For further information:

Media Contact:

Amy Yuhn

312-564-1378

ayuhn@theprivatebank.com

Investor Relations Contact:

Sarah Lewensohn

312-564-3894

slewensohn@theprivatebank.com

PrivateBancorp Reports First Quarter 2014 Earnings

Earnings per share of $0.44 for first quarter 2014, up 26 percent from first quarter 2013 and 2 percent from fourth quarter 2013

CHICAGO, April 17, 2014 - PrivateBancorp, Inc. (NASDAQ: PVTB) today reported net income of $34.5 million or $0.44 per diluted share for the first quarter 2014, compared to $27.3 million or $0.35 per diluted share for the first quarter 2013 and $33.7 million or $0.43 per diluted share for the fourth quarter 2013.

“We have built a strong commercial banking platform that drove us to our ninth-consecutive quarter of net income growth,” said Larry D. Richman, President and Chief Executive Officer, PrivateBancorp, Inc. “First quarter net income increased 27 percent from a year ago, largely on the significant improvement in credit quality we have achieved over the last year. Our loan growth continued as commercial and industrial loans drove a $281 million net increase in total loans from the prior quarter. We have a strong team in place and I am confident in our ability to both capture new market share and to expand our business with our growing client base in this gradually improving economy.”

First Quarter 2014 Highlights

| |

| • | Return on average common equity improved to 10.5 percent and return on average assets improved to 1.0 percent for the first quarter 2014. |

| |

| • | Net revenue was $135.8 million, up $1.5 million from the first quarter 2013 and comparable to the fourth quarter 2013, as loan growth and lower funding costs offset the impact of declining loan yields and lower noninterest income. |

| |

| • | Operating profit of $60.0 million was $4.7 million higher than first quarter 2013 and comparable to the fourth quarter 2013. The increase relative to the first quarter 2013 was driven by lower noninterest expense, primarily the result of a decline in credit costs. |

| |

| • | Total loans grew to $10.9 billion, up 9 percent from a year ago and 3 percent from December 31, 2013, primarily driven by commercial and industrial loans to new clients. |

| |

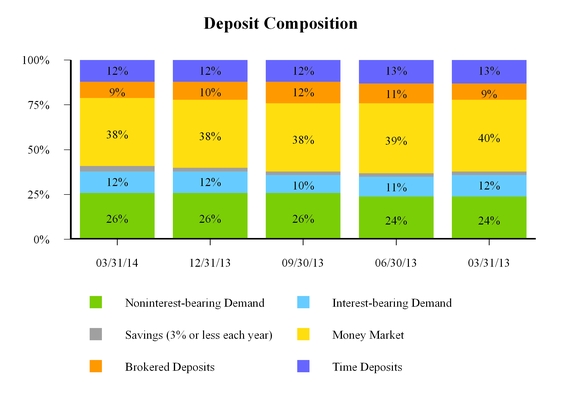

| • | Total deposits were $11.9 billion, compared to $11.4 billion as of March 31, 2013, and $12.0 billion as of December 31, 2013. The loan-to-deposit ratio was 92 percent, as compared to 88 percent as of March 31, 2013, and 89 percent as of December 31, 2013. |

| |

| • | Net interest margin was 3.23 percent, up 5 basis points from the fourth quarter 2013. The benefits of lower funding costs, reduced liquidity and interest recoveries on non-accrual loans overcame the impact of continued pricing pressure. |

| |

| • | Provision for loan losses was $3.4 million, compared to $10.1 million for the first quarter 2013 and $4.9 million for the fourth quarter 2013, reflecting above average recoveries for the second consecutive quarter. |

Operating Performance

Net interest income was $108.8 million in the first quarter 2014, an increase of 6 percent compared to the first quarter 2013, and comparable to the fourth quarter 2013, despite two fewer days in the first quarter. Compared to the previous periods, interest income benefited from higher average loan balances, while the competitive lending environment continued to put pressure on loan yields. Interest expense declined compared to the previous periods, reflecting lower deposit costs and a full quarter’s benefit of the prepayment of a subordinated debt facility in the fourth quarter 2013. Net interest margin was 3.23 percent in the first quarter 2014, compared to 3.18 percent in the fourth quarter 2013. Lower funding costs, reduced excess liquidity and interest recoveries on nonaccrual loans in the quarter offset continued pricing pressure.

Noninterest income was $26.2 million in the first quarter 2014, down $4.2 million compared to the first quarter 2013, primarily due to lower mortgage banking revenue and other income, as the prior year quarter included a $1.1 million gain on loan sale. Noninterest income was $26.7 million in the fourth quarter 2013.

Asset management revenue was $4.3 million for the first quarter 2014, compared to $4.4 million for the first quarter 2013 and $4.6 million for the fourth quarter 2013. The prior periods included fees generated by the investment management subsidiary sold at year-end. Assets under management and administration were $6.0 billion as of March 31, 2014, compared to $5.5 billion a year ago and $5.7 billion as of December 31, 2013, benefiting from growth in both managed and custody assets.

Capital markets revenue of $4.1 million declined from $5.7 million in the fourth quarter 2013. Excluding the impact of CVA in the quarter, capital markets revenue was $4.1 million, a decrease of $952,000 from the previous quarter, reflecting lower demand given the outlook for interest rates. Treasury management fees of $6.6 million grew 4 percent from the previous quarter, benefiting in part from new credit relationships. Syndication fees were $3.3 million, up $1.2 million compared to the fourth quarter 2013, as syndication activity increased from a typically slow fourth quarter.

Expenses

Noninterest expense was $75.8 million in the first quarter 2014, a decline of 4 percent from the first quarter 2013 and comparable to the fourth quarter 2013. Noninterest expense largely benefited from continued declines in credit-related costs. Net foreclosed property expense declined $3.8 million from the first quarter 2013 and $777,000 from the fourth quarter 2013, a result of reduced foreclosed property (“OREO”). Loan and collection expense was down $1.7 million from the first quarter 2013 and $1.3 million from the fourth quarter 2013, a result of reduced mortgage activity and lower workout-related costs.

Salary and employee benefits expense increased 3 percent from the first quarter 2013 and 5 percent from the fourth quarter 2013. Compared to the previous quarter, salary and benefits expense included seasonally higher payroll taxes and benefits, annual salary adjustments that went into effect during the quarter and a lower bonus accrual. Marketing expense, while up slightly compared to the first quarter 2013, declined $1.2 million compared to the fourth quarter 2013, reflecting seasonally lower advertising activity. The efficiency ratio was 55.8 percent in the first quarter 2014, compared to 58.8 percent in the first quarter 2013 and 55.7 percent in the fourth quarter 2013.

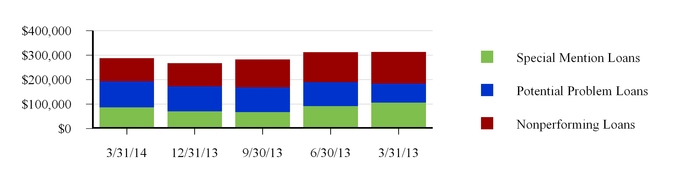

Credit Quality

Credit quality was in line with the previous quarter. Nonperforming assets were 0.82 percent of total assets at March 31, 2014, down from 1.51 percent at March 31, 2013, and 0.87 percent at December 31, 2013, largely due to OREO dispositions. At March 31, 2014, OREO was $23.6 million, down $50.3 million from March 31, 2013, and $5.0 million from December 31, 2013.

The allowance for loan losses as a percentage of total loans was 1.34 percent at March 31, 2014, and December 31, 2013. Provision for loan losses was $3.4 million for the first quarter 2014 compared to $4.9 million for the fourth quarter 2013. The current period provision was impacted by loan growth, changes in the composition of the loan portfolio and larger than average recoveries exceeding charge-offs. In the first quarter 2014, total charge-offs were $4.9 million, compared to $19.5 million for the first quarter 2013 and $11.4 million for the fourth quarter 2013.

Credit quality results exclude covered assets acquired through an FDIC-assisted transaction that are subject to a loss sharing agreement.

Balance Sheet

Total assets were $14.3 billion at March 31, 2014, up compared to $13.4 billion at March 31, 2013, and $14.1 billion at December 31, 2013. Total loans of $10.9 billion grew $891.2 million, or 9 percent, from March 31, 2013, and $281.0 million, or 3 percent, from the previous quarter end, benefiting largely from net loan growth of commercial and industrial and construction loans. At March 31, 2014, total commercial loans comprised 68 percent of total loans, up from 65 percent a year ago, and total commercial real estate and construction loans comprised 26 percent of total loans, down slightly from 27 percent at March 31, 2013. The Company's investment securities portfolio was $2.6 billion at March 31, 2014, up 8 percent from March 31, 2013, and 3 percent from December 31, 2013.

Total liabilities were $13.0 billion at March 31, 2014, up compared to $12.1 billion at March 31, 2013, and $12.8 billion compared to December 31, 2013. Total deposits were $11.9 billion at March 31, 2014, an increase of $493.9 million, or 4 percent, from March 31, 2013, and a decline of $127.5 million, or 1 percent, from December 31, 2013. At March 31, 2014, the loan-to-deposit ratio was 91.9 percent.

Noninterest bearing demand deposits comprised 26 percent of total deposits at March 31, 2014, as compared to 24 percent at March 31, 2013, and 26 percent at December 31, 2013.

Capital

As of March 31, 2014, the total risk-based capital ratio was 13.39 percent, the Tier 1 risk-based capital ratio was 11.19 percent, and the leverage ratio was 10.60 percent. The Tier 1 common capital ratio was 9.33 percent (excluding the effect of the final Basel III capital rules that go into effect January 2015) and the tangible common equity ratio was 8.74 percent at the end of the first quarter 2014.

Quarterly Conference Call and Webcast Presentation

PrivateBancorp will host a conference call Thursday, April 17, 2014, at 10 a.m. CDT. The call may be accessed by telephone at (888) 782-9127 (U.S. and Canada) or (706) 634-5643 (International) and entering passcode #15890768. A live webcast of the call can be accessed on the Company website at: investor.theprivatebank.com by visiting the Investor Relations tab under the About Us section. A rebroadcast will be available beginning approximately two hours after the call until midnight April 30, 2014, by calling (855) 859-2056 (U.S. and Canada) or (404) 537-3406 (International) and entering passcode #15890768.

About PrivateBancorp, Inc.

PrivateBancorp, Inc., through its subsidiaries, delivers customized business and personal financial services to middle-market companies, as well as business owners, executives, entrepreneurs and families in all of the markets and communities we serve. As of March 31, 2014, the Company had 33 offices in 10 states and $14.3 billion in assets. The Company’s website is www.theprivatebank.com.

