Goldman Sachs Global Energy Conference 2017 January 5-6, 2017 Filed by Patterson-UTI Energy, Inc. Pursuant to Rule 425 of the Securities Act of 1933 and deemed filed pursuant to Rule 14a-12 of the Securities Exchange Act of 1934 Subject Company: Seventy Seven Energy Inc. Commission File No.: 000-55669 Exhibit 99.1

Important Information for Investors and Stockholders This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. The proposed transaction will be submitted to the stockholders of each of Patterson-UTI Energy, Inc. (“Patterson-UTI”) and Seventy Seven Energy Inc. (“SSE”) for their consideration. Patterson-UTI will prepare and file a Registration Statement on Form S-4 that will include a prospectus and proxy statement jointly prepared by Patterson-UTI and SSE. SSE and Patterson-UTI may also file other documents with the Securities and Exchange Commission (the “SEC”) regarding the proposed transaction. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders may obtain free copies of the proxy statement/prospectus and other documents containing important information about SSE and Patterson-UTI once such documents are filed with the SEC through the website maintained by the SEC at www.sec.gov. Copies of the documents filed with the SEC by Patterson-UTI will be available free of charge on Patterson-UTI’s website at www.patenergy.com under the tab “Investors” and then through the link titled “SEC Filings” or by contacting Patterson-UTI’s Investor Relations Department by email at investrelations@patenergy.com, or by phone at (281) 765-7100. Copies of the documents filed with the SEC by SSE will be available free of charge on SSE’s website at www.77nrg.com under the tab “Investors” and then through the link titled “SEC Filings” or by contacting SSE’s Investor Relations Department at IR@77nrg.com, or by phone at (405) 608‑7730. Participants in the Solicitation Patterson-UTI, SSE and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of Patterson-UTI in connection with the proposed transaction. Information about the directors and executive officers of Patterson-UTI is set forth in the Proxy Statement on Schedule 14A for Patterson-UTI’s 2015 annual meeting of stockholders, which was filed with the SEC on April 15, 2016. Information about the directors and executive officers of SSE is set forth in the 2015 Annual Report on Form 10-K/A for SSE, which was filed with the SEC on April 29, 2016 and the Current Report on Form 8-K for SSE, which was filed with the SEC on August 1, 2016. These documents can be obtained free of charge from the sources indicated above. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available. 2

Cautionary Statement Regarding Forward-Looking Statements This presentation contains forward-looking statements which are protected as forward-looking statements under the Private Securities Litigation Reform Act of 1995 that are not limited to historical facts, but reflect Patterson-UTI’s and SSE’s current beliefs, expectations or intentions regarding future events. Words such as “may,” “will,” “could,” “should,” “expect,” “plan,” “project,” “intend,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “pursuant,” “target,” “continue,” and similar expressions are intended to identify such forward-looking statements. The statements in this presentation that are not historical statements, including statements regarding the expected timetable for completing the proposed transaction, benefits and synergies of the proposed transaction, costs and other anticipated financial impacts of the proposed transaction; the combined company’s plans, objectives, future opportunities for the combined company and services, future financial performance and operating results and any other statements regarding Patterson-UTI’s and SSE’s future expectations, beliefs, plans, objectives, financial conditions, assumptions or future events or performance that are not historical facts, are forward-looking statements within the meaning of the federal securities laws. These statements are subject to numerous risks and uncertainties, many of which are beyond Patterson-UTI's or SSE’s control, which could cause actual results to differ materially from the results expressed or implied by the statements. These risks and uncertainties include, but are not limited to: failure to obtain the required votes of Patterson-UTI’s or SSE's stockholders; the timing to consummate the proposed transaction; satisfaction of the conditions to closing of the proposed transaction may not be satisfied or that the closing of the proposed transaction otherwise does not occur; the risk that a regulatory approval that may be required for the proposed transaction is not obtained or is obtained subject to conditions that are not anticipated; the diversion of management time on transaction-related issues; the ultimate timing, outcome and results of integrating the operations of Patterson-UTI and SSE following the consummation of the proposed transaction; the effects of the business combination of Patterson-UTI and SSE following the consummation of the proposed transaction, including the combined company’s future financial condition, results of operations, strategy and plans; potential adverse reactions or changes to business relationships resulting from the announcement or completion of the proposed transaction; expected synergies and other benefits from the proposed transaction and the ability of Patterson-UTI to realize such synergies and other benefits; expectations regarding regulatory approval of the transaction; results of litigation, settlements and investigations; actions by third parties, including governmental agencies; volatility in customer spending and in oil and natural gas prices, which could adversely affect demand for Patterson-UTI’s and SSE’s services and their associated effect on rates, utilization, margins and planned capital expenditures; global economic conditions; excess availability of land drilling rigs and pressure pumping equipment, including as a result of low commodity prices, reactivation or construction; liabilities from operations; decline in, and ability to realize, backlog; equipment specialization and new technologies; adverse industry conditions; adverse credit and equity market conditions; difficulty in building and deploying new equipment; difficulty in integrating acquisitions; shortages, delays in delivery and interruptions of supply of equipment, supplies and materials; weather; loss of, or reduction in business with, key customers; legal proceedings; ability to effectively identify and enter new markets; governmental regulation; and ability to retain management and field personnel. 3

Cautionary Statement Regarding Forward-Looking Statements (Continued) Additional information concerning factors that could cause actual results to differ materially from those in the forward-looking statements is contained from time to time in Patterson-UTI’s and SSE’s SEC filings. Patterson-UTI’s filings may be obtained by contacting Patterson-UTI or the SEC or through Patterson-UTI’s web site at http://www.patenergy.com or through the SEC's Gathering and Analysis Retrieval System (EDGAR) at http://www.sec.gov. SSE’s filings may be obtained by contacting SSE or the SEC or through SSE’s web site at www.77nrg.com or through EDGAR. Patterson-UTI and SSE undertake no obligation to publicly update or revise any forward-looking statement. 4

