UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material Pursuant to §240.14a-12 |

Uroplasty, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| o | Fee paid previously with preliminary materials. |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

5420 Feltl Road

Minnetonka, Minnesota 55343

2011 ANNUAL MEETING AND PROXY STATEMENT

Dear Fellow Shareholder:

I cordially invite you to Uroplasty’s 2011 Annual Meeting of Shareholders. We will hold this meeting on Wednesday, September 14, 2011, at 1:30 p.m. (Central Time) at our corporate office located at 5420 Feltl Road, Minnetonka, Minnesota, 55343.

Please read the accompanying Notice of Annual Meeting of Shareholders and Proxy Statement for more details about the Annual Meeting and the matters to be acted upon at the meeting. In addition to voting, we will review the major developments of fiscal 2011 and answer your questions. I hope you will participate in this review of our business and operations. Our Annual Report on Form 10-K for our fiscal year ending March 31, 2011 is also enclosed.

Whether or not you plan to attend the meeting, your vote is important. Please complete, sign, date and return the enclosed proxy card as soon as possible in the reply envelope provided.

On behalf of the management and directors of Uroplasty, I want to thank you for your continued support and confidence in Uroplasty. We look forward to seeing you at our 2011 Annual Meeting.

| | Very truly yours, |

| | /s/ DAVID B. KAYSEN |

| | David B. Kaysen |

| | President and Chief Executive Officer |

Minneapolis, Minnesota

July 27, 2011

________________________________________

PLEASE COMPLETE, SIGN, DATE AND RETURN THE ENCLOSED PROXY CARD PROMPTLY TO SAVE THE COMPANY THE EXPENSE OF ADDITIONAL SOLICITATION AND TO ASSURE THAT A QUORUM WILL BE REPRESENTED AT THE MEETING.

UROPLASTY, INC.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

to be held Tuesday, September 14, 2011

To Shareholders of Uroplasty, Inc.:

The Annual Meeting of Shareholders of Uroplasty, Inc. will be held on Wednesday, September 14, 2011, at 1:30 p.m. (Central Time) at Uroplasty’s corporate office located at 5420 Feltl Road, Minnetonka, Minnesota 55343 for the following purposes:

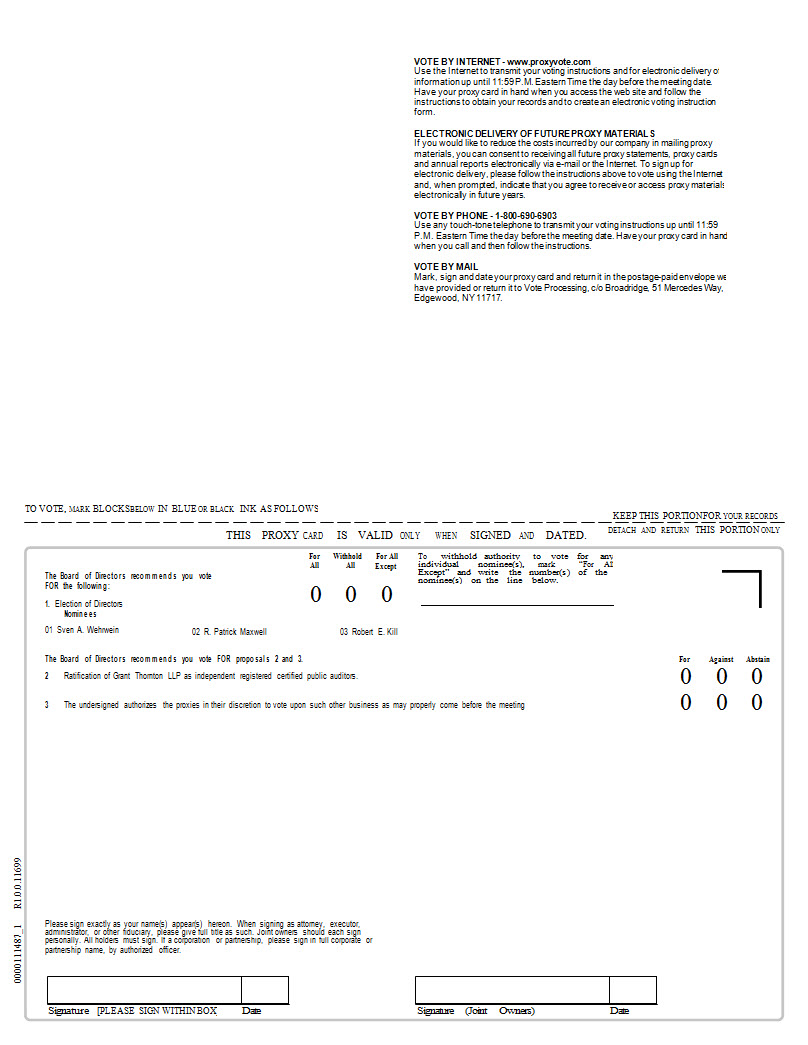

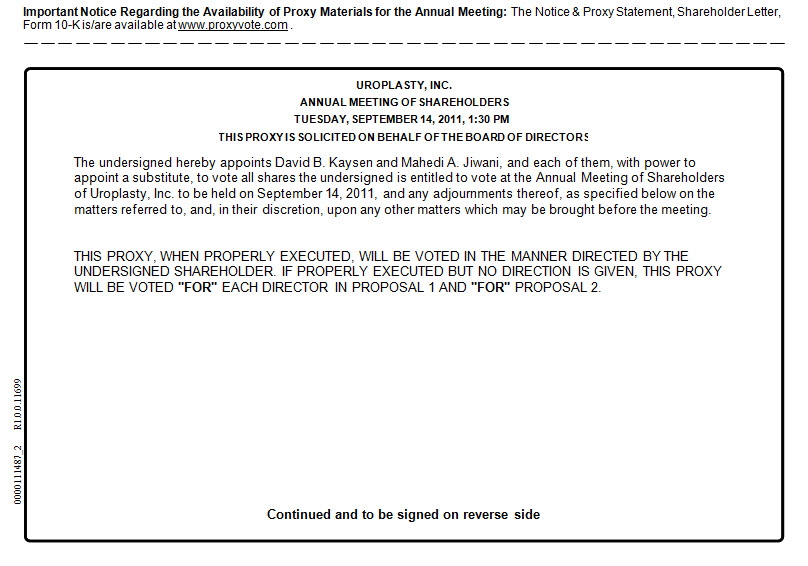

| | 1. | to elect Robert E. Kill, R. Patrick Maxwell and Sven A Wehrwein as Class II directors to serve a three-year term until their respective successors are elected and qualified; |

| | 2. | to ratify the appointment of Grant Thornton LLP as independent registered public auditors for our fiscal year ending March 31, 2012; and |

| | 3. | to attend to other business properly presented at the meeting or any adjournment. |

If you owned common stock at the close of business on July 19, 2011, you are entitled to vote at the meeting or any adjournments. Whether or not you plan to attend the meeting, you can be sure your shares are represented at the meeting by completing, signing, dating and promptly returning the enclosed proxy card in the reply envelope provided.

| | On behalf of Uroplasty’s Board of Directors, |

| | /s/ SUSAN HARTJES HOLMAN |

| | Susan Hartjes Holman |

| | Corporate Secretary and Chief Operating Officer |

Minneapolis, Minnesota

July 27, 2011

WE CORDIALLY INVITE YOU TO ATTEND THE ANNUAL MEETING. IF YOU DO NOT PLAN TO ATTEND THE MEETING, PLEASE BE SURE YOU ARE REPRESENTED AT THE MEETING BY MARKING, SIGNING, DATING AND MAILING YOUR PROXY CARD IN THE REPLY ENVELOPE.

