UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant þ

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material under §240.14a-12

Radian Group Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement if Other Than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

þ No fee required.

¨ Fee paid previously with preliminary materials.

¨ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

April 7, 2022

Dear Stockholder:

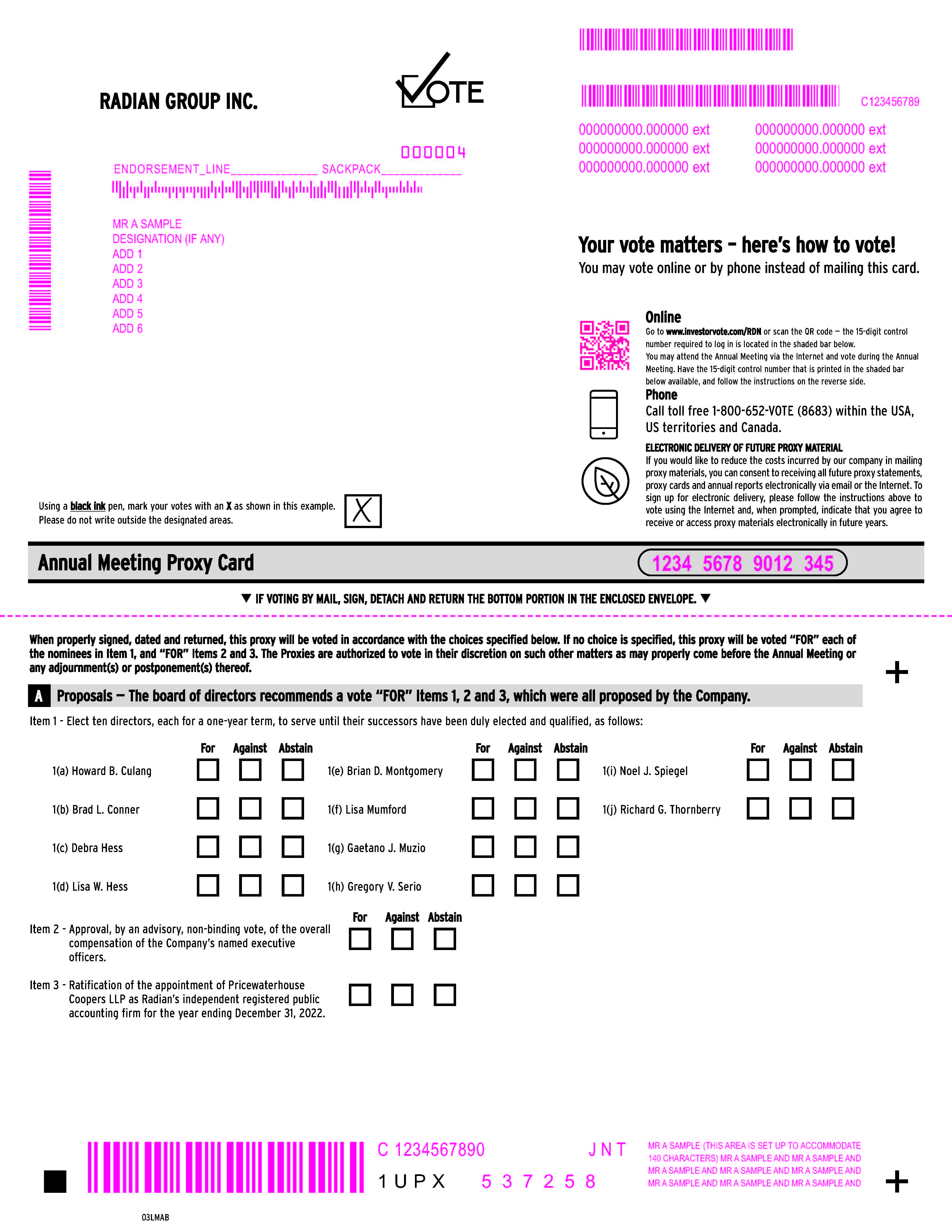

You are cordially invited to attend the 2022 Annual Meeting of Stockholders of Radian Group Inc., which will be held exclusively in virtual format via live audio webcast at 9:00 a.m. Eastern Daylight Time on May 11, 2022. The accompanying Notice of 2022 Annual Meeting of Stockholders and proxy statement describe the items to be considered and acted upon by the stockholders at the meeting. There is no physical location for the meeting.

Regardless of whether you plan to attend the virtual annual meeting, please sign, date and return the enclosed proxy card as soon as possible so that your shares can be voted in accordance with your instructions. If you attend the virtual meeting, you may revoke your proxy, if you wish, and vote your shares electronically. Because the representation of stockholders at the annual meeting is very important, we thank you in advance for your participation.

Sincerely,

Edward J. Hoffman

General Counsel and Corporate Secretary

Radian Group Inc.

550 East Swedesford Road, Suite 350 | Wayne, PA 19087 | 800.523.1988 | radian.com

NOTICE OF 2022 ANNUAL MEETING OF STOCKHOLDERS

DATE:

Wednesday, May 11, 2022

TIME:

9:00 a.m. Eastern Daylight Time

PLACE:

Live via the Internet

Please visit: www.meetnow.global/MRH5594

RECORD DATE:

Stockholders of record as of the close of business on March 14, 2022 will be entitled to notice of, and to vote at, the annual meeting or any adjournment or postponement of the meeting.

| | | | | |

ITEMS OF BUSINESS:

|

| 1 | Elect ten directors, each for a one-year term, to serve until their successors have been duly elected and qualified; |

| 2 | Conduct an advisory vote to approve the compensation of our named executive officers; |

| 3 | Ratify the appointment of PricewaterhouseCoopers LLP as Radian’s independent registered public accounting firm for the year ending December 31, 2022; and |

| 4 | In addition to the items above, the Company may transact such other business as may properly come before the meeting or any adjournment or postponement of the meeting. |

Regardless of whether you plan to attend Radian’s virtual annual meeting, please complete and submit your proxy with voting instructions. To submit your proxy by mail, please complete, sign, date and return the accompanying proxy card in the enclosed self-addressed, stamped envelope. For instructions about voting, please see “How Shares May Be Voted by Registered Holders” and “How Shares May Be Voted if Held in “Street Name” on page 2 of the proxy statement.

We have determined that it is in the best interest of Radian and its stockholders to hold the annual meeting “virtually” via live audio webcast. The virtual annual meeting affords our stockholders the same rights and opportunities as an in-person meeting, while allowing them to attend the meeting regardless of their geographic location or other circumstances that could limit their ability to attend an in-person meeting. To attend the annual meeting or examine our list of stockholders, go to www.meetnow.global/MRH5594 at the meeting date and time described above and in the accompanying proxy statement. There is no physical location for the annual meeting.

By Order of the Board of Directors,

Edward J. Hoffman

General Counsel and Corporate Secretary Wayne, Pennsylvania

April 7, 2022

Radian Group Inc.

550 East Swedesford Road, Suite 350 | Wayne, PA 19087 | 800.523.1988 | radian.com

TABLE OF CONTENTS

RADIAN GROUP INC.

550 East Swedesford Road, Suite 350

Wayne, Pennsylvania 19087

www.radian.com

PROXY STATEMENT

FOR 2022 ANNUAL MEETING OF STOCKHOLDERS

The board of directors (the “Board”) of Radian Group Inc. (“Radian” or the “Company”) is furnishing this proxy statement to solicit proxies from the Company’s stockholders for use at Radian’s 2022 Annual Meeting of Stockholders (the “Annual Meeting”). A copy of the Notice of the Annual Meeting accompanies this proxy statement. These materials are also available on the internet at www.radian.com/StockholderReports. This proxy statement and the accompanying proxy card are being mailed to stockholders beginning on or about April 7, 2022 to furnish information relating to the business to be transacted at the Annual Meeting.

We have determined that it is in the best interest of Radian and its stockholders to hold the Annual Meeting “virtually” via live audio webcast. The virtual Annual Meeting affords our stockholders the same rights and opportunities as an in-person meeting, while allowing them to attend the meeting regardless of their geographic location or other circumstances that could limit their ability to attend an in-person meeting. You will be able to attend and participate in the Annual Meeting online, vote your shares electronically and submit your questions during the meeting by visiting www.meetnow.global/MRH5594 at the meeting date and time described below. There is no physical location for the Annual Meeting.

Information About Voting

Section Table of Contents

Who May Vote

Only stockholders of record on the close of business on March 14, 2022, the record date for the Annual Meeting, may vote at the Annual Meeting. On the record date, 175,378,322 shares of our common stock were outstanding and entitled to vote at the Annual Meeting. For each share of common stock you held on the record date, you will be entitled to one vote on each matter submitted to a vote of stockholders. There is no cumulative voting.

| | | | | | | | |

| Information About Voting | | 2022 Proxy Statement 1 |

| | |

What Shares May Be Voted

You may vote all shares of our common stock owned by you as of the close of business on the record date.

