- RDN Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

CORRESP Filing

Radian (RDN) CORRESPCorrespondence with SEC

Filed: 23 Dec 13, 12:00am

Portions of this letter have been omitted based on a request for confidential treatment pursuant to 17 C.F.R. 200.83 submitted by Radian Group Inc. to the Division of Corporation Finance, and [***] denote such omissions. The omitted portions have been filed separately with the Commission.

December 23, 2013

SUBMITTED VIA EDGAR

Mr. Jim B. Rosenberg

Senior Assistant Chief Accountant

Division of Corporation Finance

United States Securities and Exchange Commission

100 F Street NE

Washington, DC 20549

| Re: | Radian Group Inc. |

| Form 10-K for the Fiscal Year Ended December 31, 2012 |

| Filed February 22, 2013 |

| Form 10-Q for the Quarterly Period Ended September 30, 2013 |

| Filed November 12, 2013 |

| File Number: 001-11356 |

Dear Mr. Rosenberg:

On behalf of Radian Group Inc., I respectfully provide our responses to the comments in your letter dated November 22, 2013. For your convenience, the text of your comments is reproduced below before the applicable response. References in this letter to “we,” “us,” “our,” or “ours,” refer to Radian Group Inc. and its consolidated subsidiaries.

Form 10-K for the Fiscal Year Ended December 31, 2012

Management’s Discussion and Analysis of Financial Condition and Results of Operations Results of Operations—Financial Guaranty Provision for Losses, page 133

| 1. | Please clarify for us how the $23.5 million claim payment related to your exposure to insured sovereign indebtedness of Greece impacted your provision for losses in 2012. If a loss reserve for this amount was not previously recognized, tell us how you determined that a loss reserve for your insured sovereign indebtedness of Greece was not required to be recorded prior to the settlement of the obligation in the third quarter of 2012. |

Jim B. Rosenberg

U.S. Securities and Exchange Commission

December 23, 2013

Page 2

Response:

We initially recognized a loss related to our insured sovereign indebtedness of Greece in our public finance reinsurance business during the second quarter of 2011 in the amount of $1.9 million, and an aggregate additional incurred loss of $2.5 million was recorded during the third and fourth quarters of 2011. As disclosed in our Q1 2012 Form 10-Q, the credit deteriorated further during the first quarter of 2012 and we recognized an additional incurred loss of $19.4 million, for a total reserve of $23.8 million at the end of the first quarter of 2012.

“Our sovereign net par exposure to Portugal, Ireland, Italy, Greece and Spain (collectively, the “Stressed Eurozone Countries”) whose sovereign obligations have been under particular stress due to economic uncertainty, potential restructuring and ratings downgrades was $100.0 million as of March 31, 2012, of which $30.5 million is related to Greece and $46.5 million is related to Spain. Recent events related to Greece resulted in a significant increase in our claim liability on this credit from $4.4 million at December 31, 2011, to $23.8 million at March 31, 2012. As of March 31, 2012, all of our sovereign net par outstanding to Greece is internally rated BIG… (p. 62).”

“The [$18.0 million] increase in the provision for losses in our financial guaranty business during the first quarter of 2012 was primarily due to increased loss developments in our public finance reinsurance business associated with our exposure to Greece (p. 66).”

During the second quarter of 2012, as disclosed in our Q2 2012 Form 10-Q, through discussions with the primary insurer for this credit, we deemed that a settlement which would require a claim payment in the amount of $23.1 million was probable, and the reserve amount was adjusted slightly to reflect that expected payment amount.

“Our net claim liability to our insured sovereign indebtedness to Greece as of June 30, 2012 is $23.1 million, compared to $4.4 million as of December 31, 2011. The increase in this net claim liability reflects our expectation that this exposure to Greece will be settled in full in the second half of 2012, resulting in aggregate net losses approximately equal to this net claim liability (subject to exchange rate fluctuation) (p. 52).”

During the third quarter of 2012, we paid $23.5 million in full settlement of our assumed obligation related to our exposure to insured sovereign indebtedness of Greece.

Jim B. Rosenberg

U.S. Securities and Exchange Commission

December 23, 2013

Page 3

Notes to the Consolidated Financial Statements

Note 1. Description of Business and Recent Developments Insurance Regulatory—Capital Requirements, page 171

| 2. | Please provide us proposed disclosure to be included in future periodic reports that names the two states that exceeded the MPP requirements as of December 31, 2012 for which you have obtained waivers or disclose the volume of business done in those states. |

Response:

Page 171 of our 2012 Form 10-K includes disclosure that Radian Guaranty, our principal mortgage insurance subsidiary, had exceeded the minimum policyholder position (“MPP”) requirement in two states as of December 31, 2012, and had obtained waivers of the requirement in both states so that it was able to continue writing new mortgage insurance business in those states regardless of whether the MPP requirement had been met. The two states where Radian Guaranty had exceeded the MPP requirements were Arizona and Wisconsin. Since that time, Radian Guaranty has been in compliance with the applicable MPP requirement in both states and is no longer relying on the referenced waivers to continue writing new insurance. To the extent that we continue to include similar MPP requirement disclosures in future periods, we will modify our disclosure to specifically identify the MPP states by name.

