- SCI Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Service Corporation International (SCI) DEF 14ADefinitive proxy

Filed: 27 Mar 20, 2:12pm

| ☑ | Filed by the Registrant | ☐ | Filed by a Party other than the Registrant |

| CHECK THE APPROPRIATE BOX: | ||

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☑ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Under Rule 14a-12 | |

| PAYMENT OF FILING FEE (CHECK THE APPROPRIATE BOX): | |||

| ☑ | No fee required. | ||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||

| 1) Title of each class of securities to which transaction applies: | |||

| 2) Aggregate number of securities to which transaction applies: | |||

| 3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| 4) Proposed maximum aggregate value of transaction: | |||

| 5) Total fee paid: | |||

| ☐ | Fee paid previously with preliminary materials: | ||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. | ||

| 1) Amount previously paid: | |||

| 2) Form, Schedule or Registration Statement No.: | |||

| 3) Filing Party: | |||

| 4) Date Filed: | |||

|  |  |  | |||

Anthony L. Coelho Lead Independent Director | Thomas L. Ryan President, Chairman, and CEO | Alan R. Buckwalter, III | Jakki L. Haussler | |||

|  |  |  | |||

| Victor L. Lund | Clifton H. Morris, Jr. | Ellen Ochoa | Sara Martinez Tucker | |||

|  | |||||

| W. Blair Waltrip | Marcus A. Watts | |||||

Executive Summary - Strategy and Performance | ||

| OTHER INFORMATION | ||

| Information About the Meeting and Voting | ||

| Proxy Solicitation | ||

| Submission of Shareholder Proposals | ||

| Other Business | ||

| Section 16(a) Beneficial Ownership Reporting Compliance | ||

| Date and Time: | Place: | Record Date: | |||||||

| Wednesday, May 13, 2020 at 8:00 a.m. Central Time | Service Corporation International Conference Center, Heritage I & II 1929 Allen Parkway Houston, Texas 77019 | March 16, 2020 | |||||||

| How to Vote | ||||||||

| By Internet | By Telephone | By Mail | In Person | |||||

Vote your shares at www.proxyvote.com. | Call toll-free number 1-800-690-6903. | Sign, date, and return the enclosed proxy card or voting instruction form. | To attend the meeting in person, you will need proof of your share ownership and valid picture I.D. | |||||

| Have your Notice of Internet Availability or proxy card in hand for the 16-digit control number. | ||||||||

| Tom Ryan answers questions received from shareholders over the course of 2019 | |

How do you plan to remain relevant with the changing nature of consumers? As the largest consolidated deathcare company in North America, we serve over 300,000 families each year. We want to stay ahead of trends in our industry that are important to the client families we serve. We are constantly evolving to meet the varying preferences and needs of our customers and we believe that remaining relevant is key to generating revenue growth. Whether a customer chooses burial or cremation, Baby Boomers are redefining funeral customs by transitioning away from traditional mourning to a personalized celebration of life ceremony. Throughout 2019, we began to further develop our strategy to attract and serve growing segments of future customers. To gain deeper insights into that customer, we commissioned a comprehensive customer segmentation study. The study validated many of our beliefs around our traditional customer base, but also raised our awareness of the varying desires of growing customer segments that prefer a more uplifting service, often referred to as a celebration of life. These customers, who we have identified as celebrators, prefer a less traditional gathering with more interaction, more participation, and more personalization. We are taking insights from the study to enhance many of our current offerings to be more responsive to these changing customer preferences. In late 2019, we selected a number of markets where our research shows higher concentrations of celebrators and have begun investing in expanding celebration of life service offerings. These services could be very simple or very elaborate depending on the customer’s desires. We have also continued repurposing certain spaces in our facilities to become more flexible with event rooms allowing us to further expand our catering offerings and celebrant services in these markets. We have replaced the casket selection process by offering a digital presentation of options that allows the customer to choose merchandise and services including unique celebration, catering, and celebrant services. In our funeral business, we focus on memorialization merchandise and services that will be meaningful to both our burial and cremation customers. The trend towards cremation requires us to be much more flexible in providing products and services. We have developed cremation service packages, which may or may not include a celebratory memorialization. The cremation trend is one that we are familiar with and has allowed us to develop a broader range of cremation service offerings, which better align our value proposition with a variety of customer preferences from very simple to full service. In our cemetery business, we continue our focus on revenue growth by increasing the number of high-end and unique cremation property development options. Our “Landmark Estates” development strategy expands across the cemetery network, increases the number of exclusive, one of a kind estate developments and private mausoleums that capture a family's vision and commemorate a legacy of a life well lived. We have expanded our cremation property developments to meet the increased demand for more personalized options such as glass niche columbariums and custom cremation gardens with unique features memorialized in granite. Our innovative cemetery merchandising strategies have introduced new memorialization options with custom designs and products in both bronze and a variety of granite colors and styles. |  | |

We will continue to listen to our customers and evolve our strategy to remain relevant to ensure we create the unique experience each customer prefers. | ||

How does the Company leverage its scale? As the largest deathcare company in North America, we are able to leverage our scale by developing our sales organization and optimizing the use of our network through technology and for the benefit of our preneed backlog. Our large scale enables us to achieve cost efficiencies through the maximization of purchasing power and utilizing economies of scale throughout our supply chain channel. We also leverage our scale with technology to offer best-in-class experiences and helpful resources for our customers. We continue driving operating discipline and leveraging our scale through standardizing processes and capitalizing on new technologies to improve the customer experience. Advancements in technology are changing the way we present our product and service offerings to customers. Our funeral atneed point of sale system, HMIS+, uses a digital platform enabled with high-resolution video and photographs to create a seamless presentation of our product and service offerings. Our newly implemented and mobile preneed funeral sales system, Beacon, provides customers with a full digital presentation experience in their home or other place of their choosing. In 2018, we completed a redesign of almost 2,000 Dignity Memorial® location websites, featuring a modern and user-friendly design. These location-specific websites have been optimized for mobile use and updated with enhanced search engine optimization capability. In addition to the contemporary and sophisticated design, client families now enjoy new features such as a streamlined obituary completion process, social media sharing capabilities, and the ability to create and share personalized content in memory of their loved one. In 2019, our websites experienced significant growth in the number of visits, which reached nearly 130 million. During 2019, we took significant steps to improve the quality of customer feedback and elevate our online reputation. We engaged a third party to improve the response rate from customers for online reviews, and we have seen a significant increase in the number of reviews over the past year. Online reviews provide visibility of customer engagement down to the location level and improve our response time in addressing customer concerns. We collaborated with a leading technology partner to deliver the J.D. Power surveys digitally, which has increased the quantity and quality of customer feedback and reduced the time it takes to receive customer feedback. In late 2019, we established a social media presence for a number of our funeral and cemetery businesses. These digital efforts have resulted in favorable customer satisfaction ratings and increased digital sales leads. In addition, we want to further leverage technology throughout all of our processes to provide customers with the type of experience they expect. For example, we replaced the funeral merchandise selection process with a fully digital presentation of options. Our customers are now able to select all of the elements of funeral merchandise and service in comfort and privacy. We have also embarked on a process that will simplify the administrative burden placed on families by streamlining arrangements in person and online. We will continue leveraging our scale by embracing the technology that our customers have come to expect. | ||

LEVERAGING OUR SCALE THROUGH EMBRACING TECHNOLOGY • HMIS+. Our funeral atneed point of sale system that helps with the seamless presentation of our products and services. • Beacon. Our recently implemented and mobile preneed sales system that provides customers with a full digital presentation experience in their homes. • Dignity Memorial® location websites. With its redesign, our client families now enjoy a streamlined obituary completion process, social media sharing capabilities, and personalized content in memory of their loved ones. | ||

GAAP Performance Measures (1) | Adjusted Performance Measures (2) | ||

| GAAP Earnings Per Share | Adjusted Earnings Per Share | ||

|  | ||

| GAAP Operating Cash Flow (in millions) | Adjusted Operating Cash Flow (in millions) | ||

|  | ||

(1) GAAP - Generally Accepted Accounting Principles | (2) Adjusted Earnings Per Share and Adjusted Operating Cash Flow are non-GAAP financial measures. Please see Annex A for disclosures and reconciliations to the appropriate GAAP measure. | ||

| We support water recycling and reclamation efforts for converting wastewater into a reusable resource. This process benefits ecosystems, improves stream flow, nourishes plant life, and recharges aquifers, all as a part of the natural water cycle. We are surveying our cemeteries to ensure we are optimizing our water usage and researching the potential for more conservation efforts. In addition to our reclamation efforts, we are piloting new water conservation technologies at several of our cemeteries. | |

| We continuously evaluate our carbon footprint through the measurement of operation processes related to our business. Our fleet consists of approximately 7,000 vehicles, including funeral procession vehicles such as limousines and hearses. We began replacing large vehicles with subcompact and hybrid vehicles in 2019 to become more fuel efficient, which results in less consumed fuel and a 3.3% reduction in carbon dioxide emissions. We plan to continue increasing the number of fuel-efficient vehicles in our fleet and are advancing our green initiatives by piloting electric vehicles in select locations. We are also installing solar panels in certain locations in California and are looking forward to reviewing the impact at these locations in 2020. | |

We created our Supplier Code of Conduct ensuring our suppliers support safe working conditions and treat their employees fairly and with respect. Additionally, we encourage responsible and environment-friendly production processes. We finalized our supplier diversity policy reflecting our Company values. SCI already procures from a very large pool of small and diverse suppliers; however, we are improving this by fostering an inclusive procurement process that provides opportunity for small and diverse businesses to participate as partners and suppliers of goods and services. Additional benefits of ensuring that these suppliers are included in the procurement process are innovation, unique products, and different perspectives. We published our Supplier Code of Conduct on our corporate website, which can be found here, https://www.sci-corp.com/about/responsibility/sustainability. | |

SCI supports and encourages giving back to the communities we serve. When our communities hurt the most, our team of compassionate caregivers are there to help. In the aftermath of national tragedies, our teams work closely with local and state authorities to provide resources, equipment, and volunteers. We help communities by providing funeral and cemetery services to families affected by these tragedies as they have enough to bear without the added burden of an unexpected funeral. We also know that grief is ongoing, and we help our communities commemorate, honor, and remember the lives lost on the anniversaries of recent tragedies. We also support our communities through other programs such as the Dignity Memorial LIFT® program, which helps people adjust to the loss of a spouse or partner. Activities include luncheons, sporting events, holiday activities, day trips, and educational seminars that provide opportunities for attendees to socialize with others who share similar feelings and experiences. There are no fees or dues to participate in the program. Participation in the program is not restricted to those who have been served by Dignity Memorial® providers. We are committed to supporting the families we serve before, during, and after the funeral service. The loss of a loved one and the accompanying grief can be extremely difficult. We are proud to provide families with helpful benefits and resources, such as the 24-hour Compassion Helpline®, which provides confidential phone access to professionals trained in grief counseling. To help people cope, we also developed the Dignity Memorial Guidance Series® featuring the insights of renowned grief experts. This extensive collection of booklets, brochures, and online resources offer professional advice and compassionate guidance to help caregivers assist others in dealing with the complex emotions of grief. Just as we are committed to the families in our care, we are honored to support our public servants, veterans, and those serving in the military who sacrifice so much in the line of duty. For decades, SCI has supported those who serve our country by actively recruiting dedicated veterans to become part of our Company, and through programs such as the Dignity Memorial Homeless Veterans Burial Program, which offer dignified funeral services with military honors to homeless or indigent veterans. Through our Dignity Memorial Public Servants Program, we recognize the courage and selflessness of first responders who serve our communities. This program offers, at no cost, dignified and honorable tributes, including funeral services and cemetery property, for career and volunteer law enforcement officers, firefighters, and emergency services personnel who fall in the line of duty. Over the years, it has been our solemn honor to serve hundreds of fallen heroes. Compassion is what differentiates our Company from others and is key to building enduring relationships as one of our core values. Our associates are the key to our Company’s future. It is their enthusiasm, positive outlook, and compassion that heighten our level of care to families and propel our Company’s continued success. | ||

| ||

Compassion is what differentiates our Company from others. Our associates are the key to our Company’s future. It is their enthusiasm, positive outlook, and compassion that heighten our level of care to families and propel our Company’s continued success. | ||

| This summary highlights information contained in this Proxy Statement. This summary does not contain all of the information you should consider. Please read the entire Proxy Statement carefully before voting. |

