Exhibit 4.6

EXECUTION COPY

ACQUISITION AGREEMENT

Between

DAVIS STREET LAND COMPANY OF TENNESSEE, L.L.C., AS TRUSTEE OF THE GREEN HILLS MALL TRUST

DAVIS STREET LAND COMPANY OF TENNESSEE II, L.L.C., AS TRUSTEE OF GH II TRUST

GARDENS SPE II, LLC

and

EL PASEO LAND COMPANY, L.L.C.

“Seller”

and

THE TAUBMAN REALTY GROUP LIMITED PARTNERSHIP

“Buyer”

Dated:

September 30, 2011

TABLE OF CONTENTS

|

| | |

| | PAGE |

|

| ARTICLE I DEFINED TERMS | 2 |

|

| 1.1 Definitions. | 2 |

|

| 1.2 Use of Defined Terms. | 31 |

|

| 1.3 Accounting Terms. | 31 |

|

| | |

| ARTICLE II ACQUISITION AND CONTRIBUTION; INDEPENDENT CONSIDERATION | 31 |

|

| 2.1 Acquisition and Contribution. | 31 |

|

| 2.2 Independent Consideration | 31 |

|

| | |

| ARTICLE III EXCHANGE CONSIDERATION; DEPOSIT | 32 |

|

| 3.1 Exchange Consideration. | 32 |

|

| 3.2 Continuing Offer; Registration Rights. | 33 |

|

| 3.3 Certain Federal Income Tax Matters. | 39 |

|

| 3.4 Put of Exchange Units. | 41 |

|

| 3.5 Tax Protection. | 41 |

|

| 3.6 Deposit. | 41 |

|

| | |

| 42 |

|

4.1Buyer’s Due Diligence. | 42 |

|

4.2Due Diligence Contingency. | 52 |

|

4.3Confidentiality of Due Diligence Information. | 52 |

|

4.4Return of Due Diligence Information. | 53 |

|

4.5Service Contracts Designation. | 53 |

|

| 53 |

|

| | |

| 54 |

|

| 54 |

|

5.2Other Operations During Contract. | 55 |

|

| 61 |

|

| 62 |

|

| | |

| 63 |

|

6.1Buyer's Conditions to Closing. | 64 |

|

6.2Seller's Conditions to Closing. | 72 |

|

6.3Benefit of Conditions. | 74 |

|

6.4Approvals not a Condition to Buyer’s Performance. | 74 |

|

6.5Failure of Conditions to Closing. | 74 |

|

| | |

| | |

| | |

| | |

|

| | |

| ARTICLE VII ESCROW AND ESCROW INSTRUCTIONS | 76 |

|

| 76 |

|

7.2Supplementary Instructions. | 76 |

|

7.3Additional Escrow Instructions. | 76 |

|

| | |

| 77 |

|

8.1Seller's Deliveries to Escrow Agent. | 77 |

|

8.2Deliveries by Buyer to Escrow Agent. | 83 |

|

8.3Possession of Real Property. | 85 |

|

| | |

| 85 |

|

| 85 |

|

9.2Permitted Disclosures. | 86 |

|

| 87 |

|

| 87 |

|

| | |

| 88 |

|

| 88 |

|

| 89 |

|

10.3Option to Extend the Closing Date. | 90 |

|

| | |

| 90 |

|

| 90 |

|

| 102 |

|

| | |

| 102 |

|

12.1Representations Regarding Authority and Status. | 102 |

|

12.2Warranties and Representations Pertaining to Real Estate and Legal Matters. | 104 |

|

12.3Representations Pertaining to Tenant Leases, Contracts and Documents. | 109 |

|

12.4Survival of Representations; Limits on Liability. | 114 |

|

12.5Notice of Breach; Seller’s Right to Cure. | 115 |

|

12.6No Reliance; “AS-IS”. | 116 |

|

12.7No Assumption of Liabilities; No Other Remedies. | 117 |

|

| | |

| 117 |

|

13.1Representations and Warranties. | 117 |

|

13.2Representations and Warranties Pertaining to the Buyer Partnership Agreement, TCI Common Stock and Legal Matters. | 119 |

