UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

x Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Pursuant to §240.14a-12

Plains Exploration & Production Company

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| | 1) | Title of each class of securities to which transaction applies: |

| | 2) | Aggregate number of securities to which transaction applies: |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | Proposed maximum aggregate value of transaction: |

¨ Fee paid previously with preliminary materials.

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | Amount Previously Paid: |

| | 2) | Form, Schedule or Registration Statement No.: |

PXP

700 Milam, Suite 3100

Houston, Texas 77002

Telephone: (713) 579-6000

March 29, 2007

Dear PXP Stockholder:

You are cordially invited to our Annual Stockholders’ Meeting on Thursday, May 3, 2007, at 9:00 a.m., Central Standard Time. The meeting will be held in the Fairfield Room of the Four Seasons Hotel, 1300 Lamar Street, Houston, Texas, 77010.

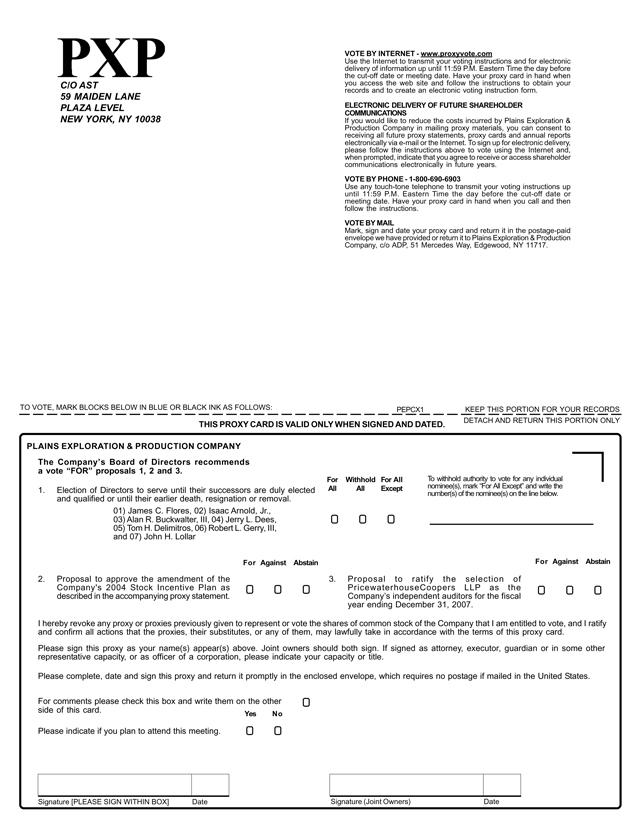

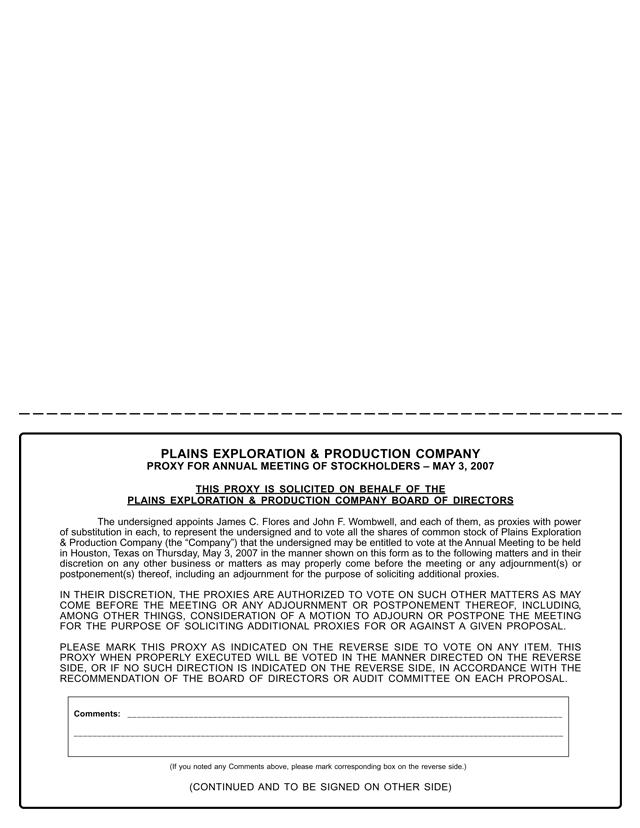

At the annual meeting you will be asked to elect seven directors to our board of directors, to consider and vote upon proposed amendments to PXP’s 2004 Stock Incentive Plan and to ratify the appointment of PricewaterhouseCoopers LLP as our independent auditors for the 2007 fiscal year.

We have enclosed a copy of our Annual Report for the fiscal year ended December 31, 2006 with this Notice of Annual Meeting of Stockholders and Proxy Statement. Please read the enclosed information carefully before completing and returning the enclosed proxy card.

Please join us on May 3. Whether or not you plan to attend, it is important that you vote your proxy promptly in accordance with the instructions on the enclosed proxy card. If you do attend the annual meeting, you may, of course, withdraw your proxy should you wish to vote in person.

|

Sincerely, |

|

|

James C. Flores Chairman of the Board, President and Chief Executive Officer |

PXP

700 Milam, Suite 3100

Houston, Texas 77002

(713) 579-6000

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 3, 2007

To the Stockholders of Plains Exploration & Production Company:

NOTICE IS HEREBY GIVEN that the annual meeting of stockholders of Plains Exploration & Production Company will be held at the Four Seasons Hotel, 1300 Lamar Street, Houston, Texas, 77010, in the Fairfield Room, on May 3, 2007 at 9:00 a.m., Central Standard Time, for the following purposes:

| | 1. | to elect seven nominees to the board of directors to serve until their successors are duly elected and qualified or until their earlier death, resignation or removal; |

| | 2. | to consider and vote upon proposed amendments to PXP’s 2004 Stock Incentive Plan, including to increase the number of common shares that may be granted under the plan from 5,000,000 to 8,400,000; |

| | 3. | to ratify the selection of PricewaterhouseCoopers LLP as our independent auditors for the fiscal year ending December 31, 2007; and |

| | 4. | to transact such other business incident to the conduct of the meeting as may properly come before the meeting or any adjournments or postponements thereof. |

PXP knows of no other matters to come before the annual meeting. Only stockholders of record at the close of business on March 22, 2007 are entitled to notice of, and to vote at, the annual meeting or at any adjournments or postponements thereof. Each share of PXP common stock is entitled to one vote per share. The election of directors requires the affirmative vote of a plurality of shares of PXP common stock present and entitled to vote. The approval of certain amendments to PXP’s 2004 Stock Incentive Plan requires the affirmative vote of the majority of votes cast on the proposal, provided that the total votes cast represents a majority of all shares of PXP common stock entitled to vote. The ratification of PricewaterhouseCoopers LLP as our independent auditors for 2007 requires the affirmative vote of a majority of the shares of PXP common stock present and voting. A complete list of stockholders entitled to vote at the annual meeting will be available for examination at PXP’s offices in Houston, Texas during normal business hours by any holder of PXP common stock for any purpose relevant to the annual meeting for a period of ten days prior to the annual meeting. Such list will also be available at the annual meeting and any PXP stockholder may inspect it for any purpose relevant to the annual meeting.

|

By Order of the Board of Directors, |

|

John F. Wombwell Executive Vice President, General Counsel and Secretary |

Houston, Texas

March 29, 2007

Your vote is important. Even if you plan to attend the annual meeting in person, we request that you sign and return the enclosed proxy or voting instruction card and thus ensure that your shares will be represented at the annual meeting if you are unable to attend. If you do attend the annual meeting and wish to vote in person, you may withdraw your proxy and vote in person.

PXP

700 Milam, Suite 3100

Houston, Texas 77002

Telephone: (713) 579-6000

PROXY STATEMENT

This proxy statement and accompanying proxy card are being mailed beginning March 29, 2007 in connection with the solicitation of proxies by the board of directors of Plains Exploration & Production Company for the Annual Meeting of Stockholders to be held on May 3, 2007.