Note 10. Losses and LAE, page 223

| 3. | You state that your results for 2012 were impacted by a $46.8 million decrease in your estimated reinsurance recoverable from your Smart Home transactions resulting from recent trends of lower claims paid and higher insurance rescissions and claim denials than were previously estimated to occur, which has in turn reduced the estimated amounts recoverable. It is unclear how a change to your reinsurance receivable would impact your net operating results as there would appear to be an offsetting amount recorded in your loss reserve. Please advise. |

Response:

While it is generally true that changes to reinsurance recoverables would be offset by adjustments recorded to loss reserves under typical reinsurance agreements that extend

Jim B. Rosenberg

U.S. Securities and Exchange Commission

December 23, 2013

Page 4

throughout the life of the underlying insured product, our coverage under the Smart Home transactions had specific maturity dates. Therefore, we were only entitled to recover amounts from these transactions to the extent we made claim payments on the underlying defaulted risk in force through the stated final maturity date or termination (if earlier) of each Smart Home transaction.

As a result, our Smart Home reinsurance recoverable was affected not only by our ultimate estimate of paid claims on the underlying defaulted loans, but also by the timing of when such claims were paid. As noted in the discussion of our reinsurance arrangements in Note 9 to our Consolidated Financial Statements in our Form 10-K for the year ended December 31, 2011:

“In 2004, we developed Smart Home as a way to effectively transfer risk from our portfolio to investors in the capital markets. Smart Home mitigates our risk against losses, concentrated positions and riskier products. Since 2004, we have completed four Smart Home reinsurance transactions. In 2011, we exercised our option to terminate two of these transactions, with RIF of approximately $41 million. The two remaining transactions will mature within the next 18 months (one in November 2012 and one in June 2013), and the ultimate recoverable amounts from these transactions will be dependent upon the amount and timing of paid losses in these transactions through their respective maturity dates, or the dates on which they are otherwise terminated (p. 209).”

As discussed in Note 10 to our Consolidated Financial Statements in our Form 10-K for the year ended December 31, 2012, our paid claims activity in 2012 was impacted by several factors that had the effect of lengthening the claim resolution period:

“Total paid claims declined for 2012 from 2011, driven primarily by an increase in the number of claims received that we are still reviewing for non-compliance with our insurance policies, which has lengthened the claim resolution period and resulted in an increase in rescissions and denials, as well as by delays created by foreclosure slowdowns, servicer issues and loan modification programs. We cannot be certain of the ultimate impact of these programs on our business or results of operations, or the timing of this impact (p. 224).”

Although these factors impacted the timing of claim payments, they did not necessarily result in an overall reduction to our ultimate expected losses. As a result of this lengthening of the claim resolution period, the timing of certain claim payments for loans covered by the Smart Home transactions were extended beyond the time previously estimated and past the maturity dates of the reinsurance agreements. This timing effect

Jim B. Rosenberg

U.S. Securities and Exchange Commission

December 23, 2013

Page 5

caused a decline in our estimated reinsurance recoverable due to the fixed maturity of the reinsurance coverage, even though our ultimate loss estimates and gross loss reserves did not experience a corresponding decline.

As of June 30, 2013, all four of our Smart Home transactions had matured or had been otherwise terminated. The financial impact during the nine months ended September 30, 2013 related to our Smart Home reinsurance recoverable was less than $3 million.

Note 16. Statutory Information, page 245

| 4. | We acknowledge Radian Guaranty’s risk to capital disclosure on page 246, but note that this only appears pertinent to the sixteen states that impose this requirement and that Radian Guaranty’s domiciliary state of Pennsylvania does not require this. Therefore, please provide us proposed disclosure to be included in future reports to disclose the amount of statutory capital and surplus necessary to satisfy regulatory requirements of Radian Guaranty if significant in relation to actual statutory capital and surplus, as required under ASC 944-505-50-1b. If not significant, please clarify in the disclosure. |

Response:

The statutory capital requirements required for our domiciliary state of Pennsylvania, as well as the other states that are not among the sixteen states that impose statutory or regulatory risk-based capital requirements, are not significant (ranging from $1 million to $5 million), and we will clarify this fact in our future disclosures as applicable. Our proposed future disclosure, based on our 2012 Form 10-K disclosure, is set forth below, with the proposed revisions underlined.

Note 16 (p. 248)

“The GSEs and state insurance regulators impose various capital requirements on our insurance subsidiaries. These include risk-to-capital ratios, risk-based capital measures and surplus requirements that limit the amount of insurance that each of our insurance subsidiaries may write. Our failure to maintain adequate levels of capital could lead to intervention by the various insurance regulatory authorities, which could materially and adversely affect our business, business prospects and financial condition. See Note 1 above.”

Jim B. Rosenberg

U.S. Securities and Exchange Commission

December 23, 2013

Page 6

Note 1 (existing language from p. 171)

“Under state insurance regulations, Radian Guaranty is required to maintain minimum surplus levels and, in certain states, a minimum amount of statutory capital relative to the level of net RIF, or “risk-to-capital.” Sixteen states (the “RBC states”) currently impose a statutory or regulatory risk-based capital requirement (the “Statutory RBC Requirement”). The most common Statutory RBC Requirement is that a mortgage insurer’s risk-to-capital ratio not exceed 25 to 1. In some of the RBC States, the Statutory RBC Requirement is that Radian Guaranty must maintain a minimum policyholder position, which is based on both risk and surplus levels (the “MPP Requirement”). Unless an RBC State grants a waiver or other form of relief, if a mortgage insurer is not in compliance with the Statutory RBC Requirement of such RBC State, it may be prohibited from writing new mortgage insurance business in that state. Radian Guaranty’s domiciliary state, Pennsylvania, is not one of the RBC States. In 2012 and 2011, the RBC States accounted for approximately 54.3% and 50.5%, respectively, of Radian Guaranty’s total primary NIW.The statutory capital requirements for the non-RBC states are de minimis (ranging from $1 million to $5 million), however, the state insurance laws generally grant broad supervisory powers to state agencies or officials to enforce rules or exercise discretion affecting almost every significant aspect of insurance business, including the power to revoke or restrict an insurance company’s ability to write new business.”

