As filed with the Securities and Exchange Commission on April 5, 2022 Securities Act File No. 333-XX |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________

FORM N-14

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Pre-Effective Amendment No. ☐

Post-Effective Amendment No. ☐

Vanguard Valley Forge Funds

(Exact Name of Registrant as Specified in Declaration of Trust)

________________________

P.O. Box 2600, Valley Forge, PA 19482

(Address of Principal Executive Office)

Registrant’s Telephone Number (610) 669-1000

________________________

Anne E. Robinson, Esquire

P.O. Box 876

Valley Forge, PA 19482

(Name and Address of Agent for Service)

Approximate Date of Proposed Public Offering: As soon as practicable after this registration statement becomes effective.

Title of securities being registered: Vanguard Baillie Gifford Global Positive Impact Stock Fund Investor Shares

Calculation of Registration Fee under the Securities Act of 1933: No filing fee is due in reliance on Section 24(f) and Rule 24f-2 under the Investment Company Act of 1940.

It is proposed this filing will become effective on May 5, 2022, pursuant to Rule 488 under the Securities Act of 1933.

BAILLIE GIFFORD POSITIVE CHANGE EQUITIES FUND

a series of BAILLIE GIFFORD FUNDS

Dear Shareholder:

A Special Meeting of Shareholders (the “Meeting”) of Baillie Gifford Positive Change Equities Fund (the “Baillie Gifford Fund”), a series of Baillie Gifford Funds (the “Baillie Gifford Trust”), will be held virtually at 11 A.M. Eastern Time on July 6, 2022. The Meeting is being called for the purpose of having Baillie Gifford Fund shareholders consider and vote on the reorganization (the “Reorganization”) of the Baillie Gifford Fund into the Vanguard Baillie Gifford Global Positive Impact Stock Fund (the “Vanguard Fund” and, together with the Ballie Gifford Fund, the “Funds”), a newly formed series of Vanguard Valley Forge Funds (the “Vanguard Trust”).

If you are a shareholder of record as of the regular close of business of the New York Stock Exchange on April 20, 2022, you are entitled to vote at the Meeting and at any adjournment or postponement of the Meeting. This package contains notice of the Meeting, information about the proposal and the materials to use when casting your vote.

The proposed Reorganization will entail the reorganization of the Baillie Gifford Fund into the Vanguard Fund, which was specifically created for the purpose of acquiring all of the assets and assuming all of the liabilities of the Baillie Gifford Fund and which will have no assets immediately prior to the Reorganization. If the Reorganization is approved, the Baillie Gifford Fund will be liquidated and dissolved after the Reorganization has been completed. If the Reorganization is approved, shareholders of the Baillie Gifford Fund will receive Investor class shares of the Vanguard Fund having a total dollar value (i.e., a net asset value) equal to the total dollar value of their investment in the Baillie Gifford Fund immediately prior to the Reorganization.

The Baillie Gifford Trust and the Vanguard Trust are each an open-end management investment company registered under the Investment Company Act of 1940 (the “1940 Act”). The Vanguard Fund has an identical investment objective and substantially similar investment strategies and policies to those of the Baillie Gifford Fund. Although the Funds describe a subset of the principal investment risks somewhat differently, the principal risks associated with investments in the Baillie Gifford Fund and the Vanguard Fund are substantially similar because the Funds have identical investment objectives and substantially similar investment strategies.

The Reorganization is not intended or expected to result in any changes to the day-to-day management of the Baillie Gifford Fund, as the existing portfolio management team will serve as portfolio managers for the Vanguard Fund. The proposed Reorganization will result in the Baillie Gifford Fund being overseen by a different board of trustees and being subject to new arrangements for distribution, custody, administration, transfer agency, legal, and audit services.

The Board of Trustees of the Baillie Gifford Trust believes that the proposed Reorganization is in the best interests of the Baillie Gifford Fund, and has unanimously approved and recommends that you vote “FOR” the Reorganization. In approving the Reorganization, the Board of Trustees of the Baillie Gifford Trust considered, among other factors:

| • | Lower Shareholder Costs – The Board considered the relative size of the Vanguard fund complex and the lower operating cost structure is expected to result in a lower total expense |

ratio for the Vanguard Fund compared to the Baillie Gifford Fund. The Board also considered The Vanguard Group, Inc.’s (“Vanguard”) reputation as a low-cost provider.

| • | Continuation of Investment Management – Baillie Gifford, who currently serves as manager to the Baillie Gifford Fund, would manage the Vanguard Fund using the same investment philosophy and process that it currently employs in managing the Baillie Gifford Fund with the same portfolio management team. |

| • | Substantially Similar Investment Program – The investment objectives, strategies, policies and risks of the Funds are substantially similar. |

| • | Future Growth of the Vanguard Fund – The Board considered Baillie Gifford Overseas Limited’s view that opportunities to grow assets due to Vanguard’s retail distribution network and the relative size of Vanguard should enable the Baillie Gifford Fund (as reorganized into the Vanguard Fund) to grow and achieve greater economies of scale. |

In light of public health concerns regarding the ongoing coronavirus (COVID-19) pandemic, and taking into account related orders and guidance issued by federal, state and local governmental bodies, the Meeting will be held in a virtual meeting format only, via the Internet, with no physical in-person meeting. All shareholders who own shares as of the record date and are interested in attending the virtual Meeting must register in advance by visiting https://www.viewproxy.com/BaillieGifford/broadridgevsm/ and submitting the required information to Broadridge Financial Solutions, Inc. (“Broadridge”), the Baillie Gifford Fund’s proxy tabulator.

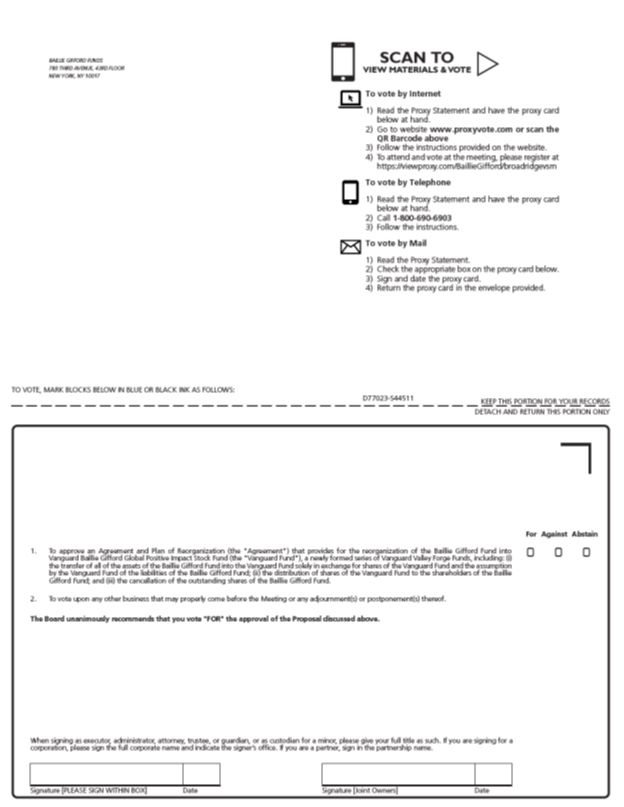

While you are, of course, welcome to join us at the virtual Meeting, most shareholders are likely to cast their votes by filling out and signing the enclosed Proxy Card. Whether or not you plan to attend the virtual Meeting, we need your vote. Please mark, sign, and date the enclosed Proxy Card and return it promptly in the enclosed, postage-paid envelope so that the maximum number of shares may be voted. You may also vote by touch-tone telephone or through the Internet as described on the enclosed Proxy Card.

We encourage you to support the Board’s recommendation to approve the proposal. Before you vote, please read the full text of the combined Proxy Statement/Prospectus.

Regardless of how many shares you own, your vote is extremely important to us. Please do not hesitate to call 1-844-394-6127 if you have any questions. Thank you for taking the time to consider this important proposal and for your investment in the Baillie Gifford Positive Change Equities Fund.

