Johnson Rice 2016 Energy Conference September 21, 2016 Exhibit 99.1

Forward Looking Statements This material and any oral statements made in connection with this material include "forward-looking statements" within the meaning of the Securities Act of 1933 and the Securities Exchange Act of 1934. Statements made which provide the Company’s or management’s intentions, beliefs, expectations or predictions for the future are forward-looking statements and are inherently uncertain. The opinions, forecasts, projections or other statements other than statements of historical fact, including, without limitation, plans and objectives of management of the Company are forward-looking statements. It is important to note that actual results could differ materially from those discussed in such forward-looking statements. Important factors that could cause actual results to differ materially include the risk factors and other cautionary statements contained from time to time in the Company’s SEC filings, which may be obtained by contacting the Company or the SEC. These filings are also available through the Company’s web site at http://www.patenergy.com or through the SEC’s Electronic Data Gathering and Analysis Retrieval System (EDGAR) at http://www.sec.gov. We undertake no obligation to publicly update or revise any forward-looking statement. Statements made in this presentation include non-U.S. GAAP financial measures. The required reconciliation to U.S. GAAP financial measures are included on our website and/or at the end of this presentation. The Red Circular Rig Logo, the Universal Logo, and the terms PATTERSON UTI, and APEX are registered trademarks of Patterson–UTI Energy, Inc.

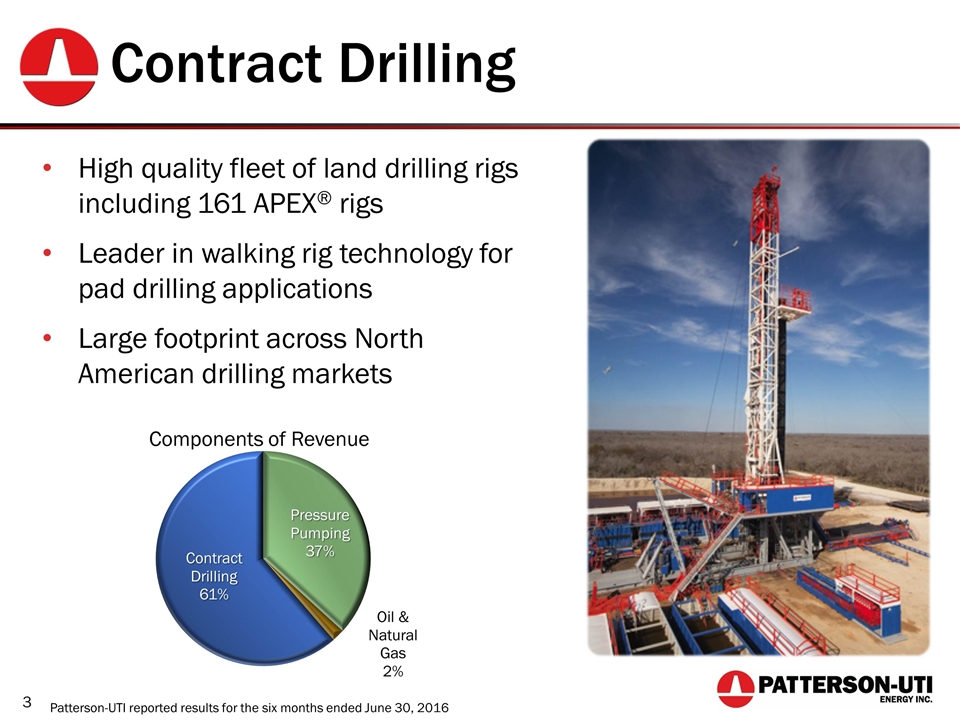

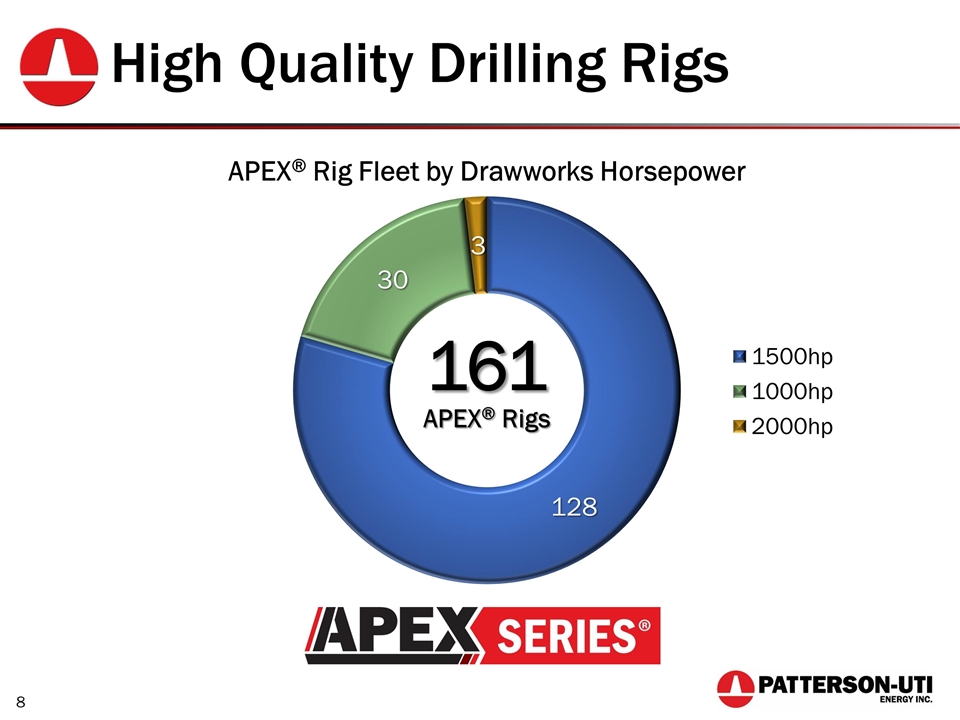

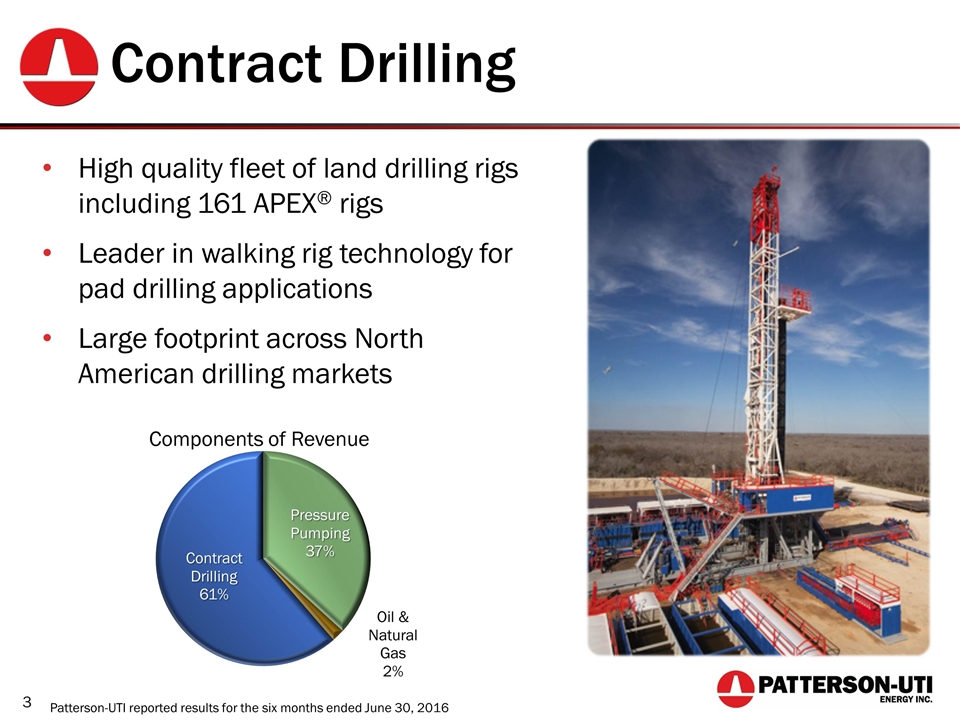

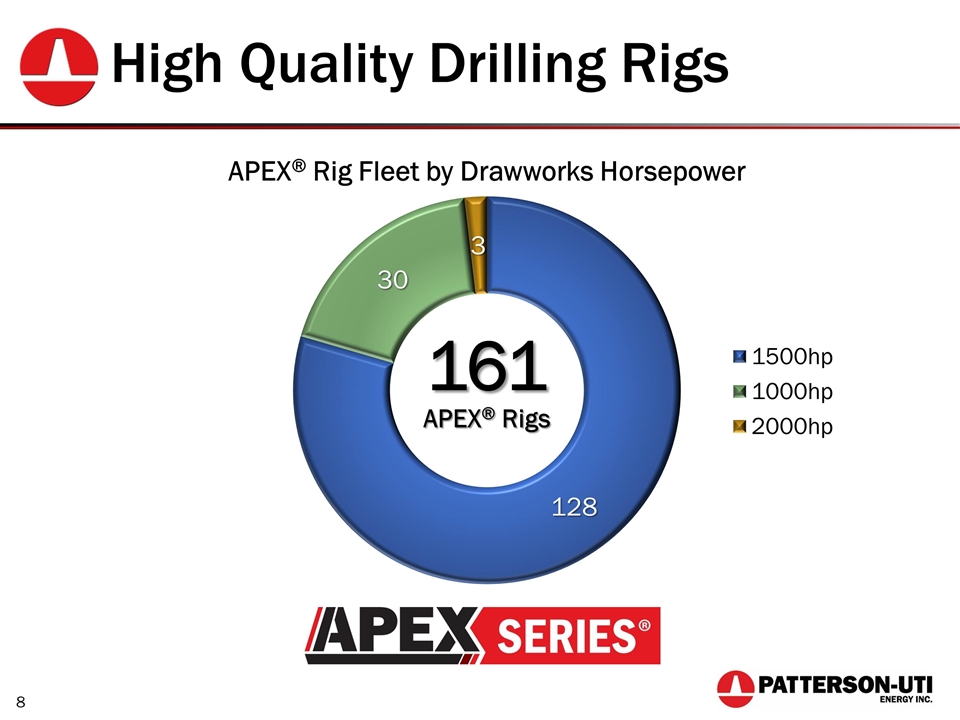

Contract Drilling High quality fleet of land drilling rigs including 161 APEX® rigs Leader in walking rig technology for pad drilling applications Large footprint across North American drilling markets Patterson-UTI reported results for the six months ended June 30, 2016

