UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number 811-07102

The Advisors’ Inner Circle Fund II

(Exact name of registrant as specified in charter)

SEI Investments

One Freedom Valley Drive

Oaks, PA 19456

(Address of principal executive offices) (Zip code)

SEI Investments

One Freedom Valley Drive

Oaks, PA 19456

(Name and address of agent for service)

Registrant’s telephone number, including area code: (877) 446-3863

Date of fiscal year end: December 31, 2023

Date of reporting period: December 31, 2023

Item 1. Reports to Stockholders.

| (a) | A copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Act”) (17 CFR § 270.30e-1), is attached hereto. |

| | |

| THE ADVISORS’ INNER CIRCLE FUND II | | SPRUCEGROVE |

| | INTERNATIONAL EQUITY FUND |

| | DECEMBER 31, 2023 |

TABLE OF CONTENTS

The Fund files its complete schedules of investments with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Fund’s Form N-PORT is available on the SEC’s website at https://www.sec.gov, and may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to fund securities, as well as information relating to how the Fund voted proxies relating to fund securities during the most recent 12-month period ended June 30, is available (i) without charge, upon request, by calling 1- 844-777-8234; and (ii) on the SEC’s website at https://www. sec.gov.

| | |

| THE ADVISORS’ INNER CIRCLE FUND II | | SPRUCEGROVE INTERNATIONAL EQUITY FUND DECEMBER 31, 2023 (Unaudited) |

To our Shareholders

International equity markets rebounded late in the year boosting the return for the year to 18.24%. The late rally was attributable to a perceived change in central bank interest rate policies from a “higher for longer” stance to an expectation of interest rate cuts in the year ahead. However, there appears to be evidence that the full effects of higher rates have been delayed in part due to excess savings and longer maturity debt taken when rates were still low. Adding to the uncertainty about economic strength in 2024 are ongoing wars in Europe and the Middle East, a weak Chinese economy, and upcoming elections in countries like Taiwan and the US.

For the one year, the Fund’s net return of +17.96% compares to +18.24% for the index. Strong contributions from our Materials and Health care holdings were offset by our positioning within Financials. The Fund is considerably underweight European Financials and has no exposure to Japanese Financials, both of which performed strongly. We are conscious that this positioning may be a headwind at times, but we believe in the risk-mitigating effect it provides to the portfolio as the majority of these financials fail to meet our quality criteria.

From a country perspective, positive stock selection in Ireland, Germany, and the U.K., was partially offset by negative stock selection in Japan and an overweight to Hong Kong.

We expect speculation about the timing and magnitude of rate cuts to continue to dominate market sentiment, while the global economy remains resilient.

1

| | |

| THE ADVISORS’ INNER CIRCLE FUND II | | SPRUCEGROVE INTERNATIONAL EQUITY FUND DECEMBER 31, 2023 (Unaudited) |

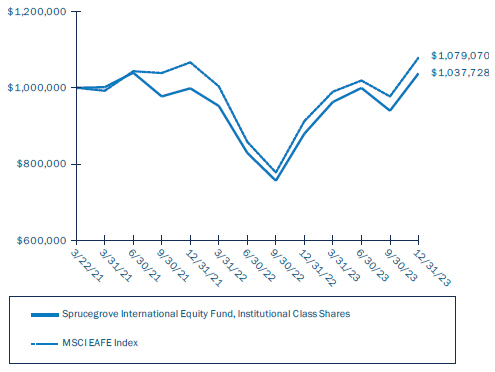

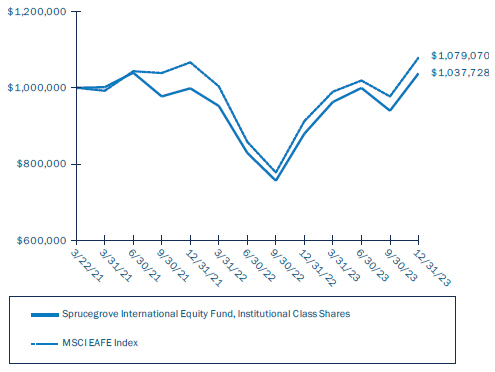

Growth of a $1,000,000 Investment

| | | | |

| |

| | | AVERAGE ANNUAL TOTAL RETURN FOR

YEAR ENDED DECEMBER 31, 2023 |

| | | One Year Return | | Annualized

Inception to Date |

Institutional Class Shares* | | 17.96% | | 1.34% |

Investor Class Shares**† | | 17.78% | | 7.25% |

Advisor Class Shares**† | | 17.46% | | 6.97% |

MSCI EAFE Index | | 18.24% | | 8.66% |

* Inception date of the Class was March 22, 2021. The Advisor managed a similar strategy of an unregistered mutual fund that commenced operations on September 30, 1985. Please refer to the most recent Sprucegrove Fund’s prospectus for historical performance.

** Inception date of the Class was May 31, 2022.

†The graph is based on only Institutional Class Shares; performance for Investor Class Shares and Advisor Class Shares would be different due to differences in fee structures.

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, may be worth less than its original cost.

2

| | |

| THE ADVISORS’ INNER CIRCLE FUND II | | SPRUCEGROVE INTERNATIONAL EQUITY FUND DECEMBER 31, 2023 (Unaudited) |

Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index. There are no assurances that the Fund will meet its stated objectives. The Fund’s holdings and allocations are subject to change because it is actively managed and should not be considered recommendations to buy individual securities.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

See definition of the comparative index below.

Definition of the Comparative Index

The MSCI EAFE Index (Europe, Australasia, Far East) is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the US & Canada. The MSCI EAFE Index consists of the following 22 developed market country indices: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Greece, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, and the United Kingdom*.

3

| | |

| THE ADVISORS’ INNER CIRCLE FUND II | | SPRUCEGROVE INTERNATIONAL EQUITY FUND DECEMBER 31, 2023 |

| | | | |

| |

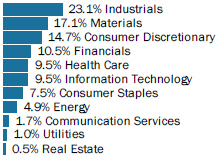

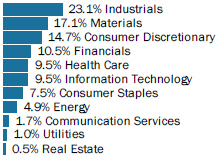

SECTOR WEIGHTING (Unaudited)† | | | | |

† Percentages are based on total investments

| | | | | | | | |

| SCHEDULE OF INVESTMENTS COMMON STOCK — 95.1% | | | | |

| | |

| | | Shares | | Value |

AUSTRALIA — 1.6% | | | | | | | | |

Adbri Ltd * | | | 460,250 | | | $ | 942,157 | |

National Australia Bank Ltd | | | 68,525 | | | | 1,435,475 | |

| | | | | | | 2,377,632 | |

| | |

BRAZIL — 3.1% | | | | | | | | |

Ambev SA ADR | | | 754,200 | | | | 2,111,760 | |

Banco Bradesco SA ADR | | | 704,199 | | | | 2,464,697 | |

Odontoprev SA | | | 5,000 | | | | 11,961 | |

| | | | | | | 4,588,418 | |

| | |

CANADA — 3.8% | | | | | | | | |

Alimentation Couche-Tard Inc | | | 19,000 | | | | 1,124,352 | |

North West Co Inc | | | 40,069 | | | | 1,193,318 | |

Saputo Inc | | | 52,600 | | | | 1,070,270 | |

Stella-Jones Inc | | | 26,100 | | | | 1,526,492 | |

Toronto-Dominion Bank | | | 10,400 | | | | 672,048 | |

| | | | | | | 5,586,480 | |

| | |

CHINA — 1.6% | | | | | | | | |

Alibaba Group Holding Ltd | | | 130,900 | | | | 1,267,334 | |

Tencent Holdings Ltd | | | 29,100 | | | | 1,094,155 | |

| | | | | | | 2,361,489 | |

| | |

FINLAND — 0.8% | | | | | | | | |

Nokian Renkaat Oyj | | | 133,622 | | | | 1,218,932 | |

| | |

FRANCE — 3.0% | | | | | | | | |

Air Liquide SA | | | 11,573 | | | | 2,251,548 | |

The accompanying notes are an integral part of the financial statements.