Sincerely,

David Salter

President, Baillie Gifford Funds

BAILLIE GIFFORD FUNDS

BAILLIE GIFFORD POSITIVE CHANGE EQUITIES FUND

--------------------

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

--------------------

To be held on July 6, 2022

To the Shareholders of the above referenced series (the “Baillie Gifford Fund”) of Baillie Gifford Funds, a Massachusetts business trust:

This is to notify you that a Special Meeting of Shareholders of the Baillie Gifford Positive Change Equities Fund will be held on July 6, 2022, at 11 A.M. Eastern Time over the Internet in a virtual format (the “Meeting”). The Meeting is being held so that shareholders can vote on the following proposal:

| 1. | To approve an Agreement and Plan of Reorganization (the “Agreement”) that provides for the reorganization of the Baillie Gifford Fund into Vanguard Baillie Gifford Global Positive Impact Stock Fund (the “Vanguard Fund”), a newly formed series of Vanguard Valley Forge Funds, including: |

(i) the transfer of all of the assets of the Baillie Gifford Fund into the Vanguard Fund solely in exchange for shares of the Vanguard Fund and the assumption by the Vanguard Fund of all of the liabilities of the Baillie Gifford Fund;

(ii) the distribution of shares of the Vanguard Fund to the shareholders of the Baillie Gifford Fund; and

(iii) the cancellation of the outstanding shares of the Baillie Gifford Fund (all of the foregoing together being referred to as the “Reorganization”).

If shareholders of the Baillie Gifford Fund approve the Agreement, and certain other closing conditions are satisfied or waived, shareholders of the Baillie Gifford Fund will receive after the closing of the Reorganization (in accordance with the terms of the Agreement), a number of shares of beneficial interest of the Vanguard Fund equal in value to the net asset value of the shares of the Baillie Gifford Fund held immediately prior to the Reorganization. The Vanguard Fund will have the same investment objective and substantially similar principal investment strategies, policies and risks as the Baillie Gifford Fund. The Reorganization is discussed in detail in the Proxy Statement/Prospectus attached to this notice. Please read those materials carefully for information concerning the Reorganization.

A copy of the form of the Agreement, which more completely describes the proposed Reorganization, is attached as Appendix A to the enclosed Proxy Statement/Prospectus. It is not anticipated that any matters other than the approval of the proposal noted above will be brought before the Meeting. If, however, any other business is properly brought before the Meeting, proxies will be voted in accordance with the judgment of the persons designated as proxies or otherwise as described in the enclosed Proxy Statement/Prospectus.

The Board of Trustees of the Baillie Gifford Fund have fixed the regular close of business of the New York Stock Exchange on April 20, 2022 as the record date for determination of shareholders entitled to notice of, and to vote at, the Meeting or any adjournment or postponement thereof. The persons named as proxies will vote in their discretion on any other business that may properly come before the Meeting.

The Board of Trustees of the Baillie Gifford Fund recommends that the shareholders of the Baillie Gifford Fund vote FOR the Proposal.

You are requested to mark, sign and date the enclosed Proxy Card and return it promptly in the enclosed, postage-paid envelope so that the Meeting may be held and a maximum number of shares may be voted or vote by touch-tone telephone. Please see the enclosed materials for telephone and Internet voting instructions. You may revoke your proxy at any time before it is exercised by submitting a written notice of revocation or a subsequently executed proxy or by attending the Meeting and voting at the Meeting.

In light of public health concerns regarding the ongoing coronavirus (COVID-19) pandemic, and taking into account related orders and guidance issued by federal, state and local governmental bodies, the Meeting will be held in a virtual meeting format only, via the Internet, with no physical in-person meeting. All shareholders who own shares as of the record date and are interested in attending the virtual Meeting must register in advance by visiting https://www.viewproxy.com/BaillieGifford/broadridgevsm/ and submitting the required information to Broadridge Financial Solutions, Inc. (“Broadridge”), the Baillie Gifford Fund’s proxy tabulator.

By Order of the Board of Trustees of Baillie Gifford Funds

______________________,

Gareth Griffiths

Secretary and Chief Legal Officer

May [ ], 2022

-------------------------------------------------------------------------------------------------------------------------------

YOUR VOTE IS IMPORTANT REGARDLESS OF THE NUMBER OF SHARES OWNED

WE URGE YOU TO MARK, SIGN, DATE AND MAIL THE ENCLOSED PROXY CARD IN THE POSTAGE-PAID ENVELOPE PROVIDED OR VOTE BY TOUCH-TONE TELEPHONE OR INTERNET SO THAT YOU WILL BE REPRESENTED AT THE MEETING.

-------------------------------------------------------------------------------------------------------------------------------

ACQUISITION OF THE ASSETS AND LIABILITIES OF

BAILLIE GIFFORD POSITIVE CHANGE EQUITIES FUND

A SERIES OF BAILLIE GIFFORD FUNDS

CALTON SQUARE

1 GREENSIDE ROW

EDINBURGH, SCOTLAND, UK EH1 3AN

011-44-131-275-2000

IN EXCHANGE FOR SHARES OF

VANGUARD BAILLIE GIFFORD GLOBAL POSITIVE IMPACT STOCK FUND

A SERIES OF VANGUARD VALLEY FORGE FUNDS

P.O. BOX 2600

VALLEY FORGE, PA 19482

(610) 669-1000

PROXY STATEMENT/PROSPECTUS DATED [___], 2022

INTRODUCTION

Proposal Summary. This Proxy Statement/Prospectus describes a proposal to reorganize Baillie Gifford Positive Change Equities Fund (the “Baillie Gifford Fund”), a series of Baillie Gifford Funds (the “Baillie Gifford Trust”) into Vanguard Baillie Gifford Global Positive Impact Stock Fund (the “Vanguard Fund”), a newly created series of Vanguard Valley Forge Funds (the “Vanguard Trust”). The Vanguard Fund is a member of The Vanguard Group, Inc. (“Vanguard”), a family of over 200 funds.

The reorganization involves a few basic steps:

(i) In accordance with the terms of the Agreement and Plan of Reorganization the Baillie Gifford Fund will transfer all of its assets to the Vanguard Fund in exchange for shares of beneficial interest of the Vanguard Fund and the Vanguard Fund will assume all of the liabilities of the Baillie Gifford Fund.

(ii) Simultaneously, the Baillie Gifford Fund will distribute such Vanguard Fund shares to its shareholders and the Vanguard Fund will open an account for each shareholder of the Baillie Gifford Fund, crediting it with an amount of shares of the Vanguard Fund equal in value to the shares of the Baillie Gifford Fund owned by such holder at the time of the reorganization.

(iii) As soon as practicable thereafter, the Baillie Gifford Fund will be dissolved, wound up, and terminated in accordance with its governing documents and applicable law (all of the foregoing together being referred to as the “Reorganization”).

The Board of Trustees of the Baillie Gifford Trust has determined that the Reorganization is in the best interest of the Baillie Gifford Fund and will not dilute the interests of existing shareholders of the Baillie Gifford Fund.

Read and Keep these Documents. Please read this entire Proxy Statement/Prospectus. This Proxy Statement/Prospectus sets forth concisely the information about the Vanguard Fund that a prospective investor should know before investing. As detailed below, a number of documents are incorporated by reference into this Proxy Statement/Prospectus and are deemed to be a part of this Proxy

Statement/Prospectus. In addition, a copy of the current prospectus of the Vanguard Fund of which you will receive shares accompanies this Proxy Statement/Prospectus. These documents are important and should be kept for future reference.

Additional Information is Available. Additional information about the Vanguard Fund and Baillie Gifford Fund is available in the following documents, each of which is incorporated by reference into this Proxy Statement/Prospectus:

These documents are on file with the U.S. Securities and Exchange Commission (“SEC”). Copies of all of these documents are available upon request without charge by writing to Baillie Gifford Overseas Limited (“Baillie Gifford”) at One Greenside Row, Calton Square, Edinburgh EH1 3AN or calling 1-844-394-6127. You also may view or obtain these documents on the EDGAR Database on the SEC’s Internet site at http://www.sec.gov, and copies of this information may be obtained, after paying a duplicating fee, by electronic request at the following e-mail address: publicinfo@sec.gov.

The Vanguard Fund’s Prospectus, which is incorporated by reference above and which accompanies this Proxy Statement/Prospectus, is intended to provide you with additional information about the Vanguard Fund. The Vanguard Fund is newly organized and will have no assets or liabilities at the time of the Reorganization. The Vanguard Fund was created specifically for the purpose of acquiring the assets and liabilities of the Baillie Gifford Fund in connection with the Agreement and will not commence operations until the closing date of the Reorganization. The Vanguard Fund has not produced any annual or semiannual reports to date. You may obtain an additional copy of the Vanguard Fund’s Prospectus or the related SAI without charge by contacting the Vanguard Trust at Vanguard.com or by calling 800-662-7447.

The Baillie Gifford Trust’s Board of Trustees has fixed the regular close of business on April 20, 2022 as the record date for the determination of shareholders entitled to notice of, and to vote at, the Meeting. This combined Proxy Statement/Prospectus is expected to be first sent to shareholders on or about May 16, 2022.

