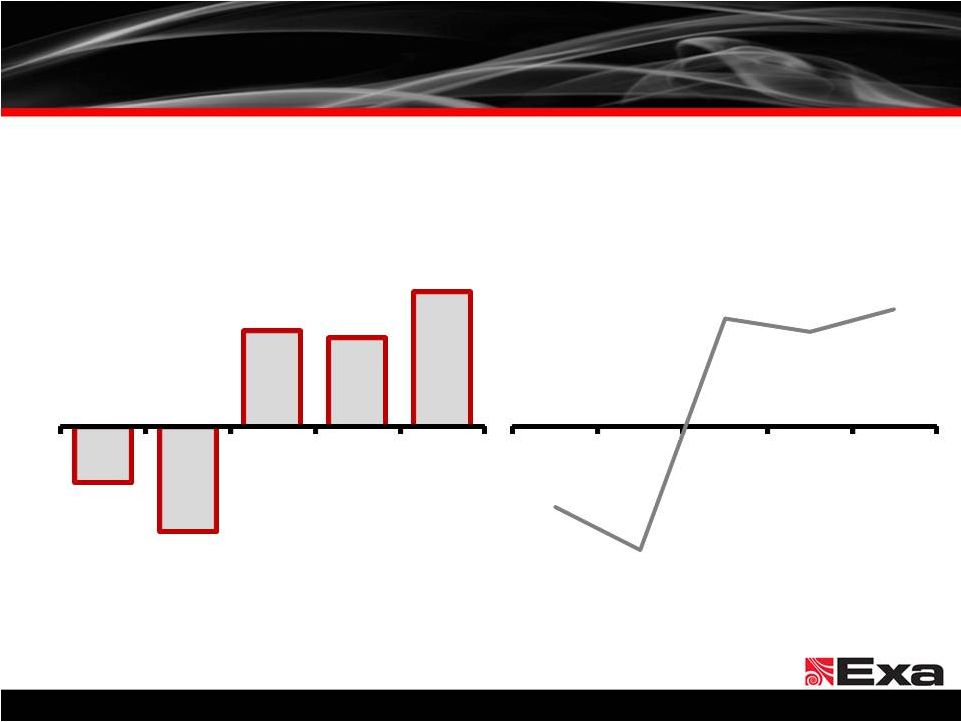

Adjusted EBITDA – Definition and Reconciliation 27 © Exa Corporation. All rights reserved. Exa Corporation Adjusted EBITDA Reconciliation (In thousands) Three Months Ended Year Ended January 31, April 30, 2008 2009 2010 Restated 2011 Restated 2012 2011 Restated 2012 Net (loss) Income $ (7,514) $ (9,846) $ (1,013) $ 395 $ 14,456 238 $ Depreciation and amortization 2,043 2,853 2,702 1,562 1,405 323 460 Interest expense, net 1,430 1,218 672 1,411 1,284 270 412 Other (income) expense (15) 71 (12) (10) 213 (66) (66) Foreign exchange loss (gain) 560 (549) 766 198 106 464 0 Provision for income tax 419 441 521 839 (11,040) 390 (84) EBITDA (3,077) (5,812) 3,636 4,395 6,424 1,619 733 Non-cash, share based compensation expense 113 291 1,406 281 636 33 241 Adjusted EBITDA $ (2,964) $ (5,521) $ 5,042 $ 4,676 $ 7,060 $ 1,652 $ 974 $ 11 Note: To supplement our consolidated financial statements, which are presented on a GAAP basis, we disclose Adjusted EBITDA, a non-GAAP measure that excludes certain amounts. This non-GAAP measure is not in accordance with, or an alternative for, generally accepted accounting principles in the United States. The GAAP measure most comparable to Adjusted EBITDA is GAAP net income (loss). A reconciliation of this non-GAAP financial measure to the corresponding GAAP measure is included above. We define EBITDA as net income (loss), excluding depreciation and amortization, interest expense, and other income (expense), foreign exchange gain (loss) and provision for income taxes. We define Adjusted EBITDA as EBITDA, excluding non-cash share-based compensation expense. Our management uses this non-GAAP measure when evaluating our operating performance and for internal planning and forecasting purposes. We believe that this measure helps indicate underlying trends in our business, is important in comparing current results with prior period results, and is useful to investors and financial analysts in assessing our operating performance. For example, management considers Adjusted EBITDA to be an important indicator of our operational strength and the performance of our business and a good measure of our historical operating trends. However, Adjusted EBITDA may have limitations as an analytical tool. The non-GAAP financial information presented here should be considered in conjunction with, and not as a substitute for or superior to, the financial information presented in accordance with GAAP and should not be considered a measure of our liquidity. There are significant limitations associated with the use of non-GAAP financial measures. Further, these measures may differ from the non-GAAP information, even where similarly titled, used by other companies and therefore should not be used to compare our performance to that of other companies. In considering our Adjusted EBITDA, investors should take into account the above reconciliation of this non-GAAP financial measure to the comparable GAAP financial measure of net income (loss) that is presented in this “Summary Consolidated Financial Information” in our registration statement on Form S-1 filed with the SEC. |