UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07156

Name of Fund: BlackRock MuniYield Investment Quality Fund (MFT)

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock MuniYield Investment Quality Fund, 55 East 52nd Street, New York, NY 10055

Registrant’s telephone number, including area code: (800) 882-0052, Option 4

Date of fiscal year end: 07/31/2012

Date of reporting period: 01/31/2012

Item 1 – Report to Stockholders

| January 31, 2012 |

Semi-Annual Report (Unaudited)

BlackRock MuniHoldings California Quality Fund, Inc. (MUC)

BlackRock MuniHoldings New Jersey Quality Fund, Inc. (MUJ)

BlackRock MuniYield Investment Quality Fund (MFT)

BlackRock MuniYield Michigan Quality Fund, Inc. (MIY)

BlackRock MuniYield New Jersey Quality Fund, Inc. (MJI)

BlackRock MuniYield Pennsylvania Quality Fund (MPA)

Not FDIC Insured • No Bank Guarantee • May Lose Value

Table of Contents

| 2 | SEMI-ANNUAL REPORT | JANUARY 31, 2012 |

Dear Shareholder

Early in 2011, global financial market action was dominated by political revolutions in the Middle East and North Africa, soaring prices of oil and other commodities, and natural disasters in Japan resulting in global supply chain disruptions. But corporate earnings were strong and the global economic recovery appeared to be on track. Investors demonstrated steadfast confidence as risk assets, including equities, commodities and high yield bonds, charged forward. Markets reversed sharply in May, however, when escalating political strife in Greece rekindled fears about sovereign debt problems spreading across Europe. Concurrently, global economic indicators signaled that the recovery had slowed. Confidence was further shaken by the prolonged debt ceiling debate in Washington, DC. On August 5th, Standard & Poor’s downgraded the US government’s credit rating and turmoil erupted in financial markets around the world. Extraordinary levels of volatility persisted in the months that followed as Greece teetered on the brink of default, debt problems escalated in Italy and Spain, and exposure to European sovereign bonds stressed banks globally. Financial markets whipsawed on hopes and fears. Macro news flow became a greater influence on trading decisions than the fundamentals of the securities traded, resulting in highly correlated asset prices. By the end of the third quarter, equity markets had fallen nearly 20% from their April peak while safe-haven assets such as US Treasuries and gold had rallied to historic highs.

October brought enough positive economic data to assuage fears of a global double-dip recession. Additionally, European leaders began to show progress toward stemming the region’s debt crisis. Investors came back from the sidelines and risk assets rallied through the month. Eventually, a lack of definitive details about Europe’s rescue plan raised doubts among investors and thwarted the rally at the end of October. The last two months of 2011 saw political instability in Greece, unsustainable yields on Italian bonds, and US policymakers in gridlock over budget issues. Global central bank actions and improving economic data invigorated investors, but confidence was easily tempered by sobering news flow. Sentiment improved in the New Year as investors saw bright spots in global economic data, particularly from the United States, China and Germany. International and emerging markets rebounded strongly through January. US stocks rallied on solid improvement in the domestic labor market and indications from the Federal Reserve that interest rates would remain low through 2014. Nonetheless, investors maintained caution as US corporate earnings began to weaken and a European recession appeared inevitable.

US equities and high yield bonds recovered their late-summer losses and posted positive returns for both the 6- and 12-month periods ended January 31, 2012. International markets, however, experienced some significant downturns in 2011 and remained in negative territory despite a strong rebound at the end of the period. Fixed income securities benefited from declining yields and delivered positive returns for the 6- and 12-month periods. US Treasury bonds outperformed other fixed income classes despite their quality rating downgrade, while municipal bonds also delivered superior results. Continued low short-term interest rates kept yields on money market securities near their all-time lows.

Many of the themes that caused uncertainty in 2011 remain unresolved. For investors, the risks are daunting. BlackRock remains committed to helping you keep your financial goals on track in this challenging environment.

Sincerely,

Rob Kapito

President, BlackRock Advisors, LLC

“BlackRock remains committed to helping you keep your financial goals on track in this challenging environment.”

Rob Kapito

President, BlackRock Advisors, LLC

Total Returns as of January 31, 2012

| 6-month | 12-month | |||

| US large cap equities | 2.71 | % | 4.22 | % |

| (S&P 500® Index) | ||||

| US small cap equities | 0.22 | 2.86 | ||

| (Russell 2000® Index) | ||||

| International equities | (10.42 | ) | (9.59 | ) |

| (MSCI Europe, Australasia, | ||||

| Far East Index) | ||||

| Emerging market | (9.56 | ) | (6.64 | ) |

| equities (MSCI Emerging | ||||

| Markets Index) | ||||

| 3-month Treasury | 0.02 | 0.09 | ||

| bill (BofA Merrill Lynch | ||||

| 3-Month Treasury | ||||

| Bill Index) | ||||

| US Treasury securities | 10.81 | 18.49 | ||

| (BofA Merrill Lynch 10- | ||||

| Year US Treasury Index) | ||||

| US investment grade | 4.25 | 8.66 | ||

| bonds (Barclays | ||||

| Capital US Aggregate | ||||

| Bond Index) | ||||

| Tax-exempt municipal | 7.25 | 14.40 | ||

| bonds (S&P Municipal | ||||

| Bond Index) | ||||

| US high yield bonds | 1.84 | 5.81 | ||

| (Barclays Capital US | ||||

| Corporate High Yield 2% | ||||

| Issuer Capped Index) | ||||

Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index.

| THIS PAGE NOT PART OF YOUR FUND REPORT | 3 |

For the 12-Month Period Ended January 31, 2012

One year ago, the municipal bond market was steadily recovering from a difficult fourth quarter of 2010 that brought severe losses amid a steepening US Treasury yield curve and a flood of inflated headlines about municipal finance troubles. Retail investors had lost confidence in municipals and retreated from the market. Political uncertainty surrounding the midterm elections and tax policies exacerbated the situation. These conditions combined with seasonal illiquidity weakened willful market participation from the trading community. December 2010 brought declining demand with no comparable reduction in supply as issuers rushed their deals to market before the Build America Bond program was retired. This supply-demand imbalance led to wider quality spreads and higher yields for municipal bonds heading into 2011.

Demand is usually strong at the beginning of a new year, but retail investors continued to move away from municipal mutual funds in the first half of 2011. From the middle of November 2010, outflows persisted for 29 consecutive weeks, totaling $35.1 billion before the trend finally broke in June 2011. However, weak demand was counterbalanced by lower supply in 2011. According to Thomson Reuters, new issuance was down 32% in 2011 as compared to the prior year. While these technical factors were improving, municipalities were struggling to balance their budgets, although the late-2010 predictions for widespread municipal defaults did not materialize. Other concerns that resonated at the beginning of the year, such as rising interest rates, weakening credits and higher rates of inflation, abated as these scenarios also did not come to fruition.

On August 5th, 2011, Standard & Poor’s (“S&P”) downgraded the US government’s credit rating from AAA to AA+. While this led to the downgrade of approximately 11,000 municipal issues directly tied to the US debt rating, this represented a very small fraction of the municipal market and said nothing about the individual municipal credits themselves. In fact, demand for municipal bonds increased as severe volatility in US equities drove investors to more stable asset classes. The municipal market benefited from an exuberant Treasury market and continued muted new issuance. As supply remained constrained, demand from both traditional and non-traditional buyers was strong, pushing long-term municipal bond yields lower and sparking a curve-flattening trend that continued through year end. Ultimately, 2011 was one of the strongest performance years in municipal market history. The S&P Municipal Bond Index returned 10.62% in 2011, making municipal bonds a top-performing fixed income asset class for the year.

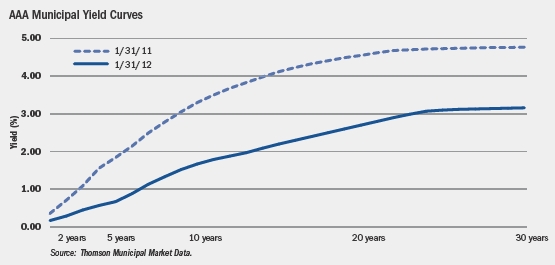

Supply and demand technicals continued to be favorable in January 2012. Overall, the municipal yield curve flattened during the period from January 31, 2011 to January 31, 2012. As measured by Thomson Municipal Market Data, yields declined by 161 basis points (“bps”) to 3.17% on AAA-rated 30-year municipal bonds and by 163 bps to 1.68% on 10-year bonds, while yields on 5-year issues fell 117 bps to 0.68%. While the entire municipal curve flattened over the 12-month time period, the spread between 2- and 30-year maturities tightened by 120 bps, and in the 2- to 10-year range, the spread tightened by 124 bps.

The fundamental picture for municipalities continues to improve. Austerity has been the general theme across the country, while a small number of states continue to rely on a “kick-the-can” approach to close their budget shortfalls, with aggressive revenue projections and accounting gimmicks. The market’s technical factors are also improving as demand outpaces supply in what is historically a light issuance period. It has been over a year since the first highly publicized interview about the fiscal problems plaguing state and local governments. Thus far, the prophecy of widespread defaults across the municipal market has not materialized. In 2011, there were fewer municipal defaults than seen in 2010. Throughout 2011 monetary defaults in the S&P Municipal Bond Index totaled roughly $805 million, representing less than 0.48% of the index. BlackRock maintains the view that municipal bond defaults will remain in the periphery and the overall market is fundamentally sound. We continue to recognize that careful credit research and security selection remain imperative amid uncertainty in this economic environment.

| 4 | SEMI-ANNUAL REPORT | JANUARY 31, 2012 |

| Fund Summary as of January 31, 2012 | BlackRock MuniHoldings California Quality Fund, Inc. |

Fund Overview

BlackRock MuniHoldings California Quality Fund, Inc.’s (MUC) (the “Fund”) investment objective is to provide shareholders with current income exempt from federal and California income taxes. The Fund seeks to achieve its investment objective by investing primarily in municipal obligations exempt from federal income taxes (except that the interest may be subject to the federal alternative minimum tax) and California income taxes. Under normal market conditions, the Fund invests at least 80% of its assets in investment grade municipal obligations with remaining maturities of one year or more at the time of investment. The Fund may invest directly in such securities or synthetically through the use of derivatives.

