Exhibit 4.1

BUILDING LOAN AGREEMENT

between

TRG IMP LLC

as Borrower

and

PNC BANK, NATIONAL ASSOCIATION

as Administrative Agent

and

THE FINANCIAL INSTITUTIONS NOW OR HEREAFTER SIGNATORIES HERETO AND THEIR ASSIGNEES PURSUANT TO SECTION 13.13, as Lenders

and

PNC CAPITAL MARKETS LLC AND JPMORGAN CHASE BANK, N.A., as Co-Lead Arrangers

and

PNC CAPITAL MARKETS LLC , as Sole Bookrunner

and

JPMORGAN CHASE BANK, N.A., as Syndication Agent

Entered into as of August 14, 2015

| Table of Contents | |||

| Page | |||

| ARTICLE 1. | DEFINITIONS | 1 | |

| 1.1 | DEFINED TERMS | 1 | |

| 1.2 | SCHEDULES AND EXHIBITS INCORPORATED | 16 | |

| ARTICLE 2. | LOAN | 16 | |

| 2.1 | LOAN | 16 | |

| 2.2 | LOAN FEES | 17 | |

| 2.3 | LOAN DOCUMENTS | 17 | |

| 2.4 | EFFECTIVE DATE | 17 | |

| 2.5 | MATURITY DATE | 17 | |

| 2.6 | INTEREST ON THE LOAN | 17 | |

| 2.7 | PAYMENTS | 19 | |

| 2.8 | FULL REPAYMENT AND RELEASE | 20 | |

| 2.9 | LENDERS' ACCOUNTING | 20 | |

| 2.10 | FIRST OPTION TO EXTEND; MANDATORY AMORTIZATION | 20 | |

| 2.11 | SECOND OPTION TO EXTEND; MANDATORY AMORTIZATION | 22 | |

| 2.12 | RESERVED | 23 | |

| 2.13 | RESERVED | 23 | |

| 2.14 | RESERVED | 23 | |

| 2.15 | EXCULPATION AND RECOURSE | 23 | |

| ARTICLE 3. | DISBURSEMENT | 24 | |

| 3.1 | CONDITIONS PRECEDENT | 24 | |

| 3.2 | ACCOUNT, PLEDGE AND ASSIGNMENT, AND DISBURSEMENT AUTHORIZATION | 27 | |

| 3.3 | RESERVED | 27 | |

| 3.4 | LOAN DISBURSEMENTS | 27 | |

| 3.5 | FUNDS TRANSFER DISBURSEMENTS | 28 | |

| ARTICLE 4. | CONSTRUCTION AND OPENING | 29 | |

| 4.1 | COMMENCEMENT AND COMPLETION | 29 | |

| 4.2 | COMMENCEMENT AND COMPLETION OF OFFSITE IMPROVEMENTS | 29 | |

| 4.3 | PROJECT OPENING | 29 | |

| 4.4 | FORCE MAJEURE | 29 | |

| 4.5 | CONSTRUCTION AGREEMENT | 30 | |

| 4.6 | ARCHITECT'S AGREEMENT | 30 | |

| 4.7 | PLANS AND SPECIFICATIONS | 30 | |

| 4.8 | CONTRACTORS/CONSTRUCTION INFORMATION | 32 | |

| 4.9 | PROHIBITED CONTRACTS | 32 | |

| 4.10 | LIENS | 32 | |

| 4.11 | CONSTRUCTION RESPONSIBILITIES | 32 | |

| 4.12 | ASSESSMENTS AND COMMUNITY FACILITIES DISTRICTS | 33 | |

| 4.13 | DELAY | 33 | |

| 4.14 | INSPECTIONS | 33 | |

| 4.15 | SURVEYS | 33 | |

| 4.16 | RESERVED | 33 | |

| Table of Contents | |||

| (continued) | |||

| Page | |||

| 4.17 | RESERVED | 33 | |

| 4.18 | RESERVED | 33 | |

| 4.19 | RESERVED | 33 | |

| 4.20 | RESERVED | 33 | |

| 4.21 | IN-BALANCE PAYMENTS | 34 | |

| ARTICLE 5. | INSURANCE | 34 | |

| 5.1 | TITLE INSURANCE | 34 | |

| 5.2 | PROPERTY INSURANCE | 34 | |

| 5.3 | FLOOD HAZARD INSURANCE | 34 | |

| 5.4 | LIABILITY INSURANCE | 35 | |

| 5.5 | BUSINESS INTERRUPTION | 35 | |

| 5.6 | SUBGUARD INSURANCE | 35 | |

| 5.7 | OTHER COVERAGE | 35 | |

| 5.8 | GENERAL | 35 | |

| ARTICLE 6. | REPRESENTATIONS AND WARRANTIES | 36 | |

| 6.1 | AUTHORITY/ENFORCEABILITY | 36 | |

| 6.2 | BINDING OBLIGATIONS | 36 | |

| 6.3 | FORMATION AND ORGANIZATIONAL DOCUMENTS | 36 | |

| 6.4 | NO VIOLATION | 36 | |

| 6.5 | COMPLIANCE WITH LAWS | 36 | |

| 6.6 | LITIGATION | 36 | |

| 6.7 | FINANCIAL CONDITION | 36 | |

| 6.8 | NO MATERIAL ADVERSE CHANGE | 37 | |

| 6.9 | LOAN PROCEEDS AND ADEQUACY | 37 | |

| 6.10 | ACCURACY | 37 | |

| 6.11 | TAX LIABILITY | 37 | |

| 6.12 | TITLE TO ASSETS; NO LIENS | 37 | |

| 6.13 | MANAGEMENT AGREEMENTS | 37 | |

| 6.14 | UTILITIES | 37 | |

| 6.15 | COMPLIANCE | 37 | |

| 6.16 | AMERICANS WITH DISABILITIES ACT COMPLIANCE | 37 | |

| 6.17 | BUSINESS LOAN | 37 | |

| 6.18 | LEASES | 38 | |

| 6.19 | NO SUBORDINATION | 38 | |

| 6.20 | PLANS AND SPECIFICATIONS | 38 | |

| 6.21 | PROPERTY DOCUMENTS | 38 | |

| 6.22 | MAJOR CONTRACTS | 38 | |

| 6.23 | COMPLIANCE WITH MATTERS OF RECORD | 38 | |

| 6.24 | USA PATRIOT ACT | 38 | |

| 6.25 | RESERVED | 38 | |

| 6.26 | GROUND LEASE | 38 | |

| 6.27 | PAYMENT AND PERFORMANCE BONDS | 39 | |

| Table of Contents | |||

| (continued) | |||

| Page | |||

| 6.28 | ANTI-MONEY LAUNDERING/INTERNATIONAL TRADE LAW COMPLIANCE | 39 | |

| 6.29 | SEPARATE TAX PARCEL | 39 | |

| 6.30 | REAFFIRMATION AND SURVIVAL OF REPRESENTATIONS AND WARRANTIES | 39 | |

| ARTICLE 7. | HAZARDOUS MATERIALS | 39 | |

| 7.1 | SPECIAL REPRESENTATIONS AND WARRANTIES | 39 | |

| 7.2 | HAZARDOUS MATERIALS COVENANTS | 40 | |

| 7.3 | INSPECTION BY ADMINISTRATIVE AGENT | 41 | |

| 7.4 | HAZARDOUS MATERIALS INDEMNITY | 41 | |

| ARTICLE 8. | RESERVED | 42 | |

| ARTICLE 9. | COVENANTS OF BORROWER | 42 | |

| 9.1 | EXPENSES | 42 | |

| 9.2 | EXISTENCE AND ORGANIZATIONAL DOCUMENTS | 42 | |

| 9.3 | TAXES AND OTHER LIABILITIES | 43 | |

| 9.4 | REQUIREMENTS OF LAW | 43 | |

| 9.5 | LEASING | 43 | |

| 9.6 | APPROVAL OF LEASES | 43 | |

| 9.7 | DELIVERY OF SUBORDINATION, NON-DISTURBANCE AND ATTORNMENT AGREEMENTS AND ESTOPPEL CERTIFICATES | 44 | |

| 9.8 | MANAGEMENT OF PROPERTY | 44 | |

| 9.9 | FACILITIES | 45 | |

| 9.10 | AMERICANS WITH DISABILITIES ACT COMPLIANCE | 45 | |

| 9.11 | SUBDIVISION MAPS | 45 | |

| 9.12 | ERISA COMPLIANCE | 45 | |

| 9.13 | RESERVED | 46 | |

| 9.14 | SPECIAL COVENANTS; SINGLE PURPOSE ENTITY | 46 | |

| 9.15 | LIMITATIONS ON DEBT, ACTIONS | 46 | |

| 9.16 | SWAP AGREEMENTS | 47 | |

| 9.17 | PROPERTY DOCUMENTS | 47 | |

