FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of November, 2021

Commission File Number: 001-12518

Banco Santander, S.A.

(Exact name of registrant as specified in its charter)

Ciudad Grupo Santander

28660 Boadilla del Monte (Madrid) Spain

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes ☐ No ☒

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ☐ No ☒

BANCO SANTANDER, S.A.

________________________

TABLE OF CONTENTS

| | | | | |

|

|

| |

| Part 1. Interim consolidated directors’ report | |

| Part 2. Interim unaudited consolidated financial statements | |

Index

This report was approved by the Board of Directors on 26 October 2021, following a favourable report from the Audit Committee. Important information regarding this report can be found on pages 88 and 89.

Key consolidated data

| | | | | | | | | | | | | | | | | | | | | | | |

| BALANCE SHEET (EUR million) | Sep-21 | Jun-21 | % | Sep-21 | Sep-20 | % | Dec-20 |

| Total assets | 1,578,295 | | 1,568,636 | | 0.6 | | 1,578,295 | | 1,514,242 | | 4.2 | | 1,508,250 | |

| Loans and advances to customers | 958,311 | | 954,518 | | 0.4 | | 958,311 | | 910,714 | | 5.2 | | 916,199 | |

| Customer deposits | 909,034 | | 894,127 | | 1.7 | | 909,034 | | 842,899 | | 7.8 | | 849,310 | |

| Total funds | 1,140,322 | | 1,121,969 | | 1.6 | | 1,140,322 | | 1,039,608 | | 9.7 | | 1,056,127 | |

| Total equity | 95,624 | | 95,745 | | (0.1) | | 95,624 | | 91,310 | | 4.7 | | 91,322 | |

| Note: Total funds includes customer deposits, mutual funds, pension funds and managed portfolios |

| | | | | | | | | | | | | | | | | | | | | | | |

| INCOME STATEMENT (EUR million) | Q3'21 | Q2'21 | % | 9M'21 | 9M'20 | % | 2020 |

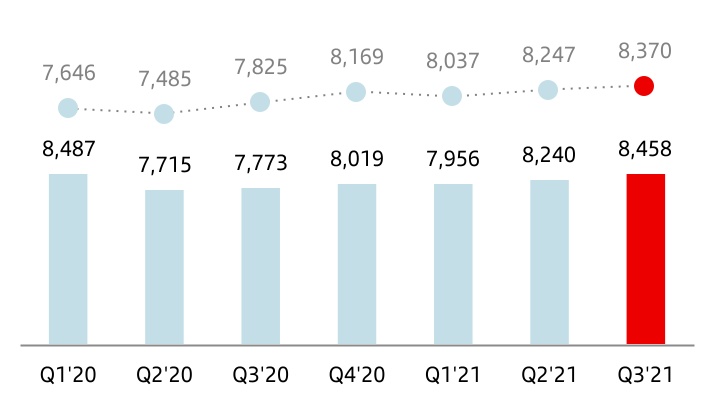

| Net interest income | 8,458 | | 8,240 | | 2.6 | | 24,654 | | 23,975 | | 2.8 | | 31,994 | |

| Total income | 11,931 | | 11,305 | | 5.5 | | 34,626 | | 33,355 | | 3.8 | | 44,279 | |

| | | | | | | |

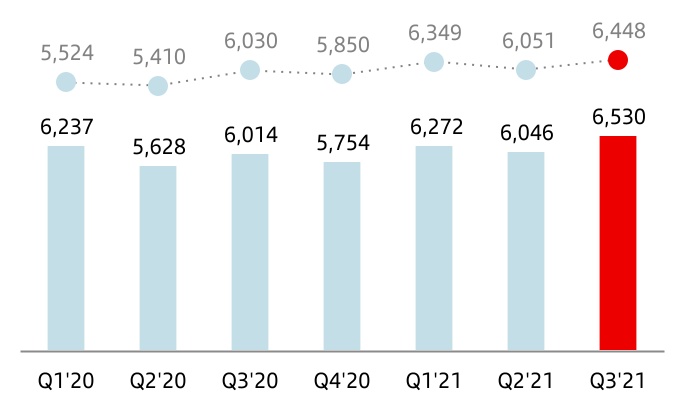

| Net operating income | 6,530 | | 6,046 | | 8.0 | | 18,848 | | 17,569 | | 7.3 | | 23,149 | |

| | | | | | | |

| Profit before tax | 3,802 | | 3,812 | | (0.3) | | 10,716 | | (3,271) | | — | | (2,076) | |

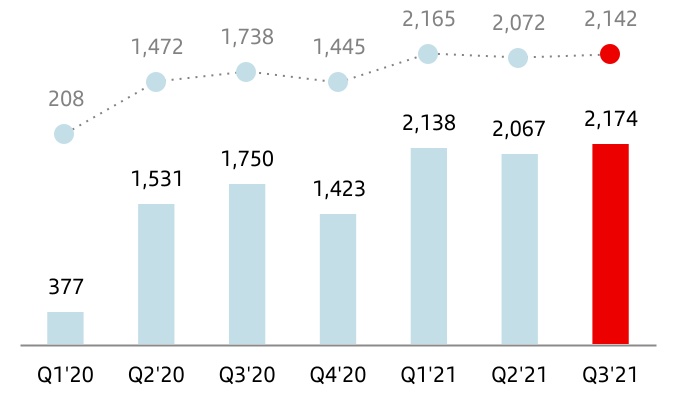

| Attributable profit to the parent | 2,174 | | 2,067 | | 5.2 | | 5,849 | | (9,048) | | — | | (8,771) | |

| Changes in constant euros: | | | | | | | |

| Q3'21 / Q2'21: NII: +1.5%; Total income: +4.3%; Net operating income: +6.5%; Profit before tax: -1.9%; Attributable profit: +3.3% |

| 9M'21 / 9M'20: NII: +7.4%; Total income: +8.4%; Net operating income: +13.2%; Profit before tax: -/+; Attributable profit: -/+ |

| | | | | | | | | | | | | | | | | | | | | | | |

| EPS, PROFITABILITY AND EFFICIENCY (%) | Q3'21 | Q2'21 | % | 9M'21 | 9M'20 | % | 2020 |

EPS (euros) (2) | 0.117 | | 0.112 | | 4.4 | | 0.313 | | (0.546) | | — | | (0.538) | |

| RoE | 10.16 | | 9.91 | | | 9.54 | | (8.54) | | | (9.80) | |

| RoTE | 12.56 | | 12.29 | | | 11.82 | | 3.30 | | | 1.95 | |

| RoA | 0.65 | | 0.64 | | | 0.61 | | (0.44) | | | (0.50) | |

| RoRWA | 1.76 | | 1.74 | | | 1.66 | | (1.17) | | | (1.33) | |

| Efficiency ratio | 45.3 | | 46.5 | | | 45.6 | | 46.8 | | | 47.0 | |

| | | | | | | | | | | | | | | | | | | | | | | |

UNDERLYING INCOME STATEMENT (1) (EUR million) | Q3'21 | Q2'21 | % | 9M'21 | 9M'20 | % | 2020 |

| Net interest income | 8,458 | | 8,240 | | 2.6 | | 24,654 | | 23,975 | | 2.8 | | 31,994 | |

| Total income | 11,931 | | 11,305 | | 5.5 | | 34,626 | | 33,605 | | 3.0 | | 44,600 | |

| | | | | | | |

| Net operating income | 6,530 | | 6,046 | | 8.0 | | 18,848 | | 17,879 | | 5.4 | | 23,633 | |

| | | | | | | |

| Profit before tax | 3,804 | | 3,815 | | (0.3) | | 11,432 | | 7,016 | | 62.9 | | 9,674 | |

| Attributable profit to the parent | 2,174 | | 2,067 | | 5.2 | | 6,379 | | 3,658 | | 74.4 | | 5,081 | |

| Changes in constant euros: | | | | | |

| Q3'21 / Q2'21: NII: +1.5%; Total income: +4.3%; Net operating income: +6.5%; Profit before tax: -1.9%; Attributable profit: +3.3% |

| 9M'21 / 9M'20: NII: +7.4%; Total income: +7.6%; Net operating income: +11.1%; Profit before tax: +73.6%; Attributable profit: +86.6% |

| | | | | | | | | | | | | | | | | | | | | | | |

UNDERLYING EPS AND PROFITABILITY (1) (%) | Q3'21 | Q2'21 | % | 9M'21 | 9M'20 | % | 2020 |

Underlying EPS (euros) (2) | 0.117 | | 0.112 | | 4.4 | | 0.344 | | 0.187 | | 83.7 | | 0.262 | |

| Underlying RoE | 10.16 | | 9.91 | | | 10.18 | | 5.32 | | | 5.68 | |

| Underlying RoTE | 12.56 | | 12.29 | | | 12.61 | | 7.08 | | | 7.44 | |

| Underlying RoA | 0.65 | | 0.64 | | | 0.65 | | 0.38 | | | 0.40 | |

| Underlying RoRWA | 1.76 | | 1.74 | | | 1.76 | | 1.01 | | | 1.06 | |

| | | | | | | | |

January - September 2021 | | 3 |

| | | | | | | | | | | | | | | | | | | | | | | |

| SOLVENCY (%) | Sep-21 | Jun-21 | | Sep-21 | Sep-20 | | Dec-20 |

| Fully-loaded CET1 ratio | 11.85 | | 11.70 | | | 11.85 | | 11.57 | | | 11.89 | |

| Fully-loaded total capital ratio | 15.82 | | 15.42 | | | 15.82 | | 15.15 | | | 15.73 | |

| | | | | | | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| CREDIT QUALITY (%) | Q3'21 | Q2'21 | | 9M'21 | 9M'20 | | 2020 |

