SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant ¨

Filed by a Party other than the Registrant þ

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| þ | Definitive Additional Materials |

| ¨ | Soliciting Material Under Rule 14a-12 |

BlackRock MuniYield Pennsylvania Quality Fund

(Name of Registrant as Specified In Its Charter)

Saba Capital Management, L.P.

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| þ | No fee required. |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11. |

Boaz R. Weinstein (“Mr. Weinstein”) posted the below messages to his X account.

Saba Capital Management, L.P. (“Saba Capital”) issued the below press release.

Saba Capital Releases Presentation Detailing Plan to Deliver Enhanced Shareholder Value at 10 BlackRock Closed-End Funds

Presentation Details the Funds’ Significant Long-Term Underperformance, BlackRock’s Attempts to Crush Shareholder Rights and the Opportunity to Unlock $1.4 Billion in Value for Investors

Join Saba’s Webinar on May 20th at 11AM EST Where Boaz Weinstein Will Detail Why BlackRock and Its Hand-Picked Directors Must Be Held Accountable, Unveil Saba’s Plans to Improve the Funds and Answer Questions from the Audience

Visit www.HeyBlackRock.com to Download the Full Presentation, Access the Webinar and Obtain Information on How to Vote for Each of Saba’s Proposals on the GOLD Proxy

NEW YORK--(BUSINESS WIRE)--Saba Capital Management, L.P. (together with its affiliates, “Saba” or “we”) today issued a presentation detailing its plan to deliver shareholder value at 10 BlackRock Advisors, LLC (“BlackRock”) closed-end funds (collectively, the “Funds”).1 The presentation can be viewed here.

As a reminder, Saba has submitted proposals to (i.) elect new, independent directors to each of the Funds’ Boards of Trustees, and (ii.) terminate the management agreement between BlackRock and six of the Funds at the upcoming 2024 Annual Meetings of Shareholders.

Saba Founder and CIO Boaz Weinstein will be hosting a live webinar today, Monday, May 20th at 11AM EST where he will detail why BlackRock and its hand-picked directors must be held accountable, unveil Saba’s plans to improve the Funds and take questions from the audience.

To gain access to the webinar and sign up for important campaign updates, visit www.HeyBlackRock.com.

***

VOTE “FOR” BOTH OF SABA’S PROPOSALS ON THE GOLD PROXY CARD:

| ü | The election of Saba’s highly qualified and independent nominees: Athanassios Diplas, Ilya Gurevich, Shavar Jeffries, David Littlewood, David Locala, Jennifer Raab and Alexander Vindman. |

| ü | The termination of BlackRock’s investment management agreement at BFZ, BCAT, ECAT, BMEZ, BIGZ and BSTZ. |

***

About Saba Capital

Saba Capital Management, L.P. is a global alternative asset management firm that seeks to deliver superior risk-adjusted returns for a diverse group of clients. Founded in 2009 by Boaz Weinstein, Saba is a pioneer of credit relative value strategies and capital structure arbitrage. Saba is headquartered in New York City. Learn more at www.sabacapital.com.

_______________________

1 The Funds include: the BlackRock California Municipal Income Trust (NYSE: BFZ), BlackRock Capital Allocation Term Trust (NYSE: BCAT), BlackRock ESG Capital Allocation Term Trust (NYSE: ECAT), BlackRock Health Sciences Term Trust (NYSE: BMEZ), BlackRock Innovation and Growth Term Trust (NYSE: BIGZ), BlackRock MuniHoldings New York Quality Fund (NYSE: MHN), BlackRock MuniYield New York Quality Fund (NYSE: MYN), BlackRock MuniYield Pennsylvania Quality Fund (NYSE: MPA), BlackRock New York Municipal Income Trust (NYSE: BNY) and BlackRock Science and Technology Term Trust (NYSE: BSTZ).

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

The information herein contains “forward-looking statements.” Specific forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts and include, without limitation, words such as “may,” “will,” “expects,” “intends,” “believes,” “anticipates,” “plans,” “estimates,” “projects,” “potential,” “targets,” “forecasts,” “seeks,” “could,” “should” or the negative of such terms or other variations on such terms or comparable terminology. Similarly, statements that describe our objectives, plans or goals are forward-looking. Forward-looking statements relate to future events or future performance and involve known and unknown risks, uncertainties, and other factors that may cause actual results, levels of activity, performance or achievements or those of the industry to be materially different from those expressed or implied by any forward-looking statements. Each of the BlackRock Funds (as defined below) has also identified additional risks relating to its business in its public filings with the Securities and Exchange Commission (the “SEC”). Saba Capital Management, L.P. (“Saba Capital”), and as applicable the other participants in the proxy solicitation, have based these forward-looking statements on current expectations, assumptions, estimates, beliefs, and projections. While Saba Capital and the other participants, as applicable, believe these expectations, assumptions, estimates, and projections are reasonable, such forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which involve factors or circumstances that are beyond the participants’ control. There can be no assurance that any idea or assumption herein is, or will be proven, correct. If one or more of the risks or uncertainties materialize, or if the underlying assumptions of Saba Capital or any of the other participants described herein prove to be incorrect, the actual results may vary materially from outcomes indicated by these statements. Accordingly, forward-looking statements should not be regarded as a representation by Saba Capital that the future plans, estimates or expectations contemplated will ever be achieved. You should not rely upon forward-looking statements as a prediction of actual results and actual results may vary materially from what is expressed in or indicated by the forward-looking statements. Except to the extent required by applicable law, neither Saba Capital nor any participant will undertake and specifically declines any obligation to disclose the results of any revisions that may be made to any projected results or forward-looking statements herein to reflect events or circumstances after the date of such projected results or statements or to reflect the occurrence of anticipated or unanticipated events.

Certain statements and information included herein have been sourced from third parties. Saba Capital does not make any representations regarding the accuracy, completeness or timeliness of such third party statements or information. Except as may be expressly set forth herein, permission to cite such statements or information has neither been sought nor obtained from such third parties. Any such statements or information should not be viewed as an indication of support from such third parties for the views expressed herein.

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

Saba Capital, Saba Capital Master Fund, Ltd. (“SCMF”), Boaz R. Weinstein (“Mr. Weinstein,” and together with Saba Capital and SCMF, “Saba”) and the Nominees (as defined below, and together with Saba, the “Participants”) have filed definitive proxy statements and accompanying GOLD proxy cards (collectively, the “Proxy Statements”) with the SEC to be used in conjunction with the solicitation of proxies in connection with the 2024 annual meeting of shareholders of each of BlackRock Innovation and Growth Term Trust (“BIGZ”); BlackRock Capital Allocation Term Trust (“BCAT”); BlackRock ESG Capital Allocation Term Trust (“ECAT”); BlackRock Health Sciences Term Trust (“BMEZ”); BlackRock California Municipal Income Trust (“BFZ”); BlackRock Science and Technology Term Trust (“BSTZ”); BlackRock MuniYield Pennsylvania Quality Fund (“MPA”); BlackRock MuniYield New York Quality Fund, Inc. (“MYN”); BlackRock New York Municipal Income Trust (“BNY”); and BlackRock MuniHoldings New York Quality Fund, Inc. (“MHN” and together with BIGZ, BCAT, ECAT, BMEZ, BFZ, BSTZ, MPA, MYN and BNY, collectively, the “BlackRock Funds”). Shareholders of the BlackRock Funds are advised to read the applicable Proxy Statements, including any supplements thereto, and other documents related to the solicitation of proxies with respect to such BlackRock Funds by the Participants because they contain important information, including additional information related to the Participants and a description of their direct or indirect interests by security holdings or otherwise. Such materials will be made available at no charge on the SEC’s website, https://www.sec.gov.

