Free signup for more

- Track your favorite companies

- Receive email alerts for new filings

- Personalized dashboard of news and more

- Access all data and search results

Filing tables

Filing exhibits

PTEN similar filings

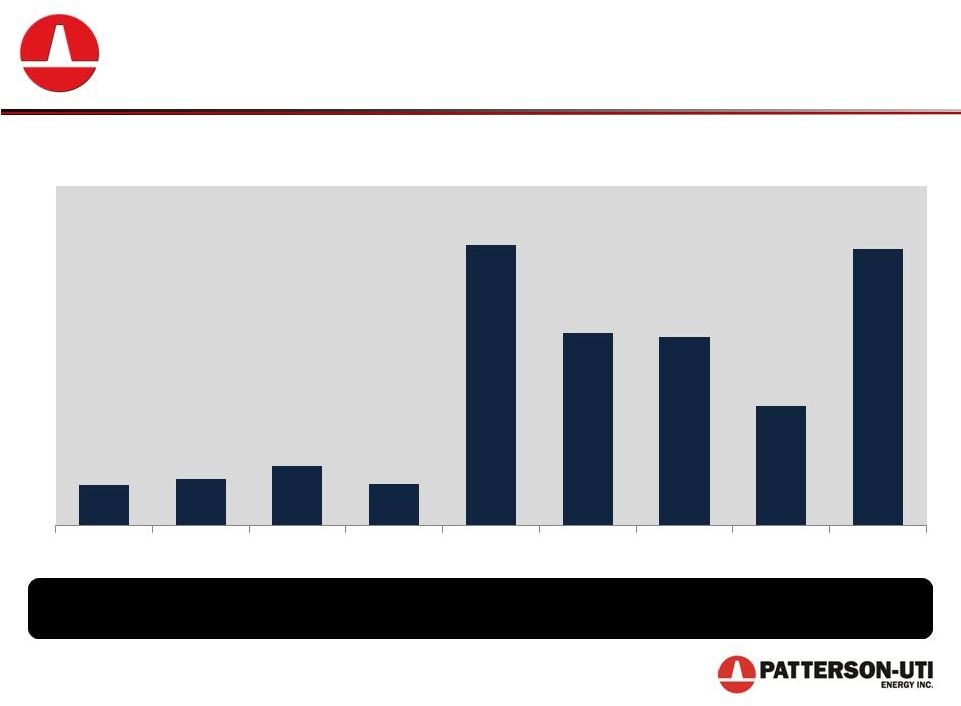

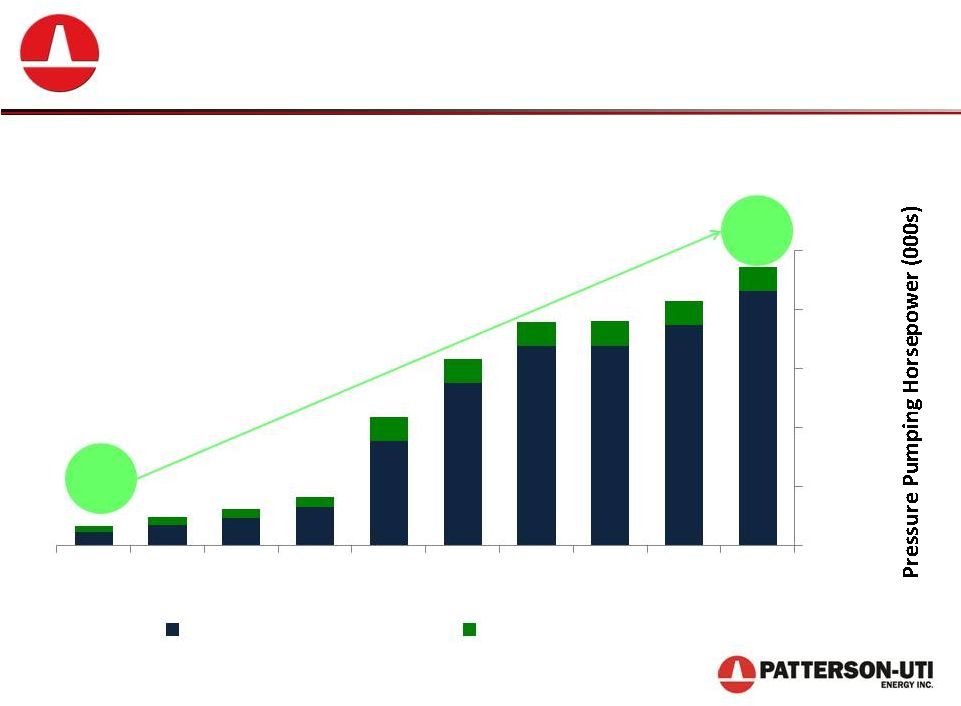

- 20 Oct 14 Patterson-UTI Energy Announces Completion of Previously Announced Pressure Pumping Acquisition

- 29 Sep 14 This material and any oral statements made in connection with this material

- 19 Sep 14 Patterson-UTI Energy Announces Agreement to Acquire Texas-Based Pressure Pumping Assets

- 2 Sep 14 This material and any oral statements made in connection with this material

- 11 Aug 14 Patterson-UTI Announces Appointment of Tiffany J. Thom to its Board of Directors

- 24 Jul 14 Results of Operations and Financial Condition

- 14 May 14 2014 Global Energy and Utilities Conference

Filing view

External links