Credit Suisse February 12-13, 2019 24th Annual Energy Summit Exhibit 99.1

Forward-Looking Statements This material and any oral statements made in connection with this material include "forward-looking statements" within the meaning of the Securities Act of 1933 and the Securities Exchange Act of 1934. Statements made which provide the Company’s or management’s intentions, beliefs, expectations or predictions for the future are forward-looking statements and are inherently uncertain. The opinions, forecasts, projections or other statements other than statements of historical fact, including, without limitation, plans and objectives of management of the Company are forward-looking statements. It is important to note that actual results could differ materially from those discussed in such forward-looking statements. Important factors that could cause actual results to differ materially include the risk factors and other cautionary statements contained from time to time in the Company’s SEC filings, which may be obtained by contacting the Company or the SEC. These filings are also available through the Company’s web site at http://www.patenergy.com or through the SEC’s Electronic Data Gathering and Analysis Retrieval System (EDGAR) at http://www.sec.gov. We undertake no obligation to publicly update or revise any forward-looking statement. Statements made in this presentation include non-U.S. GAAP financial measures. The required reconciliation to U.S. GAAP financial measures are included on our website and/or at the end of this presentation.

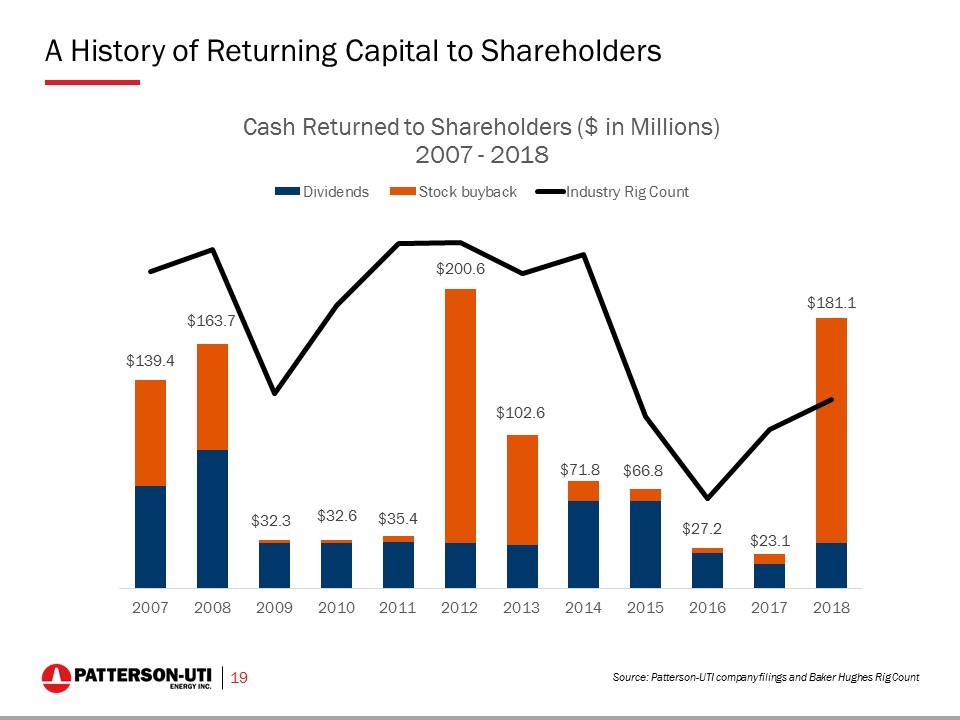

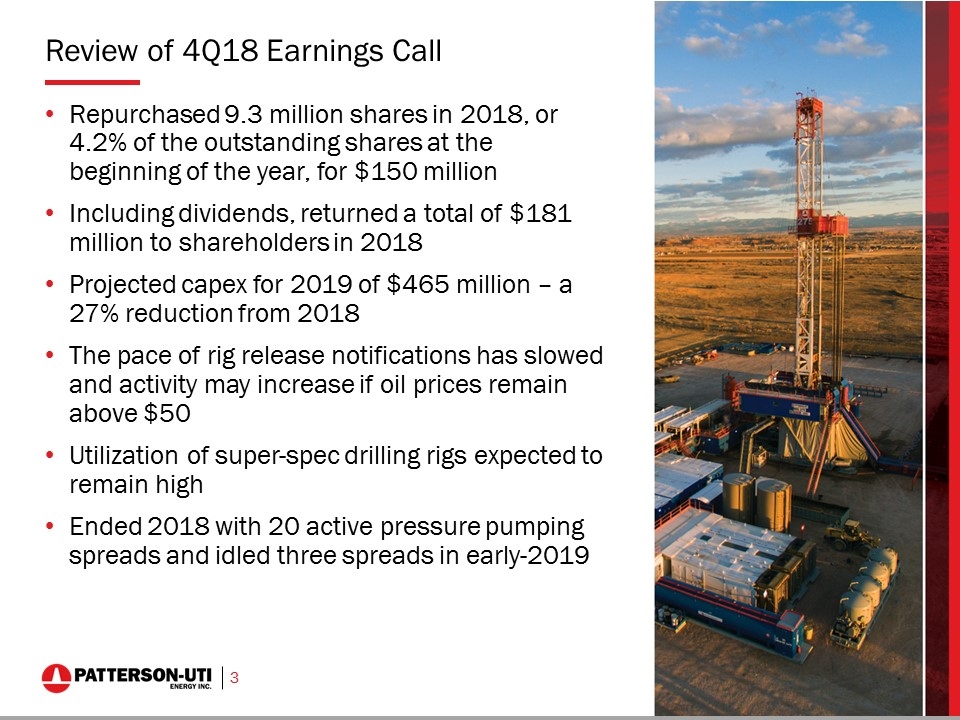

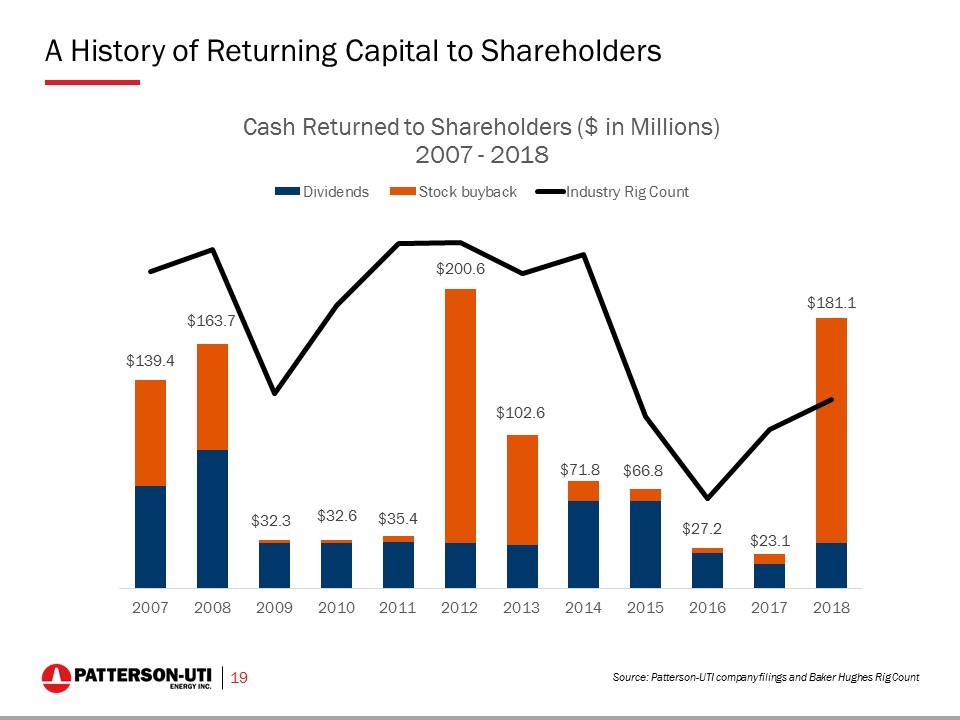

Review of 4Q18 Earnings Call Repurchased 9.3 million shares in 2018, or 4.2% of the outstanding shares at the beginning of the year, for $150 million Including dividends, returned a total of $181 million to shareholders in 2018 Projected capex for 2019 of $465 million – a 27% reduction from 2018 The pace of rig release notifications has slowed and activity may increase if oil prices remain above $50 Utilization of super-spec drilling rigs expected to remain high Ended 2018 with 20 active pressure pumping spreads and idled three spreads in early-2019

