UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant [X] |

| Filed by a Party other than the Registrant [ ] |

| Check the appropriate box: |

| [ ] | Preliminary Proxy Statement |

| [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [X] | Definitive Proxy Statement |

| [ ] | Definitive Additional Materials |

| [ ] | Soliciting Material under §240.14a-12 |

| SEQUOIA FUND, INC. |

| (Name of Registrant as Specified In Its Charter) |

| N/A |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| Payment of Filing Fee (Check the appropriate box): | ||

| [X] | No fee required. | |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

| [ ] | Fee paid previously with preliminary materials. |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

It is anticipated that definitive materials will be released to security holders on or around August 3, 2020.

SEQUOIA FUND, INC.

9 West 57th Street

Suite 5000

New York, New York 10019-2701

SPECIAL MEETING OF STOCKHOLDERS

YOUR VOTE IS IMPORTANT

Dear Stockholder:

The Board of Directors (the “Board” or the “Directors”) of Sequoia Fund, Inc., a Maryland corporation (the “Corporation”), is pleased to invite you to a Special Meeting of Stockholders (the “Meeting”) to be held on September 16, 2020, at 8:30 a.m., Eastern Time. In light of public health concerns regarding the coronavirus pandemic, the Meeting will be held in a virtual meeting format only. You will not be able to attend the Meeting in person.

The accompanying Notice of Special Meeting of Stockholders and Proxy Statement present the proposal to be considered at the Meeting, which is to consider and vote upon the election of three Directors of the Corporation, including two existing Directors and one new candidate.

The Board unanimously recommends that you vote “FOR” each of the nominees to serve as a Director of the Corporation.

The Corporation welcomes your attendance at the Meeting. Even if you plan to attend the meeting virtually, the Corporation encourages you to vote promptly by proxy. AST Fund Solutions, LLC (the “Proxy Solicitor”), a proxy solicitation firm, has been selected to assist in the proxy solicitation process. If the Corporation has not received your proxy as the date of the Meeting approaches, you may receive a telephone call from the Proxy Solicitor reminding you to vote by proxy. No matter how many shares you own, your vote is important.

| By Order of the Board of Directors, | |

| |

| John B. Harris | |

| President | |

| July 29, 2020 |

QUESTIONS AND ANSWERS

Sequoia Fund, Inc.

PROXY

Q 1. WHY DID THE CORPORATION SEND ME THIS BOOKLET?

A. This booklet contains the Notice of Special Meeting of Stockholders (the “Notice”) and accompanying Proxy Statement that provide you with information you should review before voting on the matter that will be presented at the Special Meeting of Stockholders (the “Meeting”) of Sequoia Fund, Inc., a Maryland corporation (the “Corporation”). This booklet also contains a proxy card (“Proxy Card”) on which you can authorize a proxy to cast your vote. You are receiving these proxy materials because you own shares of common stock of the Corporation. As a stockholder, you have the right to vote on the election of the Director nominees described in the Proxy Statement.

Q 2. WHO IS REQUESTING MY VOTE?

A. The Board of Directors of the Corporation (the “Board” or the “Directors”) requests that you vote at the Meeting on the election of three Directors of the Corporation. The background of each Director nominee is described in the Proxy Statement.

Q 3. HOW DOES THE BOARD RECOMMEND I VOTE?

A. The Board recommends that you vote “FOR” the election of each nominee.

Q 4. WHO IS ELIGIBLE TO VOTE?

A. Stockholders of record at the close of business on July 28, 2020 (the “Record Date”) are entitled to notice of and to vote at the Meeting or any postponement or adjournment of the Meeting. If you owned shares on the Record Date, you have the right to vote, even if you later sold your shares.

Q 5. WHAT IS THE ROLE OF THE BOARD?

A. The Board oversees the business and affairs of the Corporation.

Q 6. WHY IS THE CORPORATION HOLDING A SPECIAL MEETING TO PRESENT THREE DIRECTORS FOR ELECTION?

A. Under the Investment Company Act of 1940, as amended (the “1940 Act”), no person may serve as a director of a mutual fund unless elected to that office by the holders of the outstanding voting securities of the fund at an annual or special meeting called for that purpose. A fund may, however, fill vacancies occurring between stockholder meetings, provided that immediately after filling any vacancy at least two-thirds of the directors then holding office have been elected by the holders of the outstanding voting securities of the fund.

Of the seven current Directors of the Corporation, five Directors have been elected by the stockholders of the Corporation. While the election of directors is not required under the 1940 Act this year, at its meeting on July 28, 2020, the Board determined to nominate an individual for election as a director and to call a stockholder meeting to elect the Director nominee as contemplated by the provision of the 1940 Act discussed above. The Corporation is taking this opportunity to also present for stockholder election two current Directors who have not yet been elected by stockholders. Should stockholders elect the three nominees, the Board will have greater flexibility in the future to fill vacancies occurring on the Board between stockholder meetings, resulting in cost savings to the Corporation and its stockholders.

Q 7. WHEN AND WHERE WILL THE MEETING BE HELD?

A. The Meeting will be held on September 16, 2020, at 8:30 a.m., Eastern Time. Because of our concerns regarding the coronavirus pandemic, the Meeting will be held in a virtual meeting format only. Stockholders will not have to travel to attend the Meeting but will be able to view the Meeting live and cast their votes by accessing a web link. Stockholders must register in advance to attend the Meeting.

Q 8. HOW CAN I VOTE OR AUTHORIZE A PROXY TO VOTE MY SHARES?