The enclosed proxy is solicited by the board of directors of PXP. You may vote your shares by completing and returning the proxy card or, alternatively, calling a toll-free telephone number or using the Internet as described on the proxy card. The proxy may be revoked at any time before it is voted by submitting written notice of revocation to the secretary of the Company or by submitting another timely proxy by telephone, internet or mail. Unless revoked, shares represented by proxies will be voted at the meeting. The proposals listed in this proxy statement constitute the only business that the board of directors intends to present or is informed that others will present at the meeting. The proxy does, however, confer discretionary authority upon the persons named therein, or their substitutes, to vote on any other business that may properly come before the meeting.

Each share of common stock is entitled to one vote. No other securities are entitled to be voted at the annual meeting. Only stockholders of record at the close of business on March 22, 2007 are entitled to notice of, and to vote at, the meeting. As of the close of business on March 22, 2007, PXP had 72,498,189 shares of common stock outstanding. A majority of outstanding shares entitled to vote, represented in person or by proxy at the meeting, constitutes a quorum. Abstentions and broker non-votes are counted as shares represented at the meeting for purposes of determining whether a quorum exists. Abstentions and broker non-votes will have no effect on any proposal brought at the annual meeting. Unless you indicate otherwise on your proxy card, the persons named as your proxies will vote your shares FOR all of the nominees for director named in this proxy statement, FOR the amendments to PXP’s 2004 Stock Incentive Plan and FOR the ratification of PricewaterhouseCoopers LLP as our independent auditors.

We have retained Georgeson Shareholder Communications Inc. to solicit proxies from our stockholders at an estimated fee of $7,500, plus expenses. Some of our directors, officers and employees may also solicit proxies personally, without any additional compensation, by telephone or mail. Proxy materials also will be furnished without cost to brokers and other nominees to forward to the beneficial owners of shares held in their names. The Company will bear the expenses incurred in connection with the solicitation of proxies.

ELECTION OF DIRECTORS

At the annual meeting, PXP stockholders will elect seven individuals to serve as directors. The bylaws of PXP authorize a board of directors consisting of at least three members, with the exact number of directors being a number (not less than three) that may be determined from time to time by PXP’s board of directors. Our current board of directors consists of Messrs. Flores, Arnold, Buckwalter, Dees, Delimitros, Gerry and Lollar. Each of the nominees is currently a member of our board of directors. The directors are elected to hold office until the next annual stockholder meeting in 2008 and until his successor is duly elected and qualified, or until his earlier death, resignation or removal.

1

The nominees have consented to be nominated and have expressed their intent to serve if elected. The PXP board has no reason to believe that any of the nominees will be unable to serve if elected to office and, to the knowledge of the PXP board, the nominees intend to serve the entire term for which election is sought. Only the nominees or substitute nominees designated by the board of directors will be eligible to stand for election as directors at the annual meeting. See “Stockholder Proposals” on page 10 for information regarding the procedures for stockholders to submit director nominations.

The individuals named as proxies will vote the enclosed proxy for the election of all nominees, unless you direct them to withhold your votes. Although PXP does not expect this to occur, if any nominee becomes unable to serve as a director before the annual meeting, the persons named as proxies have the discretionary authority to vote for substitute nominees proposed by the PXP board.The election of directors requires the affirmative vote of a plurality of shares of PXP common stock present and entitled to vote.The PXP board of directors recommends you vote to approve all nominees.

The following table sets forth certain information as of March 22, 2007 regarding our present directors and executive officers. They hold office until their successors are duly elected and qualified, or until their earlier death, removal or resignation from office.

| | | | |

Name

| | Age

| | Title

|

James C. Flores | | 47 | | Chairman of the Board, President and Chief Executive Officer |

Isaac Arnold, Jr. | | 71 | | Director |

Alan R. Buckwalter, III | | 60 | | Director |

Jerry L. Dees | | 67 | | Director |

Tom H. Delimitros | | 66 | | Director |

Robert L. Gerry III | | 69 | | Director |

John H. Lollar | | 68 | | Director |

Doss R. Bourgeois | | 49 | | Executive Vice President—Exploration & Production |

Winston M. Talbert | | 44 | | Executive Vice President and Chief Financial Officer |

John F. Wombwell | | 45 | | Executive Vice President, General Counsel and Secretary |

The following biographies describe the business experience of PXP’s directors and executive officers:

James C. Flores, Chairman of the Board, President and Chief Executive Officer and a Director since September 2002. He has been Chairman of the Board and Chief Executive Officer of PXP since December 2002, and President since March 2004. He was also Chairman of the Board of Plains Resources, Inc. (“Plains Resources,” now known as Vulcan Energy Corporation) from May 2001 to June 2004 and is currently a director of Vulcan Energy. He was Chief Executive Officer of Plains Resources from May 2001 to December 2002. He was Co-founder as well as Chairman, Vice Chairman and Chief Executive Officer at various times from 1992 until January 2001 of Ocean Energy, Inc., an oil and gas company.

Isaac Arnold, Jr., Director since May 2004.He also was a director of Nuevo Energy Company from 1990 to May 2004. Mr. Arnold currently serves as Chairman of the Board of Quintana Petroleum Corporation. He has been a director of Legacy Holding Company since 1989 and Legacy Trust Company since 1997 and is currently Director Emeritus of both. He has been a director of Cullen Center Bank & Trust since its inception in 1969 and has been a director of Cullen/Frost Bankers, Inc. and is currently Director Emeritus of both. Mr. Arnold is a trustee of the Museum of Fine Arts Houston and The Texas Heart Institute. Mr. Arnold received his B.B.A. from the University of Houston in 1959.

Alan R. Buckwalter, III, Director since March 2003. He retired in January 2003 as Chairman of JPMorgan Chase Bank, South Region, a position he had held since 1998. From 1990 to 1998 he was President of Texas Commerce Bank—Houston, the predecessor entity of JPMorgan Chase Bank. Prior to 1990 Mr. Buckwalter held various executive management positions within the organization. Mr. Buckwalter currently

2

serves on the boards of Service Corporation International, the Texas Medical Center, Greater Houston Area Red Cross, University of St. Thomas and St. Luke’s Hospital System. He sits on the Audit Committee and is Chairman of the Compensation Committee for Service Corporation International.

Jerry L. Dees, Director since September 2002. He also was a director of Plains Resources from 1997 to December 2002. Mr. Dees has been a director of Geotrace Technologies, Inc. since 2005. He retired in 1996 as Senior Vice President, Exploration and Land, for Vastar Resources, Inc. (previously ARCO Oil and Gas Company), a position he had held since 1991.

Tom H. Delimitros, Director since September 2002. He also was a director of Plains Resources from 1988 to December 2002. He has been a General Partner of AMT Venture Funds, a venture capital firm, since 1989. He is also a director of Tetra Technologies, Inc., a publicly traded energy services company. He currently serves as Chairman for three privately owned companies. Previously, he has served as President and CEO for Magna Corporation, (now Baker Petrolite, a unit of Baker Hughes). From 1983 to 1988, Mr. Delimitros was a General Partner of Sunwestern Investment Funds and Senior Vice President of Sunwestern Management, Inc.

Robert L. Gerry, III, Director since May 2004.He was also a director of Nuevo from 1990 to May 2004. He has been chairman and chief executive officer of Vaalco Energy, Inc., a publicly traded independent oil and gas company which does not compete with PXP, since 1997. From 1994 to 1997, Mr. Gerry was vice chairman of Nuevo. Prior to that, he was president and chief operating officer of Nuevo since its formation in 1990. Mr. Gerry also currently serves as a trustee of Texas Children’s Hospital.

John H. Lollar, Director since September 2002. He also was a director of Plains Resources from 1995 to December 2002. He has been the Managing Partner of Newgulf Exploration L.P. since December 1996. He is also a director of Lufkin Industries, Inc., a manufacturing firm, where he is a member of the Compensation Committee and Chairman of the Audit Committee. Mr. Lollar was Chairman of the Board, President and Chief Executive Officer of Cabot Oil & Gas Corporation from 1992 to 1995, and President and Chief Operating Officer of Transco Exploration Company from 1982 to 1992.

Doss R. Bourgeois, Executive Vice President—Exploration and Production since June 2006. He was PXP’s Vice President of Development from April 2006 to June 2006. He was also PXP’s Vice President Eastern Development Unit from May 2003 to April 2006. Prior to that time, Mr. Bourgeois was Vice President from August 1993 to May 2003 at Ocean Energy, Inc.