|

13.3Survival of Representations. | 122 |

|

| | |

| 124 |

|

14.1Eminent Domain or Taking. | 124 |

|

| 125 |

|

|

| | |

| 126 |

|

15.1Seller's Indemnification of Buyer. | 127 |

|

15.2Maximum Aggregate Liability; Collateral. | 128 |

|

15.3Buyer's Indemnification of Seller. | 130 |

|

15.4Maximum Aggregate Liability.. | 132 |

|

15.5Permitted Title Nominees’ Indemnification of Seller. | 133 |

|

| 133 |

|

| 134 |

|

| | |

| 134 |

|

| 135 |

|

| 135 |

|

| 137 |

|

16.4Pre-Close Limitations. | 139 |

|

| | |

| 139 |

|

| 139 |

|

17.2Designation of Title Nominee. | 139 |

|

| | |

| 140 |

|

18.1Additional Actions and Documents. | 140 |

|

18.2Entire Agreement; Amendment. | 141 |

|

| 141 |

|

18.4Limitations on Benefits. | 143 |

|

18.5Limitation on Liability. | 143 |

|

18.6Survival Provisions; Acceptance of Deeds. | 143 |

|

| 143 |

|

| 144 |

|

| 144 |

|

| 144 |

|

18.11GOVERNING LAW; Venue. | 144 |

|

| 145 |

|

18.13Pronouns; Time; Construction. | 145 |

|

| 145 |

|

18.15Counterparts; Signatures. | 146 |

|

| 146 |

|

| 147 |

|

| 147 |

|

| 147 |

|

| 148 |

|

18.21Natural Hazard Disclosure. | 148 |

|

18.22Survival of Article XVIII. | 149 |

|

| | |

EXHIBITS

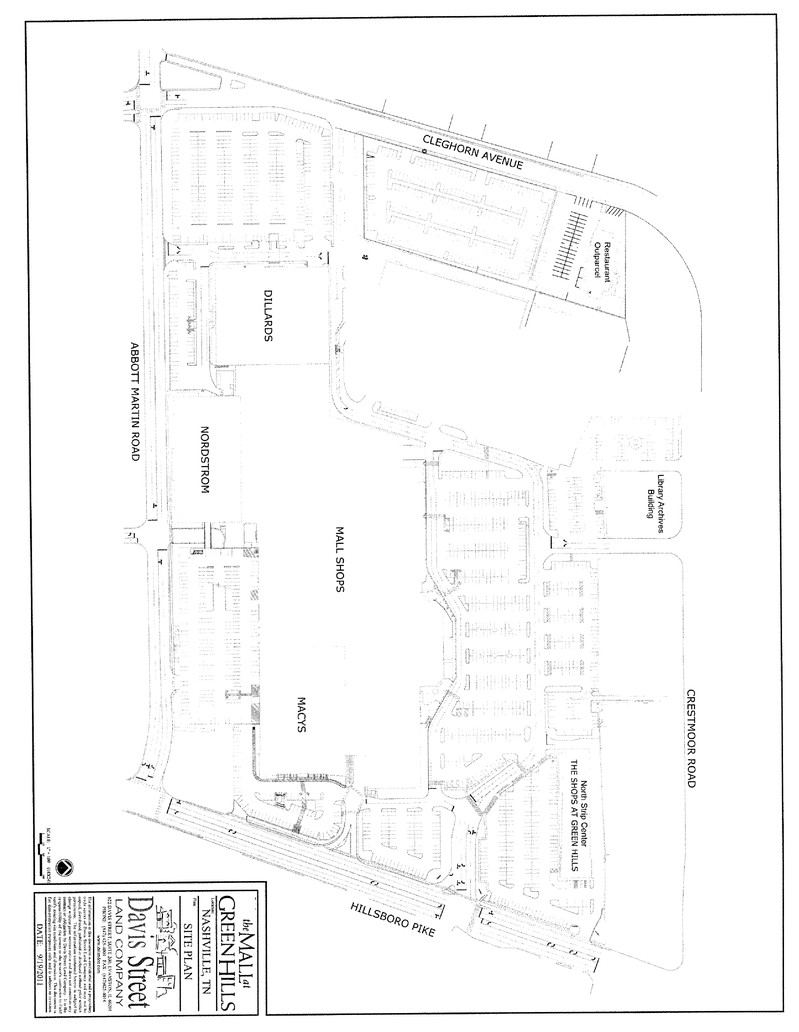

A GHM Site Plan

B GOEP and EPV Site Plan

C Intentionally Omitted

D EPV Fee Parcel Legal Description

E GHM Fee Parcel Legal Description

F GHM Ground Lease Parcel Legal Description

G GOEP Fee Parcel Legal Description

H-1 2011 Installment Note

H-2 2012 Installment Note

I Buyer Letter of Credit

J Continuing Offer

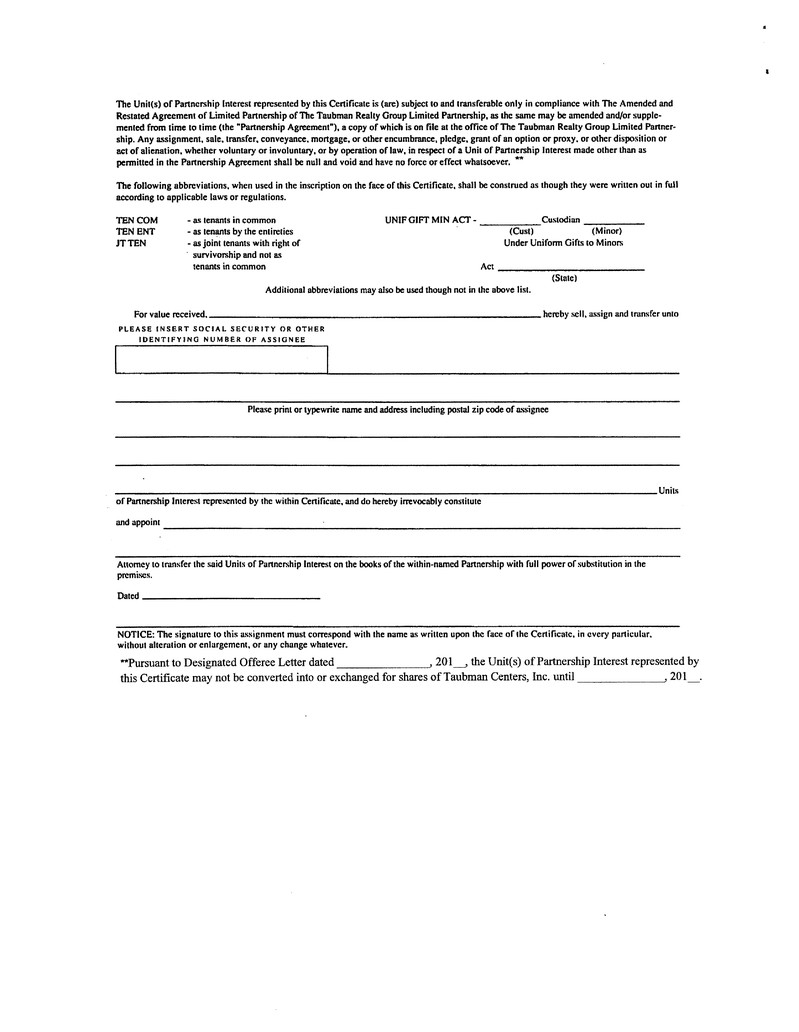

K TRG Unit Certificate

L Investment Certificate

M TCI Designated Offeree Letter

N Allocation of Exchange Consideration Amount

O Put Option Agreement

P Tax Indemnification Agreement

Q Deposit Escrow Agreement

R Space Tenant Estoppel Certificate

S Seller Estoppel Certificate

T Deeds

U Ground Lease Assignment

V Anchor Lease Assignments

W Space Tenant Lease Assignments

X Bills of Sale

Y General Assignments

Z Non-Foreign Certifications

AA Eighth Amendment to Partnership Agreement

BB Form of the Form 8-K

CC Intentionally Omitted

DD Intentionally Omitted

EE Letter of Credit Escrow Agreement

FF Legal Opinion

SCHEDULES

1.1.150 Personal Property Leases and Liens

1.1.151 Tangible Personal Property

11.1.5 Tenant Deposits

11.1.13 Loan Escrows/Reserves

12.2.3 Public Improvements; Condemnation

12.2.4 Notices Of Violations Of Governmental Regulations

12.2.5 Revoked or Terminated Licenses and Permits

12.2.6 Special Assessments

12.2.12 Sales Contracts

12.2.13 Environmental Reports

12.3.1 Anchor Leases

12.3.2 Dillard’s REA

12.3.3 Redevelopment Agreements

12.3.6 Service Contracts

12.3.10 Construction Contracts

12.3.11 First Mortgage Loan Documents

12.3.12 GHM Ground Lease

13.2.2 Litigation (Buyer)

ACQUISITION AGREEMENT

THIS ACQUISITION AGREEMENT (this “Agreement”) is made and entered into as of this 30th day of September, 2011, by and among DAVIS STREET LAND COMPANY OF TENNESSEE, L.L.C., a Delaware limited liability company, as Trustee of The Green Hills Mall Trust, a Tennessee common law trust (“GHM I”), DAVIS STREET LAND COMPANY OF TENNESSEE II, L.L.C., a Delaware limited liability company, as Trustee of GH II Trust, a Tennessee common law trust (“GHM II”, and together with GHM I, “GHM”), GARDENS SPE II, LLC, a Delaware limited liability company (“GSPE”), EL PASEO LAND COMPANY, L.L.C., a Delaware limited liability company (“EPLC,” and together with GHM and GSPE, each individually or collectively, “Seller”), and THE TAUBMAN REALTY GROUP LIMITED PARTNERSHIP, a Delaware limited partnership (“Buyer”).

RECITALS

A.GHM is the owner or ground lessee of a certain regional mall located in the City of Nashville, County of Davidson, State of Tennessee commonly known as “The Mall at Green Hills” and certain other retail and restaurant facilities (the “GHM Development”). The site plan for the GHM Development is attached hereto as Exhibit A (the “GHM Site Plan”). The GHM Development is situated on the GHM Fee Parcel (as defined below) and the GHM Ground Lease Parcel (as defined below) (together, the “GHM Development Site”) and includes the following improvements: (1) the GHM Retail Mall (as defined below); (2) the Macy’s Building (as defined below); (3) the Nordstrom Building (as defined below); and (4) the GHM Parking Facilities (as defined below).

B. GSPE is the owner of a certain retail shopping center located in the City of Palm Desert, County of Riverside, State of California commonly known as “The Gardens on El Paseo” (the “GOEP Development”). The site plan for the GOEP Development is attached hereto as Exhibit B. The GOEP Development is situated on the GOEP Fee Parcel (as defined below) and includes the following improvements: (1) the GOEP Retail Mall (as defined below); (2) the Saks Building (as defined below); and (3) the GOEP Parking Facilities (as defined below).

C. EPLC is the owner of a certain retail shopping center located in the City of Palm Desert, County of Riverside, State of California commonly known as “El Paseo Village” (the “EPV Development”). The site plan for the EPV Development is attached hereto as Exhibit B. The EPV

Development is situated on the EPV Fee Parcel and includes the following improvements: (1) the EPV Retail Mall (as defined below); and (2) the EPV Parking Facilities (as defined below).

D. Buyer and Seller desire to have Seller contribute Seller’s right, title and interest in the GHM Development, the GOEP Development and the EPV Development (each individually a “Development” and together collectively, the “Developments”) to Buyer in exchange for the Exchange Consideration described herein, all as is more particularly set forth herein.

NOW THEREFORE, in consideration of the foregoing, the mutual covenants and agreements contained herein, and the independent consideration set forth in Section 2.2 below, and intending to be legally bound, the parties hereby agree as follows:

ARTICLE I

DEFINED TERMS

1.1 Definitions. In addition to the terms defined in the foregoing Recitals, for purposes of this Agreement, the terms set forth below shall have the following meanings:

1.1.1 “Additional Escrow Instructions” shall have the meaning set forth in Section 7.3 hereto.

1.1.2 “Act” shall have the meaning set forth in Section 18.21 hereof.

1.1.3 “Affiliate” means, with respect to a Person, another Person, directly or indirectly, through one or more intermediaries, Controlling, Controlled by, or under common Control with the Person in question.

1.1.4 “Agreement” shall mean this Acquisition Agreement, as it may be amended, restated or supplemented from time to time.

1.1.5 “Anchor Buildings” means the Macy’s Building, the Nordstrom Building and the Saks Building.

1.1.6 “Anchor Leases” means the Macy’s Lease, the Nordstrom Lease and the Saks Lease.

1.1.7 “Anchor Lease Assignments” shall have the meaning set forth in Section 8.1.3 hereof.

1.1.8 “Anchor Tenants” means Saks, Macy’s and Nordstrom.

1.1.9 “Audited Financial Statements” shall have the meaning set forth in Section 4.1.2(13) hereof.

1.1.10 “Authorities” means all federal, state and local governmental and quasi-governmental bodies, boards, commissions and agencies having jurisdiction over the Property and/or Seller or Buyer, as applicable, including, without limitation, the applicable state, county and city, as the case may be.

1.1.11 “Base Rent” means all base rent, minimum rent, fixed rent or basic rental payable in fixed installments for stated periods by Tenants under the Tenant Leases. Base Rent shall not include tenant reimbursements for Operating Expenses or Percentage Rentals.

1.1.12 “Bills of Sale” shall have the meaning set forth in Section 8.1.7 hereof.

1.1.13 “Books and Records” means all of the following items relating to the construction, improvement, renovation, ownership, use, maintenance, leasing and operation of the Developments which are in the possession of or under the control of Seller or the Property Manager: (a) files, correspondence, memoranda, operating manuals, logs and similar records relating to the Tenant Leases or the operation of the Property, including, without limitation, copies of Tenant Leases, Construction Contracts, Service Contracts, Dillard’s REA, the Personal Property Leases, Redevelopment Agreements, First Mortgage Loan Documents, Ground Lease Documents and other contracts and agreements relating to the ownership or operation of the Property; (b) structural reviews, environmental assessments or audits, architectural drawings and engineering, geophysical, soils, seismic, geologic, environmental and architectural reports, studies and certificates; and (c) accounting, tax, financial and other books and records relating to the Developments. Books and Records also means such additional Books and Records relating to the Developments maintained or prepared after the date of this Agreement and prior to Closing. Notwithstanding the foregoing, Books and Records shall not include any Confidential Materials.

1.1.14 “Broker” means CoastWood Capital Group, LLC, a Connecticut limited liability company.

1.1.15 “Business Day” means any day other than Saturdays, Sundays or any other day on which national banks are not open for business in Michigan, Illinois or New York.

1.1.16 “Buyer” shall have the meaning set forth in the introductory paragraph of this Agreement.

1.1.17 “Buyer Letter of Credit’ shall have the meaning set forth in Section 3.1.1 hereof.

