September 10, 2010

VIA EDGAR

Securities and Exchange Commission

Division of Corporation Finance

100 F Street, N.E.

Washington, DC 20549

| | |

Attention: | | Kathleen Collins, Accounting Branch Chief |

| | Robert Benton, Staff Accountant |

| | Mark Shuman, Legal Branch Chief |

| | Ryan Houseal, Staff Attorney |

| |

Re: | | Epicor Software Corporation |

| | Form 10-K for the Fiscal Year Ended December 31, 2009 |

| | Filed March 12, 2010 |

| | Form 10-Q for the Quarterly Period Ended June 30, 2010 |

| | Filed August 6, 2010 |

| | File No. 000-20740 |

Ladies and Gentlemen:

On behalf of Epicor Software Corporation (the “Company”) we are submitting this letter in response to the comments from the staff (“Staff”) of the Securities and Exchange Commission (the “Commission”) contained in the letter dated August 23, 2010 (the “Second Comment Letter”). For purposes of this letter, the “Initial Comment Letter” refers to the letter from the Staff dated June 28, 2010 and “Prior Response” refers to our letter dated July 28, 2010. For your convenience, we have repeated your comments 1 through 7 below in italics, and the headings and numbered responses in this response letter correspond to the headings and numbered comments contained in the Comment Letter. Please feel free to contact me or John Ireland, Senior Vice President and General Counsel of the Company, at the numbers at the end of this response letter with any further questions or comments you may have.

Form 10-K for the Fiscal Year Ended December 31, 2009

Item 5. Market for Registrants Common Equity, page 34

1.We refer to prior comment 2 and your related response and note that you have not included the plot points showing the specific value of the company’s stock and each of the comparative indices pursuant to Instruction 2.b to Item 201(e) of Regulation S-K. Please include the required disclosure in your next supplemental response.

Response: We respectfully advise the Staff that the plot points showing the specific value of the Company’s stock and each of the comparative indices is provided herewith asExhibit A.

Securities and Exchange Commission

September 10, 2010

Page 2

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Critical Accounting Policies

Goodwill, page 39

2. We note from your response to prior comment 5 that you estimated the fair value of your license reporting unit did not substantially exceed its carrying value. While you further acknowledged that you would enhance your disclosures when any reporting unit fair value is not substantially in excess of its carrying value, we note that you did not include such disclosures in your June 30, 2010 Form 10-Q. Please explain why you have not provided the disclosures as indicated. Also, ensure that you will include them in your next Form 10-Q and supplementally provide a copy of your proposed disclosures.

Response:The Company respectfully advises the Staff that it did not provide the additional disclosure to its goodwill impairment analysis in our June 30, 2010 Quarterly Report on Form 10-Q because we did not believe that goodwill impairment disclosure was required in this filing. Our intent was to include this disclosure in our Annual Report on Form 10-K for the fiscal year ending December 31, 2010. However, as we now more clearly understand that the Staff would like the disclosure in the Company’s Form 10-Q, the Company respectfully advises the Staff that it will provide the enhanced disclosure in our September 30, 2010 Quarterly Report on Form 10-Q. The revised disclosure to Critical Accounting Policies proposed by the Company is presented below, with the changes to the Company’s existing disclosure highlighted in bold italics to facilitate the staff’s review:

Goodwill

Goodwill was recorded as a result of the Company’s acquisitions. The Company has recorded these acquisitions using the acquisition method and purchase method of accounting. The Company annually performs an impairment review of its recorded goodwill, and in 2009 determined that no impairment of goodwill existed because the estimated fair value of each reporting unit exceeded its carrying amount. The Company tests its recorded goodwill for impairment on an annual basis, or more often if indicators of potential impairment exist, by determining if the carrying value of each reporting unit exceeds its estimated fair value. The Company assesses goodwill for impairment at the reporting unit level, and the Company’s reporting units are its operating segments. The fair value of each reporting unit is estimated using an average of a market approach and an income approach. The nature of the assumptions that the Company makes in connection with goodwill impairment assessments are described under “Goodwill” in the Critical Accounting Policies section in Item 7 of the Company’s Form 10-K for the fiscal year ended December 31, 2009. In the fourth quarter of 2009, the Company performed its annual impairment review of its recorded goodwill. The amount of goodwill allocated to each reporting unit and the percentage by which the fair value of the reporting unit exceeded the carrying value as of the date of the most recent impairment test are as follows:

Securities and Exchange Commission

September 10, 2010

Page 3

| | | | |

Reporting Unit | | Goodwill

allocated to

the

reporting

unit (in

millions) | | Percentage by which

the fair value of the

reporting unit exceeded

the carrying value |

Maintenance | | $ 157 | | 35% |

Consulting | | 71 | | 27% |

License | | 140 | | 8% |

| | | | |

Total | | $ 368 | | 23% |

| | | | |

The Company determined that the estimated fair value of the Maintenance and Consulting reporting units substantially exceeded their carrying values. The fair value of our License reporting unit exceeded, but not substantially, its carrying value.

The potential events and or changes in circumstances that could reasonably be expected to negatively affect the key assumptions used in determining fair value include the following:

| | • | | a significant prolonged decrease in market valuations for comparable publicly traded companies; |

| | • | | a significant reduction in acquisition premiums for comparable publicly traded companies; and |

| | • | | a significant shortfall from the Company’s cash flow projections due to factors including (i) lower than expected revenues due to slower market acceptance of our Epicor product, a downturn in economic conditions or an increase in competition and (ii) higher than expected costs due to continued expansion of the Company’s business worldwide. |

Factors that could trigger an interim impairment test include, but are not limited to, underperformance relative to historical or projected future operating results, significant changes in the manner of use of the acquired assets or the Company’s overall business, significant negative industry or economic trends and a sustained period where market capitalization, plus an appropriate control premium, is less than

Securities and Exchange Commission

September 10, 2010

Page 4

stockholders’ equity. Future impairment reviews may require write-downs of the Company’s goodwill and could have a material adverse impact on the Company’s operating results for the periods in which such write-downs occur.

Liquidity and Capital Resources Credit

Facility, page 54

3. We note your response to prior comment 6 and your reference to the disclosure requirements of Section IV.C of SEC Release No. 33-8350. While we acknowledge that this Section refers to at least two scenarios in which companies should consider whether discussion and analysis of material covenants related to their outstanding debt may be required, the overall foundation of this Release does not limit your requirement to provide enhanced disclosures to only those times when you have breached or are likely to breach your debt covenants. In addition, Item 303 of Regulation 8-K requires that you describe any known trends or material changes in your capital resources. In this regard, your response states that “as a result of changes in the economic climate, the total leverage and fixed charge coverage ratio covenants were becoming a potential impediment to the Company’s ability to operate its business successfully and to make business changes in response to the economic climate, primarily because such covenants were influencing, at least in part, certain business decisions as the Company sought to comply with the covenants.” Please revise your disclosures in future filings (beginning with your next Form 10-Q) to provide a discussion regarding the reasons behind your request to modify the terms of your debt covenants and describe further how your prior debt covenants impacted your ability to make the necessary changes to operate your business pursuant to Item 303(A) of Regulation S-K.

Response: The Company respectfully advises the Staff that the Company will provide disclosure responsive to this comment in its September 30, 2010 Quarterly Report on Form 10-Q.

Part III (as incorporated by reference from definitive proxy filed April 26, 2010

Item 12. Security Ownership of Certain Beneficial Owners, page 19

4. We refer to prior comment 12 and your reference to Instruction 3 to Item 403 of Regulation S-K. Instruction 3 to Item 403 allows an issuer to “rely upon information set forth in such statements unless the registrant knows or has reason to believe that such information is not complete or accurate....” Given that no natural persons were listed on the Schedules 13G and 13D filed by Blackrock, Inc. and Elliott Associates, LP, respectively, it would appear that those filings may not have been complete. In your response letter, please describe any steps you took to obtain information concerning the identities of the natural persons exercising voting and dispositive powers over the shares held by these entities.

