FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of February, 2021

Commission File Number: 001-12518

Banco Santander, S.A.

(Exact name of registrant as specified in its charter)

Ciudad Grupo Santander

28660 Boadilla del Monte (Madrid) Spain

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes ☐ No ☒

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ☐ No ☒

Banco Santander, S.A.

TABLE OF CONTENTS

| | | | | |

| |

| Item | |

| 1 | 2020 Pillar III Disclosures |

| | | | | | | | | | | | | | |

| Index |

|

| Pillar 3 - Disclosures Report |

|

|

|

|

|

|

| Pillar 3 |

| | | | | | | | | | | | | | | | | |

| Introduction (Ch.1) | | Capital (Ch.2) |

| 9 | Executive Summary | | 23 | Capital |

| 13 | Santander Group Pillar 3 Report overview | | 35 | Pillar 1 - Regulatory Capital |

| 16 | Scope of consolidation | | 48 | Pillar 2 - Economic Capital |

| 18 | Regulatory framework | | | |

| | | | | |

| Risks (Ch. 3, 4, 5, 6, 7 and 8) | | Santander Group (Ch. 9 and 10) |

| 49 | Credit Risk | | 159 | Remuneration policies |

| 97 | Counterparty Credit Risk | | 168 | Appendices |

| 109 | Credit Risk - Securitisations | | Other appendices available on the Santander Group website.

Pillar 3 editable format tables. |

| 127 | Market Risk | |

| 145 | Operational Risk | |

| 151 | Other Risks | |

| | | | | |

| | | | |

| | | | | | | | |

| | |

| 1.1. Executive summary | 9 |

| 1.2. Santander Group Pillar 3 report overview | 13 |

| 1.2.1. Background information on Santander Group | 13 |

| 1.2.2. Governance: approval and publication | 14 |

| 1.2.3. Transparency enhancements | 15 |

| 1.2.4. Disclosure criteria used in this report | 16 |

| 1.3. Scope of consolidation | 16 |

| 1.3.1. Differences between the consolidation method for accounting purposes and the consolidation method for regulatory capital calculation purposes | 16 |

| 1.3.2. Substantial amendments due to a change in perimeter and corporate transactions | 18 |

| 1.4. Regulatory framework | 18 |

| 1.4.1. Regulatory changes in 2020 | 20 |

| | |

| INTRODUCTION 2020 Pillar 3 Disclosures Report |

1.Introduction

1.1. Executive summary

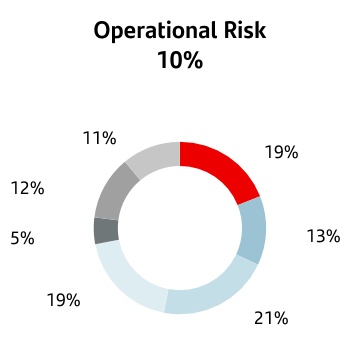

Santander is one of the largest banks in the eurozone. As of December 2020, we had EUR 1,508,250 million of assets and EUR 1,056,127 million of total funds. Our market capitalization had reached EUR 44,011 million.

Our purpose is to help people and businesses prosper in a way that is Simple, Personal and Fair. We do not merely meet our legal and regulatory obligations, but also aspire to exceed expectations. We focus on areas where our activity can have the greatest impact, helping economic growth in an inclusive and sustainable way.

We engage in all types of typical banking activities, operations and services. Our scale, business model and diversification drive our aim to be the best open digital financial services platform, acting responsibly and earning the lasting loyalty of our stakeholders (customers, shareholders, people and communities).

In 2020, against the backdrop of the pandemic, our commitment to our stakeholders was even stronger:

•Our priority was to safeguard the health and safety of our 191,189 employees, by implementing measures such as redefining our way of working, with more than 100,000 employees working from home at the peak of the pandemic, and gradual returns to the workplaces amid de-escalation. We followed local governments' recommendations at all times and based our procedures on three pillars: developing and implementing of health and safety protocols, prioritizing the health of our employees, and tracking and tracing (through health apps).

•For our 148 million customers, we strengthened our proposition, and implemented support measures to ensure the necessary financial assistance through pre-approved lines of credit, payment deferrals and special policies, as well as facilitating the granting of state-guaranteed business loans in all countries.

•For our shareholders, we kept all channels open to increase their trust, which was reflected in an increase of more than 30,000 shareholders in the year to 4,018,817.

•In line with our commitment, we contributed to the well-being of society. We implemented actions and mobilized resources together with governments and institutions to help combat the health crisis, with more than EUR 105 million dedicated to solidarity initiatives.

As the global pandemic intensified, we accelerated our digital transformation, focusing on our multi-channel strategy and digitalization of processes and businesses.

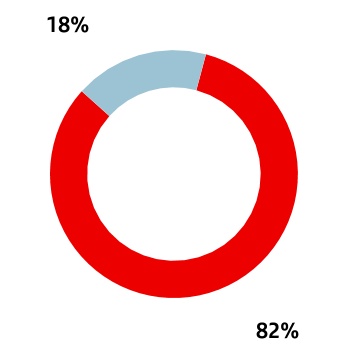

As a result, loyal and digital customers and activity continued to grow. The number of loyal customers reached 23 million (+6% in the year), picking up in individuals and corporates. Digital customers rose 15% to more than 42 million.

On average, our customers accessed digital touchpoints close to 190 million times per week and 44% of total sales were digital (36% in 2019). We also aim to be one of the top three banks for customer satisfaction in our main markets.

Besides digital channels, we interact with our customers through our global network of 11,236 branches, which we are optimizing and adapting to our customers' needs including universal offices and specialist centres for certain customer segments. We also have new collaborative spaces with increased digital capabilities (Work Café, SmartBank and Ágil branches).

Economic Context

In 2020, Santander operated in an extraordinarily complex environment characterized by the pandemic and the measures to alleviate its economic impact. The crisis has been global, severe and abrupt, and has generated enormous uncertainty given the impossibility of predicting its scope and duration. Most of the economies in which the bank operates responded with tough policies and notable coordination between their fiscal, financial and monetary counterparts to limit permanent damage from lockdown measures. Nonetheless, hopes raised by better treatments, more targeted outbreak responses and the effective vaccines announced in the final months of the year contained the situation towards the end of the year and led to better expectations that were reflected in financial markets.

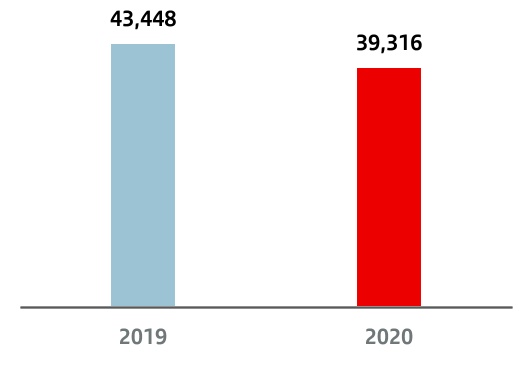

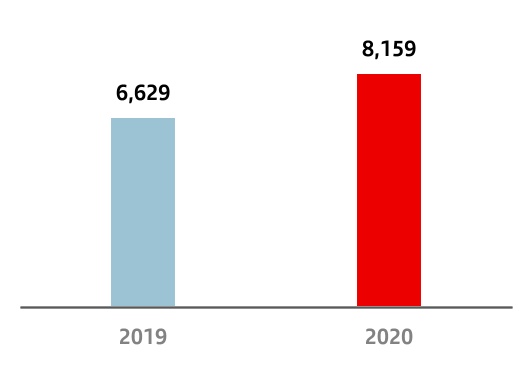

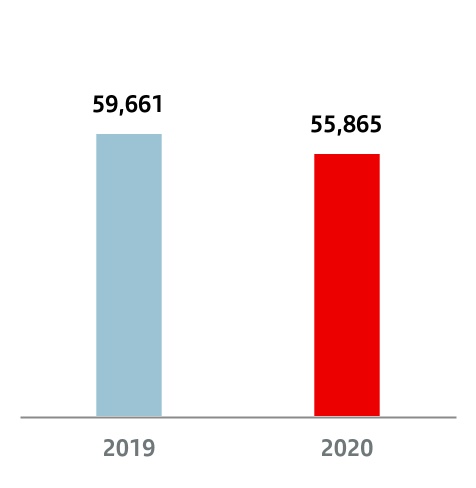

2020 Grupo Santander's results highlights

Grupo Santander's results in the year were affected by the health crisis caused by the spread of covid-19, which is reflected in a weaker economic environment, lower interest rates and a sharp depreciation of some currencies.

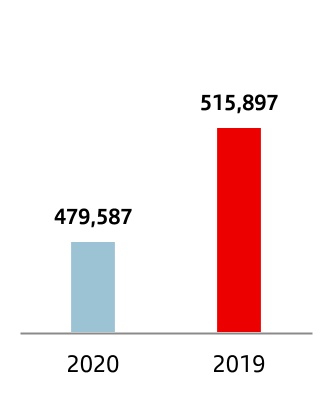

Total income fell in the year from lower activity and exchange rates. Excluding their impact, total income remained in line with 2019, as the decrease in activity and lower interest rates were offset by higher volumes, sound market volatility management and the lower cost of deposits.

Cost reduction through the optimization plans implemented in recent years, along with additional savings measures adopted since the start of the crisis. This was reflected in the fall in real terms in the majority of our markets.

Greater loan-loss provisions due to credit growth and the worsening of economic conditions arising from the pandemic and the consequent expected impact on credit quality. Cost of credit ended the year at 1.28%, in line with our expectations.

| | |

| INTRODUCTION 2020 Pillar 3 Disclosures Report |

We adjusted the goodwill ascribed to some units and to deferred tax assets in the second quarter as a result of the worsening economic outlook, totalling EUR 12,600 million, resulting in an attributable profit to the Group of -EUR 8,771 million in 2020.

Excluding the above adjustments and other costs and provisions that are outside the ordinary course of our business, underlying attributable profit to the parent was EUR 5,081 million, with net operating income of EUR 23,633 million, 2% more in constant euros than in 2019.

Capital Management and adequacy

Grupo Santander’s capital management aims to guarantee solvency and maximize profitability, while complying with internal objectives and regulatory requirements.

It is a key strategic tool for local and corporate decision making, enabling us to set a common framework of actions, criteria, policies, functions, metrics and processes.

Our active capital management applies strategies on efficient capital allocation to business lines, and considers securitizations, asset sales and issuances of capital instruments (capital hybrids and subordinated debt).

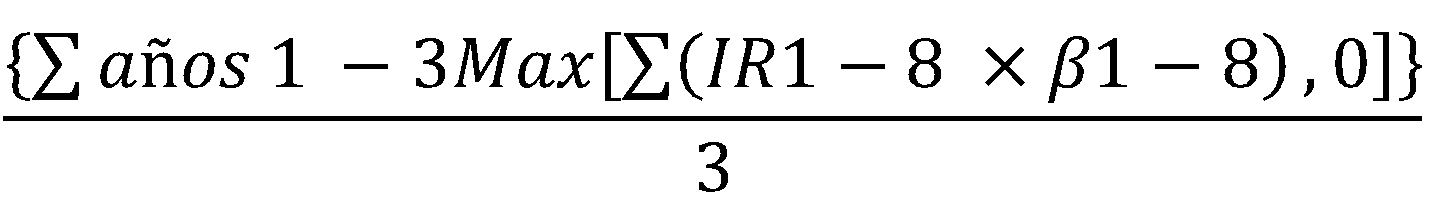

Our economic capital model aims to ensure our capital allocation is right for the risks inherent in our operations and risk appetite to optimize value creation for our group and business units.

To optimize value creation, we measure the real economic capital an activity requires and its return, and select those activities that maximize returns. We do this under both expected as well as unlikely but plausible economic scenarios, and with the solvency level decided by the Group.

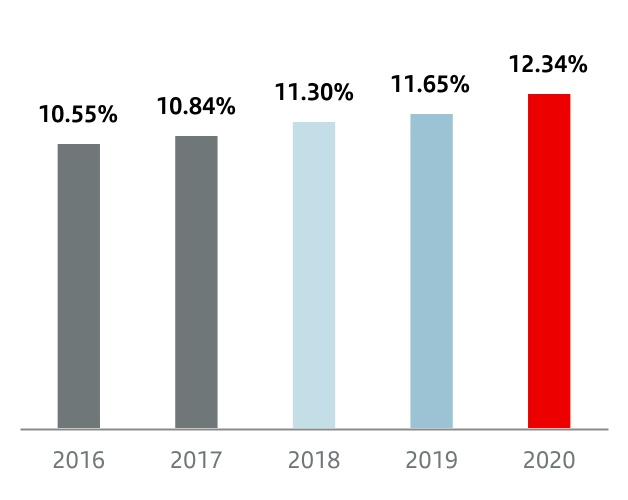

Capital ratios in 2020

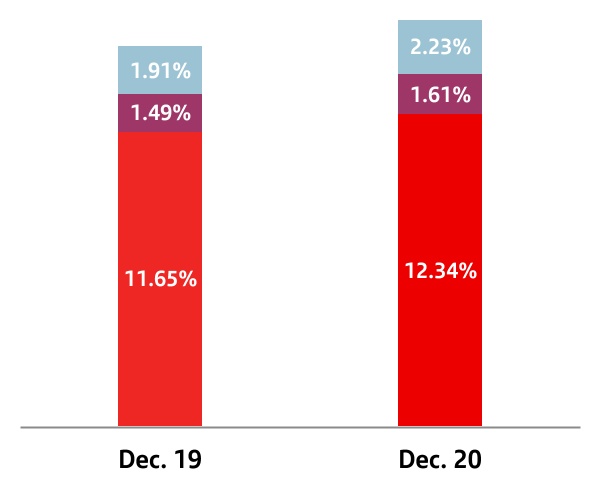

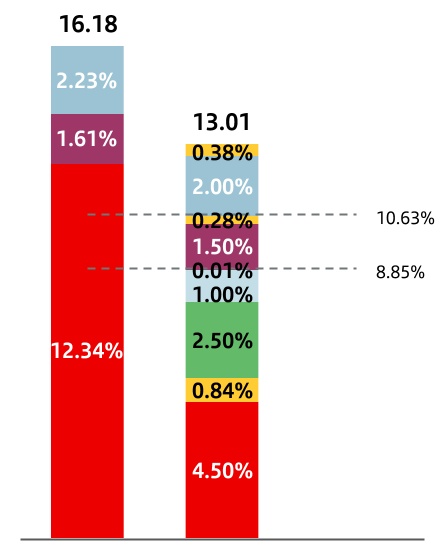

The ratios of this report are calculated by applying the CRR and IFRS9 transitory schedules.