The “Nominees” refer to (i) with respect to BIGZ, ECAT and MPA, Ilya Gurevich (“Mr. Gurevich”), Shavar Jeffries (“Mr. Jeffries”), Jennifer Raab (“Ms. Raab”), Athanassios Diplas (“Mr. Diplas”), David Littlewood (“Mr. Littlewood”), David Locala (“Mr. Locala”) and Alexander Vindman (“Mr. Vindman”); (ii) with respect to BCAT, Mr. Jeffries, Ms. Raab and Mr. Vindman; (iii) with respect to BMEZ, Mr. Gurevich, Mr. Jeffries and Mr. Locala; (iv) with respect to BFZ, Mr. Gurevich and Mr. Jeffries; (v) with respect to BSTZ, Mr. Diplas, Mr. Locala and Mr. Vindman (vi) with respect to MYN, Ms. Raab and Mr. Vindman; (vii) with respect to BNY, Mr. Gurevich and Ms. Raab; and (viii) with respect to MHN, Mr. Jeffries and Ms. Raab.

Contacts

Longacre Square Partners

Charlotte Kiaie / Kate Sylvester, 646-386-0091

ckiaie@longacresquare.com / ksylvester@longacresquare.com

###

Mr. Weinstein hosted a webinar, the transcript of which is reproduced below, followed by a presentation used during the webinar.

Moderator:

Good morning. I'm pleased to introduce Boaz Weinstein, Founder and Chief Investment Officer of Saba Capital Management, the top investor in 10 BlackRock closed-end funds. Saba is the world's single largest investor in closed-end funds. Its successful track record as a closed-end fund activist has earned it recognition as the Activist Hedge Fund Manager of the Year by Institutional Investor in both 2023 and 2024. This is the first time any closed-end fund activist has won this recognition from this prestigious publication. This year, Saba has nominated a slate of highly qualified director candidates across 10 BlackRock closed-end funds to hold BlackRock and its board members accountable for destroying billions in shareholder value. At six of these funds, Saba has also submitted a proposal to terminate BlackRock as the investment manager. Today, Boaz will detail his plan to deliver long-term value for all fund shareholders. Following the presentation portion, Boaz will take questions from the audience, which you can submit at any time in the bottom right corner of your screen. Boaz, over to you.

Boaz Weinstein:

Thank you, Charlotte. I want to welcome everyone. I'm so glad that we have this amazing turnout. We're speaking to thousands of you about this campaign, this campaign that captivated CNBC's interest and many other media outlets and they're asking for more. I was asked after today's call to speak on Bloomberg because there's tremendous interest given how large an asset manager BlackRock is, managing over $10 trillion, and given how strong our comments have been and how much is at stake. We're talking about an enormous amount of money, which I'll go into, that really can be restored to shareholders without needing to guess which way the market's going to go, which is hard enough as it is. So today, really, I wanted to take you on my journey in closed-end funds, how I began in it, and what's at stake here. And so, we're also going to do Q&A at the end.

I'll try to limit the presentation part to thirty minutes, and for those of you who are going to watch it on replay later, you can shorten it to anything you want. But I wanted to make sure I gave a full explanation for what has been going on and what our proposal is and just what is at stake for shareholders because it's not just the gain that we hope to make by encouraging or forcing BlackRock to take the steps that we've prescribed, but also potential losses if we lose because these discounts have actually been significantly bigger in the recent past. So just to kick it off, just to say that I personally bought my first closed-end fund 25 years ago. I was reading Barron's, the retail publication that talked about smart ideas, and closed-end funds has been a retail space. It's over 700 funds in the US and the UK, about $450 billion.

It's tiny by ETF standards or mutual fund standards, but it is not small. And I found a fund, Morgan Stanley was the manager, it was in Asia, so I'd be getting diversification, which I wanted, and it was at a giant discount. And so I thought that Morgan Stanley would not stand for the discount to be gaping for that long. And I was right. And they took corrective actions and the fund restored itself to NAV and a handsome gain was made. I kind of forgot about closed-end funds, got busy with my day job and fast forward to 2013 when closed-end funds grew a lot as an asset class and sank to very big discounts during the Bernanke taper tantrum. It set in motion sellers, which is really all it takes for these funds to get to discounts, because there are no real natural buyers for most closed-end funds unless they're very well run or performing well at the fair value, at the net asset value.

And that's something I'll get into when I talk about my history with speaking with BlackRock directly about this topic. So over these years, over these 11 years, we have come to become the world's largest institutional investor or investor in closed end funds. And really the only real activist with substantial positions, positions in the billions. Because traditional activists need BlackRock. They might have a campaign on Disney or on some giant company, Nestle, and BlackRock is the largest shareholder actively managed that they can go to and say, I want you to side with us instead of management, which is already a hard enough proposition. And so the idea that they would then be aggressive with the hand that might be feeding it has created a situation that I really didn't expect when I got started, which is that there's really very few others like me to do this important work.

Now, when I spoke at the 13D Monitor conference, the annual most important activist conference, I had some of the other managers come and say they would love to be doing it, but for that reason. And I get it, it's good business for them not to though we have seen firms like Elliott get involved in funds similar to ours. And I'll give you an example because that fund actually has taken steps in a very similar type of structure, that type of asset class and performance that BlackRock has not with very, very different results. So this is not about lambasting the closed-end fund industry. This is about out of the 700 or so closed-end funds, we are here today to talk about 10 of them, the ones that really are underperforming in many cases by the most in the entire industry despite BlackRock's storied reputation as a $10 trillion behemoth that really shouldn't tolerate this level of pain for their investors if they can fix it as they can. So, over that time, I've found that many of the investors in closed-end funds are the most vulnerable retail investors.

When you say retail, you generally mean uninformed, but we've also seen retail get the best of institutional, whether it's meme stocks or other plays where retail can be very smart. There are very smart retail investors in closed-end funds, but the ones that buy it at IPO at NAV and often in the past sold with exorbitant fees are some of the least sophisticated, the most vulnerable, the ones that can't do anything to get themselves out of that problem. And so we are, by nature of what we're doing, benefiting them greatly. We didn't get into it to help mom and pop dentists and lawyers and teachers, but it does give us great pleasure the incoming messages we receive and in fact that we've received on this campaign. And if someone wanted to just go on Twitter and put or X, put my handle and not read my messages, but read the incoming traffic, it's all supportive. And to be clear, zero of it is written by us.

There's only one way to look at this, which is that what we're doing is good for all shareholders, though BlackRock has tried very hard and their lobbying group, ICI, to try to claim there's some daylight between what's good for us versus good for other investors. And I'll dispel that when we talk today. So over that time, we went from some of the least sophisticated investors to the most sophisticated. So I had the pleasure of talking about closed-end funds with Warren Buffett directly in 2018, and he sent me a, maybe I'll post it on X today, a yellowed PDF of his 1950 position report right before he took Benjamin Graham's class, where two out of the three stocks he owned were discounted closed-end funds. And he was not there to hope that the manager would turn things around on their own. So, the product has been around for 150 years, and it's included Warren Buffett, Ed Thorpe, and a man for all markets discusses closed-end fund arbitrage, closed-end fund activism.

And also along the way, once in a while, we have a campaign that gets to the stage where we get sent the list of all of the shareholders that asked to be contacted, the non-objecting beneficial owners, NOBO. So you fill out your account at Schwab or Fidelity or what have you, and you're asked, do you want to be contacted? Do you want to be contacted if it's contested? Because if it's uncontested, there's no point. But if it's contested, do you want to be contacted yes or no? And we had this campaign with BlackRock last year and last year just, and I think this year though, I think they're still trying to figure out what has more PR damage for them to give us the list or not. Last year, they would not give us the list of names and addresses of people that said, please contact me – both sides – if there is a contested election because presumably in a contested election, you want to hear from both sides.

That's the whole point. And we were unable to get that list because BlackRock withheld it from us. So I've had to resort to unconventional means of getting the word out and trying to find the investors. And if it's not the investors trying to find the RIAs, the brokers, the FAs, whatever they're called at your institutions as you are here today, so that you hear the stories that you call your investors because I'm unable to reach them. And we even heard that BlackRock spoke inappropriately to one of the institutions that's a large holder of closed-end funds. They held a session for their brokers and we are unable to hold the same session. So it's been a very unequal playing field. And I thought today's webinar the first time I've ever done this way to try to reach out to you, the media, the stewards of your clients’ capital to make sure that they understand what's at stake here.