Important notice regarding the availability of proxy materials for the shareholder meeting to be held on September 14, 2011. Our proxy statement, the form of our proxy card, and annual report on Form 10-K can be viewed online at http://materials.proxyvote.com/917277. |

5420 Feltl Road

Minnetonka, Minnesota 55343

_______________________________

PROXY STATEMENT

_______________________________

ANNUAL MEETING OF SHAREHOLDERS

SEPTEMBER 14, 2011

_______________________________

INTRODUCTION

We will hold the Annual Meeting of Shareholders of Uroplasty, Inc. on Tuesday, September 14, 2011, at 1:30 p.m. (Central Time) at our principal executive office located at 5420 Feltl Road, Minnetonka, Minnesota 55343, or at any adjournment or adjournments thereof, for the purposes set forth in the Notice of Annual Meeting of Shareholders.

We enclose a proxy card for your use. Please complete and return the proxy card in the reply envelope provided. Any proxy received in time for the Annual Meeting will be voted in accordance with the instructions given in the proxy card. If you sign a proxy card but do not direct us how to vote, the proxy will be voted as recommended by our Board of Directors. You may revoke your proxy at any time before it is voted at our Annual Meeting either by providing written notice of revocation to our Secretary, by filing a properly executed proxy bearing a later date with our Secretary or by appearing at the Annual Meeting and filing a written notice of revocation with our Secretary prior to use of the proxy. No revocation of a proxy will be effective unless written notice of the revocation is received by us at or prior to the Annual Meeting.

We will bear the cost of soliciting proxies, including the preparation, assembly and mailing of this proxy statement and the accompanying annual report, as well as the cost of forwarding the material to beneficial owners of our common stock. Our directors, officers and regular employees may, without compensation other than their regular compensation, solicit proxies in person, in writing or by any form of telecommunication. We may reimburse brokerage firms and others for expenses in forwarding proxy materials to the beneficial owners of common stock.

We are first mailing this Proxy Statement and the accompanying proxy card to Uroplasty shareholders on or about July 27, 2011.

OUR BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE FOR THE PROPOSALS IN OUR NOTICE OF ANNUAL MEETING.

VOTING OF SHARES

Only holders of record of our common stock at the close of business on July 19, 2011 are entitled to vote at our Annual Meeting. As of July 19, 2011, we had 20,752,282 shares of common stock outstanding. Holders of our common stock are entitled to one vote per share.

The presence in person or by proxy at the meeting of holders of a majority (10,376,142 shares) of our outstanding shares of common stock entitled to vote at the meeting is required for a quorum for the transaction of business. Provided that a quorum is present at the meeting, directors will be elected by plurality vote, which means that the directors who receive the most votes will be elected or reelected, regardless of whether holders of shares present vote in favor of the director.

If your shares are registered directly in your name, you are considered the holder of record. If your shares are held in a stock brokerage account or by a bank, trust or other nominee, then the broker, bank, trust or other nominee is considered to be the holder of record, you are considered the beneficial owner of those shares, and your shares are said to be held in “street name.” If you hold your shares in “street name,” you must provide the holder of record with instructions on how to vote your shares with regard to the items described in this proxy statement. If you do not provide the holder of record with instructions on how to vote your shares, under certain circumstances, your brokerage firm may vote your shares for “routine” matters, such as the ratification of auditors.

If you abstain from voting on any matter, the abstention will be counted for purposes of determining whether a quorum is present at the Annual Meeting for the transaction of business as well as shares entitled to vote on that particular matter. If you hold your shares in “street name” and you do not provide voting instructions to your broker or other nominee as the record holder on matters that are not “routine,” your shares will be considered to be “broker non-votes” and will not be voted on any proposal on which your broker or other nominee does not have discretionary voting power, including the election of directors. Broker non-votes are counted as present for purposes of establishing a quorum for the meeting, but are not considered entitled to vote on the proposal in question because the broker has no discretionary voting power.

PROPOSAL 1 ─ ELECTION OF DIRECTORS

Nominations

Our Board of Directors is divided into three classes, with each class containing, as nearly as possible, one-third of the total. The members of each class are elected to serve for a term of three years. The term of office of each class is staggered so that in any one year the term of only one class expires. At each annual meeting of shareholders, a class of directors will be elected for a three-year term.

Our Board currently consists of seven directors. The term of our Class II directors will expire at our 2011 Annual Meeting requiring the election of three Class II directors at the meeting for a three-year term. Our Nominating and Corporate Governance Committee has recommended and our Board has nominated the individual nominees named below to serve as a Class II director indicated below, until his successor has been elected and duly qualified. All three nominees are current members of the Board.

If the Board should learn that a nominee will be unable to serve by reason of death, incapacity or other unexpected occurrence prior to the Annual Meeting, the proxies which otherwise would have been voted for the nominee will be voted for a substitute nominee selected by the Nominating and Corporate Governance Committee and elected by the Board. The Board has no reason to believe that a nominee will be unable to serve.

Nominees for Election at the 2011 Annual Meeting

Our Nominating and Corporate Governance Committee has nominated the following three individuals for election at the Annual Meeting:

| Name of Nominee | | Age | | Class | | Term Ends |

| Robert E. Kill | | 47 | | Class II | | 2014 Annual Meeting |

| R. Patrick Maxwell | | 67 | | Class II | | 2014 Annual Meeting |

| Sven A Wehrwein | | 60 | | Class II | | 2014 Annual Meeting |

Robert E. Kill has been a director of Uroplasty since December 2010. He has served as the President since 2007, and CEO and a Board member since 2009, of Virtual Radiologic Corporation, a national radiology organization that uses technology to enhance radiologic practice. Prior to joining Virtual Radiologic, Mr. Kill was President of Physicians Systems for Misys Healthcare Systems, a provider of clinical and practice management software applications to physician practices, group practices, health systems and managed services organizations. Before joining Misys Healthcare Systems in 2002, Mr. Kill was Executive Vice President of Entertainment Publications, Inc., where he was employed from 1996 through 2001, and Vice President of Operations for Baxter Healthcare, where he was employed from 1986 through 1996. Mr. Kill brings to our board substantial experience and insight in executive management of rapidly growing public companies, particularly companies focused on healthcare.

R. Patrick Maxwell, a lawyer, has served as Chairman of our Board since June 2006 and has served as a director of our company since April 1994. Mr. Maxwell has over 30 years of experience as a turnaround management specialist, an entrepreneur and executive in both the business and non-profit sectors. He has served as Chief Financial Officer of Tele Resources, Inc. since October 1996. He previously served as Chief Executive Officer of Entronix Inc., Northern Supply, Inc., and Telnet Systems, Inc. He also previously served as Chief Financial Officer of Magnum Tire Corporation, Midwest Legal Services, Inc. and Templeton and Associates, Inc. Mr. Maxwell serves on the board of directors of Tele Resource, Inc., and Telnet Services, Ltd., a New Zealand company. Mr. Maxwell brings to our board not only extensive financial and executive management expertise with smaller companies, but experience with financial restructuring and, importantly, the legal requirements applicable to various businesses.

Sven A. Wehrwein, has been a director of Uroplasty since August 2006. He has over 35 years of experience in accounting, corporate finance and investment banking. Mr. Wehrwein, a CPA (inactive), started his career as an auditor with Coopers & Lybrand. After receiving his master’s of science in management from the Sloan School at the Massachusetts Institute of Technology, Mr. Wehrwein spent 14 years as an investment banker with Dean Witter, Drexel Burnham Lambert and Wessels, Arnold & Henderson. From 1995 to 1999, he served as Chief Financial Officer of two public companies. Since 1999, he has provided financial-consulting services to emerging growth companies. Mr. Wehrwein serves on the board of directors of Image Sensing Systems, Inc., SPS Commerce, Inc., and Synovis Life Technologies, Inc., all of which are publicly held companies. Mr. Wehrwein also served on the board of Compellent Technologies, Inc. from April 2007 until its acquisition by Dell Inc. in February 2011, and on the board of Vital Images, Inc. from May 1997 until its acquisition by Toshiba Medical Systems Corp. in June 2011. Within the last five years, Mr. Wehrwein also served as a director of six mutual funds in the Van Wagoner group. Mr. Wehrwein brings to our board extensive experience as a public company director, both management and auditing experience in financial accounting, considerable experience in investment banking, and management and board experience with multiple companies in the medical-products industry.

