Exhibit 99.2

Consumer Portfolio Services, Inc. Historical Timeline of Significant Events Nasdaq: CPSS

Cautionary Statement Information included in the following slides is believed to be accurate, but is not necessarily complete. Any person considering an investment in securities issued by CPS is urged to review the materials filed by CPS with the U.S. Securities and Exchange Commission ("Commission"). Such materials may be found by inquiring of the Commission's EDGAR search page (http://www.sec.gov/edgar/searchedgar/companysearch.html) using CPS'sticker symbol, which is "CPSS."

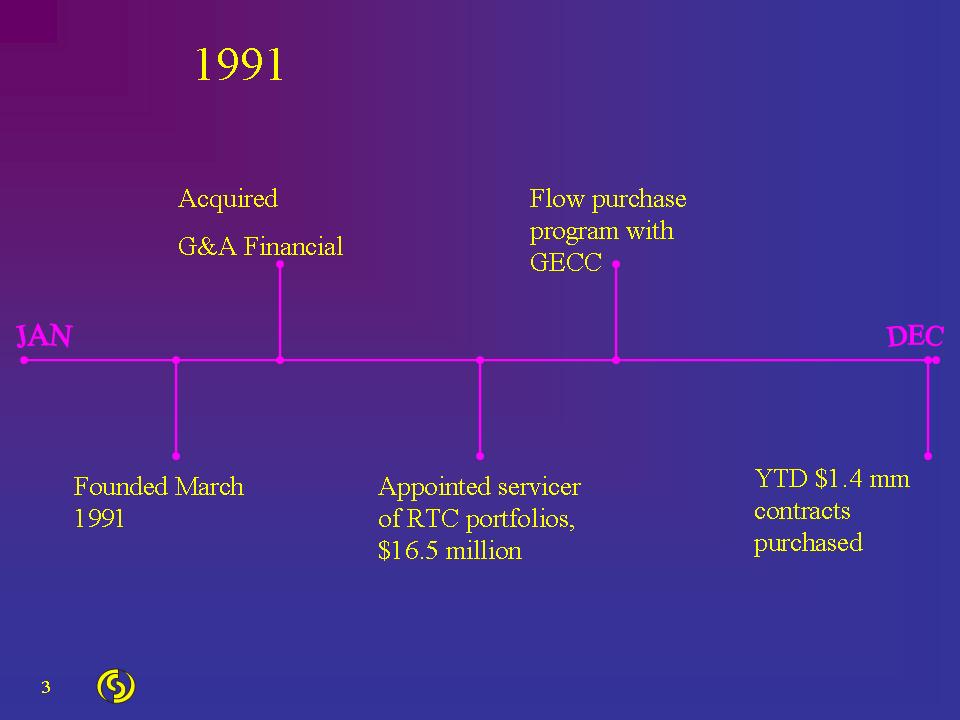

Founded March 1991AcquiredG&A Financial Appointed servicer of RTC portfolios, $16.5 million Flow purchase program with GECCYTD $1.4 mm contracts purchased 1991