These shares include:

■Shares held directly in your name as the stockholder of record; and

■Shares of which you are the beneficial owner but not the stockholder of record. These are shares not registered in your name, but registered in “street name” through an account you have with a bank, broker or other holder of record (a “Nominee”), including shares owned by the Radian Group Inc. Savings Incentive Plan Stock Fund.

How Shares May Be Voted by Registered Holders

If you are a registered stockholder, meaning you are the stockholder of record, before the Annual Meeting, you may submit a proxy to vote your shares, as follows.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| By Mail: Complete, sign, date and return the enclosed proxy card by mail. | | | | Online: Navigate to www.investorvote.com/RDN and follow the instructions on the screen. It will be necessary to have your proxy card available for reference when you access the web page. | | | | By Telephone: Call toll free 1-800-652-VOTE (1-800-652-8683) within the United States and its territories or Canada, and follow the instructions. It will be necessary to have your proxy card available for reference when you call. | |

Otherwise, you may vote your shares at the Annual Meeting if you attend online. See “How to Participate in the Virtual Annual Meeting” below.

You may revoke your proxy at any time before your shares are voted at the Annual Meeting, as follows.

■Notify our Corporate Secretary in writing that you wish to revoke your proxy;

■Submit another proxy with a later date by mail, internet or telephone, as described above; or

■Attend the Annual Meeting online and give notice of revocation of your proxy (attendance at the Annual Meeting online, by itself, will not constitute revocation).

How Shares May Be Voted if Held in “Street Name”

If you hold your shares in “street name,” meaning your shares are held by a Nominee, you will have received voting instructions from that nominee containing instructions that you must follow in order for your shares to be voted. If you hold your shares in “street name,” you should review and follow the voting instructions provided by your Nominee, including any instructions relating to revoking voting instructions. If your shares are held in “street name” and you wish to vote at the Annual Meeting online, you must obtain a legal proxy from your Nominee.

| | | | | | | | |

2 2022 Proxy Statement | | Information About Voting |

| | |

Your vote is important to Radian. We encourage you to submit your proxy, as described above, even if you plan to attend the Annual Meeting online. You can always revoke your proxy before the meeting or vote online at the meeting, as described above.

How to Participate in the Virtual Annual Meeting

The Annual Meeting will be a completely virtual meeting of stockholders and will be conducted exclusively by live audio webcast. No physical meeting will be held. You will only be able to attend the Annual Meeting online, and, subject to the eligibility requirements below, you will be able to participate by voting and submitting questions, by visiting www.meetnow.global/MRH5594.

The online meeting will begin promptly at 9:00 a.m., Eastern Daylight Time, on May 11, 2022. We encourage you to access the meeting prior to the start time to leave ample time for check-in and to ensure that you can hear streaming audio. The virtual meeting will be accessible on desktop and laptop computers, as well as tablets and smartphones.

Participation by Registered Holders

To participate in the Annual Meeting, you must have been a stockholder of the Company as of the close of business on the record date, or you must hold a valid proxy for the Annual Meeting. If you are a stockholder of record, you will need to review the information included on your proxy card, including the 15-digit control number provided in the shaded bar and log in using that control number.

Participation if Shares Held in “Street Name”

If you hold your shares through a Nominee, you must register in advance to attend the Annual Meeting.

To register, you must obtain a legal proxy, executed in your favor, from the holder of record and submit proof of your legal proxy reflecting the number of shares of Radian common stock you held as of the Record Date, along with your name and email address to Computershare (contact information below). Requests for registration must be labeled as “Legal Proxy” and be received no later than 5:00 p.m., Eastern Daylight Time, on May 6, 2022. You will receive a confirmation of your registration by email after Computershare receives your registration materials.

Requests for registration should be sent to the following.

| | | | | | | | | | | |

| By email | Forward the email from your broker, or attach an image of your legal proxy, to legalproxy@computershare.com | By mail | Computershare

Radian Group Inc. Legal Proxy

P.O. Box 43001

Providence, RI 02940-3001 |

| |

Submitting Questions

Stockholders who log in to the meeting following the instructions above will have the ability to submit questions in writing during the Annual Meeting via the meeting portal at www.meetnow.global/MRH5594.

| | | | | | | | |

| Information About Voting | | 2022 Proxy Statement 3 |

| | |

Troubleshooting Technical Difficulties

If you experience any technical difficulties accessing the Annual Meeting or during the Annual Meeting, please call the toll free number that will be available at www.meetnow.global/MRH5594 for assistance. We will have technicians ready to assist you with any technical difficulties you may have beginning 15 minutes prior to the start of the Annual Meeting.

Where to Find Voting Results

We will announce the preliminary voting results at the conclusion of the Annual Meeting, if practicable, and we will publish the voting results in a Current Report on Form 8-K that will be filed with the United States Securities and Exchange Commission (the “SEC”) within four business days after the conclusion of the Annual Meeting.

Quorum and Votes Required for Approval

A quorum is necessary for us to conduct the business of the Annual Meeting. This means that holders of at least a majority of the shares entitled to vote must be present at the meeting, either live at the virtual meeting or represented by proxy. Your shares are counted as present at the Annual Meeting if you attend and vote during the Annual Meeting online or if you properly complete and return a proxy card or follow the voting instructions provided by your Nominee, as applicable.

The following table summarizes the vote required for approval of each item of business to be transacted at the Annual Meeting. In addition, the table shows the effect on the outcome of the vote of: (i) abstentions; (ii) uninstructed shares held by a Nominee (which result in “broker non-votes” when a beneficial owner of shares held in “street name” does not provide voting instructions and, as a result, the Nominee is prohibited from voting those shares on certain proposals); and (iii) signed but unmarked (i.e., unvoted) proxy cards.

| | | | | | | | | | | | | | |

Proposal | Votes Required for Approval | Effect of Abstentions (1) | Uninstructed Shares/Effect of Broker Non-votes (1) | Signed but Unmarked Proxy Cards (2) |

| Proposal 1 | | | | |

Election of directors

| Majority of votes cast with respect to each nominee (3) | No effect (4) | Not voted/

No effect | Voted “For”

each nominee |

| Proposal 2 | | | | |

Advisory, non-binding vote to approve named executive officer compensation

| Majority of shares present or represented by proxy

and entitled to vote | Same effect as

a vote “Against” | Not voted/

No effect | Voted “For” |

| Proposal 3 | | | | |

Ratification of the appointment of PricewaterhouseCoopers LLP as Radian’s independent registered public accounting firm for the year ending December 31, 2022

| Majority of shares present or represented by proxy

and entitled to vote | Same effect as

a vote “Against” | Discretionary vote by the Nominee (5) | Voted “For” |

(1)Abstentions and broker non-votes are included for purposes of determining whether a quorum is present; however, abstentions are considered “entitled to vote” whereas broker non-votes are not.

| | | | | | | | |

4 2022 Proxy Statement | | Information About Voting |

| | |

(2)If you complete and return your proxy card properly, but do not provide instructions on your proxy card as to how to vote your shares, your shares will be voted as shown in this column and in accordance with the judgment of the individuals named as proxies on the proxy card as to any other matter properly brought before the Annual Meeting.

(3)See below for an explanation of this majority voting standard, which applies with respect to uncontested director elections.

(4)Under Section 4.13(f) of our Second Amended and Restated By-Laws (the “By-Laws”), abstentions are not counted as votes “For” or “Against” a director’s election.

(5)The Nominee is permitted to vote in its discretion with respect to Proposal 3 despite not having received instructions from the beneficial owner.

This year’s election of directors is an uncontested election of directors, meaning the number of director nominees is equal to or less than the number of directors to be elected at the meeting. As described in the table above, in an uncontested election, our directors are elected by majority voting (Proposal 1). Under the majority voting standard, a director is elected only if the number of shares voted “For” that director exceeds the number of shares voted “Against” that director. In accordance with our By-Laws, each of our incumbent directors submits a conditional resignation in advance of the Annual Meeting that will become effective if the number of shares voted “For” that director does not exceed the number of shares voted “Against” that director and the Board accepts the director’s resignation. If retirement eligible, the director also may choose to retire from the Board before the resignation is accepted by the Board and becomes effective. If a sitting director fails to receive a majority of the votes cast, our Board will determine within 90 days of the Annual Meeting whether to accept the resignation of such director, unless the director retires during this 90-day period. If a nominee fails to receive a majority of the votes cast and the Board accepts the director’s resignation or the director retires, there would be a vacancy created on the Board. Our Board would then have the option under our By-Laws either to appoint someone to fill the vacancy or to reduce the size of the Board.

| | | | | | | | |

| Information About Voting | | 2022 Proxy Statement 5 |

| | |

Proposal 1 – Election of Directors

Section Table of Contents

Our Amended and Restated Certificate of Incorporation and our By-Laws provide for the annual election of directors, with the number of directors on our Board to be determined by our Board. Our Board has set the current number of directors at 10.

