Exhibit 99.1

1 Investor Presentation As of September 30, 2012

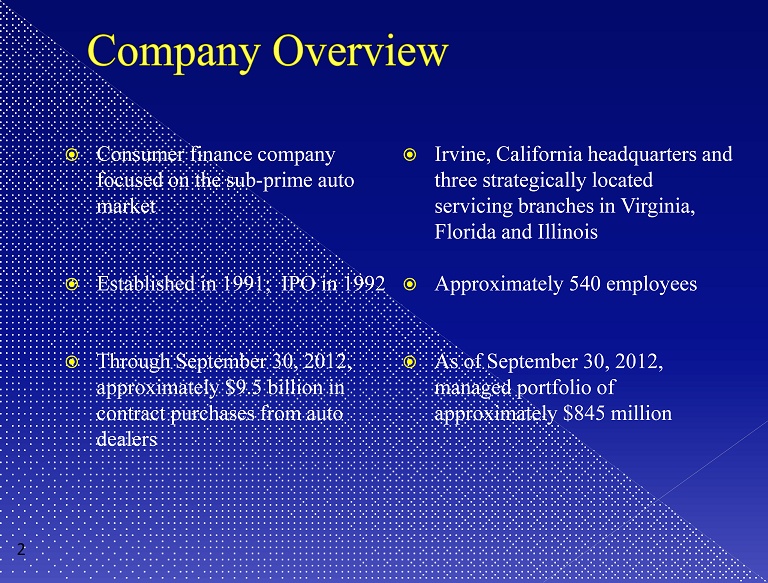

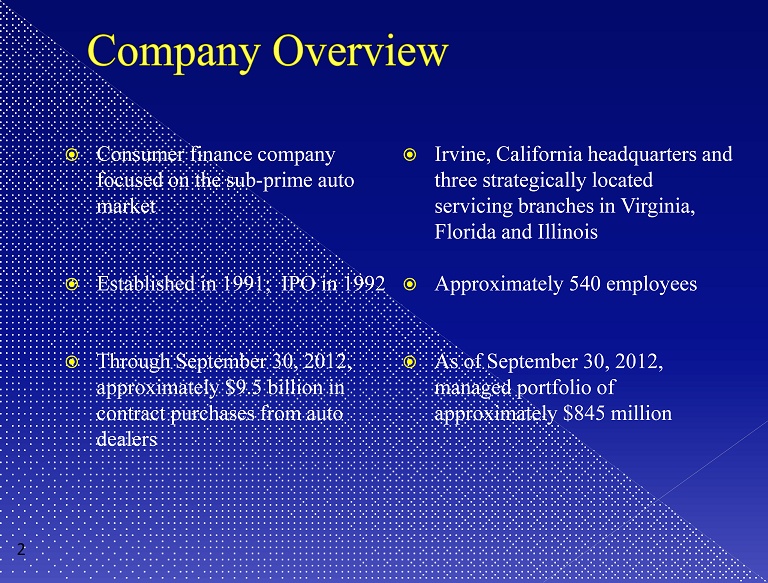

; Consumer finance company focused on the sub - prime auto market Established in 1991; IPO in 1992 Through September 30, 2012, approximately $9.5 billion in contract purchases from auto dealers Irvine, California headquarters and three strategically located servicing branches in Virginia, Florida and Illinois Approximately 540 employees As of September 30, 2012, managed portfolio of approximately $845 million 2

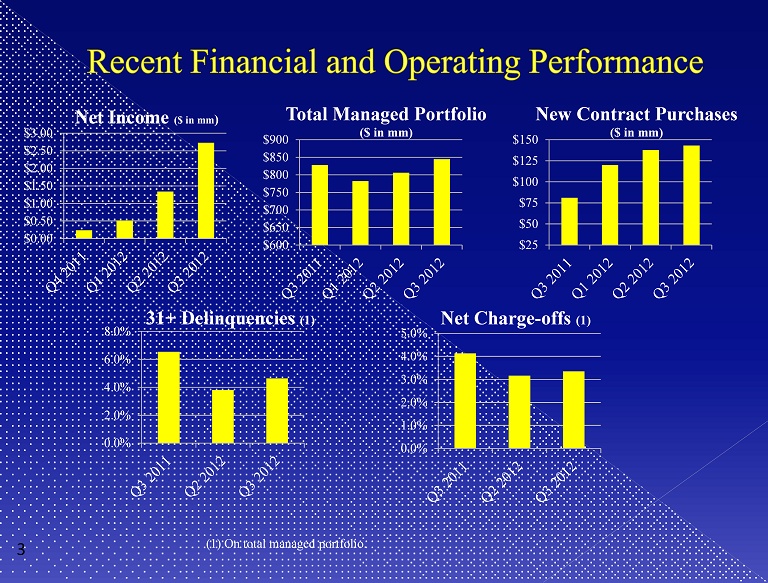

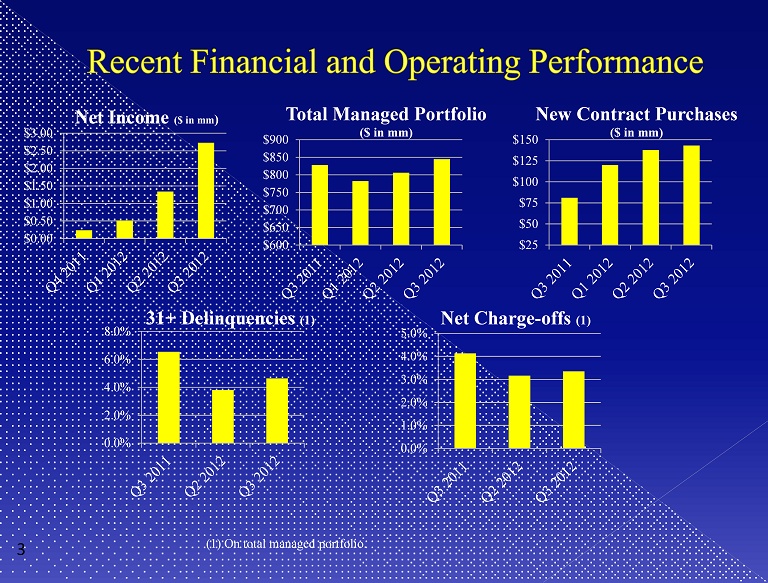

0.0% 2.0% 4.0% 6.0% 8.0% 31+ Delinquencies (1) 3 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% Net Charge - offs (1) $600 $650 $700 $750 $800 $850 $900 Total Managed Portfolio ($ in mm) $0.00 $0.50 $1.00 $1.50 $2.00 $2.50 $3.00 Net Income ($ in mm ) $25 $50 $75 $100 $125 $150 New Contract Purchases ($ in mm) (1) On total managed portfolio.

