Exhibit 99.1

Quarterly

Operating Supplement

Third Quarter 2005

Quarterly Operating Supplement

Table of Contents

| | |

| | | Page

|

Introductory Note | | 2 |

| |

Company Profile | | 2 |

| |

Company Information | | 2 |

| |

Consolidated GAAP Income Statements | | 3 |

| |

Consolidated GAAP Balance Sheets | | 4 |

| |

Statutory Information | | 5 |

| |

Total Claims-Paying Resources and Leverage Ratios | | 5 |

| |

Consolidated Gross Premiums Written by Product | | 6 |

| |

Consolidated Net Premiums Earned by Product | | 6 |

| |

Consolidated Net Unearned Premium Amortization and Estimated Future Installment Premiums | | 6 |

| |

Consolidated Selected Loss Information | | 7 |

| |

Consolidated Selected Derivative Information | | 8 |

| |

Consolidated Investment Portfolio Highlights | | 9 |

| |

Consolidated Insured Portfolio Highlights | | 10 |

| |

Consolidated CDO Exposure | | 14 |

| |

Consolidated Explanatory Notes | | 15 |

| |

Safe Harbor Statement | | 16 |

Quarterly Operating Supplement for the Period Ended Sept. 30, 2005 /Table of Contents

1

Quarterly Operating Supplement

Radian Asset Assurance Inc.

Quarterly Operating Supplement

September 30, 2005

Introductory Note

This operating supplement presents financial information for Radian Asset Assurance Inc. and its consolidated subsidiaries on a GAAP basis, and includes selected information prepared on a statutory accounting basis. The financial information for Radian Asset Assurance Inc. contained in operating supplements prior to the Second Quarter 2005 was prepared on a statutory accounting basis.

Radian Reinsurance Inc. (“Radian Reinsurance”) was merged with and into Radian Asset Assurance Inc. effective as of June 1, 2004. All financial information presented herein is as if the merger had occurred on January 1, 2004.

Company Profile

Radian Asset Assurance Inc., founded in 1985 and rated AA by Standard & Poor’s, a division of The McGraw-Hill Companies (“S&P”) and Fitch Ratings and Aa3 by Moody’s Investor Services (“Moody’s”), provides credit enhancement to the holders of debt obligations and asset-backed securities. As a direct writer of financial guaranty insurance for municipal bonds, asset-backed securities and structured transactions, Radian Asset Assurance Inc. plays an important role in extending the benefits of insurance to a broad range of institutions and securities issuers.

Radian Asset Assurance Inc. is a subsidiary of Radian Group Inc. (NYSE: RDN), a global credit risk management company headquartered in Philadelphia with significant operations in both New York and London.

Company Information

| | |

Radian Asset Assurance Inc. | | Contact: |

| 335 Madison Avenue | | John C. DeLuca |

| New York, New York 10017 | | Senior Vice President, Market Development |

| 1 877 337.4925 (within the U.S.) | | 1 212 984.9222 |

| 1 212 983.3100 | | john.deluca@radian.biz |

Quarterly Operating Supplement for the Period Ended Sept. 30, 2005 /Introductory Note /Company Profile /Company Information

2

Quarterly Operating Supplement

Radian Asset Assurance Inc.

Consolidated GAAP Income Statements*($ Thousands)

(Unaudited)

| | | | | | | | | | | | | | | | |

| | | Quarter ended

| | | Nine months ended

| |

| | | September 30

2005

| | | September 30

2004

| | | September 30

2005

| | | September 30

2004

| |

Revenues | | | | | | | | | | | | | | | | |

Gross premiums written | | $ | 78,091 | | | $ | 73,767 | | | $ | 155,241 | | | $ | 139,795 | |

Ceded premiums written | | | (227 | ) | | | (713 | ) | | | (3,057 | ) | | | (3,283 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net premiums written | | | 77,864 | | | | 73,054 | | | | 152,184 | | | | 136,512 | |

Increase (decrease) in unearned premiums | | | 22,509 | | | | 16,602 | | | | (2,740 | ) | | | (9,691 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Premiums earned | | | 55,355 | | | | 56,452 | | | | 154,924 | | | | 146,203 | |

| | | | |

Net investment income | | | 22,289 | | | | 21,389 | | | | 65,194 | | | | 62,792 | |

Gain on sale of investments | | | 3,036 | | | | 1,131 | | | | 8,152 | | | | 6,988 | |

Change in fair value of derivative instruments | | | 41,628 | | | | 5,734 | | | | 39,376 | | | | 6,988 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total revenues | | | 122,308 | | | | 84,706 | | | | 267,646 | | | | 222,971 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Expenses | | | | | | | | | | | | | | | | |

Losses and loss adjustment expenses | | | 10,454 | | | | 12,412 | | | | 25,370 | | | | 42,054 | |

Policy acquisition costs | | | 13,030 | | | | 12,047 | | | | 39,187 | | | | 29,911 | |

Other operating expenses | | | 18,085 | | | | 13,078 | | | | 46,991 | | | | 34,975 | |

Other expense | | | 3,935 | | | | 2,725 | | | | 10,004 | | | | 7,821 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total expenses | | | 45,504 | | | | 40,262 | | | | 121,552 | | | | 114,761 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Income before income taxes | | | 76,804 | | | | 44,444 | | | | 146,094 | | | | 108,210 | |

Income tax expense | | | 23,067 | | | | 12,410 | | | | 36,019 | | | | 24,360 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net income | | $ | 53,737 | | | $ | 32,034 | | | $ | 110,075 | | | $ | 83,850 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| * | See Consolidated Explanatory Notes on page 15. |

Quarterly Operating Supplement for the Period Ended Sept. 30, 2005 / Consolidated GAAP Income Statements

3

Quarterly Operating Supplement

Radian Asset Assurance Inc.