No assurance can be given that the Fund’s investment objective will be achieved.

Performance

For the six months ended January 31, 2012, the Fund returned 22.03% based on market price and 14.84% based on net asset value (“NAV”). For the same period, the closed-end Lipper California Municipal Debt Funds category posted an average return of 21.02% based on market price and 14.53% based on NAV. All returns reflect reinvestment of dividends. The Fund's discount to NAV, which narrowed during the period, accounts for the difference between performance based on price and performance based on NAV. The following discussion relates to performance based on NAV. The Fund’s slightly long duration (sensitivity to interest rate movements) had a positive impact on performance as interest rates generally declined amid the investor flight-to-quality in the US Treasury market. Increased exposure to inverse floating rate instruments (tender option bonds) while the municipal yield curve was historically steep boosted the Fund’s income accrual. The Fund’s holdings of higher quality essential service revenue bonds contributed positively, as did holdings of select general obligation bonds and school district credits with stronger underlying fundamentals. Additionally, purchases of zero-coupon bonds deemed undervalued added to the Fund’s total return.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

Fund Information

| Symbol on New York Stock Exchange (“NYSE”) | MUC |

| Initial Offering Date | February 27, 1998 |

| Yield on Closing Market Price as of January 31, 2012 ($15.55)1 | 5.90% |

| Tax Equivalent Yield2 | 9.08% |

| Current Monthly Distribution per Common Share3 | $0.0765 |

| Current Annualized Distribution per Common Share3 | $0.9180 |

| Economic Leverage as of January 31, 20124 | 41% |

| 1 | Yield on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. Past performance does not guarantee future results. |

| 2 | Tax equivalent yield assumes the maximum federal tax rate of 35%. |

| 3 | The Monthly Distribution per Common Share, declared on March 1, 2012, was increased to $0.0790 per share. The Yield on Closing Market Price, Current Monthly Distribution per Common Share and Current Annualized Distribution per Common Share do not reflect the new distribution rate. The new distribution rate is not constant and is subject to change in the future. |

| 4 | Represents Auction Market Preferred Shares (“AMPS”) and tender option bond trusts (“TOBs”) as a percentage of total managed assets, which is the total assets of the Fund, including any assets attributable to AMPS and TOBs, minus the sum of accrued liabilities. For a discussion of leveraging techniques utilized by the Fund, please see The Benefits and Risks of Leveraging on page 11. |

The table below summarizes the changes in the Fund’s market price and NAV per share:

| 1/31/12 | 7/31/11 | Change | High | Low | |

| Market Price | $15.55 | $13.15 | 18.25% | $15.57 | $12.90 |

| Net Asset Value | $15.88 | $14.27 | 11.28% | $15.88 | $14.27 |

The following charts show the sector and credit quality allocations of the Fund’s long-term investments:

Sector Allocations

| 1/31/12 | 7/31/11 | |

| County/City/Special District/School District | 38% | 37% |

| Utilities | 27 | 30 |

| Education | 12 | 11 |

| Transportation | 11 | 12 |

| Health | 7 | 4 |

| State | 5 | 2 |

| Corporate | —5 | 4 |

| 5 | Representing less than 1% of the Fund’s long-term investments. |

Credit Quality Allocations6

| 1/31/12 | 7/31/11 | |

| AAA/Aaa | 17% | 5% |

| AA/Aa | 65 | 64 |

| A | 17 | 17 |

| BBB/Baa | 1 | 5 |

| Not Rated | — | 9 |

| 6 | Using the higher of Standard & Poor’s (“S&P’s”) or Moody’s Investors Service (“Moody’s”) ratings. |

| SEMI-ANNUAL REPORT | JANUARY 31, 2012 | 5 |

| Fund Summary as of January 31, 2012 | BlackRock MuniHoldings New Jersey Quality Fund, Inc. |

Fund Overview

BlackRock MuniHoldings New Jersey Quality Fund, Inc.’s (MUJ) (the “Fund”) investment objective is to provide shareholders with current income exempt from federal income tax and New Jersey personal income taxes. The Fund seeks to achieve its investment objective by investing primarily in long-term, investment grade municipal obligations exempt from federal income taxes (except that the interest may be subject to the federal alternative minimum tax) and New Jersey personal income taxes. Under normal market conditions, the Fund invests at least 80% of its assets in municipal obligations with remaining maturities of one year or more at the time of investment. The Fund may invest directly in such securities or synthetically through the use of derivatives.

No assurance can be given that the Fund’s investment objective will be achieved.

Performance

For the six months ended January 31, 2012, the Fund returned 18.23% based on market price and 13.71% based on NAV. For the same period, the closed end Lipper New Jersey Municipal Debt Funds category posted an average return of 20.36% based on market price and 13.24% based on NAV. All returns reflect reinvestment of dividends. The Fund's discount to NAV, which narrowed during the period, accounts for the difference between performance based on price and performance based on NAV. The following discussion relates to performance based on NAV. During the period, the Fund benefited from the declining interest rate environment (bond prices rise as interest rates fall), the flattening of the yield curve (long interest rates fell more than short and intermediate rates) and tightening of credit spreads. The Fund’s exposure to zero-coupon bonds and the health sector had a positive impact on performance as these holdings derived the greatest benefit from the decline in interest rates and spread tightening during the period.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

Fund Information

| Symbol on NYSE | MUJ |

| Initial Offering Date | March 11, 1998 |

| Yield on Closing Market Price as of January 31, 2012 ($15.77)1 | 5.63% |

| Tax Equivalent Yield2 | 8.66% |

| Current Monthly Distribution per Common Share3 | $0.074 |

| Current Annualized Distribution per Common Share3 | $0.888 |

| Economic Leverage as of January 31, 20124 | 37% |

| 1 | Yield on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. Past performance does not guarantee future results. |

| 2 | Tax equivalent yield assumes the maximum federal tax rate of 35%. |

| 3 | The distribution rate is not constant and is subject to change. |

| 4 | Represents Variable Rate Demand Preferred Shares (“VRDP Shares”) and TOBs as a percentage of total managed assets, which is the total assets of the Fund, including any assets attributable to VRDP Shares and TOBs, minus the sum of accrued liabilities. For a discussion of leveraging techniques utilized by the Fund, please see The Benefits and Risks of Leveraging on page 11. |

The table below summarizes the changes in the Fund’s market price and NAV per share:

| 1/31/12 | 7/31/11 | Change | High | Low | |

| Market Price | $15.77 | $13.74 | 14.77% | $15.89 | $13.51 |

| Net Asset Value | $16.26 | $14.73 | 10.39% | $16.26 | $14.73 |

The following charts show the sector and credit quality allocations of the Fund’s long-term investments:

Sector Allocations

| 1/31/12 | 7/31/11 | |

| State | 34% | 31% |

| Transportation | 15 | 19 |

| Education | 12 | 12 |

| Health | 12 | 11 |

| County/City/Special District/School District | 11 | 14 |

| Utilities | 8 | 5 |

| Housing | 5 | 6 |

| Corporate | 2 | 1 |

| Tobacco | 1 | 1 |

Credit Quality Allocations5

| 1/31/12 | 7/31/11 | |

| AAA/Aaa | 9% | 11% |

| AA/Aa | 50 | 45 |

| A | 29 | 30 |

| BBB/Baa | 12 | 14 |

| 5 | Using the higher of S&P’s and Moody’s ratings. |

| 6 | SEMI-ANNUAL REPORT | JANUARY 31, 2012 |

| Fund Summary as of January 31, 2012 | BlackRock MuniYield Investment Quality Fund |

Fund Overview

BlackRock MuniYield Investment Quality Fund’s (MFT) (the “Fund”) investment objective is to provide shareholders with as high a level of current income exempt from federal income taxes as is consistent with its investment policies and prudent investment management. The Fund seeks to achieve its investment objective by investing at least 80% of its assets in municipal obligations exempt from federal income taxes (except that the interest may be subject to the federal alternative minimum tax). Under normal market conditions, the Fund invests primarily in long-term municipal obligations that are investment grade quality at the time of investment. The Fund may invest directly in such securities or synthetically through the use of derivatives.

No assurance can be given that the Fund’s investment objective will be achieved.