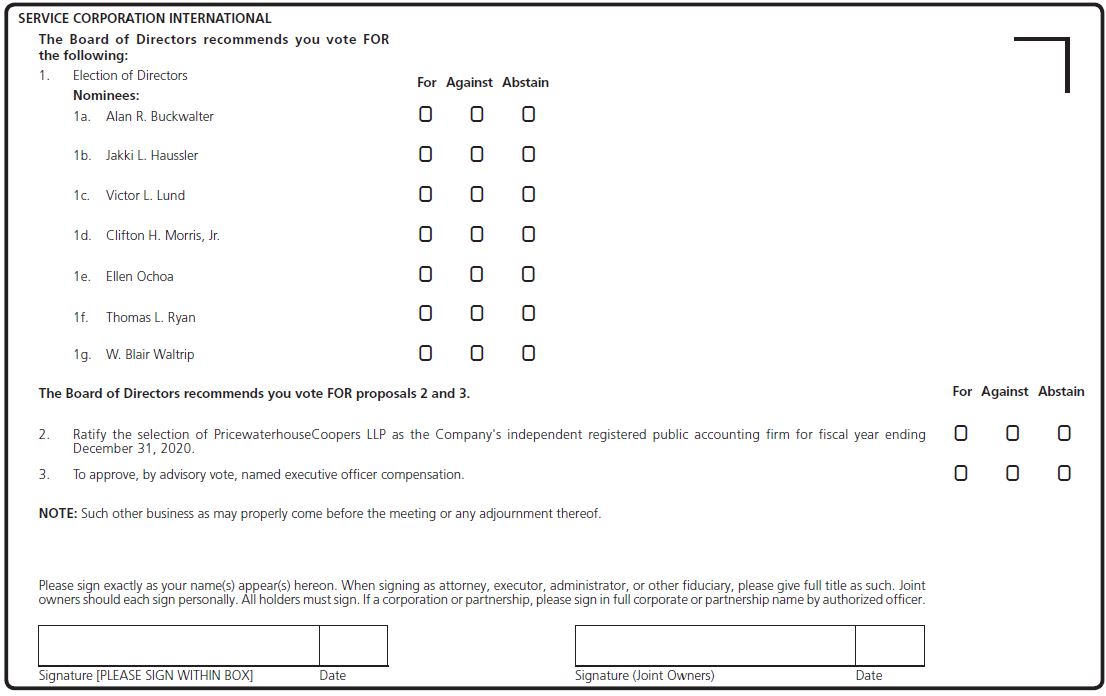

| ü | Proposal 1 |

The Board of Directors recommends that Shareholders vote “FOR” the following seven nominees. | |

| Independent | Age | Director Since | Other Public Boards* | BOARD COMMITTEE COMPOSITION | |||||

Name Occupation | A | C | E | N& CG | I | ||||

Alan R. Buckwalter Former Chairman and CEO, Chase Bank of Texas | YES | 73 | 2003 | None | C | ● | ● | ||

Jakki L. Haussler Founder and Chairwoman of the Board and former CEO, Opus Capital Management | YES | 62 | 2018 | 2 | ● | ● | |||

Victor L. Lund Interim President and CEO and former Executive Chairman of the Board, Teradata Corporation | YES | 72 | 2000 | 1 | C | ● | ● | ||

Clifton H. Morris, Jr. Chairman and CEO of JBC Funding, a corporate lending and investment firm | YES | 84 | 1990 | None | ● | ● | |||

Ellen Ochoa Former Director, NASA Johnson Space Center | YES | 61 | 2015 | None | ● | ● | |||

Thomas L. Ryan President, Chairman, and CEO, Service Corporation International | NO | 54 | 2004 | 2 | C | ||||

W. Blair Waltrip Independent consultant, family and trust investments, and former Senior Executive of the Company | NO | 65 | 1986 | None | C | ||||

Name Occupation | Independent | Age | Director Since | Other Public Boards* | BOARD COMMITTEE COMPOSITION | ||||

| A | C | E | N& CG | I | |||||

Anthony L. Coelho, Lead Independent Director Former Majority Whip of the U. S. House of Representatives Independent business and political consultant | YES | 77 | 1991 | 2 | ● | ● | ● | ||

Sara Martinez Tucker Former Chief Executive Officer, National Math + Science Initiative, a non-profit organization to improve student performance in STEM subjects | YES | 64 | 2018 | 2 | ● | ● | |||

Marcus A. Watts President, The Friedkin Group, an umbrella company overseeing various business interests that include a variety of branded automotive, hospitality, and entertainment companies | YES | 61 | 2012 | 1 | ● | ● | C | ||

A: Audit Committee | E: Executive Committee | I: Investment Committee | ● Member |

C: Compensation Committee | N&CG: Nominating & Corporate Governance Committee | C: Chair | |

* See Director Bios beginning on page 16, which includes other Public Boards for each Director. | |||

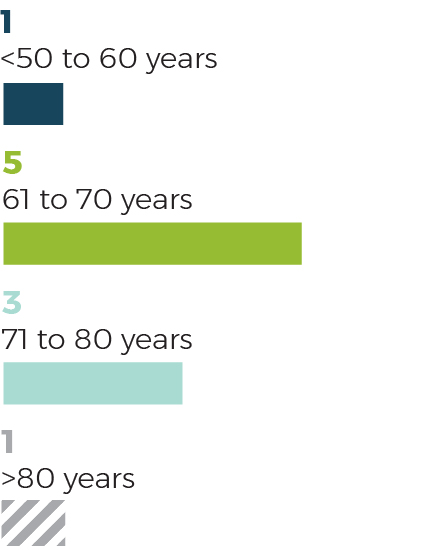

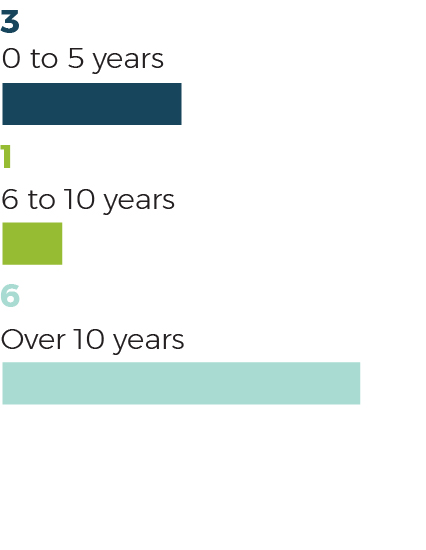

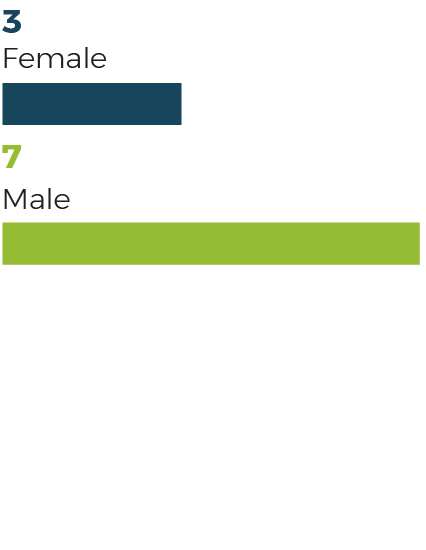

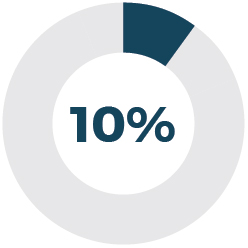

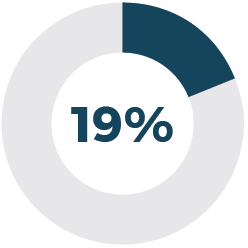

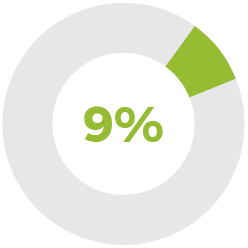

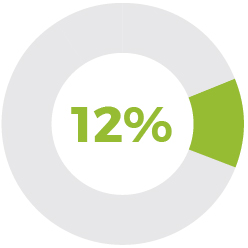

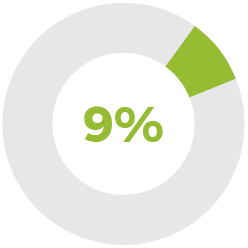

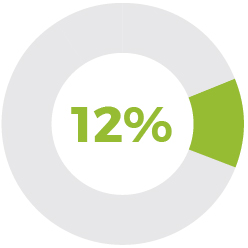

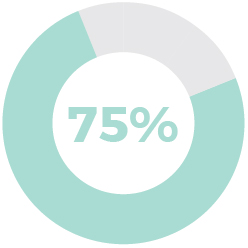

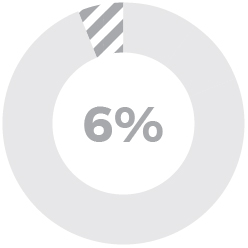

| Director Age | Director Tenure | Gender | Ethnicity | ||||||

|  |  |  | ||||||

Average age is 67 years old | Average tenure is 16 years | Gender diversity represented by 30% of the Board | Ethnic diversity represented by 30% of the Board | ||||||

• 8 out of 10 Directors are independent • 9 out of 10 Directors are non-management | • Audit, Compensation, and Nominating and Corporate Governance Committees of SCI are composed entirely of Independent Directors | • Strong Lead Independent Director role (see page 28 for list of key duties and responsibilities of Lead Independent Director) | ||||

• Personal qualities such as self awareness, respect, integrity, independence, and capacity to function effectively in challenging environments | • Experience in various leadership roles and proven record of success • Corporate governance knowledge and practices | • Appreciation for diversity of people and perspectives • Objectivity and sound judgment | ||||

| • Actively involved with overseeing Company's execution of its strategy | • 97% combined meeting attendance record for Board and Board committee meetings | • 5 Board meetings • 22 committee meetings | ||||

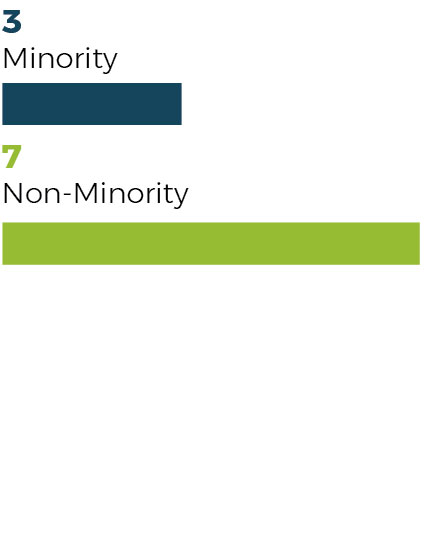

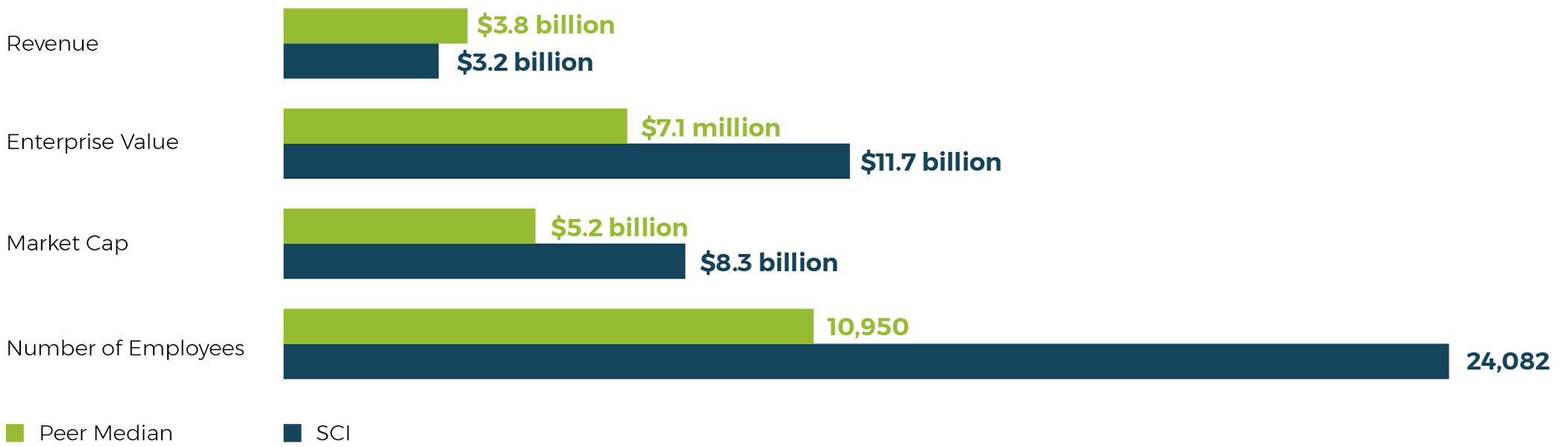

| We engaged with shareholders representing approximately | In early 2019, we engaged with shareholders representing approximately 55% of the Company’s common stock prior to our Annual Shareholder Meeting. Overall, investors’ sentiment was positive with respect to our enhanced ESG disclosures, our corporate governance practices, and our executive compensation programs. Investors expressed appreciation for our enhanced Board composition as a result of the addition of four new candidates and five vacancies since 2012. However, an area of particular focus during our engagements with investors was Board tenure and the recruitment process for new Director candidates. In recruiting new candidates, the Board recognizes that diverse individuals from different backgrounds with varying perspectives, professional experience, education, and skills are important features of a well-functioning board. The Board recruitment process starts with the desired skills we value in a board member, while also considering the value that diversity can add to the Board's skill set. Through our ongoing shareholder outreach efforts, we better understand the viewpoints of our shareholders as well as gain opportunities to communicate with transparency how our decisions align with our business goals. | ||