| 9.18 | APPROVAL OF MAJOR CONTRACTS | 47 | |

| 9.19 | ASSIGNMENT | 48 | |

| 9.20 | LIMITATIONS ON DISTRIBUTIONS, ETC | 48 | |

| 9.21 | MERGER, CONSOLIDATION AND TRANSFER OF ASSETS | 48 | |

| 9.22 | PROHIBITED TRANSFERS | 48 | |

| 9.23 | MINIMUM DEBT SERVICE COVERAGE | 50 | |

| 9.24 | FURTHER ASSURANCES | 50 | |

| 9.25 | ANCHOR LEASE | 51 | |

| 9.26 | PATRIOT ACT | 51 | |

| 9.27 | GROUND LEASE | 51 | |

| 9.28 | ANTI-MONEY LAUNDERING/INTERNATIONAL TRADE LAW COMPLIANCE | 52 | |

| 9.29 | DEVELOPMENT AND CONSTRUCTION MANAGEMENT AGREEMENT | 52 | |

| 9.30 | SUBORDINATION OF GROUND LEASE | 52 | |

| ARTICLE 10. | REPORTING COVENANTS | 52 | |

| 10.1 | FINANCIAL INFORMATION | 52 | |

| Table of Contents | |||

| (continued) | |||

| Page | |||

| 10.2 | BOOKS AND RECORDS | 53 | |

| 10.3 | REPORTS | 53 | |

| 10.4 | DEBT SERVICE COVERAGE | 54 | |

| 10.5 | KNOWLEDGE OF DEFAULT; ETC | 54 | |

| 10.6 | LITIGATION, ARBITRATION OF GOVERNMENT INVESTIGATION | 54 | |

| 10.7 | GROUND LEASE RENT CALCULATIONS | 54 | |

| 10.8 | CERTIFICATE OF BORROWER | 54 | |

| 10.9 | OTHER INFORMATION | 54 | |

| 10.10 | FORM WARRANTY | 55 | |

| ARTICLE 11. | DEFAULTS AND REMEDIES | 55 | |

| 11.1 | DEFAULT | 55 | |

| 11.2 | ACCELERATION UPON DEFAULT; REMEDIES | 58 | |

| 11.3 | DISBURSEMENTS TO THIRD PARTIES | 58 | |

| 11.4 | ADMINSTRATIVE AGENT'S COMPLETION OF CONSTRUCTION | 58 | |

| 11.5 | ADMINSTRATIVE AGENT'S CESSATION OF CONSTRUCTION | 58 | |

| 11.6 | REPAYMENT OF FUNDS ADVANCED | 59 | |

| 11.7 | RIGHTS CUMULATIVE, NO WAIVER | 59 | |

| 11.8 | ALLOCATION OF PROCEEDS | 59 | |

| ARTICLE 12. | THE ADMINISTRATIVE AGENT; INTERCREDITOR PROVISIONS | 59 | |

| 12.1 | APPOINTMENT AND AUTHORIZATION | 59 | |

| 12.2 | PNC AS LENDER | 60 | |

| 12.3 | LOAN DISBURSEMENTS | 61 | |

| 12.4 | DISTRIBUTION AND APPORTIONMENT OF PAYMENTS; DEFAULTING LENDERS | 61 | |

| 12.5 | PRO RATA TREATMENT | 62 | |

| 12.6 | SHARING OF PAYMENTS, ETC | 63 | |

| 12.7 | COLLATERAL MATTERS; PROTECTIVE ADVANCES | 63 | |

| 12.8 | POST-FORECLOSURE PLANS | 64 | |

| 12.9 | APPROVALS OF LENDERS | 65 | |

| 12.10 | NOTICE OF DEFAULTS | 65 | |

| 12.11 | ADMINSTRATIVE AGENT'S RELIANCE, ETC | 65 | |

| 12.12 | INDEMNIFICATION OF ADMINSTRATIVE AGENT | 66 | |

| 12.13 | LENDER CREDIT DECISION, ETC | 66 | |

| 12.14 | SUCCESSOR ADMINSTRATIVE AGENT | 67 | |

| 12.15 | TITLED AGENTS | 67 | |

| 12.16 | NO SET-OFFS | 68 | |

| ARTICLE 13. | MISCELLANEOUS PROVISIONS | 68 | |

| 13.1 | INDEMNITY; DAMAGE WAIVER | 68 | |

| 13.2 | FORM OF DOCUMENTS | 68 | |

| 13.3 | NO THIRD PARTIES BENEFITED | 68 | |

| 13.4 | NOTICES | 69 | |

| 13.5 | ATTORNEY-IN-FACT | 69 | |

| 13.6 | ACTIONS | 69 | |

| Table of Contents | |||

| (continued) | |||

| Page | |||

| 13.7 | RIGHT OF CONTEST | 69 | |

| 13.8 | RELATIONSHIP OF PARTIES | 69 | |

| 13.9 | DELAY OUTSIDE LENDER'S CONTROL | 69 | |

| 13.10 | ATTORNEYS' FEES AND EXPENSES; ENFORCEMENT | 70 | |

| 13.11 | IMMEDIATELY AVAILABLE FUNDS | 70 | |

| 13.12 | AMENDMENTS AND WAIVERS | 70 | |

| 13.13 | SUCCESSORS AND ASSIGNS | 71 | |

| 13.14 | ADDITIONAL COSTS; CAPITAL ADEQUACY | 74 | |

| 13.15 | TAXES | 77 | |

| 13.16 | ADDITIONAL SECURITY INTEREST | 81 | |

| 13.17 | SIGNS | 81 | |

| 13.18 | LENDER'S AGENTS | 81 | |

| 13.19 | TAX SERVICE | 81 | |

| 13.20 | WAIVER OF RIGHT TO TRIAL BY JURY | 81 | |

| 13.21 | SEVERABILITY | 82 | |

| 13.22 | TIME | 82 | |

| 13.23 | HEADINGS | 82 | |

| 13.24 | GOVERNING LAW | 82 | |

| 13.25 | USA PATRIOT ACT NOTICE | 82 | |

| 13.26 | ELECTRONIC DOCUMENT DELIVERIES | 82 | |

| 13.27 | INTEGRATION; INTERPRETATION | 83 | |

| 13.28 | RESERVED | 83 | |

| 13.29 | COUNTERPARTS | 83 | |

EXHIBITS AND SCHEDULES

SCHEDULE 1.1 - PRO RATA SHARES

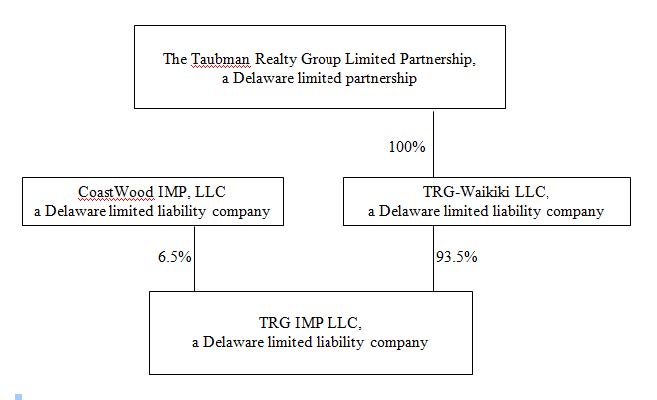

SCHEDULE 6.3 - OWNERSHIP OF BORROWER AND GUARANTOR

SCHEDULE 6.6 - LITIGATION DISCLOSURE

SCHEDULE 6.18 - LEASES

SCHEDULE 6.22 - MAJOR CONTRACTS

SCHEDULE 6.26 - ADDITIONAL GROUND LESSOR DOCUMENTS

SCHEDULE 7.1 - ENVIRONMENTAL REPORTS

SCHEDULE 11.1 - POST CLOSING

EXHIBIT A - DESCRIPTION OF PROPERTY

EXHIBIT B - DOCUMENTS

EXHIBIT C - FINANCIAL REQUIREMENTS ANALYSIS

EXHIBIT D - DISBURSEMENT PLAN

EXHIBIT E - FORM OF ASSIGNMENT AND ASSUMPTION AGREEMENT

EXHIBIT F - FORM OF PROMISSORY NOTE

EXHIBIT G - RESERVED

EXHIBIT H - DELEGATION LETTER

EXHIBIT I - FORM OF COMPLIANCE CERTIFICATE

EXHIBIT J - TAX COMPLIANCE CERTIFICATES

EXHIBIT K - INSURANCE

EXHIBIT L - ACKNOWLEDGMENT OF OPTION TO EXTEND

EXHIBIT M - CONFIRMATION OF SECOND TIER STABILIZATION

EXHIBIT N - FORM OF MANAGEMENT AGREEMENT

EXHIBIT O - PROPERTY DOCUMENTS

EXHIBIT P - FORM OF ASSIGNMENT AND SUBORDINATION OF PROPERTY MANAGEMENT

AND LEASING AGREEMENT

BUILDING LOAN AGREEMENT

THIS BUILDING LOAN AGREEMENT (“Agreement”) dated as of August 14, 2015 by and among TRG IMP LLC, a Delaware limited liability company (“Borrower”), each of the financial institutions initially a signatory hereto together with their assignees under Section 13.13 (“Lenders”), and PNC BANK, NATIONAL ASSOCIATION (“PNC”) as contractual representative of the Lenders to the extent and in the manner provided in Article 12 (in such capacity, the “Administrative Agent”).