Okay, so before we get into it, I want to just say one thing, which is there was news announced today. So there was an announcement from our friends at BlackRock, and I think they thought the timing of announcing it this morning, I can only think the most major announcement for the funds that we're running campaigns on to happen really ever for it to have come today this morning has to be related to trying to steal the thunder away from this presentation. They can say after this whether I'm wrong. And it just so happens to be coincidental that this morning they announced some sweeping changes, notably there are 70 BlackRock closed-end funds. There may even be more, but notably the changes they announced are on these very funds that I'm talking to you about. So for example, for BIGZ, which is the BlackRock Innovation and Growth closed-end fund and for ECAT, the ESG Capital Allocation Trust, BlackRock today has raised the distribution, the dividend, the annual distribution of those funds up to an eye popping 20%.

They, as of today announcing it's unclear if it's for one quarter or at least one year. They haven't said, and I think they want the flexibility to use this announcement today to try to sway voters to try to narrow the discount if they can. It's a too little too late solution, which I will go through right now, but they're basically desperate to not lose. And so right before this call, they announced the biggest news for these funds since they IPO’d three years ago, investors in BIGZ and ECAT are going to get 20%. That sounds amazing, right? For many retail investors, they will unfortunately understand that to mean they're going to get a 20% dividend every year or at least as long as BlackRock wants to pay it on these funds. But the truth, and I have a slide for this made way before today's announcement, is that these distributions have little to basically zero in many cases, zero.

When we look at the recent history, zero of it is actually a return on your capital. It is a 100% return of your capital. So this is actually one of the things that really irks sophisticated investors when they understand how unsophisticated investors might be confused about these sorts of maneuvers. You go look on your website that there's a 20% distribution and you're a retiree. That sounds amazing. It's so hard to make even 10% in the markets. But if you were told instead that you put in a hundred cents into a box and you're going to get 20 cents back the first year, so now you have 80 cents, you're getting 20 of it, and then the next year you get 20% of 80, so now you're getting 16 and now you have 64 on and on and on, you would start to feel like that wasn't quite the amazing investment you thought and the term shell game and Ponzi, which is not appropriate in my mind when we talk about these things.

But there is this idea of the investor being fooled by return of their capital and is there a level of distribution unless it's made clear with a big banner, this is you getting your money back is something that will definitely trick shareholders. Now in some sense, it's not bad when a fund's at a discount because if it's at a discount, you're getting it back effectively at NAV. It's like they're doing a distribution of NAV, which is actually our whole plan is to get investors NAV. So in that sense, it is good. And in fact the stocks are responding well. BIGZ, for example, is up 3.5% when I last checked. That's literally in fifth percentile of best days BIGZ's ever seen. And so definitely when something's going to discount getting out of a piece of it at NAV, that's exactly what we're going for.

The thing is all it's done is take the billion four that you'll see in this presentation that stands to be made. If they press that button, if they did the right things, it took it to 1.25. So 1.4 has gone to 1.25. A lot of work needs to be done to get that 1.25 to zero, that 1.4 that on the news that BlackRock will take some steps that help narrow the discount. It's improved, but it also can go the other way. And that 1.25 at the minute has been 1.8, $1.8 billion just a few months ago. Okay, so what is 1.4, which was the discount coming into today? What is 1.4 really, really mean? And Taylor Swift actually is somebody that I got to speak to her father on a closed-end fund campaign because they were the largest owner. She was the largest owner when I got that noble list of three closed-end funds.

And Scott Swift eventually sided with us, voted in our favor, and that was three of the more than 60 battles where we have fought for investors and got investors all the way from mom and pop to Taylor Swift to get a full nav exit on a big chunk or all of their investment. So how do we contextualize a billion dollars? People talk about, and I've been to two of her concerts, how amazing it is and how she's made a 1.04 billion from the Aris tour North America and all the work she put in three and a half hour concerts all around the country over and over again. It's hard, it's hard work. It's admirable what she does. Larry Fink could deliver 1,000,000,004 to his shareholders, which include his employees, which would improve the value of their portfolios, which they could then invest and earn interest on interest in compounding if they allowed shareholders an exit at NAV.

And all that's required, as I wrote above, is a push of the button. What does that mean? A push of the button. So really there are steps that are easy for the manager. Let's just talk for a second about how hard the investing world is. You've all experienced it, the best laid plans, you had a great idea, it didn't go well for the wrong reasons, for the right reasons. The thing you're worried about the unknown, unknown investing is hard. It's hard to make a million dollars. It's hard to make a hundred million dollars. But what stands to happen here is that if these funds traded at NAV as many closed-end funds do or near NAV or offered exits at NAV, or if they have done so poorly for investors, they ought to be converted to open-ended funds, which always traded at NAV or mutual funds trade at NAV $1.4 billion would be delivered to the shareholders of just these 10 funds. And with investing as hard as it is, this amount of money is something that is the reason that we're all here. We're not talking about $50 million like some small closed-in fund campaigns of the past. And so while we are the largest shareholder in these BlackRock funds, we are of course a minority investor and almost well over a billion dollars of it would be delivered to largely retail investors if they traded at NAV.

Now we're experienced, as I mentioned in this space. So our prescription, our medicine is the same things that we've done, as I said, 60 times. We own 5.8 billion as Charlotte mentioned at the top, we're the only closed-end fund activist to win the prestigious institutional investor activist of the year. We won it two years in a row and we've won a number of awards. But BlackRock's also questioned our stewardship as a manager. And instead of trying to debate that today since we're here to talk about BlackRock funds, I did want to at least throw in that we won a hedge fund of the year for our performance in 2020 in Risk.net 2021 Risk Awards hedge fund of the year for any category. And you can go to our website and find a number of others in different years, but I am firmly invested and focused on these funds.

And the problem is as a 10 trillion institution, BlackRock is not because once they place these funds, it's onto the next product and they've effectively locked in all the fees that they can because unlike ETFs and mutual funds, they don't grow and or shrink. And so they don't have to be at the top of their game. And that can mean even reducing fees because if, look at the Grayscale example, Grayscale Bitcoin had very high fees. It was a closed-end fund becomes an open-ended fund. And actually BlackRock is offering 12 basis points only management fee as a teaser. And they've been able to get grayscale money to move to BlackRock because that ETF is competitive and the old grayscale was not competitive. And it's actually a great example, in fact, even involving BlackRock this time as the good guy to help investors get out of a very big discount in the famous grayscale Bitcoin.

So our focus is not just returning these closed-end funds to their full net asset value, and that's our plan. It's also to create long-term value, whether that comes from lower fees, better management or protecting shareholder rights. Because one of the shocking things for me when I got into this campaign with BlackRock a couple of years ago is that even five years on, so we had had a campaign with them that started in 2019 that they're willing to literally shred shareholder rights at the same time out of the other side of their mouth, they launch all sorts of ESG products that purport to invest in only good governance funds. And BlackRock has made the calling balls and strikes on these very matters trivial because they actually say how the G part ought to be implemented. How should we protect shareholders with respect to electing a board and so on and so forth, which I'll get into and you'll see that they actually are violating their own words.

They're treating these funds, which are shares in the New York Stock Exchange, that have a board that you're entitled to be treated, not like a second-class citizen. They're abusing them through the tactics which are not only enshrined into the documents, but even things that they've done in addition to that and even the things they've said which are an attempt at confusing the reality, the 20% is one where I view it like a huge strategic blender. Let me just now address the strategic group at BlackRock that is watching today. If you thought that that was going to steal the thunder from this presentation, you actually reinforced it because you showed what you showed today, BlackRock, you put out a press release, you announced something and $150 million was made. You didn't have to guess what's happening to Nvidia. You proved our point that at the press of a button you could deliver nine figures to shareholders, but there's 10 figures at stake. Okay? You need to press that button a bunch more times or I'm going to press it for you.

So in 2013, our request began. We didn't start as an activist, but you can see through this timeline, I'm not going to spend much time on it, that in 2019 we had a campaign with BlackRock and we were a little bit naive. We nominated a board, they sent us, we submitted all the questions that were asked and they sent us a supplemental questionnaire and they sent us back this 47 page thing that we took a week to reply to. I was always the one that turned in my term paper two days late. We didn't know that there was a one week deadline. We turned it in I think seven days, seven business days later. And they said, ha ha, you've missed your five day deadline. Come back next year. Your nominees who filled out the appropriate questionnaire are no longer able to run for election stand for election.