The Board of Directors unanimously recommends a vote “FOR” the election of the three director nominees.

Directors Continuing in Office

The following information concerns our other directors whose terms of office extend beyond the 2011 Annual Meeting.

Class I

(Terms End 2012)

Lee A. Jones, age 54, has been a director of Uroplasty since August 2006. Ms. Jones is currently a CEO-in-Residence at the University of Minnesota Venture Center. From February 2009 until June 2010, Ms. Jones was the Chief Administrative Officer of the Schulze Diabetes Institute of the University of Minnesota. She has more than 25 years of healthcare and medical device industry experience. From 1997 to 2005, she served as President and Chief Executive Officer of Inlet Medical, Inc. (a Cooper Surgical company since November 2005), specializing in minimally interventional laparoscopic products. Prior to joining Inlet, she had a 14-year career at Medtronic, Inc. where she held various technical and operating positions, most recently serving as Director, General Manager of Medtronic Urology/Interstim division. Ms. Jones also served as a member of the board of directors of BioHeart, Inc. until June 2010. Ms. Jones has specialized knowledge of our industry, in operating a company in the urology device business and as an executive officer of a medical products company.

David B. Kaysen, age 61, has served as our President and Chief Executive Officer and as a director since May 2006. From July 2005 to May 2006, Mr. Kaysen served as President, Chief Executive Officer and a director of Advanced Duplication Services, LLC, a privately-held replicator and duplicator of optical media. Between December 2002 and June 2005, he served as President, Chief Executive Officer and a director of Diametrics Medical, Inc., then a publicly-traded manufacturer and marketer of critical care blood analysis systems that provide continuous diagnostic results at point of care. From 1992 to 2002, Mr. Kaysen served as Chief Executive Officer, President and a director of Rehabilicare Inc., then a publicly-traded manufacturer and marketer of electromedical rehabilitation and pain management products for clinician, home and industrial use. Mr. Kaysen’s extensive experience as an executive officer of publicly traded medical device companies, as a director of public companies, and as a sales manager of multi-national medical product companies, as well as his significant knowledge of our operations as our Chief Executive Officer, make him an essential member of our Board.

Class III

(Terms Ends 2013)

Thomas E. Jamison, age 51, has been a director of Uroplasty since August 2000. Mr. Jamison is a member of Fruth, Jamison & Elsass, PLLC, a business litigation firm in Minneapolis, Minnesota. From 1996 to 1999, Mr. Jamison served as an investment banker in the Corporate Finance Department of R.J. Steichen & Company. From 1991 to 1996, Mr. Jamison practiced law at Fruth & Anthony, P.A. in Minneapolis. As an investment banker for a regional broker dealer, Mr. Jamison worked with emerging companies to raise capital, analyzed their markets, their management and their business strategies and monitored their growth and business success. In addition to skills in these areas, Mr. Jamison’s legal practice in business disputes, securities litigation, business valuation, and contract disputes allows him to assist us in business negotiations and to identify and evaluate the potential litigation risks we face.

James P. Stauner, age 56, has been a director of Uroplasty since August 2006. Mr. Stauner has over 30 years of experience in the healthcare industry. Since July 2005, he has been an Operating Partner with Roundtable Healthcare Partners, a private equity firm focused on the healthcare industry. Prior to joining Roundtable Healthcare Partners, Mr. Stauner held various positions between 1999 and 2005 at Cardinal Health, Inc., most recently as President of the Manufacturing Business Groups and a member of the Senior Management Operating Committee. Mr. Stauner has extensive knowledge of the healthcare industry and of the characteristics sought by a private equity firm for investment in the healthcare industry, and experience in operating and managing a medical products business and in finance.

Corporate Governance

Board Meetings and Attendance

Our business and affairs are managed by our Board, which met seven times during the fiscal year ending March 31, 2011. Each director attended at least 75% of the meetings of the Board and any committee on which the director is a member. We encourage all Board members to attend our Annual Meetings and each attended the fiscal 2010 Annual Meeting.

Director Independence/ Independent Chairman

Our Board reviews the independence of each director. During this review, our Board considers transactions and relationships between each director (and his or her immediate family and affiliates) and Uroplasty and its subsidiaries, as well as transactions with our management, to determine whether any such transactions or relationships are inconsistent with a determination that the director was independent. We circulated questionnaires among our Board members and conducted an annual review of director independence in June 2011. Based upon this review, our Board determined that no transactions or relationships existed that would disqualify any of our directors under applicable rules and listing standards of the Nasdaq Capital Markets or require disclosure under Securities and Exchange Commission (“SEC”) rules, with the exception of Mr. Kaysen, who is our executive employee. Based upon that finding, our Board determined that Messrs. Jamison, Kill, Maxwell, Stauner, and Wehrwein, and Ms. Jones are “independent.” Our Chairman, currently R. Patrick Maxwell, is not an employee or officer but is instead an independent director who receives no compensation from Uroplasty except compensation for his service as a director.

Risk Management

Because of the scope of our operations, we have not established a separate risk management committee. Our Board as a whole monitors and considers policies to manage risk as part of its regular activities. Committees of the Board focus on and manage specific forms of risk and report their activities to the Board. Our Audit Committee is primarily responsible for the identification and review of financial risk. Our Compensation Committee works to minimize risks associated with the executive compensation plans and stock benefit plans that it establishes. Our Nominating and Corporate Governance Committee considers risks presented by changing law and regulation and recommends changes in governance and operations to comply.

Committees and Nominations

Our Board has established an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. Our Board believes all members of the Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee meet the Nasdaq’s rules governing committee composition, including the requirement that committee members all be “independent” directors as that term is defined by Nasdaq rules. The written charters for the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee are available on the investor relations page of our website at www.uroplasty.com.

Audit Committee. The current members of our Audit Committee are Messrs. Wehrwein (Chair), Kill, Maxwell and Stauner. The Audit Committee assists the Board by reviewing the integrity of our financial reporting processes and controls, the qualifications, independence and performance of our independent registered public accounting firm and our compliance with certain legal and regulatory requirements. Our Audit Committee has the sole authority to retain, compensate, oversee and terminate our independent registered public accounting firm. The Audit Committee reviews our annual audited financial statements, quarterly financial statements and filings with the SEC. The Audit Committee reviews reports on various matters, including our critical accounting policies, significant changes in our selection or application of accounting principles and our internal control processes. The Audit Committee also pre-approves all audit and non-audit services performed by our independent registered public accounting firm.

Our Audit Committee administers our Code of Ethics and reviews all related party transactions. The Audit Committee generally requires any transaction between Uroplasty and a director or officer, the immediate family of a director or officer, or any entity that a director or officer controls to be reported to our Chief Financial Officer. The Chief Financial Officer, in turn, is obligated to report the transaction to the Committee. Although it has not adopted written standards of approval, the Audit Committee generally considers these transactions consistent with its fiduciary obligations and approves transactions only if they are fair and reasonable, in the best interests of the corporation, and on terms no less favorable than could be obtained from an unaffiliated third party.

During fiscal 2011, the Audit Committee held six meetings. A report of the Audit Committee is set forth below in this Proxy Statement.

