UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| | | |

þ | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | | For the fiscal year ended December 31, 2007 |

OR |

o | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | | For the transition period from to |

Commission file number 1-6402-1

Service Corporation International

(Exact name of registrant as specified in its charter)

| | | |

Texas | | 74-1488375 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. employer

identification no.) |

| | | |

1929 Allen Parkway

Houston, Texas

(Address of principal executive offices) | | 77019

(Zip code) |

Registrant’s telephone number, including area code:

713/522-5141

Securities registered pursuant to Section 12(b) of the Act:

| | | |

Title of Each Class | | Name of Each Exchange on Which Registered |

| Common Stock ($1 par value) | | New York Stock Exchange |

| Preferred Share Purchase Rights | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 ofRegulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of thisForm 10-K or any amendment to thisForm 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | | |

Large accelerated filerþ | | | | | | Accelerated filero |

Non-accelerated filer o (Do not check if a smaller reporting company) | | Smaller Reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in the Securities Exchange Act of 1934Rule 12b-2). Yes o No þ

The aggregate market value of the common stock held by non-affiliates of the registrant (assuming that the registrant’s only affiliates are its officers and directors) was $3,455,228,251 based upon a closing market price of $12.78 on June 30, 2007 of a share of common stock as reported on the New York Stock Exchange — Composite Transactions Tape.

The number of shares outstanding of the registrant’s common stock as of February 22, 2008 was 261,814,225 (net of treasury shares)

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Proxy Statement in connection with its 2008 Annual Meeting of Shareholders (Part III)

SERVICE CORPORATION INTERNATIONAL

INDEX

2

GLOSSARY

The following terms are common to the deathcare industry, are used throughout this report, and have the following meanings:

Atneed — Funeral and cemetery arrangements after the death has occurred.

Burial Vaults — A reinforced outer burial container intended to protect the casket against the weight of the earth.

Cremation — The reduction of human remains to bone fragments by intense heat.

General Agency (GA) Revenues — Commissions paid to the General Agency (GA) for life insurance policies or annuities sold to preneed customers for the purpose of funding preneed funeral arrangements. The commission rate paid is determined based on the product type sold, the length of payment terms, and the age of the insured/annuitant. The commission rate is applied to the face amount of the policy purchased to determine the commission amount payable to the GA. GA revenues are recognized as funeral revenues when the insurance purchase transaction between the customer and third party insurance provider is completed.

Interment — The burial or final placement of human remains in the ground.

Lawn Crypt — An outer burial receptacle constructed of concrete and reinforced steel, which is usually pre-installed in predetermined designated areas.

Marker — A method of identifying the remains in a particular burial space, crypt, or niche. Permanent burial markers are usually made of bronze, granite, or stone.

Maturity — At the time of death. This is the point at which preneed contracts are converted to atneed contracts.

Mausoleum — An above ground structure that is designed to house caskets and cremation urns.

Perpetual Care or Endowment Care Fund — A trust fund used for the maintenance and upkeep of burial spaces within a cemetery in perpetuity.

Preneed — Purchase of products and services prior to use.

Preneed Backlog — Future revenues from unfulfilled preneed funeral and cemetery contractual arrangements.

Production — Sales of preneed funeral and preneed or atneed cemetery contracts.

As used herein, “SCI”, “Company”, “we”, “our”, and “us” refer to Service Corporation International and companies owned directly or indirectly by Service Corporation International, unless the context requires otherwise.

3

PART I

General

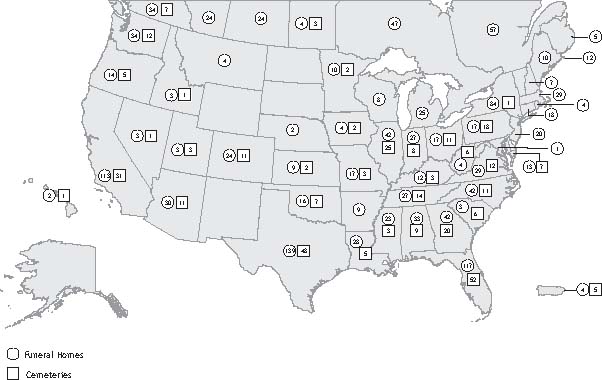

Service Corporation International (SCI) is North America’s leading provider of deathcare products and services, with a network of funeral homes and cemeteries unequalled in geographic scale and reach. At December 31, 2007, we operated 1,329 funeral service locations and 366 cemeteries (including 207 combination locations) in North America, which are geographically diversified across 43 states, eight Canadian provinces, the District of Columbia, and Puerto Rico. Our funeral segment also includes the operations of 13 funeral homes in Germany that we intend to exit when economic values and conditions are conducive to a sale. As part of the Alderwoods Group, Inc. (Alderwoods) transaction, we acquired Mayflower National Life Insurance Company (Mayflower), an insurance business that we sold in July 2007. The operations of this business through the date of sale are presented as discontinued operations in our consolidated statement of operations.

History

We were incorporated in Texas in July of 1962. Prior to 1999, we focused on the acquisition and consolidation of independent funeral homes and cemeteries in the fragmented deathcare industry in North America. During the 1990s, we also expanded our operations through acquisitions in Europe, Australia, South America, and the Pacific Rim. During the mid to late 1990s, acquisitions of deathcare facilities became extremely competitive resulting in increased prices for acquisitions and substantially reduced returns on invested capital. In 1999, we significantly reduced our level of acquisition activity and began to focus on identifying and addressing non-strategic or underperforming businesses.

This focus resulted in the divestiture of several North America and international operations beginning in 2001. During 2001 and 2002, we completed joint ventures of operations in Australia, the United Kingdom, Spain, and Portugal. In 2003, we sold our equity investment in our operations in Australia, Spain, and Portugal. During 2004, we sold our funeral operations in France and obtained an unconsolidated investment in the acquiring entity. We also sold our equity investment in the United Kingdom. During 2005, we divested of all of our operations in Argentina, Uruguay, and Chile. During 2006, we sold our funeral service location in Singapore, leaving our operations in Germany as our sole remaining funeral service locations outside of North America. During 2007, we sold our equity investment in France. We also divested 70% of the operations of Kenyon International Emergency Services (Kenyon). We may pursue discussions with various third parties concerning the sale or joint venture of our operations in Germany when economic values and conditions are conducive to a sale.

In 2006, as part of our strategy to enhance our position as North America’s premier funeral and cemetery provider, we acquired Alderwoods for $20.00 per share in cash. The purchase price of $1.2 billion included the refinancing of $357.7 million and the assumption of $2.2 million of Alderwoods debt. Alderwoods operations were substantially integrated into our operations as of December 31, 2007. These operations are operated in the same manner as our incumbent operations and are reported in the appropriate reporting segment (funeral or cemetery) in our consolidated financial statements.

Funeral and Cemetery Operations

Worldwide, we have 1,342 funeral service locations and 366 cemeteries (including 207 combination locations) covering 43 states, eight Canadian provinces, the District of Columbia, Puerto Rico, and Germany. See Part II, Item 8. Financial Statements and Supplementary Data , Note 17 of thisForm 10-K for financial information about our business segments and geographic areas.

Our funeral service and cemetery operations consist of funeral service locations, cemeteries, funeral service/cemetery combination locations, crematoria, and related businesses. We provide all professional services relating to funerals and cremations, including the use of funeral facilities and motor vehicles, and preparation and embalming services. Funeral related merchandise, including caskets, burial vaults, cremation receptacles, flowers, and other ancillary products and services, is sold at funeral service locations. Our cemeteries provide cemetery property

4

interment rights, including mausoleum spaces, lots, and lawn crypts, and sell cemetery related merchandise and services, including stone and bronze memorials, burial vaults, casket and cremation memorialization products, merchandise installations, and burial openings and closings. We also sell preneed funeral and cemetery preneed products and services whereby a customer contractually agrees to the terms of certain products and services to be delivered and performed in the future.