And we went to court with them and the judge said to them, would 500 pages have been an undue burden? Would 5,000 pages and why exactly did you ask such random questions like did the Saban nominees violate the JCPOA Iran nuclear agreement? How is that relevant or did you actually just run out of questions by page 43? So they did this tactic hats off, although I don't really find it very sporting, but the judge sided with us, they appealed and in the middle of all that, in 2020, BlackRock puts out a letter to their shareholders saying on two New York Muni closed-end funds and on one high yield closed end fund on the first two, we are going to open-end them. And then on the high yield one, they launched a tender. But the reason we're open-end them is for four things. It will eliminate the discount, it will improve liquidity.

It will be, will actually lower the expense ratio because they become part of a bigger fund and there's no tax implications. These were BlackRock's own words. I can send it to you, maybe I'll put it out after the call though. I've done it in the past. These were BlackRock's own words. There is nothing different about these funds than those funds in BlackRock kind of kicking and screaming in 2020 without claiming we were involved, did the thing that we asked for and put it in their own words. And so they've already done that medicine and the medicine today and the other things that they've announced in the last few days to try to siphon off some votes. They arranged a standstill agreement with one activist, gave him a 50% tender in one of those funds to secure, and then some small stuff on the funds that we're fighting for to try to take a few percent of the vote away to try to win the election.

Whether that's good tactics and good tactics in bad business, I think it's bad business because it may not make the difference. It's seen for what it is and it would not have happened. No one doubts that 50 tender for that muni fund would not have happened were it not for us. And today's announcement for sure would never have happened if it weren't for us. So in 19, we went through this, we won in 2020. And when I spoke to my investors about this current campaign a year ago, I told them and I was wrong, I told them, I understood from people at BlackRock that they didn't really like how it went in 2019 and when we won in 2020 that it wouldn't happen again because it wasn't worth it for them given the brand value. And we're talking about the brand of a 10 trillion manager that's already under fire because of various governance questions.

If you look at BLK or if you look at the ESG part and what it's meant, that they wouldn't for something this small, we're talking about now something as big because they didn't tend to their garden, 10 or 11 billion of AUM on a $10 trillion manager. And it doesn't take 10 trillion. Sorry, it doesn't take 10 billion fixing to eliminate the problem. It takes a few billion. So it's a few billion on 10 trillion. That few billion of buybacks or open-end or whatever assets they would lose, just like Grayscale lost is peanuts for them and they would be making their shareholders $1.4 billion. So I made a mistake thinking they wouldn't fight vociferously, but I was wrong because in 2023 they actually did something outrageous, which I'm going to get to with respect to restricting shareholder rights, which was illegal under federal law and was proven as such thanks to a lawsuit that we filed in 2023. Okay, well here we are in 2024 and game on.

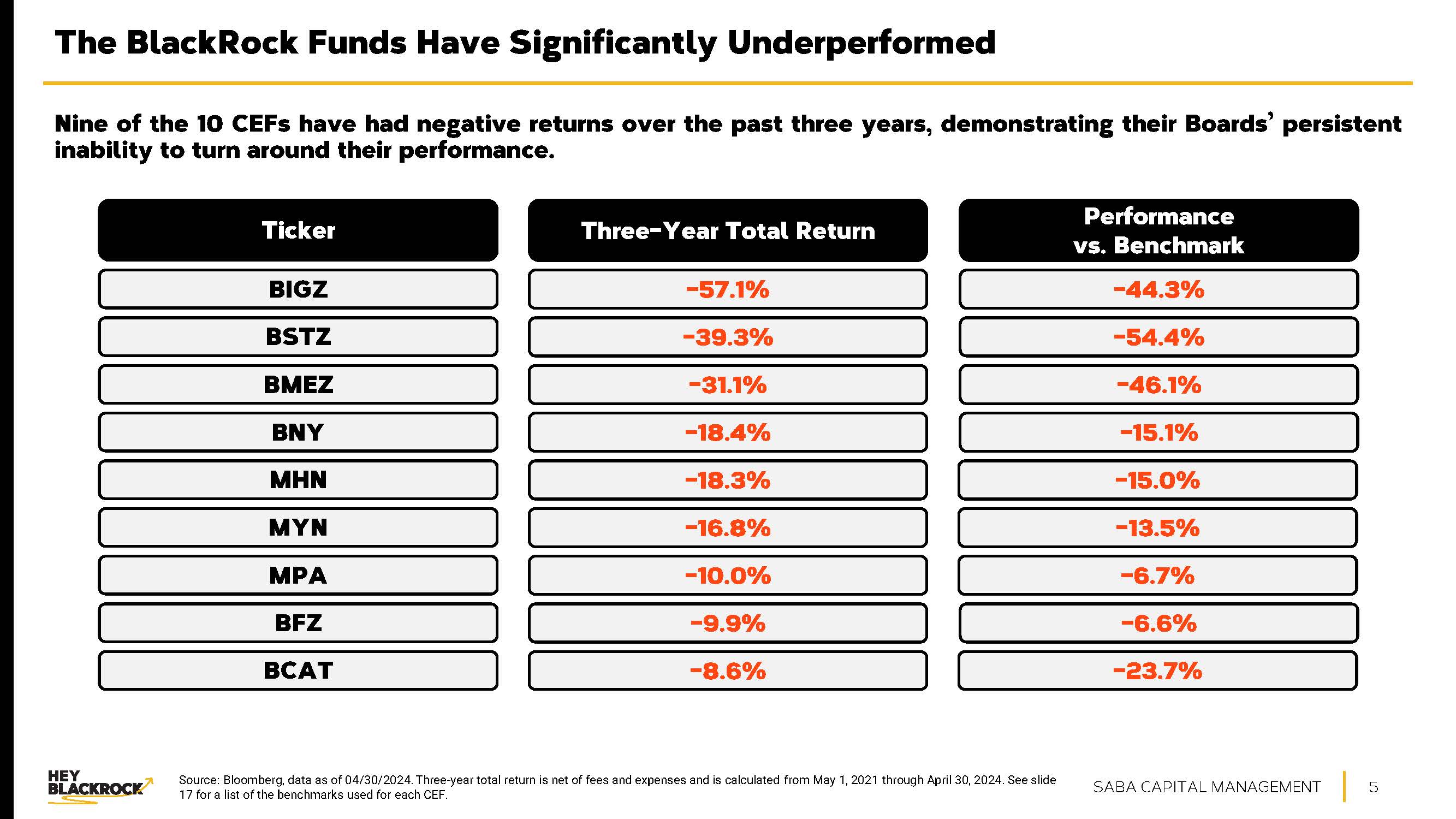

Alright, so slide five is kind of where the rubber meets the road. I could have found funds that had a big discount maybe that were performing well, there is a fund out there that's not run by BlackRock that sits at a big discount that had enormous positive returns over the last five years. But this is the combination of funds that had a big discount where we thought we could be impactful. This is nine funds. We are actually activists on 10, the 10th was not around three years ago so that we could keep all the math easy and if we did it for 10, it would've been three years and six months in a day, that would've been a really weird way to start it. So a bunch of these funds are old, but some of them are just around three and change years old. So we picked the three-year total return.

It might've hurt us, maybe it would've been better if we picked a slightly different start date. This is the three-year total return for the nine funds that were around for the last three years. It is obscene because I don't come to you at the depths of the 1929 stock market crash or March, 2020 or October, 2008. I come to you with the S&P at 5,300 and yes, some of these funds even own Nvidia. Okay? So you can't say, well, they don't have the Magnificent Seven. Some of them have actually some very exciting technology holdings, but in the main of course, stocks have done reasonably well. We're not, certainly not in the bear market. We are in a bull market and this is the three year total return. I couldn't have asked for anything more. I didn't know what the numbers would look like. I bought big discount funds and every one of them has had a total return.

Now, part of why it has a negative total return, we'll get to the discount because the discount plays a real role. It's not some ephemeral theoretical construct. The discount is what happens from NAV on top of what happens to nav. So you have the loss from poor performance for all these funds and then you have the additional loss because they're all at a discount. And again, Les, some of you think, well, all funds are at a discount. I went after the ones that I thought we could have the biggest change that were at the biggest discount, but there are funds today, I'll mention a Neuberger Berman fund. NHS, a high yield fund, is at a premium and it's at a premium despite doing two rights offerings in the years that followed a Saba campaign where they did a tender after some wrangling, they did their tender.

