Exhibit 10.14

THIRD AMENDED AND RESTATED

LIMITED LIABILITY COMPANY AGREEMENT

OF

TAUBMAN PROPERTIES ASIA LLC

A DELAWARE LIMITED LIABILITY COMPANY

THIS THIRD AMENDED AND RESTATED LIMITED LIABILITY COMPANY AGREEMENT (this “Agreement”) is effective as of the 15th day of October, 2010, by, between, and among Taubman Asia Management II LLC, a Delaware limited liability company (“T-Asia”), whose address is 200 East Long Lake Road, P. O. Box 200, Bloomfield Hills, MI 48303-0200, and René Tremblay (“Tremblay”), whose address is currently (but soon to be changed) 1928, Alfred-Pellan Street, Longueuil QC J4N 1P6, and Taubman Properties Asia LLC, a Delaware limited liability company (the “Company”).

RECITALS:

A. The Taubman Realty Group Limited Partnership, a Delaware limited partnership (“TRG”), formed the Company under the name “Taubman Properties Asia LLC,” by filing, on April 21, 2005, a Certificate of Formation (the “Certificate”) with the Delaware Secretary of State in accordance with the Delaware Limited Liability Company Act (the "Act"). TRG, as the Company's sole member, entered into and adopted an Operating Agreement of Taubman Properties Asia LLC dated as of April 21, 2005 (the “Original Agreement”). TRG subsequently assigned its entire interest in the Company to T-Asia, which became the sole member of the Company in TRG's place and stead.

B. On January 23, 2008, the Company admitted another member, and the Original Agreement was amended and restated (the “First Amended and Restated Agreement”).

C. On October 4, 2009, such other member withdrew from the Company, leaving T-Asia as the sole member of the Company, and the First Amended and Restated Agreement was once again amended and restated as of December 7, 2009 (the “Second Amended and Restated Agreement”).

D. The parties hereto desire that (i) Tremblay be admitted to the Company as an additional member on the terms and conditions hereinafter set forth, and (ii) the Second Amended and Restated Agreement be further amended and restated in order to memorialize the understandings of the parties with respect to their relationship as members of, and their respective interests in, the Company.

E. Capitalized terms used herein shall have the meanings given to such terms in Article XI hereof unless otherwise defined herein.

Accordingly, the parties hereto agree as follows:

ARTICLE I

CONTINUATION, NAME,

PURPOSE, PRINCIPAL OFFICE,

TERM OF THE COMPANY AND RELATED MATTERS

1.1 Continuation. Tremblay is hereby admitted to the Company as a member along with T-Asia. The parties shall continue the Company on the terms and for the purposes hereinafter set forth.

1.2 Name. The name of the Company is Taubman Properties Asia LLC. The Company may also conduct its business under one or more assumed names.

1.3 Purpose. The purpose of the Company is to engage, indirectly through subsidiaries and ventures with others, in (i) the acquisition, development, financing, management, leasing and/or selling or exchanging of interests in commercial real properties, and properties having a significant commercial component, in the Territory (collectively, the “Commercial Projects”), with an initial focus in China and South Korea, (ii) any other activities in which the Members by Majority Vote may resolve to engage, and (iii) any other activities incidental or related to any of the foregoing.

1.4 Term.

(a)The term of the Company commenced upon the filing of the Certificate.

(b)The term of the Company shall end, and the Company shall dissolve, on the first to occur of the following events:

(i)the decision of the Manager to dissolve the Company; or

(ii)any other event which, under this Agreement or the Act, results in dissolution of the Company.

1.5 Office and Resident Agent.

(a) The registered agent and office of the Company in the State of Delaware shall be The Corporation Service Company, having an address at 2711 Centerville Road, Suite 400, Wilmington, Delaware 19808, or such other agent and address as may be designated from time to time by the Manager.

(b) The address of the principal office of the Company shall be 200 East Long Lake Road, P. O. Box 200, Bloomfield Hills, MI 48303-0200. The Company's resident agent in the State of Michigan shall be Chris B. Heaphy, Esq., whose address is 200 East Long Lake Road, P. O. Box 200, Bloomfield Hills, MI 48303-0200.

ARTICLE II

CAPITAL CONTRIBUTIONS

AND RELATED MATTERS

2.1 Capital Contributions of the Members.

(a) T-Asia shall contribute such cash to the capital of the Company as the Manager may determine from time to time to be necessary or appropriate, less any such cash that Tremblay chooses to contribute pursuant to Section 2.1(b) below.

(b) Tremblay is, on or about the date of this Agreement, contributing the sum of One Hundred US Dollars (US $100) to the capital of the Company. At any time the Manager determines that additional contributions from the Members are necessary or appropriate, Tremblay shall be permitted to make such additional contributions to the Company up to any amount as will reduce T-Asia's Preferred Capital to, and/or maintain T-Asia's Preferred Capital at, zero. Specifically, if Tremblay gives written notice, within the ten (10) day period ending the day before the first day of a month, that he desires to contribute some share of any capital that is contributed to the Company during such month (based on the Manager's determination that the contribution of such capital is necessary or appropriate), and the maximum amount of capital that he is willing to contribute to the Company during such month, then he shall be entitled (and required) to contribute such share of any capital contributed during such month, up to such maximum amount. In the absence of any such written notice, Tremblay shall be deemed to have elected not to contribute any share of any capital contributed during such month. Except as aforesaid, Tremblay shall not be required to make any additional contribution to the capital of the Company, although certain distributions otherwise to be made to Tremblay will be withheld by the Company until T-Asia's Preferred Capital has been reduced to zero, all in accordance with Sections 3.1 and 8.1 of this Agreement.

2.2 Capital Accounts. The parties acknowledge that, as a limited liability company with a single member, the Company has previously been classified, for U.S. income tax purposes, as an entity disregarded as separate from its owner but, on account of the admission of Tremblay to the Company, has become classified, for U.S. income tax purposes, as a partnership and, more particularly, the following is, by reason of Tremblay's admission to the Company, deemed to have occurred (as set forth in IRS Revenue Ruling 99-5, 1999-1 C.B. 434, Situation 2): (i) Tremblay has contributed cash to such partnership in the amount of his contribution of cash to the capital of the Company as set forth in Section 2.1(b) hereof, and (ii) T-Asia is deemed to have contributed all of the Company's other assets, subject to the Company's liabilities, to such partnership. The Company shall maintain a separate capital account (the “Capital Account”) for each Member, which shall be (i) increased by the Member's capital contributions from and after the date of this Agreement (including, in the case of T-Asia, the contribution deemed made by T-Asia pursuant to the preceding sentence, the net agreed-upon value of which is equal to Nine Hundred US Dollars (US $900), the Member's share of any Profits of the Company, and any items of income or gain allocated to the Member under Section 3.2 below, and (ii) shall be decreased by distributions made to the Member, the Member's share of any Losses of the Company, and any items of expense or loss allocated to the Member under Section 3.2 below. Upon the happening of an event described in Section 1.704-1(b)(2)(iv)(f) of the Regulations, the Manager may, in accordance with such Regulations, mark-to-market the Company's assets on the balance sheet as computed for book purposes, and adjust the Members' Capital Accounts as though the net adjustment to the values at which the assets are carried on such balance sheet were gain or loss allocable under Section 3.2. In accordance with Section 1.704-1(b)(2)(iv)(q) of the Regulations, each Member's Capital Account shall be adjusted in a manner that maintains equality between the aggregate of all of the Members' Capital Accounts and the amount of capital reflected on the Company's balance sheet as computed for book purposes.

2.3 Loans. With the approval of the Manager, the Members may, in lieu of contributing additional cash to the capital of the Company pursuant to Section 2.1 above, advance or cause any of their affiliates to advance such cash to the Company as a loan. Any such loan shall be made on such terms as are mutually agreeable to the Manager and the Member (or affiliate of a Member) making such loan, provided that the interest charged on any such loan is at an arm's-length rate that meets U.S. transfer pricing rules.

2.4 Liability of Tremblay. Except as provided in Section 2.1(b) hereof with respect to Tremblay's initial capital contribution to the Company of One Hundred US Dollars (US $100) and in Section 3.1 and Section 8.1 hereof with respect to certain distributions otherwise to be made to Tremblay that are withheld by the Company until T-Asia's Preferred Capital has been reduced to zero, Tremblay shall not be obligated to contribute capital to the Company, lend any funds to the Company, guaranty any Company debt, or incur any personal liability with respect to the Company.

