Banco Santander (SAN) 6-KCurrent report (foreign)

Filed: 3 Feb 21, 6:49am

| Part 1. January - December 2020 Financial Report | |||||

| Financial Report | 2020 | ||||

| January - December | |||||

| BALANCE SHEET (EUR million) | Dec-20 | Sep-20 | % | Dec-20 | Dec-19 | % | Dec-18 | ||||||||||||||||

| Total assets | 1,508,250 | 1,514,242 | (0.4) | 1,508,250 | 1,522,695 | (0.9) | 1,459,271 | ||||||||||||||||

| Loans and advances to customers | 916,199 | 910,714 | 0.6 | 916,199 | 942,218 | (2.8) | 882,921 | ||||||||||||||||

| Customer deposits | 849,310 | 842,899 | 0.8 | 849,310 | 824,365 | 3.0 | 780,496 | ||||||||||||||||

| Total funds | 1,056,127 | 1,039,608 | 1.6 | 1,056,127 | 1,050,765 | 0.5 | 980,562 | ||||||||||||||||

| Total equity | 91,322 | 91,310 | 0.0 | 91,322 | 110,659 | (17.5) | 107,361 | ||||||||||||||||

| Note: Total funds includes customer deposits, mutual funds, pension funds and managed portfolios | |||||||||||||||||||||||

| INCOME STATEMENT (EUR million) | Q4'20 | Q3'20 | % | 2020 | 2019 | % | 2018 | ||||||||||||||||

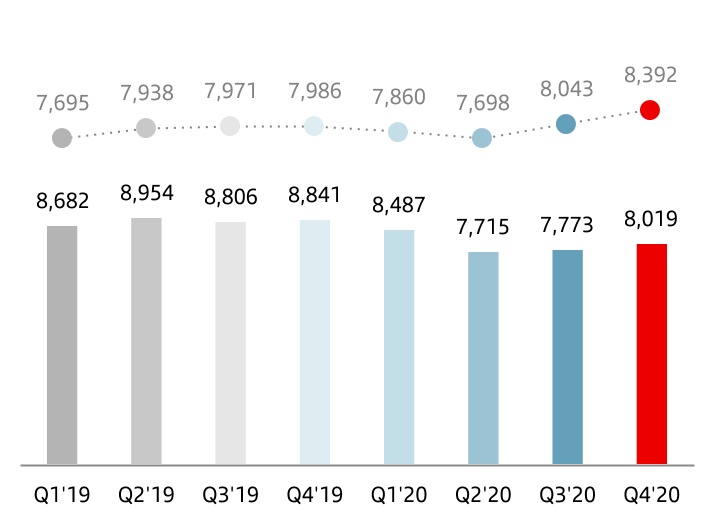

| Net interest income | 8,019 | 7,773 | 3.2 | 31,994 | 35,283 | (9.3) | 34,341 | ||||||||||||||||

| Total income | 10,924 | 11,087 | (1.5) | 44,279 | 49,229 | (10.1) | 48,424 | ||||||||||||||||

| Net operating income | 5,580 | 6,008 | (7.1) | 23,149 | 25,949 | (10.8) | 25,645 | ||||||||||||||||

| Profit before tax | 1,195 | 3,139 | (61.9) | (2,076) | 12,543 | — | 14,201 | ||||||||||||||||

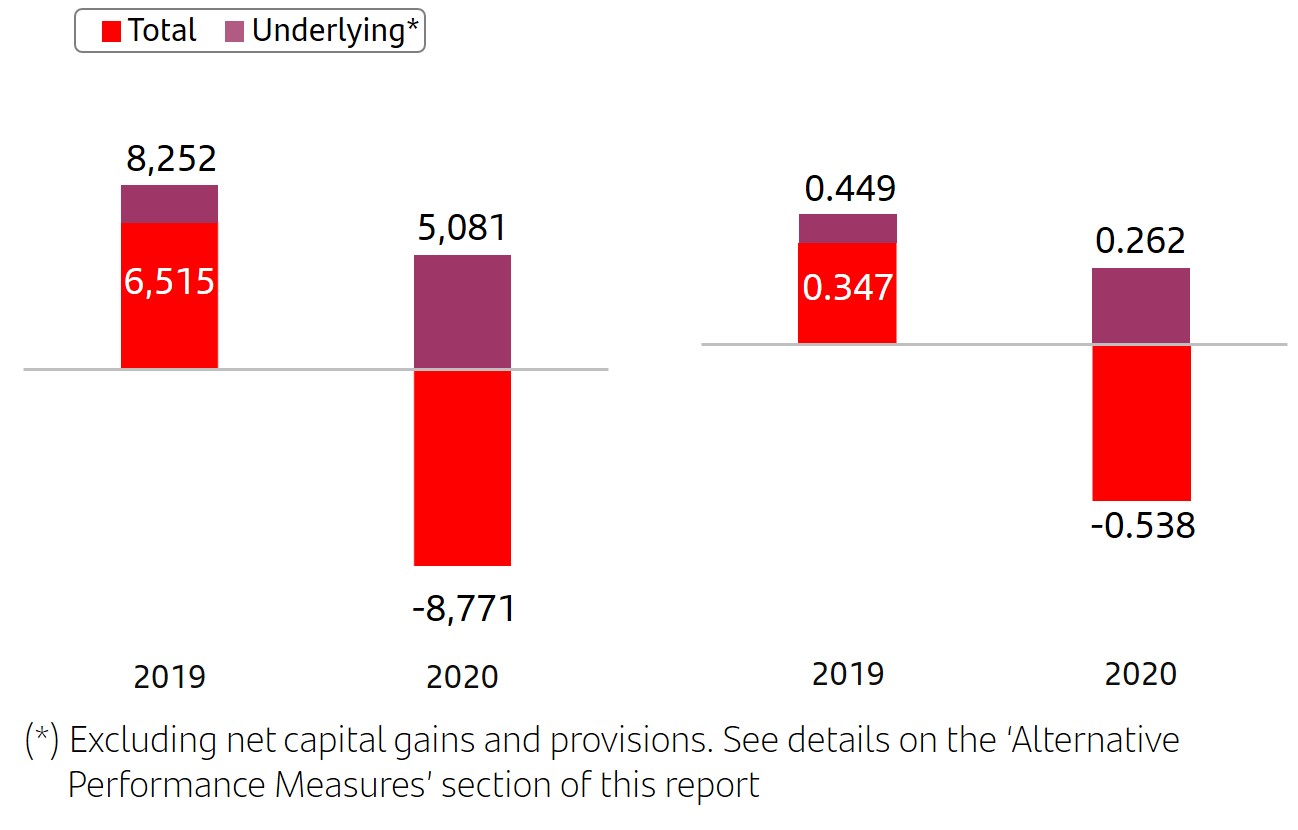

| Attributable profit to the parent | 277 | 1,750 | (84.2) | (8,771) | 6,515 | — | 7,810 | ||||||||||||||||

| Changes in constant euros: | |||||||||||||||||||||||

| Q4'20 / Q3'20: NII: +4.3%; Total income: -0.2%; Net operating income: -5.7%; Attributable profit: -79.6% | |||||||||||||||||||||||

| 2020 / 2019: NII: +1.3%; Total income: +0.2%; Net operating income: +1.5%; Attributable profit: +/- | |||||||||||||||||||||||

| EPS, PROFITABILITY AND EFFICIENCY (%) | Q4'20 | Q3'20 | % | 2020 | 2019 | % | 2018 | ||||||||||||||||

EPS (euros) (2) | 0.008 | 0.093 | (91.3) | (0.538) | 0.347 | — | 0.431 | ||||||||||||||||

| RoE | 5.54 | 8.54 | (9.80) | 6.62 | 8.21 | ||||||||||||||||||

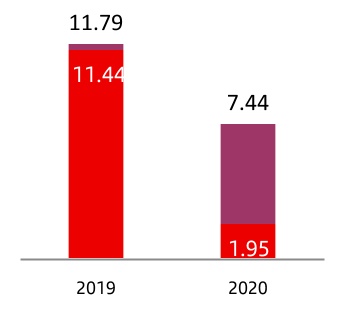

| RoTE | 6.86 | 10.58 | 1.95 | 11.44 | 11.63 | ||||||||||||||||||

| RoA | 0.38 | 0.53 | (0.50) | 0.54 | 0.64 | ||||||||||||||||||

| RoRWA | 1.04 | 1.46 | (1.33) | 1.33 | 1.55 | ||||||||||||||||||

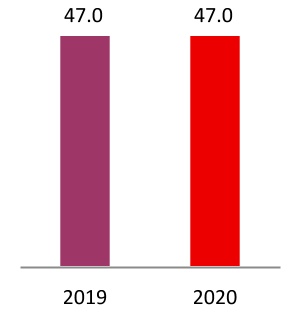

| Efficiency ratio | 47.7 | 45.8 | 47.0 | 47.0 | 47.0 | ||||||||||||||||||

UNDERLYING INCOME STATEMENT (1) (EUR million) | Q4'20 | Q3'20 | % | 2020 | 2019 | % | 2018 | ||||||||||||||||

| Net interest income | 8,019 | 7,773 | 3.2 | 31,994 | 35,283 | (9.3) | 34,341 | ||||||||||||||||

| Total income | 10,995 | 11,087 | (0.8) | 44,600 | 49,494 | (9.9) | 48,424 | ||||||||||||||||

| Net operating income | 5,754 | 6,014 | (4.3) | 23,633 | 26,214 | (9.8) | 25,645 | ||||||||||||||||

| Profit before tax | 2,658 | 3,175 | (16.3) | 9,674 | 14,929 | (35.2) | 14,776 | ||||||||||||||||

| Attributable profit to the parent | 1,423 | 1,750 | (18.7) | 5,081 | 8,252 | (38.4) | 8,064 | ||||||||||||||||

| Changes in constant euros: | |||||||||||||||||||||||

| Q4'20 / Q3'20: NII: +4.3%; Total income: +0.4%; Net operating income: -3.0%; Attributable profit: -16.3% | |||||||||||||||||||||||

| 2020 / 2019: NII: +1.3%; Total income: +0.3%; Net operating income: +2.5%; Attributable profit: -29.5% | |||||||||||||||||||||||

UNDERLYING EPS AND PROFITABILITY (1) (%) | Q4'20 | Q3'20 | % | 2020 | 2019 | % | 2018 | ||||||||||||||||

Underlying EPS (euros)(2) | 0.074 | 0.093 | (20.2) | 0.262 | 0.449 | (41.7) | 0.446 | ||||||||||||||||

| Underlying RoE | 6.93 | 8.54 | 5.68 | 8.38 | 8.48 | ||||||||||||||||||

| Underlying RoTE | 8.59 | 10.58 | 7.44 | 11.79 | 12.08 | ||||||||||||||||||

| Underlying RoA | 0.46 | 0.53 | 0.40 | 0.65 | 0.66 | ||||||||||||||||||

| Underlying RoRWA | 1.24 | 1.46 | 1.06 | 1.61 | 1.59 | ||||||||||||||||||

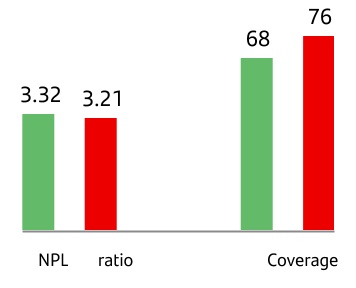

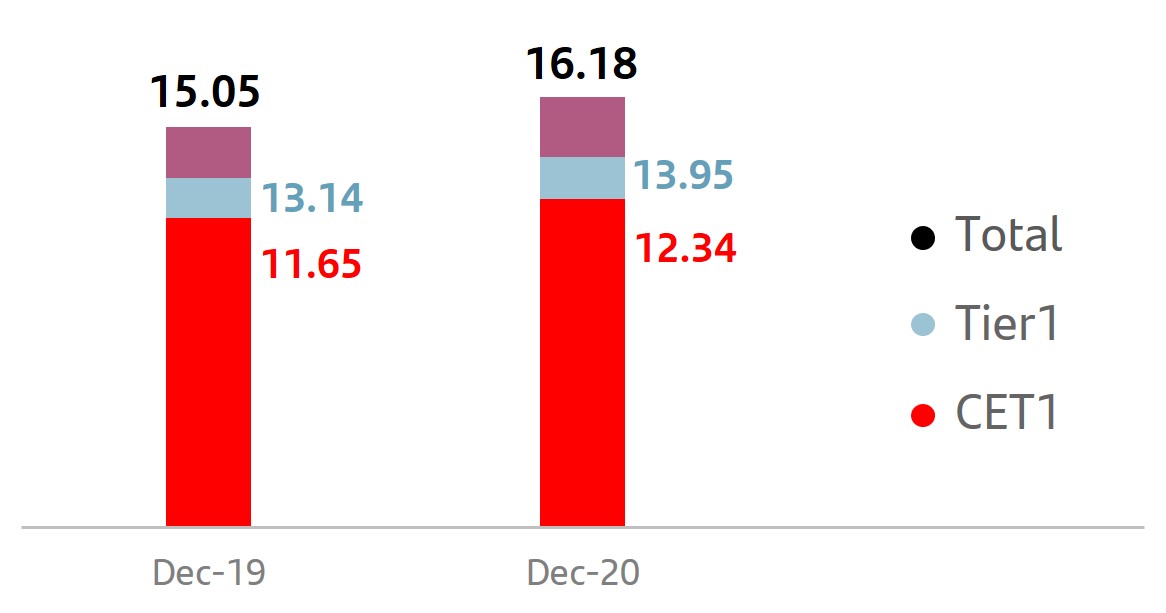

SOLVENCY (3) AND NPL RATIOS (%) | Dec-20 | Sep-20 | Dec-20 | Dec-19 | Dec-18 | ||||||||||||||||||

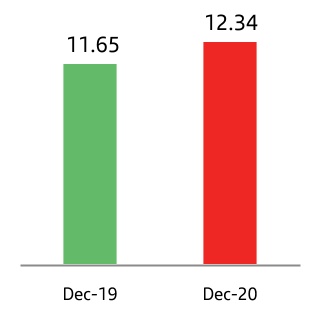

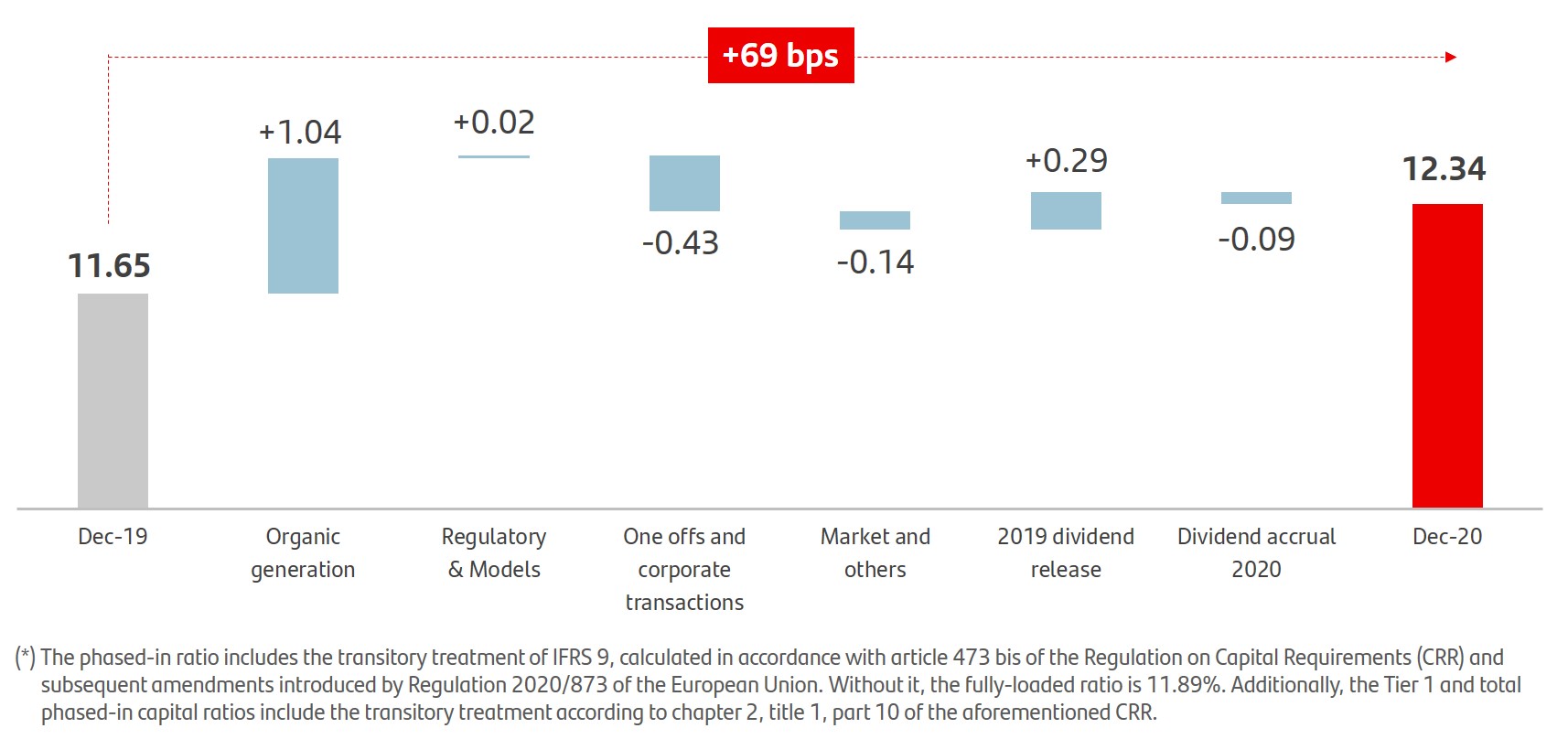

| CET1 phased-in | 12.34 | 11.98 | 12.34 | 11.65 | 11.47 | ||||||||||||||||||

| Phased-in total capital ratio | 16.18 | 15.58 | 16.18 | 15.05 | 14.98 | ||||||||||||||||||