Cost of credit (3) | 0.90 | | 0.94 | | | 0.90 | | 1.27 | | | 1.28 | |

| NPL ratio | 3.18 | | 3.22 | | | 3.18 | | 3.15 | | | 3.21 | |

| Total coverage ratio | 74 | | 73 | | | 74 | | 76 | | | 76 | |

| | | | | | | | | | | | | | | | | | | | | | | |

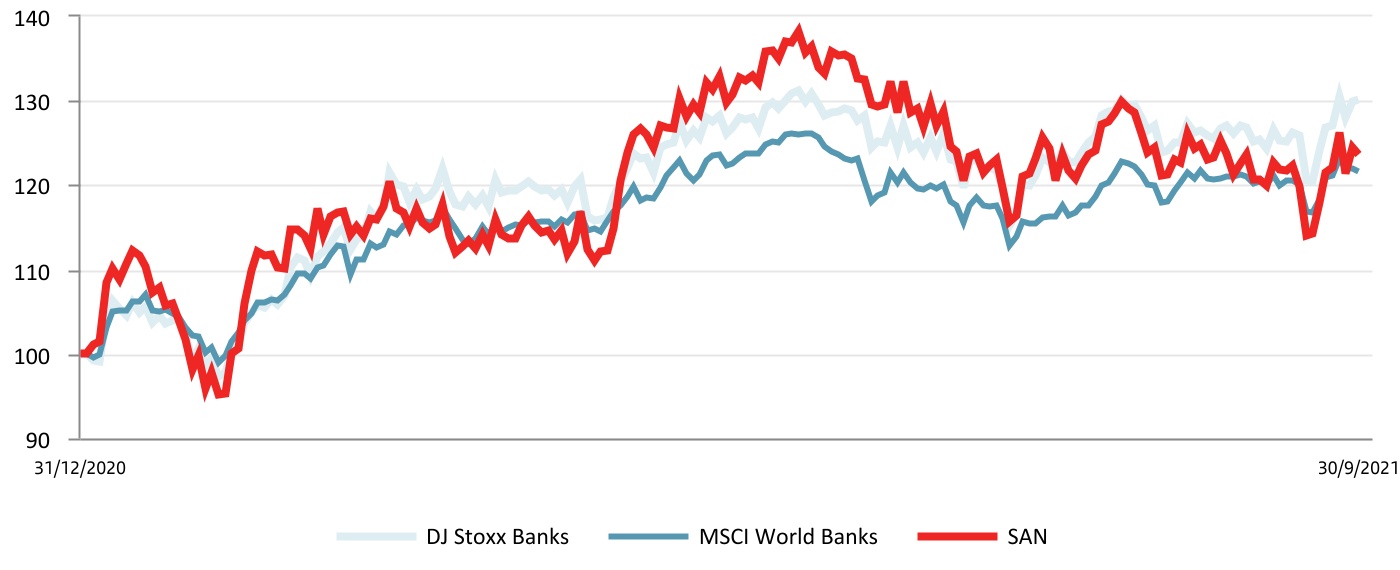

| MARKET CAPITALIZATION AND SHARES | Sep-21 | Jun-21 | % | Sep-21 | Sep-20 | % | Dec-20 |

| Shares (millions) | 17,341 | | 17,341 | | 0.0 | | 17,341 | | 16,618 | | 4.3 | | 17,341 | |

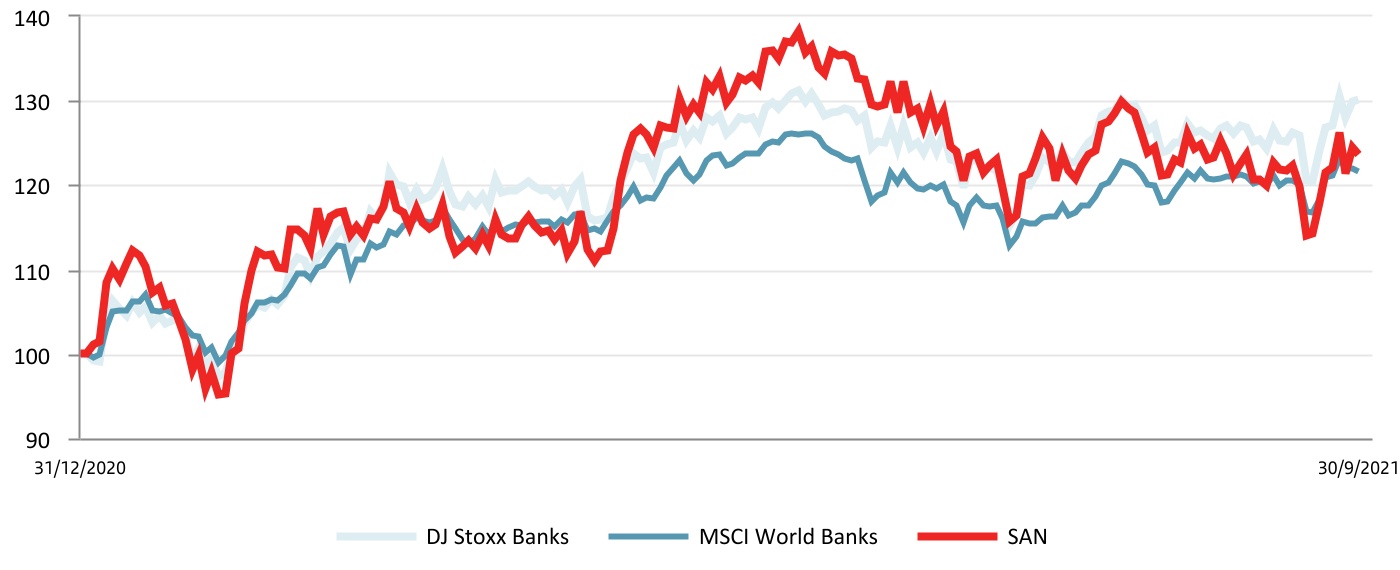

Share price (euros) (2) | 3.137 | | 3.220 | | (2.6) | | 3.137 | | 1.533 | | 104.6 | | 2.538 | |

| Market capitalization (EUR million) | 54,389 | | 55,828 | | (2.6) | | 54,389 | | 26,582 | | 104.6 | | 44,011 | |

Tangible book value per share (euros) (2) | 3.99 | | 3.98 | | | 3.99 | | 3.82 | | | 3.79 | |

Price / Tangible book value per share (X) (2) | 0.79 | | 0.81 | | | 0.79 | | 0.40 | | | 0.67 | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| CUSTOMERS (thousands) | Q3'21 | Q2'21 | % | 9M'21 | 9M'20 | % | 2020 |

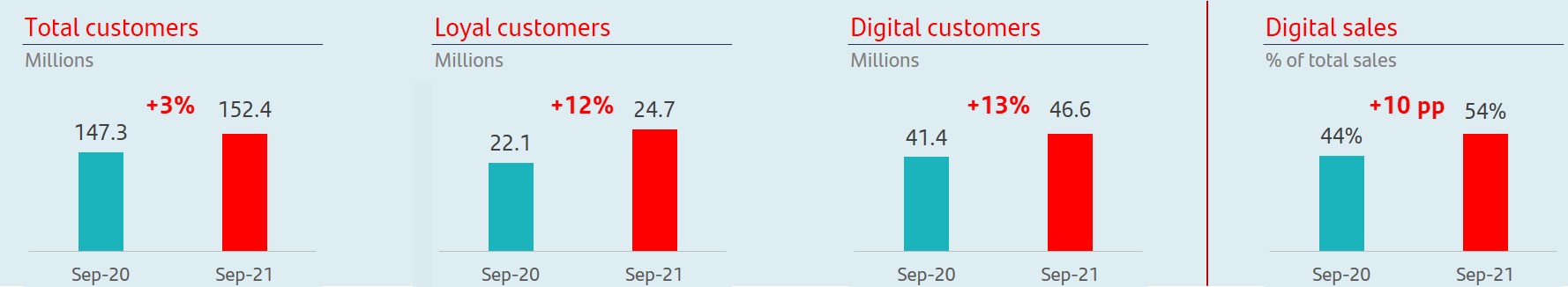

| Total customers | 152,365 | | 150,447 | | 1.3 | | 152,365 | | 147,312 | | 3.4 | 148,256 | |