Growth in managed portfolio and declines in funding costs are driving enhanced operating leverage and profitability (1) As a percentage of the average managed portfolio. Quarter Ended Sept. 2012 (1) Quarter Ended June 2012 (1) Quarter Ended Sept. 2011 (1) Interest Income 21.7% 20.9% 17.5% Servicing and Other Income 1.4% 1.3% 2.1% Interest Expense (9.4)% (10.0)% (11.0)% Net Interest Margin 13.6% 12.2% 8.6% Provision for Credit Losses (4.6)% (3.9)% (2.3)% Core Operating Expenses (7.8)% (7.7)% (8.6)% Pre - tax Return on Assets 1.3% 0.7% (2.3)% 4

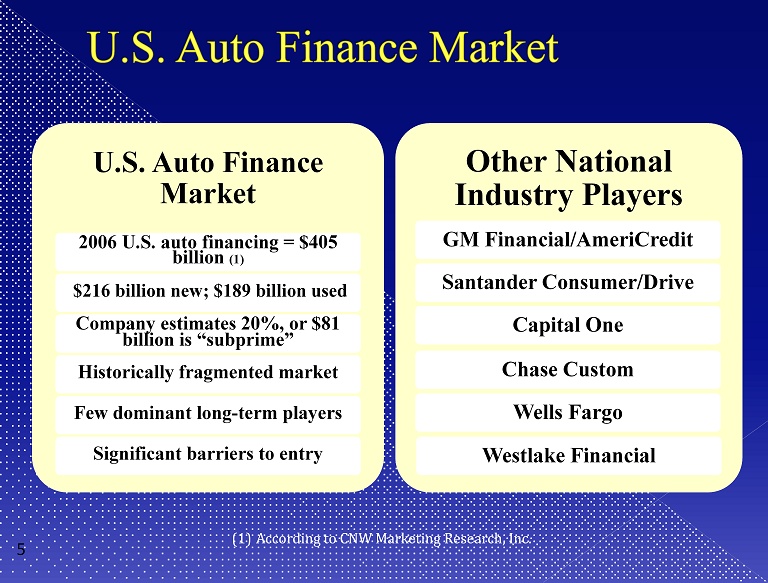

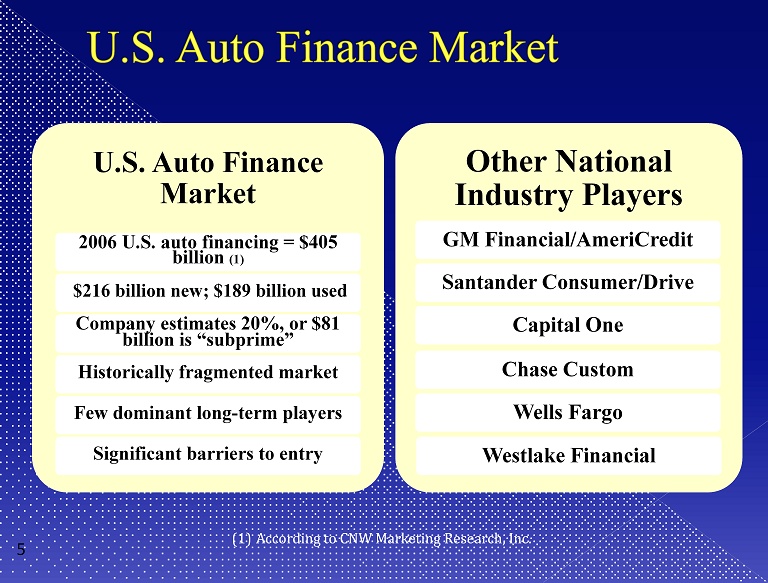

U.S. Auto Finance Market 2006 U.S. auto financing = $405 billion (1) $216 billion new; $189 billion used Company estimates 20%, or $81 billion is “subprime” Historically fragmented market Few dominant long - term players Significant barriers to entry Other National Industry Players GM Financial/AmeriCredit Santander Consumer/Drive Capital One Chase Custom Wells Fargo Westlake Financial (1) According to CNW Marketing Research, Inc. 5

Purchase contracts from dealers in over 45 states across the U.S. As of September 30, 2012 had 29 employee marketing representatives in the field and 32 in - house Primarily factory franchised dealers (1) Under the CPS programs for contracts purchased in the first three quarters of 2012. 72% 28% Contract Purchases (1) Factory Franchised Independents 6