Performance

For the six months ended January 31, 2012, the Fund returned 23.88% based on market price and 16.39% based on NAV. For the same period, the closed-end Lipper General & Insured Municipal Debt Funds (Leveraged) category posted an average return of 21.10% based on market price and 13.67% based on NAV. All returns reflect reinvestment of dividends. The Fund's discount to NAV, which narrowed during the period, accounts for the difference between performance based on price and performance based on NAV. The following discussion relates to performance based on NAV. As the yield curve flattened during the period (longer-term interest rates fell more than shorter rates), rising bond prices in the long end of the municipal curve contributed positively to the Fund’s performance. The Fund’s longer-dated holdings in the health, transportation and education sectors experienced the best price appreciation.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

Fund Information

| Symbol on NYSE | MFT |

| Initial Offering Date | October 30, 1992 |

| Yield on Closing Market Price as of January 31, 2012 ($14.89)1 | 5.72% |

| Tax Equivalent Yield2 | 8.80% |

| Current Monthly Distribution per Common Share3 | $0.071 |

| Current Annualized Distribution per Common Share3 | $0.852 |

| Economic Leverage as of January 31, 20124 | 39% |

| 1 | Yield on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. Past performance does not guarantee future results. |

| 2 | Tax equivalent yield assumes the maximum federal tax rate of 35%. |

| 3 | The distribution rate is not constant and is subject to change. |

| 4 | Represents Variable Rate Muni Term Preferred Shares (“VMTP Shares”) and TOBs as a percentage of total managed assets, which is the total assets of the Fund, including any assets attributable to VMTP Shares and TOBs, minus the sum of accrued liabilities. For a discussion of leveraging techniques utilized by the Fund, please see The Benefits and Risks of Leveraging on page 11. |

The table below summarizes the changes in the Fund’s market price and NAV per share:

| 1/31/12 | 7/31/11 | Change | High | Low | |

| Market Price | $14.89 | $12.39 | 20.18% | $14.95 | $12.05 |

| Net Asset Value | $15.13 | $13.40 | 12.91% | $15.13 | $13.40 |

The following charts show the sector and credit quality allocations of the Fund’s long-term investments:

Sector Allocations

| 1/31/12 | 7/31/11 | |

| Utilities | 29% | 30% |

| County/City/Special District/School District | 23 | 23 |

| Transportation | 22 | 18 |

| Health | 11 | 13 |

| State | 8 | 9 |

| Education | 4 | 3 |

| Housing | 2 | 3 |

| Tobacco | 1 | 1 |

Credit Quality Allocations5

| 1/31/12 | 7/31/11 | |

| AAA/Aaa | 8% | 4% |

| AA/Aa | 74 | 13 |

| A | 16 | 69 |

| BBB/Baa | 2 | 8 |

| Not Rated | —6 | 6 |

| 5 | Using the higher of S&P’s or Moody’s ratings. |

| 6 | The investment advisor has deemed certain of these non-rated securities to be of investment grade quality. As of January 31, 2012, the market value of these securities was $285,650, representing less than 1% of the Fund’s long-term investments. |

| SEMI-ANNUAL REPORT | JANUARY 31, 2012 | 7 |

| Fund Summary as of January 31, 2012 | BlackRock MuniYield Michigan Quality Fund, Inc. |

Fund Overview

BlackRock MuniYield Michigan Quality Fund, Inc.’s (MIY) (the “Fund”) investment objective is to provide shareholders with as high a level of current income exempt from federal and Michigan income taxes as is consistent with its investment policies and prudent investment management. The Fund seeks to achieve its investment objective by investing at least 80% of its assets in municipal obligations exempt from federal income taxes (except that the interest may be subject to the federal alternative minimum tax) and Michigan income taxes. Under normal market conditions, the Fund invests primarily in long-term municipal obligations that are investment grade quality at the time of investment. The Fund may invest directly in such securities or synthetically through the use of derivatives.

No assurance can be given that the Fund’s investment objective will be achieved.

Performance

For the six months ended January 31, 2012, the Fund returned 20.52% based on market price and 12.28% based on NAV. For the same period, the closed-end Lipper Michigan Municipal Debt Funds category posted an average return of 19.01% based on market price and 12.19% based on NAV. All returns reflect reinvestment of dividends. The Fund's discount to NAV, which narrowed during the period, accounts for the difference between performance based on price and performance based on NAV. The following discussion relates to performance based on NAV. During the period, the Fund benefited from the declining interest rate environment (bond prices rise as interest rates fall), the flattening of the yield curve (long interest rates fell more than short and intermediate rates) and tightening of credit spreads. The Fund’s exposure to zero-coupon bonds and the health sector had a positive impact on performance as these holdings derived the greatest benefit from the decline in interest rates and spread tightening during the period.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

Fund Information

| Symbol on NYSE | MIY |

| Initial Offering Date | October 30, 1992 |

| Yield on Closing Market Price as of January 31, 2012 ($15.63)1 | 5.87% |

| Tax Equivalent Yield2 | 9.03% |

| Current Monthly Distribution per Common Share3 | $0.0765 |

| Current Annualized Distribution per Common Share3 | $0.9180 |

| Economic Leverage as of January 31, 20124 | 36% |

| 1 | Yield on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. Past performance does not guarantee future results. |

| 2 | Tax equivalent yield assumes the maximum federal tax rate of 35%. |

| 3 | The distribution rate is not constant and is subject to change. |

| 4 | Represents VRDP Shares and TOBs as a percentage of total managed assets, which is the total assets of the Fund, including any assets attributable to VRDP Shares and TOBs, minus the sum of accrued liabilities. For a discussion of leveraging techniques utilized by the Fund, please see The Benefits and Risks of Leveraging on page 11. |

The table below summarizes the changes in the Fund’s market price and NAV per share:

| 1/31/12 | 7/31/11 | Change | High | Low | |

| Market Price | $15.63 | $13.39 | 16.73% | $15.66 | $12.97 |

| Net Asset Value | $15.91 | $14.63 | 8.75% | $15.91 | $14.63 |

The following charts show the sector and credit quality allocations of the Fund’s long-term investments:

Sector Allocations

| 1/31/12 | 7/31/11 | |

| County/City/Special District/School District | 26% | 29% |

| State | 17 | 9 |

| Health | 15 | 13 |

| Utilities | 14 | 16 |

| Education | 10 | 8 |

| Transportation | 8 | 10 |

| Housing | 5 | 5 |

| Corporate | 5 | 10 |

Credit Quality Allocations5

| 1/31/12 | 7/31/11 | |

| AAA/Aaa | 9% | 3% |

| AA/Aa | 62 | 67 |

| A | 26 | 27 |

| BBB/Baa | 2 | 2 |

| Not Rated6 | 1 | 1 |

| 5 | Using the higher of S&P’s or Moody’s ratings. |

| 6 | The investment advisor has deemed certain of these non-rated securities to be of investment grade quality. As of January 31, 2012 and July 31, 2011, the market value of these securities was $5,297,162, representing 1%, and $1,064,957, representing 1%, respectively, of the Fund's long-term investments. |

| 8 | SEMI-ANNUAL REPORT | JANUARY 31, 2012 |

| Fund Summary as of January 31, 2012 | BlackRock MuniYield New Jersey Quality Fund, Inc. |

Fund Overview

BlackRock MuniYield New Jersey Quality Fund, Inc.’s (MJI) (the “Fund”) investment objective is to provide shareholders with as high a level of current income exempt from federal income taxes and New Jersey personal income tax as is consistent with its investment policies and prudent investment management. The Fund seeks to achieve its investment objective by investing at least 80% of its assets in municipal obligations exempt from federal income taxes (except that the interest may be subject to the federal alternative minimum tax) and New Jersey personal income taxes. Under normal market conditions, the Fund invests primarily in long-term municipal obligations that are investment grade quality at the time of investment. The Fund may invest directly in such securities or synthetically through the use of derivatives.

No assurance can be given that the Fund’s investment objective will be achieved.

Performance

For the six months ended January 31, 2012, the Fund returned 25.38% based on market price and 13.70% based on NAV. For the same period, the closed-end Lipper New Jersey Municipal Debt Funds category posted an average return of 20.36% based on market price and 13.24% based on NAV. All returns reflect reinvestment of dividends. The Fund's discount to NAV, which narrowed during the period, accounts for the difference between performance based on price and performance based on NAV. The following discussion relates to performance based on NAV. During the period, the Fund benefited from the declining interest rate environment (bond prices rise as interest rates fall), the flattening of the yield curve (long interest rates fell more than short and intermediate rates) and tightening of credit spreads. The Fund’s exposure to zero-coupon bonds and the health sector had a positive impact on performance as these holdings derived the greatest benefit from the decline in interest rates and spread tightening during the period.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

Fund Information

| Symbol on NYSE | MJI |

| Initial Offering Date | October 30, 1992 |

| Yield on Closing Market Price as of January 31, 2012 ($15.99)1 | 5.40% |

| Tax Equivalent Yield2 | 8.31% |

| Current Monthly Distribution per Common Share3 | $0.072 |

| Current Annualized Distribution per Common Share3 | $0.864 |

| Economic Leverage as of January 31, 20124 | 35% |

| 1 | Yield on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. Past performance does not guarantee future results. |

| 2 | Tax equivalent yield assumes the maximum federal tax rate of 35%. |

| 3 | The distribution rate is not constant and is subject to change. |

| 4 | Represents VRDP Shares and TOBs as a percentage of total managed assets, which is the total assets of the Fund, including any assets attributable to VRDP Shares and TOBs, minus the sum of accrued liabilities. For a discussion of leveraging techniques utilized by the Fund, please see The Benefits and Risks of Leveraging on page 11. |

The table below summarizes the changes in the Fund’s market price and NAV per share:

| 1/31/12 | 7/31/11 | Change | High | Low | |

| Market Price | $15.99 | $13.16 | 21.50% | $15.99 | $12.91 |

| Net Asset Value | $16.01 | $14.53 | 10.19% | $16.01 | $14.53 |

The following charts show the sector and credit quality allocations of the Fund’s long-term investments:

Sector Allocations

| 1/31/12 | 7/31/11 | |

| State | 31% | 27% |

| Education | 15 | 17 |

| Transportation | 13 | 12 |

| Health | 11 | 10 |

| Utilities | 10 | 9 |

| County/City/Special District/School District | 9 | 14 |

| Housing | 6 | 7 |

| Corporate | 4 | 3 |

| Tobacco | 1 | 1 |

Credit Quality Allocations5

| 1/31/12 | 7/31/11 | |

| AAA/Aaa | 10% | 10% |

| AA/Aa | 44 | 44 |

| A | 33 | 33 |

| BBB/Baa | 12 | 10 |

| Not Rated6 | 1 | 3 |

| 5 | Using the higher of S&P’s and Moody’s ratings. |

| 6 | The investment advisor has deemed certain of these non-rated securities to be of investment grade quality. As of January 31, 2012 and July 31, 2011, the market value of these securities was $2,063,496, representing 1%, and $3,124,559, representing 3%, respectively, of the Fund’s long-term investments. |

| SEMI-ANNUAL REPORT | JANUARY 31, 2012 | 9 |

| Fund Summary as of January 31, 2012 | BlackRock MuniYield Pennsylvania Quality Fund |

Fund Overview

BlackRock MuniYield Pennsylvania Quality Fund’s (MPA) (the “Fund”) investment objective is to provide shareholders with as high a level of current income exempt from federal and Pennsylvania income taxes as is consistent with its investment policies and prudent investment management. The Fund seeks to achieve its investment objective by investing at least 80% of its assets in municipal obligations exempt from federal income taxes (except that the interest may be subject to the federal alternative minimum tax) and Pennsylvania income taxes. Under normal market conditions, the Fund invests primarily in long-term municipal obligations that are investment grade quality at the time of investment. The Fund may invest directly in such securities or synthetically through the use of derivatives.