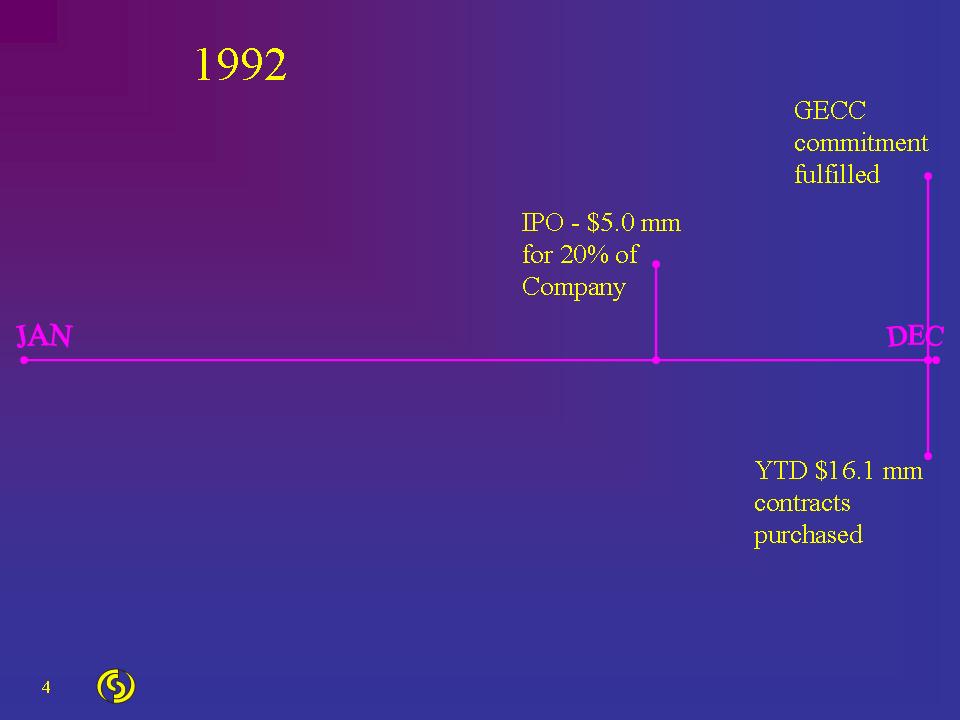

YTD $16.1 mm contracts purchased IPO -$5.0 mm for 20% of Company1992GECC commitment fulfilled

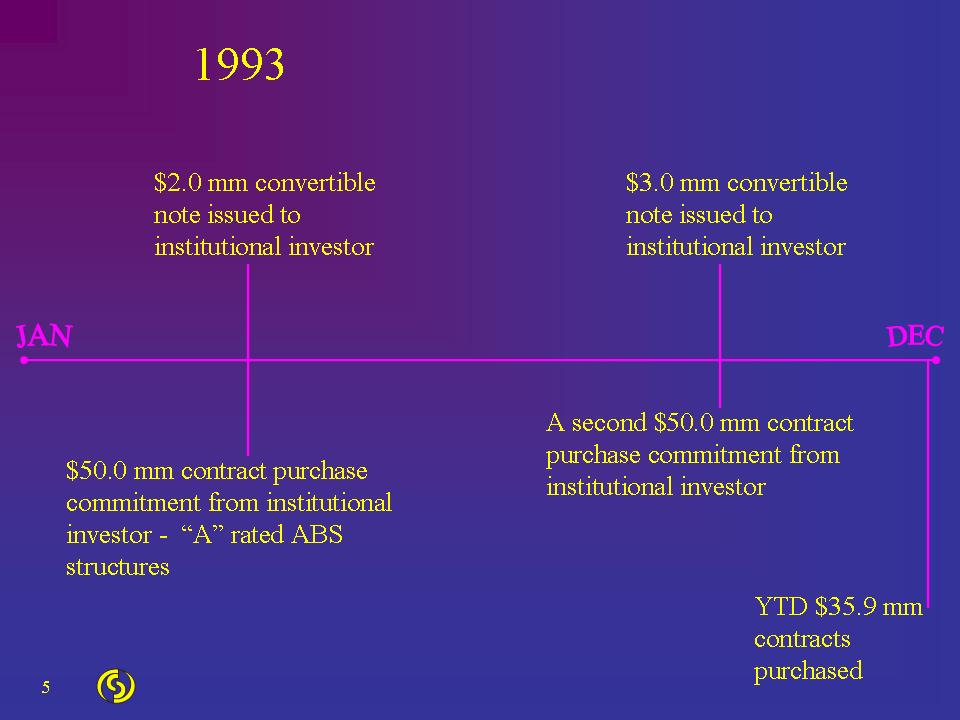

1993 $2.0 mm convertible note issued to institutional investor 5YTD $35.9 mm contracts purchased $50.0 mm contract purchase commitment from institutional investor -“A” rated ABS structures $3.0 mm convertible note issued to institutional investor A second $50.0 mm contract purchase commitment from institutional investor

$24.0 mm “AAA”ABS insured by FSA (the Company’s first)$13.1 mm ABS$28.9 mm ABS1994 $50 mm warehouse facility with GECC $28.9 mm ABS YTD $132.0 mm contracts purchased Managed portfolio = $168.4 mm