Forward-Looking Statements

Statements made in this press release that are not historical facts may constitute forward-looking statements within the meaning of federal securities laws. Our ability to predict results or the actual effects of future plans, strategies or events is inherently uncertain. Factors which could cause actual results to differ from those reflected in forward-looking statements include:

| |

| • | continued uncertainty regarding U.S. and global economic outlook that may impact market conditions or prolong weakness in demand for certain banking products and services; |

| |

| • | unanticipated developments in pending or prospective loan transactions or greater than expected paydowns or payoffs of existing loans; |

| |

| • | unanticipated changes in interest rates; |

| |

| • | competitive pressures in the financial services industry that may affect the pricing of the Company’s loan and deposit products as well as its services; |

| |

| • | unforeseen credit quality problems or changing economic conditions that could result in charge-offs greater than we have anticipated in our allowance for loan losses or changes in value of our investments; |

| |

| • | lack of sufficient or cost-effective sources of liquidity or funding as and when needed; |

| |

| • | loss of key personnel or an inability to recruit and retain appropriate talent; |

| |

| • | potential impact of adapting to the new capital standards and capital stress testing requirements; |

| |

| • | greater than anticipated impact on costs, revenues and offered products and services associated with the implementation of other regulatory changes; or |

| |

| • | failures or disruptions to our data processing or other information or operational systems, including the potential impact of disruptions or breaches at our third party service providers. |

These factors should be considered in evaluating forward-looking statements and undue reliance should not be placed on our forward-looking statements. Readers should also consider the risks, assumptions and uncertainties set forth in the "Risk Factors" section of our Form 10-K for the year ended December 31, 2013, as well as those set forth in our subsequent periodic and current reports filed with the SEC. Forward-looking statements speak only as of the date they are made and we assume no obligation to update any of these statements in light of new information, future events or otherwise unless required under the federal securities laws.

Non-U.S. GAAP Financial Measures

This press release contains both financial measures based on accounting principles generally accepted in the United States (U.S. GAAP) and non-U.S. GAAP based financial measures. We believe that presenting these non-U.S. GAAP financial measures will provide information useful to investors in understanding our underlying operational performance, our business, and performance trends and facilitates comparisons with the performance of others in the banking industry. If non-U.S. GAAP financial measures are used, the comparable U.S. GAAP financial measure, as well as the reconciliation to the comparable U.S. GAAP financial measure, can be found in this press release. These disclosures should not be viewed as a substitute for operating results determined in accordance with U.S. GAAP, nor are they necessarily comparable to non-U.S. GAAP performance measures that may be presented by other companies.

Editor's Note: Financial highlights attached. Full financial supplement available on the Company's website at investor.theprivatebank.com.

|

| | | | | | | | | | | | | | | | | | | |

| Consolidated Income Statements | | | | | | | | | |

| (Amounts in thousands, except per share data) | | | | | | | | | |

| (Unaudited) | | | | | | | | | |

| | 1Q14 | | 4Q13 | | 3Q13 | | 2Q13 | | 1Q13 |

| Interest Income | | | | | | | | | |

| Loans, including fees | $ | 110,199 |

| | $ | 110,723 |

| | $ | 108,912 |

| | $ | 107,407 |

| | $ | 106,787 |

|

| Federal funds sold and interest-bearing deposits in banks | 142 |

| | 221 |

| | 111 |

| | 112 |

| | 208 |

|

| Securities: | | | | | | | | | |

| Taxable | 13,255 |

| | 13,038 |

| | 12,931 |

| | 12,519 |

| | 12,822 |

|

| Exempt from Federal income taxes | 1,529 |

| | 1,604 |

| | 1,562 |

| | 1,532 |

| | 1,502 |

|

| Other interest income | 33 |

| | 34 |

| | 61 |

| | 62 |

| | 90 |

|

| Total interest income | 125,158 |

| | 125,620 |

| | 123,577 |

| | 121,632 |

| | 121,409 |

|

| Interest Expense | | | | | | | | | |

| Interest-bearing demand deposits | 942 |

| | 1,021 |

| | 1,032 |

| | 1,034 |

| | 1,115 |

|

| Savings deposits and money market accounts | 3,974 |

| | 4,169 |

| | 3,895 |

| | 3,887 |

| | 4,399 |

|

| Brokered and time deposits | 4,806 |

| | 5,062 |

| | 5,014 |

| | 4,956 |

| | 5,129 |

|

| Short-term and secured borrowings | 196 |

| | 161 |

| | 161 |

| | 410 |

| | 118 |

|

| Long-term debt | 6,488 |

| | 6,751 |

| | 7,640 |

| | 7,613 |

| | 7,608 |

|

| Total interest expense | 16,406 |

| | 17,164 |

| | 17,742 |

| | 17,900 |

| | 18,369 |

|

| Net interest income | 108,752 |

| | 108,456 |

| | 105,835 |

| | 103,732 |

| | 103,040 |

|

| Provision for loan and covered loan losses | 3,707 |

| | 4,476 |

| | 8,120 |

| | 8,843 |

| | 10,357 |

|

| Net interest income after provision for loan and covered loan losses | 105,045 |

| | 103,980 |

| | 97,715 |

| | 94,889 |

| | 92,683 |

|

| Non-interest Income | | | | | | | | | |

| Asset management | 4,347 |

| | 4,613 |

| | 4,570 |

| | 4,800 |

| | 4,394 |

|

| Mortgage banking | 1,632 |

| | 1,858 |

| | 2,946 |

| | 3,198 |

| | 4,170 |

|

| Capital markets products | 4,083 |

| | 5,720 |

| | 3,921 |

| | 6,048 |

| | 5,039 |

|

| Treasury management | 6,599 |

| | 6,321 |

| | 6,214 |

| | 6,209 |

| | 5,924 |

|

| Loan, letter of credit and commitment fees | 4,634 |

| | 4,474 |

| | 4,384 |

| | 4,282 |

| | 4,077 |

|

| Syndication fees | 3,313 |

| | 2,153 |

| | 4,322 |

| | 3,140 |

| | 3,832 |

|

| Deposit service charges and fees and other income | 1,297 |

| | 1,322 |

| | 1,298 |

| | 1,196 |

| | 2,391 |

|

| Net securities gains | 331 |

| | 279 |

| | 118 |

| | 136 |

| | 641 |

|

| Total non-interest income | 26,236 |

| | 26,740 |

| | 27,773 |

| | 29,009 |

| | 30,468 |

|

| Non-interest Expense | | | | | | | | | |

| Salaries and employee benefits | 44,620 |

| | 42,575 |

| | 41,360 |

| | 39,854 |

| | 43,140 |

|

| Net occupancy expense | 7,776 |

| | 7,548 |

| | 7,558 |

| | 7,387 |

| | 7,534 |

|

| Technology and related costs | 3,283 |

| | 3,443 |

| | 3,343 |

| | 3,476 |

| | 3,464 |

|

| Marketing | 2,413 |

| | 3,592 |

| | 2,986 |

| | 3,695 |

| | 2,317 |

|

| Professional services | 2,759 |

| | 2,393 |

| | 2,465 |

| | 1,782 |

| | 1,899 |

|

| Outsourced servicing costs | 1,464 |

| | 1,612 |

| | 1,607 |

| | 1,964 |

| | 1,634 |

|

| Net foreclosed property expenses | 2,823 |

| | 3,600 |

| | 4,396 |

| | 5,555 |

| | 6,643 |

|

| Postage, telephone, and delivery | 825 |

| | 845 |

| | 852 |

| | 981 |

| | 843 |

|

| Insurance | 2,903 |

| | 2,934 |

| | 2,590 |

| | 2,804 |

| | 2,539 |

|

| Loan and collection expense | 1,056 |

| | 2,351 |

| | 1,345 |

| | 2,280 |

| | 2,777 |

|

| Other expenses | 5,828 |

| | 4,934 |

| | 2,767 |

| | 7,477 |

| | 6,173 |

|

| Total non-interest expense | 75,750 |

| | 75,827 |

| | 71,269 |

| | 77,255 |

| | 78,963 |

|

| Income before income taxes | 55,531 |

| | 54,893 |

| | 54,219 |

| | 46,643 |

| | 44,188 |

|

| Income tax provision | 21,026 |

| | 21,187 |

| | 21,161 |

| | 17,728 |

| | 16,918 |

|

| Net income available to common stockholders | $ | 34,505 |

| | $ | 33,706 |

| | $ | 33,058 |

| | $ | 28,915 |

| | $ | 27,270 |

|

| Per Common Share Data | | | | | | | | | |

| Basic earnings per share | $ | 0.44 |

| | $ | 0.43 |

| | $ | 0.42 |

| | $ | 0.37 |

| | $ | 0.35 |

|

| Diluted earnings per share | $ | 0.44 |

| | $ | 0.43 |

| | $ | 0.42 |

| | $ | 0.37 |

| | $ | 0.35 |

|

| Cash dividends declared | $ | 0.01 |

| | $ | 0.01 |

| | $ | 0.01 |

| | $ | 0.01 |

| | $ | 0.01 |

|

| Weighted-average common shares outstanding | 76,675 |

| | 76,533 |

| | 76,494 |

| | 76,415 |

| | 76,143 |

|

| Weighted-average diluted common shares outstanding | 77,417 |

| | 76,967 |

| | 76,819 |

| | 76,581 |

| | 76,203 |

|

|

| | | | | | | | | | | | | | | | | | | |

| Consolidated Balance Sheets | | | | | | | | | |

| (Dollars in thousands) | | | | | | | | | |

| | 3/31/14 | | 12/31/13 | | 9/30/13 | | 6/30/13 | | 3/31/13 |

| | (Unaudited) | | (Audited) | | (Unaudited) | | (Unaudited) | | (Unaudited) |

| Assets | | | | | | | | | |

| Cash and due from banks | $ | 233,685 |

| | $ | 133,518 |

| | $ | 247,460 |

| | $ | 150,683 |

| | $ | 118,583 |

|

| Federal funds sold and interest-bearing deposits in banks | 117,446 |

| | 306,544 |

| | 180,608 |

| | 147,699 |

| | 203,647 |

|

| Loans held-for-sale | 26,262 |

| | 26,816 |

| | 27,644 |

| | 34,803 |

| | 38,091 |

|

| Securities available-for-sale, at fair value | 1,577,406 |

| | 1,602,476 |

| | 1,611,022 |

| | 1,580,179 |

| | 1,457,433 |

|

| Securities held-to-maturity, at amortized cost | 1,023,214 |

| | 921,436 |

| | 931,342 |

| | 955,688 |

| | 959,994 |

|

| Federal Home Loan Bank ("FHLB") stock | 30,005 |

| | 30,005 |

| | 34,063 |

| | 34,063 |

| | 34,288 |

|

| Loans – excluding covered assets, net of unearned fees | 10,924,985 |

| | 10,644,021 |

| | 10,409,443 |

| | 10,094,636 |

| | 10,033,803 |

|

| Allowance for loan losses | (146,768 | ) | | (143,109 | ) | | (145,513 | ) | | (148,183 | ) | | (153,992 | ) |

