Exhibit 99.2

1

1

Forward-Looking Statements

The statements in this presentation that are not historical facts are forward-looking statements

made in reliance on the “safe harbor” protections provided under the Private Securities

Litigation Reform Act of 1995. These statements may be accompanied by words that convey the

uncertainty of future events or outcomes. These statements are based on assumptions that the

Company believes are reasonable; however, many important factors could cause the Company’s

actual results in the future to differ materially from the forward-looking statements made herein

and in any other documents or oral presentations made by, or on behalf of, the Company. For

further information on these risks and uncertainties, see the Company’s Securities and

Exchange Commission filings, including the Company’s 2003 Annual Report on Form 10-K. The

Company assumes no obligation to publicly update or revise any forward-looking statements

made herein or any other forward-looking statements made by the Company, whether as a result

of new information, future events or otherwise.

Merrill Lynch Health Services Conference

November 30, 2004

2

Tom Ryan

President and Chief Operating Officer

3

SCI is the Market Leader in North America

Revenues of $1.7 billion

Free cash flow of approximately $200 million *

1,200+ funeral homes (plus 170 franchised affiliates)

400+ cemeteries

Market coverage exceeds 70%

Interact with approximately 630,000 customers on an annual

basis

20,000 employees

Please refer to the disclosures concerning free cash flow at the end of this presentation.

4

Public Company Landscape

120

7

0.0%

115

6

17

80

Stone-

More

0.9

1.1

1.2

1.6

4.1

0.9

1.1

SCI to

Peers

339

1,575

1,209

3,238

5,260

Backlog of Preneed Revs

1.0%

3.0%

5.3%

9.2%

11.0%

Funeral Market Share

8

30

7

51

211

Free Cash Flow

448

1,175

314

1,486

Peer

Group

406

1,239

298

1,706

SCI-N.A.

30

148

150

Cemeteries

139

299

730

Funeral Homes

39

120

138

Gross Profit

Properties:

151

522

733

Revenues

Carriage

Stewart

Alder-

woods

SCI estimates based on fiscal 2003 data and excluding disclosed unusual items. Please refer to

SCI’s definition of free cash flow at the end of this presentation.

(Dollars in millions)

5

SCI Strengths and Investment Considerations

Competitive advantage due to size, unparalleled network &

national branding strategy

Stable and predictable revenues and cash flows on an annual

basis

Backlog of future revenues in North America exceeds $5 billion

Favorable demographics over the long term

Meaningful progress has been made in putting major litigation

issues behind us

Significant opportunities to grow shareholder value due to

strong cash flows and liquidity, and modest debt maturities

6

Business Challenges

No near-term expansion in the number of deaths

Baby boomers do not reach age 65 until 2011

Increasing pressure on pricing

Growing cremation trend - SCI cremation mix currently 40% and

increasing 100 to 150 basis points per year

Competitive retail environment for products (caskets, vaults, markers)

Regulatory and litigation exposure

Constant move toward stricter regulation

Increasing litigation environment

Sarbanes-Oxley legislation

7

The Path to Growth

Improving the Infrastructure

Building the Brand

Growing our Revenues

8

Improving the Infrastructure

Conforming sales approach to emerging customer preferences

Outsourcing programs

Payroll, accounts payable, trust administration, cemetery

collections, IT support

New information systems

HMIS replaces 3 separate in-house systems

New management structure

Single-line management based on major and middle market

concept

Improved corporate support system (market support centers)

9

SCI Vision Statement

Our Purpose… “Who We Are”

A company that is dedicated to compassionately supporting

families at difficult times, celebrating the significance of lives

that have been lived, and preserving memories that transcend

generations, with dignity and honor.

Our Values… “What We Stand For”

*Integrity *Respect *Service Excellence *Enduring Relationships

Our Vision… “Where We Are Going”

Celebrating life with dedication, excellence and innovation.