ARTICLE III

DISTRIBUTIONS AND ALLOCATIONS

3.1 Distributions.

(a) Distributions shall be made as, when and to the extent that the Manager determines that the Company's cash on hand exceeds the current and anticipated needs of the Company to fulfill its business purposes, including, without limitation, to service its debts and obligations to third parties, service its debts and obligations to the Members and their Affiliates as provided in this Agreement, and to maintain adequate capital and reserves for, by way of example and not limitation, working capital and reasonably foreseeable needs of the Company. Distributions shall be made in the following manner and order of priority:

(i) Distributions that do not represent a return of capital shall be made to the Members pro rata, based on their Sharing Percentages at the time of such distribution, provided, however, that if, at the time of such distribution, any Preferred Capital of T-Asia is outstanding, then eighty-five percent (85%) (or such greater percentage as Tremblay may specify) of the distribution otherwise to be made to Tremblay shall be withheld and treated as a contribution by him to the Company's capital until no Preferred Capital of T-Asia is outstanding (i.e., until T-Asia's Preferred Capital has been reduced to zero); and

(ii) Distributions that do represent a return of capital shall be made to the Members pro rata, based on their Sharing Percentages at the time of such distribution, provided, however, that if, at the time of such distribution, any Preferred Capital of T-Asia is outstanding, then eighty-five percent (85%) (or such greater percentage as Tremblay may specify) of the amount otherwise to be distributed to Tremblay shall be retained by the Company until distributions under this clause (ii) can be made to Tremblay without causing there to be (or to continue to be) any outstanding Preferred Capital of T-Asia.

For purposes of the foregoing, a distribution shall be deemed to represent a return of capital except to the extent that, following such distribution, the aggregate balance in the Members' Capital Accounts exceeds (i) the aggregate amount of the Members' cash and property contributions (including any amount treated as a contribution by Tremblay under the preceding provisions of this Section 3.1) over (ii) any prior distribution(s) deemed to be a return of capital under this sentence. For this purpose, the Members' Capital Accounts shall, if the Manager so elects, be determined by closing the Company's books and records immediately prior to such distribution.

An example of the foregoing is appended as Exhibit A.

(b) The Company is authorized to withhold from distributions to a Member, or with respect to allocations to a Member, and to pay over to a federal, state, local or foreign government, any amounts required to be so withheld pursuant to the Code, or any provisions of any other federal, state, local or foreign law. Any amounts so withheld shall be treated as having been distributed to such Member pursuant to this Article III for all purposes of this Agreement, and shall be offset against the amounts otherwise distributable to such Member. In the event the Company is required to withhold from or in respect of any income allocated but not currently distributed to Tremblay, the amount so withheld shall be treated as an interest-free loan from the Company to Tremblay, and shall be repaid from any and all distributions subsequently to be made to Tremblay, which the Company shall withhold and apply against the balance of such loan until such balance is reduced to zero.

(c) The Company shall have the right to set off, against any amount otherwise to be distributed to a Member, any amount owed by such Member to the Company (whether under another provision of this Agreement or otherwise) or to any affiliate of the Company.

(d) No distribution shall be declared or made if, after giving it effect, the Company would not be able to pay its debts as they become due in the usual course of business or the Company's total assets would be less than the sum of its total liabilities.

3.2 Allocation of the Profits and Losses of the Company.

(a) After giving effect to the allocations set forth in Section 3.2(b) below, the items of income, gain, loss and deduction entering into the computation of Profit or Loss of the Company for each fiscal year of the Company shall be allocated between the Members in such proportions as will cause the Capital Account of each Member to equal, as nearly as possible, the amount such Member would receive if an amount equal to both Members' Capital Accounts (computed prior to the allocation of such Profit or Loss), increased by the amount of such Profit or reduced by the amount of such Loss, were distributed to the Members in accordance with Section 8.1(a)(4); provided, however, that no Member shall be allocated any Loss to the extent such allocation would create or increase a deficit in such Member's Adjusted Capital Account.

(b) In the event any Member receives any distribution which creates or increases a deficit (negative balance) in such Member's Adjusted Capital Account, items of income and gain shall be specially allocated to such Member in an amount and manner sufficient to eliminate such deficit as quickly as possible. This Section 3.2(b), and the proviso of Section 3.2(a), are intended to comply, and shall be interpreted consistently, with the "alternate test for economic effect" of Section 1.704-1(b)(ii)(2)(d) of the Regulations.

(c) For purposes of this Agreement:

(i) "Adjusted Capital Account" means, with respect to any Member, such Member's Capital Account, reduced by those anticipated distributions described in Section 1.704-l(b)(2)(ii)(d) of the Regulations, and increased by the amount of any deficit in such Member's Capital Account that such Member is deemed obligated to restore under Section 1.704-l(b)(2)(ii)(c) of the Regulations.

(ii) "Profit" and "Loss" each means, for each fiscal year of the Company or other period, the Company's profit or loss for Federal income tax purposes, adjusted as follows:

(A) add any tax-exempt income of the Company described in Section 705(a)(1)(B) of the Code;

(B) subtract any nondeductible expenditures of the Company described in Section 705(a)(2)(B) of the Code;

(C) if the value at which any property is carried on the Company's balance sheet as computed for book (capital accounting) purposes differs from the adjusted tax basis of such property (because such property is contributed (or deemed to have been contributed) to, rather than purchased by, the Company, or because the value of such property on such books is adjusted pursuant to Section 1.704-1(b)(2)(iv)(f) of the Regulations), then items of income, gain, loss or deduction attributable to the disposition of such property shall be computed by reference to its value on such books, and items of depreciation, amortization and other cost recovery deductions with respect to such property shall be computed by reference to such value in accordance with Section 1.704‑1(b)(2)(iv)(g) of the Regulations, and

(D) any preceding provision of this Section 3.2(c)(ii) to the contrary notwithstanding, disregard any items of income, gain, expense, or loss specially allocated pursuant to Section 3.2(b) hereof.

(iii)"Regulations" means the permanent and temporary regulations of the U.S. Department of Treasury under the Code, as such regulations may be amended from time to time (including corresponding provisions of succeeding regulations).

(iv)All items set off in quotation marks and not otherwise defined shall have the meanings ascribed to them in the Regulations.

3.3 Allocations Solely for Tax Purposes. Items of income, gain, deduction, loss, and credit for federal income tax purposes shall be allocated between the Members in the same proportions as the corresponding book items are allocated, but if there is a book/tax difference in the determination of any such items by reason of a Member's contribution (or deemed contribution) of property (including, without limitation, T-Asia's capital contribution deemed made pursuant to Section 2.2 hereof) having a value that varies from its adjusted tax basis, or by reason of any event on account of which assets are marked-to-market on the Company's book under the principles of Section 1.704-1(b)(2)(iv)(f) of the Regulations, then such difference shall be reconciled in accordance with the principles of Section 704(c) of the Code and the regulations thereunder using any permissible method selected by the Manager. Allocation pursuant to this Section 3.3 are solely for tax purposes, and shall not affect the Members' Capital Accounts.

3.4 No Deficit Capital Account Restoration Requirement. If the Capital Account of any Member has a deficit balance (after giving effect to all contributions, distributions, and allocations for all taxable years), such Member shall not be obligated to make any contribution to the capital of the Company with respect to such deficit, and such deficit shall not be considered a debt owed to the Company or to any other person or entity for any purpose whatsoever.

ARTICLE IV

BOOKS, RECORDS AND ACCOUNTING

4.1 Books and Records. The Company shall maintain complete and accurate books and records of its business and affairs as required by the Act, and such books and records shall be kept at Company's principal office. All books and records of the Company required to be maintained under this Section 4.1, as well as complete and accurate information regarding the Company's business, financial condition and other information regarding the affairs of the Company as is just and reasonable and any other information described

in Section 18-305(a) of the Act, shall be made available upon reasonable demand by any Member for any purpose reasonably related to such Member's interest as a Member, for inspection and copying at the expense of the Company, and, if such Member so requests, copies of such information shall be sent to such Member by facsimile transmission.

4.2 Fiscal Year. The Company's fiscal year shall be the calendar year.

4.3 Tax Information and Financial Statements. As soon as practicable following the end of each fiscal year, the Company shall prepare and furnish to the Members (i) all information relating to the Company that is necessary for the preparation of the Members' Federal income tax returns for such fiscal year, and (ii) such financial statements as the Manager shall decide to have prepared.

4.4 Bank Accounts. All funds of the Company shall be deposited in such bank account(s) as shall be determined by the Manager. All withdrawals therefrom shall be made upon checks signed by any person authorized to do so by the Manager.

4.5 Tax Matters Partner. T-Asia is hereby designated as Tax Matters Partner for the Company, with full power and authority to act as such for the Company and the Members, and all the rights and responsibilities of that position described in Sections 6222 through 6232 of the Code. The duties of the Tax Matters Partner shall be limited to those prescribed by the Code and regulations promulgated thereunder.

