FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of January, 2020

Commission File Number: 001-12518

Banco Santander, S.A.

(Exact name of registrant as specified in its charter)

Ciudad Grupo Santander

28660 Boadilla del Monte (Madrid) Spain

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes ☐ No ☒

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ☐ No ☒

Banco Santander, S.A.

TABLE OF CONTENTS

FINANCIAL REPORT

January - December

2019

Financial report

January - December

2019

Index

|

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Condensed consolidated financial statement | |

| |

| |

|

| |

| All customers, shareholders and the general public can use Santander’s communication channels in all the countries in which the Bank operates.

|

|

This report was approved by the Board of Directors on 28 January 2020, following a favourable report from the Audit Committee. Important information regarding this report can be found on pages 84 and 85.

Key consolidated data |

| | | | | | | | | | | | |

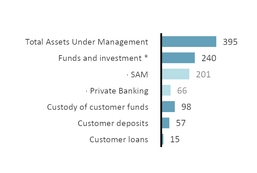

| BALANCE SHEET (EUR million) | Dec-19 |

| Sep-19 |

| % | Dec-19 |

| Dec-18 |

| % | Dec-17 |

|

| Total assets | 1,522,695 |

| 1,517,885 |

| 0.3 | 1,522,695 |

| 1,459,271 |

| 4.3 | 1,444,305 |

|

| Loans and advances to customers | 942,218 |

| 916,003 |

| 2.9 | 942,218 |

| 882,921 |

| 6.7 | 848,915 |

|

| Customer deposits | 824,365 |

| 814,285 |

| 1.2 | 824,365 |

| 780,496 |

| 5.6 | 777,730 |

|

| Total funds | 1,050,765 |

| 1,035,651 |

| 1.5 | 1,050,765 |

| 980,562 |

| 7.2 | 985,702 |

|

| Total equity | 110,659 |

| 108,526 |

| 2.0 | 110,659 |

| 107,361 |

| 3.1 | 106,832 |

|

| Note: Total funds includes customer deposits, mutual funds, pension funds and managed portfolios |

|

| | | | | | | | | | | | |

| INCOME STATEMENT (EUR million) | Q4'19 |

| Q3'19 |

| % | 2019 |

| 2018 |

| % | 2017 |

|

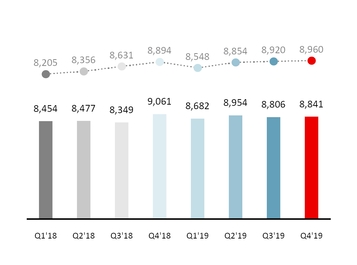

| Net interest income | 8,841 |

| 8,806 |

| 0.4 | 35,283 |

| 34,341 |

| 2.7 | 34,296 |

|

| Total income | 12,327 |

| 12,466 |

| (1.1) | 49,229 |

| 48,424 |

| 1.7 | 48,355 |

|

| Net operating income | 6,356 |

| 6,744 |

| (5.8) | 25,949 |

| 25,645 |

| 1.2 | 25,362 |

|

| Profit before tax | 3,831 |

| 2,181 |

| 75.7 | 12,543 |

| 14,201 |

| (11.7) | 12,091 |

|

| Attributable profit to the parent | 2,783 |

| 501 |

| 455.5 | 6,515 |

| 7,810 |

| (16.6) | 6,619 |

|

| Changes in constant euros: | Q4'19 / Q3'19: NII: +0.4%; Total income: -1.0%; Net operating income: -5.1%; Attributable profit: +412.0% |

| | 2019 / 2018: NII: +3.5%; Total income: +2.6%; Net operating income: +1.9%; Attributable profit: -15.9% |

|

| | | | | | | | | | | | |

UNDERLYING INCOME STATEMENT (1) (EUR million) | Q4'19 |

| Q3'19 |

| % | 2019 |

| 2018 |

| % | 2017 |

|

| Net interest income | 8,841 |

| 8,806 |

| 0.4 | 35,283 |

| 34,341 |

| 2.7 | 34,296 |

|

| Total income | 12,592 |

| 12,466 |

| 1.0 | 49,494 |

| 48,424 |

| 2.2 | 48,392 |

|

| Net operating income | 6,621 |

| 6,744 |

| (1.8) | 26,214 |

| 25,645 |

| 2.2 | 25,473 |

|

| Profit before tax | 3,506 |

| 3,844 |

| (8.8) | 14,929 |

| 14,776 |

| 1.0 | 13,550 |

|

| Attributable profit to the parent | 2,072 |

| 2,135 |

| (3.0) | 8,252 |

| 8,064 |

| 2.3 | 7,516 |

|

| Changes in constant euros: | Q4'19 / Q3'19: NII: +0.4%; Total income: +1.1%; Net operating income: -1.2%; Attributable profit: -2.3% |

| | 2019 / 2018: NII: +3.5%; Total income: +3.2%; Net operating income: +3.0%; Attributable profit: +3.2% |

|

| | | | | | | |

| EPS, PROFITABILITY AND EFFICIENCY (%) | Q4'19 | Q3'19 | % | 2019 | 2018 | % | 2017 |

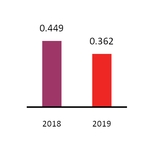

| EPS (euro) | 0.161 | 0.021 | 670.3 | 0.362 | 0.449 | (19.4) | 0.404 |

Underlying EPS (euro) (1) | 0.116 | 0.121 | (4.0) | 0.468 | 0.465 | 0.7 | 0.463 |

| RoE | 9.10 | 7.02 |

| 6.62 | 8.21 |

| 7.14 |

| RoTE | 12.62 | 9.86 |

| 9.31 | 11.70 |

| 10.41 |

Underlying RoTE (1) | 11.63 | 12.19 |

| 11.79 | 12.08 |

| 11.82 |

| RoA | 0.68 | 0.56 |

| 0.54 | 0.64 |

| 0.58 |

| RoRWA | 1.69 | 1.39 |

| 1.33 | 1.55 |

| 1.35 |

Underlying RoRWA (1) | 1.57 | 1.65 |

| 1.61 | 1.59 |

| 1.48 |

| Efficiency ratio | 47.4 | 45.9 |

| 47.0 | 47.0 |

| 47.4 |

|

| | | | | | | |

| SOLVENCY AND NPL RATIOS (%) | Dec-19 | Sep-19 | | Dec-19 | Dec-18 | | Dec-17 |

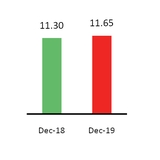

CET1 (2) | 11.65 | 11.30 |

| 11.65 | 11.30 |

| 10.84 |

Fully loaded Total Capital ratio (2) | 15.02 | 14.68 |

| 15.02 | 14.77 |

| 14.48 |

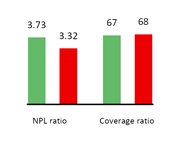

| NPL ratio | 3.32 | 3.47 |

| 3.32 | 3.73 |

| 4.08 |

| Coverage ratio | 68 | 67 |

| 68 | 67 |

| 65 |

|

| | | | | | | | | | | | | |

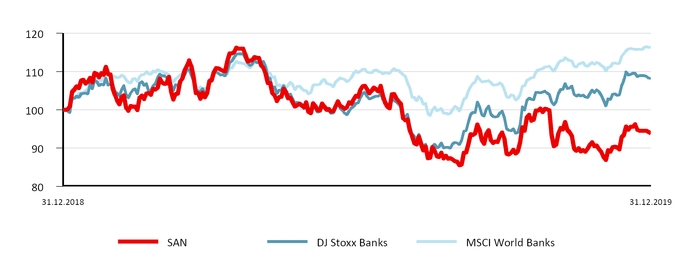

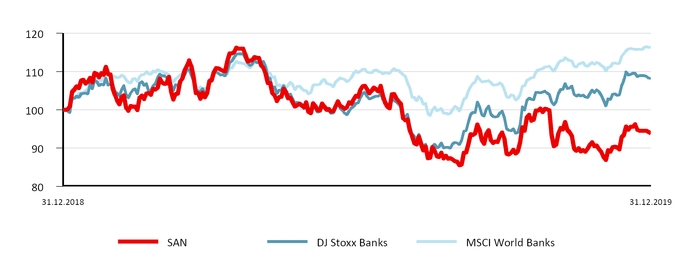

| MARKET CAPITALISATION AND SHARES | Dec-19 |

| Sep-19 |

| % |

| Dec-19 |

| Dec-18 |

| % | Dec-17 |

|

| Shares (millions) | 16,618 |

| 16,618 |

| — |

| 16,618 |

| 16,237 |

| 2.3 | 16,136 |

|

| Share price (euro) | 3.730 |

| 3.737 |

| (0.2) |

| 3.730 |

| 3.973 |

| (6.1) | 5.479 |

|

| Market capitalisation (EUR million) | 61,986 |

| 62,094 |

| (0.2) |

| 61,986 |

| 64,508 |

| (3.9) | 88,410 |

|

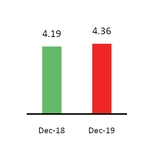

| Tangible book value per share (euro) | 4.36 |

| 4.25 |

|

|

| 4.36 |

| 4.19 |

|

| 4.15 |

|

| Price / Tangible book value per share (X) | 0.86 |

| 0.88 |

|

|

| 0.86 |

| 0.95 |

|

| 1.32 |

|

| P/E ratio (X) | 10.30 |

| 13.90 |

|

|

| 10.30 |

| 8.84 |

|

| 13.56 |

|

|

| | | | | | | | | | | | |

| OTHER DATA | Dec-19 |

| Sep-19 |

| % | Dec-19 |

| Dec-18 |

| % | Dec-17 |

|

| Number of shareholders | 3,986,093 |

| 4,025,074 |

| (1.0) | 3,986,093 |

| 4,131,489 |

| (3.5) | 4,029,630 |

|

| Number of employees | 196,419 |

| 201,017 |

| (2.3) | 196,419 |

| 202,713 |

| (3.1) | 202,251 |

|

| Number of branches | 11,952 |

| 12,691 |

| (5.8) | 11,952 |

| 13,217 |

| (9.6) | 13,697 |

|

|

|

(1) In addition to financial information prepared in accordance with International Financial Reporting Standards (IFRS) and derived from our consolidated financial statements, this report contains certain financial measures that constitute alternative performance measures (APMs) as defined in the Guidelines on Alternative Performance Measures issued by the European Securities and Markets Authority (ESMA) on 5 October 2015 and other non-IFRS measures, including the figures related to “underlying” results, as they are recorded in the separate line of “net capital gains and provisions”, above the line of attributable profit to the parent. Further details are provided on page 12 of this report.

For further details of the APMs and non-IFRS measures used, including its definition or a reconciliation between any applicable management indicators and the financial data presented in the consolidated financial statements prepared under IFRS, please see 2018 Annual Financial Report, published in the CNMV on 28 February 2019, our 20-F report for the year ending 31 December 2018 registered with the SEC in the United States as well as the “Alternative performance measures” section of the annex to this report.

|

| (2) 2019 and 2018 data applying the IFRS 9 transitional arrangements. |

SANTANDER VISION AND CORPORATE CULTURE

Our success is based on a clear purpose, aim and approach to business.

We are building a more responsible bank

|

| | | | |

| | | | |

Our purpose | | Our aim as a bank | | Our how |

To help people and businesses prosper. | | To be the best open financial services platform, by acting responsibly and earning the lasting loyalty of our people, customers, shareholders and communities.

| | Everything we do should be Simple, Personal and Fair.

|

A digital Santander

To continue growing in a sustainable and profitable way and to accelerate execution, we will remain focused on our digital transformation.

Santander expects to accelerate its digital transformation and the launch of global platforms, which will enable the Group to offer new solutions, products and services to our customers, and compete in the open market for new ones

|

| | | | |

| | | | |

| International transfers | | Payment platform | | Trading platform |

Strong corporate culture

The Santander Way is our global culture, fully aligned to our corporate strategy. It includes our purpose, our aim, and how we do business.