Consolidated GAAP Balance Sheets* ($ Thousands)**

(Unaudited)

| | | | | | |

| | | September 30

2005

| | December 31

2004

|

Assets | | | | | | |

Investments: | | | | | | |

Fixed maturity securities, available for sale, at market (amortized cost $2,008,139 and $1,929,921) | | $ | 2,068,847 | | $ | 2,008,416 |

Trading securities, at market (cost $16,360 and $16,848) | | | 22,966 | | | 22,436 |

Common stock, at market (cost $931) | | | 1,049 | | | 1,049 |

Short-term investments | | | 112,466 | | | 112,452 |

| | |

|

| |

|

|

Total Investments | | | 2,205,328 | | | 2,144,353 |

Cash and cash equivalents | | | 16,043 | | | 14,017 |

Accrued interest and dividends receivable | | | 25,538 | | | 28,211 |

Premiums and other receivables | | | 42,865 | | | 49,638 |

Deferred policy acquisition costs | | | 138,194 | | | 141,944 |

Prepaid reinsurance premiums | | | 2,072 | | | 1,846 |

Reinsurance recoverable on unpaid losses | | | 2,556 | | | 2,235 |

Prepaid federal income taxes | | | 11,495 | | | 10,978 |

Credit derivatives | | | 57,490 | | | 25,309 |

Other assets | | | 15,716 | | | 12,368 |

| | |

|

| |

|

|

Total Assets | | $ | 2,517,297 | | $ | 2,430,899 |

| | |

|

| |

|

|

Liabilities and Shareholder’s Equity | | | | | | |

Liabilities | | | | | | |

Losses and loss adjustment expenses | | $ | 191,087 | | $ | 216,202 |

Reinsurance payable on paid losses and loss adjustment expenses | | | 4,687 | | | 6,417 |

Unearned premiums | | | 618,959 | | | 623,677 |

Deferred federal income taxes | | | 80,625 | | | 75,926 |

Federal income taxes payable | | | 1,408 | | | 5,943 |

Payable to affiliates | | | 8,241 | | | 9,686 |

Accrued expenses and other liabilities | | | 48,941 | | | 20,682 |

| | |

|

| |

|

|

Total Liabilities | | | 953,948 | | | 958,533 |

| | |

|

| |

|

|

Shareholder’s Equity | | | | | | |

Common stock – $150 par value | | | | | | |

Authorized, issued and outstanding – 100,000 shares | | | 15,000 | | | 15,000 |

Additional paid-in capital | | | 590,579 | | | 590,579 |

Retained earnings | | | 912,069 | | | 801,994 |

Accumulated other comprehensive income | | | 45,701 | | | 64,793 |

| | |

|

| |

|

|

Total Shareholder’s Equity | | | 1,563,349 | | | 1,472,366 |

| | |

|

| |

|

|

Total Liabilities and Shareholder’s Equity | | $ | 2,517,297 | | $ | 2,430,899 |

| | |

|

| |

|

|

| * | See Consolidated Explanatory Notes on page 15. |

Quarterly Operating Supplement for the Period Ended Sept. 30, 2005 /Consolidated GAAP Balance Sheets

4

Quarterly Operating Supplement

Radian Asset Assurance Inc.

Statutory Information*($ Thousands except ratios)

| | | | | | | | | | | | | | | | | |

| | | Quarter ended

| | Percent

Change

| | | Nine months ended

| | Percent

Change

|

| | | September 30

2005

| | September 30

2004

| | | September 30

2005

| | September 30

2004

| |

Statutory Net Income | | $ | 23,669 | | $ | 6,102 | | 287.9 | % | | $ | 89,565 | | $ | 25,025 | | 257.9% |

| | |

|

| |

|

| | | | |

|

| |

|

| | |

Statutory Ratios

| | | | | | | | | | | | |

| | | Quarter ended

| | | Nine months ended

| |

| | | September 30

2005

| | | September 30

2004

| | | September 30

2005

| | | September 30

2004

| |

Loss and Loss Adjustment Expense Ratio | | –3.0 | % | | 6.8 | % | | –1.3 | % | | 88.9 | % |

Underwriting Expense Ratio | | 41.2 | % | | 44.4 | % | | 50.2 | % | | 44.5 | % |

| | |

|

| |

|

| |

|

| |

|

|

Combined Ratio | | 38.2 | % | | 51.2 | % | | 48.9 | % | | 133.4 | % |

| | |

|

| |

|

| |

|

| |

|

|

Total Claims-Paying Resources and Leverage Ratios*

($ Thousands except ratios)

| | | | | | |

| | | September 30

2005

| | December 31

2004

|

Capital and Surplus | | $ | 1,061,858 | | $ | 1,003,748 |

Contingency Reserve | | | 282,389 | | | 251,674 |

| | |

|

| |

|

|

Qualified Statutory Capital | | | 1,344,247 | | | 1,255,422 |

| | |

Unearned Premium Reserve | | | 709,391 | | | 694,611 |

Loss and Loss Expense Reserves | | | 60,561 | | | 87,332 |

| | |

|

| |

|

|

Total Policyholders’ Reserves | | | 2,114,199 | | | 2,037,365 |

| | |

Present Value of Future Installment Premiums | | | 282,472 | | | 251,242 |

| | |

Reinsurance and Soft Capital Facilities | | | 150,000 | | | 245,000 |

| | |

|

| |

|

|

Total Claims-Paying Resources | | $ | 2,546,671 | | $ | 2,533,607 |

| | |

|

| |

|

|

Net Debt Service (Principal and Interest) Outstanding | | $ | 103,121,732 | | $ | 101,499,932 |

Capital Leverage Ratio1 | | | 77:1 | | | 81:1 |

Claims-Paying Ratio2 | | | 40:1 | | | 40:1 |

| * | See Consolidated Explanatory Notes on page 15. |

| 1 | Capital Leverage Ratio: Net debt service/Qualified statutory capital. |

| 2 | Claims-Paying Ratio: Net debt service/Total claims-paying resources. |

Quarterly Operating Supplement for the Period Ended Sept. 30, 2005 /Statutory Information / Total Claims-Paying Resources

5

Quarterly Operating Supplement

Radian Asset Assurance Inc.