4

| | |

| THE ADVISORS’ INNER CIRCLE FUND II | | SPRUCEGROVE INTERNATIONAL EQUITY FUND DECEMBER 31, 2023 |

| | | | | | | | |

| SCHEDULE OF INVESTMENTS COMMON STOCK — continued | | | | |

| | |

| | | Shares | | Value |

FRANCE — continued | | | | | | | | |

TotalEnergies SE | | | 32,596 | | | $ | 2,218,052 | |

| | | | | | | 4,469,600 | |

| | |

GERMANY — 8.6% | | | | | | | | |

BASF SE | | | 41,970 | | | | 2,261,557 | |

Bayerische Motoren Werke AG | | | 20,726 | | | | 2,307,366 | |

Fresenius Medical Care AG | | | 58,910 | | | | 2,470,256 | |

FUCHS SE * | | | 21,840 | | | | 782,878 | |

Henkel AG & Co KGaA | | | 28,630 | | | | 2,055,075 | |

SAP SE | | | 19,090 | | | | 2,941,335 | |

| | | | | | | 12,818,467 | |

| | |

HONG KONG — 6.1% | | | | | | | | |

AIA Group Ltd | | | 306,000 | | | | 2,666,731 | |

Hongkong Land Holdings Ltd | | | 187,200 | | | | 651,456 | |

Jardine Matheson Holdings Ltd | | | 53,900 | | | | 2,221,219 | |

Johnson Electric Holdings Ltd | | | 431,823 | | | | 685,736 | |

Techtronic Industries Co Ltd | | | 95,500 | | | | 1,138,019 | |

Xinyi Glass Holdings Ltd | | | 965,494 | | | | 1,083,137 | |

Yue Yuen Industrial Holdings Ltd | | | 491,376 | | | | 543,697 | |

| | | | | | | 8,989,995 | |

| | |

INDIA — 4.2% | | | | | | | | |

Adani Ports & Special Economic Zone Ltd | | | 187,140 | | | | 2,303,668 | |

HDFC Bank Ltd | | | 132,031 | | | | 2,711,984 | |

UPL Ltd | | | 170,120 | | | | 1,200,558 | |

| | | | | | | 6,216,210 | |

| | |

IRELAND — 2.0% | | | | | | | | |

Ryanair Holdings PLC ADR * | | | 22,400 | | | | 2,987,264 | |

| | |

ITALY — 1.1% | | | | | | | | |

Brembo SpA | | | 130,538 | | | | 1,600,614 | |

| | |

JAPAN — 13.7% | | | | | | | | |

Ain Holdings Inc | | | 38,000 | | | | 1,205,930 | |

Denso Corp | | | 139,200 | | | | 2,100,145 | |

FANUC Corp | | | 17,300 | | | | 508,888 | |

Koito Manufacturing Co Ltd | | | 65,900 | | | | 1,027,204 | |

Komatsu Ltd | | | 24,100 | | | | 630,450 | |

Kubota Corp | | | 113,100 | | | | 1,702,758 | |

Makita Corp | | | 43,300 | | | | 1,194,758 | |

MISUMI Group Inc | | | 58,200 | | | | 986,444 | |

Nihon Kohden Corp | | | 80,900 | | | | 2,561,049 | |

Nitto Denko Corp | | | 41,400 | | | | 3,098,099 | |

The accompanying notes are an integral part of the financial statements.

5

| | |

| THE ADVISORS’ INNER CIRCLE FUND II | | SPRUCEGROVE INTERNATIONAL EQUITY FUND DECEMBER 31, 2023 |

| | | | | | | | |

| SCHEDULE OF INVESTMENTS COMMON STOCK — continued | | | | |

| | |

| | | Shares | | Value |

JAPAN — continued | | | | | | | | |

Omron Corp | | | 37,859 | | | $ | 1,767,810 | |

Seria Co Ltd | | | 70,300 | | | | 1,310,957 | |

Toyota Motor Corp | | | 121,100 | | | | 2,225,206 | |

| | | | | | | 20,319,698 | |

| | |

NETHERLANDS — 1.7% | | | | | | | | |

Koninklijke Vopak NV | | | 42,340 | | | | 1,423,712 | |

SBM Offshore NV | | | 85,892 | | | | 1,181,269 | |

| | | | | | | 2,604,981 | |

| | |

NORWAY — 0.8% | | | | | | | | |

Bakkafrost | | | 22,234 | | | | 1,164,714 | |

| | |

PANAMA — 1.5% | | | | | | | | |

Copa Holdings SA, Cl A | | | 21,000 | | | | 2,232,510 | |

| | |

SINGAPORE — 4.9% | | | | | | | | |

Sembcorp Industries Ltd | | | 348,000 | | | | 1,400,864 | |

Singapore Telecommunications Ltd | | | 749,525 | | | | 1,403,477 | |

United Overseas Bank Ltd | | | 109,630 | | | | 2,364,471 | |

Venture Corp Ltd | | | 203,000 | | | | 2,094,481 | |

| | | | | | | 7,263,293 | |

| | |

SOUTH KOREA — 2.0% | | | | | | | | |

Samsung Electronics Co Ltd GDR | | | 2,002 | | | | 2,998,996 | |

| | |

SPAIN — 0.6% | | | | | | | | |

Industria de Diseno Textil SA | | | 19,894 | | | | 866,514 | |

| | |

SWEDEN — 1.8% | | | | | | | | |

Assa Abloy AB, Cl B | | | 91,575 | | | | 2,637,886 | |

| | |

SWITZERLAND — 7.4% | | | | | | | | |

Cie Financiere Richemont SA, Cl A | | | 13,160 | | | | 1,809,861 | |

Holcim AG | | | 21,420 | | | | 1,680,210 | |

Novartis AG | | | 36,020 | | | | 3,632,172 | |

Roche Holding AG | | | 7,610 | | | | 2,210,711 | |

Sandoz Group AG * | | | 7,204 | | | | 231,617 | |

Swatch Group AG | | | 5,170 | | | | 1,404,220 | |

| | | | | | | 10,968,791 | |

| | |

TAIWAN — 0.8% | | | | | | | | |

Taiwan Semiconductor Manufacturing Co Ltd | | | 62,000 | | | | 1,197,960 | |

| | |

UNITED KINGDOM — 23.3% | | | | | | | | |

Anglo American PLC | | | 85,643 | | | | 2,151,447 | |

Berkeley Group Holdings PLC | | | 51,436 | | | | 3,073,938 | |

CRH PLC | | | 52,162 | | | | 3,597,425 | |

The accompanying notes are an integral part of the financial statements.

6

| | |

| THE ADVISORS’ INNER CIRCLE FUND II | | SPRUCEGROVE INTERNATIONAL EQUITY FUND DECEMBER 31, 2023 |

| | | | | | | | |

| SCHEDULE OF INVESTMENTS COMMON STOCK — continued | | | | |

| | |

| | | Shares | | Value |

UNITED KINGDOM — continued | | | | | | | | |

Croda International PLC | | | 16,606 | | | $ | 1,069,047 | |

HSBC Holdings PLC | | | 375,603 | | | | 3,030,395 | |

IMI PLC | | | 143,100 | | | | 3,072,005 | |

Renishaw PLC | | | 26,265 | | | | 1,198,003 | |

RS GROUP PLC | | | 175,423 | | | | 1,832,858 | |

Shell PLC | | | 69,355 | | | | 2,273,550 | |

Smith & Nephew PLC | | | 199,278 | | | | 2,739,806 | |

Smiths Group PLC | | | 133,300 | | | | 2,996,718 | |

Spectris PLC | | | 33,170 | | | | 1,597,948 | |

Travis Perkins PLC | | | 178,285 | | | | 1,883,215 | |

Victrex PLC | | | 86,915 | | | | 1,686,357 | |

Weir Group PLC | | | 97,250 | | | | 2,338,766 | |

| | | | | | | 34,541,478 | |

| | |

VIETNAM — 0.7% | | | | | | | | |

Vietnam Dairy Products JSC | | | 371,500 | | | | 1,035,092 | |

| | |

TOTAL COMMON STOCK

(Cost $126,596,227) | | | | | | | 141,047,014 | |

| | |

| | | | | | | | |

| | |

PREFERRED STOCK — 3.1% | | | | | | | | |

| | |

GERMANY — 3.1% | | | | | | | | |

FUCHS SE (A) | | | 60,028 | | | | 2,672,302 | |

Jungheinrich AG (A) | | | 51,540 | | | | 1,891,345 | |

| | | | | | | 4,563,647 | |

| | |

TOTAL PREFERRED STOCK | | | | | | | | |

(Cost $3,532,053) | | | | | | | 4,563,647 | |

| | |

TOTAL INVESTMENTS— 98.2% | | | | | | | | |

(Cost $130,128,280) | | | | | | $ | 145,610,661 | |

| | | | | | | | |

| | | | | | | | |

Percentages are based on Net Assets of $148,258,503.

| * | Non-income producing security. |

| (A) | There is currently no rate available. |

ADR — American Depositary Receipt

Cl — Class

GDR — Global Depositary Receipt

JSC — Joint-Stock Company

The accompanying notes are an integral part of the financial statements.

7

| | |

| THE ADVISORS’ INNER CIRCLE FUND II | | SPRUCEGROVE INTERNATIONAL EQUITY FUND DECEMBER 31, 2023 |

Ltd — Limited

PLC — Public Limited Company

As of December 31, 2023, all of the Fund’s investments were considered Level 1, in accordance with the authoritative guidance on fair value measurements and disclosure under U.S. generally accepted accounting principles.

For more information on valuation inputs, see Note 2 — Significant Accounting Policies in the Notes to Financial Statements.

The accompanying notes are an integral part of the financial statements.