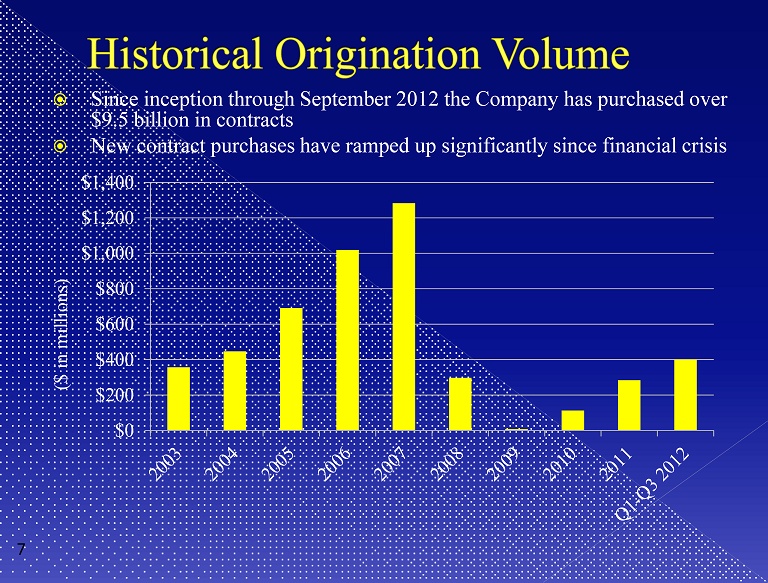

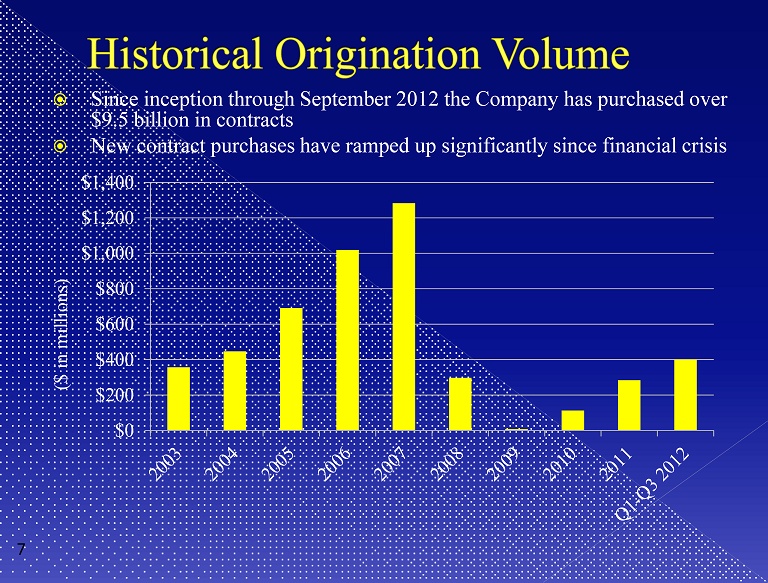

$0 $200 $400 $600 $800 $1,000 $1,200 $1,400 ($ in millions) Since inception through September 2012 the Company has purchased over $9.5 billion in contracts New contract purchases have ramped up significantly since financial crisis 7

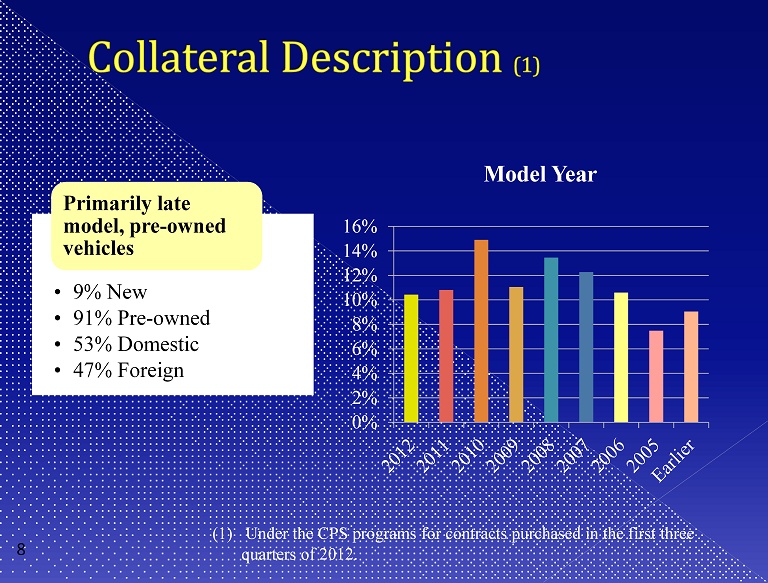

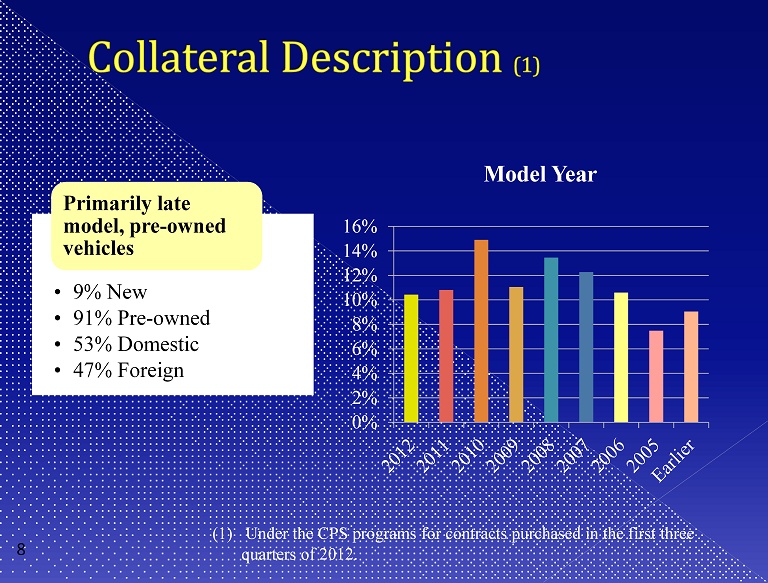

0% 2% 4% 6% 8% 10% 12% 14% 16% Model Year • 9% New • 91% Pre - owned • 53% Domestic • 47% Foreign Primarily late model, pre - owned vehicles 8 (1) Under the CPS programs for contracts purchased in the first three quarters of 2012.