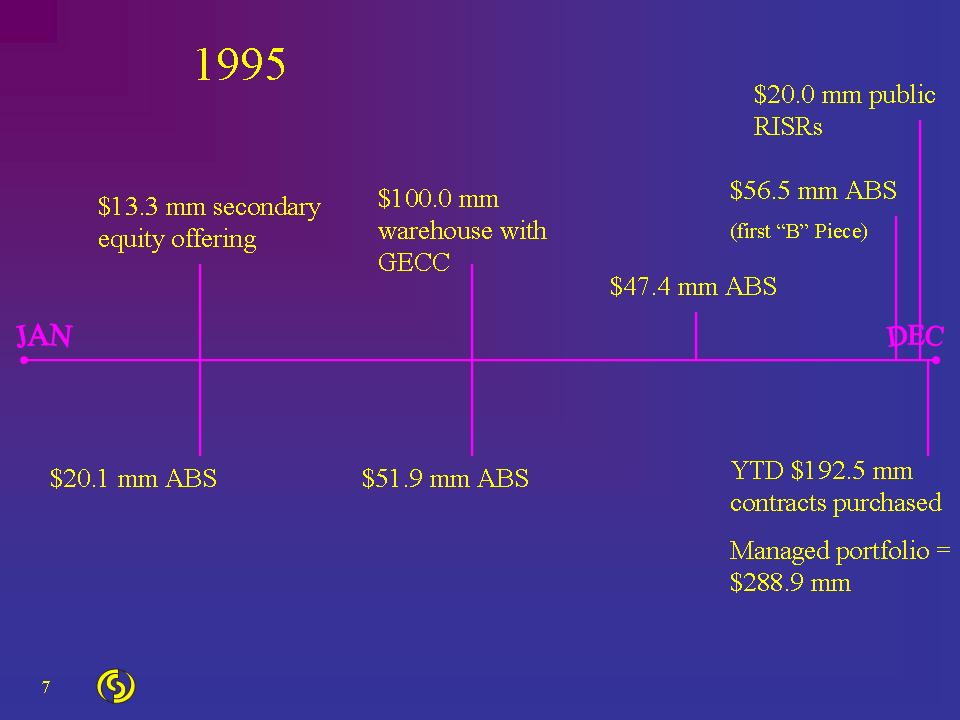

$20.0 mm public RISRs1995 YTD $192.5 mm contracts purchased Managed portfolio = $288.9 mm$56.5 mm ABS (first “B” Piece)$100.0 mm warehouse with GECC$20.1 mm ABS$51.9 mm ABS$47.4 mm ABS$13.3 mm secondary equity offering

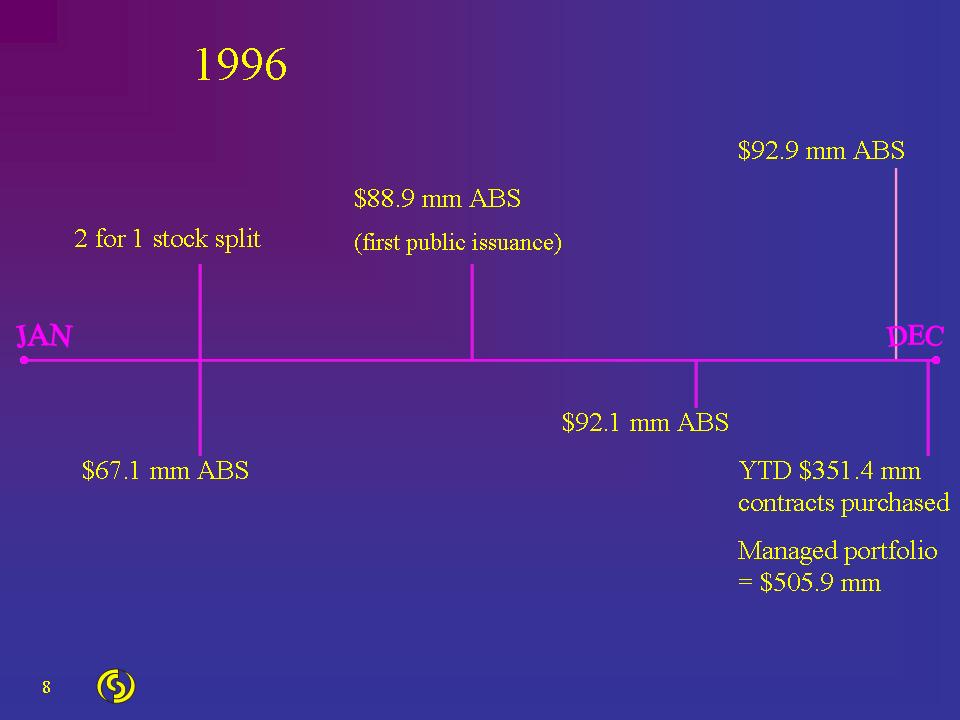

$88.9 mm ABS(first public issuance)2 for 1 stock split1996 $92.9 mm ABS $67.1 mm ABS $92.1 mm ABS YTD $351.4 mm contracts purchased Managed portfolio = $505.9 mm