8

| | |

| THE ADVISORS’ INNER CIRCLE FUND II | | SPRUCEGROVE INTERNATIONAL EQUITY FUND DECEMBER 31, 2023 |

| | | | |

| |

STATEMENT OF ASSETS AND LIABILITIES | | | | |

| | | | |

Assets: | | | | |

Investments, at Value (Cost $130,128,280) | | $ | 145,610,661 | |

Foreign Currency, at Value (Cost $573,802) | | | 562,857 | |

Cash | | | 1,188,135 | |

Reclaim Receivable | | | 934,719 | |

Dividend and Interest Receivable | | | 253,008 | |

Receivable for Investment Securities Sold | | | 6,111 | |

Unrealized Gain on Foreign Spot Currency Contracts | | | 12 | |

Other Prepaid Expenses | | | 22,094 | |

| | | | |

Total Assets | | | 148,577,597 | |

| | | | |

Liabilities: | | | | |

Payable for Investment Securities Purchased | | | 38,253 | |

Payable to Investment Adviser | | | 34,108 | |

Payable to Administrator | | | 9,342 | |

Chief Compliance Officer Fees Payable | | | 1,930 | |

Payable to Trustees | | | 339 | |

Legal Fees Payable | | | 4,957 | |

Audit Fees Payable | | | 27,300 | |

Accrued Foreign Capital Gains Tax on Appreciated Securities | | | 167,657 | |

Other Accrued Expenses and Other Payables | | | 35,208 | |

| | | | |

Total Liabilities | | | 319,094 | |

| | | | |

Commitments and Contingencies † | | | | |

Net Assets | | $ | 148,258,503 | |

| | | | |

Net Assets Consist of: | | | | |

Paid-in Capital | | $ | 133,880,841 | |

Total Distributable Earnings | | | 14,377,662 | |

| | | | |

Net Assets | | $ | 148,258,503 | |

| | | | |

Institutional Class Shares: | | | | |

Net Assets | | $ | 148,144,410 | |

Outstanding Shares of beneficial interest (unlimited authorization — no par value) | | | 2,013,894 | |

Net Asset Value, Offering and Redemption Price Per Share | | $ | 73.56 | |

| | | | |

Investor Class Shares: | | | | |

Net Assets | | $ | 104,015 | |

Outstanding Shares of beneficial interest (unlimited authorization — no par value) | | | 1,414 | |

Net Asset Value, Offering and Redemption Price Per Share | | $ | 73.54* | |

| | | | |

Advisor Class Shares: | | | | |

Net Assets | | $ | 10,078 | |

Outstanding Shares of beneficial interest (unlimited authorization — no par value) | | | 137 | |

Net Asset Value, Offering and Redemption Price Per Share | | $ | 73.32* | |

| | | | |

| † | See Note 5 in the Notes to Financial Statements. |

| * | Net Assets divided by Shares do not calculate to the stated Net Asset Value because Net Assets and Shares are shown Rounded. |

The accompanying notes are an integral part of the financial statements.

9

| | |

| THE ADVISORS’ INNER CIRCLE FUND II | | SPRUCEGROVE INTERNATIONAL EQUITY FUND FOR THE YEAR ENDED DECEMBER 31, 2023 |

| | | | |

Investment Income: | | | | |

Dividends | | $ | 5,269,816 | |

Interest | | | 174,721 | |

Less: Foreign Taxes Withheld | | | (391,410 | ) |

| | | | |

Total Investment Income | | | 5,053,127 | |

| | | | |

Expenses: | | | | |

Investment Advisory Fees | | | 778,254 | |

Administration Fees (see Note 4) | | | 114,682 | |

Trustees’ Fees | | | 32,247 | |

Chief Compliance Officer Fees | | | 7,048 | |

Shareholder Serving Fees Investor Class Shares (see Note 4) | | | 145 | |

Shareholder Serving Fees Advisor Class Shares (see Note 4) | | | 15 | |

Distribution Fees, Advisor Class Shares (see Note 4) | | | 23 | |

Registration and Filing Fees | | | 77,869 | |

Legal Fees | | | 71,265 | |

Transfer Agent Fees (see Note 4) | | | 67,709 | |

Audit Fees | | | 52,110 | |

Custodian Fees (see Note 4) | | | 20,732 | |

Printing Fees | | | 13,347 | |

Other Expenses | | | 35,027 | |

| | | | |

Total Expenses | | | 1,270,473 | |

| | | | |

Less: | | | | |

Waiver of Investment Advisory Fees (see Note 5) | | | (337,952 | ) |

| | | | |

Net Expenses | | | 932,521 | |

| | | | |

Net Investment Income | | | 4,120,606 | |

| | | | |

Net Realized Gain (Loss) on: | | | | |

Investments | | | 7,912,759 | |

Foreign Capital Gains Tax on Appreciated Securities | | | (1,676 | ) |

Foreign Currency Transactions | | | (29,804 | ) |

| | | | |

Net Realized Gain (Loss) | | | 7,881,279 | |

| | | | |

Net Change in Unrealized Appreciation (Depreciation) on: | | | | |

Investments | | | 14,563,631 | |

Foreign Capital Gains Tax on Appreciated Securities | | | (143,011 | ) |

Foreign Currency Translation | | | 31,172 | |

| | | | |

Net Change in Unrealized Appreciation (Depreciation) | | | 14,451,792 | |

| | | | |

Net Realized and Unrealized Gain (Loss) | | | 22,333,071 | |

| | | | |

Net Increase in Net Assets Resulting from Operations | | $ | 26,453,677 | |

| | | | |

The accompanying notes are an integral part of the financial statements.

10

| | |

| THE ADVISORS’ INNER CIRCLE FUND II | | SPRUCEGROVE INTERNATIONAL EQUITY FUND |

| | | | |

|

STATEMENTS OF CHANGES IN NET ASSETS |

| | | | | | | | |

| | | Year Ended

December 31,

2023 | | Year Ended

December 31,

2022 |

Operations: | | | | | | | | |

Net Investment Income | | $ | 4,120,606 | | | $ | 8,275,022 | |

Net Realized Gain on Investments | | | 7,881,279 | | | | 11,787,457 | |

Net Change in Unrealized Appreciation (Depreciation) on Investments | | | 14,451,792 | | | | (58,230,735 | ) |

| | | | | | | | |

Net Increase (Decrease) in Net Assets Resulting From Operations | | | 26,453,677 | | | | (38,168,256 | ) |

| | | | | | | | |

Distributions: | | | | | | | | |

Institutional Class Shares | | | (8,706,573 | ) | | | (8,390,869 | ) |

Investor Class Shares | | | (5,973 | ) | | | (4,511 | ) |

Advisor Class Shares | | | (580 | ) | | | (434 | ) |

| | | | | | | | |

Total Distributions | | | (8,713,126 | ) | | | (8,395,814 | ) |

| | | | | | | | |

Return of Capital: | | | | | | | | |

Institutional Class Shares | | | – | | | | (9,189,601 | ) |

Investor Class Shares | | | – | | | | (4,940 | ) |

Advisor Class Shares | | | – | | | | (474 | ) |

| | | | | | | | |

Total Return of Capital | | | – | | | | (9,195,015 | ) |

| | | | | | | | |

Capital Share Transactions: | | | | | | | | |

Master Class Shares | | | | | | | | |

Redeemed | | | – | | | | (403,301,473)(1) | |

| | | | | | | | |

Net Master Class Shares Transactions | | | – | | | | (403,301,473 | ) |

| | | | | | | | |

Institutional Class Shares | | | | | | | | |

Issued | | | 206,642 | | | | 172,662,822(1) | |

Reinvestment of Distributions | | | 8,706,172 | | | | 17,580,470 | |

Redeemed | | | (41,513,492 | ) | | | (1,469,300 | ) |

| | | | | | | | |

Net Institutional Class Shares Transactions | | | (32,600,678 | ) | | | 188,773,992 | |

| | | | | | | | |

Investor Class Shares | | | | | | | | |

Issued | | | – | | | | 93,080 | |

Reinvestment of Distributions | | | 5,973 | | | | 9,451 | |

| | | | | | | | |

Net Investor Class Shares Transactions | | | 5,973 | | | | 102,531 | |

| | | | | | | | |

Advisor Class Shares | | | | | | | | |

Issued | | | – | | | | 9,056 | |

Reinvestment of Distributions | | | 580 | | | | 908 | |

| | | | | | | | |

Net Advisor Class Shares Transactions | | | 580 | | | | 9,964 | |

| | | | | | | | |

Net Decrease in Net Assets From Capital Share Transactions | | | (32,594,125 | ) | | | (214,414,986 | ) |

| | | | | | | | |

Total Decrease in Net Assets | | | (14,853,574 | ) | | | (270,174,071 | ) |

| | | | | | | | |

Net Assets: | | | | | | | | |

Beginning of Year | | | 163,112,077 | | | | 433,286,148 | |

| | | | | | | | |

End of Year | | $ | 148,258,503 | | | $ | 163,112,077 | |

| | | | | | | | |

The accompanying notes are an integral part of the financial statements.