ARTICLE V

ASSIGNMENT OF MEMBERSHIP INTERESTS

5.1 General. A Member may not sell, assign, transfer, exchange, mortgage, pledge, grant, hypothecate, or otherwise dispose of its Membership Interest or any part or portion thereof without the consent of the Manager. Any attempted disposition of a Member's Membership Interest, or any part or portion thereof, in violation of this provision is null and void ab initio, and the Company shall not be obligated to recognize any such attempted disposition.

5.2 Admission of Substitute Members. An assignee of a Member's Membership Interest shall be admitted as a substitute member and shall be entitled to all the rights and powers of the assignor (to the extent assigned), provided that (i) the Manager approves in writing the substitution of the assignee for the assignor as a member, and (ii) the assignee accepts, adopts, approves and agrees, in writing, to be bound by all of the terms and provisions of this Agreement. If admitted, the assignee, as a substitute member, shall have, to the extent assigned, all of the rights and powers, and shall be subject to all of the restrictions and liabilities, of the assigning Member. The assignor shall not thereby be relieved of any of its unperformed obligations to the Company.

5.3 Withdrawal. No Member may withdraw from the Company, except in connection with a permitted assignment of such Member's Membership Interest and the admission of such Member's assignee to the Company in such Member's place and stead in accordance with Section 5.2 above; provided, however, that this Section 5.3 is subject to the provisions of Section 5.5 below.

5.4 Dissolution, etc. In the event of the death, dissolution, termination, bankruptcy or insolvency of a Member (such event and such Member being hereinafter referred to as the "Disabling Event" and "Disabled Member," respectively), the Company shall not dissolve, but shall continue. The Disabled Member's Representative or Successor-in-Interest (each, a "Successor") shall be admitted as a Member in the place and stead of the Disabled Member, provided that the Successor agrees in writing to be bound by

this Agreement. If the Successor refuses to agree in writing to be bound by this Agreement, then the Successor shall not be admitted to the Company, in which case the Membership Interest of the Disabled Member shall be forfeited, and the Successor shall have no interest in, or rights with respect to, the Company. The provisions of this Section 5.4 are subject in all respects to the provisions of Section 5.5 hereof.

5.5 Redemption of Tremblay's Membership Interest.

(a) If at any time on or prior to December 31, 2015, Tremblay terminates his employment with TAM without Good Reason or if Tremblay's employment with TAM is terminated by TAM for Good Cause, then the Company shall have the right, but not the obligation, by delivering written notice to Tremblay, to purchase and redeem Tremblay's entire Membership Interest; provided, however, that if Tremblay terminates his employment with TAM without Good Reason, then the Company's right to purchase and redeem Tremblay's Membership Interest under this Section 5.5(a) shall be exercisable only after the expiration of six (6) months after the date of such termination of employment. In the event such termination of employment occurs on or prior to December 31, 2013, the redemption price for Tremblay's entire Membership Interest shall be One US Dollar (US $1). In the case TAM terminates Tremblay's employment for Good Cause on or after January 1, 2014 and on or prior to December 31, 2015, or Tremblay terminates his employment with TAM without Good Reason on or after January 1, 2014 and on or prior to May 31, 2015, then the redemption price (the “Value-Based Redemption Price”) for Tremblay's entire Membership Interest shall be (x) fifty percent (50%) of the Liquidation Value (determined pursuant to Section 5.5(c) hereof) of his Membership Interest plus (y) a membership interest in each entity holding a Non-Stabilized Asset on the terms and conditions set forth in Section 5.5(e) hereof, in each case such payment constituting full payment for Tremblay's entire Membership Interest. Notwithstanding the foregoing, the cash portion of the Value-Based Redemption Price shall be reduced by any amount distributed to Tremblay after the date of delivery of the notice given to Tremblay pursuant to this Section 5.5(a). The cash portion of the Value-Based Redemption Price shall be payable according to the following schedule: (i) up to Five Million US Dollars (US $5,000,000) of the cash portion of the Value-Based Redemption Price shall be paid in cash at the closing, and (ii) any balance of the cash portion shall be paid with interest at an annual fixed rate equal to the most recent Preferred Return Rate, in three (3) equal installments on each succeeding anniversary of the closing of the purchase and redemption of Tremblay's Membership Interest pursuant to this Section 5.5(a). The closing of the purchase and redemption pursuant to this Section 5.5(a) shall take place in accordance with the applicable procedures set forth in Section 5.5(f) hereof on a business day designated by the Company with at least seven (7) days' prior notice to Tremblay, but in the case of a purchase and redemption occasioned by a termination of employment during calendar years 2014 or 2015, not later than ninety (90) days after the delivery of the notice of redemption given pursuant to this Section 5.5(a) or, if later (and to the extent applicable), the business day which is (or is nearest to) ten (10) days after the date of the Appraiser's determination of the Liquidation Value in accordance with Section 5.5(c) hereof.

(b) In each of the following situations, namely (A) at any time after November 30, 2015 if Tremblay is no longer employed by TAM, or (B) if a Termination Event occurs on or prior to November 30, 2015, at any time after the expiration of six (6) months after the date on which the Termination Event occurs, Tremblay (or in the case of his death, his estate) shall have the right to require the Company, upon ninety (90) days' written notice, to purchase and redeem Tremblay's entire Membership Interest for (x) an amount equal to the Liquidation Value (determined under Section 5.5(c) hereof) of his Membership Interest at such time plus (y) a membership interest in each entity holding a Non-Stabilized Asset on the terms set forth in Section 5.5(e) hereof, provided that the cash portion of the redemption price shall be reduced by any amount distributed to Tremblay after the date of Tremblay's notice given to the Company pursuant to this Section 5.5(b). The cash portion of the redemption price shall be payable according to the following schedule: (i) up to Ten Million US Dollars (US $10,000,000) of the cash portion of the redemption price shall be paid in cash

at the closing, and (ii) any balance of the cash portion shall be paid, with interest at an annual fixed rate equal to the most recent Preferred Return Rate, in three (3) equal installments on each succeeding anniversary of the closing of the purchase and redemption of Tremblay's Membership Interest pursuant to this Section 5.5(b). The closing of the purchase and redemption of Tremblay's Membership Interest pursuant to this Section 5.5(b) shall take place in accordance with the procedures set forth in Section 5.5(f) hereof on a business day designated by the Company with at least seven (7) days' prior notice to Tremblay but not later than ninety (90) days after the date of delivery of Tremblay's notice to the Company or, if later (and to the extent applicable), the business day which is (or is nearest to) ten (10) days after the date of the Appraiser's determination of the Liquidation Value in accordance with Section 5.5(c) hereof.

(c) For purposes of this Section 5.5 and Section 5.6 hereof, the liquidation value (the “Liquidation Value”) shall be such amount as Tremblay would have received on liquidation of the Company if the Company had liquidated all its assets, other than its Non-Stabilized Assets, at fair market value (exclusive of any value attributable to the name “Taubman”), net of the Company's liabilities, including any and all applicable taxes and the assumed costs of sale but not including liabilities, cost, and expenses allocable to the Non-Stabilized Assets, as of the date of the notice of redemption, and immediately distributed the proceeds of such liquidation in accordance with Section 8.1(a) hereof. In the event agreement cannot be reached by the parties as to the Liquidation Value within forty (40) days after the date of the redemption notice, then the Liquidation Value shall be determined by an appraiser (the “Appraiser”) mutually agreed by the Company and Tremblay. Failing agreement on an Appraiser within thirty (30) days after the expiration of the forty (40) day period, the Appraiser shall be an individual who is (i) a principal from one of the “Big Four” accounting firms and (ii) designated by the Secretary General of the HKIAC. In the event none of the “Big Four” accounting firms is willing to allow one of its principals to serve as the Appraiser, then the Liquidation Value shall be determined by the HKIAC. The Appraiser shall act as expert and not as arbitrator, and his decision as to the Liquidation Value shall, absent manifest error, be final and conclusive.