Form 10-Q for the Quarterly Period Ended September 30, 2013

Results of Operations—Mortgage Insurance

Quarter and Nine Months Ended September 30, 2013 Compared to Quarter and Nine Months Ended September 30, 2012

Default Statistics—Primary Insurance, page 77

| 5. | You disclose that recent trends in insurance claim denial activity reflect a decrease in the number of claims denied and an overall increase in the number of denials that have been reinstated (perfected). You appear to be using the same gross reinstatement assumptions beginning at approximately 60% and declining to 0% after 12 months to calculate your IBNR reserve for claims that were denied and you believe will be reinstated as of December 31, 2012 and September 30, 2013. Please tell us the key IBNR assumptions for each quarter in 2012 and the subsequent quarterly periods in 2013, and how you determined that those assumptions were appropriate given the trend in the increase in reinstated claims. In addition, please discuss any change in your IBNR reserve methodology during 2011, 2012, and nine months ending September 30, 2013. |

Jim B. Rosenberg

U.S. Securities and Exchange Commission

December 23, 2013

Page 7

Response:

Response Overview

Our reserve estimate for Incurred But Not Reported (“IBNR”) losses currently consists of reserves related primarily to three general categories of exposure – current defaults not yet reported to us by mortgage servicers (referred to herein as our “Traditional IBNR Reserve”), as well as potential reinstatements of previously rescinded policies (our “Rescission IBNR Reserve”) and previously denied claims (our “Denial IBNR Reserve,” and together with our Rescission IBNR Reserve, our “Reinstatement IBNR Reserve”). For each reporting period, we evaluate our Reinstatement IBNR Reserve by developing, based on historical and current trends, reinstatement factors that are applied to the total population of outstanding rescissions and denials based upon the length of time that has elapsed since the rescission or denial has occurred. In addition, we also consider the status of discussions with our lender and servicer customers regarding disputed rescissions and denials, including the potential settlement of these disputes, when developing our best estimate of the Reinstatement IBNR Reserve. [*** CONFIDENTIAL INFORMATION HAS BEEN OMITTED AND FURNISHED SEPARATELY TO THE SECURITIES AND EXCHANGE COMMISSION.]

The table below summarizes these three components of our IBNR reserve estimate as of December 31, 2010, 2011, and 2012, and as of September 30, 2013:

| As of Sept. | ||||||||||||||||

| As of December 31, | 30, | |||||||||||||||

| ($ in millions) | 2010 | 2011 | 2012 | 2013 | ||||||||||||

Traditional IBNR Reserve | $ | 14.5 | $ | 41.3 | $ | 20.0 | $ | 17.8 | ||||||||

| Reinstatement IBNR Reserve | ||||||||||||||||

Rescission IBNR Reserve (a) | — | 62.8 | 87.7 | 77.7 | ||||||||||||

Denial IBNR Reserve (b) | 25.0 | 66.4 | 215.3 | 172.7 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Total IBNR reserves | $ | 39.5 | $ | 170.5 | $ | 323.0 | $ | 268.2 | ||||||||

Total mortgage insurance reserves | $ | 3,525.0 | $ | 3,247.9 | $ | 3,083.6 | $ | 2,314.8 | ||||||||

IBNR reserves as % of total reserves | 1.1 | % | 5.2 | % | 10.5 | % | 11.6 | % | ||||||||

Denial IBNR Reserve as % of total reserves | 0.7 | % | 2.0 | % | 7.0 | % | 7.5 | % | ||||||||

Jim B. Rosenberg

U.S. Securities and Exchange Commission

December 23, 2013

Page 8

[*** CONFIDENTIAL INFORMATION HAS BEEN OMITTED AND FURNISHED SEPARATELY TO THE SECURITIES AND EXCHANGE COMMISSION.]

As indicated in the table above, each component of our IBNR reserves represents a relatively small portion (i.e., less than 10%) of our total mortgage insurance loss reserve estimate. In evaluating our assumptions and disclosures for this estimate, it is important to consider the sensitivity of our total mortgage insurance loss reserve estimate to potential changes in our underlying IBNR assumptions, as well as the relative size of the IBNR reserves compared to our total recorded reserves.

For example, assuming all other factors remain constant, we estimated the impact on our loss reserves of a one percentage point change in our assumed primary claim severity or our net overall default to claim rate to be approximately $63 million or $39 million, respectively, as of September 30, 2013, as disclosed in our Q3 2013 Form 10-Q (p. 101). In contrast to those potential significant impacts on our total mortgage insurance loss reserves, for every one percentage point change in our gross reinstatement rate assumptions for our general population of denials [***], we estimated that our Denial IBNR Reserve would change by approximately $7 million as of September 30, 2013. Given these relative sensitivities, while assumptions discussed in this response may be considered significant to our Denial IBNR Reserve estimate, certain assumptions would not be considered significant to our total mortgage insurance loss reserves.

[*** CONFIDENTIAL INFORMATION HAS BEEN OMITTED AND FURNISHED SEPARATELY TO THE SECURITIES AND EXCHANGE COMMISSION.]

Relevant Trends and Developments.Beginning in 2009, following an unprecedented period of poor mortgage underwriting, for the first time in our history we began to experience a significant increase in the number of insurance certificates that we were rescinding due to fraud, underwriter negligence or other factors, as well as the number of claims that we were denying due to the policyholder’s failure to submit the necessary documentation to perfect a claim within the time period permitted under our master insurance policy. These elevated levels of rescissions and denials were also a result of our decision to review a significantly larger portion of our claims for potential rescissions and denials.