Our Board has determined that all members of the Audit Committee are “independent” directors under the rules of the NASDAQ and the SEC and has determined that Mr. Wehrwein qualifies as an “audit committee financial expert” under such rules.

Compensation Committee. The current members of our Compensation Committee are Ms. Jones (Chair), Mr. Jamison and Mr. Wehrwein, each of whom is “independent” with the definition employed by the NASDAQ, is an “outside director” for purposes of Section 162(m) of the Internal Revenue Code and is a “non-employee director” for purposes of Rule 16b-3 under the Securities Exchange Act of 1934. The Compensation Committee reviews and recommends to our full Board all compensation arrangements with our executive officers and other management employees, administers and interprets our employee benefit plans, and provides guidance to management and to the Board in matters relating to the organizational structure of Uroplasty. The Board has adopted a policy of requiring the Compensation Committee to report its recommendations to, and receive ratification of its decisions by, the full Board. Generally, our Chief Executive Officer formulates proposals for the compensation of our executive officers and management other than himself, and presents those proposals to the Compensation Committee. He does not, however, formulate proposals with respect to his own compensation or participate in discussions or approval of that compensation. During fiscal 2011, the Compensation Committee met three times.

Nominating and Corporate Governance Committee. Our Nominating and Corporate Governance Committee monitors our corporate governance function and identifies individuals qualified to become Board members, recommending to the Board nominees to fill vacancies in membership of the Board as they occur, as well as a slate of nominees for election as directors at the Annual Meeting. The Nominating and Corporate Governance Committee currently consists of Mr. Maxwell (Chair), Mr. Stauner and Ms. Jones.

All director-nominees for election at our 2011 Annual Meeting have been recommended to the Board by the Nominating and Corporate Governance Committee. Generally, the Nominating and Corporate Governance Committee considers the entirety of each candidate’s credentials and does not have any specific minimum qualifications that must be met in order for a candidate to be recommended as a nominee. The Nominating and Corporate Governance Committee also considers the diversity of Board members, including diversity of experience, gender and ethnicity, when considering candidates, but has not adopted any formal diversity policies in considering the nomination of candidates for director.

Historically, our Nominating and Corporate Governance Committee has been able to locate suitable candidates for nomination as Board members through the recommendations of members of our Board and our professional advisors, rather than through the use of search firm. Mr. Kill, who was appointed to the Board in December 2010, was identified after approximately an eight month search in which Board members, service providers and other acquaintances provided recommendations for candidates to our Nominating and Corporate Governance Committee, a background check was completed for each candidate and the resume of each candidate was circulated among members of the Committee, the qualifications of each candidate was reviewed and discussed by the Committee, and Committee members interviewed candidates. Final candidates were reduced to four persons, and these persons were introduced to management. After final discussions, the candidates were limited to two, and these final two were recommended to and interviewed by the full Board. Mr. Kill was selected from these two final candidates. The Nominating and Corporate Governance Committee may in the future, but has no current plans to, hire and pay a fee to consultants or search firms to assist in the process of identifying and evaluating candidates. No such consultants or search firms have been used in connection with this year’s election and, accordingly, no fees have been paid to consultants or search firms in the past year.

The Nominating and Corporate Governance Committee will consider for inclusion in its nominations of new Board nominees, candidates who are recommended by shareholders. Candidates recommended by shareholders will be considered on the same basis as candidates referred from other sources. To be considered by the Nominating and Corporate Governance Committee, nominations must be in writing and addressed to our Secretary at the following address: 5420 Feltl Road, Minnetonka, Minnesota 55343, and must be received by us on or before the deadline for the receipt of shareholder proposals as set forth in “Shareholder Proposals for 2011 Annual Meeting” below. Candidates, or the nominating person, must also submit a brief biographical sketch of the candidate, a document indicating the candidate’s willingness to serve if elected and evidence of the nominating person’s ownership of our stock. No nominees were recommended by shareholders for election at the 2011 Annual Meeting.

Code of Ethics

We have adopted a Code of Ethics that applies to all of our directors, officers and employees, including our Chief Executive Officer, Chief Financial Officer, Controller and other finance organization employees. The Code of Ethics is publicly available on the investor relations page of our website at www.uroplasty.com. We plan to disclose any substantive amendments to the Code of Ethics or grant of any waiver from a provision of it to the Chief Executive Officer, the Chief Financial Officer or the Controller in a report on Form 8-K.

Shareholder Communications with the Board of Directors

We do not have a formal policy by which shareholders may communicate directly with directors, but any shareholder who wishes to send communications to the Board should deliver such communications to the attention of the chairman of our Audit Committee at our principal executive offices located at 5420 Feltl Road, Minnetonka, Minnesota 55343. The Audit Committee chairman will relay to the full Board all shareholder communications he receives that are addressed to the Board.

EXECUTIVE COMPENSATION

Executive Officers

Our executive officers as of the date of this Proxy Statement are as follows:

| Name | | Age | | Position |

| David B. Kaysen | | 61 | | President and Chief Executive Officer |

| Larry Heinemann | | 59 | | Vice President, Global Sales |

| Marc Herregraven | | 46 | | Vice President, Manufacturing |

| Susan Hartjes Holman | | 57 | | Chief Operating Officer |

| Mahedi A. Jiwani | | 62 | | Vice President, Chief Financial Officer and Treasurer |

| Nancy A. Kolb | | 61 | | Vice President Global Marketing |

| Arie J. Koole | | 47 | | Controller, Managing Director, Dutch Operations |

Biographical information for Mr. Kaysen is set forth in “Proposal 1 — Election of Directors” in this Proxy Statement. Biographical information for our other executive officers is set forth below.

Larry Heinemann has served as our Vice President of Global Sales since June 2007. He joined us in September 1998 as Director of Sales for North and South America and since then has served in a range of senior executive positions, primarily as a Vice President in the area of sales, marketing and business development. He is a member of the Society of Urological Nursing Association (SUNA), and served on the board as an industry liaison for the Upper Midwest Chapter. He is also a board trustee of SUNA foundation.

Marc Herregraven has served as our Vice President of Manufacturing since November 2002. He joined Bioplasty, Inc. in April 1992 as Plant Manager, and became Director of Manufacturing in 1994 and Director of Operations in 1999. Previously, he served with Advanced Bio-Surfaces, Inc., a Minnesota-based medical device developer, as Director of Manufacturing, and with Bio-Vascular, Inc., a Minnesota-based medical device manufacturer, in an engineering function.

Susan Hartjes Holman has served as our Chief Operating Officer since November 2002 and as Secretary since September 1996. She served as our Vice President of Operations and Regulatory Affairs from November 1994 to October 2002. Ms. Holman is a Senior Member and a Certified Quality Auditor of the American Society for Quality, has served several years on its Executive Board and subcommittees, and is a member of the Regulatory Affairs Professionals Society and its Ethics Task Force, and the Henrici Society for Microbiologists.

Mahedi A. Jiwani has served as our Vice President, Chief Financial Officer and Treasurer since November 2005. From 2003 to 2005, Mr. Jiwani served as Chief Financial Officer of M.A. Gedney Company. Between 1997 and 2003, he was employed by Telex Communications, Inc., most recently as Vice President of Finance.

Nancy A. Kolb has served as our Vice President of Global Marketing since May 2007. From 2005 until joining Uroplasty, Ms. Kolb was Vice President of Marketing at Inlet Medical, Inc., a manufacturer of minimally interventional laparoscopic products.

Arie J. Koole joined us in 1993 and has served as our Managing Director and Controller of our operations in The Netherlands since January 2000. From 1987 to 1993, Mr. Koole was a financial auditor with the international accounting firm Deloitte & Touche in The Netherlands.