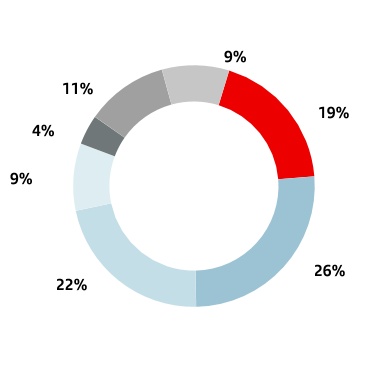

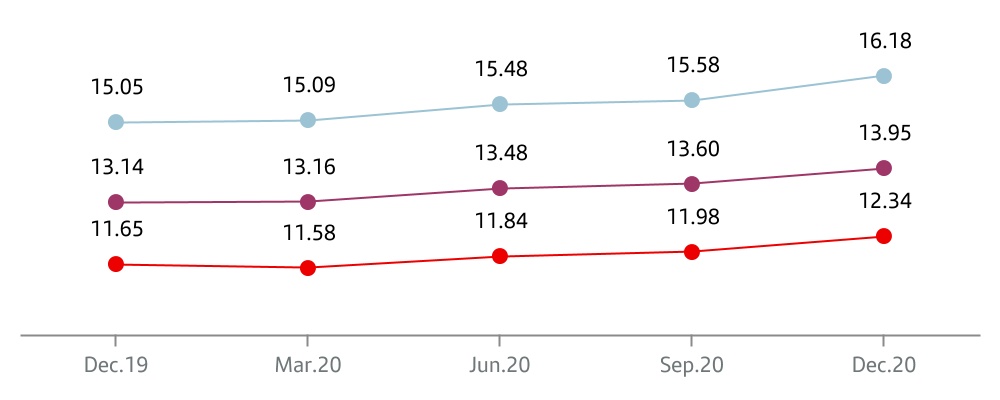

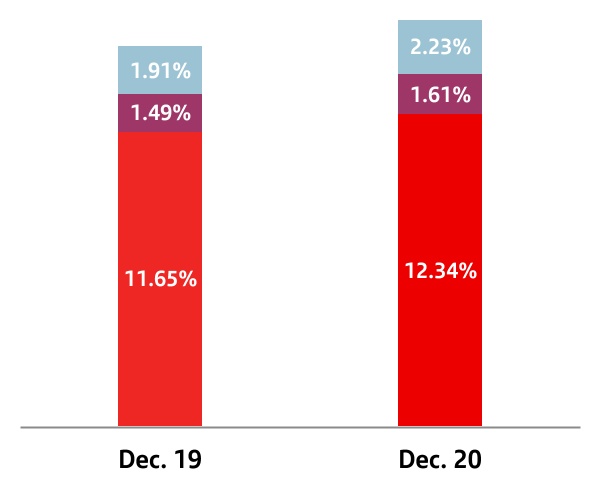

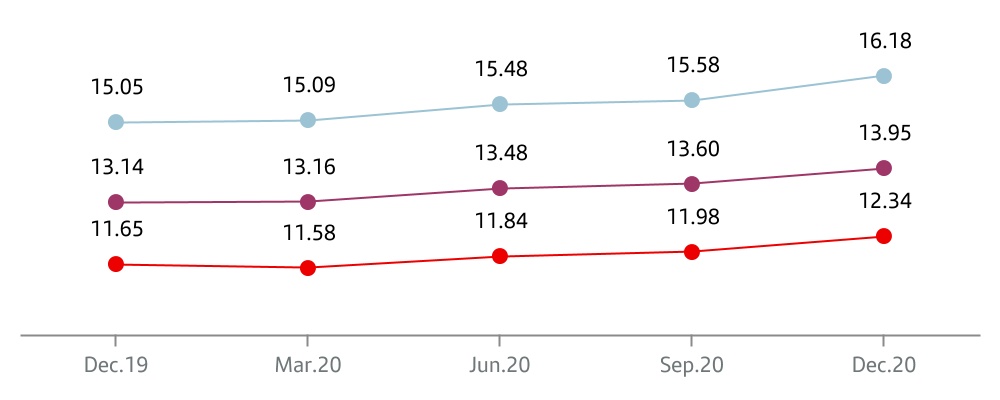

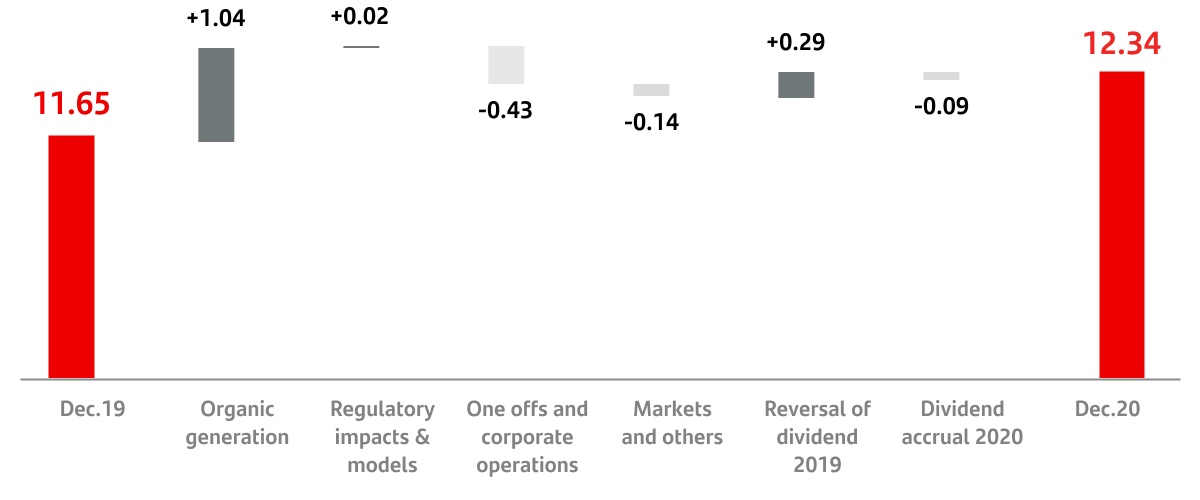

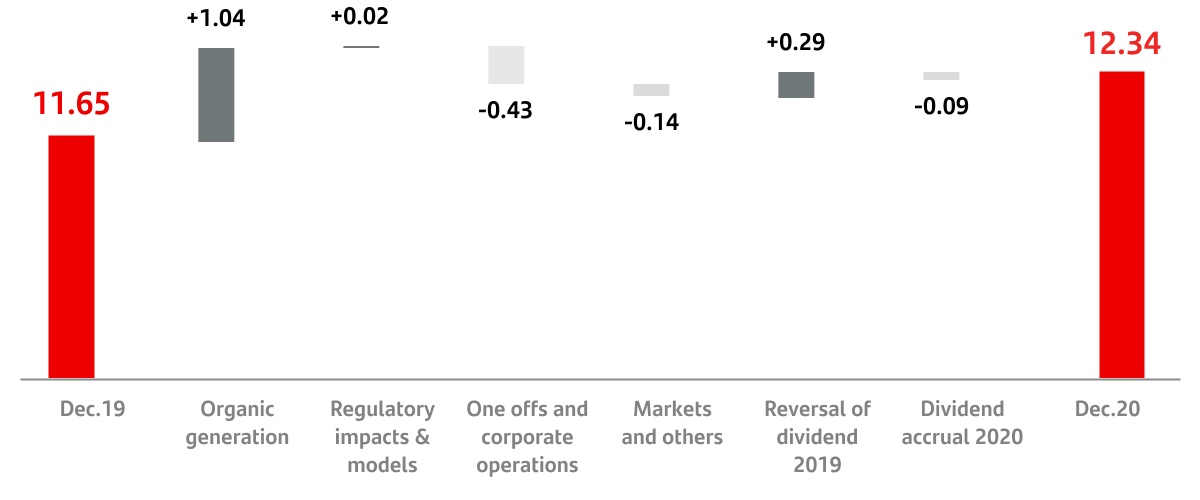

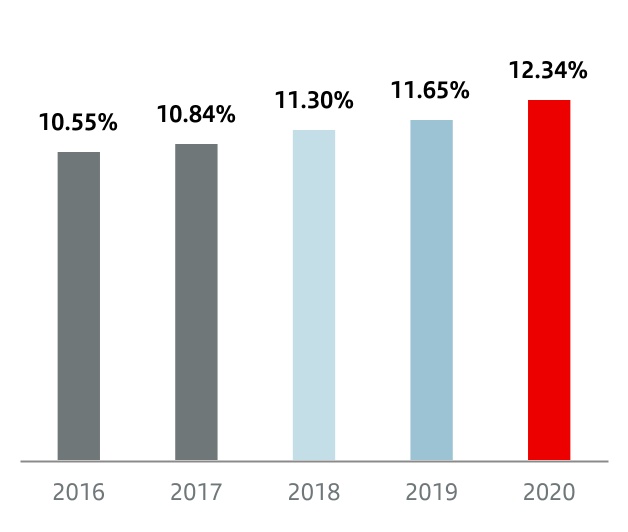

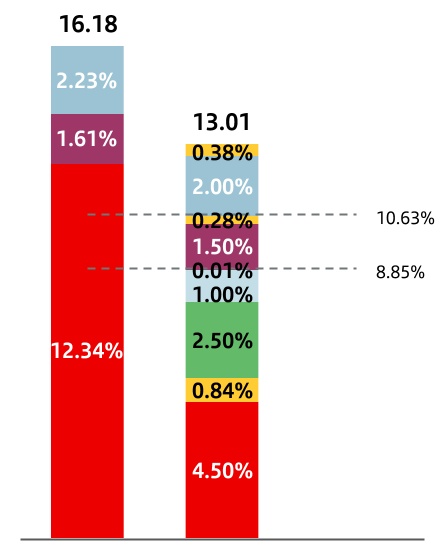

•At year-end, the CET1 ratio reached 12.34% after increasing 69 bps in the year (including 104 bps of organic generation).

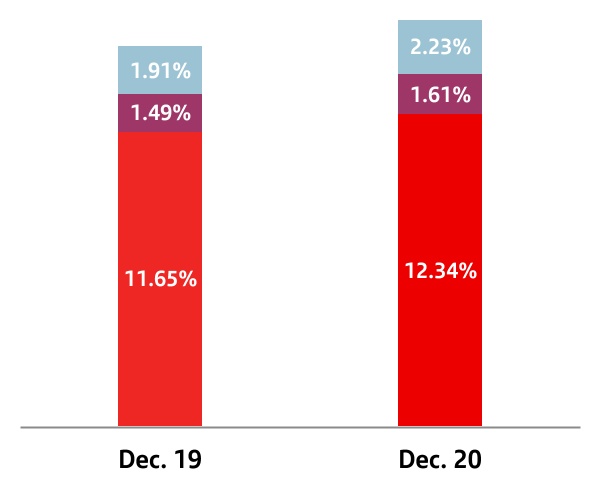

•The total capital ratio was 16.18% (+113 bps in the year).

•Our active capital management culture strengthened throughout the organization.

We have a strong capital base, comfortably meeting the minimum levels required by the European Central Bank on a consolidated basis (13.01% for total capital ratio and 8.85% for the CET1 ratio. This resulted in a CET1 management buffer of 349 bps, compared to a covid-19 buffer of 189 bp.

In the year, the CET1 ratio increased 69 bps. Of note was the strong underlying capital generation of 104 bps, partially offset by the impact of restructuring costs, corporate transactions and market performance. It also includes 9 bps related to an accrual for 2020 dividend payments, based on the limit established by recommendation 2020/63 of the ECB on 15 December 2020, which allows a maximum payment of EUR 0.0275 per share.

Had the IFRS 9 transitional arrangement not been applied, the total impact on the CET1 ratio was 45 bps, leading to a CET1 ratio of 11.89%. For more information, see Appendix XII.

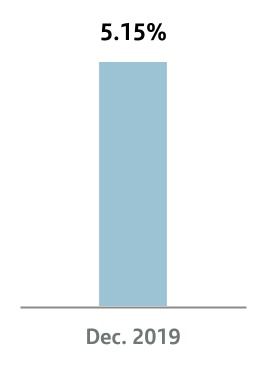

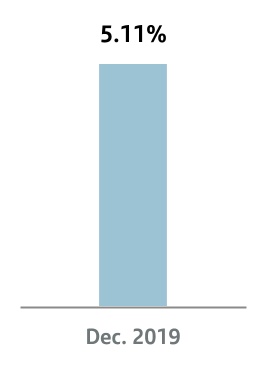

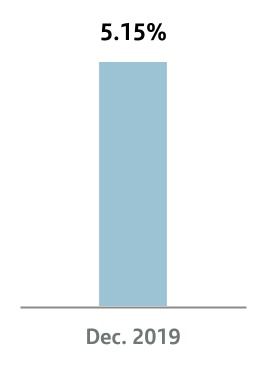

The leverage ratio stood at 5.33%. Had the IFRS9 transitional arrangement not been applied, the leverage ratio stood at 5.15%.

With regards to regulatory ratios, Santander exceeded the 2020 minimum regulatory requirements by 317 bps, taking into account the shortfalls in AT1 and T2.