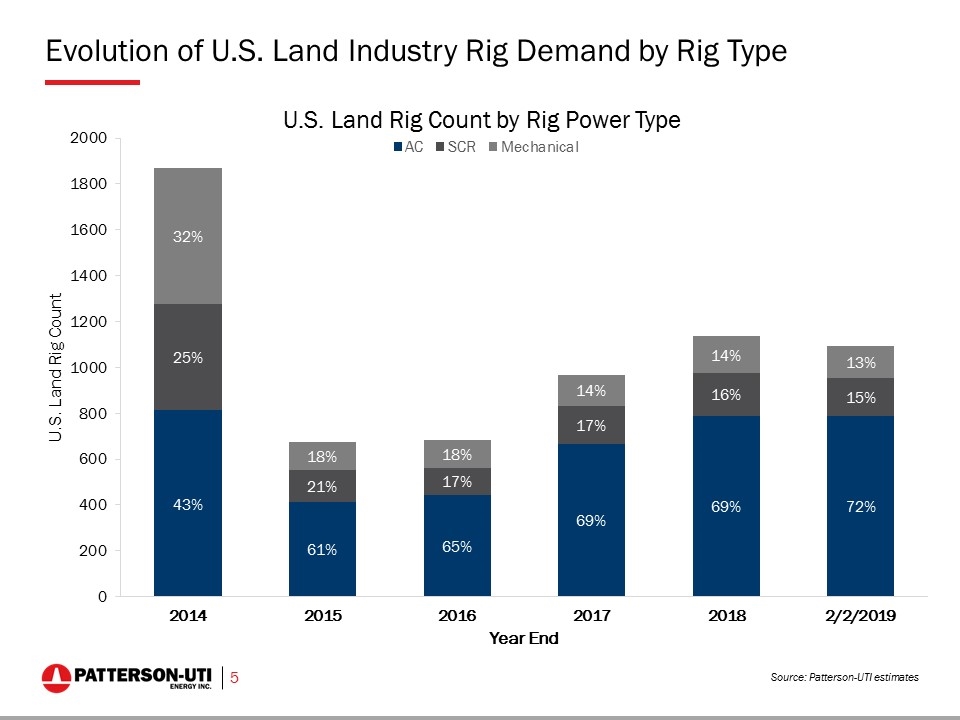

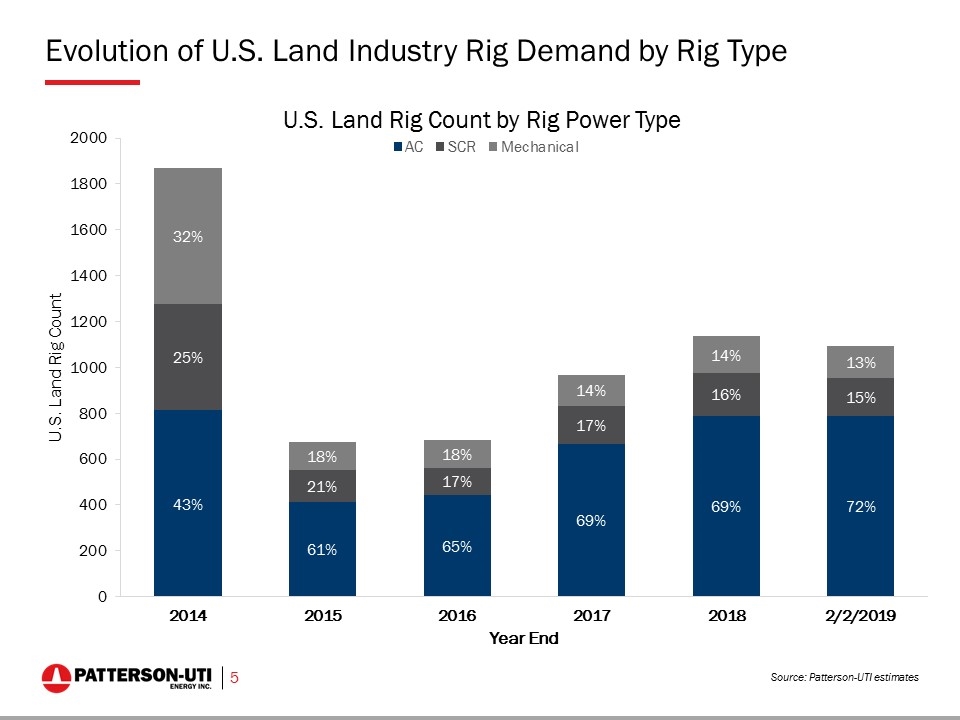

Evolution of U.S. Land Industry Rig Demand by Rig Type Source: Patterson-UTI estimates