10

Products

Casket

Flowers

Grave space

Experience/Value

Celebration of Life

Estate Planning

Grief Counseling Services

Legal Services

Travel Discounts

Internet Memorialization

Private family estates

Cremation Gardens

Building the Brand

Changing Consumer Landscape

11

Brand Strategy Initiatives

Internal focus: institutional excellence

External focus: national advertising and community programs

Dignity Memorial® packaged funeral and cremation plans

Value-added products and services

Dignity® cemetery plans in development

Utilizing technology & contemporary merchandising strategies

Funeral: modifications to casket selection rooms to promote the sale

of Dignity ® plans with an emphasis on personalization

Cemetery: standard pricing model and tiered-product strategy with a

focus on high-end cemetery property

12

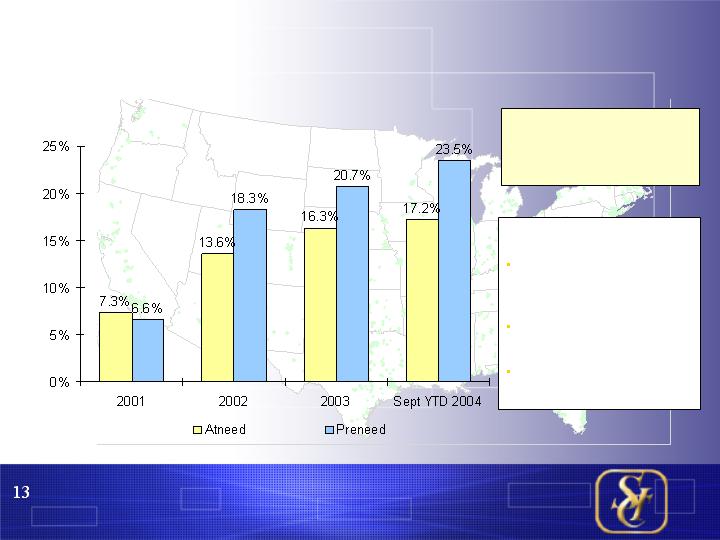

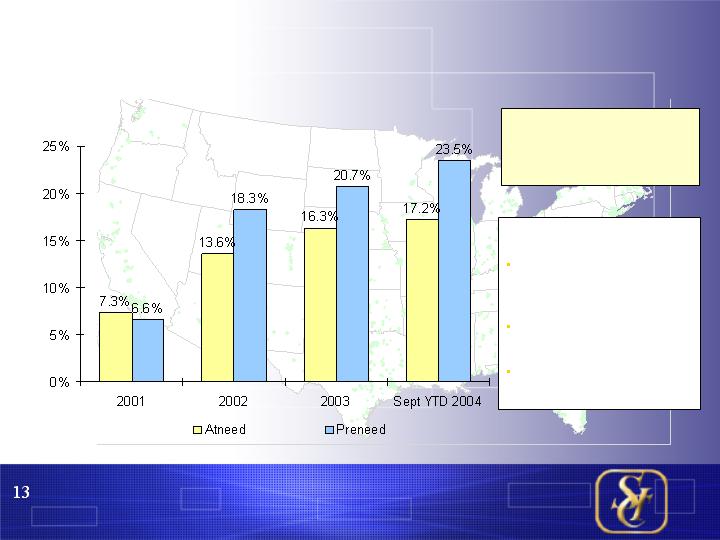

Dignity Memorial® Funeral & Cremation Plans

Selection rate for North America funeral homes

Blueprint for Success

Enhanced merchandise

displays and training in

490 locations

Over 2,200 counselors

have been certified

Targeting 550 locations

by year end

Incremental Revenue

Funeral - $2,800

Cremation - $1,900

13

Growing Revenues: High Impact in 2005

New single-line management structure

Dignity® packaged plans & contemporary merchandising

strategies

Implementation and roll-out of cemetery standard pricing

model

Development and roll-out of Dignity ® Blueprint to cemeteries

Investing in sales management in order to drive preneed

sales

14

Growing Revenues: Long-Term Impact

Developing access to customers through new channels -

branding, national marketing and affinity strategies

Executing on a cremation strategy focused on product

differentiation, personalization and simplicity

Becoming the preplanning experts – funded and unfunded

Developing our people through Dignity® University

Expanding through acquisition, construction or franchise

Developing a comprehensive internet strategy

15

Developing our People

Comprehensive Education Strategy in an

On-line Campus Format

Focus on building a “best in class” workforce

Investing in our number one resource: our employees

Emphasis on leadership development and training

Job-focused curriculum for each position in the company

Certification requirements for each position starting with customer

contact employees (sales counselors & funeral arrangers)

Blended approach using classroom, web-based courses, virtual

classroom and on-the job training

16

From Customer Satisfaction to Customer Loyalty

Customer Satisfaction

Began to track with independent surveys in 2000 (atneed funeral only)