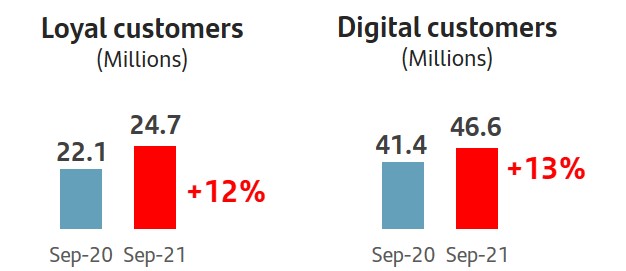

| Loyal customers | 24,687 | | 24,169 | | 2.1 | | 24,687 | | 22,058 | | 11.9 | 22,838 | |

| Loyal retail customers | 22,587 | | 22,100 | | 2.2 | | 22,587 | | 20,189 | | 11.9 | 20,901 | |

| Loyal SME & corporate customers | 2,100 | | 2,069 | | 1.5 | | 2,100 | | 1,869 | | 12.4 | 1,938 | |

| Digital customers | 46,623 | | 45,352 | | 2.8 | | 46,623 | | 41,365 | | 12.7 | 42,362 | |

| Digital sales / Total sales (%) | 57 | | 54 | | | 54 | | 44 | | | 44 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| OTHER DATA | Sep-21 | Jun-21 | % | Sep-21 | Sep-20 | % | Dec-20 |

| Number of shareholders | 3,817,454 | | 3,879,232 | | (1.6) | | 3,817,454 | | 4,103,069 | | (7.0) | | 4,018,817 | |

| Number of employees | 193,303 | | 190,751 | | 1.3 | | 193,303 | | 192,578 | | 0.4 | | 191,189 | |

| Number of branches | 9,904 | | 10,073 | | (1.7) | | 9,904 | | 11,520 | | (14.0) | | 11,236 | |

| | |

(1) In addition to financial information prepared in accordance with International Financial Reporting Standards (IFRS) and derived from our consolidated financial statements, this report contains certain financial measures that constitute alternative performance measures (APMs) as defined in the Guidelines on Alternative Performance Measures issued by the European Securities and Markets Authority (ESMA) on 5 October 2015, and other non-IFRS measures, including the figures related to “underlying” results, which do not include the items recorded in the separate line of “net capital gains and provisions”, above the line of attributable profit to the parent. Further details are provided in the “Alternative performance measures” section of the appendix to this report.

For further details of the APMs and non-IFRS measures used, including its definition or a reconciliation between any applicable management indicators and the financial data presented in the annual consolidated financial statements prepared under IFRS, please see our 2020 Annual Financial Report, published in the CNMV on 23 February 2021, our 20-F report for the year ending 31 December 2020 filed with the SEC in the United States on 26 February 2021, as updated by the Form 6-K filed with the SEC on 14 April 2021 in order to reflect our new organizational and reporting structure, as well as the “Alternative performance measures” section of the appendix to this report.

|

| (2) Data adjusted for the capital increase in December 2020. |

|

| (3) Allowances for loan-loss provisions over the last 12 months / Average loans and advances to customers over the last 12 months |

| | | | | | | | |

| 4 | | January - September 2021 |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Business model | | Group financial information | | Financial information by segments | | Responsible banking

Corporate governance

Santander share | | Appendix |

| | | | | | | | |

Our business model is based on three pillars

| | | | | | | | | | | | | | | | | | | | |

1. Our scale Local scale and leadership. Worldwide reach through our global businesses | | | 2. Customer focus Unique personal banking relationships strengthen customer loyalty | | | 3. Diversification Our geographic and business diversification makes us more resilient under adverse circumstances |

| | | | | |

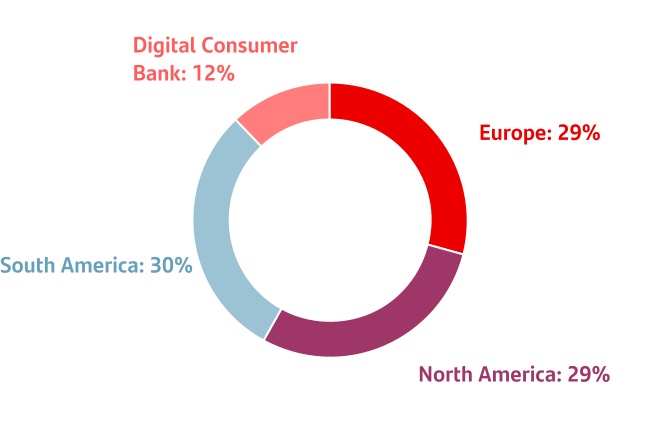

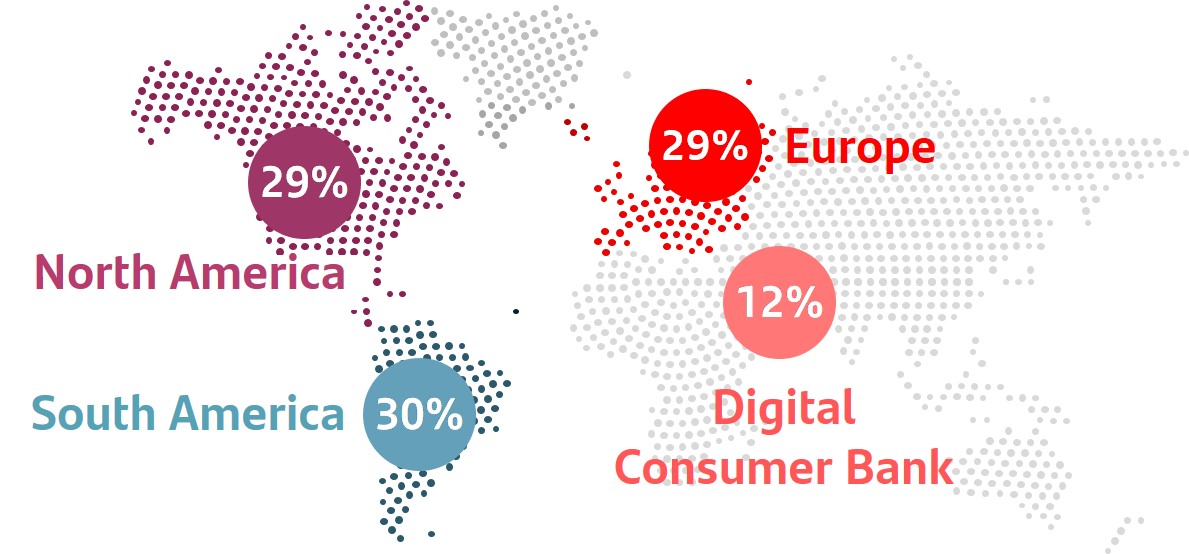

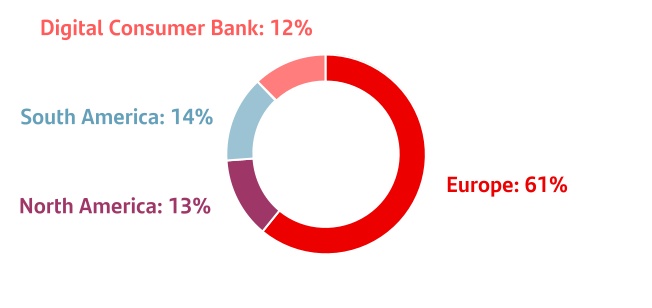

•Geographic diversification3 balanced between mature and emerging markets |

| | | | | |

| | | | |

total customers in Europe

and the Americas | | | | |

| | | | | | |

| | | | | | •Business diversification between customer segments (individuals, SMEs, mid-market companies and large corporates) |

| 1. Market share in lending as of June 2021 including only privately-owned banks. UK benchmark refers to the mortgage market. DCB refers to auto in Europe. | | | 2. NPS – Customer Satisfaction internal benchmark of active customers’ experience and satisfaction audited by Stiga / Deloitte. | | | 3. 9M'21 underlying attributable profit by region. Operating areas excluding Corporate Centre. |

Our corporate culture

The Santander Way remains unchanged to continue to deliver for all our stakeholders.

| | | | | | | | | | | |

| Our purpose To help people and businesses prosper. | | |

| | |

| Our aim To be the best open financial services platform, by acting responsibly and earning the lasting loyalty of our people, customers, shareholders and communities. | |

| | |

| Our how Everything we do should be Simple, Personal and Fair. | |

| | |

| | | | | | | | |

January - September 2021 | | 5 |

u In the quarter, the strength of our model once again enabled us to deliver another strong set of results in an environment marked by the recovery of activity in all regions, following progress in the vaccination process and the gradual lifting of covid-19 measures.

u In view of the lifting of the European Central Bank's (ECB) recommendation that had limited shareholder remuneration until 30 September 2021, the board of directors approved the shareholder remuneration policy to be applied to 2021 results, with the following objectives:

•Total remuneration of 40% of the Group's underlying profit.

•Split in equal parts between cash dividends and share buybacks.

•Two payment cycles: interim distributions around November and, subject to the appropriate corporate and regulatory approvals, a final distribution around May.

In line with this policy, the board decided to make an interim distribution from 2021 earnings amounting to a total value of c. EUR 1.7 billion, equivalent to 40% of underlying profit for the first half of 2021, which will be made in two parts:

•A cash dividend of EUR 4.85 cents per share, to be paid from 2 November 2021.

•A buyback programme that will have a maximum amount of EUR 841 million, equivalent to 20% of the Group's underlying profit in the first half of 2021, already approved by the ECB and included in the inside information disclosed on 6 October 2021.

