- RDN Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

CORRESP Filing

Radian (RDN) CORRESPCorrespondence with SEC

Filed: 3 Apr 09, 12:00am

April 3, 2009

Mr. Jim B. Rosenberg

Senior Assistant Chief Accountant

Division of Corporate Finance

United States Securities and Exchange Commission

100 F Street NE

Washington, DC 20549

| Re: | Radian Group Inc. |

Form 10-K for the Fiscal Year Ended December 31, 2007

Form 10-Q for the Fiscal Quarter Ended September 30, 2008

File Number: 001-11356

Dear Mr. Rosenberg:

On behalf of Radian Group Inc., I respectfully provide our responses to each of the comments in your letter dated February 20, 2009, other than your “comment five,” which we expect to address in a separate response to be filed on or before April 17, 2009. For your convenience, the text of each of your comments is reproduced below before the applicable response. References in this letter to “we,” “us,” “our,” or “ours,” refer to Radian Group Inc. and its consolidated subsidiaries.

Form 10-Q for the Fiscal Quarter Ended September 30, 2008

Management’s Discussion and Analysis of Financial Condition and Results of Operations, page 47

Credit Exposure of Direct Corporate CDO Portfolio, page 80

| 1. | Please refer to prior comment two. Please revise your proposed disclosure to clarify how the information presented depicts the actual deterioration in subordination that has occurred to date, as well as how much additional deterioration would need to occur before you would expect to incur material claims. For example, clarify how the relative significance of each specified credit event is considered in your analysis. In addition, we believe that additional disaggregated information may be useful to an investor, such as disaggregating the net par exposure based on the credit ratings of the underlying securities. Please revise your disclosure to provide this information, or similar data that would enable investors to assess the potential exposure to future credit events and/or claim payments. |

Response:We have included additional disclosure in our 2008 10-K filing on pages 29 and 30 regarding sustainable credit events, and further information regarding the credit deteriorationwe have experienced in terms of the reduction in number

of sustainable credit events. We have also provided disclosure ofour internal credit ratings of our insured CDO exposures (page 28 of our 2008 10-K filing) and, because much of our direct CDO insured portfolio is rated AAA, we also provided detail regarding the relative strength of the subordination for our transactions on page 29 of our 2008 10-K filing. We do not think it meaningful to provide additional information relating to the credit ratings of underlying securities, as these ratings must be considered in the context of each transaction’s subordination level in order for the reader to understand the potential impact to our insured exposure. As this information varies by transaction, it is not meaningful to investors to aggregate this data out of context, and we believe the disclosures we have presented are more directly relevant to our insured exposures.

| 2. | We were unable to determine where you have included disaggregated disclosure regarding the assets underlying your mortgage insurance domestic and international CDS, which appear to comprise 13% of your total notional derivative exposure. Please revise to include disclosures regarding the underlying asset classes, original and current subordination levels, vintages and credit ratings, as appropriate. |

Response: We have included additional information regarding our two international mortgage insurance credit default swaps on pages 9 and 105 of our 2008 10-K filing. This information includes detail on the underlying collateral types, geographic locations of the underlying collateral, and credit ratings of the underlying collateral, as well as our expectations with respect to claim payments. As also noted in this disclosure, we reduced our total risk in force related to these transactions by approximately $4.0 billion to $3.4 billion as of December 31, 2008 as a result of the termination of a large transaction in the fourth quarter of 2008. With regard to our domestic mortgage insurance credit default swaps, we have disclosed on page 104 of our 2008 10-K filing our total exposure amount, total fair value liability as of December 31, 2008, and expected loss. Given our limited exposure to domestic mortgage insurance credit default swaps (representing 0.2% of our total derivative notional exposure as of December 31, 2008, the substantial portion of which has been recognized as a liability), we do not believe that additional disclosure is necessary regarding the underlying collateral.