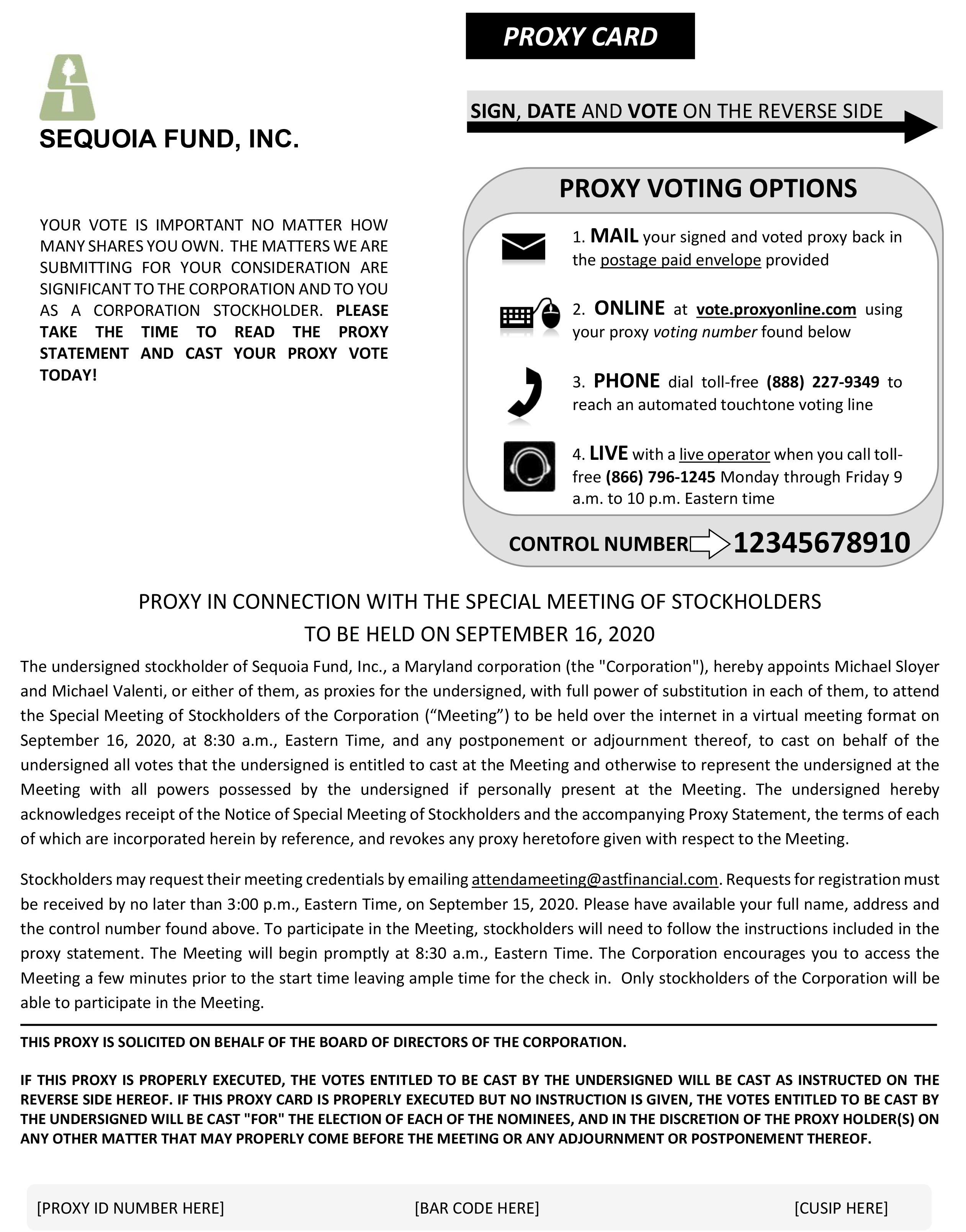

A. You can provide voting instructions by telephone, by calling the toll-free number on the Proxy Card or on the Notice, or by going to the Internet address provided on the Proxy Card or Notice and following the instructions. If you vote by telephone or via the Internet, you will be asked to enter a 12-digit control number that has been assigned to you, which is printed on your Proxy Card. This code is designed to confirm your identity, provide access to the voting website and confirm that your voting instructions are properly recorded. Alternatively, if you received your Proxy Card by mail, you can vote your shares by signing and dating the Proxy Card and mailing it in the enclosed postage-paid envelope.

You may also vote at the Meeting; however, even if you plan to attend the Meeting virtually, we still encourage you to provide voting instructions by one of the methods discussed above. In addition, we ask that you please note the following:

Due to the public health impact of the coronavirus pandemic, and to support the health and well-being of our stockholders, service providers, personnel and other stakeholders, the Meeting will be held solely on the Internet by virtual means. Stockholders of record on the Record Date for the Meeting may participate in and vote at the Meeting on the Internet by virtual means by visiting the following website: https://vote.proxyonline.com.

If you owned shares on the Record Date for the Meeting and wish to attend the Meeting you must email AST Fund Solutions, LLC (the “Proxy Solicitor”) at attendameeting@astfinancial.com, or call the Proxy Solicitor at (866) 796-1245, in order to register to attend the Meeting virtually, obtain the credentials and password to access the Meeting and verify that you were a stockholder on the Record Date. If you are a record owner of shares, please have your 12-digit control number on your Proxy Card available when you call or include it in your email.

If you hold your shares in the name of a brokerage firm, bank, nominee or other institution (“street name”) as of the Record Date, you must provide a legal proxy from that institution in order to vote your shares at the Meeting. You may forward an email from your intermediary or attach an image of your legal proxy and transmit it via e-mail to the Proxy Solicitor at attendameeting@astfinancial.com and you should label the e-mail “Legal Proxy” in the subject line. If you hold your shares in street name as of the Record Date and wish to attend, but not vote at, the Meeting, you must verify to the Proxy Solicitor that you owned shares as of the record date through an account statement or some other similar means.

Requests for registration must be received by the Proxy Solicitor no later than 3:00 p.m., Eastern Time, on September 15, 2020. You will then receive a confirmation e-mail of your registration, with a control number for voting purposes from the Proxy Solicitor (if you hold your shares in street name and obtained a legal proxy).

Voting instructions are also included on the enclosed Proxy Card.

Q 9. WHAT IF I WANT TO REVOKE MY PROXY?

A. You can revoke your proxy at any time prior to its exercise by (i) giving written notice to the Secretary of the Corporation at 9 West 57th Street, Suite 5000, New York, New York 10019-2701, (ii) by signing and submitting another proxy of a later date, or (iii) by attending the Meeting virtually and voting at the Meeting.

Q 10. WHAT NUMBER DO I CALL IF I HAVE QUESTIONS REGARDING THE PROXY?

A. Please call (866) 796-1245 if you have questions.

SEQUOIA FUND, INC.

9 West 57th Street

Suite 5000

New York, New York 10019-2701

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

SCHEDULED FOR SEPTEMBER 16, 2020

To Stockholders of Sequoia Fund, Inc., a Maryland Corporation (the “Corporation”):

Notice is hereby given that a Special Meeting of Stockholders of the Corporation (the “Meeting”) will be held on September 16, 2020, at 8:30 a.m., Eastern Time. In light of public health concerns regarding the coronavirus pandemic, the Meeting will be held in a virtual meeting format only. You will not be able to attend the Meeting in person. The Meeting will be held for the following purpose, which is described in the accompanying Proxy Statement dated July 29, 2020:

| 1. | To consider and vote upon the election of three Directors of the Corporation, each such Director to serve a term of indefinite duration and until his or her successor is duly elected and qualifies. |

In addition, stockholders will be asked to consider and vote on any other business that may properly come before the Meeting and any postponement or adjournment thereof.

Stockholders of record on the Record Date (as defined below) for the Meeting may participate in and vote at the Meeting on the Internet by virtual means by visiting the following website: https://vote.proxyonline.com. Only stockholders of record at the close of business on July 28, 2020 (the “Record Date”) are entitled to notice of, and to vote at, the Meeting or any postponement or adjournment thereof. Proxies are being solicited on behalf of the Board of Directors of the Corporation.

If you owned shares on the Record Date for the Meeting and wish to attend the Meeting you must email AST Fund Solutions, LLC (the “Proxy Solicitor”) at attendameeting@astfinancial.com, or call the Proxy Solicitor at (866) 796-1245, in order to register to attend the Meeting virtually, obtain the credentials and password to access the Meeting and verify that you were a stockholder on the Record Date. If you are a record owner of shares, please have your 12-digit control number on your Proxy Card available when you call or include it in your email.

If you hold your shares in the name of a brokerage firm, bank, nominee or other institution (“street name”) as of the Record Date, you must provide a legal proxy from that institution in order to vote your shares at the Meeting. You may forward an email from your intermediary or attach an image of your legal proxy and transmit it via e-mail to the Proxy Solicitor at attendameeting@astfinancial.com and you should label the e-mail “Legal Proxy” in the subject line. If you hold your shares in street name as of the Record Date and wish to attend, but not vote at, the Meeting, you must verify to the Proxy Solicitor that you owned shares as of the Record Date through an account statement or some other similar means.

Requests for registration must be received by the Proxy Solicitor no later than 3:00 p.m., Eastern Time, on September 15, 2020. You will then receive a confirmation e-mail of your registration, with a control number for voting purposes from the Proxy Solicitor (if you hold your shares in street name and obtained a legal proxy).

You have the right to receive notice of and to vote at the Meeting if you were a stockholder of record on the Record Date. Even if you plan to attend the Meeting virtually, you are requested to complete, date, sign and promptly return the enclosed Proxy Card, or to submit voting instructions by telephone or via the Internet as described on the enclosed Proxy Card. You may revoke your proxy at any time prior to its exercise by giving written notice to the Secretary of the Corporation at 9 West 57th Street, Suite 5000, New York, New York 10019-2701, by signing and submitting another proxy of a later date, or by attending the Meeting virtually and voting at the Meeting.

The Board of Directors recommends that you vote “FOR” the election of each Director nominee.

By Order of the Board of Directors,

Michael Sloyer

Secretary

New York, New York

July 29, 2020

YOUR VOTE IS IMPORTANT

Please indicate your voting instructions on the enclosed Proxy Card, sign and date it, and return it in the envelope provided, which needs no postage if mailed in the United States. You may also authorize (by telephone or through the Internet) a proxy to vote your shares. To do so, please follow the instructions on the enclosed Proxy Card. Your vote is very important no matter how many shares you own. Please complete, date, sign and return your Proxy Card promptly in order to save the Corporation the additional cost of further proxy solicitation and in order for the Meeting to be held as scheduled.

TABLE OF CONTENTS

| Page | |

| Introduction | 1 |

| The Proposal | 3 |

| Election of Three Directors | 3 |

| Independent Registered Public Accounting Firm | 8 |

| Proxy Voting and Stockholder Meeting | 9 |

| Other Information | 10 |

| Officer Information | 10 |

| Stock Ownership | 10 |

| Information about the Corporation's Investment Adviser and other Service Providers | 10 |

| Submission of Proposals for Next Meeting of Stockholders | 11 |

| Legal Proceedings | 11 |

| Other Matters | 14 |

| Appendix A — Additional Information Regarding Directors and Nominees | A-1 |

| Appendix B — Audit Committee Charter | B-1 |

| Appendix C — Nominating Committee Charter | C-1 |

| Appendix D — Stock Ownership | D-1 |

PROXY STATEMENT

(dated July 29, 2020)

SEQUOIA FUND, INC.

