UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07076

Wilshire Mutual Funds, Inc.

(Exact name of registrant as specified in charter)

Wilshire Mutual Funds, Inc.

1299 Ocean Avenue, Suite 700

Santa Monica, CA 90401-1085

(Address of principal executive offices) (Zip code)

Jason A. Schwarz

Wilshire Advisors LLC

1299 Ocean Avenue, Suite 700

Santa Monica, CA 90401-1085

(Name and address of agent for service)

(310) 451-3051

Registrant's telephone number, including area code

Date of fiscal year end: December 31, 2022

Date of reporting period: December 31, 2022

Item 1. Reports to Stockholders.

| (a) | Include a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Act (17 CFR 270.30e-1). |

Wilshire Mutual Funds, Inc. |

ANNUAL REPORT Large Company Growth Portfolio Large Company Value Portfolio Small Company Growth Portfolio Small Company Value Portfolio Wilshire 5000 Indexsm Fund Wilshire International Equity Fund Wilshire Income Opportunities Fund |

December 31, 2022 http://advisor.wilshire.com |

Wilshire Mutual Funds, Inc. Table of Contents |

|

Letter to Shareholders | 1 |

Commentary: | |

Large Company Growth Portfolio | 7 |

Large Company Value Portfolio | 13 |

Small Company Growth Portfolio | 19 |

Small Company Value Portfolio | 23 |

Wilshire 5000 IndexSM Fund | 27 |

Wilshire International Equity Fund | 31 |

Wilshire Income Opportunities Fund | 38 |

Disclosure of Fund Expenses | 44 |

Schedules of Investments: | |

Large Company Growth Portfolio | 47 |

Large Company Value Portfolio | 62 |

Small Company Growth Portfolio | 79 |

Small Company Value Portfolio | 87 |

Wilshire 5000 IndexSM Fund | 98 |

Wilshire International Equity Fund | 132 |

Wilshire Income Opportunities Fund | 160 |

Statements of Assets and Liabilities | 239 |

Statements of Operations | 245 |

Statements of Changes in Net Assets | 251 |

Financial Highlights: | |

Large Company Growth Portfolio | 255 |

Large Company Value Portfolio | 257 |

Small Company Growth Portfolio | 259 |

Small Company Value Portfolio | 261 |

Wilshire 5000 IndexSM Fund | 263 |

Wilshire International Equity Fund | 265 |

Wilshire Income Opportunities Fund | 267 |

Notes to Financial Statements | 269 |

Report of Independent Registered Public Accounting Firm | 314 |

Additional Fund Information | 316 |

Tax Information | 320 |

Board Approval of Advisory Agreement | 322 |

Board Approval of Subadvisory Agreements | 331 |

This report is for the general information of the shareholders of Large Company Growth Portfolio, Large Company Value Portfolio, Small Company Growth Portfolio, Small Company Value Portfolio, Wilshire 5000 IndexSM Fund, Wilshire International Equity Fund and Wilshire Income Opportunities Fund. Its use in connection with any offering of a Portfolio’s shares is authorized only if accompanied or preceded by the Portfolio’s current prospectus.

Wilshire Mutual Funds, Inc. are distributed by Compass Distributors, LLC.

Wilshire Mutual Funds, Inc. Letter to Shareholders (Unaudited) |

|

Dear Wilshire Mutual Fund Shareholder:

We are pleased to present this annual report to all shareholders of the Wilshire Mutual Funds (the “Portfolios”). This report covers the period from January 1, 2022 to December 31, 2022, for all share classes of the Large Company Growth Portfolio, Large Company Value Portfolio, Small Company Growth Portfolio, Small Company Value Portfolio, Wilshire 5000 IndexSM Fund, Wilshire International Equity Fund, and Wilshire Income Opportunities Fund.

Market Environment

As the war in Ukraine makes its way towards its one-year anniversary, the possibility of meaningful negotiations remains slim despite both sides saying they are open to peace negotiations. While the U.S. and European countries continues their supports of Ukraine, Russia continue to increase its military effort in Eastern Ukraine with Iran’s recent aid in hopes to fully capture regions that Russia recently annexed illegally. Russia’s invasion continues to impact global food and energy prices, though an unusually warm winter in Europe has substantially reduced the cost of energy price caps and created more comfort that Europe can also navigate next winter without experiencing meaningful natural gas shortages. This improved energy clarity helps remove one major macro uncertainty heading into 2023.

Inflation within the U.S. has moderated to 7.1% at the end of November 2022, dipping from a 9.1% peak in June. Growth and recession concerns continue to be in the spotlight. In addition to December’s 50 basis points increase in the Fed Funds rate, the Federal Reserve (the “Fed”) also signaled that it is prepared to raise the rate to 5.0% by the end of 2023 and this commitment to increase rates and subdue inflation created some stress for equity and fixed income markets during December. Overall, the trend for inflation is positive and inflation is expected to fall meaningfully during 2023. The biggest question is if inflation falls fast enough, and far enough, for the Fed to avoid tightening monetary policy too far.

Although not fully reflected in published data yet, it is likely that U.S. housing prices have begun to fall and may continue to fall in the coming months. Mortgage rates are no longer at recent peak levels, but they remain high relative to the last decade and even modestly falling housing prices should help put downward pressure on inflation. Job growth remains solid, which concerns the Fed, since a strong labor market may continue to spur increased wage inflation which would likely prop up consumer spending. As high as wage growth has been over the past 24 months, it has generally been lower than headline inflation, so it remains to be seen if wage growth will remain elevated even as inflation falls.

On the international front, the European Central Bank (“ECB”) also raised rates by another 50 basis points. The ECB, taking a similar stance as the Fed and other central banks around the world, also reaffirmed its conviction to raise interest rates in the future. However, recent rate hikes would likely put pressure on the Italian government as its current public debit stood at 145% of the country’s Gross Domestic Product, the highest among its European peers. In the equity markets, investors expressed optimism that the inflation and prices pressure are easing, leading to a double-digit gain in the Europe, Australasia and the Far East regions as of the quarter end.

1

Wilshire Mutual Funds, Inc. Letter to Shareholders (Unaudited) - (Continued) |

|

The aggressive action to combat unacceptably high inflation is the story of 2022 with uncertainty around Fed policy poised to drive market volatility in 2023. The Fed raised rates 4.25%, with increases becoming more dramatic in May. This marks the largest 12-month increase since 1981 (also a period of inflation near or above double-digits). Unsurprisingly, fixed income suffered but so did equities as investors repriced off a higher risk-free rate. The Fed is currently forecasting a rate 0.75% higher by the end of 2023. The market does not agree – or perhaps doubts the Fed’s credibility to continue tightening, with a modest change forecasted for the next year. How this disagreement plays out is likely to be a primary market driver this year.

Fund Performance Review

The Wilshire Large Company Growth Portfolio - Institutional Class returned -31.53%, underperforming the Russell 1000 Growth Index by -2.39%. The Wilshire Large Company Value Portfolio - Institutional Class returned -11.97%, underperforming the Russell 1000 Value Index by -4.43%. The Wilshire Small Company Growth Portfolio - Institutional Class returned -31.42%, underperforming the Russell 2000 Growth Index by -5.06%. The Wilshire Small Company Value Portfolio – Institutional Class returned -10.13%, outperforming the Russell 2000 Value Index by 4.35%. The Wilshire International Equity Fund – Institutional Class returned -18.63%, underperforming the MSCI All Country World ex USA Investable Market Index by -2.05%. The Wilshire Income Opportunities Fund - Institutional Class returned -10.91%, outperforming the Bloomberg US Universal Index by 2.08%. The Wilshire 5000 Index Fund - Institutional Class returned -18.83%, outperforming the FT Wilshire 5000 Total Market Index return of -19.04% by 0.21%.

Despite underperformance of four of the actively managed equities Portfolios, we believe that all of the Portfolios are well-positioned going into 2023 as the market deals with the ongoing pandemic and, macroeconomic and geopolitical issues.

As always, we sincerely appreciate your continued support and confidence in Wilshire Advisors.

Sincerely,

Jason Schwarz

President, Wilshire Mutual Funds

2

Wilshire Mutual Funds, Inc. Letter to Shareholders (Unaudited) - (Continued) |

|

DISCLOSURES:

This report must be preceded or accompanied by a prospectus.

Opinions expressed are those of the Portfolios and are subject to change, are not guaranteed, and should not be considered a recommendation to buy or sell any security.

Sector allocations are subject to change.