| |||

| Board Recruitment* | Board Tenure | ||||

• We may engage a third party executive search firm to identify candidates • We consider items such as the current Board composition and need for particular areas of expertise • Once a prospective nominee is identified, the Committee evaluates the candidate based on the Nominating & Corporate Governance guidelines which include items such as personal characteristics and collective core competencies • After completing the evaluation process, the Committee makes nominations to the full Board • The Board determines the nominees after considering the recommendation and report of the Committee • These efforts have resulted in four new Directors since 2012 and have increased both the diversity of perspectives and experiences as well as the number of women on our Board | • Since 2012, we have added four new Directors • Average tenure has decreased from 24 to 16 years • Average age has decreased from 70 to 67 • We believe the average age and tenure of our Directors is appropriate given our industry and consumer demographics while providing the Board a unique perspective and understanding of SCI’s consumer base. SCI’s average age of preneed cemetery consumers is in the early sixties. The average age of preneed funeral consumers is in the early seventies. | ||||

*Please see the section titled "Consideration of Director Nominees" page 25 for more information on the Board recruitment process. | ||||

| Best Practices | Board Composition | |

| • Created role of Lead Independent Director with enhanced authority to call special Board meetings and to preside over Board Meetings in the absence of the Chairman • Refreshed proxy statement to improve readability and enhance disclosures, including skills and experiences of Directors | • Appointed CEO Thomas Ryan as Chairman of the Board • Appointed Tony Coelho as Lead Independent Director • Board member Dr. Malcolm Gillis passed away (October 2015) after serving on the Board for 11 years |

• Adjusted Director compensation based on feedback from advisory firms • The Board, in response to shareholder feedback, approved changes to the performance unit plan to add a normalized return on equity modifier to the total shareholder return metric and changed the award denomination to share units rather than cash beginning in 2018 • Shareholders are allowed to call special meetings | ||

• Board recommended and shareholders approved the de-classification of our Board of Directors • Board recommended and shareholders approved elimination and reduction of certain supermajority voting requirements in our Articles of Incorporation and Bylaws • We eliminated the Umbrella Plan due to certain changes in the Tax Act | • Added diverse perspectives and experience to our Board with the addition of Sara Martinez Tucker and Jakki Haussler to our Board • After 56 years of meaningful contributions, in order to recruit the next generation of Board leaders, R.L. Waltrip decided not to seek re-election • Long-time member, Dr. Ed Williams, passed away after faithfully serving on the Board for 27 years | |

• We enhanced our disclosures around Environmental, Social, and Governance (ESG) • The Board made changes to the Company's Bylaws to permit the Chair of the Nominating and Corporate Governance Committee of the Board to preside over the Board meetings in the absence of the Board Chair, Lead Director and the Chief Executive Officer | • After 36 years of outstanding service on the Board of Directors, John Mecom decided to not seek another term as a Board member | |

• The charter of the Nominating and Corporate Governance Committee of the Board was updated to reflect their oversight responsibilities of ESG | ||

| Our best practices include: | |||||

• Majority voting standard in Director elections • Annual Board and Committee evaluation process • Board orientation and education program • No shareholder rights plan or “poison pill” | • Shareholder (10%) ability to call special meetings • Anti-hedging and anti-pledging policies applicable to all Directors and Officers • Stock ownership and retention guidelines for Directors and Officers | ||||

|  | |||||||

| We understand our associates are one of our greatest assets. Increased diversity enables solid business decisions, considering different points of view, and relevancy with our customers. | In 2018, we held our first Women's Leadership Conference, expanded our inclusive leadership training, and began tracking trends and progress for inclusion and diversity. We planned to hold a second Women’s Leadership Conference in May 2020, however, health and safety concerns arising from the spread of COVID-19 forced a delay. We are committed to holding the Women’s Leadership Conference at a time when the threat to the well-being of our associates has been alleviated. | Tom Ryan, our President, CEO, and Chairman, joined the CEO Action for Diversity & Inclusion™, and has pledged to continue to act on supporting a more diverse and inclusive workplace. See Our People. Our Purpose report under the "Our People" page on our corporate website for more information. | For a third consecutive year, SCI was certified as a Great Place to Work. This certification increases awareness of our Company culture and builds visibility of our Company values to our stakeholders. | Jakki L. Haussler and Sara Martinez Tucker were recently elected to the SCI Board of Directors. Both members bring unique perspectives and diversity to the Board. | ||||

| Product Governance | • We now have a Supplier Code of Conduct that is available on the Company's website: https://www.sci-corp.com/about/responsibility/sustainability. This policy ensures our suppliers reinforce safe working conditions and their associates are treated fairly and with respect. | ||

| • We recognize reclaiming water for reuse applications instead of using freshwater supplies can be a water-saving measure. We are surveying our cemeteries to ensure we are optimizing water usage and testing water conservation technologies at certain of our cemeteries. | |||

| • We are taking action to ensure our supplier diversity policy reflects the Company values. SCI already procures from a very large pool of small and diverse suppliers; however, we are improving this by fostering an inclusive procurement process providing an opportunity for the participation of small and diverse businesses as partners and suppliers of goods and services. | |||

| Data Privacy and Security | • We are committed to protecting the privacy of our clients and website visitors in a manner that would be expected of a company of our size. We value our relationships with existing and prospective clients and recognize an essential element of those relationships is the trust and confidence of the families we serve. In January 2020, we successfully implemented strategies to comply with the California Consumer Privacy Act. | ||

• We maintain substantial security measures and data backup systems to protect, store, and prevent unauthorized access to customer information. Our privacy policy is disclosed online at https://www.sci-corp.com/privacy-policy. | |||

| Community Impact | • Through the Dignity Memorial® Public Servants Program, Dignity Memorial funeral, cremation, and cemetery providers offer dignified and honorable tributes, at no cost, for career and volunteer law enforcement officers, firefighters, and emergency services personnel who fall in the line of duty. | ||

| • Dignity Memorial® funeral, cremation, and cemetery service providers are honored to administer the Dignity Memorial Homeless Veterans Burial Program across the nation. The U.S. Department of Veterans Affairs provides eligible veterans with opening and closing of the gravesite, a grave liner, a headstone or marker, a graveside ceremony, and burial in a National Cemetery. Participating Dignity Memorial funeral directors provide funeral services, transportation, preparation, clothing, and a casket at no charge to eligible homeless or indigent veterans. | |||

• For the past several years, we have participated in Donate Life's annual tribute to organ, eye, and tissue donors. We also have helped many client families honor their loved ones with a portrait featured on the Donate Life float in the annual Rose Parade ® held every New Year's Day in Pasadena, California. | |||

• In addition to compassionately serving families during their time of need, our team of professionals demonstrate an ongoing commitment to our communities. Please visit our Corporate Social Responsibility page for further information: https://www.sci-corp.com/about/responsibility | |||

| Corporate Responsibility | • We refreshed our corporate website: https://www.sci-corp.com/ | ||

• In 2019, we launched a new section of our website dedicated to the topic of Corporate Social Responsibility. Please go to https://www.sci-corp.com/about/responsibility for further information on this topic. | |||

| ü | Proposal 2 |

The Board of Directors recommends that Shareholders vote “FOR” ratification of the selection of PricewaterhouseCoopers LLP ("PwC") as the independent registered public accounting firm of the Company. | |

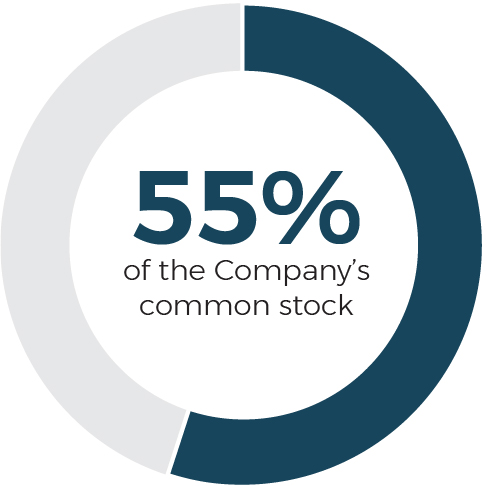

PwC Engagement: • PwC has extensive knowledge of our unique industry and has demonstrated its capability and expertise as an Independent Registered Public Accounting Firm • Our Audit Committee and PwC regularly meet to discuss audit matters and provide updates outside the presence of management • Our Audit Committee reviews SCI's engagement letter and approves PwC's annual audit and non-audit fees • Approximately 96% of the fees incurred are audit-related |

| Year-Over-Year Comparison of Our Audit to Non-Audit Fees | |

| For more information in regard to the audit and non-audit fees, please see section titled "Audit Fees and All Other Fees" under Audit Committee Matters on page 37. |

ü | Proposal 3 |

The Board of Directors recommends a vote “FOR” advisory approval of the resolution regarding compensation of our Named Executive Officers (as set forth in this Proxy Statement). | |

