UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07076

Wilshire Mutual Funds, Inc.

|

| (Exact name of registrant as specified in charter) |

|

Wilshire Associates Incorporated 1299 Ocean Avenue, Suite 700 Santa Monica, CA 90401-1085 |

| (Address of principal executive offices) (Zip code) |

Lawrence Davanzo, President

1299 Ocean Avenue, Suite 700

Santa Monica, CA 90401-1085

|

| (Name and address of agent for service) |

Registrant’s telephone number, including area code: 310-260-6639

Date of fiscal year end: December 31

Date of reporting period: December 31, 2006

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

The Report to Shareholders is attached herewith.

ANNUAL REPORT

LARGE COMPANY GROWTH PORTFOLIO

LARGE COMPANY VALUE PORTFOLIO

SMALL COMPANY GROWTH PORTFOLIO

SMALL COMPANY VALUE PORTFOLIO

DOW JONES WILSHIRE 5000 INDEX PORTFOLIO

December 31, 2006

www.wilfunds.com

Wilshire Mutual Funds, Inc.

This report is for the general information of the shareholders of Large Company Growth Portfolio, Large Company Value Portfolio, Small Company Growth Portfolio, Small Company Value Portfolio and Dow Jones Wilshire 5000 Index Portfolio. Its use in connection with any offering of a Portfolio’s shares is authorized only if accompanied or preceded by the Portfolio’s current prospectus.

Wilshire Mutual Funds, Inc. are distributed by PFPC Distributors, Inc.

Dear Wilshire Mutual Funds Shareholder,

We are pleased to present this Annual report to all shareholders of the Wilshire Mutual Funds, Inc. This report covers the year ended December 31, 2006 (the “Period”), for all share classes of the Large Company Growth, Large Company Value, Small Company Growth, Small Company Value and Dow Jones Wilshire 5000 Index Portfolio.

MARKET ENVIRONMENT

U.S. GDP growth slowed progressively during the year. The latest GDP figure showed annualized growth in GDP of 2.0% for the 3rd quarter of 2006, lower than the 5.6% and 2.6% annualized growth figures recorded for the 1st and 2nd quarter of the year, respectively. Data from the U.S. Department of Labor suggested further strengthening of the labor market. Non-farm payrolls increased by 167,000 in December; and the unemployment rate fell from 4.9% to 4.5% over the year. The Consumer Price Index (“CPI”) climbed by 2.5% for the year, the best showing since 2003 and nearly a full percentage point lower than the 3.4% jump in 2005. The CPI report showed that core inflation, which excludes energy and food costs, rose 2.6% last year, compared with 2.2% gains in both 2004 and 2005. It was the highest increase since a 2.7% jump in 2001.

The U.S. stock market posted its fourth consecutive annual advance in 2006, with the Dow Jones Wilshire 5000 Index up 15.77%. A fifth straight year of double-digit corporate earnings growth and an active mergers and acquisitions environment, fueled in large part by record levels of private equity buyouts, encouraged equity investors to push stocks higher.

Despite concerns of volatile energy prices, higher short-term interest rates, and declining home building activities, investors benefited from a strong 4th quarter rally in the broad U.S. equity market. The market rose 7.2% in the last three months of the year, the strongest quarterly return in two years.

The U.S. equity market advance was led by small cap stocks, whose outperforming trend against large cap stocks was extended to eight consecutive years. The Dow Jones Wilshire Small Cap Index returned 16.99% for the year, outperforming the Dow Jones Wilshire Large Cap Index by 1.37% for the same period. The investment environment for growth investors remained challenging. Healthcare and technology, the traditional growth sectors of the economy lagged behind the more cyclical sectors of Energy and Materials. As a result, the 9.71% return of the Dow Jones Wilshire Top 2500 Growth Index trailed the Dow Jones Wilshire Top 2500 Value Index by 11.93% for the year.

The bond market returns improved in 2006, returning 4.33% as compared to the 2.43% return from the previous year. Bond investors experienced positive returns during the second half of the year as the Fed paused from its interest rate tightening campaign and left short-term interest rate unchanged. After raising the key Fed Funds rate four times in the first six months of the year by a total of 1% from 4.25% to 5.25%, the Fed refrained from further rate hikes for the rest of the year on concerns of rapidly slowing economy. The stability in short-term interest rates served as catalyst for positive bond returns in the latter part of the year.

International equities continued the out-performance against U.S. equities for the fourth consecutive year. Measured in U.S. dollar terms, the MSCI AC World ex. U.S. Index returned 26.65% for the Period, handily outpacing the 15.77% return for the Dow Jones Wilshire 5000 Index. Strong economic growth and higher energy prices boosted returns of emerging markets around the globe. Emerging markets, as measured by the MSCI Emerging Market Index, advanced 32.16% for the Period.

1

FUND PERFORMANCE OVERVIEW*

Wilshire is pleased to discuss the results with our shareholders. With the exception of the Large Company Growth Portfolio, the remaining four funds posted double-digit returns for the Period. The Large Company Value and the Small Company Value portfolios returned 18.49% and 19.64%, respectively, for the Period. Collectively, value stocks provided the most robust returns for equity investors as value stocks continued their dominance over growth stocks. The Small Company Growth Portfolio returned 11.12% for the Period. Despite general optimism concerning a market rebound by growth stocks in 2006, growth stocks lagged value stocks for the seventh consecutive year. The Large Company Growth Portfolio gained 4.96% for the Period, in a challenging environment for large growth stocks. The Dow Jones Wilshire 5000 Index Portfolio, which is designed to provide investors with the broadest U.S. equity market exposure gained 14.46% for the Period.

Sincerely,

Lawrence E. Davanzo, President

| * | The performance stated is for Investment Class Shares. The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance quoted to the most recent month end may be obtained at www.wilfunds.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. |

2

| | |

LARGE COMPANY GROWTH PORTFOLIO COMMENTARY | |  |

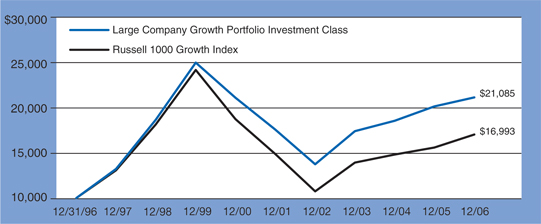

INVESTMENT CLASS SHARES

Average Annual Total Return *

| | | |

One Year Ended 12/31/06 | | 4.96 | % |

Five Years Ended 12/31/06 | | 3.74 | % |

Ten Years Ended 12/31/06 | | 7.75 | % |

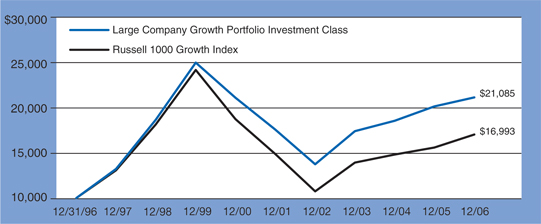

Comparison of Change in Value of $10,000 Investment in Shares of

Large Company Growth Portfolio and the Russell 1000 Growth Index

through 12/31/06.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at www.wilfunds.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The Russell 1000 Growth Index is an unmanaged index that measures the performance of the largest 1,000 U.S. companies with high price-to-book ratios and high forecasted growth values. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no taxes, transaction costs, management fees or other expenses. An individual cannot invest directly in any index. The table above does not reflect the deduction that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

The Portfolio’s Investment Class annual operating expense ratio is 1.34% as of 12/31/06.

| * | Assumes reinvestment of all dividends and distributions. During certain periods since inception, certain fees and expenses were waived or reimbursed. For the year ended December 31, 2006, waivers were less than 0.01% of average net assets. Without such waivers and reimbursements, historical total returns would have been lower. |

3

| | |

Large Company Growth Portfolio COMMENTARY - (CONTINUED) | |  |

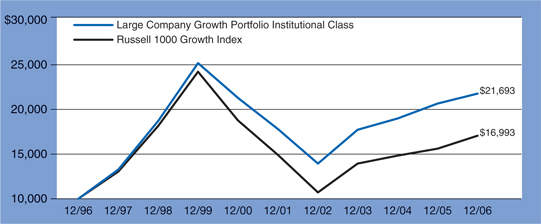

INSTITUTIONAL CLASS SHARES

Average Annual Total Return *

| | | |

One Year Ended 12/31/06 | | 5.35 | % |

Five Years Ended 12/31/06 | | 4.09 | % |

Ten Years Ended 12/31/06 | | 8.05 | % |

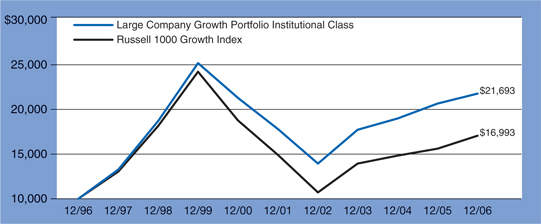

Comparison of Change in Value of $10,000 Investment in Shares of

Large Company Growth Portfolio and the Russell 1000 Growth Index through 12/31/06.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at www.wilfunds.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The Russell 1000 Growth Index is an unmanaged index that measures the performance of the largest 1,000 U.S. companies with high price-to-book ratios and high forecasted growth values. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no taxes, transaction costs, management fees or other expenses. An individual cannot invest directly in any index. The table above does not reflect the deduction that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

The Portfolio’s Institutional Class annual operating expense ratio is 0.98% as of 12/31/06.

| * | Assumes reinvestment of all dividends and distributions. During certain periods since inception, certain fees and expenses were waived or reimbursed. For the year ended December 31, 2006, waivers were less than 0.01% of average net assets. Without such waivers and reimbursements, historical total returns would have been lower. |

4

| | |

LARGE COMPANY GROWTH PORTFOLIO COMMENTARY - (CONTINUED) | |  |

Investment Class Shares of the Large Company Growth Portfolio (the “Portfolio”) returned 4.96% while the Institutional Share Class returned 5.35% for the 12-month period ended December 31, 2006 (the “Period”). The Period marked the fourth consecutive year of positive returns for the Portfolio. The Portfolio underperformed its benchmark, the Russell 1000 Growth Index, which returned 9.07% for the same Period.

For the seventh consecutive year, large growth stocks finished behind its value counterparts. Over the seven-year period, value stocks’ annualized return of 7.79% is 12.66% above the annualized return of (4.87)% for growth stocks. For the Period, the Russell 1000 Growth Index returned 9.07% while the Russell 1000 Value Index gained 22.21%. In the growth stock spectrum, smaller growth companies outperformed larger growth companies. Compared to the 9.07% return for the larger growth companies comprised in the Russell 1000 Growth Index, the Russell 2000 Growth Index, which represents smaller growth companies returned 13.35% for the Period.