1.1.18 “Buyer Parties” shall mean, collectively, (i) Buyer’s counsel; (ii) any direct or indirect owner of any beneficial interest in Buyer; (iii) any trustee, beneficiary, principal, officer, manager, director, employee, or agent of Buyer; (iv) any other Person affiliated in any way to any of the foregoing (other than Buyer); and (v) any of their respective successors and assigns.

1.1.19 “Buyer’s Knowledge” means the actual knowledge (and not implied or constructive knowledge), without any duty of investigation or inquiry, of the following persons: Steven Eder, Michael Cleary, and Hans Schaefer, and with respect to the representations and warranties of Buyer set forth herein, Esther Blum and Eric Smith.

1.1.20 “Buyer’s Representatives” shall have the meaning set forth in Section 4.1.3 hereof.

1.1.21 “Buyer’s Service Contract Notice” shall have the meaning set forth in Section 4.5 hereof.

1.1.22 “Buyer’s Title Notice” shall have the meaning set forth in Section 4.1.1(2) hereof.

1.1.23 “Buyer Warranties” shall have the meaning set forth in Section 13.3 hereof.

1.1.24 “California Property Taxes” shall have the meaning set forth in Section 11.1.3(2) hereof.

1.1.25 “Cash Escrow” shall have the meaning set forth in Section 15.2 hereof.

1.1.26 “Cash Escrow Agreement” shall have the meaning set forth in Section 15.2 hereof.

1.1.27 “Casualty” shall have the meaning set forth in Section 14.2 hereof.

1.1.28 “Certificates of Units” shall have the meaning set forth in Section 3.1.2 hereof.

1.1.29 “Closing” means the consummation of the transaction contemplated by this

Agreement, including the execution and delivery of the instruments conveying Seller’s right, title and interest in the Real Property to Buyer, the execution and/or delivery of all of the other instruments and documents as provided herein, and the delivery to Seller of the Exchange Consideration.

1.1.30 “Closing Date” means the date upon which the Closing is scheduled to occur as set forth in a written agreement between Seller and Buyer, failing which it shall be the date that is the later of (i) thirty (30) days after the Contingency Date, and (ii) the earlier of (x) ten (10) days after the waiver (pursuant to Section 6.3) or satisfaction of each of the conditions to Closing set forth in Sections 6.1.1, 6.1.2, 6.1.3, 6.1.4, 6.1.5, 6.1.12, and 6.2.4, and (y) the Outside Closing Date, or such later date to which the Closing Date may be extended pursuant to Sections 10.3, 12.4, 12.5, 14.1, 14.2 or 16.1; provided, however, if the satisfaction or waiver of the conditions to Closing set forth in clause (x) above occurs prior to the Outside Closing Date but less than ten (10) days prior to the Outside Closing Date, then the Closing shall nevertheless occur ten (10) days after the date on which all of the foregoing conditions to Closing are satisfied or waived.

1.1.31 “Closing Statement” shall have the meaning set forth in Section 8.1.11 hereof.

1.1.32 “Code” means the Internal Revenue Code of 1986, as amended from time to time (or any corresponding provisions of succeeding law).

1.1.33 “Confidential Materials” means any of the following: appraisals; budgets (other than operating and capital expenditure budgets for any of the Developments); strategic plans for the Property (other than expansion or development plans for the Developments); internal analyses; financial projections; information regarding the marketing of the Property for sale; submissions relating to obtaining internal authorization for the sale of the Property by Seller or any direct or indirect owner of any beneficial interest in Seller; internal minutes or deliberations of Seller or any governing body or council thereof; organizational documents of Seller or any direct or indirect owner of any beneficial interest in Seller; federal and state income tax returns for Davis Street or any direct or indirect subsidiary of Davis Street, attorney and accountant work product; attorney-client privileged documents; investor communications; or internal correspondence of Seller.

1.1.34 “Construction Contracts” means the contracts and agreements, including all amendments, modifications and supplements thereto, listed on Schedule 12.3.10 attached hereto.

1.1.35 “Contingency Date” means the earlier of (i) the date that is forty-five (45) days after the date of this Agreement, and (ii) the date of Buyer’s delivery to Seller of a Notice to Proceed.

1.1.36 “Contingency Period” means the period commencing on the date of this Agreement and ending on the Contingency Date.

1.1.37 “Continuing Offer” shall have the meaning set forth in Section 3.2.1 hereof.

1.1.38 “Control” means the possession, directly or indirectly, of the power to direct or cause the direction of the management or policies of a Person.

1.1.39 “Davis Street” shall mean Davis Street Properties, LLC, a Delaware limited liability company.

1.1.40 “Deeds” shall have the meaning set forth in Section 8.1.1 hereof.

1.1.41 “Deposit” shall have the meaning set forth in Section 3.6 hereof.

1.1.42 “Deposit Escrow Agent” means Chicago Title Insurance Company c/o Nancy Castro, 171 North Clark Street, Division 2, Third Floor, Chicago, Illinois 60601.

1.1.43 “Deposit Escrow Agreement” shall have the meaning set forth in Section 3.6 hereof.

1.1.44 “Development Agreement Estoppel Certificates” shall have the meaning set forth in Section 6.1.5 hereof.

1.1.45 ”Development Agreement Estoppel Criteria” means a Development Agreement Estoppel Certificate (i) does not identify any material document which comprises the applicable Redevelopment Agreement other than documents shown on Schedule 12.3.3; (ii) states that the applicable Seller is not in default under the applicable Redevelopment Agreement (which statement may be qualified by the actual knowledge of the City of Palm Desert, California); (iii) states that the applicable Redevelopment Agreement is in full force and effect.

1.1.46 “Development Agreement Estoppel Cure Period” shall have the meaning set forth in Section 6.1.5 hereof.

1.1.47 “Developments” shall have the meaning set forth in the Recitals hereof.

1.1.48 “Dillard’s” means Dillard Tennessee Operating Limited Partnership, a Tennessee limited partnership.

1.1.49 “Dillard’s REA” means that certain reciprocal easement agreement between GHM I and Dillard’s and all amendments, modifications, supplements and memoranda thereof. Attached as Schedule 12.3.2 hereto is a list of all agreements, documents and instruments which comprise the Dillard’s REA, except for any other documents disclosed in a written disclosure from Seller to Buyer given on or before date hereof.

1.1.50 “Disclosure Statement” shall have the meaning set forth in Section 18.21 hereof.

1.1.51 “Due Diligence Materials” shall have the meaning set forth in Section 4.1.2 hereof.

1.1.52 “Eighth Amendment to Partnership Agreement” shall have the meaning set forth in Section 8.2.1 hereof.

1.1.53 “Environmental Reports” shall have the meaning set forth in Section 12.2.13 hereof.

1.1.54 “EPLC” shall have the meaning set forth in the introductory paragraph of this Agreement.

1.1.55 “EPV Development” shall have the meaning set forth in the Recitals hereof.

1.1.56 “EPV Fee Parcel” means the land more particularly described on Exhibit D attached hereto, together with all rights, privileges, and interests appurtenant to said land, including rights to all streets, alleys, easements and rights of way in, on, across, in front of and abutting or adjoining said land.

1.1.57 “EPV First Mortgage Loan” means the first mortgage loan presently encumbering the EPV Development that is serviced by the EPV Lender.

1.1.58 “EPV Lender” means Wells Fargo Commercial Mortgage Servicing.

1.1.59 “EPV Parking Facilities” means the surface parking improvements situated on the EPV Fee Parcel.

1.1.60 “EPV Retail Mall” means the retail shopping center structures located within the EPV Development.

1.1.61 “Escrow” shall have the meaning set forth in Section 7.1 hereof.

1.1.62 “Event of Default” shall have the meaning set forth in Section 16.1 hereof.

1.1.63 “Exchange Act” shall have the meaning set forth in Section 3.2.2 hereof.

1.1.64 “Exchange Consideration” shall have the meaning set forth in Section 3.1 hereof.

1.1.65 “Exchange Units” shall have the meaning set forth in Section 3.1.2 hereof.

1.1.66 “Excluded Personal Property” shall mean Seller’s right, title and interest in (i) claims (including all proceeds therefrom) under Seller’s insurance policies (except as otherwise expressly provided in Section 14.2), (ii) all bankruptcy claims disclosed in a written disclosure from Seller to Buyer given on or before date hereof, (iii) all tenant litigation disclosed in a written disclosure from Seller to Buyer given on or before date hereof, and (iv) all bank accounts (other than Seller’s right, title, and interest in each escrow account with a First Mortgage Lender to be assigned by Seller to Buyer pursuant to Section 11.1.13), cash and cash equivalent investments.

1.1.67 “Failure of Condition” shall have the meaning set forth in Section 6.5.1 hereof.

1.1.68 “Fee Parcels” shall mean the GHM Fee Parcel, the GOEP Fee Parcel and the EPV Fee Parcel.

1.1.69 “Final Adjustment Date” shall have the meaning set forth in Section 11.1.9 hereof.

1.1.70 “First Mortgage Lenders” means the GHM Lender, the GOEP Lender and the EPV Lender.

1.1.71 “First Mortgage Loan Documents” means all the documents, agreements and instruments, including all amendments, modifications and supplements thereto, listed on Schedule 12.3.11 attached hereto.

1.1.72 “First Mortgage Loan Servicer” means any loan servicer or any other party

charged with administering any First Mortgage Loan on behalf of the First Mortgage Lender under the First Mortgage Loan Documents.

