Scotia Howard Weil 48th Annual Energy Conference March 24, 2020 Patterson-UTI Energy, Inc. Exhibit 99.1

Forward-Looking Statements This material and any oral statements made in connection with this material include "forward-looking statements" within the meaning of the Securities Act of 1933 and the Securities Exchange Act of 1934. Statements made which provide the Company’s or management’s intentions, beliefs, expectations or predictions for the future are forward-looking statements and are inherently uncertain. The opinions, forecasts, projections or other statements other than statements of historical fact, including, without limitation, plans and objectives of management of the Company are forward-looking statements. It is important to note that actual results could differ materially from those discussed in such forward-looking statements. Important factors that could cause actual results to differ materially include the risk factors and other cautionary statements contained from time to time in the Company’s SEC filings, which may be obtained by contacting the Company or the SEC. These filings are also available through the Company’s web site at http://www.patenergy.com or through the SEC’s Electronic Data Gathering and Analysis Retrieval System (EDGAR) at http://www.sec.gov. We undertake no obligation to publicly update or revise any forward-looking statement. Statements made in this presentation include non-U.S. GAAP financial measures. The required reconciliation to U.S. GAAP financial measures are included on our website and/or at the end of this presentation.

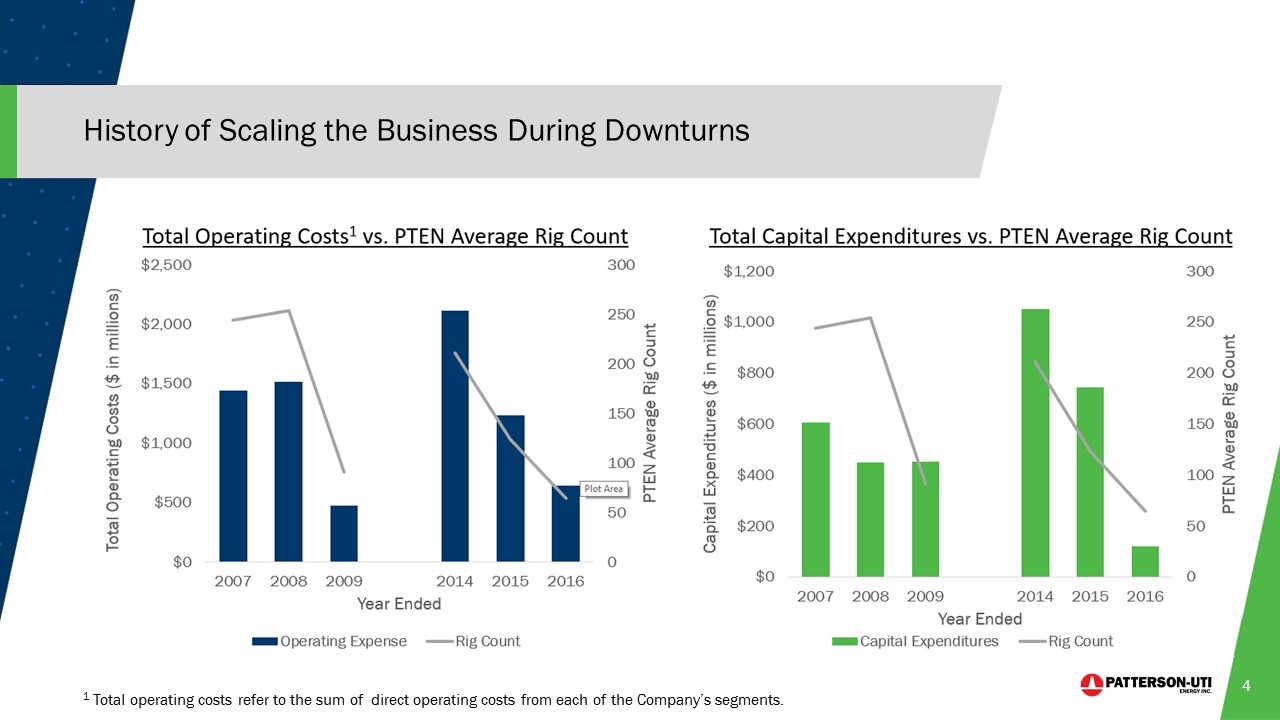

Market Outlook Economic disruptions related to COVID-19 are having a negative impact on global oil demand. At the same time, announced production increases from Russia and Saudi Arabia are expected to increase oil supply. As a result, oil prices have been negatively impacted. With the drop in oil prices, demand for drilling and completion services is expected to decrease but at this time it is too soon to determine the depth or magnitude of the decline. Patterson-UTI is prioritizing cash flow and maintaining a strong balance sheet. We believe we have an adequate liquidity position in this challenging market environment. The Company has a history of effectively scaling the business during cyclical downturns. Patterson-UTI is reducing capital expenditures and operating expenses.

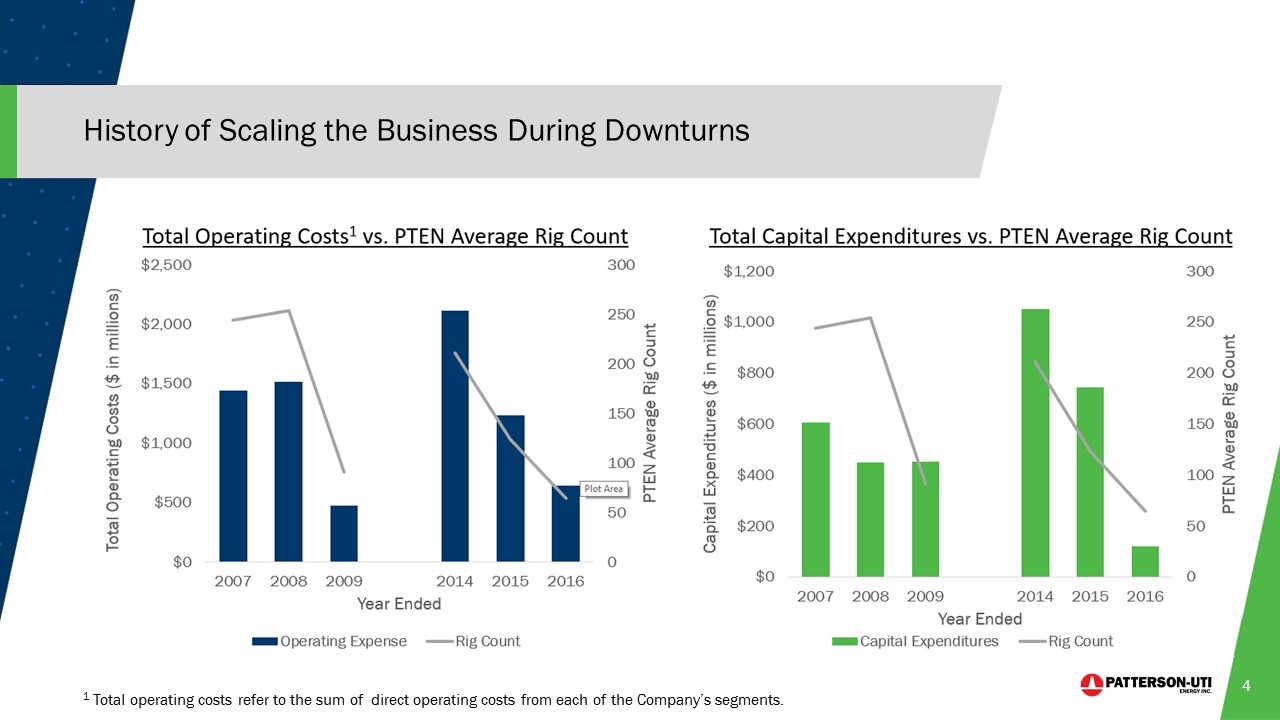

History of Scaling the Business During Downturns 1 Total operating costs refer to the sum of direct operating costs from each of the Company’s segments.