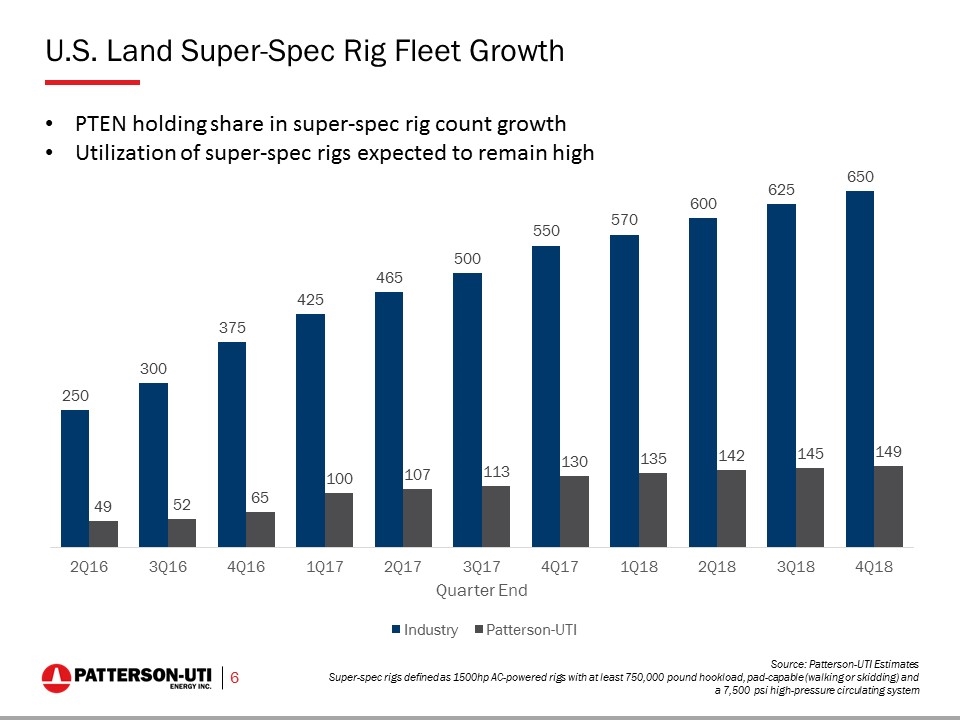

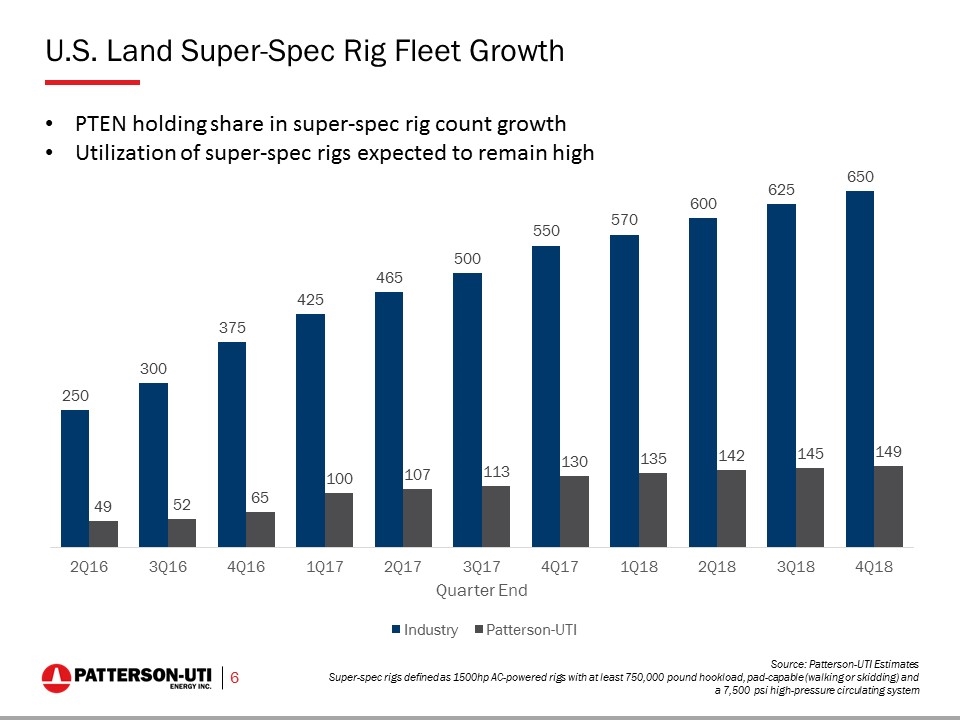

U.S. Land Super-Spec Rig Fleet Growth Source: Patterson-UTI Estimates Super-spec rigs defined as 1500hp AC-powered rigs with at least 750,000 pound hookload, pad-capable (walking or skidding) and a 7,500 psi high-pressure circulating system PTEN holding share in super-spec rig count growth Utilization of super-spec rigs expected to remain high

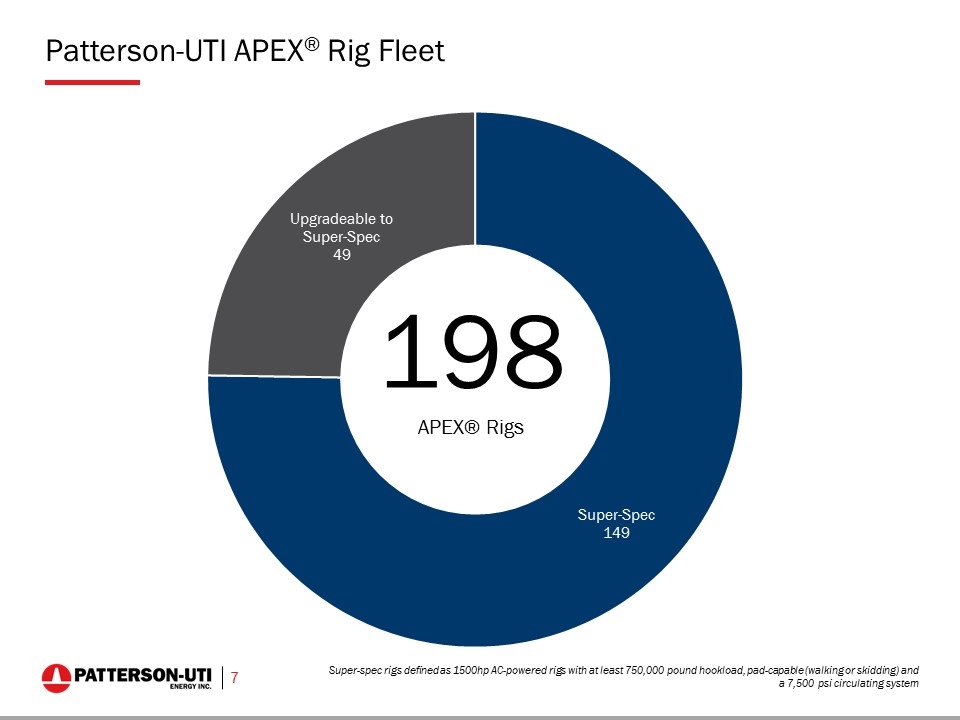

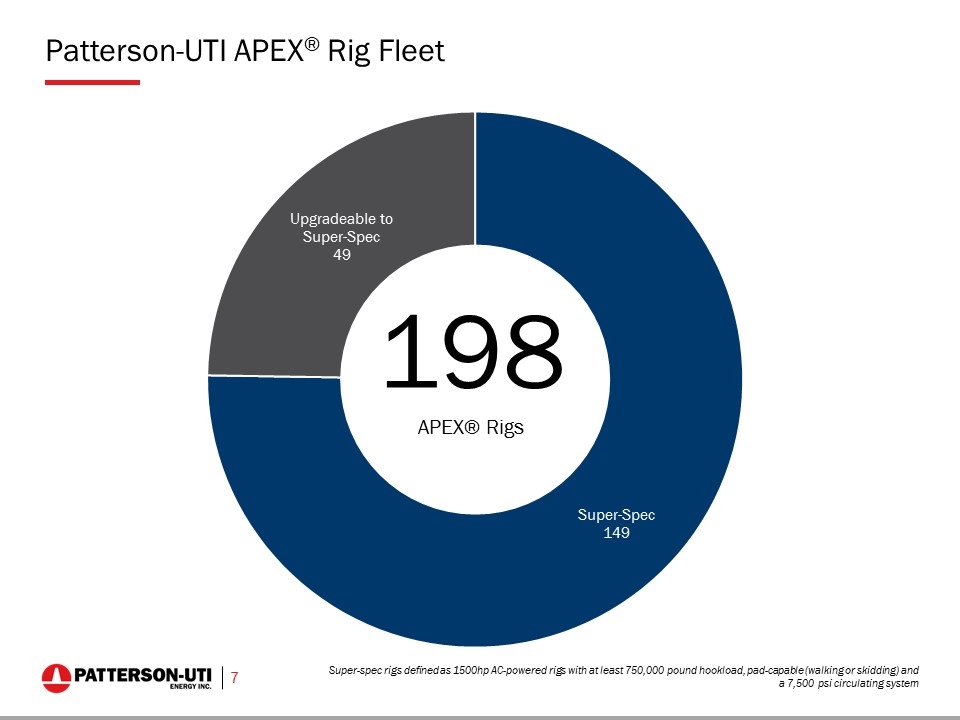

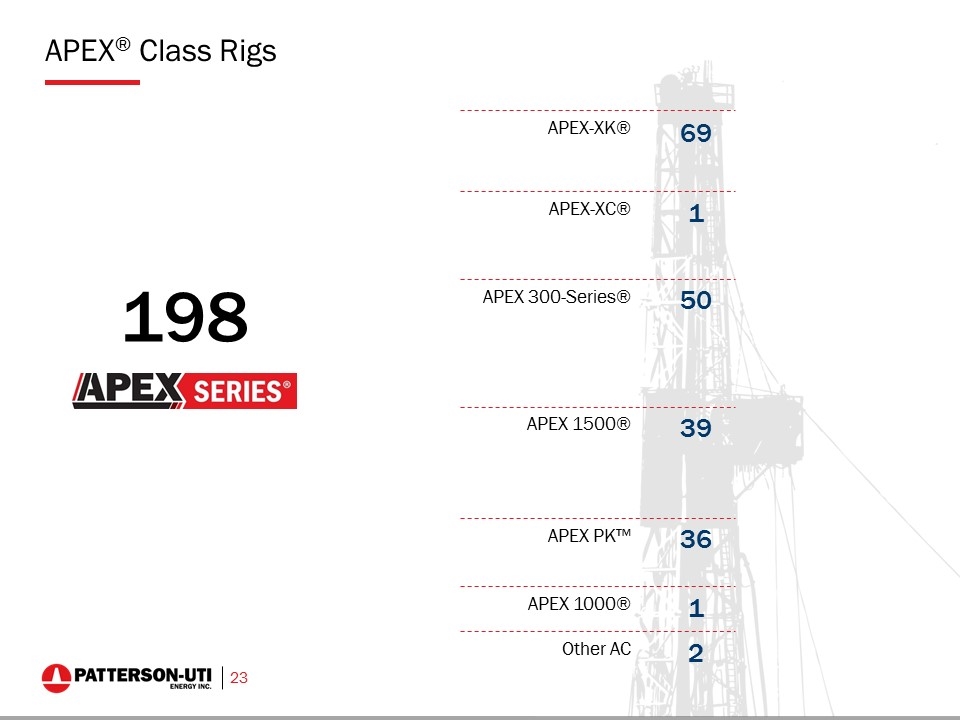

Patterson-UTI APEX® Rig Fleet Super-spec rigs defined as 1500hp AC-powered rigs with at least 750,000 pound hookload, pad-capable (walking or skidding) and a 7,500 psi circulating system