Response:We acknowledge the Staff’s comment, but respectfully advise the Staff that as of the date of the filing of the proxy statement (the “Proxy Statement”), the Company did not believe that the Schedules 13G and 13D filed by Blackrock, Inc. and Elliott Associates, L.P. were incomplete or

Securities and Exchange Commission

September 10, 2010

Page 5

inaccurate. Further, the Company was not aware that it had an affirmative obligation to verify the accuracy of information that was provided by the filer of the Schedule 13G or 13D. The Company also respectfully advises the Staff that it did not believe that disclosure of the natural persons holding voting and dispositive power over the shares held by those entities was required by Instruction 2 of Item 403 of Regulation S-K (“Item 403”) unless such information was specifically stated in the Schedules 13G and 13D filed by the stockholder (in which case, the Company would be deemed to know such information pursuant to Instruction 3 of Item 403). Instruction 2 of Item 403 states only that beneficial ownership shall be determined in accordance with Rule 13d-3 under the Exchange Act and requires the registrant to “include such additional subcolumns or other appropriate explanation of column (3) necessary to reflect amounts as to which the beneficial owner has (A) sole voting power, (B) shared voting power, (C) sole investment power, or (D) shared investment power.” Unless specifically stated in Schedules 13D or 13G, the Company would not have reason to know of any “contract, arrangement, understanding, relationship or otherwise” pursuant to which a natural person had voting or investment power. Accordingly, the Company did not take additional steps to obtain information concerning the identities of the natural persons exercising voting and dispositive powers over the shares held by these entities. In the future, if the statements filed with the Commission pursuant to section 13(d) or 13(g) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) by the Company’s stockholders who will appear in the table required by Item 403 do not contain information concerning the identities of the natural persons exercising voting and dispositive powers over the shares held by these entities, the Company will affirmatively request such information from the applicable entity. To the extent that the Company is able to obtain such information without unreasonable expense or effort, the Company will disclose such information in its future filings.

Executive Compensation

Compensation Discussion and Analysis

Overview of Compensation Program and Philosophy, page 23

5. We refer to prior comment 14. You state that you have not disclosed the calculations of your financial performance relative to your peers as of July 2009, because such calculations could be misleading to investors. Please provide your analysis supporting a conclusion that you are not required to disclose such calculations pursuant to Item 402(b)(1)(v) of Regulation S-K. That provision requires a description of how you determined the amount (and, where applicable, the formula) for each element of compensation.

Response: The Company respectfully advises the Staff that the calculations of the Company’s financial performance relative to its peers in July 2009 were not used to determine the amount of any element of compensation; accordingly, the Company does not believe that it is required to disclose such calculations. For purposes of clarity the Company notes that, as disclosed in the Proxy Statement, the elements of compensation and the amounts allocated to each element of compensation were determined at the beginning of the fiscal year; such elements and the amounts allocated to each element were not changed in July 2009. In July 2009, the Board evaluated the Company’s financial performance relative to its peers as one of many factors in the analysis of the Company’s failure to meet its operating plan and the reasons for such failure. As a result of the analysis, the Board came to the view that the failure to meet the operating plan was primarily a result of the depressed economic environment, and that the Company’s financial

Securities and Exchange Commission

September 10, 2010

Page 6

performance, while falling short of the operating plan, was superior to its peers in many respects and was resulting in the creation of significant shareholder value, including relative to its peers. This evaluation supported the Compensation Committee’s general view that, despite the fact that the named executive officers were not expected to meet the target revenue and Adjusted EBITDA levels and the named executive officers may not meet the threshold revenue and EBITDA levels, the named executive officers were performing well and were creating shareholder value. Accordingly, the Compensation Committee believed that in order for the Company’s cash and equity incentive programs to continue to meaningfully incent and reward the named executive officers’ performance for the remainder of 2009, some form of midyear adjustments to the MBP and PBRSP was necessary and, as such, the thresholds under the MBP and PBRSP were adjusted. However, the calculations of the performance of the Company relative to its peers were not directly related to and did not correlate with the amount or the magnitude of the adjustments to the thresholds under the MBP or the PBRSP or the actual payments made under the MBP or the PBRSP.