R E C I T A L S

| A. | Borrower has good and indefeasible title, pursuant to the Ground Lease (as hereinafter defined), to its 100% leasehold interest in that certain real property located in Honolulu, Hawaii, and more particularly described in Exhibit A hereto (inclusive of the Improvements (defined below), the “Property”). |

| B. | Borrower proposes to construct on the Property certain Improvements (as defined below) as part of the approximately 350,000 square foot retail mall to be commonly known as “International Market Place” and anchored by Saks Fifth Avenue. The Improvements shall be constructed in accordance with the Plans and Specifications (as defined below). |

| C. | Borrower has requested from Lenders a loan for the purpose of financing such construction, and Lenders have agreed to loan to Borrower the amount described herein on the terms and conditions set forth in this Agreement. |

NOW, THEREFORE, Borrower, Administrative Agent and Lenders agree as follows:

ARTICLE 1. DEFINITIONS

1.1 DEFINED TERMS. The following capitalized terms generally used in this Agreement shall have the meanings defined or referenced below. Certain other capitalized terms used only in specific sections of this Agreement are defined in such sections.

“Account” - means, collectively, the Borrower’s Funds Account, the Loan Disbursement Account and any other account established by Borrower in connection with the Loan from time to time.

“ADA” - means the Americans with Disabilities Act, of July 26, 1990, Pub. L. No. 101-336, 104 Stat. 327, 42 U.S.C. § 12101, et seq., as now or hereafter amended, modified, supplemented or replaced from time to time.

“Additional Costs” - shall have the meaning given to such term in Section 13.14(b).

“Administrative Agent” - means PNC Bank, National Association, or any successor Administrative Agent appointed pursuant to Section 12.14.

“Affiliate” - means, with respect to any Person, another Person that directly, or indirectly through one or more intermediaries, Controls or is Controlled by or is under common Control with the Person specified.

“Agreement” - shall have the meaning given to such term in the preamble hereto.

“Anchor” - means Saks Fifth Avenue LLC and any additional or replacement Anchor approved by Requisite Lenders.

“Anchor Lease” - means that certain Lease dated August 9, 2013 between Borrower and Saks Fifth Avenue LLC, as the same may be amended, modified or replaced from time to time in accordance with the terms hereof.

“Anti-Terrorism Laws” means any Applicable Laws relating to terrorism, trade sanctions programs and embargoes, import/export licensing, money laundering or bribery, and any regulation, order, or directive promulgated, issued or enforced pursuant to such Applicable Laws, all as amended, supplemented or replaced from time to time.

“Applicable Law” - means all constitutions, statutes, rules, regulations and orders of any Governmental Authority, including all orders and decrees of all courts, tribunals and arbitrators applicable to a Loan Party, the Property, the Administrative Agent or any Lender, as the context requires.

“Applicable Spread” - means one and seventy-five hundredths percent (1.75%); provided, however, upon the occurrence of Second Tier Stabilization, the Applicable Spread shall mean one and sixty hundredths percent (1.60%).

The reduction in the Applicable Spread set forth above shall become effective on the first Business Day of the first calendar month following Borrower having provided to Administrative Agent written confirmation that Second Tier Stabilization has occurred. Although effective upon delivery, the form and detail of the written confirmation must still be determined to be reasonably satisfactory to Administrative Agent and if Administrative Agent determines that Second Tier Stabilization has not occurred (any such determination to be made by Administrative Agent within ninety (90) days of receipt by Administrative Agent of Borrower’s written confirmation that Second Tier Stabilization has occurred), the Applicable Spread shall automatically revert back to the appropriate amount, and Borrower shall immediately pay Administrative Agent, for the benefit of the Lenders, an amount equal to the difference between (i) the interest that should have been provided to Administrative Agent from the date written confirmation that Second Tier Stabilization occurred was first provided to Administrative Agent and (ii) the interest that had been provided to Administrative Agent from the date written confirmation that Second Tier Stabilization had occurred was first provided to Administrative Agent. To confirm that Second Tier Stabilization has occurred, Borrower can provide Exhibit M attached to this Agreement, completed and fully executed by an authorized signer, to Administrative Agent for its review and approval.

“Application for Payment” - shall have the meaning given to such term in Exhibit D attached hereto.

“Appraisal” - means a written appraisal prepared by an independent MAI appraiser acceptable to Administrative Agent and subject to Administrative Agent’s customary independent appraisal requirements and prepared in compliance with all applicable regulatory requirements, including the Financial Institutions Recovery, Reform and Enforcement Act of 1989, as amended from time to time.

“Approved Fund” - means any Person (other than a natural person) that is engaged in making, purchasing, holding or investing in bank loans and similar extensions of credit in the ordinary course of its business that is administered or managed by (a) a Lender, (b) an Affiliate of a Lender, or (c) an entity or an Affiliate of any entity that administers or manages a Lender.

“Approved Lease” - means (i) an existing Lease for space on the Property as of the Effective Date, unless expressly disapproved prior to the closing of the Loan by Administrative Agent in writing in its reasonable discretion, (ii) a future Lease for space on the Property entered into by Borrower for which Administrative Agent’s approval is not required under the terms of this Agreement, and (iii) a future Lease for space on the Property entered into by Borrower and approved by Administrative Agent.

“Architect” - means JPRA Architects, PC, or such other architect as Administrative Agent may reasonably approve in writing from time to time.

“Architect’s Agreement” - means the Agreement between Owner and Architect dated September 1, 2012, by and between Borrower and Architect.

“Assignee” - shall have the meaning given to such term in Section 13.13(c).

“Assignment and Assumption Agreement” - means an Assignment and Assumption Agreement among a Lender, an Assignee, and the Administrative Agent, substantially in the form of Exhibit E.

“Bankruptcy Code” - means the Bankruptcy Reform Act of 1978 (11 USC § 101-1330) as now or hereafter amended or recodified.

“Borrower” - shall have the meaning given to such term in the preamble hereto.

“Borrower’s Funds” - means all funds of Borrower deposited with Administrative Agent, for the benefit of Lenders, pursuant to the terms and conditions of this Agreement.

“Borrower’s Funds Account” - means a demand deposit account established with Administrative Agent, in the name of Borrower or Borrower’s designee for the benefit of Lenders, or such other name as Administrative Agent may direct in writing, into which all Borrower’s Funds deposited with Administrative Agent pursuant to Section 4.21 of this Agreement shall be placed. Borrower agrees to fully cooperate with Administrative Agent to establish the Borrower’s Funds Account with the Administrative Agent.

“Business Day” - means (a) for all purposes other than as set forth in clause (b) below, any day, except a Saturday, Sunday or any other day on which commercial banks in New York, New York are authorized or required by law to close and (b) with respect to the determination of any LIBO Rate, any day that is a day for trading by and between banks in Dollar deposits in the London interbank market. Unless specifically referenced in this Agreement as a Business Day, all references to “days” shall be to calendar days.

“Calculated Interest Rate” - means the rate of interest, equal to the sum of: (a) Applicable Spread plus (b) the LIBO Rate.

“Collateral” - means the Property and any personal property or other collateral with respect to which a Lien or security interest was granted to Administrative Agent, for the benefit of Lenders, pursuant to the Loan Documents.

“Commitment” - means, as to each Lender, such Lender’s obligation to make disbursements pursuant to Section 3.4 and Section 12.3, in an amount up to, but not exceeding the amount set forth for such Lender on Schedule 1.1 attached hereto as such Lender’s “Commitment Amount” or as set forth in the applicable Assignment and Assumption Agreement, as the same may be reduced from time to time pursuant to the terms of this Agreement or as appropriate to reflect any assignments to or by such Lender effected in accordance with Section 13.13.

“Complete”, “Completed” or “Completion” - means completion of the Improvements, which shall be deemed to have occurred upon: (i) Administrative Agent’s receipt of a written statement or certificate executed by the Architect designated or shown on the Plans and Specifications approved by Administrative Agent certifying, without qualification or exception (other than punchlist items), that the Improvements are complete in all material respects, substantially in accordance with the Plans and Specifications; (ii) Administrative Agent’s receipt of all permanent certificates of occupancy or completion or other comparable governmental approvals which are required for the Improvements by the local government agency having jurisdiction and authority to issue such certificates of occupancy or completion or other approvals, and a recorded notice of completion (if applicable, taking into consideration any future tenant improvement work); (iii) the expiration of the statutory period(s) within which valid mechanic’s liens and/or materialman’s liens may be recorded and/or served by reason of the construction of the Improvements, or, alternatively, Administrative Agent’s receipt of valid, unconditional releases thereof from all persons entitled to record said liens; and (iv) Administrative Agent’s receipt of other close-out items as reasonably required and approved by Administrative Agent which are customarily delivered in connection with construction loan disbursements, such approval not be unreasonably withheld, conditioned or delayed.

“Completion Guaranty” means the Completion Guaranty by Taubman in favor of Administrative Agent, for the benefit of Lenders, dated as of the date hereof, as the same may be amended from time to time.

“Compliance Certificate” - shall have the meaning given to such term in Section 10.4.

“Construction Agreement” - means the agreement to construct the Improvements dated November 26, 2013 by and between Borrower and Contractor, as amended by the First Amendment to Construction Contract dated April 1, 2014 and the Second Amendment to Construction Contract dated July 1, 2014.

“Contractor” - means dck/FWF, LLC, or such other contractor as Administrative Agent may reasonably approve in writing from time to time.

“Control” - means the possession, directly or indirectly, of the power to direct or cause the direction of the management or policies of a Person, whether through the ability to exercise voting power, by contract or otherwise. “Controlling” and “Controlled” have meanings correlative thereto.