Please note that investments in the Fund are not bank deposits, are not federally insured, are not guaranteed by any bank or government agency and may lose value. There is no assurance that any Fund will achieve its investment objectives.

THESE SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION, NOR HAS THE SECURITIES AND EXCHANGE COMMISSION PASSED UPON THE ACCURACY OF THIS COMBINED PROXY STATEMENT/PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

TABLE OF CONTENTS

Overview | 6 |

| Details of Reorganization Proposal | 7 |

Reasons For The Reorganization

| 7 |

| How The Reorganization Will Be Accomplished | 8 |

Comparing the Baillie Gifford Fund and The Vanguard Fund

| 9 |

Investment Advisory Arrangements

| 22 |

| Additional Information About Vanguard Baillie Gifford Global Positive Impact Stock Fund | 25 |

| General Information | 29 |

KEY POINTS ABOUT THE PROPOSED REORGANIZATION

We are providing you with this overview of the proposal on which your vote is requested. Please read the full text of the Proxy Statement/Prospectus, which contains additional information about the proposal, and keep it for future reference. Your vote is important. Additional information is contained elsewhere in this Proxy Statement/Prospectus, as well as in the Baillie Gifford Fund’s Prospectus, the Vanguard Fund’s Prospectus (which is included herewith), and the SAI for this Proxy Statement/Prospectus, all of which are incorporated herein by reference.

Questions and Answers

What am I being asked to vote upon?

You are being asked to approve the reorganization (the “Reorganization”) of the Baillie Gifford Positive Change Equities Fund (the “Baillie Gifford Fund”), a series of Baillie Gifford Funds (the “Baillie Gifford Trust”), into Vanguard Baillie Gifford Global Positive Impact Stock Fund (the “Vanguard Fund”), a series of Vanguard Valley Forge Funds (the “Vanguard Trust”). The Vanguard Fund is a part of The Vanguard Group of Investment Companies (“The Vanguard Group”), one of the world’s largest mutual fund firms. Under this proposal, all of the assets and liabilities of the Baillie Gifford Fund would be transferred to the Vanguard Fund, a substantially similar fund created just for this purpose. After the Reorganization, the Vanguard Fund would continue investing your portfolio, and the Baillie Gifford Fund, which would have no remaining assets, would be dissolved.

What will happen if the Reorganization is approved?

Baillie Gifford Fund shareholders will become shareholders of the Vanguard Fund and hold Investor class shares of the Vanguard Fund. Baillie Gifford Fund shareholders will receive Vanguard Fund shares in an amount equal in value to the total dollar value of shares currently held in the Baillie Gifford Fund. The Baillie Gifford Fund will then be completely liquidated and dissolved.

Beginning shortly after shareholders have approved the Reorganization, the Baillie Gifford Fund’s distributor expects to stop accepting purchase requests from new and existing shareholders. Baillie Gifford Fund shareholders will continue to be able to redeem their shares up until the completion of the Reorganization. Purchase and redemption requests received after completion of the Reorganization (if approved) should be directed to the Vanguard Fund in accordance with its prospectus.

What is the anticipated timing of the Reorganization?

A meeting of shareholders of the Baillie Gifford Fund will be held on July 6, 2022 (together with any postponements or adjournments thereof, the “Meeting”). If shareholders of the Baillie Gifford Fund approve the Reorganization and other customary closing conditions are met or waived, it is anticipated that the Reorganization will occur in or around July 2022.

Do the fundamental investment policies materially differ between the Baillie Gifford Fund and the Vanguard Fund?

The fundamental investment policies of the Baillie Gifford Fund and the Vanguard Fund are substantially similar to one another and include certain investment policies required by the 1940 Act. For more information about the Funds’ fundamental investment policies, see the section below entitled “Comparing Fundamental Investment Restrictions.”

Are there any significant differences between the investment objectives and principal investment strategies and risks of the Baillie Gifford Fund and the Vanguard Fund?

No. The Vanguard Fund will seek capital appreciation with an emphasis on investing in businesses that deliver positive change by contributing towards a more sustainable and inclusive world. The Vanguard Fund’s investment objective is identical to that of the Baillie Gifford Fund. In addition, The Vanguard Fund is subject to substantially similar principal risks as the Baillie Gifford Fund because it has substantially similar investment strategies and policies and invests principally in the same types of securities. For a detailed comparison of the Fund’s principal risks, see the section below entitled “Comparing Risk Factors.” Baillie Gifford Overseas Limited (“Baillie Gifford”), the current investment adviser for the Baillie Gifford Fund, will serve as the investment adviser for the Vanguard Fund, carrying out an investment program for the Vanguard Fund that is substantially similar to the investment program of the Baillie Gifford Fund, subject to the direction of the Board of Trustees of the Vanguard Fund. The Vanguard Fund’s Board of Trustees will have the flexibility to make advisory changes, including changes to the contract of an existing adviser or the appointment of different or additional investment advisers, without shareholder vote, pursuant to an exemption obtained from the SEC by Vanguard. The Board of Trustees of the Baillie Gifford Fund (the “Baillie Gifford Board” and, in context, the “Board”) does not have the power to appoint different or additional investment advisers without a shareholder vote.

Will the Baillie Gifford Fund or Vanguard Fund pay the costs of this proxy solicitation or any costs in connection with the proposed Reorganization?

The costs of the solicitation related to the proposed Reorganization, including any costs directly associated with preparing, filing, printing, and distributing to the Baillie Gifford Fund shareholders all materials relating to this Proxy Statement/Prospectus and soliciting shareholder votes, as well as the operational costs associated with the proposed Reorganization, will be borne by Baillie Gifford and Vanguard, not by the Funds. Baillie Gifford and Vanguard will pay these costs whether or not the Reorganization is consummated.

Neither the Baillie Gifford Fund nor the Vanguard Fund will bear any direct fees or expenses in connection with the proposed Reorganization, nor will they bear any quantifiable transaction costs associated with the Reorganization. There may be costs associated with selling and repurchasing portfolio securities (including transaction costs and taxes), which may be necessary to effect the transfer of specific portfolio securities to the Vanguard Fund in certain non-U.S. markets. These potential costs related to the Reorganization are substantially due to the fact that, for certain foreign markets on which securities held by the Baillie Gifford Fund trade, the Baillie Gifford Fund may be required to sell the securities in market transactions in order to transfer cash to the Vanguard Fund. The Vanguard Fund would then repurchase the same securities in the foreign market with the cash received following the Reorganization. These costs are difficult to estimate and may vary depending on circumstances at the time of transfer and any mitigating options that may be available. Baillie Gifford and/or Vanguard, and not the Funds, will bear these transaction costs if they arise.

The Baillie Gifford Fund may realize capital gains or losses on the sale of such securities described above, which may result in additional taxable distributions to shareholders of the Baillie Gifford Fund prior to the Reorganization and/or to shareholders of the Vanguard Fund following the Reorganization. Absent the Reorganization, certain losses, including capital losses on the sale and repurchase of securities in a non-U.S. market where a security transfer may not be permitted, could have potentially been used to offset capital gains on other holdings under certain non-U.S. tax laws, but such an offset right may be lost in connection with the Reorganization. Certain other non-quantifiable costs may arise in connection with the Reorganization, such as the opportunity cost of certain assets being out of the market for some period of time around the consummation of the Reorganization. Especially given that the closing of the transaction

would be months away, it is not possible to estimate or predict any positive or negative market impact on the Baillie Gifford Fund and the Vanguard Fund if they are effectively required to hold cash instead of certain portfolio securities for a period of time shortly before and after closing of the Reorganization. If the non-quantifiable costs described in this paragraph were to arise, they would be borne by the Funds.

Will there be any sales load, commission, or other transactional fee in connection with the Reorganization?

No. The total value of the shares of the Baillie Gifford Fund that you own will be exchanged for shares of the Vanguard Fund without the imposition of any sales load, commission, or other transactional fee.

What are the expected federal income tax consequences of the Reorganization?

The Reorganization is intended to qualify as a tax-free reorganization for U.S. federal income tax purposes and, as a condition of closing, the Baillie Gifford Fund will receive an opinion of counsel to the effect that the Reorganization will constitute a “reorganization” within the meaning of Section 368 of the Internal Revenue Code of 1986, as amended (the “Code”). Thus, while there can be no guarantee that the U.S. Internal Revenue Service (the “IRS”) or a court will adopt a similar position, it is expected, subject to the limited exceptions described in the Proxy Statement/Prospectus under the heading “Certain U.S. Federal Income Tax Consequences of the Reorganization,” that for U.S. federal income tax purposes neither shareholders, nor the Baillie Gifford Fund, will recognize gain or loss as a direct result of the Reorganization, and the holding period for, and the aggregate tax basis of the Vanguard Fund’s shares that you will receive in the Reorganization will generally include the holding period for, and will be the same as the aggregate tax basis of the shares that you surrender in the Reorganization. Shareholders should consult their tax adviser about state, local, and, if applicable, non-U.S. tax consequences of the Reorganization, if any, because the information about tax consequences in the Proxy Statement/Prospectus relates only to the U.S. federal income tax consequences of the Reorganization.