Critical Accounting Policies, page 88

| 3. | As discussed in our conference call on February 17, 2009, please provide proposed revised disclosure that clarifies why the valuation methodology for your Corporate CDO CDS contracts does not result in double counting of your non-performance risk. To assist our understanding of your proposed revised disclosure, please provide an example that illustrates the manner in which your non-performance risk is incorporated into the valuation of your CDS contracts, including how it is considered in the valuation of: (i) the contractual premiums and (ii) the fair premium. |

Response: We have provided revised disclosure regarding our non-performance risk adjustment on pages 158-160 of our 2008 10-K filing that provides additional detail regarding our non-performance risk adjustment methodology and, we believe, makes clear that it does not result in double counting of our non-performance risk. Following is an example that illustrates the manner in which our non-performance risk adjustment for both ourcontractual premium and our fair

premium amounts are calculated. This example calculation is based on a corporate CDOtransaction with notional exposure of $400 million, a remaining life of five years, and a contractual annual premium rate of 5.9 basis points:

Disclosure excerpt from 2008 10-K filing | Example Calculation: Contractual Premium | |

| The discount rate we use to determine the present value of expected future premiums is our credit default swap spread plus a risk free rate. | Present value of scheduled premium income = $0.4 million. This amount is obtained by discounting each scheduled future premium payment using a discount rate equal to LIBOR+Radian CDS, where Radian CDS is the Radian CDS spread associated with the scheduled premium payment date. For example, a payment scheduled to occur five years into the future is discounted using the five year Radian CDS spread plus five-year LIBOR. | |

Example Calculation: Fair Premium Amount | ||

| The amount of the non-performance risk adjustment is computed based, in part, on the expected claim payment by Radian. To estimate this expected payment, we first determine the expected claim payment of a typical market participant by using a risk neutral modeling approach. A significant assumption underlying the risk neutral model approach that we use is that the typical fair premium amount is equal to the present value of expected claim payments from a typical market participant. Expected claim payments on a transaction are based on the expected loss on that transaction (also determined using a risk neutral modeling approach). | The present value of the expected claim payment for typical market participant = typical fair premium amount, assumed at $56 million (represents net present value of gross fair premium amount of $62 million, our estimation of which is further described below) for our sample insured corporate CDO transaction with five year remaining life.

Risk Neutral modeling is a market standard valuation technique which is utilized by many other market participants. | |

|

| |

| Radian’s expected claim payment is calculated based on the correlation between the default probability of the transaction and our default probability. The default probability of Radian is determined from the observed Radian Group credit default swap spread and the default probability of the transaction is determined as described above under “Defining the Equivalent Risk Tranche.” | Significant inputs for our sample calculation of expected claim payment include:

• Default probability of Radian (P1) = 71%

• Default probability of transaction (P2) = 48%

• Correlation (r) of default between transaction and Radian = 85%

The default probability of Radian (P1) is based on the Radian CDS spread and the following example calculations:

The survivability of Radian (S1) over the remaining life of the transaction is defined as:

S1=1- P1. | |

The CDS spread of Radian for the term (five years) of the transaction is 24.66%/year, which is approximately 6%/quarter. This is used as a quarterly default rate within the risk neutral modeling framework. The quarterly survivability (Q1) is thus:

Q1=1- 6%=94%.

The five year (20 quarter) survivability (S1) is obtained by the following formula:

S1=(94%)20=29%.

Using the definition of S1:

P1=1- S1=1-29%=71%.

The expected claim payment estimate relies on a calculation of the joint default probability for Radian and the transaction; the transaction default probability is 48% and the probability of the transaction and Radian defaulting together is 47.1% (the remaining 0.9% is associated with the transaction defaulting and Radian surviving, as stated above). Although that calculation is somewhat complex, it can be approximated by the following formula which includes all significant inputs (see variables defined above). For the joint default probability (P12),

P12=P1*P2+(min(P1, P2)-P1*P2)*r.