They've since done two rights offerings issuing more shares into the market. But NHS is trading fantastically well at a premium. So if this is cherrypicked in any way, it's that BlackRock put themselves in a position to be the object of my attention by having their funds perform terribly and traded giant discounts. So this is the actual three year total return as I sit here in a bull market with you. And some of this is due to discount, some of it's due to nav, but look at the far right. Okay, so now let's talk about the market. So these are versus benchmark. These funds, some of them employ leverage, some of them don't. The leverage typically makes it easier for the manager because they have higher yields and that will be compared to a benchmark that isn't levered or the markets went up and they will get the leverage on the markets going up. So in three of the funds, the discount is very big, which is not on this page, but you'll see it next. So look at BIGZ, BSTZ and BMEZ and the performance is horrific. The average of that is 40 whatever, 48% of performance versus benchmark. This is the benchmark that BlackRock said is the benchmark for the avoidance of doubt.

Actually, there's an interesting point here. Two of these funds have a different governance than the other eight and the two of those funds, I wonder if anyone can guess which two funds have better governance, which two funds do not trap shareholders in quite the same way. There's some bad governance, but it's bad. What we have found, and we've studied it, literally studied it, is that the worse the governance is, the harder it is, the more entrapped a shareholder is where they have no hope of us or someone else, the bigger the discount. So the two funds with the better governance are BFZ and MPA. They're the only two trading at smaller discounts because investors actually think there's a higher likelihood that we'll win because some of the tactics used in the worst governance funds, the other eight are not possible in these. And so the market speaking for itself, okay, so now we're on the slide where we're looking at the discounts of these funds.

Before over here we're looking at performance and performance first benchmark. And so here you have BSTZ and BIGZ and BMEZ, the first three, so you see, the worst performing funds traded the biggest discount. So what would you conclude? If you perform better, you'll be at a lower discount. If you have better governance, you'll be at a lower discount. But if you have bad on each, you're going to be at a really big discount. And for anyone familiar with high watermark math, we are not. This BSTZ is not 17.7% that one would make if it went to NAV 17.7 off the top is 82.3, right? It's trading at 82.3 when we made this chart. And to get back to par is to make 17 seven on 82. That's to make more than 20% return, 21% return. That is an enormous return. That is an enormous return for any fund. That's an enormous return for any fund that's done pretty well. But for a fund that has lost this amount of money as BSTZ has 54% to give investors back a third of their loss, 21% actually at the press of a button, it is unconscionable that they're not doing it.

Okay, so why are they not doing it? One of the main questions I get from investors is, I don't understand. This makes no sense. They run $10 trillion. Their shareholders are unhappy, their shareholders have lost money, their shareholders include their employees. We've spoken to many of their employees that own these funds. When we had our in the past, people have reached out or we found them that are hoping that we're going to win because that would mean that kind of gain for their employees. It's only in the ivory tower where keeping these fees trapped for as long as possible, the lure of permanent capital. Many of these funds are forever funds. Actually, Andrew Ross Sorkin, when he interviewed me on CNBC said what we got from BlackRock is that these funds started out as closed end funds. They have this 12 year final maturity. And so what do you object?

They'll get it back in 12 years. What do you object to that being true? Well, time value of money in 12 years, I think you all know the answer to that question and compounding. And also why is it up to BlackRock? Isn't it up to shareholders? But more than that, the reason lies in that the ETFs and the mutual funds will not command the market multiple for a UM anywhere near a closed end fund because investors are trapped and they fed the brilliant and amazing journalist, Andrew Ross Sorkin. That answer went out of the 70 or so funds that we're aware of that BlackRock has for closed end funds substantially. All of them, 90% of them are not 12 year term trust. They actually are forever funds. So they say one thing to be true for a small section of what's going on, but for the vast majority, these are funds that don't have a 12 year final maturity.

They don't have any final maturity. It is BlackRock's sincere hope of course, that these kinds of fees that they earn this expense ratio is almost all fees. And that if you take the 2023 expenses has delivered to them 141 million. Now, if they want to correct it and say it's 123 million in their pocket and 18 million for whatever administrative costs, please do that. We'd be interested to know how much BlackRock has made and you understand why they don't want that to go away four years later like it did for grayscale. So that's what this is about. This entire fight is about greed. And this time it's not the hedge fund manager that's greedy, it's the asset manager that is taking advantage of the most vulnerable investors. It's one thing to have IPO to the best of intentions, but to basically violate federal law and run elections in a way that could not possibly produce a different board is unconscionable.

And I hope the board members are listening to this because you have storied careers, venerable reputations, but you are under the spell or not, I hope not of getting paychecks. Not one paycheck for all the boards that you sit on, but you're getting paychecks for every one of the boards you sit on. And so because you sit on 70 boards, you know that if you make this decision for three of the boards and you are the voice calling out in the jury of your board member peers of what's the right thing to do, if you're that one voice saying this is wrong, shareholders have lost enough and they're calling for a fair election, that you might stand the chance to lose 69 other paychecks. And that's actually why BlackRock says on their website that no one should sit on the board of more than four public institutions and yet for publicly traded companies.

Yet BlackRock has their own board sitting on 70. JP Morgan, by the way, has 93 or 95 board seats on their closed-end funds. Their UK closed-end funds. They have 93 or 95 individuals, none of them from JP Morgan. Every one of seed is inhabited by different person because JP Morgan understands good governance. They understand that this is unreasonable to have the same seven people sit on the same 70 boards. So I'm going to get to that in a little bit, but this is about greed and fees. Okay? Now back to the return on capital birth, return of capital. So this strategic error that BlackRock made because they have empowered this idea that they can press a button and they thought they would be able to sway voters by doing a little bit of the right thing. Let's understand this return of return on. So you see BIGZ since it iPod sank like a stone.

It owns tech stocks that don't have dividends. How do you pay a 6% dividend when you don't have investments that are earning dividends? Well, you presume that you're going to have trading gains that will allow you to pay it or you're going to be giving back some return of capital. And since IPO, you could see for BIGZ, 100% came from return of your money, not a actual return. That was not true for BMEZ and BSTZ for the first two years. But you see for the last year and a half, it's been a hundred percent true for all three funds that it's return of capital and it's BIGZ and it's these funds that jumped to – and ECAT – that jumped to 20% dividends. So they're actually cranking it up 3x, 2x and they've moved everything from where it was to 12 to 20%.

And the ones that have done the worst, the ones that we own the biggest stakes in, it's at 20%. So ECAT and BIGZ to be clear, are now going to pay you back 20% of your money call the distribution. And those are the funds where Saba owns over, right around a billion dollars between those two funds. Half our position is in those two. That's where we have well over 20% of the fund. And this is clearly meant to try to cause them to win the election. Maybe they could change it back after we're out of the picture. But it's so craven. I mean, guys, it's so craven this morning to raise the distribution on the funds that we're activists in. And it's not real. It's a return of capital though we welcome it because of the discount. But the problem is sophisticated investors will understand it for what it is, it's good, but it's not that good and it's not going to do the trick.

And unsophisticated investors will see this enormous distribution and think that they're getting something that they're not, which is in effect their money back. Now what happens when they keep having to give their money back? Well, they used to cut the distribution. So you can see the arrows down for eight of the nine arrows, 22 to 24, they had to cut from the original 24 cents on BSTZ down to 10 and on BIGZ from 10 down to four, that was what they had to do because they didn't have it to pay. Now they're trying to forestall our winning elections. And so they've jacked it up. The other thing is they also said that when I was on CNBC, they gave Andrew Ross Sorkin this quote. BlackRock has a 36 year history of managing closed end funds for millions of American retirees who depend on them for income.