9 West 57th Street

Suite 5000

New York, New York 10019-2701

SPECIAL MEETING OF STOCKHOLDERS

SEPTEMBER 16, 2020

INTRODUCTION

This Proxy Statement is being furnished in connection with the solicitation of proxies on behalf of the Board of Directors (the “Board”) of Sequoia Fund, Inc., a Maryland corporation (the “Corporation”), to be voted at a Special Meeting of Stockholders of the Corporation (the “Meeting”) or at any postponement or adjournment thereof. The Meeting is scheduled to be held on September 16, 2020, at 8:30 a.m., Eastern Time. In light of public health concerns regarding the coronavirus pandemic, the Meeting will be held in a virtual meeting format only. You will not be able to attend the Meeting in person.

The Board has fixed the close of business on July 28, 2020 as the record date (the “Record Date”) for the determination of stockholders entitled to notice of, and to vote at, the Meeting and any postponement or adjournment thereof. Stockholders of record on the Record Date for the Meeting may participate in and vote at the Meeting on the Internet by virtual means by visiting the following website: https://vote.proxyonline.com. As of the Record Date, the Corporation had 24,303,704 shares of common stock outstanding. Each share is entitled to one vote. Shares may be voted in person (virtually) or by proxy. It is anticipated that definitive materials will be released to security holders on or around August 3, 2020.

If you owned shares on the Record Date for the Meeting and wish to attend the Meeting you must email AST Fund Solutions, LLC (the “Proxy Solicitor”) at attendameeting@astfinancial.com, or call the Proxy Solicitor at (866) 796-1245, in order to register to attend the Meeting virtually, obtain the credentials and password to access the Meeting and verify that you were a stockholder on the Record Date. If you are a record owner of shares, please have your 12-digit control number on your Proxy Card available when you call or include it in your email.

If you hold your shares in the name of a brokerage firm, bank, nominee or other institution (“street name”) as of the Record Date, you must provide a legal proxy from that institution in order to vote your shares at the Meeting. You may forward an email from your intermediary or attach an image of your legal proxy and transmit it via e-mail to the Proxy Solicitor at attendameeting@astfinancial.com and you should label the e-mail “Legal Proxy” in the subject line. If you hold your shares in street name as of the Record Date and wish to attend, but not vote at, the Meeting, you must verify to the Proxy Solicitor that you owned shares as of the Record Date through an account statement or some other similar means.

Requests for registration must be received by the Proxy Solicitor no later than 3:00 p.m., Eastern Time, on September 15, 2020. You will then receive a confirmation e-mail of your registration, with a control number for voting purposes from the Proxy Solicitor (if you hold your shares in street name and obtained a legal proxy).

1

At the Meeting, stockholders will be asked to consider and vote upon the election of three Directors of the Corporation, each such Director to serve a term of an indefinite duration and until his or her successor is duly elected and qualifies. In addition, stockholders will be asked to consider and vote on any other business that may properly come before the Meeting and any postponement or adjournments thereof.

The solicitation of proxies will be made primarily by mail and may also be made by telephone or through the Internet. The cost of soliciting proxies will be borne by the Corporation.

The Corporation will furnish each person to whom this Proxy Statement is delivered with a copy of its latest annual report to stockholders and its subsequent semi-annual report to stockholders, if any, upon request and without charge. To request a copy of either report, please contact the Corporation toll free at 1-800-686-6884, or write to: Sequoia Fund, Inc., 9 West 57th Street, Suite 5000, New York, New York 10019-2701. The Corporation’s reports to stockholders may also be obtained by downloading them from the Corporation’s website: www.sequoiafund.com.

2

THE PROPOSAL

Election of Three Directors

The following individuals have been nominated by the Nominating Committee for election as Director.

Melissa Crandall

Gregory Steinmetz

Katharine Weymouth

Two of the nominees, Ms. Crandall and Mr. Steinmetz, are current Directors of the Corporation. Ms. Weymouth was nominated for election as a Director of the Corporation on July 28, 2020. Each nominee has consented to serve as a Director.

The Board knows of no reason why any of the nominees would be unable to serve, but in the event any nominee is unable to serve or for good cause will not serve, the proxies received indicating a vote “FOR” such nominee will be voted for a substitute nominee as the Board may recommend. If a Proxy Card is executed but no instruction is given, the persons named as proxies in the accompanying Proxy Card will vote “FOR” each nominee named above for election as Director.

Certain information concerning the nominees is set forth below:

| Name, Address* and Age | Position(s) Held with the Corporation | Years of Service as a Director | Principal Occupation(s) During Past 5 Years and Other Relevant Experience§ | Number of Portfolios in Fund Complex Overseen or to be Overseen by Director | Other Directorships Held During Past 5 Years |

| INTERESTED DIRECTOR NOMINEE** | |||||

| Gregory Steinmetz, 58 | Director | Since January 1, 2019 | Analyst of Ruane, Cunniff & Goldfarb. | 1 | None |

| DISINTERESTED DIRECTOR NOMINEES | |||||

| Melissa Crandall, 41*** | Director | Since September 12, 2017 | Principal, Executive Recruiter, Third Street Partners (talent management) since 2018; Principal, Executive Recruiter, Braddock Matthews, LLC (talent management) 2015-2017. | 1 | None |

3

| Name, Address* and Age | Position(s) Held with the Corporation | Years of Service as a Director | Principal Occupation(s) During Past 5 Years and Other Relevant Experience§ | Number of Portfolios in Fund Complex Overseen or to be Overseen by Director | Other Directorships Held During Past 5 Years |

Katharine Weymouth, 54**** | N/A | 0 | Chief Operating Officer and President, dineXpert, since 2018; Publisher, The Washington Post, 2008-2014; Chief Executive Officer, Washington Post Media, 2008-2014. | 1 | Republic Services, Inc. (waste management); Graham Holdings Company (education and media); Cable One, Inc. (internet and cable). |

| * | The address for each of the Directors is 9 West 57th Street, Suite 5000, New York, New York 10019-2701. |

| ** | “Interested person,” as defined in the Investment Company Act of 1940, as amended (the “1940 Act”), of the Corporation because of an affiliation with Ruane, Cunniff & Goldfarb L.P., the Corporation’s investment adviser. |

| *** | Member of the Corporation’s Audit Committee and Nominating Committee. |

| **** | If elected, Ms. Weymouth will serve as a member of the Corporation’s Audit Committee and Nominating Committee. |

| § | The information reported includes the principal occupation during the last five years for each Director or nominee and, as applicable, other information relating to the professional experiences, attributes and skills relevant to each Director’s or nominee’s qualifications to serve as Director. |

The nominees were nominated to serve as Directors based on their prior personal and business experience.

Melissa Crandall

Ms. Crandall is an Executive Recruiter at Third Street Partners, an executive search firm. Ms. Crandall previously spent eight years in executive search at BraddockMatthews LLC and The Prince Houston Group, where she was a principal and senior recruiter working on assignments across the asset management and financial services industry. Earlier in her career, Ms. Crandall served as a vice president at Merrill Lynch & Co., working in a variety of jobs in institutional sales, investment banking and investment management. She is a graduate of Harvard College, cum laude.

Gregory Steinmetz

Mr. Steinmetz joined Ruane, Cunniff & Goldfarb Inc. in 2000 following a 15-year career in financial journalism. Previously he worked at the Wall Street Journal, most recently as London Bureau Chief. Prior to the Journal, he worked for Newsday, the Houston Chronicle and the Sarasota Herald-Tribune. He worked for Duff & Phelps Investment Management before entering journalism. He has a BA degree from Colgate University and a MSJ degree from Northwestern University.

4

Katharine Weymouth

Ms. Weymouth is the Chief Operating Officer of dineXpert, a group buying organization working with independent restaurants. She previously held a variety of leadership positions at The Washington Post, including Publisher and Chief Executive Officer from 2008 through 2014. Ms. Weymouth serves on the boards of directors of Republic Services, Inc., Graham Holdings Company and Cable One, Inc., and on the boards of trustees of the Philip L. Graham Fund and the Greater Washington Community Foundation. She earned a B.A. magna cum laude from Harvard University and a J.D. from Stanford Law School.

