pennsylvania September 8, 2008 | |

ADDITIONAL INFORMATION

(Unaudited)

Information about Directors

The business and affairs of the Fund are managed under the direction of the Fund's Board of Directors. Information pertaining to the directors of the Fund is set forth below. The Statement of Additional Information includes additional information about the Fund's directors and is available, without charge, upon request by calling (800) 416 2053.

Name, Address and Age | Position Held with Fund | Term of Office and Length of Time Served | Principal Occupation(s) During Past 5 Years | Other Directorships Held by Director |

| |

Interested Director |

| |

Paul Dietrich * 21509 Willisville Road Upperville, VA 20184 Age: 59 | Chairman, President, Director | Indefinite term; Director since 2001; Chairman since 2002; President since 2003 | President and Managing Director of Eton Court Asset Management, Ltd. (“Eton Court”) (parent of Foxhall Capital Management, Inc., the Fund’s investment advisor) and President of Foundation Management, Inc., the Fund’s administrator (1999 - present). | None |

| |

Non-Interested Director |

| |

Douglas W. Powell 6210 Campbell Road Suite 128 Dallas, TX 75248 Age: 68 | Director | Indefinite term; Director since 1999 | Registered representative of New Investor World Incorporated (2000 - present); COO/CFO NIW Companies, Inc. (2002 - Present); CEO Rushmore Investment Management Corp. (2001 -2002); Chairman and Chief Executive Officer of Northstar Financial Group (1995 - 2001). | None |

| * | This director is considered an “interested person” as defined in the Investment Company Act of 1940, as amended, because of his affiliations with Foxhall Capital Management, Inc., the Fund’s investment advisor, and Foundation Management, Inc., the Fund’s administrator. |

The directors received no fees for the year ended June 30, 2008.

Quarterly Portfolio Schedule

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available without charge, upon request, by calling 1-800-416-2053. The Forms N-Q are also available on the SEC’s website at http://www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC, and information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

Proxy Voting Policies and Procedures

The Fund has adopted proxy voting policies and procedures that delegate to Foxhall Capital Management, Inc., the Fund’s investment advisor (the “Advisor”), the authority to vote proxies. A description of the Fund’s proxy voting policies and procedures is available without charge, upon request, by calling the Fund toll free at 1-800-416-2053. A description of these policies and procedures is also included in the Fund’s Statement of Additional Information, which is available on the SEC’s website at http://www.sec.gov.

Proxy Voting Record

The actual voting records relating to portfolio securities during the most recent twelve month period ended June 30 are available without charge by calling 1-800-416-2053 or by accessing the SEC’s website at http://www.sec.gov.

A Note on Forward Looking Statements

Except for historical information contained in the annual report for the Fund, the matters discussed in this report may constitute forward-looking statements made pursuant to the safe-harbor provisions of the Private Securities Litigation Reform Act of 1995. These include any advisor or portfolio manager predictions, assessments, analyses or outlooks for individual securities, industries, market sectors and/or markets. These statements involve risks and uncertainties. In addition to the general risks described for the Fund in the current Prospectus, other factors bearing on this report include the accuracy of the advisor’s or portfolio manager’s forecasts and predictions, and the appropriateness of the investment programs designed by the advisor or portfolio manager to implement their strategies efficiently and effectively. Any one or more of these factors, as well as other risks affecting the securities markets and investment instruments generally, could cause the actual results of the Fund to differ materially as compared to benchmarks associated with the Fund.

ANNUAL REPORT

JUNE 30, 2008

Investment Advisor Foxhall Capital Management, Inc. 1613 Duke Street Alexandria, VA 22314 (800) 416 2053 | Transfer Agent Fund Services, Inc. 8730 Stony Point Pkwy Suite 205 Richmond, VA 23235 (800) 628 4077 | Distributor Cullum & Burks Securities, Inc. 13355 Noel Road, Suite 1300, One Galleria Tower Dallas, TX 75240 (972) 755 0270 |

| | | |

Administrator Foundation Management, Inc. 21509 Willisville Road Upperville, VA 20184 (800) 416 2053 | Independent Registered Public Accounting Firm Sanville & Company Certified Public Accountants 1514 Old York Road Abington, PA 19001 | Legal Counsel Frederick C. Summers, III, P.C. Attorney at Law 8235 Douglas Ave., Suite 1111 Dallas, TX 75225 |

| | | |

Officers Paul Dietrich Chairman, President | Directors Paul Dietrich Douglas W. Powell | Custodian RBC Dain Rauscher, Inc. 510 Marquette Ave. Minneapolis, MN 55402-1106 |

Item 2. Code of Ethics.