1.1.73 “First Mortgage Loans” means the GHM First Mortgage Loan, the GOEP First Mortgage Loan and the EPV First Mortgage Loan.

1.1.74 “General Assignments” shall have the meaning set forth in Section 8.1.8 hereof.

1.1.75 “GHM” shall have the meaning set forth in the introductory paragraph of this Agreement.

1.1.76 “GHM I” shall have the meaning set forth in the introductory paragraph of this Agreement.

1.1.77 “GHM II” shall have the meaning set forth in the introductory paragraph of this Agreement.

1.1.78 “GHM Development” shall have the meaning set forth in the Recitals hereof.

1.1.79 “GHM Development Site” shall have the meaning set forth in the Recitals hereof.

1.1.80 “GHM Fee Parcel” means the land within the GHM Development Site described on Exhibit E attached hereto, together with all rights, privileges, and interests appurtenant to said land, including rights to all streets, alleys, easements and rights of way in, on, across, in front of and abutting or adjoining said land.

1.1.81 “GHM First Mortgage Loan” means the first mortgage loan presently encumbering the GHM Development held by the GHM Lender.

1.1.82 “GHM Ground Lease” means that certain ground lease between the GHM Ground Lessor, as lessor, and GHM II, as lessee, and all amendments, modifications, supplements and memoranda thereof. Attached as Schedule 12.3.12 hereto is a list of all agreements, documents and instruments which comprise the GHM Ground Lease.

1.1.83 “GHM Ground Lease Parcel” means the land within the GHM Development Site described on Exhibit F attached hereto, together with all rights, privileges, and interests

appurtenant to said land, including rights to all streets, alleys, easements and rights of way in, on, across, in front of and abutting or adjoining said land.

1.1.84 “GHM Ground Lessor” means Seth M. Smith and Wife, Elynor W. Smith.

1.1.85 “GHM Lender” means Metropolitan Life Insurance Company.

1.1.86 “GHM Parking Facilities” means, collectively, the multi-level parking structure and the surface parking improvements situated on the GHM Development Site.

1.1.87 “GHM Property Taxes” shall have the meaning set forth in Section 11.1.3(1) hereof.

1.1.88 “GHM Retail Mall” means the retail mall structures located on the GHM Development Site, including, for purposes hereof, the “North Strip Center” and the restaurant on the “Restaurant Outparcel” as shown on the GHM Site Plan, but excluding the Macy’s Building and the Nordstrom Building.

1.1.89 “GHM Site Plan” shall have the meaning set forth in the Recitals hereof.

1.1.90 “GOEP Development” shall have the meaning set forth in the Recitals hereof.

1.1.91 “GOEP Fee Parcel” means the land more particularly described on Exhibit G attached hereto, together with all rights, privileges, and interests appurtenant to said land, including rights to all streets, alleys, easements and rights of way in, on, across, in front of and abutting or adjoining said land.

1.1.92 “GOEP First Mortgage Loan” means the first mortgage loan presently encumbering the GOEP Development that is serviced by the GOEP Lender.

1.1.93 “GOEP Lender” means LNR Partners, LLC.

1.1.94 “GOEP Parking Facilities” means, collectively, the multi‑story parking structure and the surface parking improvements situated on the GOEP Fee Parcel.

1.1.95 “GOEP Retail Mall” means the retail shopping center structures located within the GOEP Development, excluding the Saks Building.

1.1.96 “Governmental Regulations” means any laws, ordinances, rules, requirements, resolutions and regulations (including, without limitation, those relating to land use,

subdivision, zoning, environmental, wetlands, Hazardous Substances, occupational health and safety, water, earthquake hazard reduction, and building and fire codes) of the Authorities bearing on the construction, maintenance, use or operation of all or any portion of the Property or the formation, existence, business or good standing of Seller, as the case may be.

1.1.97 “Ground Lease Assignment” shall have the meaning set forth in Section 8.1.2 hereof.

1.1.98 “Ground Lease Estoppel Certificate” shall have the meaning set forth in Section 6.1.4 hereof.

1.1.99 “Ground Lease Estoppel Criteria” means the Ground Lease Estoppel Certificate (i) does not identify any material document which comprises the GHM Ground Lease other than documents shown on Schedule 12.3.12; (ii) states that GHM II is not in default under the GHM Ground Lease (which statement may be qualified by the actual knowledge of the Ground Lessor); (iii) states that the GHM Ground Lease is in full force and effect; (iv) states that no condition or state of facts presently exists that would give the GHM Ground Lessor the right to terminate the GHM Ground Lease (which statements may be qualified by the actual knowledge of the Ground Lessor); (v) states that the GHM Ground Lessor is not in default under the GHM Ground Lease (which statement may be qualified by the actual knowledge of the Ground Lessor); and (vi) states the amount of the base rent currently required to be paid under the GHM Ground Lease; provided that, if any disclosure which expressly contradicts any one or more of the required statements set forth in clauses (i) through (vi) above was contained in the Schedules to this Agreement and expressly refers to this Section 1.1.99 (as such Schedules may be updated in accordance with, and subject to, the terms and conditions of Section 5.4), then such required statement or statements shall be deemed satisfied notwithstanding such disclosure.

1.1.100 “Ground Lease Estoppel Cure Period” shall have the meaning set forth in Section 6.1.4 hereof.

1.1.101 “GSPE” shall have the meaning set forth in the introductory paragraph of this Agreement.

1.1.102 “Hazardous Substances” shall have the meaning set forth in Section 12.2.13 hereof.

1.1.103 “Improvements” means all buildings, fixtures, structures, parking areas, roadways, streets, sidewalks, walkways, elevators, storm drainage facilities, utility systems (including sanitary sewer, natural gas, fire and life safety protection, water, heating, lighting, electrical, mechanical, HVAC, plumbing, telephone and cable television systems), plantings, landscaping and any other facilities, installations and improvements situated on the Fee Parcels and the GHM Ground Lease Parcel, including, but not limited to the Retail Malls, the Saks Building, and the Parking Facilities, but excluding the Macy’s Building and the Nordstrom Building. Notwithstanding the foregoing, Improvements do not include (i) for each Tenant Lease, the Tenant’s interest in the buildings and other facilities, installations and improvements constructed and owned by such Tenant, other than the Seller’s interest therein as landlord, and (ii) the interest of the GHM Ground Lessor in the GHM Parking Facilities and any other facilities, installations and improvements located on the GHM Ground Lease Parcel.

1.1.104 “Indemnifiable Obligation” shall have the meaning set forth in Section 3.2.3(1) hereof.

1.1.105 “Indemnified Party” shall have the meaning set forth in Section 3.2.3(3) hereof.

1.1.106 “Indemnifying Party” shall have the meaning set forth in Section 3.2.3(3) hereof.

1.1.107 “Initial Deposit” shall have the meaning set forth in Section 3.6 hereof.

1.1.108 “Installment Note” shall have the meaning set forth in Section 3.1.1 hereof.

1.1.109 “Installment Note Portion” shall have the meaning set forth in Section 3.1.1 hereof.

1.1.110 “Intangible Personal Property” means all of Seller’s right, title and interest in the following: (a) telephone exchange numbers and facsimile numbers for the Developments' leasing offices and/or management offices, (b) websites, web addresses and domain names for and/or used in connection with each Development, (c) the trade names “The Mall at Green Hills,” “The Gardens on El Paseo,” “El Paseo Village” and any other trade names,

trademarks and logos used in the identification of each Development (excepting those including the name “Davis Street”), including their street addresses, (d) service marks relating to each Development, including, but not limited to, any and all attendant state and/or federal service mark registrations; (e) loans to the Tenants; and (f) any other intangible personal property of every kind and character used in connection with the ownership or operation of any Development. Notwithstanding the foregoing, Intangible Personal Property shall not include any Confidential Materials or any Excluded Personal Property.

1.1.111 “Interim Financial Statements” shall have the meaning set forth in Section 4.1.2(13) hereof.

1.1.112 “Investigations” shall have the meaning set forth in Section 4.1.3 hereof.

1.1.113 “Investment Certificate” shall have the meaning set forth in Section 3.1.2 hereof.

1.1.114 “Issuing Bank” shall have the meaning set forth in Section 3.1.1 hereof.

1.1.115 “Letter of Credit Escrow Agent” shall mean Fidelity National Title Insurance Company, c/o Maxine Lievois, 1050 Wilshire, Troy, Michigan 48084.

1.1.116 “Letter of Credit Escrow Agreement” shall have the meaning set forth in Section 15.2 hereof.

1.1.117 “Liabilities” means any and all demands, claims, actions, causes of action, assessments, losses, damages, liabilities, costs and expenses, including reasonable attorney’s fees and disbursements.

1.1.118 “Licenses and Permits” means (a) all licenses, permits, certificates of occupancy, approvals, dedications, subdivision maps or plats, land sale registrations, property reports, conditional use permits, special use permits, declarations of nonsignificance, environmental impact statements and entitlements issued, approved or granted to or for the benefit of Seller (or any predecessor‑in‑interest to Seller) by Authorities or otherwise in effect and which relate to or benefit any Development, and (b) any and all development rights and other intangible

rights, titles, interests, privileges and appurtenances owned by Seller and in any way related to or used in connection with any Development. Licenses and Permits also means any of the foregoing obtained by or on behalf of Seller following the date of this Agreement and prior to the Closing.

1.1.119 “Loan Assumption” shall have the meaning set forth in Section 5.3 hereof.

1.1.120 “Loan Assumption Approvals” shall have the meaning set forth in Section 5.3 hereof.