The Portfolio stayed true to its growth objectives and benefited from holding a handful of slightly smaller growth companies in its portfolio. The Portfolio also participated in the industries where returns were strongest, such as Industrials, Transportation, Energy, and Basic Materials. While most of the Portfolio’s holdings posted positive returns, a handful of core holdings detracted the Portfolio’s performance. Among the greatest detractors of performance for 2006 were a couple of leading performance contributors from the previous year. Posting strong positive returns in 2005, Sandisk Corp. and Genetech, Inc. declined 59% and 14%, respectively, during 2006. While valuations have improved, technology and biotechnology segments of the market continue to be challenging.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at www.wilfunds.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Portfolio holdings subject to change. The Russell 1000 Growth Index is an unmanaged index that measures the performance of the largest 1,000 companies with high price-to-book ratios and high forecasted growth values. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no taxes, transaction costs, management fees or other expenses. An individual cannot invest directly in any index.

5

| | |

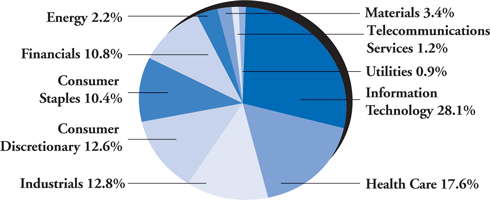

LARGE COMPANY GROWTH PORTFOLIO COMMENTARY - (CONTINUED) | |  |

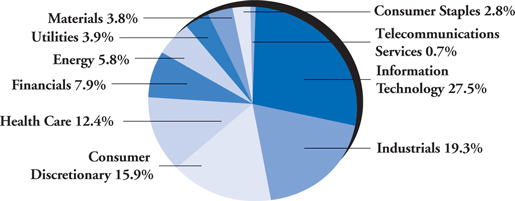

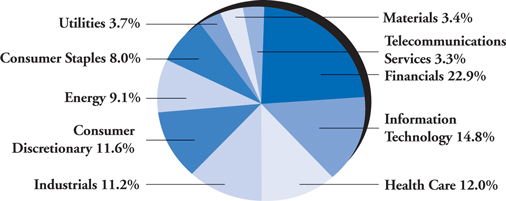

PORTFOLIO SECTOR WEIGHTING*

(As of December 31, 2006)

| * | Based on percent of Portfolio’s total investments in securities market value. |

6

| | |

LARGE COMPANY VALUE PORTFOLIO COMMENTARY | |  |

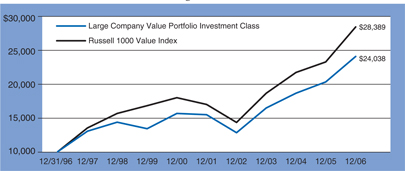

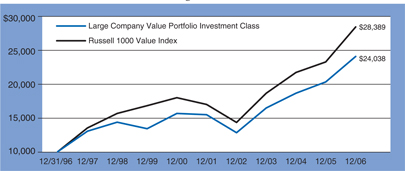

INVESTMENT CLASS SHARES

Average Annual Total Return *

| | | |

One Year Ended 12/31/06 | | 18.49 | % |

Five Years Ended 12/31/06 | | 9.23 | % |

Ten Years Ended 12/31/06 | | 9.17 | % |

COMPARATIVE PERFORMANCE

Comparison of Change in Value of $10,000 Investment in Shares of

Large Company Value Portfolio and the Russell 1000 Value Index

through 12/31/06.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at www.wilfunds.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The Russell 1000 Value Index is an unmanaged index that measures the performance of the largest 1,000 U.S. companies with lower price-to-book ratios and lower forecasted growth values. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no taxes, transaction costs, management fees or other expenses. An individual cannot directly invest in any index. The table above does not reflect the deduction that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

The Portfolio’s Investment Class annual operating expense ratio is 1.39% as of 12/31/06.

| * | Assumes reinvestment of all dividends and distributions. During certain periods since inception, certain fees and expenses were waived or reimbursed. For the year ended December 31, 2006, waivers were less than 0.01% of average net assets. Without such waivers and reimbursements, historical total returns would have been lower. |

7

| | |

LARGE COMPANY VALUE PORTFOLIO COMMENTARY - (CONTINUED) | |  |

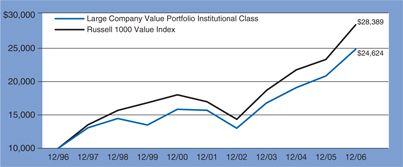

INSTITUTIONAL CLASS SHARES

Average Annual Total Return *

| | | |

One Year Ended 12/31/06 | | 18.94 | % |

Five Years Ended 12/31/06 | | 9.54 | % |

Ten Years Ended 12/31/06 | | 9.43 | % |

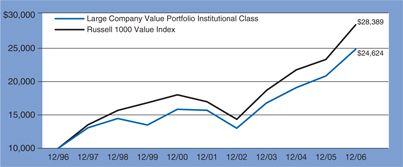

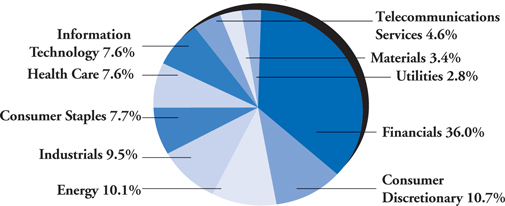

COMPARATIVE PERFORMANCE

Comparison of Change in Value of $10,000 Investment in Shares of

Large Company Value Portfolio and the Russell 1000 Value Index

through 12/31/06.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at www.wilfunds.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The Russell 1000 Value Index is an unmanaged index that measures the performance of the largest 1,000 U.S. companies with lower price-to-book ratios and lower forecasted growth values. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no taxes, transaction costs, management fees or other expenses. An individual cannot directly invest in any index. The table above does not reflect the deduction that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

The Portfolio’s Institutional Class annual operating expense ratio is 1.08% as of 12/31/06.

| * | Assumes reinvestment of all dividends and distributions. During certain periods since inception, certain fees and expenses were waived or reimbursed. For the year ended December 31, 2006, waivers were less than 0.01% of average net assets. Without such waivers and reimbursements, historical total returns would have been lower. |

8

| | |

LARGE COMPANY VALUE PORTFOLIO COMMENTARY - (CONTINUED) | |

|

Investment Class Shares of the Large Company Value Portfolio (the “Portfolio”) rose 18.49% while Institutional Class shares gained 18.94% over the 12-month period ended December 31, 2006 (the “Period”). The Period marked the fourth consecutive year of positive returns for the Portfolio. Both classes of the Portfolio underperformed the benchmark, the Russell 1000 Value Index, which surged 22.21% over the Period.

Once again, value stocks strongly outperformed growth counterparts for yet another year. Value stocks have outperformed growth stocks for seven consecutive years since year 2000. Over the seven-year period, value stocks’ annualized return of 7.79% is 12.66% above the annualized return of (4.87)% for growth stocks. Between value stocks, larger value companies underperformed smaller value companies over the Period as the Russell 2000 Value Index returned 1.27% more than the Russell 1000 Value Index.

The Portfolio’s underperformance is primarily attributable to its industry exposures. Despite higher short-term interest rates and volatilities in energy prices, Real Estate and Energy were the two top performing industries in the market over the Period. The Portfolio’s performance was detracted by its underweighting to companies in Real Estate, Energy, and Telecom combined with its overweighting to Insurance companies.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at www.wilfunds.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Portfolio holdings subject to change. The Russell 1000 Value Index is an unmanaged index that measures the performance of the largest 1,000 companies with lower price-to-book ratios and lower forecasted growth values. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no taxes, transaction costs, management fees or other expenses. An individual cannot invest directly in any index.

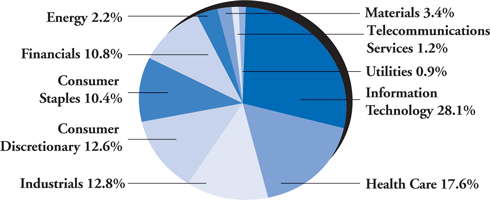

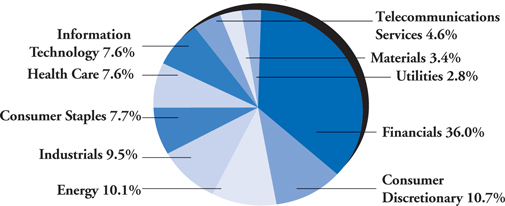

PORTFOLIO SECTOR WEIGHTING*

(As of December 31, 2006)

| * | Based on percent of Portfolio’s total investments in securities market value. |

9

| | |

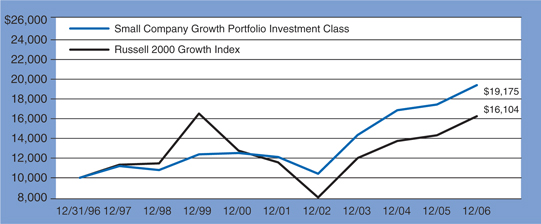

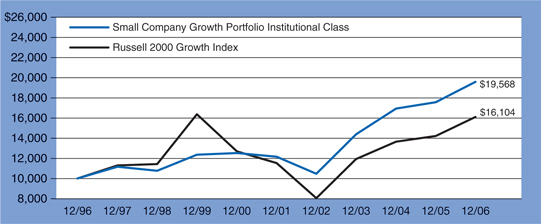

SMALL COMPANY GROWTH PORTFOLIO COMMENTARY | |  |

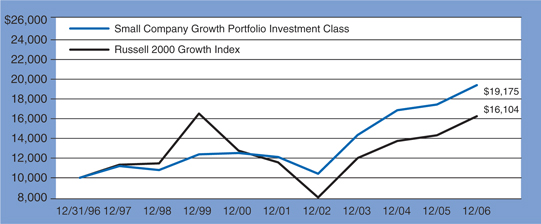

INVESTMENT CLASS SHARES

Average Annual Total Return *

| | | |

One Year Ended 12/31/06 | | 11.12 | % |

Five Years Ended 12/31/06 | | 9.71 | % |

Ten Years Ended 12/31/06 | | 6.73 | % |

COMPARATIVE PERFORMANCE

Comparison of Change in Value of $10,000 Investment in Shares of

Small Company Growth Portfolio and the Russell 2000 Growth Index

through 12/31/06.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at www.wilfunds.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The Russell 2000 Growth Index is an unmanaged index that measures the performance of the 2,000 smallest U.S. companies with higher price-to-book ratios and higher forecasted growth values. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no taxes, transaction costs, management fees or other expenses. An individual cannot invest directly in any index. The table above does not reflect the deduction that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

The Portfolio’s Investment Class annual operating expense ratio is 1.43% as of 12/31/06.