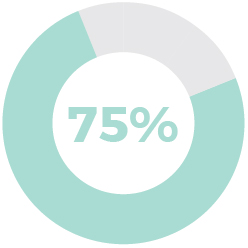

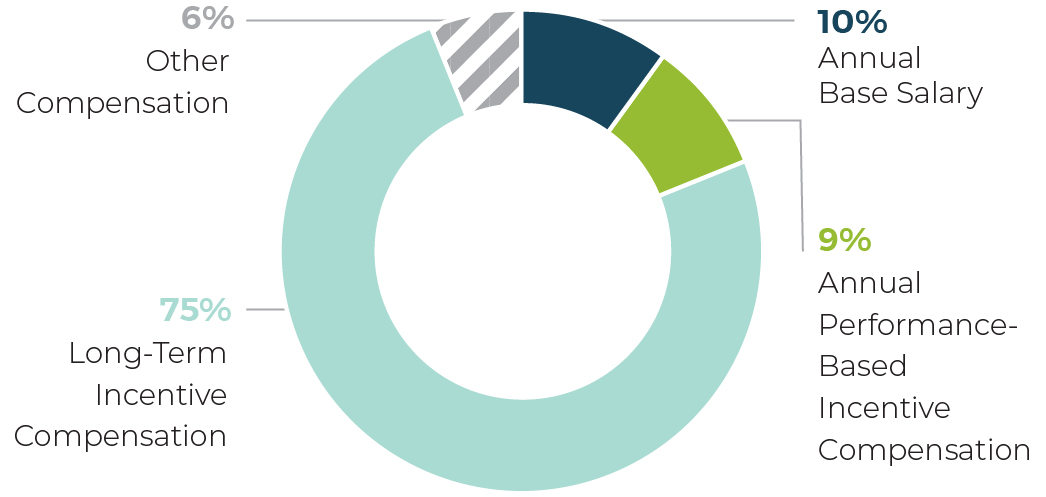

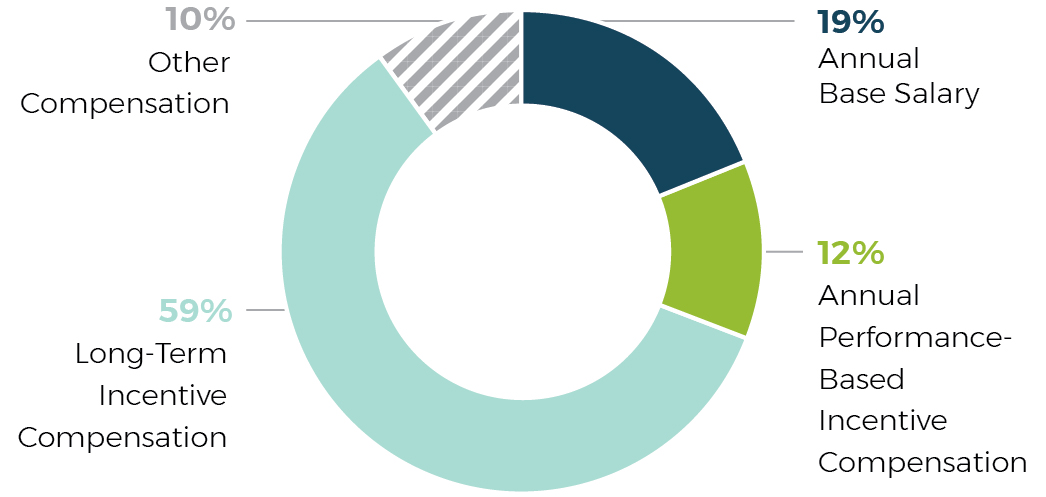

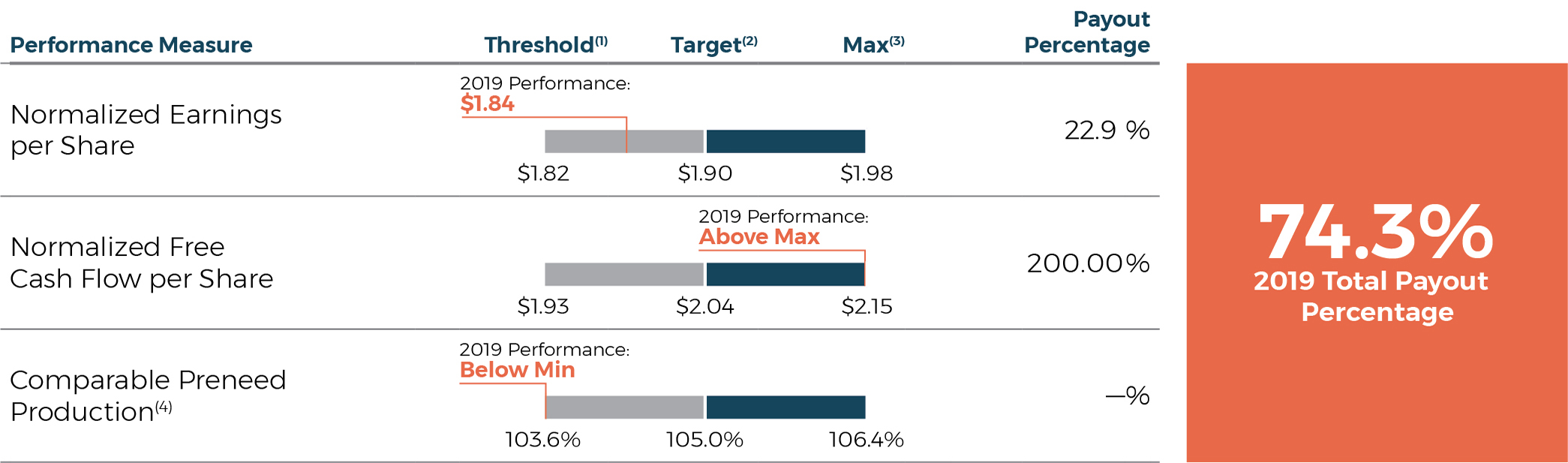

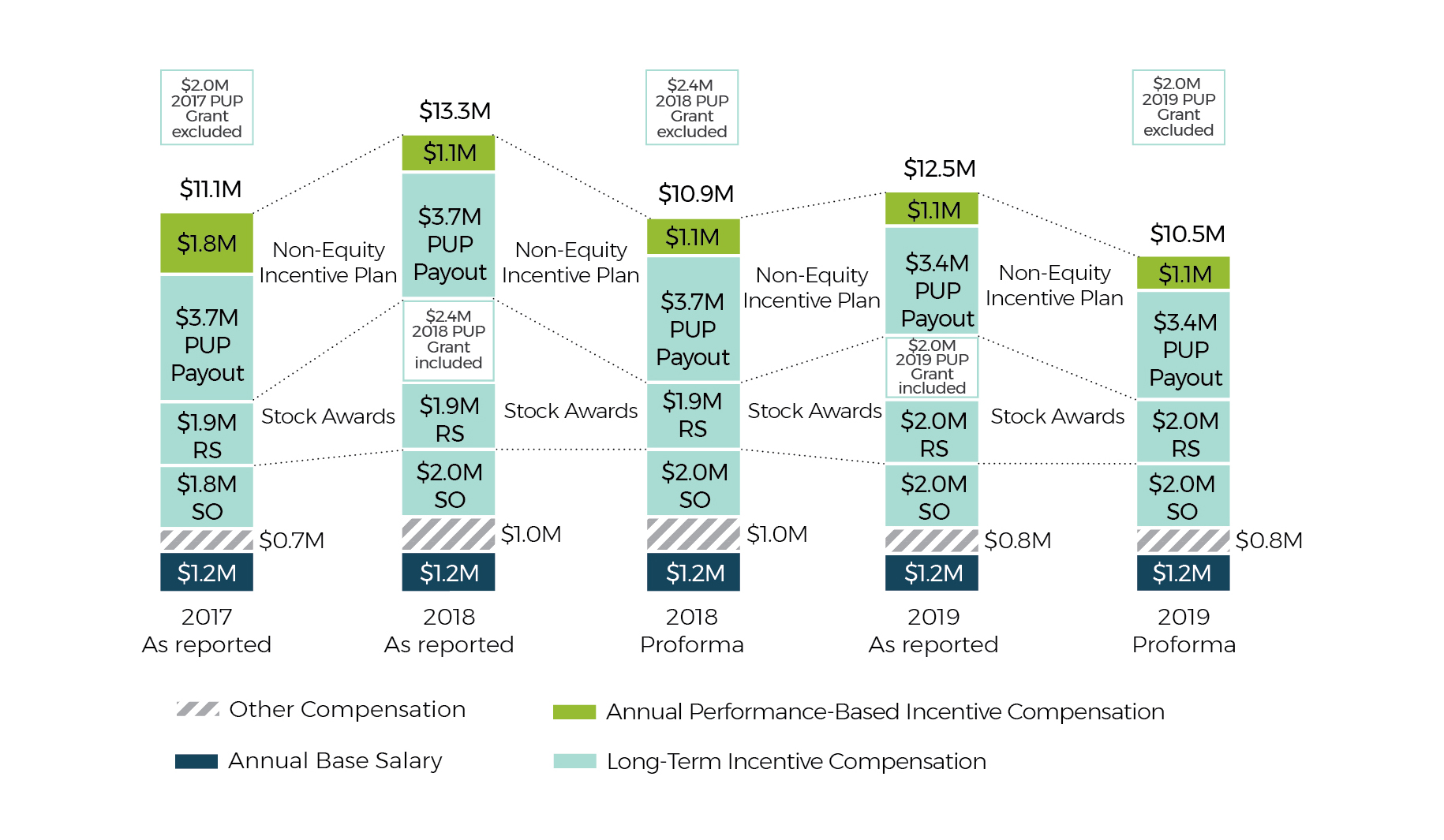

| % of 2019 Compensation for CEO and NEOs | Description | Highlights and Recent Changes | ||

| Annual Base Salary | • Fixed cash • Established based on a competitive range of benchmark pay levels | • No 2019 increases • No 2018 increases, other than Greg Sangalis (4.2% in 2018) • Updated Peer Comparator Group for benchmark studies | ||

|  | |||

| CEO | Other NEOs | |||

| Annual Performance-Based Incentive Compensation | • Performance-based cash • Tied to the attainment of performance measures: • Normalized EPS • Normalized Free Cash Flow per Share • Comparable Preneed Production • Established based on a competitive range of benchmark pay levels | • 74.3% payout percentage • 2020 plan includes a modifier based on the non-financial metric related to Google online customer satisfaction ratings | ||

|  | |||

| CEO | Other NEOs | |||

| Long-Term Incentive Compensation | (1/3) Stock Options • Vest at a rate of 1/3 per year | |||

|  | |||

(1/3) Restricted Stock: • Vest at a rate of 1/3 per year | ||||

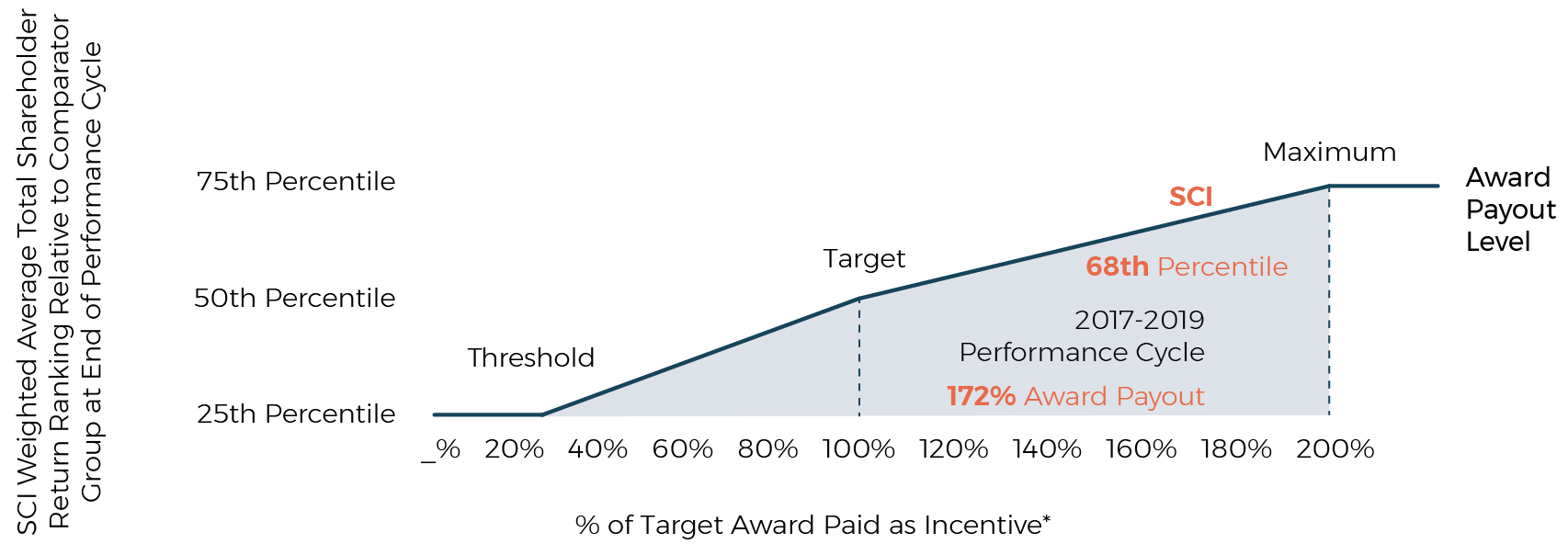

(1/3) Performance-based Units (“PUP”): • Tied to measurement of three-year total shareholder return (“TSR”) relative to a peer group of public companies (see Annex C) that is governed by a normalized return on equity (ROE) benchmark floor | • Beginning in 2018, we added a normalized return on equity modifier for long-term incentive compensation • Units are now denominated in shares instead of dollars | |||

| CEO | Other NEOs | |||

| • Long-term incentive compensation is established based on a competitive range of benchmark pay levels | ||||

| Other Compensation | Retirement Plans: • Executive Deferred Compensation Plan • 401(k) Plan | |||

|  | |||

Perquisites and Personal Benefits: • Reasonable benefits established based on benchmark pay levels | ||||