Winston M. Talbert, Executive Vice President and Chief Financial Officer since June 2006. He joined PXP in May 2003 as Vice President Finance & Investor Relations and in May 2004, Mr. Talbert became Vice President Finance & Treasurer. Prior to joining PXP, Mr. Talbert was Vice President and Treasurer at Ocean Energy, Inc. from August 2001 to May 2003 and Assistant Treasurer from October 1999 to August 2001.

John F. Wombwell, Executive Vice President, General Counsel and Secretary since September 2003. He was also Plains Resources’ Executive Vice President, General Counsel, and Secretary from September 2003 to June 2004. He was previously a Senior Executive Officer with two New York Stock Exchange traded companies, serving as General Counsel of ExpressJet Holdings, Inc. from April 2002 until September 2003 and prior to joining ExpressJet, Mr. Wombwell was General Counsel of Integrated Electrical Services, Inc. from January 1998 to April 2002. Prior to that time, Mr. Wombwell was a partner at the national law firm of Andrews Kurth LLP with a practice focused on representing public companies with respect to corporate and securities matters.

3

Committees of the Board of Directors

PXP’s board has established an audit committee, an organization & compensation committee and a nominating & corporate governance committee. Our board may establish other committees from time to time to facilitate the Company’s management. The composition of the committees is determined by the board of directors in its sole discretion. During 2006, PXP’s board held twelve meetings. No director attended fewer than 75% of the total number of meetings of PXP’s board and committees on which he served.

PXP’s audit committee currently consists of Messrs. Buckwalter, Delimitros, Gerry and Lollar, with Mr. Delimitros acting as chairman. Our audit committee selects PXP’s independent auditors to be engaged by the Company, reviews the plan, scope and results of PXP’s annual audit, and reviews PXP’s internal controls and financial management policies with our independent auditors. During 2006, our audit committee held five meetings. All of the members of PXP’s audit committee are non-employee directors, and the board has determined that a majority of the members of the audit committee, including Mr. Delimitros, are “audit committee financial experts” as defined in Item 407(d)(5) of Regulation S-K.

PXP’s organization & compensation committee currently consists of Messrs. Dees, Delimitros and Lollar, with Mr. Lollar acting as chairman. Our organization & compensation committee reviews and sets the chief executive officer’s compensation, establishes guidelines and standards relating to the determination of executive compensation, reviews executive compensation policies and determines compensation for PXP’s other officers. In evaluating executive officer pay, the organization & compensation committee may retain the services of a compensation consultant and consider recommendations from the chief executive officer with respect to goals and compensation of the other executive officers. The organization & compensation committee engaged Longnecker & Associates to assist it with compensation decisions in 2006. Longnecker was generally engaged to (i) provide an updated review of the market competitiveness for the total compensation packages and long-term incentives for the officers of PXP, (ii) prepare tally sheets to highlight the total reward dollars for the executive officers, including all components of compensation, benefits, severance and change-in-control payments; and (iii) provide updated review of board compensation against current industry standards taking into account recent changes in the governance climate and recommend actions to attract and retain outstanding board talent. The organization & compensation committee assesses the information it receives in accordance with its business judgment. The organization & compensation committee also periodically reviews director compensation.

PXP’s organization & compensation committee also administers the Company’s equity compensation plans and determines the number of shares covered by, and terms of, grants to executive officers and key employees. The committee, however, has authorized the chief executive officer to grant up to 100,000 SARS and/or restricted stock units to non-officer employees, primarily newly hired employees. The organization & compensation committee also periodically reviews compensation and equity-based plans and makes its recommendations to the board with respect to these areas.

All of the members of our compensation committee are non-employee directors. During 2006, PXP’s organization & compensation committee held two meetings.

PXP’s nominating & corporate governance committee currently consists of Messrs. Arnold, Dees and Lollar, with Mr. Dees acting as chairman. Our nominating & corporate governance committee identifies and evaluates candidates for election as directors, nominates the slate of directors for election by PXP’s stockholders, and develops and recommends PXP’s corporate governance principles to the full board. During 2006, our nominating & corporate governance committee held one meeting.

PXP’s board of directors, in its business judgment, has determined that all current members of each of its committees are “independent” as defined in the NYSE governance rules and the applicable rules of the Securities and Exchange Commission. See the further discussion of directors’ independence below under “Director Nomination Process and Nominee Independence.”

4

PXP encourages all board members to attend the annual meeting. The directors of PXP may be introduced and acknowledged at the annual meeting. All of the directors attended the Company’s 2006 annual meeting.

Our non-management directors meet regularly in executive session. There is not one single non-management director who has been chosen to preside over executive sessions of PXP’s board of directors. The presiding director at each such session rotates among non-management members, in order of seniority of board service, such that the most senior non-management board member shall serve as presiding director at a session, the second most senior non-management member shall serve as presiding director at the next session, and so forth, with members of equal seniority serving in order of age, with the oldest serving first.

Compensation Committee Interlocks and Insider Participation

None of the members of our organization & compensation committee has at any time been one of our officers or employees. None of our executive officers currently serves, or in the past year has served, as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving on our board of directors or organization & compensation committee.

Director Nomination Process and Nominee Independence

Director Nomination Process. The PXP board of directors approves PXP’s director nominees based on the recommendation of the nominating & corporate governance committee. Each member of the nominating & corporate governance committee is a member of the PXP board of directors who satisfies the NYSE’s “independence” standards.

As provided in our bylaws, the number of directors on the PXP board of directors may from time to time be fixed by resolution of the board of directors; however, the board of directors may not be comprised of less than three directors. The nominating & corporate governance committee identifies nominees in various ways. The committee considers current directors that have expressed interest in and that continue to satisfy the criteria for serving on the PXP board of directors. The results of the PXP board of directors’ annual self-evaluation process is also an important consideration for board tenure. Current directors and members of PXP’s management may propose other nominees for the PXP board of directors, and the nominating & corporate governance committee may consider these individuals. From time to time, the committee may engage a third party search firm to assist in identifying potential director nominees as well.

The nominating & corporate governance committee also will consider any nominations received by the secretary of PXP from a stockholder of record on or before the 120th calendar day before the one-year anniversary date of the release of these proxy materials to stockholders. Any such stockholder nominations must be accompanied by all information relating to such person that is required under the federal securities laws, including such person’s written consent to be named in the proxy statement as a nominee and to serving as a director on the PXP board of directors if elected. The nominating stockholder must also submit the name, age, business address and residence of the person the stockholder wishes to nominate; the principal occupation or employment of the person; the relevant biographical information of the person; and the number of shares of PXP common stock beneficially owned by the person. The nominating stockholder must also submit its name and address, as well as that of the beneficial owner if applicable, and the class and number of shares of PXP common stock that are owned beneficially and of record by such stockholder and such beneficial owner.

All PXP director nominees are evaluated according to the PXP nominating & corporate governance committee director qualification guidelines. These guidelines provide that qualifications for consideration as a director include a high level of leadership experience in business activities and a personal and professional reputation consistent with the image and reputation of PXP. Further, the guidelines provide that all PXP directors

5

should have a breadth of knowledge about the issues affecting PXP and experience on boards of directors of other, preferably public, companies. Under the guidelines, PXP directors should have the ability to devote sufficient time to carrying out the duties as member of the PXP board of directors and accordingly, are required to limit their number of public company directorships to no more than six. Additionally, the independence of a potential board nominee is considered, as well as the diversity of background and experience, including with respect to age, gender and race. Finally, each director must have the appropriate knowledge and experience so that each director is able to be a productive member of the PXP board of directors. The nominating & corporate governance committee routinely seeks a diverse group of candidates who possess the background, skills and expertise to make a significant contribution to the board, to PXP and its stockholders. PXP encourages and supports director education programs for its directors.

Each of the seven director nominees set forth in this proxy statement and the accompanying proxy card are current directors standing for re-election.