In short, from a qualitative point of view, Santander has solid capital ratios, aligned with its business model, balance sheet structure and risk profile.

| | | | | | | | | | | |

| 10 | | 2020 Pillar 3 Disclosures Report | |

| | |

| INTRODUCTION 2020 Pillar 3 Disclosures Report |

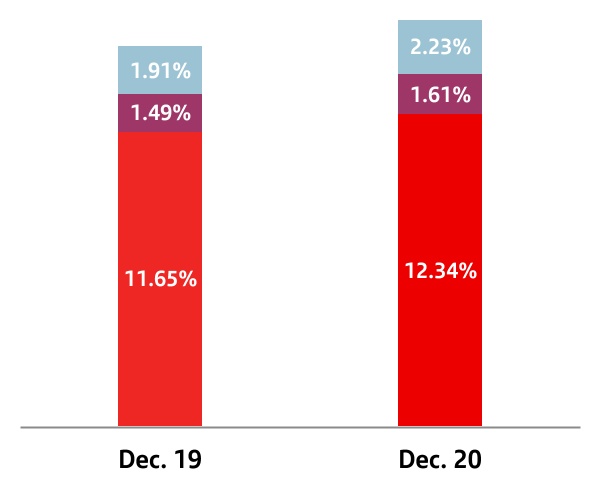

The Group’s CET1 capital ratio increased to 12.34%,

above the target rate of 11% - 12%

| | | | | |

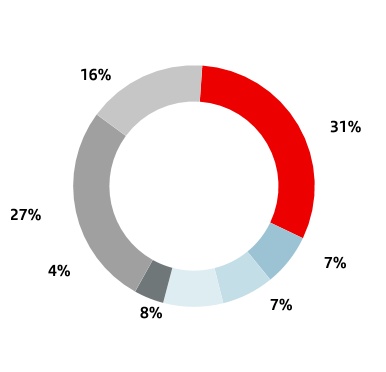

| Changes in main Capital ratios’ figures |

|

| | | | | |

| Ratios % |

| n | Tier 2 |

| n | Tier 1 |

| n | CET1 |

| |

| | | | | | | | | | | |

| | |

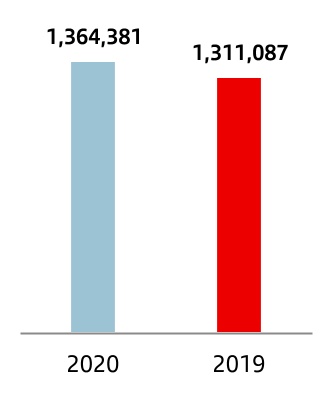

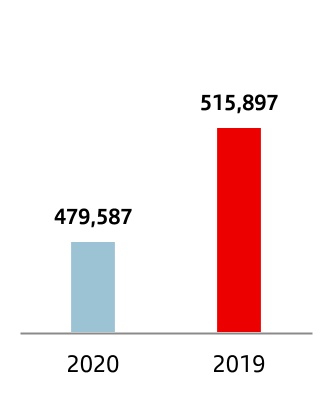

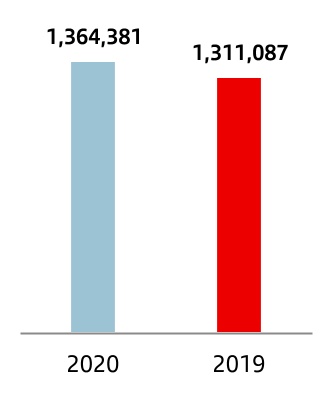

| Millon euros | Dec-2020 | Dec-2019 | |

| Common Equity (CET1) | 69,399 | 70,497 | |

| Tier 1 | 78,501 | 79,536 | |

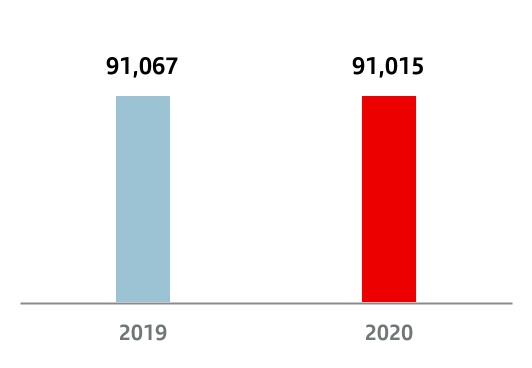

| Total capital | 91,015 | 91,067 | |

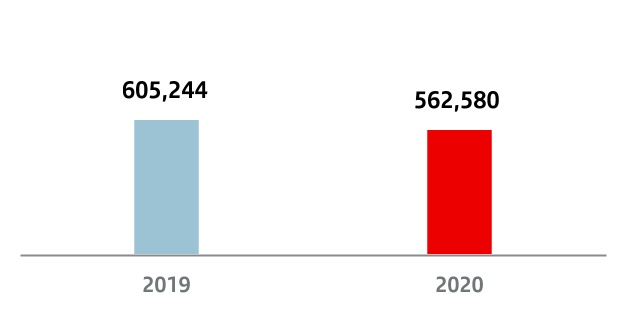

| Risk weighted assets | 562,580 | 605,244 | |

| CET1 Ratio | 12.34% | 11.65% | |

| Tier 1 Ratio | 13.95% | 13.14% | |

| Total capital ratio | 16.18% | 15.05% | |

| Leverage Ratio | 5.33% | 5.15% | |

2020 and 2019 data has been calculated under application of CRR and IFRS 9 transitional arrangements, unless otherwise indicated.

| | | | | |

| Ratios % |

| n | Total Ratio |

| n | Tier 1 |

| n | CET1 |

| |

Note: this English version is a translation of the original in Spanish for information purposes only. In the event of discrepancy, the original Spanish-language version