Generating confidence and operating responsibly, we contribute value to all our stakeholders

|

| | |

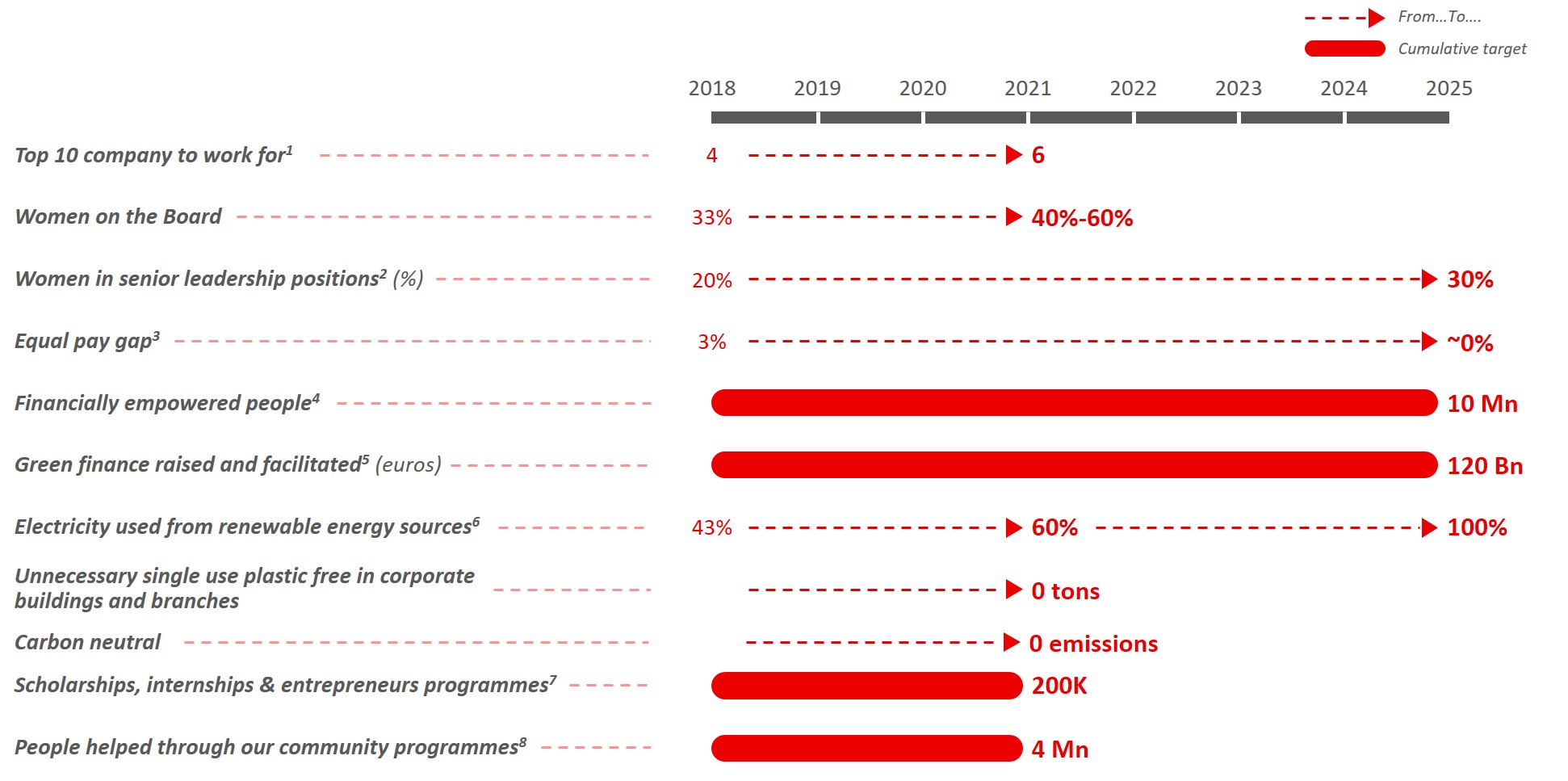

| | • The 2019 Global Engagement Survey had a high participation rate (88%) and reflected the employees' commitment, as 86% of them declared to be proud to work for Santander, 5 percentage points above the financial industry average. In addition, 85% of them believe we are open to change, sharing good practices and fostering innovation.• Santander was one of the 25 best companies to work for at global level, according to the annual ranking by Great Place to Work. It was also awarded Top Employer Europe 2019 and Best Place to Work 2019 in Latin America.• We were also named the Leader in Diversity 2020 by the Financial Times in a new index of 700 European companies. We also reaffirmed our commitment to diversity, renewing the EU led Diversity Charter initiative.• For the third consecutive year, Santander obtained the highest score amongst the 325 companies that form part of the Bloomberg Gender-Equality Index.

|

| | |

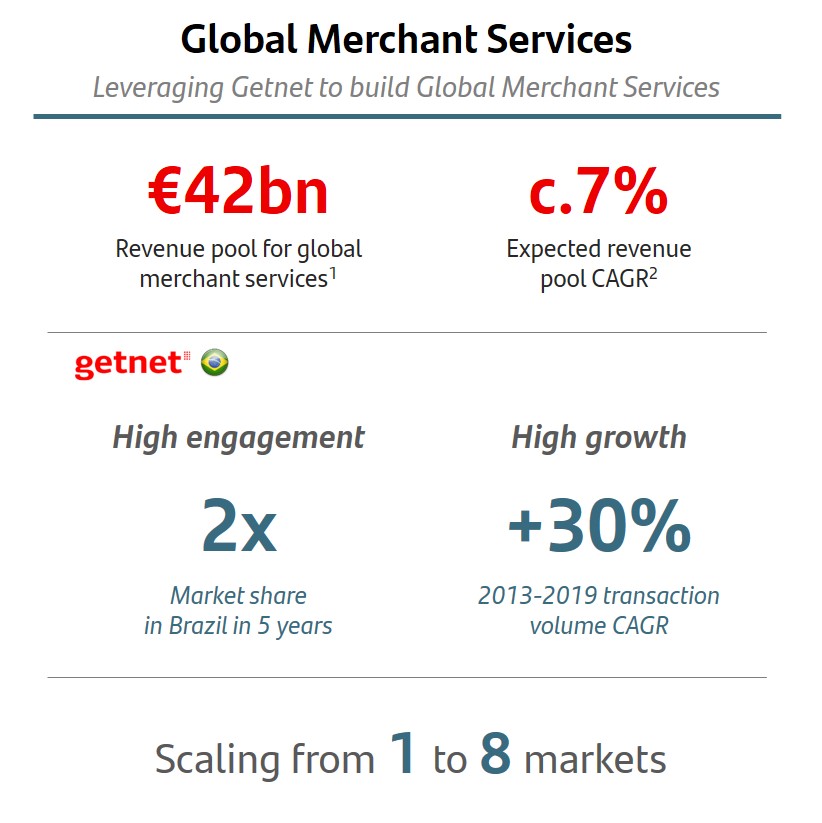

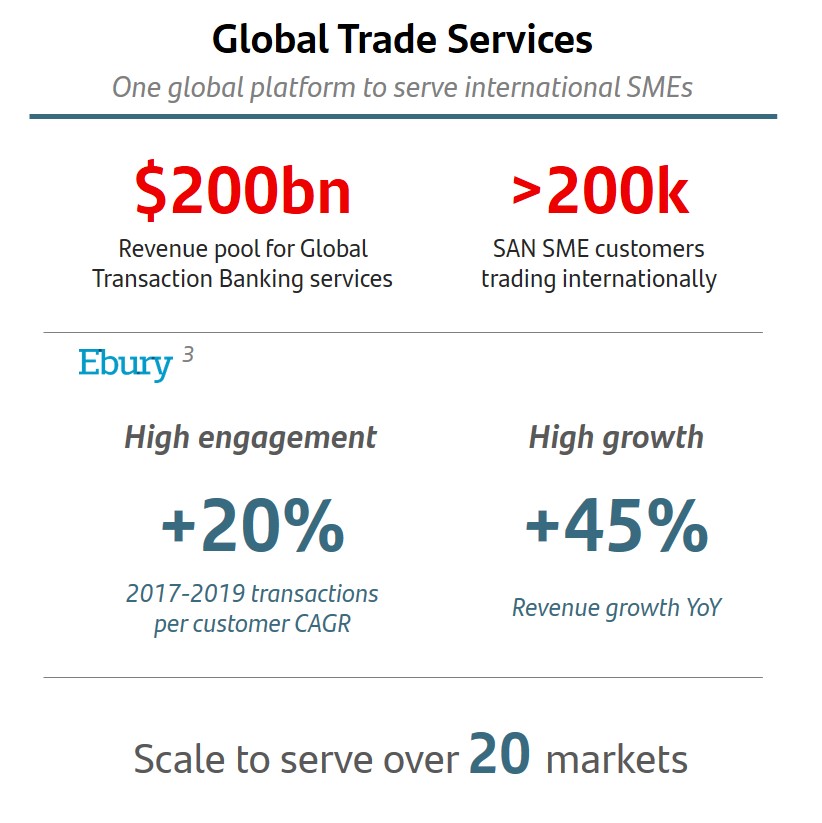

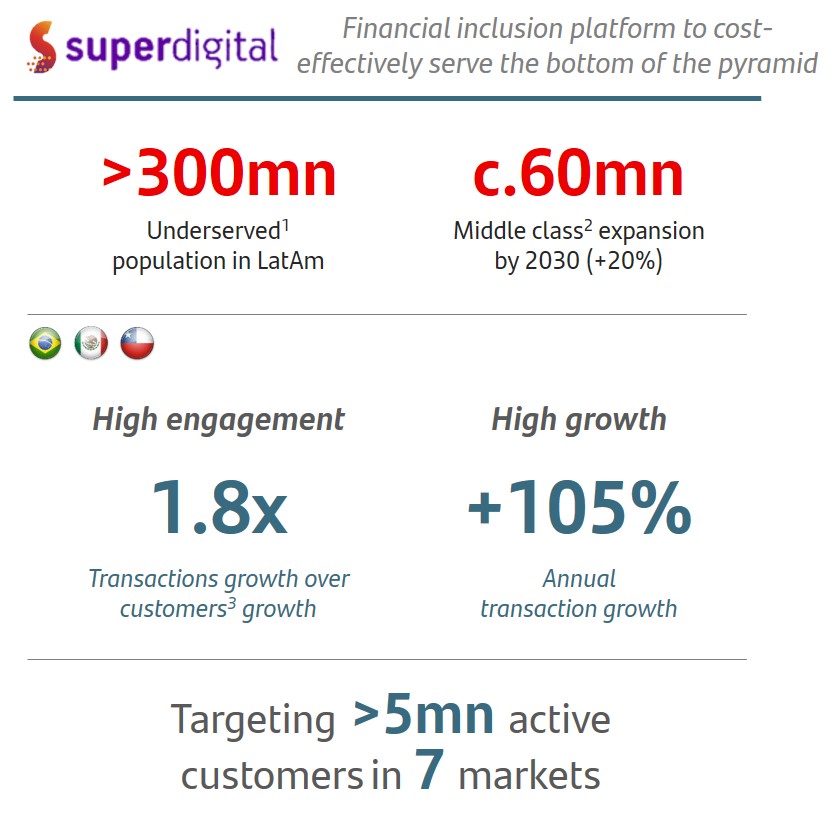

| • We continued to focus on improving customer loyalty and experience. Progress was reflected in the 1.7 million increase loyal customers, greater penetration as a percentage of active customers and 4.8 million more digital customers in the last 12 months.• We also continued to strengthen our traditional branches and develop new models (SMART, Súper Ágil and Work Café), while investing in new generation ATMs and in contact centres.• With the creation of Santander Global Platform, we have taken an step forward in our digital transformation that will enable us to offer better digital services to individual customers and corporates. We launched several initiatives as scheduled: progress continued on the Global Merchant Services and Global Trade Services platforms, Superdigital is already available in Chile and Openbank began to open accounts to customers in Germany, the Netherlands and Portugal.• In line with our responsible banking commitments, we have financially empowered more than 1,600,000 million people in the year through our microfinance programmes. |

| | |

| • In November, shareholders received the first interim dividend of EUR 0.10 per share charged to 2019’s earnings in cash. The Board of Directors of the Bank has resolved to submit to the next annual general shareholders meeting that the second payment of the remuneration against the results of 2019 amounts to EUR 0.13 per share by means of a final dividend in cash of EUR 0.10 per share and a scrip dividend (Santander Dividendo Elección scheme) that will entail the payment in cash, for those shareholders who so choose, of EUR 0.03 per share. Santander’s cash dividend would thereby increase to EUR 0.20, a year-on-year increase of c.3%, and the total dividend for 2019 would be EUR 0.23 per share (EUR 0.20 in cash and EUR 0.03 in scrip).• In line with the Bank's innovation and digitalisation strategy, the new corporate website santander.com was launched. Shareholders and investors have a new space where they can access all the information on the share and the Group in a more intuitive way, with new content and a refined user experience. |

| | |

| • The 2019 Dow Jones Sustainability Index (DJSI) recognised Santander as the world’s most sustainable bank, underscoring our actions in the economic, environmental and social fields.• Santander joined the COP25 this year, where the plans to become carbon neutral in 2020 were announced. In addition, the Group signed the Principles of Collective Commitment to Climate Action together with 30 other banks and is also one of the founding members of the Principles for Responsible Banking of the United Nations.• The Group launched the #SOMOS campaign, a global action for inclusive higher education, promoted by the United Nations, which seeks to achieve an accessible, architectural, social and technological environment, so that people with disabilities can be part of the Group.• In the year, we helped more than 1,200,000 people through our community investment programmes and supported higher education with more than 66,000 scholarships granted.