Directional Drilling MS Directional, a leading provider of directional drilling services in the United States MS Directional has a strong technology focus with proprietary mud motor, MWD and survey equipment Patented C2™ technology enables high-speed electromagnetic telemetry independent of geological formation constraints, which reduces both drilling time and expense

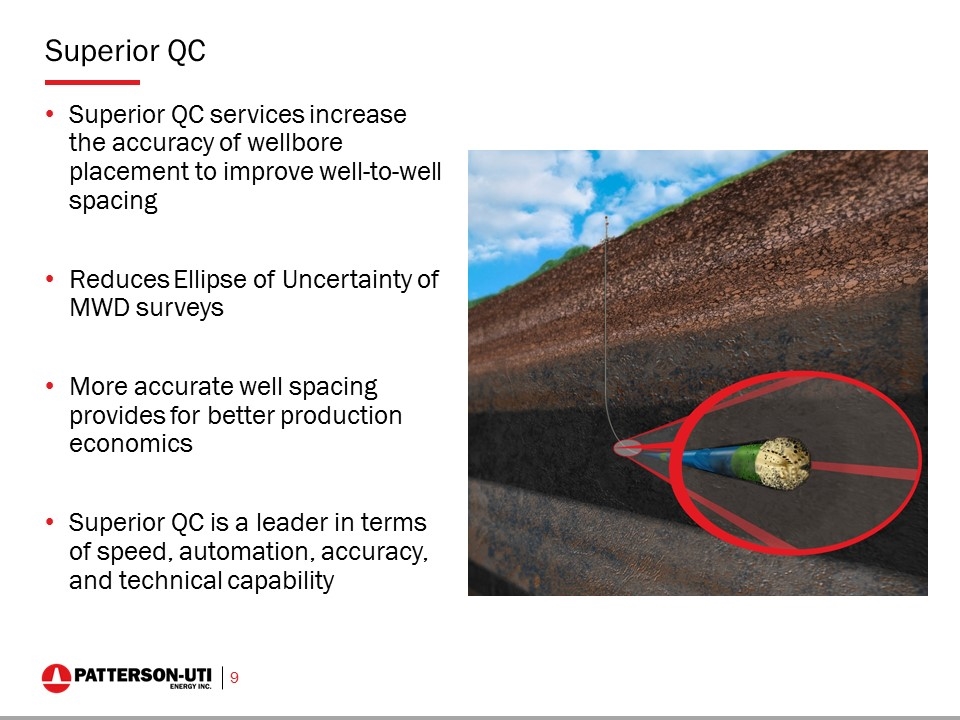

Superior QC Superior QC services increase the accuracy of wellbore placement to improve well-to-well spacing Reduces Ellipse of Uncertainty of MWD surveys More accurate well spacing provides for better production economics Superior QC is a leader in terms of speed, automation, accuracy, and technical capability

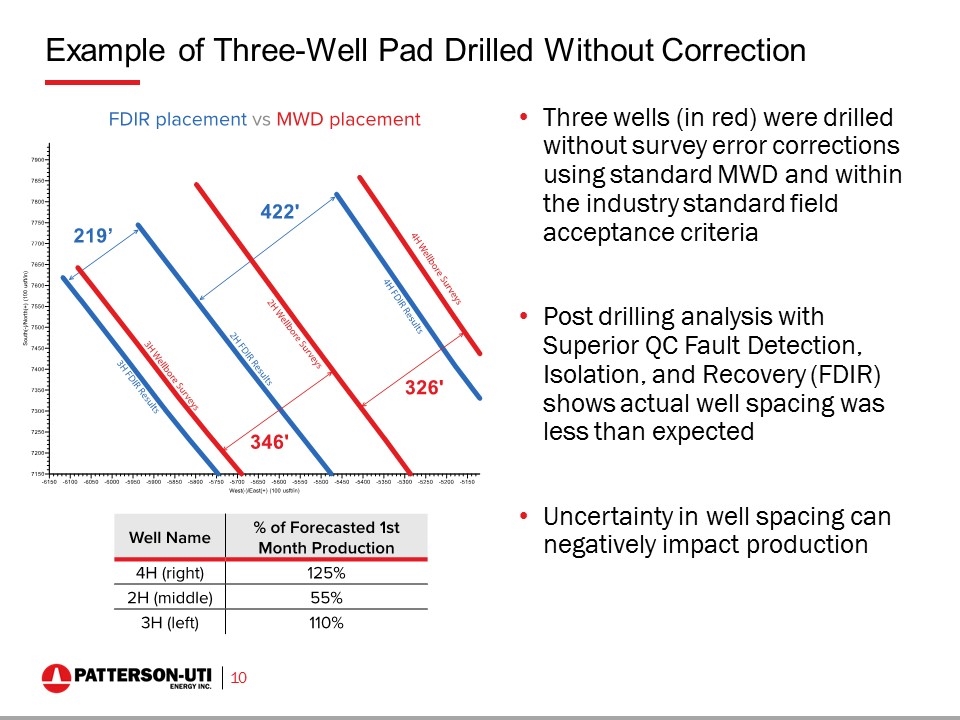

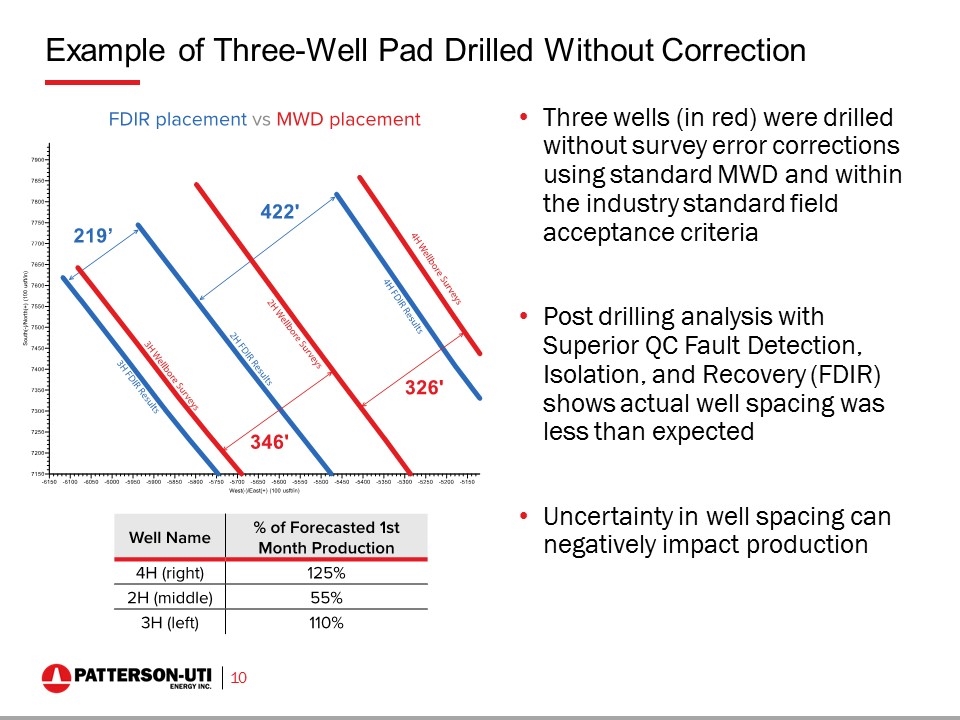

Example of Three-Well Pad Drilled Without Correction Three wells (in red) were drilled without survey error corrections using standard MWD and within the industry standard field acceptance criteria Post drilling analysis with Superior QC Fault Detection, Isolation, and Recovery (FDIR) shows actual well spacing was less than expected Uncertainty in well spacing can negatively impact production