| | |

| INTRODUCTION 2020 Pillar 3 Disclosures Report |

In 2020 there has been an increase of 69 bps,

104 bps for organic growth

| | | | | | | | | | | |

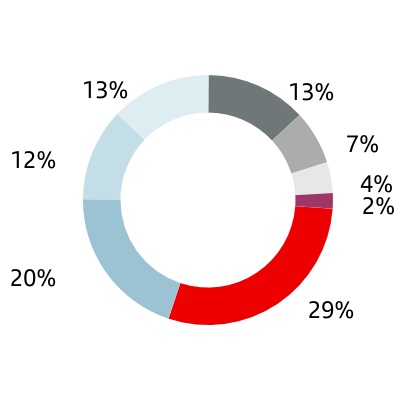

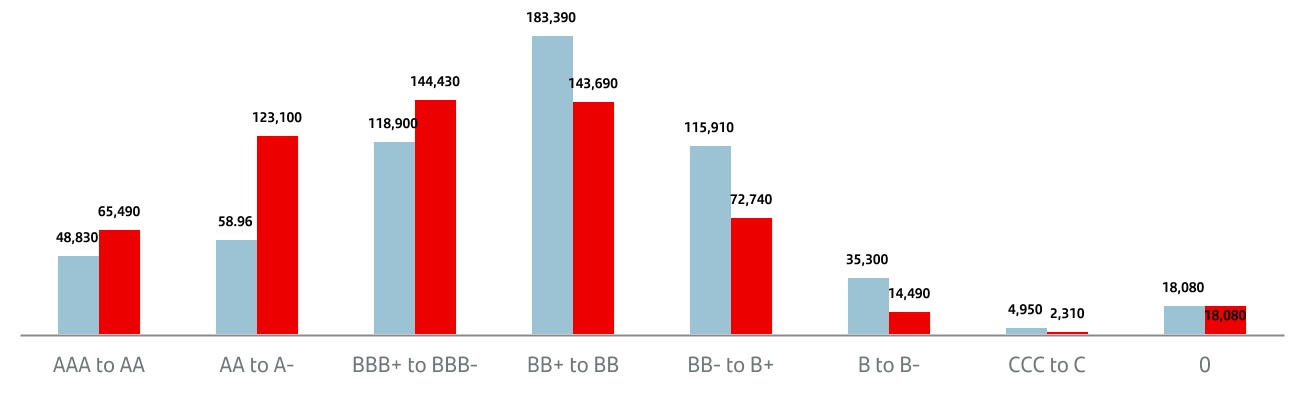

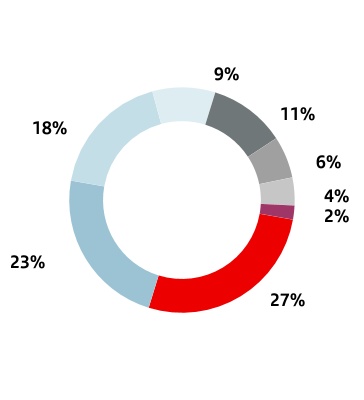

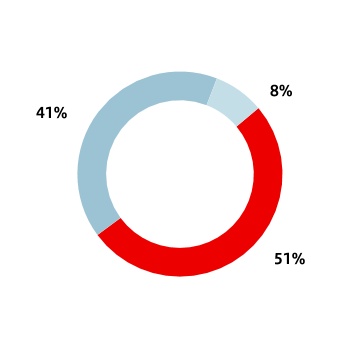

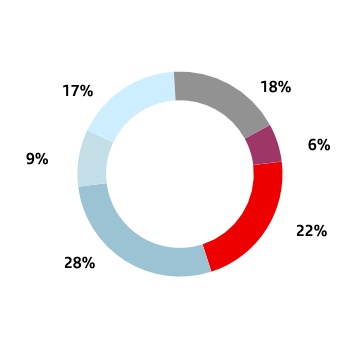

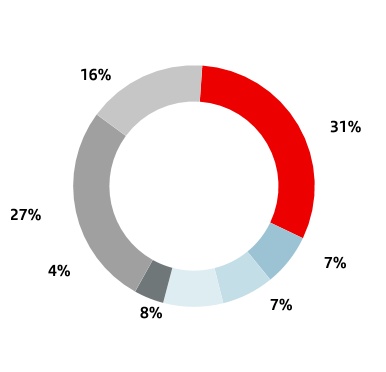

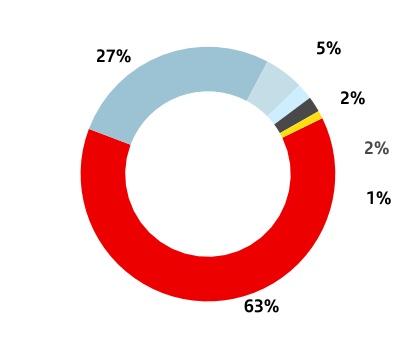

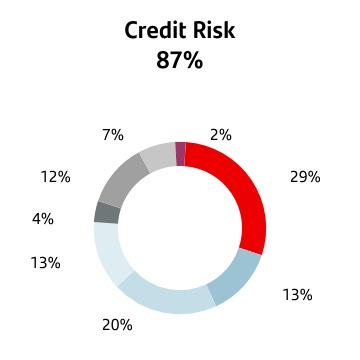

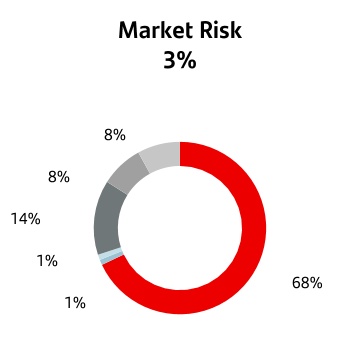

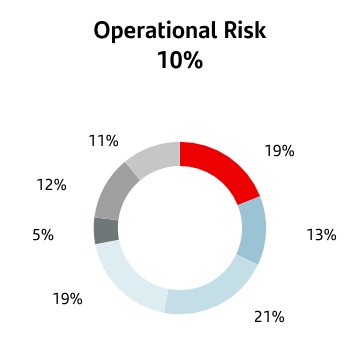

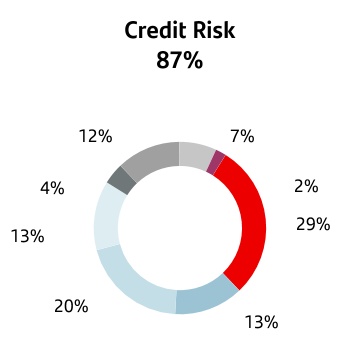

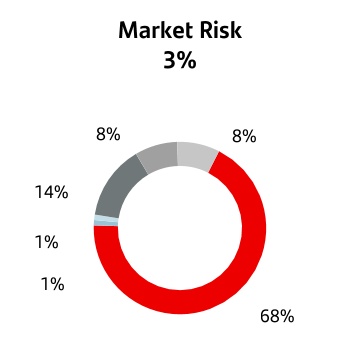

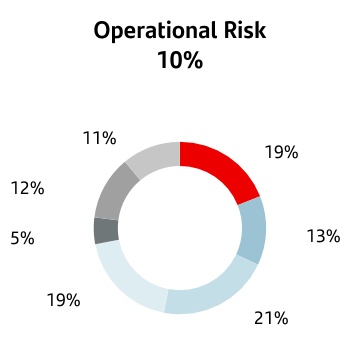

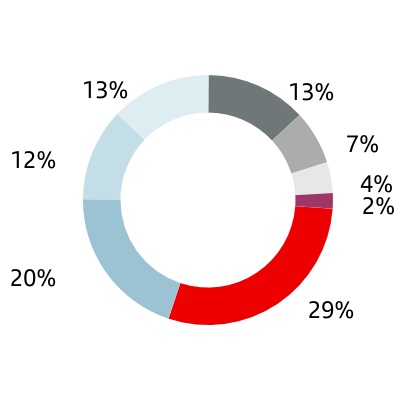

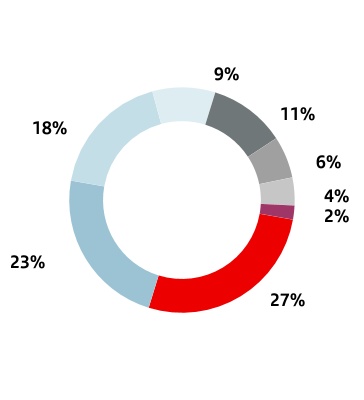

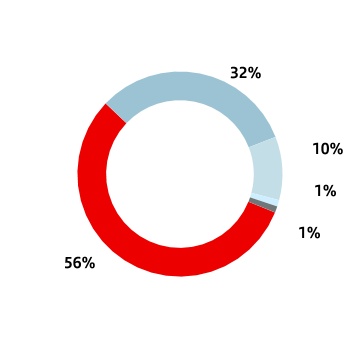

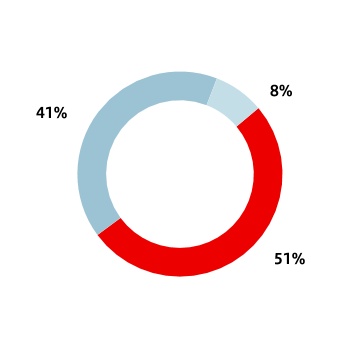

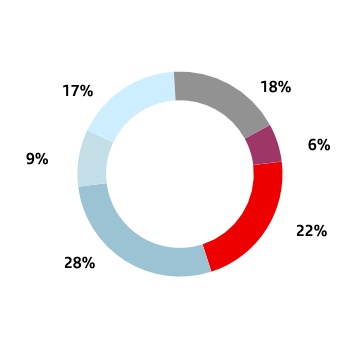

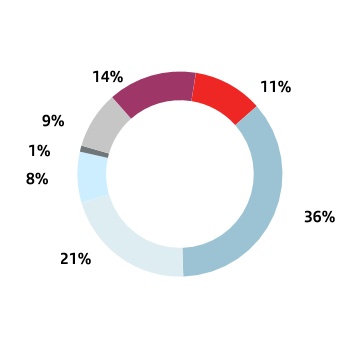

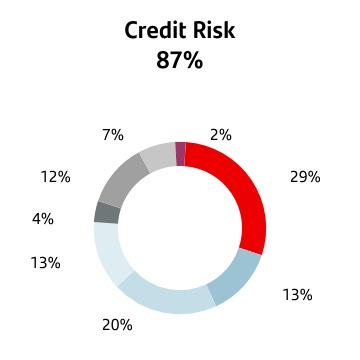

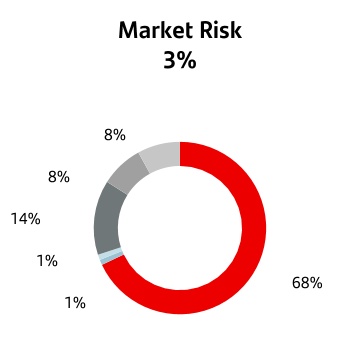

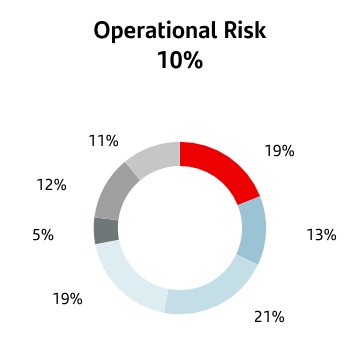

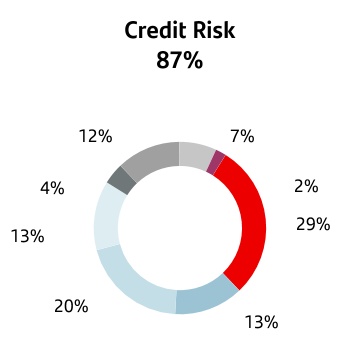

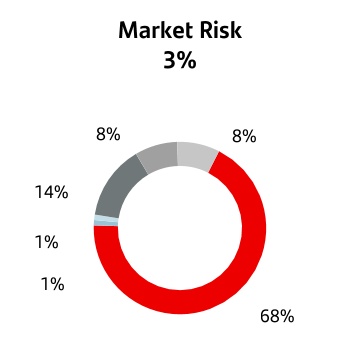

| Distribution of capital requirements by risk type and geography |

| 31 Dec. 2020 |

| | | | | |

| n | Spain |

| n | UK |

| n | Rest of Europe |

| n | USA |

| n | Rest of North America |

| n | Brazil |

| n | Rest of South America |

| n | Others |

| | | | | | | | |

| 39,096 | 1,441 | 4,469 |

| Million euros | Million euros | Million euros |

| | | | | | | | | | | |

| 12 | | 2020 Pillar 3 Disclosures Report | |

| | |

| INTRODUCTION 2020 Pillar 3 Disclosures Report |

1.2. Santander Group Pillar 3 report overview

1.2.1. Background information on Santander Group

Banco Santander, S.A. is a private-law entity subject to the rules and regulations applicable to banks operating in Spain. In addition to its direct operations, Banco Santander is the head of a group of subsidiaries engaged in a range of business activities that comprise Santander Group. The Capital Requirements Regulation (CRR), Capital Requirements Directive (CRD) IV and its transposition through Bank of Spain Circular 2/2016, on supervision and capital adequacy, are applicable at a consolidated level to the whole of Santander Group.

The exemption under Article 49 of the CRR is not used, so table INS1 on non-deducted holdings in insurance companies does not need to be published.

Under Article 7 and 9 of the CRR, the subsidiaries Santander Leasing S.A. EFC and Santander Factoring y Confirming S.A. EFC are exempt from the minimum capital requirements, the limit on large exposures and the internal corporate governance obligations at 31 December 2020. None of the exemptions under applicable regulations have been used for any other Santander Group subsidiaries.

Santander is one of the banks that have not required state aid in any of the countries in which they operate.

See Appendix II, CRR Mapping, for all aspects for which disclosure is required under Part Eight of the CRR but that are not applicable to Santander Group. These are reported as “N/A” (not applicable).

At 31 December 2020, none of the financial institutions consolidated in Santander Group had less than the minimum capital required under applicable regulations.

| | |

| INTRODUCTION 2020 Pillar 3 Disclosures Report |

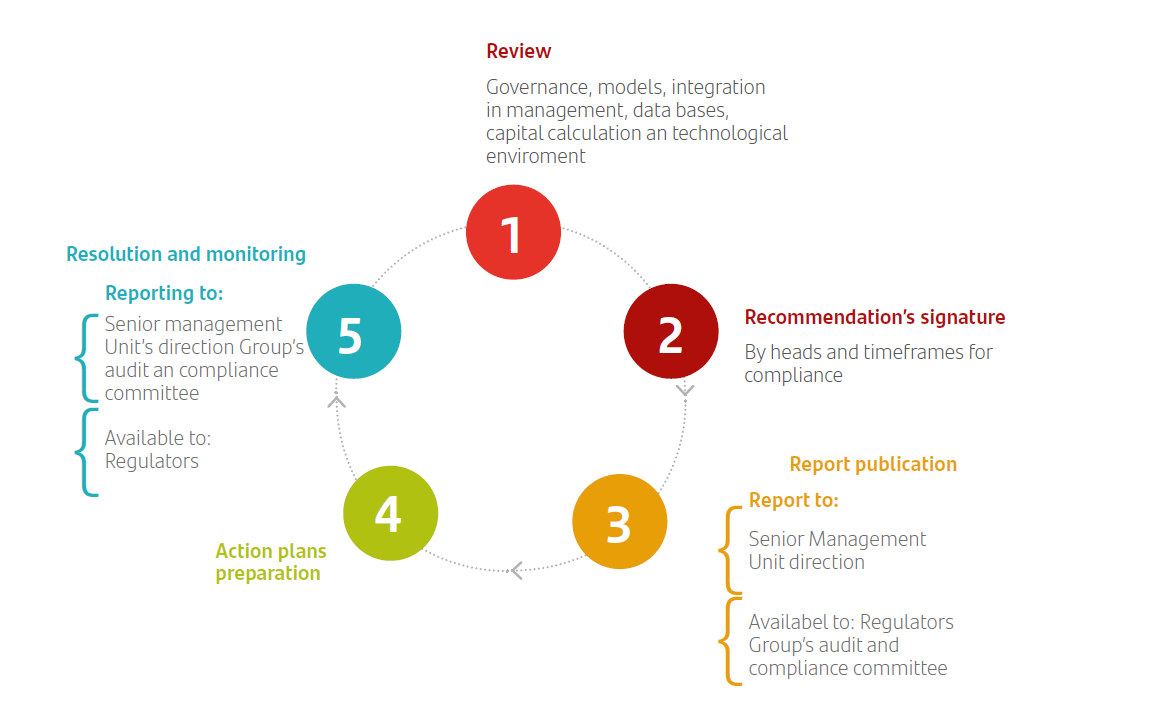

1.2.2. Governance: approval and publication

Santander Group publishes its annual Pillar 3 disclosures report following board approval, pursuant to the official disclosure policy. Prior to the board of directors’ approval on 22 February 2021, the report was reviewed by the risk supervision, regulation and compliance committee at a meeting on 19 February and by the capital committee at a meeting on 21 January 2021.

The report was reviewed by the audit committee on 19 February 2021.

Quarterly information has been published since March 2015 in compliance with the European Banking Association (EBA)’s Guidelines on materiality, proprietary and confidentiality and on disclosure frequency, and article 432, sections 1 and 2, and article 433 of Regulation (EU) 575/2013.

Appendix II lists the location of the information disclosed in accordance with the relevant articles of Part Eight of the Regulation.

The information in this report has been reviewed by the external auditor (PwC), who did not find any issues with regard to the reasonableness of the disclosures and compliance with the reporting requirements established in the CRD IV and the CRR.

Certification by governing bodies

The board of directors of Santander Group certifies that the publication of the Pillar 3 disclosures report is compliant with the guidelines in Part Eight of Regulation (EU) 575/2013 and consistent with the “Pillar 3 Disclosures Policy” adopted by the board of directors.

No exceptions have been applied for the publication of information considered proprietary or confidential.

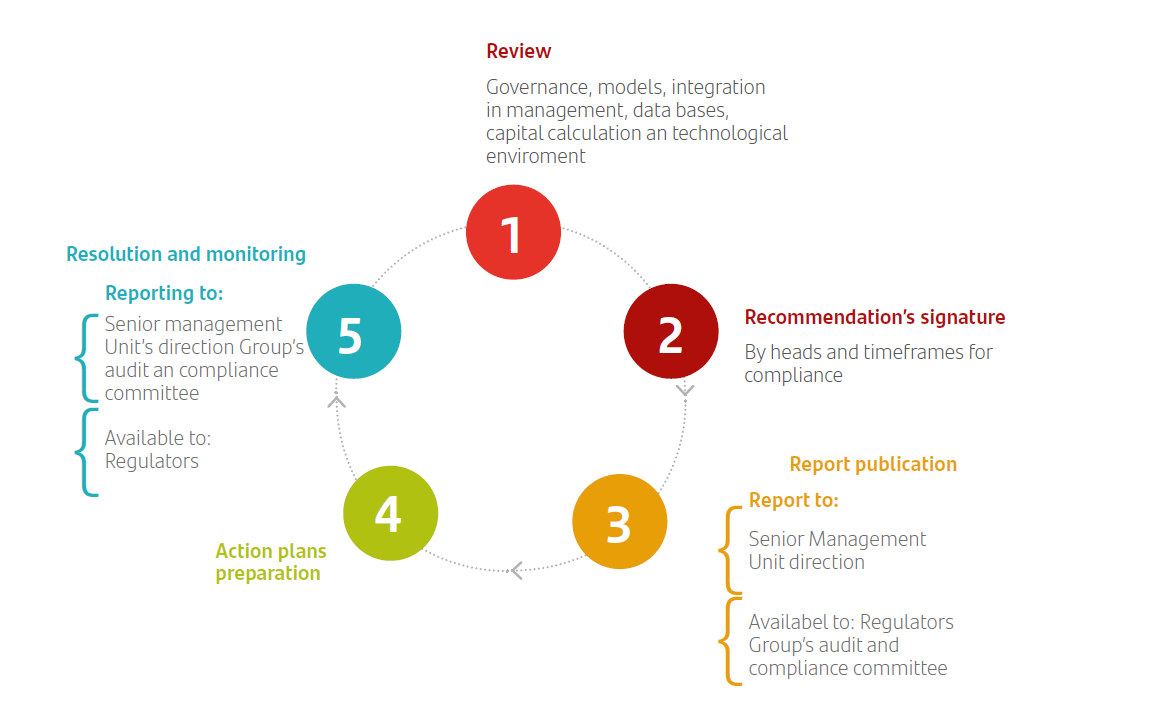

The Pillar 3 disclosures report relies on a range of processes relating to the internal control framework, with duties and responsibilities having been defined for review and certification of the information in the report at several levels of the organisation.

Further information on Santander Group's internal control model (ICM) can be found in section VIII of the Corporate governance chapter of the 2020 Annual report. The external auditors perform an ex-ante review and Internal Audit's work plans for recurring reviews also cover this report.

The Pillar 3 disclosures report is available in the Shareholders and Investors section of the Santander Group website (www.santander.com), under “Financial and economic information”. Disclosures by Santander Group subsidiaries.

In addition to the information contained in this report, Santander Group subsidiaries that are considered to have significant importance for their local market (under article 13 of the CRR, Application of disclosure requirements on a consolidated basis) publish information at the individual level on their websites, in relation to own funds, capital requirements, capital buffers, credit risk adjustments, remuneration policy and the application of credit risk mitigation techniques.

| | | | | | | | | | | |

| 14 | | 2020 Pillar 3 Disclosures Report | |

| | |

| INTRODUCTION 2020 Pillar 3 Disclosures Report |

1.2.3. Transparency enhancements

Santander Group has noted the recommendation issued by international bodies with the aim of improving the transparency of the information published each year in the Pillar 3 disclosures report.

Santander Group includes all information requirements published by the EBA, the Basel Committee and the European Commission relating to transparency vis-à-vis the market. Details of the documents can be found in Appendix I.

The main improvements in transparency include the following:

•As a result of the global health crisis, the EBA published guidelines on reporting the impact of covid-19, called "EBA guidelines on reporting and disclosure of exposures subject to measures applied in response to the covid-19 crisis" whereby it is indicated that three quantitative templates must be published semi-annually, containing information on the scope of the payment holidays.

•The EBA also published "EBA guidelines on supervisory reporting and disclosure requirements in compliance with the CRR ‘quick fix’ in response to the covid‐19 pandemic", containing measures to adapt the disclosure to the new requirements of the CRR, such as backstops or the leverage ratio. The latter required adaptation of the "LRCom" table to provide narrative information about the fact that excluded central bank exposures have been disclosed. (see section 11 of chapter 3)

In March 2020, the EBA published its "ITS on institutions' Pillar 3 disclosures", assessing institutions' public disclosures in line with new reporting and internal consistency requirements. In these, Santander Group is listed for its best practices in different aspects such as: Liquidity risk, Prudent Valuation, improvements in general sections, information presentation and other navigability aspects.

Furthermore, the Appendix II lists the location of the information required in accordance with the relevant articles of Part Eight of the CRR.

Additionally, on Santander Group's website (Financial and Economic Information > Pillar III), you can find a file with all tables shown in this document, in editable format for easier processing.

| | |

| INTRODUCTION 2020 Pillar 3 Disclosures Report |

1.2.4. Disclosure criteria used in this report

This report has been prepared in accordance with current European regulations on capital requirements (CRR).

In addition, the ratios of this report are calculated by applying the CRR and IFRS9 transitory schedules.

Details of the types of information where there are discrepancies between the regulatory information shown in this report and the information in the annual report and accounting information are as follows:

•The credit risk exposure measurements used for calculating regulatory capital requirements include:

•Not only current exposures but also potential future risk exposures arising from future commitments (contingent liabilities and commitments) and changes in market risk factors (derivative instruments).

•The mitigating factors for these exposures (netting agreements and collateral agreements for derivative exposures, and collateral and personal guarantees for on-balance-sheet exposures).

•The criteria used in classifying non-performing exposures in portfolios subject to advanced models for calculating regulatory capital is more conservative than those used for preparing the disaggregated information provided in the annual report.

This English version is a translation of the original in Spanish for information purposes only. In the event of discrepancy, the original Spanish-language version prevails.

1.3. Scope of consolidation

The Santander Group companies included in the scope of consolidation for calculating the capital adequacy ratio under the CRR are the same as those included in the scope of consolidation for accounting purposes under Bank of Spain Circular 2/2018.

1.3.1. Differences between the accounting consolidation method and the consolidation method for calculating regulatory capital

In application of Part I (General Provisions) of the CRR, some Santander Group companies are consolidated using a different method to that used for accounting consolidation.

The companies for which different consolidation methods are used, depending on the regulations applied, are listed in Appendix V of the 2020 Pillar 3 Appendix file available on the Santander Group website. At present, holdings in significant financial institutions and insurance companies are exempt from deductions under Article 49 of the CRR. For the purposes of calculating the capital adequacy ratio based on the nature of their business activities, Santander Group companies included in the prudential scope of consolidation are consolidated using the full consolidation method, with the exception of jointly controlled entities, which use proportionate consolidation. All companies that cannot be consolidated based on their business activities are accounted for using the equity method and so are treated as equity exposures.

The basis of the information used for accounting purposes differs from that used for calculating regulatory capital requirements. Risk exposure measurements may differ depending on the purpose for which they are calculated, such as financial reporting, regulatory capital reporting and management information. The exposure data included in the quantitative disclosures in this document are used for calculating regulatory capital.