“Covered Entity” - means (a) Borrower and Guarantor and (b) each Person that, directly or indirectly, is in control of a Person described in clause (a) above. For purposes of this definition, control of a Person means the direct or indirect (x) ownership of, or power to vote, 25% or more of the issued and outstanding equity interests having ordinary voting power for the election of directors of such Person or other Persons performing similar functions for

such Person, or (y) power to direct or cause the direction of the management and policies of such Person whether by ownership of equity interests, contract or otherwise.

“Debt Service Coverage Ratio” - means, as of any date of determination, the ratio of Net Operating Income to the greater of: (a) the prior quarter’s actual annualized debt service including interest and, if applicable, principal, and (b) the amount obtained by multiplying the then outstanding principal balance of the Loan by a debt constant based on a 30-year amortization schedule and a rate equal to the greater of (i) the then current 10-year Treasury Bond rate plus 1.75%, and (ii) 6.00%; provided, however, the outstanding principal balance of the Loan shall be adjusted upward to include any unfunded retainage for the testing of the Debt Service Coverage Ratio in connection with the exercise of any option to extend the Maturity Date.

“Default” - shall have the meaning given to such term in Section 11.1.

“Default Rate” - is a rate of interest per annum four percent (4%) in excess of the applicable Effective Rate in effect from time to time.

“Defaulting Lender” - means any Lender which, at any time, shall: (i) fail or refuse to perform any of its obligations under this Agreement or any other Loan Document to which it is a party within the time period specified for performance of such obligation or, if no time period is specified, if such failure or refusal continues for a period of five (5) Business Days after receipt of notice from Administrative Agent; (ii) notify Borrower, Administrative Agent or any Lender in writing that it does not intend to comply with any of its funding obligations under this Agreement or has made a public statement to the effect that it does not intend to comply with its funding obligations under this Agreement (unless such writing or public statement indicates that such position is based on such Lender’s good faith determination that a condition precedent (specifically identified and including the particular default, if any) to funding a loan under this Agreement cannot be satisfied); and/or (iii) (A) become or be insolvent or have a parent company that has become or is insolvent, and/or (B) become the subject of a bankruptcy or insolvency proceeding, or have had a receiver, conservator, trustee, or custodian appointed for it, or have taken any action in furtherance of, or indicating its consent to, approval of or acquiescence in any such proceeding or appointment or have a parent company that has become the subject of a bankruptcy or insolvency proceeding, or has had a receiver, conservator, trustee or custodian appointed for it, or has taken any action in furtherance of, or indicating its consent to, approval of or acquiescence in any such proceeding or appointment; provided that a Lender shall not be a Defaulting Lender solely by virtue of the ownership or acquisition of any equity interest in that Lender or any direct or indirect parent company thereof by a Governmental Authority so long as such ownership interest does not result in or provide such Lender with immunity from the jurisdiction of courts within the United States of America or from the enforcement of judgments or writs of attachment on its assets or permit such Lender (or such Governmental Authority) to reject, repudiate, disavow or disaffirm any contracts or agreements made with such Lender. Any determination by the Administrative Agent that a Lender is a Defaulting Lender under clauses (i) through (iii) above shall be conclusive and binding absent manifest error, and such Lender shall be deemed to be a Defaulting Lender upon delivery of written notice of such determination to the Borrower and any such Defaulting Lender. If the Borrower and the Administrative Agent agree in writing that a Lender is no longer a Defaulting Lender, the Administrative Agent will so notify the parties hereto, whereupon as of the effective date specified in such notice and subject to any conditions set forth therein, that Lender will, to the extent applicable, purchase at par that portion of outstanding Loan of the other Lenders or take such other actions as the Administrative Agent may determine to be necessary to cause the Loan to be held pro rata by the Lenders in accordance with the Commitments, whereupon such Lender will cease to be a Defaulting Lender; provided that no adjustments will be made retroactively with respect to fees accrued or payments made by or on behalf of the Borrower while that Lender was a Defaulting Lender; and provided, further, that except to the extent otherwise expressly agreed by the affected parties, no change hereunder from Defaulting Lender to Lender will constitute a waiver or release of any claim of any party hereunder arising from that Lender's having been a Defaulting Lender.

“Delivery Requirements” - means, collectively, the “Delivery Requirements” as defined in the Anchor Lease, i.e., completing and turning over the Building Shell, Shared Truck Facilities, Shared Generator, Saks Corridor and Saks Employee Entrance, as those terms are defined in the Anchor Lease, and the “Additional Requirements” as defined in the Anchor Lease, i.e., the conditions set forth as items 1 through 5 of Section 5.02 of the Anchor Lease.

“Development and Construction Management Agreement” - means Taubman Services Agreement dated July 1, 2013, effective as of February 10, 2010, between Borrower and The Taubman Company LLC.

“Disbursement Budget” - shall have the meaning given to such term in Exhibit D hereto.

“Disqualified Income” - shall mean income from Leases where (i) the tenant has filed for bankruptcy and has ceased to pay rent; provided however, with respect to a Major Lease, the tenant has filed bankruptcy, (ii) a failure to pay rent required under a Lease (other than de minimis amounts and amounts in dispute) for three (3) consecutive months, (iii) a Lease has been terminated, (iv) with respect to a Major Lease, the tenant closes for more than ninety (90) consecutive days other than for repairs as a result of casualty, rebranding of the tenant’s space or the refitting of the tenant’s space; or (v) with respect to a Major Lease, the tenant has asserted, or has the right to assert, its rights to terminate under a unilateral co-tenancy, volume out provision or similar lease provision.

“District” - shall have the meaning given to such term in Section 4.12.

“Dollars” and “$” - means the lawful money of the United States of America.

“Effective Date” - shall have the meaning given to such term in Section 2.4.

“Effective Rate” - shall have the meaning given to such term in Section 2.6(e).

“Eligible Assignee” - means (a) a Lender, (b) an Affiliate of a Lender, (c) an Approved Fund and (d) any other Person (other than a natural person) approved by (i) the Administrative Agent and (ii) unless a Default exists, the Borrower (each such approval not to be unreasonably withheld or delayed); provided that notwithstanding the foregoing, “Eligible Assignee” shall not include (1) the Borrower, (2) any of the Borrower’s Affiliates or Subsidiaries or (3) so long as the Loan has not been accelerated or Borrower has not failed to pay the loan at maturity, any Competitor. “Competitor” shall mean any private developer or public real estate investment trust that owns five (5) or more shopping malls, or any Affiliate of such private developer or public real estate investment trust.

“Embargoed Person” - means any person, entity or country which is a sanctioned person, entity or country under U.S. law, including but not limited to, the International Emergency Economic Powers Act, 50 U.S.C. §§ 1701 et seq., The Trading with the Enemy Act, 50 U.S.C. App. 1 et seq., and any Executive Orders or regulations promulgated thereunder (including regulations administered by the Office of Foreign Assets Control (“OFAC”) of the U.S. Department of the Treasury and the Specially Designated Nationals List maintained by OFAC) with the result that the investment in Borrower and/or Guarantor, as applicable (whether directly or indirectly), is prohibited by, or the Loan made by Lenders is in violation of, any applicable federal, state, county, municipal and other governmental statutes, laws, rules, orders, regulations, ordinances, judgments, decrees and injunctions affecting Borrower or any property (real or personal) securing the Loan, or any part thereof, whether now or hereafter enacted and in force.

“ERISA” - means the Employee Retirement Income Security Act of 1974, as in effect from time to time.

“Excluded Taxes” means any of the following Taxes imposed on or with respect to a Recipient or required to be withheld or deducted from a payment to a Recipient, (a) Taxes imposed on or measured by net income (however denominated), franchise taxes, and branch profits taxes, in each case, (i) imposed as a result of such Recipient being organized under the laws of, or having its principal office or, in the case of any Lender, its applicable Lending Office located in, the jurisdiction imposing such Tax (or any political subdivision thereof) or (ii) that are Other Connection Taxes, (b) in the case of a Lender, U.S. federal withholding Taxes imposed on amounts payable to or for the account of such Lender with respect to an applicable interest in a Loan or Commitment pursuant to an Applicable Law in effect on the date on which (i) such Lender acquires such interest in the Loan or Commitment or (ii) such Lender changes its lending office, except in each case to the extent that, pursuant to Section 13.15, amounts with respect to such Taxes were payable either to such Lender’s assignor immediately before such Lender became a party hereto or to such Lender immediately before it changed its lending office, (c) Taxes attributable to such Recipient’s failure to comply with Section 13.15(g) and (d) any U.S. federal withholding Taxes imposed under FATCA.

“FATCA” means Sections 1471 through 1474 of the Internal Revenue Code, as of the date of this Agreement (or any amended or successor version that is substantively comparable and not materially more onerous to comply with) and any current or future regulations or official interpretations thereof and any agreements entered into pursuant to Section 1471(b)(1) of the Internal Revenue Code.