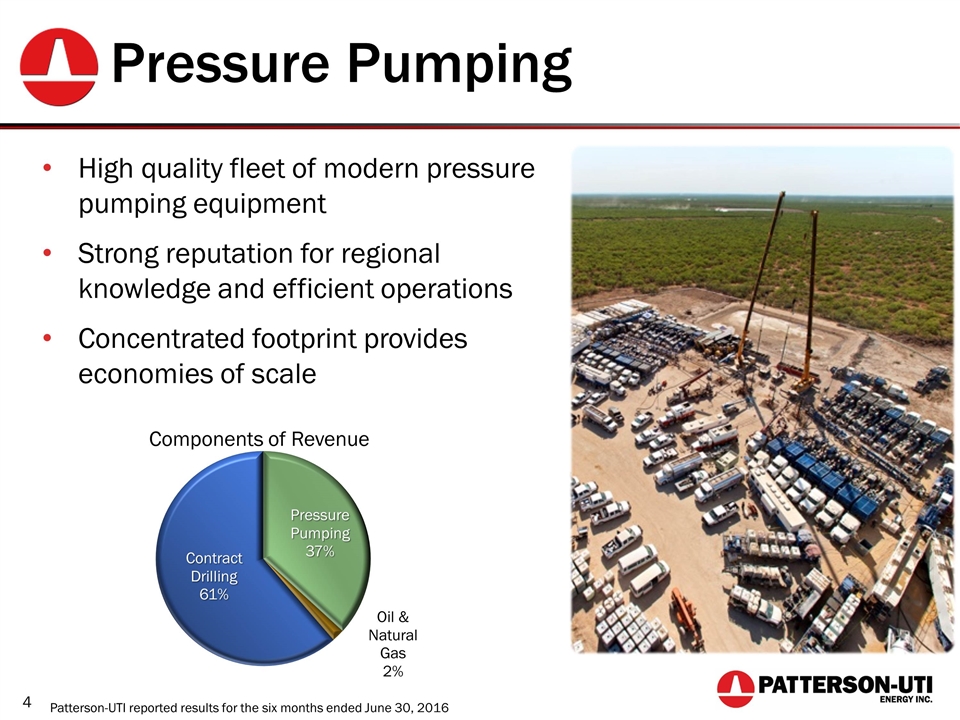

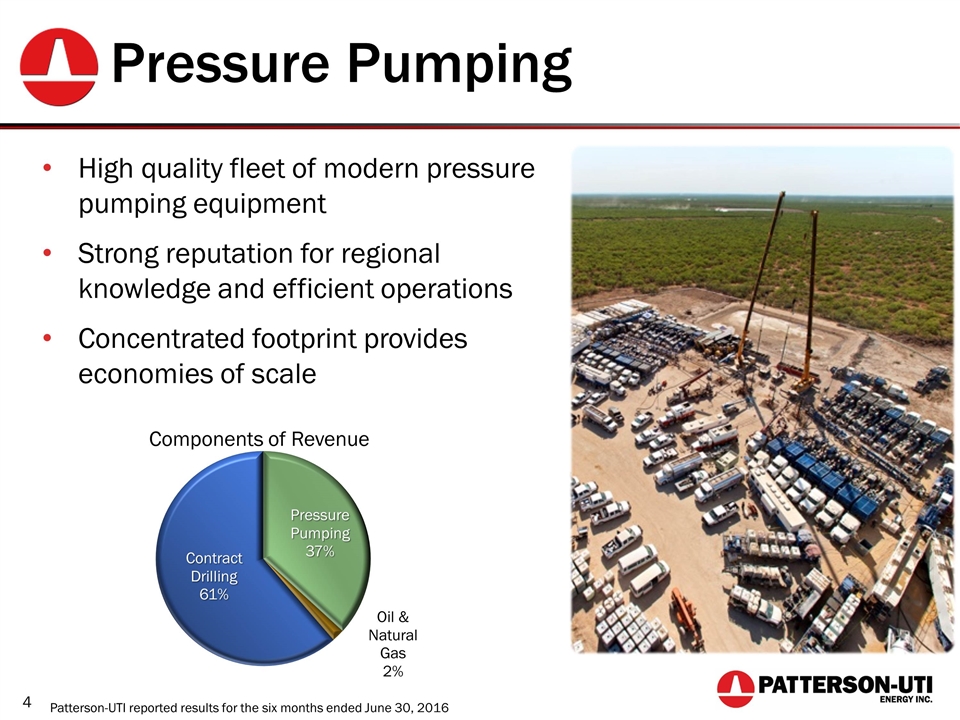

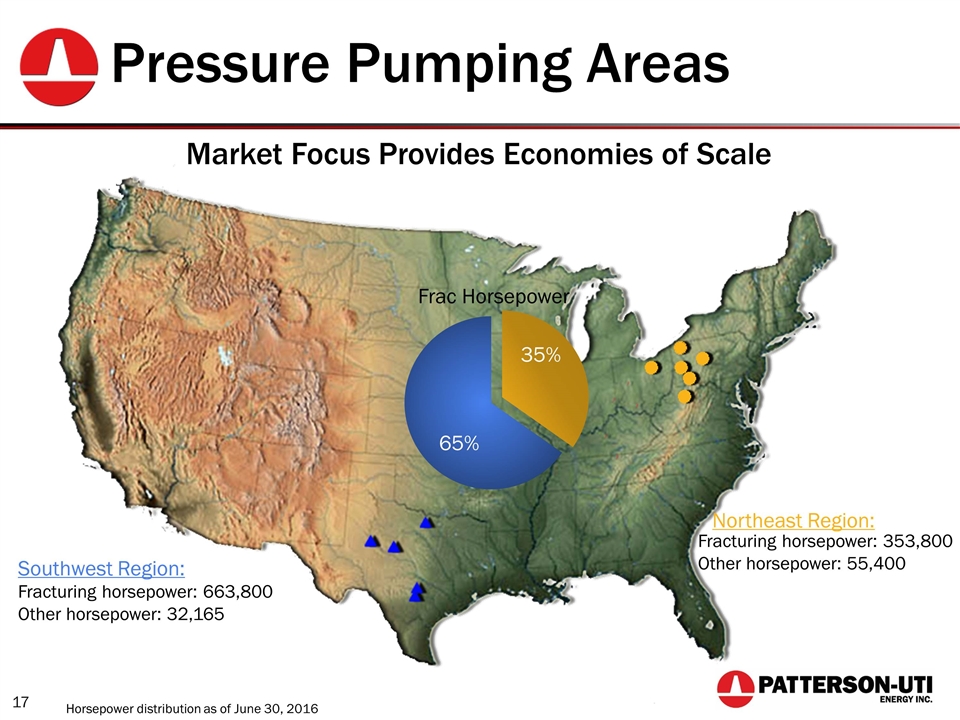

Pressure Pumping High quality fleet of modern pressure pumping equipment Strong reputation for regional knowledge and efficient operations Concentrated footprint provides economies of scale Patterson-UTI reported results for the six months ended June 30, 2016