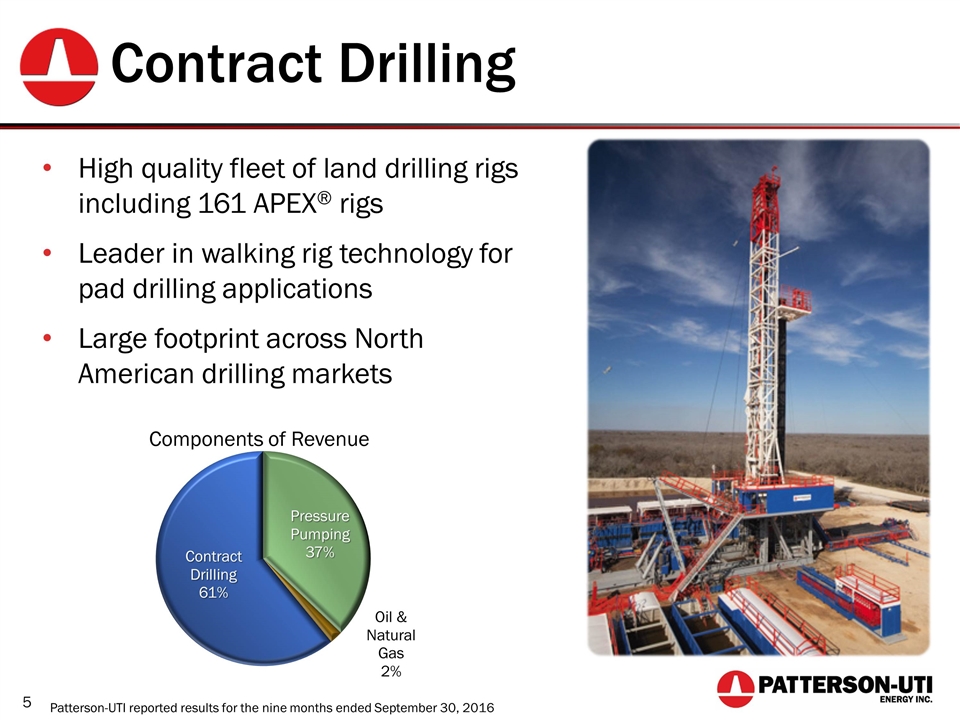

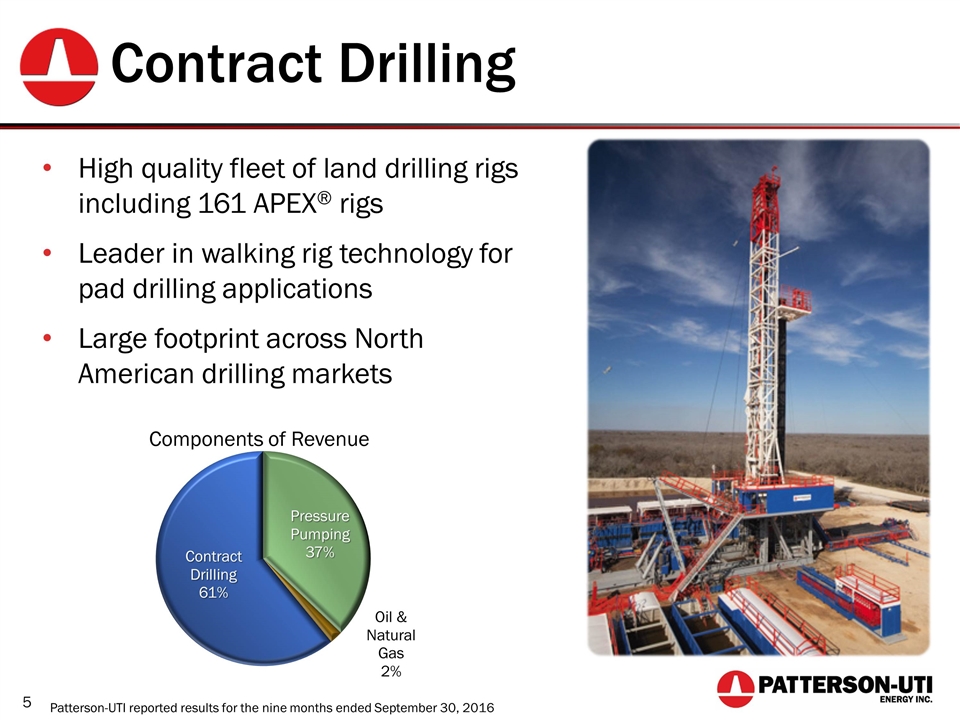

Contract Drilling High quality fleet of land drilling rigs including 161 APEX® rigs Leader in walking rig technology for pad drilling applications Large footprint across North American drilling markets Patterson-UTI reported results for the nine months ended September 30, 2016

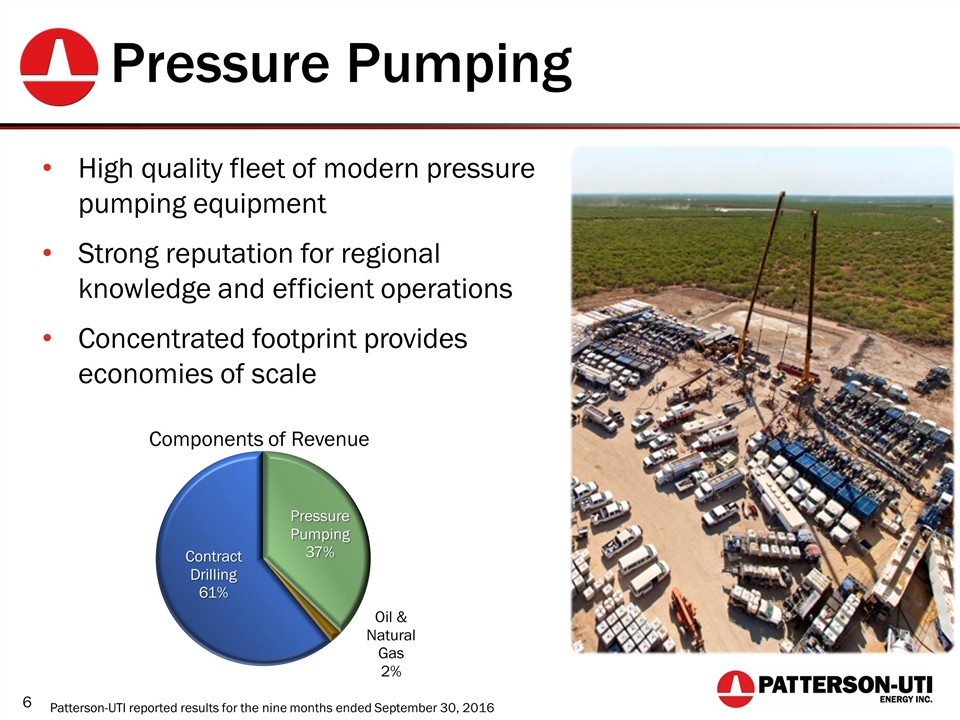

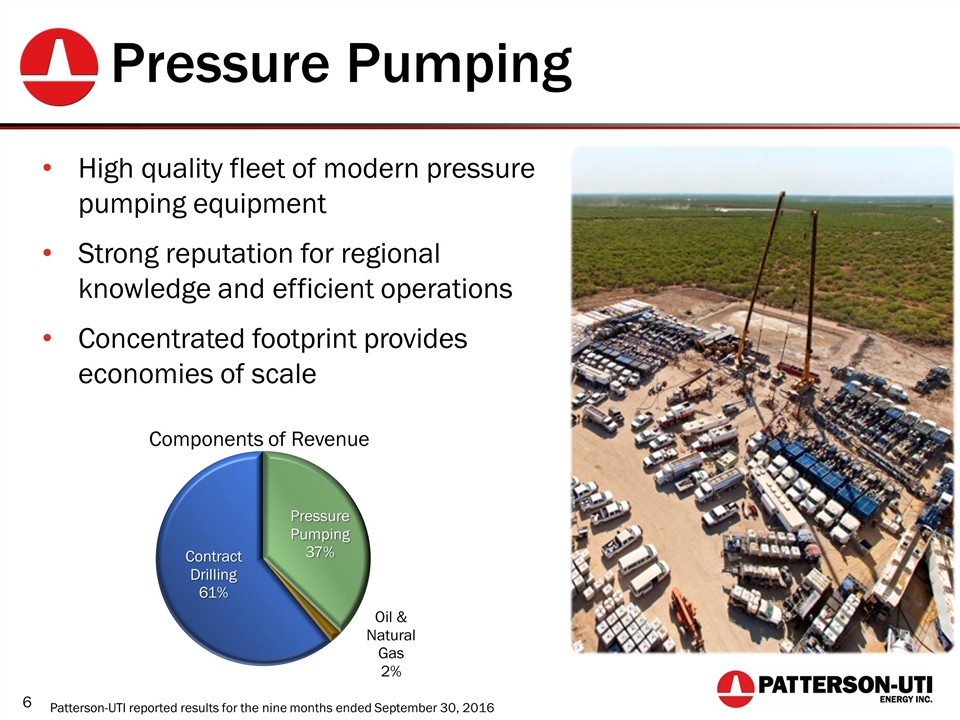

Pressure Pumping High quality fleet of modern pressure pumping equipment Strong reputation for regional knowledge and efficient operations Concentrated footprint provides economies of scale Patterson-UTI reported results for the nine months ended September 30, 2016