This greater incidence of rescissions and denials ultimately resulted in a more frequent volume and higher level of reinstatements of rescinded loans or denied claims due to servicers providing additional information or documentation. At first, the servicer challenges to our rescissions and denials generally were infrequent and non-substantive;

Jim B. Rosenberg

U.S. Securities and Exchange Commission

December 23, 2013

Page 9

however, beginning in late 2010 and early 2011, we began to observe a material increase in the number of previous rescissions and denials that were being reinstated through our claim rebuttal process, and as a result, beginning in Q4 2010, we began to incorporate an estimate for probable and estimable future reinstatements into our mortgage insurance loss reserve estimate in the form of our Reinstatement IBNR Reserve.

We have continued to refine our approach to our Reinstatement IBNR Reserve and we have continually updated our assumptions with respect to estimated reinstatements based on historical and current trends, and other factors, such as our discussions with servicers and lenders regarding disputed rescissions and denials. For example, with respect to the Staff’s comment regarding our gross reinstatement rate for denials, during the 12-month period between Q3 2012 and Q3 2013, we increased our gross initial denial reinstatement rate from 50% to 62% for our general population of denied claims.

In light of activity observed in late 2012, we saw early signs of emerging elevated trends in reinstatement rates for certain recent months, and as a result, we raised our gross initial denial reinstatement rate for our general population of denials to 58.5% as of December 31, 2012. By incorporating this change based on the emerging trends as of December 31, 2012, our gross initial denial reinstatement rate for our general population of denials generally reflected the reinstatement trends that we have observed throughout 2013. Therefore, based on our ongoing experience in 2013, we have seen limited need through the third quarter of 2013 for significant changes in our gross initial denial reinstatement rate for our general population of denials. In Q1 2013, we slightly increased our gross initial denial reinstatement rate to 62%, and there have been no further changes to that estimated rate through September 30, 2013.

In addition to general observed reinstatement trends, as mentioned above, our Reinstatement IBNR Reserve also has been informed by our discussions with servicers and lenders regarding disputed rescissions and denials [*** CONFIDENTIAL INFORMATION HAS BEEN OMITTED AND FURNISHED SEPARATELY TO THE SECURITIES AND EXCHANGE COMMISSION.].

[*** CONFIDENTIAL INFORMATION HAS BEEN OMITTED AND FURNISHED SEPARATELY TO THE SECURITIES AND EXCHANGE COMMISSION.]

Accounting Policy. As disclosed in our Critical Accounting Policies in our 2012 Form 10-K and Q3 2013 Form 10-Q,“estimating the loss reserves in both our mortgage insurance and financial guaranty business segments involves significant reliance upon assumptions and estimates with regard to the likelihood, magnitude and timing of each potential loss.”

Jim B. Rosenberg

U.S. Securities and Exchange Commission

December 23, 2013

Page 10

In setting our IBNR loss reserve estimates each period, we consider our past experience to help inform our expectations for the future. Consistent with the guidance in ASC 944-40-30-1, we also take into account current trends that may impact our ultimate unpaid claim estimate, as well as other factors. We assess our past experience and current trends related to rescission and denial reinstatement activity primarily through the review of recent reinstatement development curves, which provide the foundation for our quarterly assumptions. In addition, we may consider other quantitative analyses and/or additional factors, including qualitative factors, to help inform our estimates, as described below.

We continue to review our estimates and will make future adjustments to our methodologies or underlying assumptions as our experience changes. As with all components of our loss reserve estimate, we carefully monitor the trends and other factors affecting our IBNR reserve estimate as part of our continuous review process, making regular refinements to the underlying assumptions in our models as new information is obtained.

Additional Background Regarding IBNR Reserves and Related Disclosures

Prior to 2010, our IBNR reserve estimate consisted of our Traditional IBNR Reserve. The population of defaults that we estimated had been incurred but had not been reported to us on a timely basis has generally been relatively small compared to our overall default inventory and case reserve estimates, and the patterns observed in historical servicer reporting trends have been generally consistent over time.

In addition to this Traditional IBNR Reserve, in recent years, we have established IBNR reserves related to previously rescinded policies and denied claims that we estimate will be reinstated and subsequently paid, as noted above. We provide the insured an opportunity to challenge our decision to rescind coverage or to perfect a previously denied claim through our claim rebuttal process. As disclosed in our 2012 Form 10-K:

| • | Rescissions: “If we determine that a loan did not qualify for insurance, as part of our internal procedures, we issue an “intent to rescind” letter that explains the basis of our decision and provides the insured with a period of up to 90 days from the date of the letter to challenge or rebut our decision. We are not contractually obligated under the terms of our master insurance policy to provide the insured with this opportunity to rebut our decision to rescind coverage… (p. 19) |

Jim B. Rosenberg

U.S. Securities and Exchange Commission

December 23, 2013

Page 11

If a rebuttal to our decision to rescind is received and the insured provides additional information supporting the continuation (i.e., non-rescission) of coverage, the claim is re-examined internally by a second, independent group of individuals. If the additional information supports the continuation of coverage, the insurance is reinstated and the claim is paid. After completion of this process, if we determine that the loan did not qualify for coverage, the insurance certificate is rescinded (and the premium refunded) and we consider the rescission to be final and resolved. Although we may make a final determination internally with respect to a rescission, it is possible that a challenge to our decision to rescind coverage may be brought during a specified period of time after we have rescinded coverage. Under our master insurance policy, any suit or action arising from any right of the insured under the policy must be commenced within two years after such right first arose, and within three years for certain other policies, including certain pool insurance policies (p. 20).”