| Loans, net of allowance for loan losses and unearned fees | 10,778,217 |

| | 10,500,912 |

| | 10,263,930 |

| | 9,946,453 |

| | 9,879,811 |

|

| Covered assets | 94,349 |

| | 112,746 |

| | 140,083 |

| | 158,326 |

| | 176,855 |

|

| Allowance for covered loan losses | (16,571 | ) | | (16,511 | ) | | (21,653 | ) | | (24,995 | ) | | (24,089 | ) |

| Covered assets, net of allowance for covered loan losses | 77,778 |

| | 96,235 |

| | 118,430 |

| | 133,331 |

| | 152,766 |

|

| Other real estate owned, excluding covered assets | 23,565 |

| | 28,548 |

| | 35,310 |

| | 57,134 |

| | 73,857 |

|

| Premises, furniture, and equipment, net | 39,556 |

| | 39,704 |

| | 36,445 |

| | 37,025 |

| | 38,373 |

|

| Accrued interest receivable | 39,273 |

| | 37,004 |

| | 35,758 |

| | 38,325 |

| | 39,205 |

|

| Investment in bank owned life insurance | 54,184 |

| | 53,865 |

| | 53,539 |

| | 53,216 |

| | 52,873 |

|

| Goodwill | 94,041 |

| | 94,041 |

| | 94,484 |

| | 94,496 |

| | 94,509 |

|

| Other intangible assets | 8,136 |

| | 8,892 |

| | 10,486 |

| | 11,266 |

| | 12,047 |

|

| Derivative assets | 44,528 |

| | 48,422 |

| | 57,771 |

| | 57,361 |

| | 90,303 |

|

| Other assets | 137,486 |

| | 157,328 |

| | 130,848 |

| | 144,771 |

| | 126,450 |

|

| Total assets | $ | 14,304,782 |

| | $ | 14,085,746 |

| | $ | 13,869,140 |

| | $ | 13,476,493 |

| | $ | 13,372,230 |

|

| Liabilities | | | | | | | | | |

| Demand deposits: | | | | | | | | | |

| Noninterest-bearing | $ | 3,103,736 |

| | $ | 3,172,676 |

| | $ | 3,106,986 |

| | $ | 2,736,868 |

| | $ | 2,756,879 |

|

| Interest-bearing | 1,466,095 |

| | 1,470,856 |

| | 1,183,471 |

| | 1,234,134 |

| | 1,390,955 |

|

| Savings deposits and money market accounts | 4,786,398 |

| | 4,799,561 |

| | 4,778,057 |

| | 4,654,930 |

| | 4,741,864 |

|

| Brokered time deposits | 1,097,865 |

| | 1,119,777 |

| | 1,303,596 |

| | 1,190,796 |

| | 983,625 |

|

| Time deposits | 1,432,067 |

| | 1,450,771 |

| | 1,460,446 |

| | 1,491,604 |

| | 1,518,980 |

|

| Total deposits | 11,886,161 |

| | 12,013,641 |

| | 11,832,556 |

| | 11,308,332 |

| | 11,392,303 |

|

| Short-term and secured borrowings | 333,400 |

| | 8,400 |

| | 131,400 |

| | 308,700 |

| | 107,775 |

|

| Long-term debt | 627,793 |

| | 627,793 |

| | 499,793 |

| | 499,793 |

| | 499,793 |

|

| Accrued interest payable | 6,251 |

| | 6,326 |

| | 6,042 |

| | 5,963 |

| | 6,787 |

|

| Derivative liabilities | 40,522 |

| | 48,890 |

| | 55,933 |

| | 62,014 |

| | 84,370 |

|

| Other liabilities | 67,409 |

| | 78,792 |

| | 69,728 |

| | 58,651 |

| | 49,137 |

|

| Total liabilities | 12,961,536 |

| | 12,783,842 |

| | 12,595,452 |

| | 12,243,453 |

| | 12,140,165 |

|

| Equity | | | | | | | | | |

| Common stock: | | | | | | | | | |

| Voting | 75,428 |

| | 75,240 |

| | 75,240 |

| | 75,238 |

| | 73,144 |

|

| Nonvoting | 1,585 |

| | 1,585 |

| | 1,585 |

| | 1,585 |

| | 3,536 |

|

| Treasury stock | (1,697 | ) | | (6,415 | ) | | (7,303 | ) | | (9,001 | ) | | (9,631 | ) |

| Additional paid-in capital | 1,021,436 |

| | 1,022,023 |

| | 1,019,143 |

| | 1,016,615 |

| | 1,014,443 |

|

| Retained earnings | 233,347 |

| | 199,627 |

| | 166,700 |

| | 134,423 |

| | 106,288 |

|

| Accumulated other comprehensive income, net of tax | 13,147 |

| | 9,844 |

| | 18,323 |

| | 14,180 |

| | 44,285 |

|

| Total equity | 1,343,246 |

| | 1,301,904 |

| | 1,273,688 |

| | 1,233,040 |

| | 1,232,065 |

|

| Total liabilities and equity | $ | 14,304,782 |

| | $ | 14,085,746 |

| | $ | 13,869,140 |

| | $ | 13,476,493 |

| | $ | 13,372,230 |

|

|

| | | | | | | | | | | | | | | | | | | | |

| Selected Financial Data | | | | | | | | | | |

| (Amounts in thousands, except per share data) | | | | | | | | | | |

| (Unaudited) | | | | | | | | | | |

| | 1Q14 | | 4Q13 | | 3Q13 | | 2Q13 | | 1Q13 | |

| Selected Statement of Income Data: | | | | | | | | | | |

| Net interest income | $ | 108,752 |

| | $ | 108,456 |

| | $ | 105,835 |

| | $ | 103,732 |

| | $ | 103,040 |

| |

Net revenue (1)(2) | $ | 135,788 |

| | $ | 136,036 |

| | $ | 134,426 |

| | $ | 133,546 |

| | $ | 134,292 |

| |

Operating profit (1)(2) | $ | 60,038 |

| | $ | 60,209 |

| | $ | 63,157 |

| | $ | 56,291 |

| | $ | 55,329 |

| |

| Provision for loan and covered loan losses | $ | 3,707 |

| | $ | 4,476 |

| | $ | 8,120 |

| | $ | 8,843 |

| | $ | 10,357 |

| |

| Income before income taxes | $ | 55,531 |

| | $ | 54,893 |

| | $ | 54,219 |

| | $ | 46,643 |

| | $ | 44,188 |

| |

| Net income available to common stockholders | $ | 34,505 |

| | $ | 33,706 |

| | $ | 33,058 |

| | $ | 28,915 |

| | $ | 27,270 |

| |

| Per Common Share Data: | | | | | | | | | | |

| Basic earnings per share | $ | 0.44 |

| | $ | 0.43 |

| | $ | 0.42 |

| | $ | 0.37 |

| | $ | 0.35 |

| |

| Diluted earnings per share | $ | 0.44 |

| | $ | 0.43 |

| | $ | 0.42 |

| | $ | 0.37 |

| | $ | 0.35 |

| |

| Dividends declared | $ | 0.01 |

| | $ | 0.01 |

| | $ | 0.01 |

| | $ | 0.01 |

| | $ | 0.01 |

| |

Book value (period end) (1) | $ | 17.21 |

| | $ | 16.75 |

| | $ | 16.40 |

| | $ | 15.88 |

| | $ | 15.87 |

| |

Tangible book value (period end) (1)(2) | $ | 15.90 |

| | $ | 15.43 |

| | $ | 15.05 |

| | $ | 14.52 |

| | $ | 14.49 |

| |

| Market value (close) | $ | 30.51 |

| | $ | 28.93 |

| | $ | 21.40 |

| | $ | 21.22 |

| | $ | 18.89 |

| |

| Book value multiple | 1.77 |

| x | 1.73 |

| x | 1.31 |

| x | 1.34 |

| x | 1.19 |

| x |

| Share Data: | | | | | | | | | | |

| Weighted-average common shares outstanding | 76,675 |

| | 76,533 |

| | 76,494 |

| | 76,415 |

| | 76,143 |

| |

| Weighted-average diluted common shares outstanding | 77,417 |

| | 76,967 |

| | 76,819 |

| | 76,581 |

| | 76,203 |

| |

| Common shares issued (period end) | 78,108 |

| | 77,982 |

| | 77,993 |

| | 78,015 |

| | 78,050 |

| |

| Common shares outstanding (period end) | 78,049 |

| | 77,708 |

| | 77,680 |

| | 77,630 |

| | 77,649 |

| |

| Performance Ratio: | | | | | | | | | | |

| Return on average common equity | 10.48 | % | | 10.28 | % | | 10.43 | % | | 9.28 | % | | 9.01 | % | |

| Return on average assets | 1.00 | % | | 0.96 | % | | 0.96 | % | | 0.86 | % | | 0.81 | % | |

Return on average tangible common equity (1)(2) | 11.50 | % | | 11.33 | % | | 11.55 | % | | 10.30 | % | | 10.04 | % | |

Net interest margin (1)(2) | 3.23 | % | | 3.18 | % | | 3.18 | % | | 3.22 | % | | 3.19 | % | |

Fee revenue as a percent of total revenue (1) | 19.24 | % | | 19.61 | % | | 20.72 | % | | 21.77 | % | | 22.45 | % | |

| Non-interest income to average assets | 0.76 | % | | 0.76 | % | | 0.81 | % | | 0.87 | % | | 0.91 | % | |

| Non-interest expense to average assets | 2.19 | % | | 2.16 | % | | 2.07 | % | | 2.31 | % | | 2.35 | % | |

Net overhead ratio (1) | 1.43 | % | | 1.40 | % | | 1.26 | % | | 1.44 | % | | 1.44 | % | |

