Exhibit 99.1

EXA INVESTOR PRESENTATION

June 2017

Safe Harbor Statement Today’s presentation includes forward-looking statements intended to qualify for the Safe Harbor from liability established by the Private Securities Litigation Reform Act of 1995. These forward-looking statements, including statements regarding our financial expectations, demand for our solutions and growth in our markets, are subject to risks, uncertainties and other factors that could cause actual results to differ materially from those suggested by our forward-looking statements. These factors include, but are not limited to, the risk factors described in our Annual Report on Form10-K for the year ended January 31, 2017, as filed with the SEC on March 22, 2017. Forward-looking information in this presentation represents our outlook as of today, and we do not undertake any obligation to update these forward-looking statements. During today’s presentation we may refer to our Adjusted EBITDA. This is anon-GAAP financial measure that has been adjusted for certainnon-cash and other items, and that is not computed in accordance with generally accepted accounting principles. The GAAP measure most comparable to Adjusted EBITDA is our net income (loss). A reconciliation of our historical Adjusted EBITDA to our net income (loss) is included in our Form10-K filed with the SEC. © Exa Corporation—Public 2 2 © Exa Corporation. All rights reserved.

OUR MISSION:

Enabling better products through simulation–driven design

© Exa Corporation—Public

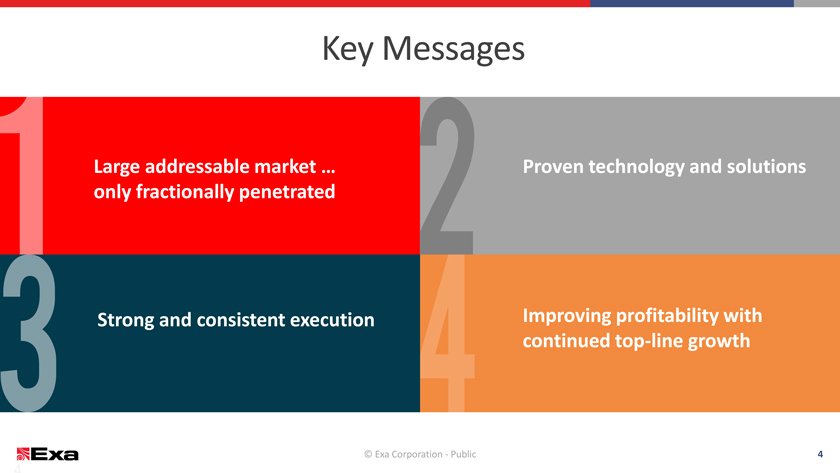

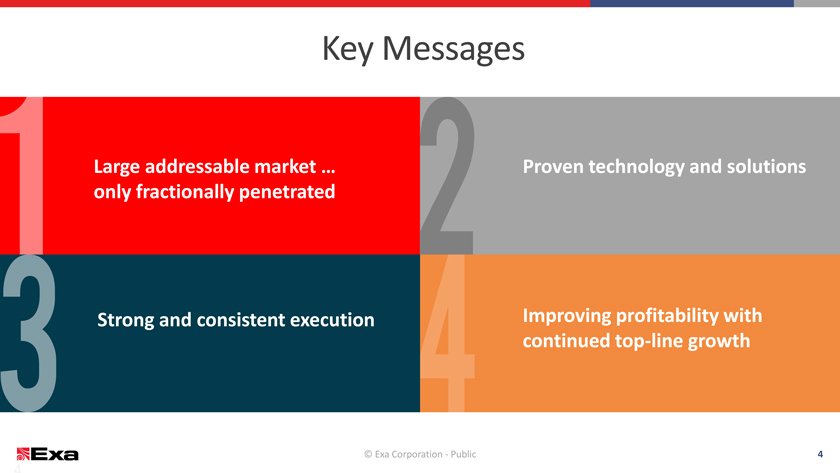

Key Messages

Large addressable market … Proven technology and solutions

only fractionally penetrated

Strong and consistent execution

Improving profitability with

continuedtop-line growth

© Exa Corporation—Public 4

4 © Exa Corporation. All rights reserved.

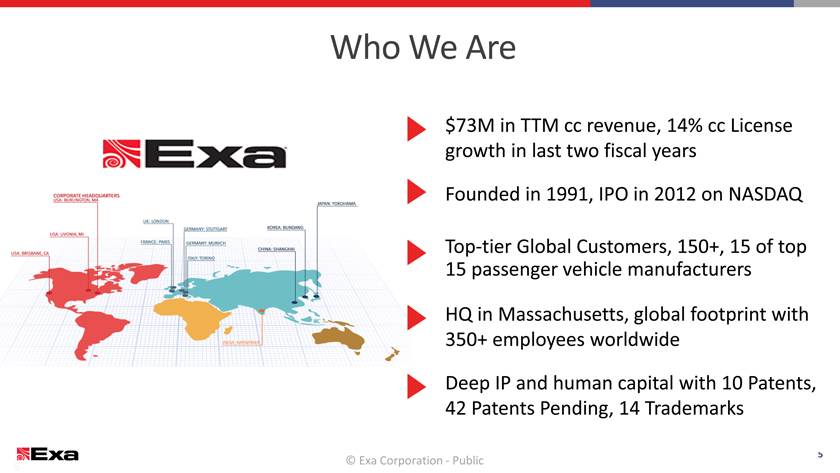

Who We Are

$73M in TTM cc revenue, 14% cc License

growth in last two fiscal years

Founded in 1991, IPO in 2012 on NASDAQ

op-tier Global Customers, 150+, 15 of top

passenger vehicle manufacturers

HQ in Massachusetts, global footprint with

350+ employees worldwide

Deep IP and human capital with 10 Patents,

42 Patents Pending, 14 Trademarks

© Exa Corporation. All rights reserved. 5

© Exa Corporation—Public

THE DIGITAL REVOLUTION

Automotive Aerospace Oil & Gas

Reduced Emissions Fuel Efficiency Digital Rock

Design Proliferation Community Noise Analytics

Reduced Product Costs Thermal Protection Enhanced Recovery

© Exa Corporation—Public

6

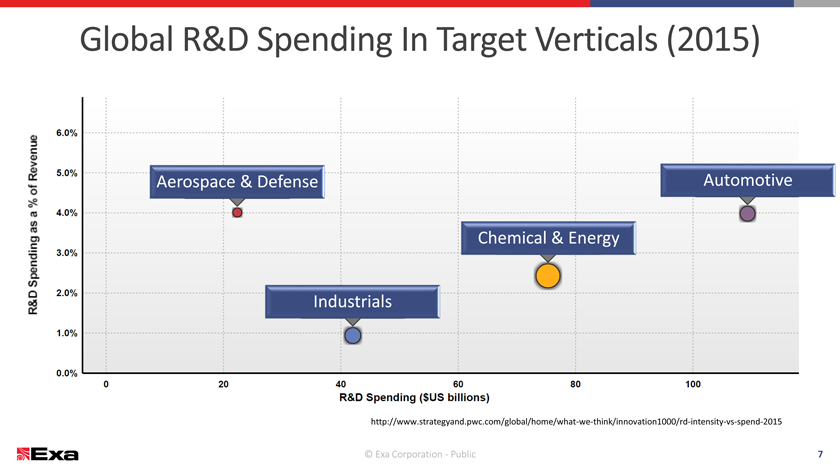

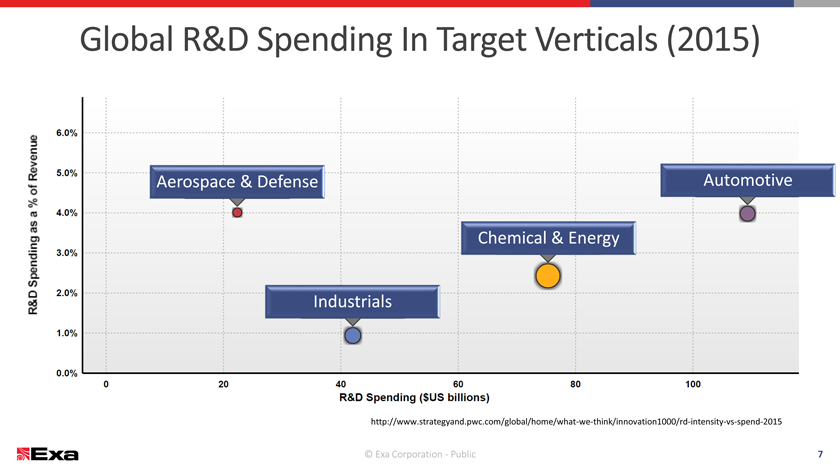

Global R&D Spending In Target Verticals (2015)