11

| | |

| THE ADVISORS’ INNER CIRCLE FUND II | | SPRUCEGROVE INTERNATIONAL EQUITY FUND |

| | | | |

|

STATEMENTS OF CHANGES IN NET ASSETS |

| | | | | | | | | | | | | | | | |

| | | | | Year Ended

December 31,

2023 | | | | Year Ended

December 31,

2022 |

Share Transactions: | | | | | | | | | | | | | | | | |

Master Class Shares | | | | | | | | | | | | | | | | |

Redeemed | | | | | | | – | | | | | | | | (5,176,996)(1) | |

| | | | | | | | |

Total Master Class Shares Transactions | | | | | | | – | | | | | | | | (5,176,996) | |

| | | | | | | | |

Institutional Class Shares | | | | | | | | | | | | | | | | |

Issued | | | | | | | 2,852 | | | | | | | | 2,224,975(1) | |

Reinvestment of Distributions | | | | | | | 118,266 | | | | | | | | 256,998 | |

Redeemed | | | | | | | (568,013 | ) | | | | | | | (21,184 | ) |

| | | | | | | | |

Total Institutional Class Shares Transactions | | | | | | | (446,895 | ) | | | | | | | 2,460,789 | |

| | | | | | | | |

Investor Class Shares | | | | | | | | | | | | | | | | |

Issued | | | | | | | – | | | | | | | | 1,195 | |

Reinvestment of Distributions | | | | | | | 81 | | | | | | | | 138 | |

| | | | | | | | |

Total Investor Class Shares Transactions | | | | | | | 81 | | | | | | | | 1,333 | |

| | | | | | | | |

Advisor Class Shares | | | | | | | | | | | | | | | | |

Issued | | | | | | | – | | | | | | | | 116 | |

Reinvestment of Distributions | | | | | | | 8 | | | | | | | | 13 | |

| | | | | | | | |

Total Advisor Class Shares Transactions | | | | | | | 8 | | | | | | | | 129 | |

| | | | | | | | |

Net Decrease in Shares Outstanding From Share Transactions | | | | | | | (446,806 | ) | | | | | | | (2,714,745 | ) |

| | | | | | | | |

| (1) | Shares redeemed for the Master Class Shares and Shares Issued for the Institutional Class Shares include 1,944,658 shares at a cost of $151,483,827 due to a reorganization. Please refer to Note 1 in Notes to Financial Statements for more detail. |

Amounts designated as “—” is $0.

The accompanying notes are an integral part of the financial statements.

12

| | |

| THE ADVISORS’ INNER CIRCLE FUND II | | SPRUCEGROVE INTERNATIONAL EQUITY FUND |

| | | | | | |

| | | Selected Per Share Data & Ratios |

| | | For a Share Outstanding |

| | | Throughout the Year/Period |

| | | | | | | | | | | | |

| | | |

Institutional Class Shares | | Year Ended

December 31,

2023 | | | Year Ended

December 31,

2022(1) | | | Period Ended

December 31,

2021(2) |

Net Asset Value, Beginning of Year/Period | | | $66.25 | | | | $83.69 | | | | $87.86 | |

| | | | | | | | | | | | |

Income (Loss) from Investment Operations: | | | | | | | | | | | | |

Net Investment Income* | | | 1.92 | | | | 2.40 | | | | 2.05 | |

Net Realized and Unrealized Gain (Loss) | | | 9.91 | | | | (12.08) | | | | (1.84) | |

| | | | | | | | | | | | |

Total from Investment Operations | | | 11.83 | | | | (9.68) | | | | 0.21 | |

| | | | | | | | | | | | |

Dividends and Distributions: | | | | | | | | | | | | |

Net Investment Income | | | (2.05) | | | | (3.58) | | | | (1.98) | |

Return of Capital | | | — | | | | (4.18) | | | | — | |

Capital Gains | | | (2.47) | | | | —^ | | | | (2.40) | |

| | | | | | | | | | | | |

Total Dividends and Distributions | | | (4.52) | | | | (7.76) | | | | (4.38) | |

| | | | | | | | | | | | |

Net Asset Value, End of Year/Period | | | $73.56 | | | | $66.25 | | | | $83.69 | |

| | | | | | | | | | | | |

Total Return† | | | 17.96% | | | | (11.61)% | | | | 0.31% | |

| | | | | | | | | | | | |

Ratios and Supplemental Data | | | | | | | | | | | | |

Net Assets, End of Year/Period (Thousands) | | | $148,145 | | | | $163,015 | | | | $433,286 | |

Ratio of Net Expenses to Average Net Assets | | | 0.60% | | | | 0.22%# | | | | 0.02%†† | |

Ratio of Gross Expenses to Average Net Assets | | | 0.82% | | | | 0.36% | | | | 0.11%†† | |

Ratio of Net Investment Income to Average Net Assets | | | 2.65% | | | | 3.14% | | | | 2.93%†† | |

Portfolio Turnover Rate‡ | | | 14% | | | | 17% | | | | 15% | |

| * | Per share calculations were performed using average shares for the period. |

| ^ | Amount represents less than $0.005 per share. |

| † | Total return is for the period indicated and has not been annualized. Returns shown do not reflect the deductions of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares |

| ‡ | Portfolio turnover is for the period indicated and has not been annualized. Excludes effect of in-kind transfers. |

| # | Expense ratio reflects a “blended” rate where the Institutional Class Shares previously operated at a lower rate prior to the re-organization (see Note 1). After the re-organization the Institutional Class Shares operated at its current annualized rate of 0.60%. |

| (1) | Due to a reorganization, activity prior to June 1, 2022 includes activity from the Sprucegrove International Equity Master Fund. Please refer to Note 1 in Notes to Financial Statements for more detail. |

| (2) | Inception date of the Class was March 22, 2021. |

| | Amounts designated as “—” are either not applicable, $0 or have been rounded to $0. |

The accompanying notes are an integral part of the financial statements.

13

| | |

| THE ADVISORS’ INNER CIRCLE FUND II | | SPRUCEGROVE INTERNATIONAL EQUITY FUND |

| | | | | | | | |

| | | Selected Per Share Data & Ratios | |

| | | For a Share Outstanding | |

| | | Throughout the Year/Period | |

| | |

Investor Class Shares | | Year Ended

December 31,

2023 | | | Period Ended

December 31,

2022** | |

Net Asset Value, Beginning of Year/Period | | | $66.24 | | | | $77.90 | |

| | | | | | | | |

Income (Loss) from Investment Operations: | | | | | | | | |

Net Investment Income* | | | 1.76 | | | | 0.54 | |

Net Realized and Unrealized Gain (Loss) | | | 9.96 | | | | (4.50) | |

| | | | | | | | |

Total from Investment Operations | | | 11.72 | | | | (3.96) | |

| | | | | | | | |

Dividends and Distributions: | | | | | | | | |

Net Investment Income | | | (1.95) | | | | (3.52) | |

Return of Capital | | | — | | | | (4.18) | |

Capital Gains | | | (2.47) | | | | —^ | |

| | | | | | | | |

Total Dividends and Distributions | | | (4.42) | | | | (7.70) | |

| | | | | | | | |

Net Asset Value, End of Year/Period | | | $73.54 | | | | $66.24 | |

| | | | | | | | |

Total Return† | | | 17.78% | | | | (5.13)% | |

| | | | | | | | |

Ratios and Supplemental Data | | | | | | | | |

Net Assets, End of Year/Period (Thousands) | | | $104 | | | | $88 | |

Ratio of Net Expenses to Average Net Assets | | | 0.75% | | | | 0.75%†† | |

Ratio of Gross Expenses to Average Net Assets | | | 0.97% | | | | 1.09%†† | |

Ratio of Net Investment Income to Average Net Assets | | | 2.43% | | | | 1.31%†† | |

Portfolio Turnover Rate‡ | | | 14% | | | | 17% | |

| * | Per share calculations were performed using average shares for the period. |

| ** | Inception date of the Class was May 31, 2022. |

| ^ | Amount represents less than $0.005 per share. |

| † | Total return is for the period indicated and has not been annualized. Returns shown do not reflect the deductions of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares |

| ‡ | Portfolio turnover is for the period indicated and has not been annualized. Excludes effect of in-kind transfers. |

| | Amounts designated as “—” are either not applicable, $0 or have been rounded to $0. |

The accompanying notes are an integral part of the financial statements.