| • | Denials: “If, after requests by us, the loan origination file or other servicing documents are not provided to us, we deny the claim. Under the terms of our master insurance policy, our insureds must provide to us the necessary documents to perfect a claim within one year after their acquisition of title to the property through foreclosure or otherwise. If we deny a claim, we continue to allow the insured the ability to perfect the claim during the one-year period specified in our master insurance policy. In those circumstances when the insured successfully perfects the claim within our specified timelines, we will process the claim, including a review of the loan to ensure appropriate underwriting and servicing (p. 19).” |

At first, the servicer challenges to our rescissions and denials generally were infrequent and non-substantive; however, beginning in late 2010 and early 2011, we began to observe a material increase in the number of previous rescissions and denials that were being reinstated through our claim rebuttal process, generally due to additional information or documentation being submitted by our lender and servicer customers. As a result, beginning in Q4 2010, we incorporated an estimate for probable and estimable future reinstatements into our mortgage insurance loss reserve estimate in the form of our Reinstatement IBNR Reserve. As disclosed in our Form 10-K for the year ended December 31, 2010:

“Our reported rescission and denial activity in any given period is subject to future challenges by our lender customers. Our IBNR reserve estimate, including defaults related to previously rescinded policies and denied claims that are expected to be reinstated or resubmitted, was $39.5 million and $13.6 million at December 31, 2010 and

Jim B. Rosenberg

U.S. Securities and Exchange Commission

December 23, 2013

Page 12

2009, respectively. The increase in this estimate primarily reflects an increase in both recent trends and in claim denial activity in 2010, as we expect a portion of such denied claims to be resubmitted with the required documentation and ultimately paid. All estimates are continually reviewed and adjustments are made as they become necessary (p. 221).”

During the first quarter of 2011, we significantly increased our Reinstatement IBNR Reserve estimate based on increases in both the volume of rescissions and denials and the level of reinstatement activity, as disclosed in our Form 10-Q for the quarter ended March 31, 2011:

“Our IBNR reserve estimate increased by $76.7 million during the first quarter of 2011, primarily related to an increase in our estimate of the future reinstatements of previously rescinded policies and denied claims… Our IBNR reserve estimate, which includes an estimate of the future reinstatements of previously rescinded policies and denied claims, was $116.2 million and $39.5 million at March 31, 2011, and December 31, 2010, respectively. The change in this estimate primarily reflects recent trends in insurance rescissions and claim denial activity as a result of lenders challenging a greater number of rescissions and denials, and the overall challenges being more substantive in nature (i.e., producing new or additional information that supports a reinstatement of coverage or a claim payment). As a result, we expect that an increasingly larger portion of previously rescinded policies will be reinstated and previously denied claims will be resubmitted with the required documentation and ultimately paid (p. 54).”

The number of rescissions and denials has remained elevated as compared to levels before 2009, and our customers have continued to challenge our decision to rescind policies or deny claims, as disclosed in our most recent Form 10-Q for the quarterly period ended September 30, 2013:

“Under our master insurance policy, any suit or action arising from any right of the insured under the policy must be commenced within two years after such right first arose and within three years for certain other policies, including certain pool insurance policies; provided, however, that in certain instances, we may agree to extend or toll this right of action period while we are in discussions with servicers regarding rescissions and denials. We have faced an increasing number of challenges from certain lender and servicer customers regarding our insurance rescissions and claim denials, which have resulted in some reversals of our decisions regarding rescissions and denials. Although we believe that our rescissions and denials are justified under our policies, if we are not successful in defending the rescissions and denials in any potential legal or other actions, or if we reach a negotiated settlement that is in excess of our assumptions, we may need to reassume the risk on, and increase loss reserves for, those policies or pay additional claims (p. 100).”

Jim B. Rosenberg

U.S. Securities and Exchange Commission

December 23, 2013

Page 13

We also consider potential settlement discussions with our customers regarding disputed rescissions and denials in developing our Reinstatement IBNR Reserve estimate. [***], there is one particular lender/servicer customer whose claims have resulted in a comparatively larger proportion of our rescissions and denials. As disclosed in our 2012 Form 10-K and subsequent quarterly reports,“a significant number of denials in 2012 relate to one servicer (p. 109).” [*** CONFIDENTIAL INFORMATION HAS BEEN OMITTED AND FURNISHED SEPARATELY TO THE SECURITIES AND EXCHANGE COMMISSION.]

[*** CONFIDENTIAL INFORMATION HAS BEEN OMITTED AND FURNISHED SEPARATELY TO THE SECURITIES AND EXCHANGE COMMISSION.]

[*** CONFIDENTIAL INFORMATION HAS BEEN OMITTED AND FURNISHED SEPARATELY TO THE SECURITIES AND EXCHANGE COMMISSION.]

Denial IBNR Reserve Methodology and Related Disclosures

As requested by the Staff, below is a discussion of our Denial IBNR Reserve methodology, including any significant changes during 2011, 2012, and the nine months ending September 30, 2013. Generally, our IBNR reserve estimates are based on the estimated ultimate cost of settling potential claims, using past experience adjusted for current trends, and any other factors that would modify past experience. A more specific discussion of our key Denial IBNR Reserve assumptions, including updates to those assumptions in recent periods, is provided further below.

As disclosed in our 2010 Form 10-K, the denial component of our Reinstatement IBNR Reserve estimate was implemented in Q4 2010 in response to a significant increase in successful challenges to our claim denials by lenders and servicers. At that time, there was a high degree of uncertainty regarding the potential reinstatement rates for recently denied claims as our experience was limited. To account for this uncertainty and given an observed increase in more recent reinstatement rates, we established an assumed initial denial reinstatement rate of 60%, which was higher for this original IBNR population than our historical experience at that time. In addition to the initial gross reinstatement rate applied immediately following a denial, declining estimated reinstatement rates were applied to the remaining exposure in subsequent periods following claim denial, as the probability of additional reinstatements decreases. We refer to these subsequent estimated reinstatement rates as conditional rates.