As their biographies indicate, the nominees have held positions with businesses or other firms and have had at least 10 years of experience in their respective industries. Their personal and business experience is expected to further strengthen the Board’s oversight of the Corporation, which is in the best interests of the Corporation.

Certain information about the other Directors of the Corporation is set forth below:

| Name, Address* and Age | Position(s) Held with the Corporation | Years of Service as a Director | Principal Occupation(s) During Past 5 Years and Other Relevant Experience§ | Other Directorships Held During Past 5 Years |

| INTERESTED DIRECTORS** | ||||

| John B. Harris, 43 | President, CEO and Director | 4 | Managing Director of Ruane, Cunniff & Goldfarb L.P. since February 2018; Analyst of Ruane, Cunniff & Goldfarb; Managing Member of Wishbone Management, LP (registered investment adviser). | None |

| DISINTERESTED DIRECTORS | ||||

| Peter Atkins, 56*** | Director | 4 | Managing Director, Permian Partners (Investment Manager). | None |

Edward Lazarus, 60*** | Chairman of the Board and Director | 5 | Chief Legal Officer and Corporate Secretary, Sonos, Inc. (consumer electronics) since January 2019; Former Executive Vice President and General Counsel of Tribune Media Co. (2013-2018). | None |

Roger Lowenstein, 66*** | Director | 21 | Writer, major Financial and News Publications | None |

Tim Medley, 76*** | Director | 4 | President, Medley & Brown, LLC (registered investment adviser). | None |

| * | The address for each Director is 9 West 57th Street, Suite 5000, New York, New York 10019-2701. |

| § | The information reported includes the principal occupation during the last five years for each Director and, as applicable, other information relating to the professional experiences, attributes and skills relevant to each Director’s qualifications to serve as Director. |

| ** | “Interested person,” as defined in the 1940 Act, of the Corporation because of an affiliation with the Corporation’s investment adviser. Directors for the Corporation who are not interested persons of the Corporation are referred to herein as “Independent Directors” or “Disinterested Directors”. |

| *** | Member of the Corporation’s Audit Committee and Nominating Committee. |

5

Leadership Structure and the Board

The Board is responsible for overseeing the business affairs of the Corporation and exercising all of its powers except those reserved for stockholders. Currently, the Board is composed of seven Directors, five of whom are not “interested persons” (as defined in the 1940 Act) of the Corporation (the “Independent Directors” or “Disinterested Directors”). If Ms. Weymouth is elected to the Board, the Board will be composed of eight directors, six of whom are Disinterested Directors. The Disinterested Directors meet regularly in executive sessions among themselves and with their independent counsel to consider a variety of matters affecting the Corporation. These sessions generally occur prior to scheduled Board meetings and at such other times as the Disinterested Directors may deem necessary. As discussed in further detail below, the Board has established two standing committees to assist the Board in performing its oversight responsibilities. The Corporation has engaged Ruane, Cunniff & Goldfarb L.P. (the “Investment Adviser”) to manage the Corporation, and the Board is responsible for overseeing the Investment Adviser and other service providers to the Corporation in accordance with the provisions of the 1940 Act and other applicable laws.

The Corporation’s Amended and Restated By-Laws and the Nominating Committee Charter do not set forth any specific qualifications to serve as a Director. In evaluating a candidate for nomination or election as a Director, the Nominating Committee will take into account the contribution that the candidate would be expected to make to the diverse mix of experience, qualifications, attributes and skills that the Nominating Committee believes contributes to good governance for the Corporation. The Chairman of the Board is a Disinterested Director. The Chairman’s role is to preside at all meetings of the Board and to act as a liaison with service providers, officers, attorneys, and other Directors generally between meetings. The Chairman may also perform other such functions as may be provided by the Board from time to time.

Among the attributes or skills common to all Directors are their abilities to review critically, evaluate, question and discuss information provided to them, to interact effectively with the other Directors, Investment Adviser, other service providers, counsel and the independent registered public accounting firm, and to exercise effective and independent business judgment in the performance of their duties as Directors. Each Director’s ability to perform his or her duties effectively has been attained through the Director’s business, consulting, public service and/or academic positions and through experience from service as a board member of the Corporation, public companies or other organizations as set forth above. Each Director’s ability to perform his or her duties effectively also has been enhanced by his or her educational background, professional training, and/or other life experiences.

It has been determined that the Board’s leadership structure is appropriate in light of the characteristics and circumstances of the Corporation, including factors such as the Corporation’s investment strategy and style, the net assets of the Corporation, the committee structure of the Corporation, and the management, distribution and other service arrangements of the Corporation. The Board believes that the current leadership structure allows the Board to exercise informed and independent judgment over matters under its purview, and it allocates areas of responsibility among service providers, committees of Directors and the full Board in a manner that enhances effective oversight. The Board believes that having a majority of Disinterested Directors is appropriate and in the best interest of the Corporation, and that the Board leadership by Mr. Lazarus provides the Board with valuable insights that assist the Board as a whole with the decision-making process. The leadership structure of the Board may be changed at any time and in the discretion of the Board including in response to changes in circumstances or the characteristics of the Corporation.

As of July 23, 2020, to the knowledge of the Corporation, the Directors, Director nominees and Officers of the Corporation collectively owned less than 1% of the total number of the outstanding shares of the Corporation’s common stock. Additional information related to the equity ownership of the Directors in the Corporation and the compensation they received from the Corporation is presented in Appendix A.

6

Since the beginning of the Corporation’s most recently completed fiscal year ended December 31, 2019, the Directors as a group did not engage in the purchase or sale of more than 1% of any class of securities of the Investment Adviser or its parent.

During the Corporation’s fiscal year ended December 31, 2019, the Board met four times. Each Director attended at least 75% of the total number of meetings of the Board held during the Corporation’s most recently completed fiscal year and, if a member, at least 75% of the total number of meetings of the committees held during the period for which he or she served. The Corporation does not have a policy requiring a Director to attend meetings of stockholders, but the Corporation encourages such attendance.

Committee Structure

The Board has two standing committees: an Audit Committee and a Nominating Committee. The Audit Committee is comprised of the Independent Directors: Peter Atkins, Melissa Crandall, Edward Lazarus, Roger Lowenstein and Tim Medley. If elected to the Board, Ms. Weymouth will join the Audit Committee. The Board has adopted a charter for the Audit Committee, a copy of which is included as Appendix B. The Audit Committee meets as needed to review the Corporation’s financial statements; to approve the selection of, and consult with, the Corporation’s independent auditors; to receive the Corporation’s independent auditors’ reports on the Corporation’s financial statements and internal controls; and to perform other related duties. The Audit Committee met three times during the fiscal year ended December 31, 2019.

The Nominating Committee is also comprised of the Independent Directors: Peter Atkins, Melissa Crandall, Edward Lazarus, Roger Lowenstein and Tim Medley. If elected to the Board, Ms. Weymouth will join the Nominating Committee. The Board has adopted a charter for the Nominating Committee, a copy of which is included as Appendix C. Pursuant to the Nominating Committee charter, the Nominating Committee identifies, evaluates, selects and nominates candidates for the Board and periodically reviews the composition of the Board. The Nominating Committee also may set standards or qualifications for Directors. When assessing a candidate for nomination, the Nominating Committee considers whether the individual’s background, skills, and experience will complement the background, skills, and experience of other nominees and will contribute to the diversity of the Board. The Nominating Committee may consider candidates for Director submitted by the Corporation’s current Directors, officers, investment adviser and other appropriate sources. The Nominating Committee does not consider candidates for Director submitted by stockholders. The Nominating Committee met once during the fiscal year ended December 31, 2019.

On July 28, 2020, the Nominating Committee nominated each of the nominees set forth above to serve as Directors of the Corporation and recommended that the Board approve such nominations and present the nominees to the stockholders for their approval. On that date, the Board approved the nominations and authorized the officers of the Corporation to call a stockholder meeting for the purpose of voting on such nominees.

Stockholder Communications

The Board has adopted a process for stockholders to send communications to Directors. To communicate with a Director, a stockholder must send a written communication to the Corporation’s principal office at 9 West 57th Street, Suite 5000, New York, New York 10019-2701, addressed to the Director. All stockholder communications received in accordance with this process will be forwarded to the individual Director to whom the communication is addressed.