Aerospace & Defense

Automotive

Chemical & Energy

Industrials

http://www.strategyand.pwc.com/global/home/what-we-think/innovation1000/rd-intensity-vs-spend-2015

© Exa Corporation—Public

7

GROUND TRANSPORTATION

© Exa Corporation—Public

8

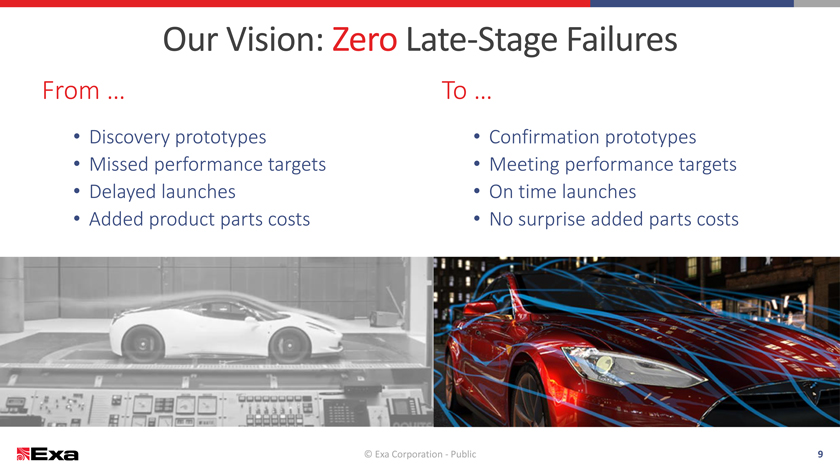

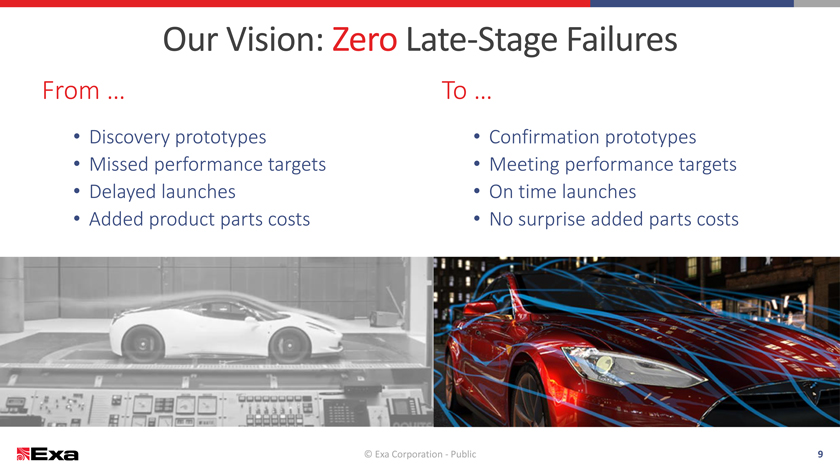

Our Vision: Zero Late-Stage Failures

From … To …

Discovery prototypes Confirmation prototypes

Missed performance targets Meeting performance targets

Delayed launches On time launches

Added product parts costs No surprise added parts costs

© Exa Corporation—Public 9

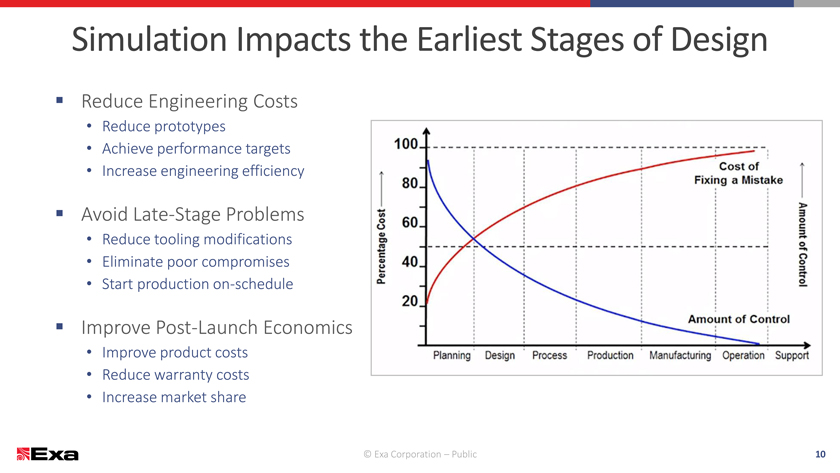

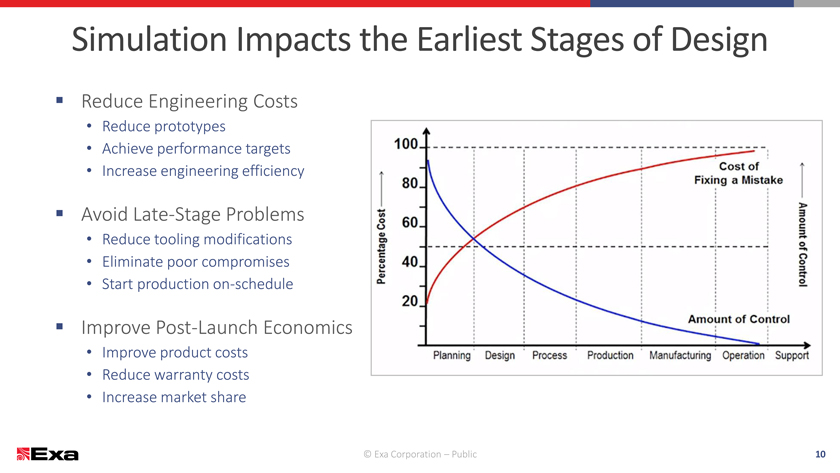

Simulation Impacts the Earliest Stages of Design

Reduce Engineering Costs

Reduce prototypes

Achieve performance targets

Increase engineering efficiency

Avoid Late-Stage Problems

Reduce tooling modifications

Eliminate poor compromises

Start productionon-schedule

Improve Post-Launch Economics

Improve product costs

Reduce warranty costs

Increase market share

© Exa Corporation – Public

10

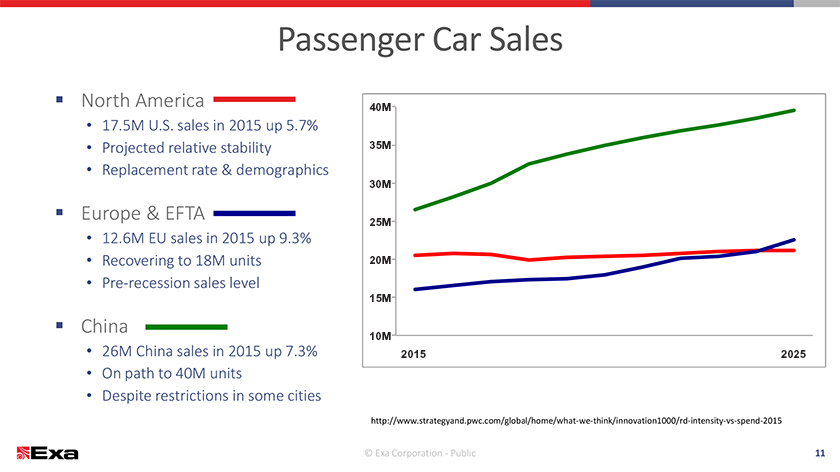

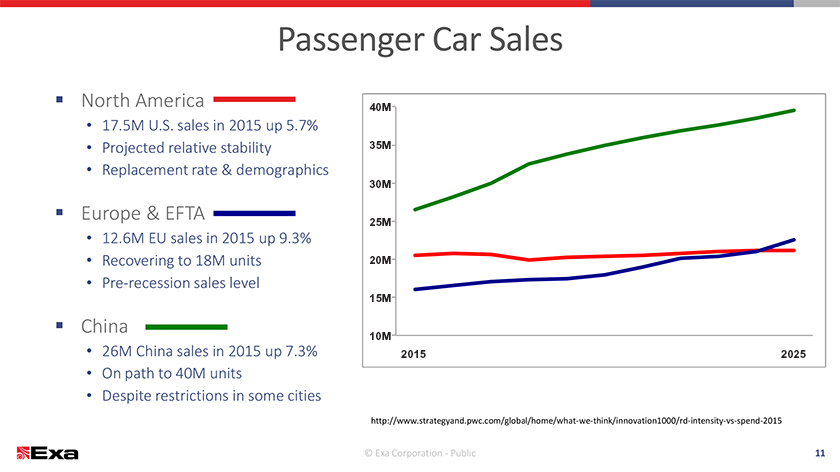

Passenger Car Sales

North America

40M

17.5M U.S. sales in 2015 up 5.7%

Projected relative stability 35

Replacement rate & demographics

30M

Europe & EFTA

25M

12.6M EU sales in 2015 up 9.3%

Recovering to 18M units 20 20

Pre-recession sales level

15 15M

China

10 10M

26M China sales in 2015 up 7.3% 2015 2015 2025

On path to 40M units

Despite restrictions in some cities