Funeral service/cemetery combination locations are those businesses in which a funeral service location is physically located within or adjoining a cemetery that we own. Combination locations allow certain facility, personnel, and equipment costs to be shared between the funeral service location and cemetery. Such combination facilities typically can be cost competitive and have higher gross margins than if the funeral and cemetery operations were operated separately. Combination locations also create synergies between funeral and cemetery sales force personnel and give families added convenience to purchase both funeral and cemetery products and services at a single location. With the acquisition of Alderwoods, we acquired Rose Hills, which is the largest combination operation in the United States, performing approximately 5,000 funeral services and 8,000 interments per year.

Our operations in the United States and Canada are organized into 37 major markets and 45 middle markets (including eight Hispana markets). Each market is led by a market director with responsibility for funeraland/or cemetery operations and preneed sales. Within each market, the funeral homes and cemeteries share common resources such as personnel, preparation services, and vehicles. There are four market support centers in North America to assist market directors with financial, administrative, pricing, and human resource needs. These support centers are located in Houston, Miami, New York, and Los Angeles. The primary functions of the support centers are to help facilitate the execution of corporate strategies, coordinate communication between the field and corporate offices, and serve as liaisons for the implementation of policies and procedures.

See Part II, Item 8. Financial Statements and Supplementary Data, Note 17 of thisForm 10-K for financial information related to our reportable segments and geographic areas.

The following table (which includes businessesheld-for-sale at December 31, 2007) provides the number of our funeral homes and cemeteries by country, and by state, territory, or province:

| | | | | | | | | | | | | |

| | | Number of

| | | Number of

| | | | |

Country, State/Territory/Province | | Funeral Homes | | | Cemeteries | | | Total | |

| |

| United States | | | | | | | | | | | | |

| Alabama | | | 33 | | | | 9 | | | | 42 | |

| Arizona | | | 30 | | | | 11 | | | | 41 | |

| Arkansas | | | 9 | | | | — | | | | 9 | |

| California | | | 113 | | | | 31 | | | | 144 | |

| Colorado | | | 24 | | | | 11 | | | | 35 | |

| Connecticut | | | 18 | | | | — | | | | 18 | |

| District of Columbia | | | 1 | | | | — | | | | 1 | |

| Florida | | | 117 | | | | 52 | | | | 169 | |

| Georgia | | | 42 | | | | 20 | | | | 62 | |

| Hawaii | | | 2 | | | | 1 | | | | 3 | |

| Idaho | | | 3 | | | | 1 | | | | 4 | |

| Illinois | | | 42 | | | | 25 | | | | 67 | |

| Indiana | | | 27 | | | | 8 | | | | 35 | |

| Iowa | | | 4 | | | | 2 | | | | 6 | |

| Kansas | | | 9 | | | | 2 | | | | 11 | |

| Kentucky | | | 12 | | | | 3 | | | | 15 | |

| Louisiana | | | 28 | | | | 5 | | | | 33 | |

| Maine | | | 10 | | | | — | | | | 10 | |

5

| | | | | | | | | | | | | |

| | | Number of

| | | Number of

| | | | |

Country, State/Territory/Province | | Funeral Homes | | | Cemeteries | | | Total | |

| |

| Maryland | | | 13 | | | | 7 | | | | 20 | |

| Massachusetts | | | 29 | | | | — | | | | 29 | |

| Michigan | | | 25 | | | | — | | | | 25 | |

| Minnesota | | | 10 | | | | 2 | | | | 12 | |

| Mississippi | | | 23 | | | | 3 | | | | 26 | |

| Missouri | | | 17 | | | | 3 | | | | 20 | |

| Montana | | | 4 | | | | — | | | | 4 | |

| Nebraska | | | 2 | | | | — | | | | 2 | |

| Nevada | | | 3 | | | | 1 | | | | 4 | |

| New Hampshire | | | 7 | | | | — | | | | 7 | |

| New Jersey | | | 20 | | | | — | | | | 20 | |

| New York | | | 84 | | | | 1 | | | | 85 | |

| North Carolina | | | 42 | | | | 11 | | | | 53 | |

| Ohio | | | 17 | | | | 11 | | | | 28 | |

| Oklahoma | | | 16 | | | | 7 | | | | 23 | |

| Oregon | | | 14 | | | | 5 | | | | 19 | |

| Pennsylvania | | | 17 | | | | 18 | | | | 35 | |

| Puerto Rico | | | 4 | | | �� | 5 | | | | 9 | |

| Rhode Island | | | 4 | | | | — | | | | 4 | |

| South Carolina | | | 3 | | | | 6 | | | | 9 | |

| Tennessee | | | 27 | | | | 14 | | | | 41 | |

| Texas | | | 139 | | | | 48 | | | | 187 | |

| Utah | | | 3 | | | | 3 | | | | 6 | |

| Virginia | | | 29 | | | | 12 | | | | 41 | |

| Washington | | | 34 | | | | 12 | | | | 46 | |

| West Virginia | | | 4 | | | | 6 | | | | 10 | |

| Wisconsin | | | 8 | | | | — | | | | 8 | |

| Canada | | | | | | | | | | | | |

| Alberta | | | 24 | | | | — | | | | 24 | |

| British Columbia | | | 34 | | | | 7 | | | | 41 | |

| Manitoba | | | 4 | | | | 3 | | | | 7 | |

| New Brunswick | | | 5 | | | | — | | | | 5 | |

| Nova Scotia | | | 12 | | | | — | | | | 12 | |

| Ontario | | | 47 | | | | — | | | | 47 | |

| Quebec | | | 57 | | | | — | | | | 57 | |

| Saskatchewan | | | 24 | | | | — | | | | 24 | |

| Germany | | | 13 | | | | — | | | | 13 | |

| | | | | | | | | | | | | |

| Total | | | 1,342 | | | | 366 | | | | 1,708 | (1) |

| | | | | | | | | | | | | |

| | |

| (1) | | Includes businesses held for sale at December 31, 2007. |

We believe we have satisfactory title to the properties owned and used in our business, subject to various liens, encumbrances, and easements, which are incidental to ownership rights and uses and do not materially detract from

6

the value of the property. We also lease a number of facilities that we use in our business under both capital and operating leases.

At December 31, 2007, we owned approximately 90% of the real estate and buildings used at our facilities, and the remainder of the facilities were leased. At December 31, 2007, our 366 cemeteries contained a total of approximately 28,362 acres, of which approximately 62% was developed.

A map of our locations in North America is presented below:

Competition

Although there are several public companies that own funeral homes and cemeteries, the majority of deathcare businesses are locally-owned, independent operations. We estimate that our funeral and cemetery market share in North America is approximately 13% based on estimated total industry revenues. The position of a single funeral home or cemetery in any community is a function of the name, reputation, and location of that funeral home or cemetery, although competitive pricing, professional service and attention, and well-maintained locations are also important.

We believe we have an unparalleled network of funeral service locations and cemeteries that offer high quality products and services at prices that are competitive with local competing funeral homes, cemeteries, and retail locations. Within this network, the funeral service locations and cemeteries operate under various names as most operations were acquired as existing businesses. We have branded our funeral operations in North America under the name Dignity Memorial®. We believe our national branding strategy gives us a strategic advantage and identity in the industry. While this branding process is intended to emphasize our seamless national network of funeral service locations and cemeteries, the original names associated with acquired operations, and their inherent goodwill and heritage, generally remain the same. For example, Geo. H. Lewis & Sons Funeral Directors is now Geo. H. Lewis & Sons Funeral Directors, a Dignity Memorial® provider.

Employees

At December 31, 2007, we employed 13,499 (13,456 in North America) individuals on a full time basis and 7,092 (7,088 in North America) individuals on a part time basis. Of the full time employees, 12,845 were employed in the funeral and cemetery operations and 654 were employed in corporate or other overhead activities and

7

services. All eligible employees in the United States who so elect are covered by our group health and life insurance plans. Eligible employees in the United States are participants in retirement plans of SCI or various subsidiaries, while international employees are covered by other SCI (or SCI subsidiary) defined or government mandated benefit plans. Approximately 3.9% of our employees in North America are represented by unions. Although labor disputes are experienced from time to time, relations with employees are generally considered favorable.

Regulation

Our operations are subject to regulations, supervision, and licensing under numerous foreign, federal, state, and local laws, ordinances, and regulations, including extensive regulations concerning trust funds, preneed sales of funeral and cemetery products and services, and various other aspects of our business. We strive to comply in all material respects with the provisions of these laws, ordinances, and regulations. Since 1984, we have operated in the United States under the Federal Trade Commission (FTC) comprehensive trade regulation rule for the funeral industry. The rule contains requirements for funeral industry practices, including extensive price and other affirmative disclosures and imposes mandatory itemization of funeral goods and services.