Performance Based Restricted Stock Program, page 38

6. We refer to prior comment 17. It is unclear how the disclosure of company-wide revenue and adjusted EBITDA targets, after you have publicly disclosed results, would enable your competitors to pull together sufficiently-specific information about your future operations and strategy to present a reasonable threat of competitive harm. Please provide a detailed description of how those company-wide targets could be used by competitors to “gain insight into [your] financial model and expectations” and further explain why any such insight would reasonably threaten competitive harm. In the alternative, disclose the targets and ensure that in subsequent filings targets are excluded in circumstances consistent with Instruction 4 of the Instructions to Item 402(b).

Response:The Company respectfully advises the Staff that it believes disclosure of the specific Company-wide revenue and adjusted EBITDA targets, in combination with the projections that the Company provides in its quarterly earnings releases as well as the information provided by the Company in its historical financial results or other information, such as pricing, that may become available to contractual partners, or competitors, would provide sufficient information from which a competitor or contractual counterparty could extract information regarding the Company’s operating plan and business model that the competitor or counterparty could use to the Company’s detriment. The Company also believes that competitors could use such information about targets to conduct compensation analysis of the Company’s employees that would allow for more effective and targeted recruitment of the Company’s employees, especially non-executive officer employees.

Specifically, the Company’s operating plan and business model are both short term (one year) and long-term plans for the Company’s business that, while subject to interim review and modification, set forth and reflect the Company’s strategic plans for and beliefs about the effect of, among other things, product development and releases, expenses (including research and development) and capital expenditures. The compensation targets are established at the beginning of each year and are heavily premised on the Company’s operating plan and business model. However, the Company’s strategies often do not develop precisely as planned or as expected at the time the compensation targets are set, in many cases, for reasons not related to the performance of any named executive officer. For example, the Company may launch a new product mid-year or may consummate an acquisition that would, by its

Securities and Exchange Commission

September 10, 2010

Page 7

nature, result in changes to the operating plan. Correspondingly, in an effort to incent employees to achieve the revised operating plan, the Company may revise the original targets during the year, including revisions to reflect the expected impact of mid year adjustments, acquisitions, divestitures, and the like. As it did in the Proxy Statement, the Company would disclose the magnitude of the revisions, but providing actual original and revised targets would provide competitors with significant insight into the Company’s expectations or foundations (original and as revised) for the event or events that resulted in the original plan and/or the revisions. In addition, over time, as targets and revised targets are disclosed, in combination with the Company’s regular public disclosures about its business, competitors would likely gain insight into the Company’s model by virtue of the Company’s expectations from year to year as well as the Company’s beliefs regarding how various events would and did affect that model.

We also note that the targets under the Performance Based Restricted Stock Program, or PBRSP, and the Management Bonus Program, or MBP, apply not only to all executive officers of the Company reporting under section 16 of the Exchange Act but also apply to numerous other personnel such as other officers and managers, ultimately totaling a group of hundreds of employees Company-wide. While the percentage of total compensation that is composed of compensation under the PBRSP and MBP differs from employee to employee, the nature of the targets as well as the actual targets themselves are the same for each of the hundreds of Epicor employees participating in the compensation programs. Accordingly, disclosure of the specific targets for the named executive officers, when coupled with the actual results for the executive officers would by necessity result in disclosure of the specific targets and results for all other participating employees, officers and managers. The Company experiences significant competition for its management and officer talent and competitors continuously endeavour to hire the Company’s officers and managers — generally on the enticement of increased compensation compared to what the Company employees may be making. Disclosure of compensation targets, combined with the information the Company discloses publicly, would provide the Company’s competitors with a roadmap of an employee’s compensation and the specific compensation areas where an employee may be vulnerable and how to recruit an employee or group of employees away from the Company. Compensation information of managers and officers other than our named executive officers is highly confidential information and the Company believes that disclosure of the specific targets for the Executives would put it at a significant competitive disadvantage in the market for retaining its talent vis a vis its competitors.

