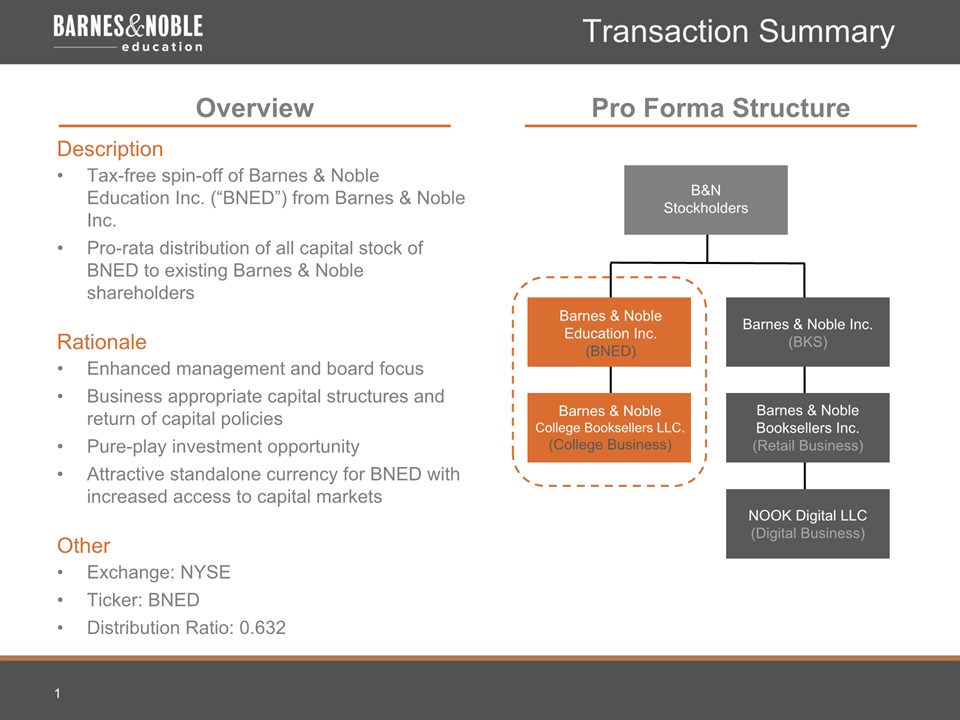

Forward Looking Statements Disclaimer This presentation contains certain forward-looking statements and information relating to our business that are based on the beliefs of our management as well as assumptions made by and information currently available to our management. When used in this communication, the words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan,” “forecasts,” “projections,” and similar expressions, as they relate to us or our management, identify forward-looking statements. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties and assumptions, the future events and trends discussed in this presentation may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements. Such statements reflect our current views with respect to future events, the outcome of which is subject to certain risks, including, among others, those described in the prospectus contained in our Registration Statement on Form S-1 filed with the Securities and Exchange Commission (the “SEC”) under the captions “Risk Factors” and “Cautionary Statement Concerning Forward-Looking Statements.” Should one or more of such risks or uncertainties materialize, or should the underlying assumptions prove incorrect, actual results or outcomes may vary materially from those described as anticipated, believed, estimated, expected, intended or planned. Subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements in this paragraph. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise after the date of this presentation except to the extent required by law.We have filed a registration statement on Form S-1 (including a prospectus) with the SEC for the spin-off to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents we have filed with the SEC for more complete information about us and the spin-off. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. You may request a copy of the prospectus relating to the spin-off at no cost by writing to us at the following address: Investor Relations, Barnes & Noble Education, Inc., 120 Mountain View Blvd., Basking Ridge, NJ 07920.