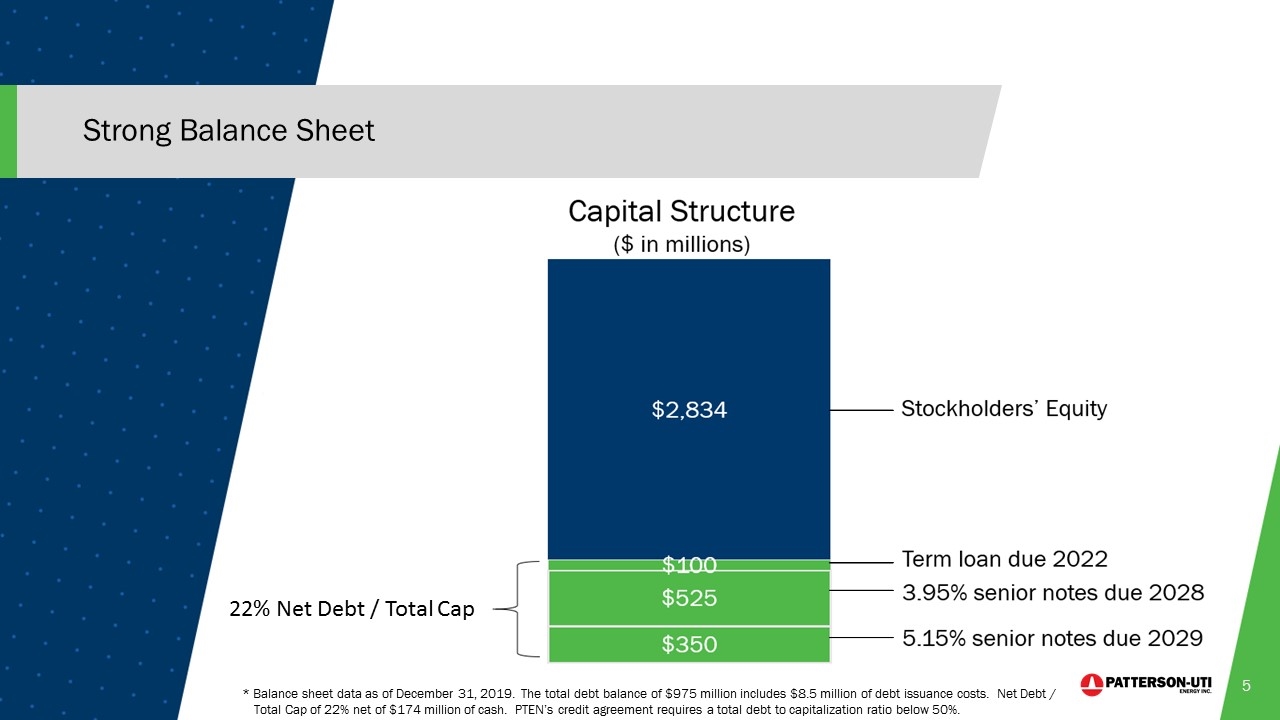

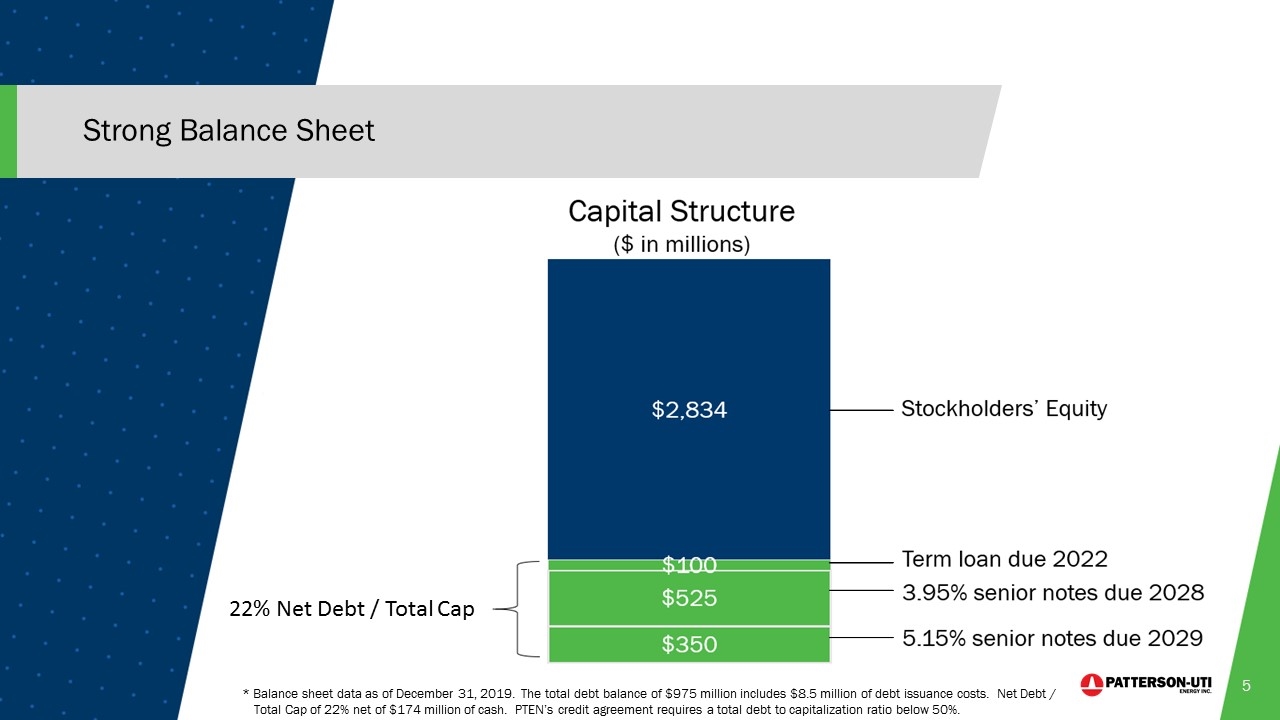

Strong Balance Sheet 22% Net Debt / Total Cap * Balance sheet data as of December 31, 2019. The total debt balance of $975 million includes $8.5 million of debt issuance costs. Net Debt / Total Cap of 22% net of $174 million of cash. PTEN’s credit agreement requires a total debt to capitalization ratio below 50%.