Past performance does not guarantee future results. The performance data quoted represent past performance and current returns may be lower or higher. Share prices and investment returns fluctuate and an investor’s shares may be worth more or less than original cost upon redemption. For periods less than one year, performance is cumulative. For performance data current to the most recent month-end please call 1-866-591-1568.

Index returns are for illustrative purposes only and do not represent actual Fund performance. Index performance returns do not reflect any management fees, transactions costs or expenses. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results.

Bonds and bond funds are subject to interest rate risk and will decline in value as interest rates rise. In addition to the normal risks associated with investing, international investments may involve risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles or from social, economic or political instability in other nations. Investments in smaller companies typically exhibit higher volatility. Investments in derivatives, such as swaps, futures contracts and options contracts and currency transactions expose a Portfolio to risks in addition to and greater than those associated with investing directly in the securities underlying those derivatives and could also result in a loss, which in some cases may be unlimited.

Investing involves risk including loss of principal. This report identifies each Portfolio’s investments on December 31, 2022. These holdings are subject to change and risk. Not all investments in each Portfolio performed the same, nor is there any guarantee that these investments will perform as well in the future. Market forecasts provided in this report may not occur.

The MSCI All Country World ex USA Investable Market Index is an equity index which captures large, mid and small cap representation across 22 of 23 Developed Markets countries (excluding the U.S.) and 26 Emerging Markets countries. With 6,434 constituents, the index covers approximately 99% of the global equity opportunity set outside the US.

The MSCI EAFE Index is an equity index which captures large and mid cap representation across 21 Developed Markets countries* around the world, excluding the US and Canada. With 825 constituents, the index covers approximately 85% of the free float adjusted market capitalization in each country.

3

Wilshire Mutual Funds, Inc. Letter to Shareholders (Unaudited) - (Continued) |

|

The MSCI Emerging Markets Index is an equity index which captures large and mid-cap representation across 26 Emerging Markets countries. With 1,385 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

The FT Wilshire 5000 Total Market Index is widely accepted as the definitive benchmark for the U.S. equity market, and measures performance of all U.S. equity securities with readily available price data.

The Wilshire US Large-Cap Index is a benchmark of the large-sized (based on capitalization) companies in the U.S. equity market. The Wilshire US Large-Cap Index is a float-adjusted, market capitalization- weighted index of the issues ranked above 750 market capitalization of the Wilshire 5000 Total Market Index.

The Wilshire US Small-Cap Index is a benchmark of the small-sized (based on capitalization) companies in the U.S. equity market. The Wilshire US Small-Cap is a float-adjusted, market capitalization-weighted index of the issues ranked between 750 and 2,500 by market capitalization of the Wilshire 5000 Total Market Index.

The Wilshire US Large-Cap Growth Index is a benchmark of the large-sized growth (based on capitalization) companies in the U.S. equity market. The Wilshire US Large-Cap Growth is a float-adjusted, market capitalization-weighted derivative index of the Wilshire US Large-Cap Index and by extension the Wilshire 5000 Total Market Index.

The Wilshire US Large-Cap Value Index is a benchmark of the large-sized value (based on capitalization) companies in the U.S. equity market. The Wilshire US Large-Cap Value is a float-adjusted, market capitalization-weighted derivative index of the Wilshire US Large-Cap Index and by extension the Wilshire 5000 Total Market Index.

The Bloomberg U.S. Universal Index represents the union of the U.S. Aggregate Index, the U.S. High-Yield Corporate Index, the 144A Index, the Eurodollar Index, the Emerging Markets Index, and the non-ERISA portion of the CMBS Index.

The Russell 1000® Growth Index: Measures the performance of the broad growth segment of the U.S. equity universe. It includes those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values.

The Russell 1000 Value Index: Measures the performance of the broad value segment of U.S. equity value universe. It includes those Russell 1000 companies with lower price-to-book ratios and lower forecasted growth values.

The Russell 2000® Growth Index measures the performance of the small-cap growth segment of the U.S. equity universe. It includes those Russell 2000 companies with higher price-to-value ratios and higher forecasted growth values.

The Russell 2000® Value Index measures the performance of small-cap value segment of the U.S. equity universe. It includes those Russell 2000 companies with lower price-to-book ratios and lower forecasted growth values.

4

Wilshire Mutual Funds, Inc. Letter to Shareholders (Unaudited) - (Continued) |

|

Mortgaged-Backed Securities are bonds secured by residential and other real estate loans.

Agency Residential Mortgaged-Backed Securities is residential mortgaged-backed securities for which a U.S. government entity guarantees payment of principal and interest to holders of securities.

Commercial Mortgage-Backed Securities are bonds secreted by commercial and multifamily mortgages.

Asset-Backed Securities are financial securities backed by income-generating assets such as loans, leases, credit card balances, or receivables.

A basis point is one hundredth of a percent or equivalently one percent of one percent.

Credit Spread is the difference in yield between a U.S. Treasury bond and another debt security of the same maturity but different credit quality.

Wilshire Mutual Funds, Inc. are distributed by Compass Distributors, LLC.

5

Wilshire Mutual Funds, Inc. Overall Fund Commentary (Unaudited) |

|

The U.S. stock market, represented by the FT Wilshire 5000 Total Market IndexSM, was down -19.04% for the year. Sector returns for the FT Wilshire 5000 Total Market IndexSM were mixed for the year. Energy (+62.48%) and Utilities (+1.21%) were the best performing sectors while Communication Services (-40.04%) and Consumer Discretionary (-36.33%) sectors were the largest detractors. For the year, large capitalization stocks underperformed small capitalization stocks with the Wilshire US Large-Cap IndexSM returning -19.03% versus -18.65% for the Wilshire US Small-Cap IndexSM. Growth lagged Value equities during the period, with Wilshire US Large-Cap Growth IndexSM returning -29.54% versus -5.51% for the Wilshire US Large-Cap Value IndexSM.

Real estate securities were up during the fourth quarter in both the United States and abroad. Commodity results also were positive for the quarter, with crude oil rising modestly by 1.0% to $80.26 per barrel. Oil prices were quite volatile in 2022, with lows approaching $70 and highs at nearly $125, due to tightening supplies with the Ukraine invasion but then falling demand from China. Natural gas prices fell dramatically during the quarter due to relatively mild winter temperatures – despite the destruction done by Winter Storm Elliott. By quarter-end, natural gas was down -33.9%, closing at $4.48 per million BTUs. Gold prices were up 9.8% during the quarter, finishing at approximately $1,826 per troy ounce, as the Federal Reserve continued its hawkish stance toward inflation.

Performance results within international equity markets were negative, with developed outperforming emerging markets. The MSCI EAFE Index was down -14.45% for the year, while the MSCI Emerging Markets Index was down -20.09%. Europe faced similar headwinds as the United States in 2022 – surging inflation and aggressive central bank tightening – but also had to more directly contend with the ongoing war in Ukraine. The labor market remains tight in the Eurozone – including Germany where unemployment has fallen below 3% – and many businesses report that a labor shortage is limiting production. Despite China’s zero-COVID policies, including widespread lockdowns, infections continued to surge. Tension among the country’s citizens continued to rise and led to protests not seen in decades. In early December, the central government took definitive steps to ease restrictions.

The U.S. Treasury yield curve was up in the short-end (below 3-years) by 50-135 basis points but largely unchanged across the remainder of the curve. The 10-year Treasury yield ended the quarter at 3.88%, up just 5 basis points from September. Credit spreads tightened during the quarter within both investment grade and high yield bonds (down 84 basis points within the speculative market). The Federal Open Market Committee met twice during the quarter, as scheduled, and increased the overnight rate by 0.75% in November and 0.50% in December, targeting a range of 4.25% to 4.50%. The Fed’s “dot plot” is messaging that the current intent is for another 75 basis points in increases before the end of 2023. Following the December meeting, Fed Chair Jerome Powell indicated that inflation data during the fourth quarter has been encouraging but that it will take “substantially more evidence” to ensure that modest price increases are sustainable.

6

Large Company Growth Portfolio Commentary (Unaudited) |

|

INVESTMENT CLASS SHARES

Average Annual Total Returns

One Year Ended 12/31/22 | -31.74% |

Five Years Ended 12/31/22 | 8.02% |

Ten Years Ended 12/31/22 | 11.16% |

RUSSELL 1000® GROWTH INDEX(1)

Average Annual Total Returns

One Year Ended 12/31/22 | -29.14% |

Five Years Ended 12/31/22 | 10.96% |

Ten Years Ended 12/31/22 | 14.10% |

COMPARATIVE PERFORMANCE

Comparison of Change in Value of $10,000 Investment in Shares of Large Company Growth Portfolio, Investment Class Shares and the Russell 1000® Growth Index through 12/31/22.