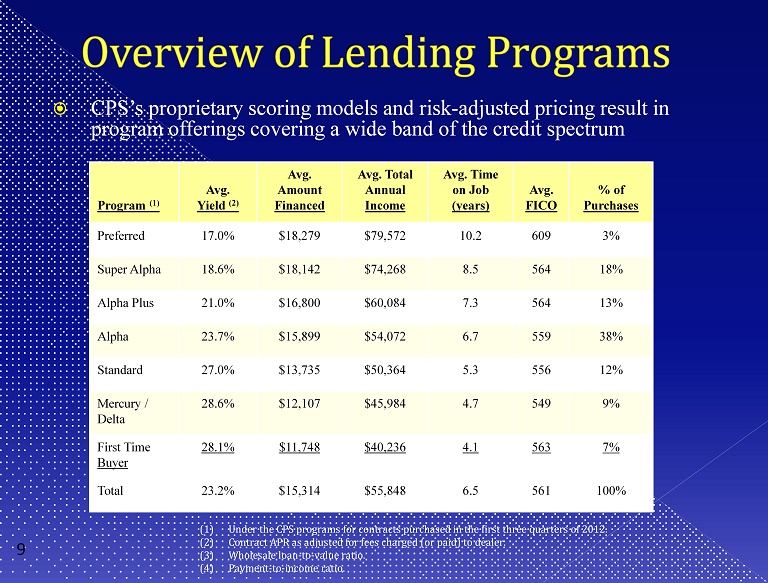

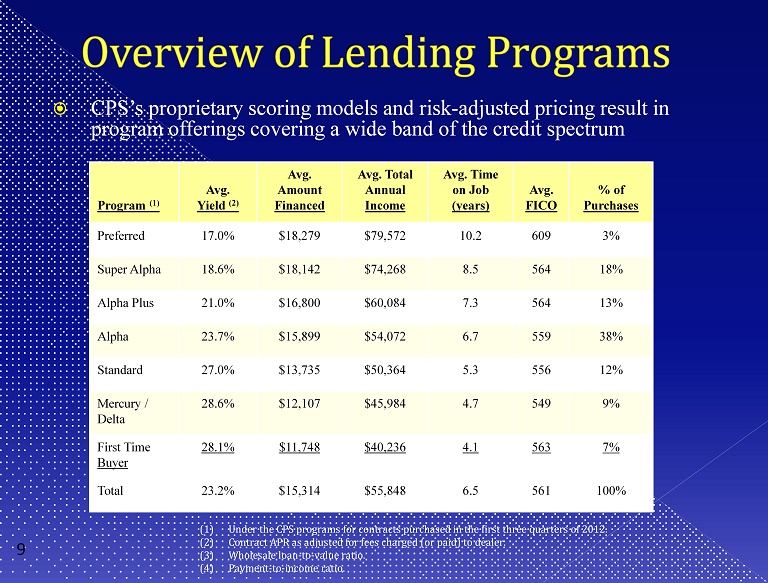

CPS’s proprietary scoring models and risk - adjusted pricing result in program offerings covering a wide band of the credit spectrum (1) Under the CPS programs for contracts purchased in the first three quarters of 2012. (2) Contract APR as adjusted for fees charged (or paid) to dealer. (3) Wholesale loan - to - value ratio. (4) Payment - to - income ratio. Program (1) Avg. Yield (2) Avg. Amount Financed Avg. Total Annual Income Avg. Time on Job (years) Avg. FICO % of Purchases Preferred 17.0% $18,279 $79,572 10.2 609 3% Super Alpha 18.6% $18,142 $74,268 8.5 564 18% Alpha Plus 21.0% $16,800 $60,084 7.3 564 13% Alpha 23.7% $15,899 $54,072 6.7 559 38% Standard 27.0% $13,735 $50,364 5.3 556 12% Mercury / Delta 28.6% $12,107 $45,984 4.7 549 9% First Time Buyer 28.1% $11,748 $40,236 4.1 563 7% Total 23.2% $15,314 $55,848 6.5 561 100% 9

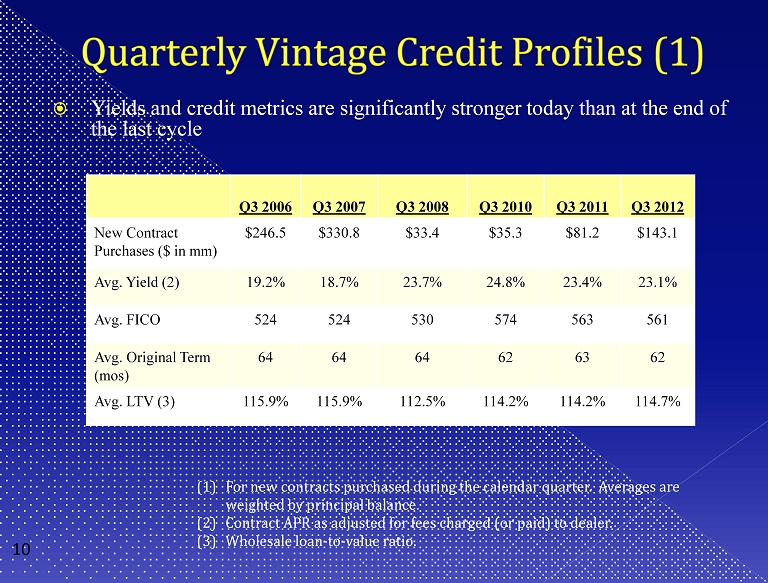

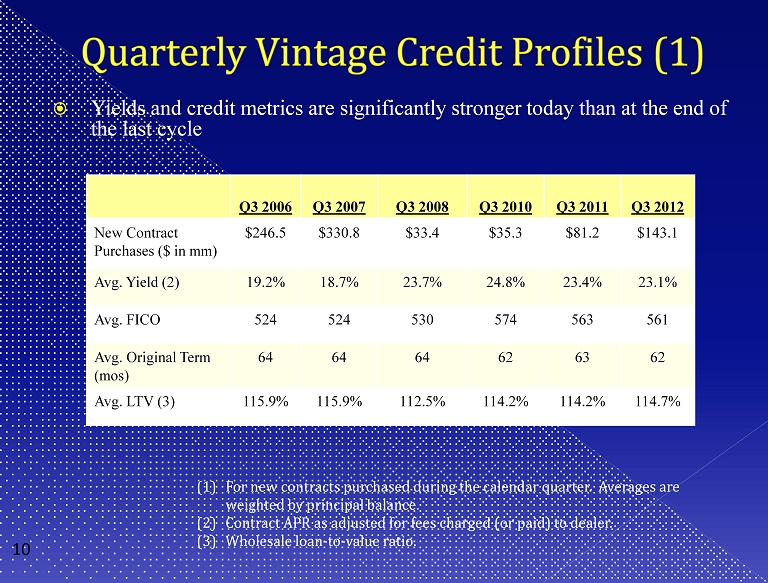

Yields and credit metrics are significantly stronger today than at the end of the last cycle (1) For new contracts purchased during the calendar quarter. Averages are weighted by principal balance. (2) Contract APR as adjusted for fees charged (or paid) to dealer . (3) Wholesale loan - to - value ratio. Q3 2006 Q3 2007 Q3 2008 Q3 2010 Q3 2011 Q3 2012 New Contract Purchases ($ in mm) $246.5 $330.8 $33.4 $35.3 $81.2 $143.1 Avg. Yield (2) 19.2% 18.7% 23.7% 24.8% 23.4% 23.1% Avg. FICO 524 524 530 574 563 561 Avg. Original Term ( mos ) 64 64 64 62 63 62 Avg. LTV (3) 115.9% 115.9% 112.5% 114.2% 114.2% 114.7% 10

• Average age 41 years • Average time in job 6 years • Average time in residence 6 years • Average credit history 13 years • Average household income $55,848 per year • Percentage of homeowners 25% Borrower: • Average amount financed $15,314 • Average monthly payment $425 • Average term 61 months • Weighted Average APR 20.2% • Weighted Average LTV 114% Contract: 11 (1) Under the CPS programs for contracts purchased in the first three quarters of 2012.