|

GROUP PERFORMANCE

|

|

"We earned the loyalty of our customers, delivering record annual revenues and strong underlying profitability. This allowed us to further strengthen our capital base and grow our CET1 capital ratio to 11.65%"

|

|

|

"Our geographic and businesses diversification continues to drive profitable and sustainable growth: South America remains a growth engine, North America is maintaining its momentum and in Europe, we are making good progress on our efficiency programmes"

|

GROWTH

GROWTHThe Group’s strategy is driving growth in loyal and digital customers and is reflected in greater activity in almost all markets

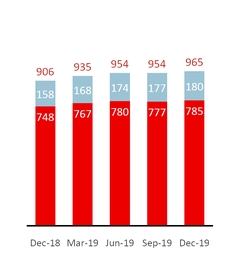

Santander’s strategy continued to focus on boosting the loyalty of our customers. Their number rose again in the fourth quarter and reached 21.6 million, 1.7 million more in the year (+9%), with growth both in individuals and companies.

The faster pace of digitalisation is reflected in the growth in digital customers, whose number increased by 4.8 million in the year (+15%) and in greater activity. On average, our customers accessed digital touchpoints five times per week and digital sales represented 36% of total sales, rising 4 percentage points in the year.

|

| |

| Digital customers |

| Millions | |

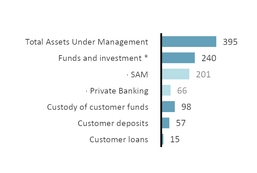

As regards volumes, gross loans and advances to customers (excluding reverse repos) and customer funds increased in the quarter (+2% and +1%, respectively).

In the year (at constant exchange rates), gross loans and advances to customers (excluding reverse repos) grew 4% and increased in eight of the 10 core markets. Customer funds rose 6% year-on-year, with growth in demand deposits and mutual funds.

Solid funding structure and liquidity: net loan-to-deposit ratio of 114% (113% in December 2018).

|

| | | | | | | | | | | | |

Activity Dec-19 vs. Dec-18 | |

| % change in constant euros | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | +6% | | |

| | | | | | | | | | | Demand | | |

| | | | | +5% | | | | | | | | |

| | | | | Individuals | | | | | | | | |

| | | | | | | | | +6% | | -1% | | |

| | | | | 0% | | | | | Time | | |

| | | +4% | | SMEs | | | | | | | | |

| | | | | | | | | | | | |

| | | | | +3% | | | | | | +15% | | |

| | | | | Corporates | | | | | | Mutual funds | | |

| | | | | | | | | | | | | |

| | Gross loans and advances to customers excl. reverse repos | | Customer deposits excl. repos + mutual funds | |

GROUP PERFORMANCE

PROFITABILITY

PROFITABILITYSolid business model based on customers, scale and diversification, which enabled us to obtain profits on a recurring basis

In a context of lower growth and interest rates, revenue reached a record high, costs reflected synergies in some countries and provisions increased in line with volumes. Underlying attributable profit rose in nine of the 10 core markets.

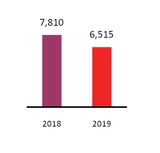

Attributable profit of EUR 6,515 million, affected by net charges of EUR 1,737 million in the 'capital gains and provisions' line (see page 12). Excluding them, underlying attributable profit (EUR 8,252 million) was 2% higher (+3% in constant euros), absorbing the interest rate reduction, higher costs for foreign currency hedging and the impact of implementing IFRS 16.

|

| |

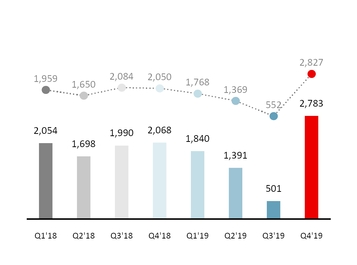

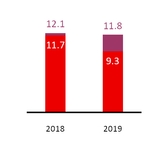

| Attrib. profit to the parent |

| EUR million |

Attributable profit to the parent amounted to a record high of EUR 2,783 million. However it was boosted by the 'net capital gains and provisions' line, which had a positive impact of EUR 711 million. Excluding this, underlying attributable profit was EUR 2,072 million, 2% higher than the fourth quarter of 2018 (+5% excluding the exchange rate impact).

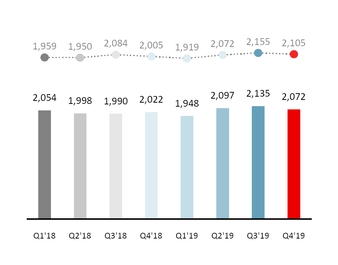

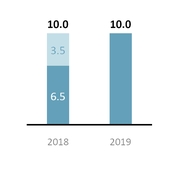

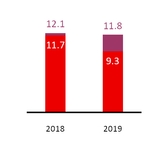

The efficiency ratio stood around 47%, one of the best among our peers. Underlying RoTE was 11.8% and underlying RoRWA 1.61%.

|

| |

| RoTE |

| % | |

n Total n Underlying* |

(*) Excluding net capital gains and provisions

STRENGTH

STRENGTHSantander is strengthening its capital ratios and improving credit quality while maintaining a high level of profitability

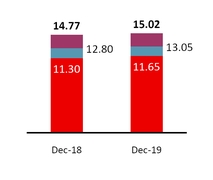

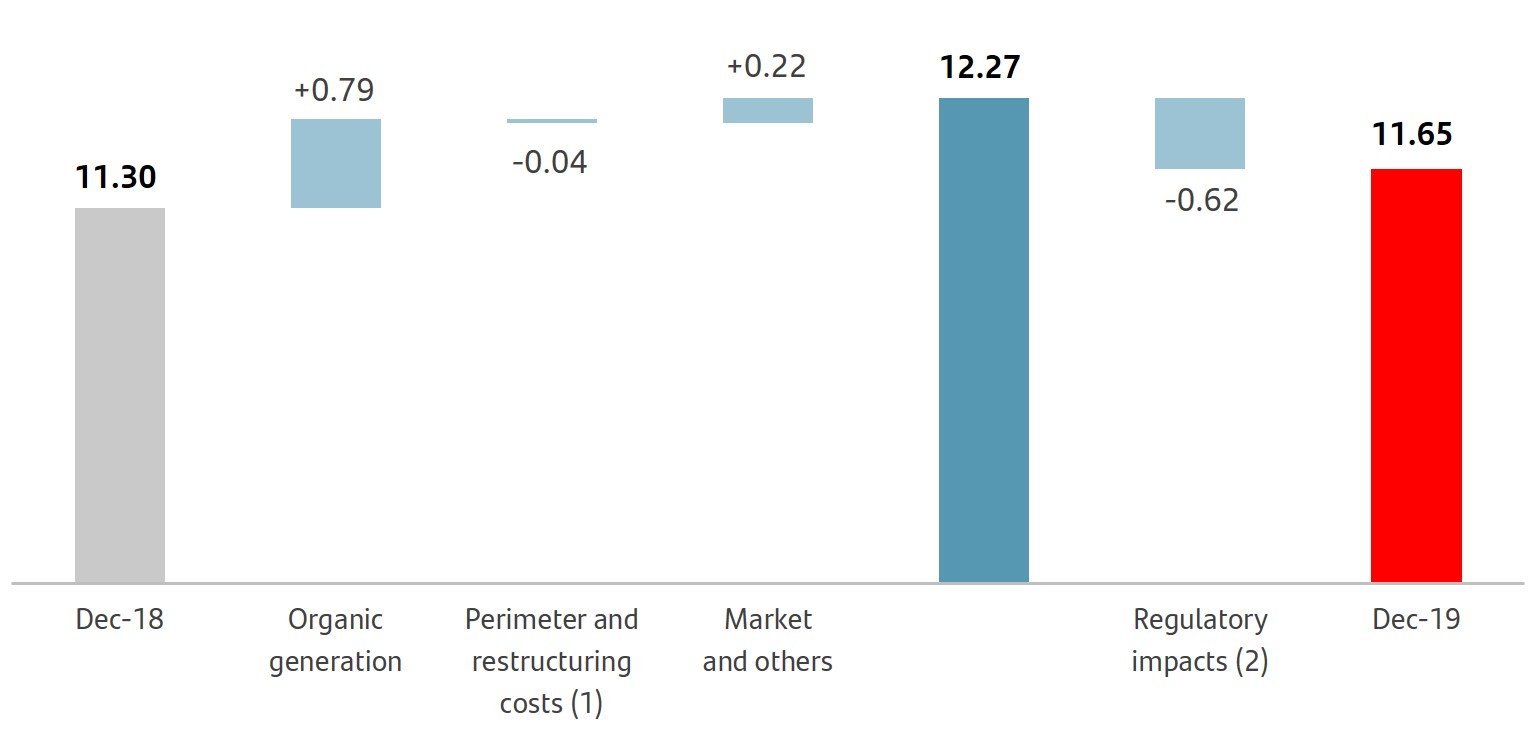

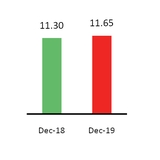

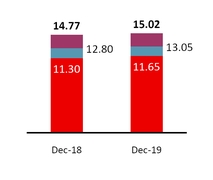

The CET1 ratio stood at 11.65% after increasing 35 bps in the quarter (31 bps organically). In the year, gross generation of 97 bps due to the organic generation and the favourable portfolio performance, which was partly offset by regulatory impacts (-62 bps).

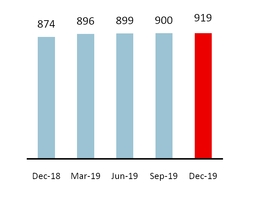

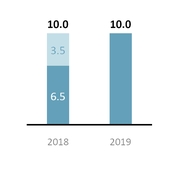

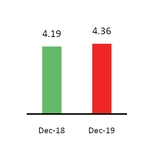

Net tangible equity per share (TNAV) at year-end was EUR 4.36 (EUR 4.19 in December 2018). In addition, and in terms of shareholder value creation, the recording of the dividend remuneration should be taken into account. Including it, the TNAV per share increased 8% in the last 12 months.

|

| |

| Tangible equity per share |

| Euros |

(*) Using the IFRS 9 transitional agreement

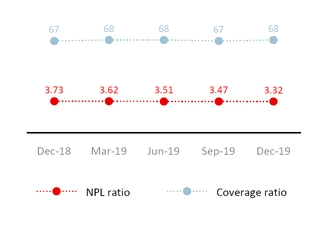

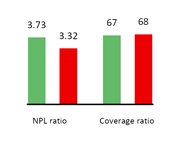

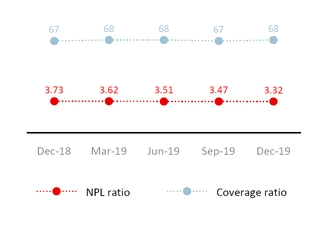

Credit quality continued to improve: the NPL ratio dropped for the tenth consecutive quarter, improving 41 bps in the year and 15 bps in the quarter, and coverage rose to 68% (67% in 2018).