Est. servicing branch in Chesapeake, VA 1997 $119.4 mm ABS $150.0 mm warehouse with First Unionv $105.9 mm ABS $95.7 mm ABS $102.3 mm ABS $20.0 mm public PENs $15.0 mm Stanwich Financial debt $150.0 mm ABS YTD $600.1 mm contracts purchased Managed portfolio = $902.7 mm

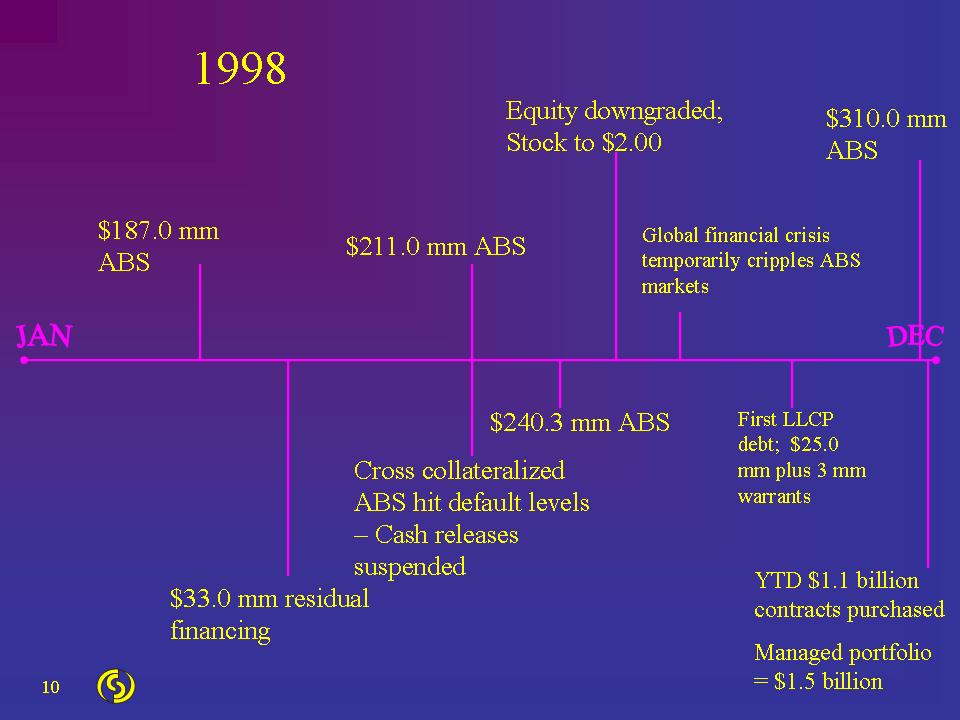

10YTD $1.1 billion contracts purchased Managed portfolio = $1.5 billion$187.0 mm ABS$211.0 mm ABS$240.3 mm ABS$310.0 mm ABS$33.0 mm residual financing Cross collateralized ABS hit default levels -Cash releases suspended Equity downgraded; Stock to $2.00Global financial crisis temporarily cripples ABS markets First LLCP debt; $25.0 mm plus 3 mm warrants1998