The joint default probability is simply the product of the default probabilities (P1*P2=71%*48%=34%) if there is no correlation (r=0). If the correlation is 100% then the joint default probability becomes equal to the smaller of the two probabilities (min(71%, 48%)=48%), since the joint default probability cannot be larger than either individual default probability. As the correlation varies from 0% to 100% the joint default probability takes on values between these two bounds (34% and 48%). Using values for P1, P2, andr, the approximate calculation gives P12=71%*48%+(min(71%, 48%)-71%*48%)*85%=46%. The difference between the 46% calculated here and the actual result of 47.1% for our sample transaction is due to some minor simplifications made to the formula for ease of understanding in this letter. |

| We also calculate the probability of a typical market participant making claim payments. This probability is generally very high as a typical market participant is a more highly rated entity and also has contracts which require daily collateral posting. In this particular example, it is determined that a typical market participant has a 45% probability of paying claims (compared to the 48% probability of a transaction default, this means most claims are paid by the typical market participant). Radian has a 0.9% probability of making claim payments (48%-47.1%=0.9%); therefore, Radian is expected to make only 2% of the claim payments of a typical market participant (0.9%/45%=2%). The expected claim payment for a typical market participant (undiscounted) is $62 million. Thus, the expected claim payment for Radian is 2% of $62 million (approximately $1.4 million). | ||

The present value of Radian’s expected claim payment is discounted using a risk free interest rate, as the expected claim payments have already been risk adjusted. |

Present value of expected claim payment = discounting of gross fair premium of $1.4 million at a risk free rate = $1.2 million. Therefore $1.2 million is the fair premium amount. | |

The reduction in our fair premium amount related to our non-performance risk is limited to a minimum fair premium amount, which is determined based on our estimate of the minimum fair premium that a market participant would require to assume the risks of our obligations. |

Current minimum fair premium amount at December 31, 2008 is $0.3 million for our example deal, based on a minimum premium rate of 2.6 basis points per year. In this example transaction, the fair premium amount exceeds the minimum fair premium, so no adjustment is performed. See our response to comment six for further information on the basis for the minimum fair premium amount. | |

| 4. | For all CDS contracts where your valuation method includes a present value calculation, please disclose the discount rate used. |

Response: We have included a description of the discount rates used in determining the fair value estimates for each of our products where present value calculations are used as described on pages 156 through 163 and pages 201 through 209 of our 2008 10-K filing.

| 5. | Please refer to the first paragraph of your disclosure on page 96. Based on our February 17, 2009 conference call, it appears that a key assumption underlying your recognition of credit derivative assets for Corporate CDOs is that the termination of the contracts by your counterparties is not assumed, even though this contractual right currently exists in 82% of your Corporate CDO contracts. If true, please revise your proposed disclosure to discuss this assumption and explain why you believe it is appropriate. Also, please provide similar disclosures regarding the key assumptions underlying other material categories of derivative assets. |

Addendum to comment five, received by letter dated March, 24, 2009:

In our recent telephonic discussion on March 18, 2009, we expressed our preliminary views regarding the appropriateness of recording a derivative asset in the current situation in which the contract termination provisions have been triggered. As you requested, we reiterate our rationale below.

Our understanding is that you have recorded derivative assets relating to Corporate CDO contracts with provisions that permit the customer to terminate the contract upon a credit downgrade, for which the termination right has been triggered. We believe that the value of a credit derivative contract should be based on the fair value of the derivative’s contractual rights and obligations. We believe that one way of considering the current situation is that triggering of the termination provisions has changed each contract into a period-by-period contract under which you no longer have any long-term contractual right to receive the premiums. Instead each period, the customer chooses in essence to renew the derivative contract for another short-term period. In our view a rational economic factor in this circumstance would choose obtain the insurance from an insurer with a similar credit risk to Radian, where for a lower price, it could achieve the same coverage. We understand that you believe that the customer at this point does not have that option because no other insurer is currently writing this business, but if the purchaser did have a choice, we believe they would either change insurers in this circumstance or renegotiate with the company. You have noted that to date, substantially all of your Corporate CDO customers have elected not to terminate the contracts. However, any value attributable to the behavior of your customers in these circumstances appears to be indicative of a customer relationship intangible or other factor rather than long-term cash flows under the derivative contract. We believe there would be no basis to recognize such an internally developed intangible asset. SAB 109 includes guidance that is applicable by analogy in this situation. SAB 109 states that in determining the value of a derivative loan commitment, the staff does not believe that internally developed intangible assets (such as customer relationship intangible assets) should be recorded as part of the fair value of a derivative loan commitment. Such non financial elements of value should not be considered a component of the related derivative instrument.