On July 21, 2020, the Large Company Growth Portfolio’s investment strategy was changed. Consequently, prior period performance may have been different if the new investment strategy had been in effect during these periods.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

(1) | The Russell 1000® Growth Index is an unmanaged index that measures the performance of the largest 1,000 U.S. companies with higher price-to-book ratios and higher forecasted growth values. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

The Portfolio’s gross expense ratio per the prospectus dated 4/30/2022 was 1.30% for Investment Class Shares. The Portfolio’s net expense ratio per the prospectus dated 4/30/2022 was 1.30% for Investment Class Shares.

7

Large Company Growth Portfolio Commentary (Unaudited) - (Continued) |

|

The Advisor has contractually agreed to waive a portion of its management fee to limit expenses of the Portfolio (excluding taxes, brokerage expenses, dividend expenses on short securities and extraordinary expenses) to 1.30% of average daily net assets for Investment Class Shares through at least April 30, 2023. The net expense ratio is applicable to shareholders.

8

Large Company Growth Portfolio Commentary (Unaudited) - (Continued) |

|

INSTITUTIONAL CLASS SHARES

Average Annual Total Returns

One Year Ended 12/31/22 | -31.53% |

Five Years Ended 12/31/22 | 8.36% |

Ten Years Ended 12/31/22 | 11.51% |

RUSSELL 1000® GROWTH INDEX(1)

Average Annual Total Returns

One Year Ended 12/31/22 | -29.14% |

Five Years Ended 12/31/22 | 10.96% |

Ten Years Ended 12/31/22 | 14.10% |

COMPARATIVE PERFORMANCE

Comparison of Change in Value of $250,000 Investment in Shares of Large Company Growth Portfolio, Institutional Class Shares and the Russell 1000® Growth Index through 12/31/22.

On July 21, 2020, the Large Company Growth Portfolio’s investment strategy was changed. Consequently, prior period performance may have been different if the new investment strategy had been in effect during these periods.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

(1) | The Russell 1000® Growth Index is an unmanaged index that measures the performance of the largest 1,000 U.S. companies with higher price-to-book ratios and higher forecasted growth values. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

The Portfolio’s gross expense ratio per the prospectus dated 4/30/2022 was 0.97% for Institutional Class Shares. The Portfolio’s net expense ratio per the prospectus dated 4/30/2022 was 0.97% for Institutional Class Shares.

9

Large Company Growth Portfolio Commentary (Unaudited) - (Continued) |

|

The Advisor has contractually agreed to waive a portion of its management fee to limit expenses of the Portfolio (excluding taxes, brokerage expenses, dividend expenses on short securities and extraordinary expenses) to 1.00% for Institutional Class Shares through at least April 30, 2023. The net expense ratio is applicable to shareholders.

10

Large Company Growth Portfolio Commentary (Unaudited) - (Continued) |

|

The U.S. stock market, represented by the FT Wilshire 5000 Total Market IndexSM, was down -19.04% for the year. Sector returns for the Wilshire 5000 Total Market IndexSM were mixed for the year. Energy (+62.48%) and Utilities (+1.21%) were the best performing sectors while Communication Services (-40.04%) and Consumer Discretionary (-36.33%) sectors were the largest detractors. For the year, large capitalization stocks underperformed small capitalization stock with the Wilshire US Large-Cap IndexSM returning -19.03% versus -18.65% for the Wilshire US Small-Cap IndexSM. Growth lagged Value equities during the period, with Wilshire US Large-Cap Growth IndexSM returning -29.54% versus -5.51% for the Wilshire US Large-Cap Value IndexSM.

Real estate securities were up during the fourth quarter in both the United States and abroad. Commodity results also were positive for the quarter, with crude oil rising modestly by 1.0% to $80.26 per barrel. Oil prices were quite volatile in 2022, with lows approaching $70 and highs at nearly $125, due to tightening supplies with the Ukraine invasion but then falling demand from China. Natural gas prices fell dramatically during the quarter due to relatively mild winter temperatures – despite the destruction done by Winter Storm Elliott. By quarter-end, natural gas was down -33.9%, closing at $4.48 per million BTUs. Gold prices were up 9.8% during the quarter, finishing at approximately $1,826 per troy ounce, as the Federal Reserve continued its hawkish stance toward inflation.

The Wilshire Large Company Growth Portfolio - Institutional Class returned -31.53% in 2022 underperforming the Russell 1000 Growth Index return of -29.14% by -2.39%. Stock selection within Information Technology was a significant detractor. Underweight exposure to Consumer Staples also weighed on relative performance. Conversely, overweight exposure to Health Care and stock selection within Communication Service aided results.

The Wilshire Large Company Growth Portfolio also uses derivatives for benchmark exposure. Collateral is invested in short term fixed income instruments to cover the costs of the swap. In 2022, returns on these fixed-income investments underperformed the cost of the swap and detracted from the Portfolio’s relative performance.

Despite recent relative underperformance, we believe the Portfolio is well-positioned going into 2023 as the market deals with the ongoing pandemic, macroeconomic and geopolitical issues.

11

Large Company Growth Portfolio Commentary (Unaudited) - (Continued) |

|

PORTFOLIO SECTOR WEIGHTING†

(As of December 31, 2022)

† | Based on the percent of Portfolio’s total investments in securities at value. |

Common Stocks are composed of:

Information Technology | 40.8% |

Health Care | 21.0% |

Consumer Discretionary | 12.8% |

Industrials | 7.0% |

Consumer Staples | 5.6% |

Communication Services | 5.5% |

Financials | 3.4% |

Energy | 2.2% |

Materials | 0.7% |

Utilities | 0.6% |

Real Estate | 0.4% |

The industry classifications represented in the Portfolio Sector Weightings and Schedules of Investments are in accordance with Global Industry Classification Standards (GICS®), which was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s LLC.

12

Large Company Value Portfolio Commentary (Unaudited) |

|

INVESTMENT CLASS SHARES

Average Annual Total Returns

One Year Ended 12/31/22 | -11.46% |

Five Years Ended 12/31/22 | 3.82% |

Ten Years Ended 12/31/22 | 8.65% |

RUSSELL 1000® VALUE INDEX(1)

Average Annual Total Returns

One Year Ended 12/31/22 | -7.54% |

Five Years Ended 12/31/22 | 6.67% |

Ten Years Ended 12/31/22 | 10.29% |

COMPARATIVE PERFORMANCE

Comparison of Change in Value of $10,000 Investment in Shares of Large Company Value Portfolio, Investment Class Shares and the Russell 1000® Value Index through 12/31/22.

On July 21, 2020, the Large Company Value Portfolio’s investment strategy was changed. Consequently, prior period performance may have been different if the new investment strategy had been in effect during these periods.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

(1) | The Russell 1000® Value Index is an unmanaged index that measures the performance of the largest 1,000 U.S. companies with lower price-to-book ratios and lower forecasted growth values. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

The Portfolio’s gross expense ratio per the prospectus dated 4/30/2022, supplemented on 8/30/2022, was 1.32% for Investment Class Shares. The Portfolio’s net expense ratio per the prospectus dated 4/30/2022, supplemented on 8/30/2022, was 1.30% for Investment Class Shares.

13

Large Company Value Portfolio Commentary (Unaudited) - (Continued) |

|

The Advisor has contractually agreed to waive a portion of its management fee to limit expenses of the Portfolio (excluding taxes, brokerage expenses, dividend expenses on short securities and extraordinary expenses) to 1.30% of average daily net assets for Investment Class Shares through at least April 30, 2023. The net expense ratio is applicable to shareholders.

14

Large Company Value Portfolio Commentary (Unaudited) - (Continued) |

|

INSTITUTIONAL CLASS SHARES

Average Annual Total Returns

One Year Ended 12/31/22 | -11.97% |

Five Years Ended 12/31/22 | 4.11% |

Ten Years Ended 12/31/22 | 8.92% |

RUSSELL 1000® GROWTH INDEX(1)

Average Annual Total Returns

One Year Ended 12/31/22 | -7.54% |

Five Years Ended 12/31/22 | 6.67% |

Ten Years Ended 12/31/22 | 10.29% |

COMPARATIVE PERFORMANCE

Comparison of Change in Value of $250,000 Investment in Shares of Large Company Value Portfolio, Institutional Class Shares and the Russell 1000® Value Index through 12/31/22.