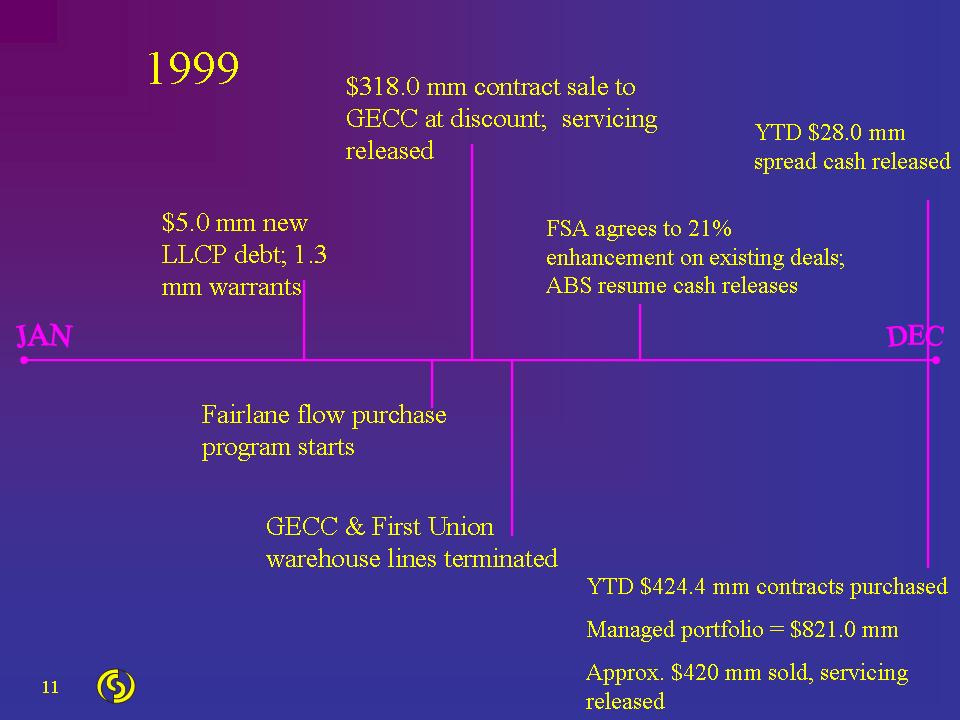

1999YTD $424.4 mm contracts purchased Managed portfolio = $821.0 mm Approx. $420 mm sold, servicing released$5.0 mm new LLCP debt; 1.3 mm warrants$318.0 mm contract sale to GECC at discount; servicing released GECC & First Union warehouse lines terminatedFairlane low purchase program start FSA agrees to 21% enhancement on existing deals; ABS resume cash release YTD $28.0 mm spread cash released

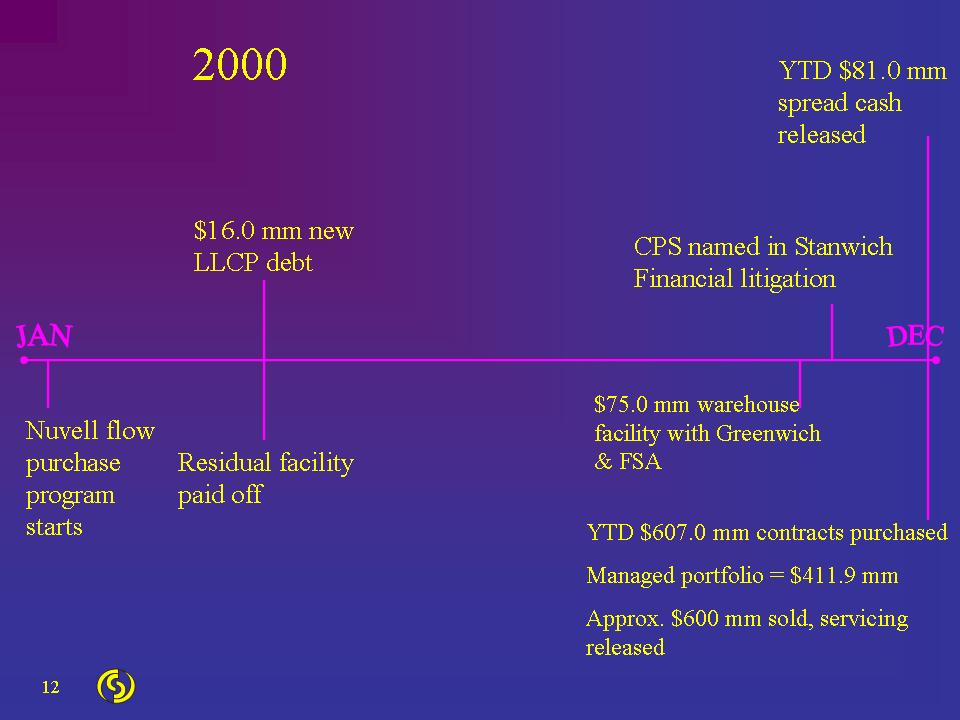

2000 YTD $81.0 mm spread cash released YTD $607.0 mm contracts purchased Managed portfolio = $411.9 mm Approx. $600 mm sold, servicing released$16.0 mm new LLCP debt Nuvell flow purchase program starts Residual facility paid off CPS named in Stanwich Financial litigation$75.0 mm warehouse facility with Greenwich & FSA