Upon election, each of our directors serves for a one-year term and until the director’s successor has been duly elected and qualified, or until the director’s earlier removal or resignation. Our Board currently consists of Howard B. Culang, Brad L. Conner, Debra Hess, Lisa W. Hess, Brian D. Montgomery, Lisa Mumford, Gaetano J. Muzio, Gregory V. Serio, Noel J. Spiegel and Richard G. Thornberry.

Upon the recommendation of the Governance Committee of our Board, the Board has nominated each of our current directors for reelection. All nominees (other than our Chief Executive Officer, Mr. Thornberry) are independent under applicable independence rules of the SEC and the New York Stock Exchange (the “NYSE”), and all nominees have consented to be named in this proxy statement and to serve if elected. If, at the time of the Annual Meeting, any nominee is not available for election, proxies may be voted for another person nominated by the Board, the position may become vacant or the size of the Board may be reduced.

| | | | | | | | |

6 2022 Proxy Statement | | Proposal 1 – Election of Directors |

| | |

Board Composition

When evaluating director nominees for election at our Annual Meeting, our Governance Committee seeks to nominate a Board that will be most effective in overseeing the affairs of the Company and in supporting the development and execution of the Company’s strategic plan. See “Item 1. Business—General—Business Strategy” on page 13 of our Annual Report on Form 10-K for the year ended December 31, 2021 (the “2021 Annual Report on Form 10-K”) for a discussion of the Company’s current strategic focus.

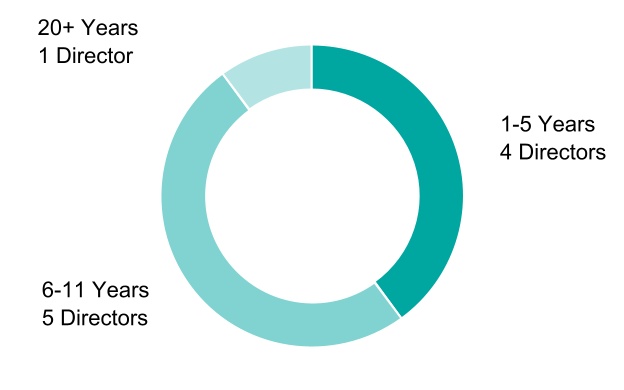

Our Governance Committee considers Board succession planning and Board refreshment a top priority and regularly engages on this topic as a committee and with the full Board. The Governance Committee frequently engages independent Board advisors to ensure that the Company’s Board succession planning discussions incorporate an independent, objective perspective and advice on best practices. As part of this process, the Governance Committee regularly reassesses its approach to Board succession planning and the needs of the Board to ensure that its aims are consistent with the Company’s evolving needs and strategic focus. As a result of this commitment and upon the recommendation of the Governance Committee, the Board has appointed four independent directors to the Board since 2019: Debra Hess (2019), Brad L. Conner (2020), Lisa Mumford (2020), and Brian Montgomery (who rejoined the Board in 2021 after stepping down in 2018 upon his appointment to serve as the Federal Housing Administration (“FHA”) Commissioner in the Department of Housing and Urban Development). The Board believes the addition of these highly qualified directors, in conjunction with the retirement of three long-serving directors from our Board during this time, reinforces the Company’s commitment to strong corporate governance, board refreshment and succession planning.

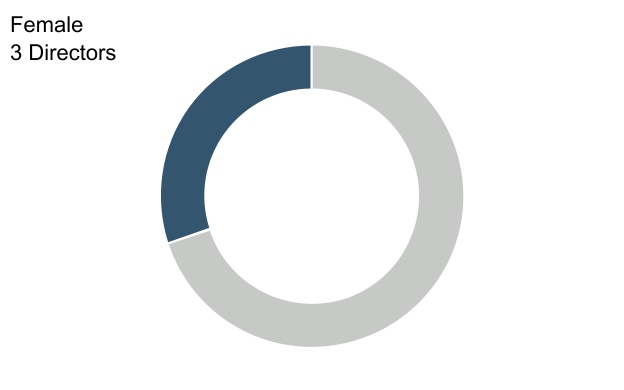

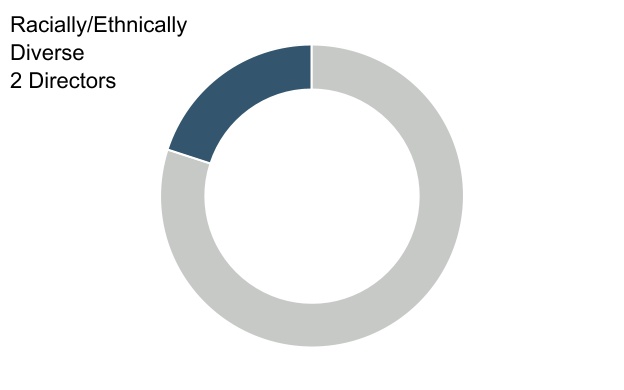

The Governance Committee regularly evaluates the composition of our Board to ensure that our Board diversity, including the naturally varying perspectives and experiences derived from such diversity, is positively contributing to the development and execution of our strategic plan in the best interest of our stockholders. The Board considers diversity in a broad sense to mean differences of race, ethnicity, national origin, gender and age, as well as a director’s tenure with Radian and background, education, professional experience and skills. When considering candidates for nomination as new directors, the Governance Committee ensures that the pool of candidates it evaluates includes qualified persons who reflect diverse backgrounds, including underrepresented areas of race, ethnicity and gender. Among our directors who have consented to such disclosure, three self-identify as female and two self-identify as racially or ethnically diverse.

Our Board believes diversity in tenure is a critical component of our Board composition. As a diversified mortgage and real estate services business providing mortgage insurance and other products and services to the real estate and mortgage finance industries through our two business segments—Mortgage and homegenius—our performance can be impacted significantly by mortgage credit and housing market cycles. The institutional knowledge that our Board has acquired through previous credit and market cycles in our industries has been critical in supporting management’s efforts to successfully navigate challenges through these periods, including most recently during the COVID-19 pandemic. The Governance Committee believes that nominating a Board that has a balance of director tenures best enables the Board to effectively oversee our businesses and support the execution of our financial and strategic objectives that are critical to driving long-term value for our stockholders during various economic and operating environments.

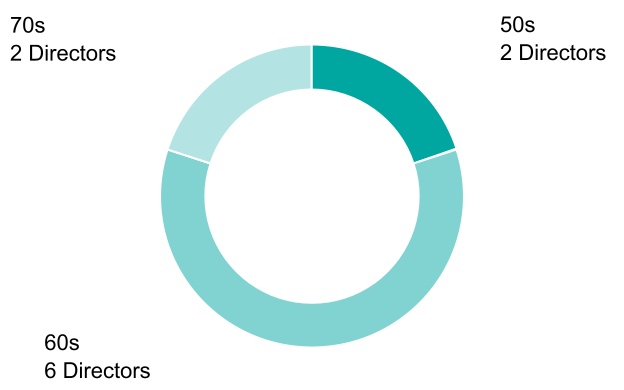

The following board composition statistics highlight the Board’s efforts with respect to Board succession planning and refreshment, including the Board’s ongoing efforts to enhance Board diversity.

| | | | | | | | |

| Proposal 1 – Election of Directors | | 2022 Proxy Statement 7 |

| | |

Board Diversity

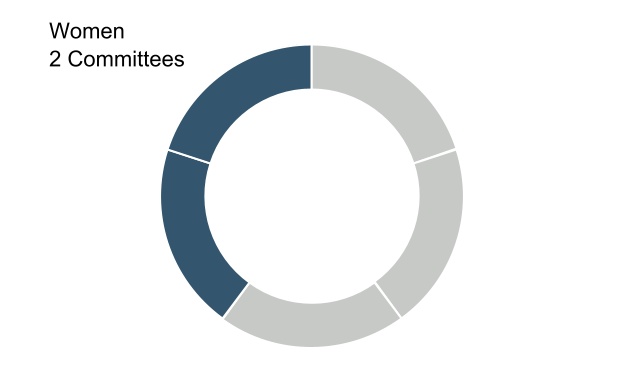

Gender Diversity (1)

