Free signup for more

- Track your favorite companies

- Receive email alerts for new filings

- Personalized dashboard of news and more

- Access all data and search results

Filing tables

Filing exhibits

PTEN similar filings

- 13 Nov 14 Regulation FD Disclosure

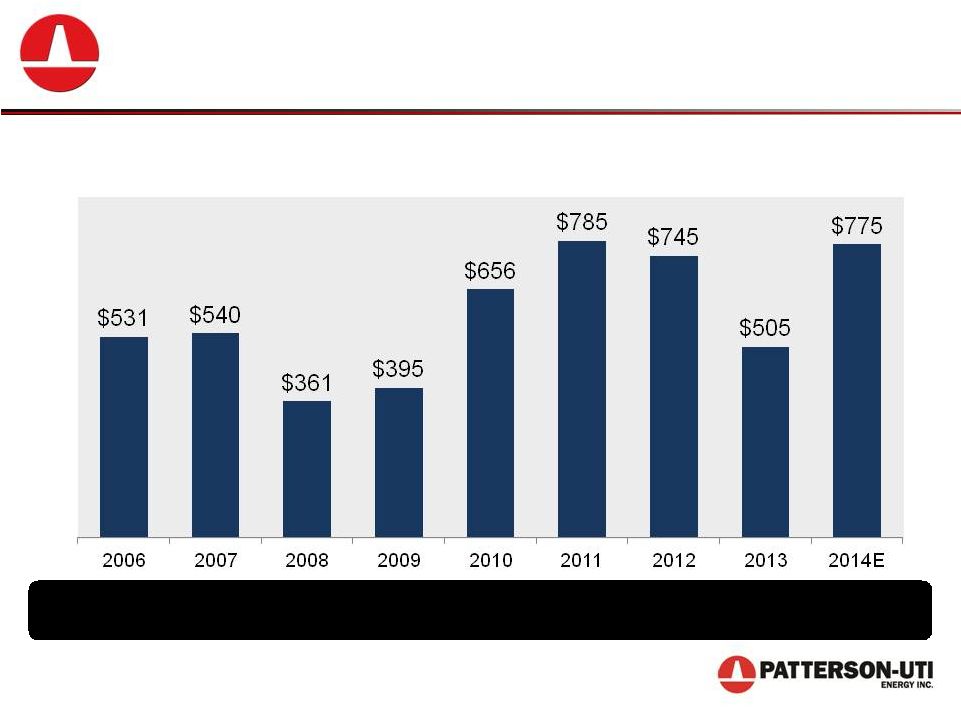

- 23 Oct 14 Patterson-UTI Energy Reports Financial Results for Three and Nine Months Ended September 30, 2014

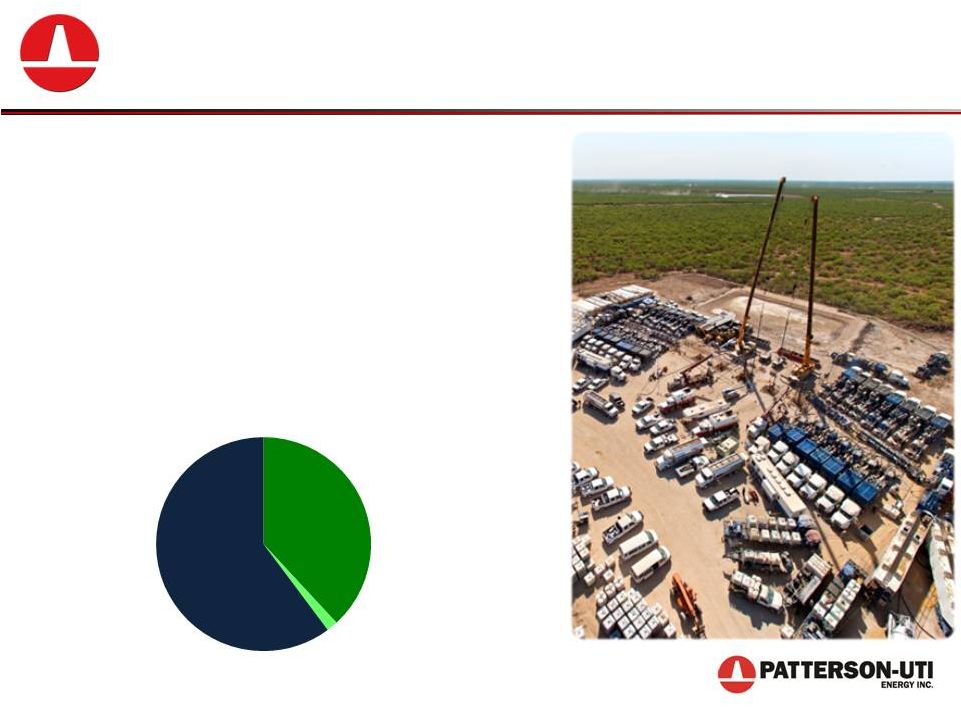

- 20 Oct 14 Patterson-UTI Energy Announces Completion of Previously Announced Pressure Pumping Acquisition

- 29 Sep 14 This material and any oral statements made in connection with this material

- 19 Sep 14 Patterson-UTI Energy Announces Agreement to Acquire Texas-Based Pressure Pumping Assets

- 2 Sep 14 This material and any oral statements made in connection with this material

- 11 Aug 14 Patterson-UTI Announces Appointment of Tiffany J. Thom to its Board of Directors

Filing view

External links