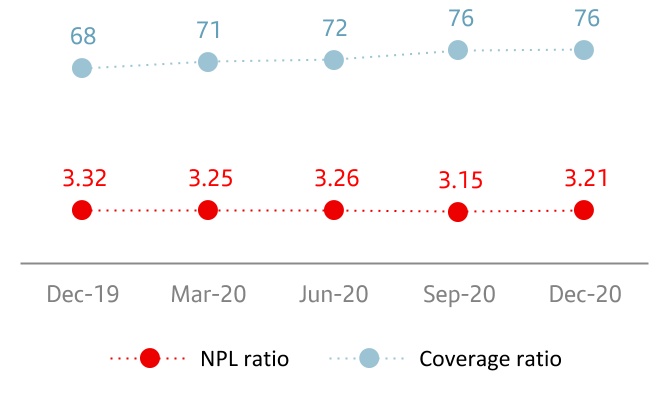

| NPL ratio | 3.21 | 3.15 | 3.21 | 3.32 | 3.73 | ||||||||||||||||||

| Coverage ratio | 76 | 76 | 76 | 68 | 67 | ||||||||||||||||||

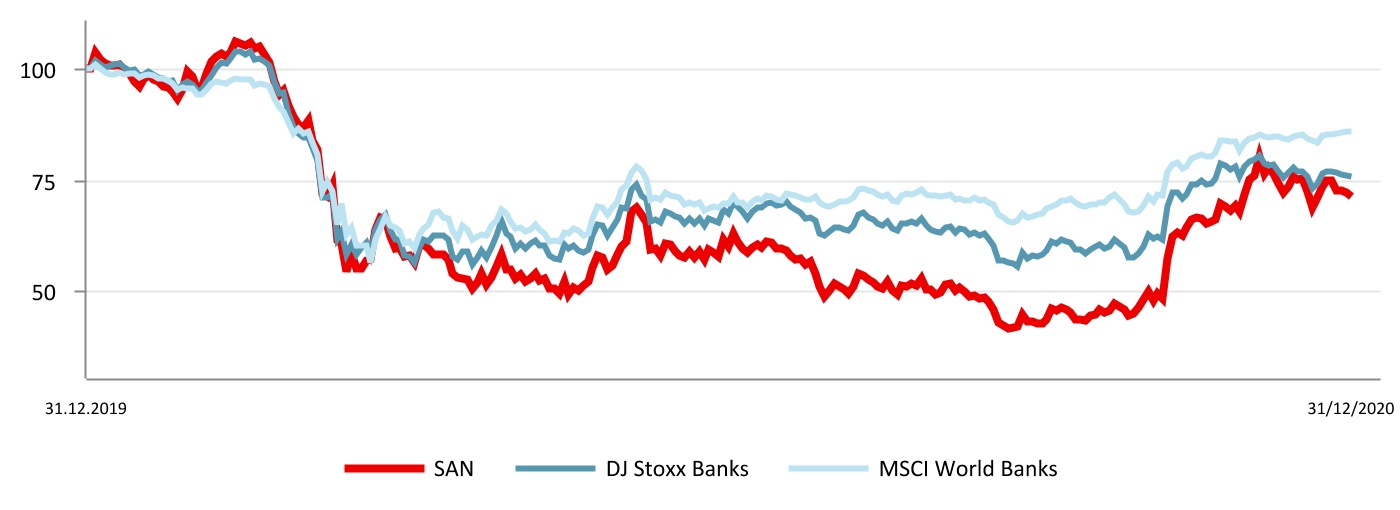

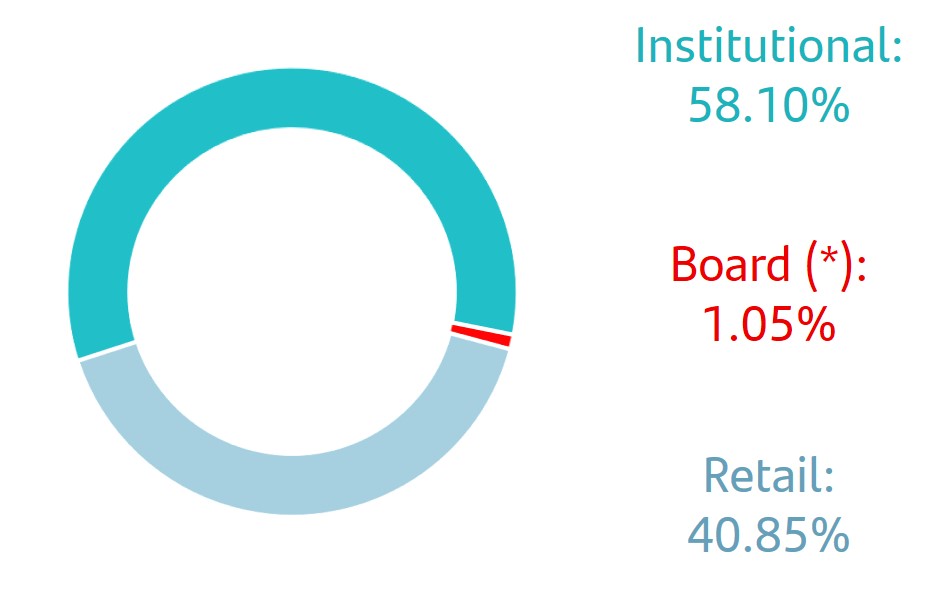

| MARKET CAPITALIZATION AND SHARES | Dec-20 | Sep-20 | % | Dec-20 | Dec-19 | % | Dec-18 | ||||||||||||||||

| Shares (millions) | 17,341 | 16,618 | 4.3 | 17,341 | 16,618 | 4.3 | 16,237 | ||||||||||||||||

Share price (euros)(2) | 2.538 | 1.533 | 65.6 | 2.538 | 3.575 | (29.0) | 3.807 | ||||||||||||||||

| Market capitalization (EUR million) | 44,011 | 26,582 | 65.6 | 44,011 | 61,986 | (29.0) | 64,508 | ||||||||||||||||

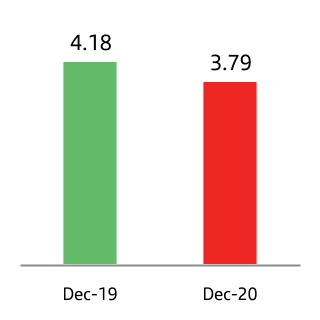

Tangible book value per share (euros)(2) | 3.79 | 3.82 | 3.79 | 4.18 | 4.01 | ||||||||||||||||||

Price / Tangible book value per share (X) (2) | 0.67 | 0.40 | 0.67 | 0.86 | 0.95 | ||||||||||||||||||

| OTHER DATA | Dec-20 | Sep-20 | % | Dec-20 | Dec-19 | % | Dec-18 | ||||||||||||||||

| Number of shareholders | 4,018,817 | 4,103,069 | (2.1) | 4,018,817 | 3,986,093 | 0.8 | 4,131,489 | ||||||||||||||||

| Number of employees | 191,189 | 192,578 | (0.7) | 191,189 | 196,419 | (2.7) | 202,713 | ||||||||||||||||

| Number of branches | 11,236 | 11,520 | (2.5) | 11,236 | 11,952 | (6.0) | 13,217 | ||||||||||||||||

| (1) In addition to financial information prepared in accordance with International Financial Reporting Standards (IFRS) and derived from our consolidated financial statements, this report contains certain financial measures that constitute alternative performance measures (APMs) as defined in the Guidelines on Alternative Performance Measures issued by the European Securities and Markets Authority (ESMA) on 5 October 2015 and other non-IFRS measures, including the figures related to “underlying” results, as they are recorded in the separate line of “net capital gains and provisions”, above the line of attributable profit to the parent. Further details are provided on the 'Alternative Performance Measures' section of this report. For further details of the APMs and non-IFRS measures used, including its definition or a reconciliation between any applicable management indicators and the financial data presented in the consolidated financial statements prepared under IFRS, please see 2019 Annual Financial Report, published in the CNMV on 28 February 2020, our 20-F report for the year ending 31 December 2019 registered with the SEC in the United States as well as the “Alternative performance measures” section of the annex to this report. | ||

| (2) 2018, 2019 and September 2020 data adjusted for the capital increase in December 2020. | ||

| (3) The phased-in ratio includes the transitory treatment of IFRS 9, calculated in accordance with article 473 bis of the Regulation on Capital Requirements (CRR) and subsequent amendments introduced by Regulation 2020/873 of the European Union. Additionally, the total phased-in capital ratio includes the transitory treatment according to chapter 2, title 1, part 10 of the aforementioned CRR. | ||

January - December 2020 |  | 3 | ||||||

Response to the covid-19 crisis | ||||||||||||||||||||||||||

| Contingency plan | |||||

Our main priority is to ensure business while safeguarding the health, well-being and economic interests of our stakeholders, which is only possible through the implementation and continuous improvement of the Special Situations Management Framework. This Framework channels the implementation of the Group's and subsidiaries' contingency plans, which is key to meet the objective of continuing to operate within the same quality standards and in compliance with our regulatory commitments. •The Framework includes as best practices in the industry those preparation activities focused on the training and correct application of action protocols in order to face any crisis. Of note were the periodic simulation exercises carried out and the recent launch of an e-learning programme for all employees as a tool to raise awareness and prepare for certain stress situations. •In addition, this Framework has provided flexibility for the activation of the corporate special situations committees with the objective of responding preventively to the environment caused by covid-19, as well as coordinating the countries' responses. At year end, the Framework continued to be fully active as a preventive measure, as no financial stress has been recorded. •Our Contingency Plans ensured the operational continuity of our businesses including measures such as segregating teams and technological infrastructures, establishing shifts between critical employees and their back-ups, as well as increasing the capacity of systems, carried out by the Technology and Operations area. | |||||

| Health of our employees | |||||

Our priority was to safeguard the health and safety of our employees: •At the peak of the pandemic, we redefined our way of working, exceding 110,000 employees working from home. •We ensured the physical and mental well-being of the employees who continued to work in our offices, or had direct contact with customers. •Financial well-being was also covered, offering various financial support measures to help employees and making exceptional payments to front line workers during the pandemic. •We continued to gradually return to the usual workplaces in some countries, always following the recommendations of local governments and based on three pillars: development and implementation of health and safety protocols, prioritization and monitoring the health status of our employees, and tracking and tracing (through health apps). For example, 90% of the Corporate Centre employees have returned to the office, and we have implemented an updated Flexiworking Policy on remote working. •Additionally, under the #SafeTogether programme, numerous initiatives are being implemented to ensure workplace safety and protect health. | |||||

| Customers | |||||

Santander has also also implemented measures to ensure the health and safety of its customers and foster their economic resilience during the crisis in all countries. Of note were: Provide liquidity and credit facilities for businesses facing hardship, as well as facilitate payment deferrals and payment holidays in many of our markets, supporting more than 6 million customers. •Proactive support for vulnerable customers trying to cover their needs. •Temporary reduction and suspension of fees (withdrawals from ATMs, interest free online purchases, bank transfers, etc.), together with specialized teams to advise customers facing financial difficulties. •Ensure covid-19 health insurance coverage. In addition, we adapted the branch network to each situation, ensuring continuity of service. Currently, over 90% of our branches are open. The countries have adapted to the new demand and introduced measures for referral to other channels and self-service. | |||||

| 4 |  | January - December 2020 | ||||||

Response to the covid-19 crisis | ||||||||||||||||||||||||||

| Business, liquidity and risks | |||||

In the quarter, business performance showed signs of normalization. Group loans and advances to customers excluding the exchange rate impact increased 5% and customer funds 9% year-on-year. The recovery of pre-covid-19 new business levels began at the end of the second quarter in various markets and segments. In the individuals segment (mortgages and consumer finance), we have seen growth from the lows in April to near pre-pandemic levels. On the other hand, activity in large corporates and companies normalized, following the sharp increase recorded in April, as the need for liquidity decreased. Liquidity has been closely monitored in the parent bank and our subsidiaries, remaining solid at all times. As of December, the Group's LCR ratio was 165%, the parent bank's was 175% and all our main subsidiaries stood above 120%. In addition, central banks have adopted measures to provide significant liquidity to the system. Regarding risks, the main indicators are also continuously monitored. As of December, 79% of total moratoria granted by the Group had expired, a total amount of EUR 89 billion, performing better than expected. Only 3% of the total is considered stage 3. In 2020, we recorded provisions amounting to EUR 12,173 million, 31% more than in 2019 (+47% excluding the exchange rate impact). This increase was reflected in a higher Group loan-loss reserves (close to EUR 4 billion in constant euros) and an 8 pp increase in the coverage ratio. In addition, due to the deterioration of the economic outlook, we adjusted the valuation of goodwill ascribed to several subsidiaries and deferred tax assets for -EUR 12.6 billion in the first half of the year. This adjustment had no impact on the Bank's liquidity or market and credit risk position, and was neutral in CET1 capital. | |||||

| Society | |||||

One of our main priorities is to contribute to the well-being of society as a whole. We have implemented actions and mobilized resources together with governments and institutions to help society combat the health crisis. Santander All. Together. Now. is the motto that brings together the Group's collective efforts around the world to stand beside the people who need it the most at this time. This effort has succeeded in mobilizing more than EUR 105 million dedicated to solidarity initiatives to fight covid-19. The main initiatives adopted are: •Creation of a solidarity fund to acquire medical equipment and materials, and to support organizations in the fight against covid-19. This fund is primarily financed by contributions from senior management, employees and the Group's subsidiaries, as well as contributions from third parties. •Supporting different projects and social initiatives to protect the vulnerable groups most impacted by the effects of the pandemic. •Santander Universidades reallocated funds to support collaboration projects with universities. We also launched Santander X Tomorrow Challenge, with the aim of supporting creativity and the entrepreneurs' capabilities. •We launched Overcome Together, an open and accessible space for individuals and companies, customers and non-customers, which contains information and resources. It is available in Spain, Portugal, Mexico, Brazil, Uruguay, Chile, Poland, Argentina, the UK and Openbank. We will continue to monitor the situation in order to continue to contribute minimizing the impact of covid-19 on society. | |||||

| Information for stakeholders | |||||

Based on transparency and anticipation, we continued to be proactive in keeping our people, customers, shareholders and investors informed at all times. The main measures announced from the beginning of the pandemic can be found on the Group's website (www.santander.com). We continued to develop several initiatives: •To stay close to all our employees, we sent out newsletters in most of our markets including updates on the health crisis. Of note were the 11 Ask Ana events held by the Chairman, and the celebration of the 12th edition of Santander Week, a time to enjoy the Group's culture, BeHealthy and show our most caring side. •We continued to issue communications to customers, including the latest digital initiatives, such as our Work Cafés, where we held 126 digital events regarding different issues, with more than 200,000 viewers. •We kept all channels open to increase the confidence of our shareholders and investors, which was reflected in an increase of more than 30,000 new shareholders since December 2019. •It is also worth highlighting the Euromoney awards won this year: Excellence in Leadership in Europe, due to the covid-19 management, and world’s best bank for SMEs. We were also named best bank in the Americas, Argentina, Brazil and Spain by The Banker. | |||||

January - December 2020 |  | 5 | ||||||

Business model | Group financial information | Financial information by segments | Responsible banking Corporate governance Santander share | Appendix | ||||||||||||||||||||||