Compensation

Our Compensation Committee, a committee composed of independent directors, formulates our executive compensation plan and recommends that plan to the full board for approval. The Committee receives input on the proposed plan from the Chief Executive Officer and the Chief Executive Officer participates in discussions regarding the compensation of all executives, except his own compensation.

We compensate our executive officers through an annual cash salary that is set by our Compensation Committee during the first quarter of our fiscal year, and normally effective as of June 1. We also provide incentive compensation through a Management Incentive Plan that is annually established by our Compensation Committee and that pays cash incentive compensation for each executive based upon the achievement of pre-established financial goals, and also based on individual performance goals.

To provide a longer term incentive, we grant stock options and restricted stock to executives. Our stock options carry exercise prices equal to the fair market value of our common stock on the date of grant. Most of these options vest with respect to one-third of the shares on the first, second and third anniversaries of the grant date and expire seven years from the grant date. Starting in fiscal 2011, we also started granting restricted stock to officers that vest with respect to one quarter of the shares on the first, second, third and fourth anniversaries of the date of grant. We do not maintain any defined benefit pension plans or non-qualified deferred compensation plans for executive officers and do not provide significant perquisites to our officers.

The level of compensation for our executive officers is generally set by reference to competitive compensation in the industry and by the officer’s experience and duties. Because of operational difficulty caused by the recession and by reimbursement issues, executive salaries during fiscal 2010 were frozen at fiscal 2009 levels. With substantial improvements in our operations during late fiscal 2010, our Compensation Committee engaged an independent compensation consultant, Financial Concepts, to assist in reformulating the executive compensation plan for fiscal 2011 based on comparable levels of compensation. Among other things, Financial Concepts presented benchmark data for our executive compensation plans, comparing the compensation of our executives to ten companies, including: Angeion Corporation; Aegis Assessments, Inc.; Cardiovascular Systems, Inc.; Enteromedics, Inc., Medtox Scientific, Inc.; Rochester Medical Corporation; Synovis LifeTech, Inc.; Urologix, Inc.; Vascular Solutions, Inc.; and Vital Images, Inc. Based upon these comparisons, and other industry data, the compensation consultant recommended increases in salaries in excess of a 2.0% cost of living increase for two executives. Further the Compensation Committee increased the salary of a third executive based upon promotion. The compensation consultant recommended, and the Compensation Committee implemented, substantial changes in the equity based compensation program to include larger grants and to provide roughly half the value of those grants in restricted stock.

For the fiscal year ending March 31, 2011, and consistent with recommendations from the compensation consultant, we increased salaries for most executives by 2%, and for two executives, including our Chief Executive Officer, by 9%, reflecting both exceptional efforts in fiscal 2010 and improved prospects for fiscal 2011. Our Management Incentive Plan for the fiscal year ending March 31, 2011 paid incentive compensation based on achievement of objectives at a threshold, at target and at a maximum, with the targeted performance equal to our budget for the year. Mr. Kaysen and Mr. Jiwani were entitled to incentive compensation of 25% of their salaries at the threshold, 50% at the target and 60% at the maximum, and Ms. Holman was entitled to incentive compensation of 20% of her salary at the threshold, 30% at the target and 50% at the maximum. For Mr. Kaysen, 60% of his incentive compensation was based on achievement of a sales goal, 20% was based on achievement of an operating profit goal and 20% was based on individual performance goals. For Mr. Jiwani, 30% was based on a sales goal, 40% was based on an operating profit goal and 30% was based on individual performance goals. For Ms. Holman, 40% of her incentive compensation was based on achievement of a sales goal, 20% was based on achievement of an operating profit goal and 40% was based on individual performance goals. We achieved 97.9% of our budgeted sales goal, and 99.5% of our budgeted operating profit goal during the fiscal year ending March 31, 2011, and each of Mr. Kaysen, Mr. Jiwani, and Ms. Holman achieved or exceeded their individual performance goals. Accordingly, we paid incentive compensation under the Management Incentive Plan of $142,969 to Mr. Kaysen, $96,629 to Mr. Jiwani, and $61,920 to Ms. Holman.

Summary Compensation Table. The following table contains information regarding all compensation earned during the fiscal years ended March 31, 2011 and 2010 by our Chief Executive Officer and our two other most highly compensated executive officers serving at the end of fiscal 2011.

| Name and Principal Position | | Year | | Salary ($) | | | Bonus ($)(1) | | | Stock Awards ($)(2) | | | Option Awards ($)(3) | | | Non-Equity Incentive Plan Compen-sation ($)(4) | | | All Other Compen-sation ($)(5) | | | Total ($) | |

| David Kaysen | | 2011 | | | 315,600 | | | | -- | | | | 100,282 | | | | 100,016 | | | | 142,969 | | | | 13,715 | | | | 672,582 | |

| President and Chief Executive Officer | | 2010 | | | 293,600 | | | | 15,000 | | | | -- | | | | 61,200 | | | | 32,296 | | | | 15,125 | | | | 417,221 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Mahedi A. Jiwani | | 2011 | | | 203,333 | | | | -- | | | | 35,074 | | | | 35,001 | | | | 96,629 | | | | 1,412 | | | | 371,449 | |

Vice President, Chief Financial Officer and Treasurer | | 2010 | | | 200,000 | | | | -- | | | | -- | | | | 18,360 | | | | 43,600 | | | | 4,624 | | | | 266,584 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Susan Hartjes Holman | | 2011 | | | 202,133 | | | | -- | | | | 25,194 | | | | 25,028 | | | | 61,920 | | | | 1,404 | | | | 315,679 | |

| | 2010 | | | 198,800 | | | | 10,000 | | | | -- | | | | 24,480 | | | | 31,808 | | | | 5,511 | | | | 270,599 | |

| (1) | Represents discretionary bonuses granted with respect to fiscal 2010 performance after year end. |

| (2) | Represents the grant date value of restricted stock. |

| (3) | Represents the full grant date fair value of the options as computed by Black-Scholes in the year of grant. Details of the assumptions used in valuing these awards are set forth in Note 3, Shareholders’ Equity, to our audited financial statements included in our Annual Report on Form 10-K for the fiscal year ending March 31, 2011. The amounts reflected does not necessarily represent the annual amount we recognize as compensation expense for accounting purposes because of such grants. |

| (4) | Represents cash bonuses earned under our Management Incentive Plan. |

| (5) | Represents employer discretionary 401(k) contributions and, for Mr. Kaysen, reimbursement for premium for personal life and disability insurance as well. All other perquisites and benefits for each named executive officer were less than $10,000 in the fiscal year reported. |

Outstanding Equity Awards at 2011 Fiscal Year End. The following table provides information about equity-based awards outstanding to the named executive officers at March 31, 2011.