No assurance can be given that the Fund’s investment objective will be achieved.

Performance

For the six months ended January 31, 2012, the Fund returned 20.10% based on market price and 12.46% based on NAV. For the same period, the closed-end Lipper Pennsylvania Municipal Debt Funds category posted an average return of 16.43% based on market price and 11.62% based on NAV. All returns reflect reinvestment of dividends. The Fund's discount to NAV, which narrowed during the period, accounts for the difference between performance based on price and performance based on NAV. The following discussion relates to performance based on NAV. During the period, municipal bond prices generally rose as the yield curve flattened and credit spreads tightened. Given these market conditions, the Fund’s exposure to longer maturity bonds and lower-quality investment grade bonds had a significant positive impact on the Fund’s performance for the period. The Fund’s distribution yield was below the median of its Lipper category, resulting in a lower total return relative to its peers.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

Fund Information

| Symbol on NYSE | MPA |

| Initial Offering Date | October 30, 1992 |

| Yield on Closing Market Price as of January 31, 2012 ($16.25)1 | 5.65% |

| Tax Equivalent Yield2 | 8.69% |

| Current Monthly Distribution per Common Share3 | $0.0765 |

| Current Annualized Distribution per Common Share3 | $0.9180 |

| Economic Leverage as of January 31, 20124 | 35% |

| 1 | Yield on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. Past performance does not guarantee future results. |

| 2 | Tax equivalent yield assumes the maximum federal tax rate of 35%. |

| 3 | The distribution rate is not constant and is subject to change. |

| 4 | Represents VRDP Shares and TOBs as a percentage of total managed assets, which is the total assets of the Fund, including any assets attributable to VRDP Shares and TOBs, minus the sum of accrued liabilities. For a discussion of leveraging techniques utilized by the Fund, please see The Benefits and Risks of Leveraging on page 11. |

| The table below summarizes the changes in the Fund’s market price and NAV per share: |

| 1/31/12 | 7/31/11 | Change | High | Low | |

| Market Price | $16.25 | $13.94 | 16.57% | $16.33 | $13.76 |

| Net Asset Value | $16.34 | $14.97 | 9.15% | $16.34 | $14.97 |

The following charts show the sector and credit quality allocations of the Fund’s long-term investments:

Sector Allocations

| 1/31/12 | 7/31/11 | |

| County/City/Special District/School District | 23% | 30% |

| State | 23 | 16 |

| Health | 14 | 14 |

| Utilities | 12 | 13 |

| Transportation | 12 | 12 |

| Education | 8 | 8 |

| Housing | 5 | 3 |

| Corporate | 3 | 4 |

Credit Quality Allocations5

| 1/31/12 | 7/31/11 | |

| AA/Aa | 80% | 79% |

| A | 17 | 17 |

| BBB/Baa | 3 | 4 |

| 5 | Using the higher of S&P’s or Moody’s ratings. |

| 10 | SEMI-ANNUAL REPORT | JANUARY 31, 2012 |

The Benefits and Risks of Leveraging

The Funds may utilize leverage to seek to enhance the yield and NAV of their common shares (“Common Shares”). However, these objectives cannot be achieved in all interest rate environments.

To obtain leverage, the Funds issue Auction Market Preferred Shares (“AMPS”), Variable Rate Demand Preferred Shares (“VRDP Shares”) or Variable Rate Muni Term Preferred Shares (“VMTP Shares”) (collectively, “Preferred Shares”). Preferred Shares pay dividends at prevailing short-term interest rates, and the Funds invest the proceeds in long-term municipal bonds. In general, the concept of leveraging is based on the premise that the financing cost of assets to be obtained from leverage, which will be based on short-term interest rates, will normally be lower than the income earned by each Fund on its longer-term portfolio investments. To the extent that the total assets of each Fund (including the assets obtained from leverage) are invested in higher-yielding portfolio investments, each Fund’s shareholders will benefit from the incremental net income.

To illustrate these concepts, assume a Fund’s Common Shares capitalization is $100 million and it issues Preferred Shares for an additional $50 million, creating a total value of $150 million available for investment in long-term municipal bonds. If prevailing short-term interest rates are 3% and long-term interest rates are 6%, the yield curve has a strongly positive slope. In this case, the Fund pays dividends on the $50 million of Preferred Shares based on the lower short-term interest rates. At the same time, the securities purchased by the Fund with assets received from Preferred Shares issuance earn income based on long-term interest rates. In this case, the dividends paid to holders of Preferred Shares (“Preferred Shareholders”) are significantly lower than the income earned on the Fund’s long-term investments, and therefore the Common Shareholders are the beneficiaries of the incremental net income.

If short-term interest rates rise, narrowing the differential between short-term and long-term interest rates, the incremental net income pickup will be reduced or eliminated completely. Furthermore, if prevailing short-term interest rates rise above long-term interest rates, the yield curve has a negative slope. In this case, the Fund pays higher short-term interest rates whereas the Fund’s total portfolio earns income based on lower long-term interest rates.

Furthermore, the value of the Funds’ portfolio investments generally varies inversely with the direction of long-term interest rates, although other factors can influence the value of portfolio investments. In contrast, the redemption value of the Funds’ Preferred Shares does not fluctuate in relation to interest rates. As a result, changes in interest rates can influence the Funds’ NAVs positively or negatively in addition to the impact on Fund performance from leverage from Preferred Shares discussed above.

The Funds may also leverage their assets through the use of tender option bond trusts (“TOBs”), as described in Note 1 of the Notes to Financial Statements. TOB investments generally will provide the Funds with economic benefits in periods of declining short-term interest rates, but expose the Funds to risks during periods of rising short-term interest rates similar to those associated with Preferred Shares issued by the Funds, as described above. Additionally, fluctuations in the market value of municipal bonds deposited into the TOB trust may adversely affect each Fund’s NAV per share.

The use of leverage may enhance opportunities for increased income to the Funds and Common Shareholders, but as described above, it also creates risks as short- or long-term interest rates fluctuate. Leverage also will generally cause greater changes in the Funds’ NAVs, market prices and dividend rates than comparable portfolios without leverage. If the income derived from securities purchased with assets received from leverage exceeds the cost of leverage, the Funds’ net income will be greater than if leverage had not been used. Conversely, if the income from the securities purchased is not sufficient to cover the cost of leverage, each Fund’s net income will be less than if leverage had not been used, and therefore the amount available for distribution to Common Shareholders will be reduced. Each Fund may be required to sell portfolio securities at inopportune times or at distressed values in order to comply with regulatory requirements applicable to the use of leverage or as required by the terms of leverage instruments, which may cause a Fund to incur losses. The use of leverage may limit each Fund’s ability to invest in certain types of securities or use certain types of hedging strategies, such as in the case of certain restrictions imposed by rating agencies that rate the Preferred Shares issued by the Funds. Each Fund will incur expenses in connection with the use of leverage, all of which are borne by Common Shareholders and may reduce income to the Common Shares.

Under the Investment Company Act of 1940, as amended (the “1940 Act”), the Funds are permitted to issue senior securities in the form of equity securities (e.g., Preferred Shares) up to 50% of their total managed assets. In addition, each Fund voluntarily limits its economic leverage to 50% of its total managed assets for Funds with AMPS or 45% for Funds with VRDPs or VMTPs. As of January 31, 2012, the Funds had economic leverage from Preferred Shares and/or TOBs as a percentage of their total managed assets as follows:

| Percent of | |

| Economic | |

| Leverage | |

| MUC | 41% |

| MUJ | 37% |

| MFT | 39% |

| MIY | 36% |

| MJI | 35% |

| MPA | 35% |

Derivative Financial Instruments

The Funds may invest in various derivative financial instruments, including financial futures contracts as specified in Note 2 of the Notes to Financial Statements, which may constitute forms of economic leverage. Such derivative financial instruments are used to obtain exposure to a market without owning or taking physical custody of securities or to hedge market and/or interest rate risks. Derivative financial instruments involve risks, including the imperfect correlation between the value of a derivative financial instrument and the underlying asset, possible default of the counterparty to the transaction or illiquidity of the derivative financial instrument. The Funds’ ability to use a derivative financial instrument successfully depends on the investment advisor’s ability to predict pertinent market movements accurately, which cannot be assured. The use of derivative financial instruments may result in losses greater than if they had not been used, may require a Fund to sell or purchase portfolio investments at inopportune times or for distressed values, may limit the amount of appreciation a Fund can realize on an investment, may result in lower dividends paid to shareholders or may cause a Fund to hold an investment that it might otherwise sell. The Funds’ investments in these instruments are discussed in detail in the Notes to Financial Statements.