1. Our scale Local scale and leadership. Worldwide reach through our global businesses (SCIB and WM&I). | 2. Customer focus Unique personal banking relationships strengthen customer loyalty | 3. Diversification Our geographic and business diversification makes us more resilient under adverse circumstances | ||||||||||||||||||

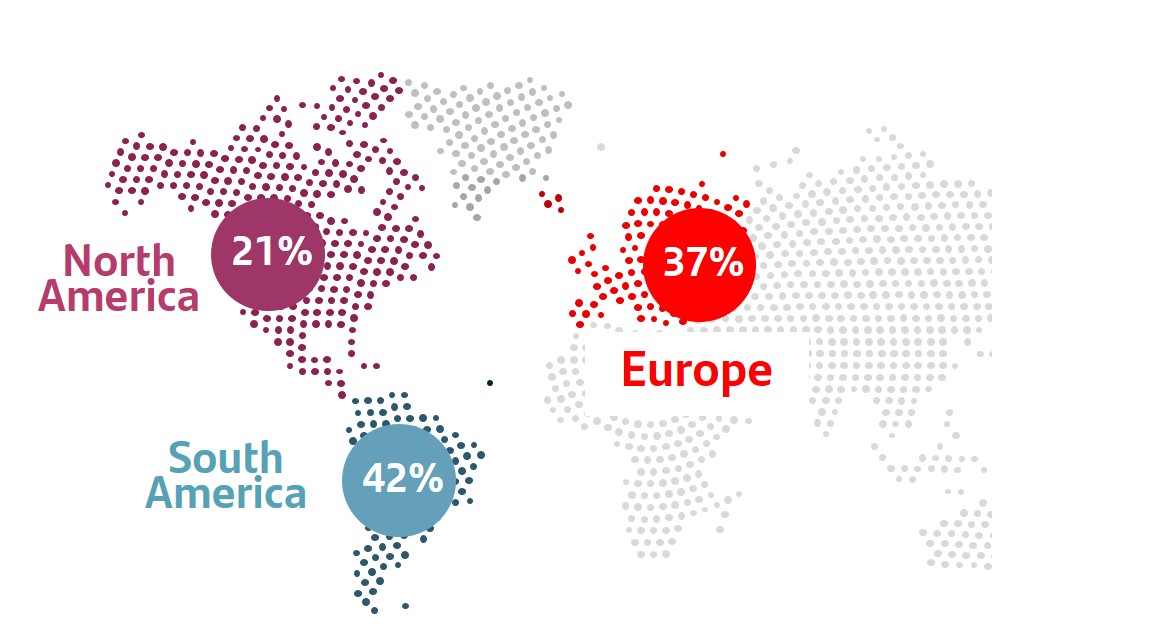

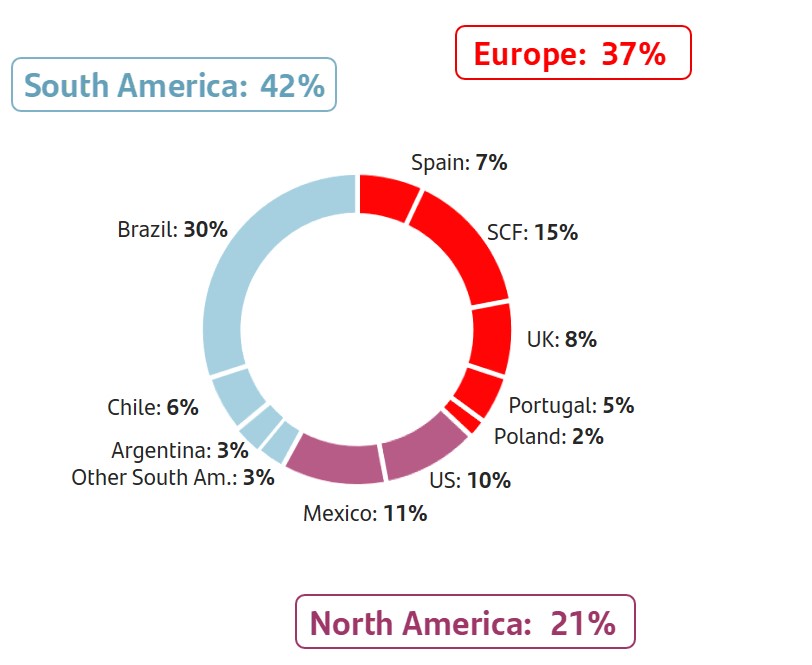

•Geographic diversification3 balanced between mature and emerging markets. | ||||||||||||||||||||

|  | |||||||||||||||||||

| ||||||||||||||||||||

| total customers in Europe and the Americas. | ||||||||||||||||||||

|  | •Business diversification between customer segments (individuals, SMEs, mid-market companies and large corporates) | ||||||||||||||||||

| 1. Market share in lending as of September 2020 including only privately-owned banks. UK benchmark refers to the mortgage market. | 2. NPS – Customer Satisfaction internal benchmark of active customers’ experience and satisfaction audited by Stiga / Deloitte. | 3. 2020 underlying attributable profit by region. Operating areas excluding Corporate Centre and SGP. | ||||||||||||||||||

Our purpose To help people and businesses prosper. |  | ||||||||||

Our aim To be the best open financial services platform, by acting responsibly and earning the lasting loyalty of our people, customers, shareholders and communities. | |||||||||||

Our how Everything we do should be Simple, Personal and Fair. | |||||||||||

| 6 |  | January - December 2020 | ||||||

GROWTH

GROWTH| Activity Dec-20 / Dec-19 | ||||||||||||||||||||||||||||||||||||||

| % change in constant euros | ||||||||||||||||||||||||||||||||||||||

| +2% | ||||||||||||||||||||||||||||||||||||||

| Individuals | ||||||||||||||||||||||||||||||||||||||

| +14% | ||||||||||||||||||||||||||||||||||||||

| +10% | Demand | |||||||||||||||||||||||||||||||||||||

| SMEs and corporates | ||||||||||||||||||||||||||||||||||||||

| +5% | -4% | |||||||||||||||||||||||||||||||||||||

| +9% | Time | |||||||||||||||||||||||||||||||||||||

| +9% | ||||||||||||||||||||||||||||||||||||||

| CIB and institutions | +3% | |||||||||||||||||||||||||||||||||||||

| Mutual funds | ||||||||||||||||||||||||||||||||||||||

| Gross loans and advances to customers excl. reverse repos | Customer deposits excl. repos + mutual funds | |||||||||||||||||||||||||||||||||||||

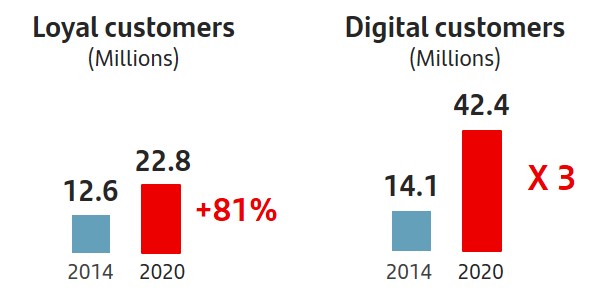

| Digital customers | Digital sales | |||||||||||||||||||||||||||||||||||||||||||

| Millions | % of total sales | |||||||||||||||||||||||||||||||||||||||||||

| 42.4 | ||||||||||||||||||||||||||||||||||||||||||||

| 44 | % | |||||||||||||||||||||||||||||||||||||||||||

| 36.8 | +15% | |||||||||||||||||||||||||||||||||||||||||||

| 36 | % | |||||||||||||||||||||||||||||||||||||||||||

| Dec-19 | Dec-20 | 2019 | 2020 | |||||||||||||||||||||||||||||||||||||||||

PROFITABILITY

PROFITABILITY| Efficiency ratio | ||

| % | ||

January - December 2020 |  | 7 | ||||||

PROFITABILITY

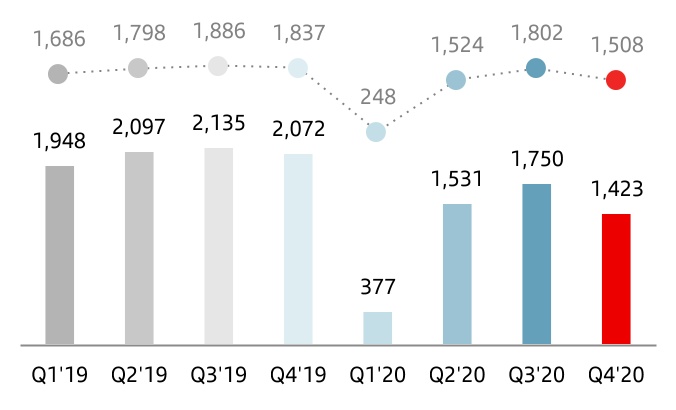

PROFITABILITY| Attr. profit to the parent | Earnings per share | |||||||

| EUR million | EUR | |||||||

| ||||||||

| RoTE | |||||||||||

| % | |||||||||||

n Total n Underlying* | |||||||||||

STRENGTH

STRENGTH| Phased-in CET1* | TNAV per share | |||||||

| % | EUR | |||||||

| Cost of credit | NPL ratio and coverage | ||||||||||||||||

| % | % | ||||||||||||||||

n Dec-19 n Dec-20 | |||||||||||||||||

| 8 |  | January - December 2020 | ||||||

| Grupo Santander. Summarized income statement | ||||||||||||||||||||||||||

| EUR million | ||||||||||||||||||||||||||

| Change | Change | |||||||||||||||||||||||||

| Q4'20 | Q3'20 | % | % excl. FX | 2020 | 2019 | % | % excl. FX | |||||||||||||||||||

| Net interest income | 8,019 | 7,773 | 3.2 | 4.3 | 31,994 | 35,283 | (9.3) | 1.3 | ||||||||||||||||||

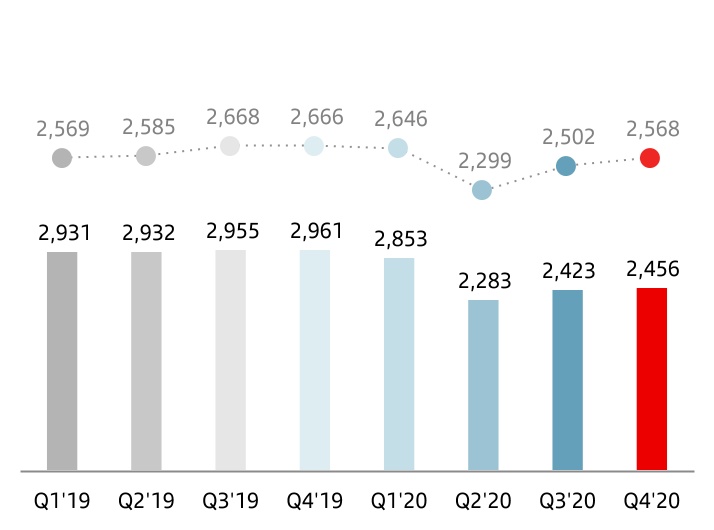

| Net fee income (commission income minus commission expense) | 2,456 | 2,423 | 1.4 | 2.6 | 10,015 | 11,779 | (15.0) | (4.5) | ||||||||||||||||||

| Gains or losses on financial assets and liabilities and exchange differences (net) | 462 | 652 | (29.1) | (27.7) | 2,187 | 1,531 | 42.8 | 55.9 | ||||||||||||||||||

| Dividend income | 69 | 57 | 21.1 | 20.7 | 391 | 533 | (26.6) | (26.1) | ||||||||||||||||||

| Share of results of entities accounted for using the equity method | (6) | 45 | — | — | (96) | 324 | — | — | ||||||||||||||||||

| Other operating income / expenses | (76) | 137 | — | — | (212) | (221) | (4.1) | 125.1 | ||||||||||||||||||

| Total income | 10,924 | 11,087 | (1.5) | (0.2) | 44,279 | 49,229 | (10.1) | 0.2 | ||||||||||||||||||

| Operating expenses | (5,344) | (5,079) | 5.2 | 6.3 | (21,130) | (23,280) | (9.2) | (1.2) | ||||||||||||||||||

| Administrative expenses | (4,634) | (4,398) | 5.4 | 6.4 | (18,320) | (20,279) | (9.7) | (1.6) | ||||||||||||||||||

| Staff costs | (2,685) | (2,628) | 2.2 | 3.2 | (10,783) | (12,141) | (11.2) | (4.1) | ||||||||||||||||||

| Other general administrative expenses | (1,949) | (1,770) | 10.1 | 11.1 | (7,537) | (8,138) | (7.4) | 2.2 | ||||||||||||||||||

| Depreciation and amortization | (710) | (681) | 4.3 | 5.6 | (2,810) | (3,001) | (6.4) | 1.6 | ||||||||||||||||||

| Provisions or reversal of provisions | (1,364) | (400) | 241.0 | 242.6 | (2,378) | (3,490) | (31.9) | (26.5) | ||||||||||||||||||

| Impairment or reversal of impairment of financial assets not measured at fair value through profit or loss (net) | (2,844) | (2,508) | 13.4 | 13.1 | (12,382) | (9,352) | 32.4 | 49.2 | ||||||||||||||||||

| Impairment on other assets (net) | (160) | (15) | — | — | (10,416) | (1,623) | — | — | ||||||||||||||||||

| Gains or losses on non financial assets and investments, net | 25 | 62 | (59.7) | (59.7) | 114 | 1,291 | (91.2) | (91.2) | ||||||||||||||||||

| Negative goodwill recognized in results | (1) | 3 | — | — | 8 | — | — | — | ||||||||||||||||||

| Gains or losses on non-current assets held for sale not classified as discontinued operations | (41) | (11) | 272.7 | 272.7 | (171) | (232) | (26.3) | (28.6) | ||||||||||||||||||

| Profit or loss before tax from continuing operations | 1,195 | 3,139 | (61.9) | (58.5) | (2,076) | 12,543 | — | — | ||||||||||||||||||

| Tax expense or income from continuing operations | (612) | (1,092) | (44.0) | (41.6) | (5,632) | (4,427) | 27.2 | 45.6 | ||||||||||||||||||

| Profit from the period from continuing operations | 583 | 2,047 | (71.5) | (67.6) | (7,708) | 8,116 | — | — | ||||||||||||||||||

| Profit or loss after tax from discontinued operations | — | — | — | — | — | — | — | — | ||||||||||||||||||

| Profit for the period | 583 | 2,047 | (71.5) | (67.6) | (7,708) | 8,116 | — | — | ||||||||||||||||||

| Attributable profit to non-controlling interests | (306) | (297) | 3.0 | 4.2 | (1,063) | (1,601) | (33.6) | (25.5) | ||||||||||||||||||

| Attributable profit to the parent | 277 | 1,750 | (84.2) | (79.6) | (8,771) | 6,515 | — | — | ||||||||||||||||||

EPS (euros) (1) | 0.008 | 0.093 | (91.3) | (0.538) | 0.347 | — | ||||||||||||||||||||

Diluted EPS (euros) (1) | 0.008 | 0.093 | (91.3) | (0.538) | 0.346 | — | ||||||||||||||||||||

| Memorandum items: | ||||||||||||||||||||||||||

| Average total assets | 1,517,201 | 1,541,134 | (1.6) | 1,537,552 | 1,508,167 | 1.9 | ||||||||||||||||||||

| Average stockholders' equity | 82,080 | 82,009 | 0.1 | 89,459 | 98,457 | (9.1) | ||||||||||||||||||||

