EXHIBIT 99.1

| News |

| For Immediate Release | Contact: |

February 5, 2009 | Rick Honey (212) 878-1831 |

MINERALS TECHNOLOGIES' FOURTH QUARTER

DILUTED EARNINGS PER SHARE WERE $0.41, EXCLUDING SPECIAL ITEMS,

REPORTED EARNINGS WERE $0.31 PER SHARE

---------

FULL YEAR 2008 EARNINGS PER SHARE WERE A RECORD $3.44

----------

Board Declares Regular Quarterly Dividend of $0.05 per Share

----------

Highlights:

• | Record Earnings for Full Year Despite Steep Fourth Quarter Decline |

• | Return on Capital of 8.0 Percent for 2008 |

• | Precipitous Fourth Quarter Drop in End Market Demand |

• | Fourth Quarter Sequential Decline in EPS of 69 Percent |

• | Aggressive, Prudent Measures to Maintain Competitiveness |

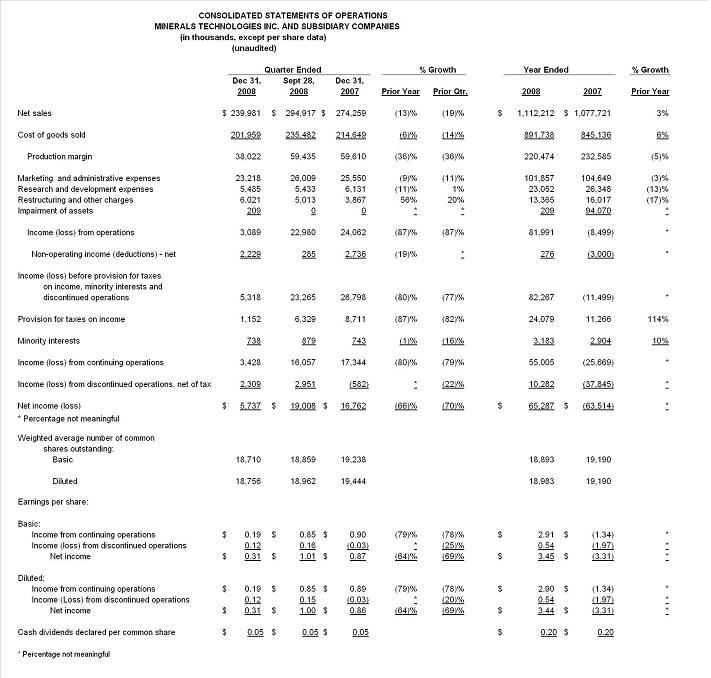

NEW YORK , February 5 - Minerals Technologies Inc. (NYSE: MTX) today reported net income of $5.7 million, or $0.31 per share, for the fourth quarter 2008, compared with $16.8 million, or $0.86 per share in the same period of 2007. Earnings per share were $0.41 excluding restructuring charges and a gain on a sale of an idle facility.

"The company achieved its highest annual earnings in 2008, with the first three quarters setting record highs," said Joseph C. Muscari, chairman and chief executive officer. "In the fourth quarter, however, the precipitous downturn in our paper, steel, construction and automotive end markets resulted in a significant drop in demand for our products. As a result, our earnings per share decreased 64-percent from the fourth quarter of 2007 and 69-percent from the third quarter of 2008."

He continued: "In October when the financial crisis occurred and the economic downturn followed, we took rapid, decisive steps to maintain the company's competitiveness by conserving cash and containing costs. In addition to a reduction in workforce, our actions included shortening work weeks, reducing overtime and continuing our aggressive expense control measures. The result was that even in this weak economic environment, the company still generated $53 million in cash flow from operations and free cash flow of $46 million during the fourth quarter."