Efficiency ratio (1)(2) | 55.79 | % | | 55.74 | % | | 53.02 | % | | 57.85 | % | | 58.80 | % | |

| Balance Sheet Ratios: | | | | | | | | | | |

Loans to deposits (period end) (3) | 91.91 | % | | 88.60 | % | | 87.97 | % | | 89.27 | % | | 88.08 | % | |

| Average interest-earning assets to average interest-bearing liabilities | 143.43 | % | | 144.87 | % | | 140.72 | % | | 139.76 | % | | 141.21 | % | |

| Capital Ratios (period end): | | | | | | | | | | |

Total risk-based capital (1) | 13.39 | % | | 13.30 | % | | 13.48 | % | | 13.70 | % | | 13.58 | % | |

Tier 1 risk-based capital (1) | 11.19 | % | | 11.08 | % | | 11.05 | % | | 11.04 | % | | 10.90 | % | |

Tier 1 leverage ratio (1) | 10.60 | % | | 10.37 | % | | 10.32 | % | | 10.25 | % | | 9.86 | % | |

Tier 1 common equity to risk-weighted assets (1)(2)(4) | 9.33 | % | | 9.19 | % | | 9.11 | % | | 9.05 | % | | 8.89 | % | |

Tangible common equity to tangible assets (1)(2) | 8.74 | % | | 8.57 | % | | 8.49 | % | | 8.43 | % | | 8.48 | % | |

| Total equity to total assets | 9.39 | % | | 9.24 | % | | 9.18 | % | | 9.15 | % | | 9.21 | % | |

| |

(1) | Refer to Glossary of Terms for definition. |

| |

(2) | This is a non-U.S. GAAP financial measure. Refer to "Non-U.S. GAAP Financial Measures" for a reconciliation from non-U.S. GAAP to U.S. GAAP. |

| |

(3) | Excludes covered assets. Refer to Glossary of Terms for definition. |

| |

(4) | For purposes of our presentation, we calculate this ratio under currently effective requirements and without giving effect to the final Basel III capital rules adopted and issued by the Federal Reserve Board in July 2013, which are effective January 1, 2014 with compliance required January 1, 2015. |

|

| | | | | | | | | | | | | | | | | | | |

| Selected Financial Data (continued) | | | | | | | | | |

| (Dollars in thousands) | | | | | | | | | |

| (Unaudited) | | | | | | | | | |

| | | | | | | | | | |

| | 1Q14 | | 4Q13 | | 3Q13 | | 2Q13 | | 1Q13 |

| Additional Selected Information: | | | | | | | | | |

(Increase) decrease credit valuation adjustment on capital markets derivatives (1) | $ | (66 | ) | | $ | 619 |

| | $ | (521 | ) | | $ | 1,882 |

| | $ | 246 |

|

| Salaries and employee benefits: | | | | | | | | | |

| Salaries and wages | $ | 24,973 |

| | $ | 23,971 |

| | $ | 23,639 |

| | $ | 23,397 |

| | $ | 24,015 |

|

| Share-based costs | 3,685 |

| | 3,316 |

| | 3,261 |

| | 3,236 |

| | 2,863 |

|

| Incentive compensation, retirement costs and other employee benefits | 15,962 |

| | 15,288 |

| | 14,460 |

| | 13,221 |

| | 16,262 |

|

| Total salaries and employee benefits | $ | 44,620 |

| | $ | 42,575 |

| | $ | 41,360 |

| | $ | 39,854 |

| | $ | 43,140 |

|

| | | | | | | | | | |

| Provision (release) for unfunded commitments | $ | 496 |

| | $ | 1,019 |

| | $ | (1,346 | ) | | $ | 467 |

| | $ | 1,723 |

|

| | | | | | | | | | |

Assets under management and administration (AUMA) (1) | $ | 6,036,381 |

| | $ | 5,731,980 |

| | $ | 5,570,614 |

| | $ | 5,427,498 |

| | $ | 5,515,199 |

|

| Custody assets included in AUMA | $ | 2,663,502 |

| | $ | 2,506,291 |

| | $ | 2,427,093 |

| | $ | 2,351,163 |

| | $ | 2,438,600 |

|

|

| | | | | | | | | | | | | | | | | | | |

| Basic and Diluted Earnings per Common Share | | | | | | | | | |

| (Amounts in thousands, except per share data) | | | | | | | | | |

| | | | | | | | | | |

| | 1Q14 | | 4Q13 | | 3Q13 | | 2Q13 | | 1Q13 |

| Basic earnings per common share | | | | | | | | | |

| Net income available to common stockholders | $ | 34,505 |

| | $ | 33,706 |

| | $ | 33,058 |

| | $ | 28,915 |

| | $ | 27,270 |

|

Earnings allocated to participating stockholders (2) | (613 | ) | | (664 | ) | | (655 | ) | | (576 | ) | | (538 | ) |

| Earnings allocated to common stockholders | $ | 33,892 |

| | $ | 33,042 |

| | $ | 32,403 |

| | $ | 28,339 |

| | $ | 26,732 |

|

| Weighted-average common shares outstanding | 76,675 |

| | 76,533 |

| | 76,494 |

| | 76,415 |

| | 76,143 |

|

| Basic earnings per common share | $ | 0.44 |

| | $ | 0.43 |

| | $ | 0.42 |

| | $ | 0.37 |

| | $ | 0.35 |

|

| Diluted earnings per common share | | | | | | | | | |

Diluted earnings applicable to common stockholders (3) | $ | 33,897 |

| | $ | 33,046 |

| | $ | 32,406 |

| | $ | 28,340 |

| | $ | 26,732 |

|

| Weighted-average diluted common shares outstanding: | | | | | | | | | |

| Weighted-average common shares outstanding | 76,675 |

| | 76,533 |

| | 76,494 |

| | 76,415 |

| | 76,143 |

|

| Dilutive effect of stock awards | 742 |

| | 434 |

| | 325 |

| | 166 |

| | 60 |

|

| Weighted-average diluted common shares outstanding | $ | 77,417 |

| | $ | 76,967 |

| | $ | 76,819 |

| | $ | 76,581 |

| | $ | 76,203 |

|

| Diluted earnings per common share | $ | 0.44 |

| | $ | 0.43 |

| | $ | 0.42 |

| | $ | 0.37 |

| | $ | 0.35 |

|

| |

(1) | Refer to Glossary of Terms for definition. |

| |

(2) | Participating stockholders are those that hold certain share-based payment awards that contain nonforfeitable rights to dividends or dividend equivalents. Such shares or units are considered participating securities (i.e., the Company’s deferred stock units and certain restricted stock units and nonvested restricted stock awards). |

| |

(3) | Earnings allocated to common stockholders for basic and diluted earnings per share may differ under the two-class method as a result of adding common stock equivalents for options to dilutive shares outstanding, which alters the ratio used to allocate earnings to common stockholders and participating securities for the purposes of calculating diluted earnings per share. |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Loan Composition (excluding covered assets (1)) |

| (Dollars in thousands) |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | 3/31/14 | | % of Total | | 12/31/13 | | % of Total | | 9/30/13 | | % of Total | | 6/30/13 | | % of Total | | 3/31/13 | | % of Total |

| | (Unaudited) | | | | (Audited) | | | | (Unaudited) | | | | (Unaudited) | | | | (Unaudited) | | |

| Commercial and industrial | $ | 5,652,008 |

| | 52 | % | | $ | 5,457,574 |

| | 51 | % | | $ | 5,384,222 |

| | 52 | % | | $ | 5,019,494 |

| | 50 | % | | $ | 4,951,951 |

| | 49 | % |

| Commercial - owner-occupied CRE | 1,744,940 |

| | 16 | % | | 1,674,260 |

| | 16 | % | | 1,604,470 |

| | 15 | % | | 1,641,973 |

| | 16 | % | | 1,640,064 |

| | 16 | % |

| Total commercial | 7,396,948 |

| | 68 | % | | 7,131,834 |

| | 67 | % | | 6,988,692 |

| | 67 | % | | 6,661,467 |

| | 66 | % | | 6,592,015 |

| | 65 | % |

| Commercial real estate | 1,974,534 |

| | 18 | % | | 1,987,307 |

| | 19 | % | | 1,914,725 |

| | 18 | % | | 1,981,541 |

| | 20 | % | | 2,002,833 |

| | 20 | % |

| Commercial real estate - multi-family | 524,872 |

| | 5 | % | | 513,194 |

| | 5 | % | | 573,371 |

| | 6 | % | | 520,160 |

| | 5 | % | | 517,418 |

| | 5 | % |

| Total commercial real estate | 2,499,406 |

| | 23 | % | | 2,500,501 |

| | 24 | % | | 2,488,096 |

| | 24 | % | | 2,501,701 |

| | 25 | % | | 2,520,251 |

| | 25 | % |

| Construction | 335,476 |

| | 3 | % | | 293,387 |

| | 3 | % | | 237,440 |

| | 3 | % | | 211,976 |

| | 2 | % | | 174,077 |

| | 2 | % |

| Residential real estate | 337,832 |

| | 3 | % | | 341,868 |

| | 3 | % | | 346,619 |

| | 3 | % | | 347,629 |

| | 3 | % | | 368,569 |

| | 4 | % |

| Home equity | 147,574 |

| | 1 | % | | 149,732 |

| | 1 | % | | 148,058 |

| | 1 | % | | 159,958 |

| | 2 | % | | 162,035 |

| | 2 | % |

| Personal | 207,749 |

| | 2 | % | | 226,699 |

| | 2 | % | | 200,538 |

| | 2 | % | | 211,905 |

| | 2 | % | | 216,856 |

| | 2 | % |

| Total loans | $ | 10,924,985 |

| | 100 | % | | $ | 10,644,021 |

| | 100 | % | | $ | 10,409,443 |

| | 100 | % | | $ | 10,094,636 |

| | 100 | % | | $ | 10,033,803 |

| | 100 | % |

| |

(1) | Refer to Glossary of Terms for definition. |

|

| | | | | | | | | | | | | |

Commercial Loans Composition by Industry Segment (excluding covered assets (1)) |

| (Dollars in thousands) |

| (Unaudited) |

| (Classified pursuant to the North American Industrial Classification System standard industry descriptions and represents our client's primary business activity) |