Another way of looking at this situation, which we believe would result in a similar answer, relates to how your model determines the fair premium. You have indicated that customers may have elected not to terminate because they essentially have nowhere else to go based on the current inactive market. However, under SFAS 157, an active market is assumed in

determining the fair value of the contract. Since the customers can terminate the agreement, they could choose to obtain coverage from another company where, based on your own estimate of the fair premium, they would be able to achieve the same coverage at a lower price. Alternatively, they could elect to renegotiate the premium with you. It appears that your current valuation model assumes an active market for your determination of the contract’s exit value but an inactive market for your customers’ determination to terminate the contract, which appears inconsistent. It appears there should be a discontinuity or nonlinearity in your valuation model that occurs because of the situation in the market faced by the customer. That is, if there is nowhere else for the customer to go, it would appear that the contractual price that is being charged under the contract is in fact the fair premium, because customers are willing to pay it. This view would also suggest that there is no derivative asset as the contractual premium charged equals the fair premium when considerations of supply and demand are factored into the valuation.

| 1. | Please tell us whether you agree or disagree with the views expressed above. If you disagree, please explain why and provide any additional information that you believe is relevant. |

| 2. | As discussed in our conference call on February 27, 2009, please tell us the amounts of derivative assets where termination rights had been triggered that were recorded at each balance date. |

Response: Our response to this comment five will be set forth in a separate letter, as discussed above.

| 6. | Please tell us and revise your proposed disclosure to address how your valuation methodology addresses the concept of a minimum fair premium amount, below which a CDS contract would not be written. If a floor premium is a key assumption in the valuation of a significant percentage of your CDS contracts, please provide appropriate disclosure regarding this assumption. |

Response: We have provided additional disclosure regarding our assumption of a minimum fair premium amount on page 160 of our 2008 10-K filing. This assumption exists for our corporate and non-corporate CDO transactions, as disclosed in our description of both of these product types. We have determined the minimum fair premium amount for these transactions to be 2.6 basis points, as this is the lowest fair premium amount we observed in the market when a more liquid market existed. It represents the minimum price we believe a market participant would require for a transaction with negligible credit risk. Please also see our response to comment three, which provides an example that includes further detail on how the minimum fair premium amount is factored into our valuation methodology.

| 7. | Please refer to your disclosure on page 99 regarding the change in the fair value estimate for one large RMBS CDO derivative transaction. Please explain in more detail your statement that the index implied credit loss duration was relatively short-term, and discuss why you believe the duration implied by the index was a reasonable proxy for the duration of the |

RMBS underlying the CDS. Tell us why you believe it was appropriate to use the market based index spreads to value this transaction through June 30, 2008, and address the circumstances under which you would expect to change your valuation methodology from a market based index spread approach to a discounted cash flow model. Revise your disclosures as appropriate. |

Response: We have included additional disclosure on page 156 of our 2008 10-K filing regarding those circumstances where we use market based index spreads and those for which we use a discounted cash flow analysis. For your reference, this disclosure is provided below:

“We determine the fair value of our derivative assets and liabilities using internally generated models. We utilize market observable inputs, such as credit spreads on similar products, whenever they are available and relevant. Because we do not expect to pay claims for most of our contracts, we believe this credit spread approach provides us with the best estimate of fair value for these contracts. When a contract experiences significant credit deterioration and we can estimate expected losses, we utilize a discounted cash flow analysis to estimate fair value. In these instances, we believe a discounted cash flow analysis results in a more accurate estimate of fair value, as it considers reasonably estimable losses associated with the specific contract and, therefore, is more relevant than using a market based index or credit spread.”