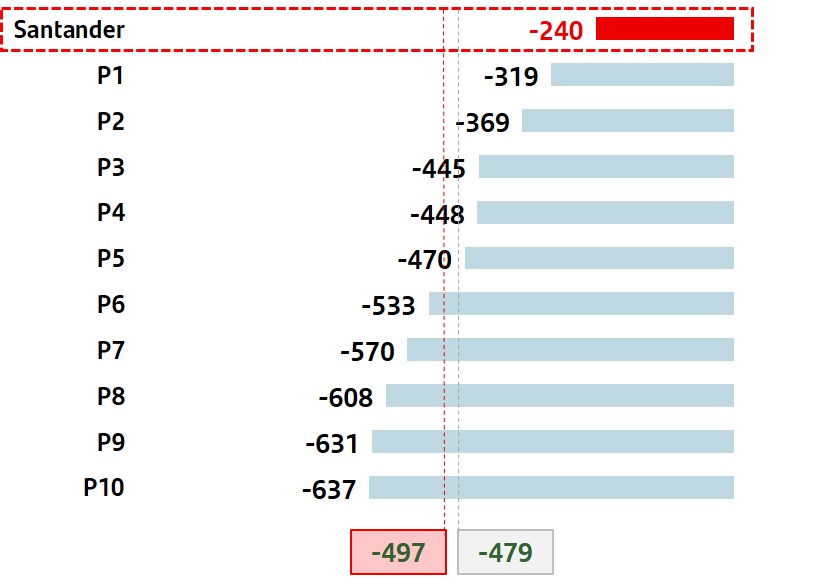

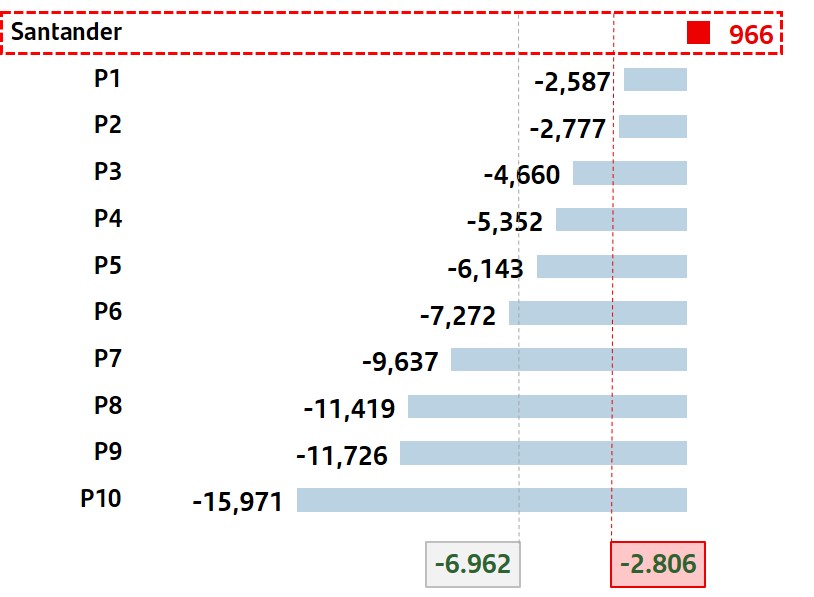

u In late July, the European Banking Authority (EBA) published the the results of its 2021 EU-wide stress test, which involved the main banks from the EU. According to these results, under the adverse scenario Santander would destroy 240 bps of phased-in CET1 capital compared to the peer average of almost 480 bps and to the average of European banking system of nearly 500 bps. In addition, in the adverse scenario, the cumulative projections of Grupo Santander's income statement show a profit of almost EUR 1 billion. This makes it the only bank among its peers capable of recording a positive accumulated result under this scenario.

u Digital adoption continued to accelerate: in 9M'21, 54% of sales were made through digital channels (57% in the third quarter) compared to 44% in 9M'20. The number of digital customers increased by more than 1 million in the quarter, reaching 47 million (+13% year-on-year).

u Loyal customers have risen by 2.6 million since September 2020, totalling 25 million, and represented 33% of total active customers.

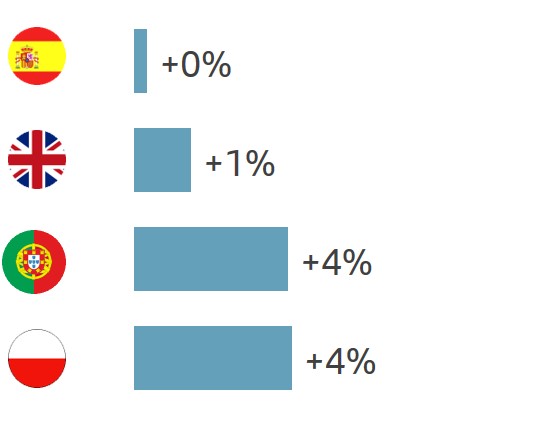

u Business volumes grew at a good pace in a context of normalization, although high liquidity in the markets continued. In this environment, and excluding the exchange rate impact, loans and advances to customers rose more than EUR 8 billion (+1%) in the quarter and 4% year-on-year. Customer funds were up over EUR 21 billion, +2% in the quarter and +7% year-on-year.

u Attributable profit amounted to EUR 2,174 million in Q3'21, with no net results recorded in the net capital gains and provisions line. Compared to the previous quarter, profit was 5% higher (+3% in constant euros).

u 9M'21 attributable profit was EUR 5,849 million. Excluding the EUR 530 million charge recorded in Q1'21 from bringing forward restructuring costs for the year as a whole, underlying attributable profit stood at EUR 6,379 million, 74% higher than in 9M'20 (+87% in constant euros), underpinned by the positive performance across regions, Digital Consumer Bank (DCB) and the global businesses.

u These results were reflected in higher profitability: underlying RoTE of 12.6% (7.1% in 9M'20), underlying RoRWA was 1.76% (1.01% in 2020) and underlying earnings per share of EUR 0.344 (EUR 0.187 in 2020).

u Cost of credit continued to improve reaching 0.90% in 9M'21 (1.28% in FY20 and 0.94% in June 2021). Total loan-loss reserves reached EUR 24.5 bn and total coverage of credit impaired loans increased in the quarter to 74%.

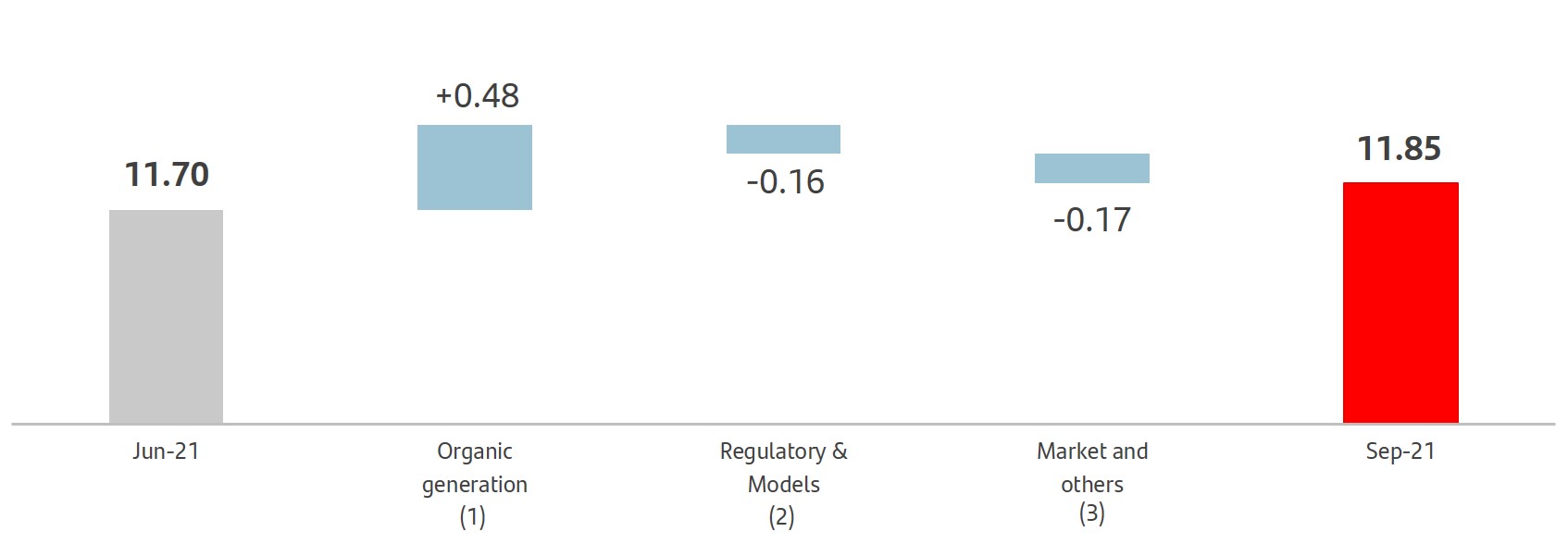

u The fully-loaded CET1 ratio was 11.85%, with an organic generation of 48 bps. On the other hand, it was affected by regulatory impacts and models (-16 bps) and markets and others (-17 bps). On the other hand, the phased-in CET1 ratio rose to 12.26%.

u TNAV per share was EUR 3.99 in September 2021. Including the EUR 2.75 cents dividend paid in May, and the approved in September (EUR 4.85 cents), growth was 1.4% in the quarter and 6.5% year-on-year.

