Exhibit 99.5

Merger Overview

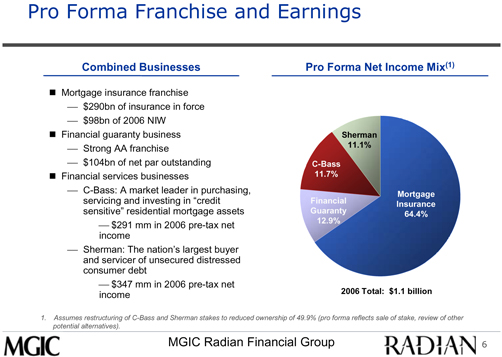

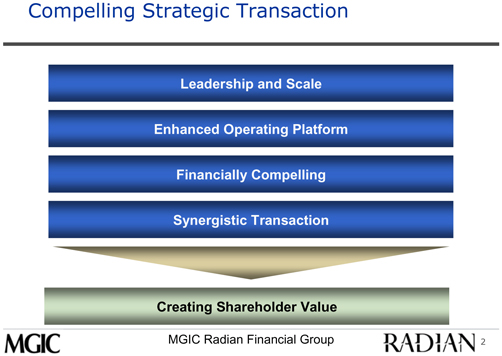

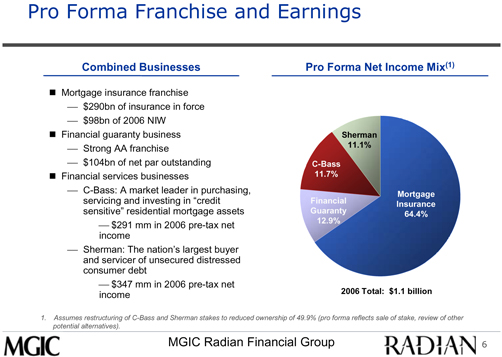

| • | | Creates a preeminent mortgage insurer and credit risk insurer |

| • | | Complimentary mix of revenues/earnings |

| • | | Stronger platform for growth |

| • | | Long term shareholder value creation with increased financial strength and flexibility |

Overview of Transaction Terms

| | |

| Structure | | 0.9658 MGIC shares per Radian share (based on February 2, 2007 market close) |

| |

| Consideration | | 100% Stock |

| |

Name | | MGIC Radian Financial Group |

| | – Mortgage Insurance business: MGIC |

| | – Financial Guaranty business: Radian Guaranty |

| |

Locations | | Headquarters: Milwaukee, WI |

| | – Mortgage Insurance: Milwaukee, WI; Philadelphia, PA; International |

| | – Financial Guaranty: New York, NY; International |

| |

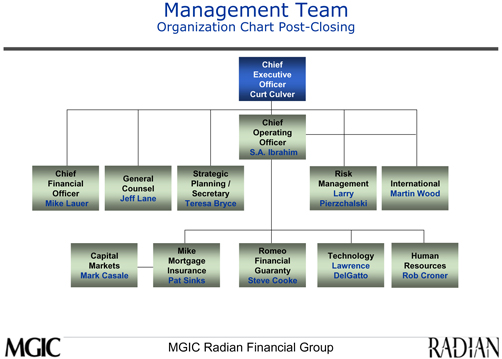

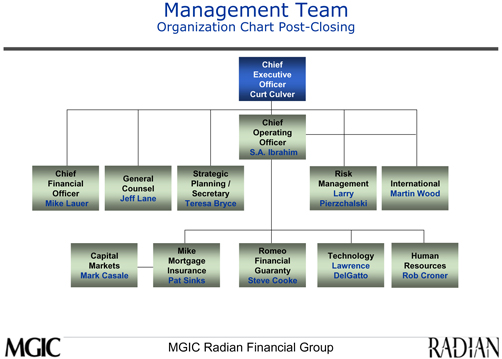

Leadership | | CC, Chairman and CEO until two years post closing |

| | SAI, President and COO; assumes CEO title two years post closing |

| | Senior management positions identified |

| |

Board Composition | | 6 MGIC directors (including Chairman); 5 independents |

| | 5 Radian directors (including Lead Director); 4 independents (to be |

| | increased to 6 directors, 5 independents upon election by shareholders following consummation of the merger) |