Has the Baillie Gifford Board considered the Reorganization, and how do they recommend I vote?

The Baillie Gifford Board believes that the Reorganization is in the best interests of the Baillie Gifford Fund and recommends that you vote “FOR” the Reorganization. A summary of the considerations of the Baillie Gifford Board in making this recommendation is provided in the “Reasons for Reorganization” section of the Proxy Statement/Prospectus.

How will the Reorganization affect my account?

If shareholders approve the Reorganization, your Baillie Gifford Fund shares will be exchanged, for U.S. federal income tax purposes, on a tax-free basis, for Vanguard Fund shares of equivalent value. Your account registration is expected to remain the same and you will have the opportunity to establish the same or similar account options. In addition, for U.S. federal income tax purposes, your aggregate tax basis in your shares is expected to remain the same.

How will the number of Vanguard Fund Shares that I will receive be determined?

As a Baillie Gifford Fund shareholder, you will receive your pro rata share of the Vanguard Fund shares received by the Baillie Gifford Fund in the Reorganization. The number of Vanguard Fund shares that a Baillie Gifford Fund shareholder will receive will be based on the net asset value (“NAV”) of such Baillie Gifford Fund shareholder’s account, determined as of the close of regular trading on the New York Stock Exchange (“NYSE”) on the business day immediately preceding the closing date. The Baillie Gifford

Fund’s assets will be valued pursuant to the Baillie Gifford Fund’s valuation procedures, determined as of immediately after the close of regular trading on the NYSE on the business day immediately preceding the Closing Date (the “Valuation Date”). With respect to matters bearing on the valuation of the securities held by the Baillie Gifford Fund as of the date hereof, the Vanguard Trust’s valuation procedures are substantially similar to the valuation procedures of the Baillie Gifford Trust. The total value of your holdings should not change as a result of the Reorganization.

What is the required vote to approve the Reorganization?

Shareholder approval of the Reorganization requires the affirmative vote of the lesser of (i) 67% or more of the shares present or represented by proxy at the Meeting, if the holders of more than 50% of the outstanding shares of the Baillie Gifford Fund are present or represented by proxy; or (ii) more than 50% of the outstanding shares of the Baillie Gifford Fund.

What if there are not enough votes to reach a quorum or to approve the Reorganization by the scheduled Meeting date?

In the event that sufficient votes in favor of the Reorganization are not received by the time scheduled for the Meeting, the persons named as proxies may propose one or more adjournments or postponements of the Meeting for a reasonable time after the date set for the original Meeting to permit further solicitation of proxies.

What will happen if shareholders of the Baillie Gifford Fund do not approve the Reorganization?

If shareholders do not approve the Reorganization, the Baillie Gifford Fund will continue in existence (unless the Baillie Gifford Board decides otherwise) and the Vanguard Fund will not commence operations.

What if I do not wish to participate in the Reorganization?

If the Reorganization is approved by shareholders and you do not wish to have your shares of the Baillie Gifford Fund exchanged for shares of the Vanguard Fund as a part of the Reorganization, you may redeem your shares prior to the consummation of the Reorganization. If you redeem your shares and you hold shares in a taxable account, you will recognize a taxable gain or loss equal to the difference between your tax basis in the shares and the amount you receive for them.

How many votes am I entitled to cast?

As a shareholder of the Baillie Gifford Fund, you are entitled to one vote for each whole share, and a proportionate fractional vote for each fractional share, that you own of the Baillie Gifford Fund on the record date of April 20, 2022 (the “Record Date”). Completion of the Reorganization is conditioned on the approval of the Reorganization by the Baillie Gifford Fund shareholders.

How do I vote my shares?

For your convenience, there are several ways you can vote:

| - | Voting at the Meeting. If you attend the virtual meeting, were the beneficial owner of your shares as of the Record Date for the Meeting, and wish to vote at the virtual Meeting, you will |

be able to. Please see the Section titled “General Information—Proxy Solicitation Methods" for additional information on how to register to vote at the Meeting.

| - | Voting by Proxy. Whether you plan to attend the Meeting or not, we urge you to complete, sign, and date the enclosed proxy care and to return it promptly in the envelope provided. Returning the proxy card will not affect your right to attend the Meeting virtually and vote. If you properly fill in and sign your proxy care and send it to us in time to vote at the Meeting, your “proxy” (the individuals names on your proxy card) will vote your shares as you have directed. If you sign your proxy card, but do not make a choice, your proxy care will vote shares “FOR” the proposal as recommended by the Baillie Gifford Board, and in their best judgment on other matters. Your proxy will have the authority to vote and act on your behalf at any adjournment or postponement of the Meeting. If you authorize a proxy to vote for you, you may revoke the authorization at any time before it is exercised by sending in another proxy card with a later date or by notifying the Secretary of the Baillie Gifford Fund in writing to the address of the Baillie Gifford Fund set forth on the cover page of the Proxy Statement/Prospectus before the Meeting that you have revoked your proxy. In addition, although merely attending the virtual Meeting will not revoke your proxy, if you are present at the Meeting you may withdraw your proxy and vote at the Meeting. |

| - | Voting by Telephone or the Internet. You may vote your shares by telephone or through a website established for that purpose by following the instructions that appear on the proxy card accompanying the Proxy Statement/Prospectus. |

Whom should I call for additional information about the Reorganization or the Proxy Statement/Prospectus?

If you need any assistance or have any questions regarding the Reorganization or how to vote your shares, please call Broadridge Investor Communication Solutions, Inc. at 833-782-7192.

I. OVERVIEW

The Proposed Reorganization. The Baillie Gifford Board has approved an Agreement and Plan of Reorganization (the “Agreement”) providing for the Reorganization of the Baillie Gifford Fund into the Vanguard Fund. The Baillie Gifford Board concluded that the proposed Reorganization is in the best interests of the Baillie Gifford Fund. If shareholders of the Baillie Gifford Fund approve the Reorganization, each Baillie Gifford Fund shareholder will receive Investor Shares of the Vanguard Fund equal in value to the value of the Class K or Institutional Class shares of the Baillie Gifford Fund held by such shareholder at the time of the Reorganization.

Investment Objectives, Strategies, and Policies of Each Fund. The Vanguard Fund’s investment objective is identical to that of the Baillie Gifford Fund. Each Fund seeks capital appreciation with an emphasis on investing in businesses that deliver positive change by contributing towards a more sustainable and inclusive world. Each Fund’s investment objective may be changed without shareholder approval. Additional information is provided below comparing the Baillie Gifford Fund to the Vanguard Fund in the section entitled, “Details of the Reorganization Proposal – Comparing the Baillie Gifford Fund and the Vanguard Fund.”

Investment Adviser. If shareholders approve the Reorganization, the Vanguard Fund will be managed by Baillie Gifford, subject to the direction of the Vanguard Trust Board of Trustees (the “Vanguard Board”). Although there are no current plans to do so, one or more new advisers could be added to the Vanguard Fund in the future, as either additions to or replacements for Baillie Gifford. The Vanguard Board has the flexibility to make changes to the investment advisers of the Vanguard Fund if it considers it to be in shareholders’ best interests, without a shareholder vote, under the terms of an SEC exemption. Any change in investment advisor impacting the Vanguard Fund will be communicated to shareholders in writing. The Board of Trustees of the Baillie Gifford Fund (the “Baillie Gifford Fund Board” and, in context, the “Board”) does not have the power to appoint different or additional investment advisers without a shareholder vote. Details of the advisory arrangements for the Baillie Gifford Fund and the Vanguard Fund are provided below in the section entitled, “Investment Advisory Arrangements.”

Investment Advisory Fees. The Vanguard Fund will pay Baillie Gifford an investment advisory fee on a quarterly basis based on certain annual percentage rates applied to average daily net assets managed by Baillie Gifford for each quarter. Note that both the Baillie Gifford Fund and the Vanguard Fund bear additional fees for non-investment advisory administration services. Although the contractual advisory fee for the Vanguard Fund is expected to be higher than the contractual advisory fee for the Baillie Gifford Fund at current asset levels, the Vanguard Fund is expected to experience lower overall total annual fund operating expenses as compared to the Baillie Gifford Fund, both before and after any applicable waivers. Additional information about the Baillie Gifford Fund and Vanguard Fund fee schedules appears below in the section entitled “Investment Advisory Arrangements - Comparing Investment Advisory Agreements.”