| | | | | | | | |

| 6 | | January - September 2021 |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Grupo Santander. Summarized income statement |

| EUR million | | | | | | | | |

| | | Change | | | Change |

| Q3'21 | Q2'21 | % | % excl. FX | 9M'21 | 9M'20 | % | % excl. FX |

| Net interest income | 8,458 | | 8,240 | | 2.6 | | 1.5 | | 24,654 | | 23,975 | | 2.8 | | 7.4 | |

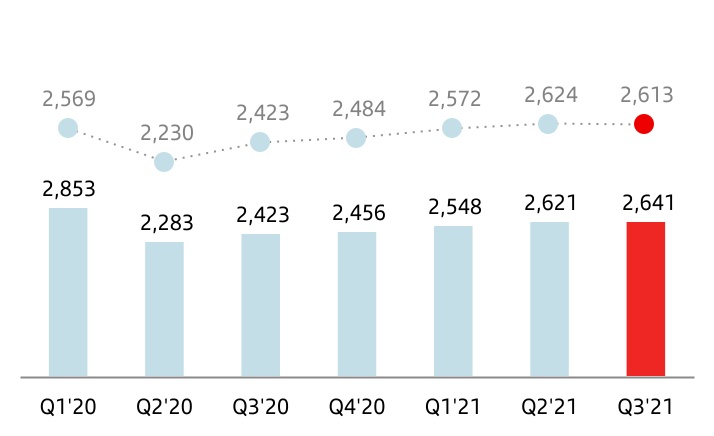

| Net fee income (commission income minus commission expense) | 2,641 | | 2,621 | | 0.8 | | (0.4) | | 7,810 | | 7,559 | | 3.3 | | 8.1 | |

| Gains or losses on financial assets and liabilities and exchange differences (net) | 326 | | 243 | | 34.2 | | 31.7 | | 1,220 | | 1,725 | | (29.3) | | (26.6) | |

| Dividend income | 95 | | 244 | | (61.1) | | (61.2) | | 404 | | 322 | | 25.5 | | 26.2 | |

| Share of results of entities accounted for using the equity method | 132 | | 87 | | 51.7 | | 52.0 | | 295 | | (90) | | — | | — | |

| Other operating income / expenses | 279 | | (130) | | — | | — | | 243 | | (136) | | — | | — | |

| Total income | 11,931 | | 11,305 | | 5.5 | | 4.3 | | 34,626 | | 33,355 | | 3.8 | | 8.4 | |

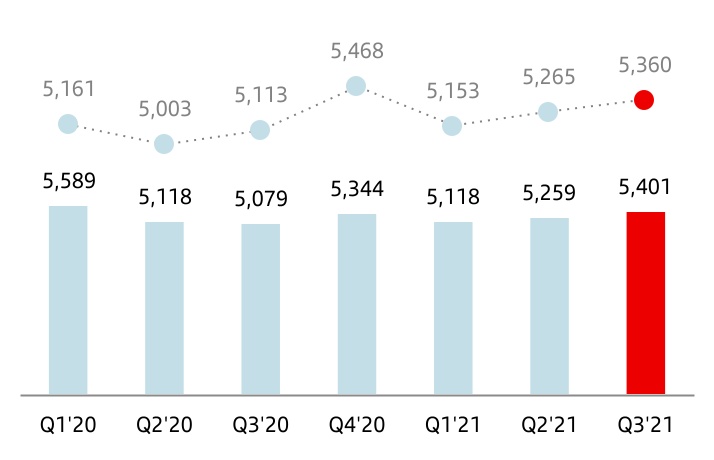

| Operating expenses | (5,401) | | (5,259) | | 2.7 | | 1.8 | | (15,778) | | (15,786) | | (0.1) | | 3.3 | |

| Administrative expenses | (4,718) | | (4,561) | | 3.4 | | 2.5 | | (13,714) | | (13,686) | | 0.2 | | 3.6 | |

| Staff costs | (2,767) | | (2,750) | | 0.6 | | (0.2) | | (8,205) | | (8,098) | | 1.3 | | 4.4 | |

| Other general administrative expenses | (1,951) | | (1,811) | | 7.7 | | 6.7 | | (5,509) | | (5,588) | | (1.4) | | 2.4 | |

| Depreciation and amortization | (683) | | (698) | | (2.1) | | (2.9) | | (2,064) | | (2,100) | | (1.7) | | 1.4 | |

| Provisions or reversal of provisions | (516) | | (531) | | (2.8) | | (3.4) | | (2,006) | | (1,014) | | 97.8 | | 109.5 | |

| Impairment or reversal of impairment of financial assets not measured at fair value through profit or loss (net) | (2,196) | | (1,748) | | 25.6 | | 24.4 | | (6,000) | | (9,538) | | (37.1) | | (34.0) | |

| | | | | | | | |

| Impairment on other assets (net) | (4) | | 8 | | — | | — | | (134) | | (10,256) | | (98.7) | | (98.7) | |

| Gains or losses on non financial assets and investments, net | (9) | | 51 | | — | | — | | 43 | | 89 | | (51.7) | | (50.1) | |

| Negative goodwill recognized in results | — | | — | | — | | — | | — | | 9 | | (100.0) | | (100.0) | |

| Gains or losses on non-current assets held for sale not classified as discontinued operations | (3) | | (14) | | (78.6) | | (81.9) | | (35) | | (130) | | (73.1) | | (73.1) | |

| Profit or loss before tax from continuing operations | 3,802 | | 3,812 | | (0.3) | | (1.9) | | 10,716 | | (3,271) | | — | | — | |

| Tax expense or income from continuing operations | (1,251) | | (1,331) | | (6.0) | | (7.7) | | (3,725) | | (5,020) | | (25.8) | | (23.6) | |

| Profit from the period from continuing operations | 2,551 | | 2,481 | | 2.8 | | 1.2 | | 6,991 | | (8,291) | | — | | — | |

| Profit or loss after tax from discontinued operations | — | | — | | — | | — | | — | | — | | — | | — | |

| Profit for the period | 2,551 | | 2,481 | | 2.8 | | 1.2 | | 6,991 | | (8,291) | | — | | — | |

| Attributable profit to non-controlling interests | (377) | | (414) | | (8.9) | | (9.3) | | (1,142) | | (757) | | 50.9 | | 56.5 | |

| Attributable profit to the parent | 2,174 | | 2,067 | | 5.2 | | 3.3 | | 5,849 | | (9,048) | | — | | — | |

| | | | | | | | |

EPS (euros) (1) | 0.117 | | 0.112 | | 4.4 | | | 0.313 | | (0.546) | | — | | |

Diluted EPS (euros) (1) | 0.116 | | 0.111 | | 4.4 | | | 0.312 | | (0.546) | | — | | |

| | | | | | | | |

| Memorandum items: | | | | | | | | |

| Average total assets | 1,575,975 | | 1,557,364 | | 1.2 | | | 1,550,943 | | 1,543,361 | | 0.5 | | |

| Average stockholders' equity | 85,608 | | 83,429 | | 2.6 | | | 83,574 | | 91,639 | | (8.8) | | |

(1) Data adjusted for the capital increase in December 2020.

| | | | | | | | |

January - September 2021 | | 7 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Executive summary | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Profit (9M'21 vs. 9M'20) | | | | | | | | | | Performance (9M'21 vs. 9M'20). In constant euros | | |

| | | | | | | | | | | | | | | |

| | Strong profit growth across regions and businesses | | | | Higher underlying profit driven by total income, cost control and significantly lower provisions | | |

| | Attributable profit | | Underlying attrib. profit | | | | | Total income | Costs | Provisions | | |

| | EUR 5,849 mn | | EUR 6,379 mn | | | | | | |

| | -EUR 9,048 mn in 9M'20 | | EUR 3,658 mn in 9M'20 | | | | | +7.6% | +3.7% | -34.5% | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Efficiency | | | | | | | | | | | Profitability | | |

| | | | | | | | | | | | | | | | |

| | The Group's efficiency ratio improved strongly, mainly driven by Europe | | | | | Strong profitability improvement compared to 9M'20 and FY'20. | | |

| | Group | | Europe | | | | | | RoTE | Underlying RoTE | RoRWA | Underlying RoRWA | | |

| | 45.6% | | 50.3% | | | | | 11.8% | 12.6% | 1.66% | 1.76% | | |

| | q 1.2 pp vs 9M'20 | | q 6.6 pp vs 9M'20 | | | | | p 8.5 pp | p 5.5 pp | p 2.8 pp | p 0.8 pp | | |

| | | | | | | | | | | | | | | | | | Changes vs. 9M'20 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

è Results performance compared to 9M'20

The Group presents, both at the total level and for each of the business units, the real changes in euros produced in the income statement, as well as variations excluding the exchange rate effect (FX), on the understanding that the latter provide a better analysis of the Group’s management. For the Group as a whole, exchange rates had a significant impact on revenue (-5 percentage points) and costs (-3 percentage points).

u Total income

Total income of EUR 34,626 million in the first nine months of 2021, up 4% with respect to 9M'20. If the FX impact is excluded, total income increased 8%, with growth in all regions and main countries, except Mexico, showing the strength provided by our geographic and business diversification. Net interest income and net fee income accounted for 94% of total income. By line:

•Net interest income amounted to EUR 24,654 million, 3% higher compared to 9M'20. Stripping out the exchange rate impact, growth was 7%, mainly due to the net effect of higher average lending and deposit volumes and the lower cost of the latter, partly offset by the reduction in revenue from low interest rates, which fell even further in most markets.

| | | | | |

| Net interest income |

| EUR million |

| constant euros |

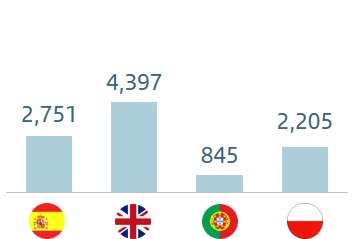

By country, growth was recorded in the UK (+27%), through decisive management deposit repricing actions (mainly the 1I2I3 current account) as well as higher volumes (especially mortgages), Spain (+4%), driven by margin management; Brazil (+12%), due to greater volumes; and Chile (+12%), due to margin management and inflation.