On July 21, 2020, the Large Company Value Portfolio’s investment strategy was changed. Consequently, prior period performance may have been different if the new investment strategy had been in effect during these periods.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

(1) | The Russell 1000® Value Index is an unmanaged index that measures the performance of the largest 1,000 U.S. companies with lower price-to-book ratios and lower forecasted growth values. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

The Portfolio’s gross expense ratio per the prospectus dated 4/30/2022, supplemented on 8/30/2022, was 0.99% for Institutional Class Shares. The Portfolio’s net expense ratio per the prospectus dated 4/30/2022, supplemented on 8/30/2022, was 0.99% for Institutional Class Shares.

15

Large Company Value Portfolio Commentary (Unaudited) - (Continued) |

|

The Advisor has contractually agreed to waive a portion of its management fee to limit expenses of the Portfolio (excluding taxes, brokerage expenses, dividend expenses on short securities and extraordinary expenses) to 1.00% for Institutional Class Shares through at least April 30, 2023. The net expense ratio is applicable to shareholders.

16

Large Company Value Portfolio Commentary (Unaudited) - (Continued) |

|

The U.S. stock market, represented by the FT Wilshire 5000 Total Market IndexSM, was down -19.04% for the year. Sector returns for the Wilshire 5000 Total Market IndexSM were mixed for the year. Energy (+62.48%) and Utilities (+1.21%) were the best performing sectors while Communication Services (-40.04%) and Consumer Discretionary (-36.33%) sectors were the largest detractors. For the year, large capitalization stocks underperformed small capitalization stock with the Wilshire US Large-Cap IndexSM returning -19.03% versus -18.65% for the Wilshire US Small-Cap IndexSM. Growth lagged Value equities during the period, with Wilshire US Large-Cap Growth IndexSM returning -29.54% versus -5.51% for the Wilshire US Large-Cap Value IndexSM.

Real estate securities were up during the fourth quarter in both the United States and abroad. Commodity results also were positive for the quarter, with crude oil rising modestly by 1.0% to $80.26 per barrel. Oil prices were quite volatile in 2022, with lows approaching $70 and highs at nearly $125, due to tightening supplies with the Ukraine invasion but then falling demand from China. Natural gas prices fell dramatically during the quarter due to relatively mild winter temperatures – despite the destruction done by Winter Storm Elliott. By quarter-end, natural gas was down -33.9%, closing at $4.48 per million BTUs. Gold prices were up 9.8% during the quarter, finishing at approximately $1,826 per troy ounce, as the Federal Reserve continued its hawkish stance toward inflation.

The Wilshire Large Company Value Portfolio - Institutional Class returned -11.97% in 2022 underperforming the Russell 1000 Value Index return of -7.54% by -4.43%. Overweight exposure to Health Care was by far the top detractor from relative performance. Stock selection within Industrials and Consumer Staples also detracted from Portfolio’s results. Conversely, stock selection within Financials and overweight exposure to Energy aided results.

The Wilshire Large Company Value Portfolio also uses derivatives for benchmark exposure. Collateral is invested in short-term fixed income instruments to cover the costs of the swap. In 2022, returns on these fixed-income investments underperformed the cost of the swap and detracted from the Portfolio’s relative performance.

Despite recent relative underperformance, we believe the Portfolio is well-positioned going into 2023 as the market deals with the ongoing pandemic, macroeconomic and geopolitical issues.

17

Large Company Value Portfolio Commentary (Unaudited) - (Continued) |

|

PORTFOLIO SECTOR WEIGHTING†

(As of December 31, 2022)

† | Based on the percent of Portfolio’s total investments in securities at value. |

Common Stocks are composed of:

Financials | 21.1% |

Information Technology | 17.8% |

Industrials | 14.9% |

Health Care | 12.2% |

Energy | 8.9% |

Consumer Staples | 6.7% |

Communication Services | 5.2% |

Consumer Discretionary | 5.0% |

Materials | 4.4% |

Utilities | 2.1% |

Real Estate | 1.7% |

18

Small Company Growth Portfolio Commentary (Unaudited) |

|

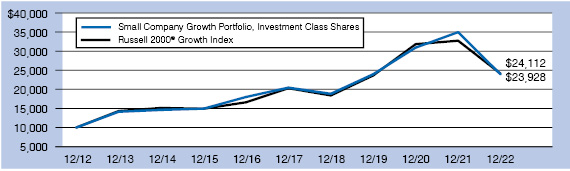

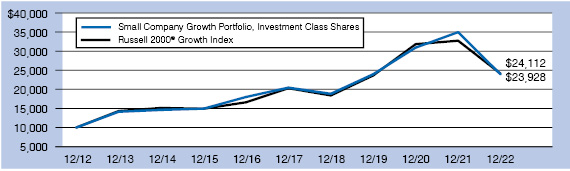

INVESTMENT CLASS SHARES

Average Annual Total Returns

One Year Ended 12/31/22 | -31.59% |

Five Years Ended 12/31/22 | 3.18% |

Ten Years Ended 12/31/22 | 9.12% |

RUSSELL 2000® GROWTH INDEX(1)

Average Annual Total Returns

One Year Ended 12/31/22 | -26.36% |

Five Years Ended 12/31/22 | 3.51% |

Ten Years Ended 12/31/22 | 9.20% |

COMPARATIVE PERFORMANCE

Comparison of Change in Value of $10,000 Investment in Shares of Small Company Growth Portfolio, Investment Class Shares and the Russell 2000® Growth Index through 12/31/22.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

(1) | The Russell 2000® Growth Index is an unmanaged index that measures the performance of the 2,000 smallest U.S. companies with higher price-to-book ratios and higher forecasted growth values. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

The Portfolio’s gross expense ratio per the prospectus dated 4/30/2022 was 1.63% for Investment Class Shares. The Portfolio’s net expense ratio per the prospectus dated 4/30/2022 was 1.35% for Investment Class Shares.

The Advisor has contractually agreed to waive a portion of its management fee to limit expenses of the Portfolio (excluding taxes, brokerage expenses, dividend expenses on short securities and extraordinary expenses) to 1.35% of average daily net assets for Investment Class Shares through at least April 30, 2023. The net expense ratio is applicable to shareholders.

19

Small Company Growth Portfolio Commentary (Unaudited) - (Continued) |

|

INSTITUTIONAL CLASS SHARES

Average Annual Total Returns

One Year Ended 12/31/22 | -31.42% |

Five Years Ended 12/31/22 | 3.44% |

Ten Years Ended 12/31/22 | 9.40% |

RUSSELL 2000® GROWTH INDEX(1)

Average Annual Total Returns

One Year Ended 12/31/22 | -26.36% |

Five Years Ended 12/31/22 | 3.51% |

Ten Years Ended 12/31/22 | 9.20% |

COMPARATIVE PERFORMANCE

Comparison of Change in Value of $250,000 Investment in Shares of Small Company Growth Portfolio, Institutional Class Shares and the Russell 2000® Growth Index through 12/31/22.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

(1) | The Russell 2000® Growth Index is an unmanaged index that measures the performance of the 2,000 smallest U.S. companies with higher price-to-book ratios and higher forecasted growth values. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

The Portfolio’s gross expense ratio per the prospectus dated 4/30/2022 was 1.38% for Institutional Class Shares. The Portfolio’s net expense ratio per the prospectus dated 4/30/2022 was 1.10% for Institutional Class Shares.

The Advisor has contractually agreed to waive a portion of its management fee to limit expenses of the Portfolio (excluding taxes, brokerage expenses, dividend expenses on short securities and extraordinary expenses) to 1.10% for Institutional Class Shares through at least April 30, 2023. The net expense ratio is applicable to shareholders.

20

Small Company Growth Portfolio Commentary (Unaudited) - (Continued) |

|

The U.S. stock market, represented by the FT Wilshire 5000 Total Market IndexSM, was down -19.04% for the year. Sector returns for the Wilshire 5000 Total Market IndexSM were mixed for the year. Energy (+62.48%) and Utilities (+1.21%) were the best performing sectors while Communication Services (-40.04%) and Consumer Discretionary (-36.33%) sectors were the largest detractors. For the year, large capitalization stocks underperformed small capitalization stock with the Wilshire US Large-Cap IndexSM returning -19.03% versus -18.65% for the Wilshire US Small-Cap IndexSM. Growth lagged Value equities during the period, with Wilshire US Large-Cap Growth IndexSM returning -29.54% versus -5.51% for the Wilshire US Large-Cap Value IndexSM.