(d) At any time Tremblay is no longer employed on a full-time basis by TAM, the Company shall have the right, but not the obligation, by delivering written notice to Tremblay, to purchase and redeem Tremblay's entire Membership Interest on the same terms and conditions as set forth in Section 5.5(b) hereof; provided, however, that the Company shall not have the right to exercise such right to purchase and redeem Tremblay's Membership Interest during the Lock-Out Period. The redemption price shall be paid on the same schedule as set forth in Section 5.5(b) hereof, except that the annual installments shall be paid on the three (3) consecutive anniversaries of the closing of the purchase and redemption of Tremblay's Membership Interest pursuant to this Section 5.5(d). The closing of the purchase and redemption pursuant to this Section 5.5(d) shall take place in accordance with the provisions of Section 5.5(f) hereof on a business day designated by the Company with at least seven (7) days' prior notice to Tremblay but not later than ninety (90) days after the date of delivery of the Company's notice to Tremblay pursuant to this Section 5.5(d) or, if later (and to the extent applicable) the business day which is (or nearest to) ten (10) days after the date of the Appraiser's determination of the Liquidation Value in accordance with Section 5.5(c) hereof. In the event the conditions of both Section 5.5(a) and this Section 5.5(d) are met, the Company shall have the absolute right to purchase and redeem Tremblay's Membership Interest pursuant to the provisions of Section 5.5(a) hereof.

(e) In the event the Company purchases and redeems Tremblay's Membership Interest pursuant to Section 5.5(b) or Section 5.5(d) hereof or pursuant to Section 5.5(a) hereof if the right to purchase and redeem arises during calendar year 2014 or 2015, the Company shall distribute to Tremblay a membership interest in each entity holding a Non-Stabilized Asset. If the purchase and redemption occur pursuant to Section 5.5(b) or Section 5.5(d) hereof, each such membership interest shall have a sharing percentage equal to (w) ten percent (10%) until such time as the aggregate distributions to Tremblay from the Company (including the distribution of the Liquidation Value) and from each entity holding a Non-Stabilized Asset

exceed Thirty Million US Dollars (US $30,000,000), and (x) after such time, five percent (5%), and if the right to purchase and redeem arises during calendar year 2014 or 2015 pursuant to Section 5.5(a) hereof, each such membership interest shall have a sharing percentage equal to (y) five percent (5%) until such time as the aggregate distributions to Tremblay from the Company (including the distribution of the Liquidation Value) and each entity holding a Non-Stabilized Asset exceed Fifteen Million US Dollars (US $15,000,000), and after such time (z) two and one-half percent (2.5%) (each such applicable percentage set forth in this Section 5.5(e) being referred to as a “Non-Stabilized Percentage”); provided however, that the Non-Stabilized Percentage shall be subordinate to an aggregate distribution to T-Asia from the Company and/or each entity holding a Non-Stabilized Asset of an amount equal to the sum of (x) T-Asia's Preferred Capital, plus (y) T-Asia's aggregate direct and indirect preferred capital (determined in the same manner as the Preferred Capital but without duplication) in the entities owning the Non-Stabilized Assets. The Company (or its affiliate) shall be the manager of each entity holding a Non-Stabilized Asset, and Tremblay shall have neither the obligation nor the right to make any capital contributions or loans to any entity holding a Non-Stabilized Asset. In the event that the Company's interest in a Non-Stabilized Asset is less than one hundred percent (100%), then Tremblay's interest in such Non-Stabilized Asset, after an aggregate distribution of an amount equal to the sum of (x) T-Asia's Preferred Capital, plus (y) T-Asia's aggregate direct and indirect preferred capital (determined in the same manner as the Preferred Capital but without duplication) in the entities owning the Non-Stabilized Assets, shall be equal to the product of T-Asia's interest in such Non-Stabilized Asset multiplied by the applicable Non-Stabilized Percentage. In no event shall Tremblay's Non-Stabilized Percentage or capital account in any such entity be reduced as a result of the admission of an additional member to such entity. The agreement governing the entity holding a Non-Stabilized Asset shall incorporate the provisions of this Section 5.5(e) and those of Section 5.6 hereof, and such other provisions as the Company deems appropriate.

(f) At the closing of the purchase and redemption of Tremblay's Membership Interest pursuant to Section 5.5(a), Section 5.5(b), or Section 5.5(d) hereof, the following, to the extent applicable, shall occur:

(i) The Company shall pay the cash portion of the redemption price to Tremblay by certified check or wire transfer, and shall deliver to Tremblay a note, in commercially reasonable form, payable as set forth in Section 5.5(b) or Section 5.5(d) hereof, as applicable, for the balance of the redemption price.

(ii) The Company shall transfer, or cause to be transferred, to Tremblay a membership interest in each entity holding a Non-Stabilized Asset.

(iii) Tremblay shall execute and deliver to the Company an assignment of his Membership Interest, free and clear of all liens and encumbrances, and such other documents, in form and substance satisfactory to the Company, as may be necessary to assign and transfer his Membership Interest to the Company free and clear of all liens and encumbrances.

5.6 Redemption of Tremblay's Interest in Non-Stabilized Assets. The governing document for each entity owning a Non-Stabilized Asset shall provide that at any time after a Non-Stabilized Asset becomes Stabilized, provided Tremblay is not then an officer or director of Taubman Centers, Inc. or any of its affiliates, the Company shall have the right, but not the obligation, by delivering written notice to Tremblay, to cause the entity owning the Non-Stabilized Asset to redeem Tremblay's entire membership interest in such entity, and Tremblay shall have the right, but not the obligation, by delivering written notice to the Company, to require the Company to cause the entity owning the Non-Stabilized Asset to purchase and redeem Tremblay's entire membership interest in such entity. In either case, the redemption price for Tremblay's entire membership interest in such entity shall be an amount determined using the same methodology as set forth in Section 5.5(c) hereof for determining the Liquidation Value of the Company, provided that the redemption

price shall be reduced by any amount distributed to Tremblay by such entity or any other entity owning a Non-Stabilized Asset after the date of delivery of either notice of redemption, such reduction to be applied first to the cash portion of the redemption price. The redemption price for Tremblay's membership interest shall be paid in accordance with the following schedule: (i) cash shall be paid at closing in an amount equal to the difference between (x) Ten Million US Dollars (US $10,000,000), except that in the case that Tremblay acquired his interest in such entity as a result of a purchase and redemption pursuant to Section 5.1(a) hereof, Five Million US Dollars (US $5,000,000) shall be substituted for Ten Million US Dollars (US $10,000,000) in this sub-clause (x), and (y) the aggregate payments made to Tremblay pursuant to this clause (i) in redemption of his membership interests in entities holding Non-Stabilized Assets, and (ii) the balance shall be paid, with interest at an annual fixed rate equal to the most recent Preferred Return Rate, in three (3) equal installments on each succeeding anniversary of the date of the closing of the purchase and redemption of Tremblay's membership interest pursuant to this Section 5.6. The closing of the purchase and redemption of Tremblay's membership interest in such entity shall take place in accordance with the applicable procedures set forth in Section 5.5(f) hereof on a business day designated by the Company with at least seven (7) days' prior notice to Tremblay, but not later than ninety (90) days after the date of delivery of the Company's notice to Tremblay pursuant to this Section 5.6 or delivery of Tremblay's notice to the Company pursuant to this Section 5.6, as the case may be, or, in each case if later (and to the extent applicable), the business day which is ten (10) days after the Appraiser's determination of the value of Tremblay's interest in such entity.

5.7 Cooperation. Notwithstanding the provisions of Section 5.5 and Section 5.6 hereof, the Members agree to work together in good faith to implement the provisions of such sections and any transactions contemplated thereby in a manner that does not alter the economic arrangement among the Members and the Company, but that is tax efficient for the Members and the Company, taking into account the various jurisdictions that have taxing authority over the Members, the Company, and the Company's subsidiaries (current and to-be-formed).

5.8 Admission of Additional Members. In the event the Manager desires to admit one or more persons as members in the Company from time to time, the Manager shall be authorized to do so, provided that in no event shall Tremblay's Sharing Percentage or Capital Account be reduced as a result of such admission.

ARTICLE VI

MANAGEMENT; NON-COMPETITION

6.1 Management of Business.

(a) The business and affairs of the Company shall be managed exclusively by a manager (the “Manager”). T-Asia shall be the Manager until T-Asia's resignation or removal, whereupon the Members, acting by Majority Vote, shall select a replacement Manager. The Manager may resign as such at any time. The Manager shall not be subject to removal, except by Majority Vote of the Members. Neither the resignation nor removal of a Manager who or which is also a Member shall affect the Membership Interest of such Member.