| | | Option Awards | | Restricted Stock Awards | |

| Name | | Number of Securities Underlying Unexercised Options (#) Exercisable | | | Number of Securities Underlying Unexercised Options (#) Unexercisable | | | Option Exercise Price | | Option Expiration Date | | Number of shares that have not vested | | | Market value of shares that have not vested | |

| Mr. Kaysen | | | 300,000 | | | | -- | | | $ | 2.50 | | 5/16/2016 | | | | | | |

| | | | 50,000 | | | | -- | | | | 4.31 | | 7/2/2012 | | | | | | |

| | | | 50,000 | | | | -- | | | | 3.15 | | 6/23/2013 | | | | | | |

| | | | 66,666 | | | | 33,334 | (1) | | | 0.85 | | 6/4/2014 | | | | | | |

| | | | -- | | | | 26,075 | (2) | | | 4.94 | | 6/7/2017 | | | | | | |

| | | | | | | | | | | | | | | | | 20,300 | | | $ | 134,183 | (3) |

| Mr. Jiwani | | | 100,000 | | | | -- | | | | 3.00 | | 11/13/2015 | | | | | | | | |

| | | | 17,500 | | | | -- | | | | 2.65 | | 2/1/2014 | | | | | | | | |

| | | | 20,000 | | | | -- | | | | 4.31 | | 7/2/2012 | | | | | | | | |

| | | | 20,000 | | | | -- | | | | 3.15 | | 6/23/2013 | | | | | | | | |

| | | | 20,000 | | | | 10,000 | (1) | | | 0.85 | | 6/4/2014 | | | | | | | | |

| | | | | | | | 9,125 | (2) | | | 4.94 | | 6/7/2017 | | | | | | | | |

| | | | | | | | | | | | | | | | | 7,100 | | | | 46,931 | (3) |

| | | | | | | | | | | | | | | | | | | | | | |

| Ms. Holman | | | 100,000 | | | | -- | | | | 5.19 | | 1/1/2015 | | | | | | | | |

| | | | 12,500 | | | | -- | | | | 2.65 | | 2/1/2014 | | | | | | | | |

| | | | 10,000 | | | | -- | | | | 4.31 | | 7/2/2012 | | | | | | | | |

| | | | 10,000 | | | | -- | | | | 3.15 | | 6/23/2013 | | | | | | | | |

| | | | 26,666 | | | | 13,334 | (1) | | | 0.85 | | 6/4/2014 | | | | | | | | |

| | | | -- | | | | 6,525 | (2) | | | 4.94 | | 6/7/2017 | | | | | | | | |

| | | | | | | | | | | | | | | | | 5,100 | | | | 33,711 | (3) |

| (1) | Vested on June 5, 2011. |

| (2) | Vests with respect to one-third of such shares on June 8, 2011, 2012 and 2013. |

| (3) | Represents unvested shares multiplied by closing market price of $6.61 on March 31, 2011. |

Employment Agreements and Payments Upon Termination or Change in Control Provisions Employment Agreements and Other Arrangements. We have employment agreements with each of Mr. Kaysen, Mr. Jiwani and Ms. Holman.

David B. Kaysen. Effective May 17, 2006, we entered into an employment agreement with Mr. Kaysen, our President and Chief Executive Officer, and amended that agreement on April 25, 2011. The agreement provides for an annual base salary of $255,000, which was increased to $293,600 effective July 1, 2008, maintained at that level for the fiscal year ended March 31, 2010 and increased to $320,000 for the fiscal year ending March 31, 2011. The agreement also provides that Mr. Kaysen is entitled to an annual cash incentive bonus under our Management Incentive Plan and requires that we reimburse Mr. Kaysen for up to $11,500 annually for his personal life and disability insurance policies. We granted Mr. Kaysen options, with a 10-year term, to purchase 300,000 shares of our common stock at a price of $2.50 per share in accordance with the agreement when it was signed.

Mr. Kaysen’s employment agreement has a one-year term, unless terminated earlier, and continues to automatically renew on a year-to-year basis. If we terminate or fail to renew the agreement without “good cause,” or if Mr. Kaysen terminates the agreement because of material and adverse changes in his duties or because we move the location of our principal officers more than 100 miles, then we must pay Mr. Kaysen 100% of his then annual base salary as severance pay. However, if we terminate his employment without “good cause” in connection with a change in control, we will be obligated to pay him 160% of his then annual base salary and a pro rated bonus for the year in which termination occurs as severance pay, and will be obligated to continue his health benefits for 1.6 years after the termination date. The employment agreement prohibits Mr. Kaysen, for one year after his employment terminates, from soliciting our employees or customers and from engaging in competition with us in the development, manufacturing, licensing, marketing or distribution of products or services for diagnosis or treatment of urinary or fecal voiding dysfunctions.

Mahedi A. Jiwani. Effective November 14, 2005, we entered into an employment agreement with Mr. Jiwani, our Vice President and Chief Financial Officer. The agreement provides for an annual base salary of $175,000, which was increased to $200,000 effective July 1, 2008, was maintained at that level for the fiscal year ended March 31, 2010 and was increased to $204,000 for the fiscal year ending March 31, 2011. The agreement also provides that Mr. Jiwani is entitled to an annual cash incentive bonus under our Management Incentive Plan. The agreement required that we grant, and we granted to Mr. Jiwani, options to purchase 100,000 shares of our common stock at an exercise price of $3.00 per share.

Mr. Jiwani’s employment agreement has a one-year term, unless terminated earlier, and continues to automatically renew on a year-to-year basis. If we terminate or fail to renew the agreement without “good cause,”or if Mr. Jiwani terminates the agreement because of material and adverse changes in his duties, because we move the location of our principal offices more than 50 miles, because we reduce Mr. Jiwani’s salary more than other executives, or because he elects to terminate the agreement at the end of its term, we must pay Mr. Jiwani 100% of his then annual base salary and a prorated share of his annual bonus earned as of the termination date assuming 100% milestone achievement as severance pay. We will pay this amount in twelve equal monthly installments provided Mr. Jiwani is not subsequently employed. The employment agreement prohibits Mr. Jiwani for one year after his employment terminates, from soliciting our employees or customers and from engaging in any business in competition with Uroplasty’s business.

Susan Hartjes Holman. We also have an employment agreement with Ms. Holman, which is dated December 7, 1999. The employment agreement specifies a base salary, which is subject to annual adjustment and was increased to $198,800 effective July 1, 2008 and was maintained at that level for the fiscal year ended March 31, 2010 and increased to $202,800 for the fiscal year ending March 31, 2011. Ms. Holman is also eligible to receive an annual cash incentive bonus under our Management Incentive Plan.

Either party may terminate Ms. Holman’s employment at any time, with or without cause, by providing 30 days’ written notice. If Ms. Holman’s employment is terminated by us “without cause,” we would continue to pay her monthly base salary for a period of 12 months.

Contemporaneously with the execution of the employment agreement, Ms. Holman executed an Employee Confidentiality, Inventions, Non-Solicitation and Non-Compete Agreement, under which she agreed not to disclose confidential information, to assign to us without charge all intellectual property relating to our business which is created or conceived during the term of employment, to not encourage employees to leave our employment for any reason and to not compete with us during the term of employment and for a period of 18 months thereafter.

Definition of Good Cause, Without Good Cause and Change of Control. Under our employment agreements with Messrs. Kaysen and Jiwani, termination for “good cause” generally means one or more of the following events: (i) the executive’s willful breach of his employment agreement; (ii) the executive’s gross negligence in the performance or nonperformance of his duties which remains uncured for 30 days; (iii) the executive’s willful dishonesty, fraud or misconduct which materially and adversely affects our operations or reputation; or (iv) the executive’s conviction of a felony crime which materially and adversely affects our operations or reputation.

Under the employment agreement with Ms. Holman, “cause” means one of the following events: (i) the employee is convicted of a felony; (ii) the employee has committed theft or fraudulent act or has acted dishonestly with respect to any business of our company; (iii) the employee has engaged in substance abuse or (iv) the employee has breached any agreement made between the employee and our company.

Under our employment agreements with our executive officers, a “change of control” generally means any of the following events:

| | • | a majority of our Board no longer consists of individuals who were directors, or who were appointed by directors or successors of directors, who served at the time that the applicable agreement was executed; |

| | • | the acquisition of our securities that results in any person owning more than 50% of either our outstanding voting securities or our common stock; |

| | • | a sale or other disposition of all or substantially all of the assets of our company (with certain exceptions); or |

| | • | the approval by our shareholders of a complete liquidation or our dissolution. |

Payments Made Upon Termination Due to Death or Disability. Generally, in the event a named executive officer’s employment is terminated due to death or disability, such officer is entitled to (a) salary and any earned, but unpaid, annual cash bonus, through the date of termination, and (b) exercise all vested options as of the termination date for a period of one year after such termination.