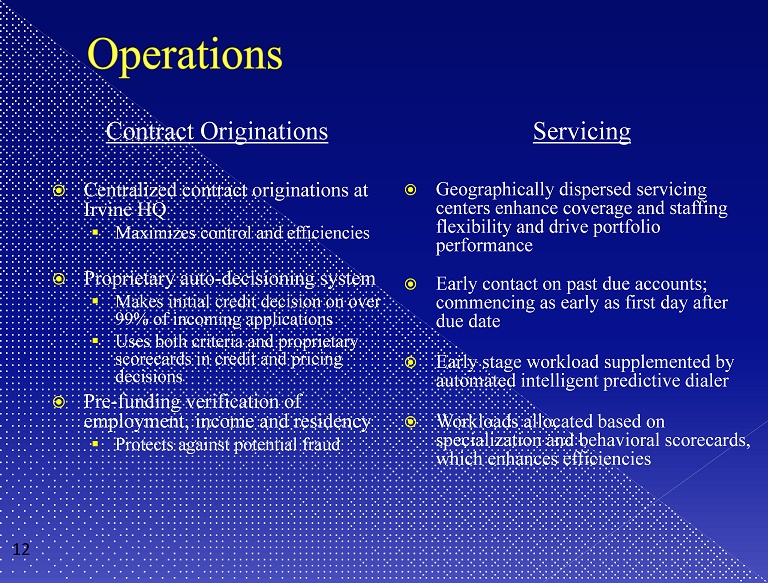

Contract Originations Centralized contract originations at Irvine HQ ▪ Maximizes control and efficiencies Proprietary auto - decisioning system ▪ Makes initial credit decision on over 99% of incoming applications ▪ Uses both criteria and proprietary scorecards in credit and pricing decisions Pre - funding verification of employment, income and residency ▪ Protects against potential fraud Servicing Geographically dispersed servicing centers enhance coverage and staffing flexibility and drive portfolio performance Early contact on past due accounts; commencing as early as first day after due date Early stage workload supplemented by automated intelligent predictive dialer Workloads allocated based on specialization and behavioral scorecards, which enhances efficiencies 12

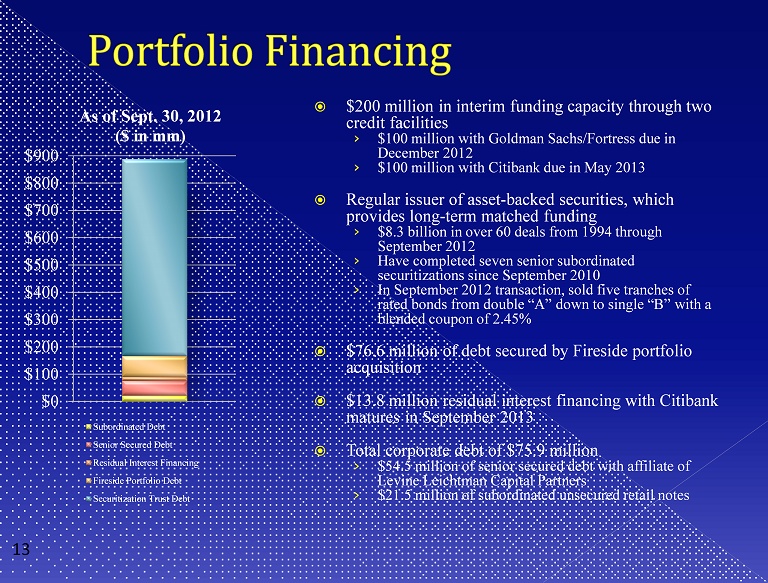

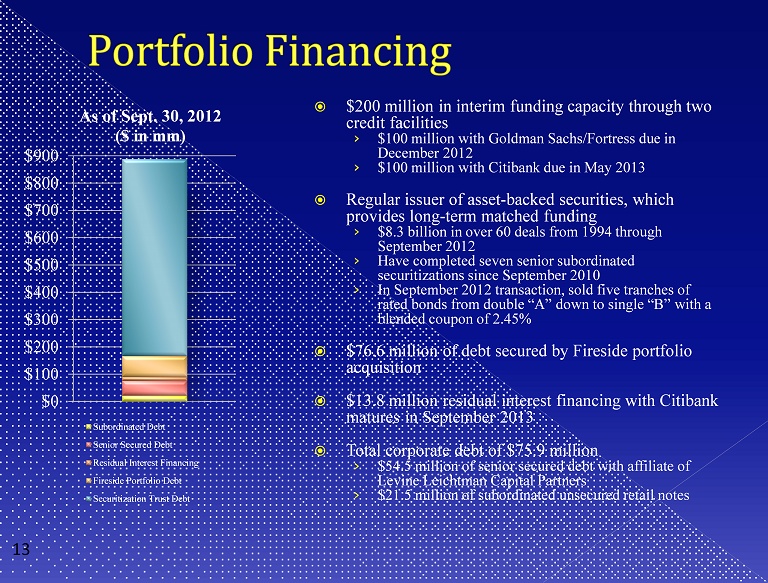

$200 million in interim funding capacity through two credit facilities › $100 million with Goldman Sachs/Fortress due in December 2012 › $100 million with Citibank due in May 2013 Regular issuer of asset - backed securities, which provides long - term matched funding › $8.3 billion in over 60 deals from 1994 through September 2012 › Have completed seven senior subordinated securitizations since September 2010 › In September 2012 transaction, sold five tranches of rated bonds from double “A” down to single “B” with a blended coupon of 2.45% $76.6 million of debt secured by Fireside portfolio acquisition $13.8 million residual interest financing with Citibank matures in September 2013 Total corporate debt of $75.9 million › $54.5 million of senior secured debt with affiliate of Levine Leichtman Capital Partners › $21.5 million of subordinated unsecured retail notes 13 $0 $100 $200 $300 $400 $500 $600 $700 $800 $900 As of Sept. 30, 2012 ($ in mm) Subordinated Debt Senior Secured Debt Residual Interest Financing Fireside Portfolio Debt Securitization Trust Debt