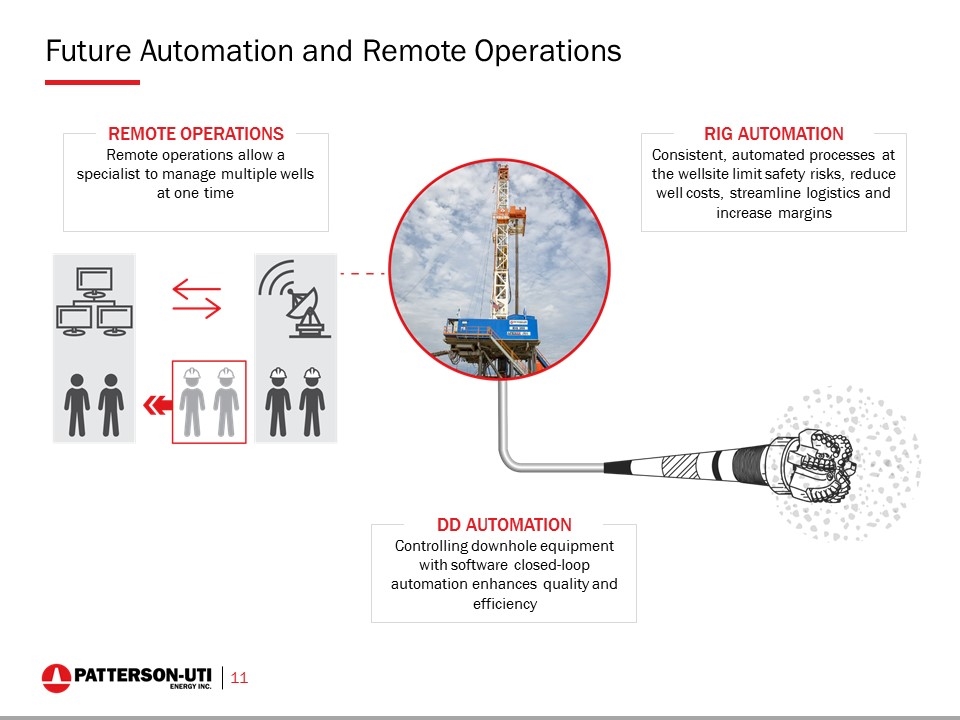

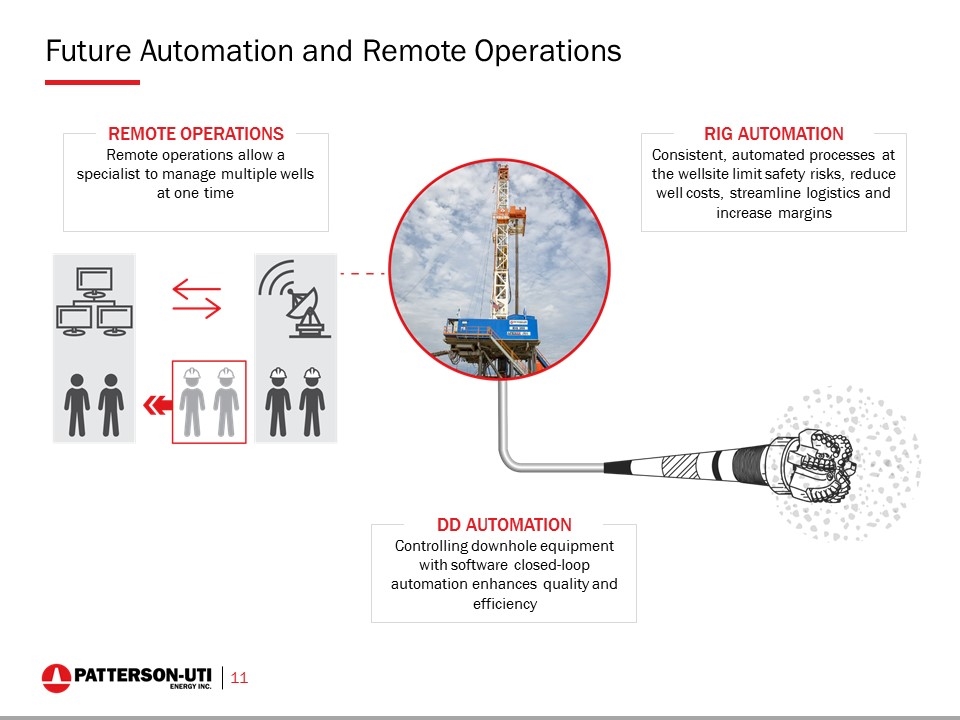

Future Automation and Remote Operations REMOTE OPERATIONS Remote operations allow a specialist to manage multiple wells at one time RIG AUTOMATION Consistent, automated processes at the wellsite limit safety risks, reduce well costs, streamline logistics and increase margins DD AUTOMATION Controlling downhole equipment with software closed-loop automation enhances quality and efficiency

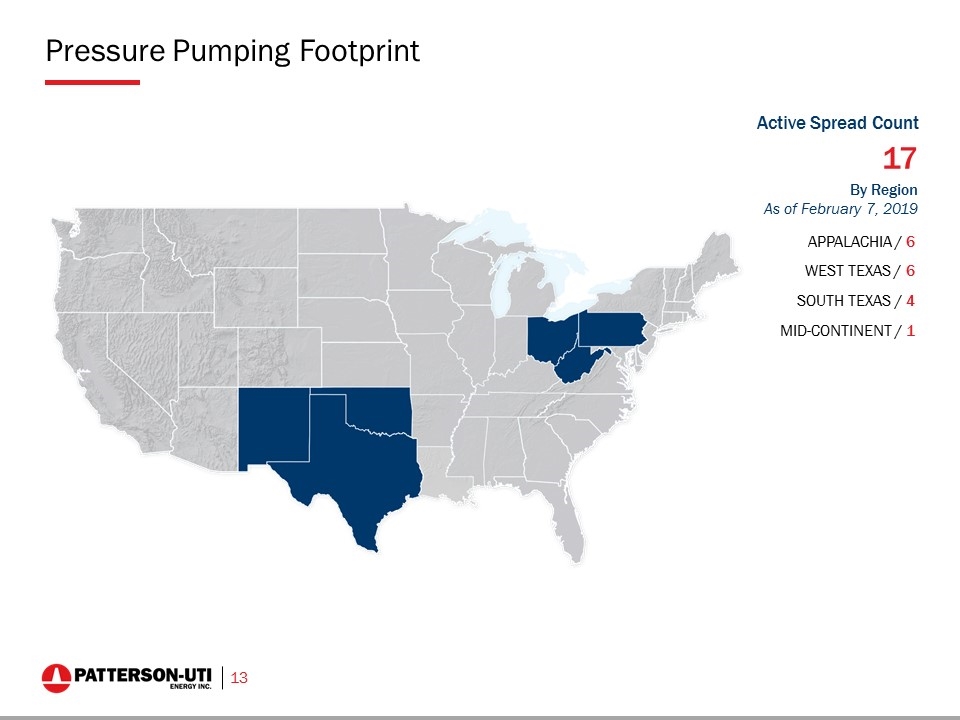

A premier source for hydraulic fracturing, cementing and acidizing services for reservoir enhancement. Universal Pressure Pumping provides well services primarily in Texas and the Mid-Continent and Appalachian regions.