Contract Drilling

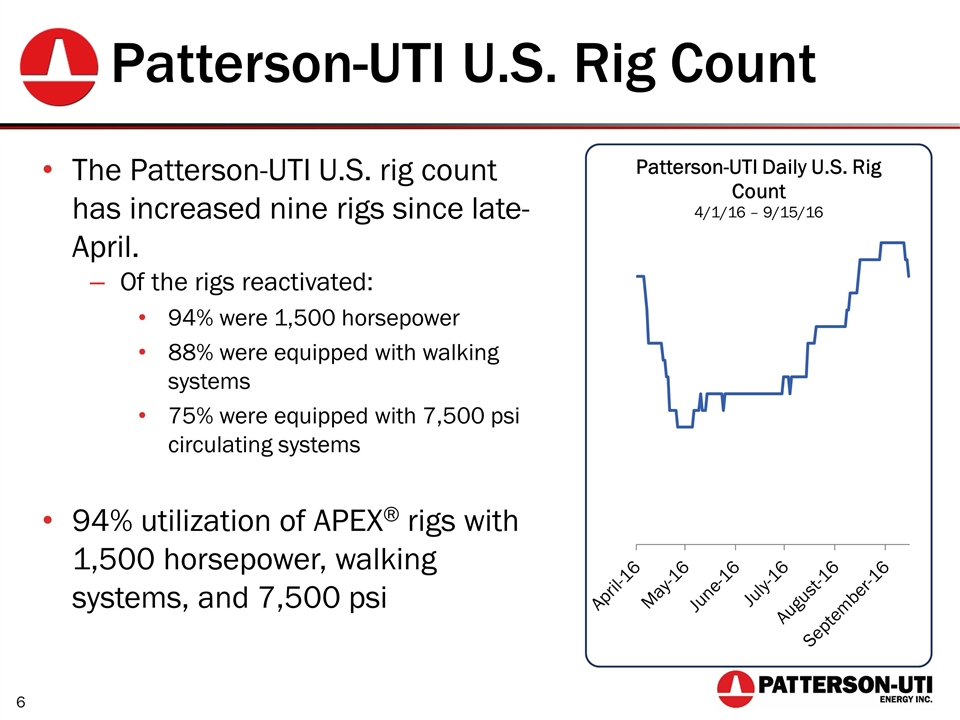

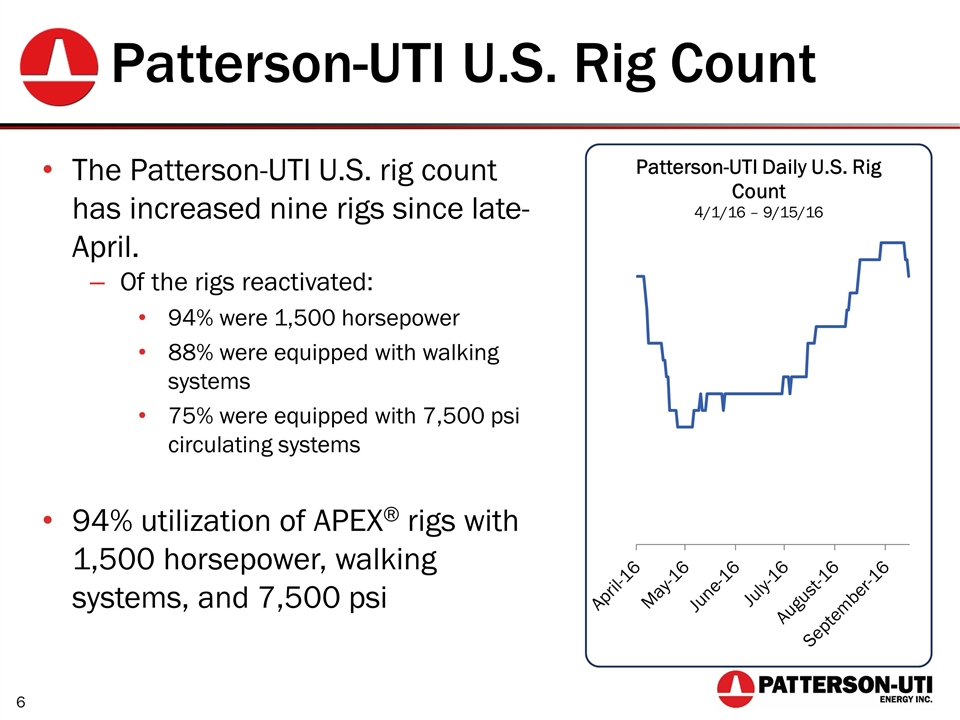

Patterson-UTI U.S. Rig Count The Patterson-UTI U.S. rig count has increased nine rigs since late-April. Of the rigs reactivated: 94% were 1,500 horsepower 88% were equipped with walking systems 75% were equipped with 7,500 psi circulating systems 94% utilization of APEX® rigs with 1,500 horsepower, walking systems, and 7,500 psi

Overcoming Reactivation Challenges Reactivation Costs Expected to be approximately $200,000 per rig Patterson-UTI expected to have ample liquidity following the extension of the revolving credit facility and repayment of term loans Labor U.S. Drilling headcount has increased by more than 200 people Approximately 90% of recent hires are former employees

High Quality Drilling Rigs 161 APEX® Rigs

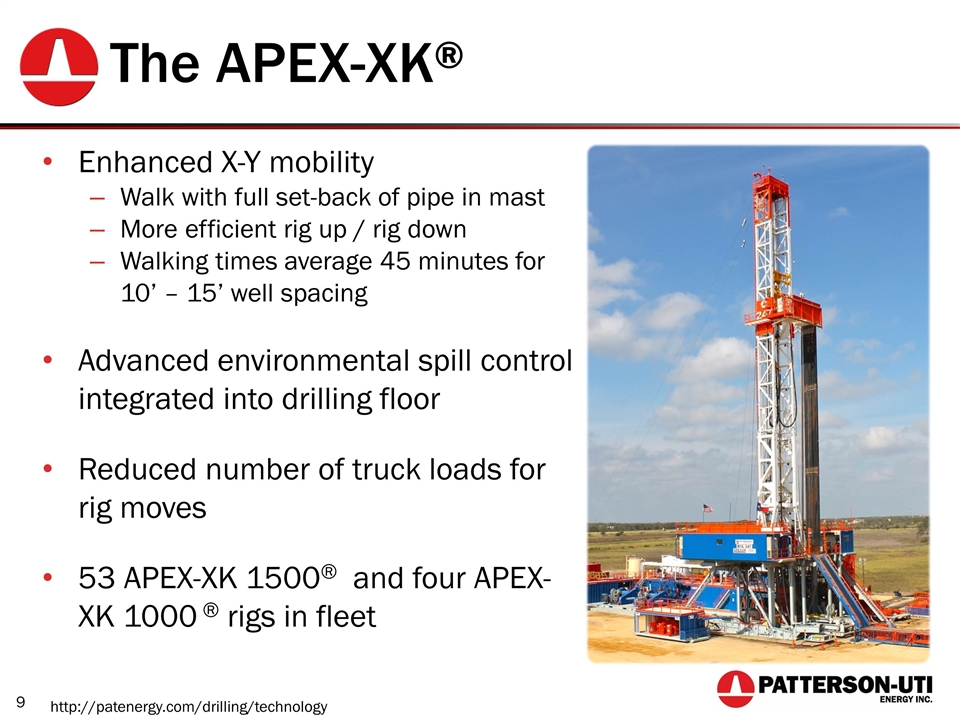

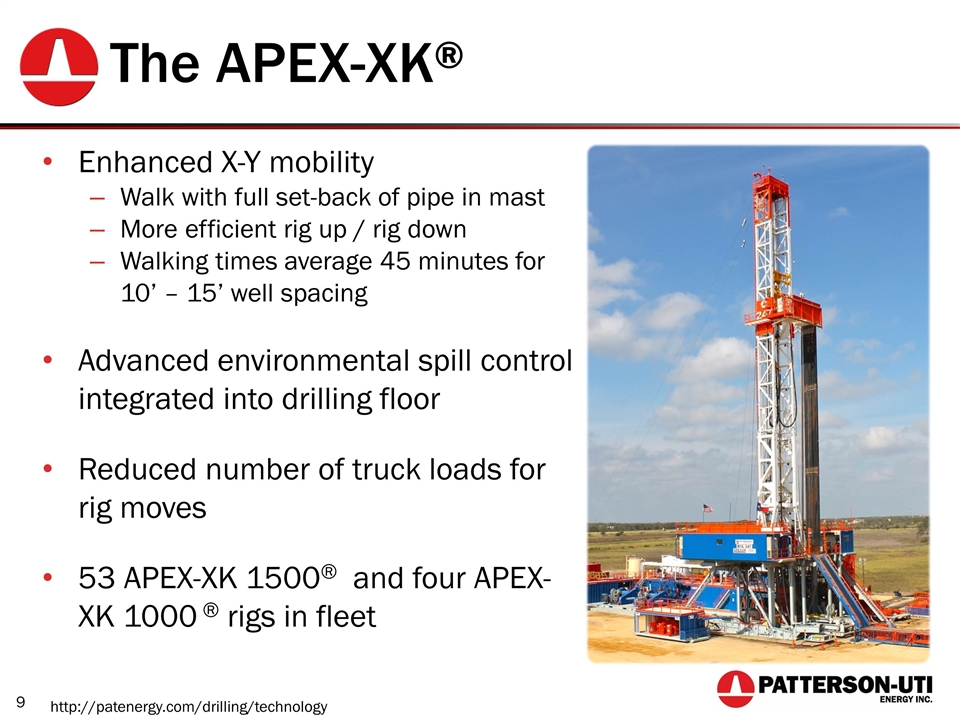

The APEX-XK® Enhanced X-Y mobility Walk with full set-back of pipe in mast More efficient rig up / rig down Walking times average 45 minutes for 10’ – 15’ well spacing Advanced environmental spill control integrated into drilling floor Reduced number of truck loads for rig moves 53 APEX-XK 1500® and four APEX-XK 1000 ® rigs in fleet http://patenergy.com/drilling/technology

APEX-XK® Integrated Walking System

APEX-XK® Rig Walking on Pad http://patenergy.com/drilling/technology/apexwalk/ Video of APEX-XK® Rig