Real estate securities were up during the fourth quarter in both the United States and abroad. Commodity results also were positive for the quarter, with crude oil rising modestly by 1.0% to $80.26 per barrel. Oil prices were quite volatile in 2022, with lows approaching $70 and highs at nearly $125, due to tightening supplies with the Ukraine invasion but then falling demand from China. Natural gas prices fell dramatically during the quarter due to relatively mild winter temperatures – despite the destruction done by Winter Storm Elliott. By quarter-end, natural gas was down -33.9%, closing at $4.48 per million BTUs. Gold prices were up 9.8% during the quarter, finishing at approximately $1,826 per troy ounce, as the Federal Reserve continued its hawkish stance toward inflation.

The Wilshire Small Company Growth Portfolio - Institutional Class returned -31.42% in 2022, underperforming the Russell 2000 Growth Index return of -26.36% by -5.06%. Stock selection within Healthcare was by far the top detractor of relative performance. Slight underweight exposure to Energy weighed on the Portfolio’s results. Conversely, stock selection within Consumer Staples and underweight exposure to Communication Services and Consumer Discretionary mitigated underperformance.

Despite recent relative underperformance, we believe the Portfolio is well-positioned going into 2023 as the market deals with the ongoing pandemic, macroeconomic and geopolitical issues.

21

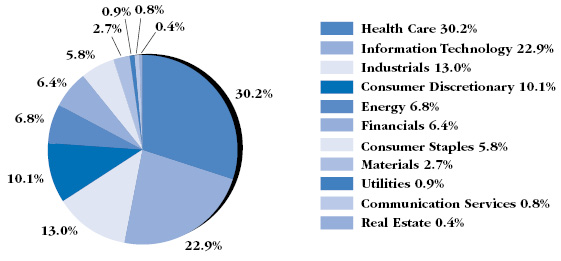

Small Company Growth Portfolio Commentary (Unaudited) - (Continued) |

|

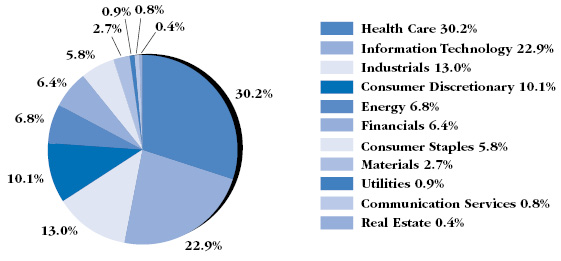

PORTFOLIO SECTOR WEIGHTING†

(As of December 31,2022)

† | Based on the percent of Portfolio’s total investments in securities at value. |

22

Small Company Value Portfolio Commentary (Unaudited) |

|

INVESTMENT CLASS SHARES

Average Annual Total Returns

One Year Ended 12/31/22 | -10.33% |

Five Years Ended 12/31/22 | 3.84% |

Ten Years Ended 12/31/22 | 9.17% |

RUSSELL 2000® VALUE INDEX(1)

Average Annual Total Returns

One Year Ended 12/31/22 | -14.48% |

Five Years Ended 12/31/22 | 4.13% |

Ten Years Ended 12/31/22 | 8.48% |

COMPARATIVE PERFORMANCE

Comparison of Change in Value of $10,000 Investment in Shares of Small Company Value Portfolio, Investment Class Shares and the Russell 2000® Value Index through 12/31/22.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

(1) | The Russell 2000® Value Index is an unmanaged index that measures the performance of the 2,000 smallest U.S. companies with lower price-to-book ratios and lower forecasted growth values. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

The Portfolio’s gross expense ratio per the prospectus dated 4/30/2022 was 1.75% for Investment Class Shares. The Portfolio’s net expense ratio per the prospectus dated 4/30/2022 was 1.35% for Investment Class Shares.

The Advisor has contractually agreed to waive a portion of its management fee to limit expenses of the Portfolio (excluding taxes, brokerage expenses, dividend expenses on short securities and extraordinary expenses) to 1.35% of average daily net assets for Investment Class Shares through at least April 30, 2023. The net expense ratio is applicable to shareholders.

23

Small Company Value Portfolio Commentary (Unaudited) - (Continued) |

|

INSTITUTIONAL CLASS SHARES

Average Annual Total Returns

One Year Ended 12/31/22 | -10.13% |

Five Years Ended 12/31/22 | 4.09% |

Ten Years Ended 12/31/22 | 9.45% |

RUSSELL 1000® GROWTH INDEX(1)

Average Annual Total Returns

One Year Ended 12/31/22 | -14.48% |

Five Years Ended 12/31/22 | 4.13% |

Ten Years Ended 12/31/22 | 8.48% |

COMPARATIVE PERFORMANCE

Comparison of Change in Value of $250,000 Investment in Shares of Small Company Value Portfolio, Institutional Class Shares and the Russell 2000® Value Index through 12/31/22.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

(1) | The Russell 2000® Value Index is an unmanaged index that measures the performance of the 2,000 smallest U.S. companies with lower price-to-book ratios and lower forecasted growth values. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

The Portfolio’s gross expense ratio per the prospectus dated 4/30/2022 was 1.46% for Institutional Class Shares. The Portfolio’s net expense ratio per the prospectus dated 4/30/2022 was 1.10% for Institutional Class Shares.

The Advisor has contractually agreed to waive a portion of its management fee to limit expenses of the Portfolio (excluding taxes, brokerage expenses, dividend expenses on short securities and extraordinary expenses) to 1.10% for Institutional Class Shares, respectively, through at least April 30, 2023. The net expense ratio is applicable to shareholders.

24

Small Company Value Portfolio Commentary (Unaudited) - (Continued) |

|

The U.S. stock market, represented by the FT Wilshire 5000 Total Market IndexSM, was down -19.04% for the year. Sector returns for the Wilshire 5000 Total Market IndexSM were mixed for the year. Energy (+62.48%) and Utilities (+1.21%) were the best performing sectors while Communication Services (-40.04%) and Consumer Discretionary (-36.33%) sectors were the largest detractors. For the year, large capitalization stocks underperformed small capitalization stock with the Wilshire US Large-Cap IndexSM returning -19.03% versus -18.65% for the Wilshire US Small-Cap IndexSM. Growth lagged Value equities during the period, with Wilshire US Large-Cap Growth IndexSM returning -29.54% versus -5.51% for the Wilshire US Large-Cap Value IndexSM.

Real estate securities were up during the fourth quarter in both the United States and abroad. Commodity results also were positive for the quarter, with crude oil rising modestly by 1.0% to $80.26 per barrel. Oil prices were quite volatile in 2022, with lows approaching $70 and highs at nearly $125, due to tightening supplies with the Ukraine invasion but then falling demand from China. Natural gas prices fell dramatically during the quarter due to relatively mild winter temperatures – despite the destruction done by Winter Storm Elliott. By quarter-end, natural gas was down -33.9%, closing at $4.48 per million BTUs. Gold prices were up 9.8% during the quarter, finishing at approximately $1,826 per troy ounce, as the Federal Reserve continued its hawkish stance toward inflation.

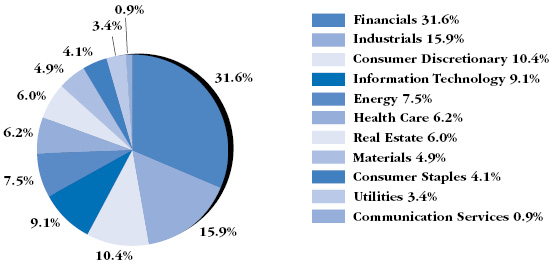

The Wilshire Small Company Value Portfolio - Institutional Class returned -10.13% in 2022 outperforming the Russell 2000 Value Index return of -14.48% by 4.35%. Stock selection within Consumer Staples and Information Technology contributed to relative performance. Underweight exposure to Health Care also aided performance. Conversely, stock selection within Energy and overweight exposure to Consumer Discretionary detracted from performance.

We are pleased with the Portfolio’s relative outperformance for the year and believe that the Portfolio is well-positioned going into 2023 as the market deals with the ongoing pandemic, macroeconomic and geopolitical issues.