| SEMI-ANNUAL REPORT | JANUARY 31, 2012 | 11 |

| Schedule of Investments January 31, 2012 (Unaudited) | BlackRock MuniHoldings California Quality Fund, Inc. (MUC) |

| (Percentages shown are based on Net Assets) |

| Par | ||||

| Municipal Bonds | (000) | Value | ||

| California — 102.4% | ||||

| Corporate — 0.4% | ||||

| City of Chula Vista California, Refunding RB, San Diego | ||||

| Gas & Electric, Series A, 5.88%, 2/15/34 | $ | 2,435 | $ | 2,818,001 |

| County/City/Special District/School District — 28.9% | ||||

| Alhambra Unified School District, GO, CAB, Election | ||||

| of 2008, Series B (AGM), 6.31%, 8/01/39 (a) | 5,000 | 1,110,750 | ||

| Centinela Valley Union High School District, GO, Election | ||||

| of 2010, Series A, 5.75%, 8/01/41 | 9,000 | 10,380,780 | ||

| Chabot-Las Positas Community College District, GO, CAB, | ||||

| Series C (AMBAC), 6.03%, 8/01/37 (a) | 11,980 | 2,874,242 | ||

| City of Garden Grove California, COP, Series A, Financing | ||||

| Project (AMBAC), 5.50%, 3/01/26 | 4,040 | 4,093,934 | ||

| City of Redding California, COP, Refunding, Series A | ||||

| (AGM), 5.00%, 6/01/30 | 5,000 | 5,521,100 | ||

| Colton Joint Unified School District, GO, Series A | ||||

| (NPFGC), 5.38%, 8/01/26 | 2,500 | 2,585,725 | ||

| County of Kern California, COP, Capital Improvements | ||||

| Projects, Series A (AGC), 6.00%, 8/01/35 | 3,500 | 4,057,935 | ||

| Covina-Valley Unified School District California, GO, | ||||

| Refunding, Series A (AGM), 5.50%, 8/01/26 | 2,395 | 2,482,489 | ||

| Culver City Redevelopment Finance Authority California, | ||||

| Tax Allocation Bonds, Refunding, Series A (AGM), | ||||

| 5.60%, 11/01/25 | 3,750 | 3,762,525 | ||

| Desert Community College District, GO, CAB, Election | ||||

| 2004 Series C (AGM), 5.90%, 8/01/46 (a) | 5,000 | 712,050 | ||

| Grossmont Healthcare District, GO, Election of 2006, | ||||

| Series B, 6.13%, 7/15/40 | 2,000 | 2,377,800 | ||

| Los Angeles Community Redevelopment Agency | ||||

| California, RB, Bunker Hill Project, Series A (AGM), | ||||

| 5.00%, 12/01/27 | 10,000 | 10,559,100 | ||

| Merced Union High School District, GO, CAB, Election | ||||

| 2008, Series C (a): | ||||

| 6.61%, 8/01/33 | 2,500 | 781,875 | ||

| 6.40%, 8/01/36 | 4,100 | 1,070,223 | ||

| 7.07%, 8/01/41 | 5,000 | 739,350 | ||

| New Haven Unified School District, GO, CAB, | ||||

| (AGC), 8/01/33 | 4,950 | 1,594,148 | ||

| Norwalk-La Mirada Unified School District California, | ||||

| GO, CAB, Election of 2002, Series E (AGC), | ||||

| 5.53%, 8/01/38 (a) | 7,500 | 1,790,025 | ||

| Orange County Sanitation District, COP, Series A, | ||||

| 5.00%, 2/01/35 | 2,500 | 2,770,300 | ||

| Oxnard Union High School District, GO, Refunding, | ||||

| Election of 2004, Series A (AGM), 5.00%, 8/01/35 | 10,000 | 10,979,000 | ||

| Port of Oakland, Refunding RB, Series M (FGIC), | ||||

| 5.38%, 11/01/27 | 18,000 | 18,239,220 | ||

| Redlands Unified School District California, GO, Election | ||||

| of 2008 (AGM), 5.25%, 7/01/33 | 5,000 | 5,559,550 | ||

| Rio Hondo Community College District, GO, CAB, Election | ||||

| of 2004, Series C, 5.32%, 8/01/36 (a) | 16,650 | 4,842,319 | ||

| San Bernardino Community College District, GO, Election | ||||

| of 2002, Series A, 6.25%, 8/01/33 | 310 | 370,918 | ||

| Par | ||||

| Municipal Bonds | (000) | Value | ||

| California (continued) | ||||

| County/City/Special District/School District (concluded) | ||||

| San Diego Regional Building Authority, RB, County | ||||

| Operations Center & Annex, Series A, 5.50%, 2/01/29 | $ | 900 | $ | 1,027,692 |

| San Jose Financing Authority, RB, Civic Center Project, | ||||

| Series B (AMBAC), 5.00%, 6/01/32 | 14,800 | 14,879,180 | ||

| San Jose Financing Authority, RB, Convention Center | ||||

| Expansion & Renovation Project: | ||||

| 5.75%, 5/01/36 | 2,560 | 2,741,581 | ||

| 5.75%, 5/01/42 | 4,500 | 5,114,745 | ||

| Santa Clara Redevelopment Agency California, Tax | ||||

| Allocation Bonds, Bayshore North Project, Series A | ||||

| (AMBAC), 5.50%, 6/01/23 | 10,000 | 10,064,900 | ||

| Snowline Joint Unified School District, COP, Refunding, | ||||

| Refining Project (AGC), 5.75%, 9/01/38 | 5,635 | 6,412,517 | ||

| Vista Unified School District California, GO, Series A | ||||

| (AGM), 5.25%, 8/01/25 | 10,000 | 10,196,200 | ||

| Walnut Valley Unified School District California, GO, | ||||

| Election of 2007, Measure S, Series A (AGM), | ||||

| 5.00%, 2/01/33 | 2,000 | 2,185,220 | ||

| West Contra Costa County Unified School District | ||||

| California, GO, Election of 2005, Series A (AGM), | ||||

| 5.00%, 8/01/35 | 12,000 | 12,507,960 | ||

| West Contra Costa Unified School District California, GO: | ||||

| Election of 2002, Series B (AGM), 5.00%, 8/01/32 | 6,690 | 6,744,256 | ||

| Election of 2010, Series A, 5.25%, 8/01/41 | 5,390 | 5,972,066 | ||

| Refunding (AGM), 5.25%, 8/01/23 | 4,500 | 5,395,365 | ||

| Westminster Redevelopment Agency California, | ||||

| Tax Allocation Bonds, Subordinate, Commercial | ||||

| Redevelopment Project No. 1 (AGC), 6.25%, 11/01/39 | 4,300 | 5,156,732 | ||

| 187,653,772 | ||||

| Education — 8.9% | ||||

| Anaheim City School District California, GO, Election | ||||

| of 2010 (AGM), 6.25%, 8/01/40 | 3,750 | 4,520,100 | ||

| California Municipal Finance Authority, RB, Emerson | ||||

| College, 6.00%, 1/01/42 | 2,500 | 2,769,775 | ||

| California State Educational Facilities Authority, RB, | ||||

| University of Southern California, Series A, | ||||

| 5.25%, 10/01/38 | 8,000 | 8,997,680 | ||

| Gavilan Joint Community College District, GO, Election | ||||

| of 2004, Series D: | ||||

| 5.50%, 8/01/31 | 2,170 | 2,613,570 | ||

| 5.75%, 8/01/35 | 8,400 | 9,991,128 | ||

| Riverside Community College District, GO, Election | ||||

| of 2004, Series C (AGM), 5.00%, 8/01/32 | 8,750 | 9,497,162 | ||

| San Diego Community College District, GO, Election | ||||

| of 2006 (AGM), 5.00%, 8/01/30 | 9,555 | 10,604,235 | ||

| University of California, RB, Series L, 5.00%, 5/15/36 | 2,995 | 3,209,262 | ||

| University of California, Refunding RB, General, Series A | ||||

| (AMBAC), 5.00%, 5/15/27 | 5,000 | 5,255,400 | ||

| 57,458,312 | ||||

Portfolio Abbreviations

To simplify the listings of portfolio holdings in the Schedules of Investments, the names and descriptions of many of the securities have been abbreviated according to the following list:

| ACA | American Capital Access Corp. |

| AGC | Assured Guaranty Corp. |

| AGM | Assured Guaranty Municipal Corp. |

| AMBAC | American Municipal Bond Assurance Corp. |

| AMT | Alternative Minimum Tax (subject to) |

| ARB | Airport Revenue Bonds |

| BHAC | Berkshire Hathaway Assurance Corp. |

| CAB | Capital Appreciation Bonds |

| CIFG | CDC IXIS Financial Guaranty |

| COP | Certificates of Participation |

| EDA | Economic Development Authority |

| EDC | Economic Development Corp. |

| ERB | Education Revenue Bonds |

| FGIC | Financial Guaranty Insurance Co. |

| GARB | General Airport Revenue Bonds |

| GO | General Obligation Bonds |

| HDA | Housing Development Authority |

| HFA | Housing Finance Agency |

| HRB | Housing Revenue Bonds |

| IDA | Industrial Development Authority |

| ISD | Independent School District |

| NPFGC | National Public Finance Guarantee Corp. |

| Q-SBLF | Qualified School Bond Loan Fund |

| RB | Revenue Bonds |

| S/F | Single-Family |

| SYNCORA | Syncora Guarantee |

See Notes to Financial Statements.