1.1.121 “Loan Assumption Costs” means, collectively, all costs and fees payable to the First Mortgage Lenders and/or First Mortgage Loan Servicers in connection with obtaining the Loan Assumption Approvals and the Loan Assumption, including, without limitation, (i) all assumption processing fees and the loan assumption fees, (ii) all of the First Mortgage Lender’s and/or First Mortgage Loan Servicer’s legal fees, (iii) all lender title insurance premiums and escrow charges, and (iv) the Tennessee indebtedness tax (if applicable); provided, however, that Buyer and Seller shall each pay its own legal fees and internal costs associated with the Loan Assumption Approvals and Loan Assumption and all such amounts shall not be considered Loan Assumption Costs hereunder.

1.1.122 “Loan Assumption Documents” shall have the meaning set forth in Section 5.3 hereof.

1.1.123 “Macy’s” means Macy’s Retail Holdings, Inc. a New York corporation.

1.1.124 “Macy’s Building” means the three‑story Macy’s department store building situated upon the GHM Fee Parcel.

1.1.125 “Macy’s Lease” means that certain ground lease between GHM I, as landlord, and Macy’s, as tenant, and all amendments, modifications, supplements thereto and memoranda thereof. Attached as 12.3.1 hereto is a list of all agreements, documents and instruments which comprise the Macy’s Lease.

1.1.126 “Major Tenant” or “Major Tenants” shall mean the Tenants identified as “Major Tenants” in a written disclosure from Seller to Buyer given on or before date hereof.

1.1.127 “Major Tenant Estoppel Certificates” shall have the meaning set forth

in Section 6.1.1 hereof.

1.1.128 “Major Tenant Estoppel Criteria” means a Major Tenant Estoppel Certificate (i) does not identify any material document which comprises the applicable Tenant Lease other than documents shown on Schedule 12.3.1 or documents previously disclosed by Seller to Buyer in writing on or before the date hereof, as applicable; (ii) states that landlord is not in default under the applicable Tenant Lease (which statement may be qualified by the Tenant’s actual knowledge); (iii) states that the applicable Tenant Lease is in full force and effect; (iv) states that no claim, charge, defense, or offset (other than percentage rent offsets and free rent, if any, set forth in the applicable Tenant Lease) presently exists against any amounts payable by tenant under the applicable Tenant Lease (which statement may be qualified by the Tenant’s actual knowledge), and (v) states that the Tenant is not it default under the applicable Tenant Lease (which statement may be qualified by the Tenant’s actual knowledge); provided that, if any disclosure which expressly contradicts any one or more of the required statements set forth in clauses (i) through (v) above was contained in the Schedules to this Agreement and expressly refers to this Section 1.1.128 (as such Schedules may be updated in accordance with, and subject to, the terms and conditions of Section 5.4), then such required statement or statements shall be deemed satisfied notwithstanding such disclosure.

1.1.129 “Major Tenant Estoppel Cure Period” shall have the meaning set forth in Section 6.1.1.

1.1.130 “Mastro’s Improvement Escrow” shall mean the amounts held in escrow by the EPV Lender for (i) payment of the leasing commission attributable to the Mastro’s Lease (in the amount of $90,000.00) and (ii) payment of the tenant allowance attributable to the Mastro’s Lease (in the amount of $768,880.00).

1.1.131 “Mastro’s Lease” shall mean the lease between EPLC, as landlord, and Mastro’s Restaurants, LLC, as tenant, and all amendments, modifications, supplements thereto and memoranda thereof, as previously disclosed by Seller to Buyer in writing on or before the date hereof.

1.1.132 “Mastro’s Possession Escrow” shall mean the amounts held in escrow by the EPV Lender for (i) the rent holdback attributable to the Mastro’s Lease (in the amount

of $210,000.00) and (ii) accrued interest as of September 1, 2011 on amounts held in escrow by the EPV Lender (in the amount of $1,192.78).

1.1.133 “Monetary Liens” means (i) all mortgages, financing statements and other voluntary liens on the Real Property securing the payment of monetary obligations, other than liens created by or existing pursuant to the First Mortgage Loan Documents, and (ii) involuntary liens on the Real Property securing the payment of monetary obligations in an aggregate amount equal to or less than $250,000.

1.1.134 “New Construction Contract” means any new construction contract entered into in connection with tenant improvements under a Tenant Lease that Seller enters into in accordance with this Agreement.

1.1.135 “Nordstrom” means Nordstrom, Inc., a Washington corporation.

1.1.136 “Nordstrom Building” means the three-story Nordstrom department store building situated upon the GHM Fee Parcel.

1.1.137 “Nordstrom Lease” means that certain ground lease between GHM I, as landlord, and Nordstrom, as tenant, and all amendments, modifications, supplements thereto and memoranda thereof. Attached as 12.3.1 hereto is a list of all agreements, documents and instruments which comprise the Nordstrom Lease.

1.1.138 “Notice to Proceed” shall have the meaning set forth in Section 4.2 hereof.

1.1.139 “Operating Expenses” means insurance, utilities (to the extent not paid directly by Tenants), common area maintenance, marketing and other operating costs and expenses incurred in the ordinary course of business consistent with past practice in connection with the operation, maintenance and management of the Real Property, excluding real estate taxes and assessments.

1.1.140 “Other Indemnifiable Claims” shall mean any third-party claims or actions asserted or brought against Buyer or a Permitted Title Nominee (i) based upon the Tenant litigation and Tenant audits disclosed in a written disclosure from Seller to Buyer given on or before date hereof, (ii) based upon the failure of Seller to pay amounts due or satisfy its other obligations

under the Construction Contracts, (iii) based upon the failure of Seller to pay all leasing commissions, tenant allowances and costs of tenant improvements or finish work with respect to any Tenant Leases in effect as of the date of this Agreement or set forth on the list previously provided by Seller to Buyer, except for the leasing commissions, tenant allowances and costs of tenant improvements or finish work (a) for which Buyer receives a credit at Closing pursuant to Section 11.1.4, and (b) arising under or pursuant to the Mastro’s Lease, or (iv) with respect to construction-related obligations under the Nordstrom Lease.

1.1.141 “Outside Closing Date” shall mean February 29, 2012.

1.1.142 “Parking Facilities” means the GHM Parking Facilities, the GOEP Parking Facilities and the EPV Parking Facilities.

1.1.143 “Partnership Agreement” shall mean the Second Amendment and Restatement of Agreement of Limited Partnership of The Taubman Realty Group Limited Partnership, dated November 30, 1998, as amended by that certain First Amendment dated March 4, 1999, that certain Second Amendment dated September 3, 1999, that certain Third Amendment dated May 2, 2003, that certain Fourth Amendment dated December 31, 2003, that certain Fifth Amendment dated February 1, 2005, that certain Sixth Amendment dated March 29, 2006 and that certain Seventh Amendment dated December 14, 2007, and as shall be amended at Closing by the Eighth Amendment to Partnership Agreement.

1.1.144 “Percentage Rentals” means percentage rents and other similar rental payments in lieu or in excess of Base Rents under the Tenant Leases, whether finally determined before or after the expiration of the fiscal years under various Tenant Leases.

1.1.145 “Permitted Contracts” means, collectively, the Service Contracts that Buyer has elected or is required to assume pursuant to Section 4.5, the Permitted Title Exceptions, the Redevelopment Agreements, the Dillard’s REA and the Personal Property Leases.

1.1.146 “Permitted Title Exceptions” means (a) all presently existing and future liens of real estate taxes or water, sewer and other taxes, and betterments and assessments, if any, provided that such items are not yet delinquent at Closing; (b) each title or survey matter relating to the Real Property, the GHM Ground Lease Parcel or the Anchor Buildings expressly identified on Schedule B to the Title Commitments or the Updated Surveys which have been

approved by Buyer or deemed approved by Buyer pursuant to Section 4.1.1; (c) the Tenant Leases, the Dillard’s REA, the Redevelopment Agreements and the GHM Ground Lease; (d) all Governmental Regulations, (e) all matters affecting title to the Property caused by Buyer or its agents or representatives, (f) all liens created by or existing pursuant to the First Mortgage Loan Documents, (g) all Personal Property Leases (to the extent the applicable Seller is not in default under such lease or rental agreement), and (h) any other matters affecting title to the Property created with the express written consent of Buyer.

1.1.147 “Permitted Title Nominee” means an entity that Buyer Controls and in which Buyer directly owns 100% of the outstanding stock or other equity interests.

1.1.148 “Permitted Unit Transferees” shall mean the persons or entities that hold an indirect interest in Davis Street and have been identified as “Permitted Unit Transferees” in a written disclosure from Seller to Buyer given on or before date hereof.

1.1.149 “Person” shall mean any individual, general partnership, limited partnership, limited liability company, corporation, joint venture, trust, business trust, cooperative, or association or other similar entity constituted under the laws of any state, the United States or any foreign jurisdiction.

1.1.150 “Personal Property Leases” shall mean all leases and rental agreements, and liens to secure lessors under such leases or rental agreements, applicable to Tangible Personal Property, as shown on Schedule 1.1.150 attached hereto.

1.1.151 “Personal Property Schedule” shall mean Schedule 1.1.151 attached hereto.

1.1.152 “Plans and Specifications” means all of the following that are in the possession of or under the control of Seller or the Property Manager: preliminary, final and proposed construction and building plans and specifications (including elevations, floor plans, schematic design drawings, renderings, working drawings, “as‑built” drawings and structural calculations) respecting the Improvements.