14

| | |

| THE ADVISORS’ INNER CIRCLE FUND II | | SPRUCEGROVE INTERNATIONAL EQUITY FUND |

| | | | | | | | |

| | | Selected Per Share Data & Ratios | |

| | | For a Share Outstanding | |

| | | Throughout the Year/Period | |

| | |

Advisor Class Shares | | Year Ended

December 31,

2023 | | | Period Ended

December 31,

2022** | |

Net Asset Value, Beginning of Year/Period | | | $66.23 | | | | $77.90 | |

| | | | | | | | |

Income (Loss) from Investment Operations: | | | | | | | | |

Net Investment Income* | | | 1.57 | | | | 0.44 | |

Net Realized and Unrealized Gain (Loss) | | | 9.93 | | | | (4.51) | |

| | | | | | | | |

Total from Investment Operations | | | 11.50 | | | | (4.07) | |

| | | | | | | | |

Dividends and Distributions: | | | | | | | | |

Net Investment Income | | | (1.94) | | | | (3.42) | |

Return of Capital | | | — | | | | (4.18) | |

Capital Gains | | | (2.47) | | | | —^ | |

| | | | | | | | |

Total Dividends and Distributions | | | (4.41) | | | | (7.60) | |

| | | | | | | | |

Net Asset Value, End of Year/Period | | | $73.32 | | | | $66.23 | |

| | | | | | | | |

Total Return† | | | 17.46% | | | | (5.27)% | |

| | | | | | | | |

Ratios and Supplemental Data | | | | | | | | |

Net Assets, End of Year/Period (Thousands) | | | $10 | | | | $9 | |

Ratio of Net Expenses to Average Net Assets | | | 1.01% | | | | 1.01%†† | |

Ratio of Gross Expenses to Average Net Assets | | | 1.24% | | | | 1.34%†† | |

Ratio of Net Investment Income to Average Net Assets | | | 2.16% | | | | 1.06%†† | |

Portfolio Turnover Rate‡ | | | 14% | | | | 17% | |

| * | Per share calculations were performed using average shares for the period. |

| ** | Inception date of the Class was May 31, 2022. |

| ^ | Amount represents less than $0.005 per share. |

| † | Total return is for the period indicated and has not been annualized. Returns shown do not reflect the deductions of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares |

| ‡ | Portfolio turnover is for the period indicated and has not been annualized. Excludes effect of in-kind transfers. |

| | Amounts designated as “—” are either not applicable, $0 or have been rounded to $0. |

The accompanying notes are an integral part of the financial statements.

15

| | |

| THE ADVISORS’ INNER CIRCLE FUND II | | SPRUCEGROVE INTERNATIONAL EQUITY FUND DECEMBER 31, 2023 |

|

|

NOTES TO FINANCIAL STATEMENTS |

1. Organization:

The Advisors’ Inner Circle Fund II (the “Trust”) is organized as a Massachusetts business trust under an Amended and Restated Agreement and Declaration of Trust dated July 24, 1992. The Trust is registered under the Investment Company Act of 1940, as amended, as an open-end management investment company with 9 funds. The financial statements herein are those of the Sprucegrove International Equity Fund (the “Fund”). The investment objective of the Fund is long-term capital appreciation. The financial statements of the remaining funds of the Trust are presented separately. The assets of each fund of the Trust are segregated, and a shareholder’s interest is limited to the fund of the Trust in which shares are held.

Investor Class and Advisor Class commenced operations on May 31, 2022.

On June 1, 2022, the Sprucegrove International Equity Master Fund (the “Master Fund”) was rebranded as the Sprucegrove International Equity Fund (the “Fund”). The Master Fund Share Class was fully exchanged into the Institutional Class Shares. The prior history for the Institutional Class reflects that of the Master Fund, which was established on March 22, 2021. As part of this event, 1,944,658 shares were redeemed out of the Master Class at a cost of $151,483,827 and exchanged into the Institutional Class for the same shares and dollars. Immediately prior to the aforementioned transaction, the remaining shareholder was redeemed as part of an in-kind transaction.

2. Significant Accounting Policies:

The following are significant accounting policies, which are consistently followed in the preparation of the financial statements of the Fund. The Fund is an investment company that applies the accounting and reporting guidance issued in Topic 946 by the U.S. Financial Accounting Standards Board (“FASB”).

Use of Estimates — The preparation of financial statements, in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amount of assets and liabilities and disclosure of contingent assets and liabilities as of the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates and such differences could be material.

Net Asset Value Determination — The Fund calculates its NAV once each Business Day as of the close of normal trading on the NYSE (normally, 4:00 p.m., Eastern Time). To receive the current Business Day’s NAV, the Fund or an authorized institution must receive any purchase order in proper form before the close of normal trading on the NYSE. If the NYSE closes early, as in the case

16

| | |

| THE ADVISORS’ INNER CIRCLE FUND II | | SPRUCEGROVE INTERNATIONAL EQUITY FUND DECEMBER 31, 2023 |

of scheduled half-day trading or unscheduled suspensions of trading, the Fund reserves the right to calculate NAV as of the earlier closing time. The Fund will not accept orders that request a particular day or price for the transaction or any other special conditions. Shares will only be priced on Business Days. Since securities that are traded on foreign exchanges may trade on days that are not Business Days, the value of the Fund’s assets may change on days when purchasing or redeeming shares is not available.

Security Valuation — Securities listed on a securities exchange, market or automated quotation system for which quotations are readily available (except for securities traded on NASDAQ), including securities traded over the counter, are valued at the last quoted sale price on an exchange or market (foreign or domestic) on which they are traded on valuation date (or at approximately 4:00 pm ET if a security’s primary exchange is normally open at that time), or, if there is no such reported sale on the valuation date, at the most recent quoted bid price. For securities traded on NASDAQ, the NASDAQ Official Closing Price will be used. The Fund calculates its NAV once each Business Day, as of the close of business, on a daily basis.

Securities for which market prices are not “readily available” are valued in accordance with fair value procedures (the “Fair Value Procedures”) established by the Adviser and approved by the Trust’s Board of Trustees (the “Board”). Pursuant to Rule 2a-5 under the 1940 Act, the Board has designated the Adviser as the “valuation designee” to determine the fair value of securities and other instruments for which no readily available market quotations are available. The Fair Value Procedures are implemented through a Fair Value Committee (the “Committee”) of the Adviser.

Some of the more common reasons that may necessitate that a security be valued using fair value procedures include: the security’s trading has been halted or suspended; the security has been de-listed from a national exchange; the security’s primary trading market is temporarily closed at a time when under normal conditions it would be open; the security has not been traded for an extended period of time; the security’s primary pricing source is not able or willing to provide a price; or trading of the security is subject to local government-imposed restrictions. When a security is valued in accordance with the fair value procedures, the Committee will determine the value after taking into consideration relevant information reasonably available to the Committee.

For securities that principally trade on a foreign market or exchange, a significant gap in time can exist between the time of a particular security’s last trade and the time at which the Fund calculates its net asset value. The closing prices of such securities may no longer reflect their market value at the time the Fund calculates net asset value if an event that could materially affect the value of those securities (a “Significant Event”) has occurred between the time of the security’s last close

17

| | |

| THE ADVISORS’ INNER CIRCLE FUND II | | SPRUCEGROVE INTERNATIONAL EQUITY FUND DECEMBER 31, 2023 |

and the time that the Fund calculates net asset value. A Significant Event may relate to a single issuer or to an entire market sector. If the Adviser of the Fund becomes aware of a Significant Event that has occurred with respect to a security or group of securities after the closing of the exchange or market on which the security or securities principally trade, but before the time at which the Fund calculates net asset value, it may request that a Committee meeting be called.

The Fund uses Intercontinental Exchange Data Pricing & Reference Data, LLC. (“ICE”) as a third party fair valuation vendor. ICE provides a fair value for foreign securities in the Fund based on certain factors and methodologies (involving, generally, tracking valuation correlations between the U.S. market and each non-U.S. security) applied by ICE in the event that there is a movement in the U.S. market that exceeds a specific threshold established by the Committee. The Committee establishes a “confidence interval” which is used to determine the level of correlation between the value of a foreign security and movements in the U.S. market before a particular security is fair valued when the threshold is exceeded. In the event that the threshold established by the Committee is exceeded on a specific day, the Fund values its non-U.S. securities that exceed the applicable “confidence interval” based upon the fair values provided by ICE. In such event, it is not necessary to hold a Committee meeting. In the event that the Adviser believes that the fair values provided by ICE are not reliable, the Adviser contacts SEI Investments Global Fund Services (the “Administrator”) and may request that a meeting of the Committee be held.

If a local market in which the Fund own securities is closed for one or more days, the Fund shall value all securities held in that corresponding currency based on the fair value prices provided by ICE using the predetermined confidence interval discussed above.