January - December 2020 |  | 9 | ||||||

| Net interest income | |||||

| EUR million | |||||

| constant euros | ||||

| Net fee income | |||||

| EUR million | |||||

| constant euros | ||||

| 10 |  | January - December 2020 | ||||||

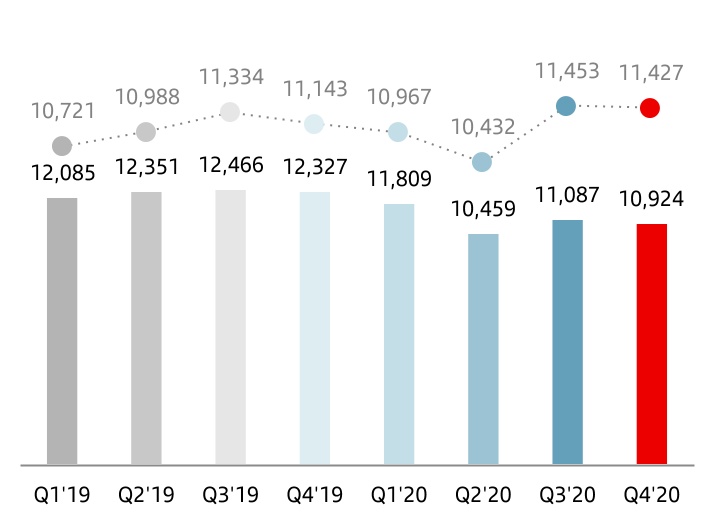

| Total income | |||||

| EUR million | |||||

| constant euros | ||||

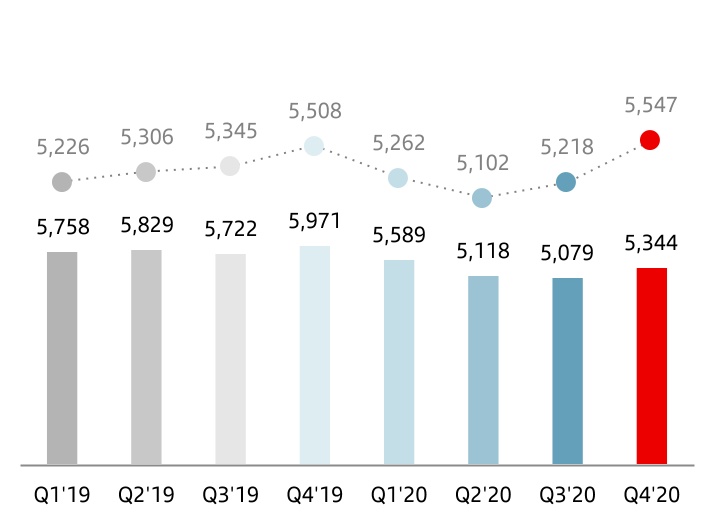

| Operating expenses | |||||

| EUR million | |||||

| constant euros | ||||

January - December 2020 |  | 11 | ||||||

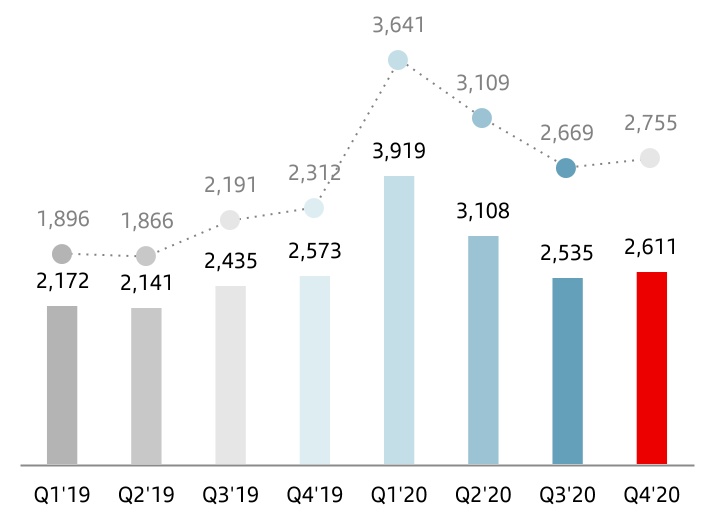

| Net loan-loss provisions | |||||

| EUR million | |||||

| constant euros | ||||

| 12 |  | January - December 2020 | ||||||

| Summarized underlying income statement | ||||||||||||||||||||||||||

| EUR million | Change | Change | ||||||||||||||||||||||||

| Q4'20 | Q3'20 | % | % excl. FX | 2020 | 2019 | % | % excl. FX | |||||||||||||||||||

| Net interest income | 8,019 | 7,773 | 3.2 | 4.3 | 31,994 | 35,283 | (9.3) | 1.3 | ||||||||||||||||||

| Net fee income | 2,456 | 2,423 | 1.4 | 2.6 | 10,015 | 11,779 | (15.0) | (4.5) | ||||||||||||||||||

Gains (losses) on financial transactions (1) | 462 | 652 | (29.1) | (27.7) | 2,187 | 1,531 | 42.8 | 55.9 | ||||||||||||||||||

| Other operating income | 58 | 239 | (75.7) | (77.2) | 404 | 901 | (55.2) | (58.4) | ||||||||||||||||||

| Total income | 10,995 | 11,087 | (0.8) | 0.4 | 44,600 | 49,494 | (9.9) | 0.3 | ||||||||||||||||||

| Administrative expenses and amortizations | (5,241) | (5,073) | 3.3 | 4.4 | (20,967) | (23,280) | (9.9) | (2.0) | ||||||||||||||||||

| Net operating income | 5,754 | 6,014 | (4.3) | (3.0) | 23,633 | 26,214 | (9.8) | 2.5 | ||||||||||||||||||

| Net loan-loss provisions | (2,611) | (2,535) | 3.0 | 3.2 | (12,173) | (9,321) | 30.6 | 47.3 | ||||||||||||||||||

| Other gains (losses) and provisions | (485) | (304) | 59.5 | 60.2 | (1,786) | (1,964) | (9.1) | 1.8 | ||||||||||||||||||

| Profit before tax | 2,658 | 3,175 | (16.3) | (14.1) | 9,674 | 14,929 | (35.2) | (25.8) | ||||||||||||||||||

| Tax on profit | (920) | (1,128) | (18.4) | (16.2) | (3,516) | (5,103) | (31.1) | (20.6) | ||||||||||||||||||

| Profit from continuing operations | 1,738 | 2,047 | (15.1) | (13.0) | 6,158 | 9,826 | (37.3) | (28.6) | ||||||||||||||||||

| Net profit from discontinued operations | — | — | — | — | — | — | — | — | ||||||||||||||||||

| Consolidated profit | 1,738 | 2,047 | (15.1) | (13.0) | 6,158 | 9,826 | (37.3) | (28.6) | ||||||||||||||||||

| Non-controlling interests | (315) | (297) | 6.1 | 7.0 | (1,077) | (1,574) | (31.6) | (23.8) | ||||||||||||||||||

| Net capital gains and provisions | (1,146) | — | — | — | (13,852) | (1,737) | 697.5 | 608.2 | ||||||||||||||||||

| Attributable profit to the parent | 277 | 1,750 | (84.2) | (79.6) | (8,771) | 6,515 | — | — | ||||||||||||||||||

Underlying attributable profit to the parent (2) | 1,423 | 1,750 | (18.7) | (16.3) | 5,081 | 8,252 | (38.4) | (29.5) | ||||||||||||||||||

January - December 2020 |  | 13 | ||||||

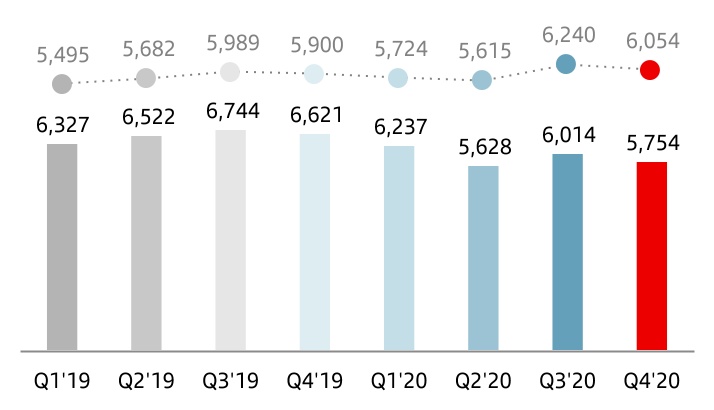

| Net operating income | |||||

| EUR million | |||||

| constant euros | ||||

| Underlying attributable profit to the parent* | |||||

| EUR million | |||||

| constant euros | ||||

| 14 |  | January - December 2020 | ||||||

| Response to the covid-19 crisis Business model | ||||||||||||||||||||||||||

| Balance sheet | ||||||||||||||||||||||||||

| Grupo Santander. Condensed balance sheet | |||||||||||||||||

| EUR million | |||||||||||||||||

| Change | |||||||||||||||||

| Assets | Dec-20 | Dec-19 | Absolute | % | Dec-18 | ||||||||||||

| Cash, cash balances at central banks and other demand deposits | 153,839 | 101,067 | 52,772 | 52.2 | 113,663 | ||||||||||||

| Financial assets held for trading | 114,945 | 108,230 | 6,715 | 6.2 | 92,879 | ||||||||||||

| Debt securities | 37,894 | 32,041 | 5,853 | 18.3 | 27,800 | ||||||||||||

| Equity instruments | 9,615 | 12,437 | (2,822) | (22.7) | 8,938 | ||||||||||||

| Loans and advances to customers | 296 | 355 | (59) | (16.6) | 202 | ||||||||||||

| Loans and advances to central banks and credit institutions | 3 | — | 3 | — | — | ||||||||||||

| Derivatives | 67,137 | 63,397 | 3,740 | 5.9 | 55,939 | ||||||||||||

| Financial assets designated at fair value through profit or loss | 53,203 | 66,980 | (13,777) | (20.6) | 68,190 | ||||||||||||

| Loans and advances to customers | 24,673 | 31,147 | (6,474) | (20.8) | 23,796 | ||||||||||||

| Loans and advances to central banks and credit institutions | 21,617 | 28,122 | (6,505) | (23.1) | 32,325 | ||||||||||||

| Other (debt securities an equity instruments) | 6,913 | 7,711 | (798) | (10.3) | 12,069 | ||||||||||||

| Financial assets at fair value through other comprehensive income | 120,953 | 125,708 | (4,755) | (3.8) | 121,091 | ||||||||||||

| Debt securities | 108,903 | 118,405 | (9,502) | (8.0) | 116,819 | ||||||||||||

| Equity instruments | 2,783 | 2,863 | (80) | (2.8) | 2,671 | ||||||||||||

| Loans and advances to customers | 9,267 | 4,440 | 4,827 | 108.7 | 1,601 | ||||||||||||

| Loans and advances to central banks and credit institutions | — | — | — | — | — | ||||||||||||

| Financial assets measured at amortized cost | 958,378 | 995,482 | (37,104) | (3.7) | 946,099 | ||||||||||||

| Debt securities | 26,078 | 29,789 | (3,711) | (12.5) | 37,696 | ||||||||||||

| Loans and advances to customers | 881,963 | 906,276 | (24,313) | (2.7) | 857,322 | ||||||||||||

| Loans and advances to central banks and credit institutions | 50,337 | 59,417 | (9,080) | (15.3) | 51,081 | ||||||||||||

| Investments in subsidiaries, joint ventures and associates | 7,622 | 8,772 | (1,150) | (13.1) | 7,588 | ||||||||||||

| Tangible assets | 32,735 | 35,235 | (2,500) | (7.1) | 26,157 | ||||||||||||

| Intangible assets | 15,908 | 27,687 | (11,779) | (42.5) | 28,560 | ||||||||||||

| Goodwill | 12,471 | 24,246 | (11,775) | (48.6) | 25,466 | ||||||||||||

| Other intangible assets | 3,437 | 3,441 | (4) | (0.1) | 3,094 | ||||||||||||

| Other assets | 50,667 | 53,534 | (2,867) | (5.4) | 55,044 | ||||||||||||

| Total assets | 1,508,250 | 1,522,695 | (14,445) | (0.9) | 1,459,271 | ||||||||||||

| Liabilities and shareholders' equity | |||||||||||||||||

| Financial liabilities held for trading | 81,167 | 77,139 | 4,028 | 5.2 | 70,343 | ||||||||||||

| Customer deposits | — | — | — | — | — | ||||||||||||

| Debt securities issued | — | — | — | — | — | ||||||||||||

| Deposits by central banks and credit institutions | — | — | — | — | — | ||||||||||||

| Derivatives | 64,469 | 63,016 | 1,453 | 2.3 | 55,341 | ||||||||||||

| Other | 16,698 | 14,123 | 2,575 | 18.2 | 15,002 | ||||||||||||

| Financial liabilities designated at fair value through profit or loss | 48,038 | 60,995 | (12,957) | (21.2) | 68,058 | ||||||||||||

| Customer deposits | 34,343 | 34,917 | (574) | (1.6) | 39,597 | ||||||||||||

| Debt securities issued | 4,440 | 3,758 | 682 | 18.1 | 2,305 | ||||||||||||

| Deposits by central banks and credit institutions | 9,255 | 22,194 | (12,939) | (58.3) | 25,707 | ||||||||||||

| Other | — | 126 | (126) | (100.0) | 449 | ||||||||||||

| Financial liabilities measured at amortized cost | 1,248,188 | 1,230,745 | 17,443 | 1.4 | 1,171,630 | ||||||||||||

| Customer deposits | 814,967 | 789,448 | 25,519 | 3.2 | 740,899 | ||||||||||||

| Debt securities issued | 230,829 | 258,219 | (27,390) | (10.6) | 244,314 | ||||||||||||

| Deposits by central banks and credit institutions | 175,424 | 152,969 | 22,455 | 14.7 | 162,202 | ||||||||||||

| Other | 26,968 | 30,109 | (3,141) | (10.4) | 24,215 | ||||||||||||

| Liabilities under insurance contracts | 910 | 739 | 171 | 23.1 | 765 | ||||||||||||

| Provisions | 10,852 | 13,987 | (3,135) | (22.4) | 13,225 | ||||||||||||

| Other liabilities | 27,773 | 28,431 | (658) | (2.3) | 27,889 | ||||||||||||

| Total liabilities | 1,416,928 | 1,412,036 | 4,892 | 0.3 | 1,351,910 | ||||||||||||

| Shareholders' equity | 114,620 | 124,239 | (9,619) | (7.7) | 120,597 | ||||||||||||

| Capital stock | 8,670 | 8,309 | 361 | 4.3 | 8,118 | ||||||||||||

| Reserves | 114,721 | 111,077 | 3,644 | 3.3 | 106,906 | ||||||||||||

| Attributable profit to the Group | (8,771) | 6,515 | (15,286) | — | 7,810 | ||||||||||||

| Less: dividends | — | (1,662) | 1,662 | (100.0) | (2,237) | ||||||||||||

| Other comprehensive income | (33,144) | (24,168) | (8,976) | 37.1 | (24,125) | ||||||||||||

| Minority interests | 9,846 | 10,588 | (742) | (7.0) | 10,889 | ||||||||||||

| Total equity | 91,322 | 110,659 | (19,337) | (17.5) | 107,361 | ||||||||||||

| Total liabilities and equity | 1,508,250 | 1,522,695 | (14,445) | (0.9) | 1,459,271 | ||||||||||||