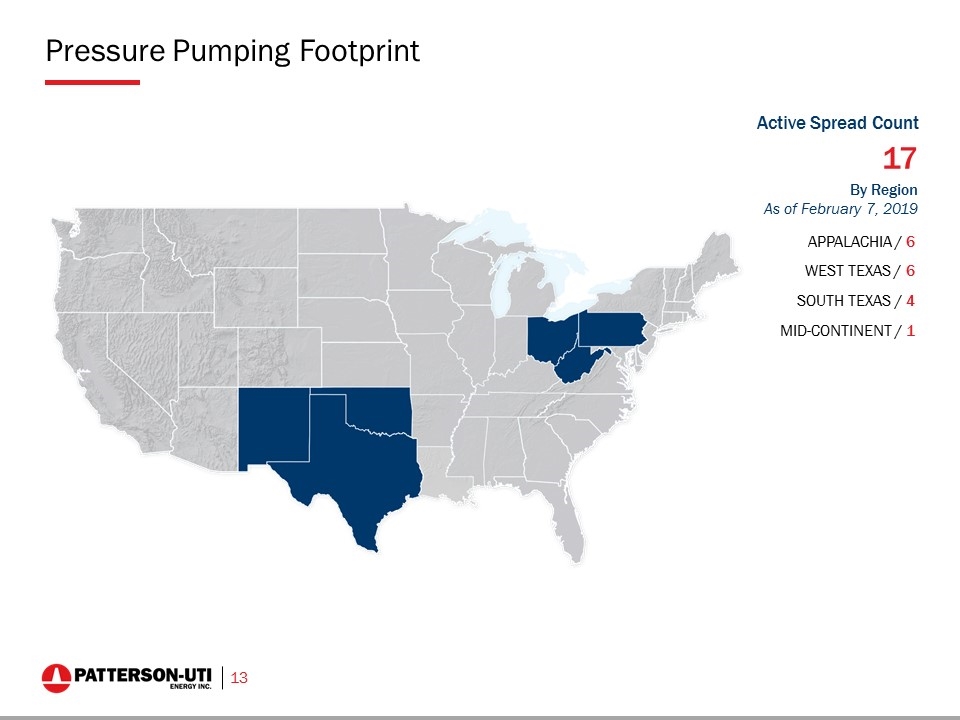

Pressure Pumping Footprint APPALACHIA / 6 WEST TEXAS / 6 SOUTH TEXAS / 4 MID-CONTINENT / 1 By Region As of February 7, 2019 Active Spread Count 17

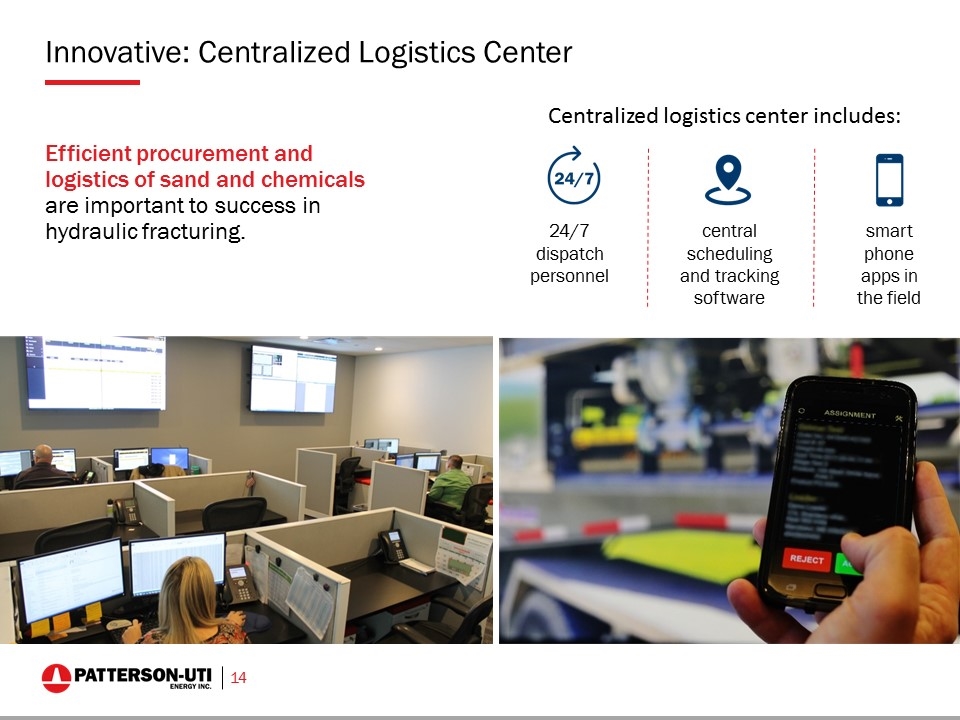

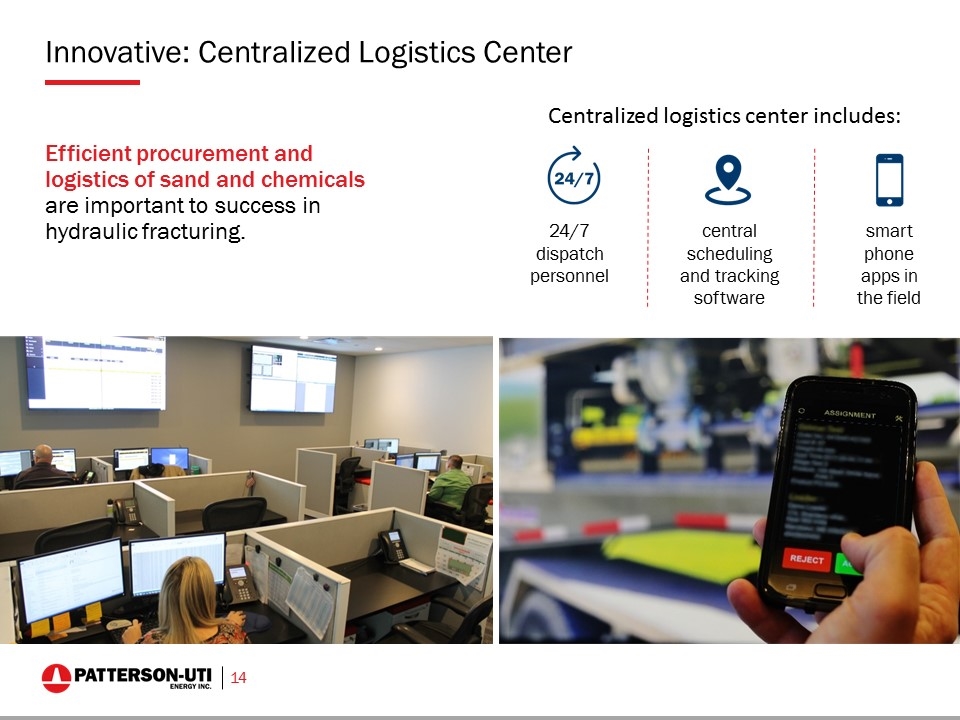

Innovative: Centralized Logistics Center Efficient procurement and logistics of sand and chemicals are important to success in hydraulic fracturing. central scheduling and tracking software 24/7 dispatch personnel smart phone apps in the field Centralized logistics center includes:

Innovative Pressure Pumping Technology: Bi-Fuel More flexible fuel source as engines can burn a fuel mix comprised of up to 70% natural gas Comparable torque and horsepower to an all diesel engine Reduces operating costs by lowering fuel costs Good for environmental sustainability