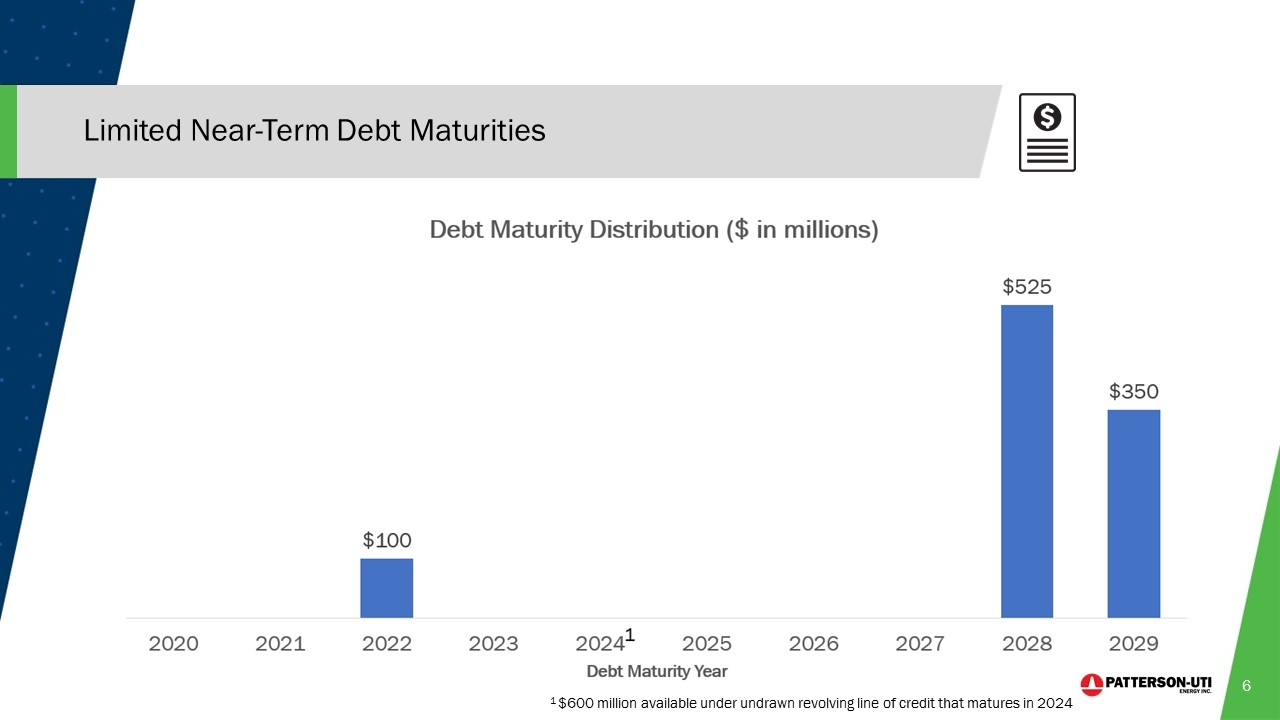

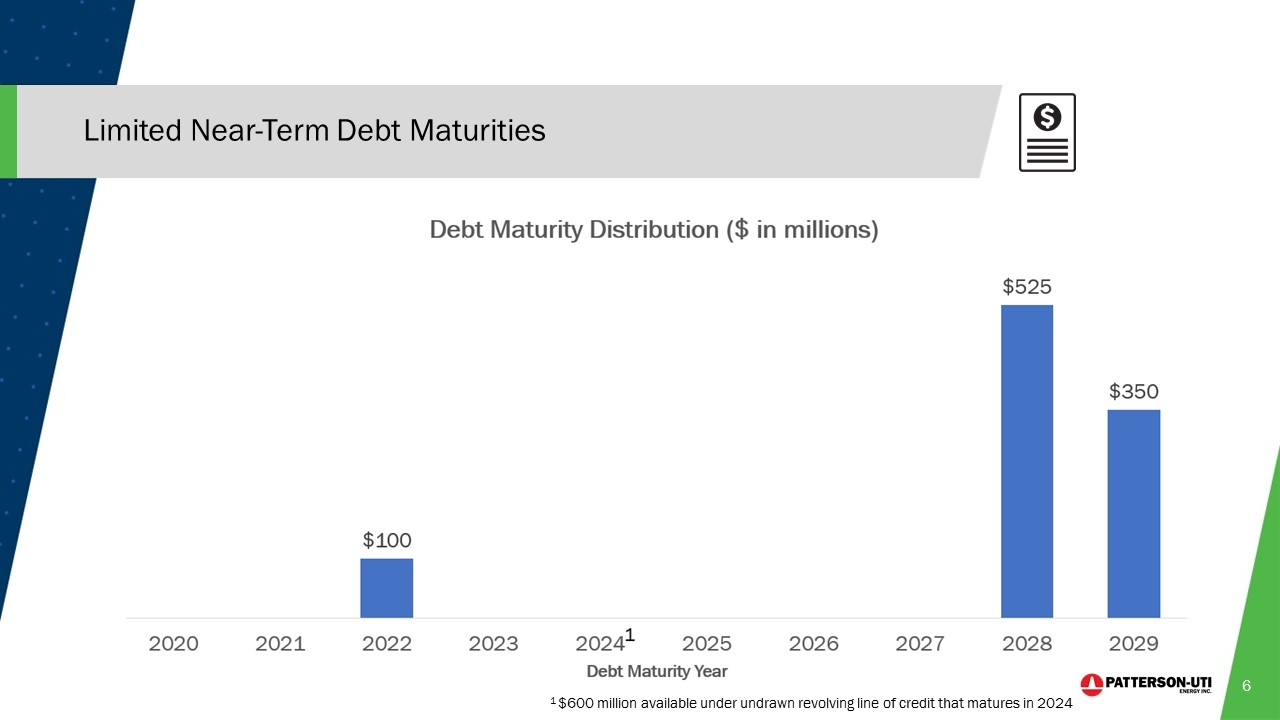

Limited Near-Term Debt Maturities 1 $600 million available under undrawn revolving line of credit that matures in 2024

