Exhibit 99.3

NASDAQ: QCOR Fourth Quarter and Full Year 2012 Conference Call

Conference Call Logistics Today’s webcast, accompanying slide presentation and archived replay is available online at http://ir.questcor.com/events.cfm Telephone replay is available by dialing: – U.S.: (855) 859-2056. – International: (404) 537-3406. – Passcode: 95427085 By webcast: At Questcor’s investor relations website: http://ir.questcor.com/

Safe Harbor Statement Note: Except for the historical information contained herein, this press release contains forward-looking statements that have been made pursuant to the Private Securities Litigation Reform Act of 1995. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as “believes,” “continue,” “could,” “estimates,” “expects,” “growth,” “may,” “plans,” “potential,” “remain,” “should,” “substantial” or “will” or the negative of such terms and other comparable terminology. These statements are only predictions. Actual events or results may differ materially. Factors that could cause or contribute to such differences include, but are not limited to, the following: Our reliance on Acthar for substantially all of our net sales and profits; Reductions in vials used per prescription resulting from changes in treatment regimens by physicians or patient compliance with physician recommendations; Our ability to receive strong levels of reimbursement from third party payers; The complex nature of our manufacturing process and the potential for supply disruptions or other business disruptions; The lack of patent protection for Acthar; and the possible FDA approval and market introduction of competitive products; Our ability to continue to generate revenue from sales of Acthar to treat current on-label therapeutic uses of Acthar, and our ability to develop other therapeutic uses for Acthar; Research and development risks, including risks associated with Questcor’s work in the area of NS and Lupus, and our reliance on third-parties to conduct research and development and the ability of research and development to generate successful results; The results of any pending or future litigation, investigations or claims, including with respect to the investigation by the United States Attorney’s Office for the Eastern District of Pennsylvania regarding the Company’s promotional practices and litigation brought by certain shareholders arising from the federal securities laws, currently pending in the United States District Court for the Central District of California; Our ability to comply with federal and state regulations, including regulations relating to pharmaceutical sales and marketing practices; Regulatory changes or other policy actions by governmental authorities and other third parties in connection with U.S. health care reform or efforts to reduce federal and state government deficits; An increase in the proportion of our Acthar unit sales comprised of Medicaid-eligible patients and government entities; Our ability to estimate reserves required for Acthar used by government entities and Medicaid-eligible patients and the impact that unforeseen invoicing of historical Medicaid prescriptions may have upon our results; Our ability to effectively manage our growth, including the expansion of our sales forces, and our reliance on key personnel; Our ability to integrate the BioVectra business with our business and to manage, and grow, a contract manufacturing business; Our ability to comply with foreign regulations related to the operation of BioVectra’s business; The impact to our business caused by economic conditions; Our ability to protect our proprietary rights; The risk of product liability lawsuits; Unforeseen business interruptions and security breaches; Volatility in Questcor’s monthly and quarterly Acthar shipments, estimated channel inventory, and end-user demand, as well as volatility in our stock price; Our ability and willingness to continue to pay our quarterly dividend or make future increases in our quarterly dividend; and other risks discussed in Questcor’s annual report on Form 10-K for the year ended December 31, 2011 as filed with the Securities and Exchange Commission, or SEC, on February 22, 2012, and other documents filed with the SEC. The risk factors and other information contained in these documents should be considered in evaluating Questcor’s prospects and future financial performance. Questcor’s