Consolidated Gross Premiums Written by Product*($ Thousands)

| | | | | | | | | | | | | | | | | | | | |

| | | Quarter ended

| | Percent

Change

| | | Nine months ended

| | | Percent

Change

| |

| | | September 30

2005

| | September 30

2004

| | | September 30

2005

| | | September 30

2004

| | |

Public Finance Direct | | $ | 22,540 | | $ | 10,006 | | 125.3 | % | | $ | 51,286 | | | $ | 35,871 | | | 43.0 | % |

Structured Finance Direct | | | 19,948 | | | 23,749 | | –16.0 | % | | | 52,608 | | | | 79,053 | | | –33.5 | % |

Public Finance Reinsurance | | | 23,374 | | | 19,305 | | 21.1 | % | | | 61,354 | | | | 56,202 | | | 9.2 | % |

Structured Finance Reinsurance | | | 3,092 | | | 6,407 | | –51.7 | % | | | 16,355 | | | | 23,813 | | | –31.3 | % |

Trade Credit Reinsurance | | | 9,137 | | | 14,300 | | –36.1 | % | | | 28,380 | | | | 41,273 | | | –31.2 | % |

| | |

|

| |

|

| | | | |

|

|

| |

|

|

| | | |

| | | | 78,091 | | | 73,767 | | 5.9 | % | | | 209,983 | | | | 236,212 | | | –11.1 | % |

Impact of Recapture | | | — | | | — | | | | | | (54,742 | ) | | | (96,417 | ) | | 43.2 | % |

| | |

|

| |

|

| | | | |

|

|

| |

|

|

| | | |

| | | $ | 78,091 | | $ | 73,767 | | 5.9 | % | | $ | 155,241 | | | $ | 139,795 | | | 11.0 | % |

| | |

|

| |

|

| | | | |

|

|

| |

|

|

| | | |

Consolidated Net Premiums Earned by Product*($ Thousands)

| | | | | | | | | | | | | | | | | | | | |

| | | Quarter ended

| | Percent

Change

| | | Nine months ended

| | | Percent

Change

| |

| | | September 30

2005

| | September 30

2004

| | | September 30

2005

| | | September 30

2004

| | |

Public Finance Direct | | $ | 7,651 | | $ | 7,327 | | 4.4 | % | | $ | 24,667 | | | $ | 19,516 | | | 26.4 | % |

Structured Finance Direct | | | 20,108 | | | 19,911 | | 1.0 | % | | | 57,098 | | | | 57,391 | | | –0.5 | % |

Public Finance Reinsurance | | | 10,058 | | | 9,725 | | 3.4 | % | | | 25,661 | | | | 30,810 | | | –16.7 | % |

Structured Finance Reinsurance | | | 4,544 | | | 7,285 | | –37.6 | % | | | 15,563 | | | | 24,948 | | | –37.6 | % |

Trade Credit Reinsurance | | | 12,994 | | | 12,204 | | 6.5 | % | | | 36,474 | | | | 38,430 | | | –5.1 | % |

| | |

|

| |

|

| | | | |

|

|

| |

|

|

| | | |

| | | | 55,355 | | | 56,452 | | –1.9 | % | | | 159,463 | | | | 171,095 | | | –6.8 | % |

Impact of Recapture | | | — | | | — | | | | | | (4,539 | ) | | | (24,892 | ) | | 81.8 | % |

| | |

|

| |

|

| | | | |

|

|

| |

|

|

| | | |

| | | $ | 55,355 | | $ | 56,452 | | –1.9 | % | | $ | 154,924 | | | $ | 146,203 | | | 6.0 | % |

| | |

|

| |

|

| | | | |

|

|

| |

|

|

| | | |

Consolidated Net Unearned Premium Amortization and Estimated Future Installment Premiums**

As of September 30, 2005

($ Millions)

| | | | | | | | | | | | |

| | | Ending Net

Unearned

Premiums

| | Unearned

Premium

Amortization

| | Future

Installments

| | Total

Premium

Earnings

|

2005 | | $ | 579.6 | | $ | 37.3 | | $ | 9.2 | | $ | 46.5 |

2006 | | | 502.3 | | | 77.3 | | | 75.2 | | | 152.5 |

2007 | | | 444.7 | | | 57.6 | | | 62.0 | | | 119.6 |

2008 | | | 395.0 | | | 49.7 | | | 45.1 | | | 94.8 |

2009 | | | 355.2 | | | 39.8 | | | 38.1 | | | 77.9 |

| | | | | |

|

| |

|

| |

|

|

2005 – 2009 | | | 355.2 | | | 261.7 | | | 229.6 | | | 491.3 |

2010 – 2014 | | | 208.8 | | | 146.4 | | | 75.0 | | | 221.4 |

2015 – 2019 | | | 106.8 | | | 102.0 | | | 16.2 | | | 118.2 |

2020 – 2024 | | | 43.3 | | | 63.5 | | | 9.8 | | | 73.3 |

After 2025 | | | 0.0 | | | 43.3 | | | 9.3 | | | 52.6 |

| | |

|

| |

|

| |

|

| |

|

|

Total | | | — | | $ | 616.9 | | $ | 339.9 | | $ | 956.8 |

| * | See Consolidated Explanatory Notes on page 15. |

| ** | This table depicts the expected amortization of the unearned premium for the existing financial guaranty portfolio, assuming no advance refundings as of September 30, 2005. Expected maturities will differ from contractual maturities because borrowers have the right to call or repay financial guaranty obligations. Unearned premium amounts are net of prepaid reinsurance. |

Quarterly Operating Supplement for the Period Ended Sept. 30, 2005 /Consolidated: Gross Premiums Written / Net Premiums Earned / Net Unearned Premium

6

Quarterly Operating Supplement

Radian Asset Assurance Inc.