Under an Administration and Supervisory Agreement, the Baillie Gifford Fund pays Baillie Gifford an Administration and Supervisory Fee quarterly, in arrears, with respect to Class K and Institutional Class shares at an annual rate of 0.17% of the Fund’s average net assets. Under the Fifth Amended and Restated Funds’ Service Agreement (the “Funds’ Service Agreement”), the Vanguard Fund expects to pay Vanguard an administration fee at an annual rate of 0.10% of the Fund’s average net assets.

Tax-Free Reorganization. It is expected that for U.S. federal income tax purposes the proposed Reorganization will be accomplished on a tax-free basis, meaning that it is expected that you won’t realize

any taxable gains or losses when your Baillie Gifford Fund shares are exchanged for shares of the Vanguard Fund.

Independent Registered Public Accounting Firm. PricewaterhouseCoopers LLP is expected to serve as independent registered public accounting firm to the Vanguard Fund, as they do for all other Vanguard funds. Cohen & Company, Ltd. currently serves as independent registered public accounting firm to the Baillie Gifford Fund.

II. DETAILS OF REORGANIZATION PROPOSAL

At a meeting of the Baillie Gifford Fund’s Board on January 12, 2022, in response to a proposal by Baillie Gifford, the Board approved the Reorganization and the Agreement. Following are some important details regarding the reasons the Board believes the Reorganization is in the best interests of the Baillie Gifford Fund:

REASONS FOR THE REORGANIZATION

The Baillie Gifford Board considered the proposed Reorganization and determined that it was in the best interests of the Baillie Gifford Fund to approve the proposed Reorganization. In reaching this conclusion for the Baillie Gifford Fund, the Board did not identify any single factor as determinative in its analysis, but rather the Board considered a variety of factors, including those discussed below. The Board did not allot a particular weight to any one factor or group of factors.

Lower Shareholder Costs. The Board considered the relative size of The Vanguard Group and lower operating cost structure is expected to result in a lower total expense ratio for the Vanguard Fund compared to the Baillie Gifford Fund. The Vanguard Fund is estimated to have a total expense ratio of approximately 0.59% for Investor Shares for the Vanguard Fund’s first full year of operations following the Reorganization. By comparison, Baillie Gifford Fund’s net expense ratio for the fiscal year ended December 31, 2021 was 0.65% for Class K shares and 0.72% for Institutional Class shares (giving effect to the contractual expense limitations). Without the contractual expense limitation, the Baillie Gifford Fund’s total expense ratio for the fiscal year ended December 31, 2021 would have been 0.70% for Class K shares and 0.77% on Institutional Class shares. In addition, the Board considered Baillie Gifford’s view that, due to the economies of scale inherent in The Vanguard Group’s size as well as investment advisory fee breakpoints provided in the advisory fee schedule for the Vanguard Fund, the total expense ratio for the Vanguard Fund is expected to continue to be lower than it would have been for the Baillie Gifford Fund as assets grow. The Board also considered The Vanguard Group’s reputation as a low-cost provider.

Continuity of Investment Management. The Board considered that Baillie Gifford, who currently serves as manager to the Baillie Gifford Fund, would manage the Vanguard Fund in accordance with the same investment philosophy and process that it currently employs for the Baillie Gifford Fund with the same portfolio management team. The Board noted that the Board of Trustees of the Vanguard Fund would have the flexibility to make advisory changes without a shareholder vote, including changes to the contract of an existing investment adviser or the appointment of different or additional investment advisers.

Substantially Similar Investment Program. The Board considered that the investment objectives, strategies, policies and risks of the Vanguard Fund are substantially similar to those of the Baillie Gifford Fund.

Future Growth of the Vanguard Fund. The Board considered Baillie Gifford’s view that opportunities to grow assets due to The Vanguard Group’s retail distribution network and the relative size of The Vanguard Group should enable the Baillie Gifford Fund (as reorganized into the Vanguard Fund) to grow and achieve greater economies of scale. The Board also considered that, to the extent that assets in the Baillie Gifford Fund (as reorganized into the Vanguard Fund) grow after joining The Vanguard Group as the result of investments by new shareholders, including retail shareholders, there would be a larger asset base over which expenses would be spread which may reduce expenses for existing shareholders.

Tax-Free Nature of the Reorganization. The Board considered that it is expected that the Reorganization will be accomplished on a tax-free basis. Accordingly, it is expected that shareholders will not realize any capital gains when Baillie Gifford Fund shares are exchanged for shares of the Vanguard Fund. The Board noted Baillie Gifford’s statements that potentially required sales and repurchases of certain securities in some non-U.S. jurisdictions may result in the realization of capital gains or losses and that the Reorganization could result in the loss of the Baillie Gifford Fund’s ability to utilize existing capital losses in such jurisdictions.

Costs of the Reorganization. The Baillie Gifford Board considered that the direct expenses of the Reorganization would not be borne by Baillie Gifford Fund shareholders nor would the brokerage expenses and other quantifiable costs associated with any potentially required sale and repurchase of securities in certain non-U.S. jurisdictions to accomplish the Reorganization.

HOW THE REORGANIZATION WILL BE ACCOMPLISHED

Agreement and Plan of Reorganization. The Agreement sets out the terms and conditions that will apply to the Reorganization (assuming that shareholders approve this proposal). For a complete description of the terms and conditions that will apply to the Reorganization, please see the Form of Agreement and Plan of Reorganization attached as Appendix A to this Proxy Statement/Prospectus.

Three steps to reorganize. If approved by shareholders, the Reorganization will be accomplished in a three-step process. First, the Baillie Gifford Fund will transfer all of its assets to the Vanguard Fund in exchange for shares of beneficial interest of the Vanguard Fund and the Vanguard Fund will assume all of the liabilities of the Baillie Gifford Fund. Second, and simultaneously with step one, the Baillie Gifford Fund will distribute such Vanguard Fund shares to its shareholders and the Vanguard Fund will open an account for each shareholder, crediting it with an amount of shares of the Vanguard Fund equal in value to the shares of the Baillie Gifford Fund owned by such holder at the time of the Reorganization. Third, the Baillie Gifford Fund will be liquidated and terminated as a series of Baillie Gifford Trust.

Effective as soon as practicable. If approved by shareholders, the Reorganization will take place as soon as practicable after all necessary regulatory approvals and other closing conditions are met or waived. It is currently anticipated that the Reorganization will be accomplished by July 2022.

The Reorganization is Conditioned on Tax-Free Treatment at the Federal Level. It is anticipated that the Reorganization will have no direct U.S. federal income tax consequences for the Baillie Gifford Fund or its shareholders. The Reorganization will not proceed until this expectation is confirmed by an opinion of counsel, although there can be no guarantee that the IRS or a court would agree with such opinion. Following the Reorganization, from a U.S. federal income tax standpoint, the aggregate tax basis of the Vanguard Fund shares received by a shareholder is expected to be the same as the aggregate tax basis of the Baillie Gifford Fund shares that the shareholder exchanged. As described above, however, any potentially required sales and repurchases of certain securities in some non-U.S. jurisdictions would be expected to result in the realization of some capital gains or losses for the Baillie Gifford Fund, which may

result in additional taxable distributions to shareholders of the Baillie Gifford Fund prior to the Reorganization and/or to shareholders of the Vanguard Fund following the Reorganization. Shareholders should consult their own tax adviser regarding the expected state, local and non-U.S. tax consequences of the Reorganization (if any). There is additional information about the U.S. federal income tax consequences of the Reorganization in the Form of Agreement and Plan of Reorganization. For additional detail, see the below section entitled “Certain U.S. Federal Income Tax Consequences of the Reorganization.”

COMPARING THE BAILLIE GIFFORD FUND AND THE VANGUARD FUND

Comparing Investment Objectives and Principal Investment Strategies. The Baillie Gifford Fund’s investment objective is to seek capital appreciation with an emphasis on investing in businesses that deliver positive change by contributing towards a more sustainable and inclusive world. The Vanguard Fund will have the same investment objective as the Baillie Gifford Fund. Each Fund’s investment objective is non-fundamental and may be changed without shareholder approval.