http://www.strategyand.pwc.com/global/home/what-we-think/innovation1000/rd-intensity-vs-spend-2015

© Exa Corporation—Public

11

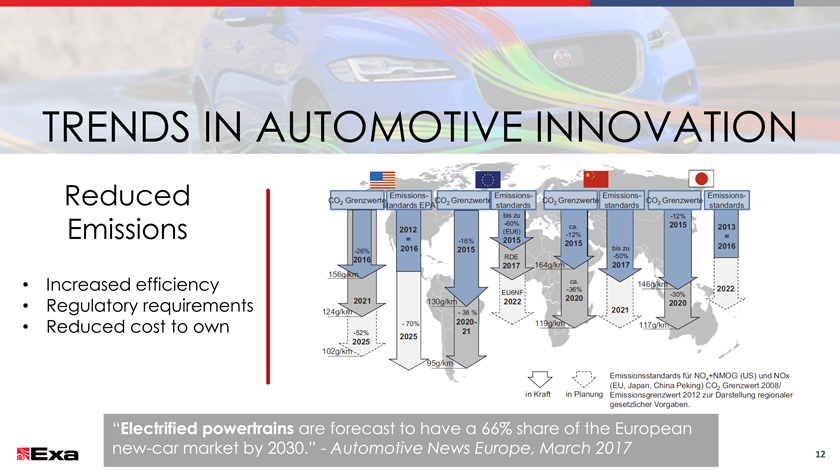

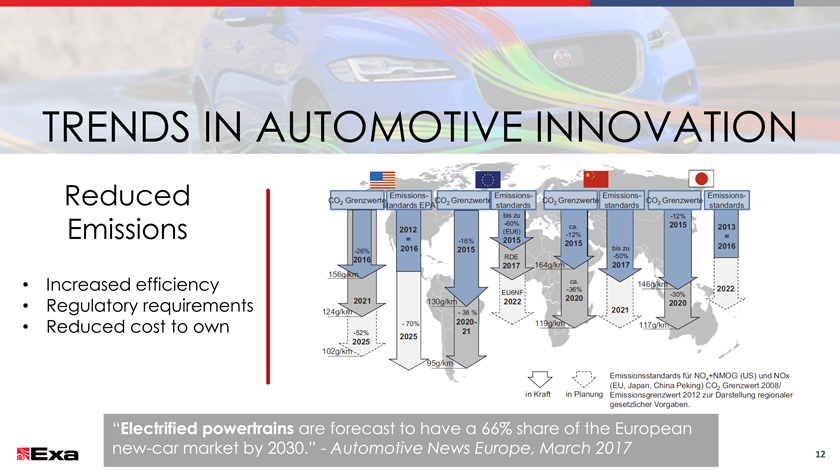

TRENDS IN AUTOMOTIVE INNOVATION

Reduced

Emissions

Increased efficiency

Regulatory requirements

Reduced cost to own

“Electrified powertrains are forecast to have a 66% share of the European

new-car market by 2030.”—Automotive News Europe, March 2017 12

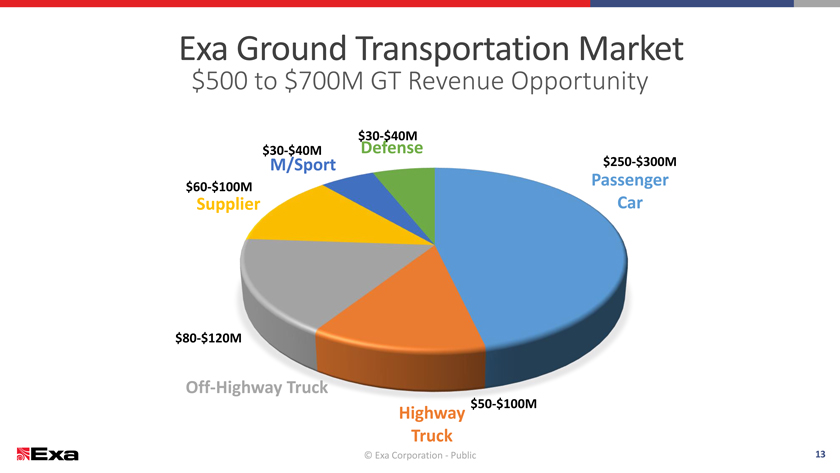

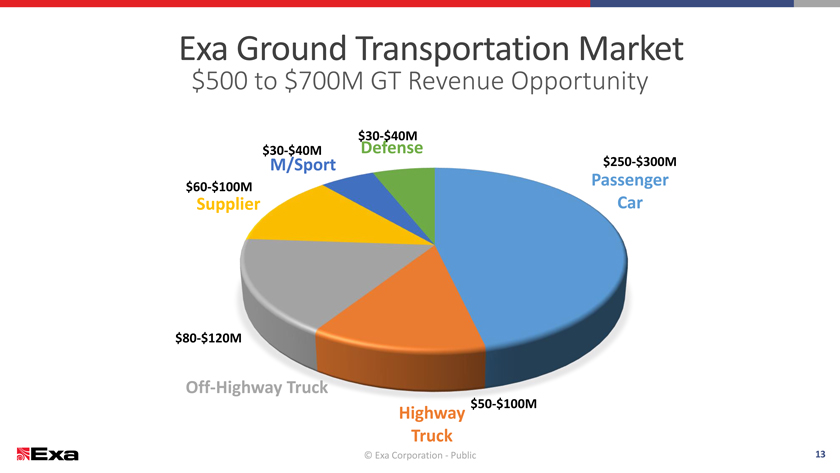

Exa Ground Transportation Market

$500 to $700M GT Revenue Opportunity

$30-$40M

$30-$40M Defense

M/Sport $250-$300M

$60-$100M Passenger

Supplier Car

$80-$120M

Off-Highway Truck

$50-$100M

Highway Truck

© Exa Corporation—Public 13

AEROSPACE

© Exa Corporation—Public

14

Total Aircraft Noise

© Exa Corporation – Public

Supersonic Jet

© Exa Corporation – Public

Jet Engines

© Exa Corporation—Public 17

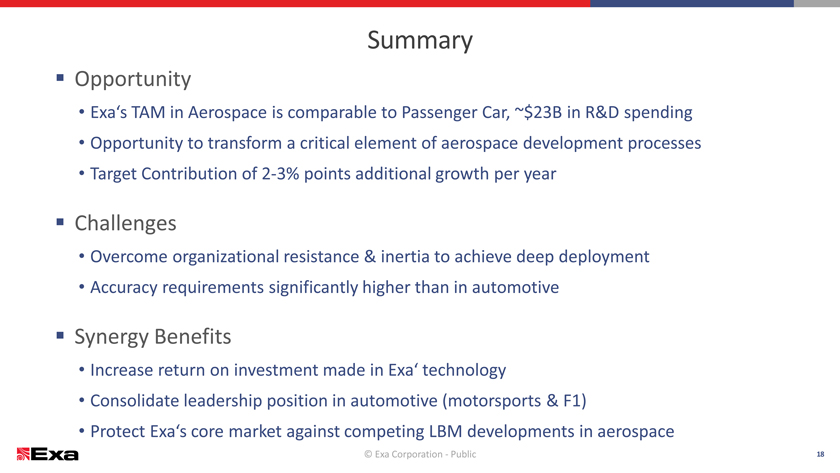

Summary

Opportunity

Exa‘s TAM in Aerospace is comparable to Passenger Car, ~$23B in R&D spending

Opportunity to transform a critical element of aerospace development processes

Target Contribution of2-3% points additional growth per year

Challenges

Overcome organizational resistance & inertia to achieve deep deployment

Accuracy requirements significantly higher than in automotive

Synergy Benefits

Increase return on investment made in Exa‘ technology

Consolidate leadership position in automotive (motorsports & F1)