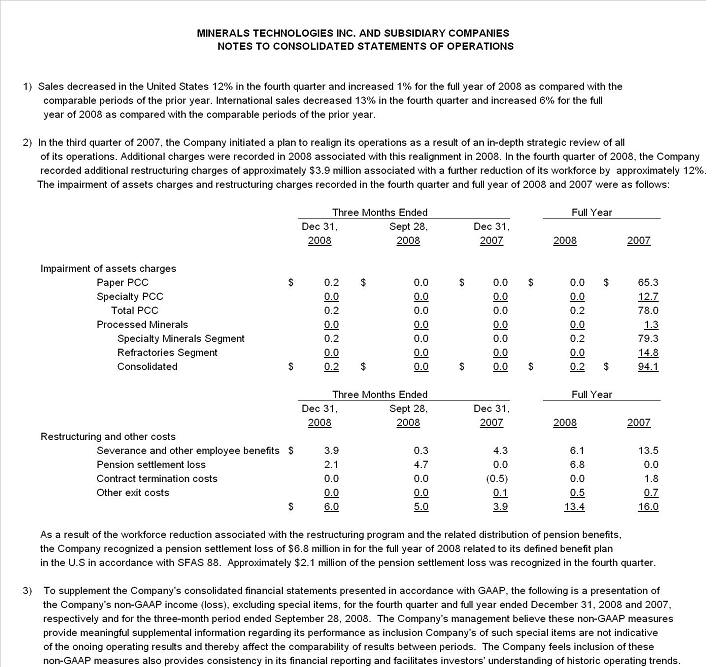

During the fourth quarter, the company recorded a pre-tax restructuring charge of

2

approximately $6 million, or $0.22 per share after-tax, which was associated primarily with reducing the workforce by 12-percent through layoffs as well as permanent reductions.

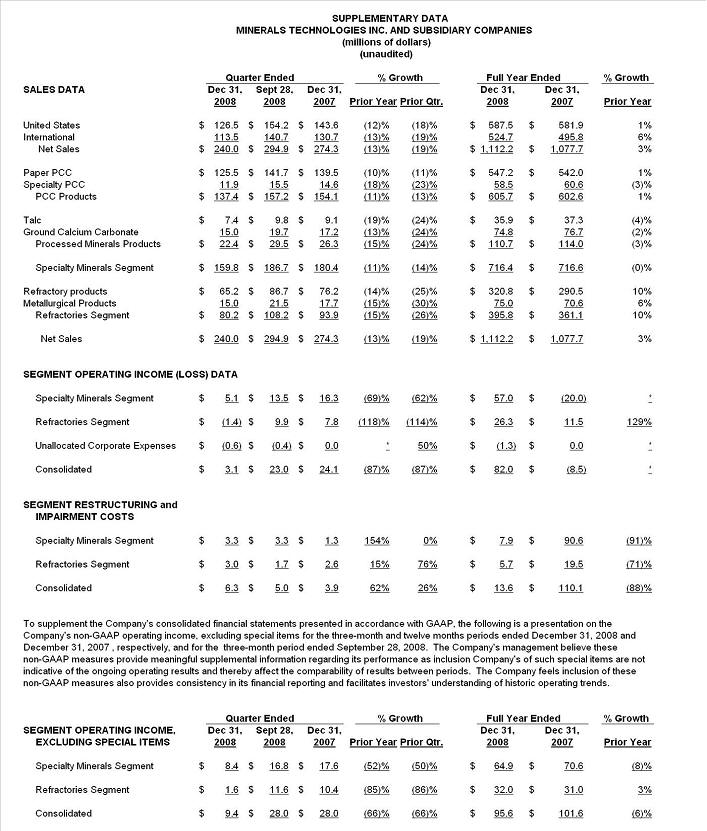

The company's worldwide sales in the fourth quarter were $240.0 million, a 13-percent decrease from the $274.3 million recorded in the same period in 2007. Foreign exchange had an unfavorable impact on sales of approximately $11.4 million or 4 percentage points. Operating income, excluding special items, was $9.4 million, a 66-percent decrease from the $28.0 million recorded in the same period in 2007.

Sequentially, operating income, excluding special items, also decreased 66 percent from the third quarter of 2008.