In accordance with the authoritative guidance on fair value measurement under U.S. GAAP, the Fund discloses the fair value of its investments in a hierarchy that prioritizes the inputs to valuation techniques used to measure the fair value. The objective of a fair value measurement is to determine the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (an exit price). Accordingly, the fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3). The three levels of the fair value hierarchy are described below:

| | ● | | Level 1 – Unadjusted quoted prices in active markets for identical, unrestricted assets or liabilities that the Fund has the ability to access at the measurement date; |

18

| | |

| THE ADVISORS’ INNER CIRCLE FUND II | | SPRUCEGROVE INTERNATIONAL EQUITY FUND DECEMBER 31, 2023 |

| | ● | | Level 2 – Other significant observable inputs (includes quoted prices for similar securities, interest rates, prepayment speeds, credit risk, referenced indices, quoted prices in inactive markets, adjusted quoted prices in active markets, adjusted quoted prices on foreign equity securities that were adjusted in accordance with the Adviser’s pricing procedures, etc.); and |

| | ● | | Level 3 – Prices, inputs or exotic modeling techniques which are both significant to the fair value measurement and unobservable (supported by little or no market activity). |

Investments are classified within the level of the lowest significant input considered in determining fair value. Investments classified within Level 3 whose fair value measurement considers several inputs may include Level 1 or Level 2 inputs as components of the overall fair value measurement.

Federal Income Taxes — It is the Fund’s intention to continue to qualify as a regulated investment company for Federal income tax purposes by complying with the appropriate provisions of Subchapter M of the Internal Revenue Code of 1986, as amended. Accordingly, no provision for Federal income taxes has been made in the financial statements.

The Fund evaluates tax positions taken or expected to be taken in the course of preparing the Fund’s tax returns to determine whether it is “more-likely-than-not” (i.e., greater than 50-percent) that each tax position will be sustained upon examination by a taxing authority based on the technical merits of the position. Tax positions not deemed to meet the more-likely-than-not threshold are recorded as a tax benefit or expense in the current year. The Fund did not record any tax provision in the current period. However, management’s conclusions regarding tax positions taken may be subject to review and adjustment at a later date based on factors including, but not limited to, examination by tax authorities (i.e., from commencement of operations, as applicable), on-going analysis of and changes to tax laws, regulations and interpretations thereof.

As of and during the year ended December 31, 2023, the Fund did not have a liability for any unrecognized tax benefits. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations. During the period, the Fund did not incur any interest or penalties.

Security Transactions and Investment Income — Security transactions are accounted for on trade date. Costs used in determining realized gains and losses on the sale of investment securities are based on the specific identification method. Dividend income and expense are recorded on the ex-dividend date. Dividend income is recorded net of unrecoverable withholding tax. Interest income is recognized on the accrual basis from settlement date. Certain dividends and

19

| | |

| THE ADVISORS’ INNER CIRCLE FUND II | | SPRUCEGROVE INTERNATIONAL EQUITY FUND DECEMBER 31, 2023 |

expenses from foreign securities will be recorded as soon as the Fund is informed of the dividend if such information is obtained subsequent to the ex-dividend date.

Cash — Idle cash may be swept into various time deposit accounts and is classified as cash on the Statement of Assets and Liabilities. The Fund maintains cash in bank deposit accounts which, at times may exceed United States federally insured limits. Amounts invested are available on the same business day.

Classes — Class specific expenses are borne by that class of shares. Income, realized and unrealized gains (losses), and non-class specific expenses are allocated to the respective class on basis of relative daily net assets.

Expenses — Most expenses of the Trust can be directly attributed to a particular fund. Expenses which cannot be directly attributed to a particular fund are apportioned among the funds of the Trust based on the number of funds and/or relative net assets.

Dividends and Distributions to Shareholders — The Fund distributes substantially all of its net investment income quarterly. Distributions from net realized capital gains, if any, are declared and paid annually. All distributions are recorded on ex-dividend date.

Foreign Currency Translation — The books and records of the Fund are maintained in U.S. dollars. Investment securities and other assets and liabilities denominated in a foreign currency are translated into U.S. dollars on the date of valuation. The Fund does not isolate that portion of realized or unrealized gains and losses resulting from changes in the foreign exchange rate from fluctuations arising from changes in the market prices of the securities. These gains and losses are included in net realized and unrealized gains and losses on investments on the Statement of Operations. Net realized and unrealized gains and losses on foreign currency transactions represent net foreign exchange gains or losses from foreign currency exchange contracts, disposition of foreign currencies, currency gains or losses realized between trade and settlement dates on securities transactions and the difference between the amount of the investment income and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent of the amounts actually received or paid.

Forward Foreign Currency Contracts — The Fund may enter into forward foreign currency contracts to protect the value of securities held and related receivables and payables against changes in future foreign exchange rates. A forward currency contract is an agreement between two parties to buy and sell currency at a set price on a future date. The market value of the contract will fluctuate with changes in currency exchange rates. The contract is marked-to market daily using the current forward rate and the change in market value is recorded by the Fund as unrealized gain or loss. The Fund recognizes realized gains or losses when the contract is closed, equal to the difference between the value of the contract at

20

| | |

| THE ADVISORS’ INNER CIRCLE FUND II | | SPRUCEGROVE INTERNATIONAL EQUITY FUND DECEMBER 31, 2023 |

the time it was opened and the value at the time it was closed. Any realized or unrealized appreciation (depreciation) during the year or period are presented on the Statement of Operations. Risks may arise from unanticipated movements in the value of a foreign currency relative to the U.S. dollar. Risks may also arise upon entering into these contracts from the potential inability of counterparties to meet the terms of their contracts and are generally limited to the amount of unrealized gain on the contracts at the date of default. As of December 31, 2023, there were no forward foreign currency contracts held by the Fund.

3. Transactions with Affiliates:

Certain officers of the Trust are also employees of SEI Investments Global Funds Services (the “Administrator”), a wholly owned subsidiary of SEI Investments Company, and/or SEI Investments Distribution Co. (the “Distributor”). Such officers are paid no fees by the Trust, other than the Chief Compliance Officer (“CCO”) as described below, for serving as officers of the Trust.

The services provided by the CCO and his staff are paid for by the Trust as incurred. The services include regulatory oversight of the Trust’s Advisors and service providers as required by SEC regulations. The CCO’s services and fees have been approved by and are reviewed by the Board.

4. Administration, Distribution, Shareholder Servicing, Custodian and Transfer Agent Agreements:

The Fund and the Administrator are parties to an Administration Agreement under which the Administrator provides administration services to the Fund. For these services, the Administrator is paid an asset based fee, which will vary depending on the number of share classes and the average daily net assets of the Fund. For the year ended December 31, 2023, Sprucegrove International Equity Fund paid $114,682 for these services.

The Fund has adopted the Distribution Plan (the “Plan”) for the Advisor Class Shares. Under the Plan, the Distributor, or third parties that enter into agreements with the Distributor, may receive up to 0.25% of the Fund’s average daily net assets attributable to Advisor Class Shares as compensation for distribution services. The Distributor will not receive any compensation for the distribution of Institutional Class Shares or Investor Class Shares of the Fund.

The Fund has adopted a shareholder servicing plan (the “Service Plan”) under which a shareholder servicing fee of up to 0.15% of average daily net assets of the Investor Class Shares and the Advisor Class Shares of the Fund will be paid to other service providers. Certain brokers, dealers, banks, trust companies and other financial representatives receive compensation from the Fund for providing a variety of services, including record keeping and transaction processing. Such fees are based on the assets of the Fund that are serviced by the financial representative. Such

21

| | |

| THE ADVISORS’ INNER CIRCLE FUND II | | SPRUCEGROVE INTERNATIONAL EQUITY FUND DECEMBER 31, 2023 |

fees are paid by the Fund to the extent that the number of accounts serviced by the financial representative multiplied by the account fee charged by the Fund’s transfer agent would not exceed the amount that would have been charged had the accounts serviced by the financial representative been registered directly through the transfer agent. All fees in excess of this calculated amount are paid by the Adviser. These fees are disclosed on the Statement of Operations as Shareholder Servicing Fees. For the year ended December 31, 2023, the Sprucegrove International Equity Fund paid $160 for these services.

Brown Brothers Harriman & Co. acts as custodian (the “Custodian”) for the Fund. The Custodian plays no role in determining the investment policies of the Fund or which securities are to be purchased or sold by the Fund.

SS&C Global Investor & Distribution Solutions, Inc. (formerly, DST Systems, Inc.) serves as the transfer agent and dividend disbursing agent for the Fund under a transfer agency agreement with the Trust. For the year ended December 31, 2023, the Fund paid $67,709 for these services.

5. Investment Advisory Agreement:

Under the terms of an investment advisory agreement, the Adviser provides investment advisory services to the Fund at a fee calculated at an annual rate of 0.50% of the Fund’s average daily net assets.

