UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-06740

Legg Mason Partners Institutional Trust

(Exact name of registrant as specified in charter)

620 Eighth Avenue, 47th Floor, New York, NY 10018

(Address of principal executive offices) (Zip code)

Marc A. De Oliveira

Franklin Templeton

100 First Stamford Place

Stamford, CT 06902

(Name and address of agent for service)

Registrant’s telephone number, including area code:

877-6LM-FUND/656-3863

Date of fiscal year end: August 31

Date of reporting period: August 31, 2024

| ITEM 1. | REPORT TO STOCKHOLDERS. |

The Annual Report to Stockholders is filed herewith.

| | |

Western Asset Premier Institutional U.S. Treasury Reserves | |

| Capital Shares [WADXX] |

| Annual Shareholder Report | August 31, 2024 |

|

This annual shareholder report contains important information about Western Asset Premier Institutional U.S. Treasury Reserves for the period September 1, 2023, to August 31, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at 877-6LM-FUND/656-3863.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment* |

Capital Shares1 | $12 | 0.12% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. Additional amounts may be voluntarily waived and/or reimbursed from time to time. |

| 1 | The expense table reflects the expenses of both the feeder Fund and the master Fund. |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

As of August 31, 2024, the seven-day current yield for Capital Shares of Western Asset Premier Institutional U.S. Treasury Reserves was 5.19% and the seven-day effective yield was 5.32%. The seven-day current yield represents net interest income generated by the Fund’s investments for the past seven days and assumes income is generated each week over a 365-day period. The seven-day effective yield assumes reinvestment of the coupon (interest payments) and will typically be slightly higher than the current yield because of the compounding effect on investment returns.

The Fund’s performance was positively impacted by an extension of its weighted average maturity (WAM), which positioned it well as yields fell later in the reporting period. The decline in yields was in response to indications of a shift towards an easier policy stance by the U.S. Federal Reserve.

The Fund’s past performance is not necessarily an indication of how the Fund will perform in the future.

For current month-end performance, please call Franklin Templeton at 877-6LM-FUND/656-3863 or visit https://www.franklintempleton.com/investments/options/money-market-funds.

KEY FUND STATISTICS (as of August 31, 2024)

| |

Total Net Assets | $1,433,573,889 |

Total Number of Portfolio Holdings* | 59 |

Total Management Fee Paid | $1,112,793 |

| * | Reflects holdings of U.S. Treasury Reserves Portfolio. |

| Western Asset Premier Institutional U.S. Treasury Reserves | PAGE 1 | WPTCC-ATSR-1024 |

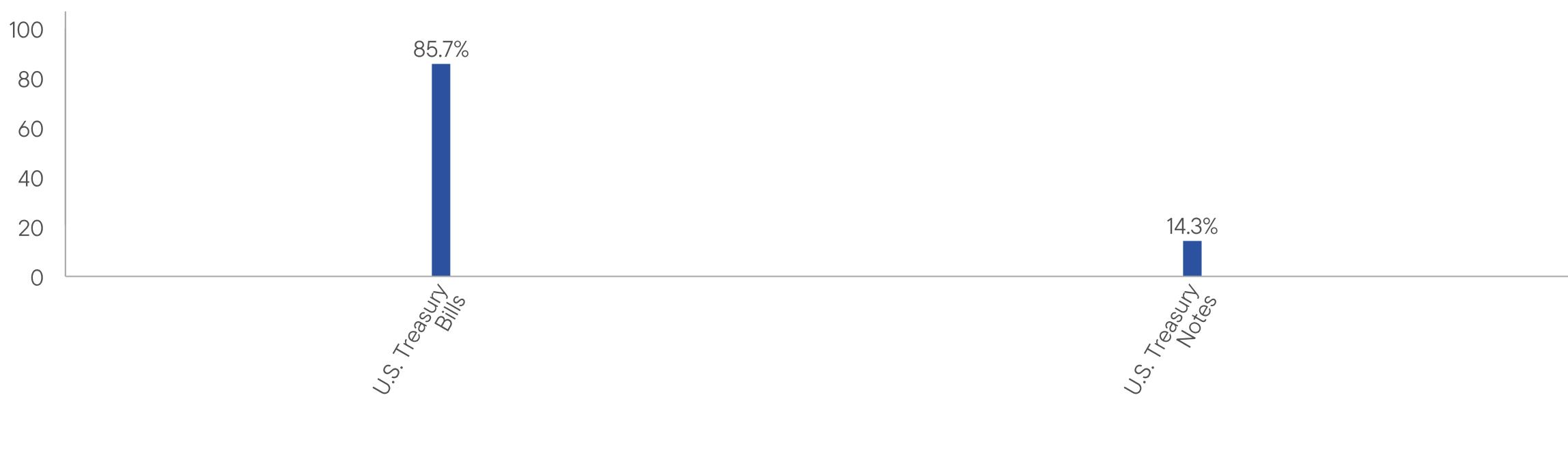

WHAT DID THE FUND INVEST IN? (as of August 31, 2024)

Portfolio Composition* (% of Total Investments)

| * | Reflects holdings of U.S. Treasury Reserves Portfolio. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

HOUSEHOLDING

You will receive the Fund’s shareholder reports every six months. In addition, you will receive an annual updated summary prospectus (detail prospectus available upon request). To reduce Fund expenses, we try to identify related shareholders in a household and send only one copy of the shareholder reports and summary prospectus. This process, called “householding,” will continue indefinitely unless you instruct us otherwise. If you prefer not to have these documents householded, please call us at 877-6LM-FUND/656-3863. At any time, you may view current prospectuses/summary prospectuses and shareholder reports on our website. If you choose, you may receive these documents through electronic delivery.

| Western Asset Premier Institutional U.S. Treasury Reserves | PAGE 2 | WPTCC-ATSR-1024 |

85.714.3

| | |

Western Asset Premier Institutional U.S. Treasury Reserves | |

| Premium Shares [WAEXX] |

| Annual Shareholder Report | August 31, 2024 |

|

This annual shareholder report contains important information about Western Asset Premier Institutional U.S. Treasury Reserves for the period September 1, 2023, to August 31, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at 877-6LM-FUND/656-3863.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment* |

Premium Shares1 | $14 | 0.14% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. Additional amounts may be voluntarily waived and/or reimbursed from time to time. |

| 1 | The expense table reflects the expenses of both the feeder Fund and the master Fund. |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

As of August 31, 2024, the seven-day current yield for Premium Shares of Western Asset Premier Institutional U.S. Treasury Reserves was 5.17% and the seven-day effective yield was 5.30%. The seven-day current yield represents net interest income generated by the Fund’s investments for the past seven days and assumes income is generated each week over a 365-day period. The seven-day effective yield assumes reinvestment of the coupon (interest payments) and will typically be slightly higher than the current yield because of the compounding effect on investment returns.

The Fund’s performance was positively impacted by an extension of its weighted average maturity (WAM), which positioned it well as yields fell later in the reporting period. The decline in yields was in response to indications of a shift towards an easier policy stance by the U.S. Federal Reserve.

The Fund’s past performance is not necessarily an indication of how the Fund will perform in the future.

For current month-end performance, please call Franklin Templeton at 877-6LM-FUND/656-3863 or visit https://www.franklintempleton.com/investments/options/money-market-funds.