Nominee Independence. The PXP board of directors has determined that all of the nominees standing for election at the PXP annual meeting, other than Mr. Flores, are independent of PXP because such nominees have no material relationship with PXP, either directly or as a partner, stockholder or affiliate of an organization that has a relationship with PXP. The board has made this determination based on the following:

Other than Mr. Flores, no nominee for director is or has been within the last three years an officer or employee of PXP or its subsidiaries or affiliates;

No nominee for director has an immediate family member who is or has been within the last three years an officer of PXP or its subsidiaries or has any current or past material relationship with PXP;

No nominee for director, other than Mr. Flores, has worked for, consulted with, been retained by, or received more than $100,000 in direct compensation from PXP aside from his or her compensation as a director;

No nominee for director or any immediate family member of the nominee is, or was within the past three years, a partner of or employed by the independent auditors for PXP;

No executive officer of PXP has served on the compensation committee or the board of directors of any corporation that employs a nominee for director or a member of the immediate family of any nominee for director in the last three years;

No nominee for director is an executive officer or employee, or an immediate family member of an executive officer, of any entity which PXP’s annual sales to or purchases from exceeded the greater of $1 million or 2% of either entity’s annual revenues for the last three years; and

No nominee for director serves as an executive officer of a charitable or non-profit organization to which PXP or its subsidiaries made charitable contributions or payments in fiscal year 2006 that exceeded the greater of $1 million or 2% of the organization’s consolidated gross revenues.

Board and Committee Governing Documents

Our board has established Corporate Governance Guidelines and the audit committee, nominating & corporate governance committee and the organization & compensation committee have adopted charters, copies of which are available at our website atwww.pxp.com. Our board has also established a Policy Concerning Corporate Ethics and Conflicts of Interest, a copy of which is also available at our website athttp://www.pxp.com/governance. Should there by any, we intend to post amendments to and waivers of our Policy Concerning Corporate Ethics and Conflicts of Interest (to the extent applicable to our principal executive officer, our principal financial officer and our principal accounting officer) at this location on our website. These documents are also available in print to any stockholder upon request by writing to the Corporate Secretary, Plains Exploration & Production Company, 700 Milam, Suite 3100, Houston, Texas 77002.

6

Stockholder and Other Interested Party Communications with Directors

We recognize the importance of providing its stockholders and other interested parties with the ability to communicate with members of PXP’s board of directors. Stockholders and other interested parties may send correspondence to PXP’s board of directors, including the non-management members as a group or to any individual director, at the following address: Plains Exploration & Production Company, Attn: General Counsel, 700 Milam, Suite 3100, Houston, Texas 77002. Correspondence may be sent by e-mail tohotline@pxp.com.

Your communication should indicate if you are a stockholder of the Company. All communications will be received by the General Counsel. Depending on the subject matter, the General Counsel will either forward the communication to the director or directors to whom it is addressed, attempt to handle the inquiry directly, or not forward the communication if it is primarily commercial in nature or if it relates to an improper or irrelevant topic. The General Counsel will maintain copies of each communication received not marked confidential. Communications marked confidential will not be opened prior to forwarding to the board or any individual director. The General Counsel also will coordinate with the board or individual director, as applicable, to facilitate an appropriate response to each communication received.

This policy may be amended from time to time with the consent of our nominating & corporate governance committee, consistent with requirements of applicable laws, rules and regulations.

Stock Ownership Policy

Our directors are required to own shares of PXP common stock with a value equal to three times their annual retainer. All executive officers are required to own shares of PXP common stock with a value equal to three times their annual salary, or, for the Chief Executive Officer, with a value equal to five times his annual salary.

7

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following tables sets forth information regarding the beneficial ownership of PXP common stock as of March 22, 2007 by each director and named executive officer of PXP during 2006, all current executive officers and directors as a group, and each person known by PXP to own beneficially more than 5% of the outstanding shares of PXP common stock.

Beneficial ownership has been determined in accordance with applicable securities laws, under which a person is deemed to be the beneficial owner of securities if he or she has or shares voting power or investment power with respect to such securities or has the right to acquire beneficial ownership within 60 days.

Unless otherwise indicated, to the knowledge of PXP, the persons listed in the table below have sole voting and investment powers with respect to the shares indicated. The address of the PXP directors and current executive officers is 700 Milam Street, Suite 3100, Houston, Texas 77002.

The percentages are based on 72,498,189 shares of PXP common stock issued and outstanding as of March 22, 2007.

| | | | | | |

Name and Address of Beneficial Owner

| | Amount and

Nature of

Beneficial

Ownership

| | | Percent

of Class

| |

Isaac Arnold, Jr. | | 178,560 | (1) | | * | |

Doss R. Bourgeois | | 38,482 | (2) | | * | |

Alan R. Buckwalter, III | | 40,550 | (3) | | * | |

Jerry L. Dees | | 44,905 | (4) | | * | |

Tom H. Delimitros | | 35,876 | (5) | | * | |

James C. Flores | | 1,609,831 | (6) | | 2.2 | % |

Robert L. Gerry III | | 91,854 | (7) | | * | |

John H. Lollar | | 51,805 | (5) | | * | |

Winston M. Talbert | | 28,584 | (8) | | * | |

John F. Wombwell | | 157,573 | (9) | | * | |

Cynthia A. Feeback | | 37,306 | (10) | | * | |

Thomas M. Gladney | | 338,354 | (11) | | * | |

Stephen A. Thorington | | 189,960 | (12) | | * | |

Directors and Executive Officers as a group (10 persons) | | 2,278,020 | (13) | | 3.1 | % |

FMR Corp. | | 11,658,600 | (14) | | 16.1 | % |

BlackRock, Inc. | | 5,516,937 | (15) | | 7.6 | % |

Third Point LLC | | 5,500,000 | (16) | | 7.6 | % |

| * | Represents less than 1%. |

| (1) | Includes 7,000 shares held by the Arnold Corporation. Also includes 10,000 shares of restricted stock that will vest within 60 days. |

| (2) | Includes 13,334 shares subject to restricted stock units that will vest within 60 days. |

| (3) | Includes 550 shares held as UGMA custodian for his children. Also includes 10,000 shares of restricted stock that will vest within 60 days. |

| (4) | Includes 10,000 shares of restricted stock that will vest within 60 days. |

| (5) | Includes 10,000 shares subject to restricted stock units that will vest within 60 days. |

| (6) | 1,000,000 of these shares are held directly by Sable Management, L.P., the general partner of which is Sable Management, LLC, of which Mr. Flores is the sole member, and 199 shares are held in a 401(k) account. The number above also includes 76,667 shares subject to restricted stock units that will vest within 60 days. |

| (7) | These shares include vested options to acquire 37,941 shares of PXP common stock and 10,000 shares of restricted stock that will vest within 60 days. |

8

| (8) | Includes 11,667 shares subject to restricted stock units that will vest within 60 days. |

| (9) | Includes 38,334 shares subject to restricted stock units that will vest within 60 days. |

| (10) | Includes 1,808 shares held in a 401(k) account and 13,334 shares subject to restricted stock units that vest within 60 days. |

| (11) | Mr. Gladney resigned from the Company on June 26, 2006. This information is based on Mr. Gladney’s Form 4 filed on April 3, 2006, together with information available to the Company prior to Mr. Gladney’s resignation. Also includes 630 shares held in a 401(k) account. |

| (12) | Mr. Thorington retired from the Company on April 11, 2006. This information is based on Mr. Thorington’s Form 4 filed on April 3, 2006, together with information available to the Company prior to Mr. Thorington’s retirement. |

| (13) | Excludes shares held by Ms. Feeback and Messrs. Gladney and Thorington as they are not currently executive officers. |

| (14) | Based on the Schedule 13G/A filed by FMR Corp. with the SEC on February 14, 2007, Fidelity Management & Research Company (“Fidelity”), a wholly owned subsidiary of FMR Corp., is the beneficial owner of 10,784,300 shares, or 14.9% of the outstanding shares, as a result of acting as investment adviser to various investment companies. Each of Edward C. Johnson 3d and FMR Corp. has sole power to dispose of the 10,784,300 shares owned by the Fidelity Funds. Neither Edward C. Johnson 3d nor FMR Corp. has the sole power to vote such shares. Fidelity Management Trust Company (“Fidelity Trust”), a wholly owned subsidiary of FMR Corp., is the beneficial owner of 25,200 shares as a result of acting as investment adviser to the institutional accounts. Each of Edward C. Johnson 3d and FMR Corp. has sole voting and dispositive power over such 25,200 shares owned by Fidelity Trust. Pyramis Global Advisors Trust Company (“PGATC”), a wholly owned subsidiary of FMR Corp., is the beneficial owners of 542,800 shares as a result of serving as investment manager of institutional accounts. Each of Edward C. Johnson 3d and FMR Corp. has sole dispositive power over such 542,800 shares owned by PGATC and sole voting power over 480,300 of such shares owned by the institutional accounts managed by PGATC. Fidelity International Limited (“FIL”) is the beneficial owner of 306,300 shares. The address of Fidelity and Fidelity Trust is 82 Devonshire Street, Boston, Massachusetts 02109. The address of PGATC is 53 State Street, Boston, Massachusetts 02109. The address of FIL is Pembroke Hall, 42 Crow Lane, Hamilton, Bermuda. |