| |

| Dividend | | $1.00 per share (current MGIC dividend) |

| |

| Approvals | | Normal shareholder and regulatory approvals |

| |

| Due Diligence | | Completed |

| |

| Timing | | Expected closing fourth quarter of 2007 |

| | Subject to regulatory approvals and approval of shareholders of both companies |

Forward Looking Statements

Discussions made in this press release that are not statements of historical fact (including statements that include terms such as “will,” “may,” “should,” “believe,” “expect,” “anticipate,” “estimate,” “intend,” and “plan”) are forward-looking statements that involve risks and uncertainties. Any forward-looking statement is not a guarantee of future performance and actual results could differ materially from those contained in the forward-looking information. Such forward-looking statements include, but are not limited to, statements about the benefits of the business combination transaction involving Radian and MGIC, including future financial and operating results, the new company’s plans, objectives, expectations and intentions and other statements that are not historical facts.

The following factors, among others, could cause actual results to differ from those set forth in the forward-looking statements: the ability to obtain regulatory approvals of the transaction on the proposed terms and schedule; the failure of Radian or MGIC to approve the transaction; the risk that the businesses will not be integrated successfully; customer attrition and disruption from the transaction making it more difficult to maintain relationships with customers, employees or suppliers; the risk that the cost savings and any other synergies from the transaction may not be fully realized or may take longer to realize than expected; competition and its effect on pricing, spending, third-party relationships and revenues; movements in market interest rates and secondary market volatility; potential sales of assets in connection with the merger; legislative and regulatory changes affecting demand for private mortgage insurance or financial guaranty insurance; downgrades of the insurance financial-strength ratings assigned by the major ratings agencies to Radian’s and MGIC’s operating subsidiaries and unfavorable changes in economic and business conditions. Additional factors that may affect future results are contained in Radian’s and MGIC’s filings with the SEC, which are available at the SEC’s websitehttp://www.sec.gov. Radian and MGIC disclaim any obligation to update and revise statements contained in these materials based on new information or otherwise.

Additional Information

The proposed merger will be submitted to shareholders of MGIC Investment Corporation and Radian Group Inc. for their consideration.Shareholders are urged to read the joint proxy statement/prospectus regarding the proposed merger when it becomes available because it will contain important information.Shareholders will be able to obtain a free copy of the joint proxy statement/prospectus, as well as other filings containing information about MGIC and Radian, without charge, at the Securities Exchange Commission’s Internet site (www.sec.gov). You will also be able to obtain these documents, free of charge, by accessing MGIC’s website (http://www.mgic.com) or Radian’s website (http:/www.radian.biz). Copies of the joint proxy statement/prospectus and the filings with the Securities and Exchange Commission that will be incorporated by reference in the joint proxy statement/prospectus can also be obtained, without charge, by directing a request to Michael Zimmerman, Vice President Investor Relations, 250 E. Kilbourn, Milwaukee, WI 53092 or Mona Zeehandelaar, Senior Vice President, Investor Relations and Corporate Communications, 1601 Market Street, Philadelphia, PA 19103

MGIC Investment Corporation and Radian Group Inc., their respective directors and executive officers and other persons may be deemed to be participants in the solicitations of proxies from the shareholders of MGIC Investment Corporation and/or Radian Group Inc. in respect of the proposed merger. Information regarding MGIC Investment Corporation’s directors and executive officers is available in its proxy statement filed with the Securities and Exchange Commission by MGIC on March 30, 2006, and information regarding Radian Group Inc’s directors and executive officers is available in it proxy statement filed with the Securities and Exchange Commission by Radian on April 18, 2006. Additional information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus when it becomes available.