1.1.153 “Property” means, collectively, (a) the Real Property, (b) the Tangible Personal Property, (c) the Intangible Personal Property, (d) the Tenant Leases and the Tenant Deposits, (e) the Dillard’s REA, (f) the Redevelopment Agreements, (g) the Personal Property

Leases, and (h) if and to the extent assignable by Seller, (i) the Licenses and Permits, (ii) the Warranties, and (iii) those Service Contracts that Buyer has elected or is required to assume pursuant to Section 4.5.

1.1.154 “Property Manager” means, collectively, Davis Street Land Company, LLC, a Delaware limited liability company, and its direct and indirect subsidiaries.

1.1.155 “Proration Date” means 11:59 P.M. on the day preceding the Closing Date, so that Buyer shall be entitled to any revenues and responsible for any expenses for the entire Closing Date (and thereafter).

1.1.156 “Put Agreement” shall have the meaning set forth in Section 3.4 hereof.

1.1.157 “Qualifying Holder” shall have the meaning set forth in Section 3.2.3(1) hereof.

1.1.158 “REA Estoppel Certificate” shall have the meaning set forth in Section 6.1.3 hereof.

1.1.159 “REA Estoppel Criteria” means the REA Estoppel Certificate (i) does not identify any material document which comprises the Dillard’s REA other than documents shown on Schedule 12.3.2; (ii) states that GHM I is not in default under the Dillard’s REA (which statement may be qualified by Dillard’s actual knowledge); (iii) states that the Dillard’s REA is in full force and effect; (iv) states that no claim, charge, defense, or offset presently exists against any amounts payable by Dillard’s under the Dillard’s REA and that no condition or state of facts presently exists that would give Dillard’s the right to terminate the Dillard’s REA (which statements may be qualified by Dillard’s actual knowledge); and (v) states that Dillard’s is not in default under the Dillard’s REA (which statement may be qualified by Dillard’s actual knowledge); provided that, if any disclosure which expressly contradicts one or more of the required statements set forth in clauses (i) through (v) above was disclosed in a written disclosure from Seller to Buyer given on or before date hereof (as such disclosure may be updated in accordance with, and subject to, the terms and conditions of Section 5.4), then such required statement or statements shall be deemed satisfied notwithstanding such disclosure.

1.1.160 “REA Estoppel Cure Period” shall have the meaning set forth in

Section 6.1.3 hereof.

1.1.161 “Real Property” means, collectively, the Fee Parcels, the Improvements and the leasehold interest in the GHM Ground Lease Parcel, together with all development rights, easements, off site parking covenants, hereditaments, privileges, tenements, appurtenances, rights, titles and interests belonging thereto and all right, title and interest in and to all streets, alleys, easements and rights of way, strips and gores in, on, across, in front of, abutting or adjoining thereto which are appurtenant or belonging thereto.

1.1.162 “REC” shall have the meaning set forth in Section 4.1.3 hereof.

1.1.163 “Redevelopment Agreements” means the documents, agreements and other instruments, including all amendments, modifications and supplements thereto, listed on Schedule 12.3.3 attached hereto.

1.1.164 “Registrable Shares” shall have the meaning set forth in Section 3.2.2 hereof.

1.1.165 “Registration Statement” shall have the meaning set forth in Section 3.2.2 hereof.

1.1.166 “Rental” or “Rentals” means, collectively, all Base Rent, tenant reimbursements for Operating Expenses, Percentage Rentals and all other sums and charges payable by Tenants pursuant to Tenant Leases.

1.1.167 “Replacement Guarantor” shall have the meaning set forth in Section 5.3 hereof.

1.1.168 “Report” shall have the meaning set forth in Section 18.21 hereof.

1.1.169 “Representation Expiration Date” shall have the meaning set forth in Section 12.4 hereof.

1.1.170 “Retail Malls” means the GHM Retail Mall, the GOEP Retail Mall and the EPV Retail Mall.

1.1.171 “Returns” shall have the meaning set forth in Section 12.2.6(2) hereof.

1.1.172 “Saks” means SCCA Store Holding, Inc., a Delaware corporation.

1.1.173 “Saks Building” means the two-story Saks department store building situated upon the GOEP Fee Parcel.

1.1.174 “Saks Lease” means that certain lease between GSPE, as landlord, and Saks, as tenant, and all amendments, modifications, supplements thereto and memoranda thereof. Attached as 12.3.1 hereto is a list of all agreements, documents and instruments which comprise the Saks Lease.

1.1.175 “Scope of Work” shall have the meaning set forth in Section 4.1.3 hereof.

1.1.176 “SEC” shall have the meaning set forth in Section 3.2.2 hereof.

1.1.177 “Second Deposit” shall have the meaning set forth in Section 3.6 hereof.

1.1.178 “Securities Act” shall have the meaning set forth in Section 3.2.2 hereof.

1.1.179 “Seller” shall have the meaning set forth in the introductory paragraph of this Agreement.

1.1.180 “Seller Estoppel” shall have the meaning set forth in Section 6.1.2 hereof.

1.1.181 “Seller Letter of Credit” shall have the meaning set forth in Section 15.2 hereof.

1.1.182 “Seller Note Designee” shall have the meaning set forth in Section 3.1.1 hereof.

1.1.183 “Seller Parties” means, collectively, (i) Seller’s counsel, (ii) the Property Manager, (iii) any direct or indirect owner of any beneficial interest in Seller or the Property Manager, (iv) any trustee, beneficiary, principal, officer, manager, director, employee or agent of Seller, the Property Manager, or any direct or indirect owner of any beneficial interest in Seller or the Property Manager, (v) any other Person affiliated in any way to any of the foregoing (other than

Seller); and (vi) any of their respective successors and assigns.

1.1.184 “Seller's Knowledge” means the actual knowledge (and not implied or constructive knowledge), without any duty of investigation or inquiry, of the following persons: (a) Robert Perlmutter, (b) Steve Di Vito, (c) Virgil Bonifazi, (d) Terri Johnson, (e) the following property-level managers: (i) with respect to matters related to the GHM Development only, Hank Woerner, and (ii) with respect to matters related to the GOEP Development or the EPV Development only, Robert Fliday, and (f) with respect to all construction matters related to the GHM Development, the GOEP Development and the EPV Development only, Michael Radis.

1.1.185 “Seller’s Title Notice” shall have the meaning set forth in Section 4.1.1(2) hereof.

1.1.186 “Seller Warranties” means Seller’s (i) representations and warranties expressly set forth in Sections 12.1, 12.2 and 12.3 and any other sections of this Agreement, and in any documents executed by Seller for the benefit of Buyer in connection with Closing, and (ii) indemnification obligations expressly set forth in Section 15.1 and any other sections of this Agreement, and in any documents executed by Seller for the benefit of Buyer in connection with Closing, as the same may be modified or deemed modified, or waived by Buyer, pursuant to the express terms and conditions of this Agreement.

1.1.187 “Service Contracts” means the contracts and agreements, including all amendments, modifications and supplements thereof, set forth on Schedule 12.3.6 attached hereto.

1.1.188 “Space Tenant Estoppel Certificates” shall have the meaning set forth in Section 6.1.2 hereof.

1.1.189 “Space Tenant Estoppel Criteria” means a Space Tenant Estoppel Certificate (i) does not identify any material document which comprises the applicable Tenant Lease other than documents previously disclosed by Seller to Buyer in writing on or before the date hereof; (ii) states that landlord is not in default under the applicable Tenant Lease (which statement may be qualified by the Tenant’s actual knowledge); (iii) states that the applicable Tenant Lease is in full force and effect; (iv) states that no claim, charge, defense, or offset (other than percentage rent offsets and free rent, if any, set forth in the applicable Tenant Lease) presently exists against any

rents payable by the Tenant under the applicable Tenant Lease and that no condition or state of facts presently exists that would give the Tenant a right to terminate the applicable Tenant Lease (other than a kick-out right based on sales) (which statements may be qualified by the Tenant’s actual knowledge); and (v) states that the Tenant is not in default under the applicable Tenant Lease (which statement may be qualified by the Tenant’s actual knowledge); provided that, if any disclosure which expressly contradicts one or more of the required statements set forth in clauses (i) through (v) above was disclosed in a written disclosure from Seller to Buyer given on or before date hereof, then such required statement or statements shall be deemed satisfied notwithstanding such disclosure.

1.1.190 “Space Tenant Estoppel Notice” shall have the meaning set forth in Section 6.1.2 hereof.

1.1.191 “Space Tenant Lease Assignments” shall have the meaning set forth in Section 8.1.4 hereof.

1.1.192 “Space Tenant Leases” means the leases, licenses, and other rental agreements, including all amendments, modifications and supplements thereto, as previously disclosed by Seller to Buyer in writing on or before the date hereof, and any other leases, licenses, and other rental agreements entered into by Seller following the date of this Agreement and prior to the Closing in accordance with the provisions hereof.

1.1.193 “Space Tenants” means all persons or entities leasing, licensing, renting or occupying space within each Development pursuant to Space Tenant Leases.

1.1.194 “Tangible Personal Property” means all equipment, appliances, tools, machinery, supplies, building materials, fixtures, furnishings, and any other tangible personal property of every kind and character owned or leased by Seller and appurtenant to, located in or used in connection with the operation of any Development including, without limitation, all of the Books and Records, all of the Plans and Specifications and those items of tangible personal property described on the Personal Property Schedule. Notwithstanding the foregoing, Tangible Personal Property shall not include any Confidential Materials or any Excluded Personal Property.

1.1.195 “Tax Indemnification Agreement” shall have the meaning set forth in Section 3.5 hereof.

1.1.196 “Tax Indemnitee” shall have the meaning set forth in Section 11.1.3(3) hereof.