The Vanguard Fund’s principal investment strategies and non-fundamental investment policies are substantially similar to those of the Baillie Gifford Fund. One material difference in the Funds’ formal investment policies is that the Vanguard Fund has adopted an investment policy to invest, under normal circumstances, at least 80% of its net assets (plus any borrowings for investment purposes) in stocks of companies that Baillie Gifford determines contribute towards a more sustainable and inclusive world. The Baillie Gifford Fund has not adopted such a policy, but has a policy to invest, under normal circumstances, at least 80% of its net assets in equity securities. Baillie Gifford believes that the Vanguard Fund’s 80% Policy is consistent with the way the Baillie Gifford Fund is currently managed and that the Baillie Gifford Fund’s current portfolio comports with the 80% Policy. Baillie Gifford does not anticipate that the new 80% Policy will result in any material differences in the way the Vanguard Fund is managed as compared to the Baillie Gifford Fund.

Comparing Risk Factors. The Vanguard Fund is subject to substantially similar principal risk factors as the Baillie Gifford Fund because it has substantially similar investment strategies and policies and invests principally in the same types of securities. Like an investment in the Baillie Gifford Fund, an investment in the Vanguard Fund could lose money over short or even long periods, and the entire amount invested could be lost. There can be no assurance that the Vanguard Fund’s investment objective or strategies will be achieved, and results may vary substantially over time.

There are some differences in how the Baillie Gifford Fund and the Vanguard Fund describe each Fund’s primary risks. Both Funds disclose the following risks: Investment Style, Manager, or Long-Term Investment Strategy Risk; Non-Diversification Risk; Impact Risk; Currency Risk; Emerging Markets Risk; Equity Securities, Market, or Stock Market Risk; Focused Investment or Asset Concentration Risk; Non-U.S. Investment or Country/Regional Risk; and Socially Responsible or ESG Investing Risk. The Baillie Gifford Fund’s prospectus currently includes a number of distinct risk factors that are not included in the Vanguard Fund’s prospectus. These risk factors are identified in the table below, along with a description of the Vanguard Fund’s approach to each risk factor.

| Baillie Gifford Fund Risk | Vanguard Fund Disclosure |

| Growth Stock Risk | The Vanguard Fund believes that the risks of investing in growth stocks are covered under its Stock Market Risk and Investment Style Risk. |

| Asia Risk | The Vanguard Fund, similar to the Baillie Gifford Fund, anticipates investing a small percentage of its portfolio in Asian securities. The Vanguard Fund believes that the risks of investing in Asian securities |

| Baillie Gifford Fund Risk | Vanguard Fund Disclosure |

| are disclosed under its Country/Regional Risk. Further information about the risks of investing in certain Asian countries can be found in the Vanguard Fund’s SAI. |

| Conflicts of Interest Risk | In line with the SEC’s focus on providing investors streamlined information and in accordance with the requirements of Form N-1A, the Vanguard Fund provides information on the potential conflicts of interest in its SAI. |

| Frontier Markets Risk | The Vanguard Fund’s Emerging and Frontier Markets Risk addresses the risks of both emerging and frontier markets. |

| Government and Regulatory Risk | The Country/Regional Risk and Emerging and Frontier Markets Risk in the Vanguard Fund address the risks associated with non-U.S. governments and regulatory authorities. The Vanguard Fund’s SAI provides more information on the risks related to government and regulatory authorities in the U.S. |

| Information Technology Risk | In line with the SEC’s efforts to provide streamlined disclosure for investors, the Vanguard Fund provides information about this risk in its SAI. |

| IPO Risk | Because IPOs are not part of the Vanguard Fund’s principal investment strategy and they present many of the same risks as other investments in publicly traded companies, the Vanguard Fund does view IPO risk as a principal investment risk. |

| Japan Risk | The Vanguard Fund, similar to the Baillie Gifford Fund, anticipates investing a small percentage of its portfolio in Japanese securities. Additionally, the Vanguard Fund believes the risks of investing in Japanese securities are covered generally under the Vanguard Fund’s Country/Regional Risk. |

| Large-Capitalization Securities Risk | The Vanguard Fund does not have a separate risk related to large-capitalization securities. The risks of investing in large-capitalization securities are addressed under the Vanguard Fund’s Investment Style Risk. |

| Liquidity Risk | The Vanguard Fund, similar to the Baillie Gifford Fund, does not anticipate that it will invest substantially in illiquid investments, and does not view liquidity risk as a principal investment risk. The risks related to investing in restricted and/or illiquid investments are disclosed in the Vanguard Fund’s SAI. |

| Market Disruption and Geopolitical Risk | In line with the SEC’s efforts to provide streamlined disclosure for investors, the Vanguard Fund provides information about this risk in its SAI. |

| Service Provider Risk | In line with the SEC’s efforts to provide streamlined disclosure for investors, the Vanguard Fund provides information about this risk in its SAI. |

| Settlement Risk | The risks related to the clearance and settlement of non-U.S. securities is addressed under the Vanguard Fund’s Emerging and Frontier Markets Risk. |

| Baillie Gifford Fund Risk | Vanguard Fund Disclosure |

| Small- and Mid-Capitalization Risk | The Vanguard Fund does not have a separate risk related to small- and mid-capitalization securities. This risks of investing in small- and mid-capitalization securities are addressed under the Vanguard Fund’s Investment Style Risk. |

| Valuation Risk | The Vanguard Fund discloses information about its fair valuation procedures in its statutory prospectus. As the Vanguard Fund, similar to the Baillie Gifford Fund, intends to invest largely in securities that will not require fair valuation under the normal course, the Vanguard Fund does not disclose this as a principal risk of the Vanguard Fund. |

Additional information about the investment objectives, principal investment strategies and risks of the Vanguard Fund can be found in the Vanguard Fund’s prospectus, which is enclosed with this Proxy Statement/Prospectus.

Comparing Fundamental Investment Restrictions. The 1940 Act requires, and Baillie Gifford Fund and the Vanguard Fund have, fundamental investment restrictions relating to borrowing, issuing senior securities, underwriting, investing in real estate, investing in physical commodities, making loans, and concentrating in particular industries. Fundamental investment restrictions of a fund cannot be changed without shareholder approval. The Baillie Gifford Fund and the Vanguard Fund have substantially similar fundamental investment restrictions, except as noted below.

Fundamental Investment Restriction Regarding Commodities. The Baillie Gifford Fund currently has a fundamental restriction that provides that the Baillie Gifford Fund will not invest in commodities, except that the Fund may invest in financial futures contracts and options thereon, and options on currencies. For the purposes of that fundamental restriction, all swap agreements and other derivative instruments that were not classified as commodity interests or commodity contracts prior to July 21, 2010 are not deemed to be commodities or commodity contracts. The Vanguard Fund’s fundamental restriction states that the Vanguard Fund may invest in commodities only as permitted by the 1940 Act or other governing statute, by the rules thereunder, or by the SEC or other regulatory agency with authority over the Vanguard Fund. The Vanguard Fund fundamental policy permits the Vanguard Fund to invest in the same types of investments as the Baillie Gifford Fund, but provides the Vanguard Fund with greater flexibility in the event that the laws governing a fund’s investment in commodities change without requiring the Vanguard Fund to seek shareholder approval.

Fundamental Restriction Regarding Lending. Under the 1940 Act, a fund must describe, and designate as fundamental, its policy with respect to making loans. In addition to the loan of cash, the term “loan” under the 1940 Act may, under certain circumstances, be deemed to include certain transactions and investment-related practices, including lending of portfolio securities, the purchase of certain debt instruments and entering into repurchase agreements. The current Baillie Gifford Fund’s fundamental restriction provides that the Fund will not make loans to others, except through the purchase of qualified debt obligations, the entry into repurchase agreements, and/or the making of loans of portfolio securities consistent with the Fund’s investment objectives and policies. For the purpose of that restriction, the short-term deposit of cash or other liquid assets of the Fund in one or more interest-bearing accounts shall not be deemed to be a loan to others. The Vanguard Fund has a fundamental investment restriction which provides that the Fund may make loans to another person only as permitted by the 1940 Act or other governing statute, by the rules thereunder, or by the SEC or other regulatory agency with authority over the Fund. The fundamental restrictions regarding lending of the Baillie Gifford Fund and the Vanguard Fund are not materially different; however, the Vanguard Fund’s fundamental restriction provides more flexibility in the event that the laws governing a fund’s lending practices change without seeking shareholder approval.

Both the Baillie Gifford Fund and Vanguard Fund may be subject to other investment restrictions that are not identified above. The full list of the Baillie Gifford Fund’s and Vanguard Fund’s investment restrictions may be found in their respective SAIs. See the cover page of this Proxy Statement/Prospectus for a description of how you can obtain a copy of the Funds’ SAIs.