CONTRACT DRILLING

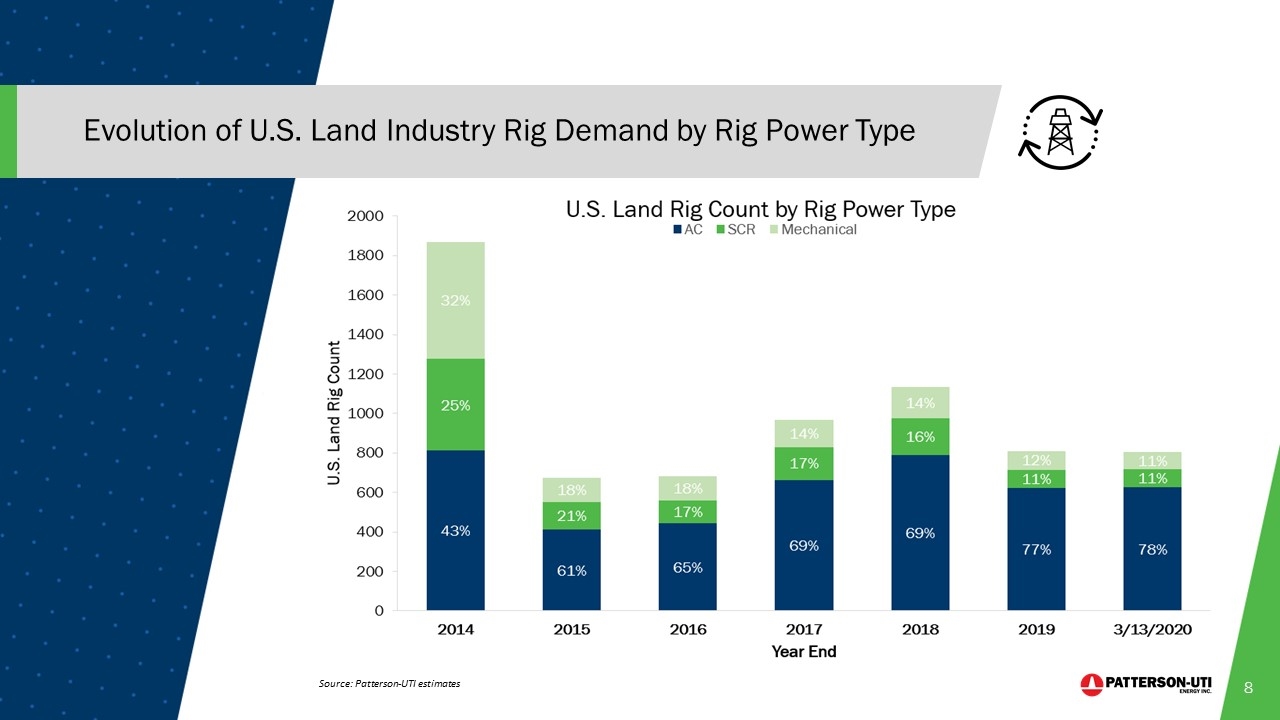

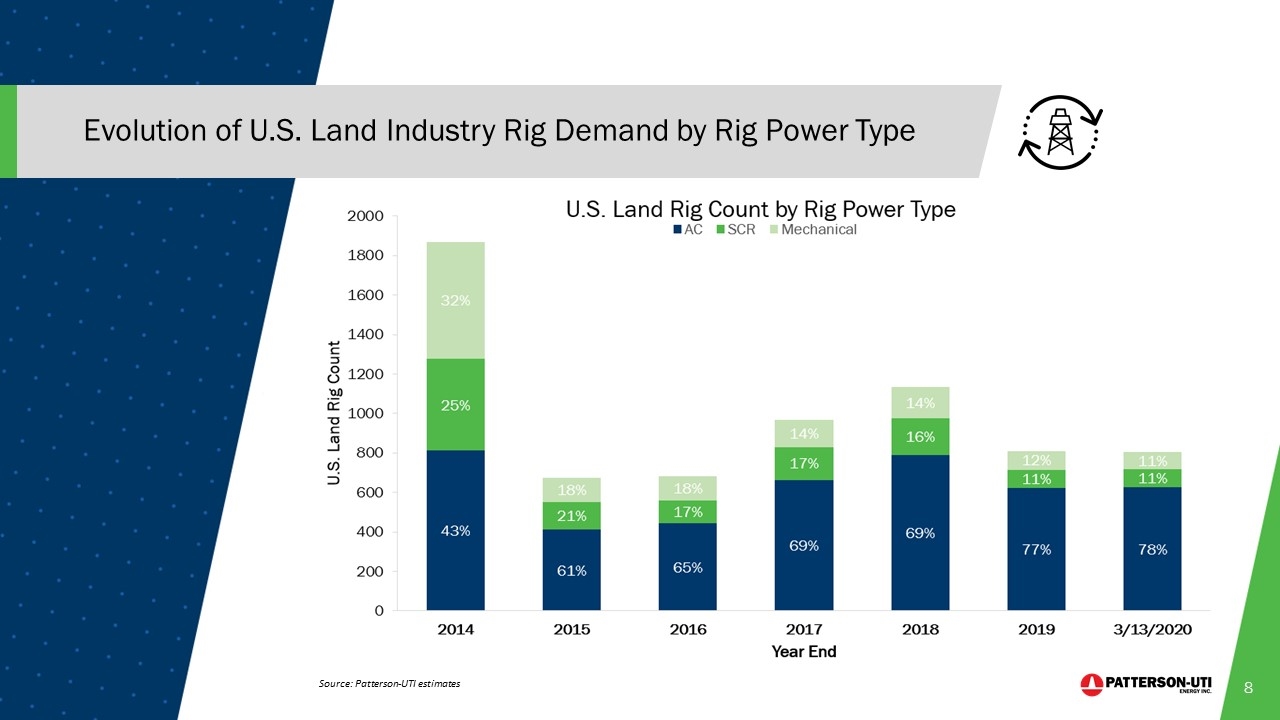

Evolution of U.S. Land Industry Rig Demand by Rig Power Type Source: Patterson-UTI estimates