(15) | Based on the Schedule 13G filed by BlackRock, Inc. (“BlackRock”) with the SEC on February 13, 2007, BlackRock is the beneficial owner of 5,516,937 shares or 7.6% of the outstanding shares, as a result of being the parent holding company for a number of investment management subsidiaries. BlackRock has shared voting power with respect to all of these shares. The address of BlackRock is 40 East 52nd Street, New York, New York 10022. |

(16) | Based on the Schedule 13G/A filed by Third Point LLC and Daniel S. Loeb with the SEC on February 13, 2007, Third Point LLC (“Third Point”) is the beneficial owners of 5,500,000 shares, or 7.6% of the outstanding shares, as a result of acting as investment adviser to various hedge funds and managed accounts. Mr. Loeb is Chief Executive Officer of Third Point and controls its business activities. Each of Third Point LLC and Daniel S. Loeb have shared voting and dispositive power over the shares owned by the hedge funds and managed accounts. The address of Third Point and Mr. Loeb is 390 Park Avenue, 18th Floor, New York, New York 10022. |

9

STOCKHOLDER PROPOSALS

Our corporate secretary must receive stockholders’ proposals intended to be presented at our 2008 annual stockholders’ meeting at our principal executive office on or before November 30, 2007 to be considered for inclusion in its proxy statement and form of proxy for the meeting. Pursuant to Rule 14a-4(c)(1) under the Exchange Act, if our corporate secretary receives any stockholder proposal at PXP’s principal executive office before February 13, 2008 but after November 30, 2007, that is intended to be presented at PXP’s 2008 annual meeting without inclusion in its proxy statement for the meeting, the proxies designated by PXP’s board will have discretionary authority to vote on such proposal.

AMENDMENT AND RESTATEMENT OF

PXP 2004 STOCK INCENTIVE PLAN PROPOSAL

Approval of the Amended and Restated 2004 Stock Incentive Plan

Our board of directors approved the amendment and restatement of the PXP 2004 Stock Incentive Plan in February 2007, subject to stockholder approval. The key amendments to the plan are summarized below. The full text of the Amended and Restated 2004 Stock Incentive Plan is attached as Annex A.

The 2004 Stock Incentive Plan

The PXP stockholders approved the PXP 2004 Stock Incentive Plan, or the Current 2004 Plan, in May 2004. PXP now seeks stockholder approval of the Amended and Restated 2004 Stock Incentive Plan, or the Amended 2004 Plan, to provide for certain amendments as described below. Approval of the Amended 2004 Plan requires the affirmative vote of the majority of votes cast on the proposal, provided that the total votes cast represents a majority of all shares of PXP common stock entitled to vote.

Proposed Amendments to the Current 2004 Stock Plan

The chart below summarizes the material amendments included in the Amended 2004 Plan. The following summary is qualified in its entirety by reference to the complete text of the Amended 2004 Plan, which is attached as Annex A.

| | | | |

Plan Provision

| | Current 2004 Plan

| | Amended 2004 Plan

|

Shares Authorized | | 5,000,000 shares. | | 8,400,000 shares. |

| | |

Limitations of Awards | | Maximum aggregate number of shares that may be granted as Restricted Stock Awards or Restricted Stock Units, other than shares of Restricted Stock made in settlement of Performance Units, is 5,000,000. Maximum aggregate number of shares that may be granted as Incentive Stock Options is 5,000,000. | | Maximum aggregate number of

shares that may be granted as

Restricted Stock Awards or

Restricted Stock Units, other

than shares of Restricted Stock

made in settlement of

Performance Units, is

8,400,000. Maximum aggregate number of

shares that may be granted as

Incentive Stock Options is

8,400,000. |

10

| | | | |

Plan Provision

| | Current 2004 Plan

| | Amended 2004 Plan

|

| | |

Grant limitations | | Options, SARs, Restricted Stock, Restricted Stock Units, Performance Awards, Other Stock-Based Awards: Maximum number of shares that may be granted to any one individual in any one calendar year period is 300,000. | | Options, SARs, Restricted Stock,

Restricted Stock Units,

Performance Awards, Other

Stock-Based Awards: Maximum

number of shares that may be

granted to any one individual in

any one calendar year period is

500,000; provided, however,

that pursuant to existing

agreements, in the event of a

change in control, the maximum

number of shares that may be

the subject of options and

awards granted to any one

individual in such year may

exceed 500,000 shares but may

not in any event exceed

2,500,000. |

The Amended 2004 Plan provides for the grant of stock options (including incentive stock options, as defined in Section 422 of the Internal Revenue Code of 1986, as amended, or the Code, and non-qualified stock options) and other awards (including stock appreciation rights (SARs), performance units, performance shares, restricted stock and other stock-based awards) to PXP’s directors, officers and employees, individuals to whom PXP has extended written offers of employment, and our consultants and advisors. Our organization & compensation committee, described below, will administer the Amended 2004 Plan. Our organization & compensation committee may grant options and SARs on such terms, including vesting and payment forms, as it deems appropriate in its discretion; however, generally no option or SAR may be exercised more than 10 years after its grant, and the purchase price for incentive stock options and non-qualified stock options may not be less than 100% of the fair market value of PXP common stock on the date of grant. The committee may grant other awards on such terms and conditions as it may in its discretion decide.

Upon an event constituting a “change in control” (as defined in the Amended 2004 Plan) of PXP, all options and SARs will become immediately exercisable in full. In addition, in such an event, unless otherwise determined by our organization & compensation committee, all other awards will vest and all restrictions on such awards will lapse.

Number of Shares Available. The maximum number of shares that may be made the subject of options and awards granted under the Amended 2004 Plan is 8,400,000, including all shares subject to options and awards granted prior to the effective date of the Amended 2004 Plan, all of which may be made the subject of either restricted stock awards or restricted stock units or may be issued upon the exercise of incentive stock options. In addition, the maximum number of shares that may be the subject of options and awards granted to a participant in any one year is 500,000; provided, however, that pursuant to currently existing agreements, in the event of a change in control, the maximum number of shares that may be the subject of options and awards granted to a participant in such year may exceed 500,000, but may not in any event exceed 2,500,000 shares. The maximum dollar amount of cash or the fair market value of shares that any participant may receive in any calendar year in respect of performance units denominated in dollars may not exceed $1,000,000.

Administration. The plan is administered by a committee appointed by the board of directors of PXP, constituted so as to comply with Rule 16b-3 under the Exchange Act, and, to the extent necessary with respect to performance awards and options, with Section 162(m) of the Code.

11

The committee has the power to make regulations and guidelines for and to interpret the Amended 2004 Plan and to determine who is to receive options and awards under the Amended 2004 Plan. No member of the committee will be liable for any actions made in good faith with respect to the Amended 2004 Plan. PXP has agreed to indemnify each member of the committee administering the Amended 2004 Plan for all costs and expenses.

Eligibility. All directors, officers, employees and consultants of PXP, its subsidiaries and affiliates, and any individual to whom PXP, its subsidiaries or its affiliates has extended a formal written offer of employment, are eligible for the Amended 2004 Plan. We currently have 7 directors, 20 officers and approximately 600 employees that would be eligible to receive awards under the Amended 2004 Plan.