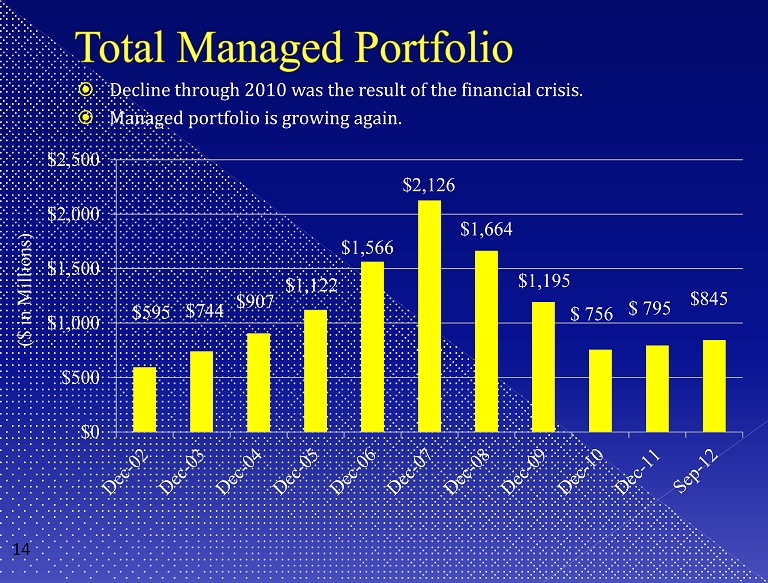

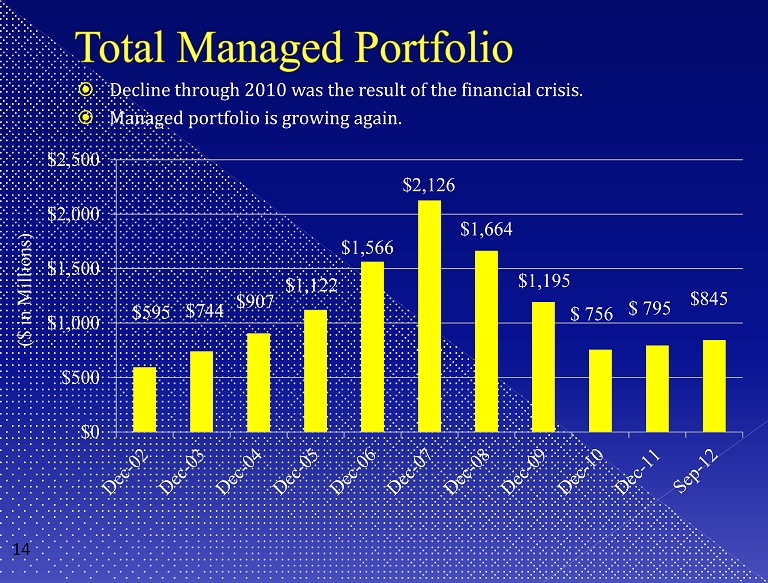

$595 $744 $907 $1,122 $1,566 $2,126 $1,664 $1,195 $ 756 $ 795 $845 $0 $500 $1,000 $1,500 $2,000 $2,500 ($ in Millions) 14 Decline through 2010 was the result of the financial crisis. Managed portfolio is growing again.

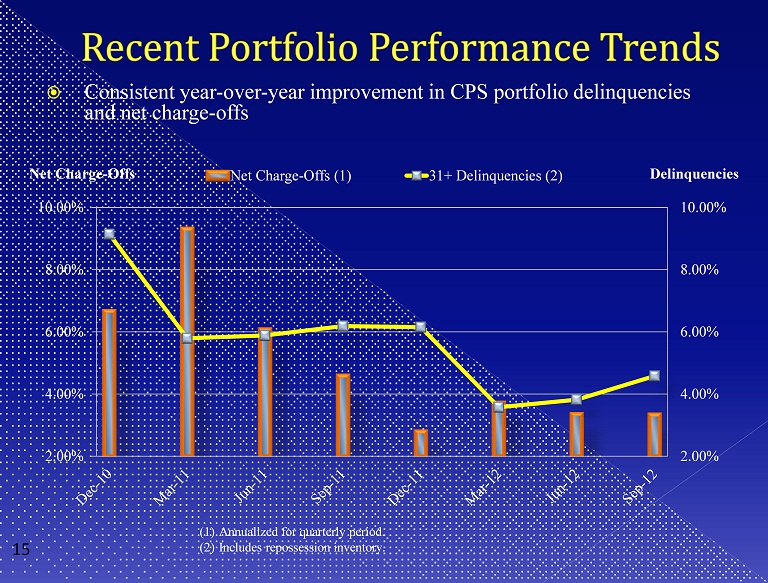

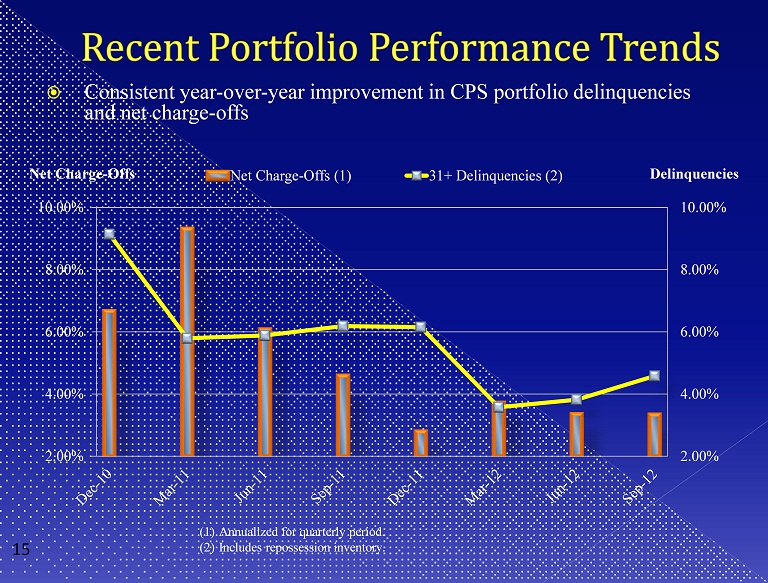

15 2.00% 4.00% 6.00% 8.00% 10.00% 2.00% 4.00% 6.00% 8.00% 10.00% Delinquencies Net Charge - Offs Net Charge-Offs (1) 31+ Delinquencies (2) (1) Annualized for quarterly period. (2) Includes repossession inventory. . Consistent year - over - year improvement in CPS portfolio delinquencies and net charge - offs

