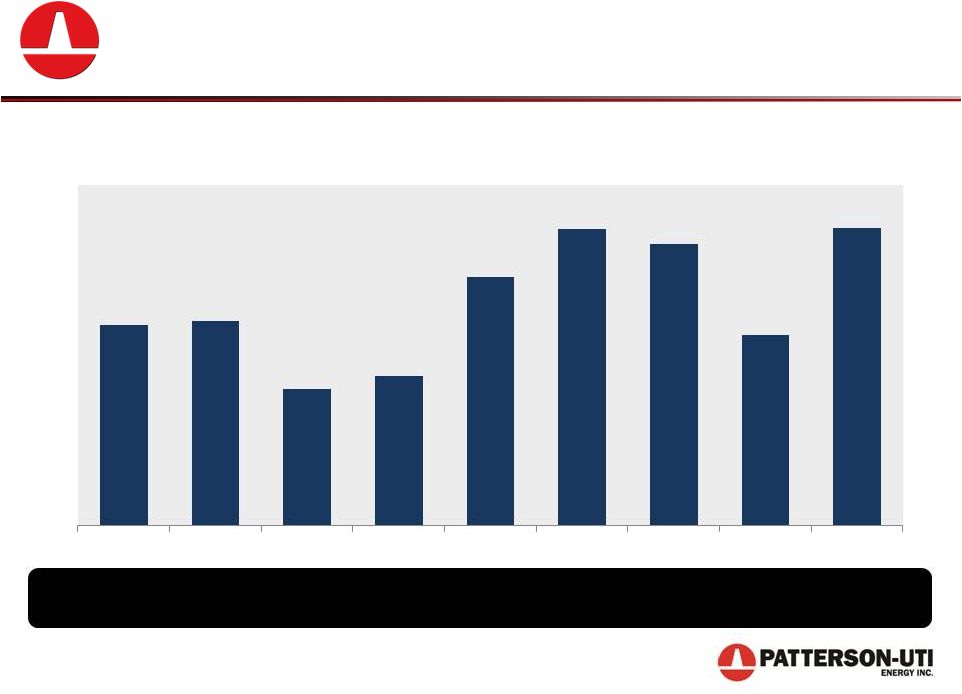

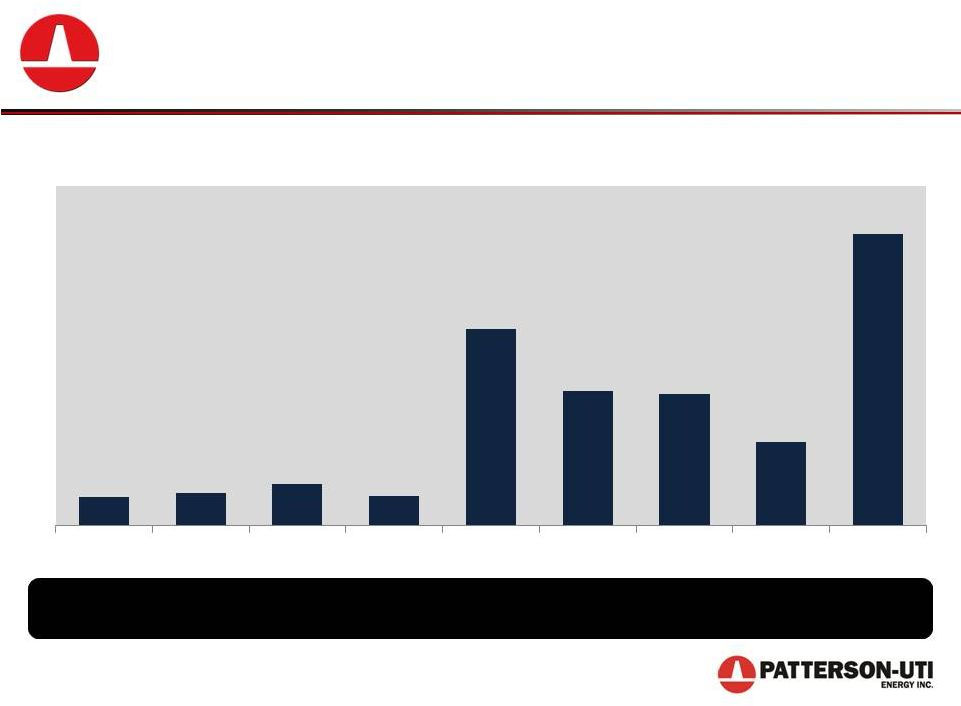

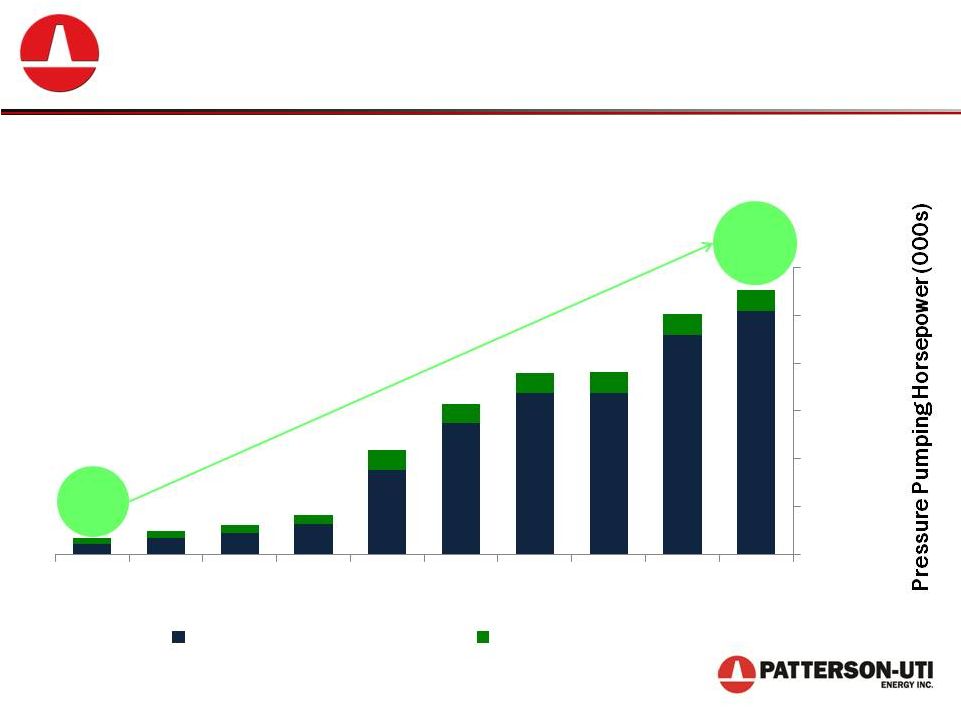

PATTERSON-UTI ENERGY, INC. Non-GAAP Financial Measures (Unaudited) (dollars in thousands) Non-GAAP Financial Measures 49 Three Months Ended September 30, Nine Months Ended September 30, 2014 2013 2014 2013 Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization (Adjusted EBITDA)(1): Net income $ 15,976 $ 74,420 $ 105,081 $ 171,418 Income tax expense 7,556 43,301 50,403 98,957 Net interest expense 6,759 7,210 20,812 20,494 Depreciation, depletion, amortization and impairment 237,825 140,734 538,573 414,351 Adjusted EBITDA $ 268,116 $ 265,665 $ 714,869 $ 705,220 Total revenue $ 845,628 $ 730,907 $2,281,072 $2,057,262 Adjusted EBITDA margin 31.7% 36.3% 31.3% 34.3% Adjusted EBITDA by operating segment: Contract drilling $ 202,804 $ 217,289 $ 557,674 $ 532,812 Pressure pumping 62,795 50,677 157,913 171,471 Oil and natural gas 11,449 10,225 29,423 35,591 Corporate and other (8,932) (12,526) (30,141) (34,654) Consolidated Adjusted EBITDA $ 268,116 $ 265,665 $ 714,869 $ 705,220 (1) The company makes use of financial measures that are not calculated in accordance with U.S. generally accepted accounting principles (“GAAP”) to help in the assessment of ongoing operating performance. These non-GAAP financial measures are reconciled to their most directly comparable GAAP measures in the tables above. We define Adjusted EBITDA as net income plus net interest expense, income tax expense and depreciation, depletion, amortization and impairment expense. We present Adjusted EBITDA because we believe it provides additional information with respect to both the performance of our fundamental business activities and our ability to meet our capital expenditures and working capital requirements. Adjusted EBITDA is not defined by GAAP and, as such, should not be construed as an alternative to net income (loss) or operating cash flow. We define margin as revenues less direct operating costs. We present margin because we believe it to be the component of our earnings most impacted by the variability in our contract drilling and pressure pumping operations. Margin is not defined by GAAP and, as such, should not be construed as an alternative to net income (loss). |