The Adviser has contractually agreed to reduce its fees and/or reimburse expenses to the extent necessary to keep the Fund’s total annual Fund operating expenses (excluding distribution and/or service (12b-1) fees, interest, taxes, brokerage commissions, and other costs and expenses relating to the securities that are purchased and sold by the Fund, dividend and interest expenses on securities sold short, fees and expenses incurred in connection with tax reclaim recovery services, other expenditures which are capitalized in accordance with generally accepted accounting principles, and non-routine expenses (collectively, “excluded expenses”)) for Institutional Class Shares, Investor Class Shares and Advisor Class Shares from exceeding 0.60% of the average daily net assets of the Fund’s share classes until May 30, 2024. This agreement may be terminated by: (i) the Board, for any reason at any time; or (ii) the Adviser, upon ninety (90) days’ prior written notice to the Trust, effective as of the close of business on May 30, 2024. In addition, the Advisor may receive from the Fund the difference between the total annual Fund operating expenses (not including excluded expenses) and the contractual expense limit to recoup all or a portion of its prior fee waivers or expense reimbursements made during the three-year period preceding the recoupment if at any point total annual Fund operating expenses (not including excluded expenses) are below the contractual expense limit (i) at the time of the fee waiver and/or expense reimbursement and (ii) at the time of the recoupment.

As of December 31, 2023, the Funds had fees which were previously waived and/ or reimbursed to the Funds by the Adviser, which may be subject to possible future

22

| | |

| THE ADVISORS’ INNER CIRCLE FUND II | | SPRUCEGROVE INTERNATIONAL EQUITY FUND DECEMBER 31, 2023 |

reimbursement, up to the expense cap in place at the time the expenses were waived and reimbursed to the Funds, as follows:

| | | | |

| Fiscal Year | | Subject to Repayment until December 31: | | Amount |

2022 | | 2025 | | $226,214 |

2023 | | 2026 | | $337,952 |

For the year ended December 31, 2023, the Adviser did not recapture any previously waived fees.

6. Investment Transactions:

For the year ended December 31, 2023, the purchases and sales of investment securities, long-term U.S. Government and short-term investments were as follows:

| | | | |

Purchases | | $ | 21,341,387 | |

Sales | | | 55,881,873 | |

There were no purchases or sales of long-term U.S. Government securities by the Fund.

7. Federal Tax Information:

The amount and character of income and capital gain distributions to be paid, if any, are determined in accordance with Federal income tax regulations, which may differ from U.S. GAAP. As a result, net investment income (loss) and net realized gain/(loss) on investment transactions for a reporting period may differ significantly from distributions during the year. The book/tax differences may be temporary or permanent. The following permanent differences are primarily attributable to reclass of distributions. There are no permanent differences that are credited or charged to Paid-in Capital and Distributable Earnings as of December 31, 2023.

The tax character of dividends and distributions declared during the year ended December 31, 2023, were as follows:

| | | | | | | | | | | | | | | | |

| | | Ordinary Income | | | Long-Term Capital

Gain | | | Return of Capital | | | Total | |

2023 | | $ | 4,023,779 | | | $ | 4,689,347 | | | $ | — | | | $ | 8,713,126 | |

2022 | | | 8,395,814 | | | | — | | | | 9,195,015 | | | | 17,590,829 | |

23

| | |

| THE ADVISORS’ INNER CIRCLE FUND II | | SPRUCEGROVE INTERNATIONAL EQUITY FUND DECEMBER 31, 2023 |

As of December 31, 2023, the components of Distributable Earnings on a tax basis were as follows:

| | | | |

Undistributed Ordinary Income | | $ | 64,813 | |

Undistributed Long-Term Capital Gains | | | 229,447 | |

Unrealized Appreciation | | | 14,083,404 | |

Other Temporary Differences | | | (2 | ) |

| | | | |

Total Distributable Earnings | | $ | 14,377,662 | |

| | | | |

During the year ended December 31, 2023, the Fund utilized $3,070,942 of short-term capital loss carryforwards to offset capital gains.

For Federal income tax purposes, the difference between Federal tax cost and book cost are primarily due to wash sales, which cannot be used for Federal income tax purposes in the current year and have been deferred for use in future years.

The Federal tax cost and aggregate gross unrealized appreciation and depreciation for investments held by the Fund at December 31, 2023, were as follows:

| | | | | | |

Federal Tax Cost | | Aggregate Gross Unrealized Appreciation | | Aggregate Gross Unrealized Depreciation | | Net Unrealized Appreciation |

$ 131,347,536 | | $ 26,247,995 | | $ (11,996,934) | | $ 14,251,061 |

8. Concentration of Shareholders:

At December 31, 2023, the percentage of total shares outstanding held by shareholders each owning 10% or greater of the aggregate total shares outstanding, are comprised of individual shareholders and omnibus accounts that are held on behalf of various individual shareholders was as follows:

| | | | |

| | | No. of

Shareholders | | %

Ownership |

International Equity Fund, Institutional Class | | 3 | | 88% |

International Equity Fund, Investor Class | | 1 | | 100% |

International Equity Fund, Advisor Class | | 1 | | 100% |

9. Indemnifications:

In the normal course of business, the Fund enters into contracts that provide general indemnifications. The Fund’s maximum exposure under these arrangements is dependent on future claims that may be made against the Fund and, therefore, cannot be established; however, based on experience, the risk of loss from such claim is considered remote.

24

| | |

| THE ADVISORS’ INNER CIRCLE FUND II | | SPRUCEGROVE INTERNATIONAL EQUITY FUND DECEMBER 31, 2023 |

10. Concentration of Risks:

As with all mutual funds, a shareholder in each Fund is subject to the risk that his or her investment could lose money. The Fund is subject to the principal risks noted below, any of which may adversely affect the Fund’s net asset value (“NAV”) and ability to meet its investment objective.

Active Management – The Fund is subject to the risk that the Adviser’s judgments about the attractiveness, value, or potential appreciation of the Fund’s investments may prove to be incorrect. If the investments selected and strategies employed by the Fund fail to produce the intended results, the Fund could underperform in comparison to other funds with similar objectives and investment strategies.

Equity Security and Market Risk – The prices of and the income generated by the Fund’s securities may decline in response to, among other things, investor sentiment, general economic and market conditions, regional or global instability, and currency and interest rate fluctuations. In addition, the impact of any epidemic, pandemic or natural disaster, or widespread fear that such events may occur, could negatively affect the global economy, as well as the economies of individual countries, the financial performance of individual companies and sectors, and the markets in general in significant and unforeseen ways. Any such impact could adversely affect the prices and liquidity of the securities and other instruments in which the Fund invests, which in turn could negatively impact the Fund’s performance and cause losses on your investment in the Fund. Market risk may affect a single issuer, an industry, a sector or the equity or bond market as a whole.

Common Stock Risk - The prices of common stock may fall over short or extended periods of time. Common stock generally is subordinate to preferred stock and debt upon the liquidation or bankruptcy of the issuing company.

International Investing Risk — Investing outside the United States involves considerations that create risks different than investing in the United States. These risks include, among other things, (i) less publicly available information; (ii) varying levels of governmental regulation and supervision; and (iii) the difficulty of enforcing legal rights in a non-U.S. jurisdiction and uncertainties as to the status, interpretation and application of laws. Moreover, in certain countries companies are not subject to uniform accounting, auditing and financial reporting disclosure standards, practices and requirements comparable to those applicable to United States companies.

Non-U.S. markets may also have different clearance and settlement procedures, and in certain markets there have been times when settlements have failed to keep pace with the volume of securities transactions, making it difficult to conduct such transactions. Transaction costs of buying and selling non-U.S. securities, including brokerage, tax and custody costs, also are generally higher than those involved in U.S. transactions. Furthermore, non-U.S. financial markets, while generally growing in volume, have, for the most part, substantially less volume than U.S. markets, and

25

| | |

| THE ADVISORS’ INNER CIRCLE FUND II | | SPRUCEGROVE INTERNATIONAL EQUITY FUND DECEMBER 31, 2023 |

securities of many non-U.S. companies are less liquid and their prices more volatile than securities of comparable U.S. companies. In addition, periodic U.S. government restrictions on investments in issuers from certain non-U.S. countries may require the Fund to sell such investments at inopportune times, which could result in losses to the Fund.

Emerging Markets Investing Risk — The Fund invests a portion of its assets in the securities of, or instruments providing exposure to Emerging Markets. The value of Emerging Market currencies and securities may be drastically affected by political developments in the country of issuance. In addition, the existing governments in the relevant countries could take actions that could have a negative impact on the Fund, including nationalization, expropriation, imposition of confiscatory taxation or regulatory or imposition of withholding taxes on interest payments.

Some of the countries in which the Fund may invest have experienced political, economic and/or social instability and dramatic swings in the value of their national currency and interest rates. There can be no assurance that such instability or such fluctuations will not occur in the future and, if they do occur, that they will not have a substantial adverse effect on the performance of the Fund.

Also, some Emerging Market country economies have a high dependence on a small group of markets or even a single market. Foreign investment in the Emerging Market countries is in some cases restricted. Certain Emerging Markets countries are particularly likely to require identifying information about entities and persons who have direct, or even indirect, exposure to the securities of issuers in those countries. Further, the securities markets of Emerging Market countries may be illiquid. Therefore, the Fund may not be able to sell Emerging Markets securities when the Fund desires to do so.