The Board unanimously recommends that stockholders vote “FOR” each of the nominees listed above to serve as a Director of the Corporation. Election of each nominee as a Director requires the affirmative vote of a majority of the votes cast at the Meeting.

7

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee is responsible for the appointment, compensation, retention and oversight of the work of the Corporation’s independent registered public accounting firm. At a meeting held on March 5, 2020, the Board, by the vote, cast in person, of a majority of the Directors, including a majority of the Directors who are not “interested persons” of the Corporation as defined under the 1940 Act, approved KPMG LLP (“KPMG”), independent registered public accounting firm, to audit the Corporation’s financial statements for the fiscal year ending December 31, 2020.

KPMG has audited the Corporation's financial statements for its two most recent fiscal years ended December 31, 2019 and December 31, 2018. Representatives of KPMG are not expected to participate in the Meeting but will be available to answer questions should they arise.

Independent Registered Public Accounting Firm’s Fees

The following table sets forth the aggregate fees billed by KPMG for the Corporation’s fiscal years ended December 31, 2019 and December 31, 2018, for professional services rendered for: (i) the audit of the Corporation’s annual financial statements included in the Corporation’s annual report(s) to stockholders; (ii) assurance and related services that are reasonably related to the performance of the audit of the Corporation’s financial statements and are not reported under (i); (iii) tax compliance, tax advice and tax return preparation; and (iv) aggregate non-audit services provided to the Corporation, the Investment Adviser and entities that control, are controlled by or under common control with the Investment Adviser that provide ongoing services to the Corporation (“Service Affiliates”).

| Audit Fees | Audit- Related Fees | Tax Fees | Aggregate Fees for Non-Audit Services Provided to the Corporation, Investment Adviser and Service Affiliates | All Other Fees | |

| 2019 | $ 55,000 | 0 | $ 3,250 | $ 38,250 | 0 |

| 2018 | $ 63,000 | 0 | $ 6,500 | $ 6,500 | 0 |

The Audit Committee charter requires the pre-approval of all audit and non-audit services provided to the Corporation by the independent registered public accounting firm. The Audit Committee charter also requires pre-approval of all audit and non-audit services provided to the Investment Adviser and Service Affiliates to the extent that these services are directly related to the operations or financial reporting of the Corporation. All of the amounts for Audit Fees, Audit-Related Fees, Tax Fees and Non-Audit Services in the preceding table were for services pre-approved by the Audit Committee. The Audit Committee has considered whether the provision of any non-audit services not pre-approved by the Audit Committee provided by the Corporation’s independent registered public accounting firm to the Investment Adviser and Service Affiliates is compatible with maintaining the independent registered public accounting firm’s independence.

8

PROXY VOTING AND STOCKHOLDER MEETING

All properly executed and timely received proxies will be voted in accordance with the instructions marked thereon or otherwise provided therein. Accordingly, unless instructions to the contrary are marked, proxies will be voted FOR the election of each nominee as a Director. Any stockholder may revoke his or her proxy at any time prior to its exercise by giving written notice to the Secretary of the Corporation at 9 West 57th Street, Suite 5000, New York, New York 10019-2701, by signing and submitting another proxy of a later date, or by attending the Meeting virtually and voting at the Meeting.

Properly executed proxies may be returned with instructions to abstain from voting (an “abstention”) or represent a “broker non-vote” (which is a proxy from a broker or nominee indicating that the broker or nominee has not received instructions from the beneficial owner or other person entitled to vote shares on a particular matter with respect to which the broker or nominee does not have discretionary power to vote).

The election of a nominee as Director requires the affirmative vote of a majority of the votes cast at the Meeting, assuming a quorum is present. A quorum for the Meeting will consist of the presence in person (virtually) or by proxy of the holders of a majority of the shares issued and outstanding and entitled to vote at the Meeting. For purposes of determining the presence of a quorum and counting votes, shares represented by abstentions and broker non-votes, if any, will be counted as present, but not as votes cast at the Meeting and will have no effect on the result of the vote in the election of Directors.

In the event that a quorum is not present at the Meeting, the chairman of the Meeting may adjourn the Meeting or the chairman or the persons named as proxies may propose and vote for one or more adjournments of the Meeting, with no other notice than announcement at the Meeting, in order to permit further solicitation of proxies. If an adjournment proposal is submitted to stockholders, the shares represented by proxies indicating a vote contrary to the position recommended by a majority of the Board on a Proposal will be voted against adjournment.

The Corporation has engaged AST Fund Solutions, LLC (the “Proxy Solicitor”), 48 Wall Street, 22nd Floor, New York, NY 10005, to assist in soliciting proxies for the Meeting. It is estimated that the Proxy Solicitor will receive a fee of $10,000 for its services, to be paid by the Corporation, plus reimbursement of additional proxy solicitation expenses.

9

OTHER INFORMATION

Officer Information

Certain information concerning the Corporation’s officers is set forth below. The Corporation’s officers are elected by the Board and serve for a term of one year and until his or her successor is duly elected and qualifies. The earliest date for which an officer was elected to serve in that capacity is presented below.

| Name, Address* and Age | Position(s) – (Month and Year First Elected) | Principal Occupation during the past 5 years |

| John B. Harris (43) | President and CEO (5/18) | Managing Director of the Investment Adviser since February 2018; Analyst of Ruane, Cunniff & Goldfarb; Managing Member of Wishbone Management, LP (registered investment adviser). |

| Wendy Goodrich (54) | Executive Vice President (3/17) | Executive Vice President of the Investment Adviser since November 2016; Managing Member of Absolute Return Consulting LLC until 2016. |

| Patrick Dennis (50) | Treasurer (11/17) | Chief Financial Officer of the Investment Adviser since November 2017; Chief Financial Officer of Associated Capital Group, Inc. from 2015 until November 2017; Global Head of Operations - Hedge Fund Administration at J.P. Morgan Chase from 2013 until 2015. |

| Michael Sloyer (59) | Chief Compliance Officer (12/13); Secretary (3/17) | General Counsel of the Investment Adviser |

| Michael Valenti (51) | Assistant Secretary (3/07) | Administrator of the Investment Adviser |

| * | The address for each of the Corporation’s officers is 9 West 57th Street, Suite 5000, New York, New York 10019-2701. |

Stock Ownership

Information regarding person(s) who owned of record or were known by the Corporation to beneficially own 5% or more of the Corporation’s shares on July 23, 2020 is provided in Appendix D.

Information About the Corporation’s Investment Adviser and Other Service Providers

The Corporation’s investment adviser is Ruane, Cunniff & Goldfarb L.P., 9 West 57th Street, Suite 5000, New York, New York 10019-2701. The Corporation’s custodian is The Bank of New York Mellon, 240 Greenwich Street, New York, New York 10286. The Corporation’s transfer agent and dividend disbursing agent is DST Systems, Inc., 333 West 11th Street, Kansas City, Missouri 64105. The Corporation’s distributor is Foreside Financial Services, LLC, Three Canal Plaza, Suite 100, Portland, Maine 04101. The Corporation’s administrator is The Bank of New York Mellon, 4400 Computer Drive, Westborough, Massachusetts 01581.

10

Submission of Proposals for Next Meeting of Stockholders

The Corporation does not hold stockholder meetings annually. Any stockholder who wishes to submit a proposal to be considered at the Corporation’s next meeting of stockholders should send the proposal to the Corporation so as to be received within a reasonable time before the Corporation begins to print and send its proxy materials relating to such meeting, in order to be included in the Corporation’s proxy statement and form of proxy card relating to such meeting.

Legal Proceedings

On January 8, 2016, Stanley H. Epstein, Harriet P. Epstein, and SEP IRA A/C Peter Christopher Gardner, derivatively and on behalf of the Corporation, filed a suit against Ruane, Cunniff & Goldfarb Inc. (“RCG”), Robert D. Goldfarb, David Poppe, Robert L. Swiggett and Roger Lowenstein (collectively, the “Defendants”) in the Supreme Court of the State of New York, County of New York. The Corporation was also named in the suit as a Nominal Defendant. On May 9, 2016, the plaintiffs filed an amended complaint, adding Edward Lazarus as an additional Defendant. The amended complaint asserted derivative claims in connection with certain of the Corporation’s investments against the Defendants for alleged breach of fiduciary duty, aiding and abetting breach of fiduciary duty, breach of contract and gross negligence. The case is Epstein v. Ruane, Cunniff & Goldfarb Inc. et al., 650100/2016, Supreme Court of the State of New York, County of New York. In February 2017, the court granted the Defendants’ motion to dismiss all claims in the action. On March 22, 2017, the plaintiffs filed a notice of appeal from the court’s dismissal. On July 5, 2018, the Supreme Court Appellate Division, First Department, unanimously affirmed the dismissal of all claims. On November 29, 2018, the plaintiffs filed an application for leave to appeal the Appellate Division’s ruling to the New York Court of Appeals. That application was denied on February 21, 2019.