(b) The Manager is authorized and empowered to act for and manage the Company to the fullest extent permitted by law. The Manager may, without the consent of any Member or other person, bind the Company in any manner whatsoever. Without limiting the foregoing, the Manager shall have the power, on behalf of the Company, to: (i) acquire any property or asset that the Manager deems necessary or appropriate to conduct the business or promote the purpose of the Company; (ii) hold, manage, maintain, mortgage, grant a security interest in, pledge, lease, exchange, sell, convey, or otherwise dispose, encumber, or deal with any such property or asset; (iii) open one or more depository accounts and make deposits into and checks and

withdrawals against such accounts; (iv) borrow money and incur liabilities and other obligations; (v) enter into any and all agreements and execute any and all contracts, documents and instruments; (vi) engage employees and agents, define their respective duties, and establish their compensation or remuneration; (vii) obtain insurance covering the business and affairs of the Company and its property and the lives and well being of its employees and agents; (viii) commence, prosecute, or defend any proceeding in the Company's name; and (ix) participate with others in partnerships or joint ventures. Without the consent of all of the Members, however, the Manager shall not cause or permit the transfer of any significant asset of the Company or any subsidiary of the Company to any Member or affiliate of a Member at less than the fair market value of such asset; provided that this sentence shall not limit transfers of assets to companies in which neither a Member nor any affiliate of a Member has an interest other than indirectly through (by reason of the ownership of an interest in) the Company (and, without limitation, transfers of assets at less than fair value among wholly-owned subsidiaries of the Company shall not be in any way restricted).

(c) No person dealing with the Company shall be required to investigate or inquire into the Manager's authority to execute agreements, instruments, or documents, or to take actions, on behalf of the Company, and any person dealing with the Company shall be entitled to rely upon any agreement, instrument or document executed, and any action taken, by the Manager on behalf of the Company, and the Company shall be bound thereby.

(d) All contracts of the Company, leases, promissory notes, deeds of trust, mortgages, and other evidences of indebtedness of the Company, and other Company instruments or documents, need be executed, signed, or endorsed only by the Manager or that person or those persons (who need not be Members) designated in writing by the Manager, and such designated person's(s') signature(s) shall be sufficient to bind the Company and its properties.

6.2 Limitations on Members.

(a) Except as otherwise expressly set forth herein, or as provided by any non-waivable provision of the Act, the Members, as such, shall have no authority to act for the Company, or to vote upon, consent to or otherwise approve any Company transaction, act or event. Without limiting the foregoing, no Member, as such, shall have (i) any power to sign or act on behalf of the Company in any manner whatsoever or (ii) any voice or participation in the management of the Company's business, except as otherwise expressly set forth herein, or as provided by any non-waivable provision of the Act.

(b) No consent or approval of any Member to any action of the Manager for or on behalf of the Company shall be required except to the extent that any other provision of this Agreement or non-waivable provision of the Act may expressly provide otherwise and, as to any such action as to which the consent or approval of the Members may be expressly required by any other provision of this Agreement or non-waivable provision of the Act, the consent or approval of the Members acting by Majority Vote shall be both necessary and sufficient, except as the Act may otherwise provide.

6.3 Compensation of Manager and its Affiliates.

(a) The Manager shall not be compensated for serving as the Manager. The Manager shall, however, be reimbursed by the Company for all out-of-pocket costs and expenses incurred by the Manager on the Company's behalf.

(b) The Manager may engage one or more of its affiliates to perform services for the Company and its affiliates, provided that the fees paid to any such affiliate of the Manager are arm's-length fees that

meet the U.S. transfer pricing rules and the transfer pricing rules of each local jurisdiction in which such services are provided.

(c) One or more affiliates of the Manager may lend funds to the Company or to affiliates of the Company on such terms as the Manager and such lending affiliate may determine, provided that the interest rate charged on any such loan meets U.S. transfer pricing rules and the transfer pricing rules of the local jurisdiction of the borrowing affiliate.

6.4 Duties; Liability. The Manager shall not be required to devote the Manager's (and no employee of the Manager shall be required to devote his or her) full time to the Company's affairs. The Manager shall have a duty of due care, but shall not be liable to the Company or to any of the Members by reason of any act performed for or on behalf of the Company or in furtherance of the Company's business, except that this provision does not eliminate or limit the liability of the Manager to the extent such elimination or limitation is not permitted by the Act.

6.5 Indemnification. The Company shall, to the fullest extent authorized or permitted by the Act, (i) indemnify any person, and such person's successors and legal representatives, if and insofar as such person was, is, or is threatened to be made, a party to any threatened, pending or completed action, suit or proceeding (whether civil, criminal, administrative or investigative) by reason of the fact that such person is or was a Manager or Member of the Company, or is or was serving at the request of the Company as a manager, director, officer, employee or agent of another company, partnership, joint venture, trust, employee benefit plan or other enterprise, whether or not for profit, or by reason of anything done by such person in such capacity (collectively, the “Covered Matters”); and (ii) pay or reimburse the reasonable expenses incurred by such person and such person's successors and legal representatives in connection with any Covered Matter in advance of final disposition of such Covered Matter. The Company may provide such other indemnification to managers, officers, employees and agents by insurance, contract or otherwise as is permitted by law and authorized by the Manager.

6.6 Limitation on Members' Duties. Each Member may cast such Member's vote on any matter, and give or withhold such Member's consent to or approval of any action or proposed action, in any manner deemed by such Member to be in such Member's own best interest, and no Member shall have any duty to the Company or any other Member except for a duty of fair dealing.

6.7 Non-Competition. Tremblay agrees that for so long as he is a Member of the Company and for a period of one (1) year thereafter, he shall not in any manner, directly or indirectly, through any Related Entity or otherwise, engage or be engaged, or assist any other person, firm, corporation, enterprise or business in engaging or being engaged, in the Line of Business in the Territory unless previously approved in writing by the Manager.

6.8 Non-Solicitation. Tremblay agrees that for so long as he is a Member of the Company and for a period of one (1) year thereafter, he will not, directly or indirectly, disrupt damage, impair, or interfere with the business of the Company or any affiliate thereof by hiring, or allowing any Related Entity to hire, any employee of the Company or any employee of an affiliate of the Company or by soliciting, influencing, encouraging, or recruiting any employee of the Company or any employee of an affiliate of the Company to work for Tremblay or a Related Entity.

6.9 Conflicts of Interest. Without limiting the foregoing, without the prior express written authorization of the Manager, Tremblay shall not, directly or indirectly, for so long as he is a Member of the Company and for one (1) year thereafter, engage in any activity (a "Conflict of Interest") competitive with or adverse to the business of Company or its affiliates, whether alone, as a partner, or as an officer, director,

employee or investor of or in any other entity. Notwithstanding anything to the contrary in the preceding sentence, it is expressly understood and agreed that:

(a) Ownership by Tremblay of less than five percent (5%) in the aggregate of the outstanding shares of capital stock of any corporation with one or more classes of its capital stock listed on a securities exchange or publicly traded in the over-the-counter market shall not be deemed to constitute a Conflict of Interest.

(b) It shall not be a Conflict of Interest for Tremblay to serve in any capacity with any civic, educational, or charitable organization.

6.10 Confidentiality. Tremblay acknowledges that, while he is a Member of the Company, he will become familiar with trade secrets and other non-public, confidential, and/or proprietary information concerning the business (including but not limited to its services, practices, policies or employees of affiliates of the Company (collectively, the “Confidential Information”). Tremblay promises never to make use of, disclose, or divulge any Confidential Information, directly or indirectly, except to the extent such use or disclosure is (i) necessary to the performance of this Agreement and in furtherance of the Company's best interests, (ii) lawfully and publicly obtainable from other sources through no fault or breach of Tremblay, or (iii) authorized in writing by the Company. All records, files, documents, drawings, specifications, software, computerized data and information on any medium, equipment, and similar items or materials containing Confidential Information or otherwise relating to the business of the Company or its affiliates, including without limitation all records relating to tenants of properties owned directly or indirectly by the Company (collectively, “Company Materials”), whether prepared by Tremblay or otherwise coming into Tremblay's possession, shall remain the exclusive property of the Company or such affiliates. At such time as Tremblay is no longer a Member of the Company, Tremblay agrees to promptly deliver to the Company all Company Materials in his possession or under his control. The provisions of this Section 6.10 shall survive Tremblay's membership in the Company, the termination of this Agreement, and the dissolution and liquidation of the Company. Tremblay promises that if he ever becomes legally compelled (for example, by court order or subpoena) to disclose any Confidential Information or Company Materials, he will notify the Company as soon as possible after learning of the requested disclosure and, prior to disclosing any such information or materials, cooperate fully with the Company in its pursuit of a protective order or other lawful efforts to resist disclosure.

ARTICLE VII

REPRESENTATIONS, WARRANTIES, AND COVENANTS

7.1 Each party hereto represents to the other as follows:

(a) Such party has the authorization, power, and right to execute, deliver, and fully perform its obligations hereunder in accordance with the terms hereof.

(b) This Agreement does not require any authorization, consent, approval, exemption, or other action by any other party that has not been obtained and does not conflict with or result in the breach of the terms, conditions or provisions of, constitute a default under, or result in a violation of any agreement, instrument, order, judgment or decree to which such party is subject.