| * | Assumes reinvestment of all dividends and distributions. During certain periods since inception, certain fees and expenses were waived or reimbursed. For the year ended December 31, 2006, fees totaling 0.62% of average net assets were waived and reimbursed. Without such waivers and reimbursements, total returns since inception would have been lower. |

10

| | |

SMALL COMPANY GROWTH PORTFOLIO COMMENTARY - (CONTINUED) | |  |

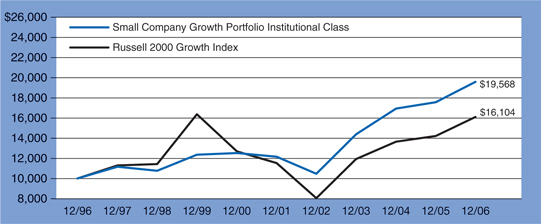

INSTITUTIONAL CLASS SHARES

Average Annual Total Return *

| | | |

One Year Ended 12/31/06 | | 11.46 | % |

Five Years Ended 12/31/06 | | 9.97 | % |

Ten Years Ended 12/31/06 | | 6.94 | % |

COMPARATIVE PERFORMANCE

Comparison of Change in Value of $10,000 Investment in Shares of

Small Company Growth Portfolio and the Russell 2000 Growth Index

through 12/31/06.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at www.wilfunds.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The Russell 2000 Growth Index is an unmanaged index that measures the performance of the 2,000 smallest U.S. companies with higher price-to-book ratios and higher forecasted growth values. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no taxes, transaction costs, management fees or other expenses. An individual cannot invest directly in any index. The table above does not reflect the deduction that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

The Portfolio’s Institutional Class annual operating expense ratio is 1.15% as of 12/31/06.

| * | Assumes reinvestment of all dividends and distributions. During certain periods since inception, certain fees and expenses were waived or reimbursed. For the year ended December 31, 2006, fees totaling 0.62% of average net assets were waived and reimbursed. Without such waivers and reimbursements, total returns since inception would have been lower. |

11

| | |

SMALL COMPANY GROWTH PORTFOLIO COMMENTARY - (CONTINUED) | |

|

The Small Company Growth Portfolio’s Investment Class Shares (the “Portfolio”) returned 11.12%, while Institutional Class Shares returned 11.46% for the 12-month period ended December 31, 2006 (the “Period”). The Portfolio delivered another year of positive returns to investors though its 11.40% return underperformed the 13.35% return for the Russell 2000 Growth Index over the Period.

For the Period, small growth companies performed much better relative to large growth companies as the Russell 2000 Growth Index outperformed the Russell 1000 Growth Index by 4.28% in 2006. Despite the double digit returns posted by small growth companies, small value companies were much better in 2006 returning 23.48%.

The Portfolio benefited from a quality bias as it focused on holding more companies with sustainable growth and fewer speculative growth companies in its portfolio. The Portfolio also participated in the industries where returns were strongest, such as Real Estate, Industrials, Transportation, and Basic Materials. The Portfolio’s performance was hampered by a handful of companies in its widely diversified portfolio. Investment environment for companies within the Technology sector continued to be challenging as the Portfolio’s holdings in Multi Fineline Electronics, Avid Technology, and Blue Coat Systems were among the main detractors of performance.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at www.wilfunds.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Small company stocks may be subject to a higher degree of market risk than the securities of more established companies because they tend to be more volatile and less liquid. Portfolio holdings subject to change. The Russell 2000 Growth Index is an unmanaged index that measures the performance of the 2,000 smallest U.S. companies with higher price-to-book ratios and higher forecasted growth values. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no taxes, transaction costs, management fees or other expenses. An individual cannot invest directly in any index.

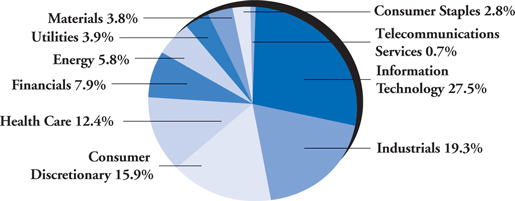

PORTFOLIO SECTOR WEIGHTING*

(As of December 31, 2006)

| * | Based on percent of Portfolio’s total investments in securities market value. |

12

| | |

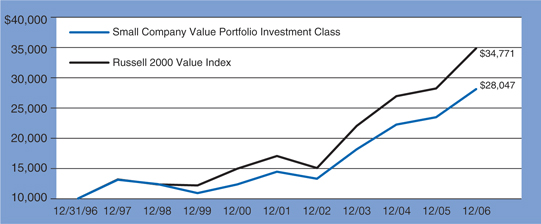

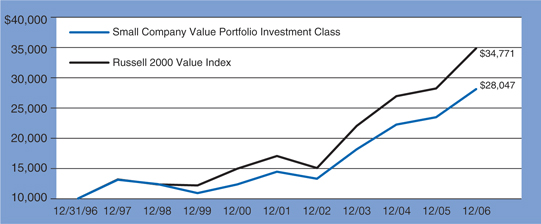

SMALL COMPANY VALUE PORTFOLIO COMMENTARY | |  |

INVESTMENT CLASS SHARES

Average Annual Total Return *

| | | |

One Year Ended 12/31/06 | | 19.64 | % |

Five Years Ended 12/31/06 | | 14.21 | % |

Ten Years Ended 12/31/06 | | 10.86 | % |

COMPARATIVE PERFORMANCE

Comparison of Change in Value of $10,000 Investment in Shares of

Small Company Value Portfolio and the Russell 2000 Value Index

through 12/31/06.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at www.wilfunds.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The Russell 2000 Value Index is an unmanaged index that measures the performance of the 2,000 smallest U.S. companies with lower price-to-book ratios and lower forecasted growth values. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no taxes, transaction costs, management fees or other expenses. An individual cannot invest directly in any index. The table above does not reflect the deduction that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

The Portfolio’s Investment Class annual operating expense ratio is 1.31% as of 12/31/06.

| * | Assumes reinvestment of all dividends and distributions. During certain periods since inception, certain fees and expenses were waived or reimbursed. For the year ended December 31, 2006, fees totaling 0.60% of average net assets were waived and reimbursed. Without such waivers and reimbursements, total returns since inception would have been lower. |

13

| | |

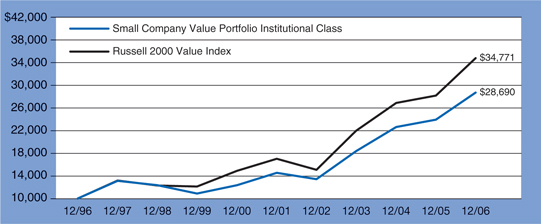

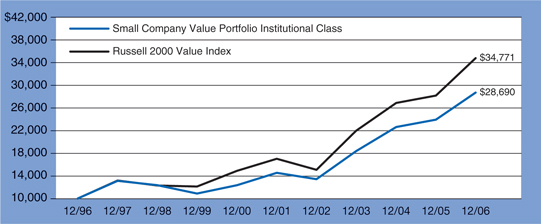

SMALL COMPANY VALUE PORTFOLIO COMMENTARY - (CONTINUED) | |  |

INSTITUTIONAL CLASS SHARES

Average Annual Total Return *

| | | |

One Year Ended 12/31/06 | | 20.05 | % |

Five Years Ended 12/31/06 | | 14.55 | % |

Ten Years Ended 12/31/06 | | 11.11 | % |

COMPARATIVE PERFORMANCE

Comparison of Change in Value of $10,000 Investment in Shares of

Small Company Value Portfolio and the Russell 2000 Value Index

through 12/31/06.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at www.wilfunds.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The Russell 2000 Value Index is an unmanaged index that measures the performance of the 2,000 smallest U.S. companies with lower price-to-book ratios and lower forecasted values. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no taxes, transaction costs, management fees or other expenses. An individual cannot invest directly in any index. The table above does not reflect the deduction that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

The Portfolio’s Institutional Class annual operating expense ratio is 1.02% as of 12/31/06.

| * | Assumes reinvestment of all dividends and distributions. During certain periods since inception, certain fees and expenses were waived or reimbursed. For the year ended December 31, 2006, fees totaling 0.60% of average net assets were waived and reimbursed. Without such waivers and reimbursements, total returns since inception would have been lower. |

14

| | |

SMALL COMPANY VALUE PORTFOLIO COMMENTARY - (CONTINUED) | |  |

The Small Company Value Portfolio’s Investment Class Shares (the “Portfolio”) gained 19.64% while Institutional Class Shares gained 20.05% during the 12-month period ended December 31, 2006 (the “Period”). The Portfolio delivered investors with strong positive returns though it underperformed the 23.48% return of the Russell 2000 Value Index. Small value companies were the strongest segment in the U.S. market.

For the third year in a row, small value stocks outperformed small growth stocks. Small growth stocks as measured by the Russell 2000 Growth Index returned 13.35% for the same period, trailing small value stocks by 10.13%. Small value companies also outperformed large value companies over the period though by a thinner margin of 1.27%.

Despite rising short-term interest rates and significant volatilities in energy and material prices, Real Estate, Utilities, and Energy were among the top performing industrial sectors within the small value universe. Technology continued to be a difficult sector for value investors. The Portfolio benefited from overall strong stock selection. Within the strong performing sectors, i.e. Real Estate, Utilities, and Energy, top contributors include Trammell Crow Co., Acergy SA and Harvest Natural Resources. These three stocks among a handful of companies in the Portfolio advanced more than 50% for the year. Positive contribution from stock selection was offset by the negative impact of the Portfolio’s relative overweighting to the Technology sector, which hampered the Portfolio’s overall performance for the Period.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at www.wilfunds.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Small company stocks may be subject to a higher degree of market risk than the securities of more established companies because they tend to be more volatile and less liquid. Portfolio holdings subject to change. The Russell 2000 Value Index is an unmanaged index that measures the performance of the 2,000 smallest U.S. companies with lower price-to-book ratios and lower forecasted growth values. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no taxes, transaction costs, management fees or other expenses. An individual cannot invest directly in any index.