On November 14, 2017, Donald Tapert, derivatively and on behalf of the Corporation, filed a suit against David M. Poppe, Edward Lazarus, Robert L. Swiggett, Roger Lowenstein, Tim Medley, John B. Harris, Peter Atkins, Melissa Crandall, Robert D. Goldfarb, and RCG, in the Baltimore City Circuit Court, Maryland. The Corporation was also named in the suit as a Nominal Defendant. The complaint asserted derivative claims for breach of fiduciary duty, aiding and abetting breach of fiduciary duty, waste of corporate assets, and unjust enrichment. The case is Tapert v. Poppe et al., Case No. 24-C-17-005430, Baltimore City Circuit Court, Maryland. Defendants moved to dismiss the complaint on March 19, 2018, and the Court granted that motion on August 14, 2019 and dismissed the claims with prejudice. Plaintiff initially appealed the court’s decision to the Maryland Court of Special Appeals on September 13, 2019, but thereafter voluntarily dismissed the previously-filed appeal in May 2020.

On February 9, 2018, Charles Wilfong & Ann R. Wilfong JTWROS, derivatively and on behalf of the Corporation, filed a suit against RCG, Robert D. Goldfarb, David Poppe and Roger Lowenstein, in the Supreme Court of the State of New York. The Corporation was also named in the suit as a Nominal Defendant. The complaint asserted derivative claims for breach of duty of loyalty, breach of duty of care, and wrongful refusal to take action. The case is Wilfong v. Ruane, Cunniff & Goldfarb Inc. et al., 650699/2018, Supreme Court of the State of New York, County of New York. The action was dismissed by stipulation of the parties on September 20, 2019 without prejudice to Plaintiffs refiling the action solely in the event that the Maryland Court of Special Appeals reversed the Baltimore City Circuit Court’s decision in the Tapert action. By virtue of the dismissal of the Tapert appeal, the dismissal of this action is now with prejudice as a result of the terms of the stipulation.

On May 21, 2018, Thomas Edwards and Michael Fortune, individually and as representatives of a purported class, filed a suit against the Corporation in the United States District Court in the Southern District of New York. The complaint asserted a claim for breach of contract. The case is Edwards v. Sequoia Fund, Inc., Case No. 1:18-cv-04501, S.D.N.Y. On October 18, 2018, the court granted the Corporation’s motion to dismiss all claims. On November 15, 2018, plaintiffs filed a notice of appeal to the U.S. Court of Appeals for the Second Circuit. The Second Circuit affirmed the District Court’s decision on September 9, 2019.

11

On March 14, 2016, Clive Cooper, individually and as a representative of a class, on behalf of the DST Systems, Inc. 401(k) Profit Sharing Plan (the “Plan”), filed a suit in the United States District Court for the Southern District of New York against RCG, DST Systems, Inc., The Advisory Committee of the DST Systems, Inc. 401(K) Profit Sharing Plan, the Compensation Committee of the Board of Directors of DST Systems, Inc., Jerome H. Bailey, Lynn Dorsey Bleil, Lowell L. Bryan, Gary D. Forsee, Gregg Wm. Givens, Charles E. Haldeman, Jr., Samuel G. Liss and John Does 1-20. The Corporation is not a defendant in this lawsuit. The complaint asserted claims for alleged breach of fiduciary duty and violation of ERISA’s prohibited transaction rules, co-fiduciary breach, and breach of trust in connection with certain investments made on behalf of the Plan. The case is Cooper v. DST Systems, Inc. et al., Case No. 1:16-cv-01900-WHP, U.S. District Court for the Southern District of New York. Upon being presented with an arbitration agreement between plaintiff and DST, plaintiff dismissed without prejudice all claims against all of the defendants other than RCG, which was thereby the only defendant remaining in the case. On August 15, 2017, the court granted RCG’s motion to compel arbitration and the case was dismissed on August 17, 2017. On September 8, 2017, the plaintiffs filed a notice of appeal from the District Court’s order granting the motion to compel arbitration and dismissing the case. Oral argument was heard on the appeal on February 5, 2019. A decision on the appeal is pending.

On September 1, 2017, plaintiffs Michael L. Ferguson, Myrl C. Jeffcoat and Deborah Smith, on behalf of the DST Systems, Inc. 401(k) Profit Sharing Plan, filed a suit in the Southern District of New York against RCG, DST Systems, Inc., The Advisory Committee of the DST Systems, Inc. 401(K) Profit Sharing Plan, the Compensation Committee of the Board of Directors of DST Systems, Inc., George L. Argyros, Tim Bahr, Jerome H. Bailey, Lynn Dorsey Bleil, Lowell L. Bryan, Ned Burke, John W. Clark, Michael G. Fitt, Gary D. Forsee, Steven Gebben, Gregg Wm. Givens, Kenneth Hager, Charles E. Haldeman, Jr., Lawrence M. Higby, Joan Horan, Stephen Hooley, Robert T. Jackson, Gerard M. Lavin, Brent L. Law, Samuel G. Liss, Thomas McDonnell, Jude C. Metcalfe, Travis E. Reed, M. Jeannine Strandjord, Beth Sweetman, Douglas Tapp and Randall Young. The Corporation is not a defendant in this lawsuit. The complaint asserts claims for alleged breach of fiduciary duty under ERISA, breach of trust, and other claims. The case is Ferguson, et al. v. Ruane, Cunniff & Goldfarb Inc., et al., Case No. 1:17-cv-06685-ALC (S.D.N.Y.). On July 25, 2018, Stephanie Ostrander, a Plan participant, filed a motion in Ferguson seeking to intervene in that case to assert a class action on behalf of certain Plan participants. The court denied the motion to intervene on March 29, 2019. On December 14, 2018, the DST defendants filed a partial motion to dismiss, seeking dismissal of certain claims relating solely to the 401(k) portion of the Plan, with which RCG had no involvement. The court granted the motion to dismiss on September 18, 2019. On April 10, 2020, Plaintiffs moved to amend their complaint to add class allegations and to delete the allegations relating to the 401(k) portion of the Plan. Contemporaneously, Plaintiffs also filed a motion to certify the class. The DST defendants are consenting to both motions. The motions are currently pending.

On September 7, 2017, plaintiff Stephanie Ostrander, as representative of a class of similarly situated persons, and on behalf of the DST Systems, Inc. 401(k) Profit Sharing Plan, filed suit in the Western District of Missouri against DST Systems, Inc., The Advisory Committee of the DST Systems, Inc., 401(k) Profit Sharing Plan, The Compensation Committee of The Board of Directors of DST Systems, Inc., RCG and John Does 1-20. The complaint asserted claims for alleged breach of fiduciary duty, breach of trust, and other claims. The case is Ostrander v. DST Systems, Inc. et al., Case No. 4:17-cv-00747-BCW. The Corporation is not a defendant in this lawsuit. On February 2, 2018, the court granted the defendants’ motion to dismiss all claims.

On September 28, 2018, counsel for Stephanie Ostrander filed another suit, Canfield v. SS&C Tech. Holdings, Inc. et al., Case No. 1:18-cv-08913-ALC (S.D.N.Y.), asserting claims that are virtually identical to those asserted in the Cooper, Ferguson, and Ostrander cases. The Corporation is not a defendant in this lawsuit.

12

On November 5, 2018, counsel for Stephanie Ostrander filed another suit, Mendon v. SS&C Tech. Holdings, Inc., et al., Case No. 1:18-cv-10252-ALC (S.D.N.Y.), asserting claims that are virtually identical to those asserted in the Cooper, Ferguson, Ostrander, and Canfield cases. The Corporation is not a defendant in this lawsuit.