Over 40% response rate of all families surveyed

Over 98% of respondents are likely to recommend our services

Satisfaction scores on a national basis has grown nearly 500%

Customer Loyalty

In 2005, moving to a new program with J.D. Power and Associates

New survey will combine funeral and cemetery

Satisfaction scores PLUS loyalty scores – measuring the relationship

between level of satisfaction and likelihood to use us again or to

recommend us

17

Significant Financial Flexibility

Cash on hand at Sept 30, 2004 exceeded $300 million

$200 million credit facility ($127M availability after LOC usage)

Anticipated proceeds of $80 to $100 million from remaining

international asset sales (may occur over several years)

Anticipated return of cash collateral of $30 to $50 million in Q4

Debt maturities in remainder of 2004 and 2005 are less than

$140 million

Substantial free cash flow*

* Please refer to the disclosures concerning free cash flow at the end of this presentation

18

Capital Allocation Considerations

Internal growth opportunities

Dignity® displays in our funeral homes

Development of high-end cemetery property

Construction or acquisition opportunities

Using a hurdle rate that is a premium to our WACC of approx 9%

Share repurchase program

Repurchased 9.5 million shares at a total cost of approximately $59.4

million ($6.25) thru October 2004

Approximately $140 million remaining under authorization

Dividend

Debt repurchases

19

Managing Liquidity & Capital Decisions

5x to 7x

Net Debt/Free Cash Flow

40% to 45%

Net Debt/Total Capital

Greater than 1.5x

Free Cash Flow/Interest expense

Please refer to the disclosures concerning free cash flow, net debt and total capital at the end of this presentation

LONG-TERM TARGET RATIOS

20

Eric Tanzberger

Vice President and Corporate Controller

21

13% - 17%

$500 - $550

Up 1% - 3%

Flat to slightly down

20% - 24%

$1,120 - $1,170

2004 Outlook

+7.5%

-0.8%

+2.3%

-0.7%

+7.0%

+0.8%

Chg

16.2%

67.0

413.5

$4,248

191,450

20.4%

171.2

839.7

YTD

9/30/04

14.9%

62.3

416.9

$4,154

192,715

19.2%

160.0

833.0

YTD

9/30/03

Average Revenue

Case Volume

CEMETERY

FUNERAL

Gross Profit

Gross Margin

Gross Margin

Gross Profit

Revenues

Revenues

North America Operating Highlights

Comparable North America businesses only

(Dollars in millions)