Other

Our corporate headquarters are located at 1929 Allen Parkway, Houston, Texas 77019. The property consists of approximately 120,000 square feet of office space and 185,000 square feet of parking space. We own and utilize two buildings located in Houston, Texas for corporate activities containing a total of approximately 172,000 square feet of office space.

We make available free of charge, on or through our website, our annual, quarterly, and current reports and any amendments to those reports, as soon as reasonably practicable after electronically filing such reports with the Securities and Exchange Commission (SEC). Our website ishttp://www.sci-corp.com and our telephone number is(713) 522-5141. The SEC also maintains an internet site athttp://www.sec.gov that contains reports, proxy and information statements, and other information regarding issuers that file electronically. The public may read and copy any materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, DC 20549. Information on the operation of the Public Reference Room may be obtained by calling the SEC at1-800-SEC-0330.

Each of our Board of Directors’ standing committee charters, our Corporate Governance Guidelines, our Code of Ethics for Board Members, and our Code of Conduct for Officers and Employees are available, free of charge, through our website or, upon request, in print. We will post on our internet website all waivers to or amendments of our Code of Conduct for Officers and Employees, which are required to be disclosed by applicable law and rules of the New York Stock Exchange listing standards. Information contained on our website is not part of this report.

Cautionary Statement on Forward-Looking Statements

The statements in thisForm 10-K that are not historical facts are forward-looking statements made in reliance on the safe harbor protections provided under the Private Securities Litigation Reform Act of 1995. These statements may be accompanied by words such as “believe”, “estimate”, “project”, “expect”, “anticipate”, or “predict” that convey the uncertainty of future events or outcomes. These statements are based on assumptions that we believe are reasonable; however, many important factors could cause our actual consolidated results in the future to differ materially from the forward-looking statements made herein and in any other documents or oral presentations made by, or on behalf of, the Company. These factors are discussed below. We assume no obligation to publicly update or revise any forward-looking statements made herein or any other forward-looking statements made by the Company, whether as a result of new information, future events, or otherwise.

8

Our ability to execute our business plan depends on many factors, many of which are beyond our control.

Our strategic plan is focused on cost management and the continued implementation of key revenue initiatives, including strategic pricing, designed to generate future internal growth in our core funeral and cemetery operations. Many of the factors necessary for the execution of our strategic plan, such as the number of deaths and general economic conditions, are beyond our control. We cannot give assurance that we will be able to execute any or all of our strategic plan. Failure to execute any or all of the strategic plan could have a material adverse effect on our financial condition, results of operations, or cash flows.

Our credit agreements and debt securities contain covenants that may prevent us from engaging in certain transactions.

Our credit agreements and debt securities contain, among other things, various affirmative and negative covenants that may prevent us from engaging in certain transactions that might otherwise be considered beneficial to us. These covenants limit, among other things, our and our subsidiaries’ ability to:

| | |

| | • | Incur additional secured indebtedness (including guarantee obligations); |

| |

| | • | Create liens on assets; |

| |

| | • | Engage in certain transactions with affiliates; |

| |

| | • | Enter into sale-leaseback transactions; |

| |

| | • | Engage in mergers, liquidations, and dissolutions; |

| |

| | • | Sell assets; |

| |

| | • | Enter into leases; |

| |

| | • | Pay dividends, distributions, and other payments in respect of capital stock and purchase our capital stock in the open market; |

| |

| | • | Make investments, loans, or advances; |

| |

| | • | Repay subordinated indebtedness or amend the agreements relating thereto; |

| |

| | • | Change our fiscal year; |

| |

| | • | Create restrictions on our ability to receive distributions from subsidiaries; and |

| |

| | • | Change our lines of business. |

Our bank credit facility also requires us to maintain certain leverage and interest coverage ratios. See Part II, Item 8. Financial Statements and Supplementary Data, Note 11 of thisForm 10-K for further information related to our bank credit facility.

If we lost the ability to use surety bonding to support our preneed funeral and preneed cemetery activities, we may be required to make material cash payments to fund certain trust funds.

We have entered into arrangements with certain surety companies whereby such companies agree to issue surety bonds on our behalf as financial assurance or as required by existing state and local regulations. The surety bonds are used for various business purposes; however, the majority of the surety bonds issued and outstanding have been issued to support our preneed funeral and cemetery activities. In the event all of the surety companies cancelled or did not renew our surety bonds, which are generally renewed for twelve-month periods, we would be required to either obtain replacement coverage or fund approximately $235.9 million as of December 31, 2007 into state-mandated trust accounts.

9

The funeral home and cemetery industry continues to be increasingly competitive.

In North America, the funeral and cemetery industry is characterized by a large number of locally owned, independent operations. To compete successfully, our funeral service locations and cemeteries must maintain good reputations and high professional standards, as well as offer attractive products and services at competitive prices. In addition, we must market the Company in such a manner as to distinguish us from our competitors. We have historically experienced price competition from independent funeral home and cemetery operators, monument dealers, casket retailers, low-cost funeral providers, and other non-traditional providers of services and merchandise. If we are unable to successfully compete, our financial condition, results of operations, and cash flows could be materially adversely affected.

Our affiliated funeral and cemetery trust funds own investments in equity securities, fixed income securities, and mutual funds, which are affected by financial market conditions that are beyond our control.

In connection with our preneed funeral and preneed cemetery merchandise and service sales, most affiliated funeral and cemetery trust funds own investments in equity securities and mutual funds. Our earnings and investment gains and losses on these equity securities and mutual funds are affected by financial market conditions that are beyond our control. In addition, our investments in our funeral, cemetery, and perpetual care trusts have an indirect exposure, through our investment fund managers, to mortgage-backed securities and therefore to sub-prime mortgage markets. At December 31, 2007, our exposure to sub-prime mortgage investments is approximately $18 million, or less than 1.0% of our total investment portfolio of over $3 billion.

As of December 31, 2007, net unrealized appreciation in the preneed funeral and cemetery merchandise and services trust funds amounted to $5.9 million and $29.4 million, respectively. Our perpetual care trust funds had net unrealized depreciation of $2.9 million as of December 31, 2007. The following table summarizes our investment returns, excluding fees, on our trust funds for the last three years.

| | | | | | | | | | | | | |

| | | 2007 | | | 2006 | | | 2005 | |

| |

| Preneed funeral trust funds | | | 9.9 | % | | | 8.8 | % | | | 6.6 | % |

| Cemetery merchandise and services trust funds | | | 9.8 | % | | | 8.4 | % | | | 6.9 | % |

| Perpetual care trust funds | | | 3.2 | % | | | 10.8 | % | | | 3.9 | % |

If earnings from our trust funds decline, we would likely experience a decline in future revenues. In addition, if the trust funds experienced significant investment losses, there could be insufficient funds in the trusts to cover the costs of delivering services and merchandise or maintaining cemeteries in the future. We would have to cover any such shortfall with cash flows from operations, which could have a material adverse effect on our financial condition, results of operations, or cash flows.

Increasing death benefits related to preneed funeral contracts funded through life insurance or annuity contracts may not cover future increases in the cost of providing a price-guaranteed funeral service.

We sell price-guaranteed preneed funeral contracts through various programs providing for future funeral services at prices prevailing when the agreements are signed. For preneed funeral contracts funded through life insurance or annuity contracts, we receive in cash a general agency commission that typically averages approximately 14% of the total sale from the third party insurance company. Additionally, there is an increasing death benefit associated with the contract of approximately 1% per year to be received in cash at the time the funeral is performed. There is no guarantee that the increasing death benefit will cover future increases in the cost of providing a price-guaranteed funeral service, which could materially adversely affect our future cash flows, revenues, and operating margins.

Unfavorable results of litigation could have a material adverse impact on our financial statements.