Stock Options

Exercise Price.The purchase price or the manner in which the exercise price is to be determined for shares under each option will be determined by the committee and set forth in the option agreement. However, the exercise price per share under each option may not be less than 100% of the fair market value of a share on the date the option is granted (110% in the case of an incentive stock option granted to an eligible individual who possesses more than 10% of the total combined voting power of all classes of stock of PXP, its subsidiaries or affiliates).

Exercise of option.Each option will become exercisable in such installments (which need not be equal) and at such times as the committee designates and sets forth in the option agreement. To the extent not exercised, installments will accumulate and be exercisable, in whole or in part, at any time after becoming exercisable, but no later than the date the option expires. The committee may accelerate the exercisability of any option.

Term of option.The committee will determine the term of the options, provided that an option will not be exercised after the expiration of ten years from the date it was granted (five years in the case of an incentive stock option granted to an individual who possesses more than 10% of the total combined voting power of all classes of stock of PXP, its subsidiaries or affiliates).

Transferability.Rights under any option may not be transferred except by will or the laws of descent and distribution. The committee, however, may provide that the option may be transferred to members of the optionee’s immediate family or to trusts solely for the benefit of such immediate family members.

Stock Appreciation Rights

General.Each stock appreciation right, or SAR, is evidenced by a SAR agreement between PXP and the grantee. The committee specifies in each SAR agreement the number of covered shares, the exercise price and the vesting schedule. Upon exercise of a vested SAR, the grantee receives cash. Options may be granted in combination with SARs, or SARs may be added to outstanding options at any time after the grant. SARs may also be granted independently of options. A SAR permits the grantee to receive the appreciation in the value of the optioned stock directly from PXP in cash. The amount payable upon exercise of a SAR is measured by the difference between the fair market value of the common stock at exercise and the exercise price under the SAR. Generally, SARs coupled with options may be exercised at any time after the underlying options vest. Upon exercise of a SAR coupled with an option, the corresponding portion of the related option will be surrendered and cannot thereafter be exercised. Conversely, upon exercise of an option to which a SAR is attached, the SAR may no longer be exercised to the extent that the corresponding option has been exercised.

Exercise of SAR.Each SAR will become exercisable in such installments (which need not be equal) and at such times as the committee may designate and set forth in the SAR agreement. To the extent not exercised, installments will accumulate and be exercisable, in whole or in part, at any time after becoming exercisable, but not later than the date the SAR expires. The committee may accelerate the exercisability of any SAR.

12

Term of SAR.The committee will determine the term of SARs but the term may not exceed ten years.

Transferability.Rights under any award may not be transferred except by will or the laws of descent and distribution. The committee, however, may provide that the SARs may be transferred to members of the grantee’s immediate family, or to trusts solely for the benefit of such immediate family members.

Restricted Stock

Grant.The committee may grant awards of restricted stock to eligible individuals, which will be evidenced by an agreement between PXP and the grantee setting out the applicable restrictions on, and terms and conditions of, the restricted stock.

Treatment of Dividends.At the time of grant, the committee may determine that the payment to the grantee of dividends declared or paid on such shares by PXP will be (a) deferred until the lapsing of the restrictions and (b) held by PXP for the account of the grantee until such time.

Lapse of Restrictions.Restrictions on shares of restricted stock will lapse at such times and on such terms as the committee determines. Unless the committee determines otherwise at the time of the grant of an award of restricted stock, the restrictions upon shares of restricted stock lapse upon a change in control of PXP.

Transferability.Until all restrictions upon the shares of restricted stock awarded to a grantee have lapsed, such shares and retained dividends may not be sold, pledged, transferred or otherwise disposed of.

Restricted Stock Units

General.A restricted stock unit is a right to receive a share of PXP common stock or a cash amount equal to the fair market value of one share of PXP common stock, as determined by the committee and the agreement between PXP and the grantee receiving such restricted stock unit.

Grant.The committee may grant awards of restricted stock units to the eligible individuals, which will be evidenced by an agreement between PXP and the grantee. Each agreement will contain such restrictions, terms and conditions as the committee in its discretion determines.

Rights of grantees.Until all restrictions upon the restricted stock units have lapsed, the grantee will not be a stockholder of PXP, nor have any of the rights or privileges of a stockholder of PXP, including voting rights and rights to receive dividends.

Vesting.Restricted stock units and any related securities, cash dividends or other property credited to the restricted stock unit account will vest at the time and on the terms as the committee determines. Unless the committee determines otherwise at the time of the grant, the restricted stock units will vest upon a change in control of PXP.

Transferability.Until all restrictions upon the restricted stock units awarded to a grantee have lapsed, the restricted stock units and any related securities, cash dividends or other property credited to a restricted stock unit account may not be sold, pledged, transferred or otherwise disposed of.

Performance Awards

General.The committee may grant awards of performance units and/or awards of performance shares. Performance units may be denominated in shares or a specific dollar amount and, contingent upon the attainment of specified performance objectives within the performance cycle, represent the right to receive specified payments. The maximum dollar amount of cash or the fair market value of the shares that any participant may

13

receive in any calendar year in respect of performance units denominated in dollars is $1,000,000. A grantee becomes vested with respect to the performance units to the extent that the performance objectives set forth in the agreement are satisfied for the performance cycle. Regarding performance shares, the committee will provide the time(s) at which the actual shares represented by such award will be issued in the name of the grantee; provided, however, that no performance shares will be issued until the grantee has executed an agreement evidencing the award, the appropriate blank stock powers and, if required, an escrow agreement and any other documents.

Performance Objectives.Performance objectives for performance awards may include any of the following: (i) revenue, (ii) net income, (iii) operating income; (iv) earnings per share, (v) share price, (vi) pre-tax profits, (vii) net earnings, (viii) return on equity or assets, (ix) sales, (x) market share, (xi) total shareholder return, (xii) total shareholder return relative to peers or (xiii) any combination of the foregoing. Performance objectives may be in respect of the performance of the Company, any of its subsidiaries or affiliates, any of its divisions or segments or any combination thereof. Performance objectives may be absolute or relative (to prior performance of the Company or to the performance of one or more other entities or external indices), and may be expressed in terms of a progression within a specified range. The performance objectives with respect to a performance cycle shall be established in writing by the committee by the earlier of (x) the date on which a quarter of the performance cycle has elapsed or (y) the date which is ninety (90) days after the commencement of the performance cycle, and in any event while the performance relating to the performance objectives remain substantially uncertain.

Transferability.Until all restrictions upon the performance shares awarded to a grantee have lapsed, the performance shares may not be sold, pledged, transferred or otherwise disposed of, nor will they be delivered to the grantee. The committee may impose such other restrictions and conditions on the performance shares, if any, it deems appropriate.

Capital Changes

If PXP common stock changes because of any stock split, reverse stock split, stock dividend, combination, reclassification or other similar change in capital structure, appropriate adjustments will be made in the number of shares remaining available for future grant under the Amended 2004 Plan, the maximum number of options and SARs that may be granted to an individual in a fiscal year, the number of shares covered by each option and SAR and the exercise price under each option and SAR.

Liquidation, Dissolution or Reorganization

If PXP is party to a merger or other reorganization or is liquidated or dissolved, awards under the Amended 2004 Plan will be subject to the agreement of merger or reorganization or plan of liquidation or dissolution. Subject to the applicable change in control provisions set forth in the Amended 2004 Plan or any individual award, the agreement may provide for continuation of the awards by the surviving company, the assumption or substitution of the outstanding awards by the surviving company, full exercisability or vesting and accelerated expiration of the outstanding awards, or settlement of the full value of awards in cash or cash equivalents followed by cancellation.

Amendment and Termination of the Plan

The PXP board of directors may amend, alter, suspend or terminate the Amended 2004 Plan. However, PXP will obtain stockholder approval for any amendment to the Amended 2004 Plan to the extent necessary to comply with any applicable law. No action by the PXP board or stockholders may alter or impair any award previously granted under the Amended 2004 Plan without the written consent of the grantee. Unless terminated earlier, the Amended 2004 Plan automatically terminates ten years from its effective date.