Protect Exa‘s core market against competing LBM developments in aerospace

© Exa Corporation—Public

18

EXA DIGITALROCK

PROVIDING CRITICAL FLOW PROPERTIES OF RESERVOIR ROCKS

© Exa Corporation—Public

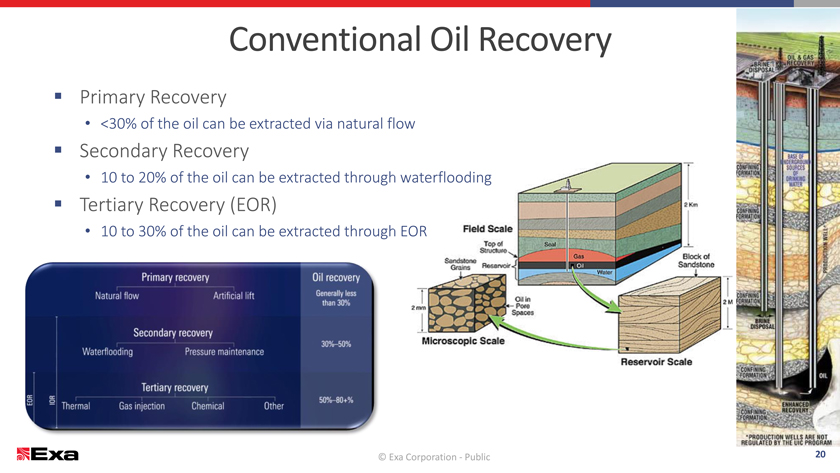

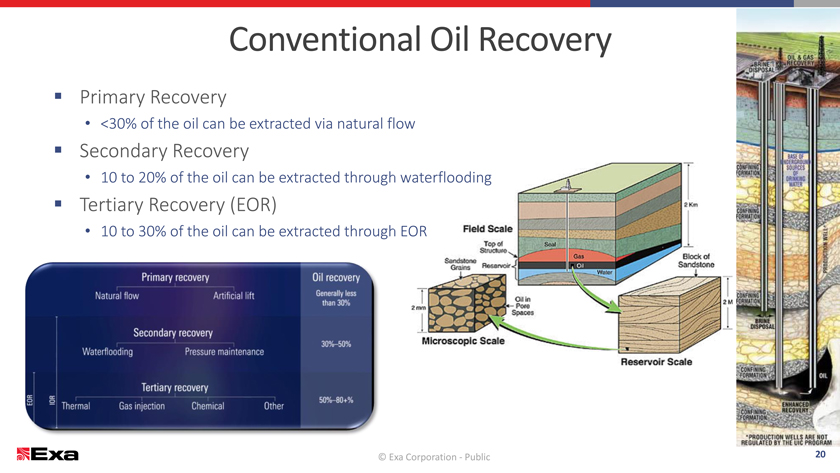

Conventional Oil Recovery

Primary Recovery

<30% of the oil can be extracted via natural flow

Secondary Recovery

10 to 20% of the oil can be extracted through

Tertiary Recovery (EOR)

10 to 30% of the oil can be extracted through

© Exa © Exa Corporation Corporation —Public —Public 20

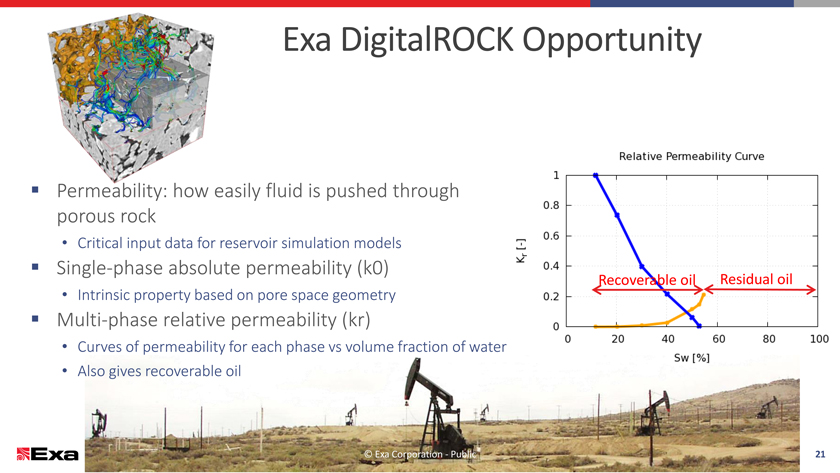

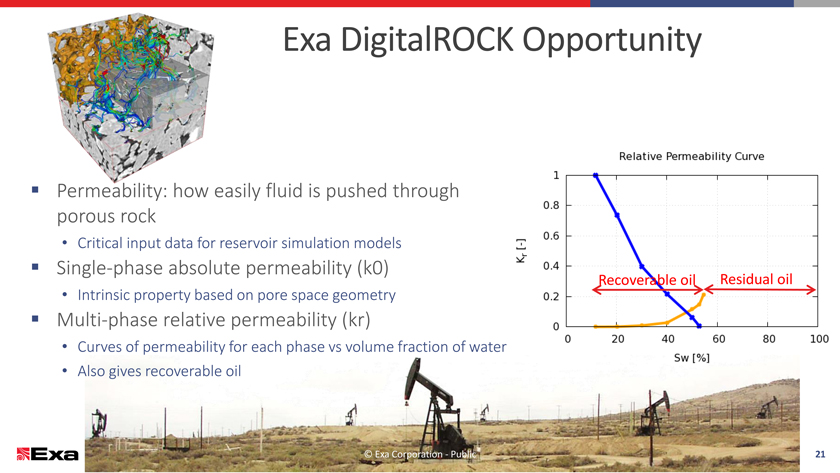

Exa DigitalROCK Opportunity

Permeability: how easily fluid is pushed through

porous rock

Critical input data for reservoir simulation models

Single-phase absolute permeability (k0)

Recoverable oilResidual oil

Intrinsic property based on pore space geometry

Multi-phase relative permeability (kr)

Curves of permeability for each phase vs volume fraction of water

Also gives recoverable oil

© Exa Corporation—Public 21

Exa DigitalROCK Opportunity

Provide flow simulation solutions to the oil & gas industry usingmicro-CT scan images of rock samples (Digital Rock)