On August 6, 2018, eleven participants of the DST Profit Sharing Plan submitted arbitration demands (the “Demands”) to the American Arbitration Association (the “Arbitrations”). The Demands assert claims that are virtually identical to those in the Cooper, Ferguson, Ostrander, Canfield, and Mendon cases. An additional approximately 466 claimants have sent demands, similar to the Demands, for submission to the American Arbitration Association. To date, arbitrators have been chosen in 314 arbitrations. The Corporation is not a defendant in these proceedings.

RCG reached an agreement to settle claims asserted against it in the Arbitrations, Canfield and Mendon on June 5, 2020.

On October 8, 2019, the Secretary of Labor filed a suit in the United States District Court for the Southern District of New York against RCG, DST Systems, Inc., Robert D. Goldfarb, The Advisory Committee of the DST Systems, Inc. 401(K) Profit Sharing Plan, the Compensation Committee of the Board of Directors of DST Systems, Inc., Kenneth Hager, Randall D. Young, Gregg W. Givins, Gerard M. Lavin, M. Elizabeth Sweetman, Douglas W. Tapp, George L. Argyros, Lawrence M. Higby, Travis E. Reed, Lowell L. Bryan, Samuel G. Liss, Brent L. Law, Lynn Dorsey Bleil, Jerome H. Bailey, Gary D. Forsee, and Charles E. Haldeman, Jr. The Corporation is not a defendant in this lawsuit. The Secretary’s complaint asserts claims for alleged breaches of fiduciary duties and co-fiduciary breach. The case is Scalia v. Ruane, Cunniff & Goldfarb Inc., et al., Case No. 1:19-cv-9302-ALC (S.D.N.Y.). On December 10, 2019, RCG, Mr. Goldfarb, and the DST defendants all requested a pre-motion conference in connection with anticipated motions to dismiss the Secretary’s complaint. The Court has not yet scheduled a conference.

RCG believes that the foregoing lawsuits are without merit and intends to defend itself vigorously against the allegations in them.

On December 10, 2019, RCG filed a suit in the United States District Court for the Southern District of New York against the claimants in the arbitrations pending before the American Arbitration Association (the “Claimants”). The suit also names, as nominal defendants, DST Systems, Inc., the plaintiffs in the Ferguson, Canfield, and Mendon cases, and the Secretary of Labor. RCG’s complaint seeks declaratory and injunctive relief regarding the overlapping and duplicative actions pending against RCG. On December 18, 2019, RCG filed a motion for preliminary injunction and appointment of a special master, seeking a stay of the arbitrations pending before the American Arbitration Association. Claimants and the Secretary of Labor have opposed that motion. In addition, Claimants moved to dismiss RCG’s complaint on January 6, 2020. The Secretary of Labor requested a pre-motion conference in connection with an anticipated motion to dismiss RCG’s complaint on February 18, 2020. RCG’s motion for a preliminary injunction and appointment of a special master and Claimants’ motion to dismiss have been fully-briefed, and no date has been set for oral argument on those motions or a pre-motion conference on the Secretary’s anticipated motion to dismiss. The case is Ruane, Cunniff & Goldfarb Inc. v. Payne, et al., Case No. 1:19-cv-11297-ALC (S.D.N.Y.).

The outcomes of these lawsuits are not expected to have a material impact on the Corporation’s financial statements.

13

Other Matters

Under Maryland law, the only matters that may be acted on at a special meeting of stockholders are those stated in the notice of the special meeting. Accordingly, other than procedural matters relating to the proposal, no other business may properly come before the Meeting. If any procedural matters properly come before the Meeting, the shares represented by proxies will be voted with respect thereto in the discretion of the person or persons exercising the proxies.

By Order of the Board of Directors,

Michael Sloyer

Secretary

July 29, 2020

14

APPENDIX A

ADDITIONAL INFORMATION REGARDING DIRECTORS AND NOMINEES

Ownership of the Corporation’s Shares

The dollar range of the Corporation’s shares owned by each existing Director or nominee is set forth below. The Investment Adviser does not provide investment advisory services to any investment companies registered under the 1940 Act other than the Corporation.

| Dollar Range of the Ownership of the Corporation’s Shares as of July 24, 2020 | |

| Interested Directors | |

| John B. Harris | Over $100,000 (1) |

| Gregory Steinmetz* | Over $100,000 |

| Disinterested Directors | |

| Peter Atkins | $1-10,000 |

| Melissa Crandall* | $10,001-$50,000 |

| Edward Lazarus | Over $100,000 |

| Roger Lowenstein | Over $100,000 |

| Tim Medley | Over $100,000 |

| Katharine Weymouth** | Over $100,000 |

| * | Nominee and existing Director. |

| ** | Nominee. |

| (1) | Mr. Harris is an officer, director and voting stockholder of Ruane, Cunniff & Goldfarb Inc., the parent company of the Investment Adviser. Mr. Harris is a beneficiary of the Profit-Sharing Plan of Ruane, Cunniff & Goldfarb Inc., which holds for its participants 285,881 shares of the Corporation’s common stock. |

A-1

Compensation from the Corporation

The table below sets forth the aggregate compensation paid by the Corporation to Directors for the Corporation’s fiscal year ended December 31, 2019*. The Corporation does not pay any fees or compensation to its officers or Interested Directors, but the Independent Directors each receive compensation from the Corporation. In addition, the Corporation reimburses its Independent Directors for reasonable travel or incidental expenses incurred by them in connection with their attendance at Board meetings. The Corporation offers no retirement plan or other benefits to its Directors.

| Name of Director | Aggregate Compensation from Corporation | Pension or Retirement Benefits Accrued as Part of Corporation Expenses | Estimated Annual Benefits Upon Retirement | Total Compensation from Corporation | ||||||||||||

| John B. Harris | $ | 0 | -0- | -0- | $ | 0 | ||||||||||

| Gregory Steinmetz | $ | 0 | -0- | -0- | $ | 0 | ||||||||||

| Peter Atkins | $ | 90,000 | -0- | -0- | $ | 90,000 | ||||||||||

| Melissa Crandall | $ | 90,000 | -0- | -0- | $ | 90,000 | ||||||||||

| Edward Lazarus | $ | 97,500 | -0- | -0- | $ | 97,500 | ||||||||||

| Roger Lowenstein | $ | 90,000 | -0- | -0- | $ | 90,000 | ||||||||||

| Tim Medley | $ | 90,000 | -0- | -0- | $ | 90,000 | ||||||||||

| * | At its May 2019 meeting, the Board, including a majority of the Independent Directors, approved an increase in the quarterly retainer to be paid to each Independent Director, other than the Chairman of the Board, to $22,500 per quarter and approved an increase in the quarterly retainer to be paid to the Chairman of the Board to $26,250 per quarter. Such increases were effective July 1, 2019. |

A-2

APPENDIX B

SEQUOIA FUND, INC.

AUDIT COMMITTEE CHARTER

SECTION 1. COMPOSITION

The Audit Committee shall be composed entirely of Directors who are not “interested” persons of Sequoia Fund, Inc. (the “Fund”) or any investment adviser or principal underwriter, as defined in the Investment Company Act of 1940, to the Fund. The full Board of Directors shall designate the members of the committee and shall either designate the Chairman or shall approve the manner of selection of the Chairman.

SECTION 2. OVERSIGHT

The function of the Audit Committee is oversight. Management1 and the accounting staff are primarily responsible for the preparation of the Fund’s financial statements and the independent auditors are responsible for auditing those financial statements. Management is also responsible for maintaining appropriate systems for accounting and internal control, and the independent auditors are primarily responsible for considering such controls in connection with their financial statement audits. The independent auditors for the Fund are accountable to the Board of Directors and Audit Committee. The Audit Committee has the authority and responsibility to select, evaluate and, where appropriate, replace the independent auditors, as has the full Board of Directors.