KEY FUND STATISTICS (as of August 31, 2024)

| |

Total Net Assets | $1,433,573,889 |

Total Number of Portfolio Holdings* | 59 |

Total Management Fee Paid | $1,112,793 |

| * | Reflects holdings of U.S. Treasury Reserves Portfolio. |

| Western Asset Premier Institutional U.S. Treasury Reserves | PAGE 1 | WPTPC-ATSR-1024 |

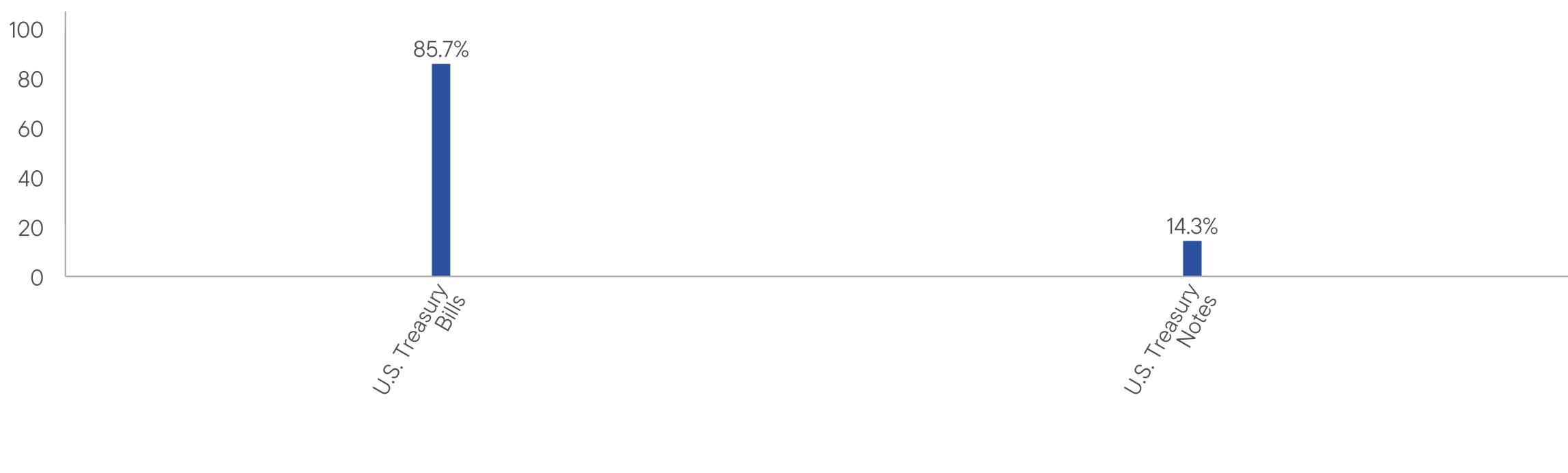

WHAT DID THE FUND INVEST IN? (as of August 31, 2024)

Portfolio Composition* (% of Total Investments)

| * | Reflects holdings of U.S. Treasury Reserves Portfolio. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

HOUSEHOLDING

You will receive the Fund’s shareholder reports every six months. In addition, you will receive an annual updated summary prospectus (detail prospectus available upon request). To reduce Fund expenses, we try to identify related shareholders in a household and send only one copy of the shareholder reports and summary prospectus. This process, called “householding,” will continue indefinitely unless you instruct us otherwise. If you prefer not to have these documents householded, please call us at 877-6LM-FUND/656-3863. At any time, you may view current prospectuses/summary prospectuses and shareholder reports on our website. If you choose, you may receive these documents through electronic delivery.

| Western Asset Premier Institutional U.S. Treasury Reserves | PAGE 2 | WPTPC-ATSR-1024 |

85.714.3

The registrant has adopted a code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller.

| ITEM 3. | AUDIT COMMITTEE FINANCIAL EXPERT. |

The Board of Trustees of the registrant has determined that Robert Abeles, Jr., possesses the technical attributes identified in Instruction 2(b) of Item 3 to Form N-CSR to qualify an “audit committee financial expert,” and has designated Mr. Abeles, Jr. as the Audit Committee’s financial expert. Mr. Abeles, Jr. is an “independent” Trustees pursuant to paragraph (a) (2) of Item 3 to Form N-CSR.

| Item 4. | Principal Accountant Fees and Services. |

a) Audit Fees. The aggregate fees billed in the last two fiscal years ending August 31, 2023 and August 31, 2024 (the “Reporting Periods”) for professional services rendered by the Registrant’s principal accountant (the “Auditor”) for the audit of the Registrant’s annual financial statements, or services that are normally provided by the Auditor in connection with the statutory and regulatory filings or engagements for the Reporting Periods, were $169,863 in August 31, 2023 and $169,863 in August 31, 2024.

b) Audit-Related Fees. The aggregate fees billed in the Reporting Period for assurance and related services by the Auditor that are reasonably related to the performance of the Registrant’s financial statements were $0 in August 31, 2023 and $0 in August 31, 2024.

(c) Tax Fees. The aggregate fees billed in the Reporting Periods for professional services rendered by the Auditor for tax compliance, tax advice and tax planning (“Tax Services”) were $47,200 in August 31, 2023 and $47,200 in August 31, 2024. These services consisted of (i) review or preparation of U.S. federal, state, local and excise tax returns; (ii) U.S. federal, state and local tax planning, advice and assistance regarding statutory, regulatory or administrative developments, and (iii) tax advice regarding tax qualification matters and/or treatment of various financial instruments held or proposed to be acquired or held.

There were no fees billed for tax services by the Auditors to service affiliates during the Reporting Periods that required pre-approval by the Audit Committee.

d) All Other Fees. The aggregate fees billed in the Reporting Periods for products and services provided by the Auditor, other than the services reported in paragraphs (a) through (c) for the Item 4 for the Legg Mason Partners Institutional Trust were $0 in August 31, 2023 and $0 in August 31, 2024.

All Other Fees. There were no other non-audit services rendered by the Auditor to Franklin Templeton Fund Adviser, LLC (“FTFA”), and any entity controlling, controlled by or under common control with FTFA that provided ongoing services to Legg Mason Partners Institutional Trust requiring pre-approval by the Audit Committee in the Reporting Period.

(e) Audit Committee’s pre-approval policies and procedures described in paragraph (c) (7) of Rule 2-01 of Regulation S-X.

(1) The Charter for the Audit Committee (the “Committee”) of the Board of each registered investment company (the “Fund”) advised by FTFA or one of their affiliates (each, an “Adviser”) requires that the Committee shall approve (a) all audit and permissible non-audit services to be provided to the Fund and (b) all permissible non-audit services to be provided by the Fund’s independent auditors to the Adviser and any Covered Service Providers if the engagement relates directly to the operations and financial reporting of the Fund. The Committee may implement policies and procedures by which such services are approved other than by the full Committee.

The Committee shall not approve non-audit services that the Committee believes may impair the independence of the auditors. As of the date of the approval of this Audit Committee Charter, permissible non-audit services include any professional services (including tax services), that are not prohibited services as described below, provided to the Fund by the independent auditors, other than those provided to the Fund in connection with an audit or a review of the financial statements of the Fund. Permissible non-audit services may not include: (i) bookkeeping or other services related to the accounting records or financial statements of the Fund; (ii) financial information systems design and implementation; (iii) appraisal or valuation services, fairness opinions or contribution-in-kind reports; (iv) actuarial services; (v) internal audit outsourcing services; (vi) management functions or human resources; (vii) broker or dealer, investment adviser or investment banking services; (viii) legal services and expert services unrelated to the audit; and (ix) any other service the Public Company Accounting Oversight Board determines, by regulation, is impermissible.

Pre-approval by the Committee of any permissible non-audit services is not required so long as: (i) the aggregate amount of all such permissible non-audit services provided to the Fund, the Adviser and any service providers controlling, controlled by or under common control with the Adviser that provide ongoing services to the Fund (“Covered Service Providers”) constitutes not more than 5% of the total amount of revenues paid to the independent auditors during the fiscal year in which the permissible non-audit services are provided to (a) the Fund, (b) the Adviser and (c) any entity controlling, controlled by or under common control with the Adviser that provides ongoing services to the Fund during the fiscal year in which the services are provided that would have to be approved by the Committee; (ii) the permissible non-audit services were not recognized by the Fund at the time of the engagement to be non-audit services; and (iii) such services are promptly brought to the attention of the Committee and approved by the Committee (or its delegate(s)) prior to the completion of the audit.

(2) None of the services described in paragraphs (b) through (d) of this Item were performed in reliance on paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) Not applicable.