Comparing Fund Performance (all Baillie Gifford Fund)

If the Reorganization is approved, the Vanguard Fund will assume and continue the performance history of the Baillie Gifford Fund. The Vanguard Fund has no performance history because it has not yet commenced operations as of the date of this Proxy Statement/Prospectus. For more information about performance, see the “Performance” section of the Baillie Gifford Fund Prospectus, which is incorporated herein by reference.

Comparing Shareholder Fees and Fund Expenses. The tables below allow Baillie Gifford Fund Shareholders to compare the sales charges, management fees and expense ratios of the Baillie Gifford Fund with the Vanguard Fund and to analyze the estimated expenses that the Vanguard Fund expects to bear following the Reorganization. Annual Fund Operating Expenses include management fees, administrative costs, sub-transfer agency expenses, and distribution and administrative services fees, if applicable, including pricing and custody services. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the table and example below. For the Vanguard Fund, Annual Fund Operating Expenses (and related Example Expenses) are presented on a pro forma combined basis.

Shareholder Fees (fees paid directly from your investment)

| | Baillie Gifford Fund | Vanguard Fund |

| | Class K Shares | Institutional Class Shares | Investor Shares |

| Sales Charge (Load) Imposed on Purchases | None | None | None |

| Purchase Fee | None | None | None |

| Sales Charge (Load) Imposed on Reinvested Dividends | None | None | None |

| Redemption Fee | None | None | None |

Account Service Fee Per Year (for certain fund account balances below $10,000) | None | None | $20 |

The table set forth below compares the expenses the Baillie Gifford Fund expects to incur in its current fiscal year and the estimated expenses of the Vanguard Fund for the first full year after the Reorganization is consummated (assuming current asset levels of the Baillie Gifford Fund remain the same).

| | Current Fees and Expenses Baillie Gifford Fund Class K Shares | Current Fees and Expenses Baillie Gifford Fund Institutional Class Shares | Estimated Expenses Vanguard Fund Investor Shares | Pro Forma Expenses as of the Reorganization Date Vanguard Fund Investor Shares |

| Management Fees | 0.50%(1) | 0.50%(1) | 0.55%(4) | 0.55%(4) |

| 12b-1 Distribution Fee | None | None | None | None |

| Other Expenses | 0.20% | 0.27% | 0.04% | 0.04% |

| Total Annual Fund Operating Expenses | 0.70% | 0.77% | 0.59% | 0.59% |

| Fee Waiver and/or Expense Reimbursement | (0.05)%(2) | (0.05)%(2) | N/A | N/A |

| Net Expenses | 0.65% | 0.72%(3) | 0.59% | 0.59% |

| (1) | The Baillie Gifford Fund Management Fee consists of a 0.33% Advisory Fee and a 0.17% Administration and Supervisory Fee paid by the Baillie Gifford Fund to Baillie Gifford. |

| (2) | Baillie Gifford has contractually agreed to waive its fees and/or bear Other Expenses of the Baillie Gifford Fund until April 30, 2023 to the extent that the Fund’s Total Annual Operating Expenses (excluding taxes, sub-accounting expenses and extraordinary expenses) exceed 0.65% for Class K and Institutional Class shares. This contractual agreement may only be terminated by the Baillie Gifford Trust Board of Trustees. |

| (3) | Expenses after waiver/reimbursement exceed 0.65% for Institutional Class due to sub-accounting expenses of 0.07%. |

| (4) | The Vanguard Fund Management Fee consists of a 0.45% Advisory Fee paid by the Vanguard Fund to Baillie Gifford and a 0.10% Administration Fee paid by the Vanguard Fund to Vanguard. |

Example

The following Example is intended to help you compare the cost of investing in the Baillie Gifford Fund and the Vanguard Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in each Fund for the time periods indicated and that you redeem your shares at the end of each period. The Example also assumes that each year your investment has a 5% return, that each Fund’s operating expenses remain the same and that all dividends and distributions are reinvested. With respect to the Baillie Gifford Fund, the example below also applies any contractual expense waivers and/or expense reimbursements to the first year of each period listed in the table. Although your actual costs and returns might be different based on these assumptions, your costs would be:

| | 1 Year | 3 Years | 5 Years | 10 Years |

| Baillie Gifford Fund – Class K | $66 | $219 | $385 | $866 |

| Baillie Gifford Fund – Institutional Class | $74 | $241 | $423 | $949 |

| Vanguard Fund – Investor Shares | $68 | $215 | $377 | $858 |

THIS EXAMPLE SHOULD NOT BE CONSIDERED TO REPRESENT ACTUAL EXPENSES OR PERFORMANCE FROM THE PAST OR FOR THE FUTURE. ACTUAL FUTURE EXPENSES MAY BE HIGHER OR LOWER THAN THOSE SHOWN.

Comparison of Portfolio Turnover

The Baillie Gifford Fund’s portfolio turnover for its most recent fiscal year ended December 31, 2021 was 28%.

The Vanguard Fund has not commenced operations as of the date of this Proxy Statement/Prospectus; however, it is anticipated that the Vanguard Fund’s portfolio turnover rate will likely be similar to that of the Baillie Gifford Fund.

The Reorganization will have no impact on the net asset value per share (“NAV”) of the Baillie Gifford Fund. As indicated below, the Reorganization will not cause the Baillie Gifford Fund’s share price to go up or down, and each shareholder will own an amount of Investor Shares of the Vanguard Fund equal in value to the Class K or Institutional Class shares of the Baillie Gifford Fund owned by such holder at the time of the Reorganization. Any declared but undistributed dividends or capital gains will carry over in the Reorganization.

The following table shows the capitalization of the Baillie Gifford Fund and the Vanguard Fund as of April 20, 2022 and the capitalization of the Vanguard Fund on a pro-forma basis as of that date after giving effect to the Reorganization. The following are examples of the number of Class K and Institutional Class shares of the Baillie Gifford Fund that would be exchanged for the Investor Shares of the Vanguard Fund if the Reorganization shown had been consummated on April 20, 2022, and do not reflect the number of such shares or the value of such shares that would actually be received if the Reorganization occurs. Amounts in the tables are in thousands, except for net asset value per share.

CAPITALIZATION TABLE

(UNAUDITED)

| | Baillie Gifford Positive Change Equities Fund | Vanguard Baillie Gifford Global Positive Impact Stock Fund | Pro forma Capitalization as of the Record Date |

| Total Net Assets as of the Record Date | | | |

| Class K | $[____] | N/A | N/A |

| Institutional Class | $[____] | N/A | N/A |

| Investor Shares | N/A | $0 | $[____] |

| Total Number of Shares Outstanding on the Record Date | | | |

| Class K | [____] | N/A | N/A |

| Institutional Class | [____] | N/A | N/A |

| Investor Shares | N/A | 0 | [____] |

| NAV on the Record Date | | | |

| Class K | $[____] | N/A | N/A |

| Institutional Class | $[____] | N/A | N/A |

| Investor Shares | N/A | $0 | $[____] |

Comparing Trustees. As previously discussed, the Baillie Gifford Fund will be reorganized into newly created series of the Vanguard Trust if shareholders approve the Reorganization. Information on the trustees of the Vanguard Trust appears in the Vanguard Fund’s SAI. Following the Reorganization, the Board of Trustees of the Baillie Gifford Trust will have no oversight over, or other involvement with, the Vanguard Fund.

Comparing Independent Registered Public Accounting Firms. Cohen & Company, Ltd. is the independent registered public accounting firm for the Baillie Gifford Fund. PricewaterhouseCoopers LLP is expected to serve as the independent registered public accounting firm for the Vanguard Fund, and currently serves in that capacity for all other Vanguard funds. In this role, PricewaterhouseCoopers LLP audits and certifies the financial statements of all Vanguard funds. PricewaterhouseCoopers LLP also reviews the Annual Reports to Shareholders of the Vanguard funds and their filings with the SEC. Neither PricewaterhouseCoopers LLP nor any of its partners have any direct or material indirect financial interest in the Vanguard funds.