Jim B. Rosenberg

U.S. Securities and Exchange Commission

December 23, 2013

Page 14

At the time we implemented the denial component of our Reinstatement IBNR Reserve estimate in Q4 2010, four general reinstatement rate assumptions were originally established over the 12-month period lenders generally have under our master policy to perfect a claim, addressing both the initial and conditional rates: 60% for denials aged 3 months and under, 43% for remaining denials aged 4 - 6 months, 22% for remaining denials aged 7 - 9 months, and 13% for remaining denials aged 10 - 12 months. This conditional probability approach was consistent with an assumed overall denial reinstatement rate of 60%.

While we consider the estimated gross reinstatement rates to be the most significant assumption for our Denial IBNR Reserve, other assumptions are also applied to develop our expectations for the reinstated exposure, such as estimated average severity rates, estimated rescission rates on reinstated claims, and the impact of any structural features related to pool insurance policies, including deductibles and stop loss limits. These other assumptions, however, are consistent with the assumptions applied to our total mortgage insurance loss reserves, and any change in such assumptions over the time period being considered did not materially impact the Denial IBNR Reserve.

After establishing the original reinstatement estimates at Q4 2010, there were no changes until the refinement of our Denial IBNR Reserve methodology in Q3 2012:

| • | In Q3 2012, given the increasing volume of denials and more developed history with respect to our reinstatement experience, we refined the general quarterly conditional rates established in late 2010 and established monthly estimated reinstatement rates, with conditional reinstatement rates for all 12 months derived from recent development and historical trends. |

In addition, in developing our Denial IBNR Reserve in Q3 2012, our assumptions were informed by the discussions then underway with certain of our lender and servicer customers with regard to prior denials. [*** CONFIDENTIAL INFORMATION HAS BEEN OMITTED AND FURNISHED SEPARATELY TO THE SECURITIES AND EXCHANGE COMMISSION.]

| • | In Q4 2012, there were no changes to our Denial IBNR Reserve methodology, [*** CONFIDENTIAL INFORMATION HAS BEEN OMITTED AND FURNISHED SEPARATELY TO THE SECURITIES AND EXCHANGE COMMISSION.]. |

Jim B. Rosenberg

U.S. Securities and Exchange Commission

December 23, 2013

Page 15

[*** CONFIDENTIAL INFORMATION HAS BEEN OMITTED AND FURNISHED SEPARATELY TO THE SECURITIES AND EXCHANGE COMMISSION.] In Q4 2012, an additional $6 million IBNR reserve, representing 0.2% of our total mortgage insurance reserves, was established related to a potential settlement with another servicer regarding previously rescinded policies (note: this settlement was ultimately executed and resolved in October 2013 consistent with this initial estimate).

In our 2012 Form 10-K, we referenced“potential settlement discussions with our lender customers (p. 111)” as one of the factors that we consider in developing our IBNR reserve estimate. We also highlighted such discussions in our Risk Factors, while acknowledging that“in the last two years (for primary loans) and the last three years (for pool loans), despite challenges to our decision to rescind, we have determined not to reinstate approximately $461.4 million of rescinded loans (p. 64).” We continued:

“We are currently in active discussions with customers regarding a portion of our rescissions, as well as claims we have denied or curtailed. These discussions, if not resolved, could result in arbitration or judicial proceedings, which could be brought with respect to all rescissions, denials and claim curtailments that have been challenged by such customers. The heightened risk of disputes with our customers regarding our increased rescissions, denials and claim curtailments could have a negative impact on our relationships with such customers or potential customers, including the potential loss of business and an increased risk of disputes and litigation…

The determination of our reserve for losses involves significant use of estimates with regard to the likelihood, magnitude and timing of a loss, including an estimate of the number of defaulted loans that will be successfully rescinded or denied. If the actual amount of rescissions and denials is significantly lower than our estimate, as a result of a greater than anticipated number of successful challenges to our rescissions and denials, litigation, settlements or other factors, or if the levels of rescission and denials decrease faster than we expect, our losses may materially increase, which could have a material adverse effect on our financial condition and results of operations (p. 65).”

Jim B. Rosenberg

U.S. Securities and Exchange Commission

December 23, 2013

Page 16

| • | [*** CONFIDENTIAL INFORMATION HAS BEEN OMITTED AND FURNISHED SEPARATELY TO THE SECURITIES AND EXCHANGE COMMISSION.] |

| [*** CONFIDENTIAL INFORMATION HAS BEEN OMITTED AND FURNISHED SEPARATELY TO THE SECURITIES AND EXCHANGE COMMISSION.] |

Key Denial IBNR Reserve Assumptions and Related Disclosures

As part of our general methodology framework described above, we apply certain assumptions to derive our best estimate for the ultimate unpaid claim estimate each period. As initially requested (and subsequently confirmed) by the Staff, below is a discussion of key assumptions with respect to our Denial IBNR Reserve estimate for each quarter during 2012 and the nine months ending September 30, 2013.

We generally determine that these assumptions are appropriate using past experience adjusted for current trends, and any other factors that would modify past experience, as described below.