As discussed in Part II, Item 8. Financial Statements and Supplementary Data, Note 13 of thisForm 10-K, we are subject to a variety of claims and lawsuits in the ordinary course of our business. Adverse outcomes in some or all of the pending cases may result in significant monetary damages or injunctive relief against us. While management currently believes that resolving all of these matters, individually or in the aggregate, will not have

10

a material adverse impact on our financial position, cash flows, or results of operations, litigation and other claims are subject to inherent uncertainties and management’s view of these matters may change in the future. There exists the possibility of a material adverse impact on our financial position, cash flows, and the results of operations for the period in which the effect of an unfavorable final outcome becomes probable and reasonably estimable.

If the number of deaths in our markets declines, our cash flows and revenues may decrease.

If the number of deaths declines, the number of funeral services and interments performed by us could decrease and our financial condition, results of operations, and cash flows could be materially adversely affected.

The continuing upward trend in the number of cremations performed in North America could result in lower revenue and gross profit dollars.

There is a continuing upward trend in the number of cremations performed in North America as an alternative to traditional funeral service dispositions. However, we have seen a recent stabilization in the trend for our businesses as our strategic pricing initiative and discounting policies have resulted in a decline in highly-discounted, low-service cremation customers. In our operations in North America during 2007, 41.6% of the comparable funeral services we performed were cremation cases compared to 41.5% and 41.4% performed in 2006 and 2005, respectively. We expect this continuing upward trend to resume in the near future. We continue to expand our cremation memorialization products and services, which have resulted in higher average sales for cremation services. If we are unable to successfully expand our cremation memorialization products and services, and cremations continue to be a significant percentage of our funeral services, our financial condition, results of operations, and cash flows could be materially adversely affected.

The funeral home and cemetery businesses are high fixed-cost businesses.

The majority of our operations are managed in groups called “markets”. Markets are geographical groups of funeral service locations and cemeteries that share common resources such as operating personnel, preparation services, clerical staff, motor vehicles, and preneed sales personnel. Personnel costs, the largest of our operating expenses, are the cost components most beneficially affected by this grouping. We must incur many of these costs regardless of the number of funeral services or interments performed. Because we cannot necessarily decrease these costs when we experience lower sales volumes, a sales decline may cause margin percentages to decline at a greater rate than the decline in revenues.

Regulation and compliance could have a material adverse impact on our financial results.

Our operations are subject to regulation, supervision, and licensing under numerous foreign, federal, state, and local laws, ordinances, and regulations, including extensive regulations concerning trust funds, preneed sales of funeral and cemetery products and services, and various other aspects of our business. The impact of such regulations varies depending on the location of our funeral and cemetery operations. Violations of applicable laws could result in fines or sanctions to us.

In addition, from time to time, governments and agencies propose to amend or add regulations, which would increase costs and decrease cash flows. For example, foreign, federal, state, local, and other regulatory agencies have considered and may enact additional legislation or regulations that could affect the deathcare industry, such as regulations that require more liberal refund and cancellation policies for preneed sales of products and services, limit or eliminate our ability to use surety bonding, increase trust requirements,and/or prohibit the common ownership of funeral homes and cemeteries in the same market. If adopted by the regulatory authorities of the jurisdictions in which we operate, these and other possible proposals could have a material adverse effect on our financial condition, results of operations, and cash flows.

Compliance with laws, regulations, industry standards, and customs concerning burial procedures and the handling and care of human remains is critical to the continued success of our business and any operations we may acquire. Litigation and regulatory proceedings regarding these issues could have a material adverse effect on our financial condition, results of operations, and cash flows. We are continually monitoring and reviewing our

11

operations in an effort to insure that we are in compliance with these laws, regulations, and standards and, where appropriate, taking appropriate corrective action.

A number of years may elapse before particular tax matters, for which we have established accruals, are audited and finally resolved.

The number of tax years with open tax audits varies depending on the tax jurisdiction. In the United States, the Internal Revenue Service is currently examining our tax returns for 1999 through 2005 and various state jurisdictions are auditing years through 2006. While it is often difficult to predict the final outcome or the timing of resolution of any particular tax matter, we believe that our accruals reflect the probable outcome of known tax contingencies. Unfavorable settlement of any particular issue would reduce a deferred tax asset or require the use of cash. Favorable resolution could result in reduced income tax expense reported in the financial statements in the future.

Failure to maintain effective internal control over financial reporting could adversely affect our financial results, our operations and our stock price, and cause investors to lose confidence in the reliability of our financial statements.

Effective internal control over financial reporting is necessary for us to provide reliable financial reports. When we identify material weaknesses in our internal control over financial reporting, such as those disclosed in Item 9A, we are unable to conclude that our internal control over financial reporting is effective. In such event, our financial results, operations and stock price could be adversely affected, and investors could lose confidence in the reliability of our financial statements.

| |

| Item 1B. | Unresolved Staff Comments. |

None.

Information regarding properties is set forth in Part I, Item 1. Business of thisForm 10-K.

| |

| Item 3. | Legal Proceedings. |

Information regarding legal proceedings is set forth in Part II, Item 8. Financial Statements and Supplementary Data, Note 13 of thisForm 10-K.

| |

| Item 4. | Submission of Matters to a Vote of Security Holders. |

None.

12

EXECUTIVE OFFICERS OF THE COMPANY

The following table sets forth as of February 29, 2008 the name and age of each executive officer of the Company, the office held, and the year first elected an officer.

| | | | | | | | | |

| | | | | | | Year First

|

| | | | | | | Became

|

Officer Name | | Age | | Position | | Officer |

| |

| R. L. Waltrip | | 77 | | Chairman of the Board | | | 1962 | |

| Thomas L. Ryan | | 42 | | President and Chief Executive Officer | | | 1999 | |

| Michael R. Webb | | 49 | | Executive Vice President and Chief Operating Officer | | | 1998 | |

| J. Daniel Garrison | | 56 | | Senior Vice President Operations Support | | | 1998 | |

| Philip C. Jacobs | | 53 | | Senior Vice President and Chief Marketing Officer | | | 2007 | |

| Stephen M. Mack | | 56 | | Senior Vice President Middle Market Operations | | | 1998 | |

| Gregory T. Sangalis | | 52 | | Senior Vice President General Counsel and Secretary | | | 2007 | |

| Eric D. Tanzberger | | 39 | | Senior Vice President Chief Financial Officer and Treasurer | | | 2000 | |

| Sumner J. Waring, III | | 39 | | Senior Vice President Major Market Operations | | | 2002 | |

| Jeffrey I. Beason | | 59 | | Vice President Corporate Controller | | | 2006 | |

| Christopher H. Cruger | | 33 | | Vice President Business Development | | | 2005 | |

| Joseph A. Hayes | | 51 | | Vice President Ethics and Business Conduct and Assistant General Counsel | | | 2007 | |

| Jane D. Jones | | 52 | | Vice President Human Resources | | | 2005 | |

| Albert R. Lohse | | 47 | | Vice President Litigation and Risk Management | | | 2004 | |

| Elisabeth G. Nash | | 46 | | Vice President Process and Technology | | | 2004 | |

| Donald R. Robinson | | 50 | | Vice President Supply Chain Management | | | 2005 | |

Mr. Waltrip is the founder, Chairman of the Company, and a licensed funeral director. He grew up in his family’s funeral business and assumed management of the firm in the 1950s after earning a Bachelor’s degree in Business Administration from the University of Houston. He began buying additional funeral homes in the 1960s, achieving cost efficiencies by pooling their resources. At the end of 2007, the network he began had grown to include more than 1,700 funeral service locations and cemeteries. Mr. Waltrip took the Company public in 1969. He has provided leadership to the Company for over 40 years. In 2005, Mr. Waltrip resigned as Chief Executive Officer, but he continues to serve as Chairman of the Board.

Mr. Ryan joined the Company in June 1996 and served in a variety of financial management roles within the Company. In February 1999, Mr. Ryan was promoted to Vice President International Finance. In November 2000, he was promoted to Chief Executive Officer of European Operations based in Paris, France. In July 2002, Mr. Ryan was appointed President and Chief Operating Officer. In February 2005, he was promoted to Chief Executive Officer. Prior to joining the Company, Mr. Ryan was a Certified Public Accountant with Coopers & Lybrand L.L.P. for more than five years. Mr. Ryan is a Certified Public Accountant and holds a Bachelor of Business Administration degree from the University of Texas-Austin.