The cost of credit stood at 1.00% in 2019, similar to the previous quarter and to 2018.

|

| |

| NPL ratio and coverage |

| % | |

n Dec-18 n Dec-19 |

GRUPO SANTANDER RESULTS

| |

| • | Fourth quarter attributable profit to the parent of EUR 2,783 million, including a net positive impact of EUR 711 million that are outside the ordinary course performance of our business. Excluding these charges, underlying attributable profit was 2% higher than the fourth quarter of 2018 at EUR 2,072 million (+5% excluding the exchange rate impact). |

| |

| • | Attributable profit of EUR 6,515 million in 2019, 17% less than in 2018, after recording net charges that are outside the ordinary course performance of our business amounting to EUR -1,737 million (EUR -254 million in 2018). Excluding these results, the underlying attributable profit was EUR 8,252 million, 2% more than in 2018 (+3% excluding the exchange rate impact). |

| |

| • | By geographic area, nine of our ten core markets grew their underlying profit year-on-year in local currency terms, five of them at double-digit rates. |

| |

| • | In 2019, the results continued to reflect a solid underlying trend: customer revenue reached a record high in the year, costs began to show the synergies obtained in various markets and loan-loss provisions rose in line with volumes. |

| |

| • | As regards profitability ratios: underlying RoTE of 11.8% and underlying RoRWA of 1.61%. |

|

| | | | | | | | | | | | | | | | |

| Grupo Santander. Summarised income statement |

| EUR million | | | | | | | | |

| | | | Change | | | Change |

| | Q4'19 |

| Q3'19 |

| % |

| % excl. FX |

| 2019 |

| 2018 |

| % |

| % excl. FX |

|

| Net interest income | 8,841 |

| 8,806 |

| 0.4 |

| 0.4 |

| 35,283 |

| 34,341 |

| 2.7 |

| 3.5 |

|

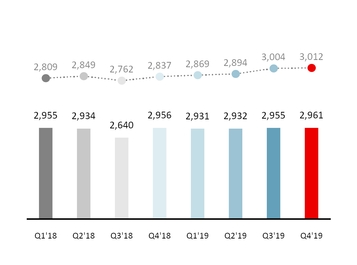

| Net fee income (commission income minus commission expense) | 2,961 |

| 2,955 |

| 0.2 |

| 0.2 |

| 11,779 |

| 11,485 |

| 2.6 |

| 4.6 |

|

| Gains or losses on financial assets and liabilities and exchange differences (net) | 596 |

| 424 |

| 40.6 |

| 39.5 |

| 1,531 |

| 1,797 |

| (14.8) |

| (11.0) |

|

| Dividend income | 100 |

| 72 |

| 38.9 |

| 38.0 |

| 533 |

| 370 |

| 44.1 |

| 44.0 |

|

| Share of results of entities accounted for using the equity method | (119 | ) | 137 |

| — |

| — |

| 324 |

| 737 |

| (56.0) |

| (55.2) |

|

| Other operating income / expenses | (52 | ) | 72 |

| — |

| — |

| (221 | ) | (306 | ) | (27.8) |

| 22.5 |

|

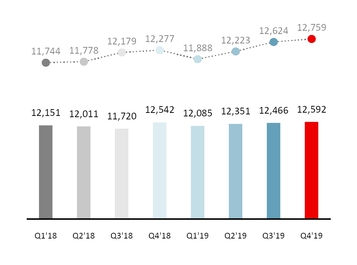

| Total income | 12,327 |

| 12,466 |

| (1.1) |

| (1.0) |

| 49,229 |

| 48,424 |

| 1.7 |

| 2.6 |

|

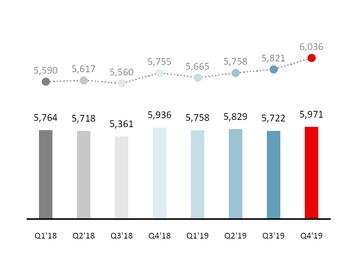

| Operating expenses | (5,971 | ) | (5,722 | ) | 4.4 |

| 3.7 |

| (23,280 | ) | (22,779 | ) | 2.2 |

| 3.4 |

|

| Administrative expenses | (5,179 | ) | (4,990 | ) | 3.8 |

| 3.2 |

| (20,279 | ) | (20,354 | ) | (0.4) |

| 0.7 |

|

| Staff costs | (3,053 | ) | (3,008 | ) | 1.5 |

| 1.0 |

| (12,141 | ) | (11,865 | ) | 2.3 |

| 3.2 |

|

| Other general administrative expenses | (2,126 | ) | (1,982 | ) | 7.3 |

| 6.5 |

| (8,138 | ) | (8,489 | ) | (4.1) |

| (2.8) |

|

| Depreciation and amortisation | (792 | ) | (732 | ) | 8.2 |

| 7.1 |

| (3,001 | ) | (2,425 | ) | 23.8 |

| 25.5 |

|

| Impairment or reversal of impairment of financial assets not measured at fair value through profit or loss (net) | (2,542 | ) | (2,442 | ) | 4.1 |

| 4.3 |

| (9,352 | ) | (8,986 | ) | 4.1 |

| 4.3 |

|

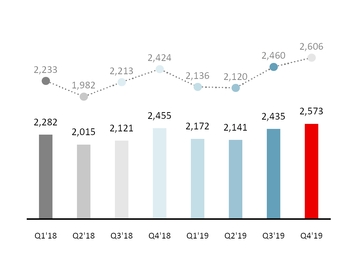

| o/w: net loan-loss provisions | (2,573 | ) | (2,435 | ) | 5.7 |

| 5.9 |

| (9,321 | ) | (8,873 | ) | 5.0 |

| 5.3 |

|

| Impairment on other assets (net) | (76 | ) | (1,520 | ) | (95.0) |

| (95.0) |

| (1,623 | ) | (207 | ) | 684.1 |

| 677.2 |

|

| Provisions or reversal of provisions | (979 | ) | (595 | ) | 64.5 |

| 64.5 |

| (3,490 | ) | (2,223 | ) | 57.0 |

| 68.8 |

|

| Gain or losses on non financial assets and investments, net | 1,038 |

| 3 |

| — |

| — |

| 1,291 |

| 28 |

| — |

| — |

|

| Negative goodwill recognised in results | — |

| — |

| — |

| — |

| — |

| 67 |

| (100.0 | ) | (100.0 | ) |

| Gains or losses on non-current assets held for sale not classified as discontinued operations | 34 |

| (9 | ) | — |

| — |

| (232 | ) | (123 | ) | 88.6 |

| 84.2 |

|

| Profit or loss before tax from continuing operations | 3,831 |

| 2,181 |

| 75.7 |

| 73.2 |

| 12,543 |

| 14,201 |

| (11.7) |

| (10.7) |

|

| Tax expense or income from continuing operations | (687 | ) | (1,291 | ) | (46.8) |

| (45.5) |

| (4,427 | ) | (4,886 | ) | (9.4) |

| (7.8) |

|

| Profit from the period from continuing operations | 3,144 |

| 890 |

| 253.3 |

| 239.2 |

| 8,116 |

| 9,315 |

| (12.9) |

| (12.3) |

|

| Profit or loss after tax from discontinued operations | — |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

|

| Profit for the period | 3,144 |

| 890 |

| 253.3 |

| 239.2 |

| 8,116 |

| 9,315 |

| (12.9) |

| (12.3) |

|

| Attributable profit to non-controlling interests | (361 | ) | (389 | ) | (7.2) |

| (5.8) |

| (1,601 | ) | (1,505 | ) | 6.4 |

| 6.3 |

|

| Attributable profit to the parent | 2,783 |

| 501 |

| 455.5 |

| 412.0 |

| 6,515 |

| 7,810 |

| (16.6) |

| (15.9) |

|

| | | | | | | | | |

| EPS (euros) | 0.161 |

| 0.021 |

| 670.3 |

|

| 0.362 |

| 0.449 |

| (19.4) |

|

|

| Diluted EPS (euros) | 0.160 |

| 0.021 |

| 669.8 |

|

| 0.361 |

| 0.448 |

| (19.4) |

|

|

| | | | | | | | | |

| Memorandum items: | | | | | | | | |

| Average total assets | 1,530,761 |

| 1,515,606 |

| 1.0 |

|

| 1,508,167 |

| 1,442,861 |

| 4.5 |

|

|

| Average stockholders' equity | 98,851 |

| 98,445 |

| 0.4 |

|

| 98,457 |

| 95,071 |

| 3.6 |

|

|

Ü Evolution of results compared to 2018

The underlying trends of the P&L remained solid compared to 2018, with customer revenue growing, both net interest income and net fee income, costs reflecting the synergies obtained in various units and a cost of credit remained close to historically low levels.

This good performance, however, is not fully reflected in the attributable profit to the parent because of the recording of a net negative amount of EUR 1,737 million for charges that are outside the ordinary course performance of our business, as set out on page 12 of this report. In addition, the comparison is also affected by the interest rate reduction, higher costs for foreign currency hedging and the impact of implementing IFRS 16.

This performance is explained in detail below:

u Revenue

Total income was 2% higher than in 2018 at EUR 49,229 million (+3% excluding the exchange rate impact). Net interest income and net fee income accounted for 95% of total income, well above the average of our competitors, enabling consistent and recurring growth while limiting the impact that periods of high volatility can have on gains on financial transactions. By lines:

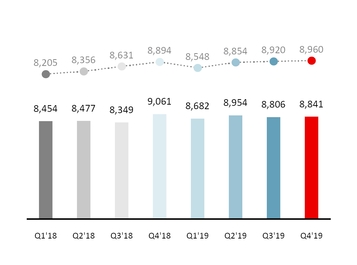

| |

| • | Net interest income amounted to EUR 35,283 million, up 3% compared to 2018. Excluding the FX impact, growth was 4% due to greater lending and deposits, and management of spreads in an environment of falling interest rates in the last year in numerous markets, and with still negative interest rates in Europe. There was also a negative impact of EUR 265 million from IFRS 16 application. |

|

| |

| Net interest income |

| EUR million |

žžžlžžž constant euros | |

Net interest income recorded rises in six of the ten core markets in local currency terms. Of note was growth in Argentina driven by high interest rates and greater central bank note volumes and Poland, by the improvement in the cost of deposits and lending dynamics. Portugal and Chile remained stable, and falls were recorded in the UK, affected by the pressure on mortgage spreads and the fall in SVR balances (Standard Variable Rate) and in Spain due to low interest rates, reduced volumes and the impact of IFRS 16.

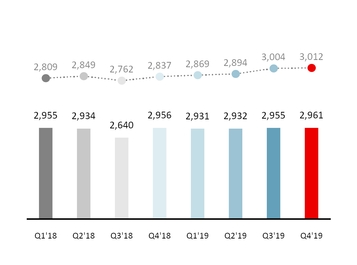

| |

| • | Net fee income amounted to EUR 11,779 million, 3% more than in 2018. Excluding the exchange rate impact, net fee income was 5% higher, reflecting the greater customer loyalty combined with the growth strategy in higher value-added services and products. Of note was the growth in the most transactional businesses from payment methods, insurance, foreign currency and cheques and transfers. On the other hand, decline in net fee income from advising operations and guarantees, affected by reduced activity in the markets and overdrafts, affected by regulatory impacts. |

By region, the increase was backed mainly by South America, which grew at double digit rates. Of note was Brazil (+12%) with growth in almost all lines, especially in cards and insurance, and Argentina (+84%), driven by greater foreign currency transactions and income from accounts and cash deposits. They also rose in North America, with a positive trend in the US and Mexico. On the other hand, falls in Europe driven by Spain (mainly due to lower activity at SCIB) and the UK (overdrafts and mutual funds).