0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% 14.00% 16.00% 18.00% 20.00% Months Seasoned 2002 2003 2004 2005 2006 2007 2008 2010 2011 Average of quarterly vintage cum. net losses as of September 30, 2012 2010 and later vintages in line or better than 2003 and 2004 vintages 16

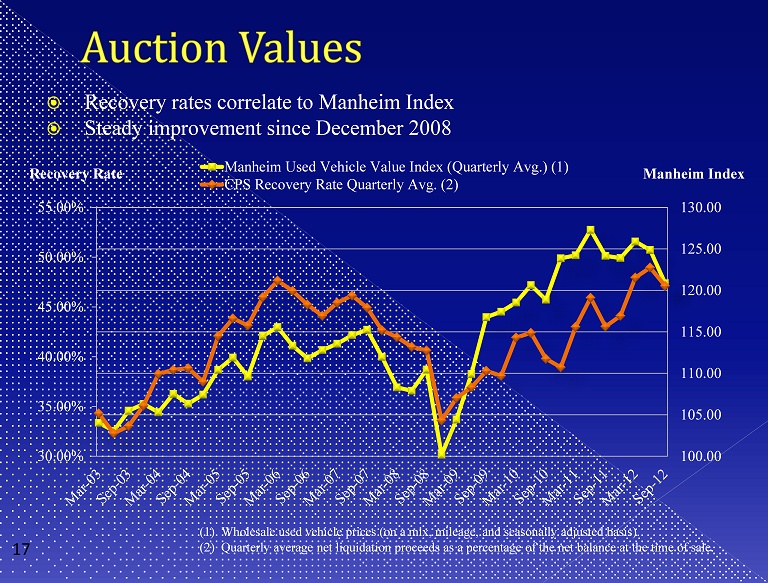

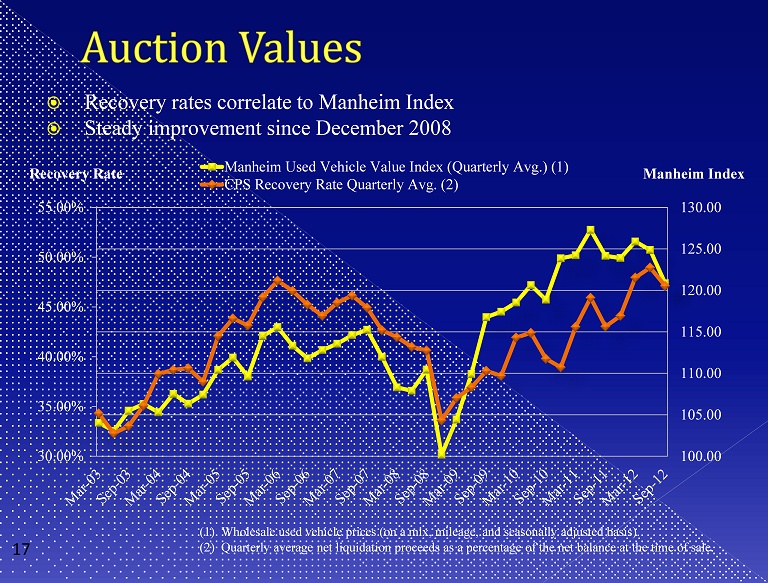

17 30.00% 35.00% 40.00% 45.00% 50.00% 55.00% 100.00 105.00 110.00 115.00 120.00 125.00 130.00 Manheim Index Recovery Rate Manheim Used Vehicle Value Index (Quarterly Avg.) (1) CPS Recovery Rate Quarterly Avg. (2) (1) Wholesale used vehicle prices (on a mix, mileage, and seasonally adjusted basis). (2) Quarterly average net liquidation proceeds as a percentage of the net balance at the time of sale. Recovery rates correlate to Manheim Index Steady improvement since December 2008