Financial Information

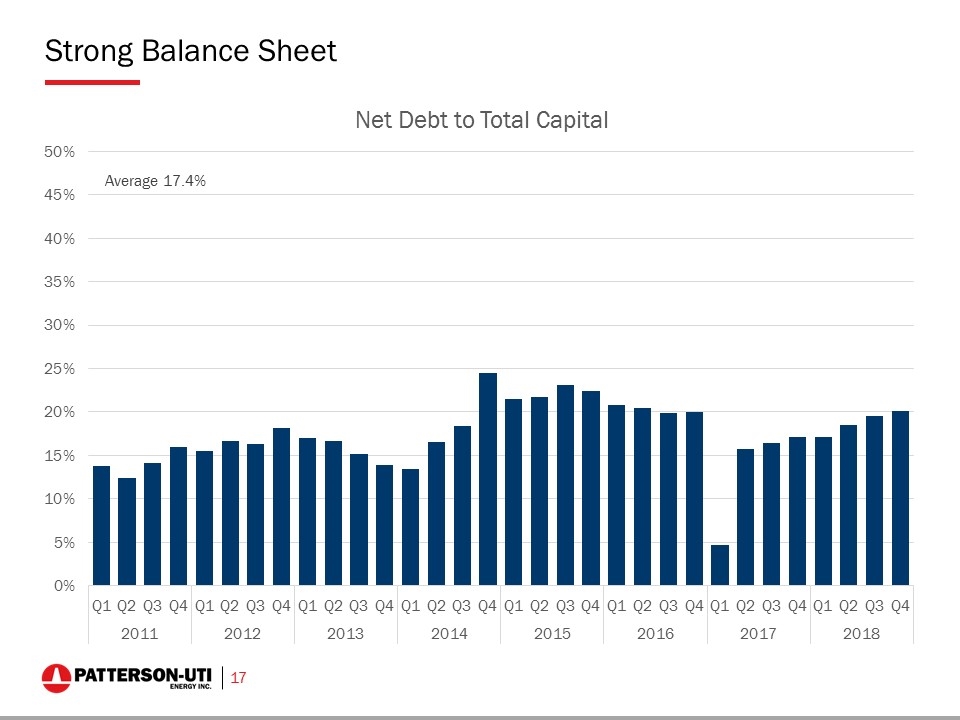

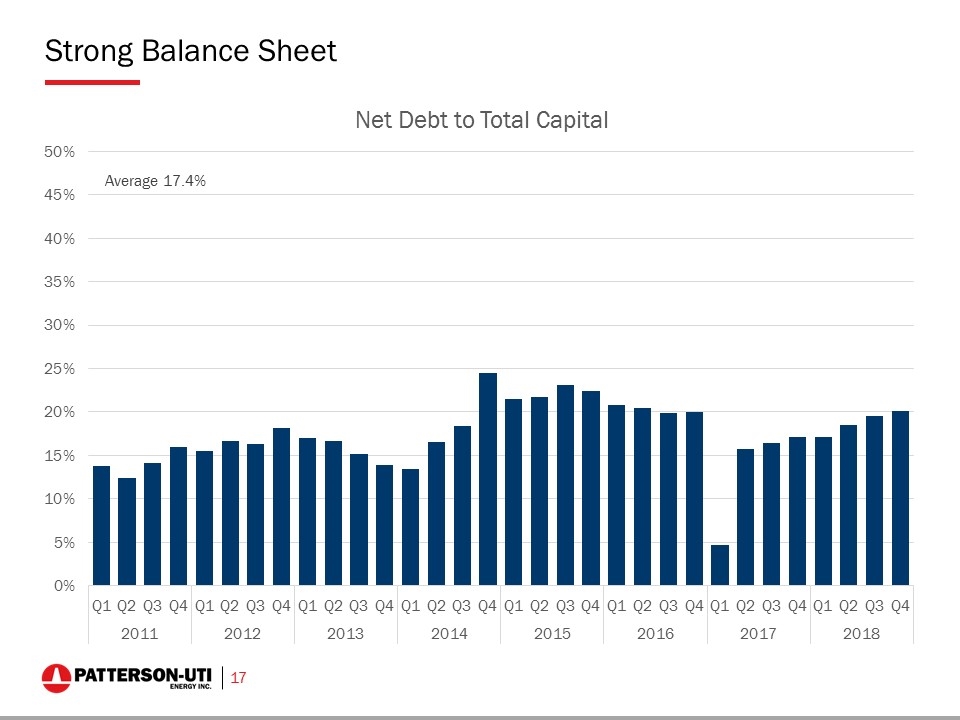

Strong Balance Sheet

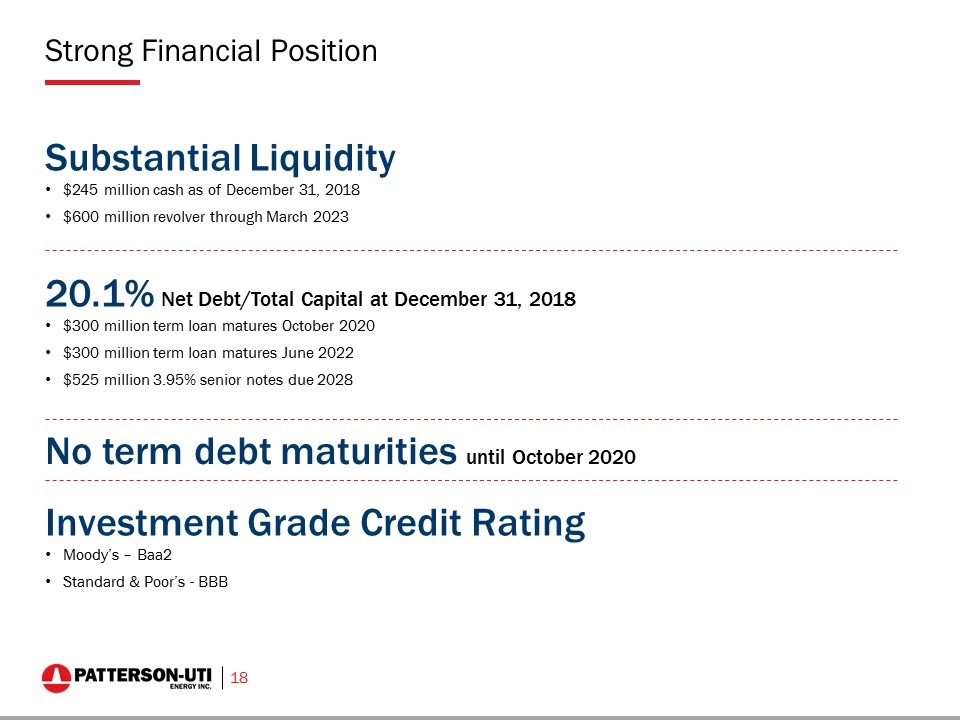

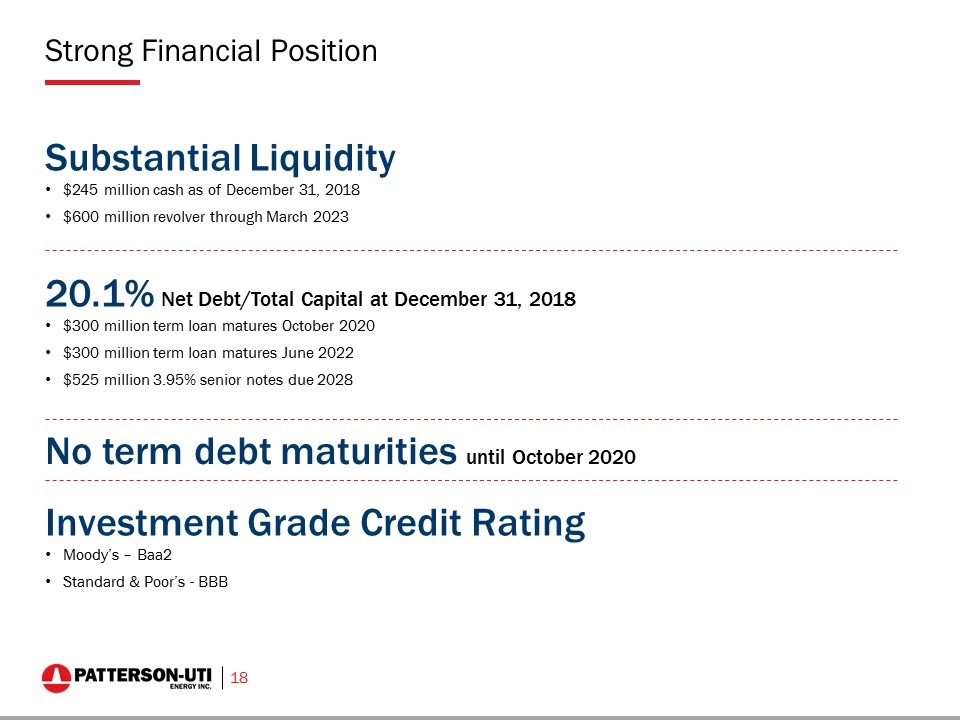

Strong Financial Position Substantial Liquidity $245 million cash as of December 31, 2018 $600 million revolver through March 2023 20.1% Net Debt/Total Capital at December 31, 2018 $300 million term loan matures October 2020 $300 million term loan matures June 2022 $525 million 3.95% senior notes due 2028 No term debt maturities until October 2020 Investment Grade Credit Rating Moody’s – Baa2 Standard & Poor’s - BBB

A History of Returning Capital to Shareholders Source: Patterson-UTI company filings and Baker Hughes Rig Count

Patterson-UTI is the only company in the U.S. onshore unconventional market leveraged to the critical path services of contract drilling, pressure pumping, and directional drilling Patterson-UTI has a history of returning cash to shareholders when appropriate Patterson-UTI has a strong balance sheet Why Invest in Patterson-UTI Energy?