25

Small Company Value Portfolio Commentary (Unaudited) - (Continued) |

|

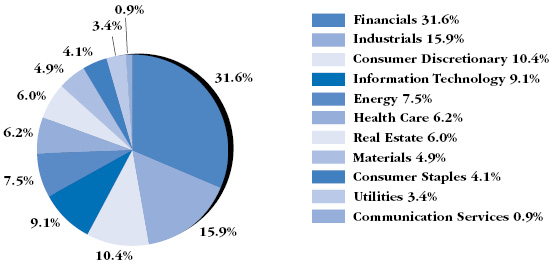

PORTFOLIO SECTOR WEIGHTING†

(As of December 31, 2022)

† | Based on percent of the Portfolio’s total investments in securities at value. |

26

Wilshire 5000 Indexsm Fund Commentary (Unaudited) |

|

INVESTMENT CLASS SHARES

Average Annual Total Returns

One Year Ended 12/31/22 | -18.98% |

Five Years Ended 12/31/22 | 8.37% |

Ten Years Ended 12/31/22 | 11.62% |

FT WILSHIRE 5000 TOTAL MARKET RETURN INDEXSM(1)

Average Annual Total Returns

One Year Ended 12/31/22 | -19.04% |

Five Years Ended 12/31/22 | 8.99% |

Ten Years Ended 12/31/22 | 12.28% |

COMPARATIVE PERFORMANCE

Comparison of Change in Value of $10,000 Investment in Shares

of Wilshire 5000 IndexSM Fund, Investment Class Shares and the

FT Wilshire 5000 Total Market Return IndexSM through 12/31/22.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Portfolio shares.

(1) | The FT Wilshire 5000 Total Market Return IndexSM is an unmanaged index that measures the performance of all U.S. headquartered equity securities with readily available price data. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

The Index Fund’s total expense ratio per the prospectus dated 4/30/2022 was 0.54% for Investment Class Shares.

27

Wilshire 5000 Indexsm Fund Commentary (Unaudited) - (Continued) |

|

INSTITUTIONAL CLASS SHARES

Average Annual Total Returns

One Year Ended 12/31/22 | -18.83% |

Five Years Ended 12/31/22 | 8.64% |

Ten Years Ended 12/31/22 | 11.91% |

FT WILSHIRE 5000 TOTAL MARKET RETURN INDEXSM(1)

Average Annual Total Returns

One Year Ended 12/31/22 | -19.04% |

Five Years Ended 12/31/22 | 8.99% |

Ten Years Ended 12/31/22 | 12.28% |

COMPARATIVE PERFORMANCE

Comparison of Change in Value of $250,000 Investment in Shares

of Wilshire 5000 IndexSM Fund, Institutional Class Shares and the

FT Wilshire 5000 Total Market Return IndexSM through 12/31/22.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Portfolio shares.

(1) | The FT Wilshire 5000 Total Market Return IndexSM is an unmanaged index that measures the performance of all U.S. headquartered equity securities with readily available price data. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

The Index Fund’s total expense ratio per the prospectus dated 4/30/2022 was 0.33% for Institutional Class Shares.

28

Wilshire 5000 Indexsm Fund Commentary (Unaudited) - (Continued) |

|

The U.S. stock market, represented by the FT Wilshire 5000 Total Market IndexSM, was down -19.04% for the year. Sector returns for the Wilshire 5000 Total Market IndexSM were mixed for the year. Energy (+62.48%) and Utilities (+1.21%) were the best performing sectors while Communication Services (-40.04%) and Consumer Discretionary (-36.33%) sectors were the largest detractors. For the year, large capitalization stocks underperformed small capitalization stock with the Wilshire US Large-Cap IndexSM returning -19.03% versus -18.65% for the Wilshire US Small-Cap IndexSM. Growth lagged Value equities during the period, with Wilshire US Large-Cap Growth IndexSM returning -29.54% versus -5.51% for the Wilshire US Large-Cap Value IndexSM.

Real estate securities were up during the fourth quarter in both the United States and abroad. Commodity results also were positive for the quarter, with crude oil rising modestly by 1.0% to $80.26 per barrel. Oil prices were quite volatile in 2022, with lows approaching $70 and highs at nearly $125, due to tightening supplies with the Ukraine invasion but then falling demand from China. Natural gas prices fell dramatically during the quarter due to relatively mild winter temperatures – despite the destruction done by Winter Storm Elliott. By quarter-end, natural gas was down -33.9%, closing at $4.48 per million BTUs. Gold prices were up 9.8% during the quarter, finishing at approximately $1,826 per troy ounce, as the Federal Reserve continued its hawkish stance toward inflation.

The Wilshire 5000 Index Fund - Institutional Class returned -18.83% for the year, outperforming the FT Wilshire 5000 Total Market Index return of -19.04% by 0.21%. Relative performance can vary as the Fund is managed using enhanced stratified sampling technique in an attempt to hold stocks representing at least 90% of the total market value of the FT Wilshire 5000 Total Market IndexSM. Relative performance is within the historical range.

29

Wilshire 5000 Indexsm Fund Commentary (Unaudited) - (Continued) |

|

PORTFOLIO SECTOR WEIGHTING†

(As of December 31, 2022)

† | Based on percent of the Portfolio’s total investments in securities at value. |

30

Wilshire International Equity Fund Commentary (Unaudited) |

|

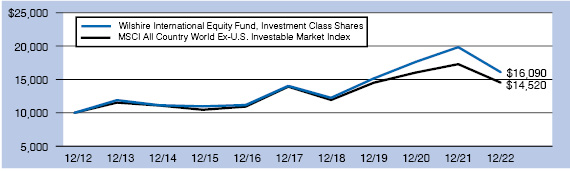

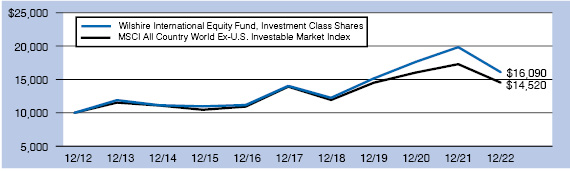

INVESTMENT CLASS SHARES

Average Annual Total Returns

One Year Ended 12/31/22 | -18.88% |

Five Years Ended 12/31/22 | 2.79% |

Ten Years Ended 12/31/22 | 4.87% |

MSCI ALL COUNTRY WORLD EX-U.S. INVESTABLE

MARKET INDEX(1)

Average Annual Total Returns

One Year Ended 12/31/22 | -16.58% |

Five Years Ended 12/31/22 | 0.85% |

Ten Years Ended 12/31/22 | 3.98% |

COMPARATIVE PERFORMANCE

Comparison of Change in Value of $10,000 Investment in Shares of Wilshire International Equity Fund, Investment Class Shares and the MSCI All Country World Ex-U.S. Index through 12/31/22.

On April 2, 2013 and July 21, 2020, the Wilshire International Equity Fund’s investment strategy was changed. Consequently, prior period performance may have been different if the new investment strategy had been in effect during these periods.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

The Portfolio’s gross expense ratio per the prospectus dated 4/30/2022 was 1.76% for Investment Class Shares. The Portfolio’s net expense ratio per the prospectus dated 4/30/2022 was 1.50% for Investment Class Shares.

31

Wilshire International Equity Fund Commentary (Unaudited) - (Continued) |

|

The Advisor has contractually agreed to waive a portion of its management fee to limit expenses of the Portfolio (excluding taxes, brokerage expenses, dividend expenses on short securities and extraordinary expenses) to 1.50% of average daily net assets for Investment Class Shares through at least April 30, 2023. The net expense ratio is applicable to shareholders.

(1) | The MSCI ACWI ex-U.S. Investable Market Index captures large, mid and small cap representation across 22 of 23 Developed Markets countries (excluding the United States) and 24 Emerging Markets countries. The index covers approximately 99% of the global equity opportunity set outside the US. Unlike a mutual fund, the performance of an index assumes no taxes, transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

32

Wilshire International Equity Fund Commentary (Unaudited) - (Continued) |

|

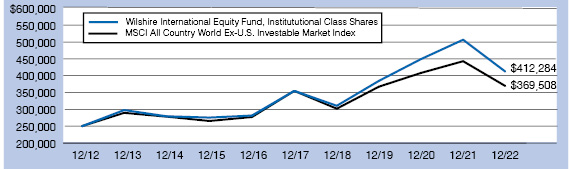

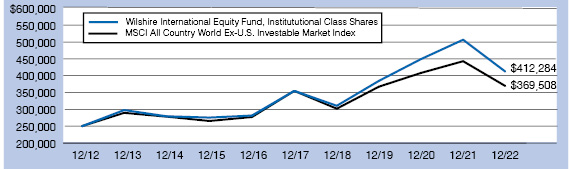

INSTITUTIONAL CLASS SHARES

Average Annual Total Returns

One Year Ended 12/31/22 | -18.63% |

Five Years Ended 12/31/22 | 3.07% |

Ten Years Ended 12/31/22 | 5.13% |

MSCI ALL COUNTRY WORLD EX-U.S. INVESTABLE

MARKET INDEX(1)

Average Annual Total Returns

One Year Ended 12/31/22 | -16.58% |

Five Years Ended 12/31/22 | 0.85% |

Ten Years Ended 12/31/22 | 3.98% |

COMPARATIVE PERFORMANCE

Comparison of Change in Value of $250,000 Investment in Shares of Wilshire International Equity Fund, Institutional Class Shares and the MSCI All Country World Ex-U.S. Index through 12/31/22.