(g) Non-audit fees billed by the Auditor for services rendered to Legg Mason Partners Institutional Trust, FTFA and any entity controlling, controlled by, or under common control with FTFA that provides ongoing services to Legg Mason Partners Institutional Trust during the reporting period were $350,359 in August 31, 2023 and $342,635 in August 31, 2024.

(h) Yes. Legg Mason Partners Institutional Trust’s Audit Committee has considered whether the provision of non-audit services that were rendered to Service Affiliates, which were not pre-approved (not requiring pre-approval), is compatible with maintaining the Accountant’s independence. All services provided by the Auditor to the Legg Mason Partners Institutional Trust or to Service Affiliates, which were required to be pre-approved, were pre-approved as required.

(i) Not applicable.

(j) Not applicable.

| ITEM 5. | AUDIT COMMITTEE OF LISTED REGISTRANTS. |

| a) | The independent board members are acting as the registrant’s audit committee as specified in Section 3(a)(58)(B) of the Exchange Act. The Audit Committee consists of the following Board members: |

Robert Abeles, Jr.

Jane F. Dasher

Anita L. DeFrantz

Susan B. Kerley

Michael Larson

Avedick B. Poladian

William E.B. Siart

Jaynie M. Studenmund

Peter J. Taylor

| ITEM 6. | SCHEDULE OF INVESTMENTS. |

| (a) | Please see schedule of investments contained in the Financial Statements and Financial Highlights included under Item 7 of this Form N-CSR. |

| ITEM 7. | FINANCIAL STATEMENTS AND FINANCIAL HIGLIGHTS FOR OPEN-END MANAGEMENT INVESTMENT COMPANIES. |

Western Asset

Premier Institutional U.S. Treasury Reserves

Financial Statements and Other Important Information

Financial Statements and Other Important Information — Annual

Financial Statements and Other Important Information — Annual

Statement of Assets and LiabilitiesAugust 31, 2024

| |

Investment in U.S. Treasury Reserves Portfolio, at value | |

| |

| |

| |

| |

Investment management fee payable | |

| |

| |

| |

| |

| |

| |

Paid-in capital in excess of par value | |

Total distributable earnings (loss) | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

See Notes to Financial Statements.

Western Asset Premier Institutional U.S. Treasury Reserves 2024 Annual Report

Statement of OperationsFor the Year Ended August 31, 2024

| |

Income from U.S. Treasury Reserves Portfolio | |

Allocated expenses from U.S. Treasury Reserves Portfolio | |

Allocated waiver and/or expense reimbursements from U.S. Treasury Reserves Portfolio | |

| |

| |

Investment management fee (Note 2) | |

Transfer agent fees (Note 3) | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Less: Fee waivers and/or expense reimbursements (Notes 2 and 3) | |

| |

| |

Net Realized Gain on Investments From U.S. Treasury Reserves Portfolio | |

Increase in Net Assets From Operations | |

See Notes to Financial Statements.

Western Asset Premier Institutional U.S. Treasury Reserves 2024 Annual Report

Statements of Changes in Net Assets

For the Years Ended August 31, | | |

| | |

| | |

| | |

Increase in Net Assets From Operations | | |

Distributions to Shareholders From (Notes 1 and 4): | | |

Total distributable earnings | | |

Decrease in Net Assets From Distributions to Shareholders | | |

Fund Share Transactions (Note 5): | | |

Net proceeds from sale of shares | | |

Reinvestment of distributions | | |

Cost of shares repurchased | | |

Increase in Net Assets From Fund Share Transactions | | |

| | |

| | |

| | |

| | |

See Notes to Financial Statements.

Western Asset Premier Institutional U.S. Treasury Reserves 2024 Annual Report

For a share of each class of beneficial interest outstanding throughout each year ended August 31,

unless otherwise noted: |

| | | | | |

Net asset value, beginning of year | | | | | |

Income (loss) from operations: |

| | | | | |

Net realized gain (loss)3 | | | | | |

Total income from operations | | | | | |

| | | | | |

| | | | | |

| | | | | |

Net asset value, end of year | | | | | |

| | | | | |

Net assets, end of year (000s) | | | | | |

Ratios to average net assets: |

| | | | | |

| | | | | |

| | | | | |

| Per share amounts have been calculated using the average shares method. |

| For the period October 30, 2019 (inception date) to August 31, 2020. |

| Amount represents less than $0.0005 or greater than $(0.0005) per share. |

| Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. Total returns for periods of less than one year are not annualized. |

| Includes the Fund’s share of U.S. Treasury Reserves Portfolio’s allocated expenses. |

| The gross expenses do not reflect the reduction in the Fund’s management fee, pursuant to the Fund’s investment management agreement, by the amount paid by the Fund for its allocable share of the management fee paid by U.S. Treasury Reserves Portfolio. |

| |

| As a result of an expense limitation arrangement, the ratio of total annual fund operating expenses, other than interest, brokerage, taxes, extraordinary expenses and acquired fund fees and expenses, to average net assets of Capital Shares did not exceed 0.12%. This expense limitation arrangement cannot be terminated prior to December 31, 2024 without the Board of Trustees’ consent. Additional amounts may be voluntarily waived and/or reimbursed from time to time. |

| Reflects fee waivers and/or expense reimbursements. |

See Notes to Financial Statements.

Western Asset Premier Institutional U.S. Treasury Reserves 2024 Annual Report

Financial Highlights (cont’d)

For a share of each class of beneficial interest outstanding throughout each year ended August 31,

unless otherwise noted: |

| | | | | |

Net asset value, beginning of year | | | | | |

Income (loss) from operations: |

| | | | | |

Net realized gain (loss)3 | | | | | |

Total income from operations | | | | | |

| | | | | |

| | | | | |

| | | | | |

Net asset value, end of year | | | | | |

| | | | | |

Net assets, end of year (millions) | | | | | |

Ratios to average net assets: |

| | | | | |

| | | | | |

| | | | | |

| Per share amounts have been calculated using the average shares method. |

| For the period October 30, 2019 (inception date) to August 31, 2020. |

| Amount represents less than $0.0005 or greater than $(0.0005) per share. |

| Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. Total returns for periods of less than one year are not annualized. |

| Includes the Fund’s share of U.S. Treasury Reserves Portfolio’s allocated expenses. |

| The gross expenses do not reflect the reduction in the Fund’s management fee, pursuant to the Fund’s investment management agreement, by the amount paid by the Fund for its allocable share of the management fee paid by U.S. Treasury Reserves Portfolio. |

| |

| As a result of an expense limitation arrangement, the ratio of total annual fund operating expenses, other than interest, brokerage, taxes, extraordinary expenses and acquired fund fees and expenses, to average net assets of Premium Shares did not exceed 0.14%. This expense limitation arrangement cannot be terminated prior to December 31, 2024 without the Board of Trustees’ consent. Additional amounts may be voluntarily waived and/or reimbursed from time to time. |

| Reflects fee waivers and/or expense reimbursements. |

See Notes to Financial Statements.

Western Asset Premier Institutional U.S. Treasury Reserves 2024 Annual Report

Notes to Financial Statements

1. Organization and significant accounting policies

Western Asset Premier Institutional U.S. Treasury Reserves (the “Fund”) is a separate diversified investment series of Legg Mason Partners Institutional Trust (the “Trust”). The Trust, a Maryland statutory trust, is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. The Fund invests all of its investable assets in U.S. Treasury Reserves Portfolio (the “Portfolio”), a separate investment series of Master Portfolio Trust, that has the same investment objective as the Fund.

The financial statements of the Portfolio, including the schedule of investments, are contained elsewhere in this report and should be read in conjunction with the Fund’s financial statements.