Contract Drilling

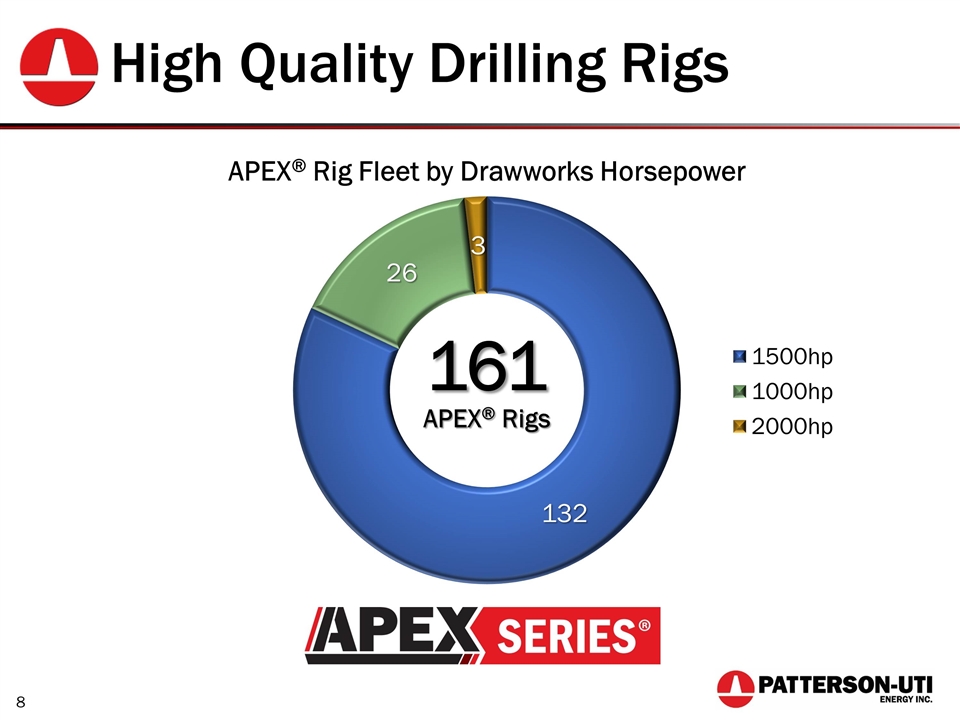

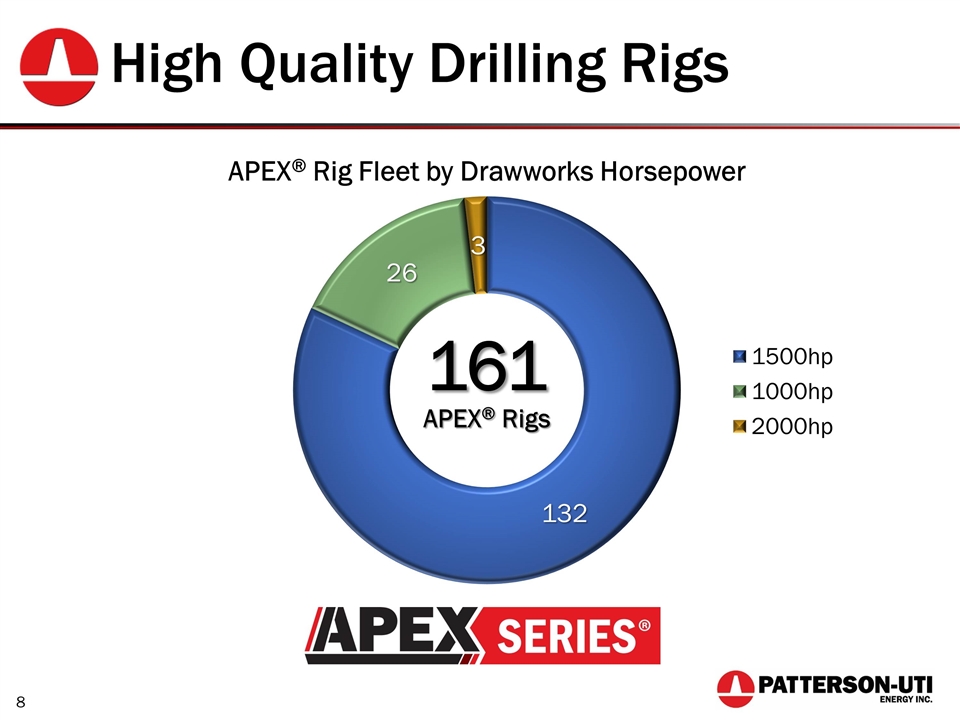

High Quality Drilling Rigs 161 APEX® Rigs

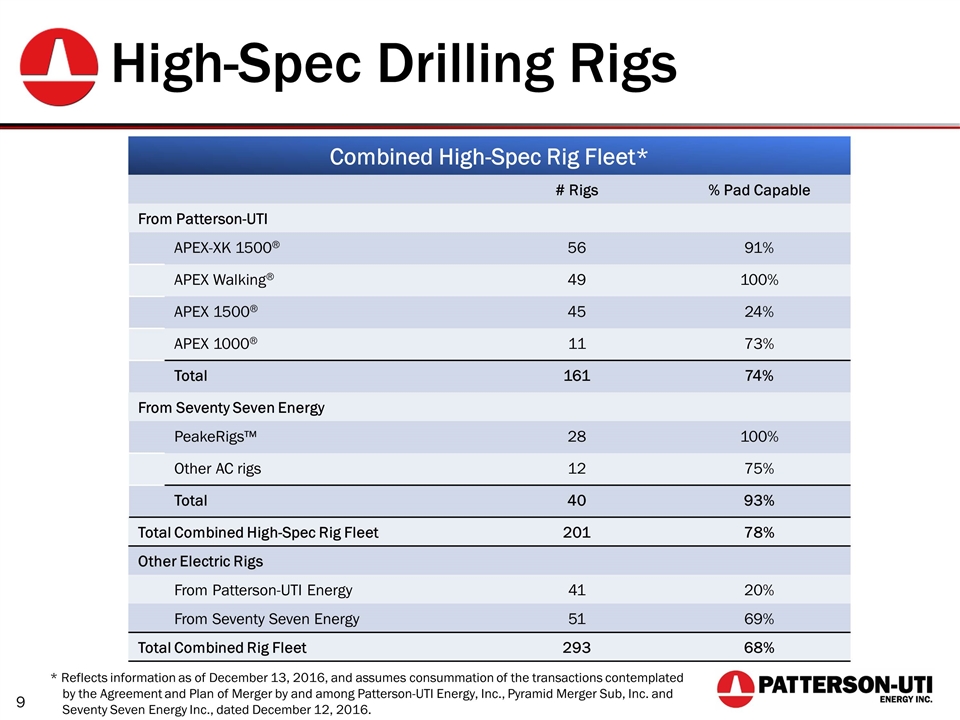

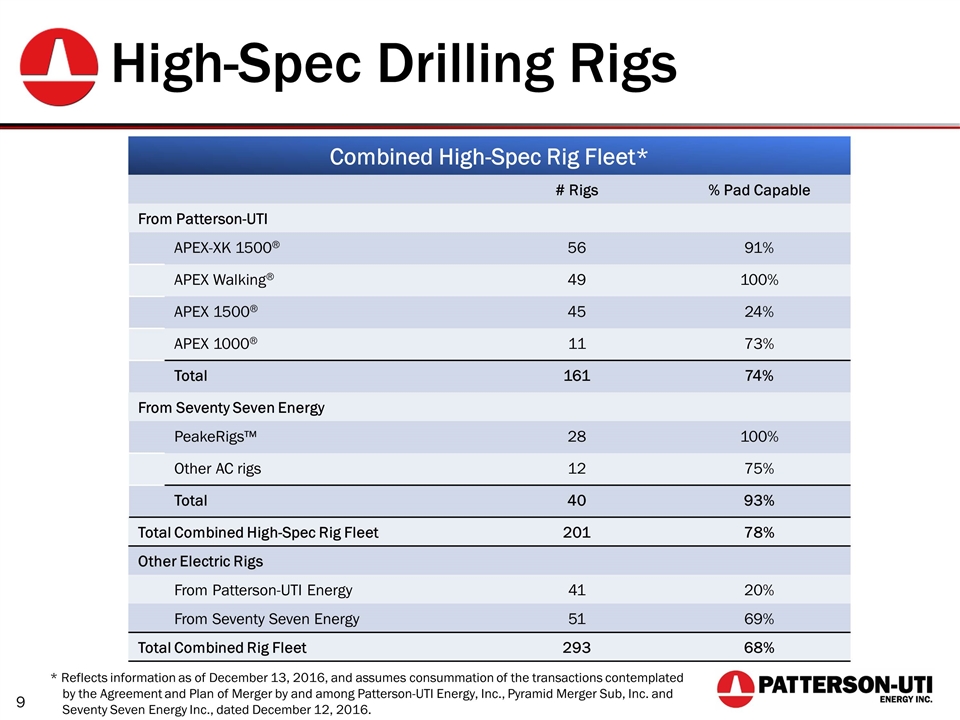

High-Spec Drilling Rigs Combined High-Spec Rig Fleet* # Rigs % Pad Capable From Patterson-UTI APEX-XK 1500® 56 91% APEX Walking® 49 100% APEX 1500® 45 24% APEX 1000® 11 73% Total 161 74% From Seventy Seven Energy PeakeRigs™ 28 100% Other AC rigs 12 75% Total 40 93% Total Combined High-Spec Rig Fleet 201 78% Other Electric Rigs From Patterson-UTI Energy 41 20% From Seventy Seven Energy 51 69% Total Combined Rig Fleet 293 68% 9 * Reflects information as of December 13, 2016, and assumes consummation of the transactions contemplated by the Agreement and Plan of Merger by and among Patterson-UTI Energy, Inc., Pyramid Merger Sub, Inc. and Seventy Seven Energy Inc., dated December 12, 2016.