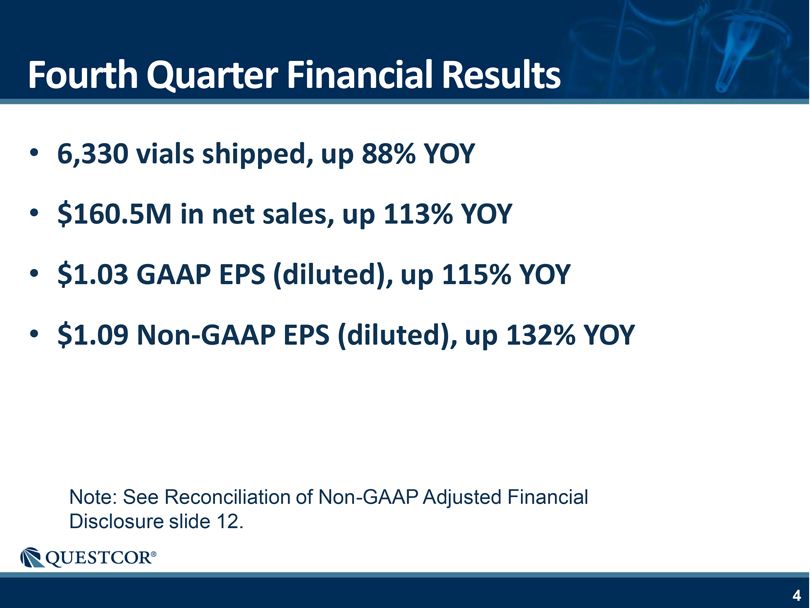

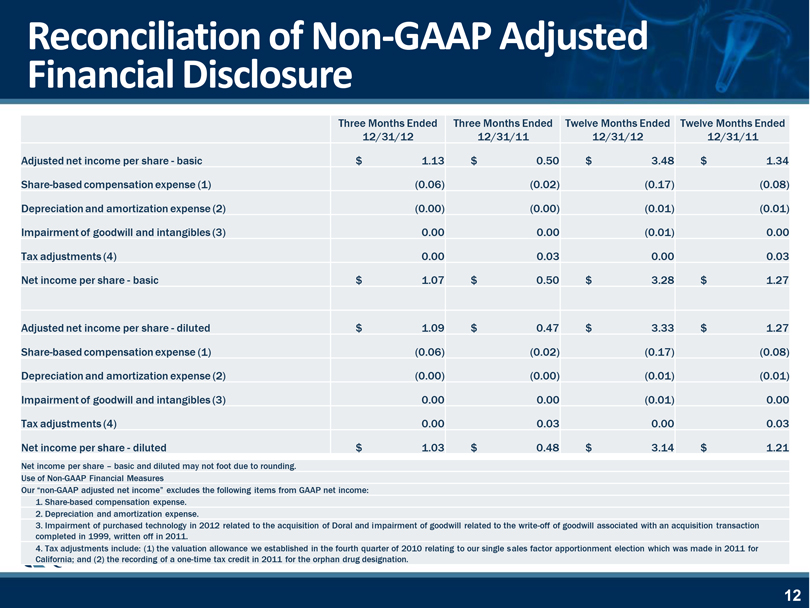

Fourth Quarter Financial Results 6,330 vials shipped, up 88% YOY $160.5M in net sales, up 113% YOY $1.03 GAAP EPS (diluted), up 115% YOY $1.09 Non-GAAP EPS (diluted), up 132% YOY Note: See Reconciliation of Non-GAAP Adjusted Financial Disclosure slide 12.

Full Year 2012 Financial Results 20,741 vials shipped, up 94% YOY $509.3M in net sales, up 133% YOY $3.14 GAAP EPS (diluted), up 160% YOY $3.33 Non-GAAP EPS (diluted), up 162% YOY Note: Note: See Reconciliation of Non-GAAP Adjusted Financial Disclosure slide 12.