Mr. Webb joined the Company in 1991 when it acquired Arlington Corporation, a regional funeral and cemetery consolidator, where he was then Chief Financial Officer. Prior to joining Arlington Corporation, Mr. Webb held various executive financial and development roles at Days Inns of America and Telemundo Group, Inc. In 1993, Mr. Webb joined our corporate development group, which he later led on a global basis before accepting operational responsibility for our Australian and Hispanic businesses. Mr. Webb was promoted to Vice President

13

International Corporate Development in February 1998 and was named Executive Vice President in July 2002. In February 2005, he was promoted to Chief Operating Officer. He is a graduate of the University of Georgia, where he earned a Bachelor of Business Administration degree.

Mr. Garrison joined the Company in 1978 and worked in a series of management positions until he was promoted to President of the Southeastern Region in 1992. In 1998, Mr. Garrison was promoted to Vice President International Operations. In 2000, Mr. Garrison became Vice President North American Cemetery Operations and was promoted to Vice President Operations Services in August 2002. He assumed his current position as Senior Vice President Operations Support in February 2005. Mr. Garrison has a Bachelor of Science degree in Administrative Management from Clemson University.

Mr. Jacobs joined SCI in 2007 as Senior Vice President and Chief Marketing Officer. Prior to joining the Company, Mr. Jacobs was employed by CompUSA as Chief Marketing Officer. Prior to that he was employed by Publicis Worldwide as Chief Marketing Officer and prior to that held other management roles over the past 23 years at several of the nation’s top advertising agencies, as well as client-side positions. Mr. Jacobs holds a Bachelor of Science degree from the University of Tennessee and a Masters degree from Vanderbilt University.

Mr. Mack joined the Company in 1973 as a resident director after graduating from Farmingdale State University of New York. He became Vice President of the Eastern Region in 1987 and in February 1998 Mr. Mack was appointed Vice President North American Funeral Operations. Mr. Mack was promoted to Senior Vice President Eastern Operations in August 2002 and assumed the office of Senior Vice President Middle Market Operations, his current position, in May 2004.

Mr. Sangalis joined the Company in 2007 as Senior Vice President General Counsel and Secretary. He previously served as Senior Vice President, Law and Administration for Team Inc., a leading provider of specialty industrial maintenance and construction services. Prior to that, Mr. Sangalis served as Managing Director and General Counsel of Main Street Equity Ventures II, a private equity investment firm, and as Senior Vice President General Counsel and Secretary for Waste Management Inc., the leading provider of waste management services in North America. Mr. Sangalis holds a bachelor’s degree in finance from Indiana University and an M.B.A. from the University of Minnesota. He earned his juris doctorate from the University of Minnesota Law School.

Mr. Tanzberger joined the Company in August 1996 as Manager of Budgets & Financial Analysis. He was promoted to Vice President Investor Relations and Assistant Corporate Controller in January 2000 and to Corporate Controller in August 2002. In 2006, Mr. Tanzberger was promoted to the position of Senior Vice President and Chief Financial Officer. In 2007, Mr. Tanzberger was appointed Treasurer. Prior to joining the Company, Mr. Tanzberger was Assistant Corporate Controller at Kirby Marine Transportation Corporation, an inland waterway barge and tanker company, from January through August 1996. Prior thereto, he was a Certified Public Accountant with Coopers & Lybrand L.L.P. for more than five years. Mr. Tanzberger is a graduate of the University of Notre Dame, where he earned a Bachelor of Business Administration degree.

Mr. Waring, a licensed funeral director, joined the Company as an Area Vice President in 1996 when we merged with his family’s funeral business. Mr. Waring was appointed Regional President of the Northeast Region in 1999 and was promoted to Regional President of the Pacific Region in September 2001. Mr. Waring was promoted to Vice President Western Operations in August 2002 and assumed the office of Vice President Major Market Operations in November 2003. In February 2006, Mr. Waring was promoted to Senior Vice President Major Market Operations. Mr. Waring holds a Bachelor of Science degree in Business Administration from Stetson University in Deland, Florida, a degree in Mortuary Science from Mt. Ida College and a Masters of Business Administration degree from the University of Massachusetts Dartmouth.

Mr. Beason joined SCI in July 2006 as Vice President and Corporate Controller. Prior to joining SCI, he was an employee of El Paso Corporation, a natural gas transmission and production company. Mr. Beason joined El Paso in 1978 and held various accounting and reporting roles until 1993. From 1993 to 1996, he held the position of Sr. Vice President Administration of Mojave Pipeline Operating Company, a wholly owned subsidiary of El Paso Corporation. From 1996 to November 2005, Mr. Beason was Senior Vice President Controller and Chief Accounting Officer of El Paso Corporation. He is a Certified Public Accountant and holds a Bachelor of Business Administration in Accounting degree from Texas Tech University.

14

Mr. Cruger oversees Corporate Development, real estate, and the Dignity Memorial® affiliate network of independent funeral homes. He initially served the Company as a financial analyst in the corporate development department from 1996 until 1999, when he left to become Manager of Financial Analysis for R. H. Donnelley Corporation. During 2000, he returned to SCI to focus on international divestitures. From 2003 to February 2005, he served as Managing Director of Corporate Development. In February 2005, he was promoted to Vice President of Business Development. Mr. Cruger graduated from Lehigh University with a Bachelor of Science in Finance.

Mr. Hayes was appointed Vice President Ethics and Business Conduct and Assistant General Counsel in November 2007. Mr. Hayes joined the Company in 1991 as corporate counsel. He was named Managing Counsel in 1996 and Assistant General Counsel in 2005. Prior to joining SCI, Mr. Hayes practiced law in Chicago and San Diego, specializing in securities, mergers and acquisitions, and commercial transactions. He received a bachelors degree in commerce from DePaul University and earned his juris doctorate from the University of California at Berkeley.

Mrs. Jones joined SCI in 2003 from Dynegy, Inc., where she served as Vice President of Total Rewards. She oversees human resources, training and education, and payroll and commission services — activities that assist approximately 20,000 employees in North America. Mrs. Jones was promoted to Vice President Human Resources in February 2005. She holds a Bachelor of Business Administration degree in Accounting with a minor in Finance from Southern Methodist University. She is a Certified Compensation Professional.

Mr. Lohse joined SCI in 2000 as Managing Director of Litigation and has since been involved in the resolution of major litigation issues for the Company. In 2004, Mr. Lohse was promoted to Vice President Corporate Governance. Before joining the Company, Mr. Lohse was Managing Partner at McDade, Fogler, Maines & Lohse where he conducted a general civil trial practice. Prior to that, he practiced tort and commercial litigation at Fulbright & Jaworski. Mr. Lohse received a Bachelor of Business Administration degree from the University of Texas and a Juris Doctor from the University of Houston Law Center.

Ms. Nash joined SCI in 2002 as Managing Director of Strategic Planning and Process Improvement. Prior to joining SCI, Ms. Nash worked for the Pennzoil Corporation and held various senior management accounting and financial positions. In 2004, Ms. Nash was promoted to Vice President Continuous Process Improvement. Her primary responsibilities include improving operating systems, reducing overhead costs, and identifying and assisting in the implementation of initiatives to improve operating profit margins and cash flow. She is a graduate of Texas A&M University where she received a Bachelor of Business Administration degree in Accounting.

Mr. Robinson joined SCI in 1996 as Director of Procurement. Prior to joining the Company Mr. Robinson was employed by Marathon Oil Company, where he spent 16 years in a variety of procurement, logistics, and information technology positions. In February 2005, he was promoted to Vice President Supply Chain Management. Prior to this promotion, he was Managing Director of Business Support Services, a position in which he oversaw fleet management and office services; voice, travel, and shipping services; and supply chain and purchasing activities. Mr. Robinson holds a Bachelor of Science degree in Business Administration with a minor in Computer Service from Taylor University in Upland, Indiana.

Each officer of the Company is elected by the Board of Directors and holds their office until a successor is elected and qualified or until earlier death, resignation, or removal in the manner prescribed in the Bylaws of the Company. Each officer of a subsidiary of the Company is elected by the subsidiary’s board of directors and holds their office until a successor is elected and qualified or until earlier death, resignation, or removal in the manner prescribed in the Bylaws of the Subsidiary.