| CEO | Other NEOs | |||

(1) A change in the denomination of the performance unit plan created a temporary distortion in the disclosure of years 2018 and 2019 total compensation by "doubling up" previous performance plan grants, which were disclosed when paid, with the initial inclusion of 2018 performance plan grant value. For more information, please see page 48 . | ||||

| Element | Qualification | Description |

| CEO Experience/Senior Leadership | Directors who have held significant leadership positions over an extended period, especially CEO positions, generally possess extraordinary leadership qualities and demonstrate a practical understanding of organizations, processes, strategy, and risk management, and know how to drive change and growth. | |

| Industry | The funeral and cemetery industry is unique. Directors with prior industry experience can help shape and develop all aspects of the Company’s strategy. | |

| Financial | SCI uses a broad set of financial metrics to measure its performance. Accurate financial reporting and robust auditing are critical to our success. We expect all of our Directors to have an understanding of finance, financial reporting processes, and internal controls. | |

| Marketing/Brand Management | We employ a multi-brand strategy and also rely heavily on marketing our products and services on a preneed basis. Directors with marketing experience and/or brand management experience provide expertise and guidance as we seek to expand brand awareness, enhance our reputation, and increase preneed sales. | |

| Investments/Financial Services | Knowledge of financial markets, investment activities, and trust and insurance operations assists our Directors in understanding, advising on, and overseeing our investment strategies. Our current trust investments include $6.5 billion in preneed funeral and cemetery trusts and related receivables that are part of our $12.0 billion backlog of future revenue. | |

| Real Estate/Business Development/Mergers and Acquisitions (M&A) | We own a significant amount of real estate. Directors with experience in real estate provide insight into our tiered product/pricing strategy for our cemeteries as well as advice on best uses of our real estate. We seek to grow through acquisitions and development of new business operations. Directors with backgrounds in business development and M&A provide insight into developing and implementing strategies for growing our business. | |

| Technology or e-Commerce | Directors with education or experience in relevant technology are useful for understanding our efforts of enhancing the customer experience as well as improve our internal processes and operations. | |

| Government/Legal | We operate in a heavily regulated industry. Directors with backgrounds in law or in government positions provide experience and insights that assist us in legal and regulatory compliance matters and in working constructively with governmental and regulatory organizations. | |

ü | The Board of Directors recommends that Shareholders vote “FOR” the following seven nominees. |

| Alan R. Buckwalter | ||||||||||||

| Occupation Former Chairman and CEO, Chase Bank of Texas Prior Business Experience • Chairman, J.P. Morgan Chase Bank, South Region (1995-2003) • President of Texas Commerce Bank (1990-1995) • Held various positions at Chemical Bank in corporate division (1970-1990) | Other Positions • Board member, Texas Medical Center • Chairman Emeritus and Board member, Central Houston, Inc. Past Public Company Boards • Freeport-McMoRan, Inc. (2013-2015) • Plains Exploration and Production (2003-2013); subsequently acquired by Freeport-McMoRan, Inc. | Other Prior Positions • Board of Directors, Federal Reserve Bank of Dallas (Houston Branch) Education • Fairleigh Dickinson University | |||||||||

| Independent | Primary Qualifications: | |||||||||||

Director Since: 2003 | CEO Experience/Senior Leadership | |||||||||||

Age: 73 | Industry | |||||||||||

If Elected Term Expires: 2021 | Financial | |||||||||||

Committees: Compensation (Chair), Executive, Investment | Investments/Financial Services | |||||||||||

Director Summary: Alan Buckwalter's extensive corporate finance and banking experience provides the Board with valuable financial and investment management insights. He is an insightful resource for relevant strategy and risk management gained from his many years in senior executive roles. His tenure with the Board allowed him to develop a robust understanding of our unique industry. Furthermore, he possesses significant corporate governance knowledge developed by current and past service on the boards of other publicly traded companies. | ||||||||||||

| Jakki L. Haussler | ||||||||||||

| Occupation Founder and Chairwoman of the Board, Opus Capital Management (since 1996), an independent registered investment advisor, providing investment solutions to institutions and high-net worth individuals Prior Business Experience • CEO Opus Capital Management (1996-2019) • Managing Director, Capvest Venture Fund, LP (2000-2011) a private equity fund for growth and expansion stage companies • Partner, Adena Ventures, LP (1999-2010) a private equity fund targeting underserved markets | Current Public Board Positions • Cincinnati Bell Inc. • Morgan Stanley Funds Other Positions • Member, Board of Directors, The Victory Funds • Member/Founder, Chase College of Law, Transaction Law Practice Center • Board of Visitors, Chase College of Law Member, Northern Kentucky University Foundation Investment Committee | Education • University of Cincinnati • Salmon P. Chase College of Law, Northern Kentucky University Primary Qualifications: | |||||||||

| CEO Experience/Senior Leadership | ||||||||||||

| Independent | ||||||||||||

Director Since: 2018 | Financial | |||||||||||

Age: 62 | Investments/Financial Services | |||||||||||

If Elected Term Expires: 2021 | Real Estate/Business Development/Mergers and Acquisitions (M&A) | |||||||||||

Committees: Audit, Investment | ||||||||||||

| ||||||||||||

Director Summary: Jakki Haussler has expertise in finance, portfolio management, and senior leadership experience as founder and Chairwoman of Opus Capital Management. Her expertise and experience provides background in investments and equity funds. Her experience as Partner in Adena Ventures provides insight into business development and M&A activity. Her other board positions have given her exposure to different industries and approaches to governance and issue resolution. | ||||||||||||

| Victor L. Lund | ||||||||||||

| Occupation Interim President and CEO (November 2019), Teradata Corporation Prior Business Experience • Executive Chairman (2019-2020) & President and CEO (2016-2018), Teradata Corporation • Chairman, DemandTec, a software company (2006-2012) • Chairman, Mariner Healthcare, Inc. (2002-2004) • Vice Chairman, Albertsons, Inc. (1999-2002) • 22-year career with American Stores Company in various positions including Chairman, CEO, CFO and Corporate Controller (1977-1999) • Audit CPA, Ernst & Ernst (1972-1977) | Current Public Board Positions • Teradata Corporation Past Public Company Boards • DemandTec • Delta Airlines • Del Monte Foods, Inc. • Mariner Healthcare, Inc. • Albertsons, Inc. • American Stores Company • NCR Corporation | Education • The University of Utah • MBA The University of Utah Primary Qualifications: | |||||||||

| CEO Experience/Senior Leadership | ||||||||||||

| Independent | Financial | |||||||||||

Director Since: 2000 | Investments/Financial Services | |||||||||||

Age: 72 | Technology or e-Commerce | |||||||||||

If Elected Term Expires: 2021 | ||||||||||||

Committees: Audit (Chair), Executive, Nominating and Corporate Governance | ||||||||||||

Director Summary: Victor Lund's years of senior executive experience and leadership such as his current position as Interim President and CEO of Teradata provide the Board with invaluable experience in technology and technological processes. As a former auditor who also worked in various corporate finance positions, he demonstrates an extensive understanding of financial reporting and auditing practices. Furthermore, his service on other boards provide SCI with valuable corporate governance expertise, which is of particular benefit to SCI in his role as Audit Committee Chair. | ||||||||||||

| Clifton H. Morris, Jr. | ||||||||||||

| Occupation Chairman and CEO of JBC Funding, a corporate lending and investment firm Prior Business Experience • Founder and Chairman, AmeriCredit Corp., financing of automotive vehicles (1988-2010; now GM Financial) • CFO, Cash America International (1984-1988) • VP of Treasury and other financial positions at SCI (1966-1971) | Other Positions • CPA, 58 years • Lifetime member of the Texas Society of Certified Public Accountants • Honorary member of the American Institute of Certified Public Accountants Past Public Company Boards • AmeriCredit Corp. • Cash America International | Education • The University of Texas at Austin Primary Qualifications: | |||||||||

| CEO Experience/Senior Leadership | ||||||||||||

| Financial | ||||||||||||

| Independent | Investments/Financial Services | |||||||||||

Director Since: 1990 | ||||||||||||

| Real Estate/Business Development/Mergers and Acquisitions (M&A) | ||||||||||||

Age: 84 | ||||||||||||

If Elected Term Expires: 2021 | ||||||||||||

Committees: Audit, Nominating and Corporate Governance | ||||||||||||

Director Summary: Cliff Morris' background in finance and senior leadership experience is evidenced through his position as founder and Chairman of AmeriCredit Corp. As a CPA with 58 years of experience, he possesses extensive insight into finance, accounting, and auditing standards and practice. Further, he possesses significant corporate governance knowledge developed by past service on other boards of other publicly traded companies. | ||||||||||||

| Ellen Ochoa | ||||||||||||

| Occupation Former Director of NASA and Independent Director and Speaker Prior Business Experience • Director of NASA Johnson Space Center (2013-2018); Astronaut at NASA Johnson Space Center (1990-2012), first Hispanic female astronaut with nearly 1,000 hours in space • Branch Chief and Research Engineer, NASA Ames Research Center • Researcher, Sandia National Laboratories (1985-1988) | Other Positions • Vice Chair, National Science Board • Member, National Academy of Engineering • Former Chair, Nomination Evaluation Committee, National Medal of Technology & Innovation • Member, Board of Directors, Mutual of America • Member, Board of Directors, Gordon and Betty Moore Foundation • Fellow, American Institute of Aeronautics and Astronautics • Fellow, American Association for the Advancement of Science • Former Member, Board of Directors, Federal Reserve Bank of Dallas • Director Emerita, former Vice Chair, Manned Space Flight Education Foundation • Former Board of Trustees, Stanford University | Education • San Diego State University • MS, PhD (Electrical Engineering), Stanford University Primary Qualifications: | |||||||||

| CEO Experience/Senior Leadership | ||||||||||||

| Independent | ||||||||||||

Director Since: 2015 | Investments/Financial Services | |||||||||||

Age: 61 | Technology or e-Commerce | |||||||||||

If Elected Term Expires: 2021 | Government/Legal | |||||||||||

Committees: Compensation, Investment | ||||||||||||

Director Summary: Ellen Ochoa's background with NASA and other governmental entities provides the Board with extensive technology and government/legal experience and insight. The senior leadership experience gained through her role as Director of NASA’s Johnson Space Center provide the Board with strategic planning, management of large projects, personnel development, and capital allocation expertise. Her many other positions include oversight capacities such as financial stewardship and organizational governance. | ||||||||||||

| Thomas L. Ryan | ||||||||||||

| Occupation President (since 2002), Chairman (since 2016), and CEO (since 2005) of SCI Prior Business Experience • CEO European Operations, SCI (2000-2002) • Variety of financial management roles, SCI (1996-2000) | Current Public Board Positions • Weingarten Realty Investors • Chesapeake Energy Other Positions • Board member, University of Texas McCombs Business School Advisory Council • Former Chairman of the Board of Trustees member, United Way of Greater Houston • Former Board member, Genesys Works Past Public Company Boards • Texas Industries | Education • The University of Texas at Austin Primary Qualifications: | |||||||||

| CEO Experience/Senior Leadership | ||||||||||||

| Industry | ||||||||||||

| Non-Independent | Financial | |||||||||||

Director Since: 2004 | Real Estate/Business Development/Mergers and Acquisitions (M&A) | |||||||||||

Age: 54 | ||||||||||||

If Elected Term Expires: 2021 | ||||||||||||

Committees: Executive (Chair) | ||||||||||||

Director Summary: Tom Ryan's current 24-year career with SCI has instilled a deep understanding of our industry and strategic insights as well as strong leadership skills. He has demonstrated operational execution to long-term strategic direction, including leadership in significant acquisition and capital allocation decision-making, as well as risk management. His service on two other publicly traded company boards has given him valuable insight into corporate governance and diverse approaches to key issues. | ||||||||||||

| W. Blair Waltrip | ||||||||||||

| Occupation Independent Consultant, Family and Trust Investments, and Former Senior Executive of SCI Prior Business Experience • Various positions at SCI including VP of Corporate Development, SVP of Funeral Operations, EVP of SCI’s real estate division, Chairman and CEO of SCI Canada, and EVP of SCI (1977-2000) | Other Positions • Treasurer, National Museum of Funeral History • Active real estate broker Past Public Company Boards • Sanders Morris Harris Group, Inc. (Edelman Financial) | Education • Sam Houston State University Primary Qualifications: | |||||||||

| Industry | ||||||||||||

| Financial | ||||||||||||

| Non-Independent | Investments/Financial Services | |||||||||||

Director Since: 1986 | Real Estate/Business Development/Mergers and Acquisitions (M&A) | |||||||||||