SECTION 3. SPECIFIC RESPONSIBILITIES AND POWERS

The Fund’s Audit Committee has the responsibility and power to:

| a) | oversee the Fund’s accounting and financial reporting processes and practices, its internal controls and, as appropriate, the internal controls of key service providers; |

| b) | approve, and recommend to the full Board of Directors for its ratification and approval in accord with applicable law, the selection and appointment of an independent auditor for the Fund prior to the engagement of such independent auditor; |

| c) | pre-approve all audit and non-audit services provided to the Fund by its independent auditor, directly or by establishing pre-approval policies and procedures pursuant to which such services may be rendered, provided however, that the policies and procedures are detailed as to the particular service and the Audit Committee is informed of each service, and such policies do not include the delegation of the Audit Committee’s responsibilities under the Securities Exchange Act of 1934 or applicable rules or listing requirements; |

| d) | pre-approve all non-audit services provided by the Fund’s independent auditor to the Fund’s investment adviser and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the Fund, if the engagement relates directly to the operations and financial reporting of the Fund; |

| 1 | For purposes of this Charter, the term “management” means the appropriate officers of the Fund and its investment adviser. |

B-1

| e) | attempt to identify, through reports from the auditor and discussions with management: conflicts of interest between management and the independent auditor as a result of employment relationships; the provision of prohibited non-audit services to the Fund by its independent auditor; violations of audit partner rotation requirements; and prohibited independent auditor compensation arrangements whereby individual auditors are compensated based on selling non-audit services to the Fund; |

| f) | ensure that the independent auditors submit on a periodic basis to the Audit Committee a formal written statement delineating all relationships between the independent auditors and the Fund; (ii) actively engage in a dialogue with the independent auditors with respect to any disclosed relationships or services that may impact the objectivity and independence of the independent auditors; and (iii) recommend that the Board of Directors take appropriate action in response to such formal written statement to satisfy themselves of the independent auditors’ independence; |

| g) | meet with the Fund’s independent auditors and management, including private meetings, as appropriate, to: (i) review the form and substance of the Fund’s financial statements and reports and to report the result of such meetings to the full Board of Directors; (ii) review the arrangements for and the scope of the annual audit and any special audits or other special services; (iii) discuss any matters of concern arising in connection with audits of the Fund’s financial statements, including any adjustments to such statements recommended by the independent auditors, or other results of the audits; (iv) review the quality and adequacy of the internal accounting staff; (v) consider the independent auditors’ comments with respect to the appropriateness and adequacy of the Fund’s financial policies, procedures and internal accounting controls (including computer system controls and controls over the daily net asset valuation process and the adequacy of the computer systems and technology used in the Fund’s operations) and review management’s responses thereto; (vi) review the matters about which Statement on Auditing Standards No. 114 (Codification of Statements on Auditing Standards, AU § 380) requires discussion; and (vii) review with the independent auditors their opinions as to the fairness of the financial statements; |

| h) | consider the effect on the Fund of: (i) any changes in accounting principles or practices proposed by management or the independent auditors; (ii) any changes in service providers, such as fund accountants or administrators, that could impact the Fund’s internal controls; or (iii) any changes in schedules (such as fiscal or tax year-end changes) or structures or transactions that require special accounting activities or resources; |

| i) | review the fees charged by the independent auditors for audit and non-audit services; |

| j) | serve as a “qualified legal compliance committee” (as such term is defined in 17 CFR Part 205), the duties of which are listed on Exhibit A to this Charter; and |

| k) | report its activities to the full Board on a regular basis and to make such recommendations with respect to the matters described above and other matters as the Committee may deem necessary or appropriate. |

B-2

SECTION 4. SUB-COMMITTEES

The Audit Committee may form and delegate authority to one or more subcommittees (which may consist of one or more Audit Committee members), as it deems appropriate from time to time. Any decision of a subcommittee to pre-approve audit or non-audit services shall be presented to the full Audit Committee at its next meeting.

SECTION 5. MISCELLANEOUS

| a) | The Fund’s Audit Committee shall meet periodically, and is empowered to hold special meetings as circumstances require. The Committee shall record minutes of its meetings and shall invite management, counsel and representatives of service providers to attend meetings and provide information as it, in its sole discretion, considers appropriate. |

| b) | The Fund’s Audit Committee shall be available to meet with appropriate officers of the Fund, and with internal accounting staff for consultation on audit, accounting and related financial matters. |

| c) | The Fund’s Audit Committee shall be given the resources and authority appropriate to discharge its responsibilities, including the authority to retain special counsel and other experts or consultants at the expense of the Fund. |

| d) | The Committee shall have such further responsibilities as are given to it from time to time by the Board of Directors. The Committee shall consult, on an ongoing basis, with management, the independent auditors and counsel as to legal or regulatory developments affecting its responsibilities. |

B-3

EXHIBIT A

QLCC DUTIES AND RESPONSIBILITIES

| 1. | An attorney reporting a “material violation” under 17 CFR Part 205 (“Reporting Attorney”), is permitted to report evidence of such a material violation directly to the qualified legal compliance committee, which is comprised of all audit committee members (“QLCC”). |

| 2. | The QLCC shall ensure that the Fund’s President, Mr. John B. Harris, provides QLCC contact information to all attorneys who provide services to the Fund. |

| 3. | The QLCC shall designate an appropriate repository for the retention of materials generated in connection with the receipt of any report of a material violation by the QLCC. |

| 4. | Once a report of evidence of a material violation by the Fund, its officers, directors, employees or agents has been received by the QLCC, the QLCC has the authority and responsibility: |

| a) | to inform Mr. Harris of such report (except in the case where the Reporting Attorney reasonably believes that it would be futile to report evidence of a material violation to Mr. Harris, and has informed the QLCC of such belief); and |

| b) | to determine whether an investigation is necessary or appropriate, and, if it determines an investigation is necessary or appropriate, to: |

| (i) | notify the full Board of Directors; |

| (ii) | initiate an investigation, which may be conducted either by Mr. Harris or by outside attorneys; and |

| (iii) | retain such additional expert personnel as the QLCC deems necessary; and, at the conclusion of such investigation, |

| (iv) | recommend, by majority vote, that the Fund implement an appropriate response to evidence of a material violation; and |

| (v) | inform Mr. Harris and the Board of Directors of the results of any such investigation and the appropriate remedial measures. |

| c) | by majority vote, to take all other appropriate action, including notifying the SEC in the event that the Fund fails in any material respect to implement an appropriate response that the QLCC has recommended. |

B-4

APPENDIX C

SEQUOIA FUND, INC.

NOMINATING COMMITTEE CHARTER

SECTION 1. MEMBERSHIP

| (a) | The Nominating Committee (the “Committee”) of the Board of Directors (the “Board,” and each director individually, a “Director”) of Sequoia Fund, Inc. (the “Corporation”) shall be composed of Directors who are not “interested persons” of the Corporation, as defined in the Investment Company Act of 1940, as amended (the “1940 Act”), and who are appointed by the Board from time to time. |

| (b) | The Committee shall appoint its Chairperson. |

SECTION 2. PURPOSES

| (a) | The Committee shall oversee the composition of both the Board and the various committees of the Corporation to ensure that competent and capable candidates fill these positions. |

| (b) | The Committee shall ensure that the selection of each Director is conducted in such a fashion so as to enhance the independence of disinterested directors whose primary loyalty is to the shareholders of the Corporation. |

SECTION 3. DUTIES AND POWERS

| (a) | The Committee shall review candidates for, and make nominations of independent directors to the Board. In carrying out this duty, the Committee shall: |

| (i) | evaluate the candidates’ qualifications and their independence from the Corporation’s investment advisers and other principal service providers; |

| (ii) | select persons who are “independent” in terms of both the letter and the spirit of the 1940 Act; and |

| (iii) | consider the effect of any relationships beyond those delineated in the 1940 Act that might impair independence, such as business, financial or family relationships with managers or service providers. |

| (b) | The Committee shall periodically review the composition of the Board to determine whether for any reason it may be appropriate to add new directors. |

| (c) | The Committee shall review the membership of each committee established by the Board. |

SECTION 4. PROCEDURAL MATTERS

| (a) | The Committee shall meet periodically as it deems necessary. |

| (b) | The Committee shall review its operations periodically and recommend changes to this Charter to the Board as appropriate. |

C-1

| (c) | The Committee shall prepare minutes of and report to the Board on its meetings. |

| (d) | The Committee shall have the authority to make reasonable expenditures, including expenditures to retain experts and counsel, related to the aforementioned duties and tasks that will be reimbursed by the Corporation. |

C-2

APPENDIX D

STOCK OWNERSHIP

The following person(s) owned of record or were known by the Corporation to beneficially own 5% or more of the Corporation’s shares as of July 23, 2020.

| Name and Address | Number of Shares | % of Shares |

Charles Schwab & Co. Inc. 222 Main St. | 2,327,891 | 9.57% |

National Financial Services Corp. Jersey City, NJ 07310-1995 | 1,268,262 | 5.22% |

D-1