Large Addressable Market

~$300M spent on physical testing today

Exa Solution Provided via ExaCLOUD as a Data Service

Integrates into existing reservoir modeling process

BP Adoption & Endorsement

Technology credibility is key

Exa LBM is Recognized Technology for Digital Rock

Exa is the recognized LBM leader

© Exa Corporation—Public 22

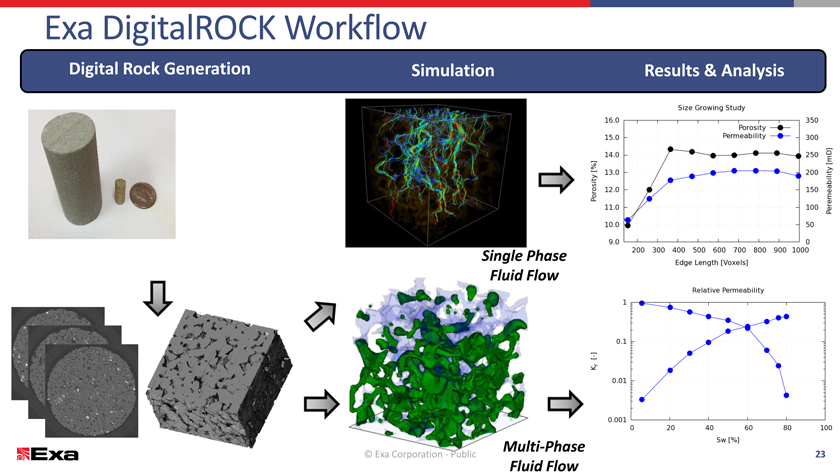

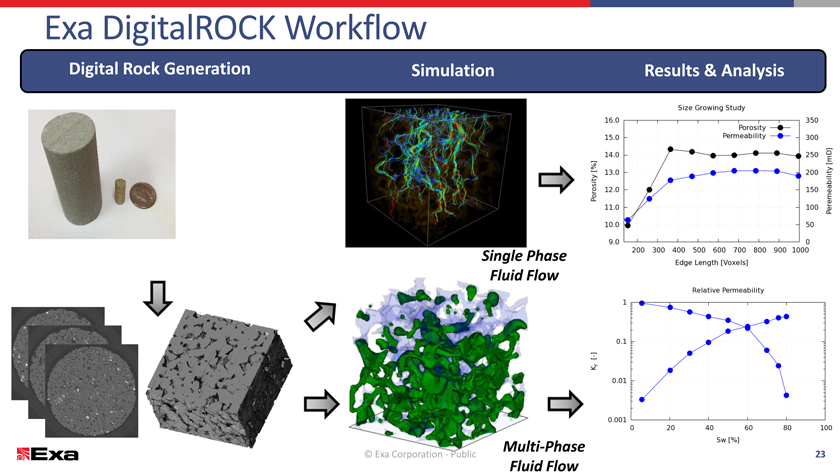

Exa DigitalROCK Workflow

Digital Rock Generation Simulation Results & Analysis

Single Phase Fluid Flow

Multi-Phase

© Exa Corporation—Public 23

Fluid Flow

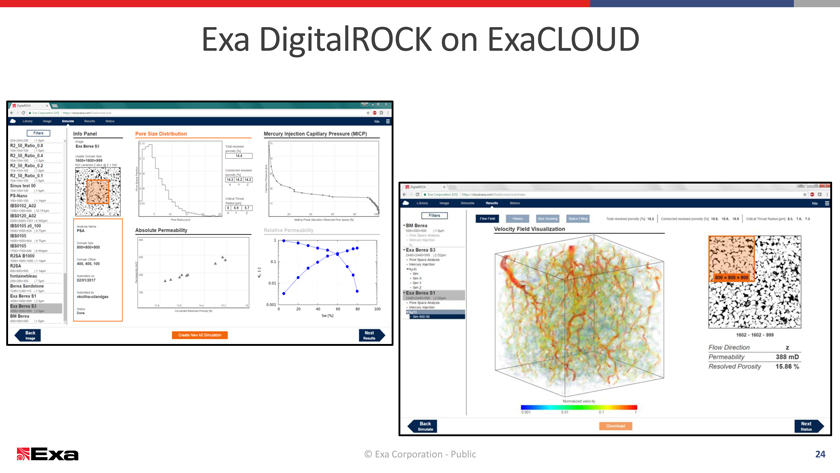

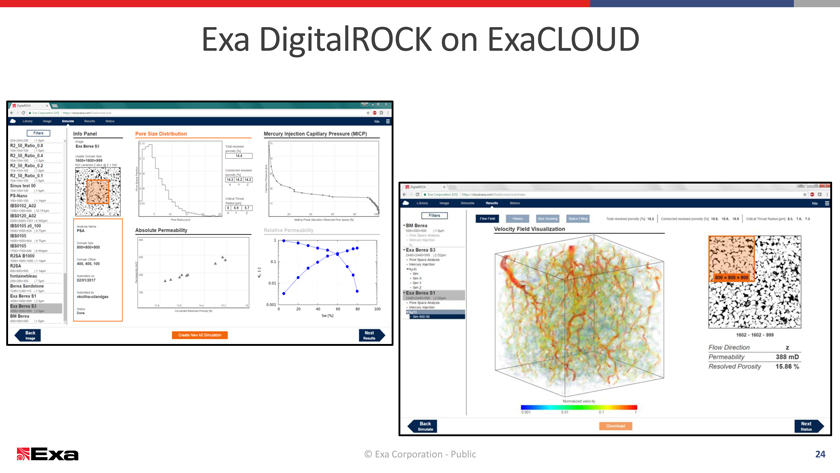

Exa DigitalROCK on ExaCLOUD

© Exa Corporation—Public 24

BP and Exa Announce Strategic Agreement

“After years of cooperative research and development, this breakthrough represents an important step forward for BP and for our industry. … It underscores BP’s continued leadership in digital technologies and their increasingly important role in helping us to develop energy

resources safely, effectively and economically.”

– Ahmed Hashmi, BP Head of Upstream Technology in World Oil: “BP Expands digital rock technology”

© Exa Corporation—Public

25

BP and Exa Announce Strategic Agreement

“This new capability will help engineering teams to make more informed decisions on wells, production facilities, and resource progression, including enhanced oil recovery. … Multiphase simulation is the ‘holy grail’ of digital rock technology.”

– “BP attains holy grail of digital rock technology through new Exa agreement”, citing Joanne Fredrich, BP Upstream Technology Senior Advisor

© Exa Corporation—Public

26

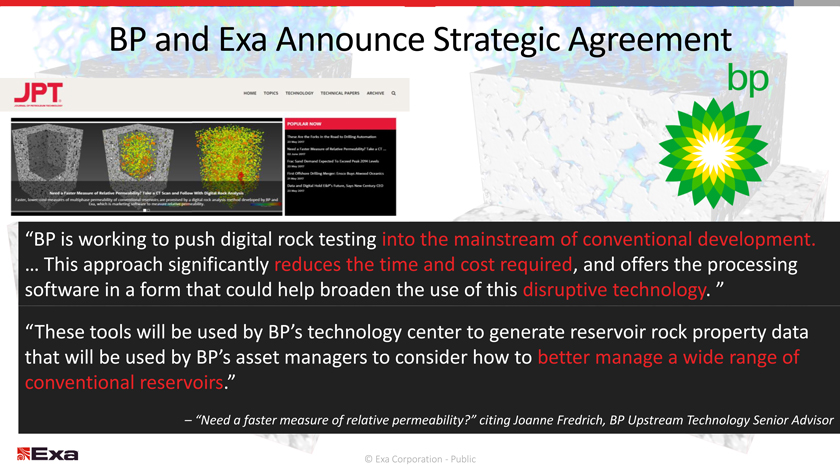

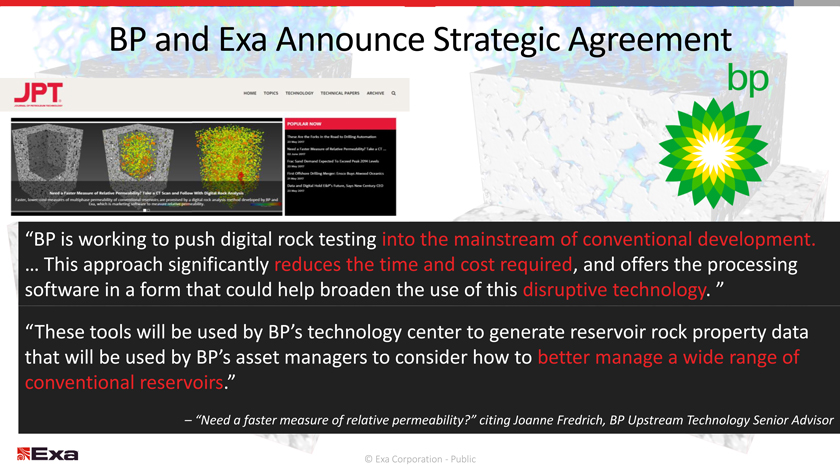

BP and Exa Announce Strategic Agreement

“BP is working to push digital rock testing into the mainstream of conventional development.