Prior to the quarter ended September 30, 2008, our loss analysis for this particular RMBS CDO transaction showed no expected losses resulting in claim payments. During this period when we did not expect losses on our insured tranche, the underlying cash flows were determined based primarily on prepayment assumptions of the underlying collateral. Based on these assumptions, the cash flows were expected to pay down our tranche in a manner consistent with other collateral originated in the same time period, which implied a relatively short duration for this transaction. Accordingly, during this period, we believed that market-based spreads and duration information provided us with the best market indicators of fair value.

During the third quarter of 2008, our insured tranche of this transaction was downgraded from AA- to B+, and at September 30, 2008, our loss analysis for the transaction showed expected losses resulting in claim payments. In accordance with our policy as outlined in the above disclosure, the identification of expected claim payments resulted in a change in our valuation approach. This change resulted in a significant increase in our gross expected claim payment and, because of our new information about expected claim payment timing, a reduction in our fair value liability due to a larger non-performance risk adjustment for this credit as explained in our September 30, 2008 10-Q disclosures. At September 30, 2008, with significant losses projected to our insured tranche, our projected claim payments were based on our payment obligations under our CDS contract, which requires us to pay principal only at the legal maturity of the deal (or earlier, upon complete disposition of all collateral), and results in a significantly longer expected life than a transaction which is expected to pay down based on prepayments. This increase in expected life resulted in a significant increase in our non-performance risk adjustment, which resulted in a significant reduction of our fair value liability.

| 8. | Please refer to your disclosures regarding put options on CPS. Please provide us with an analysis of your determination that these instruments should be accounted for as derivatives under SFAS 133. Also, please clarify why you believe that the put options could become liabilities, as indicated in your 12/31/07 10-K disclosure. Lastly, please tell us how the exercise of the put options will be accounted for. |

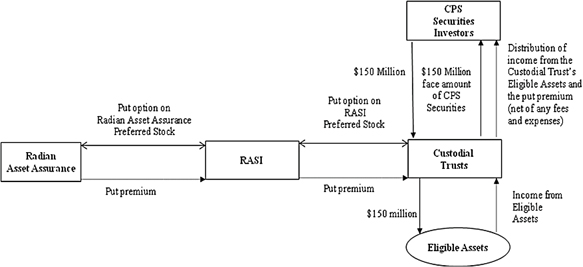

Response: In our put options on CPS structure (see illustration below), our wholly-owned consolidated subsidiary, Radian Asset Assurance, entered into a series of three perpetual put option agreements pursuant to which it has the right to put its perpetual preferred stock to another wholly-owned consolidated subsidiary, Radian Asset Securities Inc. (“RASI”). RASI, in turn entered into a series of three put option agreements, pursuant to which, upon the put option exercise by Radian Asset Assurance of its perpetual preferred stock to RASI, RASI is obligated to put its own perpetual preferred stock (on same terms to the Radian Asset Assurance perpetual preferred stock) to three third-party trusts created for the purpose of issuing the CPS securities. Third party investors funded the trusts, and the cash was invested in short-term, highly liquid securities that meet certain eligibility criteria defined in the agreements. Upon exercise of the put options, the trust investments would be liquidated, the proceeds paid to RASI, and the perpetual preferred stock would be issued and held by the trusts. In turn, RASI would pay the proceeds it received for the issuance of the RASI perpetual preferred stock to Radian Asset Assurance as payment for the issuance of the Radian Asset Assurance perpetual preferred stock, which would be held by RASI.

In determining the accounting treatment for our put options on CPS we considered the following accounting literature:

| • | EITF 00–19 “Accounting for Derivative Financial Instruments Indexed to, and Potentially Settled in, a Company’s Own Stock” (“EITF 00-19”). |

| • | FAS 133 “Accounting for Derivative Instruments and Hedging Activities” (as amended) (“FAS 133”) |

| • | EITF 00-6 “Accounting for Freestanding Derivative Financial Instruments Indexed to, and Potentially Settled in, the Stock of a Consolidated Subsidiary” (“EITF 00-06”) |

| • | EITF 01-6 “The Meaning of ‘Indexed to a Company’s Own Stock’” (“EITF 01-6”) |

| • | FAS 150 “Accounting for Certain Financial Instruments with Characteristics of both Liabilities and Equity” (“FAS 150”) |

We concluded that the put option agreements should not be classified as equity instruments, but that the put option agreements should be classified as assets and recorded at fair value in accordance with the model provided for in EITF 00-19.