| | March 31, 2014 | | December 31, 2013 |

| | Amount | | % of Total | | Amount | | % of Total |

| Manufacturing | $ | 1,693,837 |

| | 23 | % | | $ | 1,583,679 |

| | 22 | % |

| Healthcare | 1,733,221 |

| | 23 | % | | 1,653,596 |

| | 23 | % |

| Wholesale trade | 680,930 |

| | 9 | % | | 695,049 |

| | 10 | % |

| Finance and insurance | 619,757 |

| | 8 | % | | 643,119 |

| | 9 | % |

| Real estate, rental and leasing | 461,619 |

| | 6 | % | | 444,210 |

| | 6 | % |

| Professional, scientific and technical services | 462,657 |

| | 7 | % | | 454,373 |

| | 7 | % |

| Administrative, support, waste management and remediation services | 433,379 |

| | 6 | % | | 449,777 |

| | 6 | % |

| Architecture, engineering and construction | 258,868 |

| | 3 | % | | 249,444 |

| | 4 | % |

| Retail | 263,924 |

| | 4 | % | | 223,541 |

| | 3 | % |

All other (2) | 788,756 |

| | 11 | % | | 735,046 |

| | 10 | % |

Total commercial (3) | $ | 7,396,948 |

| | 100 | % | | $ | 7,131,834 |

| | 100 | % |

|

| | | | | | | | | | | | | |

| Commercial Real Estate and Construction Loan Portfolio by Collateral Type |

| (Unaudited) |

| | March 31, 2014 | | December 31, 2013 |

| | Amount | | % of Total | | Amount | | % of Total |

| Commercial Real Estate Portfolio | | | | |

| Land | $ | 205,705 |

| | 8 | % | | $ | 216,176 |

| | 9 | % |

| Residential 1-4 family | 99,917 |

| | 4 | % | | 103,568 |

| | 4 | % |

| Multi-family | 524,872 |

| | 21 | % | | 513,194 |

| | 20 | % |

| Industrial/warehouse | 275,065 |

| | 11 | % | | 271,230 |

| | 11 | % |

| Office | 461,379 |

| | 18 | % | | 470,790 |

| | 19 | % |

| Retail | 494,728 |

| | 20 | % | | 490,955 |

| | 19 | % |

| Healthcare | 150,528 |

| | 6 | % | | 167,226 |

| | 7 | % |

| Mixed use/other | 287,212 |

| | 12 | % | | 267,362 |

| | 11 | % |

| Total commercial real estate | $ | 2,499,406 |

| | 100 | % | | $ | 2,500,501 |

| | 100 | % |

| Construction Portfolio | | | | |

| Residential 1-4 family | $ | 22,880 |

| | 7 | % | | $ | 20,960 |

| | 7 | % |

| Multi-family | 88,075 |

| | 26 | % | | 58,131 |

| | 20 | % |

| Industrial/warehouse | 20,054 |

| | 6 | % | | 29,343 |

| | 10 | % |

| Office | 23,375 |

| | 7 | % | | 20,596 |

| | 7 | % |

| Retail | 89,397 |

| | 27 | % | | 83,640 |

| | 28 | % |

| Healthcare | 60,234 |

| | 18 | % | | 43,506 |

| | 15 | % |

| Mixed use/other | 31,461 |

| | 9 | % | | 37,211 |

| | 13 | % |

| Total construction | $ | 335,476 |

| | 100 | % | | $ | 293,387 |

| | 100 | % |

| |

(1) | Refer to Glossary of Terms for definition. |

| |

(2) | All other consists of numerous smaller balances across a variety of industries with no category greater than 3%. |

| |

(3) | Includes owner-occupied commercial real estate of $1.7 billion at March 31, 2014 and $1.7 billion at December 31, 2013. |

|

| | | | | | | | | | | | | | | | | | | |

Asset Quality (excluding covered assets (1)) | | | | | | | | | |

| (Dollars in thousands) | | | | | | | | | |

| (Unaudited) | | | | | | | | | |

| | 1Q14 | | 4Q13 | | 3Q13 | | 2Q13 | | 1Q13 |

| Credit Quality Key Ratios | | | | | | | | | |

| Net (recoveries) charge-offs (annualized) to average loans | -0.01 | % | | 0.28 | % | | 0.40 | % | | 0.56 | % | | 0.70 | % |

| Nonperforming loans to total loans | 0.86 | % | | 0.89 | % | | 1.09 | % | | 1.20 | % | | 1.28 | % |

| Nonperforming loans to total assets | 0.66 | % | | 0.67 | % | | 0.82 | % | | 0.90 | % | | 0.96 | % |

| Nonperforming assets to total assets | 0.82 | % | | 0.87 | % | | 1.07 | % | | 1.33 | % | | 1.51 | % |

| Allowance for loan losses to: | | | | | | | | | |

| Total loans | 1.34 | % | | 1.34 | % | | 1.40 | % | | 1.47 | % | | 1.53 | % |

| Nonperforming loans | 156 | % | | 152 | % | | 128 | % | | 122 | % | | 120 | % |

| Nonperforming assets | | | | | | | | | |

| Loans past due 90 days and accruing | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

|

| Nonaccrual loans | 93,827 |

| | 94,238 |

| | 113,286 |

| | 121,759 |

| | 128,657 |

|

| OREO | 23,565 |

| | 28,548 |

| | 35,310 |

| | 57,134 |

| | 73,857 |

|

| Total nonperforming assets | $ | 117,392 |

| | $ | 122,786 |

| | $ | 148,596 |

| | $ | 178,893 |

| | $ | 202,514 |

|

| Restructured loans accruing interest | $ | 26,462 |

| | $ | 20,176 |

| | $ | 32,343 |

| | $ | 48,281 |

| | $ | 46,591 |

|

| Loans past due and still accruing | | | | | | | | | |

| 30-59 days | $ | 4,296 |

| | $ | 7,854 |

| | $ | 3,602 |

| | $ | 7,750 |

| | $ | 14,135 |

|

| 60-89 days | $ | 8,791 |

| | $ | 1,016 |

| | $ | 3,000 |

| | $ | 3,016 |

| | $ | 7,036 |

|

| Total loans past due and still accruing | $ | 13,087 |

| | $ | 8,870 |

| | $ | 6,602 |

| | $ | 10,766 |

| | $ | 21,171 |

|

| Special mention loans | $ | 87,329 |

| | $ | 71,257 |

| | $ | 67,518 |

| | $ | 92,880 |

| | $ | 106,446 |

|

| Potential problem loans | $ | 106,474 |

| | $ | 101,772 |

| | $ | 101,324 |

| | $ | 97,196 |

| | $ | 78,185 |

|

| | | | | | | | | | |

| | | | | | | | | | |

| Nonperforming Loans Rollforward | | | | | | | | | |

| Beginning balance | $ | 94,238 |

| | $ | 113,286 |

| | $ | 121,759 |

| | $ | 128,657 |

| | $ | 138,780 |

|

| Additions: | | | | | | | | | |

| New nonaccrual loans | 14,882 |

| | 20,082 |

| | 25,642 |

| | 26,190 |

| | 31,331 |

|

| Reductions: | | | | | | | | | |

| Return to performing status | (119 | ) | | (370 | ) | | — |

| | (2,288 | ) | | — |

|

| Paydowns and payoffs, net of advances | (3,326 | ) | | (16,464 | ) | | (12,205 | ) | | (246 | ) | | (885 | ) |

| Net sales | (6,327 | ) | | (4,438 | ) | | (1,119 | ) | | (12,601 | ) | | (12,809 | ) |

| Transfer to OREO | (689 | ) | | (6,642 | ) | | (1,036 | ) | | (3,366 | ) | | (6,266 | ) |

| Transfer to loans held for sale | — |

| | — |

| | (7,359 | ) | | — |

| | (2,240 | ) |

| Charge-offs | (4,832 | ) | | (11,216 | ) | | (12,396 | ) | | (14,587 | ) | | (19,254 | ) |

| Total reductions | (15,293 | ) | | (39,130 | ) | | (34,115 | ) | | (33,088 | ) | | (41,454 | ) |

| Balance at end of period | $ | 93,827 |

| | $ | 94,238 |

| | $ | 113,286 |

| | $ | 121,759 |

| | $ | 128,657 |

|

| | | | | | | | | | |

| | | | | | | | | | |

| OREO Rollforward | | | | | | | | | |

| Beginning balance | $ | 28,548 |

| | $ | 35,310 |

| | $ | 57,134 |

| | $ | 73,857 |

| | $ | 81,880 |

|

| New foreclosed properties | 689 |

| | 6,642 |

| | 1,036 |

| | 3,366 |

| | 6,266 |

|

| Valuation adjustments | (1,463 | ) | | (3,138 | ) | | (5,734 | ) | | (6,128 | ) | | (4,458 | ) |

| Disposals: | | | | | | | | | |

| Sales proceeds | (3,892 | ) | | (10,273 | ) | | (18,902 | ) | | (14,677 | ) | | (9,067 | ) |

| Net (loss) gains on sale | (317 | ) | | 7 |

| | 1,776 |

| | 716 |

| | (764 | ) |

| Balance at end of period | $ | 23,565 |

| | $ | 28,548 |

| | $ | 35,310 |

| | $ | 57,134 |

| | $ | 73,857 |

|

| | | | | | | | | | |

| |

(1) | Refer to Glossary of Terms for definition. |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Asset Quality (excluding covered assets (1)) |

| (Dollars in thousands) | | | | | | | | | | | | | | | | |

| (Unaudited) | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Credit Quality Indicators |

| | Special Mention Loans | | % of Portfolio Loan Type | | | Potential Problem Loans | | % of Portfolio Loan Type | | | Non-Performing Loans | | % of Portfolio Loan Type | | | Total Loans |