The US remained flat due to volume pressures mainly due to the disposals made in previous quarters (Puerto Rico and Bluestem portfolio). Excluding these disposals, growth was 7%.

Mexico fell 4%, due to lower average interest rates and a smaller loan portfolio, mainly in corporates.

•Net fee income rose 3% year-on-year to EUR 7,810 million. Excluding the exchange rate impact, they were 8% higher, showing a recovery path from the lows in Q2'20.

Transactional fees continued to be affected by lower activity in early 2021, while those from card turnover and points of sale increased (+25% and +40%, respectively). Asset management and insurance businesses, as well as SCIB, also recorded double-digit growth.

| | | | | |

| Net fee income |

| EUR million |

| constant euros |

| | | | | | | | |

| 8 | | January - September 2021 |

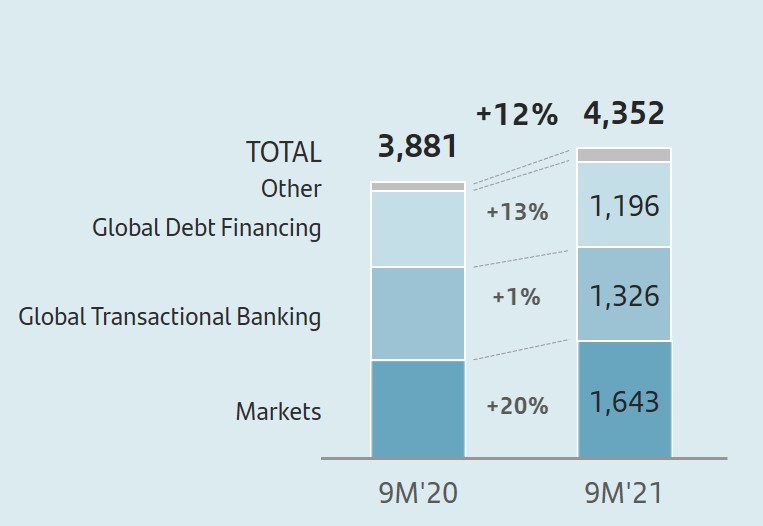

Santander Corporate & Investment Banking surged 19% year-on-year driven by strong markets growth and the positive performance in banking businesses. Wealth Management & Insurance rose 11% (including fees ceded to the branch network). Overall, both businesses together accounted for approximately 50% of the Group’s total net fee income (SCIB: 17%; WM&I: 32%).

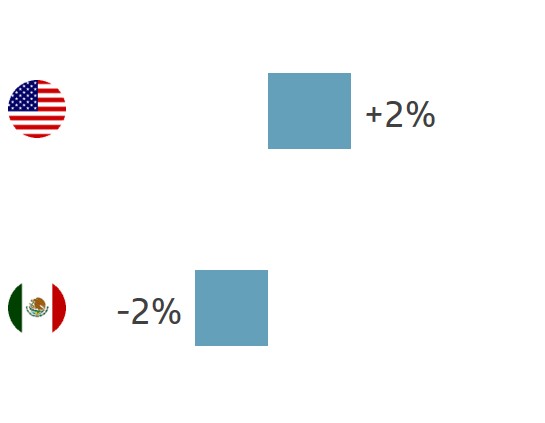

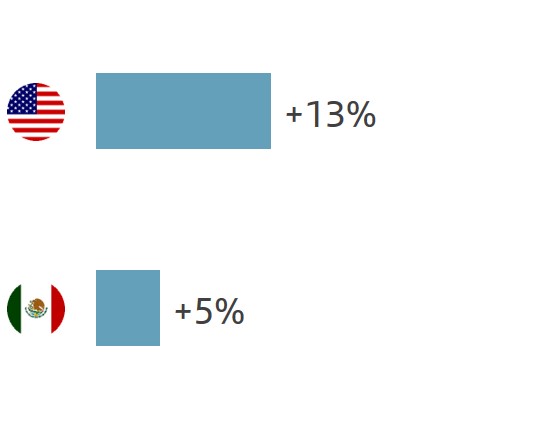

By region, Europe was up 7%, with generalized increases in all markets except the UK, due to regulatory changes affecting overdrafts since April 2020. North America was stable, affected by the disposals carried out in the US. Excluding them, growth was 7% in the region and 8% in the US. Mexico up 5% driven by transactional fees. South America increased 13% with overall growth in all markets.

•Gains on financial transactions, accounted for 4% of total income and stood at EUR 1,220 million (EUR 1,725 million in the first nine months of 2020), with falls in Spain (-42%), Mexico (-43%), Chile (-31%) and the Corporate Centre. This was due to the favourable impact of foreign exchange hedging, higher portfolio sales and increased market volatility in 2020.

•Dividend income was EUR 404 million, 25% higher than in the same period of 2020 (+26% excluding the exchange rate effect), having recovered several dividend payments, mainly in Europe, following reductions, delays or cancellations last year amid the pandemic.

•The results of entities accounted for using the equity method amounted to EUR 295 million, due to the higher contribution from the entities associated to the Group.

•Other operating income recorded a gain of EUR 243 million compared to a loss of EUR 136 million in the first nine months of 2020 due to higher results from leasing and insurance.

| | | | | |

| Total income |

| EUR million |

| constant euros |

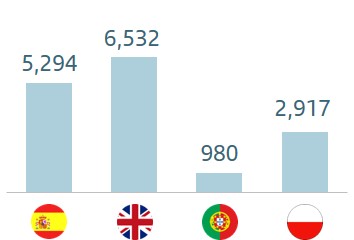

u Costs

Operating costs amounted to EUR 15,778 million, in line with the same period last year. Excluding the exchange rate impact, costs rose 4% due to the general upturn in inflation in 2021 and broad-based investments in technology and digital developments, including PagoNxt. Excluding inflation (i.e. in real terms) costs dropped 1%.

The efficiency ratio was 45.6%, improving 1.2 pp versus last year, mainly driven by Europe. This enabled Santander to remain one of the most efficient global banks in the world.

The cost trends by region and market in constant euros were as follows:

•In Europe, costs were 1% lower year-on-year, -3% in real terms (excluding average inflation), making headway in our cost reduction plan. In real terms, falls were recorded in Spain (-9%), the UK (-4%), Portugal (-3%) and Poland rose 1% due to higher personnel expenses. The efficiency ratio in the region stood at 50.3% (-6.6 pp year-on-year).

•In North America, costs rose 8%. In real terms, they were 5% higher driven by digitalization investments, the 5% increase in the US and the 2% fall in Mexico. The efficiency ratio in the region stood at 43.8%.

•In South America, the rise in costs (+9%) was greatly distorted by the very high inflation in Argentina. In real terms, costs reduced 3% in the region: Brazil (-6%), Chile (-1%) and Argentina remained flat. The efficiency ratio in the region stood at 34.6%.

•In Digital Consumer Bank, costs increased 4% due to perimeter and digital transformation investments. In real terms, costs rose 2%. The efficiency ratio stood at 45.4%.

| | | | | |

| Operating expenses |

| EUR million |

| constant euros |

| | | | | | | | |

January - September 2021 | | 9 |

u Provisions or reversal of provisions

Provisions (net of provisions reversals) rose to EUR 2,006 million (EUR 1,014 million in 9M'20). This line item includes the charges for restructuring costs, as well as charges related to CHF mortgages in Poland and Digital Consumer Bank (EUR 185 million in 9M'21).

u Impairment or reversal of impairment of financial assets not measured at fair value through profit or loss (net)

Impairment or reversal of impairment on financial assets not measured at fair value through profit or loss (net) was EUR 6,000 million, down 37% year-on-year in euros and 34% in constant euros, mainly from additional provisions recorded in 2020 based on the IFRS 9 forward-looking view and the collective and individual assessments to reflect expected credit losses arising from covid-19.

u Impairment on other assets (net)

Impairment on other assets (net) stood at EUR 134 million. In 9M'20, this line item was EUR 10,256 million due to the valuation adjustment of goodwill of -EUR 10,100 million recorded in the second quarter.