Consolidated Selected Loss Information*

($ Thousands)

Components of Claims Paid and Incurred Losses and Loss Adjustment Expenses

| | | | | | | | | | | | | |

| | | Quarter ended

| | Nine months ended

|

| | | September 30

2005

| | | September 30

2004

| | September 30

2005

| | September 30

2004

|

Claims Paid | | | | | | | | | | | | | |

Trade Credit | | $ | 3,454 | | | $ | 3,262 | | $ | 13,101 | | $ | 28,163 |

Financial Guaranty | | | (201 | ) | | | 7,469 | | | 11,284 | | | 23,890 |

Conseco Finance Corp | | | 7,443 | | | | 8,225 | | | 23,393 | | | 23,307 |

| | |

|

|

| |

|

| |

|

| |

|

|

| | | | 10,696 | | | | 18,956 | | | 47,778 | | | 75,360 |

Impact of Recapture | | | — | | | | — | | | — | | | 7,488 |

| | |

|

|

| |

|

| |

|

| |

|

|

Total | | $ | 10,696 | | | $ | 18,956 | | $ | 47,778 | | $ | 82,848 |

| | |

|

|

| |

|

| |

|

| |

|

|

Incurred Losses and Loss Adjustment Expenses | | | | | | | | | | | | | |

Trade Credit | | $ | 6,684 | | | $ | 6,009 | | $ | 13,738 | | $ | 20,319 |

Financial Guaranty | | | 3,770 | | | | 6,403 | | | 11,632 | | | 21,735 |

| | |

|

|

| |

|

| |

|

| |

|

|

Total | | $ | 10,454 | | | $ | 12,412 | | $ | 25,370 | | $ | 42,054 |

| | |

|

|

| |

|

| |

|

| |

|

|

Components of Losses and Loss Adjustment Expense Reserves

| | | | | | |

| | | September 30

2005

| | December 31

2004

|

Financial Guaranty | | | | | | |

Case | | $ | 57,621 | | $ | 91,905 |

Allocated non-specific | | | 20,750 | | | 9,750 |

Unallocated non-specific | | | 58,163 | | | 56,748 |

| | |

|

| |

|

|

| | | | 136,534 | | | 158,403 |

| | |

|

| |

|

|

Trade Credit and Other | | | | | | |

Case | | | 21,107 | | | 26,587 |

IBNR | | | 33,446 | | | 31,212 |

| | |

|

| |

|

|

| | | | 54,553 | | | 57,799 |

| | |

|

| |

|

|

Total | | $ | 191,087 | | $ | 216,202 |

| | |

|

| |

|

|

| * | See Consolidated Explanatory Notes on page 15. |

Quarterly Operating Supplement for the Period Ended Sept. 30, 2005 /Consolidated Selected Loss Information

7

Quarterly Operating Supplement

Radian Asset Assurance Inc.

Consolidated Selected Derivative Information

($ Millions)

| | | | | | | | |

| | | September 30

2005

| | | December 31

2004

| |

Notional value | | $ | 19,377.5 | | | $ | 12,500.0 | |

| | |

|

|

| |

|

|

|

Gross gains | | $ | 81.8 | | | $ | 74.9 | |

Gross losses | | | 24.3 | | | | 49.6 | |

| | |

|

|

| |

|

|

|

Net gains | | $ | 57.5 | | | $ | 25.3 | |

| | |

|

|

| |

|

|

|

| | |

Balance at January 1 | | $ | 25.3 | | | $ | (16.1 | ) |

Net gains | | | 38.4 | | | | 29.7 | |

Settlements of derivatives contracts | | | | | | | | |

Defaults | | | — | | | | — | |

Recoveries | | | (6.2 | ) | | | (4.0 | ) |

Payments | | | — | | | | 18.6 | |

Early termination receipts | | | — | | | | (2.9 | ) |

| | |

|

|

| |

|

|

|

Balance at end of period | | $ | 57.5 | | | $ | 25.3 | |

| | |

|

|

| |

|

|

|

Quarterly Operating Supplement for the Period Ended Sept. 30, 2005 /Consolidated Selected Derivative Information

8

Quarterly Operating Supplement

Radian Asset Assurance Inc.

Consolidated Investment Portfolio Highlights

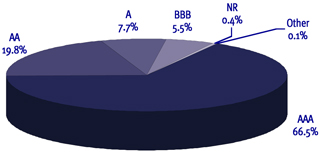

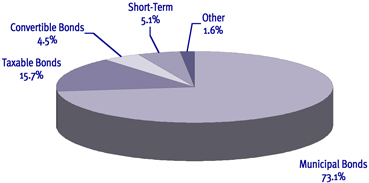

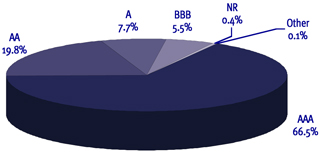

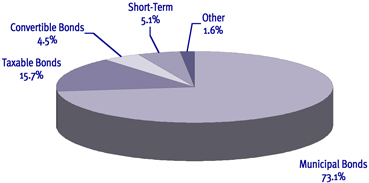

Asset Quality

As of September 30, 2005, the book value of our investment portfolio was $2.2 billion, with an average duration of 6.6 years.

Asset Class

Our conservative portfolio is invested primarily in fixed-income securities. Our primary objective is to achieve total return, with a secondary objective of maximizing after-tax income.

Quarterly Operating Supplement for the Period Ended Sept. 30, 2005 /Consolidated Investment Portfolio Highlights

9

Quarterly Operating Supplement

Radian Asset Assurance Inc.