Age: 65 | ||||||||||||

If Elected Term Expires: 2021 | ||||||||||||

Committees: Investment (Chair) | ||||||||||||

Director Summary: Blair Waltrip's experience includes various corporate finance roles at SCI, demonstrating a solid understanding of mergers and acquisitions, real estate and investment management. His tenure as EVP/COO at SCI has allowed him to develop a robust understanding of our unique industry. Further, he possesses corporate governance knowledge developed by past service on the board of another publicly traded company. | ||||||||||||

| Anthony L. Coelho | ||||||||||||

| Occupation • Former Majority Whip of the U.S. House of Representatives • Independent business and political consultant Prior Political Experience • Chairman of the President’s Committee on Employment of People with Disabilities (1994-2001) • General Chairman of Al Gore’s Presidential campaign (1999-2000) • Majority Whip (1987-1989) • Member of U.S. House of Representatives (1978-1989); original sponsor/author of the Americans With Disabilities Act | Prior Business Experience • President/CEO of Wertheim Schroder Financial Services, grew $800 million firm to $4.5 billion over 6 years (1990-1995) Current Public Company Boards • Board Chairman, Esquire Financial Holdings, Inc. • AudioEye, Inc. Select Past Public Company Boards • Chairman, Cyberonics • Chairman, Circus Circus Enterprises (now MGM Mirage) • Chairman, ICF Kaiser International, Inc. • Warren Resources, Inc. | Other Positions • Former Chairman and current Board member of the Epilepsy Foundation Education • Loyola University Los Angeles | |||||||||

Lead Independent Director | Primary Qualifications: | |||||||||||

Director Since: 1991 | CEO Experience/Senior Leadership | |||||||||||

Age: 77 | Financial | |||||||||||

Term Expires: 2021 | Government/Legal | |||||||||||

Committees: Compensation, Executive, Nominating and Corporate Governance | Investments/Financial Services | |||||||||||

Director Summary: Tony Coelho's successful role as President and CEO of a multi-billion financial services company provides the Board with financial, investing, and senior leadership expertise. His political experience and expertise provide unique insights into government, public policy matters and legal issues. Additionally, he has significant corporate governance knowledge developed by current and past service on the boards of other publicly traded companies which is invaluable to SCI in his role as Lead Independent Director. | ||||||||||||

| Sara Martinez Tucker | ||||||||||||

| Occupation Former Chief Executive Officer, National Math + Science Initiative, a non-profit organization to improve student performance in STEM (Science, Technology, Engineering, and Math) subjects Prior Business Experience • Vice President, AT&T (1997-2006) Current Public Company Boards • Sprint Corporation • American Electric Power | Other Positions • Fellow, University of Notre Dame’s Board of Trustees Past Public Company Boards • Xerox Corporation Past Other Positions • Former Chair, University of Texas System Board of Regents • Former Under Secretary of Education in the U.S. Department of Education | Education • The University of Texas at Austin • MBA, McCombs School of Business, The University of Texas at Austin Primary Qualifications: | |||||||||

| CEO Experience/Senior Leadership | ||||||||||||

| Independent | ||||||||||||

Director Since: 2018 | Technology or e-Commerce | |||||||||||

Age: 64 | Government/Legal | |||||||||||

Term Expires: 2021 | Real Estate/Business Development/Mergers and Acquisitions (M&A) | |||||||||||

Committees: Audit, Nominating and Corporate Governance | ||||||||||||

Director Summary: Sara Martinez Tucker has extensive knowledge and experience gained through her various executive leadership roles. Her most recent executive experience provides the Board with invaluable experience and expertise in technology. She also provides strong leadership and executive experience through her previous role as Vice President with AT&T. Her background serving as the Department of Education’s undersecretary has given her specific insight into governmental processes and human capital management as well as exposure to a variety of legal issues. Further, she possesses significant corporate governance knowledge developed by current and past service on the boards of other publicly traded companies. | ||||||||||||

| Marcus A. Watts | ||||||||||||

| Occupation President, The Friedkin Group (since 2011), which includes a variety of branded automotive, hospitality, and entertainment companies Prior Business Experience • Vice Chairman and Managing Partner-Houston, Locke Lord LLP (1984-2010) with a focus on corporate and securities law, governance, and related matters Current Public Company Boards • Cabot Oil & Gas | Current Other Board Positions • Board member, Highland Resources, Inc. (private real estate company) Past Other Board Positions • Former Chairman, Greater Houston Partnership • Former Chairman, Board of Trustees, United Way of Greater Houston • Former Board Chair, Federal Reserve Bank of Dallas (Houston Branch) Past Public Company Boards • Complete Production Services, Inc. (2007-2012), acquired by Superior Energy Services • Cornell Companies (2001-2005) | Education • Texas A&M University • Harvard Law School Primary Qualifications: | |||||||||

| CEO Experience/Senior Leadership | ||||||||||||

Marketing/Brand Management | ||||||||||||

| Independent | ||||||||||||

Director Since: 2012 | Government/Legal | |||||||||||

Age: 61 | Real Estate/Business Development/Mergers and Acquisitions (M&A) | |||||||||||

Term Expires: 2021 | ||||||||||||

Committees: Compensation, Executive, Nominating and Corporate Governance (Chair) | ||||||||||||

Director Summary: Marcus Watts’ executive role as President of The Friedkin Group provides the Board with senior leadership expertise and experience from oversight of various branded business interests. His previous role as Vice Chairman and Managing Partner-Houston of Locke Lord LLP, provides the Board with extensive legal and government experience. Additionally, he possesses significant marketing, brand management, and corporate governance knowledge developed by current and past service on the boards of other private and publicly traded companies. | ||||||||||||

· Accounting and finance · Industry knowledge · Strategic insight | · Understanding and fostering leadership · Business judgment and management expertise · Diverse experiences and backgrounds |

| • | Integrity, character, and accountability |

| • | Ability to provide wise and thoughtful counsel on a broad range of issues |

| • | Financial literacy and ability to read and understand financial statements and other indices of financial performance |

| • | Ability to work effectively with mature confidence as part of a team |

| • | Ability to provide counsel to management in developing creative solutions and in identifying innovative opportunities |

| • | Commitment to prepare for and attend meetings and to be accessible to management and other Directors |

| • | The Audit Committee is responsible for oversight of major financial risks relating to the Company’s accounting matters and financial reporting compliance. |

| • | The Compensation Committee has oversight of the risk assessment of the Company’s compensation programs. |

| • | The Investment Committee has oversight of risks relating to the investment of trust funds, our primary funeral preneed insurance provider, and our employer-sponsored retirement accounts. |

The Board appreciates the threats presented by cybersecurity incidents and is committed to the prevention, timely detection, and mitigation of the effects of any such incidents on the Company. ü The Audit Committee oversees the Company's controls related to cybersecurity. ü The Nominating and Corporate Governance Committee oversees the risk assessment related to cybersecurity. |

| Anthony L. Coelho | |||||

| Key Duties and Responsibilities of Lead Independent Director • Preside over all independent director executive sessions held on a regular basis • Serve as liaison to the Chairman of Board • Engage in performance evaluation of Directors and CEO • Interview Director candidates • Communicate with shareholders as needed • Consult with committee chairpersons • Authorized to call a special meeting of the Directors • Work with the Chairman on Board agenda, information, and meeting schedules | ||||

| Lead Independent Director | |||||

| • | Call meetings of the Board. The Lead Independent Director is authorized to call meetings of the Board, upon proper notice given to the members in accordance with the Bylaws. |

| • | Preside over executive sessions. The Lead Independent Director will preside at all meetings of the Board at which the Chair is not present, including all meetings and executive sessions of the independent Directors. |

| • | Serve as liaison to the Chair. The Lead Independent Director serves as the principal liaison between the independent Directors and the Chair. The Lead Independent Director is available to discuss any concerns the other independent Directors may have and to relay those concerns to the Chairman of the Board. |

| • | Board information, agendas, and meeting schedules. The Lead Independent Director consults with the Chair regarding the information sent to the Board, including the quality, quantity, appropriateness and timeliness of such information and consults with the Chair on the scheduling of Board meetings and their agendas. |

| • | Engage in performance evaluation of Directors and CEO. The Lead Independent Director works with the Nominating and Corporate Governance Committee in the process of evaluating the performance of the CEO and the Directors, including delivering evaluation feedback to them. |

| • | Interview Director candidates. The Lead Independent Director interviews Director candidates along with the Nominating and Corporate Governance Committee. |

| • | Communicate with shareholders. As requested and deemed appropriate by the Board, the Lead Independent Director is available for consultation and direct communication with shareholders and other stakeholders. |

| • | Serve as the Board Chair on an interim basis. The Lead Independent Director will serve as the Chair on an interim basis in the event of the death or disability of the Chair or if circumstances arise in which the Chair may have an actual or perceived conflict of interest. |

| • | Perform other duties as requested. The Lead Independent Director performs such other duties as the Board may from time to time delegate to assist the Board in fulfilling its responsibilities. |

| • | Consult with Committee Chairs. In performing the duties described above, the Lead Independent Director is expected to consult with the Chairs of the appropriate Board committees as needed and solicit their participation in order to avoid diluting the authority or responsibilities of such Committee Chairs. |

| • | the holders of at least 10% of the outstanding stock entitled to be voted at such meeting; |

| • | the Board of Directors; |

| • | the Chairman of the Board; or |

| • | the Chief Executive Officer. |

| SCI 2019 Board Meetings and Director Attendance |

| Number of Meetings |

|

| Audit Committee | |||||

| Key Oversight Responsibilities • Integrity of the financial statements • Engagement, qualifications, independence, and performance of the independent registered public accounting firm • Scope and results of the independent registered public accounting firm's report • Performance and effectiveness of our internal audit function • Policies with respect to risk assessment and risk management • Quality and adequacy of our internal controls, including the review of our cybersecurity controls • Financial reporting and disclosure matters Audit Committee in 2019 The Audit Committee met eight times in 2019, and the Committee attendance record was 94%. Four of the meetings were focused primarily on our quarterly financial reports and our related earnings releases. At each of these meetings, the Committee reviewed the documents as well as reviewed the independent registered public accounting firm's report. The Committee regularly meets with the independent registered public accounting firm representatives outside the presence of management. Additionally, the Committee meets regularly with individual members of management to discuss relevant matters. Lastly, the Committee meets with the Company’s internal auditors outside the presence of management. The Committee also performs quarterly reviews of any legal matters that could have a significant impact on our financial statements and plays an important role in assessing the management of financial risk. The report of the Audit Committee can be found on page 35. | ||||

Chair: Victor L. Lund Other members: Jakki L. Haussler, Clifton H. Morris, Jr., Sara Martinez Tucker Meetings in 2019: Eight Each member of the Audit Committee meets the independence requirements of the NYSE guidelines. | |||||

| Compensation Committee | |||||

| Key Oversight Responsibilities • Oversees our executive compensation and benefits policies and programs • Sets compensation for the Chairman and CEO • Reviews and approves compensation for all other executive Officers • Determines appropriate individual and Company performance measures • Approves all executive employment contracts • Determines and ensures compliance with SCI stock ownership guidelines for Officers • Assesses the risk of SCI’s compensation programs Compensation Committee in 2019 The Compensation Committee met five times in 2019 with a 96% attendance record. The Committee devoted substantial time in its oversight of SCI’s compensation programs and its review of feedback received from shareholders. As a result of input received from shareholders, the Committee added a normalized return on equity modifier to the total shareholder return metric in the performance unit plan. They also changed the performance unit plan to be denominated in SCI shares instead of dollars. Effective with the 2020 annual incentive compensation plan, the plan includes a modifier based on a non-financial metric related to Google online customer satisfaction ratings. The Committee’s full review of executive compensation matters and its decisions are discussed in the Compensation Discussion and Analysis beginning on page 38. | ||||