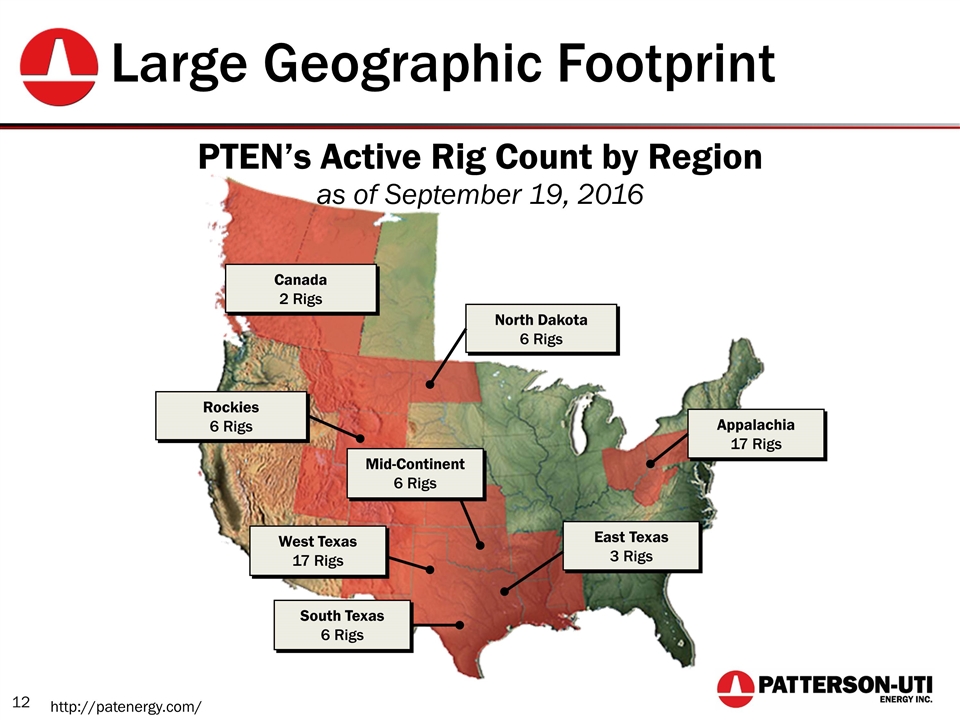

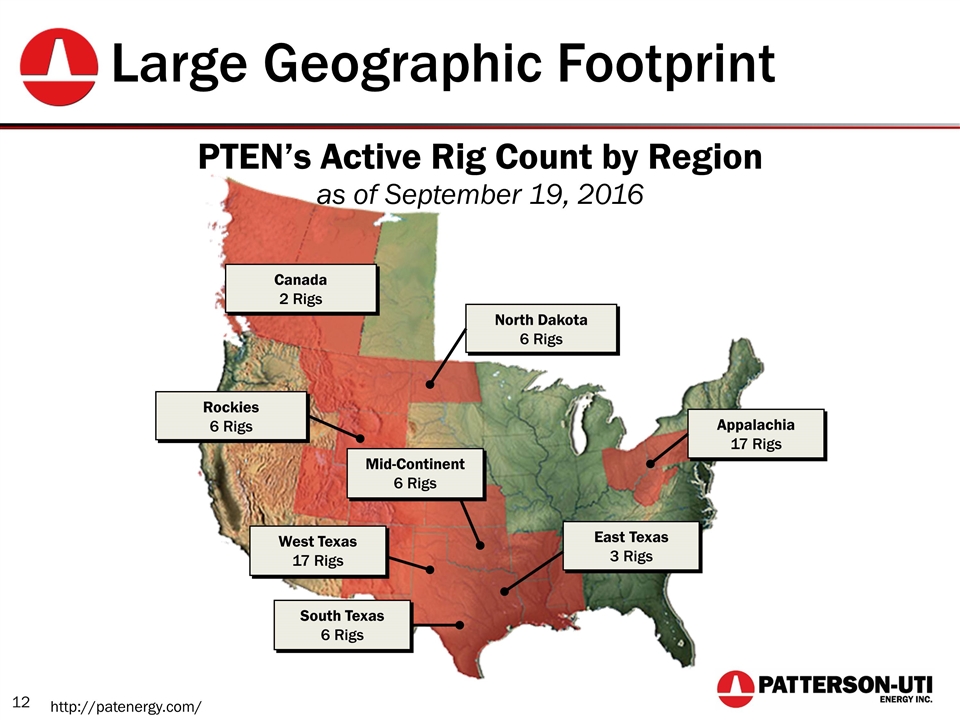

West Texas 17 Rigs Large Geographic Footprint PTEN’s Active Rig Count by Region as of September 19, 2016 Appalachia 17 Rigs East Texas 3 Rigs Mid-Continent 6 Rigs Rockies 6 Rigs South Texas 6 Rigs North Dakota 6 Rigs Canada 2 Rigs http://patenergy.com/

Drilling Technologies Designs, manufactures and services high-spec rig components with a recent focus on top drive technology Expands the Patterson-UTI technology portfolio A highly talented group of people with a tremendous amount of experience

Pressure Pumping

Managing Supply Chain Developing strategic relationships around critical materials and services to: Manage supply volumes during a recovery Mitigate potential cost inflation Leveraging technologies to improve operational efficiencies and reduce cost

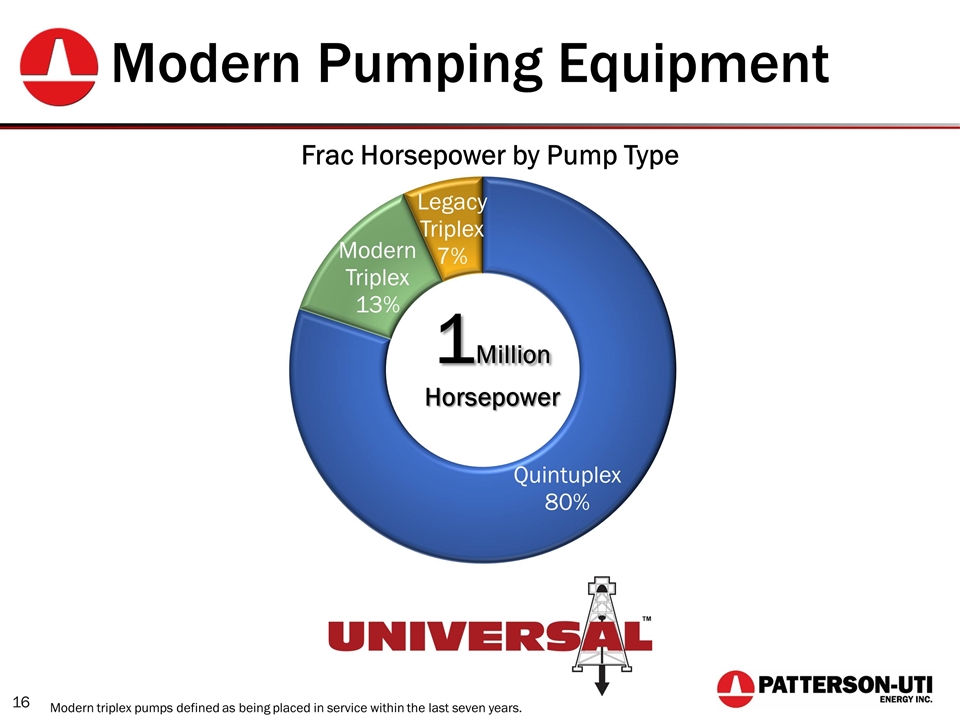

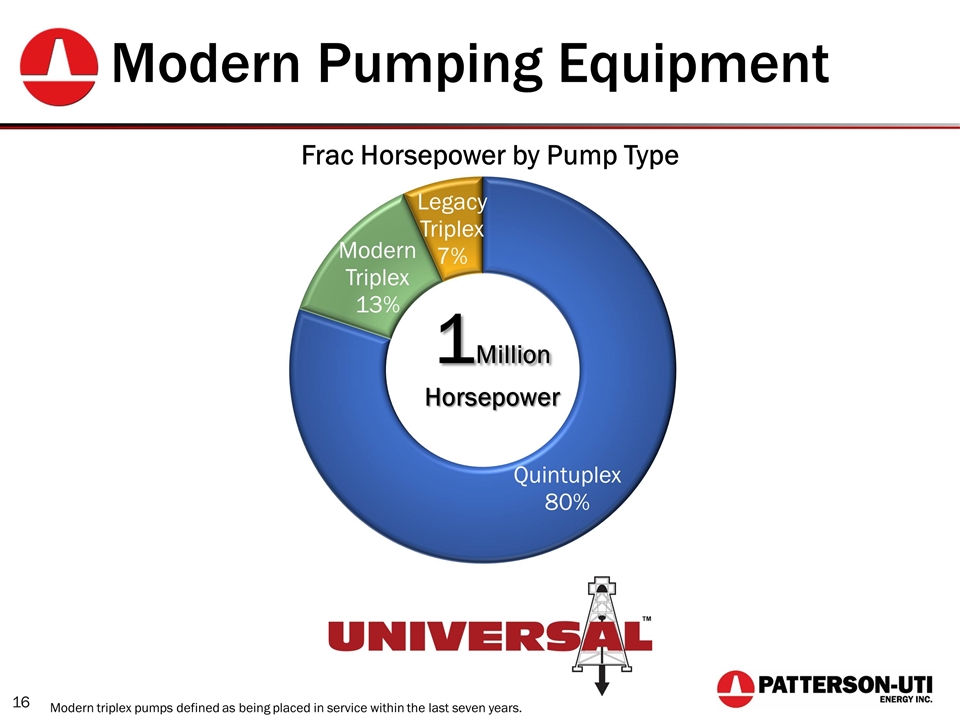

Modern Pumping Equipment Modern triplex pumps defined as being placed in service within the last seven years.

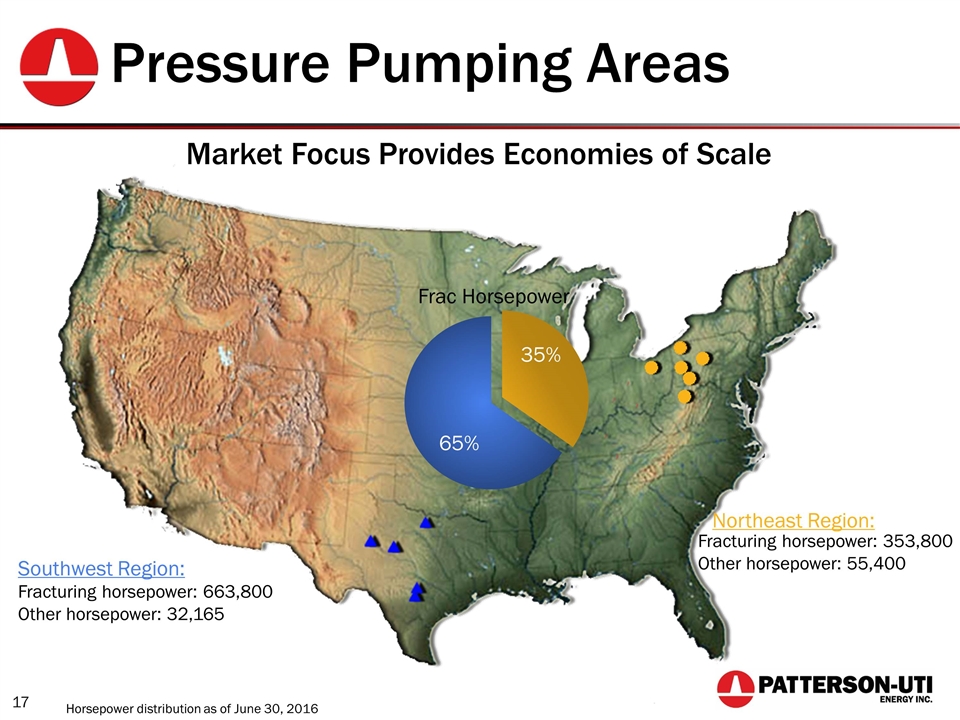

Southwest Region: Northeast Region: Fracturing horsepower: 663,800 Other horsepower: 32,165 Fracturing horsepower: 353,800 Other horsepower: 55,400 Market Focus Provides Economies of Scale Pressure Pumping Areas Horsepower distribution as of June 30, 2016