EITF 00-19 applies to contracts or embedded contracts that are indexed to or settled in a company’s own stock. EITF 00-6 applies to contracts that are indexed to and potentially settled in the stock of a consolidated subsidiary. EITF 00-6 was amended, however, by FAS 150 to clarify that “for financial instruments issued by members of a consolidated group of entities, issuer’s equity shares includes the equity shares of any entity whose financial statements are included in the consolidated financial statements.” As noted above, the put option agreements were entered into by our wholly-owned consolidated subsidiaries; and therefore, the equity issued by our wholly-owned consolidated subsidiaries is considered “the company’s own stock.” We concluded the put option agreements are “indexed to, and potentially settled in, a company’s own stock” under EITF 00-19, instead of “indexed to, and potentially settled in, the stock of a consolidated subsidiary” as provided for under EITF 00-06. As a result, we concluded that EITF 00-19, and not EITF 00-06, should be applied to determine the accounting for our put options.

Paragraph 12 of EITF 00–19 states that contracts that include “any provision that could requirenet-cash settlement cannot be accounted for as equity of the company (that is, asset or liability classification is required for those contracts), except in those limited circumstances in which holders of the underlying shares also would receive cash.”

Pursuant to the terms of the put option agreements, a put premium is paid monthly by Radian Asset Assurance to RASI and RASI, in turn, pays the put premium to the trust to be distributed to the investors. The premium amount is a floating monthly amount that is based on LIBOR. It is calculated as the excess of the floating rate on the preferred securities in a Dutch auction over the investment income realized on the eligible assets.

EITF 00-19 defines net-cash settlement as “the party with a loss delivers to the party with a gain a cash payment equal to the gain, and no shares are exchanged.” RASI is considered the party with a loss since it must fund the excess of the floating rate on the trust securities over the income realized on the eligible assets, which is paid to the investor, the party with the gain, via the put premium paid monthly in cash to the trust. Therefore, because of this put option premium feature that is part of the agreements, we have concluded that this contract includes a provision requiring net-cash settlement. Therefore, the put options are not considered indexed solely to the company’s stock and they fail the requirements for equity classification, thereby requiring fair value accounting under EITF 00-19 with the fair value amount to be classified as an asset or liability, with changes in fair value reported in earnings.

In addition, in order to further understand the meaning of “Indexed to a Company’s Own Stock”, we looked at EITF 01-6. Based on this guidance we concluded that the contract is notsolely indexed to its own stock due to monthly indexed put premium. Therefore, the put option agreements are classified as an asset and recorded at fair value in accordance with EITF 00-19.

In a speech made before the 2007 AICPA National Conference on Current SEC and PCAOB Developments by the SEC Office of the Chief Accountant, remarks regarding the accounting for equity derivatives were made as it relates to the exception from derivative accounting as provided within FAS 133 “for contracts issued or held by a reporting entity that are both (a) indexed to the company’s stock, and (b) classified in stockholders’ equity. If this exception is not applicable, those contracts are generally subject to fair value accounting as a derivative asset or liability.” Our conclusion of the accounting treatment under EITF 00-19 is consistent with those remarks and as such is recorded as a derivative asset with changes in fair value recorded in earnings.

We have clarified our disclosure to state the put option agreements are currently recorded as an asset, as indicated in our 2008 10-K disclosure on page 215. If our CDS spread were to tighten, such that the terms of issuing preferred stock or entering into similar put option agreements would be more favorable than those in the existing put options agreements, then the value of the put option agreements could potentially become a liability equal to the present value of the future expected premium payments.