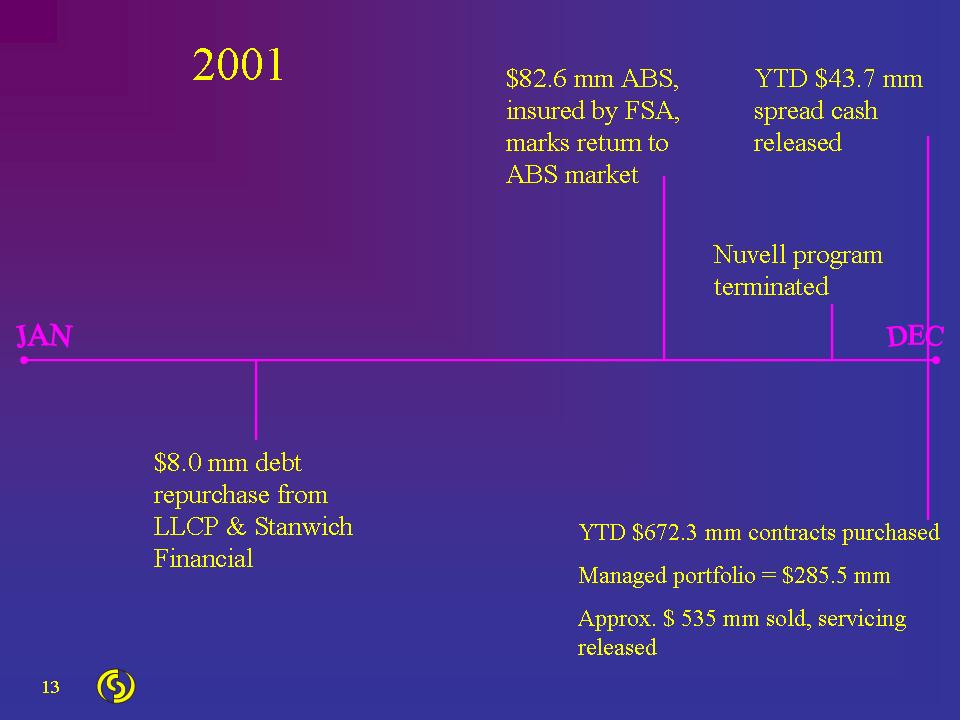

2001YTD $672.3 mm contracts purchased Managed portfolio = $285.5 mm Approx. $ 535 mm sold, servicing released YTD $43.7 mm spread cash released$8.0 mm debt repurchase from LLCP & Stanwich Financial Nuvel program terminated$82.6 mm ABS, insured by FSA, marks return to ABS market