The Fund follows the accounting and reporting guidance in Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946, Financial Services – Investment Companies (“ASC 946”). The following are significant accounting policies consistently followed by the Fund and are in conformity with U.S. generally accepted accounting principles (“GAAP”), including, but not limited to, ASC 946. Estimates and assumptions are required to be made regarding assets, liabilities and changes in net assets resulting from operations when financial statements are prepared. Changes in the economic environment, financial markets and any other parameters used in determining these estimates could cause actual results to differ. Subsequent events have been evaluated through the date the financial statements were issued.

(a) Investment valuation. The Fund records its investment in the Portfolio at value. The value of such investment in the Portfolio reflects the Fund’s proportionate interest (8.5% at August 31, 2024) in the net assets of the Portfolio.

GAAP establishes a disclosure hierarchy that categorizes the inputs to valuation techniques used to value assets and liabilities at measurement date. The disclosure and valuation of securities held by the Portfolio are discussed in Note 1(a) of the Portfolio’s Notes to Financial Statements, which are included elsewhere in this report.

(b) Investment transactions and investment income. Net investment income of the Portfolio is allocated pro rata, based on respective ownership interests, among the Fund and other investors in the Portfolio (the “Holders”) at the time of such determination. Gross realized gains and/or losses of the Portfolio are allocated to the Holders in a manner such that the net asset values per share of each Holder, after each such allocation, is closer to the total of all Holders’ net asset values divided by the aggregate number of shares outstanding for all Holders. The Fund also pays certain other expenses which can be directly attributed to the Fund.

(c) Distributions to shareholders. Distributions from net investment income on the shares of the Fund are declared each business day and are paid monthly. Distributions of net realized gains, if any, are declared at least annually. Distributions to shareholders of the Fund are recorded on the ex-dividend date and are determined in accordance with income tax regulations, which may differ from GAAP.

Western Asset Premier Institutional U.S. Treasury Reserves 2024 Annual Report

Notes to Financial Statements (cont’d)

(d) Share class accounting. Investment income, common expenses and realized gains (losses) on investments are allocated to the various classes of the Fund on the basis of daily net assets of each class. Fees relating to a specific class are charged directly to that share class.

(e) Federal and other taxes. It is the Fund’s policy to comply with the federal income and excise tax requirements of the Internal Revenue Code of 1986 (the “Code”), as amended, applicable to regulated investment companies. Accordingly, the Fund intends to distribute its taxable income and net realized gains, if any, to shareholders in accordance with timing requirements imposed by the Code. Therefore, no federal or state income tax provision is required in the Fund’s financial statements.

Management has analyzed the Fund’s tax positions taken on income tax returns for all open tax years and has concluded that as of August 31, 2024, no provision for income tax is required in the Fund’s financial statements. The Fund’s federal and state income and federal excise tax returns for tax years for which the applicable statutes of limitations have not expired are subject to examination by the Internal Revenue Service and state departments of revenue.

(f) Reclassification. GAAP requires that certain components of net assets be reclassified to reflect permanent differences between financial and tax reporting. These reclassifications have no effect on net assets or net asset value per share. During the current year, the Fund had no reclassifications.

2. Investment management agreement and other transactions with affiliates

Franklin Templeton Fund Adviser, LLC (“FTFA”) (formerly known as Legg Mason Partners Fund Advisor, LLC prior to November 30, 2023) is the Fund’s and the Portfolio’s investment manager and Western Asset Management Company, LLC (“Western Asset”) is the Fund’s and the Portfolio’s subadviser. FTFA and Western Asset are indirect, wholly-owned subsidiaries of Franklin Resources, Inc. (“Franklin Resources”).

Under the investment management agreement, the Fund pays an investment management fee, calculated daily and paid monthly, in accordance with the following breakpoint schedule:

Since the Fund invests all of its investable assets in the Portfolio, the investment management fee of the Fund will be reduced by the investment management fee allocated to the Fund by the Portfolio.

FTFA provides administrative and certain oversight services to the Fund. FTFA delegates to the subadviser the day-to-day portfolio management of the Fund. For its services, FTFA pays Western Asset a fee monthly, at an annual rate equal to 70% of the net management fee it receives from the Fund.

Western Asset Premier Institutional U.S. Treasury Reserves 2024 Annual Report

As a result of expense limitation arrangements between the Fund and FTFA, the ratio of total annual fund operating expenses, other than interest, brokerage, taxes, extraordinary expenses and acquired fund fees and expenses, to average net assets of Capital Shares and Premium Shares did not exceed 0.12% and 0.14%, respectively. These expense limitation arrangements cannot be terminated prior to December 31, 2024 without the Board of Trustees’ consent. Additional amounts may be voluntarily waived and/or reimbursed from time to time.

During the year ended August 31, 2024, fees waived and/or expenses reimbursed amounted to $1,971,172.

FTFA is permitted to recapture amounts waived and/or reimbursed to a class during the same fiscal year if the class’ total annual fund operating expenses have fallen to a level below the expense limitation (“expense cap”) in effect at the time the fees were earned or the expenses incurred. In no case will FTFA recapture any amount that would result, on any particular business day of the Fund, in the class’ total annual fund operating expenses exceeding the expense cap or any other lower limit then in effect.

Franklin Distributors, LLC (“Franklin Distributors”) serves as the Fund’s sole and exclusive distributor. Franklin Distributors is an indirect, wholly-owned broker-dealer subsidiary of Franklin Resources.

All officers and one Trustee of the Trust are employees of Franklin Resources or its affiliates and do not receive compensation from the Trust.

As of August 31, 2024, Franklin Resources and its affiliates owned 62% of the Fund.

3. Class specific expenses, waivers and/or expense reimbursements

For the year ended August 31, 2024, class specific expenses were as follows:

For the year ended August 31, 2024, waivers and/or expense reimbursements by class were as follows:

| Waivers/Expense

Reimbursements |

| |

| |

| |

Western Asset Premier Institutional U.S. Treasury Reserves 2024 Annual Report

Notes to Financial Statements (cont’d)

4. Distributions to shareholders by class

| Year Ended

August 31, 2024 | Year Ended

August 31, 2023 |

| | |

| | |

| | |

| | |

5. Shares of beneficial interest

At August 31, 2024, the Trust had an unlimited number of shares of beneficial interest authorized with a par value of $0.00001 per share. The Fund has the ability to issue multiple classes of shares. Each class of shares represents an identical interest and has the same rights, except that each class bears certain direct expenses, including those specifically related to the distribution of its shares.

Transactions in shares of each class were as follows:

| Year Ended

August 31, 2024 | Year Ended

August 31, 2023 |

| | |

| | |

Shares issued on reinvestment | | |

| | |

| | |

| | |

| | |

Shares issued on reinvestment | | |

| | |

| | |

Because the Fund has maintained a $1.00 net asset value per share from inception, the number of shares sold, shares issued on reinvestment of dividends declared, and shares repurchased is equal to the dollar amount shown in the Statements of Changes in Net Assets for the corresponding fund share transactions.

6. Income tax information and distributions to shareholders

The tax character of distributions paid during the fiscal years ended August 31, was as follows:

Western Asset Premier Institutional U.S. Treasury Reserves 2024 Annual Report

As of August 31, 2024, the components of distributable earnings (loss) on a tax basis were as follows:

Undistributed ordinary income — net | |

| |

Other book/tax temporary differences(a) | |

Total distributable earnings (loss) — net | |

| These capital losses have been deferred in the current year as either short-term or long-term losses. The losses will be deemed to occur on the first day of the next taxable year in the same character as they were originally deferred and will be available to offset future taxable capital gains. |

| Other book/tax temporary differences are attributable to book/tax differences in the timing of the deductibility of various expenses. |

Western Asset Premier Institutional U.S. Treasury Reserves 2024 Annual Report

Report of Independent Registered Public Accounting Firm

To the Board of Trustees of Legg Mason Partners Institutional Trust and Shareholders of Western Asset Premier Institutional U.S. Treasury Reserves

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities of Western Asset Premier Institutional U.S. Treasury Reserves (one of the funds constituting Legg Mason Partners Institutional Trust, referred to hereafter as the “Fund”) as of August 31, 2024, the related statement of operations for the year ended August 31, 2024, the statement of changes in net assets for each of the two years in the period ended August 31, 2024, including the related notes, and the financial highlights for each of the four years in the period ended August 31, 2024 and for the period October 30, 2019 (inception date) through August 31, 2020 (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of August 31, 2024, the results of its operations for the year ended August 31, 2024, the changes in its net assets for each of the two years in the period ended August 31, 2024 and the financial highlights for each of the four years in the period ended August 31, 2024 and for the period October 30, 2019 (inception date) through August 31, 2020 in conformity with accounting principles generally accepted in the United States of America.