(1) Two women directors added since 2019

Diversity of Age

Racial/Ethnic Diversity (2)

(2) Two diverse directors added since 2019

Diversity of Tenure

Median Tenure: 8 Years

Board Committees Chaired by Women

| | | | | | | | |

8 2022 Proxy Statement | | Proposal 1 – Election of Directors |

| | |

Board Skills and Experience

The scope and complexity of our business operations and strategy require our Board to possess a diverse set of skills and experiences to ensure effective oversight. The information below highlights the collective skills and experience of our directors with respect to various areas that are important to the current and future success of our businesses.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Mortgage & Real Estate Industry — 7/10 Directors |

| | | | | | | | | |

| | | | | | | | | |

Financial — 6/10 Directors |

| | | | | | | | | |

| | | | | | | | | |

CEO or other C-Suite — 7/10 Directors |

| | | | | | | | | |

| | | | | | | | | |

Government and Regulatory — 2/10 Directors |

| | | | | | | | | |

| | | | | | | | | |

Other Public Company Board Experience — 7/10 Directors |

| | | | | | | | | |

| | | | | | | | | |

Risk Management — 9/10 Directors |

| | | | | | | | | |

| | | | | | | | | |

Information Technology — 5/10 Directors |

| | | | | | | | | |

| | | | | | | | | |

Operations — 6/10 Directors |

| | | | | | | | | |

| | | | | | | | | |

Business Development / M&A — 8/10 Directors |

| | | | | | | | | |

| | | | | | | | |

| Proposal 1 – Election of Directors | | 2022 Proxy Statement 9 |

| | |

Biographical Information for Director Nominees

Biographical information for each of the director nominees is provided below along with a discussion of each nominee’s specific experience, qualifications, attributes or skills that have led the Board to conclude that each director should be nominated for election or reelection.

| | | | | |

| Howard B. Culang | Non-executive Chairman of the Board |

| Mr. Culang, 75, has been a director of Radian since June 1999, serving as Chair of our Risk Committee for 17 years before assuming the role of Non-executive Chairman of our Board effective December 22, 2021. From November 1985 to December 2005, Mr. Culang worked in various roles for the Prudential Home Mortgage Company, a mortgage lender, including as a Managing Director and member of the Executive Committee and as Vice Chairman of Residential Services Corporation of America, the holding company for Prudential’s mortgage lending, servicing and real estate services companies. Prior to joining Prudential, Mr. Culang held a number of senior management positions with Citibank, N.A., including as a Senior Credit Officer. More recently, Mr. Culang served as President of Laurel Corporation, a financial services firm, from January 1996 through December 2011. Mr. Culang also served as a Managing Member of JH Capital Management LLC, a management company for a private equity fund, from July 1998 to December 2010, and of Cognitive Capital Management LLC, a management company for a fund of hedge funds, from April 2001 to December 2005. Mr. Culang currently serves as a director of Phase Change Software, LLC (formerly ioSemantics, LLC), a privately-owned artificial intelligence (“AI”) software company. |

Skills and Qualifications Mr. Culang is highly qualified to serve as our Non-executive Chairman based on his deep institutional knowledge of Radian, his professional background and decades of experience in the mortgage and financial services industries. Based on his long tenure with Radian through multiple economic cycles, including his 17 years of leadership as Chair of our Risk Committee, Mr. Culang is uniquely positioned to lead our Board and ensure that the Board remains focused on supporting long-term growth in value for our stockholders. His past management experiences in both mortgage credit and real estate services, in combination with his service on the board of an AI technology company, provide him with important insights regarding the most critical aspects of our businesses, including how best to support the Company in developing and executing our strategic vision.

|

| | | | | | | | |

10 2022 Proxy Statement | | Proposal 1 – Election of Directors |

| | |

| | | | | |

| Brad L. Conner |

Risk Committee (Chair) Compensation and Human Capital Management Committee Governance Committee | Mr. Conner, 60, recently served as Vice Chairman, Head of Consumer Banking for Citizens Financial Group, Inc. (“Citizens”), a publicly-traded financial institution, beginning in January 2014. In this role, Mr. Conner was responsible for Retail Banking, Business Banking, Wealth Management, Home Lending Solutions, Auto Finance and Education Finance, as well as the Consumer Phone Bank and online channels. Mr. Conner retired from this role in January 2020. Before joining Citizens in 2008, Mr. Conner served as President of the Home Equity and Mortgage Home Loan Direct business of J.P. Morgan Chase & Co., a publicly-traded global financial services firm. Prior to this, he oversaw the combined Home Equity business of Chase and Bank One Corporation, a publicly-traded global financial services firm, after the companies merged in 2004, and served as Chief Executive Officer of Chase’s Education Finance businesses. Mr. Conner currently serves as a director of United Services Automobile Association Federal Savings Bank, a diversified financial services group of companies that provides insurance, investing and banking solutions to members of the U.S. military, veterans and military families. He has been a director of Radian since February 2020.

|

Skills and Qualifications Mr. Conner brings recent C-suite level experience in banking and lending solutions in large, publicly-traded financial institutions, which is a skill set that is highly valuable in supporting the Board’s oversight over virtually all aspects of our business. In addition, his deep knowledge of the mortgage industry provides him with valuable insight into the industries in which we operate and complements the Board’s role in overseeing our strategic direction and supporting the execution of our strategic objectives. These experiences are particularly relevant in Mr. Conner’s role as the Chair of the Risk Committee of our Board.

|

| | | | | |

| Debra Hess |

Audit Committee (Chair) Finance and Investment Committee | Ms. Debra Hess, 57, served as Chief Financial Officer of both NorthStar Asset Management Group, a global asset management firm focused on strategically managing real estate and other investment platforms, and NorthStar Realty Finance Corp., a publicly-traded real estate investment company (together with NorthStar Asset Management Group (“Northstar”), from July 2011 until January 2017. Additionally, from 2011 until 2015, Ms. Hess held various other positions, including Chief Financial Officer and Treasurer for NorthStar’s non-publicly traded companies. Prior to joining NorthStar, from August 2008 to June 2011, Ms. Hess served as Chief Financial Officer of H/2 Capital Partners, a privately-owned fund sponsor that invests in real estate related assets. From March 2003 to July 2008, Ms. Hess was a managing director at Fortress Investment Group (“Fortress”), an investment management firm, where she also served as Chief Financial Officer of Newcastle Investment Corp., a Fortress portfolio company and a NYSE-listed real estate investment trust. Prior to joining Fortress, Ms. Hess served in various positions at Goldman, Sachs & Co., including as Vice President in Goldman Sachs’ Principal Finance Group and as a Manager of Financial Reporting in Goldman Sachs’ Finance Division. Ms. Hess currently serves on the board of directors of AG Mortgage Investment Trust, Inc., a publicly-traded mortgage real estate investment trust, where she chairs the audit committee and serves as a member of the compensation committee. She also serves on the board of CenterPoint Properties Trust, a privately owned acquiror, developer and manager of industrial real estate and transportation infrastructure, where she chairs the audit committee and serves as a member of the compensation committee. She has been a director of Radian since March 2019. |

Skills and Qualifications Ms. Hess’ extensive banking, finance and real estate asset management experience provides her with valuable insight into our businesses, the industries in which we operate and the various factors impacting our strategic direction. In addition, her roles as the Chief Financial Officer of various publicly-traded companies and her executive management experience with companies in the financial services and mortgage and real estate industries provide her with significant financial, accounting and compliance expertise in areas that are valuable to the Board’s oversight responsibilities and in particular to her role as Chair of the Audit Committee of our Board.

|

| | | | | | | | |

| Proposal 1 – Election of Directors | | 2022 Proxy Statement 11 |

| | |

| | | | | |

| Lisa W. Hess |

Compensation and Human Capital Management Committee Governance Committee Risk Committee | Ms. Lisa Hess, 66, served as President and Managing Partner of SkyTop Capital Management LLC (“SkyTop”), an investment fund, from October 2010 through July 2020. From October 2002 to December 2008, she was the Chief Investment Officer of Loews Corporation, a diversified holding company, where she was responsible for managing approximately $50 billion in assets. Ms. Hess was a Founding Partner of Zesiger Capital Group, a diversified money manager, and also has held positions at First Boston Corporation, an investment bank, Odyssey Partners, a private equity firm, and Goldman, Sachs & Co. She has served on the U.S. Treasury Debt Advisory Committee and the Federal Reserve Bank of New York Investors Advisory Committee. Since June 2009, Ms. Hess has been a trustee of Teachers Insurance and Annuity Association (“TIAA”), a financial services organization, and since 2015, she has been a director of TIAA Bank (formerly Everbank) which is owned by TIAA. She has been a director of Radian since February 2011.

|

Skills and Qualifications Ms. Hess’ extensive experience managing financial assets, including her recent leadership role with SkyTop, and previously as Chief Investment Officer of Loews Corporation, and as a member of various investment and advisory committees, gives her a broad range of expertise with respect to finance, investments and the capital markets that is particularly beneficial to the Board in its oversight responsibilities and in supporting our strategic focus. In addition, her board service with TIAA brings an added perspective and insight to the Board’s consideration of corporate governance issues and the concerns of institutional shareholders.

|

| | | | | |

| Brian D. Montgomery |

Audit Committee Governance Committee Risk Committee | Mr. Montgomery, 65, completed his second tenure at the U.S. Department of Housing & Urban Development (“HUD”) in January 2021, most recently serving as the Deputy Secretary of HUD. Prior to his most recent role as Deputy Secretary, Mr. Montgomery served as FHA Commissioner from 2005 to 2009 and from 2018 to 2020. Since May 2021, Mr. Montgomery has been a partner with Gate House Strategies, LLC, an advisory firm he co-founded that is focused on housing finance-related compliance, as well as other housing-related areas such as technology, business strategy, and affordable/public housing. From August 2009 until 2017, Mr. Montgomery served in various executive leadership roles with The Collingwood Group, LLC, a consulting firm, including serving as Vice Chairman. He previously served as a director of the Company from 2012 to 2018, stepping down upon his appointment to rejoin HUD as FHA Commissioner in May 2018. Mr. Montgomery also serves as a director of Reverse Mortgage Investment Trust Inc., a real estate finance company that is focused on acquiring, originating, financing and managing home equity conversion mortgage loans, home equity conversion mortgage-backed securities guaranteed by the Government National Mortgage Association and other real estate-related assets. He rejoined Radian’s Board in June 2021.

|

Skills and Qualifications As the only person to have been confirmed twice by the U.S. Senate to lead the FHA while also serving concurrently for a period of time as HUD Deputy Secretary, Mr. Montgomery possesses a deep working knowledge of the mortgage finance industry, federal housing policies and the federal regulation of housing. This expertise is extremely valuable in supporting the Board’s oversight over the Company’s Mortgage business generally, and specifically over the operations and the credit and risk management aspects of our businesses, as well as helping the Company develop the most effective strategy for navigating the regulatory and legislative landscape in the housing and mortgage finance industries.

|

| | | | | | | | |

12 2022 Proxy Statement | | Proposal 1 – Election of Directors |

| | |

| | | | | |

| Lisa Mumford |

Finance and Investment Committee (Chair) Audit Committee | Ms. Mumford, 58, served as the Chief Financial Officer of Ellington Financial LLC (“Ellington Financial”), a publicly-traded asset management company, and as Chief Financial Officer of Ellington Financial Management LLC (Ellington Financial’s external manager), from October 2009 through her retirement in March 2018. Ms. Mumford also served as the Chief Financial Officer of Ellington Residential Mortgage REIT, a publicly-traded real estate investment trust, from April 2013 until her retirement in March 2018. From August 2008 to October 2009, Ms. Mumford served as Chief Financial Officer of ACA Financial Guaranty Corporation, a monoline bond insurance company, and prior to this, from 2003 until August 2008, Ms. Mumford served as the Chief Accounting Officer of ACA Capital Holdings, Inc. (“ACA”), a publicly-traded holding company providing financial guaranty insurance products and asset management services. Prior to joining ACA, and beginning in 1988, Ms. Mumford was with ACE Guaranty Corp., a financial guaranty company, where she held the positions of Chief Financial Officer and Controller. Ms. Mumford currently serves as a member of the board of directors of Ellington Financial. She has been a director of Radian since February 2020.

|

Skills and Qualifications Ms. Mumford brings recent and highly valuable C-suite level experience and insight that benefits the Board in overseeing virtually all aspects of our business. Her past experience as the Chief Financial Officer of insurance company enterprises provides her with extensive risk management experience, which is a core area of focus for Radian. Her public company experience and her ongoing service on another public company board provides additional perspectives on board leadership and governance that complement the Board’s collective strengths. In addition, her deep knowledge and experience in finance and real estate management provides her with valuable knowledge about the industries in which we operate. These experiences are particularly relevant in Ms. Mumford’s role as Chair of the Finance and Investment Committee of our Board.

|

| | | | | |

| Gaetano J. Muzio |

Compensation and Human Capital Management Committee (Chair) Finance and Investment Committee | Mr. Muzio, 68, is a Principal and co-founder of Ocean Gate Capital Management, LP (“Ocean Gate”), an investment fund. For 27 years prior to founding Ocean Gate, Mr. Muzio worked at Goldman, Sachs & Co. in various positions, including serving as a Managing Director from 1996 until 2004. In 1986, he became the first Global Mortgage and Asset Backed Sales Manager responsible for creating the sales team and strategy for, and was also one of the founding members of, Goldman’s Mortgage and Asset Backed Department. In 1990, he became a general partner and Co-Head of Goldman’s Mortgage Department, with responsibilities for overseeing trading, risk management, sales, research, structured finance and compliance for the department. He has been a director of Radian since May 2012.

|

Skills and Qualifications Mr. Muzio possesses a broad understanding of the mortgage industry. His significant experience in finance, risk management, corporate governance and strategy gives him extensive expertise in several areas that are valuable to the Board’s oversight responsibilities. Additionally, his roles overseeing significant functions at a large financial services institution provide him with strong operational and talent management experience that is particularly useful in his role as Chair of the Compensation and Human Capital Management Committee of our Board.

|

| | | | | | | | |

| Proposal 1 – Election of Directors | | 2022 Proxy Statement 13 |

| | |

| | | | | |

| Gregory V. Serio |

Audit Committee Finance and Investment Committee Risk Committee | Mr. Serio, 60, has served as a partner with Park Strategies, LLC (“Park Strategies”), a management and government relations consulting firm, since January 2005. He currently serves as the head of Park Strategies’ risk and insurance management practice group. He is also a partner in the D’Amato Law Group, a New York-based legal practice. Prior to joining Park Strategies, Mr. Serio served as Superintendent of Insurance for the State of New York from May 2001 to January 2005. From January 1995 until his appointment as Superintendent in 2001, Mr. Serio served as First Deputy Superintendent and General Counsel of the New York Insurance Department. Mr. Serio also has served as the Chairman of the Government Affairs Task Force of the National Association of Insurance Commissioners (“NAIC”) and as a member of and NAIC representative on the Financial Services and Banking Information Infrastructure Committee of the United States Treasury. He was also a commissioner of the International Commission on Holocaust Era Insurance Claims. He currently serves as a trustee of the Senior Health Insurance Plan Trust and director of the Senior Health Insurance Company of Pennsylvania, two positions to which he was appointed by the Commissioner of Insurance of the Commonwealth of Pennsylvania. In 2019, he was appointed to the board of the Capital District Physicians Health Plan, a not-for-profit healthcare organization in New York. Mr. Serio also currently serves on the board of PHL Group, a private insurance group. He has been a director of Radian since May 2012.

|

Skills and Qualifications From both his private and public sector roles, Mr. Serio possesses extensive knowledge and experience in the insurance industry and insurance regulatory matters in particular. His in-depth understanding of insurance regulatory matters, including financial and market conduct examinations and other compliance-related matters, combined with his experience in risk management and corporate governance matters, further strengthens the Board’s oversight and perspective in these areas. He is a Board Leadership Fellow of the National Association of Corporate Directors (“NACD”), which provides him with added perspective and insight into the Board’s corporate governance responsibilities. |

| | | | | |

| Noel J. Spiegel |

Governance Committee (Chair) Compensation and Human Capital Management Committee

| Mr. Spiegel, 74, was a partner at Deloitte & Touche, LLP (“Deloitte”) where he practiced from September 1969 until May 2010. In his career at Deloitte, he served in numerous management positions, including as Deputy Managing Partner; a member of Deloitte’s Executive Committee; Managing Partner of Deloitte’s Transaction Assurance practice, Global Offerings and International Financial Reporting Standards practice and Technology, Media and Telecommunications practice (Northeast Region); and as Partner-in-Charge of Audit Operations in Deloitte’s New York Office. Mr. Spiegel currently serves as Lead Independent Director, chairs the audit committee and serves on the nominating and governance committee of American Eagle Outfitters, Inc., a publicly-traded retail company. Mr. Spiegel also currently serves on the board, chairs the audit committee and serves on the corporate governance committee of vTv Therapeutics, Inc., a publicly-traded clinical stage pharmaceutical company. He has been a director of Radian since February 2011.

|

Skills and Qualifications Mr. Spiegel’s public company board experience provides him with a depth of experience in management, corporate governance, risk management and financial reporting. His current experience in serving on the governance committees of other publicly-traded companies provides him with a unique perspective and depth of insight with respect to corporate governance, board leadership and corporate strategy. In October 2020, the NACD named Mr. Spiegel to the 2020 NACD Directorship 100, an annual award that recognizes leading corporate directors, corporate governance experts, policymakers, and influencers who significantly impact boardroom practices and performance. Mr. Spiegel’s experience and recognized expertise are particularly relevant in Mr. Spiegel’s role as Chair of the Governance Committee of our Board.

|

| | | | | | | | |

14 2022 Proxy Statement | | Proposal 1 – Election of Directors |

| | |

| | | | | |

| Richard G. Thornberry |

| Mr. Thornberry, 63, has served as Radian’s Chief Executive Officer since March 2017. Before joining Radian, from 2006 until 2017, Mr. Thornberry served as the Chairman and Chief Executive Officer of NexSpring Group, LLC (“NexSpring Group”), a company that he co-founded in 2006. NexSpring Group has provided mortgage industry advisory and technology services to private equity investors, mortgage lenders, financial institutions, mortgage investors and other mortgage industry participants. Mr. Thornberry also has served as the Chairman and Chief Executive Officer of NexSpring Financial, LLC, a fintech company that he co-founded to focus on improving the overall value proposition for all participants in a residential mortgage origination transaction. Prior to founding NexSpring Group, from 1999 until 2005, Mr. Thornberry served as President and Chief Executive Officer of Nexstar Financial Corporation, an end-to-end mortgage business process outsourcing firm, which he co-founded in 1999 and sold to MBNA Home Finance in 2005. Mr. Thornberry has also held executive positions with MBNA Home Finance from 2005 until 2006, Citicorp Mortgage Inc. from 1996 until 1998 and Residential Services Corporation of America/ Prudential Home Mortgage Company from 1987 until 1996. Mr. Thornberry currently serves as an executive council member of the Housing Policy Council and on the board of directors of MBA Open Doors Foundation, which provides mortgage and rental payment assistance to families with a critically ill or injured child. Mr. Thornberry began his career as a certified public accountant at Deloitte where he primarily worked with financial services clients and entrepreneurial businesses. He has been a director of Radian since March 2017.

|

Skills and Qualifications Mr. Thornberry possesses a broad understanding of the mortgage and real estate industries and has significant experience building and leading innovative and values-driven organizations in the mortgage and real estate industries. In addition, his past experiences provide him with financial management, human capital management and risk management expertise that give him a unique perspective and set of skills to lead our Company and contribute to the Board.

|

Additional Information Regarding Directors

For additional information regarding our Board, its standing committees, and our standards for corporate governance and director independence, refer to the sections entitled “Corporate Governance and Board Matters” and “Compensation of Executive Officers and Directors—Director Compensation” below.

| | | | | |

| Recommendation Radian’s Board of Directors recommends a vote “FOR” each of the director nominees. Signed proxies will be voted “FOR” each of the director nominees unless a stockholder gives other instructions on the proxy card. |

| | | | | | | | |

| Proposal 1 – Election of Directors | | 2022 Proxy Statement 15 |

| | |

Corporate Governance and Board Matters

Section Table of Contents

Board of Directors and its Standing Committees

Our Board holds regularly scheduled quarterly meetings and a regularly scheduled strategic planning session. In addition, the Board holds special meetings as and when necessary. Our full Board held five regularly scheduled meetings and five special meetings during 2021. Our independent directors meet in executive session at the conclusion of each regularly scheduled Board meeting and frequently meet in executive session following special meetings of the Board. Each director participated in at least 75% of the meetings of the Board and the committees on which the director served during 2021. Our Non-executive Chairman of the Board presides over all meetings of the Board, including executive sessions of the independent members of the Board. Our policy is that all of our director nominees are expected to attend our annual meeting and all of our director nominees who were serving as directors last year attended the 2021 annual meeting. As discussed below under “Director Independence,” all of our directors, except our Chief Executive Officer, Mr. Thornberry, satisfy the requirements for independent directors under the NYSE listing standards and SEC rules. The current composition of the Board’s standing committees is as follows.

| | | | | | | | | | | | | | | | | | | | |

| Director Name | Audit Committee (1) | Compensation & Human Capital Management Committee (1) | | Finance & Investment Committee (1) | | | Governance Committee (1) | Risk Committee (1) |

| Brad L. Conner | | ü | | | | | ü | Chair |

Debra Hess (2) | Chair | | | ü | | | | |

| Lisa W. Hess | | ü | | | | | ü | ü |

| Brian D. Montgomery | ü | | | | | | ü | ü |

Lisa Mumford (2) | ü | | | Chair | | | | |

| Gaetano J. Muzio | | Chair | | ü | | | | |

| Gregory V. Serio | ü | | | ü | | | | ü |

| Noel J. Spiegel | | ü | | | | | Chair | |

(1)Each Committee met as follows in 2021: Audit Committee and Compensation and Human Capital Management Committee (each met eight times); Finance and Investment Committee and Risk Committee (each met four times); and Governance (six times).

(2)“Audit Committee Financial Expert” under SEC rules.

| | | | | | | | |

16 2022 Proxy Statement | | Corporate Governance and Board Matters |

| | |

The Board currently has five standing committees and also may form special committees, as necessary. The primary responsibilities of the Board’s standing committees are as follows.

Audit Committee

This committee is primarily responsible for appointing and overseeing the work of our independent registered public accounting firm, reviewing our annual audited and interim financial statements and related disclosures and reviewing our accounting and reporting principles and policies. See “Audit Committee Report” below for additional information regarding the work of this committee. The current members of the Audit Committee each meet the additional NYSE independence criteria applicable to audit committee members and, as noted in the table above, our Board has determined that each of Mses. Debra Hess and Mumford qualifies as an “audit committee financial expert” under the SEC’s rules.

Compensation and Human Capital Management Committee

This committee is responsible for overseeing our human capital management policies, programs and practices, including our work environment/culture, our diversity, equity and inclusion programs, and our compensation and benefits policies and programs. This committee reviews the quality and depth of officers throughout Radian, as well as our talent development and succession practices and programs. In addition, this committee has responsibility for reviewing the “Social” aspects of the Company’s ESG (Environmental, Social, Governance) programs. See “Compensation of Executive Officers and Directors—Compensation Discussion and Analysis” for additional information regarding the work of this committee. The current members of the Compensation and Human Capital Management Committee each meet the additional NYSE independence criteria applicable to compensation committee members.

Finance and Investment Committee

This committee reviews and monitors the Company’s capital structure, capital sourcing and liquidity management. This Committee also provides oversight with respect to our capital and liquidity strategies and activities, including our capital markets activities and efforts to optimize our capital structure such as through risk distribution. The Finance and Investment Committee also oversees the management of the Company’s investment portfolio and regularly reviews the performance of the investment advisors overseeing the portfolio to ensure adherence to our investment policy guidelines.

Governance Committee

This committee oversees our Board governance, including recommending committee membership and chairperson appointments; developing and ensuring compliance with our Guidelines of Corporate Governance; overseeing regular Board, committee and individual director assessments; and ensuring that Board succession planning and Board refreshment is conducted to support the Company’s evolving needs and strategic focus. This committee also is responsible for examining our overall corporate governance processes, including the “Governance” aspects of the Company’s ESG activities and programs, and reviewing the Company’s government relations function and activities. For a discussion of our Board nomination process, see “Consideration of Director Nominees” below.

Risk Committee

This committee oversees the following aspects of our risk-taking businesses: credit-based risks, credit policies, pricing strategies, risk distribution strategies, credit-related modeling, management of allocated capital and risk limits. This committee also oversees our mortgage- and title-related credit and risk management policies and procedures, including

| | | | | | | | |

| Corporate Governance and Board Matters | | 2022 Proxy Statement 17 |

| | |

our procedures for identifying and responding to emerging credit-related matters and trends that could pose significant risk implications for Radian. Specifically, this committee monitors general compliance with Radian’s underwriting and procedures, including our guidelines regarding credit diversification and counterparty exposures. The Risk Committee also oversees the development of new risk-taking products and services and significant changes to existing products and services.

For a discussion of our Board and its committees’ roles in risk oversight of the Company, see “Board and Board Committee Roles in Risk Oversight” below.

Board Leadership Structure

Our Non-executive Chairman of the Board and Chief Executive Officer are separate positions. We believe that separating these positions enhances the independent oversight of the Company and the effective functioning of the Board, as well as the monitoring and objective evaluation of the Chief Executive Officer’s performance. In addition, by separating these positions, the Board is able to remain fully engaged in providing an objective perspective with respect to the Company’s strategy and in effectively evaluating the implementation of this strategy.

Mr. Culang, our Non-executive Chairman of our Board, assumed this role on December 22, 2021 upon Herbert Wender’s voluntary retirement from the Board. Our Non-executive Chairman of the Board is independent of management and, as provided in our Guidelines of Corporate Governance, is responsible for the management, development and effective performance of the Board and for serving in an advisory capacity to the Chief Executive Officer and to other members of management on all matters concerning the interests of the Board. The Non-executive Chairman of the Board sets the agenda for Board meetings and presides over meetings of the Board.

Mr. Thornberry, in his role as the Chief Executive Officer, is responsible for the strategic direction and day-to-day leadership and performance of the Company. As described in our Guidelines of Corporate Governance, the responsibilities of the Chief Executive Officer include:

■providing strong, ethical and principled leadership of the Company’s businesses;

■establishing the Company’s mission, culture and core values;

■determining and implementing corporate strategies and policies and managing the Company’s capital;

■ensuring complete and accurate disclosures of financial, operational and management matters to the Board for its consideration and approval, as necessary;

■ensuring regulatory compliance and the integrity of all financial filings and other corporate communications; and

■communicating with the Board so it is informed with respect to Company, industry, and corporate governance matters.

Board and Board Committee Roles in Risk Oversight

Our Board is actively involved in the oversight of risks that could affect the Company. In this regard, the Board seeks to understand and oversee the most critical risks relating to our business, allocates responsibilities for the oversight of risks among the full Board and its committees, and reviews the systems and processes that management has in place to manage the current risks facing the Company, as well as those that could arise in the future. The Board regularly meets with management to receive reports from: (i) the Company’s enterprise risk management (“ERM”) function, which is designed to identify the risks we are facing, and to assess, manage and establish mitigation strategies for those risks

| | | | | | | | |

18 2022 Proxy Statement | | Corporate Governance and Board Matters |

| | |

and (ii) the Company’s information security function regarding cybersecurity risks and the Company’s efforts to mitigate such risks. The Board also receives a report directly from the Company’s head of legal compliance regarding the Company’s compliance function, including primary areas of focus and emerging compliance risks. As part of its risk oversight process, the Board considers the significant risks and exposures facing the Company and assesses the steps management is taking to minimize such risks. The full Board further considers current and potential future strategic risks facing the Company as part of its annual strategic planning session with management.

The Board conducts certain aspects of its risk oversight function through its committees. Each committee has full access to management and has the ability to engage advisors as appropriate. Specifically, each committee is charged with the following risk oversight responsibilities.

■The Audit Committee regularly meets with and makes inquiries of management, the Company’s Chief Audit Executive and the Company’s independent auditors regarding significant risks or exposures facing the Company and the steps taken by management to minimize these risks. In particular, the Audit Committee reviews and discusses our financial risk exposures, including the risk of fraud, as well as legal and compliance risks.

■The Compensation and Human Capital Management Committee monitors our executive compensation programs to ensure that they are appropriately aligned with our compensation philosophy and are achieving their intended purposes without encouraging inappropriate risk-taking. See “Compensation of Executive Officers and Directors—Compensation Discussion and Analysis—I. Compensation Principles and Objectives.” In addition, the Compensation and Human Capital Management Committee annually reviews with management a risk assessment prepared by an independent compensation consultant of all of the Company’s primary compensation policies and practices. Based on its most recent review, the Compensation and Human Capital Management Committee has concluded that the Company’s compensation program does not encourage inappropriate risk-taking and is not reasonably likely to have a material adverse effect on the Company.

■The Finance and Investment Committee monitors risks associated with the Company’s capital structure and liquidity, and oversees the management of the Company’s investment portfolio. In addition, the Finance and Investment Committee regularly reviews compliance with our investment guidelines and monitors risk in our investment portfolio.

■The Governance Committee monitors risks associated with corporate governance practices and oversees our related person transaction policy to ensure that we do not engage in transactions that would create or otherwise give the impression of a conflict of interest that could result in harm to us. See “Certain Relationships and Related Person Transactions.”

■The Risk Committee provides oversight of our credit and risk management policies and procedures for our risk-taking businesses, including the potential effect of emerging risks and trends on our risk-taking businesses and overall credit profile. The Risk Committee regularly considers the Company’s significant credit-based risks and the steps management has taken to manage those risks, such as the Company’s risk distribution strategies, and assesses their potential impact on our capital, financial and risk positions.

Each committee chair provides regular reports to the full Board regarding the committee’s risk oversight responsibilities as discussed above. The Board conducts its risk oversight responsibility in the areas discussed above through these reports, as well as through regular discussions and reports from management regarding any other significant known risks or emerging risk trends.

Director Independence

Our Guidelines of Corporate Governance provide that a substantial majority of our Board must consist of independent directors, as independence is determined under the NYSE’s listing standards and applicable SEC rules. In evaluating the independence of each of our directors, our Board, primarily through the Governance Committee, considers all relevant facts and circumstances that could impact a director’s independent judgement. Our Board has determined that all of the members of the Board, except our Chief Executive Officer, Richard G. Thornberry, are “independent” under

| | | | | | | | |

| Corporate Governance and Board Matters | | 2022 Proxy Statement 19 |

| | |

current NYSE listing standards and SEC rules. In determining that each of our non-executive directors is independent, the Board considered whether there were any facts and circumstances that might impair the independence of each director, as further discussed below. The Board concluded that no material direct or indirect relationship exists between the Company and any of its non-executive directors, other than those compensatory matters that are a direct consequence of serving on our Board and which are detailed below in “Compensation of Executive Officers and Directors—Director Compensation.”

In recommending to the Board that each of our non-executive directors is independent, the Governance Committee and the Board considered that certain director nominees hold board positions with other entities that are either Radian customers, potential Radian customers or otherwise involved in mortgage-related business or activities. Specifically, the Governance Committee considered the following relationships.

■Mr. Conner serves as a director of United Services Automobile Association (“USAA”) and USAA is a current customer of Radian’s Mortgage and homegenius businesses.

■Ms. Debra Hess serves on the board of directors of AG Mortgage Investment Trust, Inc., a publicly-traded mortgage REIT that owns a non-controlling interest in Arc Home LLC (“Arc”). Arc is a mortgage enterprise that, among other things, originates loans purchased by the government-sponsored enterprises (“GSEs”) and is a current customer of Radian’s Mortgage business.

■Ms. Lisa Hess serves as a trustee of TIAA, which owns TIAA Bank (formerly Everbank), and serves on the Board of TIAA Bank. TIAA Bank is a current customer of Radian’s Mortgage business.

■Ms. Mumford serves on the Board of Ellington Financial, a publicly-traded company that invests in a diverse array of financial assets, including residential and commercial mortgage-backed securities and residential and commercial mortgage loans. Ellington Financial has non-controlling interests in four mortgage originators, including American Heritage Lending LLC, a real estate investment lending company that is a customer of Radian’s Mortgage business.

With regard to each of the foregoing relationships, the Governance Committee determined that the dual board positions did not impair the director’s independence based on, among other factors, the current size of the relevant customer relationships, that the customer relationships are arms-length transactions on customary terms and the director’s lack of oversight and compensation benefits related to the business relationships. Based on the recommendation of the Governance Committee, the Board considered these relationships and concluded, in each case, that it did not impair the applicable director’s independence.

Consideration of Director Nominees

Director Qualifications

Our Governance Committee recommends candidates for nomination to our Board based on a number of factors, including the following minimum criteria: (i) the highest standards of personal character, conduct and integrity; (ii) the intention and ability to act in the best interests of our stockholders; (iii) the ability to understand and exercise sound judgment on issues related to Radian and its businesses; (iv) the ability and commitment to devote the time and effort required to serve effectively on our Board, including preparation for and attendance at Board and committee meetings; (v) the ability to draw upon relevant experience and expertise in contributing to Board and committee discussions; and (vi) freedom from interests or affiliations that could give rise to a biased approach to directorship responsibilities and/or a conflict of interest, actual or perceived.

The Board values diversity among its directors and believes that diversity helps to generate a comprehensive discussion of issues from multiple perspectives, which contributes to effective decision making and oversight over our businesses to help drive our results. The Board considers diversity in a broad sense to mean differences of race,

| | | | | | | | |

20 2022 Proxy Statement | | Corporate Governance and Board Matters |

| | |

ethnicity, national origin, gender and age, as well as a director’s tenure with Radian and background experience, education, professional experience and skills. The Board and the Governance Committee consider diversity as an important factor in identifying and evaluating director nominees, as discussed below.

Identifying and Evaluating Director Nominees

In evaluating candidates for the Board, the Governance Committee and the Board seek to foster a board that collectively possesses the minimum qualifications discussed above as well as the appropriate mix of diversity to oversee the Company’s businesses and to support our strategic focus. The Governance Committee does not exclusively pursue director candidates based on whether they possess a single skill, category or trait, but seeks nominees who complement the breadth and depth of our Board’s diversity and oversight. See “Proposal 1—Election of Directors” for additional information.

When considering candidates for nomination as new directors, the Governance Committee ensures that the pool of candidates it evaluates includes qualified persons who reflect diverse backgrounds, including both underrepresented areas of race and gender. When seeking and evaluating candidates for the Board, the Governance Committee considers all qualified candidates identified by members of the Governance Committee, by other members of the Board, by senior management, by stockholders (if their recommendations of candidates are submitted in accordance with the procedures described below) and by national search firms. In all cases, the Governance Committee will facilitate several interviews of a candidate if it believes the candidate to be suitable after an initial evaluation, and will perform a comprehensive background investigation on the candidate. The Governance Committee also may discuss a candidate at multiple meetings and have the candidate meet with members of senior management and the full Board.

Stockholder Nominations and Recommendations

Our By-Laws describe the procedures for stockholders to follow for nominating candidates to our Board. For our 2023 annual meeting of stockholders, stockholders may nominate a candidate for election to our Board by sending written notice to our Corporate Secretary at our principal office, which must be received on or before February 10, 2023, but no earlier than January 11, 2023 (except that if the date of the 2023 annual meeting of stockholders is more than 30 days before or more than 60 days after the anniversary date of the Annual Meeting, notice by the stockholder must be received between the close of business on the 120th day and 90th day before the date of the 2023 annual meeting or, if the first public announcement of the date of the 2023 annual meeting is less than 100 days before the date of the meeting, then the notice by the stockholder must be received by the 10th day after the public announcement).

The notice to our Corporate Secretary must contain or be accompanied by the information required by Section 4.13 of our By-Laws, which includes, among other things: (i) the name, age, principal occupation, and business and residence address of each person nominated; (ii) the class and number of shares of our capital stock which are directly or indirectly beneficially owned by each person nominated; (iii) the name and record address of the stockholder making the nomination and the beneficial owner, if any, on whose behalf the nomination is made; (iv) the class and number of shares of our capital stock owned directly or indirectly by the stockholder making the nomination or the beneficial owner, if any, on whose behalf the nomination is made; and (v) a description of any direct or indirect compensation or other material monetary agreements, arrangements or understandings, or any other material relationships (including any familial relationships) between the stockholder giving notice (or the beneficial owner) and the nominee or any respective affiliates, associates or others with whom they are acting, as well as certain other information. A copy of the full text of the relevant By-Law provisions, which includes the complete list of the information that must be submitted to nominate a director, may be obtained upon written request directed to our Corporate Secretary at our principal office. A copy of our By-Laws is also posted on the Corporate Governance section of our website (www.radian.com).

In addition to a stockholder’s ability to nominate candidates to serve on our Board as described above, stockholders also may recommend candidates to the Governance Committee for its consideration. The Governance Committee is pleased to consider recommendations from stockholders regarding director nominee candidates that are received in writing and accompanied by sufficient information to enable the Governance Committee to assess the candidate’s qualifications, along with confirmation of the candidate’s consent to serve as a director if elected. Such

| | | | | | | | |

| Corporate Governance and Board Matters | | 2022 Proxy Statement 21 |

| | |

recommendations should be sent to our Corporate Secretary at our principal office. Any recommendation received from a stockholder after January 1 of any year is not assured of being considered for nomination in that year.

Evaluations of Board Performance

The Board recognizes that a constructive board evaluation is a component of good governance practices and promotes board effectiveness. In accordance with our Guidelines of Corporate Governance, the Governance Committee facilitates an annual assessment of each director’s board performance, the performance of the Board as a whole and the performance of each of the Board’s standing committees. The Board and each of its standing committees perform an annual self-assessment as part of the Board evaluation process. As part of this annual assessment, the Board often engages an independent governance consultant to facilitate the assessment process and provide an unbiased perspective on the effectiveness of the Board and its standing committees as well as director performance, board succession planning and board dynamics. The contributions of individual directors were considered by the Governance Committee as part of its determination of whether to recommend their nomination for reelection to our Board.

Compensation and Human Capital Management Committee Interlocks and Insider Participation

Messrs. Muzio (Chair), Conner, Culang and Spiegel and Ms. Lisa Hess served on the Compensation and Human Capital Management Committee at various times during 2021. No director who served on the Compensation and Human Capital Management Committee during 2021: (i) has ever been an officer or employee of Radian or any of its subsidiaries or (ii) had any relationship with Radian or its subsidiaries during 2021 that would require disclosure under Item 404 of the SEC’s Regulation S-K.

During 2021, none of our executive officers served as a director or member of the compensation committee (or other board committee performing equivalent functions or, in the absence of any such committee, the entire board) of any other entity, one of whose executive officers is or has been a director of Radian or a member of our Compensation and Human Capital Management Committee.

Certain Relationships and Related Person Transactions

Our Board has adopted a written policy regarding related person transactions. This policy establishes procedures by which the Governance Committee must review certain transactions that could present a conflict of interest based on the interests of the Company and a related party in such transaction. The policy applies to any transaction, other than certain excluded transactions (e.g., compensation arrangements with executive officers or directors that have been approved by the Compensation and Human Capital Management Committee), in which: (i) Radian or any of its subsidiaries was or is to be a participant and (ii) any related person had or will have a direct or indirect material interest. For purposes of this policy, a related person is any of our directors or nominees for director, any of our executive officers, any stockholder known to us to own in excess of 5% of our common stock, and any immediate family member of one of our directors, nominees for director or executive officers. Under the policy, in order for a related person transaction to proceed, it must be reviewed and approved or ratified by our Governance Committee. Our Governance Committee is also responsible for providing ongoing oversight of any related person transaction that continues for a period of time.

| | | | | | | | |

22 2022 Proxy Statement | | Corporate Governance and Board Matters |

| | |

The policy provides that the Governance Committee may approve or ratify a related person transaction (including, if applicable, as modified) only upon affirmatively concluding that the transaction: (i) is on terms no less favorable to the Company than those that could be obtained in arm’s length dealings with an unrelated third party; (ii) is consistent with the applicable independence rules of the SEC and NYSE; and (iii) does not create or otherwise give the impression of a conflict of interest that could result in harm to the Company. If the Governance Committee determines that an existing related person transaction has failed to meet this standard for ratification, the transaction must be unwound promptly unless the Governance Committee further determines that: (i) the transaction was entered into in good faith (i.e., in the absence of fraud and not with the intention of circumventing the pre-approval requirements of our related person transactions policy) and (ii) the risks to the Company of unwinding the transaction outweigh the risks associated with not unwinding the transaction.

Anti-Hedging Policy

Radian’s Insider Trading Policy prohibits all Radian employees, temporary or contract workers and Board members, while employed by or providing services to Radian, from engaging in any form of hedging or monetization transaction that allows a covered person to continue to own Radian securities without taking on the full risks and rewards of such ownership. This general prohibition of speculative transactions specifically includes: (i) short sales of Radian securities and (ii) buying or selling puts or calls of Radian securities. The Insider Trading Policy is available in the Corporate Governance section of Radian’s website (www.radian.com).

Information on Our Website

In addition to our Amended and Restated Certificate of Corporation and our By-Laws, the Corporate Governance section of our website (www.radian.com) includes the following corporate governance materials, any of which are also available in print and free of charge upon request.

Board Committee Charters

Each of the standing committees of our Board operates under a written charter adopted by the full Board upon the recommendation of the Governance Committee. Each committee considers the need for amendments or enhancements to its charter at least annually and more frequently as necessary.

Guidelines of Corporate Governance

Upon the Governance Committee’s recommendation, our Board adopted our Guidelines of Corporate Governance. Among other things, these guidelines delineate the qualifications for our directors and the relative responsibilities of our Board, its standing committees, our Non-executive Chairman, our Chief Executive Officer and our Corporate Responsibility Officer. The Governance Committee and Board consider the need for amendments or enhancements to our Guidelines of Corporate Governance at least annually and more frequently as necessary.

Code of Conduct and Ethics

Our Code of Conduct and Ethics (the “Code of Conduct”) is binding on all of our employees and directors, and includes a “code of ethics” applicable to our senior executive officers.

| | | | | | | | |

| Corporate Governance and Board Matters | | 2022 Proxy Statement 23 |

| | |