Acceleration of Stock Options Upon Change in Control. Under the 2006 Stock and Incentive Plan, in the event of a change in control, whether or not an executive officer’s employment is terminated, 100% of the remaining unvested portion of their stock options will immediately vest and be exercisable for the remaining term of the option.

Director Compensation

Until July 1, 2010, our non-employee directors received an annual retainer of $10,000, plus $1,200 for each board meeting attended in-person, $600 per telephonic meeting, and $750 for each committee meeting attended. The Chairs of the Board, Audit Committee and Compensation Committee also received a quarterly fee of $1,750, $1,000 and $750, respectively. Historically, each non-employee director was also granted an annual stock option for 15,000 shares of common stock.

Our Compensation Committee recommended, and our Board of Directors adopted revised fees for our non-employee directors effective July 1, 2010. After July 1, the fees for each member of the Board of Directors who is not also an employee, payable quarterly, has consisted of:

| | • | an annual $24,000 retainer for each member of the Board; |

| | • | annual fees of $4,000 for each member of the Compensation Committee, $5,000 to each member of the Audit Committee and $2,000 for each member of the Nominating and Corporate Governance Committee; and |

| | • | annual fees (in addition to the Board retainer and committee fees) of $8,000 for the Non-Executive Chairman of the Board, $5,000 to the Audit Committee Chair, $4,000 for the Compensation Committee Chair and $2,000 for the Nominating and Corporate Governance Committee Chair. |

Further, effective at our Annual Meeting of Shareholders held September 14, 2010, and at each subsequent annual meeting of shareholders, and in lieu of the options we previously granted, each director also receives (1) a non-qualified stock option to purchase, at an exercise price equal to the closing price on the NASDAQ on such date, a number of shares of the Company’s common stock, rounded up to the nearest 25 shares, such that the option has a grant date value, based upon a Black-Scholes model (or whatever model then used by the Company to compute compensation expense for such equity awards), equal to $20,000, and (2) the number of shares of restricted stock, rounded up to the nearest 25 shares, as are equal to $15,000 divided by such closing price. The options vest with respect to 100% of the shares on the first anniversary of the date of grant and expire seven years from the date of grant and the restricted stock vests six months from the date of grant.

We do not provide any form of incentive compensation or other form of stock-based or cash based compensation to our directors, and do not provide perquisites or other forms of compensation, although we do reimburse directors for out-of-town travel to and from board meetings.

Non-Employee Director Compensation. The following table shows, for each of our non-employee directors, information concerning annual compensation earned for services in all capacities during the fiscal year ending March 31, 2011. Mr. Kaysen, our President and Chief Executive Officer, does not receive separate compensation for his services as a director.

| Name | | Fees Earned or Paid in Cash | | | Stock Awards(1) | | | Stock Option Awards (2) | | | Total | |

| Thomas E. Jamison | | $ | 30,150 | | | $ | 15,808 | | | $ | 20,039 | | | $ | 65,997 | |

| Lee A. Jones | | | 30,317 | | | | 15,808 | | | | 20,039 | | | | 66,164 | |

| Robert E. Kill(3) | | | 9,299 | | | | 15,123 | | | | 20,037 | | | | 44,459 | |

| R. Patrick Maxwell | | | 37,700 | | | | 15,808 | | | | 20,039 | | | | 73,457 | |

| James P. Stauner | | | 28,400 | | | | 15,808 | | | | 20,039 | | | | 64,247 | |

| Sven A. Wehrwein | | | 33,117 | | | | 15,808 | | | | 20,039 | | | | 68,964 | |

| | (1) | Represents the grant date fair value of restricted stock that generates compensation expense of $15,000 (rounded up to the nearest 25 shares). |

| | (2) | Represents the grant date fair value of options to purchase shares of common stock, as computed using the Black-Scholes formula, that generate compensation of approximately $20,000. For a description of the assumptions in such calculation, see Note 3, Shareholders’ Equity, to our audited financial statements included in our Annual Report on Form 10-K for the fiscal year ending March 31, 2011. As of March 31, 2011, there were options to purchase our common stock for 36,175 shares held by each of Mr. Jamison and Mr. Maxwell, 21,175 shares held by Ms. Jones, 4,900 shares for Mr. Kill, 21,175 shares for Mr. Stauner, and 41,175 held by Mr. Wehrwein. |

| | (3) | Mr. Kill was elected to the Board in December 2010. |

PRINCIPAL SHAREHOLDERS

The following table presents the beneficial ownership of our common stock on June 30, 2011, by each person we know to own more than five percent of our common stock, by each director and executive officer, and by all directors and executive officers as a group. Unless indicated by footnotes, each shareholder possesses sole voting and investment power over its shares. Shares issuable upon the exercise of outstanding stock options within 60 days of June 30, 2011, are considered outstanding for the purpose of calculating the percentage of common stock owned by each person, but not for the purpose of calculating the percentage of common stock owned by any other person.

of Beneficial Owner | | Number of Shares Beneficially Owned | | | Percent of Common Stock | |

| Beneficial Owners of More Than 5% | | | | | | |

| Manatuck Hill Partners LLC(1) | | | | | | |

| 1465 Post Road | | | | | | |

| Westport, CT 06880 | | | 1,757,000 | | | | 8.5 | % |

| Ayer Capital Management LP (2) | | | | | | | | |

| 230 California Street, Suite 600 | | | | | | | | |

| San Francisco, CA 94111-4326 | | | 1,062,036 | | | | 5.1 | % |

Executive Officers and Directors (3) | | | | | | | | |

| David B. Kaysen | | | 564,792 | | | | 2.7 | % |

| Thomas E. Jamison | | | 61,725 | | | | * | |

| Lee A. Jones | | | 29,960 | | | | * | |

| Robert E. Kill | | | 2,875 | | | | * | |

| R. Patrick Maxwell | | | 140,109 | | | | * | |

| James P. Stauner | | | 42,125 | | | | * | |

| Sven A. Wehrwein | | | 25,025 | | | | * | |

| Larry Heinemann | | | 138,025 | | | | * | |

| Susan Hartjes Holman | | | 481,584 | | | | 2.3 | % |

| Mahedi A. Jiwani | | | 216,292 | | | | 1.0 | % |

| Nancy A. Kolb | | | 132,425 | | | | * | |

| Arie J. Koole | | | 64,408 | | | | * | |

| Marc Herregraven | | | 111,025 | | | | * | |

All directors and executive officers as a group (3) | | | | | | | | |

| (13 persons) | | | 2,010,370 | | | | 9.1 | % |

* Less than 1%.

| (1) | Based on Form 13F filed on May 19, 2011. |

| (2) | Based on Schedule 13G filed April 27, 2011. |

| (3) | Includes for Mr. Kaysen 508,692 shares, for Mr. Jamison 30,000 shares, for Mr. Maxwell 30,000 shares, for Mr. Stauner 15,000 shares, for Mr. Wehrwein 20,000 shares, for Mr. Heinemann 82,175 shares, for Ms. Holman 164,675 shares, for Mr. Jiwani 190,542 shares, for Ms. Kolb 117,175 shares, for Mr. Koole 56,742 shares, for Mr. Herregraven 77,175 and for all officers and directors as a group 1,292,176 shares that may be acquired upon exercise of options that were exercisable on, or became exercisable within 60 days of, June 30, 2011. Also includes for Mr. Kaysen 27,775 shares, for Mr. Heinemann 6,975 shares, for Ms. Holman 6,975 shares, for Mr. Jiwani 9,725 shares, for Ms. Kolb 6,975 shares, for Mr. Koole 4,975 shares and for Mr. Herregraven 6,975 shares of restricted stock subject to risk of forfeiture upon termination of employment. |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires our directors and executive officers, and persons who own more than 10% of our common stock, to file with the SEC initial reports of ownership and reports of changes in ownership of our common stock and other equity securities. Executive officers, directors and greater than 10% shareholders are required by SEC regulations to furnish us with copies of all Section 16(a) reports they file.