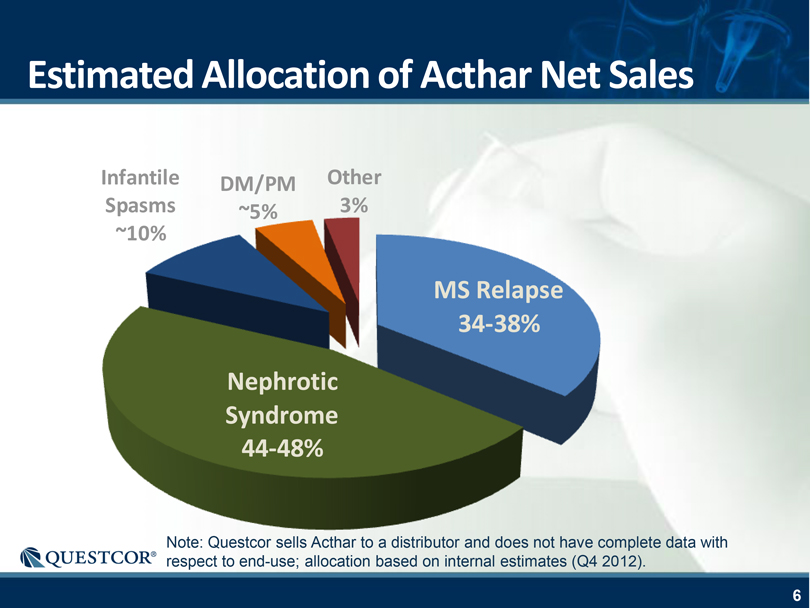

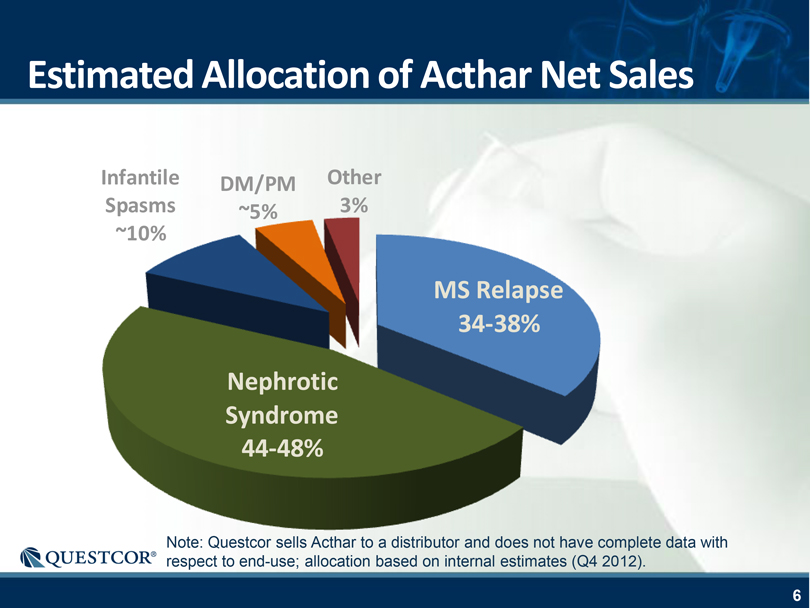

Estimated Allocation of Acthar Net Sales Infantile Spasms ~10% DM/PM ~5% Other 3% Nephrotic Syndrome 44-48% MS Relapse 34-38% Note: Questcor sells Acthar to a distributor and does not have complete data with respect to end-use; allocation based on internal estimates (Q4 2012).

Stable Reimbursement Environment MDs typically reserve Acthar for when another FDA-approved treatment alternative is needed, usually after first-line therapy – Serious, difficult-to-treat medical conditions Coverage decisions are determined on a case-by-case basis, considering patient condition, disease severity, and treatment history Consistent level of insurance coverage over last several years – Prior authorizations and close payer scrutiny continue to be the norm

The Emerging Science Behind Acthar Preclinical and Clinical Studies Understanding the biological properties of Acthar – Effect on specific biochemical pathways, cells, and tissues – Immunomodulation and anti-inflammatory effects Further research related to on-label indications – Lupus – Idiopathic Membranous Nephropathy Possible new indications to explore – Diabetic Nephropathy – Amyotrophic Lateral Sclerosis

Q4-2012 Financial Results Record Net Sales (up 113%) and GAAP EPS (up 115%) Q4 – 2012 Q4 – 2011 Net Sales ($M) $160.5 $75.5 Gross Profit ($M) $151.4 $71.5 Operating Income ($M) $94.8 $42.7 Fully Diluted, GAAP EPS $1.03 $0.48 Fully Diluted, Non-GAAP EPS $1.09 $0.47 Cash flow from operations (YTD $M) $219 $86 Diluted shares outstanding 60.3 66.6