15

PART II

| |

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. |

Our common stock has been traded on the New York Stock Exchange since May 14, 1974. On December 31, 2007, there were 5,018 holders of record of our common stock. In calculating the number of shareholders, we consider clearing agencies and security position listings as one shareholder for each agency or listing. At December 31, 2007, we had 262,858,169 shares outstanding, net of 1,961,300 treasury shares.

During 2007, we paid cash dividends totaling $34.6 million and accrued $10.6 million for dividends paid on January 31, 2008. While we intend to pay regular quarterly cash dividends for the foreseeable future, all subsequent dividends are subject to final determination by our Board of Directors each quarter after its review of our financial performance.

The table below shows our quarterly high and low closing common stock prices for the two years ended December 31, 2007:

| | | | | | | | | | | | | | | | | |

| | | 2007 | | | 2006 | |

| | | High | | | Low | | | High | | | Low | |

| |

| First quarter | | $ | 12.20 | | | $ | 10.31 | | | $ | 8.46 | | | $ | 7.75 | |

| Second quarter | | $ | 13.98 | | | $ | 11.66 | | | $ | 8.50 | | | $ | 7.73 | |

| Third quarter | | $ | 12.90 | | | $ | 11.04 | | | $ | 9.34 | | | $ | 7.37 | |

| Fourth quarter | | $ | 14.47 | | | $ | 12.83 | | | $ | 10.45 | | | $ | 8.97 | |

Options in our common stock are traded on the Philadelphia Stock Exchange. Our common stock is traded on the New York Stock Exchange under the symbol SCI.

Stock Performance Graph. This graph assumes the total return on $100 invested on December 31, 2002, in SCI Common Stock, the S&P 500 Index, and a peer group selected by the Company (the “Peer Group”). The Peer Group is comprised of Alderwoods Group, Inc., Carriage Services, Inc., Hillenbrand Industries, Inc., Matthews International Corp., Rock of Ages Corporation, and Stewart Enterprises, Inc. Alderwoods Group is included in the Peer Group until November 28, 2006, when it was acquired by SCI. Total return data assumes reinvestment of dividends.

TOTAL SHAREHOLDER RETURNS

For equity compensation plan information, see Part III of thisForm 10-K.

16

On October 31, 2007, we issued 361 deferred common stock equivalents or units pursuant to provisions regarding the receipt of dividends under the Amended and Restated Director Fee Plan to four non-employee directors. These issuances were unregistered as they did not constitute a “sale” within the meaning of Section 2(3) of the Securities Act of 1933, as amended.

Since 2004, we have repurchased a total of $868.4 million of common stock at an average cost per share of $9.70. During the three months ended December 31, 2007, we repurchased 21,614,539 shares of our common stock at an aggregate cost of $293.4 million and an average cost per share of $13.57. In November 2007, our Board of Directors approved an increase in our share repurchase program authorizing the investment of up to an additional $250 million to repurchase our common stock. The remaining dollar value of shares to be purchased under the share repurchase program was $145.6 million at December 31, 2007. As discussed in Item 1A, our credit agreement and debt securities contain covenants that restrict our ability to repurchase our common stock. Pursuant to the program, we repurchased shares of our common stock during the fourth quarter of 2007 as set forth in the table below:

| | | | | | | | | | | | | | | | | |

| | | | | | | | | Total Number of

| | | Dollar Value of

| |

| | | Total Number

| | | Average

| | | Shares Purchased

| | | Shares That May

| |

| | | of Shares

| | | Price Paid

| | | as Part of Publicly

| | | Yet be Purchased

| |

Period | | Purchased | | | per Share | | | Announced Programs | | | Under the Program | |

| |

| October 1, 2007 — October 31, 2007 | | | 3,518,100 | | | $ | 13.21 | | | | 3,518,100 | | | $ | 142,477,192 | |

| November 1, 2007 — November 30, 2007 | | | 13,590,245 | | | $ | 13.68 | | | | 13,590,245 | | | $ | 206,609,329 | |

| December 1, 2007 — December 31, 2007 | | | 4,506,194 | | | $ | 13.54 | | | | 4,506,194 | | | $ | 145,598,820 | |

| | | | | | | | | | | | | | | | | |

| | | | 21,614,539 | | | | | | | | 21,614,539 | | | | | |

Subsequent to December 31, 2007, we repurchased an additional 1,645,600 shares of common stock at an aggregate cost of $22.5 million including commissions (average cost per share of $13.68). After these purchases, the remaining dollar value of shares authorized to be purchased under our share repurchase program was approximately $123.1 million.

| |

| Item 6. | Selected Financial Data. |

The table below contains selected consolidated financial data for the years ended December 31, 2003 through December 31, 2007. The statement of operations data includes reclassifications of certain items to conform to current period presentations with no impact on net income or financial position.

The data set forth below should be read in conjunction with our consolidated financial statements and accompanying notes to the consolidated financial statements included in thisForm 10-K. This historical information is not necessarily indicative of future results.

17

Selected Consolidated Financial Information

| | | | | | | | | | | | | | | | | | | | | |

| | | Years Ended December 31, | |

| | | 2007(5) | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

| | | (Dollars in millions, except per share amounts) | |

| |

Selected Consolidated Statements of Operations Data: | | | | | | | | | | | | | | | | | | | | |

| Revenue | | $ | 2,285.3 | | | $ | 1,752.9 | | | $ | 1,717.0 | | | $ | 1,832.0 | | | $ | 2,314.5 | |

| Income from continuing operations before cumulative effect of accounting changes | | $ | 243.3 | | | $ | 52.6 | | | $ | 55.1 | | | $ | 117.4 | | | $ | 69.1 | |

| Income from discontinued operations, net of tax(1) | | $ | 4.4 | | | $ | 3.9 | | | $ | 4.5 | | | $ | 43.8 | | | $ | 16.0 | |

| Cumulative effect of accounting changes, net of tax(2)(3)(4) | | | — | | | | — | | | $ | (187.5 | ) | | $ | (50.6 | ) | | | — | |

| Net income (loss) | | $ | 247.7 | | | $ | 56.5 | | | $ | (127.9 | ) | | $ | 110.7 | | | $ | 85.1 | |

| Earnings (loss) per share: | | | | | | | | | | | | | | | | | | | | |

| Income from continuing operations before cumulative effect of accounting changes | | | | | | | | | | | | | | | | | | | | |

| Basic | | $ | .85 | | | $ | .18 | | | $ | .18 | | | $ | .37 | | | $ | .23 | |

| Diluted | | $ | .83 | | | $ | .18 | | | $ | .18 | | | $ | .36 | | | $ | .23 | |

| Net income (loss) | | | | | | | | | | | | | | | | | | | | |

| Basic | | $ | .87 | | | $ | .19 | | | $ | (.42 | ) | | $ | .35 | | | $ | .28 | |

| Diluted | | $ | .85 | | | $ | .19 | | | $ | (.42 | ) | | $ | .34 | | | $ | .28 | |

| Cash dividends declared per share | | $ | 0.13 | | | $ | 0.105 | | | $ | 0.10 | | | $ | — | | | $ | — | |

Selected Consolidated Balance Sheet Data (at December 31): | | | | | | | | | | | | | | | | | | | | |

| Total assets | | $ | 8,932.2 | | | $ | 9,729.4 | | | $ | 7,544.8 | | | $ | 8,227.2 | | | $ | 7,571.2 | |

| Long-term debt (less current maturities), including capital leases | | $ | 1,820.1 | | | $ | 1,912.7 | | | $ | 1,186.5 | | | $ | 1,200.4 | | | $ | 1,530.1 | |

| Stockholders’ equity | | $ | 1,492.1 | | | $ | 1,594.8 | | | $ | 1,581.6 | | | $ | 1,843.0 | | | $ | 1,516.3 | |