15

| | |

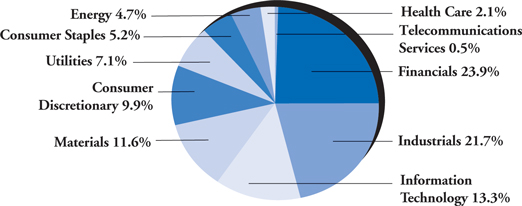

SMALL COMPANY VALUE PORTFOLIO COMMENTARY - (CONTINUED) | |  |

PORTFOLIO SECTOR WEIGHTING*

(As of December 31, 2006)

| * | Based on percent of Portfolio’s total investments in securities market value. |

16

| | |

DOW JONES WILSHIRE 5000 INDEX PORTFOLIO COMMENTARY | |

|

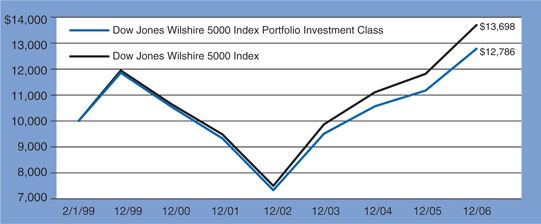

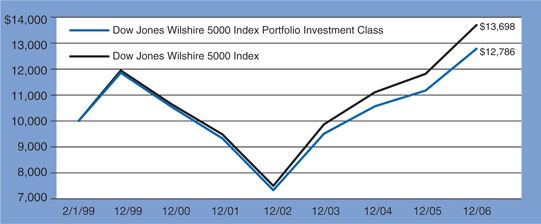

INVESTMENT CLASS SHARES

Average Annual Total Return *

| | | |

One Year Ended 12/31/06 | | 14.46 | % |

Five Years Ended 12/31/06 | | 6.51 | % |

Inception (2/1/99) through 12/31/06 | | 3.15 | % |

COMPARATIVE PERFORMANCE

Comparison of Change in Value of $10,000 Investment in Shares of

Dow Jones Wilshire 5000 Index Portfolio and the Dow Jones Wilshire 5000 Index

through 12/31/06.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at www.wilfunds.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The Dow Jones Wilshire 5000 Index is an unmanaged index that measures the performance of all U.S. headquartered equity securities with readily available price data. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no taxes, transaction costs, management fees or other expenses. An individual cannot invest directly in any index. The table above does not reflect the deduction that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

The Portfolio’s Investment Class annual operating expense ratio is 0.74% as of 12/31/06.

| * | Assumes reinvestment of all dividends and distributions. During certain periods since inception, certain fees and expenses were waived or reimbursed. For the year ended December 31, 2006, waivers were less than 0.01% of average net assets. Without such waivers and reimbursements, total returns since inception would have been lower. |

17

| | |

DOW JONES WILSHIRE 5000 INDEX PORTFOLIO COMMENTARY - (CONTINUED) | |  |

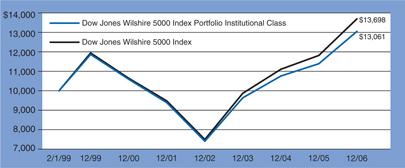

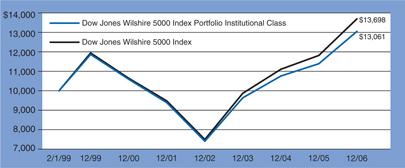

INSTITUTIONAL CLASS SHARES

Average Annual Total Return *

| | | |

One Year Ended 12/31/06 | | 14.66 | % |

Five Years Ended 12/31/06 | | 6.80 | % |

Inception (2/1/99) through 12/31/06 | | 3.43 | % |

COMPARATIVE PERFORMANCE

Comparison of Change in Value of $10,000 Investment in Shares of

Dow Jones Wilshire 5000 Index Portfolio and the Dow Jones Wilshire 5000 Index

through 12/31/06.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at www.wilfunds.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The Dow Jones Wilshire 5000 Index is an unmanaged index that measures the performance of all U.S. headquartered equity securities with readily available price data. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no taxes, transaction costs, management fees or other expenses. An individual cannot invest directly in any index. The table above does not reflect the deduction that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

The Portfolio’s Institutional Class annual operating expense ratio is 0.47% as of 12/31/06.

| * | Assumes reinvestment of all dividends and distributions. During certain periods since inception, certain fees and expenses were waived or reimbursed. For the year ended December 31, 2006, waivers were less than 0.01% of average net assets. Without such waivers and reimbursements, total returns since inception would have been lower. |

18

| | |

DOW JONES WILSHIRE 5000 INDEX PORTFOLIO COMMENTARY - (CONTINUED) | |

|

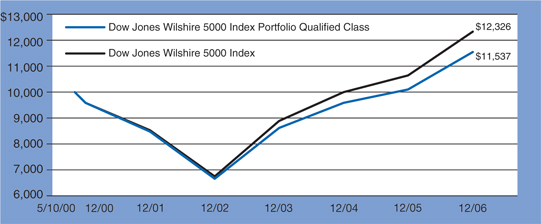

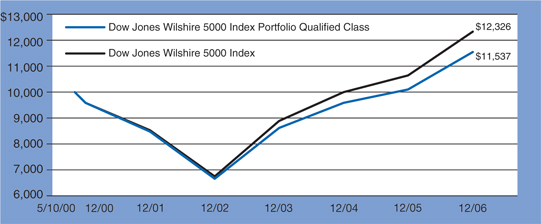

QUALIFIED CLASS SHARES

Average Annual Total Return *

| | | |

One Year Ended 12/31/06 | | 14.18 | % |

Five Years Ended 12/31/06 | | 6.37 | % |

Inception (5/10/00) through 12/31/06 | | 2.19 | % |

COMPARATIVE PERFORMANCE

Comparison of Change in Value of $10,000 Investment in Shares of

Dow Jones Wilshire 5000 Index Portfolio and the Dow Jones Wilshire 5000 Index

through 12/31/06.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at www.wilfunds.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The Dow Jones Wilshire 5000 Index is an unmanaged index that measures the performance of all U.S. headquartered equity securities with readily available price data. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no taxes, transaction costs, management fees or other expenses. An individual cannot invest directly in any index. The table above does not reflect the deduction that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

The Portfolio’s Qualified Class annual operating expense ratio is 0.83% as of 12/31/06.

| * | Assumes reinvestment of all dividends and distributions. During certain periods since inception, certain fees and expenses were waived or reimbursed. For the year ended December 31, 2006, waivers were less than 0.01% of average net assets. Without such waivers and reimbursements, total returns since inception would have been lower. |

19

| | |

DOW JONES WILSHIRE 5000 INDEX PORTFOLIO COMMENTARY - (CONTINUED) | |

|

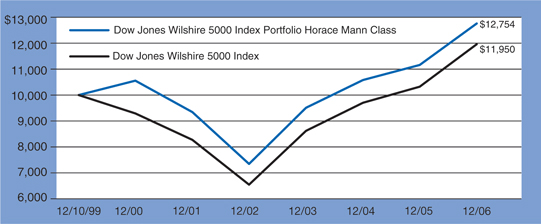

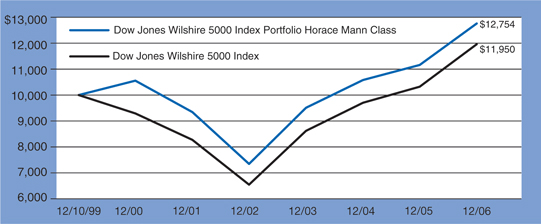

HORACE MANN CLASS SHARES

Average Annual Total Return *

| | | |

One Year Ended 12/31/06 | | 14.32 | % |

Five Years Ended 12/31/06 | | 6.44 | % |

Inception (12/10/99) through 12/31/06 | | 3.51 | % |

COMPARATIVE PERFORMANCE

Comparison of Change in Value of $10,000 Investment in Shares of

Dow Jones Wilshire 5000 Index Portfolio and the Dow Jones Wilshire 5000 Index

through 12/31/06.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at www.wilfunds.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The Dow Jones Wilshire 5000 Index is an unmanaged index that measures the performance of all U.S. headquartered equity securities with readily available price data. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no taxes, transaction costs, management fees or other expenses. An individual cannot invest directly in any index. The table above does not reflect the deduction that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

The Portfolio’s Horace Mann Class annual operating expense ratio is 0.77% as of 12/31/06.

| * | Assumes reinvestment of all dividends and distributions. During certain periods since inception, certain fees and expenses were waived or reimbursed. For the year ended December 31, 2006, waivers were less than 0.01% of average net assets. Without such waivers and reimbursements, total returns since inception would have been lower. |

20

| | |

DOW JONES WILSHIRE 5000 INDEX PORTFOLIO COMMENTARY - (CONTINUED) | |  |

Investment Class Shares of the Dow Jones Wilshire 5000 Index Portfolio (the “Portfolio”) returned 14.46% while Institutional Class Shares gained 14.66% for the 12-month period ended December 31, 2006 (the “Period”). The Period marked the fourth consecutive year of positive returns for the Portfolio and the U.S. equity market. The Portfolio’s benchmark, the Dow Jones Wilshire 5000 Index gained 15.77% for the Period. All classes of the Portfolio underperformed the benchmark.

Plagued by high energy prices, higher short-term interest rates, and declining home building activities, 2006 ended on a strong note as the broad U.S. equity market advanced more than 7% in the fourth quarter and finished the year in double digit returns. For most of the year, the Fed continued its rate hiking campaign, raising the key Fed Funds rate four times from 4.25% to 5.25%. The Period ended with an inverted yield curve despite the Fed’s pause in raising rates in the 4th quarter. Gross Domestic Product (GDP) growth slowed throughout the year from 5.6% in the 1st quarter to 2.0% in the 3rd quarter. Energy prices remained high and volatile throughout the Period. Rebounding in the 4th quarter, oil prices from the high levels of volatility experienced earlier in the year closed at $61 per barrel, down more than 20% from its all-time high near $78 in August.

The Portfolio’s underperformance during the year can be attributed to underweighting a number of the securities that performed significantly well, particularly in the Consumer Discretionary and Information Technology sectors. And the Portfolio did not hold some of the top performing financial companies such as American Real Estate Partner, BlackRock, Inc. and First Marblehead Corp. which detracted from performance as the securities each returned 124.2%, 41.7%, and 151.9%, respectively. However, the Portfolio benefited from its slight tilt towards more attractively priced securities, but it was not enough to offset the security selection in the Portfolio for the year.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at www.wilfunds.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Portfolio holdings subject to change. The Dow Jones Wilshire 5000 Index is an unmanaged index that measures the performance of all U.S. headquartered equity securities with readily available price data. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no taxes, transaction costs, management fees or other expenses. An individual cannot invest directly in any index.