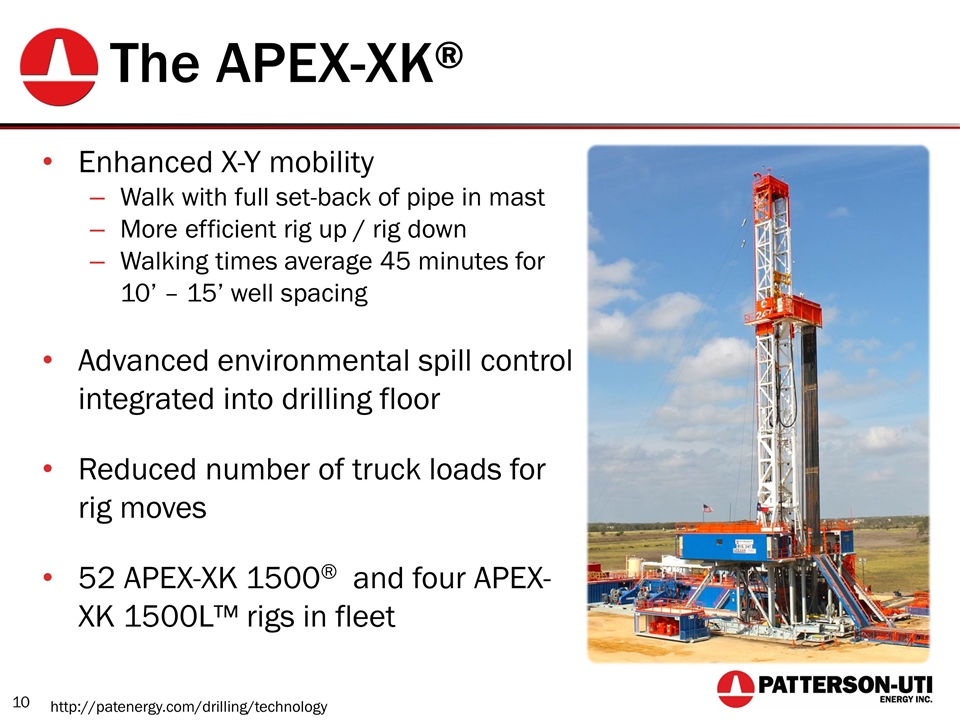

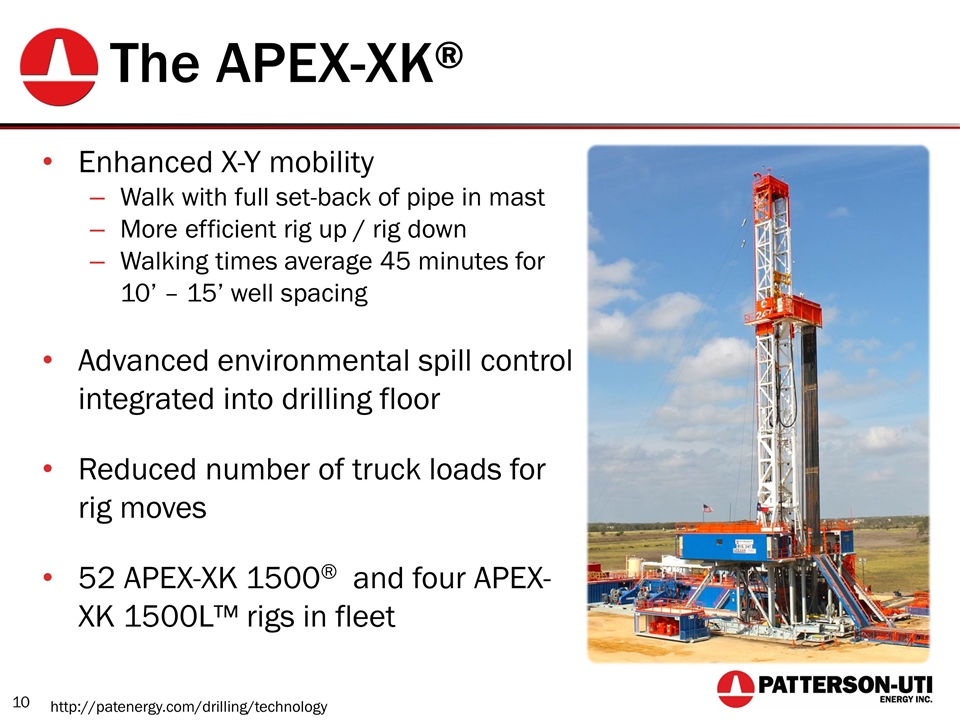

The APEX-XK® Enhanced X-Y mobility Walk with full set-back of pipe in mast More efficient rig up / rig down Walking times average 45 minutes for 10’ – 15’ well spacing Advanced environmental spill control integrated into drilling floor Reduced number of truck loads for rig moves 52 APEX-XK 1500® and four APEX-XK 1500L™ rigs in fleet http://patenergy.com/drilling/technology

APEX-XK® Integrated Walking System

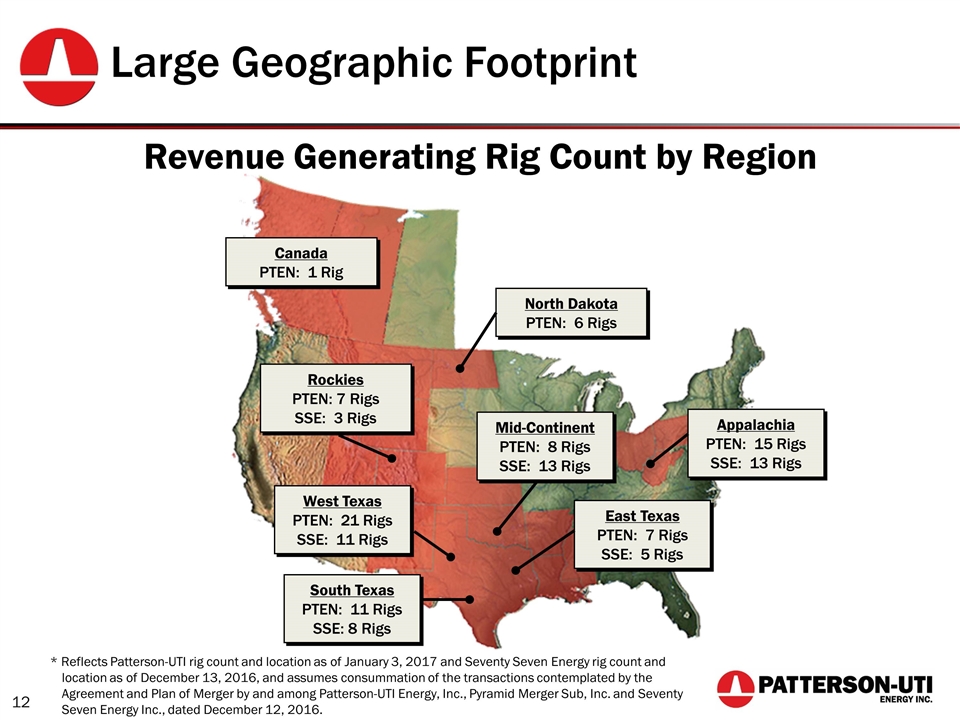

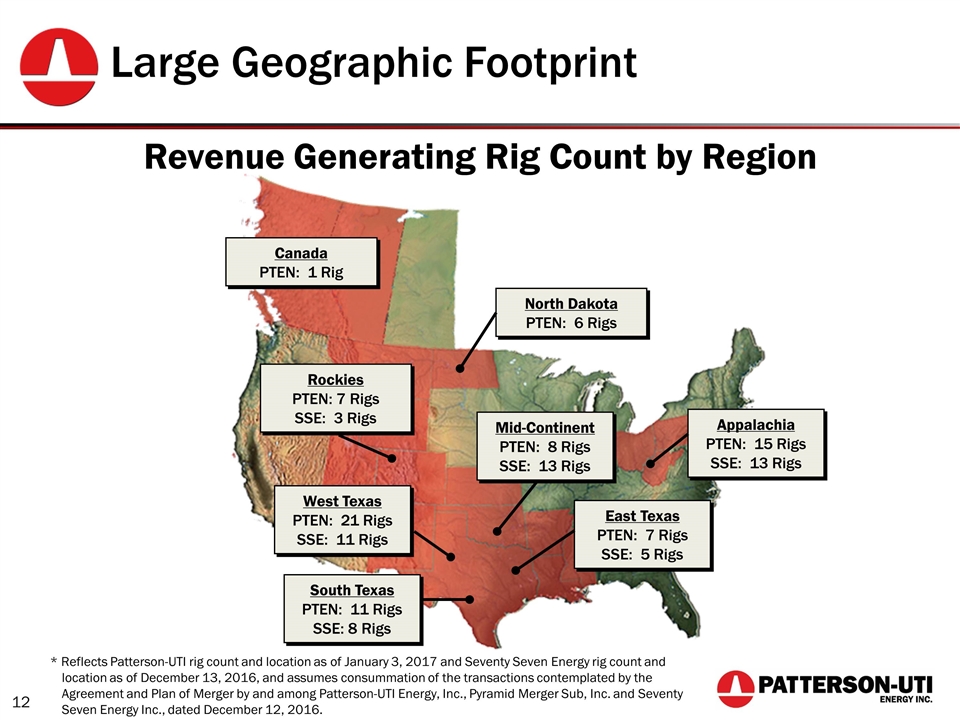

West Texas PTEN: 21 Rigs SSE: 11 Rigs Large Geographic Footprint Revenue Generating Rig Count by Region Appalachia PTEN: 15 Rigs SSE: 13 Rigs East Texas PTEN: 7 Rigs SSE: 5 Rigs Mid-Continent PTEN: 8 Rigs SSE: 13 Rigs Rockies PTEN: 7 Rigs SSE: 3 Rigs South Texas PTEN: 11 Rigs SSE: 8 Rigs North Dakota PTEN: 6 Rigs Canada PTEN: 1 Rig * Reflects Patterson-UTI rig count and location as of January 3, 2017 and Seventy Seven Energy rig count and location as of December 13, 2016, and assumes consummation of the transactions contemplated by the Agreement and Plan of Merger by and among Patterson-UTI Energy, Inc., Pyramid Merger Sub, Inc. and Seventy Seven Energy Inc., dated December 12, 2016.