“Federal Funds Rate” means, for any period, a fluctuating interest rate per annum equal for each day during such period to the weighted average of the rates on overnight Federal Funds transactions with members of the Federal Reserve System arranged by Federal Funds brokers, as published for such day (or, if such day is not a Business Day, for the next preceding Business Day) by the Federal Reserve Bank of New York, or, if such rate is not so published for any day which is a Business Day, the average of the quotations for such day on such transactions received by

Administrative Agent from three Federal Funds brokers of recognized standing selected by Administrative Agent. In no event shall the Federal Funds Rate be less than 0.0%.

“First Extended Maturity Date” - means August 14, 2019.

“First Option to Extend” - means Borrower’s option, subject to the terms and conditions of Section 2.10, to extend the term of the Loan from the Original Maturity Date to the First Extended Maturity Date.

“Foreign Lender” means (a) if the Borrower is a U.S. Person, a Lender that is not a U.S. Person, and (b) if the Borrower is not a U.S. Person, a Lender that is resident or organized under the laws of a jurisdiction other than that in which the Borrower is resident for tax purposes.

“Funding Date” - shall have the meaning given to such term in Exhibit D attached hereto.

“Governmental Authority” - means any nation or government, any federal, state, local, municipal or other political subdivision thereof or any entity exercising executive, legislative, judicial, regulatory or administrative functions of or pertaining to government.

“Ground Lease” - means that certain Retail Ground Lease, dated August 9, 2013, by and between Ground Lessor, as ground lessor, and Borrower, as tenant, a memorandum of which was recorded August 9, 2013, in the Office of the Assistant Registrar of the Land Court of the State of Hawaii as Document No. T-8621110, as amended by the Exemption Letter dated August 9, 2013, from Ground Lessor to Borrower and that certain letter agreement dated February 7, 2014, between Ground Lessor and Borrower, as the same may be further amended, modified or replaced from time to time in accordance with the terms hereof.

“Ground Lessor” - means Queen Emma Land Company, a Hawaii non-profit corporation, as ground lessor under the Ground Lease, and its successors and assigns.

“Guarantor” - means Taubman and any other person or entity who, or which, in any manner, is or becomes obligated to Lenders under any guaranty now or hereafter executed in connection or with respect to the Loan (collectively or severally as the context thereof may suggest or require).

“Guaranty” - means, individually or collectively as the context may require, the (i) Partial Repayment and Limited Guaranty, and (ii) Completion Guaranty.

“Hard Costs” - shall have the meaning given to such term in Exhibit D.

“Hazardous Materials” - shall have the meaning given to such term in Section 7.1(a).

“Hazardous Materials Claims” - shall have the meaning given to such term in Section 7.1(c).

“Hazardous Materials Laws” - shall have the meaning given to such term in Section 7.1(b).

“Improvements” - means the certain improvements owned by Borrower and to be constructed on the Property in accordance with, and to the extent described in, the Plans and Specifications, consisting of: the approximately 80,000 square foot Anchor space and the Shop Space, together with all appurtenances, fixtures, and tenant improvements now or hereafter located on the Property and owned by Borrower; provided, however, for purposes of determining Completion, only those tenant improvements for which Borrower has the obligation to construct under the Leases shall be considered Improvements.

“In-Balance” - means, with respect to the Loan, Administrative Agent’s reasonable determination from time to time that any undisbursed Loan funds shall be at all times equal to or greater than the amount which Administrative Agent from time to time reasonably determines necessary to: (i) pay, through Completion, all costs of development and construction of the Property and construction of the Improvements in accordance with the Loan Documents; provided, however, for purposes of determining In-Balance, only those tenant improvements for which Borrower has the obligation to construct or fund under the Leases shall be considered Improvements; (ii) pay all interest, insurance and taxes required to be paid by Borrower pursuant to the Loan Documents until revenue from the Project is sufficient to pay interest, insurance, taxes and operating expenses, (iii) pay all tenant improvements and leasing commissions necessary to lease the Property up to a ninety-five percent (95%) Occupancy, (iv) maintain a reasonable budgeted

contingency through Completion, and (v) pay all other sums required to be paid by Borrower pursuant to the Disbursement Budget through Completion.

“Indemnifiable Amounts” - shall have the meaning given to such term in Section 12.12.

“Indemnified Taxes” means (a) Taxes, other than Excluded Taxes, imposed on or with respect to any payment made by or on account of any obligation of the Borrower or any other Loan Party under any Loan Document and (b) to the extent not otherwise described in the immediately preceding clause (a), Other Taxes.

“Indemnitees” - means Administrative Agent, Lenders, and their respective parents, subsidiaries and Affiliates, any holder of or Participant in the Loan and all directors, officers, employees, agents, successors and assigns of any of the foregoing.

“Indemnity” - means the Unsecured Hazardous Materials Indemnity Agreement by Taubman in favor of Administrative Agent, for the benefit of Lenders, dated as of the date hereof, as the same may be amended from time to time.

“Independent Inspecting Architect” - means the architect, engineer, agent, consultant or other inspector selected and retained by Administrative Agent, at Borrower’s expense, to inspect the work on behalf of the Administrative Agent and the Lenders.

“Initial Equity” - shall have the meaning given to such term in Section 3.1.

“Interest Reserve” - means any interest reserve maintained in accordance with the Disbursement Budget.

“Lease” - shall have the meaning given to such term in Section 9.6.

“Lender” - means each financial institution from time to time party hereto as a “Lender”, together with its respective successors and permitted assigns. With respect to matters requiring the consent or approval of all Lenders at any given time, all then existing Defaulting Lenders will be disregarded and excluded, and, for voting purposes only, “all Lenders” shall be deemed to mean “all Lenders other than Defaulting Lenders”.

“Lending Office” - means, for each Lender, the office of such Lender specified in such Lender’s Administrative Questionnaire or in the applicable Assignment and Assumption Agreement, or such other office of such Lender as such Lender may notify the Administrative Agent in writing from time to time.

“LIBO Rate” - means the interest rate per annum determined by Administrative Agent on the basis of the rate for which United States Dollar deposits for delivery on the first (1st) day of each LIBO Rate Period, for a period equal to such LIBO Rate Period, as reported on the Bloomberg Page BBAM1 (or on such other substitute Bloomberg page that displays rates at which United States Dollar deposits are offered by leading banks in the London interbank deposit market), at approximately 11:00 a.m., London time, two (2) Business Days prior to the commencement of such LIBO Rate Period (the “Reset Date”) as the London interbank offered rate for United States Dollars for a comparable amount having a borrowing date and a maturity comparable to such LIBO Rate Period. If at any time, for any reason, a Bloomberg Page BBAM1 (or any substitute page) no longer exists, the interest rate per annum shall be determined, in accordance with the last two sentences of this definition, by Administrative Agent requesting quotes from four (4) leading banks in the London interbank deposit market (an “Alternate Source”) of the rates at which deposits in United States Dollars are offered by such banks at 11:00 a.m., London time on the Reset Date for a comparable amount having a borrowing date and a maturity comparable to such LIBO Rate Period. If at least two such quotations are provided, the Alternate Source rate for that Reset Date will be the arithmetic mean of the quotations. If fewer than two quotations are provided as requested, the Alternate Source rate for that Reset Date will be the arithmetic mean of the rates quoted by major banks in New York City, selected by Administrative Agent, at approximately 11:00 a.m., New York City time, on that Reset Date for loans in United States Dollars to leading European banks for a period of 30-days commencing on that Reset Date and in an appropriate amount. In no event shall the LIBO Rate be less than 0.0%.

“LIBO Rate Commencement Date” - means the date upon which the LIBO Rate Period commences.

“LIBO Rate Period” - means a period commencing on the first (1st) Business Day of a calendar month and continuing to, but not including, the first (1st) Business Day of the next calendar month; provided, however, that no LIBO Rate Period shall extend beyond the Maturity Date.

“LIBO Rate Portion” - means the principal balance of the Loan which is subject to a Calculated Interest Rate. In the event Borrower is subject to a principal amortization schedule under the terms and conditions of the Loan Documents, the LIBO Rate Portion shall in no event exceed the maximum outstanding principal balance which will be permissible on the last day of the LIBO Rate Period.

“LIBO Rate Price Adjustment” - shall have the meaning given to such term in Section 2.6(h).

“LIBOR Loan” - means a portion of the Loan bearing interest at a rate based on the LIBO Rate.

“Lien” - means any mortgage, deed of trust, pledge, hypothecation, assignment, deposit arrangement, security interest, encumbrance (including, but not limited to, easements, rights-of-way, zoning restrictions and the like), lien (statutory or other), preference, priority or other security agreement or preferential arrangement of any kind or nature whatsoever, including without limitation any conditional sale or other title retention agreement, the interest of a lessor under a capital lease, any financing lease having substantially the same economic effect as any of the foregoing, and the filing of any financing statement or document having similar effect (other than a financing statement filed by a “true” lessor pursuant to Section 9-505 (or a successor section) of the Uniform Commercial Code) naming the owner of the asset to which such Lien relates as debtor, under the Uniform Commercial Code or other comparable law of any jurisdiction.

“Loan” - means the principal sum that Lenders lend and Borrower borrows pursuant to the terms and conditions of this Agreement: up to THREE HUNDRED THIRTY MILLION EIGHT HUNDRED NINETY THOUSAND AND NO/100THS DOLLARS ($330,890,000.00).

“Loan Account” - shall have the meaning given to such term in Section 2.9.