They were very specific to use the word income. But as you all understand already or understand from this call, this is not income. And they're using that word like we're taking people's income away, we're taking their paycheck or their earnings or yield that they're getting that they need to pay their mortgage or their rent. This is not income. And so they're really in the strategic meetings using terminology that is actually tricking retirees. And if retirees need BlackRock because of how they're performing for them for their income, let's just go back for a second to this slide. You can't look at this slide enough. It's literally a car crash. Okay? What I wanted to say earlier was that if two of them had been green, it wouldn't change anything. If three of them had done well, it really wouldn't change anything. It would change things in the sense that people wouldn't want to sell it as much and maybe the discounts wouldn't be as big, but still, investors are entitled to NAV if they vote for NAV.

And yet it turns out that all of these funds have done terribly. Yet BlackRock is sending out quotes saying that actually investors need these funds. In fact, this is a good moment for me to open up my mail. So I have a mailing here from BlackRock that I happened to have found this morning, and I know it's in it, so it, it's not like the Oscar goes to, but in this mailer, BlackRock is writing to me as a shareholder and they're saying that your vote is extremely important because the activist hedge fund is attempting to take over the trust, potentially depriving you of your great investment. Doesn't say, great, that's my ad living. And then later they say that Saba is attempting to take control of a majority of the board for its own benefit. They haven't really figured out a way to explain how everyone making money is just for our benefit.

But I want to mention this word majority for a second. Why is the majority of the board up when BlackRock staggers their board? BLK does not stagger their board. So the entire board is up at the same time. So an activist can come in and win majority control all at once, but for these funds, they've decided to classify the board to stagger the board. So it goes a third, a third, a third. So if it goes a third, a third, a third, which isn't under BlackRock's own governance standards, the right way to do things, and ISS agrees, why is the majority of the board up? It's up. Because in last year's contest, because of their standards, they were not able to elect a board, whether it's their existing trustees or us, it was a failed election. And because it was failed, unfortunately, their legal advisors figured out correctly that the same three people from last year are going to have to rerun this year in addition to the three that are due this year.

And so six out of nine are here up for reelection with these election rules that Vladimir Putin would be proud of only. And yet, so this majority is only available to us to seek those seats because of the entrenchment that BlackRock themselves created and may create again this year. And if it happens this year, it's very possible that the board, you would have a majority of the board unelected and they couldn't even hold an annual meeting last year because of these crazy standards. So it's just wild what they're willing to do for the Siren song of permanent capital. And anyway, so this mailing, they're trying their best to convince you that Saba is trying to deprive you of this amazing product because if you've got that 20% return or 16% return, whatever it may be from NAV that you would somehow be unable to find across the thousands of other BlackRock products, ETFs, mutual funds, other closed end funds, products of other managers, low fee products, infinite number of investments that you would not be able to find, you need these funds. I mean, what are you going to do without these funds? So don't make that 18% year one, why don't you wait for year 12, but the other 65 funds, you're in it forever until you can sell it to someone else at a discount, which Benjamin Graham wrote about in the intelligent investors. So there's nothing new under the sun.

Okay? So here's a BlackRock talking out of both sides of its mouth. So here we put literally unquote what BlackRock says for when they're the shareholder and what BlackRock has done for these funds. I already spoke about BlackRock being the trustee on 68 or more boards, but on the left it says they shouldn't serve on more than four boards. It's their view that BlackRock. Look at number two, it's in our view, BlackRock says shareholders should be entitled to voting rights in proportion to their economic interests. That means one share, one vote. And by the way, that's what the 40 act says. The sacred 1940 Act passed in. Congress says every share gets to vote. But BlackRock last year targeted an illegal controlled share bylaw in state law that they got put in there through their lobbyist. That limited us to 9.99%. And this is where I want to tell you a little story.

It won't go for very long. In January of 23, Nuveen did the same thing and they went to court. Actually they did it before, but in January, 2023, the court said Nuveen in the court, meaning the Southern District of New York, which is where BlackRock Arc case with BlackRock later was, it's illegal. Saba wins on summary judgment. It's illegal. The 40 act applies sometimes, of course, everyone knows federal on state law at odds. And it didn't get there. Like state law was there first. The 40 Act was there decades, decades, decades before. And federal law applied and Nuveen, it was found that what they did was illegal. Now, the story is I want you to ask yourself what you would do. You run an institution, you're doing something that you think is barely legal. I'm not trying to make a pun there, a reference to anything. And you instead go and find that actually it's illegal because your peer at the two blocks down is found in a court to be doing that illegal.

Ask yourself whether you to continue to commit the act, okay, you're doing something someone's found to have done something illegal in federal court. You care about your reputation. Do you stop doing it? Okay, I know the answer for me, I would stop doing it. I don't want someone to say, how can you continue to do this thing? When the court said they didn't just say it, they screamed it. In summary judgment. This is illegal to not let every share vote. So BlackRock continued to embrace this because they basically took the position that a judge didn't tell them. And in November, Nuveen appeal was turned down unanimously. And so they lost their appeal. So in December, we had the resolution of the same suit that we, BlackRock, you're going to make us bring the suit. You need a judge to tell you. Well, a different judge interestingly told BlackRock the same thing in summary judgment in December that it's illegal.

What they did was illegal and they should have known better, certainly because of Nuveen. But the trustees, I mean, I'm interested in the minutes for that meeting whether they talked about should we do something that Nuveen was found to have done illegally? Should we do it? And they did it. They did it in June, five months after the Nuveen decision. And that is something that they'll have to speak to for future boards that they may stand for election on. Okay? I'm very interested in that question because I know what the right thing for me is. And I also know what my General Counsel, my GC would never let me get away with it. But here, BlackRock's taken it even further. They didn't just do it to us. We won this case in December. They're appealing a case that Nuveen appealed in the same jurisdiction that Nuveen's appeal was turned down unanimously.

So this really smacks of almost like what happened after nine 11 with the Swiss banks knowing they're going to have to pay eventually, but tying things up in court so they can earn those precious fees. But here again, the little guy is suffering. And so this is horrific governance. Now, I'm not going to go through all of these, but basically they are not living the ideals that they set forward. And the real irony, the reason why ESG we have the largest position is because I incorrectly thought that they won't do this in a fund that is supposed to only have investors who care about ESG because it is the ESG Capital Allocation Trust. And so in their own ESG fund, they are violating their ESG governance nine ways from Sunday. You can't make this stuff up. And so that's ECAT is one of the funds where they just moved to a 20% distribution.

So this slide, which is available, so I'm just not going to go through with it, but here's where their failings are seven different ways. And there's really no counter argument to our plan. I mean, we've had managers come out, I won't name them, but on X saying we think Saba is right. Managers not of hedge funds, managers of closed end funds say that they're not doing, they're not doing it right. And we manage two closed end funds and we live by the governance that we're asking them to live by. We have annual elections. And the main thing that they're doing this year, the reason we sued them this year is if you look at number three at seven of the 10 funds, if a shareholder does not vote in the election, their vote will in effect count for BlackRock. So now I ask you again, put yourself like I did before in their shoes.

We have a presidential election this year. Okay? Say two thirds of the country votes should one third of the votes, the people that don't vote should that third go to the incumbent. Actually, it doesn't even go to the incumbent. Okay? The incumbent gets held over. It's a failed election. Should for there to be a new president chosen, should you have to win 50% or more of all shares? So if someone wins 60 to 40, but a third didn't vote, so they win 60 of two thirds, they only got 37% of all shares, they don't win. I mean, really would we say, okay, Trump and Biden, no one won. So it stays Biden. I mean that's basically, I'm trying to put it in language that is in English. That's basically what they're saying. It's Trump first Biden. But if neither of them can get more than half of the entire country, including the third that doesn't vote to vote, then we'll just, no one will have won.

But oh wait, there is a president, there is a board of trustees. We'll just leave those in effect. And that's the vote standard that BlackRock adopted. They adopted it in the month that I went to go see the president of BlackRock, Rob Kapito. So I'll tell that story, if you will. I went with my colleagues. There's conversations we've had with BlackRock and I can't talk about those, but nothing governed under NDA. I did have a meeting with this wonderful man, and I don't mean that sarcastically. He actually, my view is a wonderful man, the president of BlackRock, Rob Kapito. I've subsequently sat in his home for dinner. I really like the guy. Maybe he's not looking at this closely, I don't get it. But when I went to see him, he said to me, you got to understand kid, these products are sold, not bought.