Drilling Technologies Designs, manufactures and services high-spec rig components with a recent focus on top drive technology Enhances the Patterson-UTI technology portfolio and engineering capabilities A highly talented group of people with a tremendous amount of experience

Pressure Pumping

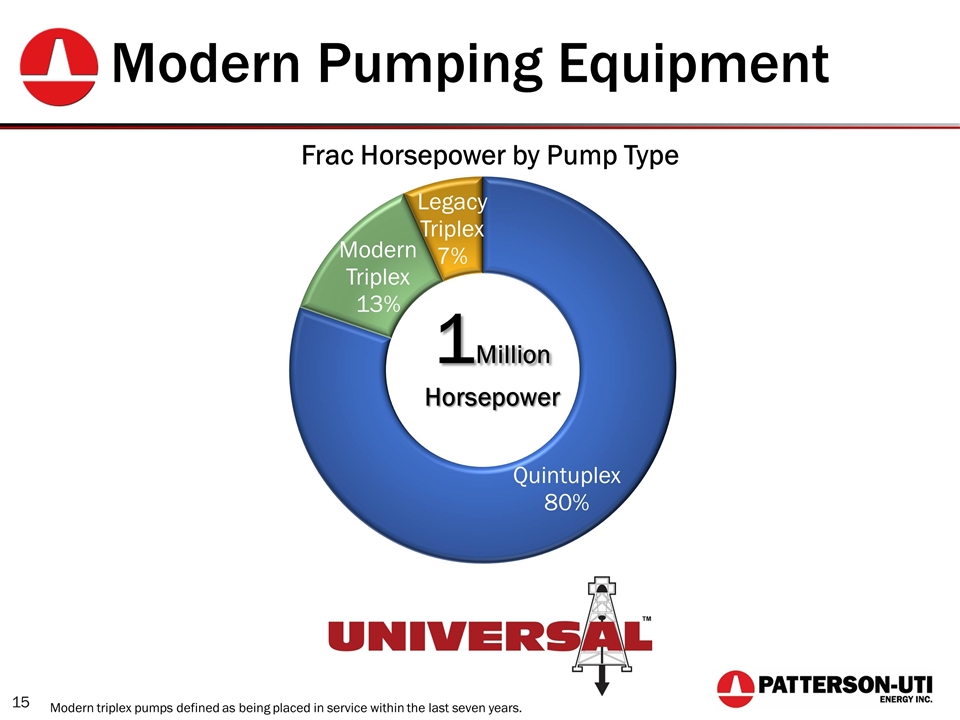

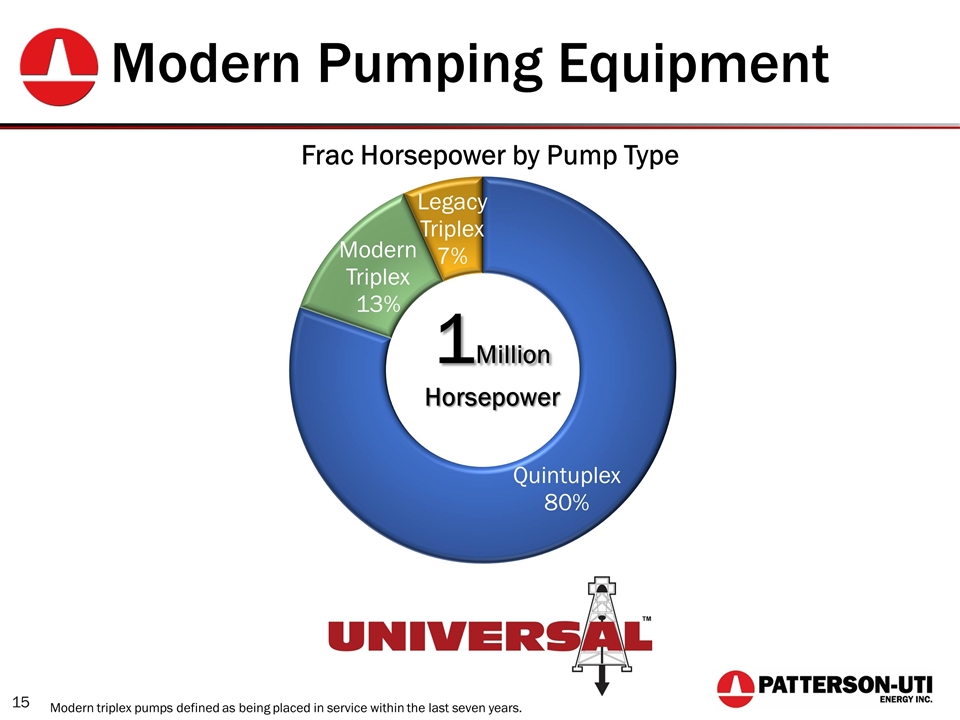

Modern Pumping Equipment Modern triplex pumps defined as being placed in service within the last seven years.

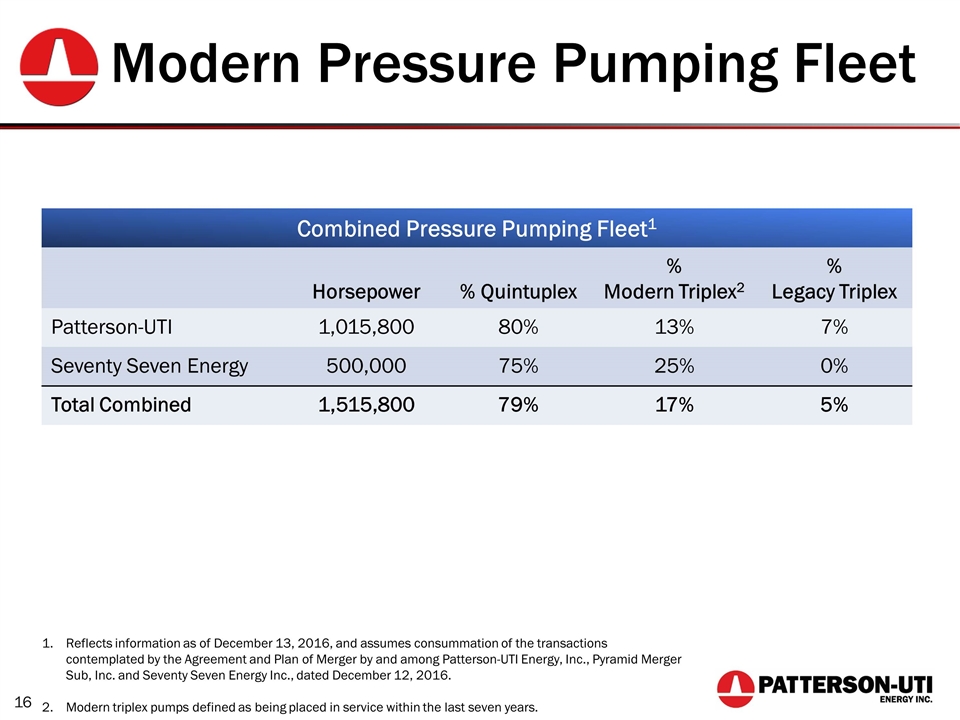

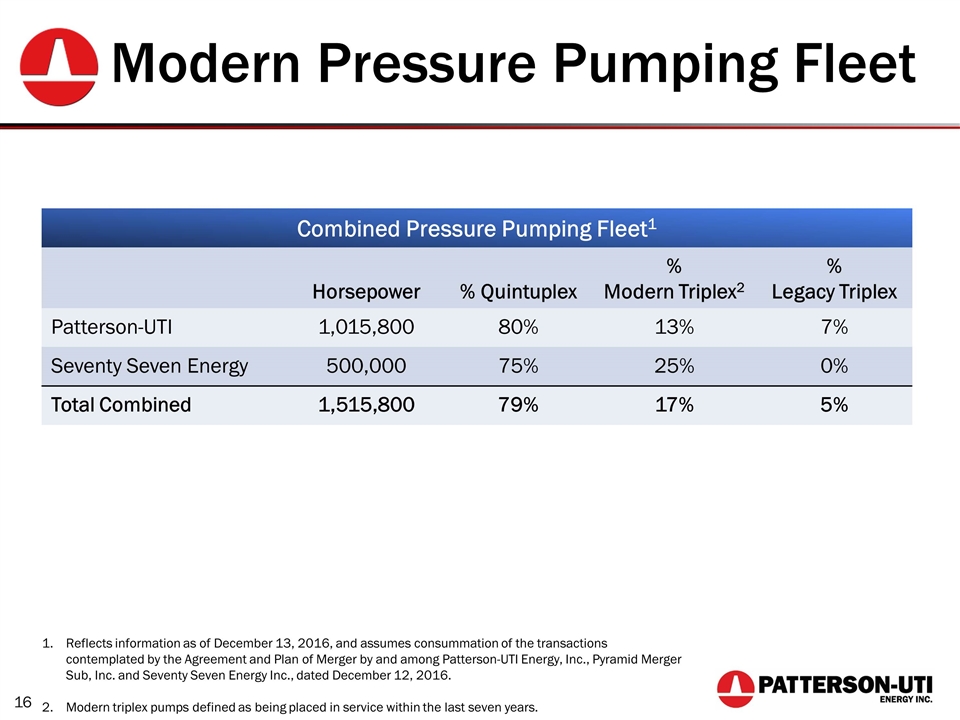

Modern Pressure Pumping Fleet Combined Pressure Pumping Fleet1 Horsepower % Quintuplex % Modern Triplex2 % Legacy Triplex Patterson-UTI 1,015,800 80% 13% 7% Seventy Seven Energy 500,000 75% 25% 0% Total Combined 1,515,800 79% 17% 5% 16 Reflects information as of December 13, 2016, and assumes consummation of the transactions contemplated by the Agreement and Plan of Merger by and among Patterson-UTI Energy, Inc., Pyramid Merger Sub, Inc. and Seventy Seven Energy Inc., dated December 12, 2016. Modern triplex pumps defined as being placed in service within the last seven years.