1.1.197 “Tax Indemnitor” shall have the meaning set forth in Section 11.1.3(3) hereof.

1.1.198 “Taxes” shall have the meaning set forth in Section 5.2.11 hereof.

1.1.199 “TCI” shall mean Taubman Centers, Inc., a Michigan corporation.

1.1.200 “TCI Common Stock” shall have the meaning set forth in Section 3.2 hereof.

1.1.201 “TCI Designation” shall have the meaning set forth in Section 3.2.1 hereof.

1.1.202 “TCI Preferred Stock” shall have the meaning set forth in Section 3.1.2 hereof.

1.1.203 “TCI Stock” shall mean TCI Common Stock and TCI Preferred Stock.

1.1.204 “TCI’s Financial Statements” shall have the meaning set forth in Section 13.2.5 hereof.

1.1.205 “Tenant Deposits” means, collectively, all security deposits, construction deposits, access card or key deposits, and other refundable deposits, plus any interest accrued thereon, received by the Seller, the Property Manager or to any other person or entity on behalf of Seller under the Tenant Leases.

1.1.206 “Tenant Leases” means, collectively, all Space Tenant Leases and all Anchor Leases.

1.1.207 “Tenants” means, collectively, all Space Tenants and Anchor Tenants.

1.1.208 “Third Party Claim” shall have the meaning set forth in Section 15.6 hereof.

1.1.209 “Title Commitments” shall have the meaning set forth in Section 4.1.1(1) hereof.

1.1.210 “Title Company” means Chicago Title Insurance Company c/o Jay Nayak, 171 North Clark Street, Division 2, Third Floor, Chicago, Illinois 60601.

1.1.211 “Title Documents” shall have the meaning set forth in Section 4.1.1(1) hereof.

1.1.212 “Title Objections” shall have the meaning set forth in Section 4.1.1(2) hereof.

1.1.213 “Title Policies” shall have the meaning set forth in Section 6.1.11 hereof.

1.1.214 “Title Response Date” shall have the meaning set forth in Section 4.1.1(3) hereof.

1.1.215 “Unit Holders” shall mean Seller, Davis Street, the Unit Recipients, the Permitted Unit Transferees and any transferees of the Permitted Unit Transferees pursuant to transfers of Exchange Units made in accordance with the terms of the Partnership Agreement.

1.1.216 “Unit Recipients” shall mean the persons or entities that hold a direct interest in Davis Street and have been identified as “Unit Recipients” in a written disclosure from Seller to Buyer given on or before date hereof.

1.1.217 “Updated Surveys” shall have the meaning set forth in Section 4.1.1(1) hereof.

1.1.218 “Violation” shall have the meaning set forth in Section 16.2 hereof.

1.1.219 “Warranties” means Seller’s right, title and interest in and to the benefit of all unexpired warranties or guaranties given to or made in favor of Seller, the Property Manager or their predecessors‑in‑interest (to the extent previously assigned to Seller) in connection with the acquisition, development, construction, maintenance, repair, rehabilitation, renovation or inspection of the Property.

1.2 Use of Defined Terms. Any defined term used in the plural shall refer to all members of the relevant class, and any defined terms used in the singular shall refer to any number of the members of the relevant class. Any reference to this Agreement or any Exhibits or Schedules hereto and any other instruments, documents and agreements shall include this Agreement,

Exhibits, Schedules and other instruments, documents and agreements as originally executed or existing and as the same may from time to time be supplemented, modified or amended by written agreement of Buyer and Seller.

1.3 Accounting Terms. All accounting terms not specifically defined in this Agreement shall be construed in conformity with generally accepted accounting principles, applied on a consistent basis.

ARTICLE II

ACQUISITION AND CONTRIBUTION;

INDEPENDENT CONSIDERATION

2.1 Acquisition and Contribution. Seller agrees to contribute to Buyer, and Buyer agrees to acquire from Seller, all of Seller’s right, title and interest in and to the Property upon and subject to the terms and conditions set forth in this Agreement.

2.2 Independent Consideration. Notwithstanding any term or provision set forth in this Agreement to the contrary, if (a) this Agreement is terminated prior to the Closing and (b) Buyer is entitled to a return of the Deposit as a result of such termination, Seller shall receive Five Thousand Dollars ($5,000) of the Deposit, which amount has been bargained for and agreed to as independent consideration for having entered into this Agreement.

ARTICLE III

EXCHANGE CONSIDERATION; DEPOSIT

3.1 Exchange Consideration. The exchange consideration to be given to Seller by Buyer for the Property at Closing shall be as follows (the “Exchange Consideration”):

3.1.1 Installment Note Portion. The Buyer shall issue two (2) promissory notes (each, an “Installment Note,” and together, the “Installment Notes”) in the aggregate principal amount of Five Hundred Sixty Million Dollars ($560,000,000) less the deemed value of the Exchange Units as elected by Seller in accordance with Section 3.1.2, and less the amount on the Closing Date of all outstanding indebtedness under any First Mortgage Loans (the “Installment Note Portion”). The Installment Notes shall be executed by Buyer and delivered at Closing to a party or parties designated by Seller in writing not less than two (2) Business Days before Closing (each, a “Seller Note Designee”). Each of the Installment Notes shall be in the form attached as

Exhibit H-1 hereto if the Closing occurs in 2011 or in the form attached as Exhibit H-2 hereto if the Closing occurs in 2012. The allocation of the Installment Note Portion between the two Installment Notes shall be designated by Seller in the writing described above in this Section 3.1.1. At Closing, Buyer shall also deliver, or cause to be delivered, to Seller two irrevocable, unconditional, sight draft, standby letters of credit securing the obligations of Buyer with respect to the respective Installment Notes (each, a “Buyer Letter of Credit,” and together, the “Buyer Letters of Credit”). Each Buyer Letter of Credit shall be in the amount of the original principal amount of the Installment Note it secures and shall be issued in favor of the applicable Seller Note Designee with respect to such Seller Note Designee’s Installment Note by either of the following (the “Issuing Bank”): (i) JP Morgan Chase Bank, N.A., or (ii) another financial institution acceptable to Seller in its reasonable discretion. Each Buyer Letter of Credit shall be in the form attached as Exhibit I hereto, subject to changes required by the Issuing Bank and approved by each of Seller and Buyer, such approval not to be unreasonably withheld, conditioned or delayed.

3.1.2 Issuance of Units of Partnership Interest. Buyer shall issue to Seller that number of Units of Partnership Interest (as defined in the Partnership Agreement) in Buyer (the “Exchange Units”) elected by Seller in writing not less than two (2) Business Days before Closing up to a maximum aggregate deemed value equal to Eighty Million Dollars ($80,000,000). For purposes of this Section 3.1.2, the value of each Exchange Unit will be deemed to be Fifty-Five Dollars ($55.00). Such Exchange Units shall be issued at Closing to the Unit Recipients as directed by Seller in the election provided above. The Exchange Units shall be evidenced by certificates (the “Certificates of Units”) of Units of Partnership Interest in Buyer in the form attached as Exhibit K. The Unit Recipients shall be admitted as limited partners of Buyer at the Closing. Without limitation of the rights of any holder of a partnership interest in Buyer to transfer such interest in accordance with the Partnership Agreement, as of the Closing, the Managing General Partner of Buyer shall make a Transfer Determination permitting the following transfers of Exchange Units: (i) transfers by Seller to Davis Street, (ii) transfers by Davis Street to the Unit Recipients, and (iii) on or after the date that is 10 days after the Closing Date, transfers by the Unit Recipients to the Permitted Unit Transferees, in each case, without the need for any further approvals or consents under the Partnership Agreement. At the Closing, Seller may purchase one share of TCI’s Series B Non-Participating Convertible Preferred Stock (the “TCI Preferred Stock”) for each Exchange

Unit received by Seller at the Closing, as described in, and in accordance with, the Restated Articles of Incorporation of Taubman Centers, Inc., as amended. Such TCI Preferred Stock shall be issued at Closing to the Unit Recipients as directed by Seller in the election provided above. Assumption of First Mortgage Loans. The assumption by Buyer of all outstanding indebtedness under the First Mortgage Loans on the Closing Date.

3.2 Continuing Offer; Registration Rights. Continuing Offer. At Closing, TRG covenants that TCI will, and TRG will cause TCI to, designate each Unit Recipient as a Designated Offeree under the Continuing Offer attached hereto as Exhibit J (the “Continuing Offer”) pursuant to the designation attached hereto as Exhibit M (the “TCI Designation”). Terms used in this Section 3.2 that are not defined in this Agreement and that are defined in the Continuing Offer shall have the meanings assigned to them in the Continuing Offer. At the Closing, Seller, Davis Street and the Unit Recipients shall each execute and deliver to Buyer the Investment Certificate attached hereto as Exhibit L (the “Investment Certificate”), pursuant to which, among other things, Seller, Davis Street and the Unit Recipients shall each agree that notwithstanding the Continuing Offer, none of them or any other Unit Holder shall be entitled to exchange the Exchange Units for shares of Common Stock, $0.01 par value, of TCI (“TCI Common Stock”) until the first anniversary of the Closing. TRG covenants that TCI will not, and TRG will cause TCI not to, amend or otherwise modify the terms and provisions of the Continuing Offer prior to the Closing without Seller’s prior written consent, which consent shall not be unreasonably withheld, conditioned or delayed.