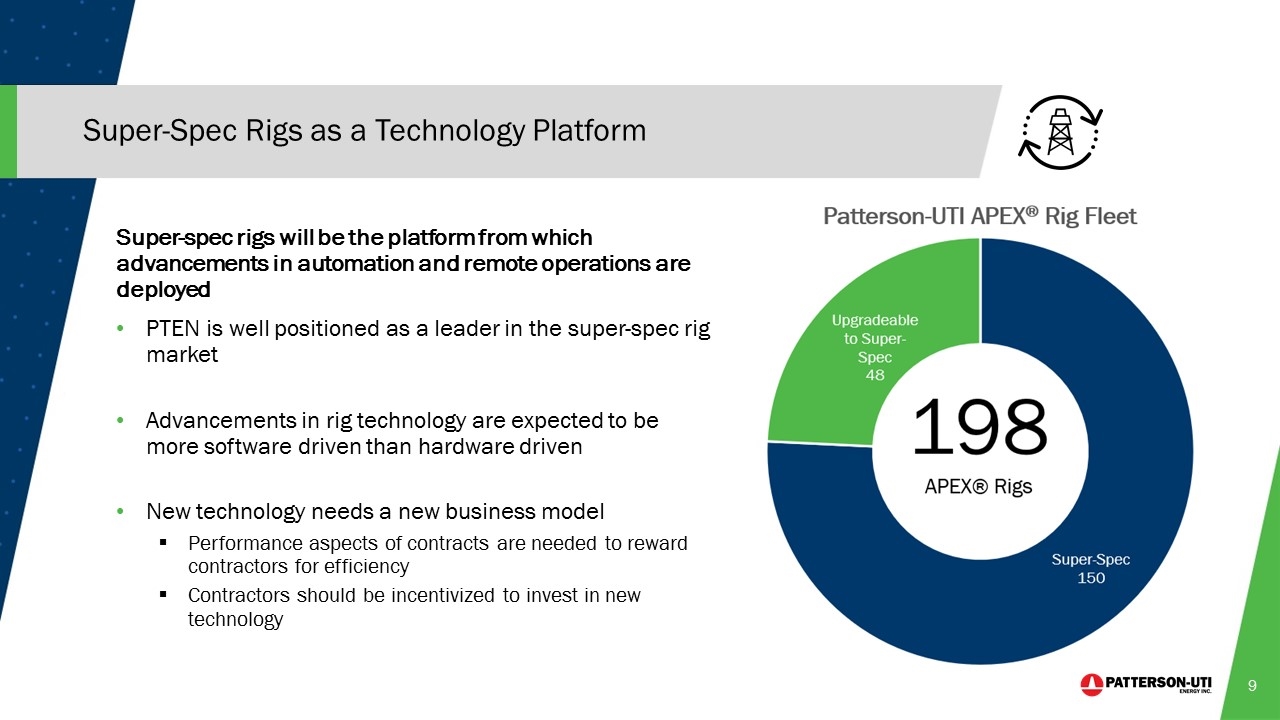

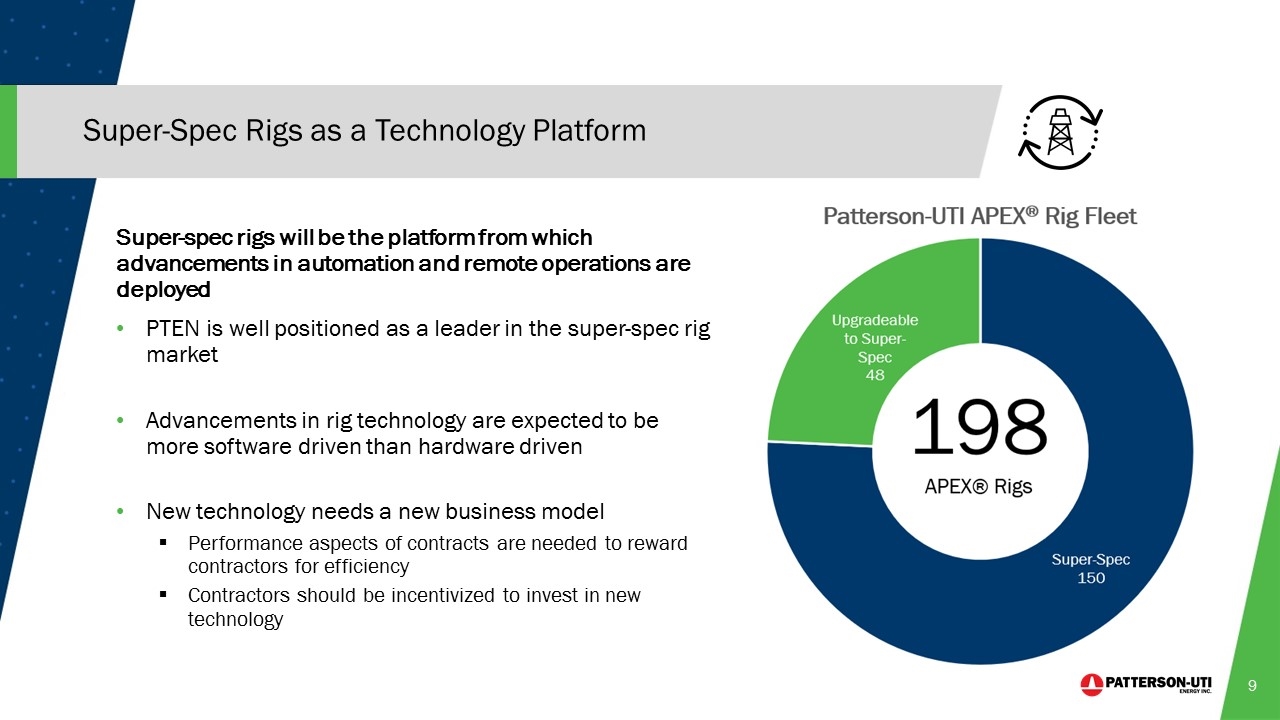

Super-Spec Rigs as a Technology Platform Super-spec rigs will be the platform from which advancements in automation and remote operations are deployed PTEN is well positioned as a leader in the super-spec rig market Advancements in rig technology are expected to be more software driven than hardware driven New technology needs a new business model Performance aspects of contracts are needed to reward contractors for efficiency Contractors should be incentivized to invest in new technology