7.2 T-Asia and the Company represent to Tremblay that, as of the date of this Agreement:

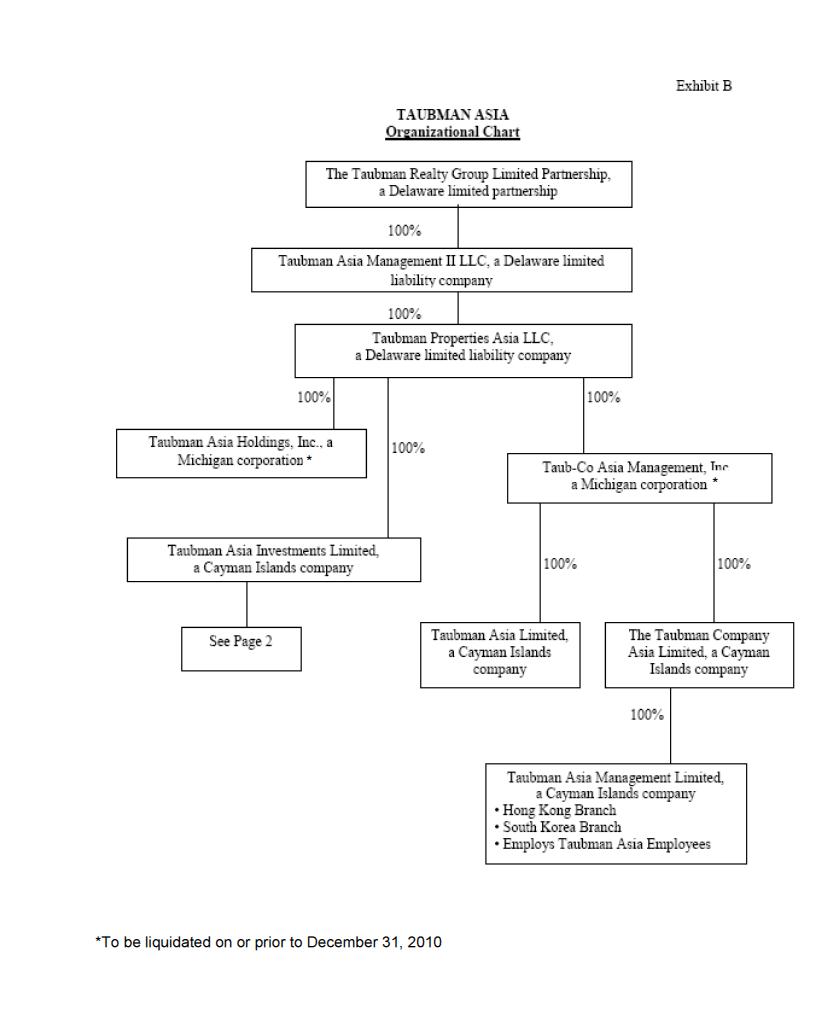

(i) the Company is the owner, beneficially and of record, of the entire issued and outstanding capital stock of Taubman Asia Investment Limited, a Cayman Islands company

("Taubman Asia"), Taubman Asia Holdings, Inc., a Michigan corporation, and Taub-Co Asia Management, Inc., a Michigan corporation (“Taub-Co”),

(ii) Taubman Asia's direct and indirect subsidiaries, and the equity holdings therein, are as set forth on Exhibit B,

(iii) Taub-Co is the owner, beneficially and of record, of the entire issued and outstanding capital stock of Taubman Asia Limited, a Cayman Islands company and The Taubman Company Asia Limited, a Cayman Islands company (“Taubman Company Asia”),

(iv) Taubman Company Asia is the owner, beneficially and of record, of the entire issued and outstanding capital stock of Taubman Asia Management Limited, a Cayman Islands company(“TAM”),

(v) Taubman Asia Holdings, Inc., a Michigan corporation, and Taub-Co shall be liquidated on or prior to December 31, 2010, and

(vi) except as set forth in the foregoing, the Company does not directly or indirectly hold any share, capital stock, partnership, membership or similar interest in any entity.

Tremblay acknowledges that the Manager may, at any time and from time to time after the date of this Agreement, effect changes to the foregoing without prior notice to or any approval of Tremblay.

7.3 TRG, T-Asia, and the Company covenant to Tremblay that for so long as Tremblay is a Member, TRG and T-Asia shall conduct their business in the Territory solely through the Company, and the Company shall conduct its business in the Territory itself or through its direct and indirect subsidiaries, except that (i) to the extent the Company acquires, directly or indirectly, an interest in a Line of Business that is conducted both within and without the Territory, T-Asia and the Company shall enter into good faith discussions with Tremblay as to the appropriate participation Tremblay should be provided in such Line of Business, and (ii) to the extent TRG or T-Asia determines to conduct a Line of Business in the Territory through an entity other than the Company or the Company's direct or indirect subsidiaries, then TRG shall offer Tremblay the right to participate in such other entity on terms and conditions that are substantially equivalent to those set forth in this Agreement.

ARTICLE VIII

DISSOLUTION AND WINDING UP;

CONTINUATION OF BUSINESS

8.1 Winding Up and Liquidation of the Company.

(a) Upon the dissolution of the Company, the Manager shall proceed to wind up the affairs and liquidate the property and assets of the Company, and shall apply and distribute the proceeds of such liquidation in the following priority:

(1) to the expenses of liquidation;

(2) to the payment of all debts and liabilities of the Company, including, without limitation, debts and obligations to the Members;

(3) to the establishment of such reserves as the Manager deems necessary or advisable to provide for any contingent or unforeseen liabilities or obligations of the Company, provided, however,

that after the expiration of such period of time as the Manager deems appropriate, the balance of such reserves remaining after payment of such contingencies shall be distributed in the manner hereinafter set forth; and

(4) the balance of such proceeds shall be distributed as follows: (i) first, to T-Asia, to the extent of T-Asia's Preferred Capital, and (ii) any remaining proceeds shall be distributed to the Members, pro rata, based on their Sharing Percentages (taking into account the reduction in Tremblay's Sharing Percentage from ten (10%) to five (5%) once distributions to him (including any made under this Section 8.1(a)(4)) exceed Thirty Million US Dollars (US $30,000,000).

(b) A reasonable time shall be allowed for the orderly liquidation of the property and assets of the Company and the payment of the debts and liabilities of the Company in order to minimize the normal losses attendant upon a liquidation.

(c) Anything contained in this Section 8.1 to the contrary notwithstanding, if the Manager shall determine that a complete liquidation of all the property and assets of the Company would involve substantial losses or be impractical or ill-advised under the circumstances, the Manager shall liquidate that portion of the assets of the Company sufficient to pay the expenses of liquidation and the debts and liabilities of the Company (excluding the debts and liabilities of the Company to the extent that they are adequately secured by mortgages on or security interests in the assets of the Company), and the remaining property and assets shall be distributed to the Members as tenants-in-common or partitioned in accordance with applicable statutes or distributed in such other reasonable manner as shall be determined by the Manager. If any assets are distributed in kind, such assets shall be distributed in a manner which is consistent with the order of priority set forth in Section 8.1 hereof.

8.2 Certificate of Dissolution. After the affairs of the Company have been wound up and the Company terminated, a certificate of dissolution shall be executed and filed in the office of the Delaware Secretary of State.

ARTICLE IX

MISCELLANEOUS PROVISIONS

9.1 Notices. Any notice or other communication required or permitted to be delivered to any party under or in connection with this Agreement shall be shall be in writing and sent to such party at the address indicated in the Preamble to this Agreement. Each such notice or other communication shall be effective and deemed delivered (i) if delivered personally to the party to whom the same is directed, then when actually delivered, (ii) if sent by certified mail, return receipt requested, postage and charges prepaid, addressed to the party to whom the same is directed, then upon the date of acceptance or refusal to accept as indicated by the return receipt, or (iii) if sent by facsimile transmission, then when transmitted to the following number (as the same may be changed pursuant to this Section 9.1) and an appropriate confirmation of transmission is received:

If to T-Asia, to: Taubman Asia Management II LLC

c/o The Taubman Company LLC

200 East Long Lake Road

P.O. Box 200

Bloomfield Hills, MI 48303-0200

Facsimile: +1-248-258-7601

Attention: President

with a copy to: The Taubman Company LLC

200 East Long Lake Road

P. O. Box 200

Bloomfield Hills, MI 48303-0200

Facsimile: +1-248-258-7586

Attention: General Counsel

If to Tremblay, to: Mr. René Tremblay

1928, Alfred-Pellan Street

Longueuil Québec,

Canada

J4N 1P6

Facsimile: +1-450-647-3404

With a copy to: Peloquin Kattan s.e.n.c.