As of September 30, 2013, our $173 million Denial IBNR Reserve estimate accounted for 7.5% of our total $2.3 billion mortgage insurance reserve estimate. Key Denial IBNR Reserve assumptions for each quarter in 2012 and the subsequent quarterly periods in 2013 were as follows:

| • | In Q1 and Q2 2012, there were no changes to the original reinstatement assumptions noted above, which included an assumed 60% initial gross reinstatement rate as first established in Q4 2010. While reinstatement trends observed in Q1 and Q2 2012 suggested reinstatement rates were trending lower than observed in the prior year, we determined not to change assumptions pending further observations suggesting such lower reinstatement trends would persist. |

| • | In Q3 2012, as a result of further experience that validated our general reinstatement trends [*** CONFIDENTIAL INFORMATION HAS BEEN OMITTED AND FURNISHED SEPARATELY TO THE SECURITIES AND EXCHANGE COMMISSION.] we updated our assumptions for our general population of denied claims [***] The initial gross denial reinstatement rate |

Jim B. Rosenberg

U.S. Securities and Exchange Commission

December 23, 2013

Page 17

assumption was decreased from 60% to 50%, based on the reinstatement trends observed since late 2011, with 11 conditional monthly estimated rates also applied over the one year horizon based on observed recent experience. |

[*** CONFIDENTIAL INFORMATION HAS BEEN OMITTED AND FURNISHED SEPARATELY TO THE SECURITIES AND EXCHANGE COMMISSION.]

As disclosed in our Q3 2012 Form 10-Q:

“Our reported rescission and denial activity in any given period is subject to future challenges by our lender customers. Recent trends in insurance rescission and claim denial activity reflect a significant relative shift toward more claim denials, which result primarily from the failure of our lender customers to provide the documentation required to perfect a claim submission. Subsequent to our initial claim denials, lenders have demonstrated an ability to produce the additional information needed for a significant portion of previously denied claims. We expect that a portion of previously rescinded policies will be reinstated and a large portion of previously denied claims will be resubmitted with the required documentation and ultimately paid, and we have considered this expectation in developing our IBNR reserve estimate. This IBNR estimate, which consists primarily of our estimate of the future reinstatements of previously rescinded policies and denied claims, was $261.6 million and $170.6 million at September 30, 2012 and December 31, 2011, respectively (p. 81).”

| • | In Q4 2012, the initial gross reinstatement rate assumption for our general population of denials was increased from 50% to 58.5%, with conditional rates for months 2 through 12 updated as well, based on rapid increases observed during the quarter in early reinstatement activity for more recent monthly cohorts, which were evident in our recent reinstatement development curves. While none of the recent monthly cohorts had experienced rates exceeding 50%, we factored these emerging trends into our estimate as of December 31, 2012, given the rapid change in recent trends. |

[*** CONFIDENTIAL INFORMATION HAS BEEN OMITTED AND FURNISHED SEPARATELY TO THE SECURITIES AND EXCHANGE COMMISSION.]

Jim B. Rosenberg

U.S. Securities and Exchange Commission

December 23, 2013

Page 18

The footnote regarding our $306 million Q4 2012 provision for losses in Note 20 to the Notes to Consolidated Financial Statements in our 2012 Form 10-K references that

“[t]he results for the fourth quarter of 2012 include the effects of an increase in our IBNR reserve estimate (p. 264).” In addition, given the increasing amount of this component of our mortgage insurance reserves, we also began to provide additional disclosure with regard to this estimate, including our initial gross reinstatement assumption of approximately 60% and reference to other factors that affect our IBNR reserve estimate. As disclosed in Note 10 in the Notes to Consolidated Financial Statements in our Form 10-K for the year ended December 31, 2012, as well as our MD&A:

“Our reported rescission and denial activity in any given period is subject to challenge by our lender customers. Recent insurance rescission and claim denial activity reflects a shift towards more claim denials, which has resulted primarily from the failure of our lender customers to provide the documentation required to perfect a claim. Subsequent to our initial claim denials, lenders have demonstrated an ability to produce the additional information needed to perfect a claim for a significant portion of previously denied claims. As a result of increases in claim denial activity during 2012, we expect that a large number of previously denied claims will be resubmitted with the required documentation and ultimately paid, and we have considered this expectation in developing our IBNR reserve estimate. This IBNR estimate was $323.0 million and $170.6 million at December 31, 2012 and 2011, respectively. For 2012, our IBNR estimate of $323.0 million includes our estimate of future reinstatements of previously rescinded policies and denied claims of $87.7 million and $215.3 million, respectively. These reserves relate to $0.6 billion of claims that were denied within the preceding 12 months and $1.0 billion related to rescinded policies within the preceding 24 months…

We estimate our claim liability related to the potential future reinstatement of these previously rescinded policies and denied claims by estimating an initial gross reinstatement rate at the time of denial or rescission, which then declines over a 12 or 24 month timeframe as certain denials and rescissions are reinstated. As of December 31, 2012, for previously denied claims, this initial gross reinstatement assumption begins at approximately 60% and declines to 0% after 12 months, while for previously rescinded policies, the initial assumed reinstatement rate begins at approximately 16% and declines to 0% after 24 months. Our IBNR reserve estimate also includes projected impacts from future estimated rescissions (with respect to reinstated denials) and future claim

Jim B. Rosenberg

U.S. Securities and Exchange Commission

December 23, 2013

Page 19

curtailments (with respect to both reinstated denials and rescissions). Therefore, at any particular point in time, our IBNR reserve estimate with respect to previously rescinded policies or denied claims is affected by not only our initial reinstatement assumption, but by the length of time since the denial or rescission, our estimated likelihood of such reinstatements resulting in a paid claim, expected claim curtailments on such paid claims, as well as potential settlement discussions with our lender customers (p. 225).”

| • | [*** CONFIDENTIAL INFORMATION HAS BEEN OMITTED AND FURNISHED SEPARATELY TO THE SECURITIES AND EXCHANGE COMMISSION.] This change resulted in an increase to the initial gross reinstatement assumption from 58.5% to 62.0% for our general population of denials, based on the development curves observed at that time. |

In addition, we updated the conditional reinstatement rates for months 2 through 12 to reflect a shift towards earlier reinstatement development following the initial denial of a claim. As observed in the progression trends at that time, the development curves begin to flatten after approximately month six, suggesting a significantly lower probability for more aged denied claims to be resubmitted and perfected. These observed trends were also consistent with our ongoing efforts with servicers to make the claim rebuttal process more efficient and timely, primarily by working with servicers to identify the most common and critical missing required documents, so that servicers could focus their attention on providing those documents to us more quickly following the initial denial of a claim.