14

Stock Plan Benefits Table

The following table presents information about the options, warrants and rights and other equity compensation under our equity plans as of December 31, 2006. The table does not include information about the Amended 2004 Plan or about tax qualified plans such as our 401(k) plan:

| | | | | | | | | | |

Plan category(1)

| | Number of shares

to be issued upon

exercise of

outstanding

options, warrants

and rights

| | | Weighted-

average

exercise

price of

outstanding

options,

warrants

and rights

| | | Number of shares

remaining available

for future issuance

under equity

compensation plans

(excluding

securities reflected

in column (a))

| |

| | | (a) | | | (b) | | | (c) | |

Plans approved by stockholders(2) | | 2,522,729 | (3) | | $ | 15.8329 | (4) | | 1,089,325 | (5) |

| (1) | PXP does not have any options, warrants or rights outstanding or available for issuance under any non-stockholder approved equity compensation plans. |

| (2) | Consists of our 2002 Stock Incentive Plan and 2004 Stock Incentive Plan. Also consists of the Nuevo Energy Company 1993 Stock Incentive Plan, Nuevo Energy Company 1999 Stock Incentive Plan and the Nuevo Energy Company 2001 Stock Incentive Plan (the “Nuevo Plans”), each of which PXP assumed the obligations under in connection with the Nuevo merger in May 2004 which was approved by PXP stockholders. |

| (3) | Includes 98,392 shares which may be issued upon exercise of options outstanding under the Nuevo Plans. The remaining 2,424,337 shares are subject to outstanding restricted stock units. |

| (4) | Consists solely of options outstanding under the Nuevo Plans. |

| (5) | Consists solely of shares available for issuance under our 2002 Stock Incentive Plan and 2004 Stock Incentive Plan. |

Certain Federal Income Tax Consequences

The following discussion is a general summary of the principal federal income tax consequences under current law relating to awards granted to employees under the Amended 2004 Plan. The summary is not intended to be exhaustive and, among other things, does not describe state, local or foreign income and other tax consequences.

Stock Options.An optionee will not recognize any taxable income upon the grant of a nonqualified stock option or an incentive stock option and PXP will not be entitled to a tax deduction with respect to such grant. Generally, upon exercise of a nonqualified stock option, the excess of the fair market value of common stock on the date of exercise over the exercise price will be taxable as ordinary income to the optionee. Subject to any deduction limitation under Section 162(m) of the Code, PXP will generally be entitled to a federal income tax deduction in the same amount and at the same time as the optionee recognizes ordinary income, (which is discussed below). The subsequent disposition of shares acquired upon the exercise of a nonqualified option will ordinarily result in capital gain or loss.

On exercise of an incentive stock option, the holder will not recognize any income and PXP will not be entitled to a deduction. However, for purposes of the alternative minimum tax, the exercise of an incentive stock option will be treated as an exercise of a nonqualified stock option. Accordingly, the exercise of an incentive stock option may result in an alternative minimum tax liability.

The disposition of shares acquired upon exercise of an incentive stock option will ordinarily result in capital gain or loss. However, if the holder disposes of shares acquired upon exercise of an incentive stock option within two years after the date of grant or one year after the date of exercise (a “disqualifying disposition”), the holder will recognize ordinary income in the amount of the excess of the fair market value of the shares on the date the option was exercised over the option exercise price (or, in certain circumstances, the gain on sale, if less). Any

15

excess of the amount realized by the holder on the disqualifying disposition over the fair market value of the shares on the date of exercise of the option will generally be capital gain. Subject to any deduction limitation under Section 162(m) of the Code, PXP will generally be entitled to a federal income tax deduction in the same amount and at the same time as the optionee recognizes ordinary income.

If an option is exercised through the use of shares previously owned by the holder, such exercise generally will not be considered a taxable disposition of the previously owned shares and thus no gain or loss will be recognized with respect to such shares upon such exercise. However, if the option is an incentive stock option, and the previously owned shares were acquired on the exercise of an incentive stock option or other tax-qualified stock option, and the holding period requirement for those shares is not satisfied at the time they are used to exercise the option, such use will constitute a disqualifying disposition of the previously owned shares resulting in the recognition of ordinary income in the amount described above.

Special rules may apply in the case of an optionee who is subject to Section 16 of the Exchange Act.

SARs.In general, a grantee would realize no taxable income upon the grant of SARs. Upon the exercise of a SAR, the grantee will include in ordinary income an amount equal to any cash received. Subject to any deduction limitation under Section 162(m) of the Code, PXP will generally be entitled to a federal income tax deduction in the same amount and at the same time as the participant recognizes ordinary income.

Restricted Stock.A grantee generally will not recognize taxable income upon the grant of restricted stock, and the recognition of any income will be postponed until such shares are no longer subject to the restriction or the risk of forfeiture. When either the restrictions or the risk of forfeiture lapses, the grantee will recognize ordinary income equal to the fair market value of the restricted stock at the time that such restrictions lapse and, subject to any deduction limitation under Section 162(m) of the Code, PXP will generally be entitled to a federal income tax deduction in the same amount and at the same time as the grantee recognizes ordinary income. A grantee may elect to be taxed at the time of the grant of restricted stock and, if this election is made, the grantee will recognize ordinary income equal to the excess of the fair market value of the restricted stock at the time of grant (determined without regard to any of the restrictions thereon) over the amount paid, if any, by the grantee for such shares. PXP will generally be entitled to a federal income tax deduction in the same amount and at the same time as the grantee recognizes ordinary income.

Restricted Stock Unit.Generally, a grantee will not realize taxable income upon the grant of restricted stock units. Upon vesting, the participant would include in ordinary income an amount equal to any cash received or the value of any shares received. Subject to any deduction limitation under Section 162(m) of the Code, PXP will generally be entitled to a deduction equal to the amount of ordinary income recognized by the participant upon exercise.

Performance Shares and Performance Units.Generally, a grantee will not recognize any taxable income and PXP will not be entitled to a deduction upon the award of performance shares or performance units. At the time performance shares vest or the grantee receives a distribution with respect to performance units, the fair market value of the vested shares or the amount of any cash or shares received in payment for such awards generally is taxable to the grantee as ordinary income. Subject to any deduction limitation under Section 162(m) of the Code, PXP will be generally entitled to a federal income tax deduction equal to the amount of ordinary income recognized by the participant.

Section 162(m) of the Internal Revenue Code.Section 162(m) of the Code generally disallows a federal income tax deduction to any publicly held corporation for compensation paid in excess of $1 million in any taxable year to the chief executive officer or any of the four other most highly compensated executive officers who are employed by the corporation on the last day of the taxable year, but does allow a deduction for “performance-based compensation,” the material terms of which are disclosed to and approved by the stockholders. PXP has structured and intends to implement and administer the Amended 2004 Plan so that

16

compensation resulting from options and performance awards can qualify as “performance-based compensation.” Our organization & compensation committee, however, has the discretion to grant awards with terms that will result in the awards not constituting performance-based compensation. To allow PXP to qualify such options and performance awards as “performance-based compensation,” PXP is seeking stockholder approval of the Amended 2004 Plan and the material terms of the performance goals applicable to performance awards under the Amended 2004 Plan.

Section 280G of the Internal Revenue Code.Under certain circumstances, the accelerated vesting or exercise of options or the accelerated lapse of restrictions with respect to other awards in connection with a change in control might be deemed an “excess parachute payment” for purposes of the golden parachute tax provisions of Section 280G of the Code. To the extent it is so considered, the grantee may be subject to a 20% excise tax and PXP may be denied a federal income tax deduction.

Section 409A Compliance.New Section 409A of the Code governs “nonqualified deferred compensation.” Generally, Awards granted under the 2004 Stock Incentive Plan are not intended to constitute nonqualified deferred compensation and therefore should not be subject to Section 409A. However, if any Award is considered nonqualified deferred compensation, the recipient of the Award could be liable for a 20% excise tax on the value of the Award if the Award is not compliant with the Section 409A requirements. Current guidance under Section 409A currently permits amendment of nonqualified deferred compensation arrangements so that they may be brought into compliance with Section 409A. Therefore, any provision under the 2004 Stock Incentive Plan that would cause it or any Award granted under it to fail to satisfy Code Section 409A will have no force or effect until it is amended to comply with Code Section 409A.