1, Westmount Square, 20th Floor

Westmount (Québec)

Canada

H3Z 2P9

Facsimile: +1-514-937-2971

Attention: Claude Péloquin

Any Member may change its address for purposes of this Agreement by giving the other Members notice of such change in the manner hereinabove provided for the giving of notices.

9.2 Article and Section Headings. The headings in this Agreement are inserted for convenience and identification only, and are in no way intended to describe, interpret, define or limit the scope, extent or intent of this Agreement or any of the provisions hereof.

9.3 Construction. Whenever the singular number is used herein, the same shall include the plural, and any one gender (including the neuter) shall include the others. If any language is stricken or deleted from this Agreement, such language shall be deemed never to have appeared herein and no other implication shall be drawn therefrom.

9.4 Severability. If any provision hereof shall be judicially determined to be illegal, or if the application thereof to any person or in any circumstance shall, to any extent, be judicially determined to be invalid or unenforceable, the remainder of this Agreement, or the application of such provision to persons or in circumstances other than those to which it has been judicially determined to be invalid or unenforceable, shall not be affected thereby, and each provision of this Agreement shall be valid and enforceable to the fullest extent permitted by law.

9.5 Governing Law. This Agreement shall be construed in accordance with, and governed by, the laws of the State of Delaware applicable to contracts made and performed in such jurisdiction and without regard to choice of law principles, to the extent permitted by law.

9.6 Counterparts. This Agreement may be executed in any number of counterparts, each of which shall, for all purposes, constitute an original and all of which, taken together, shall constitute one and the same Agreement.

9.7 Entire Agreement. This Agreement constitutes the entire agreement of the parties hereto with respect to the subject matter hereof. All prior agreements between the parties hereto with respect to the subject matter hereof, whether written or oral, are merged herein and shall be of no force or effect.

9.8 Amendments. This Agreement may be amended or modified with the express written consent of all of the Members, provided, however, that no Member shall unreasonably withhold or delay his written consent to any such amendment or modification proposed by Members acting by Majority Vote if such amendment or modification neither enlarges the obligations, nor reduces the rights, of such Member in a material way.

9.9 Benefits Limited to Members. Except as otherwise provided in this Agreement, nothing in this Agreement is intended to confer, and nothing in this Agreement shall confer, any rights or benefits of any kind on any person who is not a Member.

9.10 Successors and Assigns. Subject to the restrictions on transferability contained herein, this Agreement shall be binding upon, and shall inure to the benefit of, the successors and assigns of the respective parties hereto.

9.11 Waiver. No failure on the part of any party to exercise or delay in exercising any right hereunder shall be deemed a waiver thereof or of any other right, nor shall any single or partial exercise preclude any further or other exercise of such right or any other right. A waiver by a Member of any breach or default by the other Member under this Agreement shall be effective only if in writing and signed by the Member against whom enforcement of the waiver is sought.

9.12 Choice of Venue. Any dispute, controversy or claim arising out of or in respect of this Agreement (or its validity, interpretation, or enforcement, or alleging breach thereof) shall be submitted to, adjudicated by, and subject to the exclusive jurisdiction of the state or federal courts in the City of New York, County of New York, and both Members hereby consent to such venues as the exclusive forums for resolution of the aforementioned disputes, submit to the personal jurisdiction of said courts to hear such disputes, and waive all objections to such courts hearing and adjudicating such disputes.

9.13 Representation By Counsel; Interpretation. T-Asia and Tremblay each acknowledge that each party to this Agreement has been represented by counsel in connection with this Agreement and the matters contemplated by this Agreement. Accordingly, any rule of law, or any legal decision that would require interpretation of any claimed ambiguities in this Agreement against the party that drafted it has no application and is expressly waived. The provisions of this Agreement shall be interpreted in a reasonable manner to effect the intent of the parties.

ARTICLE X

DEFINITIONS

The terms set forth below shall have the following meanings when used in this Agreement:

"Act" has the meaning specified in Recital A to this Agreement.

"Adjusted Capital Account" has the meaning specified in Section 3.2(c)(i) hereof.

"Agreement" means this Amended and Restated Limited Liability Company Agreement of Taubman Properties Asia LLC, a Delaware limited liability company.

“Applicable Gross-Up Fraction” means, at any time, a fraction, the numerator of which is one (1) minus Tremblay's Sharing Percentage at such time, and the denominator of which is Tremblay's Sharing Percentage at such time.

“Appraiser” has the meaning specified in Section 5.5(b) hereof.

"Capital Account" has the meaning specified in Section 2.2 hereof.

"Certificate" has the meaning specified in Recital A to this Agreement.

“Code" means the Internal Revenue Code of 1986, as amended from time to time (or any corresponding provision of succeeding law).

“Commercial Projects” has the meaning specified in Section 1.3 hereof.

"Company" has the meaning specified in Recital A to this Agreement.

“Company Materials” has the meaning specified in Section 6.10 hereof.

“Confidential Information” has the meaning specified in Section 6.10 hereof.

“Conflict of Interest” has the meaning specified in Section 6.9 hereof.

“Covered Matter” has the meaning specified in Section 6.5 hereof.

“Disability” is as described as a reason for termination of employment in Section 4.1(a) of the Employment Agreement.

"Disabled Member" and "Disabling Event" have the respective meanings specified in Section 5.4 hereof.

“Employment Agreement” means that certain Employment Agreement between Taubman Asia Management Limited and René Tremblay of even date herewith.

“First Amended and Restated Agreement” has the meaning specified in Recital B to this Agreement.

“Good Cause” is defined in the Employment Agreement as “good cause.”

“Good Reason” is defined in the Employment Agreement as “good reason.”

“HKIAC” means the Hong Kong International Arbitration Centre.

“Line of Business” means investment in commercial properties and/or the development, operation, or management of such properties.

“Liquidation Value” has the meaning specified in Section 5.5(c) hereof.

“Lock-Out Period” means the period that begins on June 1, 2015 and ends on November 30, 2015.

“Majority Vote” of the Members means the vote of those Members whose interests in the Company exceed fifty percent (50%) of all Members' interests in the Company, treating, for this purpose, Tremblay's interest at any time as equal to his Sharing Percentage at such time, and T-Asia's interest at any time as equal to one hundred percent (100%) minus Tremblay's Sharing Percentage at such time.

“Manager” has the meaning specified in Section 6.1(a) hereof.

"Member" means each of T-Asia and Tremblay, and any other person who hereafter may be admitted to the Company as a member, each for so long as it or he is a member of the Company.

"Membership Interest" shall mean all of the right, title, and interest of a Member (in his or its capacity as a member of the Company within the meaning of the Act) in and to the Company.

“Non-Stabilized Asset” means a Commercial Project that has been approved by the Board of Directors of Taubman Centers, Inc., but which is not yet Stabilized; provided, however, solely for the purpose of Section 5.5(d) hereof, if the Company exercises its right to purchase and redeem Tremblay's Membership Interest on or prior to December 31, 2014, the term “Non-Stabilized Asset” shall also include any Commercial Project that the Company has identified and is actively evaluating at the time of Tremblay's termination of employment with TAM on a full-time basis provided that the Board of Directors of Taubman Centers, Inc. approves such Commercial Project on or prior to the expiration of twelve (12) months after the date of Tremblay's termination of employment with TAM on a full-time basis.

“Non-Stabilized Percentage” has the meaning specified in Section 5.5(e) hereof.

“Original Agreement” has the meaning specified in Recital A to this Agreement.

“Preferred Capital” means the capital contributions of T-Asia after the date of this Agreement, adjusted as follow:

(1) any additional contribution of cash by T-Asia to the capital of the Company after the date of this Agreement will increase the Preferred Capital;

(2) any distribution of cash to T-Asia from the Company as a return of capital under Section 3.1(a)(ii) will reduce the Preferred Capital;

(3) any cash that Tremblay actually contributes, or is deemed to have contributed under Section 3.1(a)(i) (relating to distributions of profit), to the Company will reduce the Preferred Capital by the product of (A) the amount of such cash and (B) the Applicable Gross-Up Fraction at the time of such contribution;

(4) any cash that is distributed to Tremblay under Section 3.1(a)(ii) (relating to distributions of capital) will increase the Preferred Capital by the product of (A) the amount of such cash and (B) the Applicable Gross-Up Fraction at the time of such distribution, except that if Tremblay's Membership Interest has been redeemed as the result of the Company's exercise of the right to purchase and redeem his Membership Interest arising during calendar year 2014 or 2015 pursuant to Section 5.5(a) hereof, in determining the Applicable Gross-Up Percentage, Tremblay's then Non-Stabilized Percentage shall be substituted for Tremblay's Sharing Percentage; and

(5) there shall be added to the Preferred Capital, on the last day of each quarter of each year and on any other date on which (x) any adjustment to the Preferred Capital is made under any of the foregoing clauses (1) through (4), or (y) the determination of the Preferred Capital is relevant, a preferred return determined in the same manner as interest at the Preferred Return Rate from the date of the most-recent prior adjustment to the Preferred Capital under this clause (5).