Technology Focused PropLogic™ Sand Management System Fully enclosed well-site sand management system More accurate than conventional sand trailers/bins More efficient use of proppant as less sand is wasted

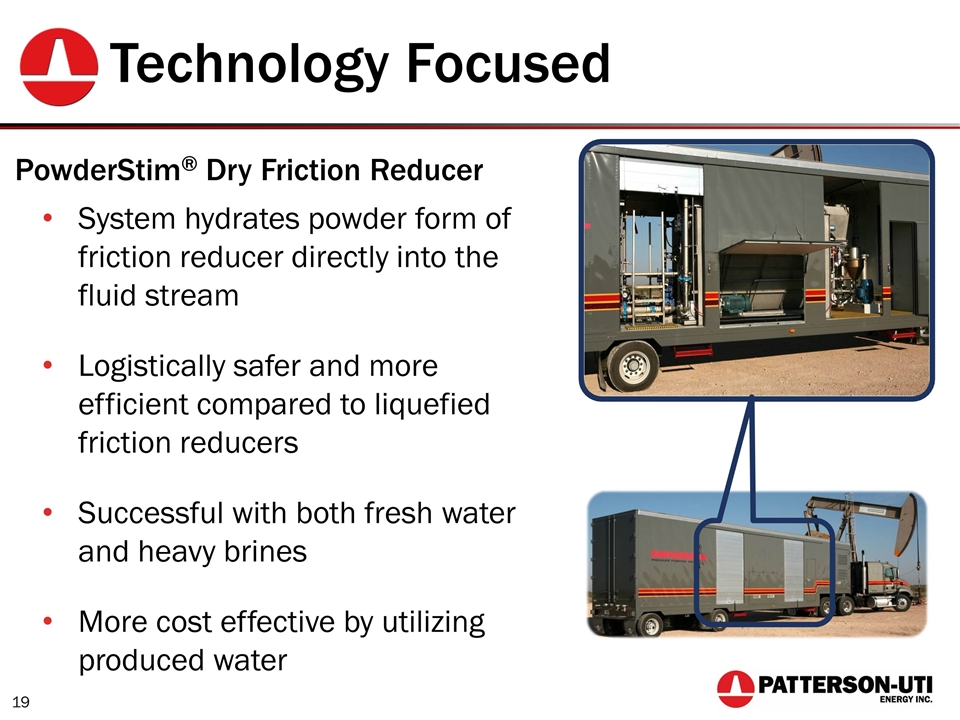

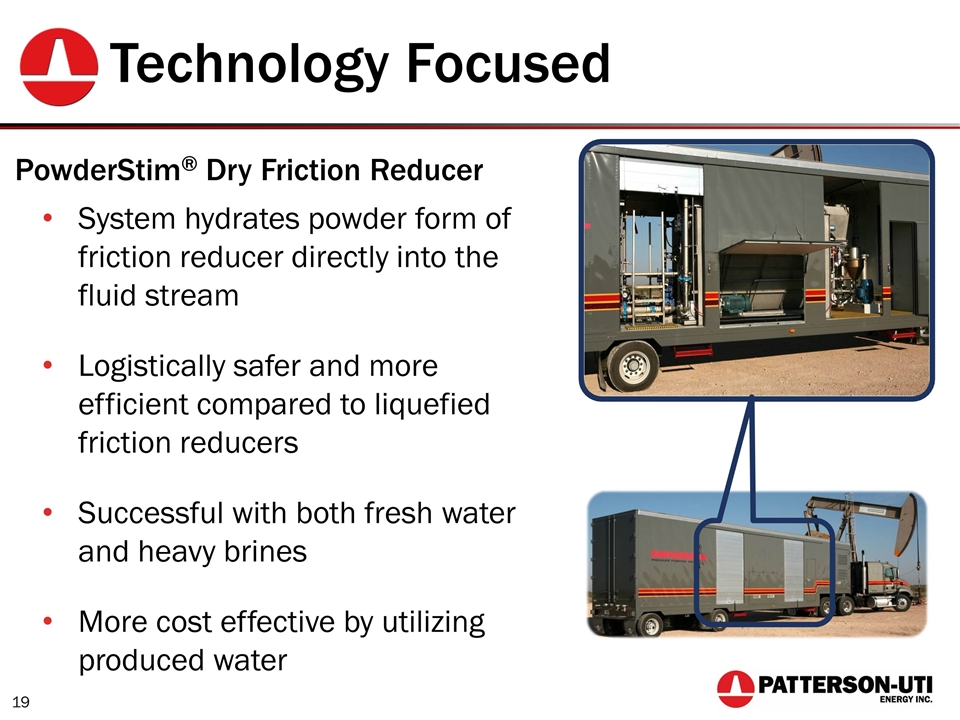

Technology Focused PowderStim® Dry Friction Reducer System hydrates powder form of friction reducer directly into the fluid stream Logistically safer and more efficient compared to liquefied friction reducers Successful with both fresh water and heavy brines More cost effective by utilizing produced water

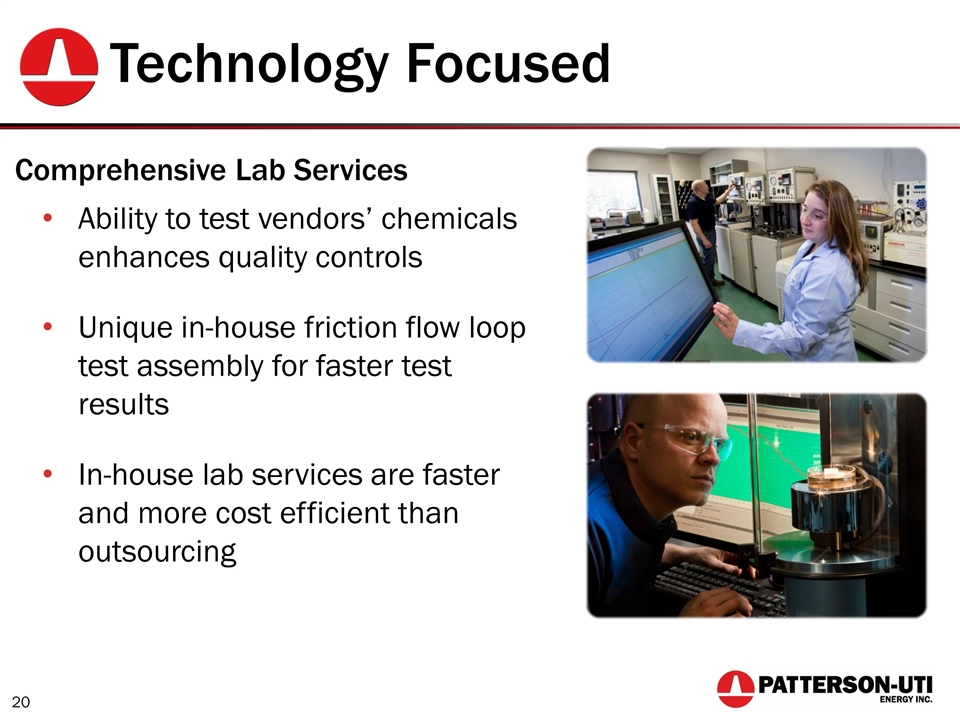

Technology Focused Comprehensive Lab Services Ability to test vendors’ chemicals enhances quality controls Unique in-house friction flow loop test assembly for faster test results In-house lab services are faster and more cost efficient than outsourcing