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits of these financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of the security owned as of August 31, 2024 by correspondence with the accounting agent. We believe that our audits provide a reasonable basis for our opinion.

/s/PricewaterhouseCoopers LLP

Baltimore, Maryland

October 21, 2024

We have served as the auditor of one or more investment companies in the Franklin Templeton Group of Funds since 1948.

Western Asset Premier Institutional U.S. Treasury Reserves 2024 Annual Report

Important Tax Information (unaudited)

By mid-February, tax information related to a shareholder’s proportionate share of distributions paid during the preceding calendar year will be received, if applicable. Please also refer to www.franklintempleton.com for per share tax information related to any distributions paid during the preceding calendar year. Shareholders are advised to consult with their tax advisors for further information on the treatment of these amounts on their tax returns.

The following tax information for the Fund is required to be furnished to shareholders with respect to income earned and distributions paid during its fiscal year.

The Fund hereby reports the following amounts, or if subsequently determined to be different, the maximum allowable amounts, for the fiscal year ended August 31, 2024:

| | |

Long-Term Capital Gain Dividends Distributed | | |

Qualified Net Interest Income (QII) | | |

Section 163(j) Interest Earned | | |

Note (1) - The law varies in each state as to whether and what percentage of dividend income attributable to Federal obligations is exempt from state income tax. Shareholders are advised to consult with their tax advisors to determine if any portion of the dividends received is exempt from state income taxes.

Western Asset Premier Institutional U.S. Treasury Reserves

Changes in and Disagreements with AccountantsFor the period covered by this report

Results of Meeting(s) of ShareholdersFor the period covered by this report

Remuneration Paid to Directors, Officers and OthersFor the period covered by this report

Refer to the financial statements included herein.

Western Asset Premier Institutional U.S. Treasury Reserves

Board Approval of Management andSubadvisory Agreements (unaudited) The Executive and Contracts Committee of the Board of Trustees (the “Executive and Contracts Committee”) considered the Management Agreement between the Trust and Franklin Templeton Fund Adviser, LLC (“FTFA”) (formerly known as Legg Mason Partners Fund Advisor, LLC) with respect to the Fund and the subadvisory agreement between FTFA and Western Asset Management Company, LLC (“Western Asset” or the “Subadviser”, and together with FTFA, the “Advisers”) with respect to the Fund (collectively, the “Agreements”) at a meeting held on April 30, 2024. At an in-person meeting held on May 16, 2024, the Executive and Contracts Committee reported to the full Board of Trustees their considerations and recommendation with respect to the Agreements, and the Board of Trustees, including a majority of the Independent Trustees, considered and approved renewal of the Agreements.

In arriving at their decision to approve the renewal of the Agreements, the Trustees met with representatives of the Advisers, including relevant investment advisory personnel; considered a variety of information prepared by the Advisers, materials provided by Broadridge and advice and materials provided by counsel to the Independent Trustees; reviewed performance and expense information for peer groups of comparable funds selected by Broadridge (the “Performance Universe”) and certain other comparable products available from Western Asset or affiliates of Western Asset, including separate accounts managed by Western Asset; and requested and reviewed additional information as necessary. These reviews were in addition to information obtained by the Trustees at their regular quarterly meetings (and various committee meetings) with respect to the Fund’s performance and other relevant matters and related discussions with the Advisers’ personnel. The information received and considered by the Board both in conjunction with the May meeting and at prior meetings was both written and oral. With respect to the Broadridge materials, the Board was provided with a description of the methodology used to determine the similarity of the Fund with the funds included in the Performance Universe. It was noted that while the Board found the Broadridge data generally useful they recognized its limitations, including that the data may vary depending on the end date selected and that the results of the performance comparisons may vary depending on the selection of the peer group and its composition over time. The Board noted that the Fund is a “feeder fund” in a “master-feeder” structure, whereby, as a feeder fund, the Fund has the same investment objective and policies as the master fund, U.S. Treasury Reserves Portfolio (the “Master Fund”), a series of Master Portfolio Trust, and the Fund invests substantially all of its assets in the Master Fund.

As part of their review, the Trustees examined FTFA’s ability to provide high quality oversight and administrative and shareholder support services to the Fund and the Subadviser’s ability to provide high quality investment management services to the Fund. The Trustees considered the experience of FTFA’s personnel in providing the types of services that FTFA is responsible for providing to the Fund; the ability of FTFA to attract and

Western Asset Premier Institutional U.S. Treasury Reserves

Board Approval of Management andSubadvisory Agreements (unaudited) (cont’d) retain capable personnel; and the capability and integrity of FTFA’s senior management and staff. The Trustees also considered the investment philosophy and research and decision-making processes of the Subadviser; the experience of their key advisory personnel responsible for management of the Fund; the ability of the Subadviser to attract and retain capable research and advisory personnel; the risks to the Advisers associated with sponsoring the Fund (such as entrepreneurial, operational, reputational, litigation and regulatory risk), as well as FTFA’s and the Subadviser’s risk management processes; the capability and integrity of the Advisers’ senior management and staff; and the level of skill required to manage the Fund. In addition, the Trustees reviewed the quality of the Advisers’ services with respect to regulatory compliance and compliance with the investment policies of the Fund, and conditions that might affect the Advisers’ ability to provide high quality services to the Fund in the future, including their business reputations, financial conditions and operational stabilities. The Board also considered the policies and practices of FTFA and the Subadviser regarding the selection of brokers and dealers and the execution of portfolio transactions at the Master Fund level. Based on the foregoing, the Trustees concluded that the Subadviser’s investment process, research capabilities and philosophy were well suited to the Fund given its investment objectives and policies, and that the Advisers would be able to meet any reasonably foreseeable obligations under the Agreements.

The Board reviewed the qualifications, backgrounds and responsibilities of FTFA’s and Western Asset’s senior personnel and the team of investment professionals primarily responsible for the day-to-day portfolio management of the Fund. The Board also considered, based on its knowledge of FTFA and its affiliates, the financial resources of Franklin Resources, Inc., the parent organization of the Advisers. The Board recognized the importance of having a fund manager with significant resources.

In reviewing the quality of the services provided to the Fund, the Trustees also reviewed comparisons of the performance of the Fund to the performance of certain comparable funds and to its investment benchmark over the 1- and 3-year and since inception periods ended December 31, 2023. The information comparing the Fund’s performance to that of its Performance Universe, consisting of all funds (including the Fund) classified as institutional U.S. Treasury money market funds by Broadridge, showed, among other data, that the Fund’s performance for the 1- and 3- year and since inception periods ended December 31, 2023 was above the median. The Board noted that the Fund’s performance exceeded the performance of its investment index for the since 1- and 3-year and since-inception periods ended December 31, 2023. The Board considered the factors involved in the Fund’s performance relative to the performance of its investment index and Performance Universe.