| March 31, 2014 | | | | | | | | | | | | | | | | |

| Commercial | $ | 79,362 |

| | 1.1 | % | | | $ | 92,962 |

| | 1.3 | % | | | $ | 31,074 |

| | 0.4 | % | | | $ | 7,396,948 |

|

| Commercial real estate | 1,004 |

| | * |

| | | 4,677 |

| | 0.2 | % | | | 40,928 |

| | 1.6 | % | | | 2,499,406 |

|

| Construction | — |

| | — | % | | | — |

| | — | % | | | — |

| | — | % | | | 335,476 |

|

| Residential real estate | 4,000 |

| | 1.2 | % | | | 6,613 |

| | 2.0 | % | | | 9,354 |

| | 2.8 | % | | | 337,832 |

|

| Home equity | 2,774 |

| | 1.9 | % | | | 2,171 |

| | 1.5 | % | | | 11,846 |

| | 8.0 | % | | | 147,574 |

|

| Personal | 189 |

| | 0.1 | % | | | 51 |

| | * |

| | | 625 |

| | 0.3 | % | | | 207,749 |

|

| Total | $ | 87,329 |

| | 0.8 | % | | | $ | 106,474 |

| | 1.0 | % | | | $ | 93,827 |

| | 0.9 | % | | | $ | 10,924,985 |

|

| | | | | | | | | | | | | | | | | |

| December 31, 2013 | | | | | | | | | | | | | | | | |

| Commercial | $ | 62,272 |

| | 0.9 | % | | | $ | 87,391 |

| | 1.2 | % | | | $ | 24,779 |

| | 0.3 | % | | | $ | 7,131,834 |

|

| Commercial real estate | 1,016 |

| | * |

| | | 4,489 |

| | 0.2 | % | | | 46,953 |

| | 1.9 | % | | | 2,500,501 |

|

| Construction | — |

| | — | % | | | — |

| | — | % | | | — |

| | — | % | | | 293,387 |

|

| Residential real estate | 4,898 |

| | 1.4 | % | | | 7,177 |

| | 2.1 | % | | | 9,976 |

| | 2.9 | % | | | 341,868 |

|

| Home equity | 2,884 |

| | 1.9 | % | | | 2,538 |

| | 1.7 | % | | | 11,879 |

| | 7.9 | % | | | 149,732 |

|

| Personal | 187 |

| | 0.1 | % | | | 177 |

| | 0.1 | % | | | 651 |

| | 0.3 | % | | | 226,699 |

|

| Total | $ | 71,257 |

| | 0.7 | % | | | $ | 101,772 |

| | 1.0 | % | | | $ | 94,238 |

| | 0.9 | % | | | $ | 10,644,021 |

|

|

| | | | | | | | | | | | | | | | | | | |

| Nonaccrual loans | | | | | | | | |

| | 1Q14 | | 4Q13 | | 3Q13 | | 2Q13 | | 1Q13 |

| Nonaccrual loans | | | | | | | | | |

| Commercial | $ | 31,074 |

| | $ | 24,779 |

| | $ | 26,881 |

| | $ | 47,782 |

| | $ | 31,323 |

|

| Commercial real estate | 40,928 |

| | 46,953 |

| | 62,954 |

| | 45,759 |

| | 63,643 |

|

| Construction | — |

| | — |

| | — |

| | — |

| | 402 |

|

| Residential real estate | 9,354 |

| | 9,976 |

| | 11,237 |

| | 12,812 |

| | 14,966 |

|

| Personal and home equity | 12,471 |

| | 12,530 |

| | 12,214 |

| | 15,406 |

| | 18,323 |

|

| Total | $ | 93,827 |

| | $ | 94,238 |

| | $ | 113,286 |

| | $ | 121,759 |

| | $ | 128,657 |

|

| Nonaccrual loans as a percent of total loan type: | | | | | | |

| Commercial | 0.4 | % | | 0.4 | % | | 0.4 | % | | 0.7 | % | | 0.5 | % |

| Commercial real estate | 1.6 | % | | 1.9 | % | | 2.5 | % | | 1.8 | % | | 2.5 | % |

| Construction | — | % | | — | % | | — | % | | — | % | | 0.2 | % |

| Residential real estate | 2.8 | % | | 2.9 | % | | 3.2 | % | | 3.7 | % | | 4.1 | % |

| Personal and home equity | 3.5 | % | | 3.3 | % | | 3.5 | % | | 4.1 | % | | 4.8 | % |

| Total | 0.9 | % | | 0.9 | % | | 1.1 | % | | 1.2 | % | | 1.3 | % |

| |

(1) | Refer to Glossary of Terms for definition. |

|

| | | | | | | | | | | | | | | | | | | | | | | |

Nonaccrual Loan Stratification (excluding covered assets (1)) |

| (Dollars in thousands) | | | | | | | | | | | |

| (Unaudited) | | | | | | | | | | | |

| | | | | | | | | | | | |

| |

| | | | | | | | | | | | |

| | $10.0 Million or More | | $5.0 to $9.9 Million | | $3.0 to $4.9 Million | | $1.5 to $2.9 Million | | Under $1.5 Million | | Total |

| March 31, 2014 | | | | | | | | | | | |

| Amount: | | | | | | | | | | | |

| Commercial | $ | — |

| | $ | 16,289 |

| | $ | — |

| | $ | 6,585 |

| | $ | 8,200 |

| | $ | 31,074 |

|

| Commercial real estate | — |

| | 14,325 |

| | 7,693 |

| | 2,563 |

| | 16,347 |

| | 40,928 |

|

| Residential real estate | — |

| | — |

| | 3,438 |

| | — |

| | 5,916 |

| | 9,354 |

|

| Personal and home equity | — |

| | — |

| | — |

| | — |

| | 12,471 |

| | 12,471 |

|

| Total | $ | — |

| | $ | 30,614 |

| | $ | 11,131 |

| | $ | 9,148 |

| | $ | 42,934 |

| | $ | 93,827 |

|

| | | | | | | | | | | | |

| Number of borrowers: | | | | | | | | | | | |

| Commercial | — |

| | 2 |

| | — |

| | 3 |

| | 25 |

| | 30 |

|

| Commercial real estate | — |

| | 2 |

| | 2 |

| | 1 |

| | 28 |

| | 33 |

|

| Residential real estate | — |

| | — |

| | 1 |

| | — |

| | 28 |

| | 29 |

|

| Personal and home equity | — |

| | — |

| | — |

| | — |

| | 51 |

| | 51 |

|

| Total | — |

| | 4 |

| | 3 |

| | 4 |

| | 132 |

| | 143 |

|

| | | | | | | | | | | | |

| December 31, 2013 | | | | | | | | | | | |

| Amount: | | | | | | | | | | | |

| Commercial | $ | — |

| | $ | 9,393 |

| | $ | 3,749 |

| | $ | 5,150 |

| | $ | 6,487 |

| | $ | 24,779 |

|

| Commercial real estate | — |

| | 15,440 |

| | 9,035 |

| | 7,583 |

| | 14,895 |

| | 46,953 |

|

| Residential real estate | — |

| | — |

| | 3,438 |

| | — |

| | 6,538 |

| | 9,976 |

|

| Personal and home equity | — |

| | — |

| | — |

| | — |

| | 12,530 |

| | 12,530 |

|

| Total | $ | — |

| | $ | 24,833 |

| | $ | 16,222 |

| | $ | 12,733 |

| | $ | 40,450 |

| | $ | 94,238 |

|

| | | | | | | | | | | | |

| Number of borrowers: | | | | | | | | | | | |

| Commercial | — |

| | 1 |

| | 1 |

| | 2 |

| | 23 |

| | 27 |

|

| Commercial real estate | — |

| | 2 |

| | 2 |

| | 4 |

| | 26 |

| | 34 |

|

| Residential real estate | — |

| | — |

| | 1 |

| | — |

| | 30 |

| | 31 |

|

| Personal and home equity | — |

| | — |

| | — |

| | — |

| | 46 |

| | 46 |

|

| Total | — |

| | 3 |

| | 4 |

| | 6 |

| | 125 |

| | 138 |

|

| |

(1) | Refer to Glossary of Terms for definition. |

|

| | | | | | | | | | | | | | | | | | | |

Foreclosed Real Estate (OREO), excluding covered assets (1) | | | | | | | | | | |

| (Dollars in thousands) | | | | | | | | | | | |

| (Unaudited) | | | | | | | | | | | |

| | | | | | | | | | | | |

| OREO Properties by Type | | | | | | | | | | | |

| | | | | | | | | | | | |

| | March 31, 2014 | | December 31, 2013 |

| | Number of Properties | | Amount | | % of Total | | Number of Properties | | Amount | | % of Total |

| Single-family homes | 11 |

| | $ | 1,733 |

| | 7 | % | | 12 |

| | $ | 3,405 |

| | 12 | % |

| Land parcels | 140 |

| | 10,746 |

| | 46 | % | | 142 |

| | 12,710 |

| | 44 | % |

| Multi-family | 1 |

| | 124 |

| | 1 | % | | 1 |

| | 175 |

| | 1 | % |

| Office/industrial | 15 |

| | 10,005 |

| | 42 | % | | 20 |

| | 11,301 |

| | 40 | % |

| Retail | 1 |

| | 957 |

| | 4 | % | | 1 |

| | 957 |

| | 3 | % |

| Total | 168 |

| | $ | 23,565 |

| | 100 | % | | 176 |

| | $ | 28,548 |

| | 100 | % |

| |

(1) | Refer to Glossary of Terms for definition. |

|

| | | | | | | | | | | | | | | | | | | |

Allowance for Loan Losses (excluding covered assets (1)) | | | | | | | | | |

| (Dollars in thousands) | | | | | | | | | |

| (Unaudited) | | | | | | | | | |

| | 1Q14 | | 4Q13 | | 3Q13 | | 2Q13 | | 1Q13 |

| Change in allowance for loan losses: | | | | | | | | | |

| Balance at beginning of period | $ | 143,109 |

| | $ | 145,513 |

| | $ | 148,183 |

| | $ | 153,992 |

| | $ | 161,417 |

|

| Loans charged-off: | | | | | | | | | |

| Commercial | (1,487 | ) | | (1,536 | ) | | (7,285 | ) | | (2,372 | ) | | (11,146 | ) |

| Commercial real estate | (2,582 | ) | | (7,297 | ) | | (1,706 | ) | | (8,725 | ) | | (7,566 | ) |

| Construction | — |

| | — |

| | — |

| | — |

| | 70 |

|

| Residential real estate | (235 | ) | | (1,887 | ) | | (395 | ) | | (783 | ) | | (436 | ) |

| Home equity | (447 | ) | | (591 | ) | | (2,146 | ) | | (334 | ) | | (374 | ) |

| Personal | (130 | ) | | (51 | ) | | (893 | ) | | (2,776 | ) | | (5 | ) |

| Total charge-offs | (4,881 | ) | | (11,362 | ) | | (12,425 | ) | | (14,990 | ) | | (19,457 | ) |