On April 2, 2013 and July 21, 2020, the Wilshire International Equity Fund’s investment strategy was changed. Consequently, prior period performance may have been different if the new investment strategy had been in effect during these periods.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

The Portfolio’s gross expense ratio per the prospectus dated 4/30/2022 was 1.38% for Institutional Class Shares. The Portfolio’s net expense ratio per the prospectus dated 4/30/2022 was 1.25% for Institutional Class Shares.

The Advisor has contractually agreed to waive a portion of its management fee to limit expenses of the Portfolio (excluding taxes, brokerage expenses, dividend expenses on short securities and extraordinary expenses) to 1.25% for Institutional Class Shares through at least April 30, 2023. The net expense ratio is applicable to shareholders.

33

Wilshire International Equity Fund Commentary (Unaudited) - (Continued) |

|

(1) | The MSCI ACWI ex-U.S. Investable Market Index captures large, mid and small cap representation across 22 of 23 Developed Markets countries (excluding the United States) and 24 Emerging Markets countries. The index covers approximately 99% of the global equity opportunity set outside the US. Unlike a mutual fund, the performance of an index assumes no taxes, transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

34

Wilshire International Equity Fund Commentary (Unaudited) - (Continued) |

|

Performance results within international equity markets were negative, with developed outperforming emerging markets. The MSCI EAFE Index was down -14.45% for the year, while the MSCI Emerging Markets Index was down -20.09%. Europe faced similar headwinds as the United States in 2022 – surging inflation and aggressive central bank tightening – but also had to more directly contend with the ongoing war in Ukraine. The labor market remains tight in the Eurozone – including Germany where unemployment has fallen below 3% – and many businesses report that a labor shortage is limiting production. Despite China’s zero-COVID policies, including widespread lockdowns, infections continued to surge. Tension among the country’s citizens continued to rise and led to protests not seen in decades. In early December, the central government took definitive steps to ease restrictions.

The Wilshire International Equity Fund - Institutional Class returned -18.63% in 2022 underperforming the MSCI All Country World ex USA Investable Market Index return of -16.58% by -2.05%. Stock selection within Materials and Health Care detracted from relative performance. Stock selection within United Kingdom also weighed on performance. Lastly, overweight exposure to Information Technology detracted from the Portfolio’s results.

The Wilshire International Equity Fund also uses derivatives for benchmark exposure. Collateral is invested in short-term fixed income instruments to cover the costs of the swap. In 2022, returns on these fixed-income investments underperformed the cost of the swap and detracted from the Portfolio’s relative performance.

Despite recent relative underperformance, we believe the Portfolio is well-positioned going into 2023 as the market deals with the ongoing pandemic, macroeconomic and geopolitical issues.

35

Wilshire International Equity Fund Commentary (Unaudited) - (Continued) |

|

PORTFOLIO SECTOR WEIGHTING†

(As of December 31, 2022)

† | Based on percent of the Portfolio’s total investments in securities at value. |

Common Stocks are composed of:

Japan | 13.3% |

Britain | 10.4% |

France | 9.1% |

Switzerland | 5.9% |

Canada | 5.6% |

China | 5.4% |

Netherlands | 4.7% |

United States | 4.4% |

Germany | 3.7% |

Taiwan | 3.4% |

Denmark | 3.1% |

Hong Kong | 3.1% |

Ireland | 3.1% |

India | 3.0% |

South Korea | 2.7% |

Sweden | 2.7% |

Australia | 2.7% |

Italy | 2.6% |

Finland | 1.5% |

Brazil | 1.3% |

Spain | 1.2% |

Singapore | 1.0% |

Luxembourg | 0.7% |

36

Wilshire International Equity Fund Commentary (Unaudited) - (Continued) |

|

Thailand | 0.7% |

South Africa | 0.6% |

Turkey | 0.5% |

Mexico | 0.5% |

Norway | 0.5% |

United Arab Emirates | 0.4% |

Indonesia | 0.3% |

Malaysia | 0.3% |

Israel | 0.2% |

Portugal | 0.2% |

Philippines | 0.2% |

New Zealand | 0.2% |

Austria | 0.1% |

Saudi Arabia | 0.1% |

Poland | 0.1% |

Belgium | 0.1% |

Egypt | 0.1% |

Chile | 0.1% |

Greece | 0.1% |

Mauritius | 0.1% |

Isle Of Man | 0.0% |

Georgia | 0.0% |

Jersey | 0.0% |

Czech Republic | 0.0% |

Qatar | 0.0% |

Gibraltar | 0.0% |

Columbia | 0.0% |

Russia | 0.0% |

37

Wilshire Income Opportunities Fund Commentary (Unaudited) |

|

INVESTMENT CLASS SHARES

Average Annual Total Returns

One Year Ended 12/31/22 | -11.18% |

Five Years Ended 12/31/22 | 0.11% |

Inception (03/30/16) through 12/31/22 | 1.47% |

BLOOMBERG U.S. UNIVERSAL INDEX(1)

Average Annual Total Returns

One Year Ended 12/31/22 | -12.99% |

Five Years Ended 12/31/22 | 0.18% |

Inception (03/30/16) through 12/31/22 | 0.89% |

CUSTOM BLENDED INDEX(2)

Average Annual Total Returns

One Year Ended 12/31/22 | -11.82% |

Five Years Ended 12/31/22 | 0.67% |

Inception (03/30/16) through 12/31/22 | 1.69% |

COMPARATIVE PERFORMANCE

Comparison of Change in Value of $10,000 Investment in Shares of Wilshire Income Opportunities Fund, Investment Class Shares and the Bloomberg U.S. Universal Index through 12/31/22.

38

Wilshire Income Opportunities Fund Commentary (Unaudited) - (Continued) |

|

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

(1) | The Bloomberg U.S. Universal Index represents the union of the U.S. Aggregate Index, U.S. Corporate High Yield Index, Investment Grade 144A Index, Eurodollar Index, U.S. Emerging Markets Index, and the non-ERISA eligible portion of the CMBS Index. The index covers USD-denominated, taxable bonds that are rated either investment grade or high-yield. Some U.S. Universal Index constituents may be eligible for one or more of its contributing subcomponents that are not mutually exclusive. The Bloomberg U.S. Universal Index includes Treasury securities, Government agency bonds, mortgage-backed bonds, corporate bonds, and a small amount of foreign bonds traded in U.S. Unlike a mutual fund, the performance of an index assumes no taxes, transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

(2) | The Custom Blended Index consists of 70% Bloomberg U.S. Universal Index, 10% Bloomberg U.S. Corporate High Yield 2% Issuer Capped Bond Index, 10% S&P/LSTA Leveraged Loan Index, and 10% Bloomberg Emerging Markets USD Aggregate Bond Index. |

The Portfolio’s gross expense ratio per the prospectus dated 4/30/2022 was 1.32% for Investment Class Shares. The Portfolio’s net expense ratio per the prospectus dated 4/30/2022 was 1.16% for Investment Class Shares.

The Advisor has contractually agreed to waive a portion of its management fee to limit expenses of the Portfolio (excluding taxes, brokerage expenses, dividend expenses on short securities and extraordinary expenses) to 1.15% of average daily net assets for Investment Class Shares through at least April 30, 2023. The net expense ratio is applicable to shareholders.