For the fourth quarter, worldwide sales in the company's Specialty Minerals segment, which consists of precipitated calcium carbonate (PCC) and Processed Minerals, were $159.8 million compared with $180.4 million in the fourth quarter of 2007, an 11-percent decrease. Both product lines in the segment experienced volume declines. Foreign exchange had an unfavorable impact on sales growth for the quarter of approximately 3 percentage points. For the fourth quarter, income from operations, excluding special items, was $8.4 million, a decrease of 52 percent from $17.6 million in the same period in 2007.

Sequentially, sales declined 14 percent in the Specialty Minerals segment from the $186.7 million recorded in the third quarter of 2008, and income from operations, excluding special items, decreased 50 percent from the $16.8 million recorded in the third quarter.

Worldwide sales of PCC, which is used mainly in the manufacturing processes of the paper industry, were $137.4 million, an 11-percent decrease from the $154.1 million recorded in the fourth quarter of 2007.

Sequentially, PCC sales declined 13 percent from $157.2 million in the third quarter of 2008. This decrease was associated primarily with PCC volume declines caused by a worldwide decline in paper demand that resulted in both temporary and permanent paper mill shutdowns and production curtailments late in the fourth quarter.

Worldwide sales of Processed Minerals products were $22.4 million, a 15-percent decrease from $26.3 million in the fourth quarter of 2007. Processed Minerals products, which include ground calcium carbonate and talc, are used in the building materials, polymers, ceramics, paints and coatings, glass and other manufacturing industries. The

3

decline in Processed Minerals products was a result of fourth quarter production curtailment by customers serving the already weak residential and commercial construction and automotive industries.

In the company's Refractories segment, sales in the fourth quarter 2008 were $80.2 million, a 15-percent decline from the $93.9 million recorded in the same period in 2007. Foreign exchange had an unfavorable impact on sales of $6.3 million, or 7 percentage points for the fourth quarter.

The Refractory segment recorded operating income, excluding special items, of $1.6 million in the fourth quarter of 2008 compared with operating income of $10.4 million in the same period in 2007.

Sequentially, sales in the Refractory segment, decreased 26 percent from the $108.2 million recorded in the third quarter of 2008, and operating income, excluding special items, declined 86 percent from third quarter. The rapid collapse of North American steel production in the fourth quarter was the cause of this decline.

Full Year Results

For the full year, the company reported net income of $65.3 million, or $3.44 per share, compared with a net loss of $63.5 million, or a loss of $3.31 per share, in the prior year. Earnings per share, excluding special items, increased 22 percent to $3.44 compared with $2.82 in the prior year.

Worldwide sales for the full year 2008 were $1.11 billion, a 3-percent increase over the $1.08 billion reported in 2007. For the year, foreign exchange had a favorable impact on sales of $25 million or 2 percentage points of growth. The company recorded operating income of $82.0 million for the full year 2008 compared to an operating loss of $8.5 million for the full year 2007, which included impairment of assets and restructuring charges relating to a major realignment of the company's operations in the third quarter of 2007.

Specialty Minerals segment sales were $716.4 million, slightly lower than the $716.6 million recorded in 2007. Foreign exchange had a favorable impact on sales of approximately 2 percentage points of growth. Specialty Minerals recorded operating income of $57.0 million for 2008 compared with an operating loss of $20.0 million in 2007 that was a result of the company's restructuring.

4

PCC sales increased 1 percent for the full year 2008 to $605.7 million from $602.6 in 2007. Sales growth was attributable to increased selling prices from the pass through to customers of raw material cost increases and to foreign currency. Paper PCC sales volume decreased 4 percent from the prior year. Increased PCC volumes at several facilities and the ramp up of two new satellite plants were more than offset by paper industry production curtailments, primarily in North America .

Processed Minerals product sales decreased 3 percent in 2008 to $110.7 million from $114.0 million in 2007. This decrease was due primarily to the sharp fourth quarter drop off in demand from the previously weak commercial and residential construction and automotive industries.

Sales for the full year for the Refractories segment were $395.8 million, a 10-percent increase over the $361.1 million recorded in 2007. This increase was largely due to price increases necessitated by increased raw material costs. Foreign exchange had a favorable impact on sales of $9.4 million for the year, or 3 percentage points of sales growth.