Organization. The Vanguard Fund is a series of a trust organized as a Delaware statutory trust. The Baillie Gifford Fund is a series of a trust organized as a Massachusetts business trust.

| | Vanguard Trust

(Delaware Statutory Trust) | | Baillie Gifford Trust (Massachusetts Business Trust) |

| Shareholder Liability | Shareholders are protected from liability under Delaware statutory law, which provides that shareholders of a Delaware statutory trust have the same limitation of personal liability as is extended to shareholders of a private corporation for profit incorporated in the state of Delaware. In addition, any shareholder or former shareholder exposed to liability by reason of a claim or demand relating solely to his or her being or having been a shareholder, and not because of his acts or omissions, the shareholder or former shareholder (or his or her heirs, executors, administrators, or other legal representatives or in the case of a corporation or other entity, its corporate or other general successor) will be entitled to be held harmless from and indemnified out of the assets of the Trust against all loss and expense arising from such claim or demand. | | The shareholders of a Massachusetts business trust could, under certain circumstances, be held personally liable as partners for its obligations. However, the Declaration of Trust contains express disclaimers of shareholder liability. |

| Indemnification of Shareholders | Under Delaware law, any shareholder or former shareholder exposed to liability by reason of a claim or demand relating solely to his or her being or having been a shareholder, and not because of his acts or omissions, the shareholder or former shareholder (or his or her heirs, executors, administrators, or other legal representatives or in the case of a corporation or other entity, its corporate or other general successor) will be entitled to be held harmless from and indemnified out of the assets of the Trust against all loss and expense arising from such claim or demand. | | In case any Shareholder or former Shareholder shall be held to be personally liable solely by reason of his or her being or having been a Shareholder of the Trust or of a particular Series or Class and not because of his or her acts or omissions or for some other reason, the Shareholder or former Shareholder (or his or her heirs, executors, administrators or other legal representatives or, in the case of a corporation or other entity, its corporate or other general successor) shall be entitled out of the assets of the Series (or attributable to the Class) of which he or she is a Shareholder or former Shareholder to be held harmless from and indemnified against all loss and expense arising from such liability. |

| | Vanguard Trust

(Delaware Statutory Trust) | | Baillie Gifford Trust (Massachusetts Business Trust) |

| Shareholder Voting Rights | Shareholders have only the right to vote (i) for the election or removal of Trustees as provided in the Declaration of Trust, and (ii) with respect to such additional matters relating to the Vanguard Trust as may be required by the applicable provisions of the 1940 Act, and (iii) on such other matters as the Trustees may consider necessary or desirable. Shares may be voted in person or by proxy or in any manner authorized by the Trustees. All shares entitled to vote on a matter shall vote without differentiation between the separate series; provided however, if a matter to be voted on affects only the interests of one or more but not all series (or one or more but not all of a class of a series), then only the shareholders of such affected Series (or class) shall be entitled to vote on the matter. Each shareholder shall have one vote for each dollar (and a fractional vote for each fractional dollar) of the net asset value of each share (including fractional shares) held by such shareholder on the record date set pursuant to the By-Laws. There is no cumulative voting in the election of Trustees. | | The Shareholders shall have power to vote, to the extent and as provided in the Declaration of Trust, (i) only for the election and removal of Trustees; (ii) with respect to any amendment of the Declaration of Trust; (iii) to the same extent as stockholders of a Massachusetts business corporation as to whether or not a court action, proceeding or claim should or should not be brought or maintained derivatively or as a class action on behalf of the Baillie Gifford Trust or its shareholders; (iv) with respect to the termination of the Baillie Gifford Trust or any series or class; (v) to remove Trustees from office; or (vi) with respect to such additional matters relating to the Baillie Gifford Trust as required by its Declaration of Trust, By-Laws, or any registration of the Baillie Gifford Trust with the SEC or any state, or as the Baillie Gifford Board may consider necessary or desirable. Each whole Share shall be entitled to one vote as to any matter on which it is entitled to vote and each fractional share shall be entitled to a proportionate fractional vote. Shares may be voted in person or by proxy. There shall be no cumulative voting in the election of Trustees. |

| Shareholder Meetings | The Vanguard Trust is not required to hold annual meetings of shareholders unless the 1940 Act requires the election of Trustees to be acted upon. Special meetings of the Shareholders may be called at any time by the chairman, or president, or by the Board of Trustees. | | The Baillie Gifford Trust is not required to hold annual meetings of shareholders. Meetings of the Shareholders may be called by the Trustees for the purpose of electing Trustees and for such other purposes as may be prescribed by law, by the Declaration of Trust or by the By-Laws. Meetings of the Shareholders may also be called by the Trustees from time to time for the purpose of taking action upon any other matter deemed by the Trustees to be necessary or desirable. |

| Shareholder Quorum | Except when a larger quorum is required by the 1940 Act or the Declaration of Trust, thirty-three and one-third percent (33 1/3%) of the total combined net asset value of all shares issued and outstanding and entitled to vote constitutes a quorum at a shareholders’ meeting. Either the chairman of the meeting (without a shareholder vote) or the holders of a majority of the votes present in person or by proxy shall have the power to adjourn the meeting from time to time, without notice other than announcement at the meeting, until a quorum shall be present or represented. | | Except when a larger quorum is required by law, by the By-Laws or by the Declaration of Trust, 40% of the shares entitled to vote shall constitute a quorum at a shareholders’ meeting. When any one or more series or classes is to vote as a single class separate from any other shares which are to vote on the same matters as a separate class or classes, 40% of the shares of each such class entitled to vote shall constitute a quorum at a shareholders’ meeting of that class. Any meeting of shareholders may be adjourned from time to time by a majority of the votes properly cast upon the question, whether or not a quorum is present, and the meeting may be held as adjourned within a reasonable time after the date set for the original meeting without further |

| | Vanguard Trust

(Delaware Statutory Trust) | | Baillie Gifford Trust (Massachusetts Business Trust) |

|

| | notice. When a quorum is present at any meeting, a majority of the Shares voted shall decide any questions and a plurality shall elect a Trustee, except when a larger vote is required by any provision of the Declaration of Trust or the By-Laws or by law. |

| Shareholder Meeting Demand Procedure | Special meetings of the shareholders shall be called by the secretary of the Vanguard Trust upon written request of the holders of shares entitled to cast not less than twenty percent of all the votes entitled to be cast at such meeting provided that (a) such request shall state the purposes of such meeting and the matters proposed to be acted on, (b) the shareholders requesting such meeting shall have paid to the Vanguard Trust the reasonable estimated cost of preparing and mailing the notice thereof, which the secretary shall determine and specify to such shareholders, and (c) the shareholders requesting such meeting must provide ninety (90) days advance notice of business to be brought to a vote at a shareholder meeting and for nomination of directors, unless such notice runs counter to the proxy rules under the Securities Exchange Act of 1934. | | Whenever ten or more shareholders of record who have been such for at least six months preceding the date of application, and who hold in the aggregate shares having a net asset value of at least 1 per centum of the outstanding shares, shall apply to the Trustees in writing, stating that they wish to communicate with other shareholders with a view to obtaining signatures to a request for a meeting and accompanied by a form of communication and request which they wish to transmit, the Trustees shall within five business days after receipt of such application either (a) afford to such applicants access to a list of the names and addresses of all shareholders as recorded on the books of the Baillie Gifford Trust; or (b) inform such applicants as to the approximate number of shareholders of record, and the approximate cost of transmitting to them the proposed communication and form of request. |

| Number of Authorized Shares and Par Value | The beneficial interest in the Vanguard Trust shall at all times be divided into an unlimited number of shares, with a par value of $ .001 per share unless the Trustees shall designate another par value. | | The beneficial interest in the Baillie Gifford Trust shall at all times be divided into an unlimited number of Shares, without par value. |

| Preemptive Rights | Shareholders shall have no preemptive or other right to subscribe to any additional shares or other securities issued by the Vanguard Trust or any series. | | Shareholders shall have no preemptive or other right to subscribe to any additional shares or other securities issued by the Baillie Gifford Trust. |

| Trustee Power to Amend Organizational Document | Subject to any requirements under the 1940 Act requiring shareholder approval of an amendment to the Declaration of Trust, the Trustees may, without shareholder vote or approval, amend the Declaration of Trust. Unless otherwise provided by the Trustees, any such amendment will be effective (i) upon the adoption by a majority of the Trustees then holding office of a resolution specifying the amendment, supplemental agreement or amendment and restatement or (ii) upon the execution in writing of an instrument signed by a majority of the Trustees then holding office specifying the amendment, supplemental agreement or amended and restated trust instrument. Notwithstanding the above, if shares have been issued, shareholder approval shall be | | The Baillie Gifford Trust may be amended at any time by an instrument in writing signed by a majority of the then Trustees when authorized to do so by vote of a majority of the shares entitled to vote with respect to such amendment, except that amendments described in Article III, Section 5 and 6 or having the purpose of changing the name of the Trust or of any series or class of shares or of supplying any omission, curing any ambiguity or curing, correcting, or supplementing any defective or inconsistent provision contained in the Declaration of Trust shall not require authorization by shareholder vote. Notwithstanding the above, the Trustees shall have the power to amend the Declaration of Trust, at any time and from time to time, in such manner as the Trustees may determine |

| | Vanguard Trust