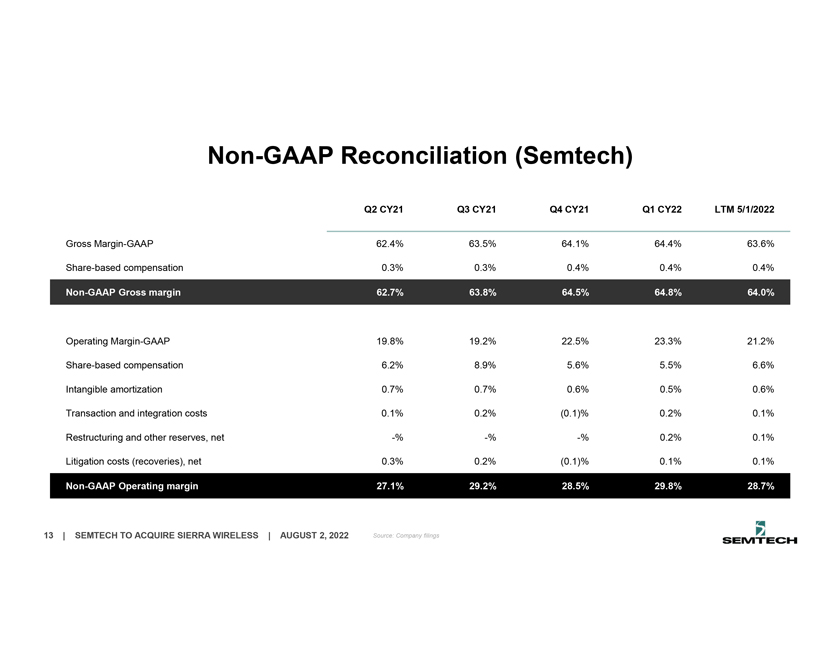

Forward -Looking Statements This presentation contains “forward -looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, as amended, based on Semtech Corporation’s (the “Company’s”) current expectations, estimates and projections about its operations, industry, financial condition, performance, results of operations and liquidity. Forward -looking statements are statements other than historical information or statements of current condition and relate to matters such as the expected timing to consummate the proposed transaction with Sierra Wireless and the synergies, expected financial results and other benefits to be realized if the proposed transaction is consummated. Forward -looking statements involve known and unknown risks and uncertainties that could cause actual results and events to differ materially from those projected. Potential factors that could cause actual results to differ materially from those in the forward -looking statements include, but are not limited to: the failure of Sierra Wireless to obtain shareholder approval as required for the proposed transaction; the failure to obtain regulatory approvals required for the closing of the proposed transaction; failure by Sierra Wireless to obtain approval of the Supreme Court of British Columbia; failure to satisfy the conditions to the closing of the proposed transaction; the effect of the announcement of the proposed transaction on the ability of the Company or Sierra Wireless to retain and hire key personnel and maintain business relationships with customers, suppliers and others with whom they each do business, or on the Company’s and Sierra Wireless’ operating results, market price of common stock and business generally; potential legal proceedings relating to the proposed transaction and the outcome of any such legal proceeding; the inherent risks, costs and uncertainties associated with integrating the businesses successfully and risks of not achieving all or any of the anticipated benefits of the proposed transaction, or the risk that the anticipated benefits of the proposed transaction may not be fully realized or take longer to realize than expected; the occurrence of any event, change or other circumstances that could give rise to the termination of the arrangement agreement; the risk that the proposed transaction will not be consummated within the expected time period, or at all; the uncertain, but potential negative impact to the Company of the ongoing supply chain constraints and any disruptions associated with the COVID -19 pandemic on global economic conditions that could impact the Company’s results; and the factors identified under the heading “Risk Factors” in the Company’s Annual Report on Form 10-K for the fiscal year ended January 31, 2021, as such risk factors may be updated, amended or superseded from time to time by subsequent reports that the Company files with the Securities and Exchange Commission. Investors are cautioned not to place undue reliance on any forward -looking information contained herein, which reflect management’s analysis only as of the date hereof. Except as required by law, the Company assumes no obligation to publicly release the results of any update or revision to any forward -looking statement that may be made to reflect new information, events or circumstances after the date hereof or to reflect the occurrence of unanticipated or future events, or otherwise. This presentation also includes a presentation of select non-GAAP financial measures, namely: Gross Margin, and Operating Margin. The reconciliations of these to the most comparable GAAP measures are shown at the end of the presentation. 1 | SEMTECH TO ACQUIRE SIERRA WIRELESS | AUGUST 2, 2022