January - December 2020 |  | 15 | ||||||

| Response to the covid-19 crisis Business model | ||||||||||||||||||||||||||

| Balance sheet | ||||||||||||||||||||||||||

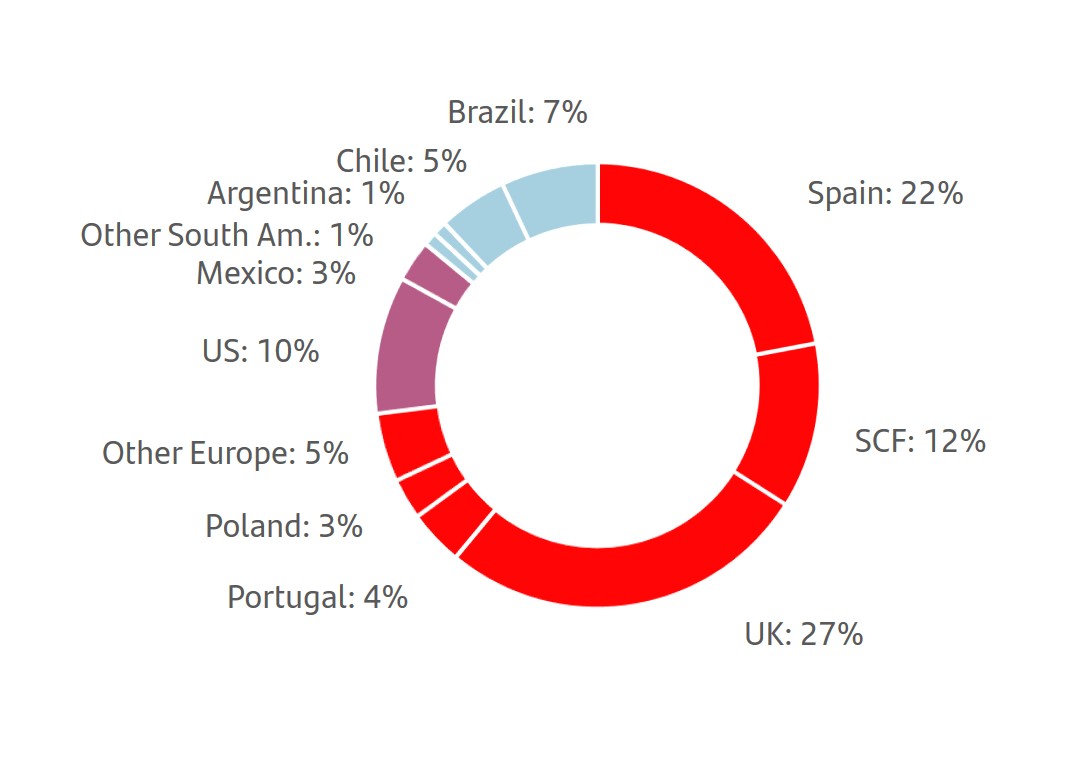

| Gross loans and advances to customers (excl. reverse repos) | Gross loans and advances to customers (excl. reverse repos) | |||||||||||||

| EUR billion | % operating areas. December 2020 | |||||||||||||

|  | |||||||||||||

| 16 |  | January - December 2020 | ||||||

| Response to the covid-19 crisis Business model | ||||||||||||||||||||||||||

| Balance sheet | ||||||||||||||||||||||||||

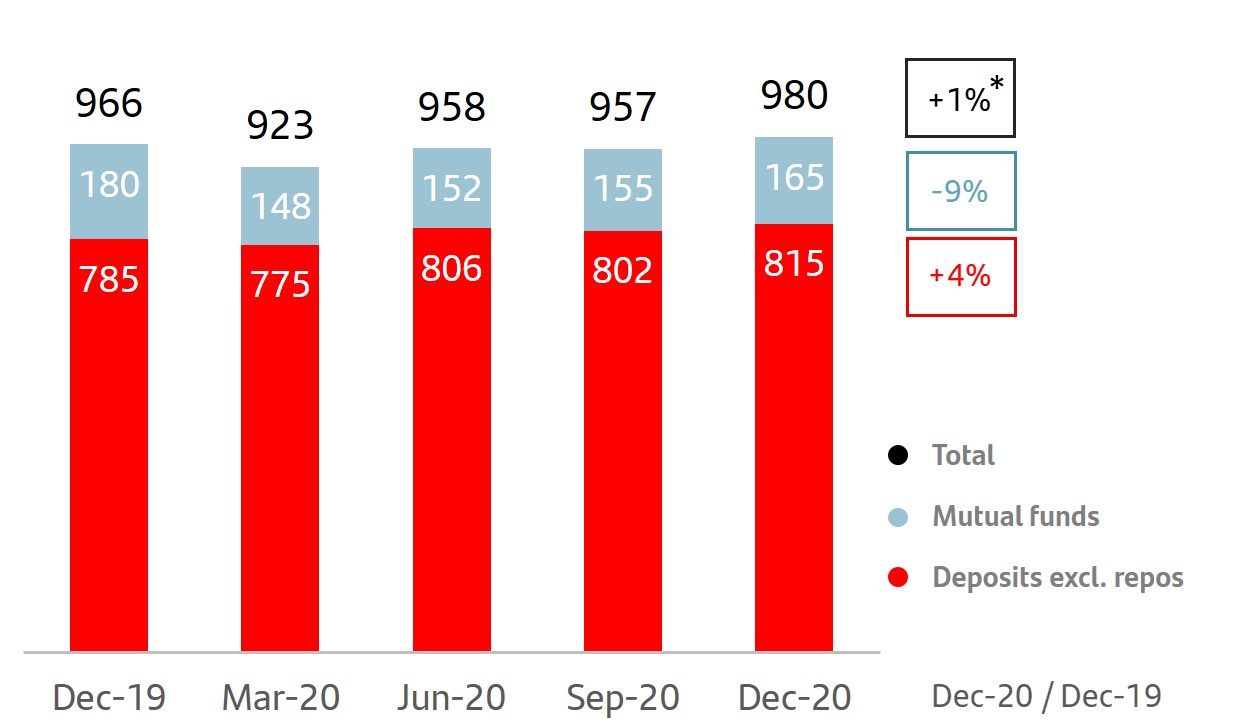

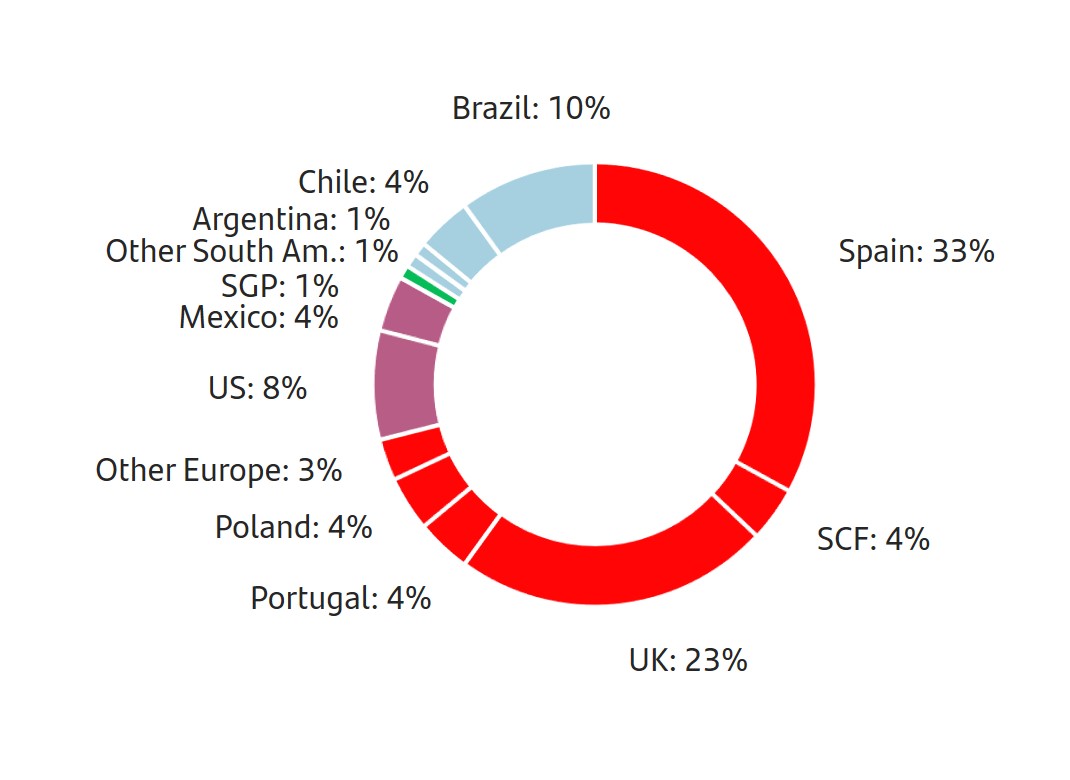

| Customer funds | Customer funds | |||||||||||||

| EUR billion | % operating areas. December 2020 | |||||||||||||

|  | |||||||||||||

January - December 2020 |  | 17 | ||||||

| Eligible capital. December 2020 | Phased-in capital ratio* | |||||||||||||

| EUR million | % | |||||||||||||

| Phased-in* | Fully-loaded |  | ||||||||||||

| CET1 | 69,399 | 66,784 | ||||||||||||

| Basic capital | 78,501 | 75,510 | ||||||||||||

| Eligible capital | 91,015 | 88,369 | ||||||||||||

| Risk-weighted assets | 562,580 | 561,850 | ||||||||||||

| CET1 capital ratio | 12.34 | 11.89 | ||||||||||||

| T1 capital ratio | 13.95 | 13.44 | ||||||||||||

| Total capital ratio | 16.18 | 15.73 | ||||||||||||

| Phased-in CET1 ratio performance* | ||

| % | ||

| ||

| 18 |  | January - December 2020 | ||||||

| Credit Risk | ||||||||||||||

| EUR million | ||||||||||||||

| Dec-20 | Dec-19 | Chg (%) | Dec-18 | |||||||||||

| Non-performing loans | 31,767 | 33,799 | (6.0) | 35,692 | ||||||||||

| NPL ratio (%) | 3.21 | 3.32 | 3.73 | |||||||||||

| Loan-loss allowances | 24,272 | 22,965 | 5.7 | 24,061 | ||||||||||

| For impaired assets | 13,780 | 14,093 | (2.2) | 15,148 | ||||||||||

| For other assets | 10,492 | 8,872 | 18.3 | 8,913 | ||||||||||

| Coverage ratio (%) | 76 | 68 | 67 | |||||||||||

| Cost of credit (%) | 1.28 | 1.00 | 1.00 | |||||||||||

| NPL and coverage ratios. Total Group | ||

| % | ||

January - December 2020 |  | 19 | ||||||

| Key metrics geographic performance. December 2020 | ||||||||||||||

| % | Change (bps) | |||||||||||||

| NPL ratio | QoQ | YoY | Coverage ratio | |||||||||||

| EUROPE | 3.15 | 2 | (10) | 57.3 | ||||||||||

| Spain | 6.23 | 25 | (71) | 47.1 | ||||||||||

| Santander Consumer Financie | 2.36 | (14) | 6 | 111.0 | ||||||||||

| United Kingdom | 1.21 | (9) | 20 | 47.9 | ||||||||||

| Portugal | 3.89 | (36) | (94) | 66.5 | ||||||||||

| Poland | 4.74 | 16 | 43 | 70.7 | ||||||||||

| NORTH AMERICA | 2.23 | 27 | 3 | 182.5 | ||||||||||

| USA | 2.04 | 19 | (16) | 210.4 | ||||||||||

| Mexico | 2.81 | 48 | 62 | 120.8 | ||||||||||

| SOUTH AMERICA | 4.39 | (1) | (47) | 97.4 | ||||||||||

| Brazil | 4.59 | (5) | (73) | 113.2 | ||||||||||

| Chile | 4.79 | 3 | 15 | 61.4 | ||||||||||

| Argentina | 2.11 | (77) | (128) | 275.1 | ||||||||||

| GROUP | 3.21 | 6 | (11) | 76.4 | ||||||||||

| Loan-loss provisions. Geographic distribution | |||||||||||||||||

| EUR million | Q1'20 | Q2'20 | Q3'20 | Q4'20 | 2020 | ||||||||||||

| EUROPE | 1,335 | 877 | 956 | 1,131 | 4,299 | ||||||||||||

| Spain | 628 | 313 | 449 | 611 | 2,001 | ||||||||||||

| Santander Consumer Finance | 317 | 184 | 211 | 186 | 899 | ||||||||||||

| United Kingdom | 191 | 239 | 189 | 114 | 733 | ||||||||||||

| Portugal | 80 | 24 | 47 | 42 | 193 | ||||||||||||

| Poland | 95 | 89 | 65 | 81 | 330 | ||||||||||||

| Other | 23 | 29 | (5) | 97 | 143 | ||||||||||||

| NORTH AMERICA | 1,246 | 1,123 | 775 | 773 | 3,916 | ||||||||||||

| USA | 972 | 832 | 572 | 561 | 2,937 | ||||||||||||

| Mexico | 273 | 291 | 203 | 212 | 979 | ||||||||||||

| SOUTH AMERICA | 1,325 | 1,110 | 787 | 702 | 3,923 | ||||||||||||

| Brazil | 1,066 | 843 | 569 | 540 | 3,018 | ||||||||||||

| Chile | 163 | 183 | 154 | 94 | 594 | ||||||||||||

| Argentina | 75 | 57 | 46 | 48 | 226 | ||||||||||||

| Other | 20 | 26 | 18 | 20 | 86 | ||||||||||||

| SANTANDER GLOBAL PLATFORM | 0 | 1 | 1 | 1 | 3 | ||||||||||||

| CORPORATE CENTRE | 3 | 8 | 16 | 4 | 31 | ||||||||||||

| GROUP | 3,909 | 3,118 | 2,535 | 2,611 | 12,173 | ||||||||||||

| Non-performing loans by quarter | ||||||||||||||||||||||||||

| EUR million | ||||||||||||||||||||||||||

| Q1'19 | Q2'19 | Q3'19 | Q4'19 | Q1'20 | Q2'20 | Q3'20 | Q4'20 | |||||||||||||||||||

| Balance at beginning of period | 35,692 | 35,590 | 34,421 | 34,326 | 33,799 | 32,743 | 32,782 | 30,894 | ||||||||||||||||||

| Net additions | 2,147 | 2,511 | 3,190 | 2,696 | 2,543 | 2,805 | 1,595 | 3,334 | ||||||||||||||||||

| Increase in scope of consolidation | — | — | — | — | — | — | (44) | — | ||||||||||||||||||

| Exchange rate differences and other | 479 | (162) | (110) | (51) | (964) | (353) | (1,673) | (345) | ||||||||||||||||||

| Write-offs | (2,728) | (3,518) | (3,175) | (3,172) | (2,635) | (2,413) | (1,766) | (2,116) | ||||||||||||||||||

| Balance at period-end | 35,590 | 34,421 | 34,326 | 33,799 | 32,743 | 32,782 | 30,894 | 31,767 | ||||||||||||||||||

| 20 |  | January - December 2020 | ||||||

| Coverage ratio by stage | |||||||||||||||||||||||

| EUR billion | |||||||||||||||||||||||

Exposure1 | Coverage | ||||||||||||||||||||||

| Dec-20 | Sep-20 | Dec-19 | Dec-20 | Sep-20 | Dec-19 | ||||||||||||||||||

| Stage 1 | 864 | 862 | 898 | 0.5 | % | 0.6 | % | 0.5 | % | ||||||||||||||

| Stage 2 | 69 | 60 | 53 | 8.5 | % | 8.8 | % | 8.7 | % | ||||||||||||||

| Stage 3 | 32 | 31 | 34 | 43.4 | % | 43.3 | % | 41.7 | % | ||||||||||||||

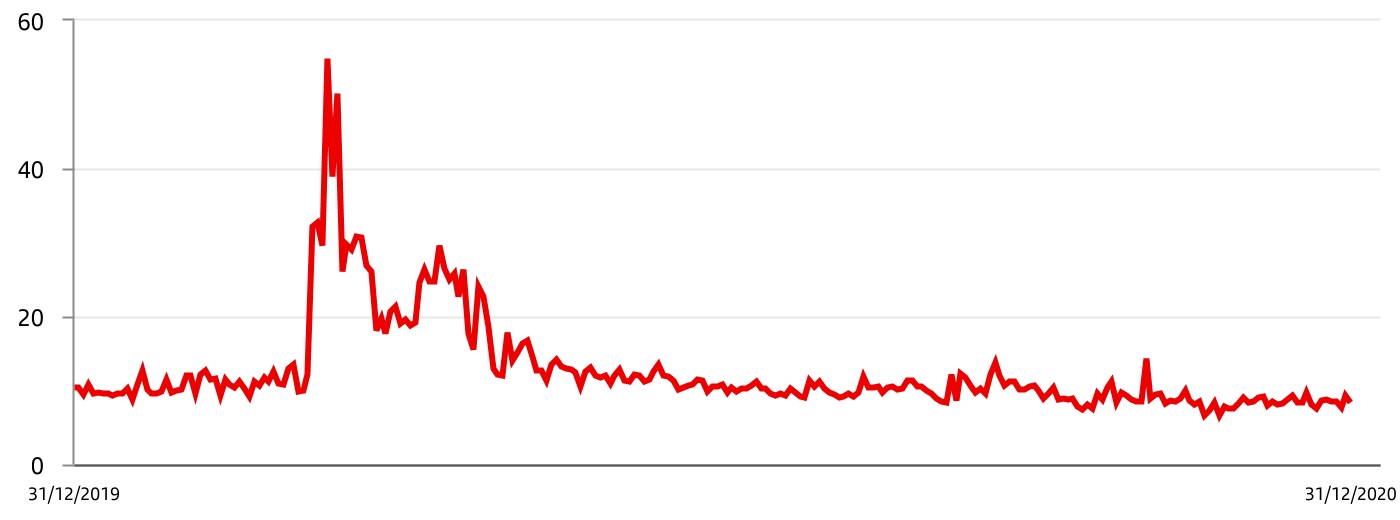

Trading portfolios1. VaR performance | ||

| EUR million | ||

January - December 2020 |  | 21 | ||||||

Trading portfolios (1). VaR by geographic region | ||||||||||||||

| EUR million | ||||||||||||||

| 2020 | 2019 | |||||||||||||

| Fourth quarter | Average | Latest | Average | |||||||||||

| Total | 8.7 | 8.3 | 10.7 | |||||||||||

| Europe | 7.7 | 8.0 | 7.3 | |||||||||||

| North America | 5.0 | 2.9 | 4.1 | |||||||||||

| South America | 3.6 | 4.5 | 7.9 | |||||||||||

Trading portfolios (1). VaR by market factor | ||||||||||||||

| EUR million | ||||||||||||||

| Fourth quarter | Min. | Avg. | Max. | Last | ||||||||||

| VaR total | 6.5 | 8.7 | 14.3 | 8.3 | ||||||||||

| Diversification effect | (8.7) | (11.6) | (14.7) | (11.8) | ||||||||||

| Interest rate VaR | 4.7 | 6.3 | 8.7 | 5.4 | ||||||||||

| Equity VaR | 2.3 | 3.2 | 4.8 | 3.1 | ||||||||||

| FX VaR | 3.1 | 5.0 | 9.4 | 6.0 | ||||||||||

| Credit spreads VaR | 3.2 | 4.4 | 6.3 | 4.5 | ||||||||||

| Commodities VaR | 0.9 | 1.5 | 2.5 | 1.1 | ||||||||||

| 22 |  | January - December 2020 | ||||||

| Country | GDP Change1 | Economic performance | |||||||||

| Eurozone | -6.8% | The contraction in economic activity resulted in a strong economic policy response. The ECB eased funding conditions through expansionary measures, complemented with temporary regulatory and supervisory measures to boost lending. The EU supported countries in expanding their fiscal policy while creating various funds to provide liquidity. | ||||||||