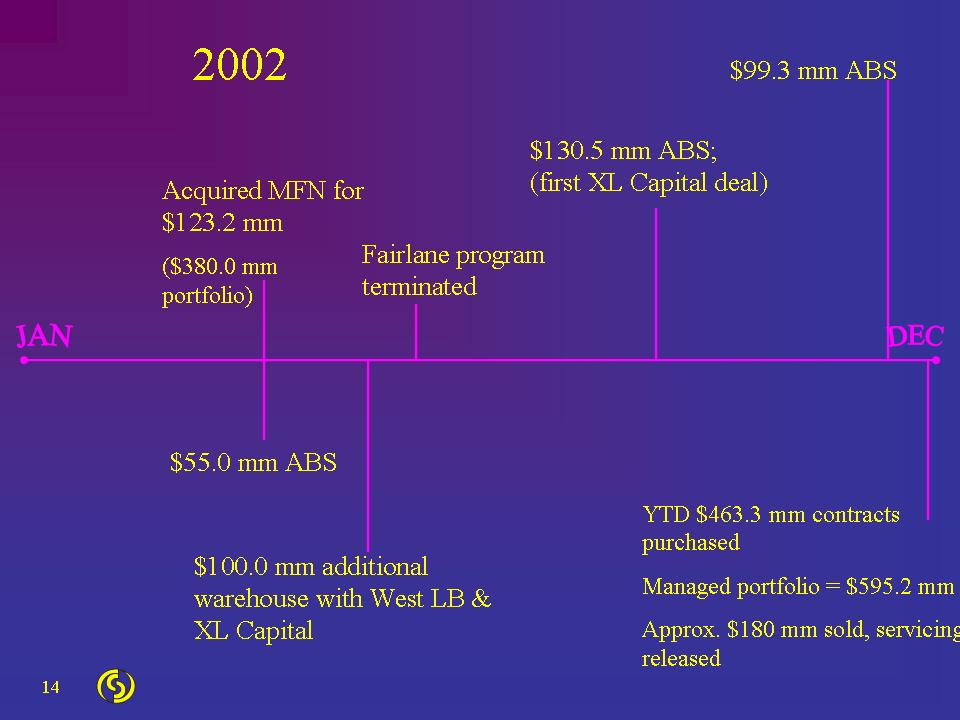

2002 $99.3 mm ABS YTD $463.3 mm contracts purchased Managed portfolio = $595.2 mm Approx. $180 mm sold, servicing released Acquired MFN for $123.2 mm($380.0 mm portfolio)Fairlane program terminated$100.0 mm additional warehouse with West LB & XL Capital$55.0 mm ABS$130.5 mm ABS; (first XL Capital deal)

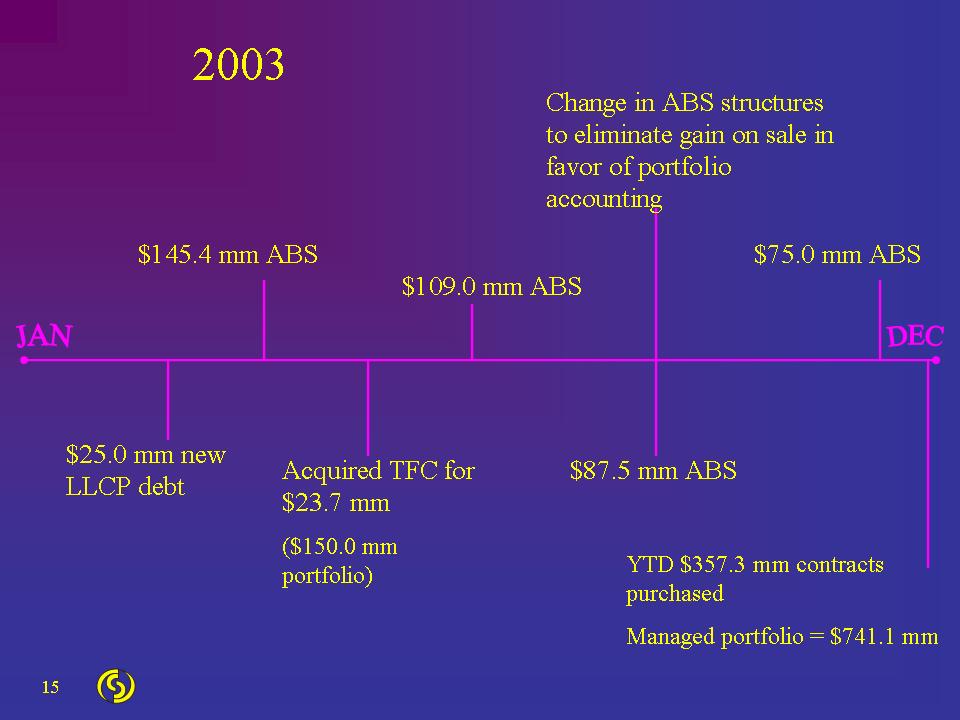

2003 Change in ABS structures to eliminate gain on sale in favor of portfolio accounting YTD $357.3 mm contracts purchased Managed portfolio = $741.1 mm Acquired TFC for $23.7 mm($150.0 mm portfolio)$25.0 mm new LLCP debt$87.5 mm ABS$145.4 mm ABS$109.0 mm ABS$75.0 mm ABS