“Loan Disbursement Account” - means an account with Comerica Bank, account number 1852636198, in the name of Borrower or Borrower’s designee into which Loan proceeds and other amounts will be deposited when eligible for disbursement.

“Loan Documents” - means those documents, as hereafter amended, supplemented, replaced or modified, properly executed and in recordable form, if necessary, listed in Exhibit B as Loan Documents.

“Loan Party” - means Borrower, Guarantor, and any other person or entity obligated under the Loan Documents or Other Related Documents.

“Loan-to-Value Percentage” - shall mean the amount, expressed as a percentage, obtained by dividing (a) the aggregate amount of the Commitments of all Lenders hereunder by (b) the “as is” market value of the Property then encumbered by the Mortgage (after adjustment for senior liens and special tax assessments), as such value is determined by a current Appraisal reasonably acceptable to Administrative Agent.

“Major Contract” - means any maintenance, service or other contract or agreement of any kind entered into by Borrower (other than the Development and Construction Management Agreement, Management Agreement, Approved Leases, Property Documents, Construction Agreement or Architect’s Agreement and Permitted Liens) of a material nature (materiality for these purposes to include contracts with annual payments in excess of $100,000.00 (unless cancelable on thirty (30) days or less notice without requiring the payment of termination fees or payments of any kind) or which extend beyond one year (unless cancelable on thirty (30) days or less notice without requiring the payment of termination fees or payments of any kind)), in either case relating to the ownership, development, leasing, management, use, operation, maintenance, repair or restoration of the Property, whether written or oral.

“Major Lease” - means any Lease greater than 10,000 square feet of gross leasable area.

“Major Subcontract” - means any subcontract or other agreement between Contractor and any subcontractor or material supplier with respect to the Project which provides for an aggregate contract price equal to or greater than $500,000.00.

“Management Agreement” - means the Property Management and Leasing Agreement that will be entered into between Borrower and Manager upon Project Opening in the form attached as Exhibit N hereto.

“Manager” - means The Taubman Company LLC, an Affiliate of Taubman.

“Material Adverse Change” - means (a) a material adverse change in, or a material adverse effect on the value or use of the Property taken as a whole, (b) a material impairment of the ability of the Loan Parties to repay the Loan, or (c) a material adverse effect on the validity or enforceability of the Loan Documents or the ability of Administrative Agent to exercise the rights or remedies thereunder upon the occurrence of a Default.

“Maturity Date” - means the Original Maturity Date, the First Extended Maturity Date or the Second Extended Maturity Date, as applicable.

“Minimum Debt Service Coverage” - shall have the meaning given to such term in Section 9.23(a).

“Mortgage” - means the Leasehold Mortgage, Assignment of Leases and Rents, Security Agreement and Fixture Filing of even date herewith executed by Borrower in favor of Administrative Agent, for the benefit of Lenders, as hereafter amended, supplemented, replaced or modified.

“Net Operating Income” or “NOI” - means, with respect to any Test Period, the amount of revenues and expenses utilized to calculate the “income before interest, depreciation and amortization” (or its financial equivalent) on the financial statements required to be delivered by Borrower pursuant to the Loan Documents corresponding to such Test Period, which financial statements shall be prepared in accordance with generally accepted accounting principles (except that the effects of straight lining rent shall be eliminated), adjusted so that:

| (a) | such amount is calculated based on (a) revenues (net of percentage rent) for the two (2) most recently ended fiscal quarters annualized, plus (b) actual percentage rent collected during such Test Period, plus (c) when testing Net Operating Income for Guarantor recourse reduction or extension qualification only, proforma annualized revenues for fully executed Approved Leases with occupancy scheduled to take place within the next 120-day period, provided that any actual revenue from the space covered by such Approved Leases shall be excluded so as to avoid duplication of rent from the same space; |

| (b) | such amount reflects (X) annual Property management fees equal to the greater of: (i) actual fees incurred and (ii) three percent (3%) of gross revenue, and (Y) annual Property capital reserves equal to $0.10 per rentable square foot during the initial loan term, and $0.25 per rentable square foot during any extension term; and |

| (c) | the following are excluded from revenues: (a) lease cancellation revenue in excess of $300,000 per annum, and (b) when testing Net Operating Income for Guarantor recourse reduction or extension qualification only, Disqualified Income. |

“Non-Pro Rata Advance” - means a Protective Advance or a disbursement under the Loan with respect to which fewer than all Lenders have funded their respective Pro Rata Shares in breach of their obligations under this Agreement.

“Note” or “Notes” - means each Promissory Note Secured by Mortgage in the form attached hereto as Exhibit F, collectively in the original principal amount of the Loan, each executed by Borrower and payable to the order of a Lender, together with such other replacement notes as may be issued from time to time pursuant to Section 13.13, as hereafter amended, supplemented, replaced or modified.

“Occupancy” - shall be calculated by the Borrower using the methodology that is used by Taubman Centers, Inc. for public reporting purposes and as modified from time to time in keeping with industry standard practices. The Borrower shall provide notice to the Administrative Agent of any such modification that it considers significant.

“Offsite Materials” - shall have the meaning given to such term in Exhibit D.

“Onsite Materials” - shall have the meaning given to such term in Exhibit D.

“Opening Date” - means the earlier to occur of: (a) the date of the Project Opening, and (b) December 25, 2016.

“Original Maturity Date” - means August 14, 2018.

“Other Connection Taxes” - means, with respect to any Recipient, Taxes imposed as a result of a present or former connection between such Recipient and the jurisdiction imposing such Tax (other than connections arising from such Recipient having executed, delivered, become a party to, performed its obligations under, received payments under, received or perfected a security interest under, engaged in any other transaction pursuant to or enforced any Loan Document, or sold or assigned an interest in any Loan or Loan Document).

“Other Related Documents” - means those documents, as hereafter amended, supplemented, replaced or modified from time to time, properly executed and in recordable form, if necessary, listed in Exhibit B as Other Related Documents.

“Other Taxes” - means all present or future stamp, court or documentary, intangible, recording, filing or similar Taxes that arise from any payment made under, from the execution, delivery, performance, enforcement or registration of, from the receipt or perfection of a security interest under, or otherwise with respect to, any Loan Document, except any such Taxes that are Other Connection Taxes imposed with respect to an assignment (other than an assignment made pursuant to Section 13.15(i)(b) hereof).

“Partial Repayment and Limited Guaranty” means that certain Partial Repayment and Limited Guaranty dated of even date herewith, executed by Taubman in favor of Administrative Agent for the benefit of the Lenders.

“Participant” - shall have the meaning given to such term in Section 13.13.

“Permit” - means any permit, approval, authorization, license, variance or permission required from a Governmental Authority under an applicable Requirement of Law.

“Permitted Liens” - means:

| (a) | Liens (other than environmental Liens and any Lien imposed under ERISA) for taxes, assessments or charges of any Governmental Authority for claims not yet delinquent; |

| (b) | Any laws, ordinances or regulations affecting the Property; |

| (c) | Liens imposed by laws, such as mechanics’ liens and other similar liens, arising in the ordinary course of business which secure payment of obligations not more than thirty (30) days past due, subject to Section 4.10 of this Agreement; |

| (d) | All matters shown on the Title Policy as exceptions to Lender’s coverage thereunder; |

| (e) | Liens in favor of Administrative Agent, for the benefit of Lenders, under the Mortgage and the other Loan Documents; |

| (f) | All Liens expressly permitted under the terms of this Agreement; |

| (g) | All easements, rights of way, and similar Liens incidental to the conduct of Borrower’s business which do not materially interfere with the ordinary course of business of Borrower, and that (i) do not secure any monetary obligations for borrowed money, (ii) do not violate any terms and conditions of this Agreement and (iii) are not reasonably likely to result in a Material Adverse Change; and |

| (h) | All Liens otherwise approved by Administrative Agent in writing. |

“Person” - means any natural person, corporation, limited partnership, general partnership, joint stock company, limited liability company, limited liability partnership, joint venture, association, company, trust, bank, trust company, land trust, business trust or other organization, whether or not a legal entity, or any other nongovernmental entity, or any Governmental Authority.

“Plans and Specifications” - means the plans and specifications for the construction of the Improvements heretofore or hereafter delivered to and approved by Administrative Agent, as amended in order to comply with the terms and conditions of this Agreement.

“PNC” - shall have the meaning given to such term in the preamble hereto.

“Post-Foreclosure Plan” - shall have the meaning given to such term in Section 12.8.

“Potential Default” - means an event, circumstance or condition for which there is no expectation of cure which, with the giving of notice or the passage of time, or both, would constitute a Default.

“Price Adjustment Date” - shall have the meaning given to such term in Section 2.6(h).

“Principal Guaranty” - means the portion of the principal balance of the Loan being guaranteed by the Guarantor.

“Pro Rata Share” - means, as to each Lender, the ratio, expressed as a percentage, of (a) the amount of such Lender’s Commitment to (b) the aggregate amount of the Commitments of all Lenders hereunder; provided, however, that if at the time of determination the Commitments have terminated or been reduced to zero, the “Pro Rata Share” of each Lender shall be the Pro Rata Share of such Lender in effect immediately prior to such termination or reduction.

“Prohibited Property Transfer” - shall have the meaning given to such term in Section 9.22(a).

“Prohibited Equity Transfer” - shall have the meaning given to such term in Section 9.22(b).