Now I nodded, but I didn't actually know what he meant. And I say that to maybe that's a little embarrassing. It's a famous Wall Street expression. So I asked him to explain it. No one calls their broker and says, get me the latest BlackRock, California Muni Fund or the latest BlackRock ESG fund. They say, get me Nvidia, get me Amazon, get me GameStop lately. But their broker actually calls them, the broker sells it to them, says, you want safety, there's a new BlackRock muni fund. You can buy that in IPO at NAV. Does the broker notice that there is exactly the same California Muni fund IPOA decade earlier at a 10% discount is the client sold BlackRock muni closed-end funds at NAV for higher broker fees when they could have bought one at a discount to nav of double digits maybe. But that's what sold, not bought means.

And the weakest investors are buying these at IPO. There are no real sophisticated investors. I say no, effectively none that are buying it unless there's something very unusual going on. And we're talking about a tiny portion of sophisticated investors. So they trust their broker. Broker says they should do it. And I don't even think the brokers necessarily doing something untoward, but that's how these are sold. But that doesn't mean that shareholder rights if things go south are such that they shouldn't have the right to elect a board, which is all we're asking for. And so the thing that makes my head explode is that that's how they want to count votes this year. They also want to limit our ability to vote all our shares, but they can't do that because of last year's lawsuit. So we have sued them this year to show that they actually are running an election where we could not possibly get a majority of the shares outstanding because such a high proportion don't vote.

And last year, actually, because they even suppressed the vote by not giving us that list of who owns it. So we couldn't make those calls and only they could and only if they wanted to for some of the funds, less than half the shares voted. So literally we would've needed more than half. You couldn't even get there. Even if we got every single vote that was cast, we still wouldn't been able to. And so last year we were not allowed, we were not able to elect a board. And this year we come back swinging with many more shares, a litigation under our belt with Nuveen and BlackRock on the prior practice. That's now illegal, and it's by the way, illegal in the UK to do either of these things, but they're making us have the courts say so, even though it's absurd, it's just pure entrenchment for one reason.

Now, I just want to just take a minute to contrast. Regular closed fund, sorry, regular activism with closed-end fund activism. There are totally reasonable examples where a CIO, a CEO, whatever of a company doesn't like the plan of an activist and they'll try to block it. It's a bad plan to sell off a state, close down a division to think about ESPN and Disney or Nestle, you can think where there's a matter of differences of opinion and who are you going to trust? The CEO for 30 years or a hedge fund that is thinking short term. But our proposal gives a gain, which is not short term. We've been in these funds for years. But even if it were short-term, when people say you're being short-term, what they're really saying is you're being shortsighted because there's a long-term pain. But there has been no ability of this manager to say that there is any long-term pain because of course there's no long-term pain offering shareholders a chance for a nav exit.

Just like there isn't long-term pain in being in an ETF, if that's what the new board would decide or offering a tender at a NAV. There is no long-term pain. You would get your cash out at NAV and you'd go back into, if it's still a closed-end fund, you'd go back in at a discount if it were still at a discount or you'd go into anything else. So this story about activism is true for non closed-end fund activism because sometimes the plan doesn't work. But you can't tar the activist space by saying sometimes it doesn't work. What if it usually works? The shareholders should get to decide in closed-end fund activism. It always works. And they have had a very long time and I invite them again to show me where it hasn't worked. We've done it five or six dozen times so they know it.

We're back to, they can press a button. Okay, now a little bit, I'm going to go a little bit quicker and then we'll get to questions. BlackRock is trying to mislead shareholders about its own rules. So this past Friday was shocked that BlackRock, in advance of this Monday's announcement about the distributions, put out a statement in their own voice, a press release. Let's read it together. It's very misleading to say they mean for Saba to say it because I said it on CNBC. It's very misleading to say that non votes count as votes for BlackRock nominees for any dissident investor to propose significant changes to the board as in to change the board. These funds, I love the word simply, it's delicious. These funds simply as if it's simple, require that most shareholders vote affirmatively in favor. So they're saying all you have to do, it's simple.

Just get most shareholders. Now, they don't mean most votes. They mean most of the shareholders back to the whoever doesn't vote counts for BlackRock. Because even you can't replace BlackRock unless you can get most votes of all shares, not most of the votes that actually come in. And so it's not only not simple, it was impossible last year, literally impossible. Literally, they put out, I mean someone at BlackRock who wrote this quote, they should be excoriated for trying to pull the wool over their shareholders' eyes. Not mentioned casually, but mentioned, but I don't know many drafts this went through. They simply have to get an impossible thing to happen. It was literally impossible last year on the funds that didn't have 50% of the vote, and I don't know of an election where it was actually possible. So they use the word simply and they write it in forked tongue doublespeak to make people think what Boaz said on CNBC was wrong. You just need to get the most votes. It's a fair election. And so on the right is my tweet, which I won't reread where I say some version of what I've just said. Now for shame, as Sebastian Maniscalco said it best, aren't you embarrassed?

Okay, here's the 1.4 by fund. You could see the share price when we did this. Share price move, nav move. And then with today's announcement, it's now a billion and a quarter. These are the trap dollars, and in four of the funds it adds up to a billion. Our plan is to create long-term value, offer a liquidity event for shareholders so they can exit at nav. Those liquidity events have come in three different forms. I'm not even here to say it should be an open ending. It should be a tender at nav. It should be a liquidation BlackRock themself. You can see in the bottom check mark chose to open-end to funds back in 2019, 2020 actually MNE and BQH. And they announced a tender just last week to respond to a closed-end fund activist, a smaller activist on MUI to secure their votes against us in these bigger funds.

It's really a, you could say it's a clever tactic, but it shows that they're trying to trap you by giving them a very big tender in a very small fund, but in order to secure their vote on these other things. And so you can restructure the fund, you can tender, it'll be up to the board. It's happened five or six times before through Saba and it's always worked. And then in the future, they can do things like change the governance that will lower the discount. Remember that slide of the ones with better governance, smaller discount, they can repurchase shares, which is accretive to NAV and a much faster rate than they have. And the managed distribution plans, there are many, many things that they can do, but one thing they can do is not have the same seven people on 70 boards. Because we actually sat down for a meeting we had recently with a very important investor or very important voice in this story.

And they asked us if you thought about how much time is needed to be on the board of a closed-end fund. And so again, this is the third time I'm going to ask you, put yourself in the shoes of the BlackRock board, okay? You're on the board of a public company. Yes. It doesn't make, it's not Amazon, sorry, you didn't get to the board of Amazon, but you're on the board of a closed-in fund. Let's say one closed-in fund four times a year. How much time do you spend in that board meeting? Three hours, two and a half hours? Three. Let's go with three hours. And then before the meeting, maybe there's some important item to be discussed, like losing 57% of shareholder capital. Let's look at the risk. Let's look at steps taken. Let's look at the marks on the private bucket. Do we think that it's marked appropriately?

Maybe, I don't know, four hours? Let's take seven hours total per quarter to administer a fund responsibly. You can take exception with my seven. Make it six, make it whatever you want. Let's take seven. Okay, well, unfortunately, that individual doesn't only have to spend seven hours one time because they're on 68 other boards. So I learned in elementary school, seven times seven is 49. Now we're at 490 hours. Okay? 70 boards, seven hours, 400 per board, 490 hours, okay? 490 hours, four in eight hour workday. And these people have big jobs. And Dean of Columbia Business School seems like a lovely man, by the way, Glenn, if I may say so. Okay, so 490 hours, eight hour days. If they spent the entire day, they got a one hour break for lunch. That's the ninth hour working nine to five, Dolly Parton, 490 hours divided by eight.

So you know what that is? That it would take something in the sixties number of days for you to go through all 68 funds. Now you'd say, well, some of them didn't need five hours. Okay, fine. Cut that 68 down, cut it to 30. You're really spending every quarter, 30 days, 30 business days. So you're spending more than one. You're not working on Saturday, Sundays, you're literally spending, we just chopped it in half and we're still spending more than a month every quarter, one out of three on these funds. What is clearly true is how disgusting it is to give the importance, the honor of serving on a board, the responsibility to do good to people that are going to spend five minutes per seat with a rubber stamp. Because once you don't make it five minutes, once you make it hours, you end up in an insane place.