Selected Consolidated Statement of Cash Flows Data: | | | | | | | | | | | | | | | | | | | | |

| Net cash provided by operating activities | | $ | 356.2 | | | $ | 324.2 | | | $ | 312.9 | | | $ | 94.2 | | | $ | 374.3 | |

| | |

| (1) | | Our operations in Singapore, which were sold in 2006 and in Argentina, Uruguay, and Chile, which were sold in 2005 have been classified as discontinued operations for all periods presented. The operations of Mayflower, which were sold in 2007, have been classified as discontinued operations in 2007 and 2006 (since acquisition). For more information regarding discontinued operations, see Part II, Item 8. Financial Statements and Supplementary Data, Note 20, of thisForm 10-K. |

| |

| (2) | | Results for 2007, 2006, and 2005 reflect our change in accounting for direct selling costs related to preneed funeral and cemetery contracts. Results for 2005 include a $187.5 million charge, net of tax, for the cumulative effect of this change. For more information regarding this accounting change, see Part II, Item 8. Financial Statements and Supplementary Data, Note 3, of thisForm 10-K. |

| |

| (3) | | On March 18, 2004, we implemented revised Financial Accounting Standards Board (FASB) Interpretation No. 46 (FIN 46R). Under the provisions of FIN 46R, we are required to consolidate our preneed funeral and cemetery merchandise and service trust assets, cemetery perpetual care trusts, and certain cemeteries. As a result of this accounting change, we recognized a cumulative effect charge of $14.0 million, net of tax, in 2004. |

| |

| (4) | | Results for 2007, 2006, 2005, and 2004 reflect our change in accounting for pension gains and losses. Results for 2004 include a $36.6 million charge, net of tax, for the cumulative effect of this change. |

| |

| (5) | | Results for 2007 include a $158.1 million pretax gain on redemption of securities. |

18

| |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations. |

The Company

We are North America’s leading provider of deathcare products and services, with a network of funeral homes and cemeteries unequalled in geographic scale and reach. During 2007, we accomplished our key goal by substantially completing the integration of Alderwoods into our operations. By combining the two leading companies in the deathcare industry, we have realized several cost-saving synergies through the elimination of duplicate information technology systems and infrastructure; duplicate accounting, finance, legal, and other systems; overlapping management; and duplicate executive and public company costs. In connection with the acquisition of Alderwoods, we identified annual pretax cost savings and revenue enhancement opportunities totaling $90 million to $100 million related to our integration of Alderwoods.

We continue to focus on returning capital to our shareholders. Since August 2004, we have invested nearly $1 billion in cumulative stock repurchases and quarterly dividends. We currently have over $123.1 million authorized to repurchase our common stock. Our financial stability is further enhanced by our $6.7 billion backlog of future revenues at December 31, 2007, which is the result of preneed funeral and cemetery sales. We believe we have the financial strength and flexibility to reward shareholders through dividends while maintaining a prudent capital structure and pursuing new opportunities for profitable growth.

Strategies for Growth

We are confident about our competitive position, our financial strength, and our ability to further our principal strategies to generate profitable growth over the long-term are as follows:

Target Our Customer

In 2007, we made good progress in better understanding our atneed consumers and their preferences. We are replacing the industry’s traditional one-size-fits-all service approach with a flexible operating and marketing strategy that is tailored to our customers’ needs. By doing so, we can focus our resources on the most profitable customer categories and improve our effectiveness. We continue to refine our pricing, product and market strategies to support this approach.

Consistent with this strategy, we made local business decisions in the last few years to exit unprofitable business relationships and activities, which resulted in a decrease in the number of total funeral services performed. However, we also experienced significant improvements in average revenue per funeral service. We expect these improvements to continue into the future as we redeploy resources to more profitable areas. We continue to analyze our existing operations, including those acquired in the Alderwoods acquisition, and may exit certain business relationships or activities that do not fit our customer segmentation strategy.

Going forward, our primary focus is shifting to the preneed consumer. We intend to develop a more compelling marketing message that is tailored to our customers and explore new marketing channels that will take advantage of our size. We are improving our selling approach and process to better attract and educate prospective customers. We continue to review our product and service offerings for opportunities to better serve our customers. And, we are working to establish an appropriate and effective means of ongoing communications with our preneed consumers that will lead to referrals.

Drive Operating Discipline and Leverage Our Scale

Although we have already made substantial improvements to our infrastructure, we believe we can continue to achieve operating improvements through better centralization and standardization of processes for staffing, central care, fleet management and cemetery maintenance. The acquisition of Alderwoods provides further opportunities for synergies and operating efficiencies, which will allow us to utilize our scale and increase profitability. We have developed and will continue to refine operating standards and track shared best practices to support higher productivity. We also intend to continue to capitalize on our nationwide network of properties by pursuing strategic affinity partnerships. Over the longer term, we believe these relationships can be important to potential customers in their funeral home and cemetery selection process.

19

Manage and Grow the Footprint

We are managing our network of business locations by positioning each business location to support the preferences of its local customer base while monitoring each market for changing demographics and competitive dynamics. As we develop comprehensive plans for each of our markets, we anticipate that we will have opportunities to decrease the number of locations without losing significant earnings. In addition, we expect to pursue selective business expansion through construction or targeted acquisitions of cemeteries and funeral homes with a focus on the highest return customer categories. Over the long term, our size and scale also allow us the opportunity to pursue a franchise business model, which could drive incremental revenue at very little cost.

Financial Condition, Liquidity and Capital Resources

Capital Allocation Considerations

Since 1999, we have gained significant financial flexibility by reducing debt and improving our cash flow. We rely on cash flow from operations as a significant source of liquidity. Our cash flow from operating activities provided $356.2 million in 2007. Our current cash and cash equivalents balance is approximately $150 million as of February 25, 2008. In addition, we have approximately $246 million in borrowing capacity under our5-year revolving credit facility (which is currently supporting $54.3 million of letters of credit). We have $45.2 million in 6.5% notes due in March 2008; however, we intend to refinance these notes on a long-term basis through the utilization of our revolving credit agreement. We believe these sources of liquidity can be supplemented by our ability to access the capital markets for additional debt or equity securities.

In order to finance the Alderwoods acquisition, we significantly increased our indebtedness in the fourth quarter of 2006. In addition to using $608 million of cash on hand, we issued $500 million in senior notes, $200 million in privately placed debt securities, and took out a $150 million term loan for up to three years under our new credit facility. We prepaid $50 million of our term loan indebtedness in December 2006 and prepaid the remaining $100 million in 2007. At December 31, 2007, our current liabilities exceeded our current assets by $5.1 million. We believe our future operating cash flows and the available capacity under our credit facility described above will be adequate to meet our working capital needs.

During 2007, we had the following issuances and repayments of our debt:

| | | | | | | | | | | | |

| | | Interest Rate | | | Principal | | | Due Date |

| | | (In millions) |

Issuances | | | | | | | | | | | |

| Notes | | | 6.75% | | | $ | 200 | | | | 2015 |

| Notes | | | 7.5% | | | | 200 | | | | 2027 |

| | | | | | | | | | | | |

| Issuances through December 31, 2007 | | | | | | $ | 400 | | | | |

| | | | | | | | | | | | |

Repayments — normal retirements | | | | | | | | | | | |

| Notes | | | 6.875% | | | $ | 13 | | | | 2007 |

| Other | | | various | | | | 16 | | | | various |

| | | | | | | | | | | | |

| Repayments through December 31, 2007 | | | | | | $ | 29 | | | | |

| | | | | | | | | | | | |

Repayments — early extinguishment | | | | | | | | | | | |

| Notes | | | 6.5% | | | $ | 150 | | | | 2008 |

| Notes | | | 7.7% | | | | 174 | | | | 2009 |

| Senior Notes Series A | | | Libor + 2.0% | | | | 50 | | | | 2011 |

| Term Loan | | | Libor + 2.0% | | | | 100 | | | | 2009 |

| | | | | | | | | | | | |

| Repayments through December 31, 2007 | | | | | | $ | 474 | | | | |

| | | | | | | | | | | | |

We will continue to focus on funding growth initiatives that generate increased profitability, revenue, and cash flows. These capital investments include the construction of high-end cemetery property (such as private family estates) and the construction of funeral home facilities. We will also consider the acquisition of additional deathcare operations that fit our long-term customer-focused strategy, if the expected returns exceed our cost of capital.