As it relates to the exercise of the put options, we concluded that EITF 00-19 would continue to be applicable as these contracts are perpetual agreements and would still exist even after the exercise. In accordance with the perpetual put option agreements, Radian Asset Assurance could call its preferred securities issued to RASI (and RASI would call its preferred securities issued to the trust) resulting in a perpetual put/call option agreement. Once the put options are exercised however, they meet the criteria for equity classification since we would have issued preferred securities (that are not considered liabilities under FAS 150) in exchange for cash. According to EITF 00-19 “if the classification required under this Issue changes as a result of events during the period then the contract should be reclassified as of the date of the event that caused the reclassification.” EITF 00-19 also states that if a contract “is reclassified from an asset or a liability to equity, gains or losses recorded to account for the contract at fair value during the period that the contract was classified as an asset or a liability should not be reversed.” Under EITF 00-19, “contracts that require that the company deliver shares as part of a physical settlement or a net-share settlement should be initially measured at fair value and reported in permanent equity. Subsequent changes in fair value should not be recognized as long as the contracts continue to be classified as equity.” As such, the preferred securities issued as part of the exercise will be classified as equity and initially recognized at the fair value amount as of the issuance date. Subsequent changes in fair value will not be recognized, and changes in fair value of the put options recorded in earnings while classified as an asset will not be reversed.

| 9. | Please tell us why the discount rate used to value put options on CPS incorporates your own CDS spread, given that these instruments appear to be purchased put options on your own equity. Also, please clarify what a “market-implied recovery rate” is, how it is derived, and how you use it to adjust the discount rate. Revise your disclosures as appropriate. |

Response: The fair value estimate of our put option agreements represents the difference between the market-implied yield on our preferred stock (if issued as of the measurement date) and the stated fixed rate at which we are contractually entitled to issue our preferred stock under the put option agreement, referred to in our response to comment eight. In order to estimate the market-implied yield we use the observable market yield on similar securities issued in the market, if available. We adjust this yield by a factor that takes into account our credit risk, after taking into account an industry standard recovery rate. The adjustment made to account for our credit risk is derived by comparing our CDS spread to the observed CDS spread of the issuer(s) of similar securities. The adjustments to the observed market yield reflect the difference in the market’s perception of the market-implied yield of our preferred stock as compared to the observable market yield of similar securities.

As noted on page 203 of our 2008 10-K we concluded that given the market’s view of our credit risk at that date, we determined that there were no market observations of relevance, and that there is currently no liquidity for these securities. Therefore, based on our assessment that the perpetual preferred securities could not be issued currently at any reasonable interest rate, we estimated that the current market value of the option agreements approximates the issuance amount, which is $150 million.

| 10. | Please refer to your disclosures regarding assumed financial guaranty credit derivatives. Please revise your proposed disclosure to address how you factor in your non-performance risk and the credit risk of your counterparties. |

Response: We have added additional disclosure regarding the non-performance risk adjustment on assumed financial guaranty derivatives on page 161 of our 2008 10-K. We consider counterparty credit risk in our analysis of these derivatives, but do not make an additional adjustment related to this credit risk. Our consideration of counterparty credit risk takes into account the joint probability of Radian surviving, the transaction surviving, and the protection buyer and/or primary insurer defaulting on its contractual premium payments to us. Since the primary insurer, Radian, and the transaction are all significantly correlated and the credit quality of our transactions is generally higher than that of Radian, the joint probability of these events occurring is very remote.

In connection with the responses to the comments set forth above, we acknowledge that:

| • | We are responsible for the adequacy and accuracy of the disclosure in our filings; |

| • | Staff comments or changes to disclosure in response to Staff comments do not foreclose the Securities and Exchange Commission from taking any action with respect to the filings; and |

| • | We may not assert Staff comments as a defense in any proceeding initiated by the Securities and Exchange Commission or any person under the federal securities laws of the United States. |

If you have any questions about any of the responses to your comments or require further explanation, please do not hesitate to contact me at (215) 231-1444.

| Sincerely, |

/s/ C. Robert Quint |

| C. Robert Quint |

| Chief Financial Officer |

| Radian Group Inc. |