The Trustees also considered the management fee payable by the Fund to FTFA, total expenses payable by the Fund and the fee that FTFA pays to the Subadviser. They reviewed

Western Asset Premier Institutional U.S. Treasury Reserves

information concerning management fees paid to investment advisers of similarly managed funds as well as fees paid by Western Asset’s other clients, including separate accounts managed by Western Asset. The Trustees noted that the Fund’s expense information reflected both management fees and total expenses payable by the Fund as well as management fees and total expenses payable by the Master Fund. The Trustees also noted that the Fund does not pay any management fees directly to the Subadviser because FTFA pays the Subadviser for services provided to the Fund out of the management fee FTFA receives from the Fund. The information comparing the Fund’s Contractual and Actual Management Fees as well as its actual total expense ratio to its peer group, consisting of a group of institutional U.S. Treasury money market funds (including the Fund) chosen by Broadridge to be comparable to the Fund, showed that the Fund’s Contractual Management Fee was above the median and that its Actual Management Fee was below the median. The Board noted that the Fund’s actual total expense ratio was below the median. The Board also considered that the current limitation on the Fund’s expenses is expected to continue through December 2024.

The Trustees further evaluated the benefits of the advisory relationship to the Advisers, including, among others, the profitability of the relationship to the Advisers; the direct and indirect benefits that the Advisers may receive from their relationships with the Fund, including the “fallout benefits,” such as reputational value derived from serving as investment adviser to the Fund; and the affiliation between the Advisers and certain other service providers for the Fund. In that connection, the Board considered that the ancillary benefits that the Advisers receive were reasonable. The Trustees noted that Western Asset does not have soft dollar arrangements.

Finally, the Trustees considered, in light of the profitability information provided by the Advisers, the extent to which economies of scale would be realized by the Advisers as the assets of the Fund grow. The Trustees considered an analysis of the profitability of FTFA and its affiliates in providing services to the Fund and in providing services to the Master Fund in which the Fund invests. The Board noted that the Fund’s Contractual Management Fee was above the median and the Fund’s Actual Management Fee was below the median of the peer group.

In their deliberations with respect to these matters, the Independent Trustees were advised by their independent counsel, who is independent, within the meaning of the Securities and Exchange Commission rules regarding the independence of counsel, of the Advisers. The Independent Trustees weighed the foregoing matters in light of the advice given to them by their independent counsel as to the law applicable to the review of investment advisory contracts. In arriving at a decision, the Trustees, including the Independent Trustees, did not identify any single matter as all-important or controlling, and each Trustee may have attributed different weight to the various factors in evaluating the Agreements. The

Western Asset Premier Institutional U.S. Treasury Reserves

Board Approval of Management andSubadvisory Agreements (unaudited) (cont’d) foregoing summary does not detail all the matters considered. The Trustees judged the terms and conditions of the Agreements, including the investment advisory fees, in light of all of the surrounding circumstances.

Based upon their review, the Trustees, including all of the Independent Trustees, determined, in the exercise of their business judgment, that they were satisfied with the quality of investment advisory services being provided by the Advisers; that the fees to be paid to the Advisers under the Agreements were fair and reasonable given the scope and quality of the services rendered by the Advisers; and that approval of the Agreements was in the best interest of the Fund and its shareholders.

Western Asset Premier Institutional U.S. Treasury Reserves

Schedule of InvestmentsAugust 31, 2024 U.S. Treasury Reserves Portfolio

(Percentages shown based on Portfolio net assets)

| | | | | |

Short-Term Investments — 101.4% |

U.S. Treasury Bills — 86.8% |

U.S. Cash Management Bill | | | | |

U.S. Cash Management Bill | | | | |

U.S. Cash Management Bill | | | | |

U.S. Cash Management Bill | | | | |

U.S. Cash Management Bill | | | | |

U.S. Cash Management Bill | | | | |

U.S. Cash Management Bill | | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

See Notes to Financial Statements.

U.S. Treasury Reserves Portfolio 2024 Annual Report

Schedule of Investments (cont’d)August 31, 2024 U.S. Treasury Reserves Portfolio

(Percentages shown based on Portfolio net assets)

| | | | | |

U.S. Treasury Bills — continued |

| | | | |

| | | | |

| | | | |

|

Total U.S. Treasury Bills | |

U.S. Treasury Notes — 14.6% |

| | | | |

| | | | |

U.S. Treasury Notes (3 mo. U.S. Treasury Money Market Yield + 0.140%) | | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

U.S. Treasury Notes (3 mo. U.S. Treasury Money Market Yield + 0.169%) | | | | |

| | | | |

U.S. Treasury Notes (3 mo. U.S. Treasury Money Market Yield + 0.125%) | | | | |

U.S. Treasury Notes (3 mo. U.S. Treasury Money Market Yield + 0.170%) | | | | |

U.S. Treasury Notes (3 mo. U.S. Treasury Money Market Yield + 0.245%) | | | | |

U.S. Treasury Notes (3 mo. U.S. Treasury Money Market Yield + 0.150%) | | | | |

|

Total U.S. Treasury Notes | |

Total Investments — 101.4% (Cost — $17,243,496,547#) | |

Liabilities in Excess of Other Assets — (1.4)% | |

Total Net Assets — 100.0% | |

See Notes to Financial Statements.

U.S. Treasury Reserves Portfolio 2024 Annual Report

U.S. Treasury Reserves Portfolio

| Aggregate cost for federal income tax purposes is substantially the same. |

| Rate shown represents yield-to-maturity. |

| Securities traded on a when-issued or delayed delivery basis. |

| Variable rate security. Interest rate disclosed is as of the most recent information available. Certain variable rate securities are not based on a published reference rate and spread but are determined by the issuer or agent and are based on current market conditions. These securities do not indicate a reference rate and spread in their description above. |

See Notes to Financial Statements.

U.S. Treasury Reserves Portfolio 2024 Annual Report

Statement of Assets and LiabilitiesAugust 31, 2024

| |

| |

| |

| |

| |

| |

Payable for securities purchased | |

| |

| |

| |

| |

| |

| |

See Notes to Financial Statements.

U.S. Treasury Reserves Portfolio 2024 Annual Report

Statement of OperationsFor the Year Ended August 31, 2024

| |

| |

| |

Investment management fee (Note 2) | |

| |

| |

| |

| |

| |

| |

| |

| |

Less: Fee waivers and/or expense reimbursements (Note 2) | |

| |

| |

Net Realized Gain on Investments | |

Increase in Net Assets From Operations | |

See Notes to Financial Statements.

U.S. Treasury Reserves Portfolio 2024 Annual Report

Statements of Changes in Net Assets

For the Years Ended August 31, | | |

| | |

| | |

| | |

Increase in Net Assets From Operations | | |

| | |

Proceeds from contributions | | |

| | |

Increase (Decrease) in Net Assets From Capital Transactions | | |

Increase (Decrease) in Net Assets | | |

| | |

| | |

| | |

See Notes to Financial Statements.

U.S. Treasury Reserves Portfolio 2024 Annual Report

For the years ended August 31: |

| | | | | |

Net assets, end of year (millions) | | | | | |

| | | | | |

Ratios to average net assets: |

| | | | | |

| | | | | |

| | | | | |

| Performance figures may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. |

| The investment manager, pursuant to the terms of the feeder fund’s investment management agreement, has agreed to waive 0.10% of Portfolio expenses, attributable to the Portfolio’s investment management fee. Additional amounts may be voluntarily waived and/or reimbursed from time to time. |

| Reflects fee waivers and/or expense reimbursements. |

See Notes to Financial Statements.

U.S. Treasury Reserves Portfolio 2024 Annual Report

Notes to Financial Statements

1. Organization and significant accounting policies

U.S. Treasury Reserves Portfolio (the “Portfolio”) is a separate diversified investment series of Master Portfolio Trust (the “Trust”). The Trust, a Maryland statutory trust, is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. The Declaration of Trust permits the Trustees to issue beneficial interests in the Portfolio. At August 31, 2024, all investors in the Portfolio were funds advised or administered by the investment manager of the Portfolio and/or its affiliates.

The Portfolio follows the accounting and reporting guidance in Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946, Financial Services – Investment Companies (“ASC 946”). The following are significant accounting policies consistently followed by the Portfolio and are in conformity with U.S. generally accepted accounting principles (“GAAP”), including, but not limited to, ASC 946. Estimates and assumptions are required to be made regarding assets, liabilities and changes in net assets resulting from operations when financial statements are prepared. Changes in the economic environment, financial markets and any other parameters used in determining these estimates could cause actual results to differ. Subsequent events have been evaluated through the date the financial statements were issued.