| Recoveries on loans previously charged-off: | | | | | | | | | |

| Commercial | 3,662 |

| | 2,898 |

| | 1,301 |

| | 459 |

| | 396 |

|

| Commercial real estate | 688 |

| | 302 |

| | 366 |

| | 141 |

| | 1,364 |

|

| Construction | 7 |

| | 7 |

| | 7 |

| | 25 |

| | 9 |

|

| Residential real estate | 300 |

| | 4 |

| | 7 |

| | 2 |

| | 2 |

|

| Home equity | 28 |

| | 80 |

| | 135 |

| | 199 |

| | 61 |

|

| Personal | 406 |

| | 757 |

| | 142 |

| | 46 |

| | 52 |

|

| Total recoveries | 5,091 |

| | 4,048 |

| | 1,958 |

| | 872 |

| | 1,884 |

|

| Net recoveries (charge-offs) | 210 |

| | (7,314 | ) | | (10,467 | ) | | (14,118 | ) | | (17,573 | ) |

| Provisions charged to operating expenses | 3,449 |

| | 4,910 |

| | 7,797 |

| | 8,309 |

| | 10,148 |

|

| Balance at end of period | $ | 146,768 |

| | $ | 143,109 |

| | $ | 145,513 |

| | $ | 148,183 |

| | $ | 153,992 |

|

| | | | | | | | | | |

| Allocation of allowance for loan losses: | | | | | | | | | |

| General allocated reserve: | | | | | | | | | |

| Commercial | $ | 81,402 |

| | $ | 75,873 |

| | $ | 74,734 |

| | $ | 64,868 |

| | $ | 57,280 |

|

| Commercial real estate | 28,096 |

| | 29,826 |

| | 30,843 |

| | 36,820 |

| | 45,030 |

|

| Construction | 3,547 |

| | 3,338 |

| | 3,314 |

| | 2,626 |

| | 2,011 |

|

| Residential real estate | 4,780 |

| | 5,143 |

| | 4,254 |

| | 4,945 |

| | 5,800 |

|

| Home equity | 3,226 |

| | 3,262 |

| | 2,952 |

| | 3,070 |

| | 3,700 |

|

| Personal | 2,950 |

| | 3,290 |

| | 2,718 |

| | 3,130 |

| | 2,900 |

|

| Total allocated | 124,001 |

| | 120,732 |

| | 118,815 |

| | 115,459 |

| | 116,721 |

|

| Specific reserve | 22,767 |

| | 22,377 |

| | 26,698 |

| | 32,724 |

| | 37,271 |

|

| Total | $ | 146,768 |

| | $ | 143,109 |

| | $ | 145,513 |

| | $ | 148,183 |

| | $ | 153,992 |

|

| | | | | | | | | | |

| Allocation of reserve by a percent of total allowance for loan losses: |

| General allocated reserve: | | | | | | | | | |

| Commercial | 56 | % | | 53 | % | | 52 | % | | 44 | % | | 37 | % |

| Commercial real estate | 19 | % | | 21 | % | | 21 | % | | 25 | % | | 29 | % |

| Construction | 2 | % | | 2 | % | | 2 | % | | 2 | % | | 1 | % |

| Residential real estate | 3 | % | | 4 | % | | 3 | % | | 3 | % | | 4 | % |

| Home equity | 2 | % | | 2 | % | | 2 | % | | 2 | % | | 3 | % |

| Personal | 2 | % | | 2 | % | | 2 | % | | 2 | % | | 2 | % |

| Total allocated | 84 | % | | 84 | % | | 82 | % | | 78 | % | | 76 | % |

| Specific reserve | 16 | % | | 16 | % | | 18 | % | | 22 | % | | 24 | % |

| Total | 100 | % | | 100 | % | | 100 | % | | 100 | % | | 100 | % |

| | | | | | | | | | |

| Allowance for loan losses to: | | | | | | | | | |

| Total loans | 1.34 | % | | 1.34 | % | | 1.40 | % | | 1.47 | % | | 1.53 | % |

| Nonperforming loans | 156 | % | | 152 | % | | 128 | % | | 122 | % | | 120 | % |

| |

(1) | Refer to Glossary of Terms for definition. |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Deposits |

| (Dollars in thousands) |

| | | | | | | | | | | | | | | | | | | | |

| | 3/31/14 | | % of Total | | 12/31/13 | | % of Total | | 9/30/13 | | % of Total | | 6/30/13 | | % of Total | | 3/31/13 | | % of Total |

| | (Unaudited) | | | | (Audited) | | | | (Unaudited) | | | | (Unaudited) | | | | (Unaudited) | | |

| Noninterest-bearing deposits | $ | 3,103,736 |

| | 26 | % | | $ | 3,172,676 |

| | 26 | % | | $ | 3,106,986 |

| | 26 | % | | $ | 2,736,868 |

| | 24 | % | | $ | 2,756,879 |

| | 24 | % |

| Interest-bearing demand deposits | 1,466,095 |

| | 12 | % | | 1,470,856 |

| | 12 | % | | 1,183,471 |

| | 10 | % | | 1,234,134 |

| | 11 | % | | 1,390,955 |

| | 12 | % |

| Savings deposits | 288,686 |

| | 3 | % | | 284,482 |

| | 2 | % | | 260,822 |

| | 2 | % | | 245,133 |

| | 2 | % | | 245,762 |

| | 2 | % |

| Money market accounts | 4,497,712 |

| | 38 | % | | 4,515,079 |

| | 38 | % | | 4,517,235 |

| | 38 | % | | 4,409,797 |

| | 39 | % | | 4,496,102 |

| | 40 | % |

| Brokered time deposits: | | | | | | | | | | | | | | | | | | | |

| Traditional | 458,344 |

| | 4 | % | | 408,365 |

| | 3 | % | | 548,429 |

| | 5 | % | | 445,666 |

| | 4 | % | | 330,851 |

| | 3 | % |

Client CDARS(1) | 639,521 |

| | 5 | % | | 711,412 |

| | 7 | % | | 755,167 |

| | 7 | % | | 695,130 |

| | 6 | % | | 652,774 |

| | 6 | % |

Non-client CDARS(1) | — |

| | — | % | | — |

| | — | % | | — |

| | — | % | | 50,000 |

| | 1 | % | | — |

| | — | % |

| Total brokered time deposits | 1,097,865 |

| | 9 | % | | 1,119,777 |

| | 10 | % | | 1,303,596 |

| | 12 | % | | 1,190,796 |

| | 11 | % | | 983,625 |

| | 9 | % |

| Time deposits | 1,432,067 |

| | 12 | % | | 1,450,771 |

| | 12 | % | | 1,460,446 |

| | 12 | % | | 1,491,604 |

| | 13 | % | | 1,518,980 |

| | 13 | % |

| Total deposits | $ | 11,886,161 |

| | 100 | % | | $ | 12,013,641 |

| | 100 | % | | $ | 11,832,556 |

| | 100 | % | | $ | 11,308,332 |

| | 100 | % | | $ | 11,392,303 |

| | 100 | % |

Client deposits(1) | $ | 11,427,817 |

| | 96 | % | | $ | 11,605,276 |

| | 97 | % | | $ | 11,284,127 |

| | 95 | % | | $ | 10,812,666 |

| | 95 | % | | $ | 11,061,452 |

| | 97 | % |

| |

(1) | Refer to Glossary of Terms for definition. |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Interest Margin | | | | | | | | | | | | | | | | | | | |

| (Dollars in thousands) | | | | | | | | | | | | | | | | | | | |

| (Unaudited) | | | | | | | | | | | | | | | | | | | |

| | Quarters Ended |

| | March 31, 2014 | | | December 31, 2013 | | | March 31, 2013 |

| | Average Balance | |

Interest (1)

| | Yield/ Rate | | | Average Balance | |

Interest (1)

| | Yield/ Rate | | | Average Balance | |

Interest (1)

| | Yield/ Rate |

| Assets: | | | | | | | | | | | | | | | | | | | |

| Federal funds sold and interest-bearing deposits in banks | $ | 233,311 |

| | $ | 142 |

| | 0.24 | % | | | $ | 352,247 |

| | $ | 221 |

| | 0.24 | % | | | $ | 335,916 |

| | $ | 208 |

| | 0.25 | % |

| Securities: | | | | | | | | | | | | | | | | | | | |

| Taxable | 2,237,628 |

| | 13,255 |

| | 2.37 | % | | | 2,234,704 |

| | 13,038 |

| | 2.33 | % | | | 2,106,304 |

| | 12,822 |

| | 2.44 | % |

Tax-exempt (2) | 265,551 |

| | 2,329 |

| | 3.51 | % | | | 267,966 |

| | 2,444 |

| | 3.65 | % | | | 220,522 |

| | 2,286 |

| | 4.15 | % |

| Total securities | 2,503,179 |

| | 15,584 |

| | 2.49 | % | | | 2,502,670 |

| | 15,482 |

| | 2.47 | % | | | 2,326,826 |

| | 15,108 |

| | 2.60 | % |

| FHLB stock | 30,005 |

| | 33 |

| | 0.44 | % | | | 30,269 |

| | 34 |

| | 0.43 | % | | | 38,129 |

| | 90 |

| | 0.94 | % |

| Loans, excluding covered assets: | | | | | | | | | | | | | | | | | | | |

| Commercial | 7,186,657 |

| | 78,215 |

| | 4.35 | % | | | 7,023,617 |

| | 78,550 |

| | 4.38 | % | | | 6,529,029 |

| | 71,256 |

| | 4.37 | % |

| Commercial real estate | 2,487,677 |

| | 22,009 |

| | 3.54 | % | | | 2,468,364 |

| | 22,738 |

| | 3.60 | % | | | 2,651,132 |

| | 25,392 |

| | 3.83 | % |

| Construction | 315,136 |

| | 3,077 |

| | 3.91 | % | | | 263,992 |

| | 2,691 |

| | 3.99 | % | | | 188,211 |

| | 1,953 |

| | 4.15 | % |

| Residential | 350,388 |

| | 3,357 |

| | 3.83 | % | | | 357,996 |

| | 3,324 |

| | 3.71 | % | | | 406,091 |

| | 3,762 |

| | 3.71 | % |

| Personal and home equity | 362,335 |

| | 2,753 |

| | 3.08 | % | | | 358,003 |

| | 2,871 |

| | 3.18 | % | | | 389,395 |

| | 3,206 |

| | 3.34 | % |

Total loans, excluding covered assets (3) | 10,702,193 |

| | 109,411 |

| | 4.09 | % | | | 10,471,972 |

| | 110,174 |

| | 4.12 | % | | | 10,163,858 |

| | 105,569 |

| | 4.16 | % |

Covered assets (4) | 95,842 |

| | 788 |

| | 3.30 | % | | | 115,474 |

| | 549 |

| | 1.87 | % | | | 161,842 |

| | 1,218 |

| | 3.02 | % |

Total interest-earning assets (2) | 13,564,530 |

| | $ | 125,958 |

| | 3.72 | % | | | 13,472,632 |

| | $ | 126,460 |

| | 3.69 | % | | | 13,026,571 |

| | $ | 122,193 |

| | 3.75 | % |

| Cash and due from banks | 146,746 |

| | | | | | | 151,792 |

| | | | | | | 142,925 |

| | | | |

| Allowance for loan and covered loan losses | (164,933 | ) | | | | | | | (168,901 | ) | | | | | | | (188,894 | ) | | | | |