Consolidated Insured Portfolio Highlights*

($ Millions)

Geographic Diversification

| | | | | | | | | | | | |

State

| | Net Par

Outstanding

(9/30/2005)

| | Percent

of total

Net Par

| | | Net Par

Outstanding

(12/31/2004)

| | Percent

of total

Net Par

| |

California | | $ | 4,832 | | 6.8 | % | | $ | 5,243 | | 7.9 | % |

New York | | | 4,796 | | 6.7 | % | | | 4,516 | | 6.8 | % |

Texas | | | 3,434 | | 4.8 | % | | | 3,375 | | 5.1 | % |

Pennsylvania | | | 2,750 | | 3.9 | % | | | 2,690 | | 4.0 | % |

Florida | | | 2,702 | | 3.8 | % | | | 2,623 | | 3.9 | % |

Illinois | | | 2,445 | | 3.4 | % | | | 2,589 | | 3.9 | % |

Massachusetts | | | 1,919 | | 2.7 | % | | | 1,709 | | 2.6 | % |

New Jersey | | | 1,850 | | 2.6 | % | | | 1,565 | | 2.3 | % |

Washington | | | 1,385 | | 2.0 | % | | | 1,208 | | 1.8 | % |

Colorado | | | 1,161 | | 1.6 | % | | | 1,142 | | 1.7 | % |

Top ten states – public finance subtotal | | | 27,274 | | 38.3 | % | | | 26,660 | | 40.0 | % |

Total of other states – public finance | | | 16,466 | | 23.1 | % | | | 17,800 | | 26.7 | % |

Domestic structured finance | | | 21,861 | | 30.7 | % | | | 17,520 | | 26.2 | % |

International | | | 5,633 | | 7.9 | % | | | 4,771 | | 7.1 | % |

Total | | $ | 71,234 | | 100.0 | % | | $ | 66,751 | | 100.0 | % |

| * | See Consolidated Explanatory Notes on page 15. |

Quarterly Operating Supplement for the Period Ended Sept. 30, 2005 /Consolidated Insured Portfolio Highlights

10

Quarterly Operating Supplement

Radian Asset Assurance Inc.

Consolidated Insured Portfolio Highlights*

($ Millions)

Sector Breakout

| | | | | | | | | | | | | | | | | | | | | | | | |

Public Finance

| | Gross Par

Outstanding

(9/30/2005)

| | Percent

of total

Gross Par

| | | Net Par

Outstanding

(9/30/2005)

| | Percent

of total

Net Par

| | | Gross Par

Outstanding

(12/31/2004)

| | Percent

of total

Gross Par

| | | Net Par

Outstanding

(12/31/2004)

| | Percent

of total

Net Par

| |

General Obligations | | $ | 14,426 | | 19.8 | % | | $ | 14,404 | | 20.2 | % | | $ | 13,612 | | 19.8 | % | | $ | 13,586 | | 20.3 | % |

Healthcare | | | 8,276 | | 11.4 | % | | | 8,276 | | 11.6 | % | | | 8,191 | | 11.9 | % | | | 8,191 | | 12.3 | % |

Utilities | | | 5,625 | | 7.8 | % | | | 5,513 | | 7.7 | % | | | 6,144 | | 9.0 | % | | | 6,014 | | 9.0 | % |

Transportation | | | 4,684 | | 6.4 | % | | | 4,684 | | 6.6 | % | | | 5,059 | | 7.4 | % | | | 5,059 | | 7.6 | % |

Tax Backed | | | 4,148 | | 5.7 | % | | | 4,144 | | 5.8 | % | | | 4,475 | | 6.5 | % | | | 4,471 | | 6.7 | % |

Education | | | 3,375 | | 4.6 | % | | | 3,375 | | 4.7 | % | | | 3,601 | | 5.3 | % | | | 3,601 | | 5.4 | % |

Investor Owned Utilities | | | 1,461 | | 2.0 | % | | | 1,461 | | 2.1 | % | | | 1,728 | | 2.5 | % | | | 1,728 | | 2.6 | % |

Long Term Care | | | 1,186 | | 1.6 | % | | | 1,186 | | 1.7 | % | | | 1,126 | | 1.6 | % | | | 1,126 | | 1.7 | % |

Other Public Finance | | | 1,146 | | 1.6 | % | | | 891 | | 1.3 | % | | | 1,451 | | 2.1 | % | | | 1,196 | | 1.8 | % |

Housing | | | 599 | | 0.8 | % | | | 599 | | 0.8 | % | | | 693 | | 1.0 | % | | | 694 | | 1.0 | % |

Second-To-Pay Municipal Wrap | | | 507 | | 0.7 | % | | | 507 | | 0.7 | % | | | 708 | | 1.0 | % | | | 708 | | 1.1 | % |

Subtotal Public Finance | | $ | 45,433 | | 62.4 | % | | $ | 45,040 | | 63.2 | % | | $ | 46,788 | | 68.1 | % | | $ | 46,374 | | 69.5 | % |

| | | | | | | | |

Structured Finance

| | Gross Par

Outstanding

(9/30/2005)

| | Percent

of total

Gross Par

| | | Net Par

Outstanding

(9/30/2005)

| | Percent

of total

Net Par

| | | Gross Par

Outstanding

(12/31/2004)

| | Percent

of total

Gross Par

| | | Net Par

Outstanding

(12/31/2004)

| | Percent

of total

Net Par

| |

Collateralized Debt Obligations | | $ | 20,204 | | 27.7 | % | | $ | 20,204 | | 28.4 | % | | $ | 13,156 | | 19.2 | % | | $ | 13,156 | | 19.7 | % |

Asset Backed – Consumer | | | 1,678 | | 2.3 | % | | | 1,678 | | 2.4 | % | | | 2,728 | | 4.0 | % | | | 2,728 | | 4.1 | % |

Asset Backed – Commercial and Other | | | 1,481 | | 2.0 | % | | | 1,481 | | 2.1 | % | | | 1,783 | | 2.6 | % | | | 1,783 | | 2.7 | % |