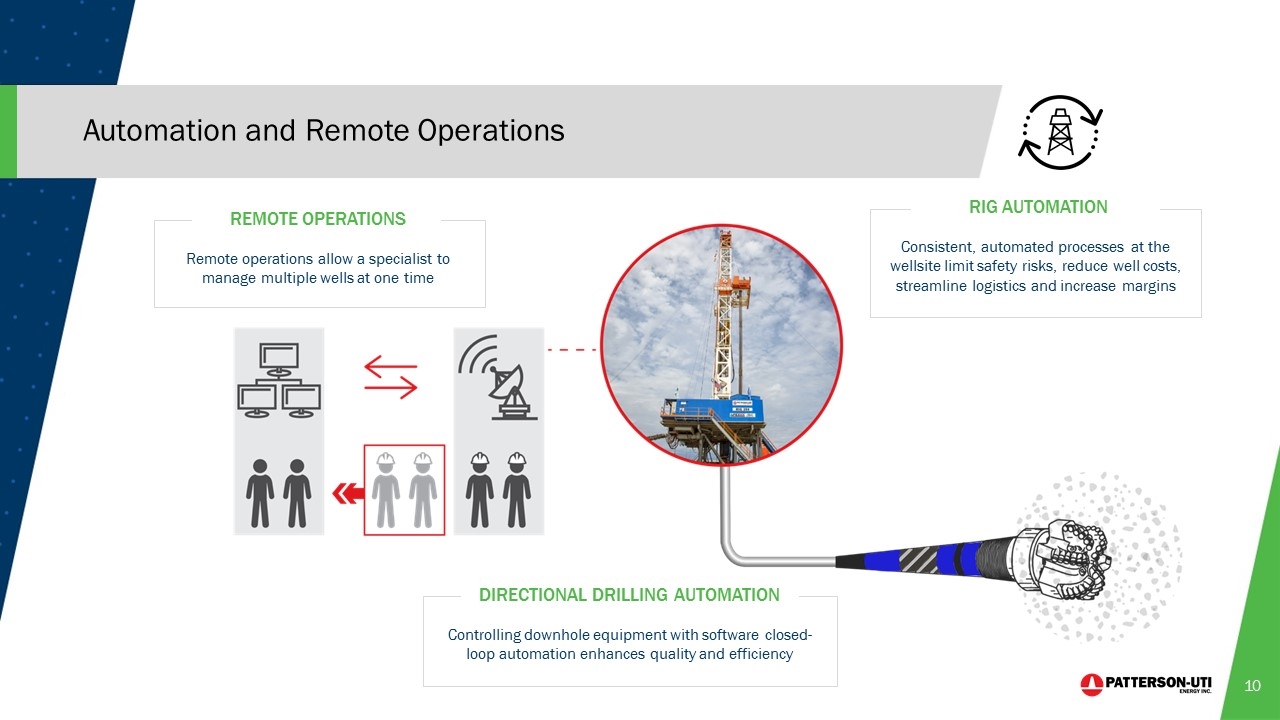

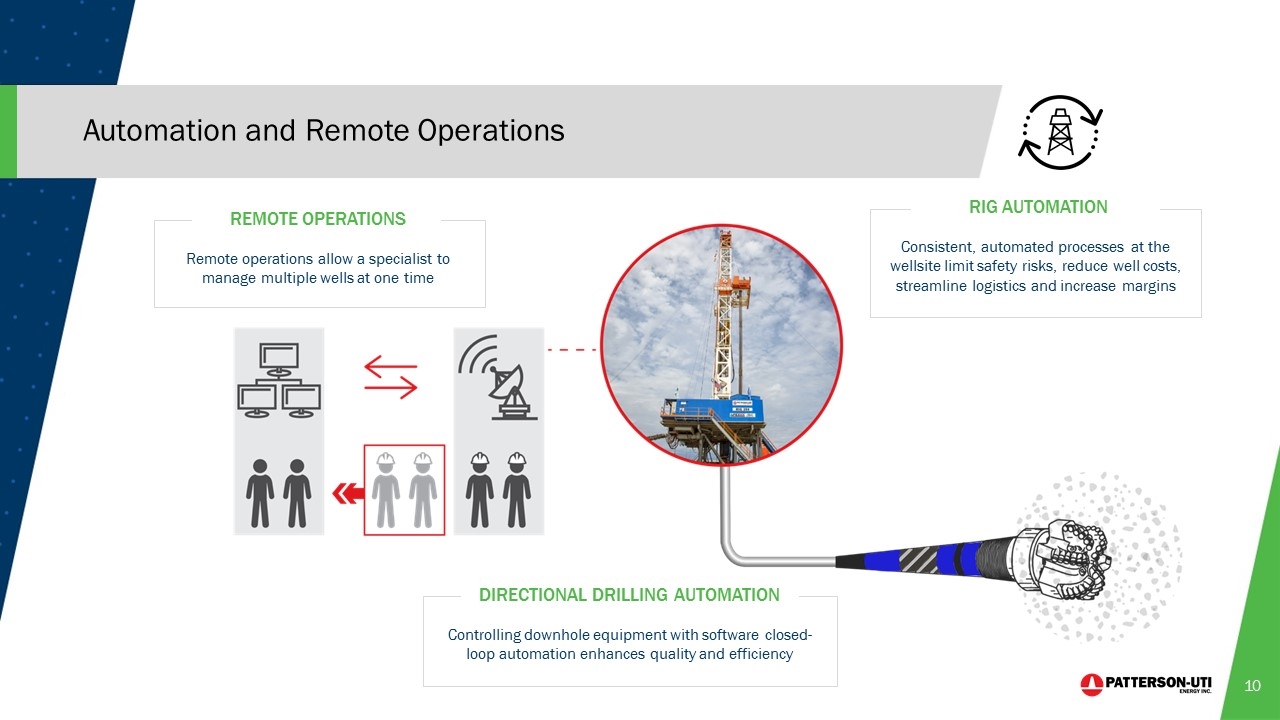

RIG AUTOMATION Consistent, automated processes at the wellsite limit safety risks, reduce well costs, streamline logistics and increase margins Automation and Remote Operations REMOTE OPERATIONS Remote operations allow a specialist to manage multiple wells at one time DIRECTIONAL DRILLING AUTOMATION Controlling downhole equipment with software closed-loop automation enhances quality and efficiency

Applications Adaptive Auto-Driller: Adaptive control loops maximize rate of penetration (ROP) through changing formations and minimize dysfunction. Optimized to consistently replicate expert driller performance. Easy to use interface that accelerates driller learning and development. Automated Toolface Drilling Control Closed loop technology that automates toolface control while slide drilling, enabling the process of remote directional drilling control. Stick-Slip Mitigation: Removes harmful torsional vibration allowing for increased ROP, lifespan of the drill bit, and other BHA components. Pipe Oscillator: Automated pipe oscillation while slide drilling to increase ROP and assisting directional driller in manual toolface steering. ™ ™ ™ ™ ™

Superior QC Superior QC services increase the accuracy of wellbore placement to improve well-to-well spacing More accurate well spacing provides for: Fewer frac hits Less parent-child communication between wells Generally better production economics Superior QC is a leader in terms of speed, automation, accuracy, and technical capability ™ ™ ™ ™

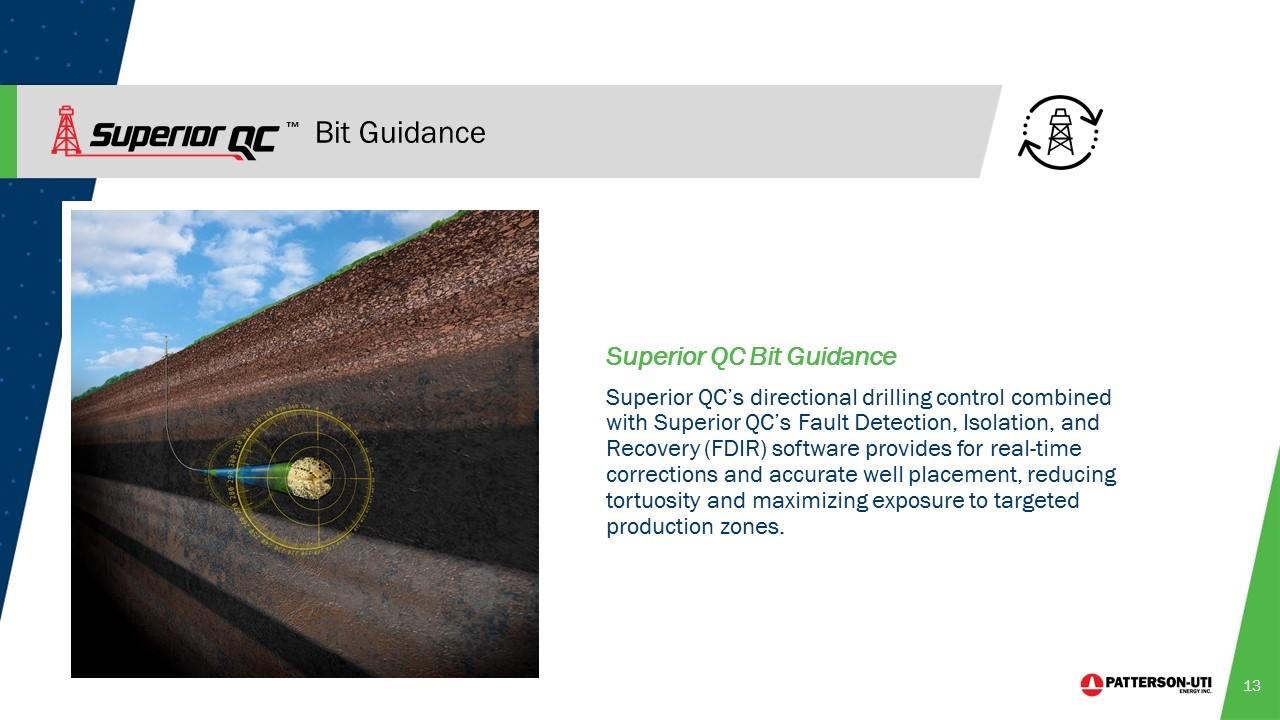

Bit Guidance Superior QC Bit Guidance Superior QC’s directional drilling control combined with Superior QC’s Fault Detection, Isolation, and Recovery (FDIR) software provides for real-time corrections and accurate well placement, reducing tortuosity and maximizing exposure to targeted production zones. ™

powered by GenAssist™ is an energy management software system that leverages EcoCell’s™ stored energy to optimize fuel efficiency and emissions. Automatically starts/stops engines and sets optimal load to achieve best possible fuel economy and emissions levels. Alternative solution to 4th generator requirements Reduces fuel consumption If utilizing dual-fuel engines, GenAssist™ will maximize substitution rates, dramatically improving fuel savings Reduces air emissions Added redundancy – can power rig for startup without using cold-start engine Extended maintenance intervals due to reduced engine run hours Improved power quality and response (instant power available) Designed for easy integration with APEX® Rigs Capable of providing 1.5x more power than a genset at full load - Stores up to 500 kW-hours ™ ™ ™

PRESSURE PUMPING

More flexible fuel source as engines can burn a fuel mix comprised of up to 70% natural gas Comparable torque and horsepower to an all diesel engine Reduces operating costs by lowering fuel costs Good for environmental sustainability Dual-Fuel Frac Spreads

Dual-Fuel Frac Spreads Patterson-UTI began dual fuel operations in 2012 Patterson-UTI has completed more than 12,400 dual fuel fracturing stages saving customers approximately 10 million gallons of diesel more than 7.3 million gallons of diesel

Blender Remote Control & Automation Developing new control systems to allow the blender to be remotely operated from the data van Increased data collection capability will improve predictive analytics modeling helping to improve blender up time and reduce maintenance costs Remote operations with automation will lead to more efficient and consistent operations