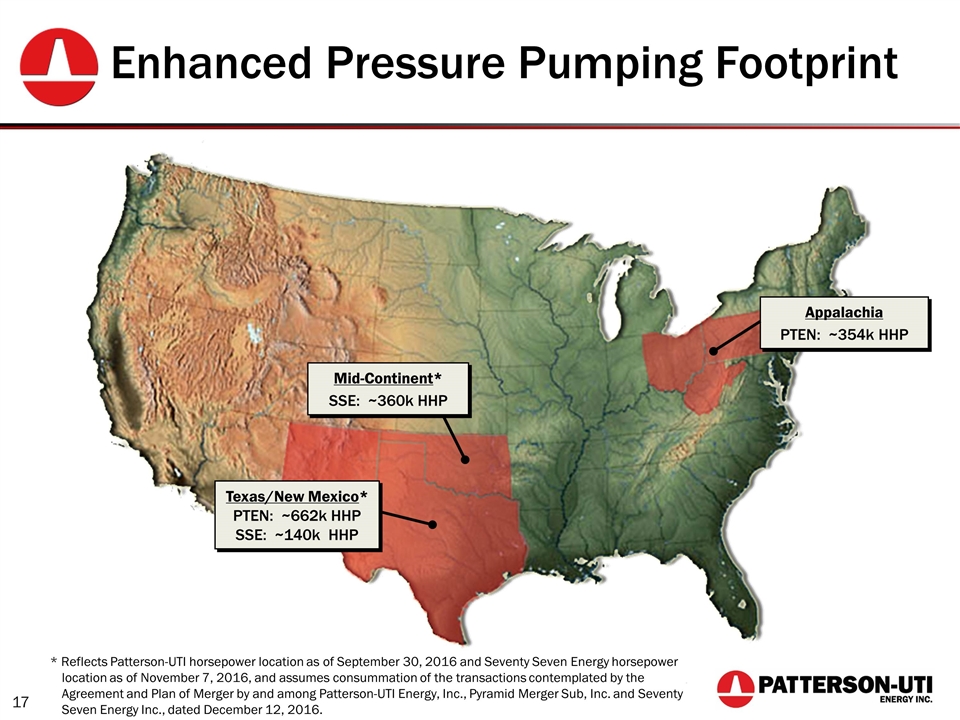

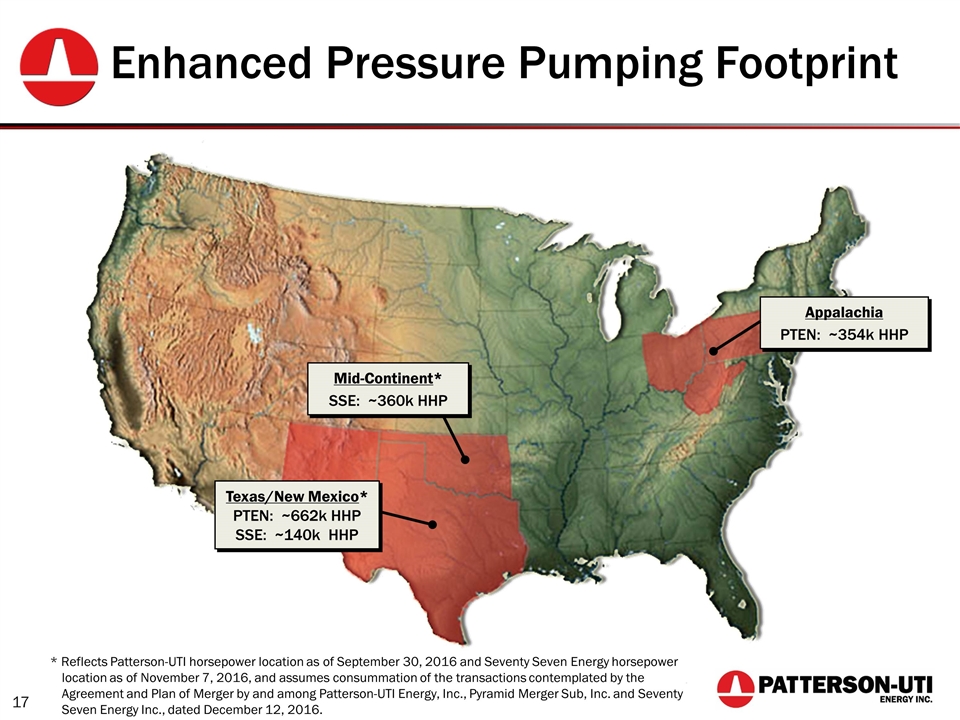

Enhanced Pressure Pumping Footprint Appalachia PTEN: ~354k HHP Texas/New Mexico* PTEN: ~662k HHP SSE: ~140k HHP Mid-Continent* SSE: ~360k HHP * Reflects Patterson-UTI horsepower location as of September 30, 2016 and Seventy Seven Energy horsepower location as of November 7, 2016, and assumes consummation of the transactions contemplated by the Agreement and Plan of Merger by and among Patterson-UTI Energy, Inc., Pyramid Merger Sub, Inc. and Seventy Seven Energy Inc., dated December 12, 2016.

Technology Focused PropLogic™ Sand Management System Fully enclosed well-site sand management system More accurate than conventional sand trailers/bins More efficient use of proppant as less sand is wasted

Technology Focused PowderStim® Dry Friction Reducer System hydrates powder form of friction reducer directly into the fluid stream Logistically safer and more efficient compared to liquefied friction reducers Successful with both fresh water and heavy brines More cost effective by utilizing produced water

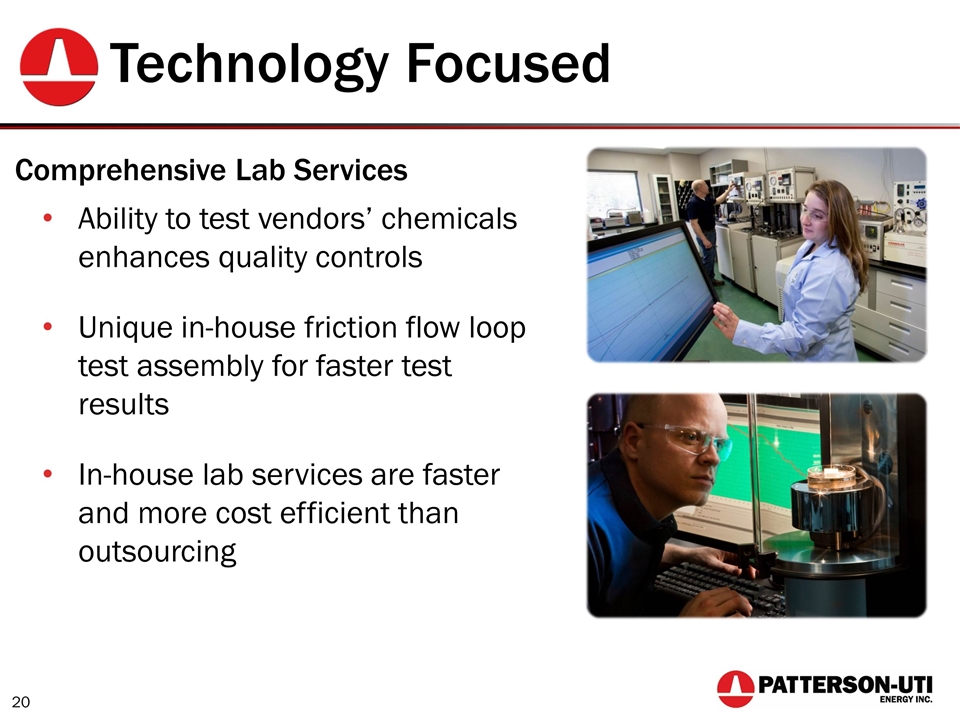

Technology Focused Comprehensive Lab Services Ability to test vendors’ chemicals enhances quality controls Unique in-house friction flow loop test assembly for faster test results In-house lab services are faster and more cost efficient than outsourcing