[*** CONFIDENTIAL INFORMATION HAS BEEN OMITTED AND FURNISHED SEPARATELY TO THE SECURITIES AND EXCHANGE COMMISSION.]

| • | In Q2 2013, the estimated initial gross denial reinstatement assumption for our general population of denials remained constant at 62%, with conditional rates for months 2 through 12 also held steady based on observed development trends, which were similar to the prior quarter. |

[*** CONFIDENTIAL INFORMATION HAS BEEN OMITTED AND FURNISHED SEPARATELY TO THE SECURITIES AND EXCHANGE COMMISSION.]

Jim B. Rosenberg

U.S. Securities and Exchange Commission

December 23, 2013

Page 20

| • | In Q3 2013, the estimated initial gross denial reinstatement assumption for our general population of denials remained at 62%, with conditional rates for months 2 through 12 updated to reflect recent reinstatement timing trends. |

| [*** CONFIDENTIAL INFORMATION HAS BEEN OMITTED AND FURNISHED SEPARATELY TO THE SECURITIES AND EXCHANGE COMMISSION.] |

In our Form 10-Q for the quarterly period ended September 30, 2013, we have continued to provide details on our Rescission and Denial IBNR Reserve estimates:

“As of September 30, 2013, the IBNR reserve estimate of $268 million includes an estimate of future reinstatements of previously denied claims and rescinded policies of $173 million and $78 million, respectively. These reserves relate to $381 million of claims that were denied within the preceding 12 months and $450 million of policies that were rescinded within the preceding 24 months, as well as additional denials and rescissions that were denied or rescinded in earlier periods but remain the subject of discussion with certain of our lender and servicer customers (p. 76).”

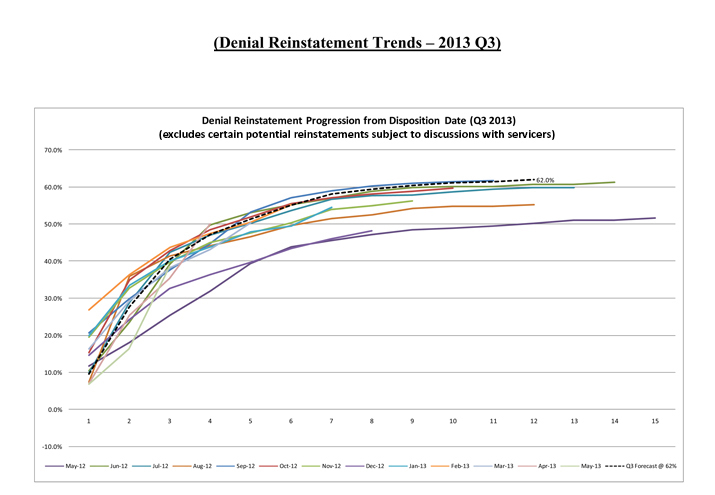

In the attached Appendix, we have included an example, as of Q3 2013, of the reinstatement development curves used in our Denial IBNR reserving process, showing the progression of our cumulative reinstatement rates since initial denial for each given month. In the reinstatement progression graph presented in the Appendix, the “y axis” represents the cumulative reinstatement rate (defined as the cumulative percentage of claims reinstated for a group of denials in each given month), while the “x axis” represents the number of months since denial for each grouping, or monthly cohort, of denied claims.

The past experience and current trends reflected in our reinstatement development graphs provide support for the appropriateness of our general reinstatement rate assumptions each period, including as shown in the Appendix for our 62% gross initial reinstatement rate estimate as of September 30, 2013.

* * * *

Jim B. Rosenberg

U.S. Securities and Exchange Commission

December 23, 2013

Page 21

In connection with the responses to the comments set forth above, we acknowledge that:

| • | we are responsible for the adequacy and accuracy of the disclosure in our filings; |

| • | Staff comments or changes to disclosure in response to Staff comments do not foreclose the Securities and Exchange Commission from taking any action with respect to the filings; and |

| • | we may not assert Staff comments as a defense in any proceeding initiated by the Securities and Exchange Commission or any person under the federal securities laws of the United States. |

If you have any questions about the response to your comment or require further explanation, please do not hesitate to contact me at (215) 231-1444.

| Sincerely, |

| /s/ C. Robert Quint |

| C. Robert Quint |

| Chief Financial Officer |

| Radian Group Inc. |

December 23, 2013

| Re: | Radian Group Inc. |

| Form 10-K for the Fiscal Year Ended December 31, 2012 |

| Filed February 22, 2013 |

| Form 10-Q for the Quarterly Period Ended September 30, 2013 |

| Filed November 12, 2013 |

| File Number: 001-11356 |

APPENDIX

(Denial Reinstatement Trends – 2013 Q3)

Denial Reinstatement Progression from Disposition Date (Q3 2013)

(excludes certain potential reinstatements subject to discussions with servicers)

70.0% 60.0% 50.0% 40.0% 30.0% 20.0% 10.0% 0.0% -10.0%

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

May-12 Jun-12 Jul-12 Sep-12 Oct-12 Nov-12 Dec-12 Jan-13 Feb-13 Mar-13 Apr-13 May-13 Q3 Forecast @ 62%

Page 10 of 10