(a) Investment valuation. In accordance with Rule 2a-7 under the 1940 Act, money market instruments are valued at amortized cost, which approximates market value. This method involves valuing portfolio securities at their cost and thereafter assuming a constant amortization to maturity of any discount or premium. The Portfolio’s use of amortized cost is subject to its compliance with certain conditions as specified by Rule 2a-7 under the 1940 Act.

Pursuant to policies adopted by the Board of Trustees, the Portfolio’s manager has been designated as the valuation designee and is responsible for the oversight of the daily valuation process. The Portfolio’s manager is assisted by the Global Fund Valuation Committee (the “Valuation Committee”). The Valuation Committee is responsible for making fair value determinations, evaluating the effectiveness of the Portfolio’s pricing policies, and reporting to the Board of Trustees.

The Portfolio uses valuation techniques to measure fair value that are consistent with the market approach and/or income approach, depending on the type of security and the particular circumstance. The market approach uses prices and other relevant information generated by market transactions involving identical or comparable securities. The income approach uses valuation techniques to discount estimated future cash flows to present value.

U.S. Treasury Reserves Portfolio 2024 Annual Report

GAAP establishes a disclosure hierarchy that categorizes the inputs to valuation techniques used to value assets and liabilities at measurement date. These inputs are summarized in the three broad levels listed below:

•

Level 1 — unadjusted quoted prices in active markets for identical investments

•

Level 2 — other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.)

•

Level 3 — significant unobservable inputs (including the Portfolio’s own assumptions in determining the fair value of investments)

The inputs or methodologies used to value securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used in valuing the Portfolio’s assets carried at fair value:

|

| | Other Significant

Observable Inputs

(Level 2) | Significant

Unobservable

Inputs

(Level 3) | |

| | | | |

| See Schedule of Investments for additional detailed categorizations. |

(b) Repurchase agreements. The Portfolio may enter into repurchase agreements with institutions that its subadviser has determined are creditworthy. Each repurchase agreement is recorded at cost. Under the terms of a typical repurchase agreement, the Portfolio acquires a debt security subject to an obligation of the seller to repurchase, and of the Portfolio to resell, the security at an agreed-upon price and time, thereby determining the yield during the Portfolio’s holding period. When entering into repurchase agreements, it is the Portfolio’s policy that its custodian or a third party custodian, acting on the Portfolio’s behalf, take possession of the underlying collateral securities, the market value of which, at all times, at least equals the principal amount of the repurchase transaction, including accrued interest. To the extent that any repurchase transaction maturity exceeds one business day, the value of the collateral is marked-to-market and measured against the value of the agreement in an effort to ensure the adequacy of the collateral. If the counterparty defaults, the Portfolio generally has the right to use the collateral to satisfy the terms of the repurchase transaction. However, if the market value of the collateral declines during the period in which the Portfolio seeks to assert its rights or if bankruptcy proceedings are commenced with respect to the seller of the security, realization of the collateral by the Portfolio may be delayed or limited.

(c) Securities traded on a when-issued and delayed delivery basis. The Portfolio may trade securities on a when-issued or delayed delivery basis. In when-issued and delayed delivery transactions, the securities are purchased or sold by the Portfolio with

U.S. Treasury Reserves Portfolio 2024 Annual Report

Notes to Financial Statements (cont’d)

payment and delivery taking place in the future in order to secure what is considered to be an advantageous price and yield to the Portfolio at the time of entering into the transaction.

Purchasing such securities involves risk of loss if the value of the securities declines prior to settlement. These securities are subject to market fluctuations and their current value is determined in the same manner as for other securities.

(d) Interest income and expenses. Interest income (including interest income from payment-in-kind securities) consists of interest accrued and discount earned (including both original issue and market discount adjusted for amortization of premium) on the investments of the Portfolio. Expenses of the Portfolio are accrued daily. The Portfolio bears all costs of its operations other than expenses specifically assumed by the investment manager.

(e) Method of allocation. Net investment income of the Portfolio is allocated pro rata, based on respective ownership interests, among the Fund and other investors in the Portfolio (the “Holders”) at the time of such determination. Gross realized gains and/or losses of the Portfolio are allocated to the Holders in a manner such that the net asset values per share of each Holder, after each such allocation, is closer to the total of all Holders’ net asset values divided by the aggregate number of shares outstanding for all Holders.

(f) Compensating balance arrangements. The Portfolio has an arrangement with its custodian bank whereby a portion of the custodian’s fees is paid indirectly by credits earned on the Portfolio’s cash on deposit with the bank.

(g) Income taxes. The Portfolio is classified as a partnership for federal income tax purposes. As such, each investor in the Portfolio is treated as owner of its proportionate share of the net assets, income, expenses and realized gains and losses of the Portfolio. Therefore, no federal income tax provision is required. It is intended that the Portfolio’s assets will be managed so an investor in the Portfolio can satisfy the requirements of Subchapter M of the Internal Revenue Code.

Management has analyzed the Portfolio’s tax positions taken on income tax returns for all open tax years and has concluded that as of August 31, 2024, no provision for income tax is required in the Portfolio’s financial statements. The Portfolio’s federal and state income tax returns for tax years for which the applicable statutes of limitations have not expired are subject to examination by the Internal Revenue Service and state departments of revenue.

(h) Other. Purchases, maturities and sales of money market instruments are accounted for on the date of the transaction. Realized gains and losses are calculated on the identified cost basis.

2. Investment management agreement and other transactions with affiliates

Franklin Templeton Fund Adviser, LLC (“FTFA”) (formerly known as Legg Mason Partners Fund Advisor, LLC prior to November 30, 2023) is the Portfolio’s investment manager and

U.S. Treasury Reserves Portfolio 2024 Annual Report

Western Asset Management Company, LLC (“Western Asset”) is the Portfolio’s subadviser. FTFA and Western Asset are indirect, wholly-owned subsidiaries of Franklin Resources, Inc. (“Franklin Resources”).

Under the investment management agreement, the Portfolio pays an investment management fee, calculated daily and paid monthly, at an annual rate of 0.10% of the Portfolio’s average daily net assets.

FTFA provides administrative and certain oversight services to the Portfolio. FTFA delegates to the subadviser the day-to-day portfolio management of the Portfolio. For its services, FTFA pays Western Asset a fee monthly, at an annual rate equal to 70% of the net management fee it receives from the Portfolio.

As a result of the investment management agreement between FTFA and the feeder fund, FTFA has agreed to waive 0.10% of Portfolio expenses, attributable to the Portfolio’s investment management fee. Additional amounts may be voluntarily waived and/or reimbursed from time to time.

During the year ended August 31, 2024, fees waived and/or expenses reimbursed amounted to $16,419,302.

FTFA is permitted to recapture amounts waived and/or reimbursed to the Portfolio during the same fiscal year under certain circumstances.

All officers and one Trustee of the Trust are employees of Franklin Resources or its affiliates and do not receive compensation from the Trust.

3. Derivative instruments and hedging activities

During the year ended August 31, 2024, the Portfolio did not invest in derivative instruments.

U.S. Treasury Reserves Portfolio 2024 Annual Report

Report of Independent Registered Public Accounting Firm

To the Board of Trustees of Master Portfolio Trust and Investors of U.S. Treasury Reserves Portfolio

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of U.S. Treasury Reserves Portfolio (one of the portfolios constituting Master Portfolio Trust, referred to hereafter as the “Portfolio”) as of August 31, 2024, the related statement of operations for the year ended August 31, 2024, the statement of changes in net assets for each of the two years in the period ended August 31, 2024, including the related notes, and the financial highlights for each of the five years in the period ended August 31, 2024 (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Portfolio as of August 31, 2024, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period ended August 31, 2024 and the financial highlights for each of the five years in the period ended August 31, 2024 in conformity with accounting principles generally accepted in the United States of America.