Additional References

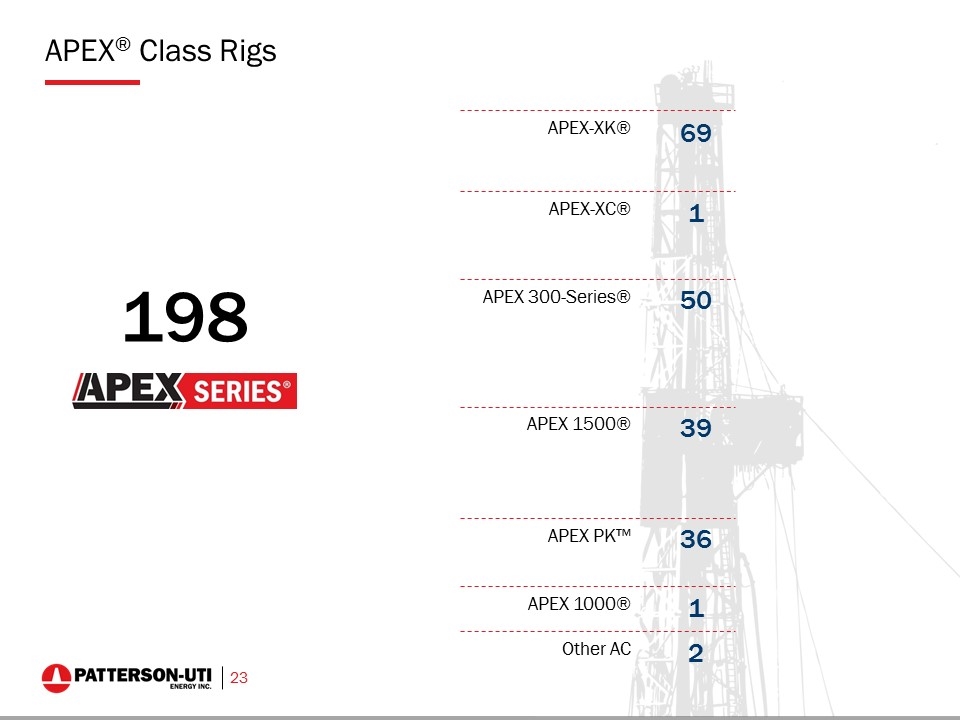

APEX® Class Rigs 198 APEX-XK® APEX 300-Series® APEX 1500® APEX PK™ APEX 1000® Other AC 69 50 39 36 1 2 APEX-XC® 1

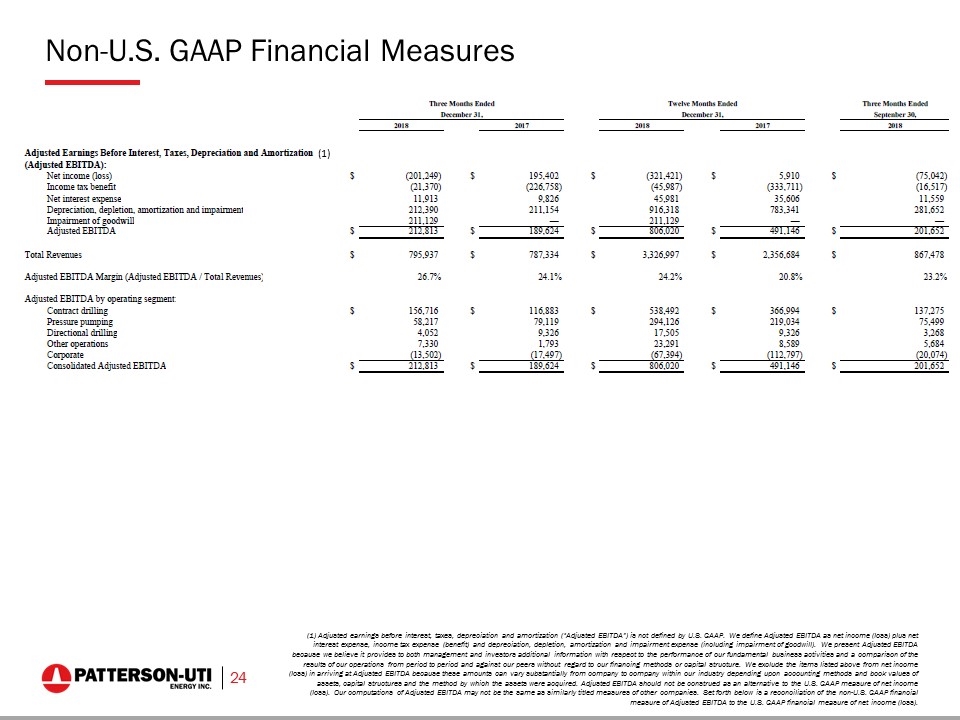

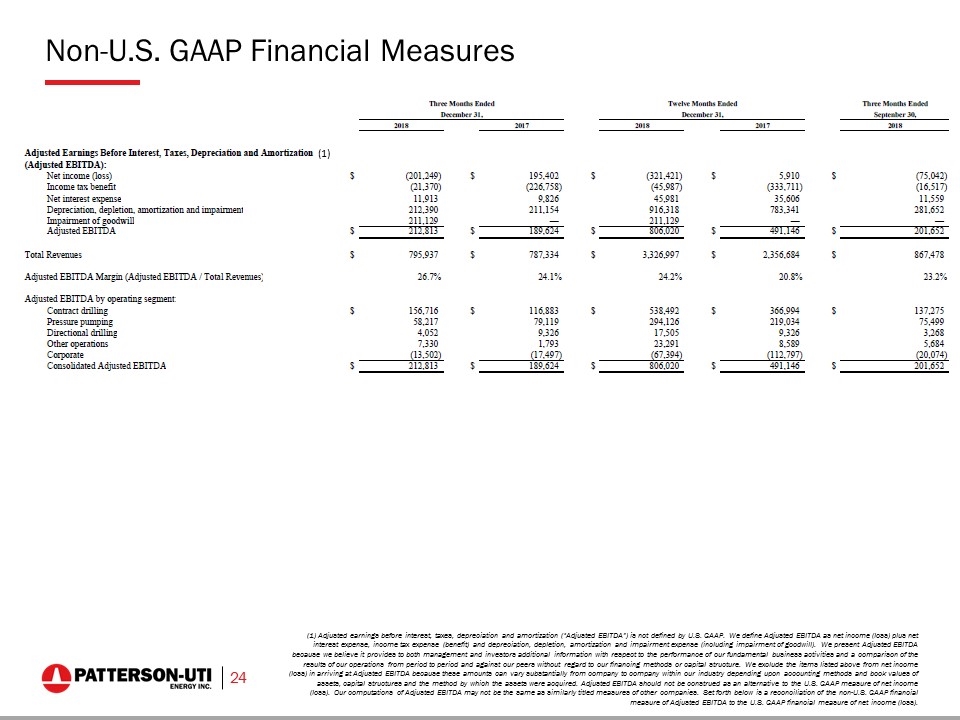

Non-U.S. GAAP Financial Measures (1) Adjusted earnings before interest, taxes, depreciation and amortization (“Adjusted EBITDA”) is not defined by U.S. GAAP. We define Adjusted EBITDA as net income (loss) plus net interest expense, income tax expense (benefit) and depreciation, depletion, amortization and impairment expense (including impairment of goodwill). We present Adjusted EBITDA because we believe it provides to both management and investors additional information with respect to the performance of our fundamental business activities and a comparison of the results of our operations from period to period and against our peers without regard to our financing methods or capital structure. We exclude the items listed above from net income (loss) in arriving at Adjusted EBITDA because these amounts can vary substantially from company to company within our industry depending upon accounting methods and book values of assets, capital structures and the method by which the assets were acquired. Adjusted EBITDA should not be construed as an alternative to the U.S. GAAP measure of net income (loss). Our computations of Adjusted EBITDA may not be the same as similarly titled measures of other companies. Set forth below is a reconciliation of the non-U.S. GAAP financial measure of Adjusted EBITDA to the U.S. GAAP financial measure of net income (loss). (1)