| | | | | |

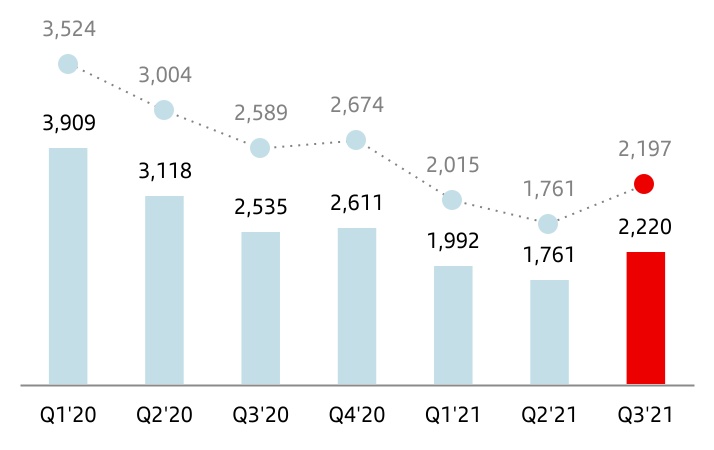

| Net loan-loss provisions |

| EUR million |

| constant euros |

u Gains or losses on non-financial assets and investments (net)

This line item recorded EUR 43 million in the first nine months of 2021, compared to EUR 89 million in the same period of 2020.

u Negative goodwill recognized in results

This line item recorded EUR 0 million in 9M'21 (EUR 9 million in 9M'20).

u Gains or losses on non-current assets held for sale not classified as discontinued operations

This line item, which mainly includes impairment of foreclosed assets recorded and the sale of properties acquired upon foreclosure, totalled -EUR 35 million in the first nine months of 2021, compared to -EUR 130 million in the same period of 2020.

u Profit before tax

Profit before tax amounted to EUR 10,716 million in the first nine months of 2021, increasing from -EUR 3,271 million in the same period of 2020, spurred by growth in total income and lower provisions in 2021 and the valuation adjustment of goodwill in 2020.

u Income tax

Total corporate income tax was EUR 3,725 million (EUR 5,020 million in the first nine months of 2020, which recorded the EUR 2,500 million valuation adjustment to deferred tax assets).

u Attributable profit to non-controlling interests

Attributable profit to non-controlling interests amounted to EUR 1,142 million, up 51% year-on-year (+56% excluding the exchange rate impact).

u Attributable profit to the parent

Attributable profit to the parent amounted to EUR 5,849 million in 9M'21, compared with a loss of EUR 9,048 million in 9M'20.

RoTE stood at 11.8% (3.3% in 9M'20), RoRWA of 1.66% (-1.17% in 9M'20) and earnings per share stood at EUR 0.313 (-EUR 0.546 in 9M'20).

| | | | | | | | |

| 10 | | January - September 2021 |

u Underlying attributable profit to the parent

Attributable profit to the parent recorded in the first nine months of 2021 and 2020 was affected by results that are outside the ordinary course of our business and distort the year-on-year comparison, and are detailed below:

•In 9M'21, these results totalled -EUR 530 million for restructuring costs, fully recorded in Q1'21, as follows: -EUR 293 million in the UK, -EUR 165 million in Portugal, -EUR 16 million in Digital Consumer Bank and -EUR 56 million in the Corporate Centre.

•In 9M'20, these results amounted to -EUR 12,706 million from the valuation adjustment of goodwill ascribed to various Group units (-EUR 10,100 million) and the valuation adjustment to deferred tax assets of the Spanish consolidated fiscal group with an impact of -EUR 2,500 million. In addition, restructuring costs and other provisions had a net impact of -EUR 106 million.

For further information see the 'Alternative performance measures' section of this report.

Excluding these results from the various P&L lines where they are recorded, and incorporating them separately in the net capital gains and provisions line, the adjusted or underlying attributable profit to the parent was EUR 6,379 million in the first nine months of 2021 and EUR 3,658 million in the same period last year.

The Group’s cost of credit (considering the last 12 months) stood at 0.90%.

Considering the first nine months of the year, it was 0.83%, performing better than expected, due to lower provisions in most markets, mainly in the US, Digital Consumer Bank, Brazil and Chile, together with the net releases in the UK.

Before the recording of loan-loss provisions, the Group's underlying net operating income (total income less operating expenses) was EUR 18,848 million, a 5% increase year-on-year +11% excluding the FX impact, with the following performance of the latter by line and region:

By line:

•Total income up primarily driven by net interest income (+7%) and net fee income (+8%), which continued on the path of recovery.

•Costs grew driven by the upturn in inflation. In real terms, broad-based declines across markets except Poland and the US.

By region:

•In Europe, net operating income increased 29% with rises in all markets.

•In North America, net operating income dropped 1%, with a 6% increase in the US and a 10% fall in Mexico. Excluding the disposals mentioned in other sections of this report, growth was 17% in the US and +5% in the region.

•In South America, growth was 12% with rises in Brazil (+14%), Chile (+11%) and Argentina (+17%).

•In Digital Consumer Bank, net operating income increased 4%.

In the first nine months of 2021, the Group’s underlying RoTE was 12.6% (7.1% in 9M'20), underlying RoRWA was 1.76% (1.01% in 9M'20) and underlying earnings per share EUR 0.344 (EUR 0.187 in 9M'20).

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Summarized underlying income statement |

| EUR million | | | Change | | | Change |

| Q3'21 | Q2'21 | % | % excl. FX | 9M'21 | 9M'20 | % | % excl. FX |

| Net interest income | 8,458 | | 8,240 | | 2.6 | 1.5 | 24,654 | | 23,975 | | 2.8 | 7.4 |

| Net fee income | 2,641 | | 2,621 | | 0.8 | (0.4) | 7,810 | | 7,559 | | 3.3 | 8.1 |

Gains (losses) on financial transactions (1) | 326 | | 243 | | 34.2 | 31.7 | 1,220 | | 1,725 | | (29.3) | (26.6) |

| Other operating income | 506 | | 201 | | 151.7 | 149.8 | 942 | | 346 | | 172.3 | 178.7 |

| Total income | 11,931 | | 11,305 | | 5.5 | 4.3 | 34,626 | | 33,605 | | 3.0 | 7.6 |

| Administrative expenses and amortizations | (5,401) | | (5,259) | | 2.7 | 1.8 | (15,778) | | (15,726) | | 0.3 | 3.7 |

| Net operating income | 6,530 | | 6,046 | | 8.0 | 6.5 | 18,848 | | 17,879 | | 5.4 | 11.1 |

| Net loan-loss provisions | (2,220) | | (1,761) | | 26.1 | 24.8 | (5,973) | | (9,562) | | (37.5) | (34.5) |

| Other gains (losses) and provisions | (506) | | (470) | | 7.7 | 7.1 | (1,443) | | (1,301) | | 10.9 | 14.5 |

| Profit before tax | 3,804 | | 3,815 | | (0.3) | (1.9) | 11,432 | | 7,016 | | 62.9 | 73.6 |

| Tax on profit | (1,253) | | (1,334) | | (6.1) | (7.7) | (3,911) | | (2,596) | | 50.7 | 60.8 |

| Profit from continuing operations | 2,551 | | 2,481 | | 2.8 | 1.2 | 7,521 | | 4,420 | | 70.2 | 81.1 |

| Net profit from discontinued operations | — | | — | | — | | — | | — | | — | | — | | (100.0) | |

| Consolidated profit | 2,551 | | 2,481 | | 2.8 | 1.2 | 7,521 | | 4,420 | | 70.2 | 81.1 |

| Non-controlling interests | (377) | | (414) | | (8.9) | (9.7) | (1,142) | | (762) | | 49.9 | 55.4 |

| Net capital gains and provisions | — | | — | | — | (36.1) | (530) | | (12,706) | | (95.8) | (95.8) |

| Attributable profit to the parent | 2,174 | | 2,067 | | 5.2 | 3.3 | 5,849 | | (9,048) | | — | — |

Underlying attributable profit to the parent (2) | 2,174 | | 2,067 | | 5.2 | 3.3 | 6,379 | | 3,658 | | 74.4 | 86.6 |

| | | | | | | | |

(1) Includes exchange differences.

(2) Excludes net capital gains and provisions.

| | | | | | | | |

January - September 2021 | | 11 |

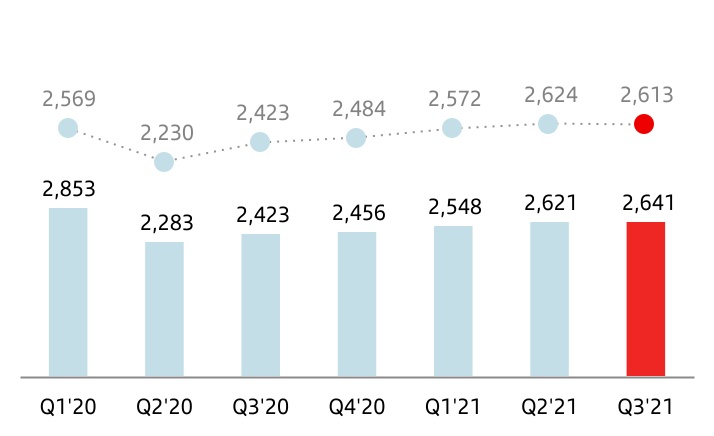

è Results performance compared to the previous quarter

In the third quarter, attributable profit to the parent amounted to EUR 2,174 million, with no net results recorded in the net capital gains and provisions line.

Attributable profit to the parent recorded a 5% increase in euros (+3% in constant euros) compared to the second quarter.