| Spain | -10.8% | Economic recession in 2020 was more severe than the euro area average due to the greater exposure to tourism and the relatively stronger impact of the first wave of the pandemic. The unemployment rate rose to 16.3% in Q3'20. Inflation was negative, reflecting the contraction in demand and lower energy prices. | ||||||||

| United Kingdom | -11.5% | The economy was heavily impacted by the pandemic, which for some time overshadowed post-Brexit relationships with the EU. The service sector was the most affected. Inflation was low (0.6% in December) and the unemployment rate (4.8% in September) remained under control thanks to government employment protection schemes. The official interest rate has been 0.1% since March. | ||||||||

| Portugal | -8.1% | The service sector was the most affected by the covid-19 crisis, which had a direct impact on tourism. The unemployment rate (7.8% in Q3'20) will continue to rise. There was no inflation, with a -0.2% rate in December. The fiscal deficit was 4.3% of GDP through October. | ||||||||

| Poland | -2.9% | The economic recession was less severe than in other surrounding countries supported by better private consumption and external demand. The unemployment rate rose to 3.4% in Q3'20, although inflation remained stubbornly high (2.4% in December). The official interest rate has stood at 0.1% since May. | ||||||||

| United States | -3.5% | Fiscal packages and softer restriction measures in general allowed the economy to shrink less than in other regions. After peaking at 14.7%, recovery enabled the jobless rate to fall to 6.7% in December. The shock exerted downward pressure on inflation. After cutting rates to 0-0.25%, the Fed adopted a wide range of facilities to stabilize markets and encourage lending. | ||||||||

| Mexico | -9.2% | The economy's sharp slump was induced by the pandemic and the resulting restrictive measures. The incipient recovery began in Q3'20 and was led by manufacturing and exports, while domestic demand remained weak. After a temporary rebound, inflation moderated at year-end (3.2%). The central bank lowered the official rate to 4.25% (vs. 7.25% at the end of 2019). | ||||||||

| Brazil | -4.1% | The fall in economic activity arising from the pandemic was more moderate than in other countries in the region because fiscal support measures mitigated the fall in Q2 and accelerated recovery in Q3. Inflation rebounded at the end of the year (4.5% in December) while underlying inflation remained low (2.8%). The central bank cut the official rate by 250 bps to a record low of 2.0%. | ||||||||

| Chile | -6.0% | The duration of lockdown measures and the cessation of activity lasted longer than in other countries, resulting in a late recovery. The positive contribution of external demand, and measures to boost liquidity and further fiscal stimulus led to greater dynamism in recent months. Inflation ended the year at 3% and the central bank cut interest rates by 125 bps in the year to 0.5%. | ||||||||

| Argentina | -10.4% | Argentina successfully restructured its foreign debt (99% acceptance), extending maturities and reducing the interest burden. GDP contracted for the third consecutive year and inflation, after slowing in mid-2020, rebounded at year-end to monthly rates greater than 3.5%. | ||||||||

January - December 2020 |  | 23 | ||||||

| Response to the covid-19 crisis Business model | ||||||||||||||||||||||||||

| 24 |  | January - December 2020 | ||||||

| Response to the covid-19 crisis Business model | ||||||||||||||||||||||||||

As described on the previous page, the results of our business areas presented below are provided on the basis of underlying results only and including the impact of foreign exchange rate fluctuations. However, for a better understanding of the actual changes in the performance of our business areas, we provide and discuss the year-on-year changes to our results excluding such impact. On the other hand, certain figures contained in this report, including financial information, have been subject to rounding to enhance their presentation. Accordingly, in certain instances, the sum of the numbers in a column or a row in tables contained in this report may not conform exactly to the total figure given for that column or row. | ||

January - December 2020 |  | 25 | ||||||

| Response to the covid-19 crisis Business model | ||||||||||||||||||||||||||

| January-December 2020 | ||||||||||||||||||||

| Main items of the underlying income statement | ||||||||||||||||||||

| EUR million | ||||||||||||||||||||

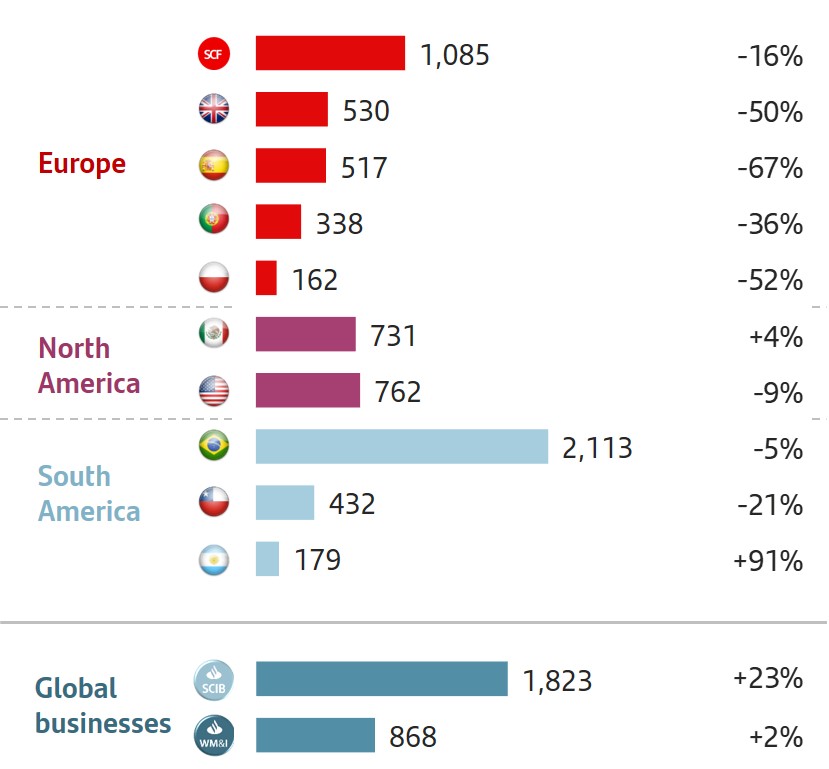

| Primary segments | Net interest income | Net fee income | Total income | Net operating income | Profit before tax | Underlying attributable profit to the parent | ||||||||||||||

| EUROPE | 14,046 | 4,737 | 19,693 | 9,379 | 4,167 | 2,656 | ||||||||||||||

| Spain | 3,957 | 2,314 | 6,782 | 3,175 | 715 | 517 | ||||||||||||||

| Santander Consumer Finance | 3,832 | 750 | 4,685 | 2,703 | 1,869 | 1,085 | ||||||||||||||

| United Kingdom | 3,808 | 506 | 4,339 | 1,697 | 697 | 530 | ||||||||||||||

| Portugal | 787 | 388 | 1,296 | 706 | 483 | 338 | ||||||||||||||

| Poland | 1,037 | 452 | 1,524 | 895 | 370 | 162 | ||||||||||||||

| Other | 626 | 328 | 1,067 | 203 | 32 | 24 | ||||||||||||||

| NORTH AMERICA | 8,469 | 1,661 | 11,011 | 6,379 | 2,332 | 1,492 | ||||||||||||||

| US | 5,645 | 889 | 7,360 | 4,281 | 1,250 | 731 | ||||||||||||||

| Mexico | 2,825 | 772 | 3,651 | 2,098 | 1,082 | 762 | ||||||||||||||

| SOUTH AMERICA | 10,723 | 3,566 | 14,845 | 9,533 | 5,291 | 2,927 | ||||||||||||||

| Brazil | 7,625 | 2,824 | 10,866 | 7,325 | 4,045 | 2,113 | ||||||||||||||

| Chile | 1,787 | 335 | 2,263 | 1,363 | 785 | 432 | ||||||||||||||

| Argentina | 912 | 273 | 1,128 | 496 | 200 | 179 | ||||||||||||||

| Other | 398 | 134 | 588 | 349 | 262 | 203 | ||||||||||||||

| SANTANDER GLOBAL PLATFORM | 129 | 81 | 192 | (190) | (204) | (150) | ||||||||||||||

| CORPORATE CENTRE | (1,374) | (29) | (1,141) | (1,470) | (1,912) | (1,844) | ||||||||||||||

| TOTAL GROUP | 31,994 | 10,015 | 44,600 | 23,633 | 9,674 | 5,081 | ||||||||||||||

| Secondary segments | ||||||||||||||||||||

| RETAIL BANKING | 29,544 | 6,850 | 37,215 | 20,368 | 7,531 | 4,196 | ||||||||||||||

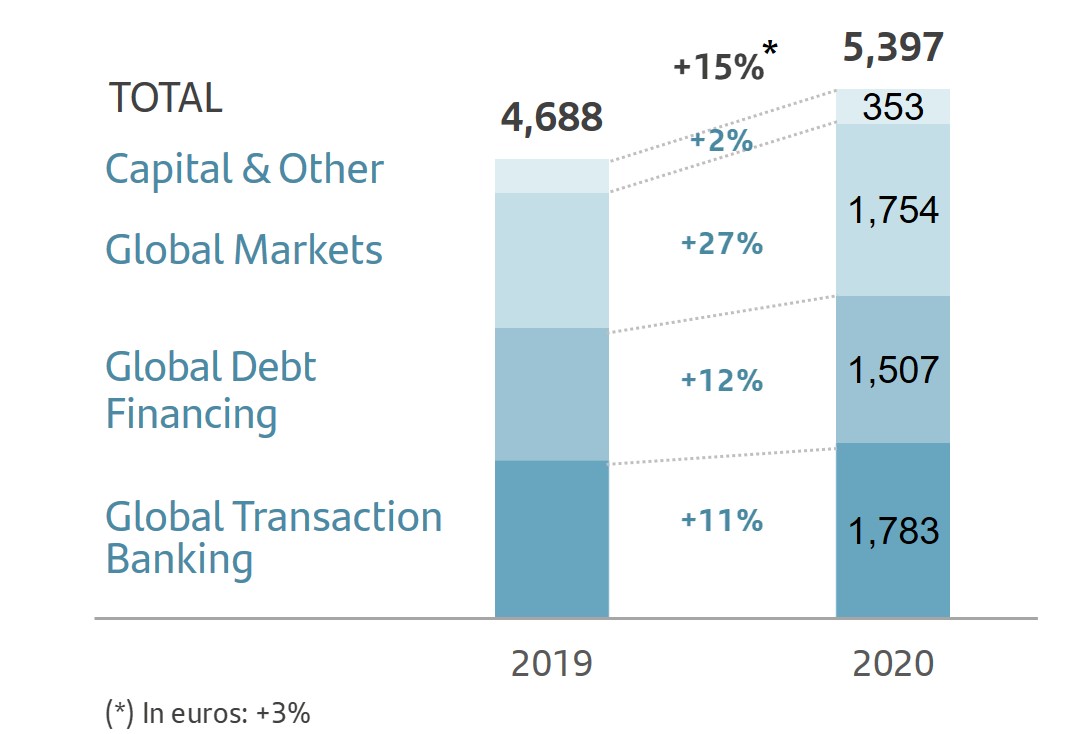

| CORPORATE & INVESTMENT BANKING | 2,953 | 1,550 | 5,397 | 3,328 | 2,726 | 1,823 | ||||||||||||||

| WEALTH MANAGEMENT & INSURANCE | 454 | 1,194 | 2,135 | 1,229 | 1,199 | 868 | ||||||||||||||

| SANTANDER GLOBAL PLATFORM | 416 | 449 | 994 | 178 | 130 | 39 | ||||||||||||||

| CORPORATE CENTRE | (1,374) | (29) | (1,141) | (1,470) | (1,912) | (1,844) | ||||||||||||||

| TOTAL GROUP | 31,994 | 10,015 | 44,600 | 23,633 | 9,674 | 5,081 | ||||||||||||||

| Underlying attributable profit geographic distribution* | Underlying attributable profit 2020. Core markets | |||||||

| January - December 2020 | EUR million. % change YoY in constant euros | |||||||

|  | |||||||

| (*) As a % of operating areas. Excluding Corporate Centre and Santander Global Platform. | ||||||||

| 26 |  | January - December 2020 | ||||||

| Response to the covid-19 crisis Business model | ||||||||||||||||||||||||||

| January-December 2019 | ||||||||||||||||||||

| Main items of the underlying income statement | ||||||||||||||||||||

| EUR million | ||||||||||||||||||||

| Primary segments | Net interest income | Net fee income | Total income | Net operating income | Profit before tax | Underlying attributable profit to the parent | ||||||||||||||

| EUROPE | 14,201 | 5,260 | 21,001 | 9,957 | 7,350 | 4,878 | ||||||||||||||

| Spain | 3,919 | 2,481 | 7,506 | 3,485 | 2,174 | 1,585 | ||||||||||||||

| Santander Consumer Finance | 3,848 | 823 | 4,710 | 2,672 | 2,215 | 1,314 | ||||||||||||||

| United Kingdom | 3,788 | 866 | 4,727 | 1,892 | 1,455 | 1,077 | ||||||||||||||

| Portugal | 856 | 390 | 1,375 | 751 | 750 | 525 | ||||||||||||||

| Poland | 1,171 | 467 | 1,717 | 1,024 | 681 | 349 | ||||||||||||||

| Other | 620 | 234 | 966 | 133 | 76 | 28 | ||||||||||||||

| NORTH AMERICA | 8,926 | 1,776 | 11,604 | 6,636 | 2,776 | 1,667 | ||||||||||||||

| US | 5,769 | 947 | 7,605 | 4,309 | 1,317 | 717 | ||||||||||||||

| Mexico | 3,157 | 829 | 3,998 | 2,327 | 1,459 | 950 | ||||||||||||||

| SOUTH AMERICA | 13,316 | 4,787 | 18,425 | 11,769 | 7,232 | 3,924 | ||||||||||||||

| Brazil | 10,072 | 3,798 | 13,951 | 9,345 | 5,606 | 2,939 | ||||||||||||||

| Chile | 1,867 | 404 | 2,539 | 1,508 | 1,129 | 630 | ||||||||||||||

| Argentina | 940 | 446 | 1,316 | 554 | 217 | 144 | ||||||||||||||

| Other | 437 | 138 | 619 | 362 | 280 | 212 | ||||||||||||||

| SANTANDER GLOBAL PLATFORM | 92 | 6 | 81 | (159) | (166) | (120) | ||||||||||||||

| CORPORATE CENTRE | (1,252) | (50) | (1,617) | (1,990) | (2,262) | (2,097) | ||||||||||||||

| TOTAL GROUP | 35,283 | 11,779 | 49,494 | 26,214 | 14,929 | 8,252 | ||||||||||||||

| Secondary segments | ||||||||||||||||||||

| RETAIL BANKING | 32,862 | 8,561 | 42,599 | 23,672 | 12,953 | 7,580 | ||||||||||||||

| CORPORATE & INVESTMENT BANKING | 2,728 | 1,520 | 5,227 | 2,945 | 2,699 | 1,713 | ||||||||||||||

| WEALTH MANAGEMENT & INSURANCE | 570 | 1,199 | 2,226 | 1,271 | 1,281 | 929 | ||||||||||||||

| SANTANDER GLOBAL PLATFORM | 375 | 549 | 1,061 | 315 | 258 | 127 | ||||||||||||||

| CORPORATE CENTRE | (1,252) | (50) | (1,617) | (1,990) | (2,262) | (2,097) | ||||||||||||||

| TOTAL GROUP | 35,283 | 11,779 | 49,494 | 26,214 | 14,929 | 8,252 | ||||||||||||||

January - December 2020 |  | 27 | ||||||

Business model | ||||||||||||||||||||||||||

| Primary segments | ||||||||||||||||||||||||||

| EUROPE | |||||

| Highlights (changes in constant euros) •One Santander, whose first focus is Europe, is accelerating our business transformation in the region, to achieve superior growth under a more efficient operating model. •Volume growth in all units in the year: +4% in loans and +6% in deposits, with significant recovery in activity since April’s lows. •Total underlying attributable profit of EUR 2,656 million for the year, affected by the extraordinary provisions recorded. Customer revenue showed the resilience and strength of our model in a low activity environment, with a recovery in recent months which drove the fourth quarter to be the highest of the past two years. Strong cost control across all markets mitigating the negative impact on net operating income (-5%). | ||||