22

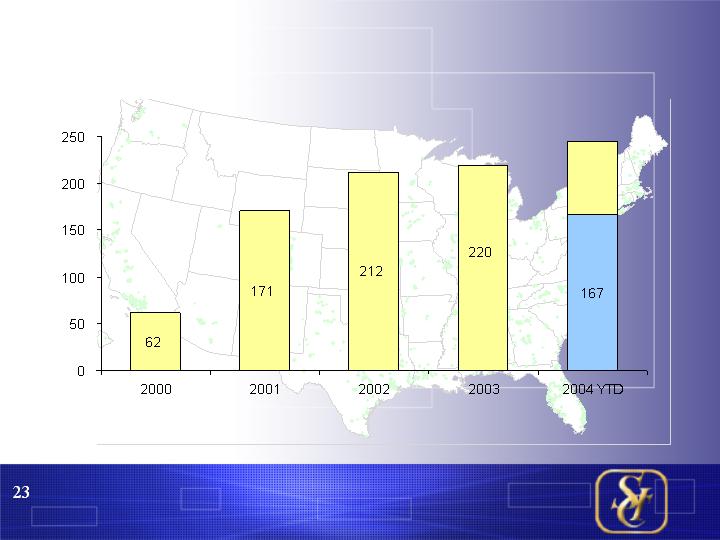

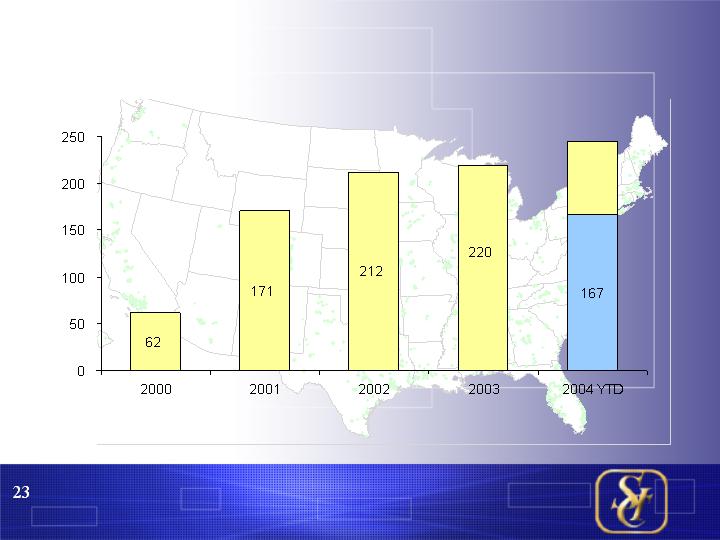

Continued Strong Free Cash Flow

(In millions)

Target

$200 to $245

at

9/30/04

14.6

Net Debt/

Free Cash Flow

51.9

8.4

6.7

4.5

LTM

Please refer to free cash flow /recurring free cash flow disclosures and reconciliations to cash flow from operating

activities at the end of this presentation.

23

(94.5)

Unusual tax refund

-3.1%

-8.7%

Chg

$200 - $245

($65 - $70)

$270 - $310

2004 Outlook

$172.1

(62.1)

234.2

25.1

$303.6

YTD

9/30/03

$166.8

(47.1)

213.9

31.4

(0.7)

$183.2

YTD

9/30/04

Settlement of significant legal matters,

net of insurance recoveries

Free Cash Flow

Capital improvements to maintain

existing facilities

Pension contribution/repayment of

policy loan on retirement plan

Adj Cash flows from operations

Cash flows from operations

Free Cash Flow Highlights

(Dollars in millions)

Please refer to additional disclosures concerning free cash flow at the end of this presentation

24

Net Debt

(Total Debt Less Cash)

Significant Debt Reduction

(In millions)

34%

Net Debt/

Total Capital

49%

57%

64%

62%

53%

Credit ratings:

“BB” with S&P

“Ba3” with

Moody's and

highest liquidity

rating of SGL-1

Please refer to the disclosures and reconciliations concerning net debt at the end of this presentation

25

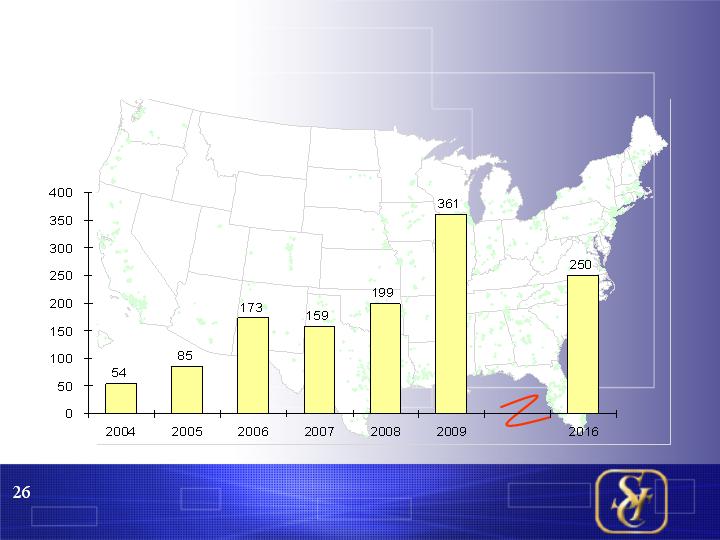

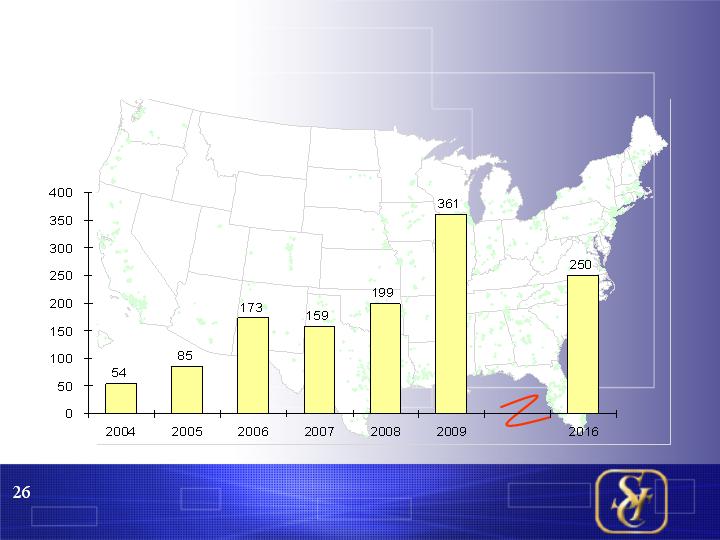

Debt Maturity Profile

SCI has reduced its near term debt maturity profile to levels comfortably

within expected levels of on-going recurring free cash flow.