By global businesses, excluding the exchange rate impact, the total fee income generated by Wealth Management & Insurance, including those transferred to the branch network rose 6% in the year (30% of the Group's total). Fee income from Santander Corporate & Investment Banking increased 1% in 2019, reflecting a clear trend of improvement during the year (fee income in the second half of the year was 12% higher than in the first half of the year).

|

| |

| Net fee income |

| EUR million |

žžžlžžž constant euros | |

| |

| • | Gains on financial transactions, which account for 3% of total income, decreased 15% (11% excluding the FX impact) to EUR 1,531 million compared to 2018 mainly due to the higher cost of foreign currency hedging in 2019, combined with the positive performance of markets in the first half of 2018. |

| |

| • | Dividend income was EUR 533 million in 2019, 44% more than in 2018 mainly due to dividends of the trading portfolio. |

| |

| • | The share of results of entities accounted for by the equity method were EUR 324 million in 2019, 56% lower than in 2018 (-55% excluding the FX impact) mainly driven by the sale of Testa and WiZink as well as losses in real estate equity. |

| |

| • | Other operating income recorded a loss of EUR 221 million in 2019. This item includes the contribution to the Deposit Guarantee Fund and the Single Resolution Fund. |

u Costs

Costs totalled EUR 23,280 million, 2% higher year-on-year. Excluding the exchange rate impact, they rose 3% as a result of higher investments in transformation and digitalisation, together with the improvements made to the distribution networks, the slight impact from the integration of the retail and SME business acquired from Deutsche Bank Polska and the impact on Argentina of high inflation.

In real terms (excluding inflation and perimeter), costs were slightly lower, falling or remaining stable for the third year running due to cost management. (-0.4% in 2019, -0.5% in 2018 and +0.3% in 2017).

In 2019 we continued to be one of the world's most efficient global banks, maintaining the efficiency ratio at 47.0%.

|

| |

| Total income |

| EUR million |

žžžlžžž constant euros | |

The Group’s aim is to improve our operational capacity and at the same time manage our costs more efficiently adapted to each area, via an exemplary execution of the integrations and fostering the use of shared services. For a better comparison, the trends by region and market are detailed below:

| |

| • | In Europe, costs are beginning to reflect the synergies of integrations, and fell 1% in nominal terms and 2.4% in real terms. Of note were the declines in Spain (-8%) and Portugal (-4%) due to the efficiencies resulting from the integration of Popular, and the optimisation efforts and the UK (-3%) reflecting the first cost savings from our transformation programme. |

The main rises were in Poland (+7%), impacted by the previously mentioned integration. Excluding this impact, costs rose very slightly, with a a relatively good performance in an environment with high single-digit wage pressure at the national level. In SCF, costs rose 2%, although at a slower pace than business growth, benefiting from the efficiency projects carried out in the year. The efficiency ratio in the region maintained practically stable.

| |

| • | In North America, costs were 5% higher in nominal terms affected by inflation. In real terms, they rose 3% mainly driven by Mexico (+4%), spurred by the three-year investment plan, while in the US they rose 2%. The higher revenue is enabling us to maintain the efficiency ratio in this region. |

| |

| • | Lastly, in South America, the increase in costs was significantly distorted by the very high inflation in Argentina. Excluding it, the increase was 4.6% in nominal terms and 1% in real terms, with Brazil and Chile performing well, combining investments to improve distribution capacity with close to zero growth in costs. Efficiency improvement in the region across all markets. |

We believe this management by region will enable us to continue to optimise costs, which should be reflected in further improvements in the cost-to-income ratio, while improving customer experience.

|

| |

| Operating expenses |

| EUR million |

žžžlžžž constant euros | |

|

| | |

| 10 | | January - December 2019 |

u Impairment or reversal of impairment of financial assets not measured at fair value through profit or loss (net)

Impairment or reversal of impairment of financial assets not measured at fair value through profit or loss (net) were EUR 9,352 million in 2019, a 4% increase compared to 2018 both in euros and excluding the exchange rate impact.

In this item, net loan-loss provisions was 5% higher, both in euros and excluding the exchange rate impact, at EUR 9,321 million. The largest increase was recorded in Europe, while in North and South America, the increases were more moderate, both below the rise in lending volumes.

Cost of credit remained stable at 1.00%

u Impairment on other assets (net)

Impairment on other assets in 2019 increased to EUR 1,623 million after recording the impairment of goodwill ascribed to the UK of EUR 1,491 million. In 2018, this item amounted to EUR 207 million.

u Provisions or reversal of provisions

Provisions (net of reversal provisions) rose 57% in 2019, to EUR 3,490 million (EUR 2,223 million in 2018). Excluding the exchange rate impact, 69% increase primarily due to restructuring charges mainly in Spain and the UK, which are set out on page 12 of this report. In addition, higher provisions for legal claims in Brazil.

u Gains or losses on non-financial assets and investments (net)

Net gains on non-financial assets and investments were EUR 1,291 million in 2019, compared to EUR 28 million in 2018. The increase was mainly due to the recording of capital gains from the agreement with Crédit Agricole S.A. for the integration of the custody businesses and from the sale of 51% our stake in Prisma Medios de Pago S.A. and the revaluation of the rest of the stake (49%).

u Negative goodwill recognised in results

In 2019, EUR 0 million compared to the EUR 67 million recorded in 2018 due to the difference between the fair value of the net assets acquired with the acquisition of Deutsche Bank Polska in Poland and the transaction value.

u Gains or losses on non-current assets held for sale not classified as discontinued operations

This item, which includes mainly impairment of foreclosed assets recorded and the sale of properties acquired upon foreclosure, were EUR -232 million in 2019, compared to EUR -123 million in 2018.

u Profit before tax

Profit before tax was 12% lower than in 2018, at EUR 12,543 million. Excluding the exchange rate impact, it dropped 11%, conditioned by the non-recurring operation mentioned above.

u Income tax

Corporate income tax was EUR 4,427 million in 2019, a 9% decrease year-on-year (-8% excluding the exchange rate impact).

u Attributable profit to non-controlling interests

The attributable profit to non-controlling interests was EUR 1,601 million, 6% higher than in 2018 both in euros and excluding the exchange rate impact.

u Attributable profit to the parent

Attributable profit to the parent amounted to EUR 6,515 million, 17% less compared to 2018. Excluding the exchange rate impact, -16%.

RoE was 6.6%, RoTE 9.3% and RoRWA 1.33% (8.2%, 11.7% y 1.55%, respectively in 2018).

Earnings per share was EUR 0.362, EUR 0.449 in 2018.

|

| |

| Net loan-loss provisions |

| EUR million |

žžžlžžž constant euros | |

|

| |

| Attributable profit to the parent |

| EUR million |

žžžlžžž constant euros | |

|

| | |

January - December 2019 | | 11 |

u Underlying attributable profit to the parent

The attributable profit to the parent previously recorded was affected, in 2019 and 2018, by the results (net of tax), that are outside the ordinary course performance of our business and distort the year-on-year comparison, and are detailed in the table below:

|

| | | |

| 2019 |

| | | |

| | -864 |

|

– Spain ......................................................................... | -600 | |

– United Kingdom ........................................................ | -127 | |

– Brazil ......................................................................... | -90 | |

– Poland ...................................................................... | -23 | |

– Consumer ................................................................ | -16 | |

– United States ........................................................... | -8 | |

| | | |

• Real estate assets and stakes (Spain) | | -405 |

|

| | | |

| | -183 |

|

| | | |

| | -174 |

|

| | | |

• Capital gains Prisma - Argentina | | 136 |

|

| | | |

| | 551 |

|

| | | |

| | 693 |

|

| | | |

| Subtotal | | -246 |

|

| | | |

| | -1,491 |

|

| | | |

NET: EUR -1,737 million

|

|

| | |

| 2018 |

| | | |

| | -320 |

– Spain ........................................................................ | -280 | |

– Corporate Centre ..................................................... | -40 | |

| | | |

| | 20 |

| | | |

| | 45 |

| | | |

| NET: EUR -254 million |

Excluding these results from the various P&L lines where they are recorded, and incorporating them separately in the net capital gains and provisions line, underlying attributable profit to the parent was EUR 8,252 million in 2019 and EUR 8,064 million in 2018, 2% higher year-on-year (+3% without the FX impact).

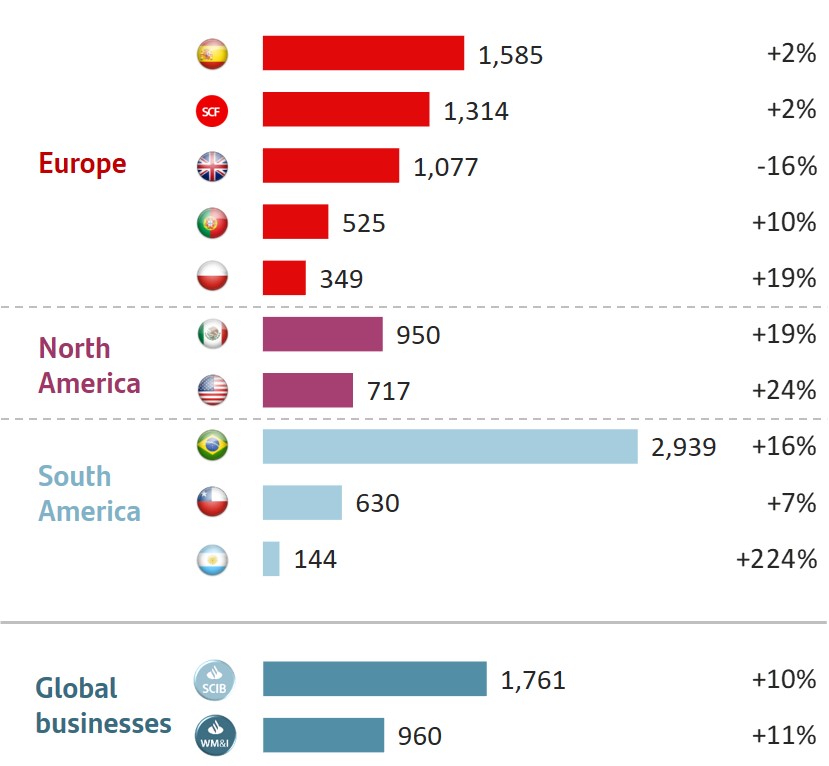

By region, and excluding the exchange rate impact, of note was double-digit growth in North America (+21%) and South America (+18%), while in Europe, in a more complicated business environment, there was a 3% decline.

By market, nine of the 10 core markets increased in their local currency, and at double-digit rates in Poland, the US, Mexico, Brazil and Argentina. The only decrease was in the UK, mainly because of competitive pressure on revenue.