Strong Financial Position

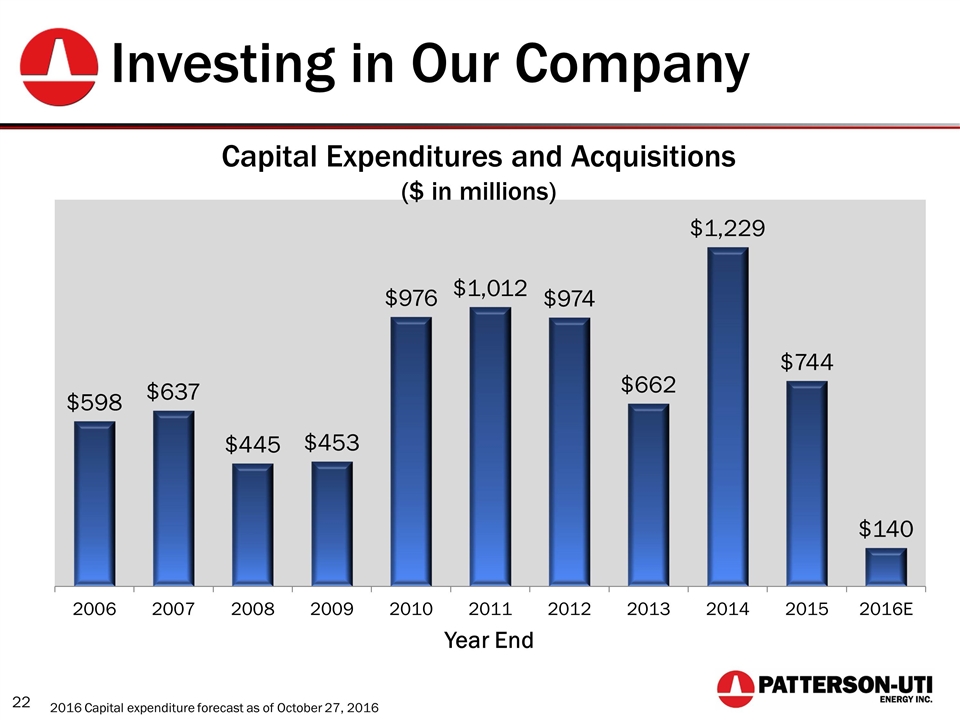

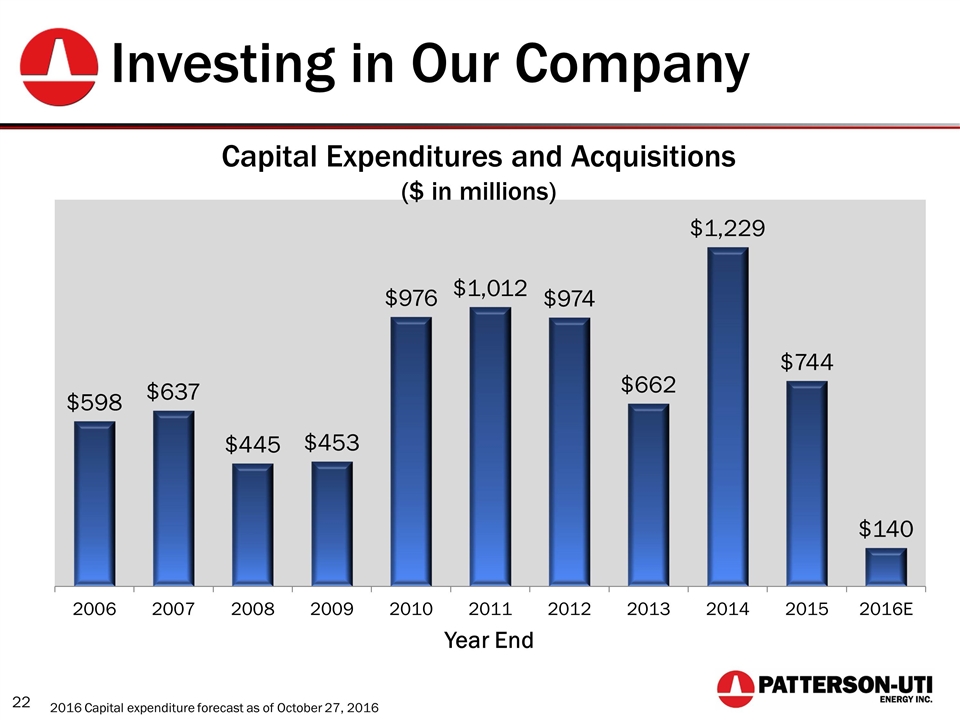

Investing in Our Company Capital Expenditures and Acquisitions ($ in millions) 2016 Capital expenditure forecast as of October 27, 2016

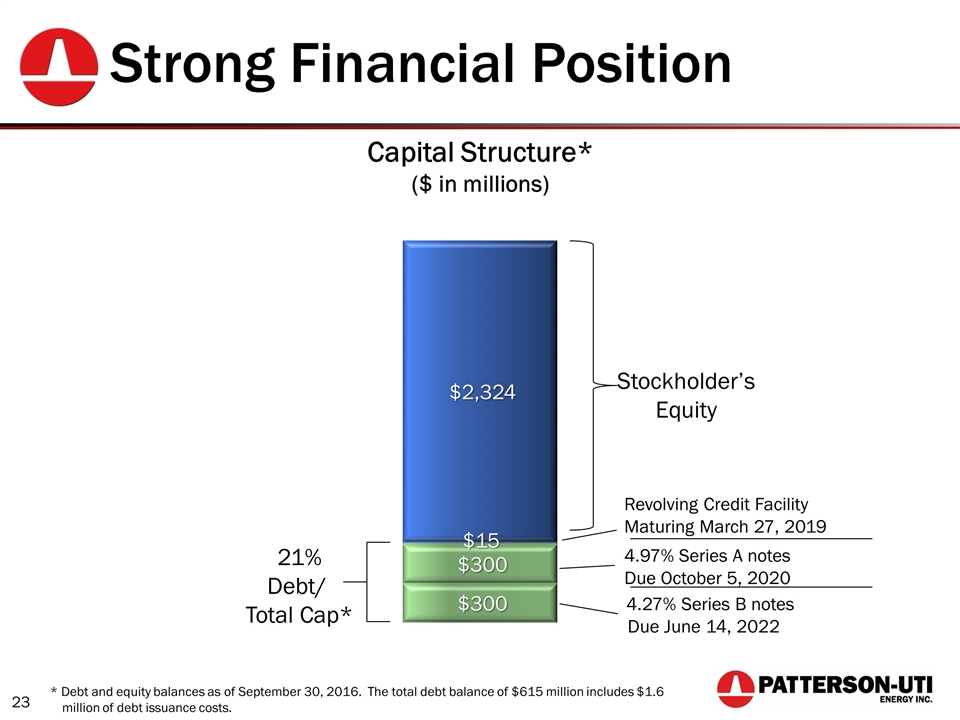

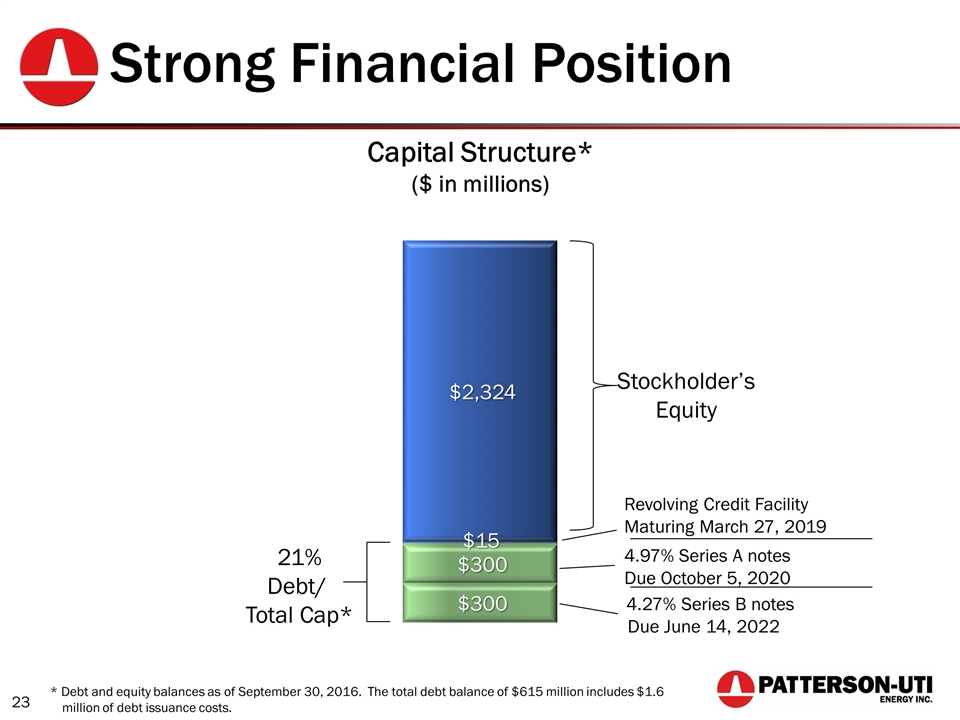

Strong Financial Position 21% Debt/ Total Cap* Stockholder’s Equity 4.97% Series A notes Due October 5, 2020 4.27% Series B notes Due June 14, 2022 Revolving Credit Facility Maturing March 27, 2019 * Debt and equity balances as of September 30, 2016. The total debt balance of $615 million includes $1.6 million of debt issuance costs. Capital Structure* ($ in millions)

Patterson-UTI Total Liquidity $37 million cash as of September 30, 2016 $500 million revolver through September 27, 2017 $358 million of revolver extended through March 27, 2019 Subject to a borrowing base comprised of eligible cash, inventory, receivables and equipment Undrawn with $500 million borrowing base availability as of December 13, 2016 $150 million Senior Unsecured Bridge Financing Commitment Available if needed in a single draw prior to closing of planned merger to repay indebtedness of Seventy Seven Energy and transaction expenses No term debt maturities until October 2020 $300 million term loan matures October 2020 $300 million term loan matures June 2022