20

We paid our shareholders cash dividends from 1974 to 1999. In early 2005, we resumed paying shareholders a quarterly cash dividend of $0.025 per common share. In November 2006, we increased our quarterly dividend to $0.03 per common share. In November 2007, we increased our dividend to $0.04 per common share. While we intend to pay regular quarterly cash dividends for the foreseeable future, all future dividends are subject to final determination by our Board of Directors each quarter after its review of our financial performance and to limitations in debt covenants.

We currently have approximately $123.1 million authorized under our share repurchase program. We intend to make purchases from time to time in the open market or through privately negotiated transactions, subject to market conditions, debt covenants, and normal trading restrictions. Our credit agreement and privately-placed debt securities contain covenants that limit our ability to repurchase our common stock. There can be no assurance that we will buy our common stock under our share repurchase program in the future.

Cash Flow

We believe our ability to generate strong operating cash flow is one of our fundamental financial strengths and provides us with substantial flexibility in meeting operating and investing needs. Highlights of cash flow for the year ended December 31, 2007 compared to 2006 and 2005 are as follows:

Operating Activities — Cash flows from operating activities were $356.2 million in 2007 compared to $324.2 million in 2006. The 2006 cash flows from operating activities increased by $11.4 million as compared to the operating cash flows in 2005. Included in 2007 are one-time transition costs related to the Alderwoods acquisition of $38.6 million, $11.7 million of premiums paid on the early extinguishment of debt, pension termination costs of $40.9 million, and a distribution from our equity investment in our French operations of $17.0 million. Included in 2006 are transition costs related to the Alderwoods acquisition of $3.2 million and $15.7 million of premiums paid on the early extinguishment of debt. Included in 2005 was a federal income tax refund of $29.0 million and $12.2 million of premiums paid on the early extinguishment of debt.

Excluding the above items, cash flows from operating activities in 2007 increased approximately $87 million compared to 2006. This increase includes additional cash flow and synergies achieved related to the Alderwoods acquisition as well as $26.1 million in trust proceeds arising from our recent reconciliations of the preneed funeral and cemetery backlogs of Alderwoods. These increases were partially offset by $42.4 million in additional interest payments resulting from increased borrowings to finance the Alderwoods acquisition and $29 million in additional cash tax payments.

In addition to the items discussed above, the increase in operating cash flows in 2006 as compared to 2005 is the result of $21.2 million of rent payments that were classified in operating cash flows in 2005, but which are classified as principal payments on capital leases as a component of cash flows from financing activities in 2006 due to our revised lease terms. The remaining increase is the result of $10.9 million in proceeds from the redemption of convertible preferred equity certificates received in connection with our disposition of our operations in France, the receipt of $7.9 million of endowment care proceeds as a result of the resolution of disputes over ownership rights, and a net source of approximately $10.0 million from working capital. This working capital source resulted from an increase in preneed and atneed cash receipts, and increases in cash interest income, which were partially offset by an increase in bonus and long-term incentive compensation payments in 2006 related to a 2003 compensation program.

We did not pay federal income taxes in 2006 or 2005. Because of our net operating loss carryforwards, we did not pay federal income taxes until the fourth quarter of 2007. The federal income tax payment was $8.3 million in 2007. We expect to pay federal income taxes in 2008. Foreign, state, and local income tax payments increased $20.6 million to $36.2 million in 2007 as compared to $15.6 million in 2006 and $6.6 million in 2005 primarily as a result of the additional taxable income generated from our Alderwoods operations acquired at the end of 2006.

Investing Activities — Investing activities provided net cash flows of $378.1 million in 2007 compared to net cash used of $1.3 billion in 2006, due to $1.3 billion in cash outflows for acquisitions in 2006 (primarily Alderwoods) and a $327.5 million increase in proceeds from divestitures in 2007 compared to 2006. The 2006 net

21

cash outflows from investing activities of $1.3 billion represents a $1.5 billion change from 2005 primarily due to the 2006 acquisition of Alderwoods.

In 2007, we completed the sale of Mayflower National Life Insurance Company, Alderwoods former insurance subsidiary, and we divested all of our properties required to be divested by the FTC as a result of the Alderwoods acquisition. We also received $4.7 million of proceeds held as an income tax receivable related to the 2005 sale of our operations in Chile, $1.9 million in cash proceeds related to the 2006 sale of our operations in Singapore, and $144.0 million related to redemption of securities.

In 2006, we acquired Alderwoods for $1.2 billion, including refinancing of $357.7 million of Alderwoods debt. We also received $11.0 million of proceeds held as an income tax receivable related to the 2005 sale of our operations in Chile and $10.6 million in cash proceeds from the fourth quarter 2006 sale of our operations in Singapore.

In 2005, we received $90.4 million from the disposition of our cemetery operations in Chile, $42.7 million related to the collection of the EUR 10 million note receivable and the redemption of preferred equity certificates related to our equity investment in our former French operations (of which $39.7 million is reported as an investing activity), and $21.6 million from the disposition of our Argentina and Uruguay businesses.

Financing Activities — Cash flows from financing activities used $607.5 million in 2007 compared to generating $565.2 million in 2006. This $1.2 billion net decrease in financing cash flows in 2007 compared to 2006 was driven by lower proceeds from the issuance of long-term debt, higher share repurchases, and an increase in debt extinguishments. Cash flows from financing activities generated incremental cash of $891.6 million in 2006 compared to 2005 primarily due to higher proceeds from the issuance of long-term debt, a reduction in share repurchases, and a reduction in debt payments.

Proceeds from long-term debt (net of debt issuance costs) were $392.6 million in 2007 due to the issuance of $200.0 million of senior unsecured 6.75% notes due 2015 and $200.0 million of senior unsecured 7.50% notes due 2027. Proceeds from long-term debt (net of debt issuance costs) were $825.3 million in 2006 due to the issuance of $250.0 million of senior unsecured 7.625% notes due 2018, $250.0 million of senior unsecured 7.375% notes due 2014, $200 million of private placement offerings, and $150 million term loan. Proceeds from long term debt (net of debt issuance costs) were $291.5 million in 2005 due to the issuance of $300 million of senior unsecured 7.00% notes due 2017.

Payments of debt in 2007 were $528.8 million due to early extinguishments of $472.5 million, the acceptance of the tender of $13.5 million of our 6.875% notes due October 2007, $3.7 million in scheduled debt payments, $27.1 million in payments on capital leases, and $12.0 million of other note payments. Payments of debt in 2006 were $228.9 million due to early extinguishments of $181.5 million, $26.1 million in scheduled debt payments, and $21.3 million in payments on capital leases. The $377.1 million of debt payments in 2005 include early extinguishments of $291.3 million, the $63.5 million final payment of our 6.00% notes due December 2005 and $22.3 million of other note payments.

We repurchased 38.5 million shares of common stock for $505.1 million in 2007, compared to 3.4 million shares for $27.9 million in 2006 and 31.0 million shares for $225.1 million in 2005.

We paid $34.6 million of cash dividends during 2007, $29.4 million of cash dividends during 2006 and $22.6 million of cash dividends during 2005 related to the quarterly cash dividend reinstated in 2005 by the Board of Directors.

Off-Balance Sheet Arrangements, Contractual Obligations, and Commercial and Contingent Commitments

We have assumed various financial obligations and commitments in the ordinary course of conducting our business. We have contractual obligations requiring future cash payments under existing contractual arrangements, such as debt maturities, interest on long-term debt, and employment, consulting, and non-competition agreements. We also have commercial and contingent obligations that result in cash payments only if certain events occur requiring our performance pursuant to a funding commitment.

22

The following table details our known future cash payments (on an undiscounted basis) related to various contractual obligations as of December 31, 2007.

| | | | | | | | | | | | | | | | | | | | | |

| | | Payments Due by Period | |

Contractual Obligations | | 2008 | | | 2009-2010 | | | 2011-2012 | | | Thereafter | | | Total | |

| | | (Dollars in millions) | |

| |

| Debt maturities(1)(2) | | $ | 36.6 | | | $ | 91.4 | | | $ | 209.2 | | | $ | 1,519.5 | | | $ | 1,856.7 | |

| Interest obligation on long-term debt(3) | | | 131.1 | | | | 254.0 | | | | 233.3 | | | | 570.1 | | | | 1,188.5 | |

| Operating lease agreements(4) | | | 11.3 | | | | 18.4 | | | | 13.1 | | | | 55.4 | | | | 98.2 | |