These financial statements are the responsibility of the Portfolio’s management. Our responsibility is to express an opinion on the Portfolio’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Portfolio in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits of these financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of August 31, 2024 by correspondence with the custodian and brokers; when replies were not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

/s/PricewaterhouseCoopers LLP

Baltimore, Maryland

October 21, 2024

We have served as the auditor of one or more investment companies in the Franklin Templeton Group of Portfolios since 1948.

U.S. Treasury Reserves Portfolio 2024 Annual Report

Changes in and Disagreements with AccountantsFor the period covered by this report

Results of Meeting(s) of ShareholdersFor the period covered by this report

Remuneration Paid to Directors, Officers and OthersFor the period covered by this report

Refer to the financial statements included herein.

U.S. Treasury Reserves Portfolio

Board Approval of Management andSubadvisory Agreements (unaudited) The Executive and Contracts Committee of the Board of Trustees (the “Executive and Contracts Committee”) considered the Management Agreement between the Trust and Franklin Templeton Fund Adviser, LLC (“FTFA”) (formerly known as Legg Mason Partners Fund Advisor, LLC) with respect to the Fund and the subadvisory agreement between FTFA and Western Asset Management Company, LLC (“Western Asset” or the “Subadviser”, and together with FTFA, the “Advisers”) with respect to the Fund (collectively, the “Agreements”) at a meeting held on April 30, 2024. At an in-person meeting held on May 16, 2024, the Executive and Contracts Committee reported to the full Board of Trustees their considerations and recommendation with respect to the Agreements, and the Board of Trustees, including a majority of the Independent Trustees, considered and approved renewal of the Agreements.

In arriving at their decision to approve the renewal of the Agreements, the Trustees met with representatives of the Advisers, including relevant investment advisory personnel; considered a variety of information prepared by the Advisers, materials provided by Broadridge and advice and materials provided by counsel to the Independent Trustees; reviewed performance and expense information for peer groups of comparable funds selected by Broadridge (the “Performance Universe”) and certain other comparable products available from Western Asset or affiliates of Western Asset, including separate accounts managed by Western Asset; and requested and reviewed additional information as necessary. These reviews were in addition to information obtained by the Trustees at their regular quarterly meetings (and various committee meetings) with respect to the Fund’s performance and other relevant matters and related discussions with the Advisers’ personnel. The information received and considered by the Board both in conjunction with the May meeting and at prior meetings was both written and oral. With respect to the Broadridge materials, the Board was provided with a description of the methodology used to determine the similarity of the Fund with the funds included in the Performance Universe. It was noted that while the Board found the Broadridge data generally useful they recognized its limitations, including that the data may vary depending on the end date selected and that the results of the performance comparisons may vary depending on the selection of the peer group and its composition over time. The Board noted that the Fund is a “master fund” in a “master-feeder” structure, in which each feeder fund has the same investment objective and policies as the Fund and invests substantially all of its assets in the Fund. The information provided and presentations made to the Board encompassed the Fund and all funds for which the Board has responsibility, including the following feeder funds in the Fund (each, a “Feeder Fund”): Western Asset Institutional U.S. Treasury Reserves, a series of Legg Mason Partners Institutional Trust, and Western Asset Premier Institutional U.S. Treasury Reserves, a series of Legg Mason Partners Institutional Trust.

As part of their review, the Trustees examined FTFA’s ability to provide high quality oversight and administrative and shareholder support services to the Fund and the

U.S. Treasury Reserves Portfolio

Subadvisers’ ability to provide high quality investment management services to the Fund. The Trustees considered the experience of FTFA’s personnel in providing the types of services that FTFA is responsible for providing to the Fund; the ability of FTFA to attract and retain capable personnel; and the capability and integrity of FTFA’s senior management and staff. The Trustees also considered the investment philosophy and research and decision-making processes of the Subadviser; the experience of their key advisory personnel responsible for management of the Fund; the ability of the Subadviser to attract and retain capable research and advisory personnel; the risks to the Advisers associated with sponsoring the Fund (such as entrepreneurial, operational, reputational, litigation and regulatory risk), as well as FTFA’s and the Subadviser’s risk management processes; the capability and integrity of the Advisers’ senior management and staff; and the level of skill required to manage the Fund. In addition, the Trustees reviewed the quality of the Advisers’ services with respect to regulatory compliance and compliance with the investment policies of the Fund, and conditions that might affect the Advisers’ ability to provide high quality services to the Fund in the future, including their business reputations, financial conditions and operational stabilities. The Board also considered the policies and practices of FTFA and the Subadviser regarding the selection of brokers and dealers and the execution of portfolio transactions. Based on the foregoing, the Trustees concluded that the Subadviser’s investment process, research capabilities and philosophy were well suited to the Fund given its investment objectives and policies, and that the Advisers would be able to meet any reasonably foreseeable obligations under the Agreements.

The Board reviewed the qualifications, backgrounds and responsibilities of FTFA’s and Western Asset’s senior personnel and the team of investment professionals primarily responsible for the day-to-day portfolio management of the Fund. The Board also considered, based on its knowledge of FTFA and its affiliates, the financial resources of Franklin Resources, Inc., the parent organization of the Advisers. The Board recognized the importance of having a fund manager with significant resources.

In considering the performance of the Fund, the Board received and considered performance information for each Feeder Fund as well as for the Performance Universe selected by Broadridge. The Board noted that the Feeder Funds’ performance was the same as the performance of the Fund (except for the effect of fees at the Feeder Fund level), and therefore was relevant to the Board’s consideration of the Fund’s performance. The Board was provided with a description of the methodology used to determine the similarity of the Feeder Funds with the funds included in the Performance Universe. It was noted that while the Board found the Broadridge data generally useful they recognized its limitations, including that the data may vary depending on the end date selected and that the results of the performance comparisons may vary depending on the selection of the peer group and its composition over time. The Board also noted that it had received and discussed with management information throughout the year at periodic intervals comparing each Feeder

U.S. Treasury Reserves Portfolio

Board Approval of Management andSubadvisory Agreements (unaudited) (cont’d) Fund’s performance against its benchmark and against each Feeder Fund’s peers. In addition, the Board considered each Feeder Fund’s performance in light of overall financial market conditions.

• The information comparing Western Asset Institutional U.S. Treasury Reserves’ performance to that of its Performance Universe, consisting of all funds (including the Feeder Fund) classified as institutional U.S. Treasury money market funds by Broadridge, showed, among other data, that the Feeder Fund’s performance for the 1-, 3-, 5- and 10-year periods ended December 31, 2023 was above the median.

• The information comparing Western Asset Premier Institutional U.S. Treasury Reserves’ performance to that of its Performance Universe, consisting of all funds (including the Feeder Fund) classified as institutional U.S. Treasury money market funds by Broadridge, showed, among other data, that the Feeder Fund’s performance for the 1- and 3- year and since inception periods ended December 31, 2023 was above the median.

The Trustees also considered the management fee payable by the Fund to FTFA, total expenses payable by the Fund and the fee that FTFA pays to the Subadviser. They reviewed information concerning management fees paid to investment advisers of similarly managed funds as well as fees paid by Western Asset’s other clients, including separate accounts managed by Western Asset. The Trustees also noted that the Fund does not pay any management fees directly to the Subadviser because FTFA pays the Subadviser for services provided to the Fund out of the management fee FTFA receives from the Fund.

• The information comparing Western Asset Institutional U.S. Treasury Reserves’ Contractual and Actual Management Fees as well as its actual total expense ratio to its expense group, consisting of a group of institutional U.S. Treasury money market funds (including the Feeder Fund) chosen by Broadridge to be comparable to the Feeder Fund, showed that the Feeder Fund’s Contractual Management Fee and Actual Management Fee were at the median. The Board noted that the Feeder Fund’s actual total expense ratio was at the median. The Board also considered that the current limitation on the Feeder Fund’s expenses is expected to continue through December 2024.