In 2019, the Group’s underlying RoTE was 11.8% (12.1% in 2018), the underlying RoRWA rose to 1.61% from 1.59% in 2018, and underlying earnings per share EUR 0.468, 1% higher than in 2018.

|

| | | | | | | | | | | | | | | | |

| Summarised underlying income statement |

| (EUR millIon) | | | Change | | | Change |

| | Q4'19 | Q3'19 | % | % excl. FX | 2019 | 2018 | % | % excl. FX |

| Net interest income | 8,841 |

| 8,806 |

| 0.4 |

| 0.4 |

| 35,283 |

| 34,341 |

| 2.7 |

| 3.5 |

|

| Net fee income | 2,961 |

| 2,955 |

| 0.2 |

| 0.2 |

| 11,779 |

| 11,485 |

| 2.6 |

| 4.6 |

|

Gains (losses) on financial transactions (1) | 596 |

| 424 |

| 40.6 |

| 39.5 |

| 1,531 |

| 1,797 |

| (14.8) |

| (11.0) |

|

| Other operating income | 194 |

| 281 |

| (31.0) |

| (31.4) |

| 901 |

| 801 |

| 12.5 |

| (1.4) |

|

| Total income | 12,592 |

| 12,466 |

| 1.0 |

| 1.1 |

| 49,494 |

| 48,424 |

| 2.2 |

| 3.2 |

|

| Administrative expenses and amortisations | (5,971 | ) | (5,722 | ) | 4.4 |

| 3.7 |

| (23,280 | ) | (22,779 | ) | 2.2 |

| 3.4 |

|

| Net operating income | 6,621 |

| 6,744 |

| (1.8) |

| (1.2) |

| 26,214 |

| 25,645 |

| 2.2 |

| 3.0 |

|

| Net loan-loss provisions | (2,573 | ) | (2,435 | ) | 5.7 |

| 5.9 |

| (9,321 | ) | (8,873 | ) | 5.0 |

| 5.3 |

|

| Other gains (losses) and provisions | (542 | ) | (465 | ) | 16.6 |

| 17.2 |

| (1,964 | ) | (1,996 | ) | (1.6) |

| (0.5) |

|

| Profit before tax | 3,506 |

| 3,844 |

| (8.8) |

| (7.9) |

| 14,929 |

| 14,776 |

| 1.0 |

| 2.0 |

|

| Tax on profit | (1,109 | ) | (1,315 | ) | (15.7) |

| (14.5) |

| (5,103 | ) | (5,230 | ) | (2.4) |

| (0.9) |

|

| Profit from continuing operations | 2,397 |

| 2,529 |

| (5.2) |

| (4.4) |

| 9,826 |

| 9,546 |

| 2.9 |

| 3.6 |

|

| Net profit from discontinued operations | — |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

|

| Consolidated profit | 2,397 |

| 2,529 |

| (5.2) |

| (4.4) |

| 9,826 |

| 9,546 |

| 2.9 |

| 3.6 |

|

| Non-controlling interests | (325 | ) | (394 | ) | (17.5) |

| (16.0) |

| (1,574 | ) | (1,482 | ) | 6.2 |

| 6.0 |

|

| Underlying attributable profit to the parent | 2,072 |

| 2,135 |

| (3.0) |

| (2.3) |

| 8,252 |

| 8,064 |

| 2.3 |

| 3.2 |

|

| Net capital gains and provisions | 711 |

| (1,634 | ) | — |

| — |

| (1,737 | ) | (254 | ) | 583.9 |

| 582.8 |

|

| Attributable profit to the parent | 2,783 |

| 501 |

| 455.5 |

| 412.0 |

| 6,515 |

| 7,810 |

| (16.6) |

| (15.9) |

|

(1) Includes exchange differences.

|

| | |

| 12 | | January - December 2019 |

Ü Fourth quarter results compared to the third quarter of 2019

Attributable profit to the parent amounted to EUR 2,783 million, a record high. However it was boosted by the net capital gains and provisions1 line, as detailed in the previous page.

Excluding these impacts, underlying attributable profit to the parent amounted to EUR 2,072 million, 2% higher than the fourth quarter of 2018 in euros (+5% without the FX impact).

Compared to the third quarter of 2019, it was 3% lower (-2% excluding the exchange rate impact), affected by the contribution to the Deposit Guarantee Fund (DGF) in Spain. Without it, growth was 5% in the quarter. Excluding the exchange rate impact, the increase was also 5%, with the following evolution by lines:

| |

| • | Total income was up 1%, due to the positive performance of customer revenue, up for the third quarter running, and higher gains on financial transactions. This helped to absorb the contribution to the FGD in Spain, excluding it, total income rose 3%. |

| |

| • | Operating expenses rose 4% driven by the high inflation adjustment in Argentina, increased marketing and technology costs in Brazil, investments in Santander Global Platform and Mexico, and higher personnel expenses in the US. |

| |

| • | Loan-loss provisions rose 6% primarily due to the seasonality of SC USA and the increases in the UK, due to a single name case, and Brazil, stemming from portfolio sales in the third quarter and greater volumes in the fourth. |

|

| |

| Underlying attributable profit to the parent* |

| EUR million |

žžžlžžž constant euros | |

(*) Excluding net capital gains and provisions.

(1) Positive results of EUR 693 million stemming from the agreement with Crédit Agricole S.A. for the integration of the custody businesses and EUR 551 million due to changes in tax regulation in Brazil, and negative results of EUR 225 million related to real estate stakes (Spain), EUR 140 million of restructuring costs and EUR 168 million for intangible assets and other.

|

| | |

January - December 2019 | | 13 |

|

| | | | | | | | | | |

| Grupo Santander. Condensed balance sheet |

| EUR million | | | | | |

| | | | Change | |

| Assets | Dec-19 |

| Dec-18 |

| Absolute |

| % |

| Dec-17 |

|

| Cash, cash balances at central banks and other demand deposits | 101,067 |

| 113,663 |

| (12,596 | ) | (11.1) |

| 110,995 |

|

| Financial assets held for trading | 108,230 |

| 92,879 |

| 15,351 |

| 16.5 |

| 125,458 |

|

| Debt securities | 32,041 |

| 27,800 |

| 4,241 |

| 15.3 |

| 36,351 |

|

| Equity instruments | 12,437 |

| 8,938 |

| 3,499 |

| 39.1 |

| 21,353 |

|

| Loans and advances to customers | 355 |

| 202 |

| 153 |

| 75.7 |

| 8,815 |

|

| Loans and advances to central banks and credit institutions | — |

| — |

| — |

| — |

| 1,696 |

|

| Derivatives | 63,397 |

| 55,939 |

| 7,458 |

| 13.3 |

| 57,243 |

|

| Financial assets designated at fair value through profit or loss | 66,980 |

| 68,190 |

| (1,210 | ) | (1.8) |

| 34,781 |

|

| Loans and advances to customers | 31,147 |

| 23,796 |

| 7,351 |

| 30.9 |

| 20,475 |

|

| Loans and advances to central banks and credit institutions | 28,122 |

| 32,325 |

| (4,203 | ) | (13.0) |

| 9,889 |

|

| Other (debt securities an equity instruments) | 7,711 |

| 12,069 |

| (4,358 | ) | (36.1) |

| 4,417 |

|

| Financial assets at fair value through other comprehensive income | 125,708 |

| 121,091 |

| 4,617 |

| 3.8 |

| 133,271 |

|

| Debt securities | 118,405 |

| 116,819 |

| 1,586 |

| 1.4 |

| 128,481 |

|

| Equity instruments | 2,863 |

| 2,671 |

| 192 |

| 7.2 |

| 4,790 |

|

| Loans and advances to customers | 4,440 |

| 1,601 |

| 2,839 |

| 177.3 |

| — |

|

| Loans and advances to central banks and credit institutions | — |

| — |

| — |

| — |

| — |

|

| Financial assets measured at amortised cost | 995,482 |

| 946,099 |

| 49,383 |

| 5.2 |

| 916,504 |

|

| Debt securities | 29,789 |

| 37,696 |

| (7,907 | ) | (21.0) |

| 31,034 |

|

| Loans and advances to customers | 906,276 |

| 857,322 |

| 48,954 |

| 5.7 |

| 819,625 |

|

| Loans and advances to central banks and credit institutions | 59,417 |

| 51,081 |

| 8,336 |

| 16.3 |

| 65,845 |

|

| Investments in subsidiaries, joint ventures and associates | 8,772 |

| 7,588 |

| 1,184 |

| 15.6 |

| 6,184 |

|

| Tangible assets | 35,235 |

| 26,157 |

| 9,078 |

| 34.7 |

| 22,975 |

|

| Intangible assets | 27,687 |

| 28,560 |

| (873 | ) | (3.1) |

| 28,683 |

|

| Goodwill | 24,246 |

| 25,466 |

| (1,220 | ) | (4.8) |

| 25,769 |

|

| Other intangible assets | 3,441 |

| 3,094 |

| 347 |

| 11.2 |

| 2,914 |

|

| Other assets | 53,534 |

| 55,044 |

| (1,510 | ) | (2.7) |

| 65,454 |

|

| Total assets | 1,522,695 |

| 1,459,271 |

| 63,424 |

| 4.3 |

| 1,444,305 |

|

| | | | | | |

| Liabilities and shareholders' equity | | | | | |

| Financial liabilities held for trading | 77,139 |

| 70,343 |

| 6,796 |

| 9.7 |

| 107,624 |

|

| Customer deposits | — |

| — |

| — |

| — |

| 28,179 |

|

| Debt securities issued | — |

| — |

| — |

| — |

| — |

|

| Deposits by central banks and credit institutions | — |

| — |

| — |

| — |

| 574 |

|

| Derivatives | 63,016 |

| 55,341 |

| 7,675 |

| 13.9 |

| 57,892 |

|

| Other | 14,123 |

| 15,002 |

| (879 | ) | (5.9) |

| 20,979 |

|

| Financial liabilities designated at fair value through profit or loss | 60,995 |

| 68,058 |

| (7,063 | ) | (10.4) |

| 59,617 |

|

| Customer deposits | 34,917 |

| 39,597 |

| (4,680 | ) | (11.8) |

| 28,945 |

|

| Debt securities issued | 3,758 |

| 2,305 |

| 1,453 |

| 63.0 |

| 3,056 |

|

| Deposits by central banks and credit institutions | 22,194 |

| 25,707 |

| (3,513 | ) | (13.7) |

| 27,027 |

|

| Other | 126 |

| 449 |

| (323 | ) | (71.9) |

| 589 |

|

| Financial liabilities measured at amortised cost | 1,230,745 |

| 1,171,630 |

| 59,115 |

| 5.0 |

| 1,126,069 |

|

| Customer deposits | 789,448 |

| 740,899 |

| 48,549 |

| 6.6 |

| 720,606 |

|

| Debt securities issued | 258,219 |

| 244,314 |

| 13,905 |

| 5.7 |

| 214,910 |

|

| Deposits by central banks and credit institutions | 152,969 |

| 162,202 |

| (9,233 | ) | (5.7) |

| 162,714 |

|

| Other | 30,109 |

| 24,215 |

| 5,894 |

| 24.3 |

| 27,839 |

|

| Liabilities under insurance contracts | 739 |

| 765 |

| (26 | ) | (3.4) |

| 1,117 |

|

| Provisions | 13,987 |

| 13,225 |

| 762 |

| 5.8 |

| 14,490 |

|

| Other liabilities | 28,431 |

| 27,889 |

| 542 |

| 1.9 |

| 28,556 |

|

| Total liabilities | 1,412,036 |

| 1,351,910 |

| 60,126 |

| 4.4 |

| 1,337,472 |

|

| Shareholders' equity | 122,103 |

| 118,613 |

| 3,490 |

| 2.9 |

| 116,265 |

|

| Capital stock | 8,309 |

| 8,118 |

| 191 |

| 2.4 |

| 8,068 |

|

| Reserves | 108,941 |

| 104,922 |

| 4,019 |

| 3.8 |

| 103,608 |

|

| Attributable profit to the Group | 6,515 |

| 7,810 |

| (1,295 | ) | (16.6) |

| 6,619 |

|

| Less: dividends | (1,662 | ) | (2,237 | ) | 575 |

| (25.7) |

| (2,029 | ) |

| Other comprehensive income | (22,032 | ) | (22,141 | ) | 109 |

| (0.5) |

| (21,777 | ) |

| Minority interests | 10,588 |

| 10,889 |

| (301 | ) | (2.8) |

| 12,344 |

|

| Total equity | 110,659 |

| 107,361 |

| 3,298 |

| 3.1 |

| 106,832 |

|

| Total liabilities and equity | 1,522,695 |

| 1,459,271 |

| 63,424 |

| 4.3 |

| 1,444,305 |

|

|

| | |

| 14 | | January - December 2019 |

GRUPO SANTANDER BALANCE SHEET

| |

| • | Overall positive volume performance in the year, with increases in both gross loans and advances to customers (excluding reverse repos) as well as in customer funds. |

| |

| • | Gross loans and advances to customers excluding reverse repos rose 5% year-on-year (+4% in constant euros), with eight of the 10 core countries growing, particularly in North and South America, which grew 10% and 9%, respectively. |

| |

| • | Customer funds increased 7% year-on-year (+6% in constant euros), with growth in nine of our 10 core markets. Demand deposits increased, as well as mutual funds. |

Ü Loans and advances to customers

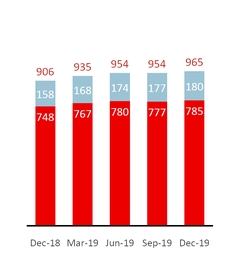

Gross loans and advances to customers rose to EUR 942,218 million in December 2019, 7% growth year-on-year.

