UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |||

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| ¨ | Definitive Proxy Statement | |||

| ¨ | Definitive Additional Materials | |||

| x | Soliciting Material Pursuant to §240.14a-12 | |||

EPICOR SOFTWARE CORPORATION | ||||

| (Name of Registrant as Specified In Its Charter) | ||||

| ||||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| x | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid: | |||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

Apax Partners proposed acquisition of Epicor and Activant April 4, 2011 |

Forward Looking Statements This presentation contains certain statements which constitute forward-looking statements under the Private Securities Litigation Reform Act of 1995. These forward-looking statements include statements regarding expected completion of the transaction, expected revenues, market share, business model, sales pipelines and opportunities, competitive advantage and other statements that are not historical fact. These forward-looking statements are based on currently available competitive, financial and economic data together with management’s views and assumptions regarding future events and business performance as of the time the statements are made and are subject to risks and uncertainties. Actual results may differ materially from those expressed or implied in the forward-looking statements. Such risks and uncertainties include, but are not limited to, satisfaction of closing conditions to the transaction, including satisfaction of the conditions to Apax’s acquisition of Activant, changes in the demand for enterprise resource planning products, particularly in light of competitive offerings; the timely availability and market acceptance of new products and upgrades, including Epicor 9; the impact of competitive products and pricing; the discovery of undetected software errors; changes in the financial condition of Epicor's major commercial customers and Epicor's future ability to continue to develop and expand its product and service offerings to address emerging business demand and technological trends; and other factors discussed in Epicor's annual report on Form 10-K for the year ended December 31, 2010 and other reports Epicor files with the SEC. As a result of these factors the business or prospects expected by the Company as part of this announcement may not occur. Except as required by law, Epicor undertakes no obligation to revise or update publicly any forward-looking statements. Additional Information and Where to Find It The tender offer for the outstanding shares of Epicor Software Corporation described herein has not yet commenced. This communication is provided for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to sell any securities of Epicor Software Corporation pursuant to the tender offer by Eagle Parent, Inc. (an affiliate of Apax Partners) or otherwise. Any offers to purchase or solicitations of offers to sell will be made only pursuant to the Tender Offer Statement on Schedule TO (including the offer to purchase, the letter of transmittal and other documents relating to the tender offer) which will be filed with the U.S. Securities and Exchange Commission (“SEC”) by Eagle Parent, Inc. and Eagle Merger Sub, Inc., a wholly owned subsidiary of Eagle Parent. In addition, Epicor Software Corporation will file with the SEC a Solicitation/Recommendation Statement on Schedule 14D-9 with respect to the tender offer. Epicor Software Corporation’s stockholders are advised to read these documents, any amendments to these documents and any other documents relating to the tender offer that are filed with the SEC carefully and in their entirety prior to making any decision with respect to Eagle Parent’s tender offer because they contain important information, including the terms and conditions of the offer. This communication may be deemed to be solicitation material in respect of the proposed acquisition of Epicor by Eagle Parent. In connection with the proposed acquisition, Epicor intends to file relevant materials with the SEC, including Epicor’s proxy statement in preliminary and definitive form. Epicor stockholders are strongly advised to read all relevant documents filed with the SEC, including Epicor’s definitive proxy statement, because they will contain important information about the proposed transaction. Epicor Software Corporation’s stockholders may obtain copies of these documents (when they become available) for free at the SEC's website at www.sec.gov or from Epicor’s Investor Relations Department at (949) 585-EPIC or dswright@epicor.com. Participants in the Solicitation Epicor and its directors and executive officers, may be deemed to be participants in the solicitation of proxies from the holders of Epicor common stock in respect of the proposed transaction. Information about the directors and executive officers of Epicor is set forth in the proxy statement for Epicor’s 2010 Annual Meeting of Stockholders, which was filed with the SEC on April 26, 2010. Investors may obtain additional information regarding the interest of such participants by reading the definitive proxy statement regarding the acquisition when it becomes available. Epicor Software Corporation © 2011 Epicor Software Corporation. |