And obviously they're not doing it. So this board should be fired. Leave aside Saba, it should be fired because it can't possibly be its duties sitting on 70, and that doesn't include everything else they're doing. So I wanted to say that our plan is to have a board that only sits on a couple of boards or a few boards so they actually can put in the time to look at risk, to look at changes, derivative law changes for the leverage, performance fees, discount management, and that alone, that's like drop the mic. They should all be fired. Okay, let them sit on 60 boards next year instead of 70. These 10, they don't deserve it.

Who is our board? Okay, well, first, BlackRock Limited, who we could put on a board. They can't work for a financial institution. They can't have been paid by Sava, though of course they're paying their board members, they really can't have, it's very hard to get people with a lot of finance experience, but we did. When they can't work at a financial institution yet theirs can. But we wanted a mix of people who understand good governance, who understand capital markets, who understand risk. And we found that incredible people who sit on other esteem boards or who have spoken truth to power and said, enough is enough. I don't care who you are. I don't care if you're the president. I don't care if you're the president of BlackRock or president of the United States. I'm going to do the right thing as I see fit. And we have people with a lot of tech experience in tech banking and risk experience.

One of whom I used to work with, Athanassios Diplas, who was at the Fed the weekend Lehman failed sitting with me when we were in the group where I was representing Deutsche Bank as the head of credit. So his experience stands out as exceptional for what this board needs. But each of these members are in their own way exceptional. So I've done it. I went through all of the slides and available for you in their annual report. We have, if you want to see the benchmarks, how we selected these benchmarks that they have. Atrociously underperformed our disclaimer, but I've gone through it and now it's question time and I'm going to turn it back to Charlotte to ask me the questions.

Moderator:

Thanks Boaz. So we will now transition to the Q&A portion of today's event. If you have a question, please submit it in the box in the bottom righthand corner of your screen and it will be added to the queue. All questions will be anonymous. First question from the audience. Why are these funds losing so much money?

Boaz Weinstein:

Alright, there's a – let's see, let's go. Losing so much money. Well, some of them have not lost so much money. Let's just pull up the slide. Why are they not positive? Why are they losing so much money? Okay, so the discount is a chunk of it. The discount sits at 11.8% when we did this snapshot. And so that's a double-digit return. It's not even necessarily a gain. It's a recouping of a loss for many of the investors. But I mean, simply these numbers would be green for the bottom. Well, it'd be almost green. I don't even know if he could get to green from simply trading it now. But basically, a decent amount of the loss could be offset by these funds trading at NAV. I mentioned NHS trades at a premium. PDI, a giant PIMCO fund, traded at a premium for years. It's 5 billion.

PIMCO funds tend to trade at premiums. PIMCO cares greatly about this question. PIMCO has, I think, shown excellent governance in the past. So the discount is a chunk of it that's easily correctable. I also think the other problem is that BlackRock has $10 trillion and it's very hard to give the right level of senior attention. How many senior people can you have when you have 10 trillion to manage? And these funds have already locked in the investor, they can't leave. I mean, this was an ETF. All the money would've been gone, right? Take BIGZ, all the money would've been gone. It lost 57%. Not all the money, but almost all. But because they're locked in, they can't leave. So if it were an open-ended forum, the manager would've to worry quite a bit more. And it would be, it's just desserts. If investors chose to leave, but they might lower the fees, they might say, Hey, I know you.

I know you're unhappy, so we're going to cut the fees, right? They didn't cut the BIGZ fee, but they have cut the fees on ETFs. So that's a part of it. And I think that they've also performed really poorly. Look at these performance first benchmark numbers. At least four of them are atrocious. Three of them are bad, and two of them are a little bit bad. So I don't know what to say. But some of them, I think that they've lost. They've lost the right to do anything other than express their profound apologies to the investor. Instead, they're trying to, I'll use a technical term, screw the investor by not letting the investors vote, carry the election. I'm not saying we need to win the election. I'm saying run a fair election. It is outrageous. Aren't you embarrassed? Next question.

Moderator:

Thanks Boaz. Another question from the audience. What is your goal? BlackRock has said that you want to take over their funds. Is this true?

Boaz Weinstein:

My goal is liquidity. At NAV. We have been in more than six dozen campaigns. We only run two funds. It's not for me to decide what ultimately the board would choose to do. Is it tender, liquidation, open-end, or some other solution? It's liquidity at NAV. That's my hope. That's the billion four that we're talking about, or the billion two, five today. That could go much worse if we lose and we're unable to affect change. That's it. That's our plan. Liquidity at NAV. We've done it five times. We'll do it again five dozen times. Sorry, go ahead, please.

Moderator:

Thanks, Boaz. Why did you select these 10 funds? Aren't there many other BlackRock closed-end funds that are also performing poorly?

Boaz Weinstein:

Yeah, so there are funds that trade at big discounts. These are the funds that we decided we could have the most impact. Some of it gets to how big our position is because it changes and it takes us time and a lot of care and effort to accumulate a position. So these were the most egregious ones we had, as I had mentioned, three from 2019. And no doubt we'll have more in the future because this is not going to be solved overnight unless BlackRock really changes the governance greatly. And then maybe they can be like PIMCO, they'll trade it, premiums, the portfolios will be worth more, shareholders will be happy. We will be happy. We will not be activists on any of their funds.

Moderator:

Why did Saba purchase such a substantial interest in these funds? If they're so poorly run, don't you have an obligation to your own investors to make sound investments?

Boaz Weinstein:

Wow. Well, we do have an obligation to make sound investments. Part of the activist job is to try to fix something that's broken. And we knew that there's a solution we had won three times before with BlackRock. I said, we made a mistake. I made a mistake thinking that they didn't want to experience this again in a much bigger way. And after they experienced it last year and did the things they did to entrench themselves, we didn't think they would do it again. In fact, sometimes we've had this happen where the first year or something like this happens, not this bad. And then the manager comes to us and we make peace, meaning the shareholders get an NAV exit right after the first election here. They continue with these tactics. So we knew that the most broken funds have the biggest gain for investors through the solution, which are the first three listed above, and plus ECAT and BCAT.

Moderator:

So Boaz, earlier you mentioned a conversation with BlackRock's President. BlackRock has said that it welcomes engagement with shareholders. Have you ever tried to engage with Larry Fink or anyone else privately about these funds and what was their response?

Boaz Weinstein:

So, I can't really speak to things that are governed under an NDA. I mentioned this Rob Kapito story where we were rewarded by, see what happened was when I went to see him, I probably was the first person ever to see him where there was real risk that they might have to do the right thing for funds that were not trivial size. Because prior to Saba, the great activist of the last four decades, has taken on, very impressively, funds that have $100 million AUM, $200 million AUM, buying 10-15% stakes. But BlackRock being so successful at marketing, BIGZ was sold, I think it was 5 billion at IPO, or maybe it was four and a half billion dollars. It's a billion-nine now of NAV. Maybe it's a billion-seven or five or something of market value. They incinerated billions of dollars. But because it's so big, they never thought that an activist could be big enough.

Because before this, there was no activist that could have in BIGZ and in ECAT, literally a billion dollar position. But thanks to us winning in court on behalf of ourselves, let's be very clear on behalf of our shareholders. That's who we did it for. Our investors, I should say, and the shareholders in our closed end funds and our ETF, we got a claim from II, which then got us a lot of institutional investors. State pensions, so invested in these funds are not just single family offices and retail investors. There's millions of Americans from three different states. The teachers, the firemen, all of the government workers that have their pensions who selected Saba, three different state pensions are invested. So we have literally tens of millions of investors that stand to make the gain that we would make for them. And so when we saw Kapito, it was very disheartening that actually they made the governance worse because for the first time they saw something where they're really at risk and it's easy to have good governance when you're not at risk. They slammed the door on that when finally there's a threat. And here we emerge through the courts as our solution with a much bigger threat for them to have to do the right thing for shareholders.

Moderator:

Next question. Saba has been very critical of the fact that these funds trade at deep discounts to NAV, but isn't it true that almost all closed end funds tend to trade at a discount? It's a bit confusing. So what is the difference?

Boaz Weinstein: