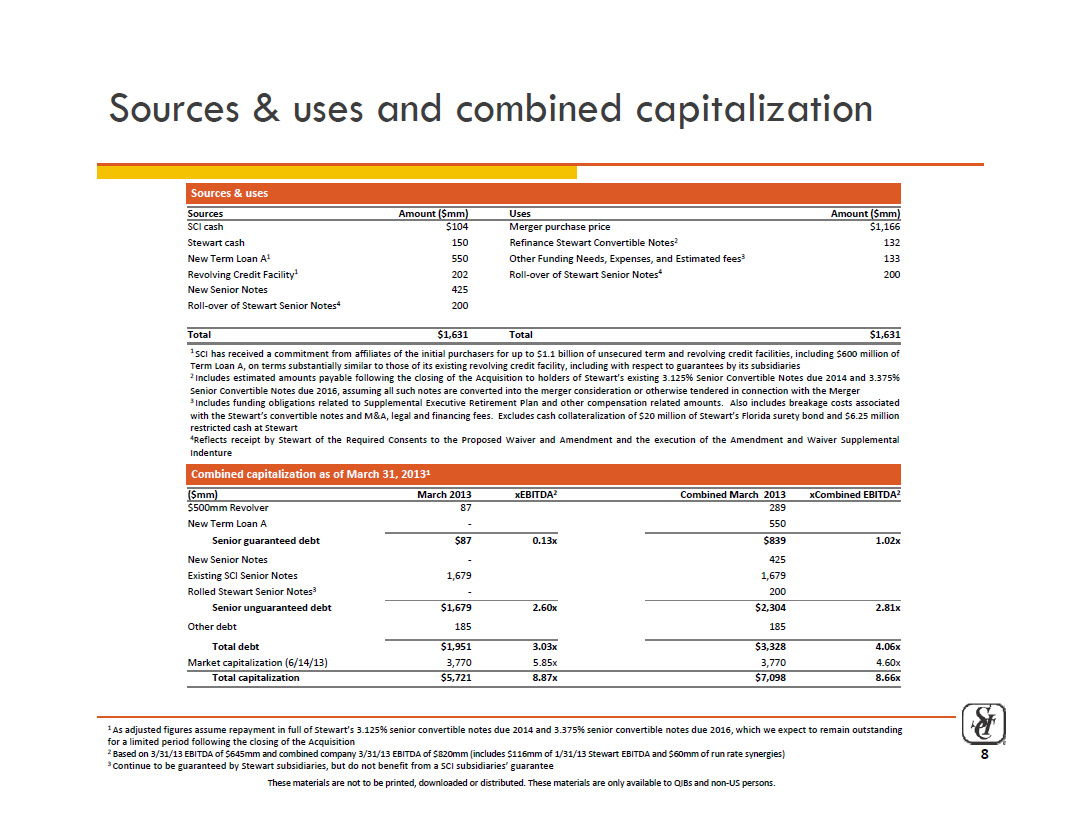

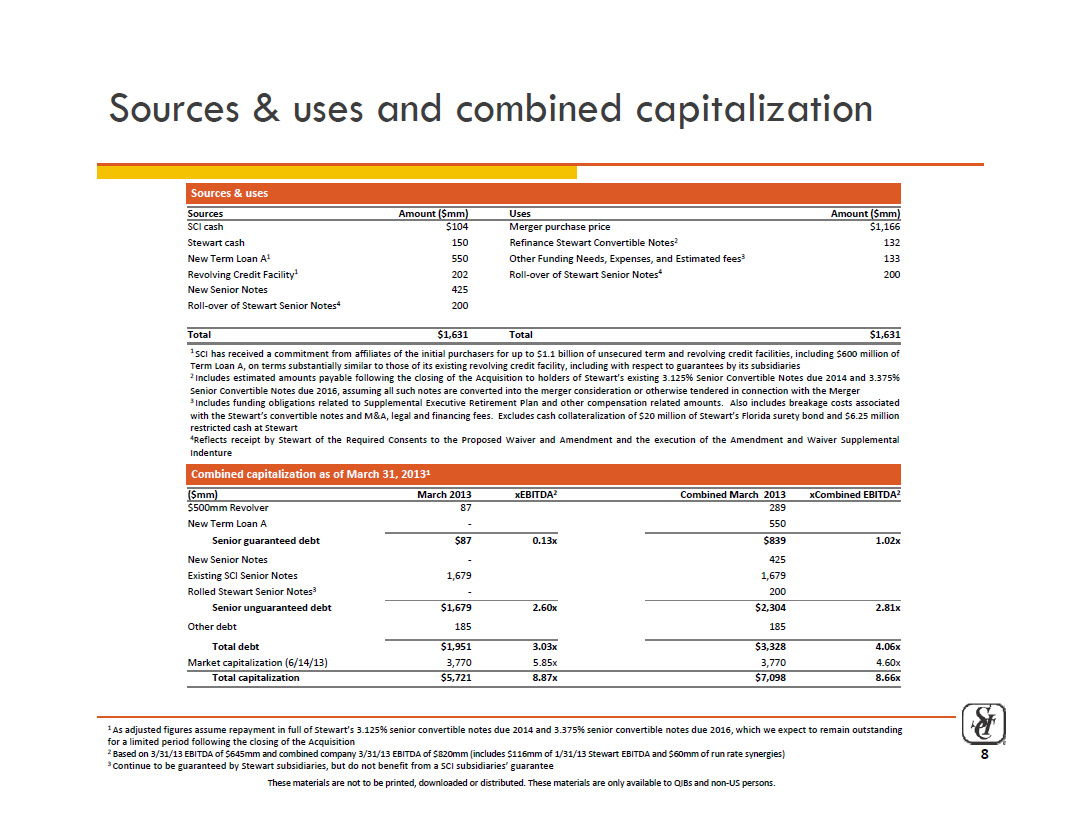

Sources & uses and combined capitalization Sources Amount

($mm) Uses Amount ($mm) SCI cash $104 Merger purchase price

$1,166 Stewart cash 150 Refinance Stewart Convertible Notes2

132 New Term Loan A1 550 Other Needs Expenses fees3 133

Sources & uses A Funding Needs, Expenses, and Estimated fees

Revolving Credit Facility1 202 Roll-over of Stewart Senior

Notes4 200 New Senior Notes 425 Roll-over of Stewart Senior

Notes4 200 Total $1,631 Total $1,631 1 SCI has received a

commitment from affiliates of the initial purchasers for up

to $1.1 billion of unsecured term and revolving credit

facilities, including $600 million of Term Loan A on terms

substantially similar A, to those of its existing revolving

credit facility, including with respect to guarantees by its

subsidiaries 2 Includes estimated amounts payable following

the closing of the Acquisition to holders of Stewart's