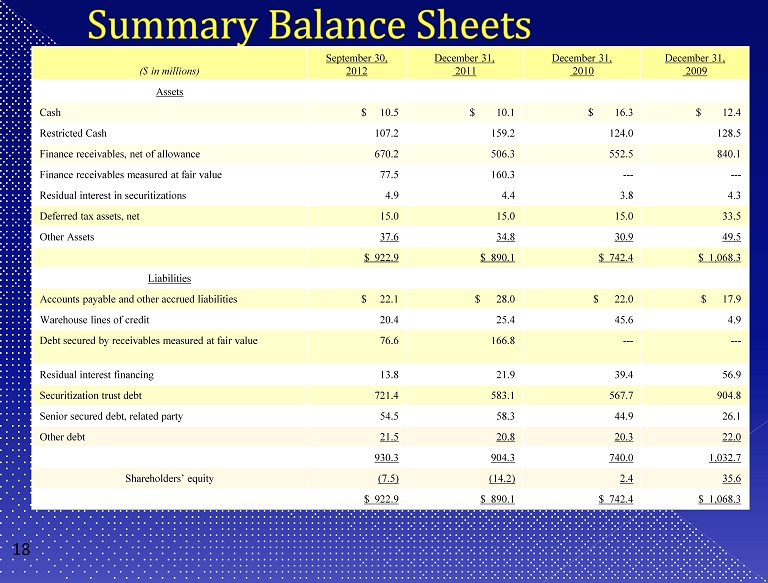

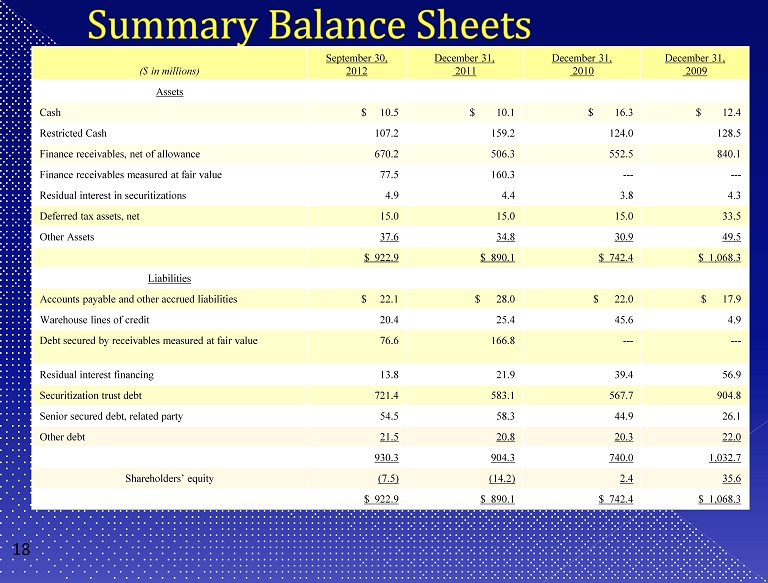

18 ($ in millions) September 30, 2012 December 31, 2011 December 31, 2010 December 31, 2009 Assets Cash $ 10.5 $ 10.1 $ 16.3 $ 12.4 Restricted Cash 107.2 159.2 124.0 128.5 Finance receivables, net of allowance 670.2 506.3 552.5 840.1 Finance receivables measured at fair value 77.5 160.3 --- --- Residual interest in securitizations 4.9 4.4 3.8 4.3 Deferred tax assets, net 15.0 15.0 15.0 33.5 Other Assets 37.6 34.8 30.9 49.5 $ 922.9 $ 890.1 $ 742.4 $ 1,068.3 Liabilities Accounts payable and other accrued liabilities $ 22.1 $ 28.0 $ 22.0 $ 17.9 Warehouse lines of credit 20.4 25.4 45.6 4.9 Debt secured by receivables measured at fair value 76.6 166.8 --- --- Residual interest financing 13.8 21.9 39.4 56.9 Securitization trust debt 721.4 583.1 567.7 904.8 Senior secured debt, related party 54.5 58.3 44.9 26.1 Other debt 21.5 20.8 20.3 22.0 930.3 904.3 740.0 1,032.7 Shareholders’ equity (7.5) (14.2) 2.4 35.6 $ 922.9 $ 890.1 $ 742.4 $ 1,068.3

19 Nine Months Ended Years Ended ($ in millions) September 30, 2012 September 30, 2011 December 31, 2011 December 31, 2010 December 31, 2009 Revenues Interest income $ 127.2 $ 86.6 $ 127.9 $ 137.1 $ 208.2 Servicing fees 1.9 3.5 4.3 7.7 4.6 Other i ncome 7.5 7.2 10.9 10.4 11.1 136.6 97.4 143.1 155.2 223.9 Expenses Employee costs 25.9 23.3 32.3 33.8 37.3 General and administrative 22.4 19.3 26.8 26.1 32.2 Interest 61.7 57.4 83.1 81.6 111.8 Provision for credit losses 22.0 12.0 15.5 29.9 92.0 132.0 112.1 157.6 171.4 273.3 Pretax income (loss) 4.6 (14.7) (14.5) (16.2) (49.4) Income tax expense (gain) --- --- --- 17.0 7.8 Net income (loss) $ 4.6 $ (14.7) $ (14.5) $ (33.2) $ (57.2) EPS (loss) (fully diluted) $ 0.19 $ (0.78) $ (0.76) $ (1.90) $ (3.07)

(1) Revenues less interest expense and provision for credit losses. (2) Total expenses less provision for credit losses and interest expense. ($ in millions) Nine Months Ended Years Ended September 30, 2012 September 30, 2011 December 31, 2011 December 31, 2010 December 31, 2009 Auto contract purchases $400.9 $192.0 $284.2 $113.0 $8.6 Total managed portfolio $844.9 $827.8 $794.6 $756.2 $1,194.7 Risk - adjusted margin (1) $52.9 $28.0 $44.6 $43.7 $4.7 Core operating expenses (2) $ amount $48.3 $42.6 $59.0 $59.9 $69.5 % of average managed portfolio 8.0% 8.5% 8.3% 6.5% 5.2% Total delinquencies and repo inventory (30+ days) (% of total owned portfolio) 4.6% 6.5% 6.0% 9.2% 8.8% Annualized net charge - offs (% of average owned portfolio) 3.5% 6.6% 5.2% 9.0% 11.0% 20

CPS has weathered two industry cycles to remain one of the few independent public auto finance companies Four quarters of improving profitability and operating performance Attractive industry fundamentals with fewer large competitors than last cycle Credit performance of 2008 and later vintages in line or better than 2003 and 2004 vintages Growing portfolio enhances operating leverage through economies of scale Opportunistic, successful acquisitions Stable senior management team with significant equity ownership » Senior management, including vice presidents, average over 16 years of service with CPS 21

Any person considering an investment in securities issued by CPS is urged to review the materials filed by CPS with the U . S . Securities and Exchange Commission ("Commission") . Such materials may be found by inquiring of the Commission‘s EDGAR search page (http : //www . sec . gov/edgar/searchedgar/companysearch . html) using CPS's ticker symbol, which is "CPSS . " Risk factors that should be considered are described in Item 1 A, “Risk Factors," of CPS's annual report on Form 10 - K, which report is on file with the Commission and available for review at the Commission's website . Such description of risk factors is incorporated herein by reference . 22

Information included in the preceding slides is believed to be accurate, but is not necessarily complete . Such information should be reviewed in its appropriate context . The implication that historical trends will continue in the future, or that past performance is indicative of future results, is disclaimed . To the extent that one reading the preceding material nevertheless makes such an inference, such inference would be a forward - looking statement, and would be subject to risks and uncertainties that could cause actual results to vary . Such risks include variable economic conditions, adverse portfolio performance (resulting, for example, from increased defaults by the underlying obligors), volatile wholesale values of collateral underlying CPS assets, reliance on warehouse financing and on the capital markets, fluctuating interest rates, increased competition, regulatory changes, the risk of obligor default inherent in sub - prime financing, and exposure to litigation . 23