| EUR 2,656 Mn | |||||

| Underlying attributable profit | |||||

| Customers | ||||||||||||||

| December 2020. Thousands | ||||||||||||||

| Loyal customers | Digital customers | |||||||||||||

| 10,021 |  | 15,187 | |||||||||||

| 36 | % | /active customers | +10 | % | YoY | |||||||||

| Activity | ||||||||||||||||||||||||||||||||

| December 2020. EUR billion and % change in constant euros | ||||||||||||||||||||||||||||||||

| +1% | +2% | |||||||||||||||||||||||||||||||

| QoQ | QoQ | |||||||||||||||||||||||||||||||

| 658 | 696 | |||||||||||||||||||||||||||||||

| +4% | +6% | |||||||||||||||||||||||||||||||

| YoY | YoY | |||||||||||||||||||||||||||||||

| Gross loans and advances to customers excl. reverse repos | Customer deposits excl. repos + mutual funds | |||||||||||||||||||||||||||||||

| Underlying income statement | |||||||||||||||||

| EUR million and % change in constant euros | |||||||||||||||||

| Q4'20 | / Q3'20 | 2020 | / 2019 | ||||||||||||||

| Revenue | 4,987 | -3 | % | 19,693 | -5 | % | |||||||||||

| Expenses | -2,534 | 0 | % | -10,314 | -6 | % | |||||||||||

| Net operating income | 2,453 | -6 | % | 9,379 | -5 | % | |||||||||||

| LLPs | -1,131 | +18 | % | -4,299 | +136 | % | |||||||||||

| PBT | 959 | -34 | % | 4,167 | -43 | % | |||||||||||

| Underlying attrib. profit | 634 | -33 | % | 2,656 | -45 | % | |||||||||||

| 28 |  | January - December 2020 | ||||||

Business model | ||||||||||||||||||||||||||

| Primary segments | ||||||||||||||||||||||||||

| SPAIN | ||||||||

| Highlights | |||||||

•The year was eminently marked by the health crisis. Since the beginning, we have worked to be a part of the solution to the recovery of economic activity, through initiatives to support households, the self-employed and businesses. Among others, we remained at the forefront of mobilizing ICO funding, having granted around EUR 31 billion and with a 27% market share. •We made further progress in transforming our distribution model, strengthening our digital capabilities and optimizing costs. Our new app and website were redesigned to fit customer needs and improve their experience. •Underlying attributable profit was EUR 517 million, 67% lower than 2019, predominantly affected by higher provisions, which were partly offset by lower costs. In the quarter, profit decreased due to the contribution to the Deposit Guarantee Fund (DGF) and higher provisions. | ||||||||

| EUR 517 Mn | ||||||||

| Underlying attributable profit | ||||||||

| Customers | ||||||||||||||

| December 2020. Thousands | ||||||||||||||

| Loyal customers | Digital customers | |||||||||||||

| 2,643 |  | 5,234 | |||||||||||

| 34 | % | /active customers | +11 | % | YoY | |||||||||

| Activity | ||||||||||||||||||||||||||||||||

| December 2020. EUR billion and % change | ||||||||||||||||||||||||||||||||

| +1% | ||||||||||||||||||||||||||||||||

| +1% | QoQ | |||||||||||||||||||||||||||||||

| QoQ | ||||||||||||||||||||||||||||||||

| 201 | 321 | |||||||||||||||||||||||||||||||

| +5% | +4% | |||||||||||||||||||||||||||||||

| YoY | YoY | |||||||||||||||||||||||||||||||

| Gross loans and advances to customers excl. reverse repos | Customer deposits excl. repos + mutual funds | |||||||||||||||||||||||||||||||

| Underlying income statement | |||||||||||||||||

| EUR million and % change | |||||||||||||||||

| Q4'20 | / Q3'20 | 2020 | / 2019 | ||||||||||||||

| Revenue | 1,632 | -9 | % | 6,782 | -10 | % | |||||||||||

| Expenses | -873 | -2 | % | -3,607 | -10 | % | |||||||||||

| Net operating income | 759 | -16 | % | 3,175 | -9 | % | |||||||||||

| LLPs | -611 | +36 | % | -2,001 | +134 | % | |||||||||||

| PBT | 20 | -94 | % | 715 | -67 | % | |||||||||||

| Underlying attrib. profit | 20 | -92 | % | 517 | -67 | % | |||||||||||

January - December 2020 |  | 29 | ||||||

Business model | ||||||||||||||||||||||||||

| Primary segments | ||||||||||||||||||||||||||

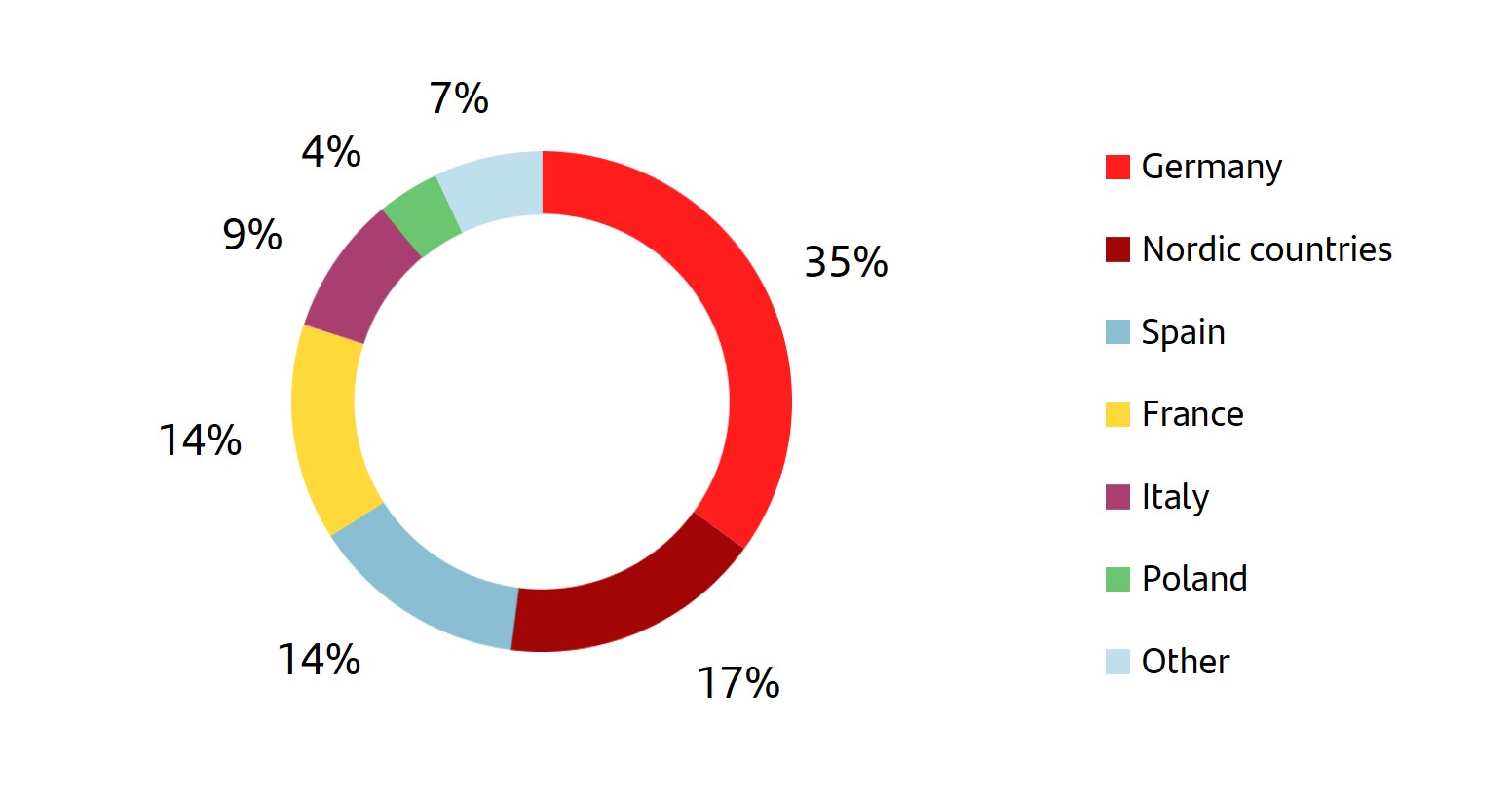

| SANTANDER CONSUMER FINANCE | ||||||||

| Highlights (changes in constant euros) | |||||||

•During 2020, SCF prioritized the management of the covid-19 impact. This has been reflected in the protection of our employees’ health, in ensuring business continuity and service and in supporting our customers and business partners (car manufacturers, dealers and retailers). •As a result of the health crisis, in 2020 new business fell 12% year-on-year. However, most markets showed strong signs of recovery in the second half from the lows seen in April. Second wave impacts have been much less severe. •Underlying attributable profit was EUR 1,085 million, mainly affected by increased provisions. However, of note was growth in top line results, supported by solid net interest income and cost reductions (net operating income: +3%). Underlying RoTE remained in double digits (13%) and RoRWA of 1.9%. | ||||||||

| EUR 1,085 Mn | ||||||||

| Underlying attributable profit | ||||||||

| Customer loan distribution | |||||

| December 2020 | |||||

| |||||

| Activity | ||||||||||||||||||||||||||||||||

| December 2020. EUR billion and % change in constant euros | ||||||||||||||||||||||||||||||||

| +2% | ||||||||||||||||||||||||||||||||

| QoQ | -7% | |||||||||||||||||||||||||||||||

| 104 | QoQ | |||||||||||||||||||||||||||||||

| —% | -12% | |||||||||||||||||||||||||||||||

| YoY | 39 | YoY | ||||||||||||||||||||||||||||||

| Gross loans and advances to customers excl. reverse repos | New lending | |||||||||||||||||||||||||||||||

| Underlying income statement | |||||||||||||||||

| EUR million and % change in constant euros | |||||||||||||||||

| Q4'20 | / Q3'20 | 2020 | / 2019 | ||||||||||||||

| Revenue | 1,223 | +2 | % | 4,685 | +1 | % | |||||||||||

| Expenses | -515 | +7 | % | -1,981 | -2 | % | |||||||||||

| Net operating income | 708 | 0 | % | 2,703 | +3 | % | |||||||||||

| LLPs | -186 | -12 | % | -899 | +92 | % | |||||||||||

| PBT | 532 | +9 | % | 1,869 | -14 | % | |||||||||||

| Underlying attrib. profit | 324 | +14 | % | 1,085 | -16 | % | |||||||||||

| 30 |  | January - December 2020 | ||||||

Business model | ||||||||||||||||||||||||||

| Primary segments | ||||||||||||||||||||||||||

| UNITED KINGDOM | ||||||||

| Highlights (changes in constant euros) | |||||||

•Supporting our customers, people and communities remained our top priority. Although covid-19 materially impacted our results, the decisive management actions and extraordinary work of our colleagues helped deliver a remarkably resilient performance despite the challenging environment. •Underlying attributable profit year-on-year was down 50% mainly due to covid-19 related provisions for expected credit losses; underlying credit quality remains strong. •Two straight quarters of solid growth in underlying profit driven by strong lending, particularly mortgages, further efficiency savings and a notable improvement in income. This resulted in an 11 bp increase in NIM and a further 3 pp improvement in efficiency in the quarter. | ||||||||

| EUR 530 Mn | ||||||||

| Underlying attributable profit | ||||||||

| Customers | ||||||||||||||

| December 2020. Thousands | ||||||||||||||

| Loyal customers | Digital customers | |||||||||||||

| 4,450 |  | 6,267 | |||||||||||

| 31 | % | /active customers | +8 | % | YoY | |||||||||

| Activity | ||||||||||||||||||||||||||||||||

| December 2020. EUR billion and % change in constant euros | ||||||||||||||||||||||||||||||||

| +1% | +2% | |||||||||||||||||||||||||||||||

| QoQ | QoQ | |||||||||||||||||||||||||||||||

| 242 | 223 | |||||||||||||||||||||||||||||||

| +3% | +8% | |||||||||||||||||||||||||||||||

| YoY | YoY | |||||||||||||||||||||||||||||||

| Gross loans and advances to customers excl. reverse repos | Customer deposits excl. repos + mutual funds | |||||||||||||||||||||||||||||||

| Underlying income statement | |||||||||||||||||

| EUR million and % change in constant euros | |||||||||||||||||

| Q4'20 | / Q3'20 | 2020 | / 2019 | ||||||||||||||

| Revenue | 1,146 | +2 | % | 4,339 | -7 | % | |||||||||||

| Expenses | -626 | -3 | % | -2,642 | -6 | % | |||||||||||

| Net operating income | 519 | +10 | % | 1,697 | -9 | % | |||||||||||

| LLPs | -114 | -39 | % | -733 | +194 | % | |||||||||||

| PBT | 253 | +4 | % | 697 | -51 | % | |||||||||||

| Underlying attrib. profit | 212 | +18 | % | 530 | -50 | % | |||||||||||

January - December 2020 |  | 31 | ||||||

Business model | ||||||||||||||||||||||||||

| Primary segments | ||||||||||||||||||||||||||

| PORTUGAL | ||||||||

| Highlights | |||||||

•In the environment of the pandemic, Santander Portugal's priority was to support its customers and the economy by mobilizing state-backed lines of credit for businesses, as well as through capital and interest payment holidays on mortgages, consumer loans and business loans. •We strengthened our leadership position as the country’s largest bank in terms of domestic loans and advances to customers, with market shares in new lending to corporates of 18% and mortgages of 25%. •Underlying attributable profit decreased 36% year-on-year, weighed down by the impact of the crisis on income and provisions, which was only partly mitigated by cost reductions. | ||||||||

| EUR 338 Mn | ||||||||

| Underlying attributable profit | ||||||||

| Customers | ||||||||||||||

| December 2020. Thousands | ||||||||||||||

| Loyal customers | Digital customers | |||||||||||||

| 812 |  | 930 | |||||||||||

| 48 | % | /active customers | +20 | % | YoY | |||||||||

| Activity | ||||||||||||||||||||||||||||||||

| December 2020. EUR billion and % change | ||||||||||||||||||||||||||||||||

| 0% | ||||||||||||||||||||||||||||||||

| +1% | QoQ | |||||||||||||||||||||||||||||||

| QoQ | ||||||||||||||||||||||||||||||||

| 39 | 43 | |||||||||||||||||||||||||||||||

| +8% | +2% | |||||||||||||||||||||||||||||||

| YoY | YoY | |||||||||||||||||||||||||||||||

| Gross loans and advances to customers excl. reverse repos | Customer deposits excl. repos + mutual funds | |||||||||||||||||||||||||||||||

| Underlying income statement | |||||||||||||||||

| EUR million and % change | |||||||||||||||||

| Q4'20 | / Q3'20 | 2020 | / 2019 | ||||||||||||||

| Revenue | 317 | +2 | % | 1,296 | -6 | % | |||||||||||

| Expenses | -149 | +2 | % | -590 | -5 | % | |||||||||||

| Net operating income | 168 | +1 | % | 706 | -6 | % | |||||||||||

| LLPs | -42 | -11 | % | -193 | — | ||||||||||||

| PBT | 133 | +11 | % | 483 | -36 | % | |||||||||||

| Underlying attrib. profit | 95 | +14 | % | 338 | -36 | % | |||||||||||

| 32 |  | January - December 2020 | ||||||

Business model | ||||||||||||||||||||||||||

| Primary segments | ||||||||||||||||||||||||||

| POLAND | ||||||||

| Highlights (changes in constant euros) | |||||||

•The main management focus is on customer relationships and maximizing business income. •Santander Bank Polska is Poland's third largest bank in terms of assets and continues to be recognized as an industry leader in traditional and digital banking. Accordingly, we are accelerating digitalization and our Smart omnichannel offering. •Underlying attributable profit in 2020 was 52% lower year-on-year affected by interest rate cuts, provisions recorded due to regulatory changes after the CJEU rulings and covid-19 related impairment charges. | ||||||||