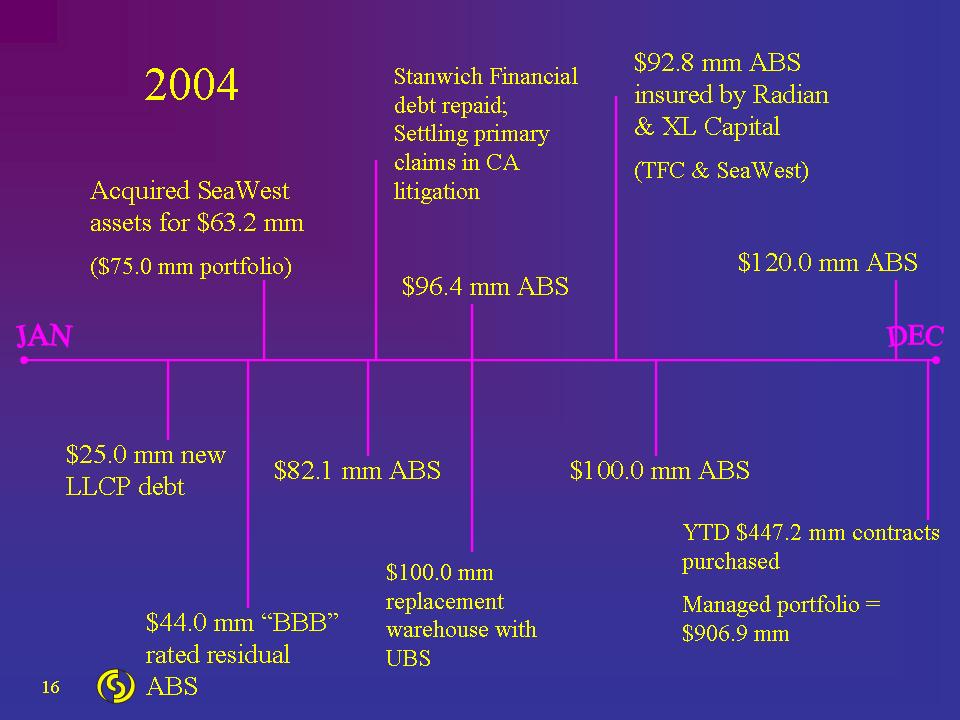

2004Acquired SeaWest assets for $63.2 mm($75.0 mm portfolio)$25.0 mm new LLCP debt$100.0 mm ABS $82.1 mm ABS $96.4 mm ABS $92.8 mm ABS insured by Radian & XL Capital(TFC & SeaWest) $120.0 mm ABS Stanwich Financial debt repaid; Settling primary claims in CA litigation $44.0 mm “BBB” rated residual ABS $100.0 mm replacement warehouse with UBS YTD $447.2 mm contracts purchased Managed portfolio = $906.9 mm

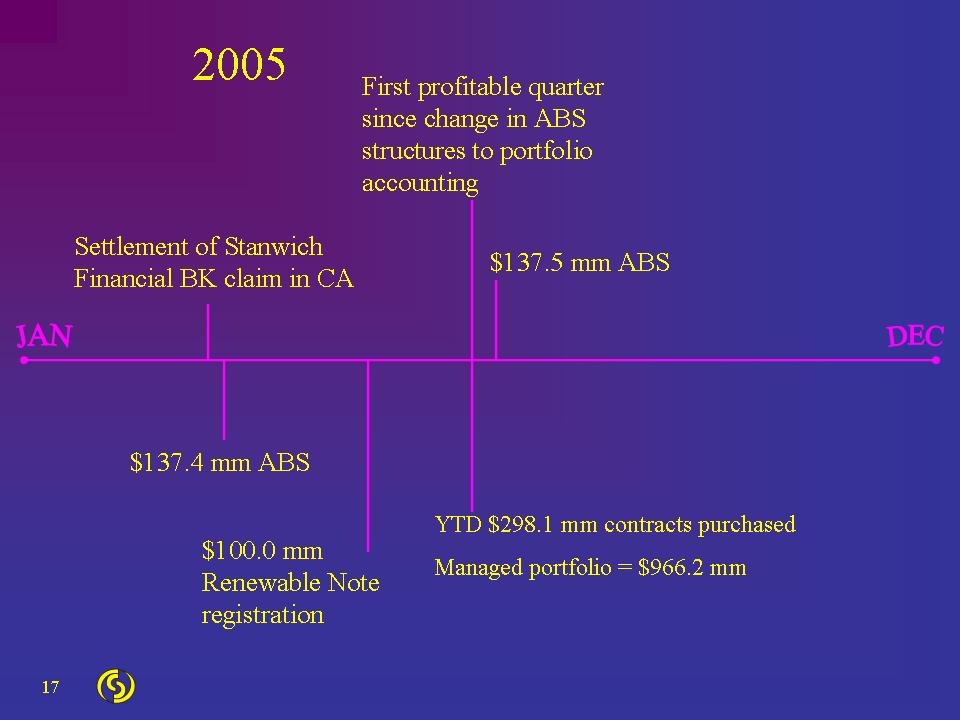

2005 First profitable quarter since change in ABS structures to portfolio accounting $137.4 mm ABS Settlement of Stanwich Financial BK claim in CA$100.0 mm Renewable Note registration $137.5 mm ABSYTD $298.1 mm contracts purchased Managed portfolio = $966.2 mm

Consumer Portfolio Services, Inc.Nasdaq: CPSS