The Group uses gross loans and advances to customers excluding reverse repos for the purpose of analysing traditional commercial banking loans.

| |

| • | Compared to December 2018, gross loans and advances to customers excluding reverse repos and the exchange rate impact increased 4%, with the following evolution by region: |

| |

| – | In Europe, moderate growth (+2%), with different performance by units. Increases in Santander Consumer Finance (+7%, with all countries growing), Poland (+5%) and the UK (+4%), where the increase in mortgages and other retail loans was partially offset by lower exposure to commercial real estate. On the other hand, there were declines in Spain (-6%), due to lower wholesale balances and with institutions, and in Portugal, affected by the sale of non-productive portfolios. |

| |

| – | In North America, the increase was 10%, with the US up 12%, with growth in SC USA and SBNA. Mexico also grew 5%. |

|

| |

| Gross loans and advances to customers (Excl. reverse repos) |

| EUR billion |

(*) In constant EUR: +4%

| |

| – | Growth in South America was 9%, with Brazil and Chile growing 8% and Argentina 40%, the latter driven by peso balances and the impact of the currency's depreciation on dollar balances. |

| |

| • | Quarter-on-quarter, gross loans and advances to customers, excluding reverse repos and the exchange rate impact, rose 2%. Growth of 4% in Brazil, the US, Santander Consumer Finance and Argentina, 3% in Mexico, and 2% in the UK and Chile. Poland and Portugal were broadly stable while Spain decreased 2% mainly due to portfolio sales and lower institutional balances. |

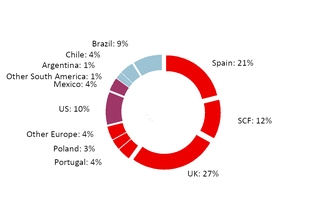

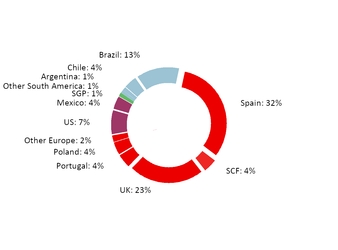

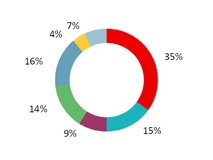

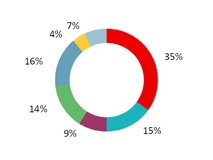

Gross loans and advances to customers excluding reverse repos maintained a balanced structure: individuals (47%), consumer credit (17%), SMEs and corporates (24%) and SCIB (12%).

|

| |

| Gross loans and advances to customers (Excl. reverse repos) |

| % operating areas. December 2019 |

|

| | |

January - December 2019 | | 15 |

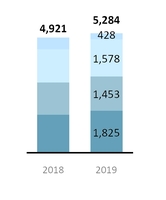

Ü Customer funds

Customer deposits amounted to EUR 824,365 million, 6% growth in the last 12 months (in euros).

The Group uses customer funds (customer deposits excluding repos, and including mutual funds) for the purpose of analysing traditional retail banking funds.

| |

| • | Compared to December 2018, customer funds, excluding the exchange rate impact, increased 6%, as follows: |

| |

| – | The strategy focused on increasing loyalty was reflected in demand deposits (+6%), which increased in all units except Mexico. Time deposits remained virtually unchanged overall. Mutual funds rose 15%, with growth in all core markets. |

| |

| – | By markets, customer funds rose in all of them except Mexico, which remained stable. Of note were Argentina (+24%), Brazil (+12%), Chile (+12%) and the US (+11%). There was more moderate growth in Portugal and Santander Consumer Finance (+8% each), Poland (+6%) and Spain (+3%). |

| |

| • | In the fourth quarter, customer funds were 1% higher, both in euros and excluding exchange rate impacts: |

| |

| – | By products, demand deposits rose 1%, with most of the countries growing. Time deposits decreased 2% and mutual funds increased 2%. |

| |

| – | By markets, South America rose 4%, mainly driven by Brazil, North America grew 1% and Europe remained stable. |

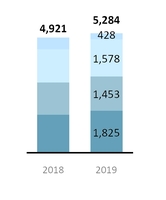

Customer funds continued to be well diversified by products: 61% demand deposits, 20% time deposits and 19% mutual funds.

|

| |

| Customer funds |

| EUR billion |

|

|

| +7% * |

| +14% |

| +5% |

| |

l Total |

l Mutual funds |

l Deposits excl. repos |

| |

| Dec-19 / Dec-18 |

| |

(*) In constant EUR: +6%

As well as capturing customer deposits, Grupo Santander, for strategic reasons, maintains a selective policy of issuing securities in the international fixed income markets and strives to adapt the frequency and volume of its market operations to the structural liquidity needs of each unit, as well as to the receptiveness of each market.

• In 2019, the Group issued:

| |

| – | Medium- and long-term covered bonds placed in the market of EUR 8,941 million and senior debt amounting to EUR 20,057 million, which includes the EUR 1 billion green bond issued initiating the Bank's global sustainable debt issuance plan. |

| |

| – | There were EUR 19,191 million of securitisations placed in the market. Additionally, the contractual maturity of EUR 1.2 billion of securitisations was extended, totalling EUR 20,391 million. |

| |

| – | Issuances to meet the TLAC (Total Loss-Absorbing Capacity) requirement amounting to EUR 3,850 million, in order to strengthen the Group’s situation (senior non-preferred: EUR 2,778 million, preferred: EUR 1,072 million). |

| |

| – | Maturities of medium- and long-term debt of EUR 23,838 million. |

| |

| • | The net loan-to-deposit ratio was 114% (113% in December 2018). The ratio of deposits plus medium- and long-term funding to the Group’s loans was 113%, underscoring the comfortable funding structure. |

| |

| • | Of note is the EUR 1.5 billion issuance of contingent convertible bonds (CoCos) issued in January 2020, eligible for AT1 regulatory capital treatment, with a coupon of 4.375%. The spread was 6 year midswap plus 4.534%, thanks to strong demand (7 times over subscribed) and the large number of investors. |

|

| |

| Customer funds |

| % operating areas. December 2019 |

|

| | |

| 16 | | January - December 2019 |

SOLVENCY RATIOS

| |

| • | At year-end, the CET1 ratio reached 11.65% after increasing 35 bps in the quarter. In the year, record gross generation of 97 bps partially offset by regulatory impacts (-62 bps). |

| |

| • | Tangible equity per share was EUR 4.36, 4% higher in the year. Including the cash dividend paid, growth was 8%. |

| |

| • | The fully loaded leverage ratio was stable at 5.1% in the year. |

At the end of the quarter, the total phased-in capital ratio stood at 15.05% and the CET1 ratio (phased-in and fully loaded) at 11.65%, comfortably meeting the minimum levels required by the European Central Bank on a consolidated basis (13.18% for the total capital ratio and 9.68% for the CET1 ratio).

In the quarter, we continued to generate capital organically, +31 bps, as a result of underlying profit and the active management of risk weighted assets. As such, the organic generation in the year was 79 bps.

This organic generation, together with favourable market movements benefiting from the held to collect and sell portfolios (due to falling interest rates), a slight positive perimeter impact (the acquisition of minority interests in Mexico and integration of custody business) as well as the negative 15 bps impact from restructuring costs.

|

| | | | |

| Eligible capital. December 2019* |

| EUR million | | |

| | Phased-in |

| Fully loaded |

|

| CET1 | 70,497 |

| 70,497 |

|

| Basic capital | 79,536 |

| 78,964 |

|

| Eligible capital | 91,067 |

| 90,937 |

|

| Risk-weighted assets | 605,244 |

| 605,244 |

|

| | | |

| CET1 capital ratio | 11.65 |

| 11.65 |

|

| T1 capital ratio | 13.14 |

| 13.05 |

|

| Total capital ratio | 15.05 |

| 15.02 |

|

As a result, the gross generation achieved an increase of 97 bps, boosting the fully loaded CET1 ratio to 12.27% in December, before the accounting and regulatory impacts recorded in this period (-62 bps, mainly because of the IFRS 16 application and TRIMs).

Had the IFRS 9 transitional arrangement not been applied, the total impact on the CET1 would have been -23 bps.

In April 2019, the European Central Bank published the aggregate result of its Supervisory Review and Evaluation Process (SREP) carried out in 2018. Santander has lower capital requirements than the average of SSM banks. This positive differential was wider in 2018 than in 2017.

|

|

| Fully-loaded capital ratio* |

| % |

|

| | | |

| | QoQ evolution | |

| | Organic Generation | +31 bps | |

| | Others | +13 bps | |

| | Regulatory Impacts | -9 bps | |

| | | | |

| | | | |

(1) Restructuring costs (-15 bps); Share buyback Mexico (+4 bps); Custody (+3 bps); Other (+4 bps).

(2) IFRS 16 (-19 bps); models and TRIM (-36 bps); Other (-7 bps).

(*) All 2018 and 2019 data was calculated using the IFRS 9 transitional arrangements, unless otherwise indicated.

|

| | |

January - December 2019 | | 17 |

RISK MANAGEMENT

| |

| • | In the fourth quarter, Santander’s credit quality improved further. Low market risk activity aimed to service our customers and limited exposure to operational risk events continued as in previous quarters, maintaining our medium-low risk profile. |

| |

| • | The NPL ratio ended 2019 at 3.32%, having decreased in the quarter and in the year, while cost of credit remained at 1% levels. Coverage increased to 68%. |

| |

| • | Our market risk exposure, in the fourth quarter, remained at low levels, in spite of the prevailing uncertainty and volatility in the geopolitical scenario. |

| |

| • | The operational risk profile remained stable with a similar distribution of losses by category in the quarter. |

u Credit risk management

The positive trend in credit quality continued during the fourth quarter, supported by the positive year-on-year evolution of the NPL ratio, and a stable coverage and cost of credit.

Non-performing loans amounted to EUR 33,799 million in December, 1% less than in the previous quarter. Excluding the exchange-rate impact, the total volume of NPLs also decreased, due to the reductions observed in our European units despite a slight increase in South and North America.

The Group’s NPL ratio decreased to 3.32% (-15 bps QoQ and -41 bps YoY). Reductions were observed on a year-on-year basis mainly in Portugal, the US, Mexico and Spain. The NPL ratio in Spain continued to be affected by the integration of Banco Popular and the real estate business.

Loan-loss provisions made in the fourth quarter amounted to EUR 2,573 million, 6% greater in constant euros than in the third quarter, mainly driven by seasonality in SC USA and loan growth in Brazil.

Cumulative loan-loss provisions also increased year-on-year adding up to EUR 9,321 million (+5% in constant euros), led by Brazil, the US and SCF, in line with portfolio growth.