New Plan Benefits

Because awards under the Amended 2004 Plan are discretionary, awards to key employees are not determinable at this time. The committee has not granted any awards under the Amended 2004 Plan. However, pursuant to the terms of the deferred long-term retention agreements with Messrs. Flores and Wombwell, to the extent there are shares available under the 2004 Stock Incentive Plan or any successor plan at the time of each annual grant, such shares will be credited to the executive’s account. Please read “Compensation—Executive Compensation—Long-Term Retention and Deferral Arrangement” for more information.

The PXP board of directors unanimously proposes and recommends that you vote to approve the proposal to adopt the PXP Amended and Restated 2004 Stock Incentive Plan.

RATIFICATION OF INDEPENDENT AUDITORS

PricewaterhouseCoopers LLP served as independent auditors for PXP and its subsidiaries for the year ended December 31, 2006 and has acted as such since PXP’s formation in 2002 and for PXP’s former parent, Plains Resources Inc., since 1977. The audit committee of PXP’s board has appointed PricewaterhouseCoopers LLP, an independent registered public accounting firm, as auditors to examine the financial statements of PXP for the fiscal year ending December 31, 2007, and to perform other appropriate accounting services and is requesting ratification of such appointment by the stockholders. If the stockholders do not ratify the appointment of PricewaterhouseCoopers LLP, the adverse vote will be considered as a direction to the audit committee to select other auditors for the next fiscal year. However, because of the difficulty and expense of making any substitution of auditors after the beginning of the current fiscal year, it is contemplated that the appointment for the fiscal year ending December 31, 2007, will be permitted to stand unless the audit committee finds other reasons for making a change. It is understood that even if the selection of PricewaterhouseCoopers LLP is ratified, the audit committee, in its discretion, may direct the appointment of a new independent accounting firm at any time during the year if the audit committee feels that such a change would be in the best interests of PXP and its stockholders.

17

The ratification of PricewaterhouseCoopers LLP requires the affirmative vote of holders of a majority of the shares of PXP common stock present, in person or proxy, and voting at the annual meeting.

Representatives of PricewaterhouseCoopers LLP are expected to be present at the annual meeting, will have the opportunity to make a statement if they desire to do so and are expected to be available to respond to appropriate questions.

| | | | | | |

| | | 2005

| | 2006

|

Audit Fees:(1) | | $ | 1,565,100 | | $ | 2,216,800 |

Audit-Related Fees:(2) | | | 82,500 | | | 48,254 |

Tax Fees:(3) | | | — | | | — |

All Other Fees:(4) | | | 1,600 | | | 11,799 |

| | |

|

| |

|

|

Total | | $ | 1,649,200 | | $ | 2,276,853 |

| | |

|

| |

|

|

| (1) | Audit Fees: Fees billed for professional services rendered by PricewaterhouseCoopers LLP for (i) the integrated audits of PXP’s annual financial statements for the years ended December 31, 2005 and 2006, (ii) the review of PXP’s quarterly financial statements, and (iii) assurance and related services, including accounting advice related to securities transactions in 2005 and 2006. |

| (2) | Audit Related Fees: Fees billed by PricewaterhouseCoopers LLP for the performance of assurance and related services related to the audits of certain partnerships involved in PXP’s oil and gas operations. One hundred percent of the total audit-related fees in 2005 and 2006 were approved by the audit committee. |

| (3) | Tax Fees: Fees for professional services performed by PricewaterhouseCoopers LLP related to tax compliance, tax advice and tax planning. |

| (4) | All Other Fees: Fees for other permissible work performed by PricewaterhouseCoopers LLP that does not meet any of the above category descriptions. Fees billed by PricewaterhouseCoopers LLP in 2005 and 2006 are for an accounting research information service and in 2006 for agreed on procedures for compensation data included in the proxy statement. Such fees were approved by the audit committee. |

The PXP audit committee recommends that you vote to approve the proposal to ratify the selection of PricewaterhouseCoopers LLP as PXP’s independent auditors for the fiscal year ending December 31, 2007.

18

REPORT OF THE AUDIT COMMITTEE

The Board of Directors has established an audit committee, which currently consists of four Board members, Messrs. Delimitros, Buckwalter, Gerry, and Lollar. The Board of Directors has adopted a written charter for the committee, which has been annually reviewed by the Board and outlines the committee’s roles and responsibilities. A copy of the current audit committee charter is available on our website atwww.pxp.com/governance.

Management of PXP has the primary responsibility for the financial statements and the reporting process, including the systems of internal accounting and financial controls. Our independent auditors are responsible for expressing an opinion on PXP’s internal controls over financial reporting and on the conformity of PXP’s audited financial statements with auditing standards generally accepted in the United States and ensuring that the financial statements fairly present PXP’s results of operations and financial position in accordance with accounting principles generally accepted in the United States. The audit committee monitors and oversees these processes. In fulfilling its oversight responsibilities, the committee reviewed and discussed the audited financial statements in the Annual Report on Form 10-K with management, including a discussion of the quality and the effectiveness of PXP’s financial reporting and controls.

The committee discussed with the independent auditors their judgments as to the quality and the effectiveness of PXP’s financial reporting and internal controls and such other matters as are required to be discussed with the committee under audit standards generally accepted in the United States. The audit committee has received and reviewed the written disclosures and the letter from its independent auditors required by Standard No. 1 of the Independence Standards Board and has discussed with the independent auditors the auditors’ independence. The committee has also considered whether the provision of services by the independent auditors for matters other than the annual audit and quarterly reviews is compatible with maintaining the auditors’ independence. In addition, the committee has discussed with the independent auditors the matters required to be discussed pursuant to SAS 61 (Codification of Statements on Auditing Standards, Communication with Audit Committees).

Based on the review and discussions referred to above, the committee recommended to the Board of Directors that the year-end audited financial statements be included in PXP’s Annual Report on Form 10-K for the year ended December 31, 2006 for filing with the Securities and Exchange Commission. The committee also appointed PricewaterhouseCoopers LLP to audit PXP’s financial statements for 2007.

AUDIT COMMITTEE

Tom H. Delimitros,Chairman

Alan R. Buckwalter, III

Robert L. Gerry III

John H. Lollar

19

AUDIT COMMITTEE FINANCIAL EXPERT

Each member of the audit committee is “independent” from PXP’s management, as that term is defined in the NYSE governance rules and the applicable rules of the SEC, as determined by the Board of Directors, in its business judgment. In addition, the PXP board of directors has determined that a majority of the audit committee, including Mr. Delimitros, are “audit committee financial experts” as defined in Item 407(d)(5) of Regulation S-K.

PROCEDURES FOR APPROVAL OF RELATED PERSON TRANSACTIONS

In February 2006, our board of directors adopted a written policy relating to the approval of transactions with related persons. For purposes of this policy, a related person transaction is one in which PXP was, is or will be a participant and the amount involved exceeds $120,000, and in which any related person had, has or will have a direct or indirect material interest. Our policy provides for all compensation-related matters to be approved by the organization & compensation committee. All other related party transactions (i) must be reviewed and approved by the audit committee and be on terms comparable to those that could be obtained in arms’ length dealings with an unrelated third party or (ii) must be reviewed and approved by the disinterested members of our board of directors.

PRE-APPROVAL PROCEDURES

Our audit committee is responsible for the engagement of the independent auditors and for approving, in advance, all auditing services and permitted non-audit services to be provided by the independent auditors. The audit committee maintains a policy for the engagement of independent auditors that is intended to maintain the independence from PXP of the independent auditors. In adopting this policy, our audit committee considered the various services that independent auditors have historically performed or may be needed to perform in the future for PXP. Under this policy, which is subject to review and re-adoption at least annually by the audit committee:

| | • | | The audit committee approves the performance by the independent auditors of audit-related services, subject to restrictions in certain cases, based on the audit committee’s determination that this would not be likely to impair the independence of the independent auditors from PXP; |

| | • | | PXP’s management must obtain the specific prior approval of our audit committee for each engagement of the independent auditors to perform any auditing or permitted non-audit services; provided however, that specific prior approval by the Company’s audit committee is not required for any auditing services that are within the scope of a pre-approved engagement and are consistent with other services provided by the auditor in the past; and provided further that specific prior approval is not required for permitted non-audit services that: |

| | (i) | in the aggregate do not total more than $50,000; |