21

| | |

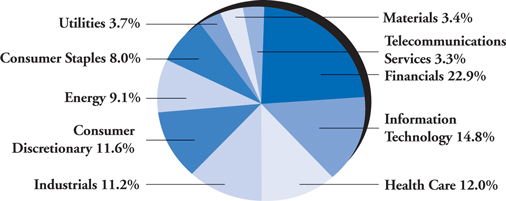

DOW JONES WILSHIRE 5000 INDEX PORTFOLIO COMMENTARY - (CONTINUED) | |  |

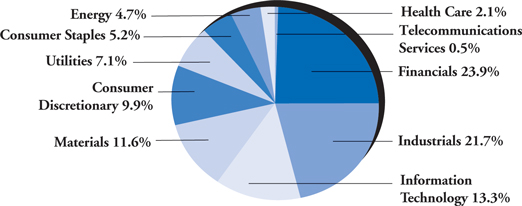

PORTFOLIO SECTOR WEIGHTING*

(As of December 31, 2006)

| * | Based on percent of Portfolio’s total investments in securities market value. |

22

| | |

WILSHIRE MUTUAL FUNDS, INC. DISCLOSUREOF FUND EXPENSES For the Six Month Period Ended December 31, 2006 | |  |

We believe it is important for you to understand the impact of fees regarding your investment. All mutual funds have operating expenses. As a shareholder of a Portfolio (or a “fund”), you incur ongoing costs, which include costs for investment advisory, administrative services, distribution and/or shareholder services and shareholder reports (like this one), among others. Operating expenses, which are deducted from a fund’s gross income, directly reduce the investment return of the fund. A fund’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing fees (in dollars) of investing in your fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

This table illustrates your fund’s costs in two ways:

Actual Fund Return: This section helps you to estimate the actual expenses, after any applicable fee waivers, that you paid over the period. The “Ending Account Value” shown is derived from the Portfolio’s actual return for the past six month period. The “Expense Ratio” column shows the period’s annualized expense ratio and the “Expenses Paid During Period” column shows the dollar amount that would have been paid by an investor who started with $1,000 in the Portfolio at the beginning of the period.

You may use the information here, together with your account value, to estimate the expenses that you paid over the period. To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your fund in the first line under the heading entitled “Expenses Paid During Period.”

Hypothetical 5% Return: This section is intended to help you compare your fund’s costs with those of other mutual funds. The “Ending Account Value” shown is derived from hypothetical account values and hypothetical expenses based on the Portfolio’s actual expense ratio and assumed rate of return. It assumes that the Portfolio had an annual return of 5% before expenses, but that the expense ratio is unchanged. In this case, because the return used is not the Portfolio’s actual return, the results do not apply to your investment. This example is useful in making comparisons to other mutual funds because the Securities and Exchange Commission requires all mutual funds to calculate expenses based on an assumed 5% annual return. You can assess your fund’s ongoing costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight and help you compare your ongoing costs only and do not reflect any transactional costs such as sales charges (loads), redemption fees, or exchange fees. Wilshire Mutual Funds, Inc. has no such charges, but these may be present in other funds to which you compare this data. Therefore, the hypothetical portions of the table are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

23

| | |

WILSHIRE MUTUAL FUNDS, INC. DISCLOSUREOF FUND EXPENSES - (Continued) For the Six Month Period Ended December 31, 2006 | |  |

| | | | | | | | | | | | |

| | | Beginning

Account

Value

07/01/06 | | Ending

Account

Value

12/31/06 | | Expense

Ratio (1) | | | Expenses Paid During Period

07/01/06 —12/31/06 (2) |

Large Company Growth Portfolio | | | | | | | | | | | | |

Actual Fund Return | | | | | | | | | | | | |

Investment Class | | $ | 1,000.00 | | $ | 1,063.80 | | 1.36 | % | | $ | 7.07 |

Institutional Class | | $ | 1,000.00 | | $ | 1,065.70 | | 1.00 | % | | $ | 5.21 |

Hypothetical 5% Return | | | | | | | | | | | | |

Investment Class | | $ | 1,000.00 | | $ | 1,018.35 | | 1.36 | % | | $ | 6.92 |

Institutional Class | | $ | 1,000.00 | | $ | 1,020.16 | | 1.00 | % | | $ | 5.09 |

| | | | |

Large Company Value Portfolio | | | | | | | | | | | | |

Actual Fund Return | | | | | | | | | | | | |

Investment Class | | $ | 1,000.00 | | $ | 1,132.50 | | 1.39 | % | | $ | 7.47 |

Institutional Class | | $ | 1,000.00 | | $ | 1,134.30 | | 1.09 | % | | $ | 5.86 |

Hypothetical 5% Return | | | | | | | | | | | | |

Investment Class | | $ | 1,000.00 | | $ | 1,018.20 | | 1.39 | % | | $ | 7.07 |

Institutional Class | | $ | 1,000.00 | | $ | 1,019.71 | | 1.09 | % | | $ | 5.55 |

| | | | |

Small Company Growth Portfolio | | | | | | | | | | | | |

Actual Fund Return | | | | | | | | | | | | |

Investment Class | | $ | 1,000.00 | | $ | 1,067.00 | | 1.50 | % | | $ | 7.81 |

Institutional Class | | $ | 1,000.00 | | $ | 1,068.80 | | 1.22 | % | | $ | 6.36 |

Hypothetical 5% Return | | | | | | | | | | | | |

Investment Class | | $ | 1,000.00 | | $ | 1,017.64 | | 1.50 | % | | $ | 7.63 |

Institutional Class | | $ | 1,000.00 | | $ | 1,019.06 | | 1.22 | % | | $ | 6.21 |

| | | | |

Small Company Value Portfolio | | | | | | | | | | | | |

Actual Fund Return | | | | | | | | | | | | |

Investment Class | | $ | 1,000.00 | | $ | 1,078.40 | | 1.24 | % | | $ | 6.50 |

Institutional Class | | $ | 1,000.00 | | $ | 1,080.50 | | 1.01 | % | | $ | 5.30 |

Hypothetical 5% Return | | | | | | | | | | | | |

Investment Class | | $ | 1,000.00 | | $ | 1,018.95 | | 1.24 | % | | $ | 6.31 |

Institutional Class | | $ | 1,000.00 | | $ | 1,020.11 | | 1.01 | % | | $ | 5.14 |

| | | | |

Dow Jones Wilshire 5000 Index Portfolio | | | | | | | | | | | | |

Actual Fund Return | | | | | | | | | | | | |

Investment Class | | $ | 1,000.00 | | $ | 1,114.10 | | 0.69 | % | | $ | 3.68 |

Institutional Class | | $ | 1,000.00 | | $ | 1,114.00 | | 0.45 | % | | $ | 2.40 |

Qualified Class | | $ | 1,000.00 | | $ | 1,111.40 | | 0.81 | % | | $ | 4.31 |

Horace Mann Class | | $ | 1,000.00 | | $ | 1,112.70 | | 0.73 | % | | $ | 3.89 |

Hypothetical 5% Return | | | | | | | | | | | | |

Investment Class | | $ | 1,000.00 | | $ | 1,021.73 | | 0.69 | % | | $ | 3.52 |

Institutional Class | | $ | 1,000.00 | | $ | 1,022.94 | | 0.45 | % | | $ | 2.29 |

Qualified Class | | $ | 1,000.00 | | $ | 1,021.12 | | 0.81 | % | | $ | 4.13 |

Horace Mann Class | | $ | 1,000.00 | | $ | 1,021.53 | | 0.73 | % | | $ | 3.72 |

| (1) | Annualized, based on the Portfolio’s most recent fiscal half-year expenses. |

| (2) | Expenses are equal to the Portfolio’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the period, then divided by 365. |

24

| | | | |

WILSHIRE MUTUAL FUNDS, INC. LARGE COMPANY GROWTH PORTFOLIO SCHEDULEOF INVESTMENTS | | December 31, 2006 | |  |

| | | | | |

| Shares | | Value |

| COMMON STOCK — 99.8% | | | |

| |

| Consumer Discretionary — 12.6% | | | |

| 24,769 | | Amazon.com, Inc.† | | $ | 977,385 |

| 53,250 | | American Eagle Outfitters | | | 1,661,933 |

| 19,556 | | Apollo Group, Inc., Class A† | | | 762,097 |

| 21,900 | | Autoliv, Inc. | | | 1,320,570 |

| 67,500 | | Autonation, Inc.† | | | 1,439,100 |

| 7,600 | | Best Buy Co., Inc. | | | 373,844 |

| 24,200 | | Big Lots, Inc.† | | | 554,664 |

| 24,553 | | Cablevision Systems Corp., Class A | | | 699,269 |

| 67,749 | | CBS Corp., Class B | | | 2,112,414 |

| 23,700 | | Choice Hotels International, Inc. | | | 997,770 |

| 82,266 | | Circuit City Stores, Inc. | | | 1,561,409 |

| 74,200 | | Comcast Corp., Class A† | | | 3,140,886 |

| 49,900 | | Darden Restaurants, Inc. | | | 2,004,483 |

| 38,200 | | Dillard’s, Inc., Class A | | | 1,335,854 |

| 25,200 | | DIRECTV Group, Inc. (The)† | | | 628,488 |

| 7,200 | | Harman International Industries, Inc. | | | 719,352 |

| 5,300 | | Home Depot, Inc. | | | 212,848 |

| 6,300 | | IAC/InterActiveCorp.† | | | 234,108 |

| 175,000 | | International Game Technology | | | 8,085,000 |

| 13,370 | | Jarden Corp.† | | | 465,142 |

| 19,400 | | Johnson Controls, Inc. | | | 1,666,848 |

| 49,300 | | Marriott International, Inc., Class A | | | 2,352,596 |

| 37,900 | | McGraw-Hill Cos., Inc. (The) | | | 2,577,958 |

| 130,000 | | MGM Mirage† | | | 7,455,500 |

| 1,400 | | Nutri/System, Inc.† | | | 88,746 |

| 68,127 | | Office Depot, Inc.† | | | 2,600,408 |

| 39,353 | | OfficeMax, Inc. | | | 1,953,876 |

| 5,300 | | R.H. Donnelley Corp.† | | | 332,469 |

| 25,420 | | Saks, Inc. | | | 452,984 |

| 350,000 | | Staples, Inc. | | | 9,345,000 |

| 78,400 | | Starbucks Corp.† | | | 2,776,928 |

| 4,200 | | Target Corp. | | | 239,610 |

| 1,560 | | Tiffany & Co. | | | 61,214 |

| 211,379 | | Time Warner, Inc. | | | 4,603,835 |

| 25,800 | | TJX Cos., Inc. | | | 735,816 |

| 15,600 | | United Auto Group, Inc. | | | 367,692 |

| 82,900 | | Walt Disney Co. (The) | | | 2,840,983 |

| 115,000 | | Weight Watchers International, Inc. | | | 6,040,950 |

| 9,200 | | Wendy’s International, Inc. | | | 304,428 |

| 800 | | Yum! Brands, Inc. | | | 47,040 |

| | | | | |

| | | | | 76,131,497 |

| | | | | |

| |

| Consumer Staples — 10.4% | | | |

| 29,195 | | Altria Group, Inc. | | | 2,505,515 |

| 15,366 | | Anheuser-Busch Cos., Inc. | | | 756,007 |

| 20,600 | | Archer-Daniels-Midland Co. | | | 658,376 |

| 78,497 | | Avon Products, Inc. | | | 2,593,541 |

| 76,600 | | Coca-Cola Co. (The) | | | 3,695,950 |

| 17,300 | | Colgate-Palmolive Co. | | | 1,128,652 |

| 51,800 | | Costco Wholesale Corp. | | | 2,738,666 |

| 28,666 | | CVS Corp. | | | 886,066 |

| 29,900 | | Dean Foods Co.† | | | 1,264,172 |

| 29,900 | | Energizer Holdings, Inc.† | | | 2,122,601 |

| 60 | | Estee Lauder Cos., Inc.(The), Class A | | | 2,449 |

| 22,900 | | General Mills, Inc. | | | 1,319,040 |

| 8,530 | | HJ Heinz Co. | | | 383,935 |

| 831 | | Kellogg Co. | | | 41,600 |

| 22,900 | | Kroger Co. (The) | | | 528,303 |

| 6,173 | | Molson Coors Brewing Co., Class B | | | 471,864 |

| 57,000 | | PepsiCo, Inc. | | | 3,565,350 |

| 199,185 | | Procter & Gamble Co. | | | 12,801,620 |

| 34,500 | | Safeway, Inc. | | | 1,192,320 |

| 33,111 | | Tyson Foods, Inc., Class A | | | 544,676 |

| 36,100 | | UST, Inc. | | | 2,101,020 |

See Notes to Financial Statements.