… This approach significantly reduces the time and cost required, and offers the processing software in a form that could help broaden the use of this disruptive technology. ”

“These tools will be used by BP’s technology center to generate reservoir rock property data that will be used by BP’s asset managers to consider how to better manage a wide range of conventional reservoirs.”

– “Need a faster measure of relative permeability?” citing Joanne Fredrich, BP Upstream Technology Senior Advisor

© Exa Corporation—Public

Our Product Suite:

Simulation-driven design

Intake and Simulate

prepare CAD results

PowerDELTA PowerCASE PowerCOOLPowerFLOWPowerTHERM

[Graphic Appears Here]

Accurate real-world simulations leverage validated, physics-based modeling

Fast turnaround times with results that target problem areas and recommend solutions

[Graphic Appears Here]

Test multiple design variants, compare results, and evaluate tradeoffs across domains

Ramp up quickly with a graphical, intuitive user experience and benefit from CFD

© Exa Corporation – Public 28

Our Product Suite:

on the ExaCLOUD

START: No upfront SCALE: Access world-class SECURE: Level 3 data

investment high performance computing center & encryption

SOLVE: Focus on solving SHARE: Enable frictionless

design challenges collaboration

© Exa Corporation—Public 29

Key Messages- Financial Foundation

Solid progress towards Investments aimed

Target Model at size and timing of

market opportunity

Focused on recurring Strong, consistent, balanced

license revenue execution

© Exa Corporation—Public 30

30 © Exa Corporation. All rights reserved.

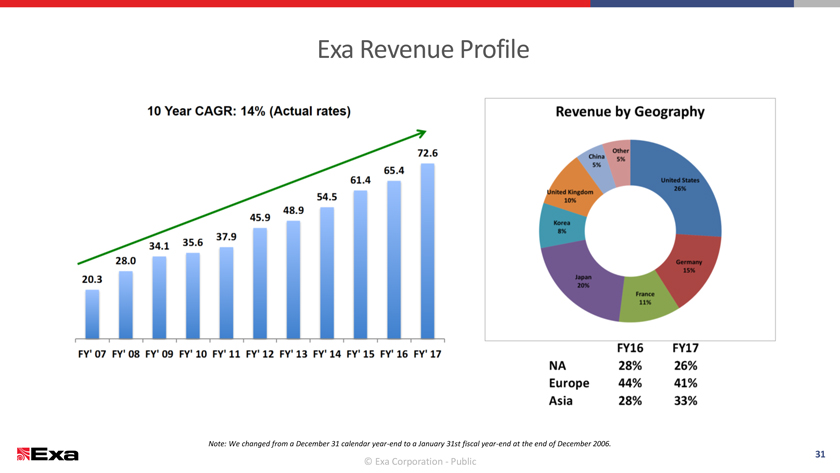

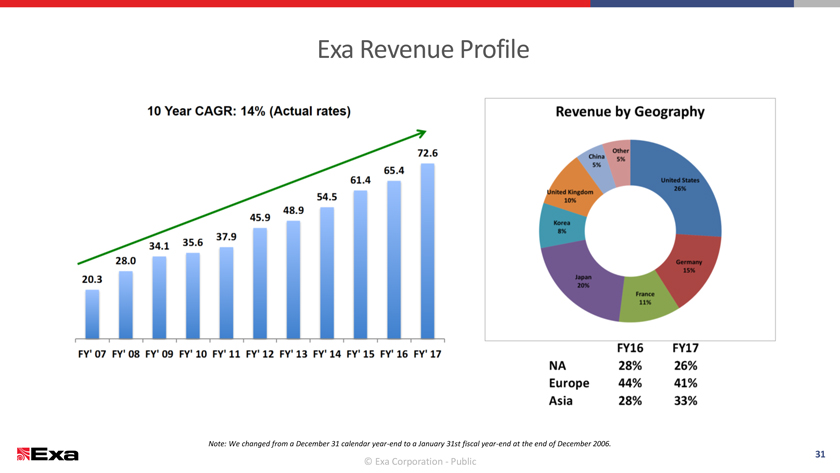

Exa Revenue Profile

Note: We changed from a December 31 calendaryear-end to a January 31st fiscalyear-end at the end of December 2006.

32

© Exa© Corporation. Exa Corporation All rights—Public reserved.

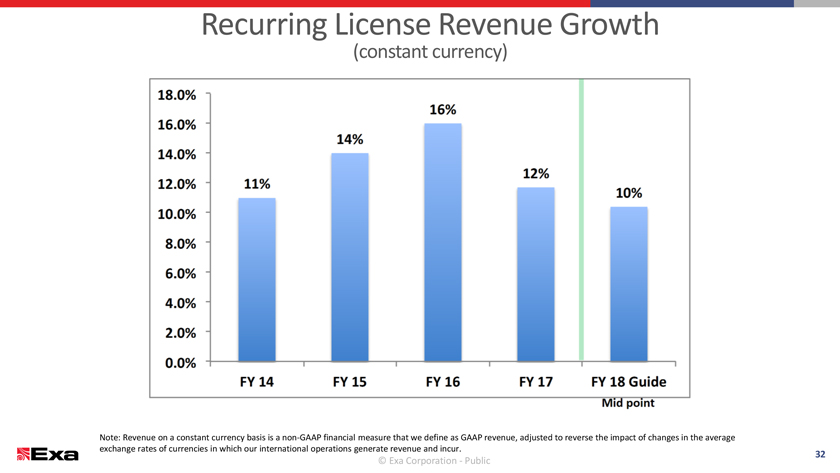

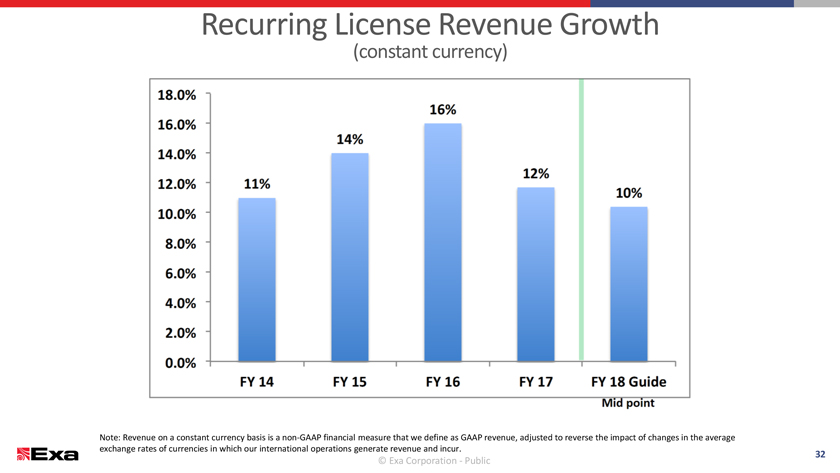

Recurring License Revenue Growth

(constant currency)

Note: Revenue on a constant currency basis is anon-GAAP financial measure that we define as GAAP revenue, adjusted to reverse the impact of changes in the average exchange rates of currencies in which our international operations generate revenue and incur.