Strong Financial Position

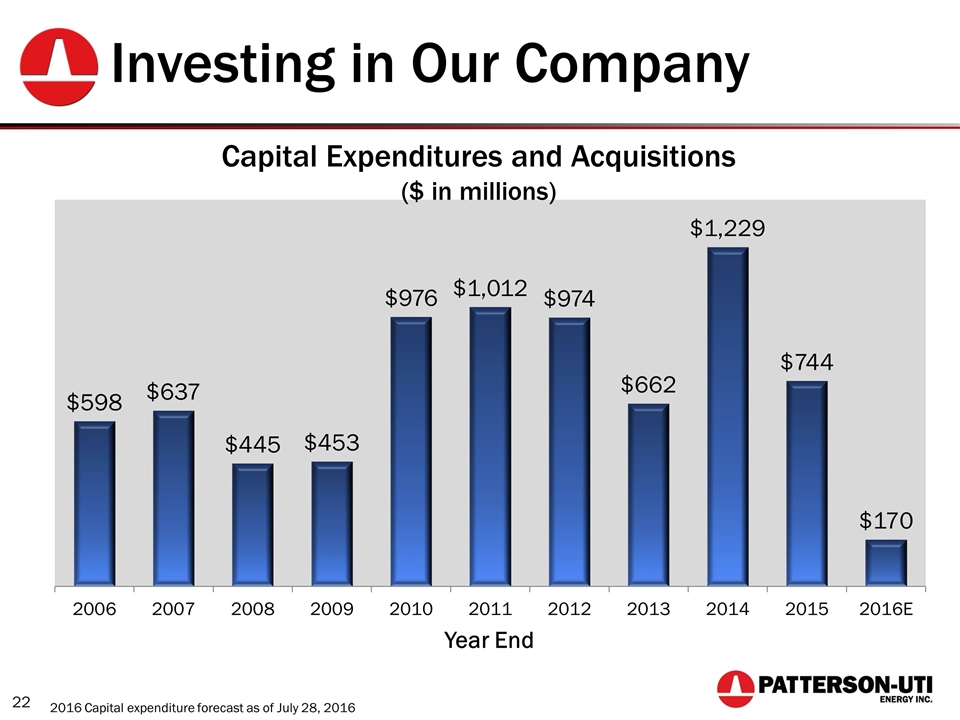

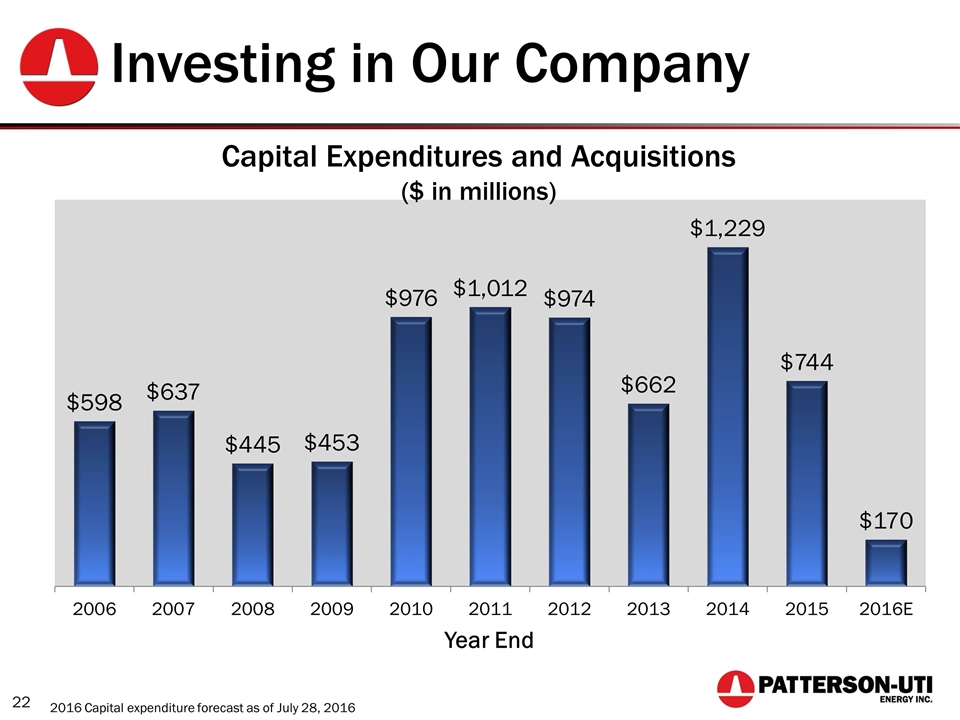

Investing in Our Company Capital Expenditures and Acquisitions ($ in millions) 2016 Capital expenditure forecast as of July 28, 2016

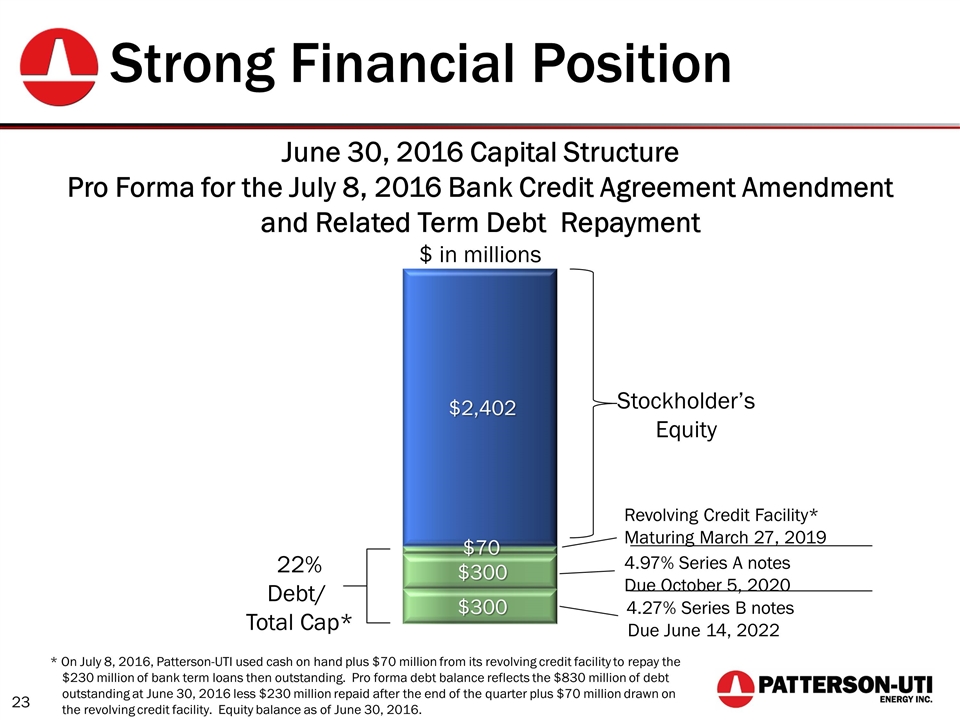

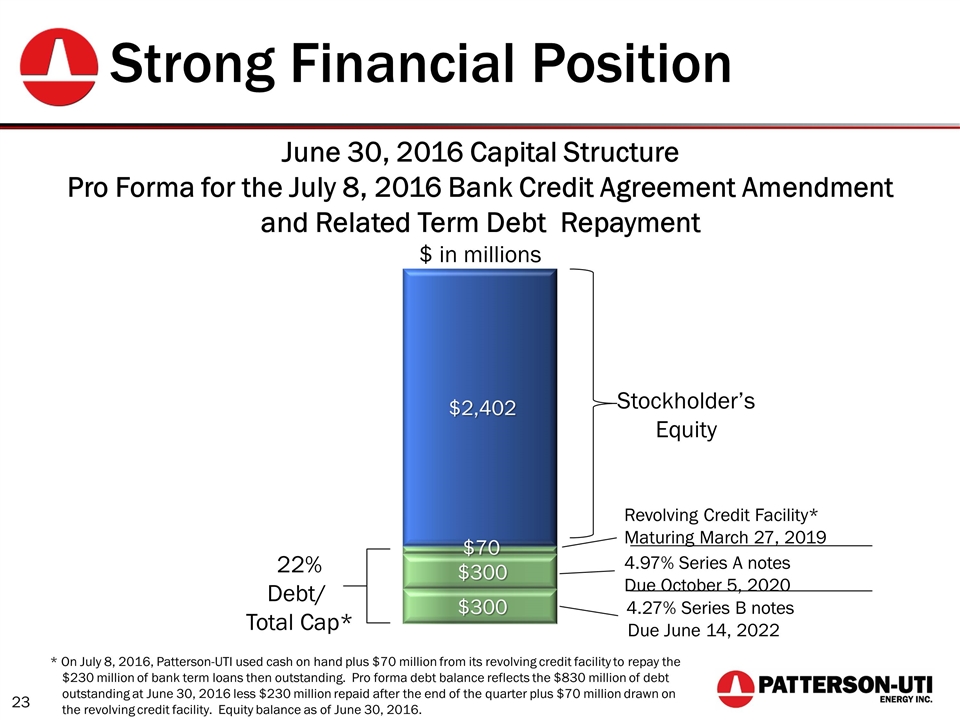

Strong Financial Position 22% Debt/ Total Cap* Stockholder’s Equity 4.97% Series A notes Due October 5, 2020 4.27% Series B notes Due June 14, 2022 Revolving Credit Facility* Maturing March 27, 2019 * On July 8, 2016, Patterson-UTI used cash on hand plus $70 million from its revolving credit facility to repay the $230 million of bank term loans then outstanding. Pro forma debt balance reflects the $830 million of debt outstanding at June 30, 2016 less $230 million repaid after the end of the quarter plus $70 million drawn on the revolving credit facility. Equity balance as of June 30, 2016. June 30, 2016 Capital Structure Pro Forma for the July 8, 2016 Bank Credit Agreement Amendment and Related Term Debt Repayment $ in millions

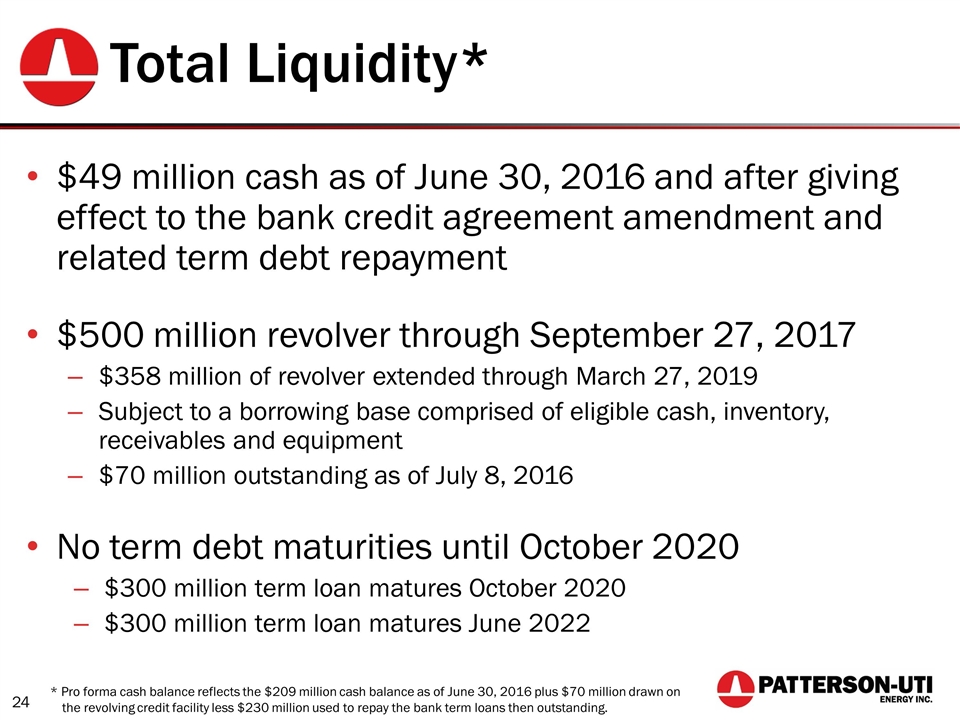

Total Liquidity* $49 million cash as of June 30, 2016 and after giving effect to the bank credit agreement amendment and related term debt repayment $500 million revolver through September 27, 2017 $358 million of revolver extended through March 27, 2019 Subject to a borrowing base comprised of eligible cash, inventory, receivables and equipment $70 million outstanding as of July 8, 2016 No term debt maturities until October 2020 $300 million term loan matures October 2020 $300 million term loan matures June 2022 * Pro forma cash balance reflects the $209 million cash balance as of June 30, 2016 plus $70 million drawn on the revolving credit facility less $230 million used to repay the bank term loans then outstanding.