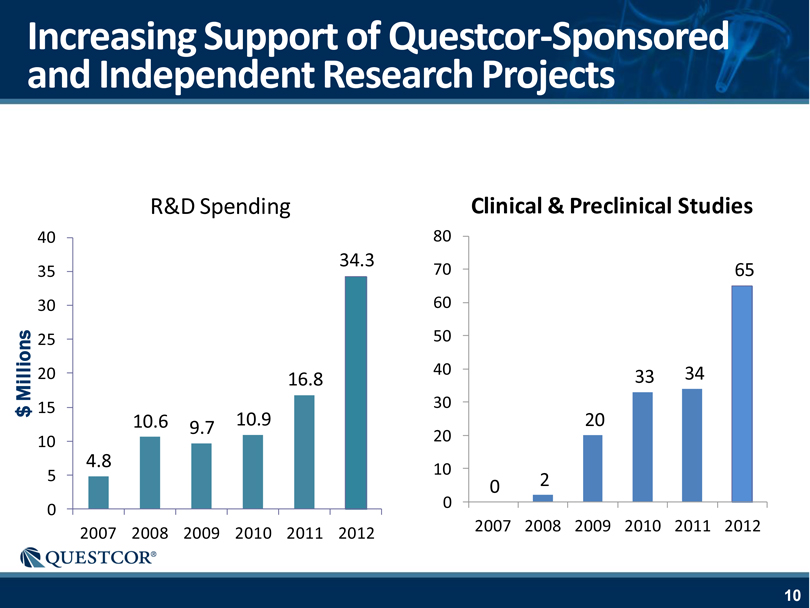

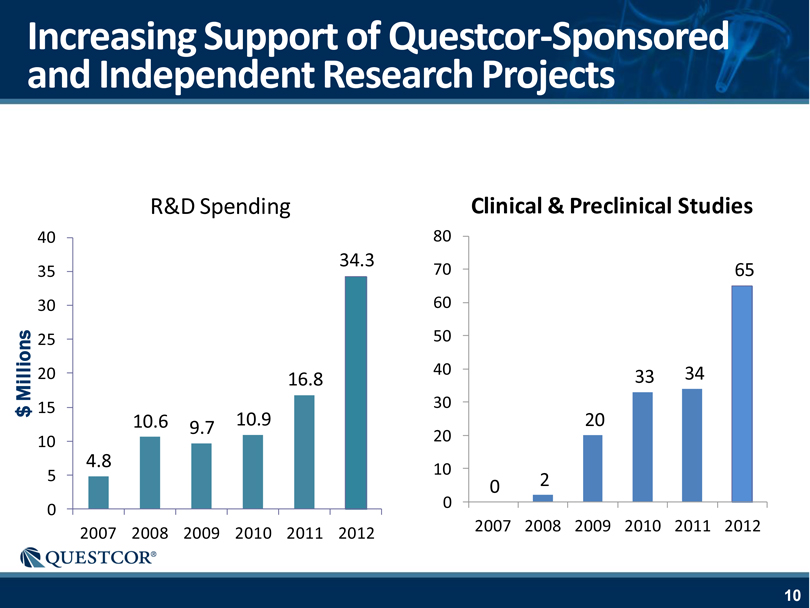

Increasing Support of Questcor-Sponsored and Independent Research Projects R&D Spending Clinical & Preclinical Studies $ Millions 40 35 30 25 20 15 10 5 0 2007 2008 2009 2010 2011 2012 80 70 60 50 40 30 20 10 0 2007 2008 2009 2010 2011 2012 4.8 10.6 10.9 9.7 16.8 34.3 0 2 33 34 20