“Project” - means the proposed approximately 350,000 square foot retail mall to be commonly known as “International Market Place” and anchored by Saks Fifth Avenue and related parking structure containing approximately 700 parking spaces, including the Improvements to be constructed by Borrower.

“Project Opening” - means the opening of the Shop Space to the public.

“Property” - shall have the meaning given to such term in Recital A.

“Property Documents” - means the agreements listed in Exhibit O hereto.

“Protective Advance” - means any advances made by Administrative Agent in accordance with the provisions of Section 12.7(e) to protect the Collateral securing the Loan.

“Recipient” means (a) the Administrative Agent, and (b) any Lender, as applicable.

“Regulatory Change” - means, with respect to any Lender, any change effective after the Effective Date in Applicable Law (including without limitation, Regulation D of the Board of Governors of the Federal Reserve System) or the adoption or making after such date of any interpretation, directive or request applying to a class of banks, including such Lender, of or under any Applicable Law (whether or not having the force of law and whether or not failure to comply therewith would be unlawful) by any Governmental Authority or monetary authority charged with the interpretation or administration thereof or with the compliance by any Lender with any request or directive regarding capital adequacy. Notwithstanding anything herein to the contrary, (a) the Dodd-Frank Wall Street Reform and Consumer Protection Act and all requests, rules, guidelines or directives thereunder or issued in connection therewith after the Effective Date and (b) all requests, rules, guidelines or directives promulgated after the Effective Date by the Bank for International Settlements, the Basel Committee on Banking Supervision (or any successor or similar authority) or the United States or foreign regulatory authorities, in each case pursuant to Basel III, shall in each case be deemed to be a “Regulatory Change.”

“Regulatory Costs” - means, collectively, future, supplemental, emergency or other increases in the Reserve Percentage or the FDIC assessment rates, or any other new or increased requirements or costs imposed by any domestic or foreign Governmental Authority to the extent that they are attributable to a Lender having entered into the Loan Documents or the performance of such Lender’s obligations thereunder, and which (i) are incurred by a Lender or (ii) result in a reduction in such Lender’s rate of return from the Loan, such Lender’s rate of return on overall capital or any amount due and payable to such Lender under any Loan Document. Regulatory Costs shall not, however,

include any requirements or costs that are incurred or suffered by Lender as a direct result of a Lender’s willful misconduct.

“Reportable Compliance Event” means that any Covered Entity becomes a Sanctioned Person, or is charged by indictment, criminal complaint or similar charging instrument, arraigned, or custodially detained in connection with any Anti-Terrorism Law or any predicate crime to any Anti-Terrorism Law, or has knowledge of facts or circumstances to the effect that it is reasonably likely that any aspect of its operations is in actual or probable violation of any Anti-Terrorism Law.

“Requirements of Law” - means, as to any entity, the charter and by-laws, partnership agreement or other organizational or governing documents of such entity, and any law, rule or regulation, Permit, or determination of an arbitrator or a court or other Governmental Authority, in each case applicable to or binding upon such entity or any of its property or to which such entity or any of its property is subject, including without limitation, applicable securities laws and any certificate of occupancy, zoning ordinance, building, environmental or land use requirement or Permit or occupational safety or health law, rule or regulation.

“Requisite Lenders” - means, as of any date, Lenders (which must include the Lender then acting as Administrative Agent) having at least sixty-six and two-thirds percent (66-2/3%) of the aggregate amount of the Commitments, or, if the Commitments have been terminated or reduced to zero, Lenders holding at least sixty-six and two-thirds percent (66-2/3%) of the principal amount outstanding under the Loan, provided that (a) in determining such percentage at any given time, all then existing Defaulting Lenders will be disregarded and excluded and the Pro Rata Shares of the Loan of Lenders shall be re-determined, for voting purposes only, to exclude the Pro Rata Shares of the Loan of such Defaulting Lenders, and (b) at all times when less than three Lenders are party to this Agreement, the term “Requisite Lenders” shall mean all Lenders who are not Defaulting Lenders.

“Reserve Percentage” - means at any time the percentage announced within Administrative Agent as the reserve percentage for the Loan under Regulation D, or other regulations from time to time in effect concerning reserves for Eurocurrency Liabilities, as defined in Regulation D, from related institutions as though Administrative Agent were in a net borrowing position, as promulgated by the Board of Governors of the Federal Reserve System, or its successor.

“Restricted Party” - means each of (i) Borrower, (ii) Guarantor, (iii) any entity other than a Guarantor obligated under any guaranty or indemnity made in favor of Lender in connection with the Loan, and (iv) any shareholder, partner, member or non-member manager, or any direct or indirect legal or beneficial owner of Borrower.

“Sanctioned Country” means a country subject to a sanctions program maintained under any Anti-Terrorism Law.

“Sanctioned Person” means any individual person, group, regime, entity or thing listed or otherwise recognized as a specially designated, prohibited, sanctioned or debarred person, group, regime, entity or thing, or subject to any limitations or prohibitions (including but not limited to the blocking of property or rejection of transactions), under any Anti-Terrorism Law.

“Second Extended Maturity Date” - means August 14, 2020.

“Second Option to Extend” - means Borrower’s option, subject to the terms and conditions of Section 2.11, to extend the term of the Loan from the First Extended Maturity Date to the Second Extended Maturity Date.

“Second Tier Stabilization” - means the satisfaction of the following conditions;

(a)Completion of the Improvements shall have occurred;

(b)Administrative Agent shall have determined in its discretion (based upon a new Appraisal of the Property, obtained at Borrower’s sole cost and expense; provided, however, the requirements for a new Appraisal of the Property shall not be required if an Appraisal has been obtained within the prior six (6) months and no material changes have occurred to the Project or market) that the Loan-to-Value Percentage does not exceed sixty percent (60%); provided, however, in order to satisfy this condition, Borrower may either (i) pay down, without fee or premium, the principal outstanding under the Loan in an amount sufficient to meet such Loan-to-Value Percentage requirement or (ii) deliver to Administrative Agent an unconditional letter of credit, in satisfactory form and issued by a bank acceptable

to Administrative Agent in its reasonable discretion, in an amount equivalent to the principal payment amount necessary to meet such required Loan-to-Value Percentage;

(c)Borrower shall have delivered to Administrative Agent a Compliance Certificate in the form attached as Exhibit I hereto, signed by an authorized signatory of Borrower, that establishes that the Debt Service Coverage Ratio, measured as of the last day of the calendar quarter most recently ended, is not less than 1.35 to 1.00; provided, however, in order to satisfy this condition, Borrower may either (i) pay down, without fee or premium, the principal outstanding under the Loan in an amount sufficient to meet such Debt Service Coverage Ratio or (ii) deliver to Administrative Agent an unconditional letter of credit, in satisfactory form and issued by a bank acceptable to Administrative Agent in its reasonable discretion, in an amount equivalent to the principal payment amount necessary to meet such required Debt Service Coverage Ratio;

(d)Anchor shall be open to the public for business in the Project, Anchor shall not have a right to terminate its operating covenant under Section 6.02B of the Anchor Lease, and the operating covenant of Anchor set forth in Section 6.02A of the Anchor Lease shall be in full force and effect; and

(e)The minimum Occupancy of the Shop Space pursuant to Approved Leases shall be no less than eighty-five percent (85%).

“Senior Loans” - shall have the meaning given to such term in Section 12.4(b).

“Separateness Provisions” - shall have the meaning given to such term in Section 9.14(b).

“Shop Space” - shall mean the portion of the Improvements owned by Borrower consisting of approximately 270,000 square feet of in-line, restaurant and mini-anchor space.

“Subdivision Map” - shall have the meaning given to such term in Section 9.11.

“Substantially Complete”, “Substantially Completed” or “Substantial Completion” - means that (i) temporary certificates of occupancy (subject only to punchlist items) have been issued for the shell, core and common areas of the Improvements, (ii) the architect has issued its certificate of substantial completion with respect to the Improvements (other than any space to be occupied by Anchor and the interior of Shop Spaces), and (iii) all costs of construction of the Improvements (other than any space to be occupied by Anchor and the interior of Shop Spaces) except for retainages and costs of punchlist items have been paid (or if a bona fide disputes exists, a reserve has been established in Administrative Agent’s control in an amount reasonably satisfactory to Administrative Agent) and there are no liens against the Improvements (except for those liens which are bonded over or insured over by the title insurer to the extent permitted herein).

“Substantial Completion Date” - means February 8, 2017, subject to extension pursuant to Section 4.4 of this Agreement; provided, however, that Administrative Agent shall have the unilateral right, in its sole discretion, to extend the Substantial Completion Date upon Borrower’s request for up to one hundred and eighty (180) days, following which Requisite Lender approval shall be required for any extension of the Substantial Completion Date.

“Swap Agreement” - means a “swap agreement” as defined in Section 101 of the Bankruptcy Code, entered into by Borrower and a Lender (or with another financial institution which is acceptable to Administrative Agent), together with all modifications, extensions, renewals and replacements thereof.

“Taubman” - means The Taubman Realty Group Limited Partnership.