To our knowledge, based solely on a review of the copies of such reports furnished to us during the fiscal year ending March 31, 2011 and on written representation by each of our officers and directors, we believe all Section 16(a) filing requirements applicable to our executive officers, directors and greater than 10% shareholders were complied with for such fiscal year.

AUDITING MATTERS

Audit Committee Report

The primary purpose of the Audit Committee is to assist the Board of Directors in fulfilling its oversight responsibilities relating to our accounting, reporting practices and the quality and integrity of our financial reports and our other publicly disseminated financial information. Management is responsible for internal controls and our financial reporting process. Our independent accountants are responsible for performing an independent audit of our consolidated financial statements in accordance with generally accepted auditing standards and to issue a report on those financial statements. In this context, the Audit Committee has met with management (including the Chief Executive Officer and Chief Financial Officer) and Grant Thornton, LLP, our independent registered public accounting firm (“Independent Auditors”), both independently and in concert.

In connection with our consolidated financial statements for the fiscal year ending March 31, 2011, the Audit Committee has:

| | • | Reviewed and discussed the audited financial statements with management and with representatives of Grant Thornton LLP, our Independent Registered Public Accounting Firm; |

| | • | Discussed with our Independent Registered Public Accounting Firm the matters required to be discussed by PCAOB AU sec. 380, Communications with Audit Committees and SEC Rule 2-07, Communications with Audit Committees; and |

| | • | Received the written disclosures and letter from Grant Thornton LLP required by applicable requirements of the Public Company Accounting Oversight Board regarding Grant Thornton LLP’s communication with the audit committee concerning independence, and has discussed with Grant Thornton LLP its independence. |

Based upon the Audit Committee’s discussion with management and the independent accountants and the Audit Committee’s review of the representation of management and the report of the independent accountants to the Audit Committee, the Audit Committee recommended to the Board of Directors that the audited consolidated financial statements be included in our Annual Report on Form 10-K for the fiscal year ending March 31, 2011 filed with the Securities and Exchange Commission.

| | AUDIT COMMITTEE |

| | Robert E. Kill |

| | R. Patrick Maxwell |

| | James P. Stauner |

| | Sven A. Wehrwein, Chair |

Fees

The following table presents the aggregate fees for professional services provided by Grant Thornton, LLP, in the fiscal years ended March 31, 2010 and 2011.

| | | Fiscal Year 2010 | | | Fiscal Year 2011 | |

| Audit Fees (1) | | $ | 126,491 | | | $ | 161,830 | |

| Audit-Related Fees (2) | | | 6,450 | | | | -- | |

| Tax Fees (3) | | | 14,589 | | | | 11,205 | |

| Total | | $ | 147,530 | | | $ | 173,035 | |

| | (1) | Audit fees consist of fees for the audit of our annual consolidated financial statements, review of our interim consolidated financial statements, services rendered relative to regulatory filings and attendance at Audit Committee meetings. |

| | (2) | Audit-related fees are principally for technical accounting research. |

| | (3) | Tax fees principally consist of fees for the preparation of tax returns and advice on tax audit. |

There were no other services provided by Grant Thornton, LLP not included in the captions above during 2010 or 2011.

Pre-Approval Process

The Audit Committee pre-approves all audit and permitted non-audit services to be performed for us by our Independent Auditors.

PROPOSAL 2 — RATIFY THE APPOINTMENT OF OUR

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Our Audit Committee is asking shareholders to ratify its appointment of Grant Thornton LLP as our independent registered public accounting firm for the fiscal year ending March 31, 2012, in order to ascertain the views of our shareholders on this appointment. In the event the shareholders fail to ratify the appointment, the Audit Committee will reconsider this appointment. Even if the appointment is ratified, the Audit Committee, in its discretion, may appoint a different independent registered public accounting firm at any time during the year if the Audit Committee determines that such a change would be in the best interests of Uroplasty and its shareholders.

Representatives of Grant Thornton LLP will be present at the Annual Meeting and will have the opportunity to make a statement if they desire to do so. These representatives will also be available to respond to appropriate questions after the meeting.

The Audit Committee of the Board of Directors recommends that the shareholders vote FOR the ratification of the appointment of Grant Thornton LLP to serve as our independent registered public accounting firm for our fiscal year ending March 31, 2012. Proxies solicited by the Board of Directors will, unless otherwise directed, be voted for the ratification of the appointment.

The affirmative vote of the holders of a majority of the shares of common stock present and entitled to vote at the Annual Meeting on this item of business is required for the approval of the proposal (provided that the number of shares voted in favor of the proposal constitutes more than 25% of the outstanding shares of our common stock). If a shareholder abstains from voting on this proposal, then the shares held by that shareholder will be deemed present at the Annual Meeting for purposes of determining a quorum and for purposes of calculating the vote with respect to this proposal, but will not be deemed to have been voted in favor of this proposal. Brokers and other nominees have discretionary authority to vote on this matter as they choose unless they receive specific voting instructions from the beneficial owner. If you hold shares in any brokerage account or through a bank, trust or other nominee and wish to assure those shares are voted on this proposal in a specific manner, then you should instruct the broker, bank, trust or other nominee how to vote the shares using the instructions provided.

SHAREHOLDER PROPOSALS FOR 2012 ANNUAL MEETING

If you want to submit a proposal for our 2012 annual meeting and wish to have your proposal included in our proxy statement for the 2012 meeting, you must submit your proposal to us before March 29, 2012. If you wish to nominate an individual for election as a director, or have any other proposal considered at the annual meeting that is not included in our proxy statement, our bylaws require that you submit your proposal to us no earlier than May 17, 2012 and no later than June 16, 2012. In either case, your proposal must be in writing, must include your name and record address and the name and record address of any other person for whom you are submitting the proposal, the number of shares you own, beneficially or of record, and the number of shares owned by any person for whom you are submitting the proposal.

If you wish to nominate an individual to serve as a director, you must also include in the written notification (i) the name, age, principal occupation and employment of the nominee, (ii) the number of shares of the company owned by the nominee, (iii) both the business and residence address of the nominee, (iv) any relationship with any person that would provide the nominee or any associate of the nominee the opportunity to profit from an increase in the value of our common stock, and (v) information regarding your relationship with the nominee. If you wish to have another proposal considered at the 2012 meeting, you must also include in your written notification (i) a complete description of the business desired to be brought before the annual meeting and the reasons you believe this business should be conducted at the annual meeting, and (ii) any material interest in that business that you have and or that the person on whose behalf you are making the proposal might have.

In addition to the requirements described above, in order for your proposal, including any director nomination, to be considered at the 2012 Annual Meeting, you must be a shareholder of record of our common stock as of the date you provide us written notice of your proposal, and must remain a shareholder of record on the record date for our 2012 Annual Meeting. If you do not comply with these requirements, we may refuse to consider your proposal at the 2012 Annual Meeting.

Other Matters

We do not know of any other matters that are likely to be brought before the 2011 Annual Meeting. However, if any other matters should properly come before the Annual Meeting, the persons named in the enclosed proxy will have discretionary authority to vote such proxy in accordance with their best judgment on such matters.

Annual Report to Shareholders

Our Annual Report on Form 10-K for the fiscal year ending March 31, 2011 (including audited financial statements) accompanies this Proxy Statement.

| | BY ORDER OF THE BOARD OF DIRECTORS: |

| | /s/ SUSAN HARTJES HOLMAN |

| | Susan Hartjes Holman |

| | Corporate Secretary and Chief Operating Officer |

Minneapolis, Minnesota