In no event shall T-Asia's Preferred Capital be reduced below zero.

“Preferred Return Rate” means a rate equal to TRG's blended cost of funds from time to time, compounded quarterly, but in no event less than five percent (5%) nor greater than ten percent (10%) per annum.

"Profit" and "Loss" each has the meaning specified in Section 3.2(c)(ii) hereof.

“Related Entity” means any person, firm, corporation, enterprise, or partnership, other than the Company, in which Tremblay holds any interest or in respect of which Tremblay serves as an officer, director, shareholder, investor, or employee or serves as an advisor or consultant, or in relation to which Tremblay is otherwise affiliated.

"Regulations" has the meaning specified in Section 3.2(c)(iii) hereof.

“Representative” means, with respect to a Disabled Member, (A) the personal representative(s), executor(s), or administrator(s) of the estate of a deceased Member, and (B) the committee or other legal representative(s) of the estate of an insane, incompetent, or bankrupt Member.

“Second Amended and Restated Agreement” has the meaning specified in Recital C hereof.

"Sharing Percentage" means, with respect to Tremblay, (i) ten percent (10%) until such time as the aggregate distributions to Tremblay (including distributions in or upon liquidation of the Company) exceed Thirty Million US Dollars (US $30,000,000) and (ii) five percent (5%) thereafter, and means, with respect to T-Asia, one hundred percent (100%) less the Sharing Percentage of Tremblay.

“Stabilized” means that at least seventy-five percent (75%) of the gross leasable area of a Commercial Project has been open for business to the public for a period of at least two (2) years.

"Successor" has the meaning specified in Section 5.4 hereof.

“Successor-in-Interest” means, with respect to a Disabled Member, the legal representative(s) or successor(s) of a corporation, partnership or other business organization, or trust or other entity which is dissolved (without timely reconstitution or continuation) or terminated or whose legal existence has ceased.

“T-Asia” has the meaning specified in the Preamble to this Agreement.

“TAM” has the meaning specified in Section 7.2 hereof.

“Taub-Co” has the meaning specified in Section 7.2 hereof.

“Taubman Asia” has the meaning specified in Section 7.2 hereof.

“Taubman Company Asia” has the meaning specified in Section 7.2 hereof.

"Tax Matters Partner" has the meaning specified in Section 4.5 hereof.

“Termination Event” means each of (i) the termination of Tremblay's employment with TAM by Tremblay for Good Reason, (ii) the termination of Tremblay's employment with TAM by TAM without Good Cause, (iii) the termination of Tremblay's employment with TAM as a result of a Disability, and (iv) the termination of Tremblay's employment with TAM as a result of Tremblay's death.

“Territory” means, for so long as Tremblay is a Member of the Company, the People's Republic of China, the Hong Kong Special Administrative Region, the Macau Special Administrative Region, the Republic of

China, the Republic of Korea, Japan, Singapore, Malaysia, Indonesia, Thailand, Cambodia, Vietnam, Australia and India, and once Tremblay is no longer a Member of the Company only those of the foregoing jurisdictions in which the Company is actively conducting a Line of Business or actively evaluating or pursuing a potential Line of Business at such time as Tremblay ceases to be a Member of the Company.

“Tremblay” has the meaning specified in the Preamble to this Agreement.

"TRG" has the meaning specified in Recital A to this Agreement.

“Value-Based Redemption Price” has the meaning specified in Section 5.5(a) hereof.

IN WITNESS WHEREOF, the parties hereto make and execute this Agreement as of the date first-above written.

|

| | |

| TAUBMAN ASIA MANAGEMENT II LLC, |

| a Delaware limited liability company |

| | | |

| By: | /s/ | Chris Heaphy |

| | | Chris Heaphy |

| Its: | | Authorized Signatory |

| | | |

| /s/ | RENÉ TREMBLAY |

| | RENÉ TREMBLAY |

| | | |

| | | |

| TAUBMAN PROPERTIES ASIA LLC, |

| a Delaware limited liability company |

| | | |

| By: | /s/ | Chris Heaphy |

| | | Chris Heaphy |

| Its: | | Authorized Signatory |

|

| | |

| Solely for the purpose of Section 7.3 hereof: |

| |

| THE TAUBMAN REALTY GROUP LIMITED PARTNERSHIP |

| a Delaware limited liability company |

| | | |

| By: | /s/ | Chris Heaphy |

| | | Chris Heaphy |

| Its: | | Authorized Signatory |

EXHIBIT A

Year One:

Assume that, on the first day of a year, T-Asia contributes $20 million, and Tremblay contributes $20,000, to the capital of the Company. Tremblay's Sharing Percentage at the time is 10% and T-Asia's is 90%. The Preferred Capital of T-Asia is therefore $20 million minus ($20,000 x .9/.1), or $19,820,000.

During the year, the Company realizes no net income or loss. The Company borrows, however, $5 million and distributes the proceeds on the last day of the year. Because such distribution will reduce the aggregate amount of the Members' Capital Accounts below the aggregate amount of their capital contributions, such distribution is a return of capital. As such, the distribution is to be made 90% (or $4,500,000) to T-Asia and 10% (or $500,000) to Tremblay; however, of Tremblay's $500,000, only 15%, or $75,000 is to be distributed, while the balance, or $425,000, is to be retained by the Company (assuming that Tremblay does not elect to have the Company retain a larger share). Accordingly, $75,000 is distributed to Tremblay, and $4,500,000 is distributed to T-Asia.

T-Asia's Preferred Capital is reduced to $17,580,600, which is $19,820,000 minus $4,500,000 plus ($75,000 x .9/.1) plus ($19,820,000 x .08, assuming that TRG's blended cost of capital for the year is 8%).

Year Two:

In the following year, the Company earns net income of $3 million. On the last day of the year, the Company distributes $4 million. The Members' Capital Accounts immediately before the distribution, taking into account the $3 million of net income, aggregate $18,445,000 (i.e., $20,020,000 of original capital, minus a $4,575,000 distribution, plus $3 million of income). The Members' contributions exceed prior returns of capital by $15,445,000. Therefore, of the $4 million distribution, an amount equal to the excess of $18,445,000 over $15,445,000, or $3,000,000, is considered a distribution of profit and the balance is considered a return of capital.

The $3 million distribution of profit is to be made $300,000 (which is 10%) to Tremblay and $2.7 million (which is 90%) to T-Asia, but 85% (assuming Tremblay does not specify a higher percentage) of the distribution to Tremblay, or $255,000, is to be withheld and treated as having been contributed by Tremblay to the Company's capital. Of the $1 million distribution representing a return of capital, 90% (or $900,000) is made to T-Asia and 10% (or $100,000) is to be made Tremblay; however, of Tremblay's $100,000, only 15%, or $15,000 is to be distributed, while the balance, or $85,000, is to be retained by the Company (assuming that Tremblay does not elect to have the Company retain a larger share).

T-Asia's Preferred Capital is reduced to $15,927,048, which is $17,580,600 minus $900,000 minus ($255,000 x .9/.1) plus ($15,000 x .9/.1) plus ($17,580,600 x .08, assuming that TRG's blended cost of capital for the year is 8%).

Third Year:

On the last day of the succeeding year, the Company's assets are sold at a $4 million profit, yielding proceeds for distribution of $18,785,000. This amount is distributed first to T-Asia to the extent of T-Asia's Preferred Capital which, by the end of such year, would have grown to $15,927,048 x 1.08, or $17,201,212. The balance of $1,583,788 is distributed 90% to T-Asia and 10% to Tremblay. Tremblay therefore receives $158,379.

Following is a reconciliation:

Profits: Year 1 Year 2 Year 3 Total

$0 3,000,000 4,000,000 7,000,000

Preferred Returns 1,585,600 1,406,448 1,274,164 4,266,212

Profits >Preferred

Returns on Capital $2,733,788

Tremblay's Share

.10

Distributions of

Profit to Tremblay $273,379

Return of Tremblay's

Original Contribution 20,000

Total Distributions

to Tremblay $293,379

Distributions to

Tremblay by Year 75,000 60,000 158,379 293,379