The following table shows the relationship between the categories in the financial statements and the risk categories in accordance with prudential requirements.

| | | | | | | | | | | |

| 16 | | 2020 Pillar 3 Disclosures Report | |

| | |

| INTRODUCTION 2020 Pillar 3 Disclosures Report |

| | | | | | | | | | | | | | | | | | | | | | | |

| Table 1. Differences between accounting and regulatory scopes of consolidation and mapping of financial statements categories with regulatory risk categories (LI1) |

| Million euros | | | | | | | |

| | | | | | 31 Dec. 2020 |

| Carrying values as reported in published financial statements | Carrying values under scope of regulatory consolidation | Carrying values of items: |

| Subject to credit risk framework | Subject to the CCR framework | Subject to securitisation framework | Subject to market risk framework | Not subject to capital requirements or subject to deduction from capital |

| Assets | | | | | | | |

| Cash and cash balances at central banks | 153,839 | | 153,907 | | 153,907 | | — | | — | | 0 | — | |

| Financial assets held for trading | 114,945 | | 114,923 | | — | | 67,131 | | 16 | | 114,906 | | — | |

| Financial assets not held for trading valued mandatorily at fair value through profit or loss | 4,486 | | 3,120 | | 806 | | — | | 557 | | 1,758 | | — | |

| Financial assets designated at fair value through profit or loss | 48,718 | | 46,182 | | — | | 25,856 | | — | | 36,701 | | — | |

| Financial assets at fair value through other comprehensive income | 120,953 | | 106,584 | | 102,791 | | — | | 3,794 | | — | | — | |

| Financial assets at amortised cost | 958,378 | | 962,153 | | 928,201 | | 32,104 | | 1,801 | | — | | 46 | |

| Derivatives - Hedge accounting | 8,325 | | 8,325 | | — | | 8,325 | | — | | — | | — | |

| Fair value changes of the hedged items in portfolio hedge of interest rate risk | 1,980 | | 1,980 | | — | | — | | — | | — | | 1,980 | |

| Investments in subsidiaries, joint ventures and associates | 7,622 | | 8,705 | | 6,946 | | — | | — | | — | | 1,759 | |

| Reinsurance assets | 261 | | — | | — | | — | | — | | — | | — | |

| Tangible assets | 32,735 | | 30,572 | | 30,572 | | — | | — | | — | | — | |

| Intangible assets | 15,908 | | 16,135 | | — | | — | | — | | — | | 16,135 | |

| Tax assets | 24,586 | | 24,636 | | 23,539 | | — | | — | | — | | 1,097 | |

| Other assets | 11,070 | | 9,990 | | 9,354 | | — | | — | | — | | 635 | |

| Non-current assets and disposal groups classified as held for sale | 4,445 | | 4,574 | | 4,574 | | — | | — | | — | | — | |

| Total assets | 1,508,250 | | 1,491,784 | | 1,260,689 | | 133,416 | | 6,168 | | 153,365 | | 21,652 | |

| Liabilities | | | | | | | |

| Financial liabilities held for trading | 81,167 | | 81,174 | | — | | 64,476 | | — | | 81,174 | | — | |

| Financial liabilities designated at fair value through profit or loss | 48,038 | | 27,868 | | — | | 14,641 | | — | | 27,868 | | — | |

| Financial liabilities measured at amortised cost | 1,248,188 | | 1,252,912 | | — | | — | | — | | — | | 1,252,912 | |

| Derivatives – Hedge accounting | 6,869 | | 6,912 | | — | | 6,912 | | — | | — | | — | |

| Fair value changes of the hedged items in portfolio hedge of interest rate risk | 286 | | 286 | | — | | — | | — | | — | | — | |

| Liabilities under insurance contracts | 910 | | — | | — | | — | | — | | — | | — | |

| Provisions | 10,852 | | 10,849 | | 700 | | — | | — | | — | | 10,149 | |

| Tax liabilities | 8,282 | | 8,148 | | — | | — | | — | | — | | 8,148 | |

| Other liabilities | 12,336 | | 12,333 | | — | | — | | — | | — | | 12,621 | |

| Total liabilities | 1,416,928 | | 1,400,482 | | 700 | | 86,029 | | — | | 109,042 | | 1,283,830 | |

| | |

| INTRODUCTION 2020 Pillar 3 Disclosures Report |

The difference in total assets between the public and the reserved scopes is not material and corresponds to the exclusion of financial institutions and the inclusion of jointly controlled and intragroup entities. The most notable differences in this regard are in financial assets at fair value through other comprehensive income (€14.369 billion) and in financial liabilities at fair value through profit or loss (€20.17 billion).

In addition, the sum of the carrying amounts of certain items is greater than the carrying amounts under the scope of

prudential consolidation, as the financial assets held for trading and the financial assets at fair value through profit or loss are subject to the capital requirements of more than one risk category under the regulatory scope.

The main differences between the carrying amounts in the financial statements and the exposures for prudential purposes are shown below:

| | | | | | | | | | | | | | | | | |

| Table 2. Main sources of differences between regulatory exposure amounts and carrying amounts in the financial statements (LI2) |

|

| Million euros | | | | | |

| | | | | 31 Dec. 2020 |

| Total | Items subject to: |

| Credit risk framework | CCR framework | Securitisation framework | Market risk framework |

| Asset carrying value amount under scope of regulatory consolidation (as per template EU LI1) | 1,553,638 | | 1,260,689 | | 133,416 | | 6,168 | | 153,365 | |

| Liabilities carrying value amount under regulatory scope of consolidation (as per template EU LI1) | (195,771) | | (700) | | (86,029) | | — | | (109,042) | |

| Total net amount under regulatory scope of consolidation | 1,357,868 | | 1,259,989 | | 47,387 | | 6,168 | | 44,323 | |

| Off-balance sheet amounts | 302,547 | | 302,547 | | | — | | — | |

| Regulatory Add-on | 34,404 | | | 34,404 | | | — | |

| Differences in valuations | — | | | | | — | |

| Differences due to different netting rules, other than those already included in row 2 | (65,227) | | | (20,904) | | | (44,323) | |

| Non-eligibility of the balances corresponding to accounting hedges (derivatives) | (8,325) | | | (8,325) | | | — | |

| Securitisations with risk transfer | — | | (37,833) | | | 37,833 | | — | |

| Other | 8,611 | | 12,526 | | | (3,914) | | — | |

| Differences due to consideration of provisions | (15,173) | | (14,998) | | — | | (176) | | — | |

| Differences due to CRMs | (22,203) | | (6,657) | | (14,951) | | (596) | | — | |

| Differences due to CCFs | (221,067) | | (221,067) | | — | | — | | — | |

| Exposure amounts considered for regulatory purposes (EAD) | 1,371,434 | | 1,294,507 | | 37,611 | | 39,316 | | — | |

This table shows a breakdown of the differences between the amounts of exposures for prudential purposes and the carrying amounts according to various parameters

The main causes in this case, result from the amount of off-balance sheet items (+€302.547 billion) and the application of CCFs (-€221.067 billion). The regulatory add-on (+€34.404 billion and the differences resulting from the various offsetting rules (-€65.227 billion).

The reconciliation of the public and non-public balance sheets is shown in Appendix VI, which is available on the Santander Group website.

1.3.2. Substantial amendments due to a change in the perimeter and corporate transactions

For more information on the main acquisitions and disposals of holdings in other companies and other major corporate transactions by Santander Group last year, refer to section 3 of the Notes to the consolidated financial statements in the Audit Report section of the 2020 Annual Report. 1.4. Regulatory framework

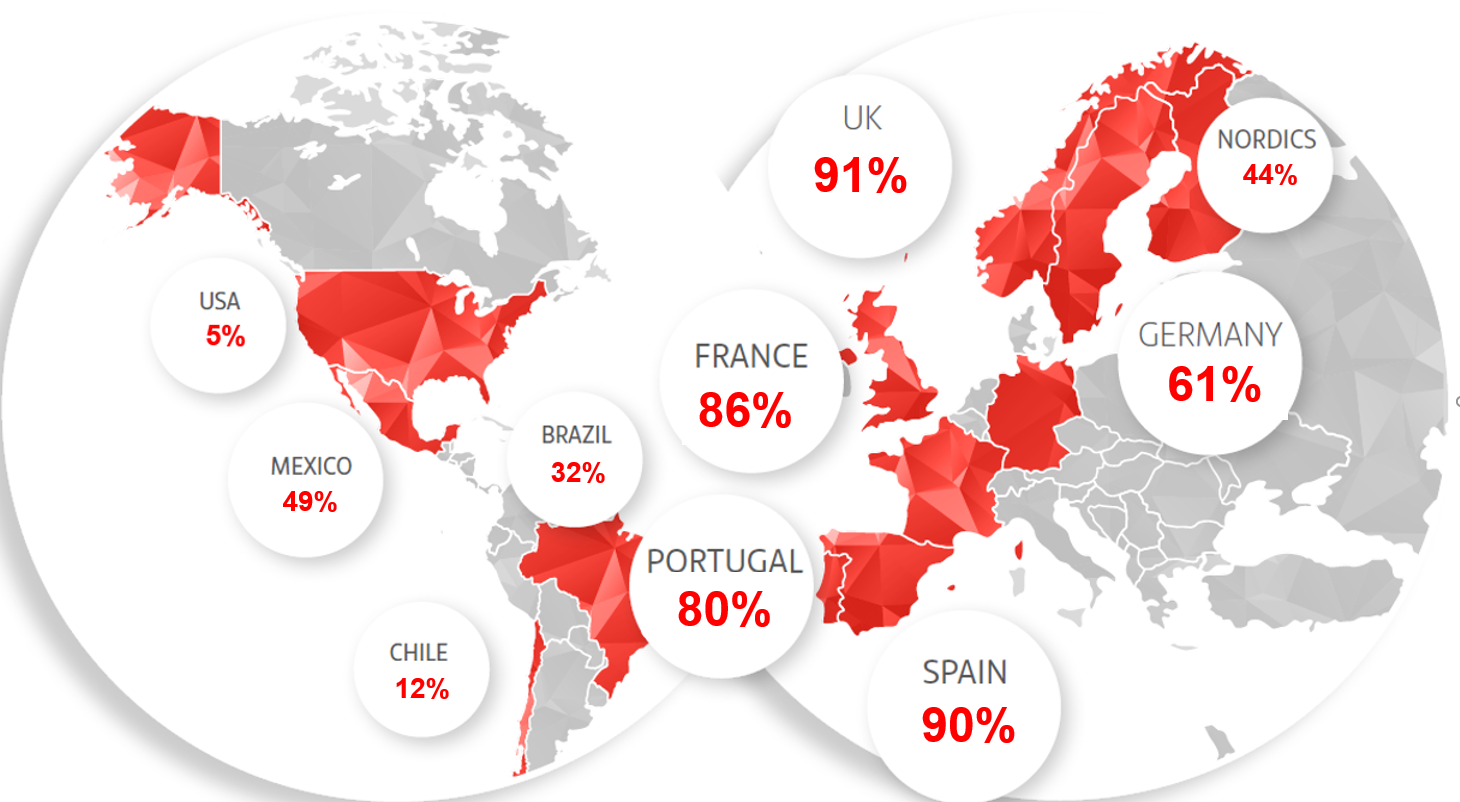

A. 2020 prudential framework: Key aspects on Solvency and Resolution

The financial institutions must meet a set of minimum capital and liquidity requirements. These minimum requirements are regulated by the European capital requirements regulation, better known as CRR, and in the Capital Requirements

| | | | | | | | | | | |

| 18 | | 2020 Pillar 3 Disclosures Report | |

| | |

| INTRODUCTION 2020 Pillar 3 Disclosures Report |

Directive (CRD). In June 2019 these regulations were significantly modified, so that references to CRR2 and CRDV are understood as such regulations with the latest modifications incorporated respectively.

Among the amendments to the CRR2, it is worth highlighting the introduction of the minimum requirement of TLAC (Total Loss Absorbing Capacity) applicable only to entities of global systemic importance (G-SIBs). This requirement is a minimum requirement for own funds and eligible liabilities (in terms of a percentage of the total risk exposure amount, currently 16% and, after the transitional period, 18%; in terms of a percentage of the total exposure measure, currently 6% and, after the transitional period, 6.75%).

The CRDV, as a directive, must be transposed into the national legal system to be applicable in the Member States. In Spain, the transposition is expected to be developed during 2021. The CRDV includes relevant amendments such as the regulation of Pillar 2 Guidance requirements.

Regarding to the resolution regulations, financial institutions must have an adequate financing structure that allows them, in the event of financial difficulties, to recover their situation or to resolve it, ensuring the protection of depositors and the financial stability.

The directive that regulates the aforementioned resolution framework is the Restructuring and Resolution Directive, BRRD. Like CRR2 and CRDV, BRRD was amended in June 2019. BRRD2 refers BRRD as amended. The transposition of this directive in Spain is also planned for 2021.

The BRRD2 has introduced important modifications to the minimum requirement for own funds and eligible liabilities (MREL). Thus, for example, the aforementioned TLAC requirement is now considered a Pillar 1 resolution requirement for G-SIBs. For large banks (which are defined as those whose total assets exceed EUR 100 billion euros) or those that the resolution authority otherwise considers systemic, the BRRD2 establishes a minimum subordination requirement of 13.5% of risk-weighted assets, or 5% of the exposure of the leverage ratio, whichever is higher. Other entities' subordination requirement will be determined on a case-by-case basis by the resolution authority.

B. Regulatory response to the impacts of COVID 19

The severe economic disruption caused by the covid-19 pandemic in 2020 has revealed the importance of institutions' funding functions in contributing to recovery. The competent authorities (national, European and international) have acted by reducing liquidity, capital and operational requirements so financial institutions can continue to provide financing to the economy, while ensuring that such institutions continue to act prudently as they can also be negatively affected by the deterioration of the economic situation.

As part of these measures, the European Central Bank issued a recommendation in March 2020 urging European banks to refrain from paying dividends against 2019 and 2020 financial years. On 27 July, the ECB extended that recommendation to 1 January 2021. On 15 December 2020, the ECB issued its recommendation 2020/35, repealing previous referred recommendations, and by which it recommended that banks under the scope of its direct supervision exercise extreme prudence on dividends and share buy-backs. The ECB asks the banks to consider not distributing any cash dividends or

conducting share buybacks, or to limit such distributions until 30 September 2021. Given the persisting uncertainty over the economic impact of the covid-19 pandemic, the ECB also considers that it would not be prudent for credit institutions to consider making a distribution and share buy-backs amounting to more than 15% of their accumulated profit for the financial years 2019 and 2020, or more than 20 basis points in terms of the CET1 ratio, whichever is lower.