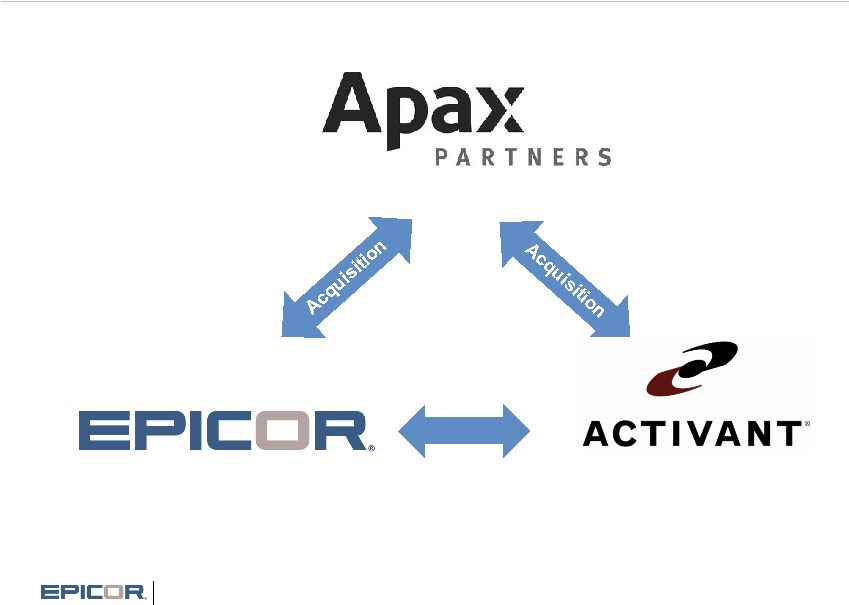

Proposed Transaction Summary • Apax has entered into definitive agreements to acquire Epicor Software Corporation and Activant Solutions, Inc. – Transaction valued at $2B • Combined company post merger – Epicor Software Corporation Epicor Software Corporation © 2011 Epicor Software Corporation. Delivering Value “We are extremely excited to be bringing together two of the premier enterprise software companies to create a global market leader.” Apax Partners April 4, 2011 Delivering Value Delivering Value “We are extremely excited to be bringing together two of the premier enterprise software companies to create a global market leader.” Apax Partners April 4, 2011 |

About Apax Partners • A leading global private equity advisory firm • $40B of funds under advice and management • Typically invests in companies with a value of between $1B-$5B • Invests in large companies across 5 global growth sectors: Tech & Telecom Media Retail & Consumer Healthcare Financial & Business Services • 300+ employees, 12 Global offices Epicor Software Corporation © 2011 Epicor Software Corporation. Focused on Growth “Apax Partners buy stakes in large companies that have strong, established market positions and the potential to expand.” Focused on Growth Focused on Growth “ “Apax Partners buy stakes in large companies that have strong, established market positions and the potential to expand.” |

Two Premier ERP Companies Founded Founded 1984 1972 Ownership Ownership Public Private Employees Employees 2,600 1,600 Offices Offices 50 (Global) 11 (US/UK) Revenues (2010) Revenues (2010) (2010) $454M* $372M EBITDA (2010) EBITDA (2010) (2010) ) $74M* $114M Customers Customers 20,000 13,000 Market Focus Market Focus Midmarket to Enterprise Small to Midmarket Go-to-Market Direct / Partner Direct Industries Industries Manufacturing Wholesale and and Distribution Distribution Verticals Verticals Retail (Soft Goods) Retail (Hard Goods) Hospitality & Services Catalog Content & Services Epicor Software Corporation © 2011 Epicor Software Corporation. * Proforma includes full year of Spectrum HCM |

Epicor Target Industries Epicor Software Corporation © 2011 Epicor Software Corporation. Manufacturing Manufacturing Hospitality & Hospitality & Entertainment Entertainment Services Services Industrial Machinery Fabricated Metals Electronics Instruments & Controls Medical Devices Automotive Aerospace & Defense Furniture & Fixtures Primary Metals Print and Packaging Rubber & Plastics Specialty Retailing General Merchandising Apparel & Footwear Sporting Goods Gifts &Novelty Souvenir, News Hobby, Toy, Games Luggage & Leather Office Supplies Pet Supplies Cosmetics, Beauty Supply Jewelry Department Stores Specialty Retail Specialty Retail Soft Goods Soft Goods Distribution Distribution Consumer Goods Pharmaceutical 3PL & Logistics Services Value-add Distribution Hospitality (Food) Hospitality (Property) Hotels & Lodging Resorts & Gaming Sports & Entertainment Professional Services Financial Services Non-Profit ISV & IT Services Healthcare / Aged Care |