existing 3.125% Senior Convertible Notes due 2014 and 3.375%

Senior Convertible Notes due 2016, assuming all such notes

are converted into the merger consideration or otherwise

tendered in connection with the Merger 3 Includes funding

obligations related to Supplemental Executive Retirement

Plan and other compensation related amounts. Also includes

breakage costs associated with the Stewart's convertible

notes and M&A, legal and financing fees. Excludes cash

collateralization of $20 million of Stewart's Florida surety

bond and $6.25 million restricted cash at Stewart 4Reflects

receipt by Stewart of the Required Consents to the Proposed

Waiver and Amendment and the execution of the Amendment and

Waiver Supplemental Indenture Combined capitalization as of

March 31 20131 ($mm) March 2013 xEBITDA2 Combined March 2013

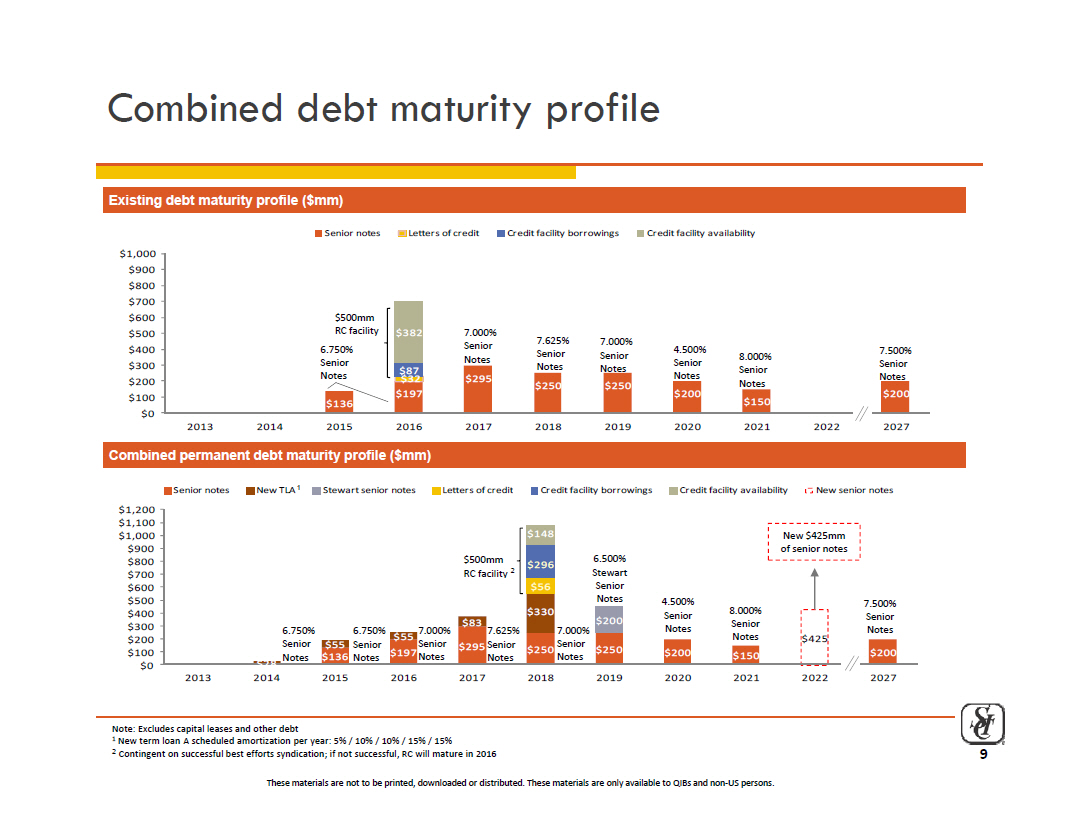

xCombined EBITDA2 $500mm Revolver 87 289 New Term Loan A -

550 Senior guaranteed debt $87 0.13x $839 1.02x New Senior

