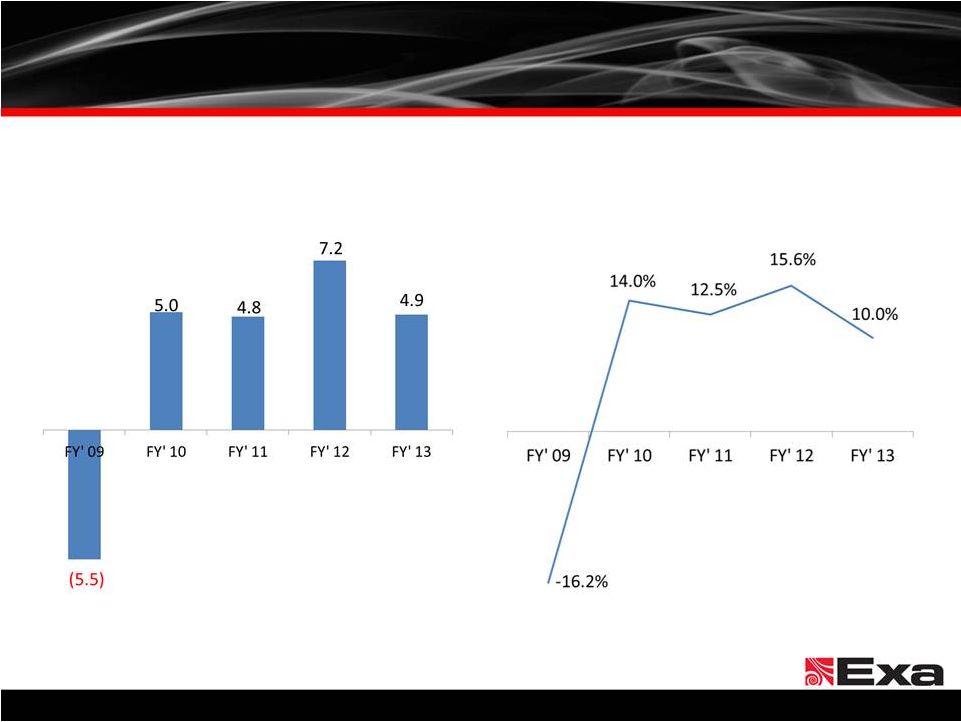

Adjusted EBITDA and Non-GAAP Operating Income – Definitions and Reconciliations 23 © Exa Corporation. All rights reserved. Non-GAAP Operating Income April 30, July 31, October 31, (In thousands) 2011 2012 2013 2013 2013 2013 Operating (loss) income 3,116 $ 5,035 $ 1,960 $ (457) $ (184) $ 678 $ Add back: Stock based compensation expense 281 636 924 245 251 350 Amortization of acquired intangible assets 0 65 383 88 87 88 Non-GAAP operating income 3,397 $ 5,736 $ 3,267 $ (124) $ 154 $ 1,116 $ Adjusted EBITDA Reconciliation April 30, July 31, October 31, (In thousands) 2011 2012 2013 2013 2013 2013 Net (loss) Income 691 $ 14,138 $ 763 $ (541) $ (798) $ 516 $ Depreciation and amortization 1,356 1,502 2,009 496 543 522 Interest expense, net 1,411 1,284 1,631 377 171 67 Loss on extinguishment of debt 0 0 0 0 755 0 Other (income) expense (10) 213 (529) (2) (3) (2) Foreign exchange loss (gain) 198 106 (17) (37) 93 (31) Provision for income tax 826 (10,706) 112 (254) (402) 128 EBITDA 4,472 6,537 3,969 39 359 1,200 281 636 924 245 251 350 Adjusted EBITDA 4,753 $ 7,173 $ 4,893 $ 284 $ 610 $ 1,550 $ Three Months Ended Three Months Ended Year Ended January 31, Year Ended January 31, Non-cash, share based compensation expense measures that exclude certain amounts. These non-GAAP measures are not in accordance with, or an alternative for, generally accepted accounting principles in the United States. The GAAP measures most comparable to Non-GAAP Operating Income and Adjusted EBITDA are GAAP income from operations and GAAP net income (loss), respectively. Reconciliations of these non-GAAP financial measures to the corresponding GAAP measures are included above. We define non-GAAP operating income as GAAP operating income excluding non-cash, stock-based compensation expense and amortization of acquired intangible assets. We define EBITDA as net income (loss), excluding depreciation and amortization, interest expense, loss on extinguishment of debt, other income (expense), foreign exchange gain (loss) and provision for income taxes. We define Adjusted EBITDA as EBITDA, excluding non-cash share-based compensation expense. Note: To supplement our consolidated financial statements, which are presented on a GAAP basis, we disclose Non-GAAP Operating Income and Adjusted EBITDA, non-GAAP |