Complementary Alignment with Activant Manufacturing Manufacturing Hospitality & Hospitality & Entertainment Entertainment Services Services Industrial Machinery Fabricated Metals Electronics Instruments & Controls Medical Devices Automotive Aerospace & Defense Furniture & Fixtures Primary Metals Print and Packaging Rubber & Plastics Hospitality (Food) Hospitality (Property) Hotels & Lodging Resorts & Gaming Sports & Entertainment Professional Services Financial Services Non-Profit ISV & IT Services Healthcare / Aged Care Specialty Retailing General Merchandising Apparel & Footwear Sporting Goods Gifts &Novelty Souvenir, News Hobby, Toy, Games Luggage & Leather Office Supplies Pet Supplies Cosmetics, Beauty Supply Jewelry Department Stores Specialty Retail Specialty Retail Soft Goods Soft Goods Epicor Software Corporation © 2011 Epicor Software Corporation. Distribution Distribution Consumer Goods Pharmaceutical 3PL & Logistics Services Value-add Distribution Fasteners Electrical HVAC Industrial Medical Janitorial Packaging Plumbing Tile Paper Fluid Power General Hardware Stores Lawn & Garden Specialty Retail Farm / Agricultural Lumber Home Centers Automotive Aftermarket Large Lumber Operations Large Auto Operations Pharmacy Specialty Retail Specialty Retail Hard Goods Hard Goods Wholesale Wholesale Distribution Distribution |

Epicor Global ERP and Retail Enabling the Extended Value Chain Design Design Produce Produce Distribute Distribute Sell Sell Service Service Procure Procure Product-centric Process-centric People-centric Global Software Solutions Local Business Experience Business to Business (B2B) Business to Consumer (B2C) Corporate Manufacturer Consumer Warehouse Retail Store Distributor Supplier Value Chain Epicor Software Corporation © 2011 Epicor Software Corporation. |

Epicor’s Focus Design Design Produce Produce Distribute Distribute Sell Sell Service Service Procure Procure Business to Business (B2B) Business to Consumer (B2C) Value Chain Soft Goods Hard Goods - Aligned with Activant’s Focus Epicor Software Corporation © 2011 Epicor Software Corporation. Product-centric Process-centric People-centric Corporate Manufacturer Consumer Warehouse Retail Store Distributor Supplier |

The New Opportunity with Apax Partners 6th Largest Global ERP Provider* ~$825M Revenue ~30,000 Customers ~4,000 Employees Global Coverage End-to-end Industry Solutions Manufacture Distribute Sell Service Technology Leadership Based on Microsoft Positioned as a Visionary** Epicor Software Corporation © 2011 Epicor Software Corporation. * Source: IDC August 2010 Vendor Shares Ranking ** Source: Magic Quadrant for ERP for Product-Centric Midmarket Companies, Gartner |

Next Steps • Transaction projected to close in calendar Q2 contingent on – Apax simultaneously completing acquisition of Activant – Successful tender offer or receipt of Epicor shareholder approval – Antitrust (HSR) clearance – Expiration of Epicor “Go Shop” period (May 5, 2011) – Completion of marketing period for buyer financing – Satisfaction of other closing conditions • Until the transaction is complete Epicor and Activant must operate as completely separate companies – Due to regulatory requirements, until the acquisition is completed, none of the parties can discuss go forward management, organization, product and technology strategies, etc. – Until then, it is business as usual. But… Epicor Software Corporation © 2011 Epicor Software Corporation. |

We Agree… Epicor Software Corporation © 2011 Epicor Software Corporation. “Both Epicor and Activant’s customers will benefit from the combined entity’s increased scale, solutions portfolio and expanded service offerings. “We look forward to partnering with the management team and to providing the resources and support that can accelerate the growth and expansion of the business and the value it creates globally.” Jason Wright, Partner |

Apax Partners is Acquiring Epicor and Activant Merger Merger $40B funds under management Epicor Software Corporation © 2011 Epicor Software Corporation. Revenue: $454M* Revenue: $372M Transaction valued at over $2B |