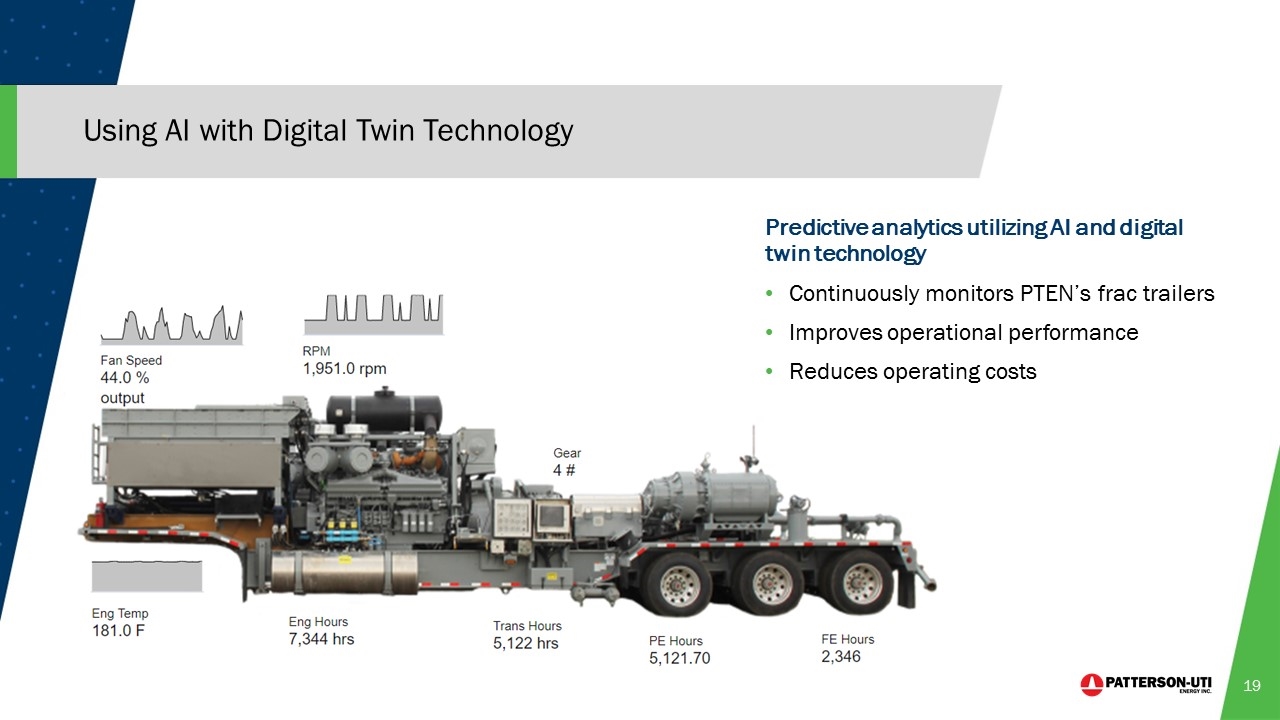

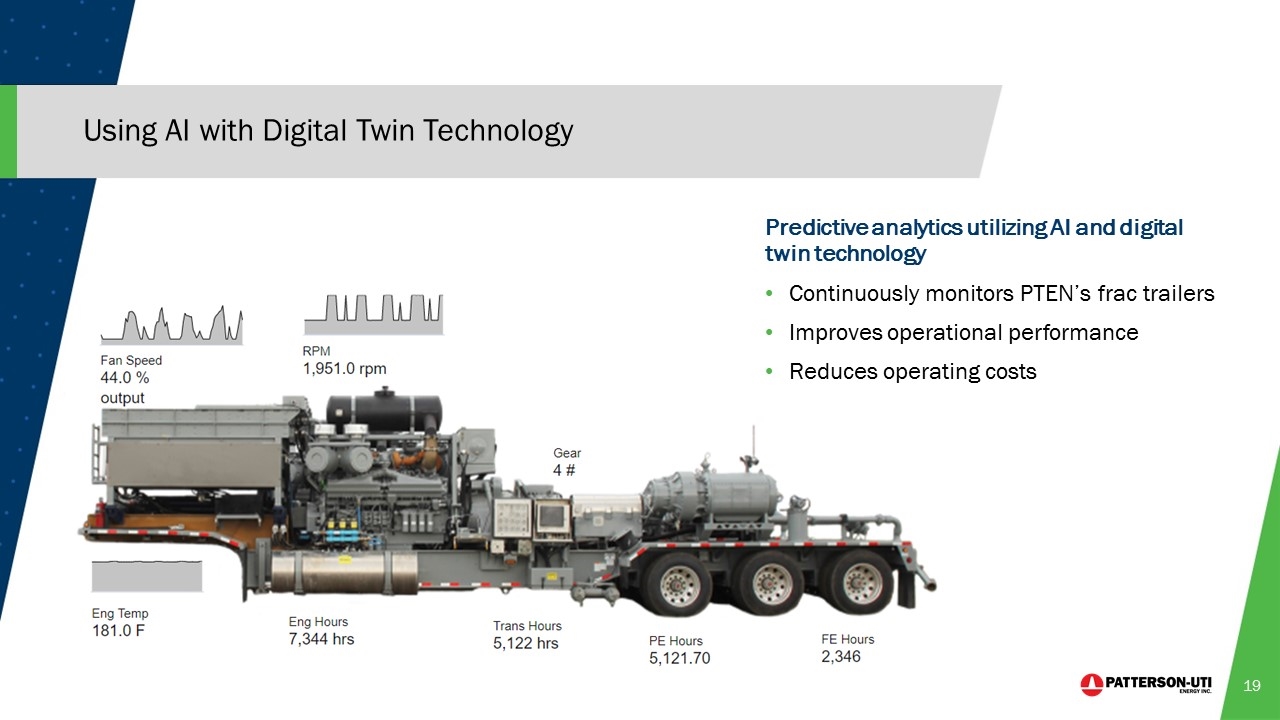

Using AI with Digital Twin Technology Predictive analytics utilizing AI and digital twin technology Continuously monitors PTEN’s frac trailers Improves operational performance Reduces operating costs

ENVIRONMENTAL AND SOCIAL RESPONSIBILITY

Patterson-UTI Core Values Safety and Environment We believe that the safety of our employees and the protection of our environment is a cornerstone Operational Excellence We deliver high-quality, value-added services and focus on innovative solutions in all aspects of our work Honesty and Integrity We will act with honesty and integrity in everything we do Respectful Workplace We are committed to providing a working environment that is inclusive, respectful, and supportive Development of our People We are committed to the growth and development of every employee Profitable Business We are committed to delivering superior returns

Environmental Air Quality We utilize natural gas engines, dual-fuel equipment and other technologies that reduce our air emissions Water Quality We strive to conduct our drilling and completion activities in a manner that protects the quality of ground and surface water Land Use We employ spill prevention plans and use additional protective measures in environmentally sensitive areas

Social Our people are our most important asset and our greatest strength Health and Safety Our goal is to provide an incident-free work environment. The safety of our employees and others is our highest priority Diversity and Inclusion We are committed to fostering a work environment where all people feel valued and respected We embrace our diversity of people, thoughts and talents, and combine these strengths to pursue extraordinary results for PTEN, our employees and our stockholders

Patterson-UTI Energy, Inc. Contract Drilling Originally founded in 1978, Patterson-UTI’s contract drilling business is a leading provider of super-spec drilling rigs with a large footprint across U.S. drilling markets. Pressure Pumping A leading provider of hydraulic fracturing services across Texas, Appalachia, and the Mid-Continent. Directional Drilling MS Directional offers a comprehensive suite of directional drilling services including directional drilling, downhole performance motors, and measurement while drilling ("MWD"). Superior QC provides advanced drilling analytics software to improve accuracy of horizontal wellbore placement.