As of September 30, 2004

(In millions)

26

Sarbanes-Oxley

Dedicating a significant amount of resources and time to

compliance efforts

Expect total costs in 2004 associated with SOX 404 to be $5-$7

million

As a result of testing, we have become aware of deficiencies in

our internal controls

Actively working to remediate identified deficiencies

Finalizing our assessment of the effectiveness of our internal

controls

27

Building Shareholder Value

Continued strong free cash flow, liquidity and improved capital

structure gives us significant financial flexibility

Streamlined infrastructure and new management structure

establishes solid platform for growth

We have unique opportunities for long-term growth with

strategies centered on Dignity Memorial®

We are investing in our people and our businesses to drive

revenue growth and customer satisfaction

We continue to focus on achieving excellence in all aspects of

the organization to increase our effectiveness

28

29

29

Free Cash Flow

Free cash flow is a non-GAAP financial measure. We define free cash flow as cash flows from

operating activities (adjusted for certain unusual items described below) less capital

improvements deemed reasonably necessary to maintain our existing facilities in a condition

consistent with company standards and to extend their useful lives. We believe that free cash

flow provides useful information to investors regarding our financial condition and liquidity as

well as our ability to generate cash for purposes such as reducing debt, expanding through

strategic investments and repurchasing stock or paying dividends. Free cash flow is not

reduced by capital expenditures intended to grow revenues and profits such as the acquisition

of funeral service locations or cemeteries in large or strategic North America markets,

construction of high-end cemetery property inventory or the construction of funeral home

facilities on SCI-owned cemeteries.

While we believe free cash flow, as defined, is helpful in managing our business and provides

useful information to investors, certain events may arise, financial or otherwise, which could

require the use of free cash flow so that it would not be available for the purposes described

above, as more fully described in our public filings with the Securities and Exchange

Commission. Furthermore, free cash flow should be reviewed in addition to, but not as a

substitute for, the data provided in our consolidated statement of cash flows.

Further information can be found on our website in the press release dated November 8, 2004 and in

the Form 8-K furnished to the SEC on November 8, 2004.

30

Free Cash Flow Reconciliation to GAAP

27.1

---------

Add: Settlement of significant legal matters, net of insurance recoveries

(86.7)

(72.9)

Less: Capital improvements to maintain existing facilities

2003

2002

Free Cash Flow

$212.1

285.0

(67.2)

$352.2

$220.0

306.7

(94.5)

$374.1

Adjusted cash flows from operations

Less: Unusual tax refunds/escrow receipt

Free Cash Flow

Cash flows from operations

(Dollars in millions)

170.5

62.0

Recurring Operating Free Cash Flow

34.6

------

Add: Payments to pension plan & other nonrecurring items

(116.3)

------

Less: Unusual tax refund

------

32.8

Add: Effect of swap terminations

22.8

46.7

Add: Payments on restructuring charges

$383.3

$223.6

Cash flows from operating activities

(79.8)

(157.7)

Less: Special trust receipts

2001

2000

Recurring Operating Free Cash Flow

83.4

145.4

74.1

244.6

Less: Capital improvements to maintain existing facilities

Adjusted cash flows from operations

31

Net Debt & Total Capital

Net debt and total capital are non-GAAP financial measures. We define net

debt as total debt less cash and cash equivalents. We define total capital as

net debt (as defined previously) plus total stockholders’ equity.

2,853.5

2,999.2

3,110.9

3,938.2

5,196.0

7,497.5

Total Capital

1,876.8

1,527.0

1,326.7

1,432.9

1,975.8

3,495.3

Total Stockholders’ Equity

976.7

1,472.2

1,784.2

2,505.3

3,220.2

4,002.2

Net Debt

1,294.7

1,711.6

1,984.8

2,534.6

3,268.1

4,060.0

Total Debt

318.0

239.4

200.6

29.3

47.9

57.8

Less: Cash

Sept 2004

2003

2002

2001

2000

1999

32