| 12 | SEMI-ANNUAL REPORT | JANUARY 31, 2012 |

| Schedule of Investments (continued) | BlackRock MuniHoldings California Quality Fund, Inc. (MUC) |

| (Percentages shown are based on Net Assets) |

| Par | ||||

| Municipal Bonds | (000) | Value | ||

| California (continued) | ||||

| Health — 11.4% | ||||

| ABAG Finance Authority for Nonprofit Corps, Refunding | ||||

| RB, Sharp Healthcare, 6.25%, 8/01/39 | $ | 5,000 | $ | 5,775,300 |

| ABAG Finance Authority for Nonprofit Corps, Sharp | ||||

| Healthcare, Refunding RB, Series A, 6.00%, 8/01/30 | 2,250 | 2,713,410 | ||

| California Health Facilities Financing Authority, RB: | ||||

| Adventist Health System, Series A, 5.00%, 3/01/33 | 3,190 | 3,212,585 | ||

| Providence Health Services, Series B, | ||||

| 5.50%, 10/01/39 | 3,970 | 4,387,208 | ||

| Sutter Health, Series A, 5.25%, 11/15/46 | 19,000 | 19,802,560 | ||

| Sutter Health, Series B, 6.00%, 8/15/42 | 9,655 | 11,122,946 | ||

| California Health Facilities Financing Authority, | ||||

| Refunding RB, Catholic Healthcare West, Series A, | ||||

| 6.00%, 7/01/34 | 3,700 | 4,268,172 | ||

| California Health Facilities Financing Authority Revenue | ||||

| Bonds, Series A Kaiser Permanente, 5.25%, 4/01/39 | 6,500 | 6,715,345 | ||

| California Statewide Communities Development | ||||

| Authority, RB: | ||||

| Health Facility Memorial Health Services, Series A, | ||||

| 6.00%, 10/01/23 | 4,915 | 5,107,914 | ||

| Kaiser Permanente, Series B, 5.25%, 3/01/45 | 6,100 | 6,312,341 | ||

| City of Newport Beach California, RB, Hoag Memorial | ||||

| Hospital Presbyterian, 6.00%, 12/01/40 | 3,820 | 4,545,456 | ||

| 73,963,237 | ||||

| State — 9.1% | ||||

| California State Public Works Board, RB, Department | ||||

| of Education, Riverside Campus Project, Series B, | ||||

| 6.50%, 4/01/34 | 3,670 | 4,234,079 | ||

| California State Public Works Board, RB, California State | ||||

| Prisons, Series C, 5.75%, 10/01/31 | 1,205 | 1,380,942 | ||

| State of California, GO: | ||||

| 6.00%, 3/01/33 | 5,800 | 6,889,356 | ||

| 6.00%, 4/01/38 | 28,265 | 32,805,207 | ||

| University of California, RB, Limited Project, Series D | ||||

| (NPFGC), 5.00%, 5/15/41 | 13,000 | 13,871,000 | ||

| 59,180,584 | ||||

| Transportation — 16.0% | ||||

| City of Fresno California, RB, Series B, AMT (AGM), | ||||

| 5.50%, 7/01/20 | 4,455 | 4,565,217 | ||

| City of San Jose California, RB: | ||||

| Series A-1, AMT, 6.25%, 3/01/34 | 1,400 | 1,614,816 | ||

| Series A-1, AMT, 5.25%, 3/01/23 | 2,985 | 3,315,738 | ||

| Series D (NPFGC), 5.00%, 3/01/28 | 5,000 | 5,127,000 | ||

| County of Orange California, RB, Series B, | ||||

| 5.75%, 7/01/34 | 6,345 | 7,140,282 | ||

| County of Sacramento California, RB: | ||||

| Senior Series A (AGC), 5.50%, 7/01/41 | 7,275 | 7,917,019 | ||

| Senior Series B, 5.75%, 7/01/39 | 2,650 | 2,924,249 | ||

| Senior Series B, AMT, (AGM), 5.25%, 7/01/33 | 19,525 | 20,791,196 | ||

| Senior Series B, AMT (AGM), 5.75%, 7/01/28 | 13,275 | 14,888,709 | ||

| Los Angeles Department of Airports, RB: | ||||

| Senior Series D, 5.25%, 5/15/29 | 2,590 | 3,000,308 | ||

| Series A, 5.25%, 5/15/39 | 2,775 | 3,088,658 | ||

| Los Angeles Department of Airports, Refunding RB, | ||||

| Senior, Series A, 5.00%, 5/15/35 | 2,945 | 3,284,971 | ||

| Los Angeles Harbor Department, RB, Series B, | ||||

| 5.25%, 8/01/34 | 5,530 | 6,284,568 | ||

| San Francisco City & County Airports Commission, RB, | ||||

| Series E, 6.00%, 5/01/39 | 9,650 | 11,182,420 | ||

| Par | ||||

| Municipal Bonds | (000) | Value | ||

| California (concluded) | ||||

| Transportation (concluded) | ||||

| San Francisco City & County Airports Commission, | ||||

| Refunding RB, Second Series 34E, AMT (AGM), | ||||

| 5.75%, 5/01/24 | $ | 5,000 | $ | 5,723,800 |

| San Joaquin County Transportation Authority, RB, Limited | ||||

| Tax, Measure K, Series A, 6.00%, 3/01/36 | 2,400 | 2,881,968 | ||

| 103,730,919 | ||||

| Utilities — 27.7% | ||||

| Anaheim Public Financing Authority, RB, Electric System | ||||

| Distribution Facilities, Series A, 5.38%, 10/01/36 | 2,200 | 2,534,026 | ||

| City of Escondido California, COP, Refunding, Series A | ||||

| (NPFGC), 5.75%, 9/01/24 | 465 | 466,795 | ||

| City of Los Angeles California, Refunding RB: | ||||

| Sub-Series A, 5.00%, 6/01/32 | 3,000 | 3,408,570 | ||

| Sub-Series A, 5.00%, 6/01/28 | 2,000 | 2,328,160 | ||

| Dublin-San Ramon Services District, Refunding RB, | ||||

| 6.00%, 8/01/41 | 4,000 | 4,739,200 | ||

| East Bay Municipal Utility District, Refunding RB, | ||||

| Sub-Series A (AMBAC), 5.00%, 6/01/33 | 6,545 | 7,178,687 | ||

| Eastern Municipal Water District, COP, Series H, | ||||

| 5.00%, 7/01/33 | 2,500 | 2,719,775 | ||

| Imperial Irrigation District, Refunding RB, System, | ||||

| 5.13%, 11/01/38 | 9,500 | 10,143,530 | ||

| Los Angeles Department of Water & Power, RB: | ||||

| 5.00%, 7/01/41 | 5,000 | 5,561,950 | ||

| Series A, 5.38%, 7/01/38 | 10,500 | 11,885,790 | ||

| System Series A, 5.25%, 7/01/39 | 16,000 | 18,326,080 | ||

| Metropolitan Water District of Southern California, RB, | ||||

| Series B-1 (NPFGC), 5.00%, 10/01/33 | 8,605 | 9,105,037 | ||

| Oxnard Financing Authority, RB (NPFGC): | ||||

| Project, 5.00%, 6/01/31 | 10,000 | 10,618,500 | ||

| Redwood Trunk Sewer & Headworks, Series A, | ||||

| 5.25%, 6/01/34 | 9,750 | 10,436,302 | ||

| Sacramento City Financing Authority California, | ||||

| Refunding RB (NPFGC), 5.00%, 12/01/29 | 8,775 | 9,159,608 | ||

| Sacramento Municipal Utility District, RB, Series R | ||||

| (NPFGC), 5.00%, 8/15/33 | 20,000 | 20,831,400 | ||

| San Diego Public Facilities Financing Authority, | ||||

| Refunding RB, Senior Series A: | ||||

| 5.25%, 5/15/34 | 1,000 | 1,136,460 | ||

| 5.25%, 5/15/39 | 3,165 | 3,550,877 | ||

| San Francisco City & County Public Utilities | ||||

| Commission, RB: | ||||

| Local Water Main Sub-Series C, 5.00%, 11/01/41 | 5,000 | 5,627,950 | ||

| Series A (NPFGC), 5.00%, 11/01/32 | 15,000 | 15,220,200 | ||

| Series B, 5.00%, 11/01/30 | 14,000 | 16,142,420 | ||

| Southern California Public Power Authority, Milford Wind | ||||

| Corridor Phase II, 5.25%, 7/01/28 | 6,980 | 8,304,036 | ||

| 179,425,353 | ||||

| Total Municipal Bonds in California | 664,230,178 | |||

| Puerto Rico — 0.4% | ||||

| County/City/Special District/School District — 0.4% | ||||

| Puerto Rico Sales Tax Financing Corp., RB, Series C, | ||||

| 6.00%, 8/01/39 (a) | 12,420 | 2,892,245 | ||

| Total Municipal Bonds in Puerto Rico | 2,892,245 | |||

| Total Municipal Bonds — 102.8% | 667,122,423 | |||

See Notes to Financial Statements.