25

| | | | |

WILSHIRE MUTUAL FUNDS, INC. LARGE COMPANY GROWTH PORTFOLIO SCHEDULEOF INVESTMENTS - (CONTINUED) | | December 31, 2006 | |  |

| | | | | |

| Shares | | Value |

| Consumer Staples (continued) | | | |

| 210,850 | | Walgreen Co. | | $ | 9,675,907 |

| 254,149 | | Wal-Mart Stores, Inc. | | | 11,736,601 |

| | | | | |

| | | | | 62,714,231 |

| | | | | |

| |

| Energy — 2.2% | | | |

| 3,200 | | Baker Hughes, Inc. | | | 238,912 |

| 7,946 | | ConocoPhillips | | | 571,715 |

| 25,900 | | Devon Energy Corp. | | | 1,737,372 |

| 91,600 | | Exxon Mobil Corp. | | | 7,019,308 |

| 11,000 | | Holly Corp. | | | 565,400 |

| 8,000 | | Marathon Oil Corp. | | | 740,000 |

| 20,000 | | Overseas Shipholding Group | | | 1,126,000 |

| 19,000 | | Schlumberger, Ltd. | | | 1,200,040 |

| 4,300 | | Tidewater, Inc. | | | 207,948 |

| | | | | |

| | | | | 13,406,695 |

| | | | | |

| |

| Financials — 10.8% | | | |

| 4,800 | | AMBAC Financial Group, Inc. | | | 427,536 |

| 12,400 | | American Express Co. | | | 752,308 |

| 63,600 | | AmeriCredit Corp.† | | | 1,600,812 |

| 33,800 | | Ameriprise Financial, Inc. | | | 1,842,100 |

| 16,896 | | CB Richard Ellis Group, Inc., Class A† | | | 560,947 |

| 106,000 | | Charles Schwab Corp. (The) | | | 2,050,040 |

| 20,500 | | Chicago Mercantile Exchange Holdings, Inc., Class A | | | 10,449,875 |

| 23,484 | | Commerce Bancorp, Inc. | | | 828,281 |

| 47,400 | | Countrywide Financial Corp. | | | 2,012,130 |

| 1,784 | | Eaton Vance Corp. | | | 58,890 |

| 23,679 | | Fannie Mae | | | 1,406,296 |

| 17,965 | | Federated Investors, Inc., Class B | | | 606,858 |

| 5,993 | | Fidelity National Financial, Inc., Class A | | | 143,113 |

| 9,300 | | Freddie Mac | | | 631,470 |

| 100 | | General Growth Properties, Inc. | | | 5,223 |

| 12,379 | | Hartford Financial Services Group, Inc. | | | 1,155,084 |

| 1 | | Hudson City Bancorp, Inc. | | | 14 |

| 88,000 | | IntercontinentalExchange, Inc.† | | | 9,495,200 |

| 19,600 | | Janus Capital Group, Inc. | | | 423,164 |

| 10,100 | | Jones Lang LaSalle, Inc. | | | 930,917 |

| 46,000 | | JPMorgan Chase & Co. | | | 2,221,800 |

| 14,500 | | Lehman Brothers Holdings, Inc. | | | 1,132,740 |

| 25,215 | | MBIA, Inc. | | | 1,842,208 |

| 192,306 | | Moody’s Corp. | | | 13,280,652 |

| 23,600 | | Morgan Stanley | | | 1,921,748 |

| 559 | | Nationwide Financial Services, Class A | | | 30,298 |

| 4,000 | | Principal Financial Group, Inc. | | | 234,800 |

| 69,708 | | Progressive Corp. (The) | | | 1,688,328 |

| 5,300 | | Public Storage, Inc. | | | 516,750 |

| 10,468 | | Realogy Corp.† | | | 317,390 |

| 13,600 | | SEI Investments Co. | | | 810,016 |

| 8,100 | | SL Green Realty Corp. | | | 1,075,518 |

| 33,958 | | T. Rowe Price Group, Inc. | | | 1,486,341 |

| 73,225 | | TD Ameritrade Holding Corp. | | | 1,184,780 |

| 51,258 | | UnumProvident Corp. | | | 1,065,141 |

| 34,500 | | W.R. Berkley Corp. | | | 1,190,595 |

| | | | | |

| | | | | 65,379,363 |

| | | | | |

| |

| Health Care — 17.5% | | | |

| 26,520 | | Abbott Laboratories | | | 1,291,789 |

| 21,784 | | Abraxis BioScience, Inc.† | | | 595,575 |

| 75,000 | | Allergan, Inc. | | | 8,980,500 |

| 49,200 | | AmerisourceBergen Corp. | | | 2,212,032 |

| 118,341 | | Amgen, Inc.† | | | 8,083,874 |

See Notes to Financial Statements.

26

| | | | |

WILSHIRE MUTUAL FUNDS, INC. LARGE COMPANY GROWTH PORTFOLIO SCHEDULEOF INVESTMENTS - (CONTINUED) | | December 31, 2006 | |  |

| | | | | |

| Shares | | Value |

| Health Care (continued) |

| 18,300 | | Amylin Pharmaceuticals, Inc.† | | $ | 660,081 |

| 63,500 | | Applera Corp.—Applied Biosystems Group | | | 2,329,815 |

| 5,000 | | Bard (C.R.), Inc. | | | 414,850 |

| 21,400 | | Becton Dickinson & Co. | | | 1,501,210 |

| 13,700 | | Biogen Idec, Inc.† | | | 673,903 |

| 32,391 | | Cardinal Health, Inc. | | | 2,086,952 |

| 88,745 | | Caremark Rx, Inc. | | | 5,068,227 |

| 43,600 | | Celgene Corp.† | | | 2,508,308 |

| 2,434 | | Cigna Corp. | | | 320,241 |

| 7,000 | | Dentsply International, Inc. | | | 208,950 |

| 28,600 | | Eli Lilly & Co. | | | 1,490,060 |

| 38,500 | | Emdeon Corp.† | | | 477,015 |

| 29,200 | | Forest Laboratories, Inc.† | | | 1,477,520 |

| 169,288 | | Genentech, Inc.† | | | 13,734,336 |

| 59,441 | | Genzyme Corp.† | | | 3,660,377 |

| 400 | | Hospira, Inc.† | | | 13,432 |

| 39,100 | | Humana, Inc.† | | | 2,162,621 |

| 178,828 | | Johnson & Johnson | | | 11,806,225 |

| 34,800 | | King Pharmaceuticals, Inc.† | | | 554,016 |

| 43,500 | | McKesson Corp. | | | 2,205,450 |

| 74,040 | | Medtronic, Inc. | | | 3,961,880 |

| 70,300 | | Merck & Co., Inc. | | | 3,065,080 |

| 3,700 | | PerkinElmer, Inc. | | | 82,251 |

| 83,827 | | Pfizer, Inc. | | | 2,171,119 |

| 2,860 | | Thermo Fisher Scientific, Inc.† | | | 129,529 |

| 195,000 | | UnitedHealth Group, Inc. | | | 10,477,350 |

| 17,600 | | Waters Corp.† | | | 861,872 |

| 20,474 | | Wyeth | | | 1,042,536 |

| 122,700 | | Zimmer Holdings, Inc.† | | | 9,617,226 |

| | | | | |

| | | | | 105,926,202 |

| | | | | |

| Industrials — 12.8% |

| 27,750 | | 3M Co. | | | 2,162,558 |

| 63,498 | | AGCO Corp.† | | | 1,964,628 |

| 26,009 | | American Standard Cos., Inc. | | | 1,192,513 |

| 4,372 | | Avery Dennison Corp. | | | 296,990 |

| 3,747 | | Avis Budget Group, Inc. | | | 81,272 |

| 55,095 | | Boeing Co. | | | 4,894,640 |

| 35,952 | | Burlington Northern Santa Fe Corp. | | | 2,653,617 |

| 23,700 | | Caterpillar, Inc. | | | 1,453,521 |

| 4,136 | | Con-way, Inc. | | | 182,149 |

| 4,000 | | Corrections Corp. of America† | | | 180,920 |

| 72,500 | | CSX Corp. | | | 2,496,175 |

| 15,200 | | DRS Technologies, Inc. | | | 800,736 |

| 165,000 | | Expeditors International Washington, Inc. | | | 6,682,500 |

| 19,280 | | FedEx Corp. | | | 2,094,194 |

| 11,940 | | GATX Corp. | | | 517,360 |

| 220,093 | | General Electric Co. | | | 8,189,661 |

| 16,700 | | Goodrich Corp. | | | 760,685 |

| 46,400 | | Honeywell International, Inc. | | | 2,099,136 |

| 6,400 | | Illinois Tool Works, Inc. | | | 295,616 |

| 6,400 | | ITT Corp. | | | 363,648 |

| 9,900 | | Laidlaw International, Inc. | | | 301,257 |

| 5,800 | | Lockheed Martin Corp . | | | 534,006 |

| 32,000 | | Manpower, Inc. | | | 2,397,760 |

| 51,300 | | Norfolk Southern Corp. | | | 2,579,877 |

| 32,500 | | Northrop Grumman Corp. | | | 2,200,250 |

| 8,900 | | Paccar, Inc. | | | 577,610 |

| 8,700 | | Pall Corp. | | | 300,585 |

| 42,900 | | Pitney Bowes, Inc. | | | 1,981,551 |

| 21,500 | | Precision Castparts Corp. | | | 1,683,020 |

| 9,100 | | Raytheon Co. | | | 480,480 |

| 9,700 | | Republic Services, Inc. | | | 394,499 |

| 4,000 | | Steelcase, Inc., Class A | | | 72,640 |

| 9,100 | | Swift Transportation Co., Inc.† | | | 239,057 |

| 29,300 | | Terex Corp.† | | �� | 1,892,194 |

| 18,151 | | Textron, Inc. | | | 1,702,019 |

| 21,902 | | Timken Co. | | | 639,100 |

| 24,600 | | Tyco International, Ltd. | | | 747,840 |

See Notes to Financial Statements.