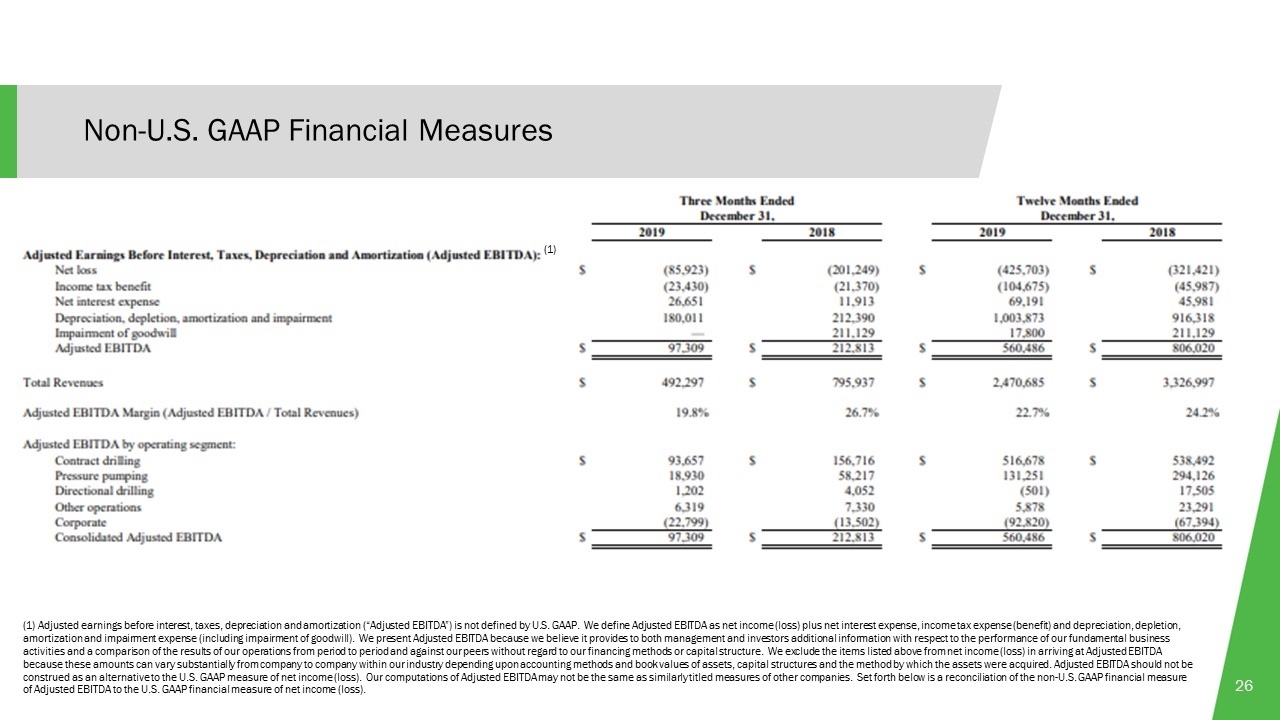

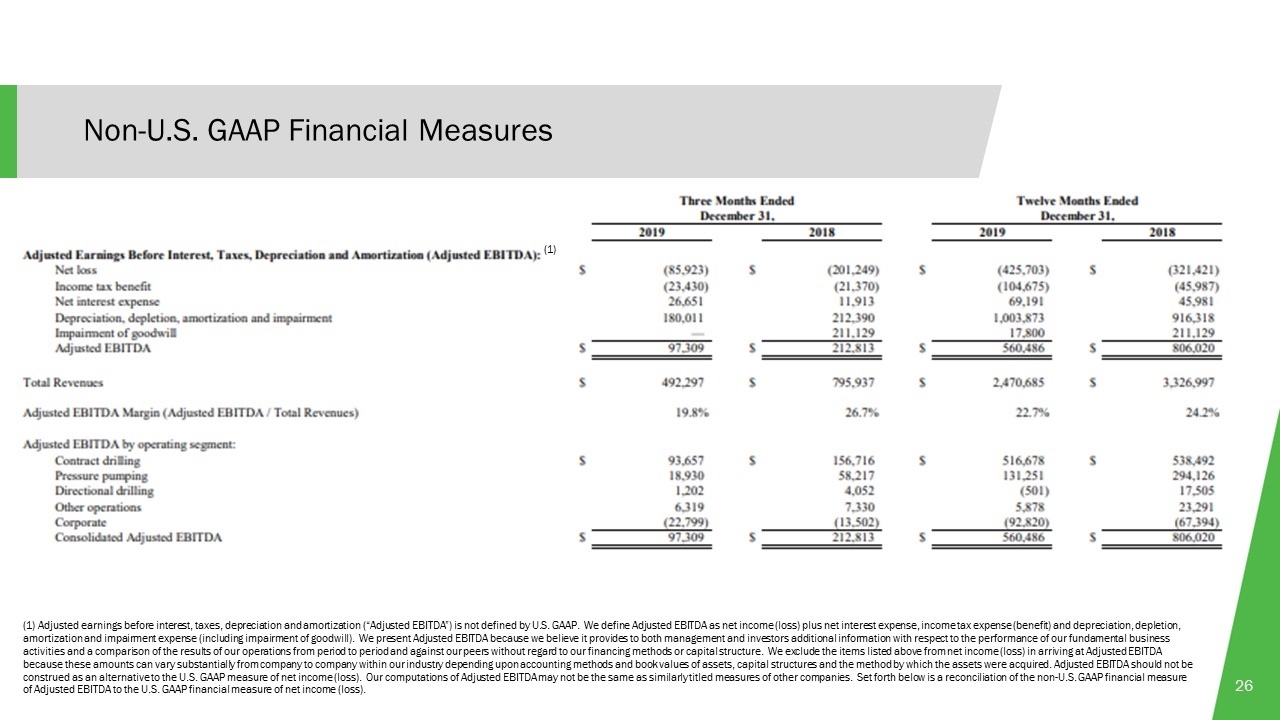

Non-U.S. GAAP Financial Measures (1) Adjusted earnings before interest, taxes, depreciation and amortization (“Adjusted EBITDA”) is not defined by U.S. GAAP. We define Adjusted EBITDA as net income (loss) plus net interest expense, income tax expense (benefit) and depreciation, depletion, amortization and impairment expense (including impairment of goodwill). We present Adjusted EBITDA because we believe it provides to both management and investors additional information with respect to the performance of our fundamental business activities and a comparison of the results of our operations from period to period and against our peers without regard to our financing methods or capital structure. We exclude the items listed above from net income (loss) in arriving at Adjusted EBITDA because these amounts can vary substantially from company to company within our industry depending upon accounting methods and book values of assets, capital structures and the method by which the assets were acquired. Adjusted EBITDA should not be construed as an alternative to the U.S. GAAP measure of net income (loss). Our computations of Adjusted EBITDA may not be the same as similarly titled measures of other companies. Set forth below is a reconciliation of the non-U.S. GAAP financial measure of Adjusted EBITDA to the U.S. GAAP financial measure of net income (loss). (1)