The national governments have taken measures to address the economic and social impact of covid-19, specifically in the form of legislative moratoria that were aimed at containing non-performing loans (NPLs) and helping the population to meet liquidity needs. Throughout 2020, the European Banking Authority (EBA) adopted a series of guidelines, including the Guidelines on legislative and non-legislative moratoria applied in the context of the covid-19 crisis on 2 April 2020. These guidelines clarify the requirements for public and private moratoria to avoid classification of exposures affected by moratoria as forborne exposures.

Although these guidelines were initially expected to apply to moratoria granted before 30 June 2020, the EBA decided on 2 December 2020 that these guidelines would apply to moratoria requested before 31 March 2021.

Other measures adopted to provide flexibility in complying with these requirements have been the approval and entry into force of the 'quick fix' of the CRR (urgent and extraordinary regulatory measures aimed at making the regulatory framework more flexible in response to covid-19), which modifies CRR2. Among the amendments introduced by the quick fix, it is worth highlighting the extension of the transitional period granted before the pandemic due to the entry into force of IFRS 9, as a result of the sudden and significant increase in provisions for expected credit losses that must be recognized. Additionally, the application of certain provisions of CRR2 has been delayed, such as those relating to the leverage ratio buffer (whose application date is postponed until 1 January 2023), and includes the possibility to exclude from the calculation of such ratio exposures to central banks. Similarly, the date of application of other favourable provisions for entities, such as the support factor for small and medium enterprises (SMEs) and the support factor for infrastructure has been brought forward, as well as the new treatment of software assets (applicable since the day following the publication of the Delegated Regulation where it is developed).

C. Other regulations: Sustainability

With regard to the integration of sustainable finance in the financial sector, the Taxonomy Regulation (Regulation 2020/852) has been published, which establishes the criteria for determining whether an economic activity qualifies as environmentally sustainable and also lays down disclosure obligations for the financial services sector to be applied on 2022. This taxonomy supplements the rules on sustainability-related disclosures in the financial services sector laid down in Regulation (EU) 2019/2088. In addition, the ECB and Banco de España (Spain's central bank) supervisory expectations will gradually incorporate into the supervisory dialogue the management and disclosure of climate and environmental risks.

| | |

| INTRODUCTION 2020 Pillar 3 Disclosures Report |

1.4.1. Regulatory changes in 2020

The main event in 2020 was the explosion of covid-19, which disrupted regulatory agendas and priorities at the European and international levels. Regulators reacted by adopting a set of relief measures for capital and liquidity requirements, along with other operational measures, to help financial institutions channel funding to the economy. Against the backdrop of this pandemic, it has also become clear that the crisis management framework needs to be reviewed to ensure its effectiveness in systemic scenarios. The European legislative agenda on climate change and sustainable financing was already one of the key items on the agenda in recent years, but it is now even more of a priority given the way the pandemic has unfolded. The digital agenda has also occupied a large part of the current regulatory environment. This includes issues such as the possibility of adopting new technologies, the competition framework for large platforms and discussions about the supervisory and regulatory framework that needs to be applied to non-banking players.

International prudential framework

In 2020, international authorities acted in a coordinated way to implement a raft of exceptional measures in response to the outbreak of the covid-19 pandemic. The Basel Committee on Banking Supervision (BCBS) considered that priority should be given to the use of capital buffers to support the real economy and absorb losses, stating that supervisors should give banks sufficient time to restore their buffers. Highlights:

•Basel III standards. The BCBS has agreed to delay the implementation of the Basel III standards by one year, to 1 January 2023.

•Technical guidelines on the treatment of provisions in relation to exceptional moratoria and guarantee measures and the amendment of the transitional provisions for the treatment of expected credit losses in regulatory capital.

In addition to covid-19 measures, the BCBS continued to work on the following in 2020:

•Interaction and cooperation between prudential and anti-money laundering supervision. The BCBS has amended the guidelines on robust risk management for anti-money laundering and combating the financing of terrorism to introduce additional guidelines on cooperation and information exchange between prudential and anti-money laundering and terrorist financing supervisory authorities.

•Pillar III disclosure requirements. During the year the BCBS worked on: (i) Sovereign exposure disclosure templates, the implementation of which is voluntary, unless requested by national supervisors; (ii) Revisions to market risk exposure disclosure templates, to reflect the changes introduced by the final standard on minimum capital requirements for market risk. Both final standards are pending publication by the BCBS.

•Credit valuation adjustment risk (CVA). The BCBS has published revisions to the CVA risk framework, which replaces the 2017 version. These recalibrate risk weightings, establish different treatment for certain derivatives with customer compensation and provide for a comprehensive recalibration of the standardised and basic approaches. This will come into effect on 1 January 2023.

•Securitisations of non-performing loans. The BCBS has published a technical amendment establishing prudential treatment for securitisations of non-performing loans.

•Operational risk and operating resilience: the BCBS has launched a review of existing principles for good operational risk management and a new set of principles for operational resilience. These are designed to bolster banks' ability to withstand events such as pandemics, cyber-incidents, technological failures and natural disasters. Authorities are also watching the financial sector's growing dependence on technology providers more closely, and working out how to ensure that financial institutions adequately manage third party risks, plus the question of concentration risk (e.g. in the provision of cloud services). The FSB and IOSCO published consultations during the year on these specific issues.

Crisis management framework

In 2020, the Financial Stability Board (FSB) continued monitoring the implementation of Total Loss-Absorbing Capacity (TLAC) across the various jurisdictions. It estimates that all G-SIBs now meet their 2022 TLAC requirement.

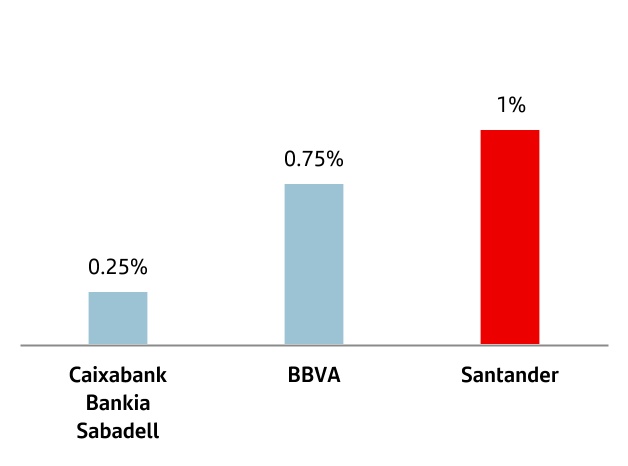

In November 2020, the FSB updated the list of G-SIBs for 2021. Santander remains within the least systemically important group of banks and is subject to the minimum additional capital buffer for global systemically important banks (1%).

Other

In the digital arena, the fintech phenomenon and the need to review the regulatory and supervisory framework are increasingly pressing issues for international authorities. In 2020, various authorities (FSB, BIS, IMF) published important reports concerning the need for cooperation between authorities in the regulation and supervision of technology firms that provide financial services. This was specifically to overcome the lack of information and regulation on these entities, especially in the area of lending.

The OECD is leading the multilateral initiatives to address the tax challenges resulting from the digitalisation of the economy, to ensure that digital companies pay tax wherever they have consumers and their activities generate profits. This year, considerable progress has been made in defining Pillar 1 (rules on how to establish the fiscal nexus and attribute tax capacity to states) and Pillar 2 (a global minimum tax), although negotiations have been held up by the pandemic and the US elections. Agreement is now expected in mid 2021.

European regulation

European authorities have adopted various packages of measures coordinated by European Union authorities to tackle the pandemic, many in response to actions by international authorities.

Prudential European Commission

•Implementation of Basel III standards. The European Commission postponed its plans to publish the legislative proposal after the BCBS decided to delay the implementation date to 1 January 2023. The legislative proposal is expected to be published in 2021.

| | | | | | | | | | | |

| 20 | | 2020 Pillar 3 Disclosures Report | |

| | |

| INTRODUCTION 2020 Pillar 3 Disclosures Report |

•The CRR "Quick Fix”. This amendment was published and came into force in June. It aims to maximise the capacity of financial institutions to provide financing and absorb losses related to the covid-19 pandemic while ensuring their resilience. This Quick Fix brought forward the implementation of certain elements of the prudential framework, having a positive impact on capital (such as the SME and infrastructure support factor and the new treatment of software assets,applicable since the day following the publication of the Delegated Regulation where it is developed), while delaying other elements with a negative impact (e.g. the global systemic institutions' buffer for the leverage ratio, transitional provisions in relation to the dynamic component of IFRS9 provisions and the impact of unrealised losses on the sovereign debt portfolio).

•Capital Markets Recovery Package. The European Commission issued a legislative proposal for a capital market recovery plan to be published in 2021, aimed at making it easier for companies to raise capital in the markets. This modifies the regulations for MIFID II, prospectuses and the securitisation framework.

•Non-Performing Loans Action Plan. The European Commission has published a plan to prevent a potential build-up of non-performing loans across the European Union as a result of the covid-19 crisis.

•Capital Markets Union Action Plan. Following on from the 2015 plan, and successive updates, the European Commission has published this new plan aimed at making sure funding flows smoothly through the capital market in Europe, to the benefit of consumers, investors and companies, wherever they may be. It also revises the prudential framework for securitisation and the capital requirements for long-term holdings by financial institutions in small and medium-sized enterprises.

EBA

•When the crisis began, the EBA issued a statement on measures to mitigate the impact of covid-19 in the banking sector, including postponing the stress test to 2021 across the EU and recommending that competent authorities make use of the flexibility contained in the regulatory framework. It also published clarifications of its expectations in relation to remuneration policies, guidance on how to implement flexibility in supervisory reporting obligations and reminders of the measures needed to prevent money laundering and terrorist financing.

•Guidelines on legislative and non-legislative moratoria. The EBA published guidelines in April. These guidelines clarify the cases and conditions under which granting moratoria would not require provisions to be made. These guidelines initially expired on 30 June and were subsequently extended to 30 September. In December, the EBA decided to reinstate these guidelines in light of the second wave of the pandemic, setting an expiration date of 31 March 2021.

•Software. In October, the EBA published draft technical standards on the prudential treatment of software assets, to encourage banks to invest in software. Under these standards, banks' capital requirements are revised by only deducting the amount of the investment from CET1 in part, rather than in full. These technical standards are expected to be published, come into force and be implemented along 2021.

•Final guidelines on loan origination and monitoring, to be applied from 30 June 2021. These guidelines attempt to clarify the governance and internal control framework for granting credit, establish requirements to gather information and data from borrowers, and set out the documentation and requirements for assessing creditworthiness The guidelines also include: environmental, social and governance, anti-money laundering and counter-terrorist financing, and technological innovation factors.

European Central Bank (ECB)

•The ECB has provided temporary relief in terms of capital and operational requirements in response to the coronavirus pandemic: (i) allowing banks to operate below the level of capital defined by P2G, the capital conservation buffer and the liquidity coverage ratio (LCR), (ii) allowing the partial use of AT1 and Tier 2 instruments to meet P2R requirements, by anticipating the implementation of the changes introduced by CRR II in this area, (iii) by issuing a no-objection decision on measures such as reducing the counter-cyclical buffer by macro-prudential authorities, and (iv) other measures, such as providing temporary relief from market risk capital requirements.

•With regard to the distribution of dividends and share buybacks, the ECB issued a recommendation to financial institutions to restrict distributions until 1 October 2020. This was later extended until January 2021 with clarification of the timetable for restoring capital buffers. In December 2020, the ECB issued a communication allowing banks to distribute dividends or buy back shares provided that this does not exceed 15% of their accumulated profit in 2019-2020 or 20 basis points of CET1, until 30 September at least, but calling on them to exercise extreme caution. They will only be able to do so if they are profitable and have robust capital positions. The ECB also called on banks again to exercise extreme restraint in terms of variable pay for executives. The regulator justified these constraints by pointing to the continuing uncertainty about the economic impact of the coronavirus pandemic.

Crisis management framework

Europe also continues to make progress with the implementation of the crisis management framework. The Single Resolution Mechanism (SRM), the second pillar of Banking Union after the Single Supervisory Mechanism, has been operational since 1 January 2016. The Single Resolution Board and the national resolution authorities have defined the framework to determine the MREL (Minimum Requirement for own funds and Eligible Liabilities) and are making further progress in ensuring the effectiveness of the resolution framework.

| | |

| INTRODUCTION 2020 Pillar 3 Disclosures Report |

With regard to the Single Resolution Fund managed by the Single Resolution Board, the period of gradual mutualisation will enable transition from national resolution funds to the Single Resolution Fund, which will be fully implemented by 2024. The funding target of the Single Resolution Fund is 1% of covered deposits in 2024.

In December 2020, it was agreed that national parliaments would sign and ratify a new ESM treaty in 2021. They have also agreed to bring forward the implementation of the backstop from 2024 to 2022. This backstop will mean that the Single Resolution Fund will have access to credit lines, which will subsequently have to be returned by the Fund, i.e. by the banks, if the amount is not enough for the resolution of one or more entities. ESM support is limited to the same amount as the Resolution Fund.

Negotiations have resumed this year on the third pillar of the Banking Union, EDIS (European Deposit Insurance Scheme), for which the European Commission presented a proposal in 2015. These are advancing slowly and are expected to continue next year.

In late 2020, the Commission started to prepare the revision of the resolution and deposit guarantee directive (BRRD/SRMR/DGSD). Consultations are planned for 2021.

The European Commission is continuing to enhance the anti-money laundering and counter-terrorist financing framework. The Commission has presented an action plan setting out the measures it will take over the coming months to improve the strengthening, monitoring and coordination of EU rules in this area. The key areas of the plan include drafting a regulation to resolve current areas of disagreement, and strengthening supervision by considering creating a European supervisory authority.

There has been further important progress in the legislative agenda in relation to climate change and sustainable financing. In the last year a series of key initiatives have been approved, including the European Union Taxonomy Regulation, which will be used as a framework for classifying sustainable economic activities according to six environmental objectives. From 2022, companies and financial institutions will have to publicly demonstrate how their activities are aligned with the taxonomy activities, using a series of indicators yet to be defined. In 2021, the European Commission and the European Supervisory Agencies (ESAs) will do further work on completing the taxonomy framework, with criteria for the identification of the four remaining environmental objectives. They will also decide whether to extend the framework to identify activities that are harmful to environmental objectives (the "brown taxonomy") and activities with social objectives.

In 2020, progress has been made on defining disclosure requirements for financial market participants and financial advisers on how they are integrating sustainability factors into investment policies. Under the Sustainable Finance Disclosure Regulation adopted last year, this information will have to be provided on websites, in pre-contractual product information and in regular reports. The first requirements should be implemented from March 2021. ESAs are expected to complete the additional requirements in early 2021, for implementation in 2022.