© Exa Corporation. All rights reserved. 32

© Exa Corporation—Public

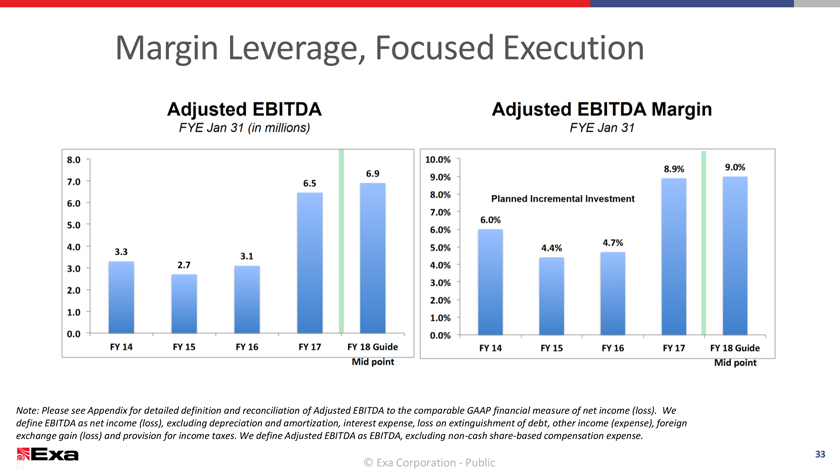

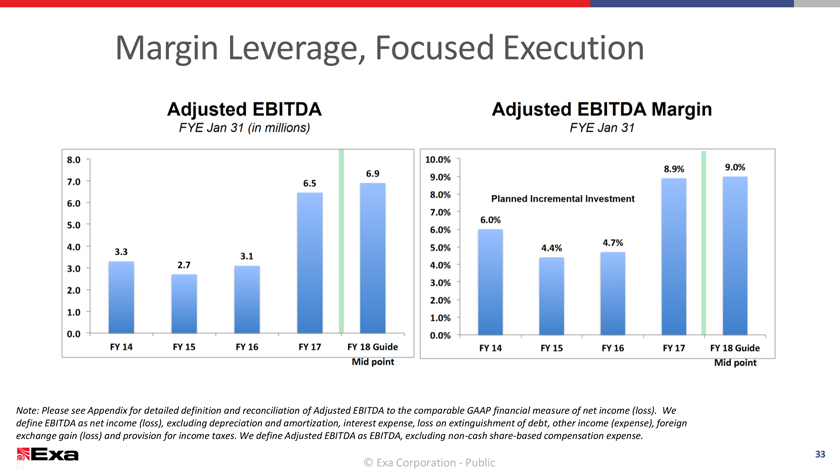

Margin Leverage, Focused Execution

Note: Please see Appendix for detailed definition and reconciliation of Adjusted EBITDA to the comparable GAAP financial measure of net income (loss). We define EBITDA as net income (loss), excluding depreciation and amortization, interest expense, loss on extinguishment of debt, other income (expense), foreign exchange gain (loss) and provision for income taxes. We define Adjusted EBITDA as EBITDA, excludingnon-cash share-based compensation expense.

© Exa Corporation © Exa Corporation . All rights - Public reserved. 34

33

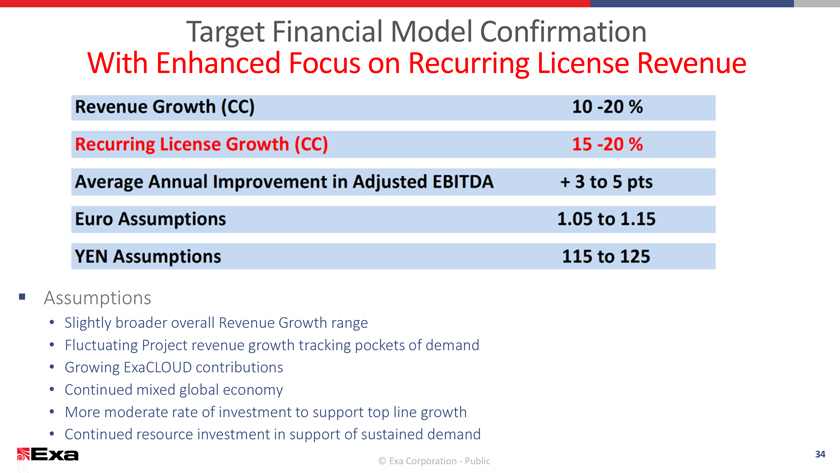

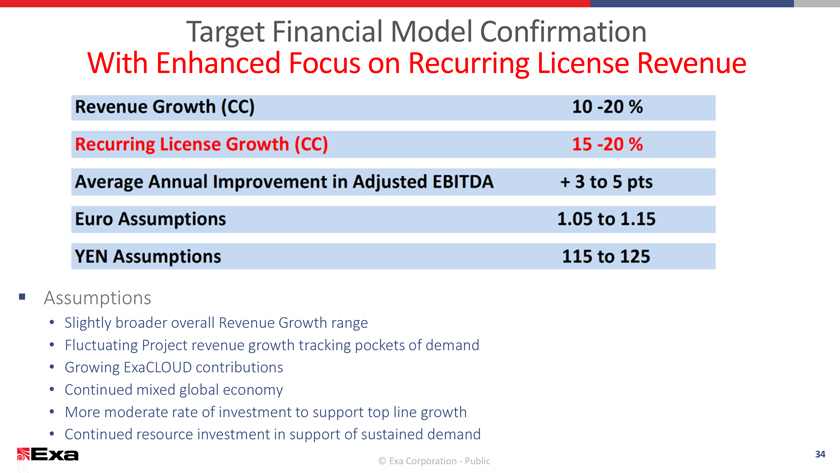

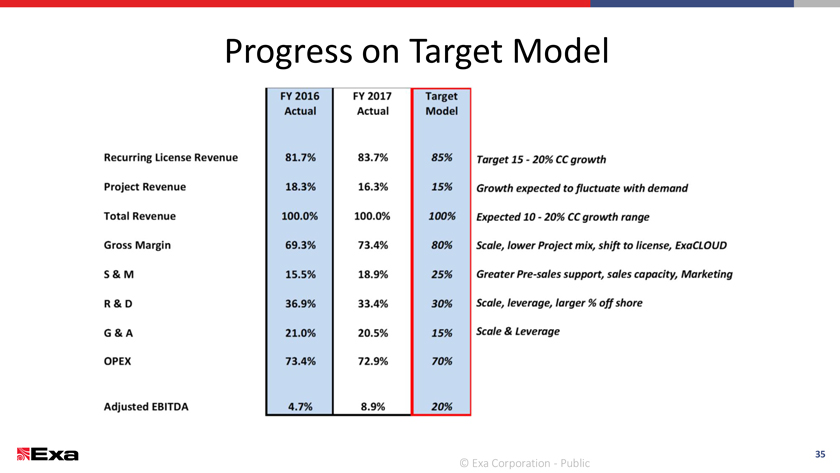

Target Financial Model Confirmation

With Enhanced Focus on Recurring License Revenue

Assumptions

Slightly broader overall Revenue Growth range

Fluctuating Project revenue growth tracking pockets of demand

Growing ExaCLOUD contributions

Continued mixed global economy

More moderate rate of investment to support top line growth

Continued resource investment in support of sustained demand

© Exa Corporation. All rights reserved. 34

© Exa Corporation—Public

35

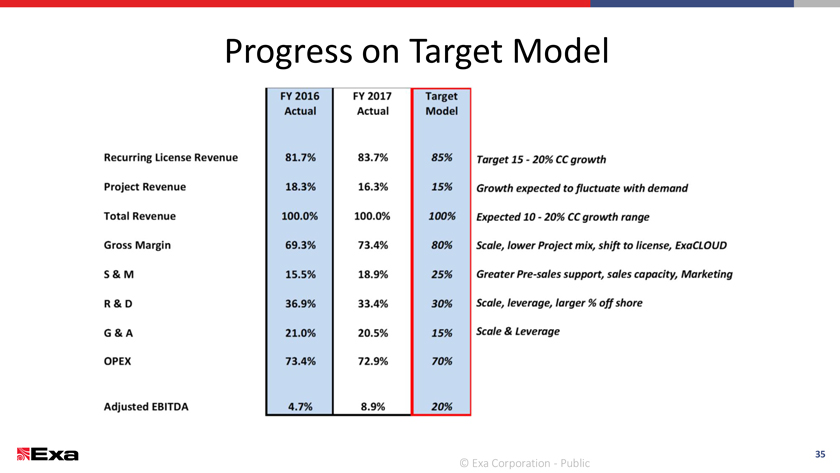

Progress on Target Model

© Exa Corporation—Public 36

Summary

Strong and expanding market opportunity Significant deployment expansion runway Competitive technical advantage Strong customer base Extended market reach via ExaCLOUD Recurring License growth momentum Considerable margin expansion opportunity

© Exa Corporation—Public

36

Questions?

Large addressable market … Proven technology and solutions

only fractionally penetrated

Strong and consistent execution

[Graphic Appears Here]

Improving profitability with

continuedtop-line growth

© Exa Corporation—Public 38

38 © Exa Corporation. All rights reserved.