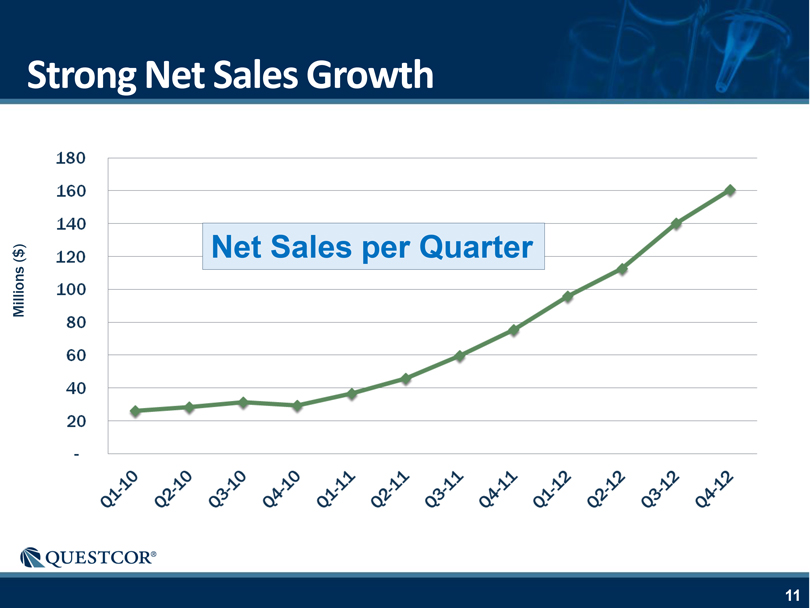

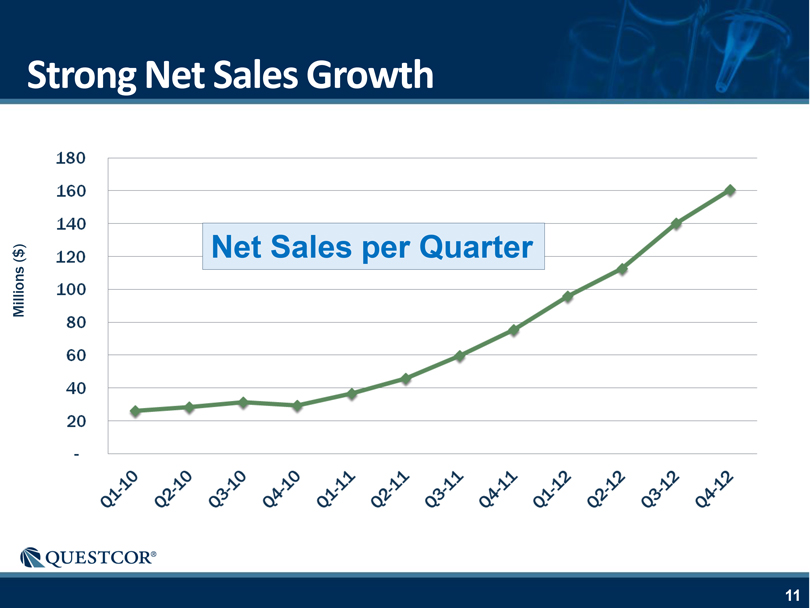

Strong Net Sales Growth 180 160 140 120 100 80 60 40 20— Q1-10 Q2-10 Q3-10 Q4-10 Q1-11 Q2-11 Q3-11 Q4-11 Q1-12 Q2-12 Q3-12 Q4-12 Net Sales per Quarter Millions ($)

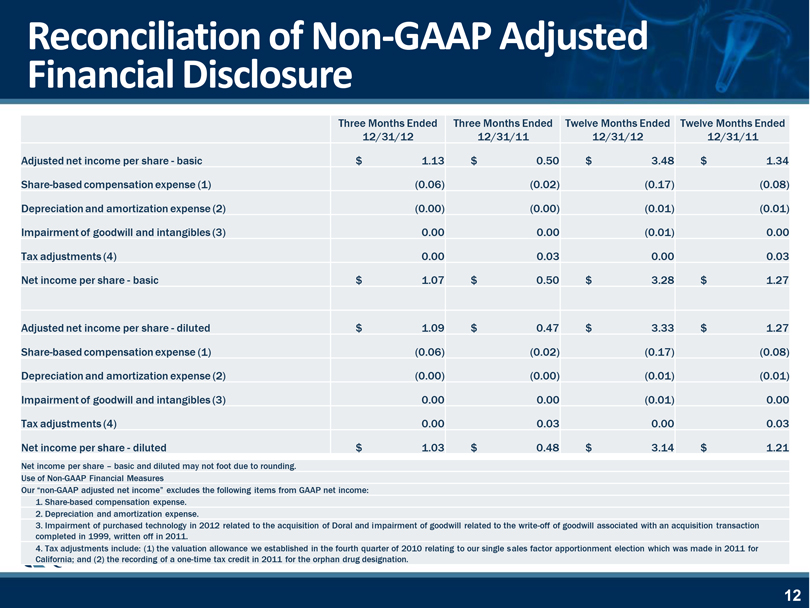

Reconciliation of Non-GAAP Adjusted Financial Disclosure Three Months Ended Three Months Ended Twelve Months Ended Twelve Months Ended 12/31/12 12/31/11 12/31/12 12/31/11 Adjusted net income per share—basic $ 1.13 $ 0.50 $ 3.48 $ 1.34 Share-based compensation expense (1)(0.06)(0.02)(0.17)(0.08) Depreciation and amortization expense (2)(0.00)(0.00)(0.01)(0.01) Impairment of goodwill and intangibles (3) 0.00 0.00(0.01) 0.00 Tax adjustments (4) 0.00 0.03 0.00 0.03 Net income per share—basic $ 1.07 $ 0.50 $ 3.28 $ 1.27 Adjusted net income per share—diluted $ 1.09 $ 0.47 $ 3.33 $ 1.27 Share-based compensation expense (1)(0.06)(0.02)(0.17)(0.08) Depreciation and amortization expense (2)(0.00)(0.00)(0.01)(0.01) Impairment of goodwill and intangibles (3) 0.00 0.00(0.01) 0.00 Tax adjustments (4) 0.00 0.03 0.00 0.03 Net income per share—diluted $ 1.03 $ 0.48 $ 3.14 $ 1.21 Net income per share – basic and diluted may not foot due to rounding. Use of Non-GAAP Financial Measures Our “non-GAAP adjusted net income” excludes the following items from GAAP net income: 1. Share-based compensation expense. 2. Depreciation and amortization expense. 3. Impairment of purchased technology in 2012 related to the acquisition of Doral and impairment of goodwill related to the write-off of goodwill associated with an acquisition transaction completed in 1999, written off in 2011. 4. Tax adjustments include: (1) the valuation allowance we established in the fourth VB quarter of 2010 relating to our single sales factor apportionment election which was made in 2011 for California; and (2) the recording of a one-time tax credit in 2011 for the orphan drug designation.

NASDAQ: QCOR Fourth Quarter and Full Year 2012 Conference Call