27

| | | | |

WILSHIRE MUTUAL FUNDS, INC LARGE COMPANY GROWTH PORTFOLIO SCHEDULEOF INVESTMENTS - (CONTINUED) | | December 31, 2006 | |  |

| | | | | |

| Shares | | Value |

| Industrials (continued) | | | |

| 2,000 | | Union Pacific Corp. | | $ | 184,040 |

| 169,944 | | United Parcel Service, Inc., Class B | | | 12,742,401 |

| 8,800 | | United Rentals, Inc.† | | | 223,784 |

| 50,500 | | United Technologies Corp. | | | 3,157,260 |

| 58,400 | | Waste Management, Inc. | | | 2,147,368 |

| 12,300 | | WESCO International, Inc.† | | | 723,363 |

| 1,394 | | YRC Worldwide, Inc.† | | | 52,596 |

| | | | | |

| | | | | 77,317,076 |

| | | | | |

| |

| Information Technology — 28.0% | | | |

| 28,000 | | Agere Systems, Inc.† | | | 536,760 |

| 14,294 | | Amphenol Corp., Class A | | | 887,371 |

| 33,916 | | Analog Devices, Inc. | | | 1,114,819 |

| 2,500 | | Apple Computer, Inc.† | | | 212,100 |

| 3,050 | | Applied Materials, Inc. | | | 56,272 |

| 100 | | Arrow Electronics, Inc.† | | | 3,155 |

| 100 | | Atmel Corp.† | | | 605 |

| 10,400 | | AVX Corp. | | | 153,816 |

| 513,384 | | Cisco Systems, Inc.† | | | 14,030,785 |

| 16,902 | | Citrix Systems, Inc.† | | | 457,199 |

| 37,900 | | Computer Sciences Corp.† | | | 2,022,723 |

| 21,353 | | Corning, Inc.† | | | 399,515 |

| 42,848 | | Cypress Semiconductor Corp.† | | | 722,846 |

| 20,811 | | Dell, Inc.† | | | 522,148 |

| 1,958 | | Diebold, Inc. | | | 91,243 |

| 306,379 | | eBay, Inc.† | | | 9,212,816 |

| 27,490 | | EMC Corp.† | | | 362,868 |

| 80 | | Fidelity National Information Services, Inc. | | | 3,207 |

| 70,000 | | First Data Corp. | | | 1,786,400 |

| 36,420 | | Google, Inc., Class A† | | | 16,770,682 |

| 12,994 | | Hewitt Associates, Inc., Class A† | | | 334,595 |

| 109,400 | | Hewlett-Packard Co. | | | 4,506,186 |

| 257,720 | | Intel Corp. | | | 5,218,830 |

| 40,417 | | International Business Machines Corp. | | | 3,926,512 |

| 31 | | International Rectifier Corp.† | | | 1,194 |

| 91,800 | | Intersil Corp., Class A | | | 2,195,856 |

| 306,900 | | Intuit, Inc.† | | | 9,363,519 |

| 27,564 | | Jabil Circuit, Inc. | | | 676,696 |

| 28,690 | | Juniper Networks, Inc.† | | | 543,389 |

| 1,700 | | KLA-Tencor Corp. | | | 84,575 |

| 4,100 | | Lam Research Corp.† | | | 207,542 |

| 33,400 | | Lexmark International, Inc., Class A† | | | 2,444,880 |

| 17,077 | | Linear Technology Corp. | | | 517,775 |

| 18,362 | | McAfee, Inc.† | | | 521,114 |

| 7,000 | | MEMC Electronic Materials, Inc.† | | | 273,980 |

| 3,928 | | Mettler-Toledo International, Inc.† | | | 309,723 |

| 157,300 | | Micron Technology, Inc.† | | | 2,195,908 |

| 588,166 | | Microsoft Corp. | | | 17,562,637 |

| 120,200 | | Motorola, Inc. | | | 2,471,312 |

| 17,300 | | Network Appliance, Inc.† | | | 679,544 |

| 66,600 | | Novellus Systems, Inc.† | | | 2,292,372 |

| 24,500 | | Oracle Corp.† | | | 419,930 |

| 195,000 | | Paychex, Inc. | | | 7,710,300 |

| 15,100 | | Polycom, Inc.† | | | 466,741 |

| 329,867 | | QUALCOMM, Inc. | | | 12,465,674 |

| 37,000 | | Research In Motion, Ltd.† | | | 4,727,860 |

| 170,000 | | SanDisk Corp.† | | | 7,315,100 |

| 355,000 | | Seagate Technology | | | 9,407,500 |

| 385,982 | | Sun Microsystems, Inc.† | | | 2,092,022 |

| 89,500 | | Symantec Corp.† | | | 1,866,075 |

| 104,078 | | Synopsys, Inc.† | | | 2,782,005 |

| 34,498 | | Tech Data Corp.† | | | 1,306,439 |

| 18,500 | | Teradyne, Inc.† | | | 276,760 |

| 146,118 | | Texas Instruments, Inc. | | | 4,208,198 |

| 100 | | Unisys Corp.† | | | 784 |

| 28,352 | | VeriSign, Inc.† | | | 681,866 |

| 57,400 | | Western Digital Corp.† | | | 1,174,404 |

See Notes to Financial Statements.

28

| | | | |

WILSHIRE MUTUAL FUNDS, INC. LARGE COMPANY GROWTH PORTFOLIO SCHEDULEOF INVESTMENTS - (CONTINUED) | | December 31, 2006 | |  |

| | | | | |

| Shares | | Value |

| Information Technology (continued) | | | |

| 238,100 | | Western Union Co. (The) | | $ | 5,338,202 |

| 65,560 | | Yahoo!, Inc.† | | | 1,674,402 |

| | | | | |

| | | | | 169,589,731 |

| | | | | |

| |

| Materials — 3.4% | | | |

| 15,900 | | Ashland, Inc. | | | 1,099,962 |

| 14,596 | | Cabot Corp. | | | 635,948 |

| 83,166 | | Dow Chemical Co. (The) | | | 3,321,650 |

| 19,187 | | FMC Corp. | | | 1,468,765 |

| 10,303 | | Huntsman Corp.† | | | 195,448 |

| 12,064 | | International Flavors & Fragrances, Inc. | | | 593,066 |

| 61,500 | | Monsanto Co. | | | 3,230,595 |

| 7,600 | | Newmont Mining Corp. | | | 343,140 |

| 14,500 | | Nucor Corp. | | | 792,570 |

| 31,666 | | Owens-Illinois, Inc.† | | | 584,237 |

| 125,000 | | Praxair, Inc. | | | 7,416,250 |

| 15,200 | | Southern Copper Corp. | | | 819,128 |

| | | | | |

| | | | | 20,500,759 |

| | | | | |

| |

| Telecommunication Services — 1.2% | | | |

| 24,500 | | CenturyTel, Inc. | | | 1,069,670 |

| 105,316 | | Level 3 Communications, Inc.† | | | 589,770 |

| 4,300 | | NII Holdings, Inc.† | | | 277,092 |

| 142,104 | | Qwest Communications International, Inc.† | | | 1,189,410 |

| 206,157 | | Sprint Nextel Corp. | | | 3,894,306 |

| | | | | |

| | | | | 7,020,248 |

| | | | | |

| Utilities — 0.9% | | | |

| 1,880 | | Exelon Corp. | | | 116,353 |

| 6,749 | | FPL Group, Inc. | | | 367,281 |

| 24,600 | | ONEOK, Inc. | | | 1,060,752 |

| 29,300 | | PG&E Corp. | | | 1,386,769 |

| 49,500 | | TXU Corp. | | | 2,683,395 |

| | | | | |

| | | | | 5,614,550 |

| | | | | |

| | | |

| |

Total Investments — 99.8% | | | |

(Cost $ 491,183,785) | | | 603,600,352 |

Other Assets & Liabilities, Net — 0.2% | | | 1,015,572 |

| | | |

| NET ASSETS — 100.0% | | $ | 604,615,924 |

| | | |

FUTURES CONTRACTS—LONG POSITIONS

| | | | | |

Number of

Contracts | | | | Unrealized Appreciation |

| 4 | | CME E-Mini S&P 500, Expires March 2007 | | $ | 642 |

| | | | | |

| † | Non-income producing security. |

See Notes to Financial Statements.