THANK YOU

© Exa Corporation—Public

Appendix

© Exa Corporation—Public

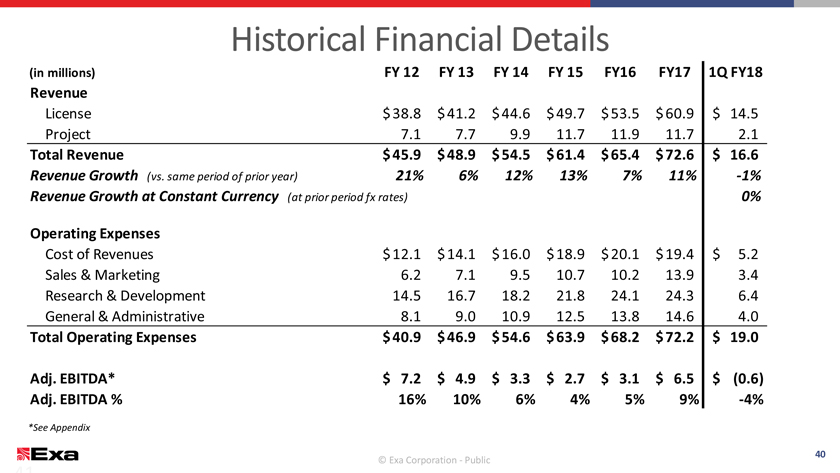

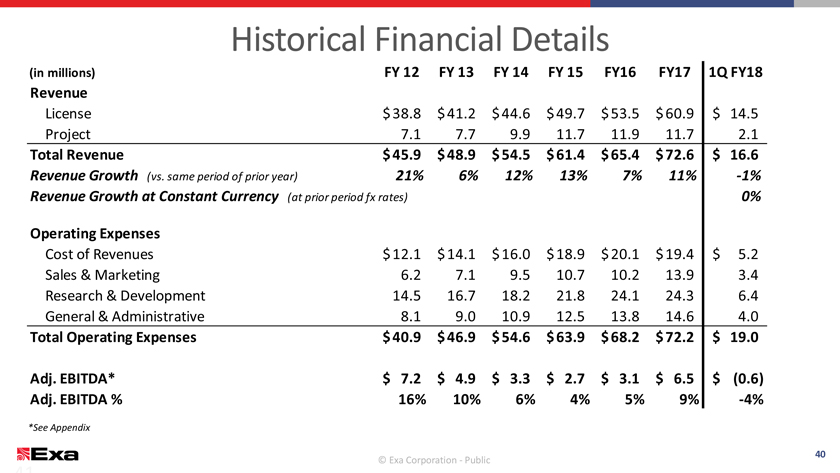

Historical Financial Details

(in millions) FY 12 FY 13FY 14FY 15FY16FY171Q FY18

Revenue

License $ 38.8 $41.2$44.6$ 49.7$53.5$ 60.9$14.5

Project 7.17.79.911.711.911.72.1

Total Revenue $ 45.9 $48.9$54.5$ 61.4$65.4$ 72.6$16.6

Revenue Growth (vs. same period of prior year) 21% 6%12%13%7%11%-1%

Revenue Growth at Constant Currency (at prior period fx rates) 0%

Operating Expenses

Cost of Revenues $ 12.1 $14.1$16.0$ 18.9$20.1$ 19.4$5.2

Sales & Marketing 6.27.19.510.710.213.93.4

Research & Development 14.5 16.718.221.824.124.36.4

General & Administrative 8.19.010.912.513.814.64.0

Total Operating Expenses $ 40.9 $46.9$54.6$ 63.9$68.2$ 72.2$19.0

Adj. EBITDA* $7.2$4.9$3.3$2.7$3.1$ 6.5$(0.6)

Adj. EBITDA % 16% 10%6%4%5%9%-4%

*See Appendix

© Exa Corporation. © Exa Corporation All rights—Public reserved. 41

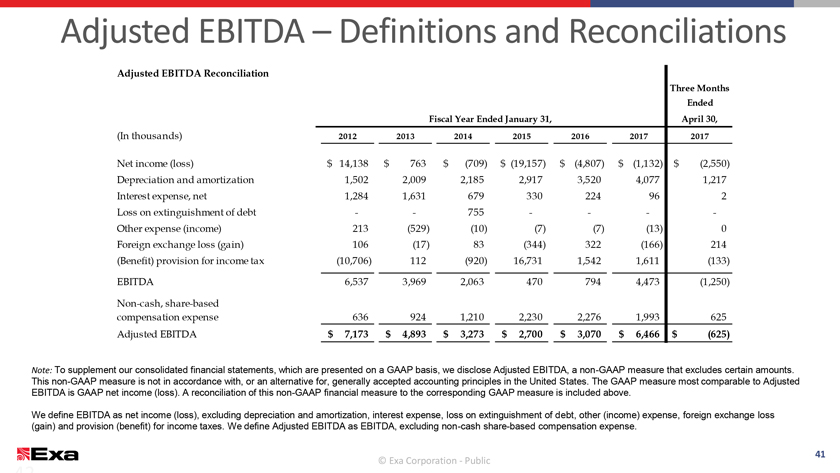

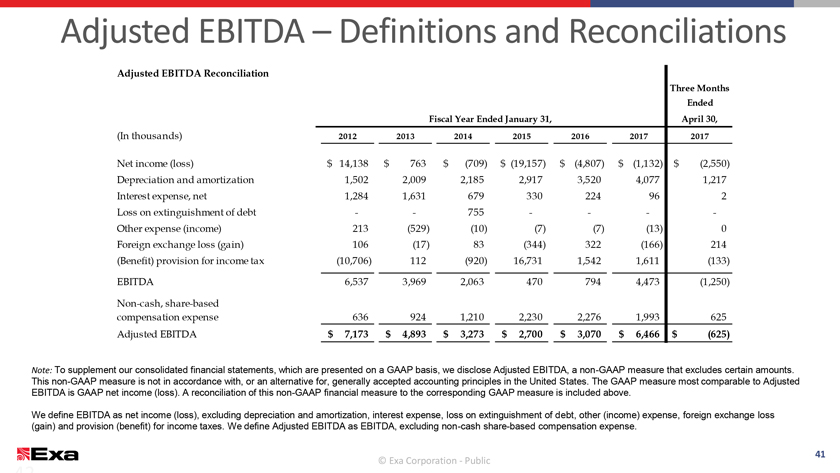

Adjusted EBITDA – Definitions and Reconciliations

Adjusted EBITDA Reconciliation

Three Months

Ended

Fiscal Year Ended January 31,April 30,

(In thousands) 2012 201320142015201620172017

Net income (loss) $ 14,138 $763$(709)$(19,157)$ (4,807)$ (1,132)$(2,550)

Depreciation and amortization 1,502 2,0092,1852,9173,5204,0771,217

Interest expense, net 1,284 1,631679330224962

Loss on extinguishment of debt - -755----

Other expense (income) 213 (529)(10)(7)(7)(13)0

Foreign exchange loss (gain) 106 (17)83(344)322(166)214

(Benefit) provision for income tax (10,706) 112(920)16,7311,5421,611(133)

EBITDA 6,537 3,9692,0634707944,473(1,250)

Non-cash, share-based

compensation expense 636 9241,2102,2302,2761,993625

Adjusted EBITDA $ 7,173 $4,893$3,273$2,700$ 3,070$ 6,466$(625)

Note: To supplement our consolidated financial statements, which are presented on a GAAP basis, we disclose Adjusted EBITDA, anon-GAAP measure that excludes certain amounts. Thisnon-GAAP measure is not in accordance with, or an alternative for, generally accepted accounting principles in the United States. The GAAP measure most comparable to Adjusted EBITDA is GAAP net income (loss). A reconciliation of thisnon-GAAP financial measure to the corresponding GAAP measure is included above.

We define EBITDA as net income (loss), excluding depreciation and amortization, interest expense, loss on extinguishment of debt, other (income) expense, foreign exchange loss (gain) and provision (benefit) for income taxes. We define Adjusted EBITDA as EBITDA, excludingnon-cash share-based compensation expense.

All rights reserved. 42

© Exa Corporation—Public