Chair: Alan R. Buckwalter Other members: Anthony L. Coelho Ellen Ochoa Marcus A. Watts Meetings in 2019: Five Each member of the Compensation Committee meets the independence requirements of the NYSE guidelines. | |||||

| Nominating and Corporate Governance Committee | ||||||

| Key Oversight Responsibilities • Composition of the Board and Board committees • Identification and recruitment of new candidates for the Board • Review process for renomination of current Board members and nominees recommended by shareholders • Development of corporate governance principles and practices • SCI’s enterprise risk management function, including cybersecurity risks • Succession planning for CEO and other SCI executives • Performance evaluation of the CEO, Directors, Board, and Board committees Nominating and Corporate Governance Committee in 2019 The Nominating and Corporate Governance Committee (NCGC) met five times in 2019, and the Committee attendance record was 92%. As a result of John Mecom's retirement from the Board in 2019, the NCGC evaluated current responsibilities to determine the best fit based on Director background and Board needs and transitioned Alan Buckwalter from the Audit Committee to the Investment Committee and added Sara Martinez Tucker to the Audit Committee. The charter was updated reflecting that the NCGC is responsible for the oversight of the Company's ESG policies. | |||||

Chair: Marcus A. Watts Other members: Anthony L. Coelho Victor L. Lund Clifton H. Morris, Jr. Sara Martinez Tucker Meetings in 2019: Five Each member of the Nominating and Corporate Governance Committee meets the independence requirements of the NYSE guidelines. | ||||||

| Investment Committee | |||||

| Key Oversight Responsibilities • Oversight of SCI’s preneed and perpetual care trust funds; SCI’s Investment Operating Committee, headed by SCI executives; as well as SCI's wholly-owned registered investment advisor (RIA) subsidiary and a third party RIA consultant • Management and performance of the trust funds, performance of the independent trustees, and changes to investment managers made by the trustees • Ongoing review of investment policies and guidelines in conjunction with the Investment Operating Committee and wholly-owned RIA subsidiary and third party RIA consultant • Reviews SCI’s primary funeral preneed insurance provider • Oversight of the Company's employer sponsored retirement accounts Investment Committee in 2019 The Investment Committee met four times in 2019, and the Committee attendance record was 100%. The Committee provided guidance on monitoring and improving the structure of SCI's preneed and perpetual care trust portfolios. Additionally, the Committee monitored the financial condition of the Company’s primary prearranged funeral insurance provider. | ||||

Chair: W. Blair Waltrip Other members: Alan R. Buckwalter Jakki L. Haussler Ellen Ochoa Meetings in 2019: Four | |||||

| Executive Committee | |||||

| Key Oversight Responsibilities • Authorized to exercise many of the powers of the full Board between Board meetings • Meets in circumstances when it is impractical to call a meeting of the full Board and there is urgency for Board discussion and decision making on a specific issue Executive Committee in 2019 The Executive Committee did not meet in 2019 as all matters were handled at the regular Board meetings. | ||||

Chair: Thomas L. Ryan Other members: Alan R. Buckwalter Anthony L. Coelho Victor L. Lund Marcus A. Watts Meetings in 2019: None | |||||

| • | The annual Board cash retainer is $90,000. |

| • | Additional cash retainers for leadership positions on the Board are as follows: |

| • | Lead Independent Director - $30,000 |

| • | Audit Committee Chair - $25,000 |

| • | Compensation Committee Chair - $20,000 |

| • | Investment Committee Chair - $15,000 |

| • | Nominating and Corporate Governance Committee (NCGC) Chair - $15,000 |

| • | Annual stock grants are based on a target value of $180,000 per Director. |

| Name | Fees Earned or Paid in Cash | Stock Awards(1) | Change in Pension Value and Nonqualified Deferred Compensation Earnings(2) | Total | ||||||||

Alan R. Buckwalter (Chair - Compensation Committee) | $ | 110,000 | $ | 180,019 | $ | — | $ | 290,019 | ||||

Anthony L. Coelho, Lead Independent Director | 120,000 | 180,019 | 10,294 | 310,313 | ||||||||

| Jakki L. Haussler | 90,000 | 180,019 | — | 270,019 | ||||||||

Victor L. Lund (Chair - Audit Committee) | 115,000 | 180,019 | — | 295,019 | ||||||||

John W. Mecom, Jr.(3) | 45,000 | — | 26,216 | 71,216 | ||||||||

| Clifton H. Morris, Jr. | 90,000 | 180,019 | 10,294 | 280,313 | ||||||||

| Ellen Ochoa | 90,000 | 180,019 | — | 270,019 | ||||||||

| Sara Martinez Tucker | 90,000 | 180,019 | — | 270,019 | ||||||||

W. Blair Waltrip (Chair - Investment Committee) | 105,000 | 180,019 | — | 285,019 | ||||||||

Marcus A. Watts (Chair - NCGC Committee) | 105,000 | 180,019 | — | 285,019 | ||||||||

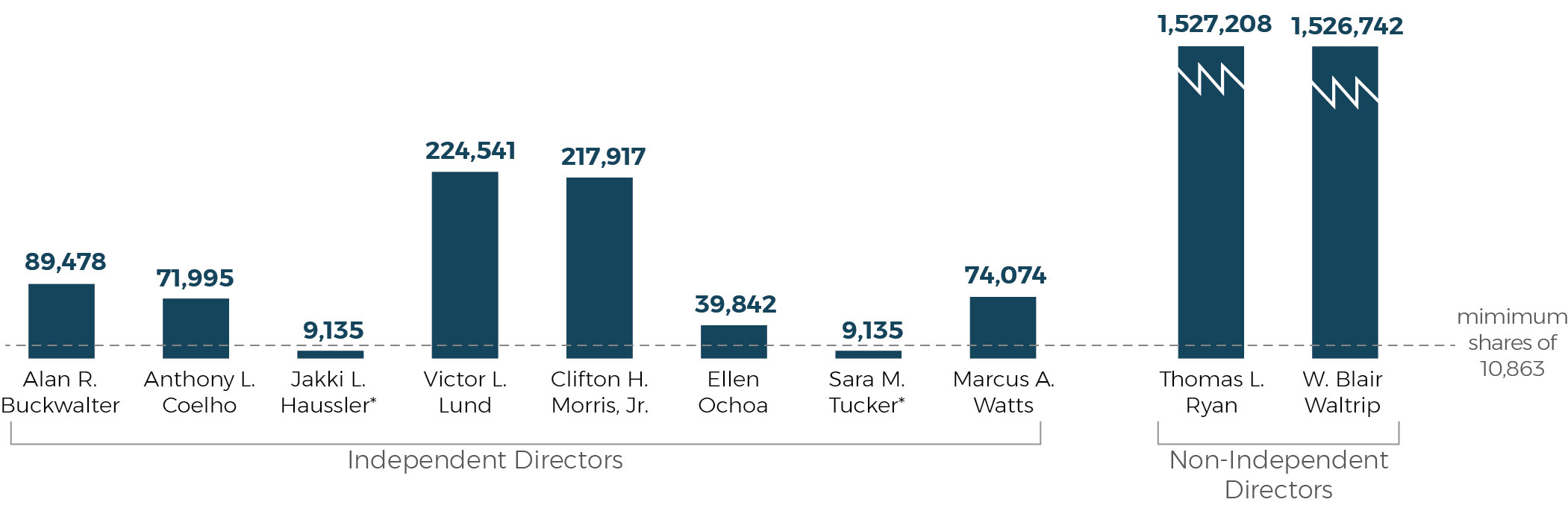

| SCI Common Shares Beneficially Owned |

|

| ü | The Board of Directors recommends that Shareholders vote “FOR” ratification of the selection of PricewaterhouseCoopers LLP as the independent registered public accounting firm of the Company. |

| • | ensuring the integrity of the Company’s accounting functions and proper internal control over financial reporting, |

| • | ensuring the Company’s compliance with legal and regulatory requirements; |

| • | reviewing the independent registered public accounting firm’s qualifications, and |

| • | overseeing the performance of the Company’s internal audit function. |

| • | quarterly financial statements and the annual audited financial statements of the Company, including the Company's specific disclosures included in Management's Discussion and Analysis of Financial Condition and Results of Operations; |

| • | earnings releases and guidance provided to analysts and rating agencies; |

| • | any major issues regarding accounting principles and financial statement presentations, including any significant changes in the Company's selection or application of accounting principles; and |

| • | issues as to the adequacy of the Company's internal controls, including those related to cybersecurity, and any special steps adopted in light of material control deficiencies. |

|  |  |  |

| Victor L. Lund, Chair | Jakki L. Haussler | Sara Martinez Tucker | Clifton H. Morris, Jr. |

Audit fees1 | Audit-related fees2 | Tax3 | All other fees4 | Total | |||||||||||

| 2019 | $ | 6,341,425 | $ | 467,600 | $ | 315,825 | $ | 4,500 | $ | 7,129,350 | |||||

| 2018 | $ | 6,381,640 | $ | 778,774 | $ | 248,000 | $ | 4,900 | $ | 7,413,314 | |||||

(1) | Fees associated with the annual audit of the Company’s consolidated financial statements in Form 10-K and the effectiveness of the Company’s internal control over financial reporting in accordance with Section 404 of the Sarbanes-Oxley Act, the reviews of the Company’s quarterly reports on Form 10-Q, and fees related to statutory audits. |

(2) | Audit-related fees in both periods were related to various accounting standards adopted during 2018 and 2019. 2019 audit-related fees also included a comfort letter related to the Company's issuance of $750.0 million 5.125% Senior Notes due June 2029. |

(3) | Fees for tax services for both years were related to LLC tax return preparation for our consolidated trust funds. |

(4) | All other fees in both years were for research database licensing and the Company's disclosure checklist tool. |

| ü | The Board of Directors recommends a vote “FOR” advisory approval of the resolution regarding compensation of our Named Executive Officers (as set forth in this Proxy Statement). |

| Thomas L. Ryan | President, Chairman of the Board, and Chief Executive Officer |

| Eric D. Tanzberger | Senior Vice President, Chief Financial Officer |

| Sumner J. Waring, III | Senior Vice President, Chief Operating Officer |

| Gregory T. Sangalis | Senior Vice President, General Counsel and Secretary |

| Steven A. Tidwell | Senior Vice President, Sales and Marketing |

| • | aligning executive pay and benefits with the performance of the Company and shareholder returns while fostering a culture of highly ethical standards and integrity. |

| • | attracting, motivating, rewarding, and retaining the broad-based management talent required to achieve our corporate objectives. |

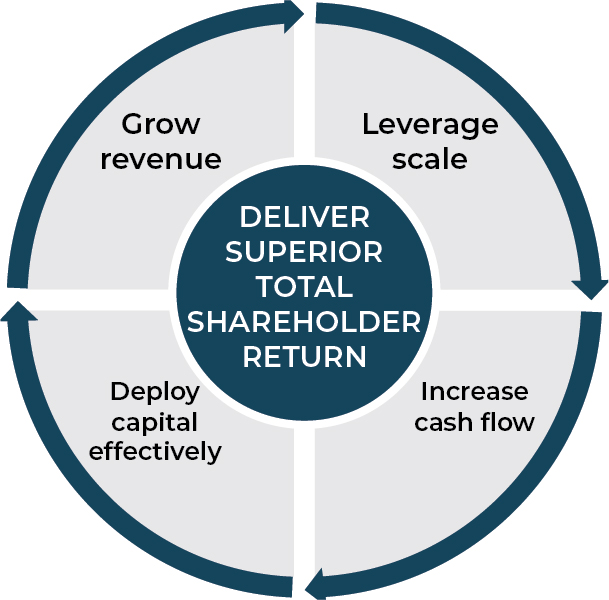

| Grow revenue | We plan to grow revenue by remaining relevant to our customers as their preferences evolve through a combination of price, product, and service differentiation strategies. Growing our preneed sales will drive future revenue growth. In 2019, we grew revenue by $41 million to $3.2 billion as a result of a 4.6% and 1.5% growth in our funeral and cemetery preneed sales production, respectively. | ||

Leverage scale | We leverage our scale by developing our sales organization and optimizing the use of our network through the use of technology and for the benefit of our preneed backlog. Our large scale enables us to achieve cost efficiencies through the maximization of purchasing power and utilizing economies of scale through our supply chain channel. This year, we took significant steps to improve the quality of customer feedback and elevate our online reputation. | |||

Implementing our core strategy allows us to deliver superior total shareholder return | Growing revenue and leveraging scale increases cash flow, which enables us to: | |||