“Taubman Credit Facility” - means that certain $1,100,000,000 revolving credit loan, which is evidenced by that certain Revolving Credit Agreement dated as of February 28, 2013, by and among Taubman, the lenders party thereto, and JPMorgan Chase Bank, N.A., as Administrative Agent, as amended by that certain Amendment No. 1 to Revolving Credit Agreement, dated as of November 12, 2013, and that certain Amendment No. 2 to Revolving Credit Agreement, dated as of November 20, 2014, as the same may hereafter be further amended.

“Taxes” means all present or future taxes, levies, imposts, duties, deductions, withholdings (including backup withholding), assessments, fees or other charges imposed by any Governmental Authority, including any interest, additions to tax or penalties applicable thereto.

“Test Period” - means each twelve (12) month period ending on the last day of a fiscal quarter. If the Improvements have been opened for less than four (4) fiscal quarters, then expenses and percentage rent shall be determined based upon an annualization of such amounts incurred or received since the Project Opening date.

“Title Company” - means Fidelity National Title Insurance Company.

“Titled Agent” - shall have the meaning given to such term in Section 12.15.

“Title Policy” - means the ALTA Lender’s Policy of Title Insurance as issued by the Title Company, in such form and including such endorsements and reinsurance requirements as Administrative Agent may reasonably require.

“Transfer” or “Transferred” - means any sale, installment sale, exchange, mortgage, pledge, hypothecation, assignment, encumbrance or other transfer, conveyance or disposition, whether voluntarily, involuntarily or by operation of law or otherwise, or any termination, extinguishment, expiration, or merger of any ground lease interest, whether voluntarily, involuntarily or by operation of law or otherwise.

“Transfer Authorizer Designation” - means a Transfer Authorizer Designation in the form attached hereto as Exhibit H, or such other form as Administrative Agent may require from time to time.

“Trigger Event” - shall have the meaning given to such term in Section 9.23(b).

“UCC” - means the Uniform Commercial Code in effect from time to time in the state where Borrower is organized or where the Property is located, as applicable, as now or hereafter amended or modified.

“U.S. Person” means any Person that is a “United States Person” as defined in Section 7701(a)(30) of the Internal Revenue Code.

“Variable Rate” - means the Calculated Interest Rate for a LIBO Rate Period of one month, reset daily; provided, that if for any reason the LIBOR Market Index Rate is unavailable, Variable Rate shall mean the sum of: (a) the per annum rate of interest equal to the Federal Funds Rate plus 0.75% and (b) the Applicable Spread.

“Withholding Agent” means (a) the Borrower, (b) any other Loan Party and (c) the Administrative Agent, as applicable.

1.2 SCHEDULES AND EXHIBITS INCORPORATED. Schedules 1.1, 6.3, 6.6, 6.18, 6.22, 7.1 and 11.1 and Exhibits A, B, C, D, E, F, G, H, I, J-1, J-2, J-3, J-4, K, L, M, N, O, and P all attached hereto, are hereby incorporated into this Agreement.

ARTICLE 2. LOAN

2.1 LOAN. By and subject to the terms of this Agreement, Lenders, each up to the amount of its respective Commitment, severally, agree to lend to Borrower the principal sum of THREE HUNDRED THIRTY MILLION EIGHT HUNDRED NINETY THOUSAND AND NO/100THS DOLLARS ($330,890,000.00, and Borrower agrees to borrow from Lenders the principal sum of up to THREE HUNDRED THIRTY MILLION EIGHT HUNDRED NINETY THOUSAND AND NO/100THS DOLLARS ($330,890,000.00), said sum to be evidenced by the Notes. The Notes shall be secured, in part, by the Mortgage encumbering certain real property and improvements as legally defined therein. Amounts disbursed to or on behalf of Borrower pursuant to the Notes shall be used to finance the construction of the Improvements and for such other purposes and uses as may be permitted under this Agreement and the other Loan Documents.

2.2 LOAN FEES. Borrower shall pay to Administrative Agent, at Loan closing, a loan fee and other amounts as set forth in a separate letter agreement between Borrower and Administrative Agent dated as of the date hereof (the “Fee Letter”).

2.3 LOAN DOCUMENTS. Borrower shall execute and deliver (or cause to be executed and delivered) to Administrative Agent concurrently with this Agreement each of the documents, properly executed and in recordable form, as applicable, described in Exhibit B as Loan Documents, together with those documents described in Exhibit B as Other Related Documents.

2.4 EFFECTIVE DATE. The date of the Loan Documents is for reference purposes only. The effective date of delivery and transfer to Administrative Agent of the security under the Loan Documents and of Borrower’s and Lenders’ obligations under the Loan Documents shall be the earlier of (a) the date Administrative Agent first authorizes the Loan proceeds to be released to, or for the benefit of, Borrower and (b) date the Mortgage is recorded in the Land Court of the State of Hawaii and/or the State of Hawaii Bureau of Conveyance, as applicable (such earlier date, the “Effective Date”).

2.5 MATURITY DATE. All sums due and owing under this Agreement and the other Loan Documents shall be repaid in full on or before the Maturity Date. All payments due to Administrative Agent and Lenders under this Agreement, whether at the Maturity Date or otherwise, shall be paid in Dollars in immediately available funds.

2.6 INTEREST ON THE LOAN.

(a)Interest Payments. Interest accrued on the outstanding principal balance of the Loan shall be due and payable, in the manner provided in Section 2.7, on the first Business Day of each month commencing with the first month after the Effective Date.

(b)Default Interest. Notwithstanding the rates of interest specified in Sections 2.6(e) below and the payment dates specified in Section 2.6(a), at Requisite Lenders’ discretion at any time during the existence of a Default, the principal balance of the Loan then outstanding and, to the extent permitted by Applicable Law, any interest payments on the Loan not paid when due, shall bear interest payable upon demand at the Default Rate. All other amounts due Administrative Agent or Lenders (whether directly or for reimbursement) under this Agreement or any of the other Loan Documents if not paid when due after any applicable notice and cure period, or if no time period is expressed, if not paid within ten (10) days after demand shall likewise, at the option of Requisite Lenders, bear interest from and after demand and the expiration of any applicable cure period at the Default Rate.

(c)Late Fee. Borrower acknowledges that late payment to Administrative Agent will cause Administrative Agent and Lenders to incur costs not contemplated by this Agreement. Such costs include, without limitation, processing and accounting charges. Therefore, if Borrower fails timely to pay any sum due and payable hereunder through the Maturity Date (other than payment of the entire outstanding balance of the Loan on the Maturity Date), then, unless waived by Administrative Agent, a late charge of four cents ($.04) for each dollar of any such principal payment, interest or other charge due hereon and which is not paid within fifteen (15) days after such payment is due, shall be charged by Administrative Agent (for the benefit of Lenders) and paid by Borrower for the purpose of defraying the expense incident to handling such delinquent payment. Borrower and Administrative Agent agree that this late charge represents a reasonable sum considering all of the circumstances existing on the date hereof and represents a fair and reasonable estimate of the costs that Administrative Agent and Lenders will incur by reason of late payment. Borrower and Administrative Agent further agree that proof of actual damages would be costly and inconvenient. Acceptance of any late charge shall not constitute a waiver of the default with respect to the overdue installment, and shall not prevent Administrative Agent from exercising any of the other rights available hereunder or any other Loan Document. Such late charge shall be paid without prejudice to any other rights of Administrative Agent.

(d)Computation of Interest. Interest shall be computed on the basis of the actual number of days elapsed in the period during which interest or fees accrue and a year of three hundred sixty (360) days on the principal balance of the Loan outstanding from time to time. In computing interest on the Loan, the date of the making of a disbursement under the Loan shall be included and the date of payment shall be excluded. Notwithstanding any provision in this Section 2.6, interest in respect of the Loan shall not exceed the maximum rate permitted by Applicable Law.

(e)Effective Rate. Provided no Default exists under this Agreement, the “Effective Rate” upon which interest shall be calculated for the Loan shall, from and after the Effective Date of this Agreement, be one or more of the following:

| (i) | Initial Disbursement; Subsequent Disbursements During Any Calendar Month. For the initial disbursement of principal under the Loan, and for any subsequent disbursements of principal during any calendar month, the Effective Rate on such principal amount shall be the Calculated Interest Rate on the date of disbursement as determined by Administrative Agent (e.g. if Borrower receives a subsequent disbursement on November 15, 2015 and the LIBO Rate for the month of November is equal to 0.25% (as determined on the 1st Business Day of November), then the Calculated Interest |

Rate for such subsequent disbursement would be equal to 2.0% (Applicable Spread (1.75%) + the current LIBO Rate (0.25%)). Such Effective Rate shall apply to such principal amount from the date of disbursement through and including the date immediately preceding the first (1st) Business Day of the next calendar month. On the first (1st) Business Day of the next calendar month, any principal disbursed during the prior calendar month shall be added to (or become) the LIBO Rate Portion for purposes of calculation of the Effective Rate under subsection (e)(ii) below.

| (ii) | Reset of Effective Rate. Commencing with the first (1st) Business Day of the first (1st) calendar month after the initial disbursement of principal under the Loan, and continuing thereafter on the first (1st) Business Day of each succeeding calendar month, the Effective Rate on the outstanding LIBO Rate Portion under the Loan (i.e., all outstanding principal on such first (1st) Business Day) shall be reset to the Calculated Interest Rate, as determined by Administrative Agent on each such first (1st) Business Day. |

(f)Reserved.