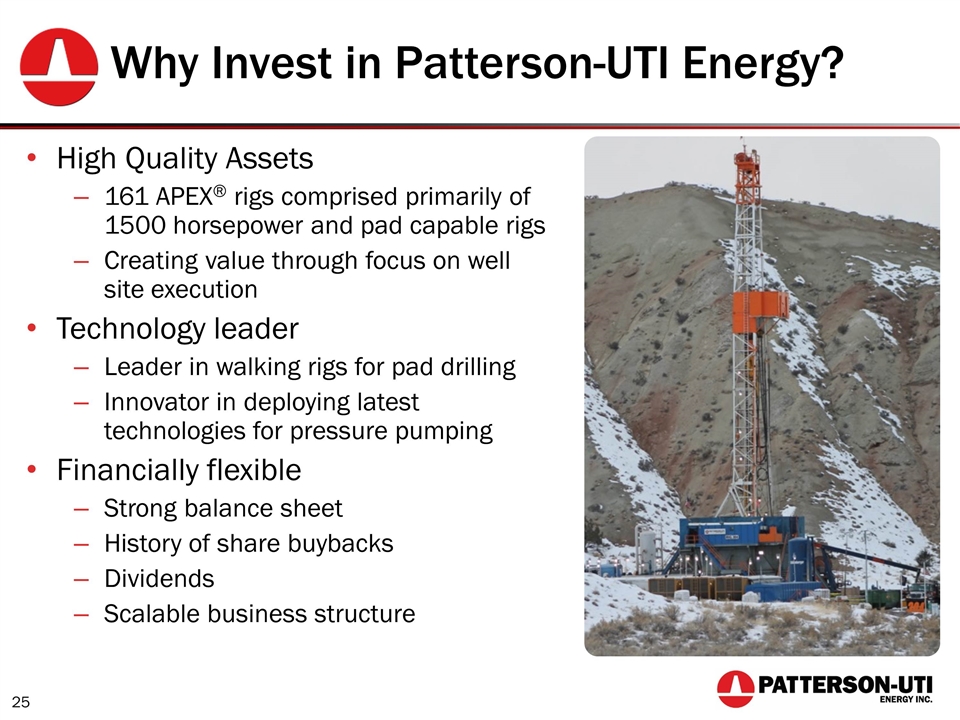

Why Invest in Patterson-UTI Energy? High Quality Assets 161 APEX® rigs comprised primarily of 1500 horsepower and pad capable rigs Creating value through focus on well site execution Technology leader Leader in walking rigs for pad drilling Innovator in deploying latest technologies for pressure pumping Financially flexible Strong balance sheet History of share buybacks Dividends Scalable business structure

Johnson Rice 2016 Energy Conference September 21, 2016

Additional References

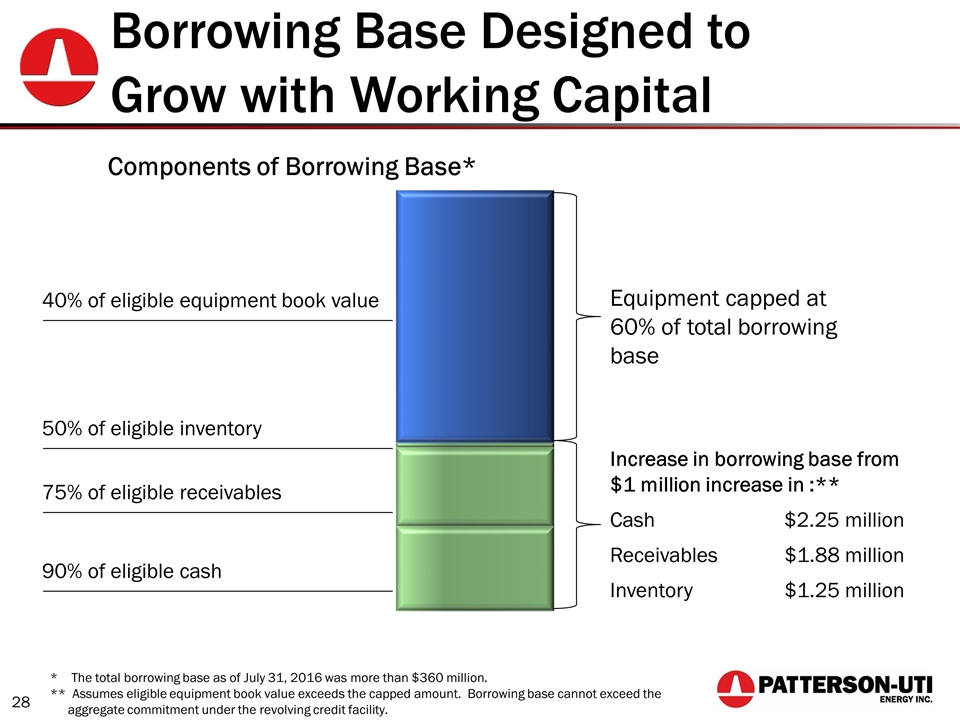

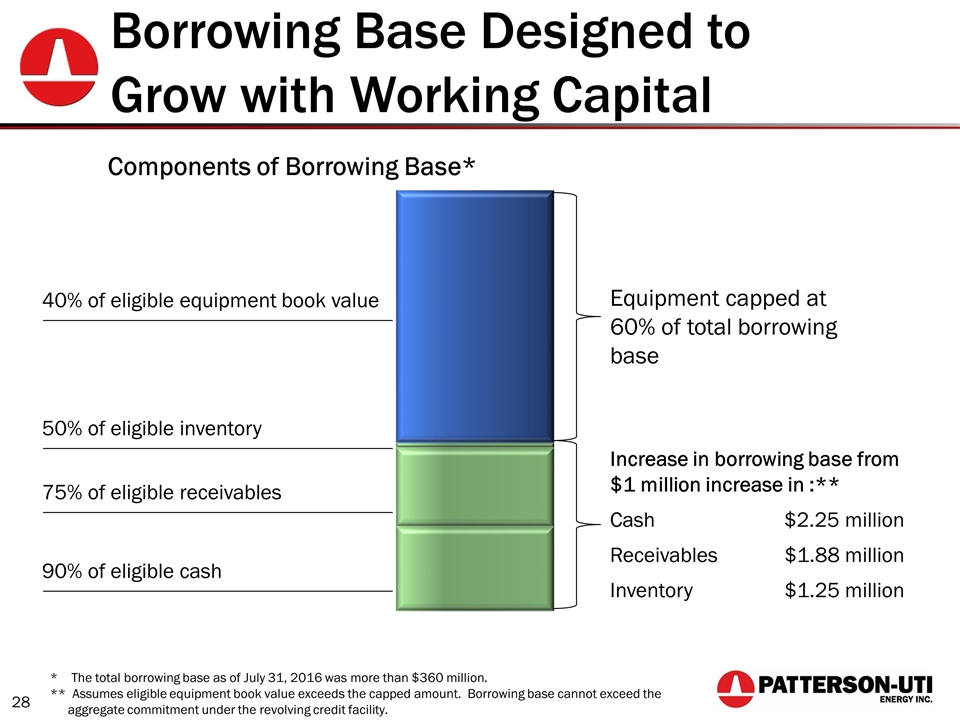

Borrowing Base Designed to Grow with Working Capital Equipment capped at 60% of total borrowing base 40% of eligible equipment book value 50% of eligible inventory 75% of eligible receivables 90% of eligible cash Increase in borrowing base from $1 million increase in :** Cash $2.25 million Receivables $1.88 million Inventory $1.25 million Components of Borrowing Base* * The total borrowing base as of July 31, 2016 was more than $360 million. ** Assumes eligible equipment book value exceeds the capped amount. Borrowing base cannot exceed the aggregate commitment under the revolving credit facility.