3.2.2 Registration. TRG covenants that TCI will, and TRG will cause TCI to, file with the Securities and Exchange Commission (the “SEC”) a new registration statement on Form S-3 under the Securities Act of 1933, as amended (the “Securities Act”), or an amendment to, or a prospectus supplement under, TCI’s currently effective registration statement on Form S-3 under the Securities Act (as amended and supplemented and together with any replacements, the “Registration Statement”), that registers for resale under the Securities Act the shares of TCI Common Stock that the Unit Holders that own Exchange Units would have the right to acquire upon acceptance of the Continuing Offer with respect to their Exchange Units (such shares of TCI Common Stock issued or issuable on exchange of Exchange Units and any other securities issued as a dividend or other distribution with respect to, or in exchange for or in replacement of, such shares, the “Registrable Shares”). TRG covenants that TCI will, and TRG will cause TCI to, file

such registration statement, amendment or prospectus supplement with the SEC no later than the 305th day following the Closing, use its best efforts to have it declared effective by the SEC as soon as practicable after the first anniversary of the Closing and to cause such Registration Statement to remain effective for so long as any of the Unit Holders or their “assignees” (as defined in the Continuing Offer) owns any Exchange Units or Registrable Shares, including amending and supplementing the Registration Statement and the prospectus contained therein, and timely filing reports under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), as and to the extent necessary to comply with the Securities Act and any applicable state securities statutes and regulations, and shall notify the holders of the Exchange Units of the effectiveness of the Registration Statement. TRG shall bear the costs and expenses of the Registration Statement including, without limitation, printing expenses (including a reasonable number of prospectuses for circulation by the Qualifying Holders), legal fees and disbursements of counsel for TRG or TCI, “blue sky” expenses, accounting fees and filing fees, but shall not include underwriting commissions or similar charges, legal fees and disbursements of counsel (if any) for the Qualifying Holders. The holders of the Exchange Units will take all steps reasonably requested by Buyer to enable such Registration Statement to be declared effective and, thereafter, to enable TCI to satisfy any undertakings included therein. Each Unit Holder acknowledges and agrees that: (a) upon acceptance of the Continuing Offer with respect to any of the Exchange Units, it may not resell any shares of TCI Common Stock issued in exchange for such Exchange Units except pursuant to an exemption under the Securities Act or until TCI has caused the Registration Statement to become effective; (b) the Unit Holders’ ability to accept the Continuing Offer will be subject to all of the terms, conditions and limitations set forth therein, including, without limitation, the Ownership Limit; and (c) notwithstanding any provision to the contrary contained in the Continuing Offer, TCI will have no obligation to deliver shares of TCI Stock to the Unit Holders that hold Exchange Units until the first anniversary of the Closing.

3.2.3 Indemnification.

(1) To the extent permitted by Law, TRG will indemnify and hold harmless each Unit Holder and any “assignee” (as defined in the Continuing Offer) of any Unit Holder (each, a “Qualifying Holder”), any underwriter (as defined in the Securities Act) for a Qualifying Holder, its officers, directors, stockholders or partners and each Person, if any, who controls or is alleged

to control a Qualifying Holder or underwriter within the meaning of the Securities Act or the Exchange Act, against any losses, claims, damages, or liabilities (joint or several) to which they may become subject under the Securities Act, the Exchange Act or other federal or state Law, insofar as such losses, claims, damages, or liabilities (or actions in respect thereof) arise out of or are based upon any of the following statements, omissions or violations (collectively a “Indemnifiable Violation”): (A) any untrue statement or alleged untrue statement of a material fact contained or incorporated by reference in the Registration Statement, including any preliminary prospectus or final prospectus contained therein or any amendments or supplements thereto, (B) the omission or alleged omission to state or incorporate by reference therein a material fact required to be stated or incorporated by reference therein, or necessary to make the statements included or incorporated by reference therein not misleading, or (C) any violation or alleged violation by TCI of the Securities Act, the Exchange Act or any state securities law or any rule or regulation promulgated under the Securities Act, the Exchange Act or any state securities Law; and TRG will pay to such Qualifying Holder, underwriter or controlling Person, any legal or other expenses reasonably incurred by them in connection with investigating or defending any such loss, claim, damage, Liability, or action; provided, however, that the indemnity agreement contained in this Section 3.2.3(1) shall not apply to amounts paid in settlement of any such loss, claim, damage, Liability, or action if such settlement is effected without the consent of TRG (which consent may not be unreasonably withheld); nor shall TRG be liable to any Qualifying Holder in any such case for any such loss, claim, damage, Liability, or action to the extent that it arises out of or is based upon an Indemnifiable Violation which occurs in reliance upon and in conformity with written information furnished by such Qualifying Holder expressly for use in the Registration Statement.

(2) To the extent permitted by Law, each Qualifying Holder will indemnify and hold harmless TCI, each of its directors, each of its officers who has signed the Registration Statement, each Person, if any, who controls TCI within the meaning of the Securities Act, any underwriter, and any controlling Person of any such underwriter, and each other Qualifying Holder against any losses, claims, damages, or liabilities (joint or several) to which any of the foregoing Persons may become subject under the Securities Act, the Exchange Act or any state securities Law, insofar as, and only to the extent that, such losses, claims, damages, or liabilities (or actions in respect thereto) arise out of or are based upon any Indemnifiable Violation (which includes

without limitation the failure of such Qualifying Holder to deliver the most current prospectus provided by TCI prior to the date of such sale), in each case to the extent (and only to the extent) that such Indemnifiable Violation occurs in reliance upon and in conformity with written information furnished by such Qualifying Holder expressly for use in the Registration Statement or such Indemnifiable Violation is caused by such Qualifying Holder’s failure to deliver to the purchaser of such Qualifying Holder’s Registrable Shares a prospectus (or amendment or supplement thereto) that, if requested by the Qualified Holder, had been provided to such Qualifying Holder by TCI prior to the date of the sale; and such Qualifying Holder will pay any legal or other expenses reasonably incurred by any Person intended to be indemnified pursuant to this Section 3.2.3(2) in connection with investigating or defending any such loss, claim, damage, Liability, or action; provided, however, that the indemnity agreement contained in this Section 3.2.3(2) shall not apply to amounts paid in settlement of any such loss, claim, damage, Liability or action if such settlement is effected without the consent of such Qualifying Holder, which consent shall not be unreasonably withheld. The aggregate indemnification and contribution Liability of such Qualifying Holder under this Section 3.2.3(2) and Section 3.2.3(4) below shall not exceed the net proceeds received by such Qualifying Holder in connection with sale of shares pursuant to the Registration Statement.

(3) Each Person entitled to indemnification under this Section 3.2.3 (the “Indemnified Party”) shall give notice to the party required to provide indemnification (the “Indemnifying Party”) promptly after such Indemnified Party has actual knowledge of any claim as to which indemnity may be sought and shall permit the Indemnifying Party to assume the defense of any such claim and any litigation resulting therefrom, provided that counsel for the Indemnifying Party who conducts the defense of such claim or any litigation resulting therefrom shall be approved by the Indemnified Party (whose approval shall not unreasonably be withheld), and the Indemnified Party may participate in such defense at such party’s expense, and provided further that the failure of any Indemnified Party to give notice as provided herein shall not relieve the Indemnifying Party of its obligations under this Section 3.2.3 unless the Indemnifying Party is materially prejudiced thereby. No Indemnifying Party, in the defense of any such claim or litigation, shall (except with the consent of each Indemnified Party) consent to entry of any judgment or enter into any settlement that does not include as an unconditional term thereof the giving by the claimant or plaintiff to such Indemnified Party of a release from all Liability in respect to such claim or litigation. Each Indemnified

Party shall furnish such information regarding itself or the claim in question as an Indemnifying Party may reasonably request in writing and as shall be reasonably required in connection with the defense of such claim and litigation resulting therefrom.

(4) To the extent that the indemnification provided for in this Section 3.2.3 is held by a court of competent jurisdiction to be unavailable to an Indemnified Party with respect to any loss, Liability, claim, damage or expense referred to herein, then the Indemnifying Party, in lieu of indemnifying such Indemnified Party hereunder, shall contribute to the amount paid or payable by such Indemnified Party as a result of such loss, Liability, claim, damage or expense in such proportion as is appropriate to reflect the relative fault of the Indemnifying Party on the one had and of the Indemnified Party on the other in connection with the statements or omissions which resulted in such loss, Liability, claim, damage or expense, as well as any other relevant equitable considerations. The relative fault of the Indemnifying Party and of the Indemnified Party shall be determined by reference to, among other things, whether the untrue of alleged untrue statement of a material fact or the omission or alleged omission to state a material fact relates to information supplied by the Indemnifying Party or by the Indemnified Party and the parties’ relative intent, knowledge, access to information and opportunity to correct or prevent such statement or omission.

3.2.4 Copies of Prospectuses. When a Qualifying Holder is entitled to sell Registrable Shares pursuant to the Registration Statement, TRG covenants that TCI will, and TRG will cause TCI to, within two (2) trading days following the request, furnish to such Qualifying Holder a reasonable number of copies of a supplement to or an amendment of such prospectus as may be necessary so that, as thereafter delivered to the purchasers of such Registrable Shares, such prospectus shall not as of the date of delivery to such Qualifying Holder include an untrue statement of a material fact or omit to state a material fact required to be stated therein or necessary to make the statement therein not misleading or incomplete in the light of the circumstances then existing.

3.2.5 Assignment. The rights of each party designated as a Designated Offeree under this Section 3.2 and the Continuing Offer may be assigned to any Qualifying Holder subject to and with the benefit of the obligations and rights provided in this Section 3.2.

3.2.6 Survival. The terms and provisions of this Section 3.2 shall survive the Closing.

3.3 Certain Federal Income Tax Matters.