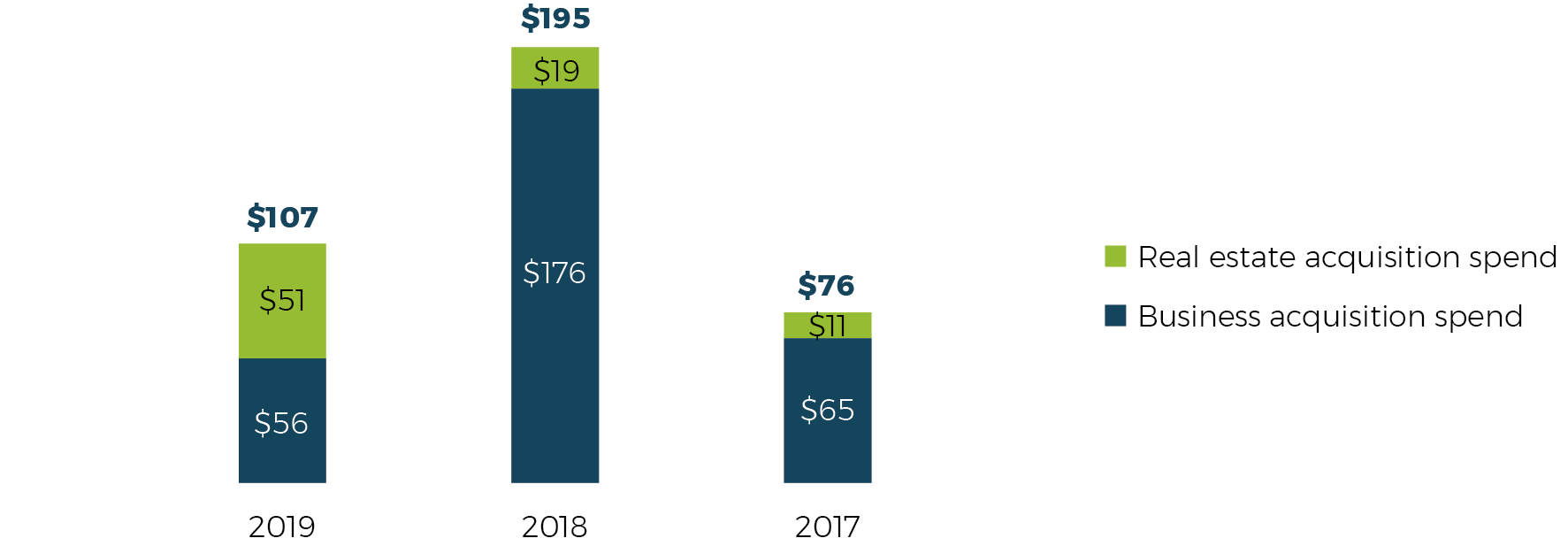

Deploy capital | We continue maximizing capital deployment opportunities in a disciplined and balanced manner to the highest relative return opportunity. Our priorities for capital deployment are: 1) investing in acquisitions and building new funeral service locations, 2) paying dividends, 3) repurchasing shares, and 4) managing debt. In 2019, we deployed capital of $404 million, investing $143 million in acquisitions, new build opportunities, and acquiring land for cemeteries and returning $261 million to shareholders through dividends and share repurchases. | |||

| • | Normalized Earnings per share: Growth is the result of growing revenue and leveraging our scale, which in turn, enhances shareholder value. |

| • | Normalized Free Cash Flow per share: Growth in normalized free cash flow per share is tied directly to our strategy to increase our cash flow and effectively deploy capital. Growth in this metric drives current performance of the Company and enhances shareholder value. |

| • | Comparable Preneed Production: Comparable preneed production is the percentage of growth over prior year in combined total preneed funeral sales production and total preneed cemetery sales production at comparable same-store locations in mixed currency. Preneed sales production is driving current and future market share growth, adding stability to our future revenue stream and creating future value for our shareholders. |

| • | Total Shareholder Return: As we grow revenue and leverage our scale, we increase our cash flow allowing the Company to deploy capital and deliver superior total shareholder return. |

| • | Normalized Return on Equity: Growth in return on equity is the long term result of effectively implementing our core strategy of growing revenue and deploying capital as described above. |

|

GAAP Performance Measures (1) | Adjusted Performance Measures (2) | ||

| GAAP Earnings Per Share | Adjusted Earnings Per Share | ||

|  | ||

| GAAP Operating Cash Flow (in millions) | Adjusted Operating Cash Flow (in millions) | ||

|  | ||

(1) GAAP - Generally Accepted Accounting Principles | (2) Adjusted Earnings Per Share and Adjusted Operating Cash Flow are non-GAAP financial measures. Please see Annex A for disclosures and reconciliations to the appropriate GAAP measure. | ||

| • | Maintaining our position as the largest provider in the Company’s industry, with 15% to16% revenue market share. |

| • | Growing consolidated revenue by $41 million to $3.2 billion in 2019. |

| • | Increasing funeral and cemetery preneed sales by 4.6% and 1.5%, respectively, to $1.9 billion, bringing our preneed backlog to $12.0 billion in 2019. |

| • | Increasing adjusted earnings per share by approximately 6% compared to 2018. |

| • | Increasing adjusted operating cash flow 4% over the prior year to approximately $635 million, exceeding our November guidance range of $575-$615 million. This increase was primarily due to increased cash earnings as a result of improved preneed installment collections. It was somewhat offset by expected increases in cash interest and cash tax payments, of $19 million, collectively. |

| • | Enhancing shareholder value by deploying capital of $404 million, investing $143 million in acquisitions, new build opportunities, and acquiring land for cemeteries, and returning $261 million to shareholders through dividends and share repurchases. |

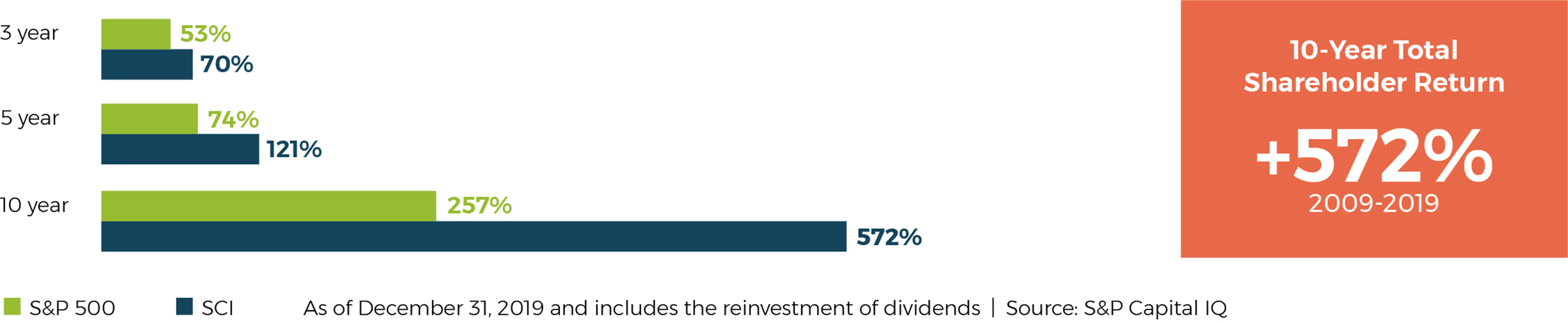

| • | Achieving a total shareholder return (TSR) of 572% over the last ten fiscal years, outpacing the return of the S&P 500 of 257%. |

| What We Do | What We Don't Do | ||||

ü We pay for performance. A significant portion of the compensation of our Named Executive Officers is directly linked to the Company’s performance, as demonstrated by the historical payouts related to our annual and long-term incentive plans. ü We require stock ownership. Our stock ownership guidelines require each of the Company Officers to hold Company stock with a value linked to a multiple of their respective salaries and to retain all SCI stock acquired from grants of restricted stock and stock options (net of acquisition and tax costs and expenses) until stock ownership guidelines are met. ü We have claw-backs. Our claw-back provisions may be triggered in certain circumstances. If triggered, the provisions allow the Company to recoup annual performance-based incentives, stock options, restricted stock, and performance units. ü We seek independent advice. We engage independent consultants to review executive compensation and provide advice to the Compensation Committee. ü We have an ongoing shareholder outreach program. As part of our commitment to effective corporate governance practices, we regularly engage with shareholders. We specifically discuss executive compensation along with other important governance topics regularly as part of our outreach program. | û We do not allow tax gross-ups. We do not provide tax gross-ups in our compensation programs, and we do not have provisions in our executive employment agreements that provide for tax gross-ups in the event of a change of control of the Company. û We do not allow hedging or pledging. Our policies prohibit Officers and Directors from hedging or pledging their SCI stock ownership. û We do not allow the repricing of stock options. Our policies prohibit subsequent alterations of stock option pricing without shareholder approval. | ||||

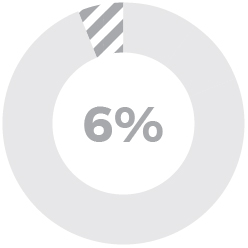

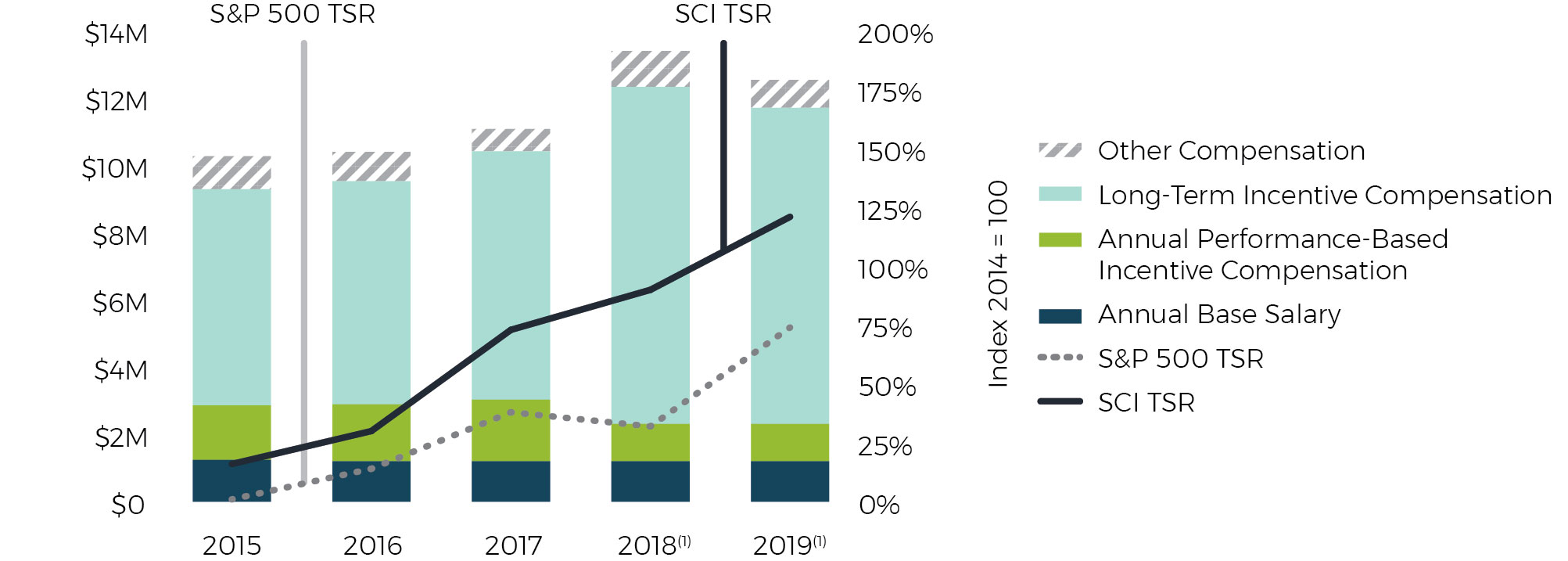

| CEO Pay and Performance Alignment |

|

(1) A change in the denomination of the performance unit plan created a temporary distortion in the disclosure of years 2018 and 2019 total compensation by "doubling up" previous performance plan grants, which were disclosed when paid, with the initial inclusion of 2018 performance plan grant value. For more information, please see page 48 . | ||||

| CEO Direct Compensation | Other NEO Direct Compensation | ||

|  | ||

% of 2019 compensation for CEO and NEOs | Description | Link to shareholder value | How we determine amount | ||