Cost of credit remained at similar levels compared to the previous quarter and on a year-on-year basis reflecting the stability of our loan portfolio’s credit quality.

|

| | | | | | | |

| Credit risk |

| EUR million | | | | |

| | Dec-19 |

| Dec-18 |

| Chg (%) | Dec-17 |

|

| Non-performing loans | 33,799 |

| 35,692 |

| (5.3) | 37,596 |

|

| NPL ratio (%) | 3.32 |

| 3.73 |

|

| 4.08 |

|

| Loan-loss allowances | 22,965 |

| 24,061 |

| (4.6) | 24,529 |

|

| For impaired assets | 14,093 |

| 15,148 |

| (7.0) | 16,459 |

|

| For other assets | 8,872 |

| 8,913 |

| (0.5) | 8,070 |

|

| Coverage ratio (%) | 68 |

| 67 |

|

| 65 |

|

| Cost of credit (%) | 1.00 |

| 1.00 |

|

| 1.07 |

|

|

|

| NPL and coverage ratios. Total Group |

| % |

|

| | | | | | | | |

| Key metrics geographic performance. December 2019 |

| % | NPL |

| Change (pb) | Coverage |

|

| | ratio |

| QoQ |

| YoY |

| ratio |

|

| Spain | 6.94 |

| -29 |

| -38 |

| 41 |

|

| Consumer Finance | 2.30 |

| 5 |

| 1 |

| 106 |

|

| United Kingdom | 1.01 |

| -7 |

| -7 |

| 37 |

|

| Portugal | 4.83 |

| -7 |

| -111 |

| 53 |

|

| Poland | 4.31 |

| -4 |

| 3 |

| 67 |

|

| US | 2.20 |

| 2 |

| -72 |

| 162 |

|

| Mexico | 2.19 |

| -11 |

| -24 |

| 128 |

|

| Brazil | 5.32 |

| -1 |

| 7 |

| 100 |

|

| Chile | 4.64 |

| 16 |

| -2 |

| 56 |

|

| Argentina | 3.39 |

| -25 |

| 22 |

| 124 |

|

|

| | |

| 18 | | January - December 2019 |

|

| | | | | | | | | | | | | | | | |

| Non-performing loans by quarter | | |

| EUR million | | | | | | | | |

| | Q1'18 |

| Q2'18 |

| Q3'18 |

| Q4'18 |

| Q1'19 |

| Q2'19 |

| Q3'19 |

| Q4'19 |

|

| Balance at beginning of period | 37,596 |

| 37,407 |

| 36,654 |

| 36,332 |

| 35,692 |

| 35,590 |

| 34,421 |

| 34,326 |

|

| Net additions | 2,340 |

| 2,906 |

| 2,528 |

| 3,136 |

| 2,147 |

| 2,511 |

| 3,190 |

| 2,696 |

|

| Increase in scope of consolidation | — |

| — |

| — |

| 177 |

| — |

| — |

| — |

| — |

|

| Exchange rate differences and other | 361 |

| (409 | ) | (140 | ) | (130 | ) | 479 |

| (162 | ) | (110 | ) | (51 | ) |

| Write-offs | (2,890 | ) | (3,250 | ) | (2,710 | ) | (3,823 | ) | (2,728 | ) | (3,518 | ) | (3,175 | ) | (3,172 | ) |

| Balance at period-end | 37,407 |

| 36,654 |

| 36,332 |

| 35,692 |

| 35,590 |

| 34,421 |

| 34,326 |

| 33,799 |

|

Total loan-loss reserves amounted to EUR 22,965 million. Coverage at the end of 2019 increased to 68% for the Group. It should be taken into account that in Spain and the UK, a large part of their portfolios has real estate collateral, which justifies lower coverage levels.

The Group’s coverage by IFRS 9 stages remained stable on a year-on-year basis, with no significant movements.

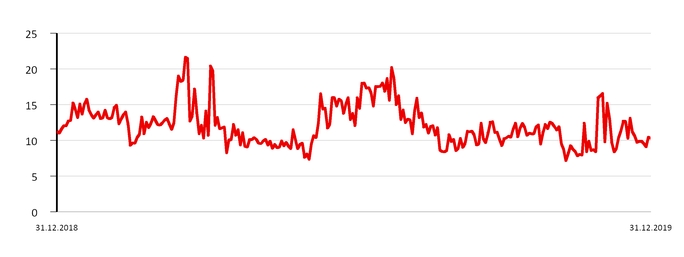

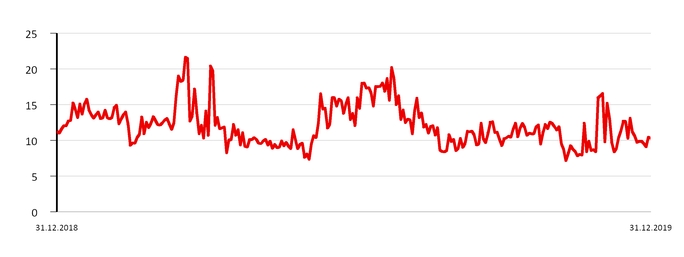

u Market risk

The global corporate banking trading activity risk is mainly interest rate driven, focused on servicing our customer's needs and measured in daily VaR terms at 99%. In the fourth quarter, VaR fluctuated around an average value of EUR 10.7 million and reached a maximum of EUR 16.6 million, mainly as a result of the market volatility caused by the political uncertainty in Chile, always within the established limits. These figures are low compared to the size of the Group’s balance sheet and activity. In addition, there are other positions classified for accounting purposes as trading (total VaR of EUR 10.4 million at the end of December 2019).

|

| | | | | | | |

| Coverage ratio by stage |

| EUR billion | | |

| | Exposure* | | Coverage |

| | Dec-19 |

| | Dec-19 |

| Dec-18 |

|

| Stage 1 | 898 |

| | 0.5 | % | 0.5 | % |

| Stage 2 | 53 |

| | 8.7 | % | 9.2 | % |

| Stage 3 | 34 |

| | 41.7 | % | 42.4 | % |

(*) Exposure subject to impairment.

Stage 1: financial instruments for which no significant increase in credit risk is identified since its initial recognition.

Stage 2: if there has been a significant increase in credit risk since the date of initial recognition but the impairment event has not materialised, the financial instrument is classified in Stage 2.

Stage 3: a financial instrument is catalogued in this stage when it shows effective signs of impairment as a result of one or more events that have already occurred resulting in a loss.

Additionally, there are EUR 24 billion in loans and advances to customers not subject to impairment recorded at mark to market with changes through P&L.

|

|

| Trading portfolios*. VaR performance |

| EUR million |

(*) Corporate & Investment Banking performance in financial markets.

|

| | |

January - December 2019 | | 19 |

|

| | | | | | | |

| Trading portfolios *. VaR by geographic region |

| EUR million | | | | |

| | 2019 | | 2018 |

| Second quarter | Average | Latest | | Average |

| | | | | |

| Total | 10.7 |

| 10.3 |

| | 10.1 |

|

| Europe | 7.3 |

| 10.1 |

| | 5.3 |

|

| North America | 4.1 |

| 3.8 |

| | 5.1 |

|

| South America | 7.9 |

| 6.0 |

| | 8.6 |

|

(*) Activity performance in Corporate & Investment Banking markets.

u Structural and liquidity risk

| |

| • | Regarding structural exchange rate risk, Santander’s CET1 ratio coverage remained around 100% in order to protect it from foreign currency movements. |

| |

| • | In structural interest rate risk, positive performance in the ALCO activity despite high volatility during the quarter, mainly due to the US/China trade tensions and political uncertainty in several countries where the Group operates. |

| |

| • | Regarding liquidity risk, the Group maintained a comfortable position, supported by a robust and diversified liquidity buffer, with ratios well above regulatory limits. |

|

| | | | | | | | |

| Trading portfolios *. VaR by market factor |

| EUR million | | | | |

| Four quarter 2019 | Min. | Avg. | Max. | Last |

| VaR total | 7.1 |

| 10.7 |

| 16.6 |

| 10.3 |

|

| Diversification effect | (3.3 | ) | (8.7 | ) | (13.3 | ) | (9.9 | ) |

| Interest rate VaR | 6.7 |

| 8.9 |

| 12.1 |

| 9.2 |

|

| Equity VaR | 1.7 |

| 3.3 |

| 5.1 |

| 4.8 |

|

| FX VaR | 2.3 |

| 3.9 |

| 6.4 |

| 2.6 |

|

| Credit spreads VaR | 2.6 |

| 3.4 |

| 4.1 |

| 3.5 |

|

| Commodities VaR | 0.0 |

| 0.0 |

| 0.0 |

| 0.0 |

|

(*) Activity performance in Corporate & Investment Banking markets.

NOTE: In the North America and South America and Asia portfolios, VaR corresponding to the credit spreads factor other than sovereign risk is not relevant and is included in the interest rate factor.

u Operational risk

| |

| • | The main focus points in the fourth quarter in terms of operational risk management were the evolution of legacy cases, labour claims in Brazil and ongoing legal and regulatory cases. |

| |

| • | In relative terms, levels of losses by Basel categories were higher in those derived from customer claims, while external fraud showed a reduction compared to last year. |

| |

| • | The cumulative impact from PPI claims in the year is EUR 183 million (net of tax), which is higher than last year due to the end of the redress period in August. |

| |

| • | Specific risk-monitoring frameworks continued to be enhanced, such as those for suppliers (focusing on actions to ensure compliance with the EBA Guidelines), the most significant transformation processes (including digitalisation initiatives), as well as the implementation of fraud mitigating measures in the main units (Mexico, the UK and Brazil). |

| |

| • | Cybersecurity, a key area for the Group, continued to improve. Progress continued in the second half of 2019 in our cybersecurity transformation programme in order to strengthen detection, response and protection mechanisms. New policies have been developed and deployed to enhance management and control over critical IT infrastructure and assets. |

|

| | |

| 20 | | January - December 2019 |

GENERAL BACKGROUND

Grupo Santander carried out its business in 2019 in an slowing economic environment (to around 3% estimated vs. 3.6% growth in 2018) due to trade tensions between the US and China and the uncertainty regarding the manner in which the UK would leave the EU. Uncertainty reduced at year end: the US and China reached a trade agreement and the result of the UK elections points to a non-traumatic outcome.

This reduction in uncertainty, together with the expansionary monetary policy measures, allowed activity to stabilise.

|

| | | |

| | Country | GDP Change1 | Economic performance |

| Eurozone | +1.2% | The negative impact from the external environment weakened GDP, driven by cyclical depletion. Inflation remained stagnant at around 1%. The ECB reacted with another set of monetary easing measures, including a cut in interest rates and the resumption of the asset purchase programme. |

| Spain | +1.9% | Economic expansion continued, although at more moderate rates. The unemployment rate fell again, to around 14%. The economy is not showing inflationary pressures due to the fall in energy prices and a compression of business margins which have offset wage rises. |

| United Kingdom | +1.2% | Economic performance was very volatile throughout the year, influenced by the attempts to exit the EU. The main element supporting growth was private consumption backed by real wage increases, which were higher as inflation fell (1.3% in December). The unemployment rate (3.8% in Q3'19) remained at historical lows. The base rate remained at 0.75%. |

| Portugal | +1.9% | The economy moderated its growth supported by private consumption and investment, whose momentum generated an increase in imports that reduced the contribution of the external sector to GDP. The jobless rate continued to fall (6.1%) and inflation stood at just 0.4% in December. |

| Poland | +4.2% | The economy continued to grow at a good pace, although at more modest rates, backed by domestic demand. The unemployment rate was at a historic low (close to 3%). Inflation increased significantly in December to 3.4%, though this is expected to moderate and as such the central bank held its key interest rate at 1.5%. |

| United States | +2.3% | GDP decelerated by 60 basis points in the year due to lower global growth, geopolitical uncertainty and the dilution of fiscal stimuli. Unemployment remained low, but with inflation below target, the Fed made an adjustment by cutting interest rate by 75 bps to 1.50-1.75%. |

| Mexico | -0.1% | Economic growth was stagnant in 2019 due to a fall in investment and fiscal adjustment. Inflation moderated to 2.8%, below the central bank's target (3%), which began to cut its key rate in August (a total of 100 bps in the year) to 7.25%. The recent process on the approval of the trade agreement between Mexico, the US and Canada ended uncertainty about the economic relationship between the three countries. |

| Brazil | +1.2% | The recovery gained momentum during the year, from private consumption and investment. Inflation rebounded to 4.31%, slightly above the target of 4.25%, but core inflation was lower (3.4%). The central bank cut its benchmark rate by 200 bps to 4.5%. S&P improved the outlook for sovereign rating (at BB-) from stable to positive, given the progress in fiscal consolidation measures. |

| Chile | +1.1% | The economy was impacted by the social protests that began in mid-October, although the situation has now normalised. Inflation of 3%, coinciding with the central bank's target, who cut the official rate to 1.75% (vs 2.75% at the end of 2018) and established an exchange rate intervention programme to control the peso's volatility. |

| Argentina | -2.3% | GDP shrank as a result of financial volatility since August, which dampened consumption and investment and caused inflation to rise. The central bank introduced capital controls, which allowed it to cut interest rates in the final few months of the year, reversing the previous rise. |

(1) Estimated year-on-year change 2019.

|

| | |

January - December 2019 | | 21 |

DESCRIPTION OF SEGMENTS

The segment reporting is based on financial information presented to the chief operating decision maker, which excludes certain items included in the statutory results that distort year-on-year comparisons and are not considered for management reporting purposes. This financial information (underlying basis) is computed by adjusting reported results for the effects of certain gains and losses (e.g.: capital gains, write-downs, impairment of goodwill, etc.). These gains and losses are items that management and investors ordinarily identify and consider separately to better understand the underlying trends in the business.

The Group has aligned the information in this operating segment section in a manner consistent with the underlying information used internally for management reporting purposes and with that presented throughout the Group’s other public documents.