29

| | | | |

WILSHIRE MUTUAL FUNDS, INC. LARGE COMPANY VALUE PORTFOLIO SCHEDULEOF INVESTMENTS | | December 31, 2006 | |  |

| | | | | |

| Shares | | Value |

| COMMON STOCK — 96.2% | | | |

| |

| Consumer Discretionary — 10.3% | | | |

| 2,100 | | Autoliv, Inc. | | $ | 126,630 |

| 7,700 | | Autozone, Inc.† | | | 889,812 |

| 1,200 | | Black & Decker Corp. | | | 95,964 |

| 1,300 | | BorgWarner, Inc. | | | 76,726 |

| 10,000 | | Cablevision Systems Corp., Class A | | | 284,800 |

| 15,702 | | CBS Corp., Class B(a) | | | 489,588 |

| 6,700 | | Comcast Corp., Class A†(a) | | | 283,611 |

| 1,900 | | DaimlerChrysler AG | | | 116,679 |

| 1,700 | | Dillard’s, Inc., Class A | | | 59,449 |

| 1,300 | | Dollar Tree Stores, Inc.† | | | 39,130 |

| 5,700 | | Gap, Inc. (The) | | | 111,150 |

| 800 | | Harman International Industries, Inc. | | | 79,928 |

| 15,000 | | Home Depot, Inc. | | | 602,400 |

| 497 | | Idearc, Inc.† | | | 14,239 |

| 6,300 | | Interpublic Group of Cos., Inc.† | | | 77,112 |

| 9,798 | | Johnson Controls, Inc. | | | 841,844 |

| 1,200 | | Jones Apparel Group, Inc. | | | 40,116 |

| 138 | | Liberty Global, Inc., Class A† | | | 4,023 |

| 5,200 | | Limited Brands, Inc. | | | 150,488 |

| 14,525 | | Magna International, Inc., Class A | | | 1,169,989 |

| 3,100 | | Mattel, Inc. | | | 70,246 |

| 5,900 | | McDonald’s Corp. | | | 261,547 |

| 3,400 | | Office Depot, Inc.†. | | | 129,778 |

| 3,014 | | OfficeMax, Inc. | | | 149,645 |

| 2,600 | | Saks, Inc. | | | 46,332 |

| 39,357 | | Time Warner, Inc. | | | 857,195 |

| 21,350 | | TJX Cos., Inc. | | | 608,902 |

| 1,300 | | Viacom, Inc., Class B† | | | 53,339 |

| 1,300 | | Walt Disney Co. (The) | | | 44,551 |

| 10,525 | | Whirlpool Corp.(a) | | | 873,786 |

| | | | | |

| | | | | 8,648,999 |

| | | | | |

| |

| Consumer Staples — 7.4% | | | |

| 5,624 | | Altria Group, Inc. | | $ | 482,652 |

| 11,532 | | Anheuser-Busch Cos., Inc. | | | 567,374 |

| 18,058 | | Avon Products, Inc.(a) | | | 596,636 |

| 3,300 | | Brown-Forman Corp., Class B | | | 218,592 |

| 4,975 | | Clorox Co. | | | 319,146 |

| 2,300 | | Colgate-Palmolive Co. | | | 150,052 |

| 3,000 | | ConAgra Foods, Inc. | | | 81,000 |

| 2,600 | | General Mills, Inc. | | | 149,760 |

| 200 | | HJ Heinz Co. | | | 9,002 |

| 14,163 | | Kellogg Co. | | | 709,000 |

| 9,200 | | Kimberly-Clark Corp. | | | 625,140 |

| 7,400 | | Kroger Co. (The) | | | 170,718 |

| 600 | | Loews Corp. - Carolina Group | | | 38,832 |

| 1,675 | | Molson Coors Brewing Co., Class B | | | 128,037 |

| 6,600 | | Procter & Gamble Co. | | | 424,182 |

| 2,216 | | Reynolds American, Inc.(a) | | | 145,082 |

| 13,925 | | Sara Lee Corp. | | | 237,143 |

| 500 | | Supervalu, Inc.(a) | | | 17,875 |

| 800 | | Tyson Foods, Inc., Class A | | | 13,160 |

| 500 | | UST, Inc.(a) | | | 29,100 |

| 23,375 | | Wal-Mart Stores, Inc. | | | 1,079,457 |

| | | | | |

| | | | | 6,191,940 |

| | | | | |

| |

| Energy — 9.7% | | | |

| 700 | | Apache Corp. | | | 46,557 |

| 13,195 | | Arch Coal, Inc.(a) | | | 396,246 |

| 10,375 | | BP PLC ADR | | | 696,163 |

| 23,078 | | Chevron Corp. | | | 1,696,925 |

| 20,737 | | ConocoPhillips | | | 1,492,027 |

| 1,368 | | Devon Energy Corp. | | | 91,765 |

| 3,736 | | EOG Resources, Inc. | | | 233,313 |

| 37,049 | | Exxon Mobil Corp. | | | 2,839,065 |

| 425 | | GlobalSantaFe Corp. | | | 24,982 |

| 4,506 | | Hess Corp.(a) | | | 223,362 |

| 2,300 | | Marathon Oil Corp. | | | 212,750 |

See Notes to Financial Statements.

30

| | | | |

WILSHIRE MUTUAL FUNDS, INC. LARGE COMPANY VALUE PORTFOLIO SCHEDULEOF INVESTMENTS - (CONTINUED) | | December 31, 2006 | |  |

| | | | | |

| Shares | | Value |

| Energy (continued) | | | |

| 650 | | Occidental Petroleum Corp. | | $ | 31,740 |

| 426 | | Pioneer Natural Resources Co. | | | 16,908 |

| 900 | | Royal Dutch Shell PLC ADR | | | 63,711 |

| 1,300 | | Total SA ADR | | | 93,496 |

| | | | | |

| | | | | 8,159,010 |

| | | | | |

| |

| Financials — 34.6% | | | |

| 1,800 | | ACE, Ltd. | | | 109,026 |

| 15,650 | | Allstate Corp. (The) | | | 1,018,972 |

| 250 | | AMBAC Financial Group, Inc. | | | 22,268 |

| 9,370 | | American International | | | |

| | Group, Inc. | | | 671,454 |

| 10,325 | | AON Corp.(a) | | | 364,886 |

| 700 | | Astoria Financial Corp. | | | 21,112 |

| 50,996 | | Bank of America Corp. | | | 2,722,676 |

| 1,400 | | BB&T Corp. | | | 61,502 |

| 3,100 | | Bear Stearns Cos., Inc. (The) | | | 504,618 |

| 1,600 | | Boston Properties, Inc. | | | 179,008 |

| 400 | | Charles Schwab Corp. (The) | | | 7,736 |

| 1,300 | | Chicago Mercantile Exchange Holdings, Inc., Class A(a) | | | 662,675 |

| 1,800 | | Chubb Corp. | | | 95,238 |

| 60,575 | | Citigroup, Inc. | | | 3,374,027 |

| 200 | | City National Corp.(a) | | | 14,240 |

| 10,175 | | Comerica, Inc.(a) | | | 597,069 |

| 2,600 | | Conseco, Inc.† | | | 51,948 |

| 4,300 | | Countrywide Financial Corp. | | | 182,535 |

| 900 | | Equity Office Properties Trust | | | 43,353 |

| 24,050 | | Fannie Mae | | | 1,428,330 |

| 30,105 | | Fidelity National Financial, Inc., Class A | | | 718,907 |

| 6,001 | | Fifth Third Bancorp(a) | | | 245,621 |

| 17,250 | | Freddie Mac | | | 1,171,275 |

| 5,090 | | Genworth Financial, Inc., Class A(a) | | | 174,129 |

| 3,400 | | Hartford Financial Services Group, Inc.(a) | | | 317,254 |

| 4,400 | | Huntington Bancshares, Inc.. | | | 104,500 |

| 45,271 | | JPMorgan Chase & Co. | | | 2,186,589 |

| 4,100 | | KeyCorp(a) | | | 155,923 |

| 10,386 | | Lehman Brothers Holdings, Inc.(a) | | | 811,354 |

| 2,200 | | Loews Corp. | | | 91,234 |

| 3,400 | | MBIA, Inc.(a). | | | 248,404 |

| 27,750 | | MetLife, Inc. | | | 1,637,528 |

| 1,900 | | MGIC Investment Corp. | | | 118,826 |

| 100 | | Moody’s Corp.(a) | | | 6,906 |

| 14,925 | | Morgan Stanley | | | 1,215,343 |

| 16,006 | | National City Corp.(a) | | | 585,179 |

| 1,100 | | Nationwide Financial Services, Class A | | | 59,620 |

| 5,400 | | Old Republic International Corp. | | | 125,712 |

| 2,200 | | PMI Group, Inc. (The) | | | 103,774 |

| 3,400 | | Prudential Financial, Inc. | | | 291,924 |

| 2,929 | | Realogy Corp.† | | | 88,807 |

| 1,800 | | RenaissanceRe Holdings, Ltd. | | | 108,000 |

| 4,700 | | St. Paul Travelers Cos., Inc. (The) | | | 252,343 |

| 4,200 | | State Street Corp. | | | 283,248 |

| 2,100 | | SunTrust Banks, Inc. | | | 177,345 |

| 1,200 | | Synovus Financial Corp. | | | 36,996 |

| 7,160 | | TD Ameritrade Holding Corp.(a) | | | 115,849 |

| 17,657 | | TD Banknorth, Inc. | | | 569,968 |

| 13,325 | | Torchmark Corp. | | | 849,602 |

| 4,800 | | U.S. Bancorp | | | 173,712 |

| 3,100 | | UnionBanCal Corp. | | | 189,875 |

| 26,958 | | UnumProvident Corp. | | | 560,187 |

| 3,400 | | Wachovia Corp.(a) | | | 193,630 |

See Notes to Financial Statements.

31

| | | | |

WILSHIRE MUTUAL FUNDS, INC. LARGE COMPANY VALUE PORTFOLIO SCHEDULEOF INVESTMENTS - (CONTINUED) | | December 31, 2006 | |  |

| | | | | |

| Shares | | Value |

| Financials (continued) | | | |

| 2,100 | | Waddell & Reed Financial, Inc., Class A | | $ | 57,456 |

| 27,196 | | Washington Mutual, Inc.(a) | | | 1,237,146 |

| 7,400 | | Wells Fargo & Co. | | | 263,144 |

| 17,525 | | XL Capital, Ltd., Class A | | | 1,262,150 |

| 1,100 | | Zions Bancorp | | | 90,684 |

| | | | | |

| | | | | 29,012,817 |

| | | | | |

| |

| Health Care — 7.3% | | | |

| 204 | | Abbott Laboratories | | | 9,937 |

| 955 | | Abraxis BioScience, Inc.†(a) | | | 26,110 |

| 6,584 | | Aetna, Inc. | | | 284,297 |

| 8,900 | | AmerisourceBergen Corp. | | | 400,144 |

| 1,000 | | Biogen Idec, Inc.†(a) | | | 49,190 |

| 42,300 | | Bristol-Myers Squibb Co. | | | 1,113,336 |

| 3,721 | | Cardinal Health, Inc. | | | 239,744 |

| 7,669 | | Genentech, Inc.† | | | 622,186 |

| 6,950 | | Johnson & Johnson | | | 458,839 |

| 3,007 | | McKesson Corp. | | | 152,455 |

| 7,900 | | Merck & Co., Inc. | | | 344,440 |

| 81,412 | | Pfizer, Inc. | | | 2,108,571 |

| 5,400 | | Tenet Healthcare Corp.† | | | 37,638 |

| 2,100 | | Thermo Fisher Scientific, Inc.†(a) | | | 95,109 |

| 3,846 | | Wyeth(a) | | | 195,838 |

| | | | | |

| | | | | 6,137,834 |

| | | | | |

| |

| Industrials — 9.1% | | | |

| 400 | | 3M Co. | | | 31,172 |

| 20,858 | | AGCO Corp.†(a) | | | 645,346 |

| 1,500 | | Avery Dennison Corp. | | | 101,895 |

| 1,081 | | Avis Budget Group, Inc. | | | 23,447 |

| 1,600 | | Boeing Co. | | | 142,144 |

| 5,089 | | Burlington Northern Santa Fe Corp. | | | 375,619 |