Other Structured Finance | | | 1,450 | | 2.0 | % | | | 1,450 | | 2.0 | % | | | 912 | | 1.3 | % | | | 912 | | 1.3 | % |

Asset Backed – Mortgage and MBS | | | 2,587 | | 3.6 | % | | | 1,381 | | 1.9 | % | | | 3,328 | | 4.8 | % | | | 1,798 | | 2.7 | % |

Subtotal Structured Finance | | $ | 27,400 | | 37.6 | % | | $ | 26,194 | | 36.8 | % | | $ | 21,907 | | 31.9 | % | | $ | 20,377 | | 30.5 | % |

Total | | $ | 72,833 | | 100.0 | % | | $ | 71,234 | | 100.0 | % | | $ | 68,695 | | 100.0 | % | | $ | 66,751 | | 100.0 | % |

| | | | | | |

| Rating Distribution | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

Rating**

| | Gross Par

Outstanding

(9/30/2005)

| | Percent

of total

Gross Par

| | | Net Par

Outstanding

(9/30/2005)

| | Percent

of total

Net Par

| | | Gross Par

Outstanding

(12/31/2004)

| | Percent

of total

Gross Par

| | | Net Par

Outstanding

(12/31/2004)

| | Percent

of total

Net Par

| |

AAA | | $ | 20,699 | | 28.4 | % | | $ | 19,492 | | 27.4 | % | | $ | 13,403 | | 19.5 | % | | $ | 11,881 | | 17.8 | % |

AA | | | 14,900 | | 20.4 | % | | | 14,812 | | 20.8 | % | | | 15,989 | | 23.3 | % | | | 15,880 | | 23.8 | % |

A | | | 19,892 | | 27.3 | % | | | 19,588 | | 27.5 | % | | | 21,941 | | 32.0 | % | | | 21,635 | | 32.4 | % |

BBB | | | 14,271 | | 19.6 | % | | | 14,271 | | 20.0 | % | | | 14,009 | | 20.4 | % | | | 14,002 | | 21.0 | % |

Investment Grade | | | 565 | | 0.8 | % | | | 565 | | 0.8 | % | | | 422 | | 0.6 | % | | | 422 | | 0.6 | % |

Below Investment Grade | | | 1,158 | | 1.6 | % | | | 1,158 | | 1.6 | % | | | 1,602 | | 2.3 | % | | | 1,602 | | 2.4 | % |

Not Rated | | | 1,348 | | 1.9 | % | | | 1,348 | | 1.9 | % | | | 1,329 | | 1.9 | % | | | 1,329 | | 2.0 | % |

Total | | $ | 72,833 | | 100.0 | % | | $ | 71,234 | | 100.0 | % | | $ | 68,695 | | 100.0 | % | | $ | 66,751 | | 100.0 | % |

| * | See Consolidated Explanatory Notes on page 15. |

| ** | Indicated category reflects highest rating of the three rating agencies. |

Quarterly Operating Supplement for the Period Ended Sept. 30, 2005 /Consolidated Insured Portfolio Highlights

11

Quarterly Operating Supplement

Radian Asset Assurance Inc.

Consolidated Insured Portfolio Highlights*

($ Millions)

10 Largest Public Finance Exposures

| | | | | | | | |

| | | Net Par

Outstanding

(9/30/2005)

| | Percent

of total

Net Par

| | | Rating1

|

New York, New York GO | | $ | 643 | | 0.9 | % | | A+ |

Port Authority of New York & New Jersey | | | 474 | | 0.7 | % | | AA– |

California State GO | | | 357 | | 0.5 | % | | A |

Massachusetts State GO | | | 340 | | 0.5 | % | | AA |

Long Island Power Authority New York | | | 317 | | 0.4 | % | | A– |

New York City Muni Water Finance | | | 309 | | 0.4 | % | | AA+ |

Illinois State GO | | | 276 | | 0.4 | % | | AA |

Jefferson County Alabama Gas & Sewer | | | 275 | | 0.4 | % | | A |

Metropolitan Transportation Authority New York | | | 274 | | 0.4 | % | | A |

Commonwealth of Puerto Rico GO | | | 249 | | 0.3 | % | | BBB |

Total | | $ | 3,514 | | 4.9 | % | | |

| | | |

| 10 Largest Structured Finance Exposures | | | | | | | | |

| | | |

| | | Net Par

Outstanding

(9/30/2005)

| | Percent

of total

Net Par

| | | Rating2

|

Second to Pay CDO Wrap | | $ | 450 | | 0.6 | % | | AAA |

UK Static Synthetic Investment Grade CDO | | | 450 | | 0.6 | % | | AAA |

Global Static Synthetic Investment Grade CDO | | | 400 | | 0.6 | % | | AAA |

US Static Synthetic Investment Grade CDO | | | 400 | | 0.6 | % | | AAA |

UK Static Synthetic Investment Grade CDO | | | 400 | | 0.6 | % | | AAA |

UK Static Synthetic Investment Grade CDO | | | 400 | | 0.6 | % | | AAA |

US Static Synthetic Investment Grade CDO | | | 400 | | 0.6 | % | | AAA |

US Static Synthetic Investment Grade CDO | | | 400 | | 0.6 | % | | AAA |

CDO of ABS | | | 390 | | 0.5 | % | | AA |

Global CDO of ABS | | | 390 | | 0.5 | % | | AAA |

Total | | $ | 4,080 | | 5.8 | % | | |

| * | See Consolidated Explanatory Notes on page 15. |

| 1 | Indicated category reflects highest rating of the three rating agencies. |

| 2 | Indicated category reflects highest rating of the three rating agencies. Represents lowest attachment point of transactions. |

Quarterly Operating Supplement for the Period Ended Sept. 30, 2005 /Consolidated Insured Portfolio Highlights

12

Quarterly Operating Supplement

Radian Asset Assurance Inc.