Currency Risk – As a result of the Fund’s investments in securities or other investments being denominated in, and/or receiving revenues in, foreign currencies, the Fund will be subject to currency risk. Currency risk is the risk that foreign currencies will decline in value relative to the U.S. dollar, in which case, the dollar value of an investment in the Fund would be adversely affected. Currency exchange rates may fluctuate in response to, among other things, changes in interest rates, intervention (or failure to intervene) by U.S. or foreign governments, central banks or supranational entities, or by the imposition of currency controls or other political developments in the United States or abroad.

Large Capitalization Risk – If valuations of large capitalization companies appear to be greatly out of proportion to the valuations of small or medium capitalization companies, investors may migrate to the stocks of small and medium-sized companies. The risk that larger, more established companies may be unable to respond quickly to new competitive challenges such as changes in technology and consumer tastes.

26

| | |

| THE ADVISORS’ INNER CIRCLE FUND II | | SPRUCEGROVE INTERNATIONAL EQUITY FUND DECEMBER 31, 2023 |

Larger companies also may not be able to attain the high growth rates of successful smaller companies.

Small and Medium Capitalization Risk – The risk that small and medium capitalization companies in which the Fund may invest may be more vulnerable to adverse business or economic events than larger, more established companies. In particular, small and medium capitalization companies may have limited product lines, markets and financial resources and may depend upon a relatively small management group. Therefore, small capitalization and medium capitalization stocks may be more volatile than those of larger companies. Small capitalization and medium capitalization stocks may be traded OTC. OTC stocks may trade less frequently and in smaller volume than exchange listed stocks and may have more price volatility than that of exchange-listed stocks.

Convertible and Preferred Securities Risk — Convertible and preferred securities have many of the same characteristics as stocks, including many of the same risks. In addition, convertible securities may be more sensitive to changes in interest rates than stocks. Convertible securities are subject to credit risk and prepayment risk. Credit risk is the risk that a decline in the credit quality of an investment could cause the Fund to lose money. Prepayment risk is the risk that, in a declining interest rate environment, securities with stated interest rates may have the principal paid earlier than expected, requiring the Fund to invest the proceeds at generally lower interest rates.

Preferred stocks are nonvoting equity securities that pay a stated fixed or variable rate dividend. Due to their fixed income features, preferred stocks provide higher income potential than issuers’ common stocks, but are typically more sensitive to interest rate changes than an underlying common stock. Preferred stocks are also subject to equity market risk, which is the risk that stock prices will fluctuate and can decline and reduce the value of the Fund’s investment. The rights of preferred stocks on the distribution of a corporation’s assets in the event of a liquidation are generally subordinate to the rights associated with a corporation’s debt securities. Preferred stock may also be subject to prepayment risk, which is discussed above.

Rights and Warrants Risk – Investments in rights or warrants involve the risk of loss of the purchase value of a right or warrant if the right to subscribe to additional shares is not exercised prior to the right’s or warrant’s expiration. Also, the purchase of rights and/or warrants involves the risk that the effective price paid for the right and/or warrant added to the subscription price of the underlying security may exceed the market price of the underlying security in instances such as those where there is no movement in the price of the underlying security.

Investments in Other Investment Companies Risk – To the extent the Fund invests in other investment companies, such as ETFs, closed-end funds and other mutual funds, the Fund will be subject to substantially the same risks as those associated

27

| | |

| THE ADVISORS’ INNER CIRCLE FUND II | | SPRUCEGROVE INTERNATIONAL EQUITY FUND DECEMBER 31, 2023 |

with the direct ownership of the securities held by such other investment companies. As a shareholder of another investment company, the Fund relies on that investment company to achieve its investment objective. If the investment company fails to achieve its objective, the value of the Fund’s investment could decline, which could adversely affect the Fund’s performance. By investing in another investment company, Fund shareholders indirectly bear the Fund’s proportionate share of the fees and expenses of the other investment company, in addition to the fees and expenses that Fund shareholders directly bear in connection with the Fund’s own operations.

Liquidity Risk – The risk that certain securities may be difficult or impossible to sell at the time and price that the Fund would like. The Fund may have to lower the price of the security, sell other securities instead or forego an investment opportunity, any of which could have a negative effect on Fund management or performance. Liquidity risk may be heightened in the emerging market countries in which the Fund invests, as a result of their markets being less developed. The liquidity of the Fund’s investments may change over time.

Investment Style Risk – The Adviser’s value investment style may increase the risks of investing in the Fund. If the Adviser’s assessment of market conditions, or a company’s value or prospects for exceeding earnings expectations is inaccurate or differs from that of the market or other market participants, the Fund could suffer losses or produce poor performance relative to other funds. In addition, “value stocks” can continue to underperform the market for long periods of time.

Cyber Security Risk – The Fund and its service providers may be susceptible to operational and information security risks resulting from a breach in cyber security, including cyber-attacks. Cyber-attacks may interfere with the processing of shareholder transactions, impact the Fund’s ability to calculate its net asset value, cause the release of private shareholder information or confidential company information, impede redemptions, subject the Fund to regulatory fines or financial losses, and cause reputational damage. Similar types of cyber security risks are also present for issuers of securities in which the Fund invests.

11. Subsequent Events:

The Fund has evaluated the need for additional disclosures and/or adjustments resulting from subsequent events through the date the financial statements were issued. Based on this evaluation, no additional disclosures and/or adjustments were required to the financial statements as of December 31, 2023.

28

| | |

| THE ADVISORS’ INNER CIRCLE FUND II | | SPRUCEGROVE INTERNATIONAL EQUITY FUND DECEMBER 31, 2023 |

Report of Independent Registered Public Accounting Firm

To the Board of Trustees of The Advisors’ Inner Circle Fund II and Shareholders of Sprucegrove International Equity Fund

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Sprucegrove International Equity Fund (one of the Funds constituting The Advisors’ Inner Circle Fund II, referred to hereafter as the “Fund”) as of December 31, 2023, the related statement of operations for the year ended December 31, 2023, the statements of changes in net assets for each of the two years in the period ended December 31, 2023, including the related notes, and the financial highlights for each of the periods indicated therein (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of December 31, 2023, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period ended December 31, 2023 and the financial highlights for the periods indicated therein in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange

Commission and the PCAOB.

We conducted our audits of these financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of December 31, 2023 by correspondence with the custodian and brokers; when replies were not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

/s/ PricewaterhouseCoopers LLP

Philadelphia, Pennsylvania

February 29, 2024

We have served as the auditor of one or more investment companies in Sprucegrove Investment Management Ltd. since 2021.

29

| | |

| THE ADVISORS’ INNER CIRCLE FUND II | | SPRUCEGROVE INTERNATIONAL EQUITY FUND DECEMBER 31, 2023 (Unaudited) |

|

TRUSTEES AND OFFICERS OF THE ADVISORS’ INNER CIRCLE FUND II |

Set forth below are the names, years of birth, positions with the Trust, length of term of office, and the principal occupations for the last five years of each of the persons currently serving as Trustees and Officers of the Trust. Unless otherwise noted, the business address of each Trustee is SEI Investments Company, 1 Freedom Valley Drive, Oaks, Pennsylvania 19456. Trustees who are deemed not to be “interested persons” of the Trust are referred to as “Independent Trustees.” Messrs. Nesher and Klauder are Trustees who may be deemed to be “interested” persons of the Trust as that term is defined in the 1940 Act by virtue of their affiliation with the Trust’s Distributor.

| | | | |

Name and Year of Birth | | Position with Trust and Length of Time Served1 | | Principal Occupations In the Past Five Years |

|

| INTERESTED TRUSTEES 3 4 |

| | |

Robert Nesher (Born: 1946) | | Chairman of the Board of Trustees (since 1991) | | SEI employee 1974 to present; currently performs various services on behalf of SEI Investments for which Mr. Nesher is compensated. President, Chief Executive Officer and Trustee of SEI Daily Income Trust, SEI Tax Exempt Trust, SEI Institutional Managed Trust, SEI Institutional International Trust, SEI Institutional Investments Trust, SEI Asset Allocation Trust, Adviser Managed Trust, New Covenant Funds, SEI Insurance Products Trust and SEI Catholic Values Trust. President and Director of SEI Structured Credit Fund, LP. Vice Chairman of Winton Series Trust to 2017. Vice Chairman of Winton Diversified Opportunities Fund (closed-end investment company), The Advisors’ Inner Circle Fund III, Gallery Trust, Schroder Series Trust and Schroder Global Series Trust to 2018. |

| | |

N. Jeffrey Klauder (Born: 1952) | | Trustee (since 2018) | | Senior Advisor of SEI Investments since 2018. Executive Vice President and General Counsel of SEI Investments, 2004 to 2018. |

| 1 | Each Trustee shall hold office during the lifetime of this Trust until the election and qualification of his or her successor, or until he or she sooner dies, resigns, or is removed in accordance with the Trust’s Declaration of Trust. |