The EBA is continuing the mandates relating to sustainable financing received through the review of the CRD and CRR: the possibility of including environmental, social and corporate governance risks (ESG) in the SREP; greater disclosure for companies with regard to ESG risk; and the mandate enabling the EBA to analyse the viability of setting capital requirements for banks (green/brown factor).

In the retail arena, the Commission has published its New Consumer Agenda, presenting the EU's consumer policies from 2020 to 2025, focusing on five priority areas: the ecological transition, digital transformation, respect for consumer rights, the needs of certain groups, revision of the consumer credit directive and international cooperation.

This year, the European Commission also started work on the revision of significant directives in the retail field, particularly the mortgage credit directive and the consumer credit directive. Santander Group has and communicates views from the corporate and local levels on the matters being discussed where they affect its activities. The corporate and local Public Policy functions identify the regulatory alerts and establish Santander Group's position, in coordination with the business and support units concerned in each case.

The main resulting actions include:

•Santander Group is an active participant in the main banking associations worldwide and in Europe, and in the main markets in which we operate, submitting responses to regulatory consultations.

•Santander Group maintains proactive and constructive dialogue with policy-makers through all available channels (public hearings, consultations, forums and conferences) and sends individual replies to official consultations on issues it considers relevant.

•Because of its subsidiary and "multiple point of entry" resolution models, Santander Group firmly believes in the strength of its organisational model, with autonomous subsidiaries that control their own capital and liquidity, the benefits of our geographic diversification and the equivalence of the third-country jurisdictions where we operate.

•Santander is also convinced that the regulatory framework should enable banks to play an active role in the new digital economy, implementing their transformations with a level playing field so that they can continue to respond to changing consumer needs.

| | | | | | | | | | | |

| 22 | | 2020 Pillar 3 Disclosures Report | |

| | | | | |

| |

| 2.1. Capital | 25 |

| 2.1.1. Capital function | 28 |

| 2.1.1.1. Organisation | 28 |

| 2.1.1.2. Capital governance | 29 |

| 2.1.2. Capital management and adequacy | 29 |

| 2.1.3. Capital management priorities | 31 |

| 2.1.4. Capital targets | 32 |

| 2.1.5. Capital buffers and capital requirements | 32 |

| 2.1.5.1. Global systemically important institutions | 34 |

| 2.1.5.2. Domestic Systemically Important Institutions | 35 |

| 2.2. Pillar 1 - Regulatory capital | 35 |

| 2.2.1. Eligible capital | 36 |

| 2.2.2. Capital requirements | 38 |

| 2.2.2.1. Plan to deploy advanced internal models and supervisory approval | 41 |

| 2.2.3. Leverage ratio | 45 |

| 2.3. Pillar 2 - Economic capital | 48 |

| 2.4. Recovery and resolution plans and special situations response framework | 48 |

| 2.5. Total Loss-Absorbing Capacity (TLAC) and Minimum Requirement for own funds and Eligible Liabilities (MREL) | 48 |

| | |

| CAPITAL 2020 Pillar 3 Disclosures Report |

2. Capital

| | | | | | | | | | | | | | | | | |

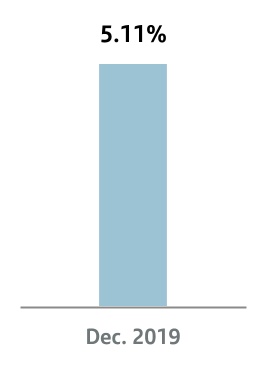

| Table 3. Main capital figures and capital adequacy ratios |

| Million euros |

| CRR Fully loaded | | CRR Phased-in |

| Dec-2020 | Dec-2019 | | Dec-2020 | Dec-19 |

| Common Equity Tier 1 (CET1) | 69,399 | | 70,497 | | | 69,399 | | 70,497 | |

| Tier 1 | 78,126 | | 78,964 | | | 78,501 | | 79,536 | |

| Total capital | 90,933 | | 90,937 | | | 91,015 | | 91,067 | |

| Risk weighted assets | 562,580 | | 605,244 | | | 562,580 | | 605,244 | |

| CET1 Ratio | 12.34 | % | 11.65 | % | | 12.34 | % | 11.65 | % |

| Tier 1 Ratio | 13.89 | % | 13.05 | % | | 13.95 | % | 13.14 | % |

| Total capital ratio | 16.16 | % | 15.02 | % | | 16.18 | % | 15.05 | % |

| Leverage Ratio | 5.31 | % | 5.11 | % | | 5.33 | % | 5.15 | % |

Note: 2019 and 2020 figures are calculated applying the transitional arrangements of CRR unless specified otherwise. | | | | | |

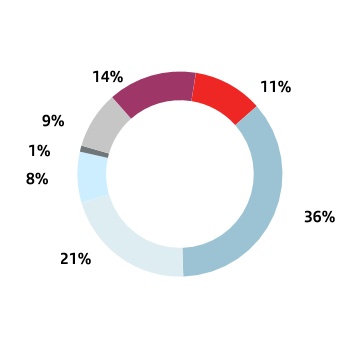

| CET1 Fully loaded Capital evolution |

| % |

Note: 2019 and 2020 figures are calculated applying the transitional arrangements of CRR unless specified otherwise.

2.1. Capital

Capital management and control at Santander Group is a fully transversal process that seeks to ensure the bank’s solvency, while complying with regulatory requirements and maximising profitability. It is determined by the strategic objectives and risk appetite set by the board of directors. To achieve this, the following policies have been established that shape the approach that Santander Group applies to capital management:

•Establish adequate capital planning, so as to meet with needs and provide the necessary resources to cover the needs of the business plans, regulatory requirements and the associated risks in the short and medium term, while maintaining the risk profile approved by the board.

•Ensure that Santander Group and its companies have adequate capital to cover needs resulting from the increase in risks derived from deteriorated macroeconomic conditions.

•Optimise capital use through appropriate capital allocation among the businesses, based on the relative returns on regulatory and economic capital and taking the risk appetite, growth and strategic objectives into account.

Santander Group maintains a very comfortable capital adequacy position, well above the levels required by applicable regulations and by the European Central Bank.

Santander Group’s capital adequacy ratios at 31 December 2020 are as shown in table 3. The phased-in ratios are calculated by applying the Basel III transitory schedules, while the fully-loaded ratios are calculated without applying any schedule (i.e. with the final regulations).

IFRS 9 became effective on 1 January 2018, implying changes in accounting that affect capital ratios. Santander decided to apply the transitional arrangements, which means a 7-year transitional period.

| | |

| CAPITAL 2020 Pillar 3 Disclosures Report |

If IFRS 9 transitional arrangement had not been applied, the total impact on the fully loaded CET 1 ratio as of December would have been -45bp. See Appendix XII for further details. CET1 Ratio in December stood at 12.34%, increasing by 69 bp during the year. The fully-loaded capital ratio was 16.16%, up 114 bp during the year.

| | | | | | | | | | | |

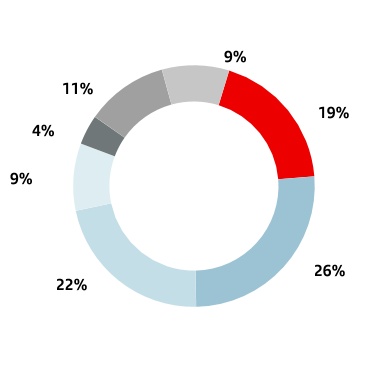

| Changes in main Capital ratios’ figures |

| | | | | |

| Ratios % |

| n | Tier 2 |

| n | Tier 1 |

| n | CET1 |

| |

| | | | | | | | | | | |

| 26 | | 2020 Pillar 3 Disclosures Report | |

| | |

| CAPITAL 2020 Pillar 3 Disclosures Report |

In the year, the increase was 69 basis points. Of note was the strong underlying capital generation of 104 pb, partially offset by the impact of restructuring costs, corporate transactions and market performance. It also includes 9 bps related to an accrual for 2020 dividend payments, based on the limit established by recommendation 2020/63 of the ECB on 15 December 2020, which allows a maximum payment of EUR cents 2.75 per share.

From a qualitative point of view, Santander Group has solid ratios that are suited to its business model, the structure of its balance sheet and its risk profile. Santander Group exceeds the 2020 minimum regulatory capital requirements for the total ratio by 317 basis points, taking into account the shortfalls of AT1 and T2.

| | | | | |

| ¤ | For further information, see section 2.1.5. |

| | |

| CAPITAL 2020 Pillar 3 Disclosures Report |

| | |

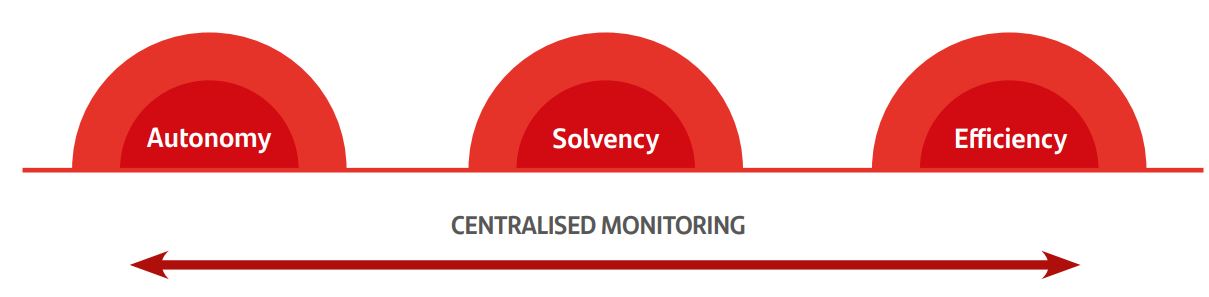

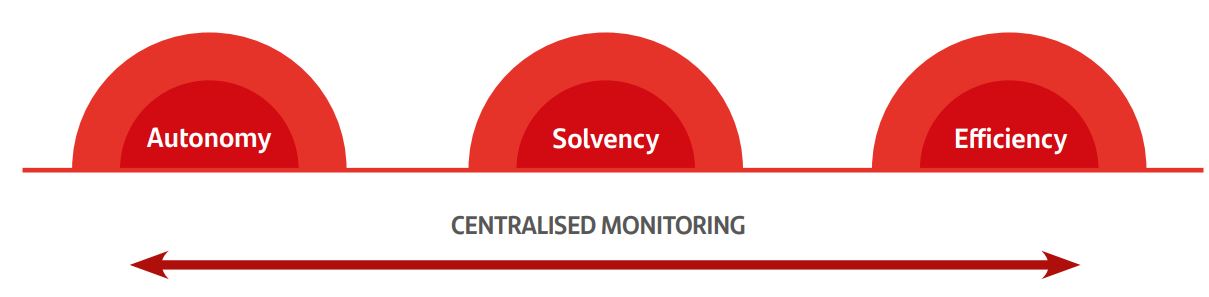

| Strategic principles of the capital function |

| | | | | | | | | | | | | | | | | | | | |

•Autonomy. The Group’s corporate structure is based on a legally independent subsidiary model, each responsible for its own capital and liquidity. This provides advantages when raising funds and limits the risk of contagion, thus reducing systemic risk. Under this structure, subsidiaries are subject to two tiers of supervision and internal control: local and global. Each unit must raise and manage its own financial resources accordingly in order to maintain the required levels of capital at all times. Local units must have the necessary capital to carry on their activity autonomously and meet local regulatory requirements and the expectations of their local market. | | •Solvency. The Group and its subsidiaries must ensure at all times that the structure and level of their capital is suitable in view of the risks to which they are exposed. Capital must be allocated accordingly so as to ensure the effective management of the risks assumed within the subsidiaries and it should be assigned to these risks.

| | •Efficiency. The Group and its subsidiaries must carry out mechanisms to actively seek and promote an efficient use of capital and to ensure that the value created by an investment exceeds at least the cost of the capital invested. Capital is a scarce commodity that must be used as efficiently as possible, given the high cost of generating capital, whether organically or through the markets. Subsidiaries must have on - going monitoring mechanisms in place to optimise their capital consumption. |

| •Centralised monitoring. The capital management model must ensure a holistic view, through a corporate environment of global coordination and review (every business, every geography). The first level of monitoring, by the local units themselves, is complemented by the monitoring activity of the corporate units. One of the main ways the Group achieves this is by defining and applying standard policies, metrics, methodologies and tools across the Group, though these may be adapted accordingly to bring them in line with local regulations and supervisory requirements and to reflect the degree of progress made by each subsidiary. | |

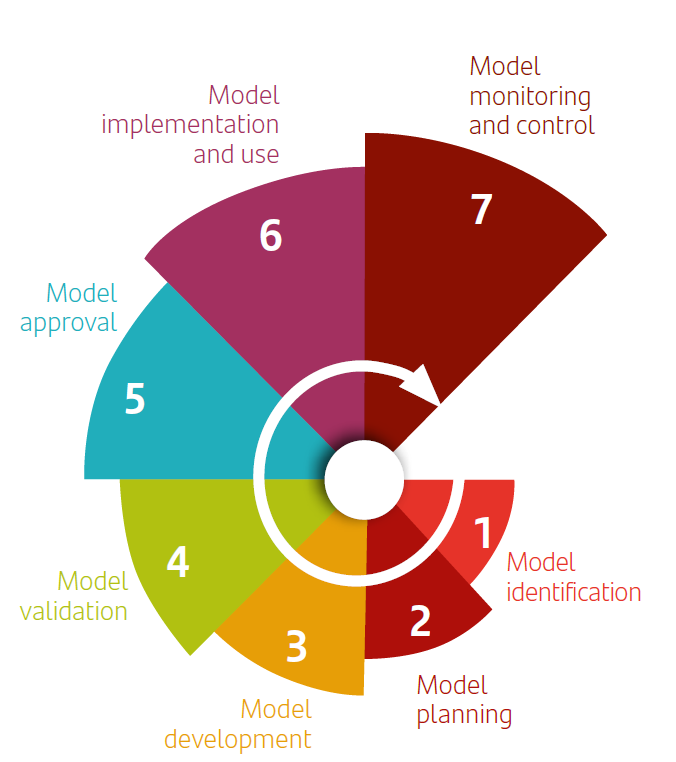

2.1.1. Capital function

The core principles establish the basic guidelines governing the actions of Santander Group entities in capital management, monitoring and control processes.

2.1.1.1. Organisation

The organisational structure has been defined with the aim of guaranteeing compliance with the core principles in relation to capital and ensuring that the relationship between the subsidiaries and the corporate centre is maintained. This function allows twin objectives to be met: preserve the subsidiary’s financial autonomy while retaining coordinated monitoring at Group level.