| SEMI-ANNUAL REPORT | JANUARY 31, 2012 | 13 |

| Schedule of Investments (continued) | BlackRock MuniHoldings California Quality Fund, Inc. (MUC) |

| (Percentages shown are based on Net Assets) |

| Municipal Bonds Transferred to | Par | |||

| Tender Option Bond Trusts (b) | (000) | Value | ||

| California — 63.3% | ||||

| County/City/Special District/School District — 33.1% | ||||

| Alameda County Joint Powers Authority, Refunding RB, | ||||

| Lease (AGM), 5.00%, 12/01/34 | $ | 13,180 | $ | 14,214,366 |

| Contra Costa Community College District California, GO, | ||||

| Election of 2002 (NPFGC), 5.00%, 8/01/28 | 7,800 | 8,252,244 | ||

| Desert Community College District California, GO, | ||||

| Series C (AGM), 5.00%, 8/01/37 | 16,530 | 17,624,451 | ||

| Foothill-De Anza Community College District, GO, | ||||

| Series C, 5.00%, 8/01/40 | 10,000 | 11,152,100 | ||

| Los Angeles Community College District California, GO: | ||||

| Election of 2001, Series E-1, 5.00%, 8/01/33 | 11,770 | 12,982,663 | ||

| Election of 2003, Series E (AGM), 5.00%, 8/01/31 | 11,216 | 12,114,926 | ||

| Election of 2003, Series F-1, 5.00%, 8/01/33 | 10,000 | 11,030,300 | ||

| Election of 2008, Series A, 6.00%, 8/01/33 | 9,596 | 11,537,726 | ||

| Los Angeles Community College District California, | ||||

| GO, Series A, Election of 2001, Series A (NPFGC), | ||||

| 5.00%, 8/01/32 | 6,647 | 7,271,030 | ||

| Los Angeles County Metropolitan Transportation Authority, | ||||

| Refunding RB, Proposition A, First Tier, Senior Series A | ||||

| (AMBAC), 5.00%, 7/01/35 | 8,997 | 9,909,171 | ||

| Los Angeles County Sanitation Districts Financing | ||||

| Authority, Refunding RB, Capital Project 14 (BHAC), | ||||

| 5.00%, 10/01/34 | 7,917 | 8,369,388 | ||

| Ohlone Community College District, GO, Series B (AGM), | ||||

| 5.00%, 8/01/30 | 16,518 | 17,693,383 | ||

| Poway Unified School District, GO, Election of 2002, | ||||

| Improvement District 02, Series 1-B (AGM), | ||||

| 5.00%, 8/01/30 | 10,000 | 10,875,600 | ||

| San Bernardino Community College District California, | ||||

| GO, Election of 2002, Series C (AGM), 5.00%, 8/01/31 | 17,770 | 19,700,000 | ||

| San Diego Community College District California, GO, | ||||

| Election of 2002 (AGM), 5.00%, 5/01/30 | 12,549 | 13,759,804 | ||

| San Francisco Bay Area Rapid Transit District, Refunding | ||||

| RB, Series A (NPFGC), 5.00%, 7/01/30 | 23,100 | 25,365,186 | ||

| San Francisco Bay Area Transit Financing Authority, | ||||

| Refunding RB, Series A (NPFGC), 5.00%, 7/01/34 | 2,499 | 2,744,396 | ||

| 214,596,734 | ||||

| Education — 11.8% | ||||

| Chaffey Community College District, GO, Election | ||||

| of 2002, Series B (NPFGC), 5.00%, 6/01/30 | 9,905 | 10,577,930 | ||

| Los Rios Community College District, GO, Election | ||||

| of 2008, Series A, 5.00%, 8/01/35 | 11,000 | 12,127,610 | ||

| Mount Diablo California Uniform School District, GO, | ||||

| 5.00%, 6/01/31 | 4,000 | 4,190,240 | ||

| Riverside Community College District, GO, Election | ||||

| of 2004, Series C (NPFGC), 5.00%, 8/01/32 | 8,910 | 9,652,203 | ||

| University of California, RB: | ||||

| Limited Project, Series B (AGM), 5.00%, 5/15/33 | 17,397 | 18,218,783 | ||

| Limited Project, Series D (AGM), 5.00%, 5/15/41 | 8,000 | 8,536,000 | ||

| Series O, 5.75%, 5/15/34 | 11,190 | 13,166,714 | ||

| 76,469,480 | ||||

| Transportation — 1.6% | ||||

| San Mateo County Transportation Authority, Refunding | ||||

| RB, Series A (NPFGC), 5.00%, 6/01/32 | 10,000 | 10,515,900 | ||

| Utilities — 16.8% | ||||

| City of Napa California, RB (AMBAC), 5.00%, 5/01/35 | 9,100 | 9,776,130 | ||

| East Bay Municipal Utility District, RB, Sub-Series A | ||||

| (NPFGC), 5.00%, 6/01/35 | 12,070 | 13,359,317 | ||

| East Bay Municipal Utility District, Refunding RB, | ||||

| Sub-Series A (AMBAC), 5.00%, 6/01/37 | 14,510 | 15,691,840 | ||

| Los Angeles Department of Water & Power, RB, Power | ||||

| System (AGM): | ||||

| Sub-Series A-1, 5.00%, 7/01/31 | 4,993 | 5,326,218 | ||

| Sub-Series A-2, 5.00%, 7/01/35 | 7,500 | 8,007,075 | ||

| Municipal Bonds Transferred to | Par | ||||

| Tender Option Bond Trusts (b) | (000) | Value | |||

| California (concluded) | |||||

| Utilities (concluded) | |||||

| Metropolitan Water District of Southern California, RB, | |||||

| Series A (AGM), 5.00%, 7/01/35 | $ | 12,870 | $ | 14,197,026 | |

| Rancho Water District Financing Authority, Refunding RB, | |||||

| Series A (AGM), 5.00%, 8/01/34 | 5,008 | 5,472,223 | |||

| Sacramento Regional County Sanitation District, RB, | |||||

| Sacramento Regional County Sanitation (NPFGC), | |||||

| 5.00%, 12/01/36 | 4,500 | 4,798,845 | |||

| San Diego County Water Authority, COP, Series A (AGM), | |||||

| 5.00%, 5/01/31 | 4,000 | 4,233,040 | |||

| San Diego County Water Authority, COP, Refunding: | |||||

| Series 2002-A (NPFGC), 5.00%, 5/01/32 | 10,000 | 10,142,600 | |||

| Series 2008-A (AGM), 5.00%, 5/01/33 | 16,740 | 18,108,495 | |||

| 109,112,809 | |||||

| Total Municipal Bonds Transferred to | |||||

| Tender Option Bond Trusts — 63.3% | 410,694,923 | ||||

| Total Long-Term Investments | |||||

| (Cost — $1,005,772,469) — 166.1% | 1,077,817,346 | ||||

| Short-Term Securities | Shares | ||||

| BIF California Municipal Money Fund, | |||||

| 0.00% (c)(d) | 14,314,399 | 14,314,399 | |||

| Total Short-Term Securities | |||||

| (Cost — $14,314,399) — 2.2% | 14,314,399 | ||||

| Total Investments (Cost — $1,020,086,868) — 168.3% | 1,092,131,745 | ||||

| Other Assets Less Liabilities — 1.7% | 10,819,299 | ||||

| Liability for TOB Trust Certificates, Including Interest | |||||

| Expense and Fees Payable — (30.9)% | (200,060,576 | ) | |||

| AMPS, at Redemption Value — (39.1)% | (254,004,140 | ) | |||

| Net Assets Applicable to Common Shares — 100.0% | $ | 648,886,328 | |||

| (a) | Represents a zero-coupon bond. Rate shown reflects the current yield as of report date. |

| (b) | Securities represent bonds transferred to a TOB in exchange for which the Fund acquired residual interest certificates. These securities serve as collateral in a financing transaction. See Note 1 of the Notes to Financial Statements for details of municipal bonds transferred to TOBs. |

| (c) | Investments in companies considered to be an affiliate of the Fund during the period, for purposes of Section 2(a)(3) of the Investment Company Act of 1940, as amended, were as follows: |

| Shares Held | Shares Held | ||||

| at July 31, | Net | at January 31, | |||

| Affiliate | 2011 | Activity | 2012 | Income | |

| BIF California | |||||

| Municipal | |||||

| Money Fund | 7,347,551 | 6,966,848 | 14,314,399 | $ | 262 |

| (d) | Represents the current yield as of report date. |

| • | For Fund compliance purposes, the Fund’s sector classifications refer to any one or more of the sector sub-classifications used by one or more widely recognized market indexes or rating group indexes and/or as defined by Fund management. These definitions may not apply for purposes of this report, which may combine such sector sub-classifications for reporting ease. |

| • | Financial futures contracts sold as of January 31, 2012 were as follows: |

| Notional | Unrealized | ||||

| Contracts | Issue | Exchange | Expiration | Value | Depreciation |

| 10-Year US | Chicago Board | March | |||

| 75 | Treasury Note | of Trade | 2012 | $9,918,750 | $ (131,393) |

See Notes to Financial Statements.

| 14 | SEMI-ANNUAL REPORT | JANUARY 31, 2012 |

| Schedule of Investments (concluded) | BlackRock MuniHoldings California Quality Fund, Inc. (MUC) |

| • | Fair Value Measurements — Various inputs are used in determining the fair value of investments and derivative financial instruments. These inputs are categorized into a disclosure hierarchy consisting of three broad levels for financial statement purposes as follows: |

| • | Level 1 — unadjusted price quotations in active markets/exchanges for identical assets and liabilities |

| • | Level 2 — other observable inputs (including, but not limited to: quoted prices for similar assets or liabilities in markets that are active, quoted prices for identical or similar assets or liabilities in markets that are not active, inputs other than quoted prices that are observable for the assets or liabilities (such as interest rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks and default rates) or other market-corroborated inputs) |

| • | Level 3 — unobservable inputs based on the best information available in the circumstances, to the extent observable inputs are not available (including the Fund’s own assumptions used in determining the fair value of investments and derivative financial instruments) |

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. The categorization of a value determined for investments and derivative financial instruments is based on the pricing transparency of the investment and derivative financial instrument and does not necessarily correspond to the Fund’s perceived risk of investing in those securities. For information about the Fund’s policy regarding valuation of investments and derivative financial instruments and other significant accounting policies, please refer to Note 1 of the Notes to Financial Statements.