The Registrant has adopted a code of ethics that applies to its principal executive officer, principal financial officer and principal accounting officer. The Registrant will provide to any person without charge, upon request, a copy of such code of ethics, by calling the Registrant at 1-800-416-2053.

Item 3. Audit Committee Financial Expert.

The Registrant does not have an audit committee financial expert. The Registrant does not have an audit committee financial expert because the small size of the Registrant limits the ability of the Registrant’s Administrator to engage an audit committee financial expert.

Item 4. Principal Accountant Fees and Services.

(a) Audit Fees. The aggregate fees billed for each of the last two fiscal years for professional services by the principal accountant for the audit of the registrant’s annual financial statements, or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years, were as follows:

| Year ended June 30, |

| 2007 | 2008 |

| $11,000 | $12,000 |

(b) Audit-Related Fees. The aggregate fees billed in each of the last two fiscal years for assurance and related services by the principal accountant that are reasonably related to the performance of the audit of the registrant’s financial statements and are not reported under “Audit Fees” above were as follows:

| Year ended June 30, |

| 2007 | 2008 |

| $-0- | $-0- |

(c) Tax Fees. The aggregate fees billed in each of the last two fiscal years for professional services rendered by the principal accountant for tax compliance, tax advice and tax planning were as follows:

| Year ended June 30, |

| 2007 | 2008 |

| $1,200 | $1,800 |

The nature of the services comprising the fees disclosed under this category was preparation of tax returns.

(d) All Other Fees. The aggregate fees billed in each of the last two fiscal years for products and services provided by the principal accountant, other than the services reported in the above categories were as follows:

| Year ended June 30, |

| 2007 | 2008 |

| $-0- | $-0- |

(e)(1) Disclose the audit committee’s pre-approval policies and procedures described in paragraph (c)(7) of Rule 2-01 of Regulation S-X.

The registrant does not have an audit committee.

(2) Disclose the percentage of services described in each of paragraphs (b) through (d) of this Item that were approved by the audit committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

The registrant does not have an audit committee.

(f) If greater than 50 percent, disclose the percentage of hours expended on the principal accountant’s engagement to audit the registrant’s financial statements for the most recent fiscal year that were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees. Not applicable.

(g) Disclose the aggregate non-audit fees billed by the registrant’s accountant for services rendered to the registrant, and rendered to the registrant’s investment adviser, and any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the registrant for each of the last two fiscal years of the registrant.

| Year ended June 30, |

| 2007 | 2008 |

| $-0- | $-0- |

(h) Disclose whether the registrant’s audit committee of the board of directors has considered whether the provision of non-audit services that were rendered to the registrant’s investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant that were not pre-approved pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X is compatible with maintaining the principal accountant’s independence.

The registrant does not have an audit committee.

Item 5. Audit Committee of Listed Registrants

Not applicable to open-end investment companies.

Item 6. Schedule of Investments

The schedule is included as part of the report to shareholders filed under Item 1 of this Form.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable to open-end investment companies.

Item 10. Submission of Matters to a Vote of Security Holders.

The registrant does not currently have procedures by which shareholders may recommend nominees to the registrant’s board of directors.

Item 11. Controls and Procedures.

(a) Based on their evaluation of registrant’s disclosure controls and procedures (as defined in rule 30a-3(c) under the Investment Company Act of 1940) as of the filing date of this report, registrant’s principal executive officer and principal financial officer found such disclosure controls and procedures to be effective.

(b) There were no significant changes in the registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the Investment Company Act of 1940) that occurred during the registrant’s second fiscal quarter of the period covered by this report that have materially affected, or are reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 12. Exhibits.

(a) Any code of ethics. Previously filed.

(b) Certifications pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. Filed herewith.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Dominion Funds, Inc.

By: /S/ Paul Dietrich

Paul Dietrich, President

Date: September 8, 2008

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By: /S/ Paul Dietrich

Paul Dietrich, principal executive and principal financial officer

Date: September 8, 2008