Santander Group’s risk management and control model is based on three lines of defence. The first line comprises the business functions or activities that assume or generate exposure to risk. Risks undertaken or generated within the first line of defence must be compatible with the risk appetite and limits in place. The first line of defence must have the resources to identify, measure, address and report the risks assumed, to perform its function. The second line of defence comprises the Risk Control and Supervision function and the Compliance function. This second line of defence is charged with effective control of risks and ensures that they are managed in accordance with the established risk appetite.

Internal Audit is the third line of defence and the last layer of control, and regularly assesses policies, methods and procedures to ensure they are suitable, and also checks they are operational.

The risk control function, the compliance function and the internal audit function are sufficiently separate and independent from each other and also regarding the other functions they control and supervise when carrying out their tasks. They likewise have access to the board of directors and/or to its committees at the highest level.

| | | | | | | | | | | |

| 28 | | 2020 Pillar 3 Disclosures Report | |

| | |

| CAPITAL 2020 Pillar 3 Disclosures Report |

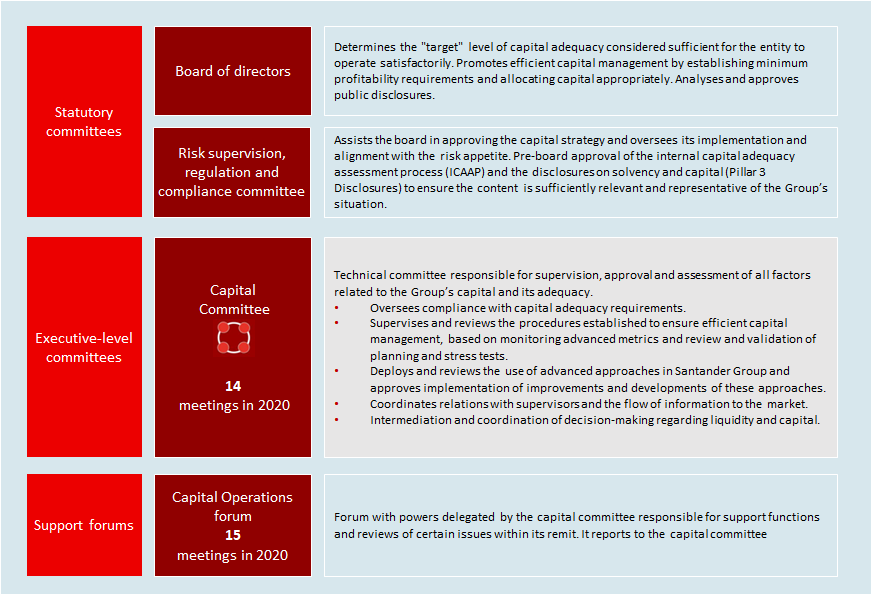

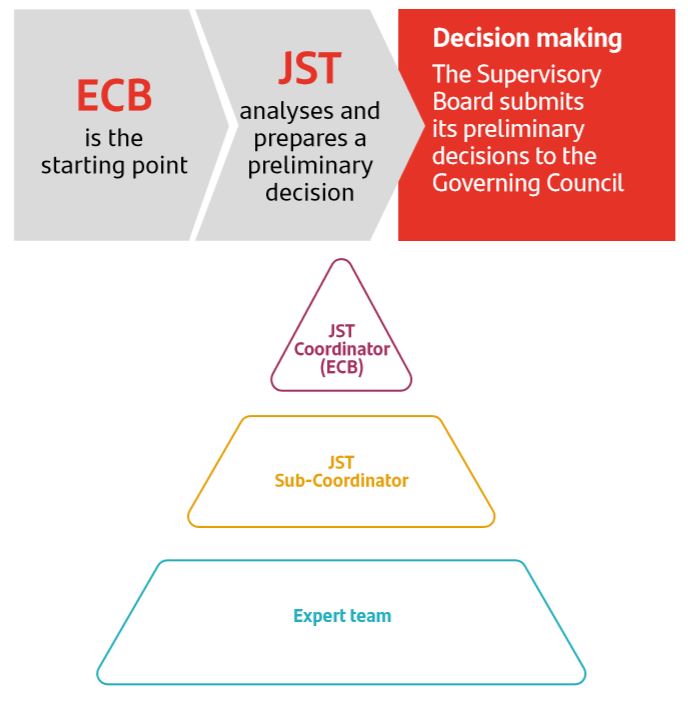

2.1.1.2. Capital governance

Santander Group has developed a structure of agile and efficient governing bodies, ensuring the Capital function operates properly when it comes to both decision-making and supervision and control. This ensures the involvement of all the areas concerned and the necessary involvement of senior management. Santander Group’s characteristic subsidiary-based structure means the governance structure of the Capital function must be adapted to preserve the autonomy of each subsidiary's capital, while allowing centralised monitoring and coordinated management at Group level. There are also various committees that have responsibilities at the regional level and also for coordination at Group level. The local committees must report to the corporate committees in due time. | | |

| Governance of the Capital function |

| | |

| CAPITAL 2020 Pillar 3 Disclosures Report |

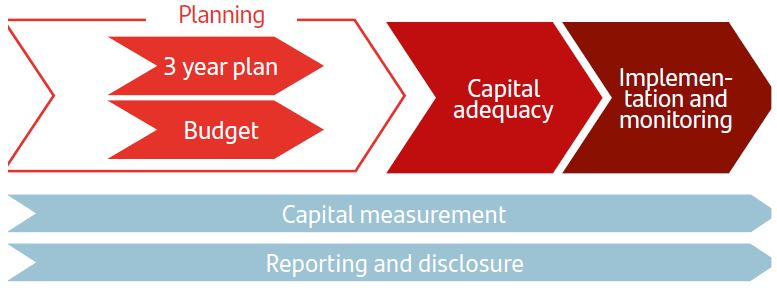

2.1.2. Capital management and adequacy

The aim of capital management and adequacy at Santander Group is to guarantee the entity’s solvency and maximise its profitability, while ensuring compliance with internal capital targets and regulatory requirements.

Capital management is a fundamental strategic tool for decision making at both local and corporate level and serves to create a common framework of action by establishing uniform definitions of capital management criteria, policies, functions, metrics and processes.

| | | | | | | | | | | | | | | | | | | | |

| Key capital figures |

|

| The Group works with the following variables relating to the concept of capital: | |

|

| | Regulatory capital | | | Return on risk-adjusted capital (RoRAC) | |

| |

•Capital requirements: The minimum amount of capital the supervisory authority requires the entity to safeguard its solvency, based on the amount of risk assumed, in terms of credit, market and operational risk. •Eligible capital: The capital the regulator considers eligible to meet with capital requirements. The main components of eligible capital are accounting capital and reserves. | The return (profit after tax) on internally required economic capital. Therefore, an increase in economic capital decreases RoRAC. The Group therefore requires transactions or business involving higher capital consumption to deliver higher returns. RoRAC takes investment risk into account, providing a risk-adjusted measure of return. The use of RoRAC allows the Bank to manage its activities better, assess the real risk-adjusted return of businesses and be more efficient in itsinvestment decisions. |

|

| Economic capital |

| |

•Capital adequacy: The minimum amount of capital that the Group needs with a specified level of probability to absorb unexpected losses deriving from its current exposure to all risks taken on by the entity (including risks additional to those contemplated under the regulatory capital requirements). •Available capital: The amount of capital the Group itself considers eligible, on management criteria, to meet with capital needs. | | Return on Risk Weighted Asset (RoRWA) |

|

Defined as the return (understood as net profit after tax) on a business’ risk-weighted assets. The use of RoRWA allows the Bank to set up strategies to allocate regulatory capital and ensure the maximum return is obtained. |

| |

| Cost of Capital | | Value creation |

| |

| The minimum return required by investors (shareholders) as compensation for the opportunity cost and risk assumed when investing their capital in the entity. This cost of capital represents a “cut-off rate” or “minimum return” to be achieved and allows comparisons between the business units to assess their efficiency. | Any profit generated above and beyond the cost of economic capital. The Bank will create value when the risk-adjusted return, measured by RoRAC, is higher than its cost of capital. Otherwise value will be destroyed. It measures the risk-adjusted return in absolute terms (monetary units), supplementing the RoRAC result. |

| |

| Leverage ratio | | Expected loss |

| |

| A regulatory measure that monitors the financial solidity and strength of the financial institution by linking its size and capital. This is calculated as the ratio between Tier 1 and the leverage exposure, which takes into account the size of the balance sheet and adjustments due to derivatives, securities financing transactions and off-balance-sheet items. | Average credit risk losses that are expected over the course of an economic cycle. From the point of view of expected loss, defaults are considered a “cost” that could be eliminated or reduced through appropriate selection of borrowers. |

| | | | | | | | | | | |

| 30 | | 2020 Pillar 3 Disclosures Report | |

| | |

| CAPITAL 2020 Pillar 3 Disclosures Report |

The Group’s Capital function is carried out on two levels:

•Regulatory capital: regulatory capital management is based on an analysis of the capital base, the solvency ratios as defined by applicable regulations and the scenarios used in capital planning. The objective is for the capital structure to be as efficient as possible, in terms of both cost and compliance with regulatory requirements. Active capital management includes strategies for the allocation of capital and its efficient use in business units, securitisations, asset sales and issuances of equity instruments (capital and subordinated debt hybrids).

•Economic capital: the objective of the economic capital model is to ensure that the Group has adequately allocated its available capital to cover all the risks to which it is exposed as a result of its activity and risk appetite. It also aims to optimise value creation in the Group and all of the business units that comprise it.

The real economic measurement of the capital needed for an activity, together with its return, enables value creation to be optimised by selecting those activities that maximise the return on capital. This allocation is carried out under different economic scenarios, both expected as well as unlikely but plausible, and with the level of solvency set by Santander Group.

2.1.3. Priorities and main activities in capital management

Santander Group’s most notable capital management activities are:

•Establishing solvency and capital contribution targets aligned with minimum regulatory requirements and internal policies, to guarantee robust capital levels consistent with our risk profile and efficient use of capital to maximise shareholder value.

•Developing a capital plan to meet those objectives, in line with the strategic plan. Capital planning is an essential part of executing the three-year strategic plan.

•Assessing capital adequacy to ensure that the capital plan is also consistent with our risk profile and risk appetite framework in stress scenarios.

•Developing the annual capital budget as part of the group’s budgeting process.

•Monitoring and controlling the group's budget execution and drawing up action plans to correct any deviations from the budget.

•Integrating capital metrics into business management to ensure consistency with Group objectives.

•Preparing internal capital reports, and reports for the supervisory authorities and the market.

•Planning and management of other loss absorbing instruments (MREL and TLAC)

Details of the most significant actions undertaken are set out below:

Issues of hybrid capital and other loss absorbing instruments

At 31 December 2020, Banco Santander S.A. has issued a total of €3,756 million of subordinated debt, including €2,256 million of T2 subordinated debt and €1,500 million of contingent convertible preference shares (CCPS). The contingent convertible preference shares were issued in place of the early repayment of an equivalent issue in euros.

At 31 December 2020, Banco Santander S.A. has also issued €7,006 million of senior non-preferred debt.

Dividend policy

In view of the ECB's recommendation calling on European banks not to pay dividends for financial years 2019 and 2020, on 2 April 2020 the board of directors decided to cancel the payment of the final dividend for 2019 and the dividend policy for 2020. On 27 July, the ECB extended its recommendation until 1 January 2021.

Based on this new recommendation, the board of directors agreed to submit the approval of a capital increase to the General Shareholders' Meeting on 27 October. This involves the distribution of new shares equivalent to €0.10 per share as supplementary remuneration for 2019. This brings the total remuneration corresponding to 2019 profit to €0.20 per share. The board of directors also said that it intended to pay €0.10 per share in 2021 from the share premium reserve, subject to the ECB's recommendations and provided it is authorised. The General Shareholders' Meeting approved both resolutions on 27 October.

On 15 December 2020, the ECB issued a third recommendation limiting the payment of interim dividends from the profits of 2019 and 2020 to either 15% of the accumulated profit in 2019 and 2020 or 0.2% of the CET1 ratio, whichever was lower. It also restricted the payment of any interim dividend from 2021 profits until September 2021.

In some areas not subject to ECB supervision, local supervisors have also recommended that no dividends were paid in 2020. As a result, subsidiaries in Poland, Portugal, Mexico and SCF have not paid out any dividends in 2020. Santander Brazil paid out 25% of its profits, as this is the legal minimum. The Chile and Uruguay subsidiaries were able to pay dividends without any constraint. The USA subsidiary has only paid out the dividend for the first quarter of 2020. In the UK, the PRA announced on 10 December 2020 that it was lifting the suspension on dividend payments announced in March 2020, limiting it to a maximum of 25% of accumulated profits in 2019 and 2020 or 0.2% of the CET1 ratio.

See the Corporate governance chapter (section 3.3) of the 2020 Annual report for more information.

| | |

| CAPITAL 2020 Pillar 3 Disclosures Report |

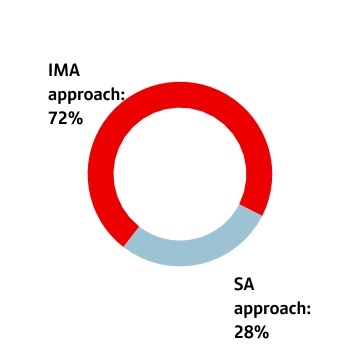

2.1.4. Capital targets

Santander Group is working towards a CET1 ratio from 11% to 12% in the medium term.

| | | | | |

| CET1 Fully loaded Capital evolution |

Note: 2019 and 2020 figures are calculated applying the transitional arrangements of CRR unless specified otherwise.

The continuous improvement in the capital ratios reflects Santander Group's profitable growth strategy and a culture of active capital management at all levels of the organisation.

Highlights:

•The reinforcement of teams dedicated to capital management and greater coordination with the corporate centre and local teams.

•All countries and business units have developed individual capital plans focused on achieving a business that maximises the return on capital.

•A higher weighting of capital management in incentives. Certain aspects relating to capital management and returns are taken into account when setting the variable remuneration payable to members of the senior management:

•The relevant metrics include the Group’s CET1, the capital contribution of the countries to the Group ratio or the return on tangible equity (RoTE).

•The qualitative aspects considered include the proper management of regulatory changes affecting capital, effective management of capital relating to business decisions, capital generation sustainable over time and an effective capital allocation.

At the same time, the Group has completed this year a programme of action to ensure the ongoing improvement of infrastructure, processes and methodologies that support all aspects relating to capital, with the aim of encouraging ever more active capital management, enabling the Group to respond in a more agile way to the numerous and growing number of regulatory requirements and carrying out all associated activities more efficiently.

2.1.5. Capital buffers and eligible capital requirements

Santander Group must always comply with the combined capital buffer requirement, which is defined as the total CET1 capital necessary to meet the following obligations:

•Capital conservation buffer (CCB): mandatory for all entities from 1 January 2016. The buffer for banks in 2021 is 2.5%.