Despite the Company’s concerns regarding the competitive harm that would be caused by the disclosure of the information regarding the targets, the Company does not believe that such information is material to an investor’s investment decision. The Company provides disclosure regarding its actual results of operations, including adjusted EBITDA as well as its projections/guidance each quarter and, it reports its financial results in compliance with the Commission’s rules and regulations. Accordingly, investors are well aware of the Company’s actual financial performance as compared to its guidance. Further, the Company discloses the threshold, target and maximum awards in stock and cash under each of the Company’s equity plans as well as the compensation actually paid to its executive officers. From this information, the Company believes that an investor can adequately assess whether the Company is paying appropriate compensation in respect of the actual performance of the named executive officers and adequately incentivizing its executive officers.

Securities and Exchange Commission

September 10, 2010

Page 8

Form 10-Q for the Three Months Ended June 30, 2010

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Results of Operations

Income Tax Provision (Benefit), page 30

7. We note that your effective income tax rates were (69.6)% and 487.5% for the three months ended June 30, 2010 and 2009, respectively and (88.9)% and (10.6)% for the six months ended June 30, 2010 and 2009, respectively. While we note from your disclosures that your effective tax rates are impacted by various factors, considering the significant swings in such rates from period to period, tell us how you considered including a quantified discussion of the material factors that impacted your effective tax rate for each period.

Response:The Company respectfully advises the Staff that it will provide disclosure responsive to this comment in its future periodic filings with the Commission.

Securities and Exchange Commission

September 10, 2010

Page 9

* * * * *

The Company also acknowledges that:

| | • | | the Company is responsible for the adequacy and accuracy of the disclosure in the filing; |

| | • | | staff comments or changes to disclosure in response to staff comments do not foreclose the Commission from taking any action with respect to the filing; and |

| | • | | the Company may not assert staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

Should the Staff have any additional comments or questions, please contact me at (650) 493-9300 or John Ireland at (949) 585-4225. We respectfully request that the Staff confirm that it has no additional requests or comments.

|

Very truly yours, |

|

WILSON SONSINI GOODRICH & ROSATI |

Professional Corporation |

|

/s/ Lisa L. Stimmell |

Lisa L. Stimmell |

| cc: | John D. Ireland, Esq., Senior Vice President and General Counsel |

Katharine A. Martin, Wilson Sonsini Goodrich & Rosati

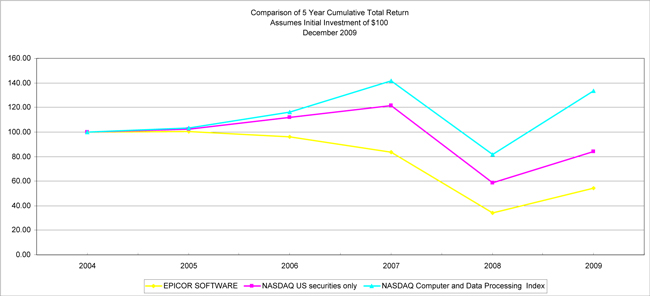

Exhibit A

CUMULATIVE TOTAL RETURN SUMMARY

December 2009

| | | | | | | | | | | | | | |

| | | | | 2004 | | 2005 | | 2006 | | 2007 | | 2008 | | 2009 |

EPICOR SOFTWARE | | Return % | | | | 0.28 | | -4.39 | | -12.82 | | -59.25 | | 58.76 |

| | Cum $ | | 100.00 | | 100.28 | | 95.88 | | 83.59 | | 34.06 | | 54.08 |

| | | | | | | |

NASDAQ US securities only | | Return % | | | | 2.13 | | 9.84 | | 8.45 | | -51.80 | | 43.76 |

| | Cum $ | | 100.00 | | 102.13 | | 112.18 | | 121.67 | | 58.64 | | 84.30 |

| | | | | | | |

NASDAQ Computer and Data Processing Index | | Return % | | | | 3.39 | | 12.27 | | 22.19 | | -42.43 | | 63.45 |

| | Cum $ | | 100.00 | | 103.39 | | 116.07 | | 141.83 | | 81.65 | | 133.45 |