Consolidated Insured Portfolio Highlights*

($ Millions)

Net Debt Service Amortization

| | | | | | |

| | | Scheduled

Net Debt Service

Amortization

as of 9/30/2005

| | Ending

Net Debt Service

Outstanding

|

2005 | | $ | 1,383 | | $ | 101,799 |

2006 | | | 5,656 | | | 96,143 |

2007 | | | 7,167 | | | 88,976 |

2008 | | | 6,165 | | | 82,811 |

2009 | | | 8,037 | | | 74,774 |

2010 – 2014 | | | 27,460 | | | 47,314 |

2015 – 2019 | | | 17,508 | | | 29,806 |

2020 – 2024 | | | 13,008 | | | 16,798 |

After 2024 | | | 16,798 | | | — |

Total | | $ | 103,182 | | | |

| * | See Consolidated Explanatory Notes on page 15. |

Quarterly Operating Supplement for the Period Ended Sept. 30, 2005 /Consolidated Insured Portfolio Highlights

13

Quarterly Operating Supplement

Radian Asset Assurance Inc.

Consolidated CDO Exposure*($ Millions)

Total CDO Exposure

| | | | | | | | | | | | |

| | | Net Par

Outstanding

(9/30/2005)

| | Percent of

Total CDO

Net Par

| | | Net Par

Outstanding

(12/31/2004)

| | Percent of

Total CDO

Net Par

| |

Direct | | $ | 18,973 | | 93.9 | % | | $ | 11,704 | | 89.0 | % |

Assumed | | | 1,231 | | 6.1 | % | | | 1,452 | | 11.0 | % |

Total | | $ | 20,204 | | 100.0 | % | | $ | 13,156 | | 100.0 | % |

| | | | |

| Total CDO Portfolio Rating Distribution | | | | | | | | | | | | |

| | | | |

| | | Net Par

Outstanding

(9/30/2005)

| | Percent of

Total CDO

Net Par

| | | Net Par

Outstanding

(12/31/2004)

| | Percent of

Total CDO

Net Par

| |

AAA | | $ | 15,739 | | 77.9 | % | | $ | 8,474 | | 64.4 | % |

AA | | | 2,481 | | 12.2 | % | | | 2,612 | | 19.9 | % |

A | | | 558 | | 2.8 | % | | | 790 | | 6.0 | % |

BBB | | | 1,145 | | 5.7 | % | | | 619 | | 4.7 | % |

Below Investment Grade | | | 161 | | 0.8 | % | | | 521 | | 4.0 | % |

Not Rated | | | 120 | | 0.6 | % | | | 140 | | 1.0 | % |

Total | | $ | 20,204 | | 100.0 | % | | $ | 13,156 | | 100.0 | % |

| | | | |

| Direct CDO Underlying Asset Types | | | | | | | | | | | | |

| | | | |

| | | Net Par

Outstanding

(9/30/2005)

| | Percent of

Total CDO

Net Par

| | | Net Par

Outstanding

(12/31/2004)

| | Percent of

Total CDO

Net Par

| |

Corporates | | $ | 17,548 | | 92.5 | % | | $ | 10,577 | | 90.4 | % |

ABS | | | 1,425 | | 7.5 | % | | | 1,127 | | 9.6 | % |

Total | | $ | 18,973 | | 100.0 | % | | $ | 11,704 | | 100.0 | % |

| * | All direct CDO deals are synthetic. $16,126 million of direct CDO net par outstanding, representing 85.0% of net par outstanding, was comprised of static deals as of 9/30/05. $2,847 million of direct CDO net par outstanding, representing 15.0% of net par outstanding, was comprised of managed deals as of 9/30/05. |

Quarterly Operating Supplement for the Period Ended Sept. 30, 2005 /Consolidated CDO Exposure

14

Quarterly Operating Supplement

Radian Asset Assurance Inc.

Consolidated Explanatory Notes

1. The accompanying unaudited GAAP financial information includes the accounts of Radian Asset Assurance Inc. (the “Company” or “Radian Asset”), Radian Asset Assurance Limited, Radian Financial Products Limited, Van-American Companies, Inc. and Asset Recovery Solutions.

These unaudited consolidated financial statements do not include all of the information and disclosures required by generally accepted accounting principles. These financial statements should be read in conjunction with the audited consolidated financial statements and notes thereto, including the Report of Independent Registered Public Accounting Firm for the Company for the year ended December 31, 2004, as filed in accordance with 15c2-12 of the Securities Exchange Act of 1934.

2. In May 2004, Moody’s provided Radian Asset with an initial insurance financial strength rating of Aa3. Concurrently, and in anticipation of the merger of Radian Reinsurance with and into Radian Asset, Moody’s downgraded the insurance financial strength rating of Radian Reinsurance from Aa2 to Aa3. As a result of this downgrade, two of the primary insurer customers had the right to recapture previously written business ceded to Radian Reinsurance. One of these customers agreed, without cost to or concessions by the Company, to waive its recapture rights. Effective February 28, 2005, the remaining primary insurer customer with recapture rights recaptured approximately $7.4 billion of par in-force that it had ceded to Radian Reinsurance, including $54.7 million of premiums written through the recapture date, $4.5 million of which already had been treated as earned under GAAP and was required to be recorded as an immediate reduction of earned premium at the time of recapture. Also, in connection with the recapture in the first quarter of 2005, the Company was reimbursed for policy acquisition costs of approximately $17.1 million for which the carrying value under GAAP was $18.8 million. This required the Company to write-off policy acquisition costs of $1.7 million. The aggregate result of the recapture was a reduction in pre-tax income of $6.2 million. In March 2005, without cost to or concessions by the Company, this customer waived its remaining right to recapture an additional $5.2 billion of par in force that it had ceded to the Company through December 31, 2004.