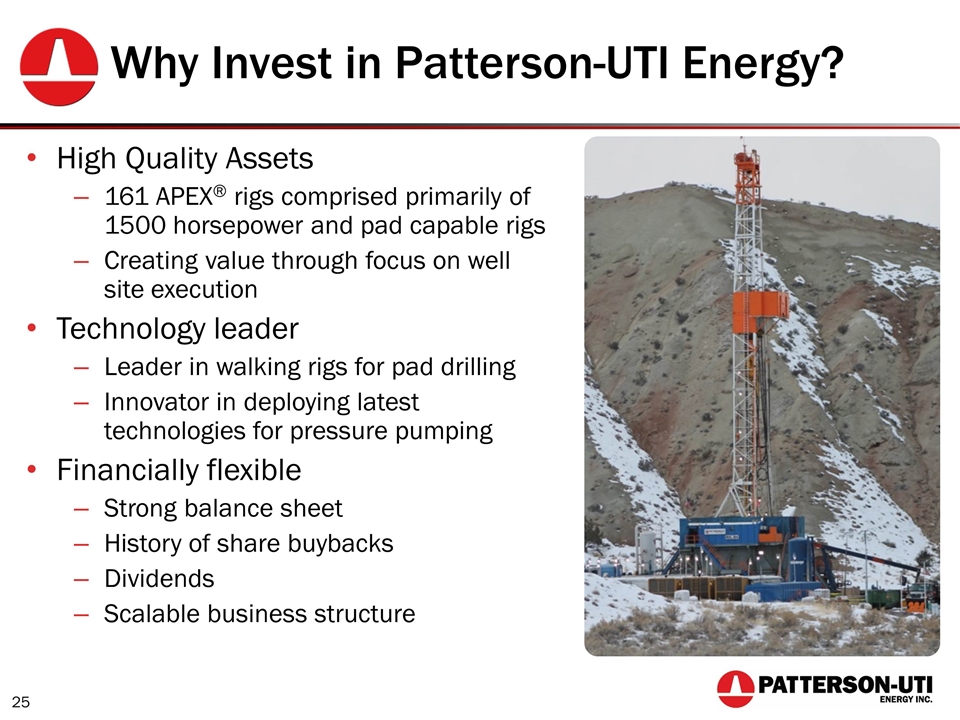

Why Invest in Patterson-UTI Energy? High Quality Assets 161 APEX® rigs comprised primarily of 1500 horsepower and pad capable rigs Creating value through focus on well site execution Technology leader Leader in walking rigs for pad drilling Innovator in deploying latest technologies for pressure pumping Financially flexible Strong balance sheet History of share buybacks Dividends Scalable business structure

Goldman Sachs Global Energy Conference 2017 January 5-6, 2017

Additional References

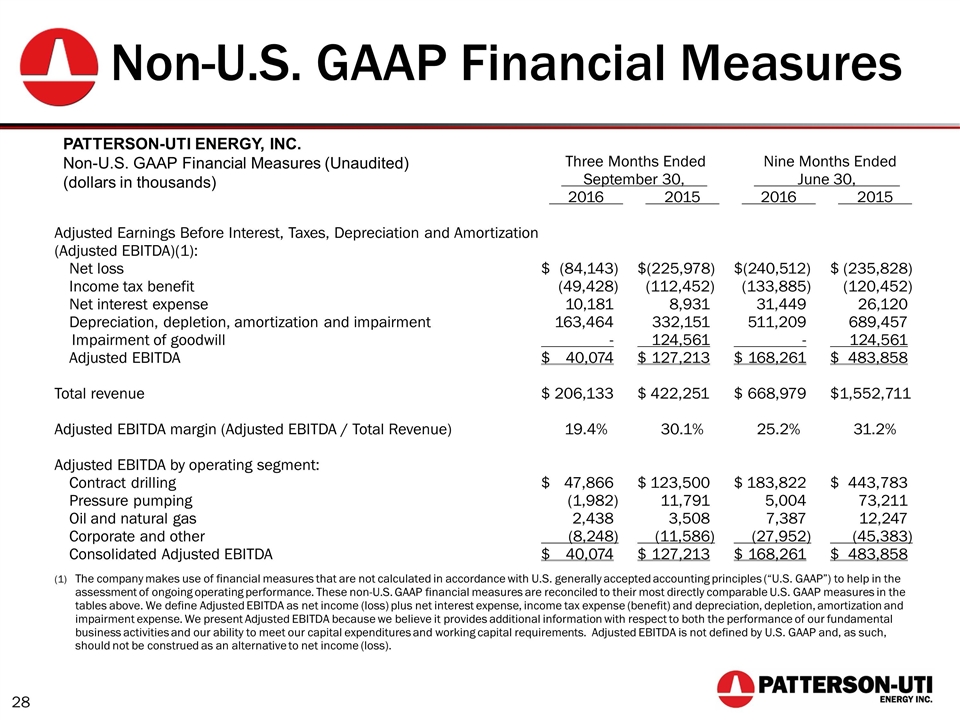

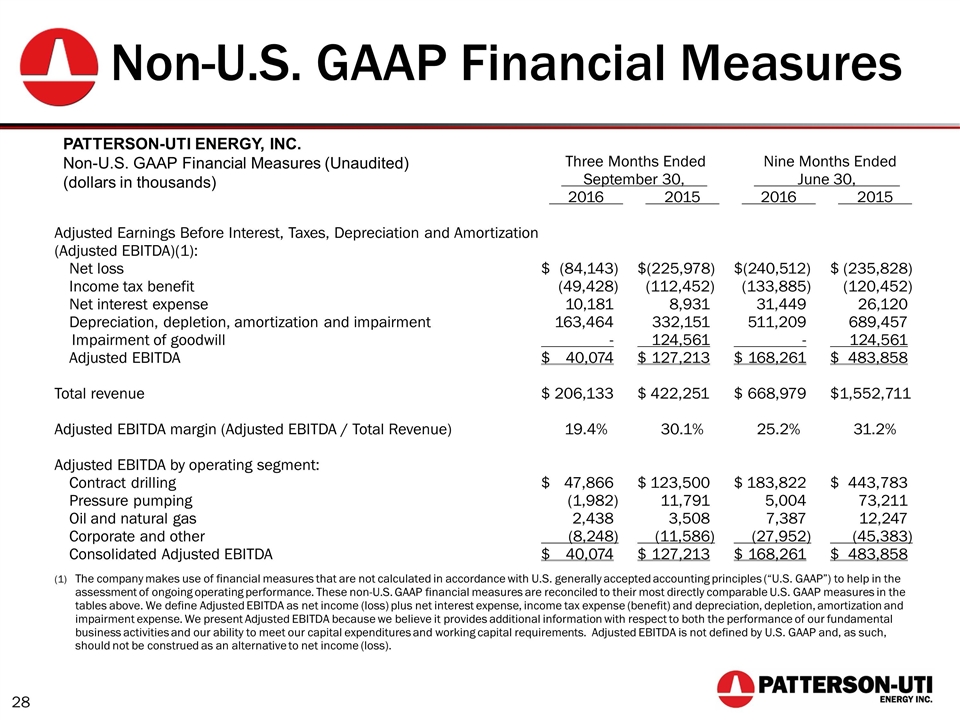

Three Months Ended September 30, Nine Months Ended June 30, 2016 2015 2016 2015 Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization (Adjusted EBITDA)(1): Net loss $ (84,143) $ (225,978) $ (240,512) $ (235,828) Income tax benefit (49,428) (112,452) (133,885) (120,452) Net interest expense 10,181 8,931 31,449 26,120 Depreciation, depletion, amortization and impairment 163,464 332,151 511,209 689,457 Impairment of goodwill - 124,561 - 124,561 Adjusted EBITDA $ 40,074 $ 127,213 $ 168,261 $483,858 Total revenue $ 206,133 $422,251 $ 668,979 $1,552,711 Adjusted EBITDA margin (Adjusted EBITDA / Total Revenue) 19.4% 30.1% 25.2% 31.2% Adjusted EBITDA by operating segment: Contract drilling $ 47,866 $ 123,500 $ 183,822 $ 443,783 Pressure pumping (1,982) 11,791 5,004 73,211 Oil and natural gas 2,438 3,508 7,387 12,247 Corporate and other (8,248) (11,586) (27,952) (45,383) Consolidated Adjusted EBITDA $ 40,074 $ 127,213 $ 168,261 $ 483,858 (1) The company makes use of financial measures that are not calculated in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”) to help in the assessment of ongoing operating performance. These non-U.S. GAAP financial measures are reconciled to their most directly comparable U.S. GAAP measures in the tables above. We define Adjusted EBITDA as net income (loss) plus net interest expense, income tax expense (benefit) and depreciation, depletion, amortization and impairment expense. We present Adjusted EBITDA because we believe it provides additional information with respect to both the performance of our fundamental business activities and our ability to meet our capital expenditures and working capital requirements. Adjusted EBITDA is not defined by U.S. GAAP and, as such, should not be construed as an alternative to net income (loss). PATTERSON-UTI ENERGY, INC. Non-U.S. GAAP Financial Measures (Unaudited) (dollars in thousands) Non-U.S. GAAP Financial Measures