| EUR 162 Mn | ||||||||

| Underlying attributable profit | ||||||||

| Customers | ||||||||||||||

| December 2020. Thousands | ||||||||||||||

| Loyal customers | Digital customers | |||||||||||||

| 2,115 |  | 2,756 | |||||||||||

| 55 | % | /active customers | +10 | % | YoY | |||||||||

| Activity | ||||||||||||||||||||||||||||||||

| December 2020. EUR billion and % change in constant euros | ||||||||||||||||||||||||||||||||

| 0% | +4% | |||||||||||||||||||||||||||||||

| QoQ | QoQ | |||||||||||||||||||||||||||||||

| 29 | 39 | |||||||||||||||||||||||||||||||

| +1% | +10% | |||||||||||||||||||||||||||||||

| YoY | YoY | |||||||||||||||||||||||||||||||

| Gross loans and advances to customers excl. reverse repos | Customer deposits excl. repos + mutual funds | |||||||||||||||||||||||||||||||

| Underlying income statement | |||||||||||||||||

| EUR million and % change in constant euros | |||||||||||||||||

| Q4'20 | / Q3'20 | 2020 | / 2019 | ||||||||||||||

| Revenue | 388 | 0 | % | 1,524 | -8 | % | |||||||||||

| Expenses | -154 | -3 | % | -629 | -6 | % | |||||||||||

| Net operating income | 234 | +2 | % | 895 | -10 | % | |||||||||||

| LLPs | -81 | +25 | % | -330 | +57 | % | |||||||||||

| PBT | 66 | -50 | % | 370 | -44 | % | |||||||||||

| Underlying attrib. profit | 20 | -69 | % | 162 | -52 | % | |||||||||||

January - December 2020 |  | 33 | ||||||

Business model | ||||||||||||||||||||||||||

| Primary segments | ||||||||||||||||||||||||||

| NORTH AMERICA | |||||

| Highlights (changes in constant euros) •In North America, the US and Mexico are managed according to their local priorities, increasing coordination and cooperation between them, creating a joint value proposition, leveraging the experience and preventing duplication. •Volume growth in the year, mainly in customer funds, boosted by higher deposits in SBNA, Mexico and the New York branch. •Underlying attributable profit amounted to EUR 1,492 million in the year, only 3% lower than 2019 despite the increase in pandemic-related provisions. Revenue remained stable and net operating income was 1% higher. | ||||

| EUR 1,492 Mn | |||||

| Underlying attributable profit | |||||

| Customers | ||||||||||||||

| December 2020. Thousands | ||||||||||||||

| Loyal customers | Digital customers | |||||||||||||

| 3,942 |  | 6,011 | |||||||||||

| 36 | % | /active customers | +16 | % | YoY | |||||||||

| Activity | ||||||||||||||||||||||||||||||||

| December 2020. EUR billion and % change in constant euros | ||||||||||||||||||||||||||||||||

| 0% | ||||||||||||||||||||||||||||||||

| QoQ | +1% | |||||||||||||||||||||||||||||||

| QoQ | ||||||||||||||||||||||||||||||||

| 121 | 118 | |||||||||||||||||||||||||||||||

| +2% | +15% | |||||||||||||||||||||||||||||||

| YoY | YoY | |||||||||||||||||||||||||||||||

| Gross loans and advances to customers excl. reverse repos | Customer deposits excl. repos + mutual funds | |||||||||||||||||||||||||||||||

| Underlying income statement | |||||||||||||||||

| EUR million and % change in constant euros | |||||||||||||||||

| Q4'20 | / Q3'20 | 2020 | / 2019 | ||||||||||||||

| Revenue | 2,691 | 0 | % | 11,011 | 0 | % | |||||||||||

| Expenses | -1,194 | +8 | % | -4,631 | -2 | % | |||||||||||

| Net operating income | 1,498 | -6 | % | 6,379 | +1 | % | |||||||||||

| LLPs | -773 | -1 | % | -3,916 | +12 | % | |||||||||||

| PBT | 668 | -14 | % | 2,332 | -10 | % | |||||||||||

| Underlying attrib. profit | 431 | -4 | % | 1,492 | -3 | % | |||||||||||

| 34 |  | January - December 2020 | ||||||

Business model | ||||||||||||||||||||||||||

| Primary segments | ||||||||||||||||||||||||||

| UNITED STATES | ||||||||

| Highlights (changes in constant euros) | |||||||

•Santander US focused on supporting its customers through the difficult environment created by the pandemic while preserving the strength of its balance sheet and its upward trend in profitability during the year. •By leveraging our resilient origination capabilities and the commercialization of our network, our year-on-year trend in customer loans and deposits improved preserving net interest income despite historically low rates and the uncertain operating environment caused by covid-19. •We continued to build on recent success with underlying profit increasing 4% in constant euros due to resilient net interest income performance, notable cost reduction and lower weight of non-controlling interests. | ||||||||

| EUR 731 Mn | ||||||||

| Underlying attributable profit | ||||||||

| Customers | ||||||||||||||

| December 2020. Thousands | ||||||||||||||

| Loyal customers | Digital customers | |||||||||||||

| 347 |  | 1,011 | |||||||||||

| 22 | % | /active customers | +6 | % | YoY | |||||||||

| Activity | ||||||||||||||||||||||||||||||||

| December 2020. EUR billion and % change in constant euros | ||||||||||||||||||||||||||||||||

| +2% | ||||||||||||||||||||||||||||||||

| QoQ | +1% | |||||||||||||||||||||||||||||||

| QoQ | ||||||||||||||||||||||||||||||||

| 90 | 77 | |||||||||||||||||||||||||||||||

| +3% | +16% | |||||||||||||||||||||||||||||||

| YoY | YoY | |||||||||||||||||||||||||||||||

| Gross loans and advances to customers excl. reverse repos | Customer deposits excl. repos + mutual funds | |||||||||||||||||||||||||||||||

| Underlying income statement | |||||||||||||||||

| EUR million and % change in constant euros | |||||||||||||||||

| Q4'20 | / Q3'20 | 2020 | / 2019 | ||||||||||||||

| Revenue | 1,801 | 0 | % | 7,360 | -1 | % | |||||||||||

| Expenses | -772 | +9 | % | -3,079 | -5 | % | |||||||||||

| Net operating income | 1,029 | -5 | % | 4,281 | +1 | % | |||||||||||

| LLPs | -561 | -1 | % | -2,937 | +7 | % | |||||||||||

| PBT | 431 | -14 | % | 1,250 | -3 | % | |||||||||||

| Underlying attrib. profit | 260 | +3 | % | 731 | +4 | % | |||||||||||

January - December 2020 |  | 35 | ||||||

Business model | ||||||||||||||||||||||||||

| Primary segments | ||||||||||||||||||||||||||

| MEXICO | ||||||||

| Highlights (changes in constant euros) | |||||||

•The multichannel innovation and boost to digital channels strengthened our value proposition with new products and services, allowing us to make a headway with our customer attraction and loyalty strategy. •Gross loans and advances to customers (excluding reverse repos) remained flat year-on-year, as corporate loans began to normalize following the uptick at the beginning of the pandemic. In individuals, of note were mortgages and auto loans. Customer funds rose 14%. •Positive performance in revenue (+3%) in the year. However, underlying attributable profit fell 9% impacted by higher provisions and costs (amortizations and technology). | ||||||||

| EUR 762 Mn | ||||||||

| Underlying attributable profit | ||||||||

| Customers | ||||||||||||||

| December 2020. Thousands | ||||||||||||||

| Loyal customers | Digital customers | |||||||||||||

| 3,595 |  | 5,000 | |||||||||||

| 39 | % | /active customers | +20 | % | YoY | |||||||||

| Activity | ||||||||||||||||||||||||||||||||

| December 2020. EUR billion and % change in constant euros | ||||||||||||||||||||||||||||||||

| +1% | ||||||||||||||||||||||||||||||||

| -5% | QoQ | |||||||||||||||||||||||||||||||

| QoQ | ||||||||||||||||||||||||||||||||

| 30 | 41 | |||||||||||||||||||||||||||||||

| 0% | +14% | |||||||||||||||||||||||||||||||

| YoY | YoY | |||||||||||||||||||||||||||||||

| Gross loans and advances to customers excl. reverse repos | Customer deposits excl. repos + mutual funds | |||||||||||||||||||||||||||||||

| Underlying income statement | |||||||||||||||||

| EUR million and % change in constant euros | |||||||||||||||||

| Q4'20 | / Q3'20 | 2020 | / 2019 | ||||||||||||||

| Revenue | 891 | -1 | % | 3,651 | +3 | % | |||||||||||

| Expenses | -422 | +7 | % | -1,552 | +5 | % | |||||||||||

| Net operating income | 469 | -7 | % | 2,098 | +2 | % | |||||||||||

| LLPs | -212 | -3 | % | -979 | +28 | % | |||||||||||

| PBT | 238 | -15 | % | 1,082 | -16 | % | |||||||||||

| Underlying attrib. profit | 171 | -12 | % | 762 | -9 | % | |||||||||||

| 36 |  | January - December 2020 | ||||||

Business model | ||||||||||||||||||||||||||

| Primary segments | ||||||||||||||||||||||||||

| SOUTH AMERICA | |||||

| Highlights (changes in constant euros) •During the year, work protocols were implemented in all countries to protect our employees' safety while supporting our customers through products and services to mitigate the impact of the pandemic, ensuring business continuity across the region. •Double-digit growth in loans and advances to customers, reflecting the countries' capacity to adapt to the new environment, and customer deposits, with volumes and transactionality gradually recovering in the second half of the year. •We continued to focus on delivering profitable growth backed by operational excellence as well as cost and risk control. •Underlying attributable profit in the year fell 4% affected by covid-19 related provisions. Net operating income rose 5% backed by NII and gains on financial transactions. | ||||

| EUR 2,927 Mn | |||||

| Underlying attributable profit | |||||

| Customers | ||||||||||||||

| December 2020. Thousands | ||||||||||||||

| Loyal customers | Digital customers | |||||||||||||

| 8,614 |  | 20,200 | |||||||||||

| 27 | % | /active customers | +17 | % | YoY | |||||||||

| Activity | ||||||||||||||||||||||||||||||||

| December 2020. EUR billion and % change in constant euros | ||||||||||||||||||||||||||||||||

| +2% | ||||||||||||||||||||||||||||||||

| +1% | QoQ | |||||||||||||||||||||||||||||||

| QoQ | ||||||||||||||||||||||||||||||||

| 119 | 153 | |||||||||||||||||||||||||||||||

| +15% | +18% | |||||||||||||||||||||||||||||||

| YoY | YoY | |||||||||||||||||||||||||||||||

| Gross loans and advances to customers excl. reverse repos | Customer deposits excl. repos + mutual funds | |||||||||||||||||||||||||||||||

| Underlying income statement | |||||||||||||||||

| EUR million and % change in constant euros | |||||||||||||||||

| Q4'20 | / Q3'20 | 2020 | / 2019 | ||||||||||||||

| Revenue | 3,514 | +5 | % | 14,845 | +5 | % | |||||||||||

| Expenses | -1,314 | +11 | % | -5,312 | +4 | % | |||||||||||

| Net operating income | 2,201 | +2 | % | 9,533 | +5 | % | |||||||||||

| LLPs | -702 | -8 | % | -3,923 | +35 | % | |||||||||||

| PBT | 1,444 | +8 | % | 5,291 | -6 | % | |||||||||||

| Underlying attrib. profit | 808 | +14 | % | 2,927 | -4 | % | |||||||||||

January - December 2020 |  | 37 | ||||||

Business model | ||||||||||||||||||||||||||

| Primary segments | ||||||||||||||||||||||||||

| BRAZIL | ||||||||

| Highlights (changes in constant euros) | |||||||

•Commercial activity in the second half of the year exceeded pre-covid-19 levels, boosting revenue growth in the year. Likewise, our continuous cost control efforts through process transformation resulted in a new improvement of the efficiency ratio. •Credit quality indicators remained at controlled levels, backed by loan expansion towards lower risk products, mainly with guarantees, and the effectiveness of our risk models. •Underlying attributable profit was EUR 2,113 million, -5% year-on-year, affected by covid-19 related provisions. Net operating income was 3% higher, receiving an uplift from total income and cost control. | ||||||||

| EUR 2,113 Mn | ||||||||

| Underlying attributable profit | ||||||||

| Customers | ||||||||||||||

| December 2020. Thousands | ||||||||||||||

| Loyal customers | Digital customers | |||||||||||||

| 6,382 |  | 15,556 | |||||||||||

| 23 | % | /active customers | +16 | % | YoY | |||||||||

| Activity | ||||||||||||||||||||||||||||||||

| December 2020. EUR billion and % change in constant euros | ||||||||||||||||||||||||||||||||

| +1% | ||||||||||||||||||||||||||||||||

| +3% | QoQ | |||||||||||||||||||||||||||||||

| QoQ | ||||||||||||||||||||||||||||||||

| 67 | 100 | |||||||||||||||||||||||||||||||

| +19% | +16% | |||||||||||||||||||||||||||||||

| YoY | YoY | |||||||||||||||||||||||||||||||

| Gross loans and advances to customers excl. reverse repos | Customer deposits excl. repos + mutual funds | |||||||||||||||||||||||||||||||

| Underlying income statement | |||||||||||||||||

| EUR million and % change in constant euros | |||||||||||||||||

| Q4'20 | / Q3'20 | 2020 | / 2019 | ||||||||||||||

| Revenue | 2,544 | +2 | % | 10,866 | +3 | % | |||||||||||

| Expenses | -897 | +12 | % | -3,541 | +1 | % | |||||||||||

| Net operating income | 1,648 | -2 | % | 7,325 | +3 | % | |||||||||||

| LLPs | -540 | -4 | % | -3,018 | +31 | % | |||||||||||

| PBT | 1,072 | +1 | % | 4,045 | -5 | % | |||||||||||

| Underlying attrib. profit | 568 | +6 | % | 2,113 | -5 | % | |||||||||||

| 38 |  | January - December 2020 | ||||||

Business model | ||||||||||||||||||||||||||

| Primary segments | ||||||||||||||||||||||||||

| CHILE | ||||||||

| Highlights (changes in constant euros) | |||||||

•Santander Chile was the country's first bank to be included in the DJSI for Emerging Markets, and the Sustainable Leaders Agenda 2020 (ALAS20) recognized us as the leading company for sustainability in Chile. •Gross loans and advances to customers (excluding reverse repos) rose 6% year-on-year, but dropped in the quarter following the strong growth recorded in the first half of the year. •Sharp year-on-year increase in demand deposits (+42%) with growth in all segments. Account openings saw continued growth, boosted by Superdigital and Life. •Underlying attributable profit decreased year-on-year primarily due to higher provisions, as total income grew 2% and net operating income 4%. In the quarter, profit increased 88%. | ||||||||

| EUR 432 Mn | ||||||||

| Underlying attributable profit | ||||||||

| Customers | ||||||||||||||

| December 2020. Thousands | ||||||||||||||

| Loyal customers | Digital customers | |||||||||||||

| 764 |  | 1,547 | |||||||||||

| 44 | % | /active customers | +24 | % | YoY | |||||||||

| Activity | ||||||||||||||||||||||||||||||||

| December 2020. EUR billion and % change in constant euros | ||||||||||||||||||||||||||||||||

| -3% | +2% | |||||||||||||||||||||||||||||||

| QoQ | QoQ | |||||||||||||||||||||||||||||||

| 41 | 38 | |||||||||||||||||||||||||||||||

| +6% | +11% | |||||||||||||||||||||||||||||||

| YoY | YoY | |||||||||||||||||||||||||||||||

| Gross loans and advances to customers excl. reverse repos | Customer deposits excl. repos + mutual funds | |||||||||||||||||||||||||||||||

| Underlying income statement | |||||||||||||||||

| EUR million and % change in constant euros | |||||||||||||||||

| Q4'20 | / Q3'20 | 2020 | / 2019 | ||||||||||||||

| Revenue | 594 | +11 | % | 2,263 | +2 | % | |||||||||||

| Expenses | -219 | -2 | % | -900 | 0 | % | |||||||||||

| Net operating income | 375 | +20 | % | 1,363 | +4 | % | |||||||||||

| LLPs | -94 | -39 | % | -594 | +54 | % | |||||||||||

| PBT | 285 | +67 | % | 785 | -20 | % | |||||||||||

| Underlying attrib. profit | 163 | +88 | % | 432 | -21 | % | |||||||||||

January - December 2020 |  | 39 | ||||||

Business model | ||||||||||||||||||||||||||

| Primary segments | ||||||||||||||||||||||||||

| ARGENTINA | ||||||||

| Highlights (changes in constant euros) | |||||||