The Refractories segment operating income for 2008, excluding special items, was $32.0 million, a 3-percent increase over the $31.0 million recorded in the previous year. For the first nine months of 2008, the Refractories segment recorded 18-percent sales growth and a 47-percent increase in operating income, the highest earnings for that period in the segment's history. However, the collapse of steel production, especially in North America , dampened Refractories' full year financial results.

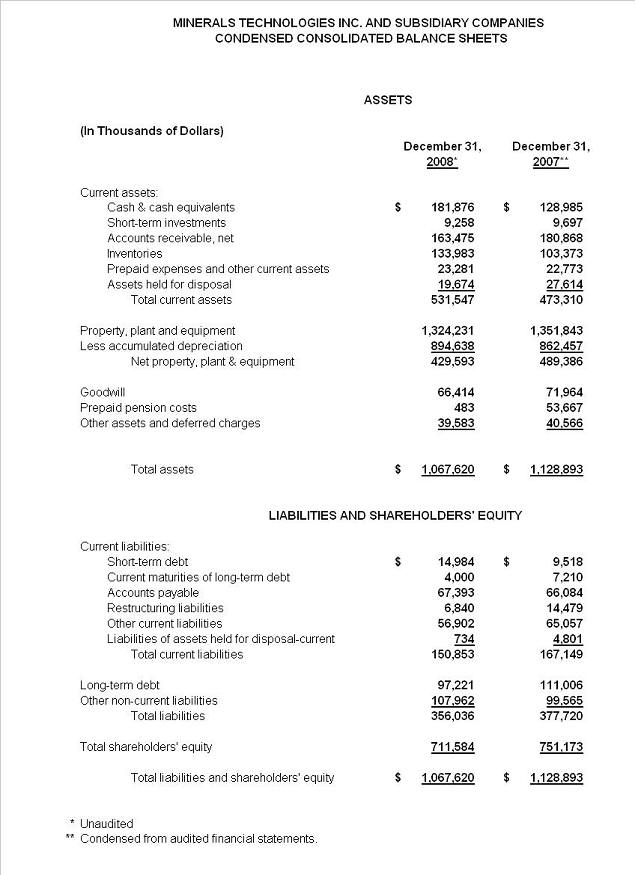

At year end, the company had $182 million in cash and $170 million of unused credit facilities. The debt to capital ratio was very low at approximately 14 percent. Operating cash flow for the full year was approximately $132 million and free cash flow was $115 million, as the company continues to reduce capital spending, focus on working capital management and reduce overall spending.

"The year 2008 reflected record-setting earnings for Minerals Technologies despite the fourth quarter's steep economic downturn that persists today," said Mr. Muscari. "I believe we are in a better position to effectively manage through these extraordinarily difficult, and uncertain times because of the actions we took in 2007 to restructure, realign and refocus our businesses. Although our fourth quarter results were poor, the company today

5

has a stronger foundation than it did a year ago. We continue to have a strong balance sheet, good cash flow, leaner operations, and we will make the adjustments necessary to keep pace with changes in our customers' requirements and to effectively navigate this global recession."

----------

The company also declared a regular quarterly dividend of $0.05 per share on its common stock. The dividend is payable on March 18, 2009 to stockholders of record on February 27, 2009.

----------

Minerals Technologies will sponsor a conference call tomorrow, February 6, 2009, at 11 a.m. The conference call will be broadcast live on the company web site: www.mineralstech.com.

----------

This press release may contain "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995 which describe or are based on current expectations. Actual results may differ materially from these expectations. In addition, any statements that are not historical fact (including statements containing the words "believes," "plans," "anticipates," "expects," "estimates," and similar expressions) should also be considered to be forward-looking statements. The company undertakes no obligation to publicly update any forward-looking statement, whether as a result of new information, future events, or otherwise. Forward-looking statements in this document should be evaluated together with the many uncertainties that affect our businesses, particularly those mentioned in the risk factors and other cautionary statements in our 2007 Annual Report on Form 10-K and in our other reports filed with the Securities and Exchange Commission.

----------

For further information about Minerals Technologies Inc. look on the internet at http://www.mineralstech.com.

####

6

7

8

9