The following tables summarize the inputs used as of January 31, 2012 in determining the fair valuation of the Fund’s investments and derivative financial instruments:

| Valuation Inputs | Level 1 | Level 2 | Level 3 | Total |

| Assets: | ||||

| Investments: | ||||

| Long-Term | ||||

| Investments1 | — | $1,077,817,346 | — | $1,077,817,346 |

| Short-Term | ||||

| Securities | $14,314,399 | — | — | 14,314,399 |

| Total | $14,314,399 | $1,077,817,346 | — | $1,092,131,745 |

| 1 | See above Schedule of Investments for values in each sector. |

| Valuation Inputs | Level 1 | Level 2 | Level 3 | Total |

| Derivate Financial Instruments2 | ||||

| Liabilities: | ||||

| Interest rate | ||||

| contracts | $(131,393) | — | — | $(131,393) |

| 2 | Derivative financial instruments are financial futures contracts, which are valued at the unrealized appreciation/depreciation on the instrument. |

See Notes to Financial Statements.

| SEMI-ANNUAL REPORT | JANUARY 31, 2012 | 15 |

| Schedule of Investments January 31, 2012 (Unaudited) | BlackRock MuniHoldings New Jersey Quality Fund, Inc. (MUJ) |

| (Percentages shown are based on Net Assets) |

| Par | ||||

| Municipal Bonds | (000) | Value | ||

| New Jersey — 125.8% | ||||

| Corporate — 3.2% | ||||

| New Jersey EDA, RB, AMT: | ||||

| New Jersey American Water Co., Inc. Project, | ||||

| Series A (AMBAC), 5.25%, 11/01/32 | $ | 3,000 | $ | 3,061,530 |

| Waste Management of New Jersey, Series A, | ||||

| Mandatory Put Bonds, 5.30%, 6/01/15 (a) | 2,500 | 2,697,800 | ||

| New Jersey EDA, Refunding RB, AMT: | ||||

| New Jersey American Water Co., Inc. Project, | ||||

| Series A, AMT, 5.70%, 10/01/39 | 2,500 | 2,750,700 | ||

| New Jersey American Water Co., Inc. Project, | ||||

| Series B, 5.60%, 11/01/34 | 2,150 | 2,402,367 | ||

| 10,912,397 | ||||

| County/City/Special District/School District — 17.5% | ||||

| Borough of Hopatcong New Jersey, GO, Refunding, | ||||

| Sewer (AMBAC), 4.50%, 8/01/33 | 2,690 | 2,848,199 | ||

| City of Perth Amboy New Jersey, GO, CAB (AGM) (b): | ||||

| 5.22%, 7/01/32 | 4,605 | 4,792,700 | ||

| 5.23%, 7/01/33 | 1,395 | 1,446,266 | ||

| 5.27%, 7/01/37 | 1,470 | 1,507,206 | ||

| County of Middlesex New Jersey, COP, Refunding | ||||

| (NPFGC), 5.50%, 8/01/16 | 1,375 | 1,380,665 | ||

| County of Union New Jersey, GO: | ||||

| 4.00%, 3/01/29 | 2,590 | 2,833,356 | ||

| 4.00%, 3/01/30 | 2,590 | 2,800,955 | ||

| 4.00%, 3/01/31 | 2,925 | 3,131,944 | ||

| East Orange Board of Education, COP (AGM), | ||||

| 5.50%, 8/01/12 | 1,420 | 1,435,975 | ||

| Edgewater Borough Board of Education, GO (AGM): | ||||

| 4.25%, 3/01/34 | 1,235 | 1,370,319 | ||

| 4.25%, 3/01/35 | 1,300 | 1,433,510 | ||

| 4.30%, 3/01/36 | 1,370 | 1,509,480 | ||

| Essex County Improvement Authority, RB, County | ||||

| Correctional Facility Project, Series A (FGIC), | ||||

| 5.00%, 10/01/13 (c) | 4,400 | 4,744,300 | ||

| Essex County Improvement Authority, Refunding RB, | ||||

| Project Consolidation: | ||||

| (AMBAC), 5.25%, 12/15/18 | 1,000 | 1,218,800 | ||

| (NPFGC), 5.50%, 10/01/27 | 250 | 324,185 | ||

| (NPFGC), 5.50%, 10/01/28 | 4,840 | 6,283,724 | ||

| Hudson County Improvement Authority, RB: | ||||

| County Secured, County Services Building Project | ||||

| (AGM), 5.00%, 4/01/27 | 750 | 821,265 | ||

| Harrison Parking Facility Project, Series C (AGC), | ||||

| 5.25%, 1/01/39 | 2,000 | 2,213,300 | ||

| Harrison Parking Facility Project, Series C (AGC), | ||||

| 5.38%, 1/01/44 | 3,600 | 4,004,352 | ||

| Middlesex County Improvement Authority, RB, | ||||

| Senior Citizens Housing Project, AMT (AMBAC), | ||||

| 5.50%, 9/01/30 | 500 | 500,570 | ||

| Monmouth County Improvement Authority, RB, | ||||

| Governmental Loan (AMBAC): | ||||

| 5.35%, 12/01/17 | 5 | 5,016 | ||

| 5.38%, 12/01/18 | 5 | 5,016 | ||

| Morristown Parking Authority, RB (NPFGC): | ||||

| 5.00%, 8/01/30 | 1,830 | 1,993,950 | ||

| 5.00%, 8/01/33 | 3,000 | 3,231,150 | ||

| New Jersey State Transit Corp., COP, Subordinate, | ||||

| Federal Transit Administration Grants, Series A (AGM), | ||||

| 5.00%, 9/15/21 | 2,000 | 2,135,620 | ||

| Newark Housing Authority, RB, South Ward Police Facility | ||||

| (AGC), 6.75%, 12/01/38 | 275 | 338,508 | ||

| Newark Housing Authority, Refunding RB, Newark | ||||

| Redevelopment Project (NPFGC), 4.38%, 1/01/37 | 620 | 566,767 | ||

| Par | ||||

| Municipal Bonds | (000) | Value | ||

| New Jersey (continued) | ||||

| County/City/Special District/School District (concluded) | ||||

| South Jersey Port Corp., Refunding RB: | ||||

| 4.50%, 1/01/15 | $ | 3,750 | $ | 3,850,950 |

| 4.50%, 1/01/16 | 1,920 | 1,968,499 | ||

| 60,696,547 | ||||

| Education — 17.9% | ||||

| New Jersey EDA, RB, International Center For Public | ||||

| Health Project, University of Medicine and Dentistry | ||||

| (AMBAC), 6.00%, 6/01/32 | 5,000 | 5,006,450 | ||

| New Jersey Educational Facilities Authority, RB: | ||||

| Higher Education Capital Improvement, Series A | ||||

| (AMBAC), 5.13%, 9/01/12 (c) | 5,500 | 5,658,070 | ||

| Montclair State University, Series A (AMBAC), | ||||

| 5.00%, 7/01/21 | 1,200 | 1,326,012 | ||

| Montclair State University, Series A (AMBAC), | ||||

| 5.00%, 7/01/22 | 2,880 | 3,163,421 | ||

| Richard Stockton College, Series F (NPFGC), | ||||

| 5.00%, 7/01/31 | 2,625 | 2,767,170 | ||

| Rowan University, Series C (NPFGC), | ||||

| 5.00%, 7/01/14 (d) | 3,260 | 3,614,427 | ||

| Rowan University, Series C (NPFGC), | ||||

| 5.13%, 7/01/14 (c) | 3,615 | 4,018,868 | ||

| New Jersey Educational Facilities Authority, Refunding RB: | ||||

| College of New Jersey, Series D (AGM), | ||||

| 5.00%, 7/01/35 | 9,740 | 10,532,154 | ||

| Montclair State University, Series J (NPFGC), | ||||

| 4.25%, 7/01/30 | 3,775 | 3,872,735 | ||

| New Jersey Institute of Technology, Series H, | ||||

| 5.00%, 7/01/31 | 3,000 | 3,314,010 | ||

| Ramapo College, Series I (AMBAC), 4.25%, 7/01/31 | 1,250 | 1,285,287 | ||

| Ramapo College, Series I (AMBAC), 4.25%, 7/01/36 | 900 | 913,068 | ||

| Stevens Institute of Technology, Series A, | ||||

| 5.00%, 7/01/27 | 2,800 | 2,952,488 | ||

| Stevens Institute of Technology, Series A, | ||||

| 5.00%, 7/01/34 | 900 | 925,308 | ||

| William Paterson University, Series C (AGC), | ||||

| 5.00%, 7/01/28 | 250 | 278,055 | ||

| William Paterson University, Series C (AGC), | ||||

| 4.75%, 7/01/34 | 4,000 | 4,299,320 | ||

| Rutgers-State University of New Jersey, Refunding RB, | ||||

| Series F, 5.00%, 5/01/39 | 1,000 | 1,102,670 | ||

| University of Medicine & Dentistry of New Jersey, COP | ||||

| (NPFGC), 5.00%, 6/15/29 | 2,000 | 2,052,500 | ||

| University of Medicine & Dentistry of New Jersey, RB, | ||||

| Series A (AMBAC), 5.50%, 12/01/27 | 4,740 | 4,872,957 | ||

| 61,954,970 | ||||

| Health — 17.6% | ||||

| New Jersey Health Care Facilities Financing Authority, RB: | ||||

| AHS Hospital Corp., 6.00%, 7/01/41 | 3,080 | 3,617,398 | ||

| Greystone Park Psychiatric Hospital (AMBAC), | ||||