In October 2002, S&P downgraded the insurance financial strength rating of Radian Reinsurance, before its merger with and into Radian Asset from AAA to AA. As a result of this downgrade, effective January 31, 2004, one of the primary insurer customers of Radian Reinsurance exercised its right to recapture approximately $16.4 billion of par in force, including $96.4 million of written premiums with a GAAP carrying value of approximately $71.5 million. The entire impact of this recapture was reflected as a reduction of written premiums in the first quarter of 2004. Because the Company, in accordance with GAAP, already had reflected $24.9 million of these recaptured written premiums as having been earned, the Company was required to record the entire $24.9 million reduction in earned premiums in the first quarter of 2004. Also, in connection with the recapture in the first quarter of 2004, the Company was reimbursed for policy acquisition costs of approximately $31.0 million for which the carrying value under GAAP was $21.3 million. In addition, the Company also reimbursed the primary insurer approximately $7.5 million for case reserves which were net of $4.0 million of salvage. Finally, the Company took a charge of $0.8 million for mark-to-market adjustments related to certain insurance policies associated with the recapture. The sum of the above adjustments resulted in an immediate reduction of pre-tax income of $15.9 million. Without cost to or concessions by the Company, the remaining primary insurer customers with recapture rights agreed not to exercise those rights with respect to the October 2002 downgrade by S&P.

3. For the year to date period of 2005, policy acquisition costs were $9.3 million higher than the same period of 2004. The February 28, 2005 recapture resulted in a $1.7 million increase in policy acquisition costs, as compared to the January 31, 2004 recapture which resulted in a $9.7 million reduction.

4. Change in fair value of derivative instruments for the year to date period of 2005 was $39.4 million as compared to $7.0 million for the 2004 period. This increase is primarily the result of overall tightening of credit spreads.

5. The liability for losses and loss adjustment expenses decreased $25.1 million to $191.1 million at September 30, 2005 from $216.2 million at December 31, 2004. This decrease is primarily the result of $23.4 million of claims paid pertaining to Conseco Finance Corp. (“Conseco”)

6. Unearned premiums were $4.7 million lower at September 30, 2005 compared to December 31, 2004 primarily as a result of the February 28, 2005 recapture of financial guaranty business by one of the Company’s primary insurer customers.

7. The statutory loss and loss adjustment expense ratio for the nine months ended September 30, 2004 reflects the establishment of a $111.3 million reserve on a statutory basis (recorded on a GAAP basis in 2003) pertaining to Conseco.

Quarterly Operating Supplement for the Period Ended Sept. 30, 2005 /Consolidated Explanatory Notes

15

Quarterly Operating Supplement

Safe Harbor Statement

All statements made in this document that address events or developments that we expect or anticipate may occur in the future are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934 and the U.S. Private Securities Litigation Reform Act of 1995. These statements are made on the basis of management’s current views and assumptions with respect to future events. The forward-looking statements, as well as Radian’s prospects as a whole, are subject to risks and uncertainties, including the following: changes in general financial and political conditions such as extended national or regional economic recessions (or expansions), changes in housing values, population trends and changes in household formation patterns, changes in unemployment rates, changes or volatility in interest rates, or other political instability; changes in investor perception of the strength of private mortgage insurers or financial guaranty providers, and risks faced by the businesses, municipalities or pools of assets covered by Radian’s insurance; the loss of a customer with whom Radian has a concentration of its insurance in force; rising delinquencies in mortgage loans insured by Radian resulting from increased consolidation of mortgage lenders and servicers; increased severity or frequency of losses associated with certain Radian products that are riskier than traditional mortgage insurance and municipal guaranty insurance policies; material changes in persistency rates of Radian’s mortgage insurance policies; downgrades of the insurance financial-strength ratings assigned by the major ratings agencies to Radian’s operating subsidiaries; heightened competition from other insurance providers and from alternative products to private mortgage insurance and financial guaranty insurance; changes in the business practices of Fannie Mae and Freddie Mac; the application of existing federal or state consumer lending, insurance and other applicable laws and regulations, or unfavorable changes in these laws and regulations or the way they are interpreted or applied, including: (i) the possibility of private lawsuits or investigations by state insurance departments and state attorneys general alleging that services offered by the mortgage insurance industry, such as captive reinsurance, pool insurance and contract underwriting, are violative of the Real Estate Settlement Procedures Act and/or similar state regulations (particularly in light of public reports that some state insurance departments may review or investigate captive reinsurance arrangements used in the mortgage insurance industry), (ii) the outcome of private lawsuits that have been brought against us and other mortgage insurers under the Fair Credit Reporting Act or (iii) legislative and regulatory changes affecting demand for private mortgage insurance or financial guaranty insurance; the possibility that we may fail to estimate accurately the likelihood, magnitude and timing of losses in connection with establishing loss reserves for our mortgage insurance or financial guaranty businesses or to estimate accurately the fair value amounts of derivative financial guaranty contracts in determining gains and losses on these contracts; changes in accounting guidance from the SEC or the Financial Accounting Standards Board regarding income recognition and the treatment of loss reserves in the mortgage insurance or financial guaranty industries; changes in claims against mortgage insurance products resulting from the aging of Radian’s mortgage insurance policies; vulnerability to the performance of Radian’s strategic investments; international expansion of our mortgage insurance and financial guaranty businesses into new markets and risks associated with our international business activities; and the loss of executive officers or other key personnel. Investors are also directed to other risks discussed in documents filed by Radian with the SEC, including the factors detailed in our annual report on Form 10-K for the year ended December 31, 2004 in the section immediately preceding Part I of the report. We caution you not to place undue reliance on these forward-looking statements, which are current only as of the date on which this information was publicly released. Radian does not intend to and disclaims any duty or obligation to update or revise any forward-looking statements made in this document to reflect new information, future events or for any other reason.

Quarterly Operating Supplement for the Period Ended Sept. 30, 2005 /Safe Harbor Statement

16