Notes - 425 Existing 1,679 1,679 31, SCI Senior Notes Rolled

Stewart Senior Notes3 - 200 Senior unguaranteed debt $1,679

2.60x $2,304 2.81x Other debt 185 185 Total debt $1,951

3.03x $3,328 4.06x Market capitalization (6/14/13) 3,770

5.85x 3,770 4.60x Total capitalization $5,721 8.87x $7,098

8.66x 1 As adjusted figures assume repayment in full of

Stewart's 3.125% senior convertible notes due 2014 and

3.375% senior convertible notes due 2016, which we expect to

remain outstanding for a limited period following the

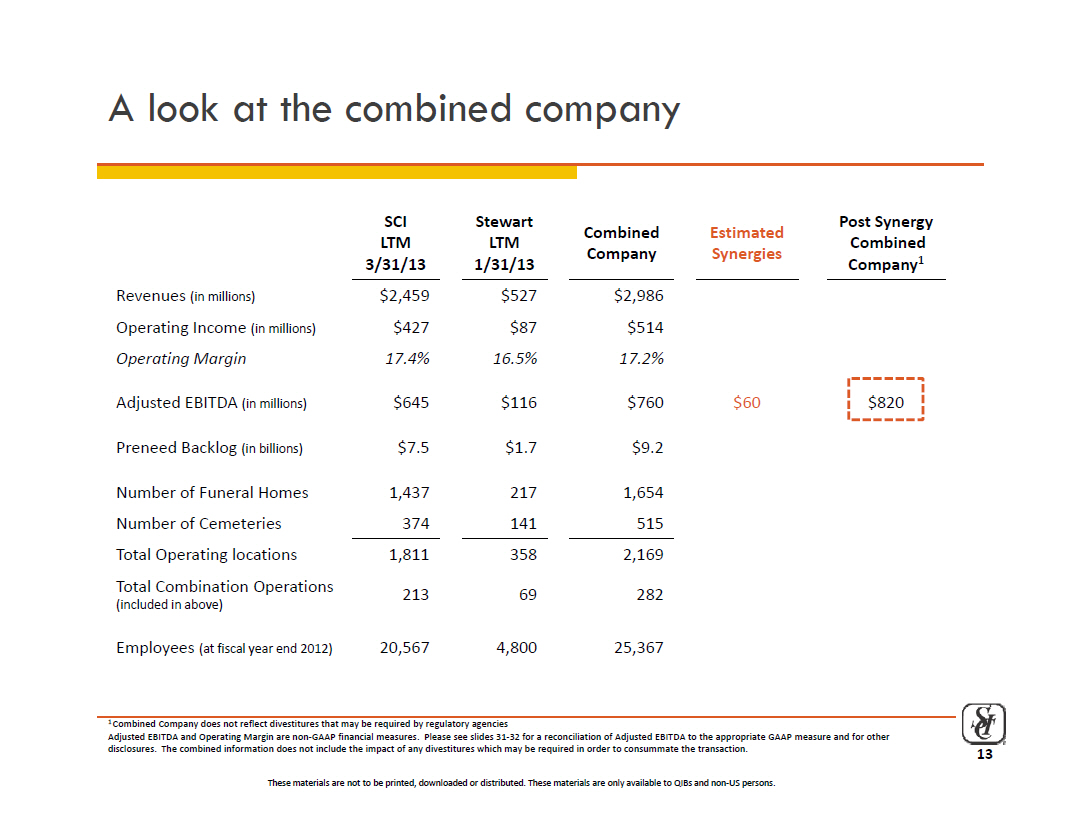

closing of the Acquisition 2 Based on 3/31/13 EBITDA of

$645mm and combined company 3/31/13 EBITDA of $820mm

(includes $116mm of 1/31/13 Stewart EBITDA and $60mm of run

rate synergies) 3 Continue to be guaranteed by Stewart

subsidiaries, but do not benefit from a SCI subsidiaries'

guarantee These materials are not to be printed, downloaded

or distributed. These materials are only available to QIBs

and non-US persons. 8

|  |