39

Wilshire Income Opportunities Fund Commentary (Unaudited) |

|

INSTITUTIONAL CLASS SHARES

Average Annual Total Returns

One Year Ended 12/31/22 | -10.91% |

Five Years Ended 12/31/22 | 0.36% |

| Inception (03/30/16) through 12/31/22 | 1.68% |

BLOOMBERG U.S. UNIVERSAL INDEX(1)

Average Annual Total Returns

One Year Ended 12/31/22 | -12.99% |

Five Years Ended 12/31/22 | 0.18% |

Inception (03/30/16) through 12/31/22 | 0.89% |

CUSTOM BLENDED INDEX(2)

Average Annual Total Returns

One Year Ended 12/31/22 | -11.82% |

Five Years Ended 12/31/22 | 0.67% |

Inception (03/30/16) through 12/31/22 | 1.69% |

COMPARATIVE PERFORMANCE

Comparison of Change in Value of $250,000 Investment in Shares of Wilshire Income Opportunities Fund, Institutional Class Shares and the Bloomberg U.S. Universal Index through 12/31/22.

40

Wilshire Income Opportunities Fund Commentary (Unaudited) - (Continued) |

|

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

(1) | The Bloomberg U.S. Universal Index represents the union of the U.S. Aggregate Index, U.S. Corporate High Yield Index, Investment Grade 144A Index, Eurodollar Index, U.S. Emerging Markets Index, and the non-ERISA eligible portion of the CMBS Index. The index covers USD-denominated, taxable bonds that are rated either investment grade or high-yield. Some U.S. Universal Index constituents may be eligible for one or more of its contributing subcomponents that are not mutually exclusive. The Bloomberg U.S. Universal Index includes Treasury securities, Government agency bonds, mortgage-backed bonds, corporate bonds, and a small amount of foreign bonds traded in U.S. Unlike a mutual fund, the performance of an index assumes no taxes, transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

(2) | The Custom Blended Index consists of 70% Bloomberg U.S. Universal Index, 10% Bloomberg U.S. Corporate High Yield 2% Issuer Capped Bond Index, 10% S&P/LSTA Leveraged Loan Index, and 10% Bloomberg Emerging Markets USD Aggregate Bond Index. |

The Portfolio’s gross expense ratio per the prospectus dated 4/30/2022 was 0.93% for Institutional Class Shares. The Portfolio’s net expense ratio per the prospectus dated 4/30/2022 was 0.91% for Institutional Class Shares.

The Advisor has contractually agreed to waive a portion of its management fee to limit expenses of the Portfolio (excluding taxes, brokerage expenses, dividend expenses on short securities and extraordinary expenses) to 0.90% for Institutional Class Shares, respectively, through at least April 30, 2023. The net expense ratio is applicable to shareholders.

41

Wilshire Income Opportunities Fund Commentary (Unaudited) - (Continued) |

|

The U.S. Treasury yield curve was up in the short-end (below 3-years) by 50-135 basis points but largely unchanged across the remainder of the curve. The 10-year Treasury yield ended the quarter at 3.88%, up just 5 basis points from September. Credit spreads tightened during the quarter within both investment grade and high yield bonds (down 84 basis points within the speculative market). The Federal Open Market Committee met twice during the quarter, as scheduled, and increased the overnight rate by 0.75% in November and 0.50% in December, targeting a range of 4.25% to 4.50%. The Fed’s “dot plot” is messaging that the current intent is for another 75 basis points in increases before the end of 2023. Following the December meeting, Fed Chair Jerome Powell indicated that inflation data during the fourth quarter has been encouraging but that it will take “substantially more evidence” to ensure that modest price increases are sustainable.

The Wilshire Income Opportunities Fund - Institutional Class returned -10.91% for 2022, outperforming the Bloomberg US Universal Index return of -12.99% by 2.08%. Exposure to most fixed income sectors generally detracted from performance. Exposure to Emerging Market Debt and U.S. Investment Grade Corporate were the top detracting sectors. Exposures to Credit sectors, such as U.S. Agency Mortgage Back Securities, High Yield Corporate and Bank Loans, outperformed the Bloomberg US Universal Index but still generated negative returns. Security selection within High Yield aided relative Portfolio results.

We are pleased with the Portfolio’s relative outperformance for the year and believe that the Portfolio is well-positioned going into 2023 as the market deals with the ongoing pandemic, macroeconomic and geopolitical issues.

42

Wilshire Income Opportunities Fund Commentary (Unaudited) - (Continued) |

|

PORTFOLIO SECTOR WEIGHTING†

(As of December 31, 2022)

† | Based on percent of the Portfolio’s total investments in securities at value. |

43

Wilshire Mutual Funds, Inc. Disclosure of Fund Expenses (Unaudited) |

|

All mutual funds have operating expenses. As a shareholder of a Portfolio, you incur ongoing costs, which include costs for investment advisory, administrative services, distribution and/or shareholder services and shareholder reports (like this one), among others. Operating expenses, which are deducted from a fund’s gross income, directly reduce the investment return of the Portfolio. A Portfolio’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing fees (in dollars) of investing in the Portfolios and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period and held for the entire period from July 1, 2022 to December 31, 2022.

The table on the next page illustrates the Portfolios’ costs in two ways:

Actual Fund Return: This section helps you to estimate the actual expenses, after any applicable fee reductions, that you paid over the period. The “Ending Account Value” shown is derived from each Portfolio’s actual return for the period. The “Expense Ratio” column shows the period’s annualized expense ratio and the “Expenses Paid During Period” column shows the dollar amount that would have been paid by an investor who started with $1,000 in the Portfolios at the beginning of the period.

You may use the information here, together with your account value, to estimate the expenses that you paid over the period. To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for the Portfolio in the first line under the heading entitled “Expenses Paid During Period.”

Hypothetical 5% Return: This section is intended to help you compare the Portfolios’ costs with those of other mutual funds. The “Ending Account Value” shown is derived from hypothetical account values and hypothetical expenses based on the Portfolio’s actual expense ratio and assumed rate of return. It assumes that each Portfolio had an annual return of 5% before expenses, but that the expense ratio is unchanged. In this case, because the return used is not each Portfolio’s actual return, the results do not apply to your investment. This example is useful in making comparisons to other mutual funds because the U.S. Securities and Exchange Commission (“SEC”) requires all mutual funds to calculate expenses based on an assumed 5% annual return. You can assess the Portfolios’ ongoing costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight and help you compare your ongoing costs only and do not reflect any transactional costs such as sales charges (loads), redemption fees, or exchange fees. Wilshire Mutual Funds, Inc. has no such charges, but these may be present in other funds to which you compare this data. Therefore, the hypothetical portions of the table are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

44

Wilshire Mutual Funds, Inc. Disclosure of Fund Expenses (Unaudited) - (Continued) For the Six Months Ended December 31, 2022 (Unaudited) |

|

| | | Beginning

Account

Value

07/01/2022 | | | Ending

Account

Value

12/31/2022 | | | Net

Expense

Ratio(1) | | | Expenses

Paid During

Period

07/01/2022-

12/31/2022(2) | |

Large Company Growth Portfolio |

Based on Actual Fund Return | | | | | | | | | | | | | | | | |

Investment Class | | $ | 1,000.00 | | | $ | 977.00 | | | | 1.30 | % | | $ | 6.48 | |

Institutional Class | | $ | 1,000.00 | | | $ | 978.30 | | | | 1.02 | % | | $ | 5.09 | |

Based on Hypothetical 5% Return | | | | | | | | | | | | | | | | |

Investment Class | | $ | 1,000.00 | | | $ | 1,018.65 | | | | 1.30 | % | | $ | 6.61 | |

Institutional Class | | $ | 1,000.00 | | | $ | 1,020.06 | | | | 1.02 | % | | $ | 5.19 | |

Large Company Value Portfolio |

Based on Actual Fund Return | | | | | | | | | | | | | | | | |

Investment Class | | $ | 1,000.00 | | | $ | 1,060.50 | | | | 1.28 | % | | $ | 6.65 | |

Institutional Class | | $ | 1,000.00 | | | $ | 1,061.80 | | | | 1.01 | % | | $ | 5.25 | |

Based on Hypothetical 5% Return | | | | | | | | | | | | | | | | |

Investment Class | | $ | 1,000.00 | | | $ | 1,018.75 | | | | 1.28 | % | | $ | 6.51 | |

Institutional Class | | $ | 1,000.00 | | | $ | 1,020.11 | | | | 1.01 | % | | $ | 5.14 | |

Small Company Growth Portfolio |

Based on Actual Fund Return | | | | | | | | | | | | | | | | |

Investment Class | | $ | 1,000.00 | | | $ | 1,002.80 | | | | 1.33 | % | | $ | 6.71 | |

Institutional Class | | $ | 1,000.00 | | | $ | 1,004.00 | | | | 1.08 | % | | $ | 5.46 | |

Based on Hypothetical 5% Return | | | | | | | | | | | | | | | | |