| Other assets | 483,870 |

| | | | | | | 500,949 |

| | | | | | | 636,726 |

| | | | |

| Total assets | $ | 14,030,213 |

| | | | | | | $ | 13,956,472 |

| | | | | | | $ | 13,617,328 |

| | | | |

| Liabilities and Equity: | | | | | | | | | | | | | | | | | | | |

| Interest-bearing demand deposits | $ | 1,293,652 |

| | $ | 942 |

| | 0.30 | % | | | $ | 1,291,824 |

| | $ | 1,021 |

| | 0.31 | % | | | $ | 1,264,740 |

| | $ | 1,115 |

| | 0.36 | % |

| Savings deposits | 284,703 |

| | 196 |

| | 0.28 | % | | | 275,656 |

| | 200 |

| | 0.29 | % | | | 274,310 |

| | 164 |

| | 0.24 | % |

| Money market accounts | 4,660,158 |

| | 3,778 |

| | 0.33 | % | | | 4,643,505 |

| | 3,969 |

| | 0.34 | % | | | 4,566,766 |

| | 4,235 |

| | 0.38 | % |

| Time deposits | 1,443,401 |

| | 3,642 |

| | 1.02 | % | | | 1,473,248 |

| | 3,805 |

| | 1.02 | % | | | 1,525,931 |

| | 3,936 |

| | 1.05 | % |

| Brokered time deposits | 1,104,107 |

| | 1,164 |

| | 0.43 | % | | | 1,192,264 |

| | 1,257 |

| | 0.42 | % | | | 1,000,613 |

| | 1,193 |

| | 0.48 | % |

| Total interest-bearing deposits | 8,786,021 |

| | 9,722 |

| | 0.45 | % | | | 8,876,497 |

| | 10,252 |

| | 0.46 | % | | | 8,632,360 |

| | 10,643 |

| | 0.50 | % |

| Short-term and secured borrowings | 43,289 |

| | 196 |

| | 1.81 | % | | | 11,063 |

| | 161 |

| | 5.67 | % | | | 92,906 |

| | 118 |

| | 0.51 | % |

| Long-term debt | 627,793 |

| | 6,488 |

| | 4.13 | % | | | 412,467 |

| | 6,751 |

| | 6.53 | % | | | 499,793 |

| | 7,608 |

| | 6.09 | % |

| Total interest-bearing liabilities | 9,457,103 |

| | 16,406 |

| | 0.70 | % | | | 9,300,027 |

| | 17,164 |

| | 0.73 | % | | | 9,225,059 |

| | 18,369 |

| | 0.80 | % |

| Noninterest-bearing demand deposits | 3,101,219 |

| | | | | | | 3,207,659 |

| | | | | | | 3,005,007 |

| | | | |

| Other liabilities | 136,478 |

| | | | | | | 147,893 |

| | | | | | | 159,634 |

| | | | |

| Equity | 1,335,413 |

| | | | | | | 1,300,893 |

| | | | | | | 1,227,628 |

| | | | |

| Total liabilities and equity | $ | 14,030,213 |

| | | | | | | $ | 13,956,472 |

| | | | | | | $ | 13,617,328 |

| | | | |

Net interest spread (2) | | | | | 3.02 | % | | | | | | | 2.96 | % | | | | | | | 2.95 | % |

| Contribution of noninterest-bearing sources of funds | | | | | 0.21 | % | | | | | | | 0.22 | % | | | | | | | 0.24 | % |

Net interest income/margin (2) | | | 109,552 |

| | 3.23 | % | | | | | 109,296 |

| | 3.18 | % | | | | | 103,824 |

| | 3.19 | % |

| Less: tax equivalent adjustment | | | 800 |

| | | | | | | 840 |

| | | | | | | 784 |

| | |

| Net interest income, as reported | | | $ | 108,752 |

| | | | | | | $ | 108,456 |

| | | | | | | $ | 103,040 |

| | |

| |

(1) | Interest income included $6.2 million, $7.1 million, and $5.1 million in loan fees for the quarter ended March 31, 2014, December 31, 2013, and March 31, 2013, respectively. |

| |

(2) | Interest income and yields are presented on a tax-equivalent basis, assuming a federal income tax rate of 35%. This is a non-U.S. GAAP measure. |

| |

(3) | Average loans on a nonaccrual basis for the recognition of interest income totaled $93.0 million, $108.1 million, and $137.0 million for the quarter ended March 31, 2014, December 31, 2013, and March 31, 2013, respectively, and are included in loans for purposes of this analysis. Interest foregone on nonperforming loans was estimated to be approximately $870,000, $1.1 million and $1.4 million for the quarter ended March 31, 2014, December 31, 2013, and March 31, 2013, respectively, based on the average loan portfolio yield for the corresponding period. |

| |

(4) | Covered interest-earning assets consist of loans acquired through an FDIC-assisted transaction that are subject to a loss share agreement and the related indemnification asset. |

| |

(5) | Refer to Glossary of Terms for definition. |

NON-U.S. GAAP FINANCIAL MEASURES

This press release contains both U.S. GAAP and non-U.S. GAAP based financial measures. These non-U.S. GAAP financial measures include net interest income, net interest margin, net revenue, operating profit, and efficiency ratio all on a fully taxable-equivalent basis, return on average tangible common equity, Tier 1 common equity to risk-weighted assets, tangible equity to tangible assets, tangible equity to risk-weighted assets, tangible common equity to tangible assets, and tangible book value. We believe that presenting these non-U.S. GAAP financial measures will provide information useful to investors in understanding our underlying operational performance, our business, and performance trends and facilitates comparisons with the performance of others in the banking industry.

We use net interest income on a taxable-equivalent basis in calculating various performance measures by increasing the interest income earned on tax-exempt assets to make it fully equivalent to interest income earned on taxable investments assuming a 35% tax rate. Management believes this measure to be the preferred industry measurement of net interest income as it enhances comparability to net interest income arising from taxable and tax-exempt sources, and accordingly believes that providing this measure may be useful for peer comparison purposes.

In addition to capital ratios defined by banking regulators, we also consider various measures when evaluating capital utilization and adequacy, including return on average tangible common equity, Tier 1 common equity to risk-weighted assets, tangible equity to tangible assets, tangible equity to risk-weighted assets, tangible common equity to tangible assets, and tangible book value. These calculations are intended to complement the capital ratios defined by banking regulators for both absolute and comparative purposes. All of these measures exclude the ending balances of goodwill and other intangibles while certain of these ratios exclude preferred capital components. Because U.S. GAAP does not include capital ratio measures, we believe there are no comparable U.S. GAAP financial measures to these ratios. We believe these non-U.S. GAAP financial measures are relevant because they provide information that is helpful in assessing the level of capital available to withstand unexpected market conditions. Additionally, presentation of these measures allows readers to compare certain aspects of our capitalization to other companies. However, because there are no standardized definitions for these ratios, our calculations may not be comparable with other companies, and this may affect the usefulness of these measures to investors. Calculations of the Tier 1 common equity to risk-weighted assets ratio contained herein exclude the effect of the final Basel III capital rules adopted and issued by the Federal Reserve Board in July 2013, which are effective January 1, 2014 with compliance required January 1, 2015.

Non-U.S. GAAP financial measures have inherent limitations, are not required to be uniformly applied, and are not audited. Although these non-U.S. GAAP financial measures are frequently used by stakeholders in the evaluation of a company, they have limitations as analytical tools, and should not be considered in isolation or as a substitute for analyses of results as reported under U.S. GAAP. As a result, we encourage readers to consider our Consolidated Financial Statements in their entirety and not to rely on any single financial measure.

Non-U.S. GAAP Financial Measures

(Amounts in thousands)

(Unaudited)

The following table reconciles non-U.S. GAAP financial measures to U.S. GAAP.

|

| | | | | | | | | | | | | | | | | | | |

| | Quarters Ended |

| | 2014 | | 2013 |

| | March 31 | | December 31 | | September 30 | | June 30 | | March 31 |

| Taxable-equivalent net interest income | | | | | | | | | |

| U.S. GAAP net interest income | $ | 108,752 |

| | $ | 108,456 |

| | $ | 105,835 |

| | $ | 103,732 |

| | $ | 103,040 |

|

| Taxable-equivalent adjustment | 800 |

| | 840 |

| | 818 |

| | 805 |

| | 784 |

|

Taxable-equivalent net interest income (a) | $ | 109,552 |

| | $ | 109,296 |

| | $ | 106,653 |

| | $ | 104,537 |

| | $ | 103,824 |

|

| | | | | | | | | | |

Average Earning Assets (b) | $ | 13,564,530 |

| | $ | 13,472,632 |

| | $ | 13,154,557 |

| | $ | 12,858,942 |

| | $ | 13,026,571 |

|

| | | | | | | | | | |

Net Interest Margin ((a) annualized) / (b) | 3.23 | % | | 3.18 | % | | 3.18 | % | | 3.22 | % | | 3.19 | % |

| | | | | | | | | | |

| Net Revenue | | | | | | | | | |

| Taxable-equivalent net interest income | $ | 109,552 |

| | $ | 109,296 |

| | $ | 106,653 |

| | $ | 104,537 |

| | $ | 103,824 |

|

| U.S. GAAP non-interest income | 26,236 |

| | 26,740 |

| | 27,773 |

| | 29,009 |

| | 30,468 |

|

Net revenue (c) | $ | 135,788 |

| | $ | 136,036 |

| | $ | 134,426 |

| | $ | 133,546 |

| | $ | 134,292 |

|

| | | | | | | | | | |

| Operating Profit | | | | | | | | | |

| U.S. GAAP income before income taxes | $ | 55,531 |

| | $ | 54,893 |

| | $ | 54,219 |

| | $ | 46,643 |

| | $ | 44,188 |

|

| Provision for loan and covered loan losses | 3,707 |

| | 4,476 |

| | 8,120 |

| | 8,843 |

| | 10,357 |

|

| Taxable-equivalent adjustment | 800 |

| | 840 |

| | 818 |

| | 805 |

| | 784 |

|

| Operating profit | $ | 60,038 |

| | $ | 60,209 |

| | $ | 63,157 |

| | $ | 56,291 |

| | $ | 55,329 |

|

| | | | | | | | | | |

| Efficiency Ratio | | | | | | | | | |

U.S. GAAP non-interest expense (d) | $ | 75,750 |

| | $ | 75,827 |

| | $ | 71,269 |

| | $ | 77,255 |

| | $ | 78,963 |

|

| Net revenue | $ | 135,788 |

| | $ | 136,036 |