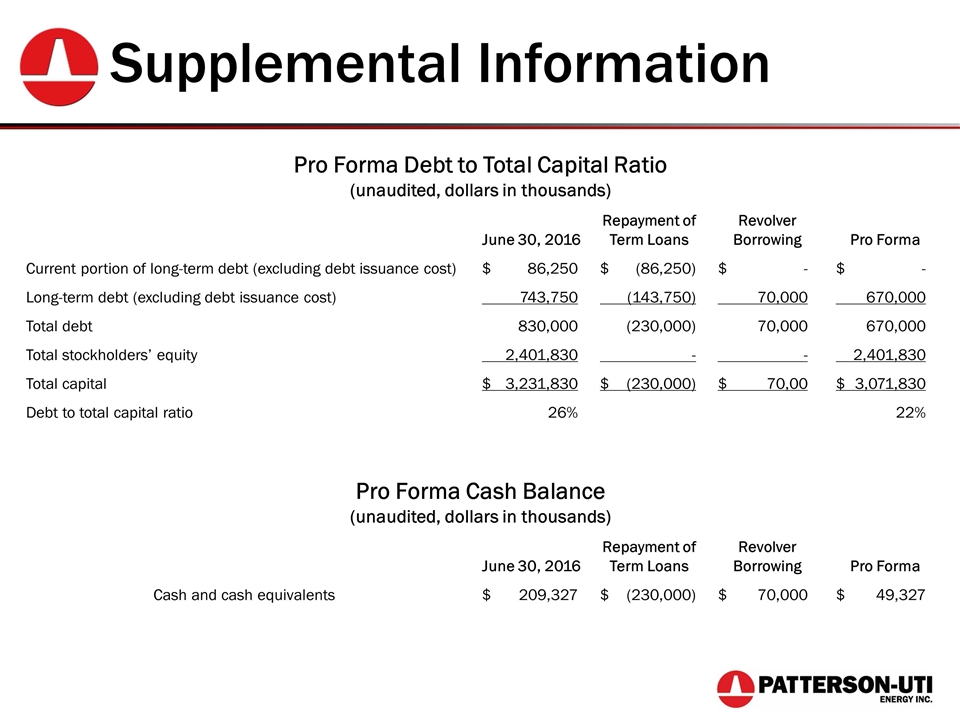

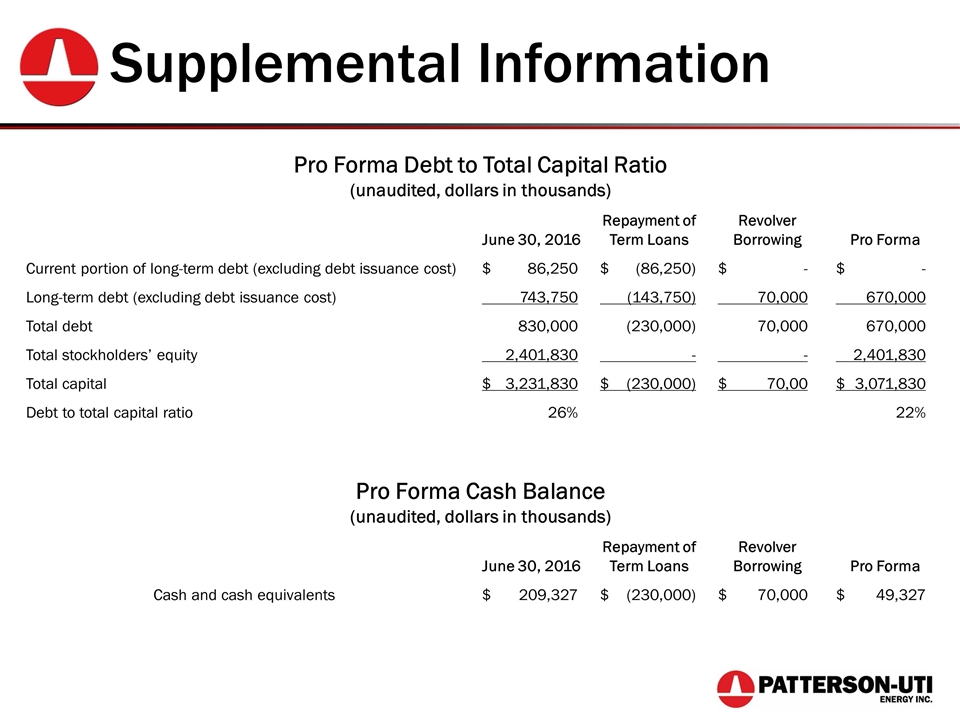

Supplemental Information Pro Forma Debt to Total Capital Ratio (unaudited, dollars in thousands) June 30, 2016 Repayment of Term Loans Revolver Borrowing Pro Forma Current portion of long-term debt (excluding debt issuance cost) $86,250 $(86,250) $- $- Long-term debt (excluding debt issuance cost) 743,750 (143,750) 70,000 670,000 Total debt 830,000 (230,000) 70,000 670,000 Total stockholders’ equity 2,401,830 - - 2,401,830 Total capital $3,231,830 $(230,000) $70,00 $3,071,830 Debt to total capital ratio 26% 22% Pro Forma Cash Balance (unaudited, dollars in thousands) June 30, 2016 Repayment of Term Loans Revolver Borrowing Pro Forma Cash and cash equivalents $209,327 $(230,000) $70,000 $49,327

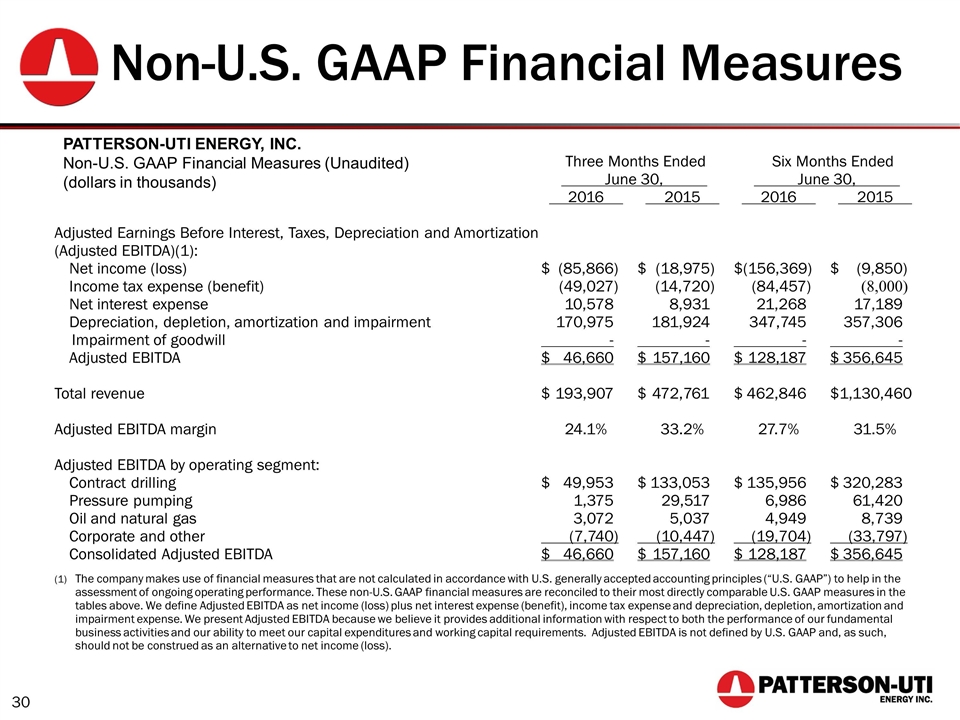

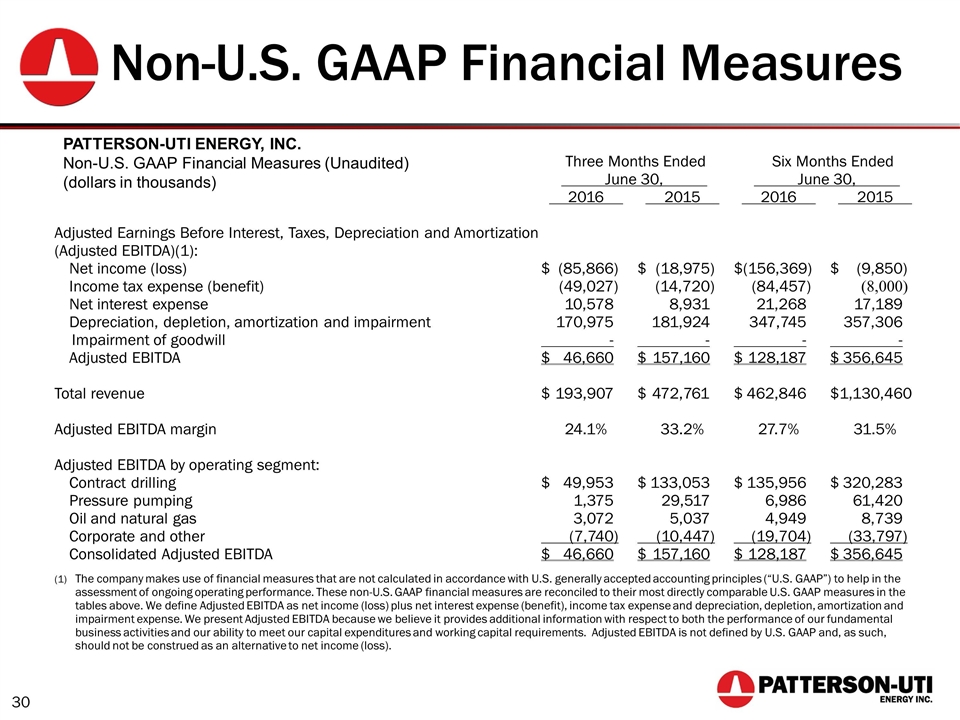

Three Months Ended June 30, Six Months Ended June 30, 2016 2015 2016 2015 Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization (Adjusted EBITDA)(1): Net income (loss) $ (85,866) $ (18,975) $ (156,369) $ (9,850) Income tax expense (benefit) (49,027) (14,720) (84,457) (8,000) Net interest expense 10,578 8,931 21,268 17,189 Depreciation, depletion, amortization and impairment 170,975 181,924 347,745 357,306 Impairment of goodwill - - - - Adjusted EBITDA $ 46,660 $ 157,160 $ 128,187 $356,645 Total revenue $ 193,907 $472,761 $ 462,846 $1,130,460 Adjusted EBITDA margin 24.1% 33.2% 27.7% 31.5% Adjusted EBITDA by operating segment: Contract drilling $ 49,953 $ 133,053 $ 135,956 $ 320,283 Pressure pumping 1,375 29,517 6,986 61,420 Oil and natural gas 3,072 5,037 4,949 8,739 Corporate and other (7,740) (10,447) (19,704) (33,797) Consolidated Adjusted EBITDA $ 46,660 $ 157,160 $ 128,187 $ 356,645 (1) The company makes use of financial measures that are not calculated in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”) to help in the assessment of ongoing operating performance. These non-U.S. GAAP financial measures are reconciled to their most directly comparable U.S. GAAP measures in the tables above. We define Adjusted EBITDA as net income (loss) plus net interest expense (benefit), income tax expense and depreciation, depletion, amortization and impairment expense. We present Adjusted EBITDA because we believe it provides additional information with respect to both the performance of our fundamental business activities and our ability to meet our capital expenditures and working capital requirements. Adjusted EBITDA is not defined by U.S. GAAP and, as such, should not be construed as an alternative to net income (loss). PATTERSON-UTI ENERGY, INC. Non-U.S. GAAP Financial Measures (Unaudited) (dollars in thousands) Non-U.S. GAAP Financial Measures