Attributable profit to the parent and underlying attributable profit, both in the second and third quarters, recorded the same amount as there were no items recorded outside the ordinary performance of our business.

The performance of the main lines of the income statement in constant euros was as follows:

•Total income was 4% higher quarter-on-quarter driven by the positive performance by line.

Net interest income grew 1%, maintaining its upward trend; net fee income remained broadly stable, affected by some seasonality; gains on financial increased mainly driven by SCIB; and other operating income rose benefitting from the SRF contribution recorded in the second quarter.

| | | | | |

| Net operating income |

| EUR million |

| constant euros |

•Continued rigorous expense management. However, the continued upturn in inflation in Q3 (especially in North and South America), and the signing and update of collective labour agreements in Brazil and Argentina, led to a 2% rise in the Group. In Europe, decreases were recorded in Spain, Portugal and the UK, on the back of the ongoing efficiency programmes.

•Net loan-loss provisions increased 25% mainly due to the US (positive net charge-offs recorded in Q2), the UK, which registered releases in the second quarter, and Brazil, due to higher volumes and growth in retail.

•Other gains (losses) and provisions recorded a -EUR 31 million charge related to CHF mortgages in Poland and Digital Consumer Bank.

| | | | | |

| Underlying attributable profit to the parent* |

| EUR million |

| constant euros |

(*) Excluding net capital gains and provisions.

| | | | | | | | |

| 12 | | January - September 2021 |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Business model | |

| |

| | | |

|

| | Balance sheet | | | | | | |

| | | | | | | | | | | | | | | | | |

| Grupo Santander. Condensed balance sheet |

| EUR million | | | | | |

| | | Change | |

| Assets | Sep-21 | Sep-20 | Absolute | % | Dec-20 |

| Cash, cash balances at central banks and other demand deposits | 191,035 | | 148,175 | | 42,860 | | 28.9 | | 153,839 | |

| Financial assets held for trading | 122,967 | | 117,654 | | 5,313 | | 4.5 | | 114,945 | |

| Debt securities | 30,834 | | 34,107 | | (3,273) | | (9.6) | | 37,894 | |

| Equity instruments | 14,586 | | 7,235 | | 7,351 | | 101.6 | | 9,615 | |

| Loans and advances to customers | 3,651 | | 247 | | 3,404 | | — | | 296 | |

| Loans and advances to central banks and credit institutions | 17,246 | | — | | 17,246 | | — | | 3 | |

| Derivatives | 56,650 | | 76,065 | | (19,415) | | (25.5) | | 67,137 | |

| Financial assets designated at fair value through profit or loss | 42,126 | | 67,007 | | (24,881) | | (37.1) | | 53,203 | |

| Loans and advances to customers | 22,930 | | 29,215 | | (6,285) | | (21.5) | | 24,673 | |

| Loans and advances to central banks and credit institutions | 11,876 | | 30,850 | | (18,974) | | (61.5) | | 21,617 | |

| Other (debt securities an equity instruments) | 7,320 | | 6,942 | | 378 | | 5.4 | | 6,913 | |

| Financial assets at fair value through other comprehensive income | 109,570 | | 117,461 | | (7,891) | | (6.7) | | 120,953 | |

| Debt securities | 98,016 | | 105,574 | | (7,558) | | (7.2) | | 108,903 | |

| Equity instruments | 2,690 | | 3,075 | | (385) | | (12.5) | | 2,783 | |

| Loans and advances to customers | 8,864 | | 8,812 | | 52 | | 0.6 | | 9,267 | |

| Loans and advances to central banks and credit institutions | — | | — | | — | | — | | — | |

| Financial assets measured at amortised cost | 1,011,994 | | 950,571 | | 61,423 | | 6.5 | | 958,378 | |

| Debt securities | 34,079 | | 27,316 | | 6,763 | | 24.8 | | 26,078 | |

| Loans and advances to customers | 922,867 | | 872,440 | | 50,427 | | 5.8 | | 881,963 | |

| Loans and advances to central banks and credit institutions | 55,048 | | 50,815 | | 4,233 | | 8.3 | | 50,337 | |

| Investments in subsidiaries, joint ventures and associates | 7,684 | | 7,679 | | 5 | | 0.1 | | 7,622 | |

| Tangible assets | 32,446 | | 33,277 | | (831) | | (2.5) | | 32,735 | |

| Intangible assets | 16,246 | | 15,698 | | 548 | | 3.5 | | 15,908 | |

| Goodwill | 12,645 | | 12,359 | | 286 | | 2.3 | | 12,471 | |

| Other intangible assets | 3,601 | | 3,339 | | 262 | | 7.8 | | 3,437 | |

| Other assets | 44,227 | | 56,720 | | (12,493) | | (22.0) | | 50,667 | |

| Total assets | 1,578,295 | | 1,514,242 | | 64,053 | | 4.2 | | 1,508,250 | |

| | | | | |

| Liabilities and shareholders' equity | | | | | |

| Financial liabilities held for trading | 80,147 | | 88,128 | | (7,981) | | (9.1) | | 81,167 | |

| Customer deposits | 4,809 | | — | | 4,809 | | — | | — | |

| Debt securities issued | — | | — | | — | | — | | — | |

| Deposits by central banks and credit institutions | 5,350 | | — | | 5,350 | | — | | — | |

| Derivatives | 55,086 | | 73,044 | | (17,958) | | (24.6) | | 64,469 | |

| Other | 14,902 | | 15,084 | | (182) | | (1.2) | | 16,698 | |

| Financial liabilities designated at fair value through profit or loss | 47,900 | | 59,459 | | (11,559) | | (19.4) | | 48,038 | |

| Customer deposits | 36,694 | | 40,469 | | (3,775) | | (9.3) | | 34,343 | |

| Debt securities issued | 5,401 | | 4,362 | | 1,039 | | 23.8 | | 4,440 | |

| Deposits by central banks and credit institutions | 5,805 | | 14,628 | | (8,823) | | (60.3) | | 9,255 | |

| Other | — | | — | | — | | — | | — | |

| Financial liabilities measured at amortized cost | 1,317,759 | | 1,237,314 | | 80,445 | | 6.5 | | 1,248,188 | |

| Customer deposits | 867,531 | | 802,430 | | 65,101 | | 8.1 | | 814,967 | |

| Debt securities issued | 238,882 | | 240,195 | | (1,313) | | (0.5) | | 230,829 | |

| Deposits by central banks and credit institutions | 180,221 | | 169,646 | | 10,575 | | 6.2 | | 175,424 | |

| Other | 31,125 | | 25,043 | | 6,082 | | 24.3 | | 26,968 | |

| Liabilities under insurance contracts | 779 | | 970 | | (191) | | (19.7) | | 910 | |

| Provisions | 9,815 | | 10,118 | | (303) | | (3.0) | | 10,852 | |

| Other liabilities | 26,271 | | 26,943 | | (672) | | (2.5) | | 27,773 | |

| Total liabilities | 1,482,671 | | 1,422,932 | | 59,739 | | 4.2 | | 1,416,928 | |

| Shareholders' equity | 118,380 | | 114,493 | | 3,887 | | 3.4 | | 114,620 | |

| Capital stock | 8,670 | | 8,309 | | 361 | | 4.3 | | 8,670 | |

| Reserves | 104,702 | | 116,894 | | (12,192) | | (10.4) | | 114,721 | |

| Attributable profit to the Group | 5,849 | | (9,048) | | 14,897 | | — | | (8,771) | |

| Less: dividends | (841) | | (1,662) | | 821 | | (49.4) | | — | |

| Other comprehensive income | (32,992) | | (32,747) | | (245) | | 0.7 | | (33,144) | |

| Minority interests | 10,236 | | 9,564 | | 672 | | 7.0 | | 9,846 | |

| Total equity | 95,624 | | 91,310 | | 4,314 | | 4.7 | | 91,322 | |

| Total liabilities and equity | 1,578,295 | | 1,514,242 | | 64,053 | | 4.2 | | 1,508,250 | |

| | | | | | | | |

January - September 2021 | | 13 |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Business model | |

| |

| | | |

|

| | Balance sheet | | | | | | |

| | | | | | | | |

| GRUPO SANTANDER BALANCE SHEET |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Executive summary * | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Loans and advances to customers (excl. reverse repos) | | | | | | | Customer funds (deposits excl. repos + mutual funds) | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

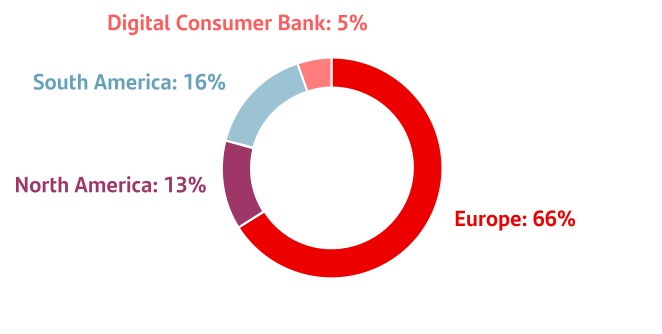

| | Credit normalization following the uptick at the beginning of the pandemic, due to high liquidity in the system | | | | | Strong increase in customer funds benefiting from the higher propensity to save derived from the health crisis | | |

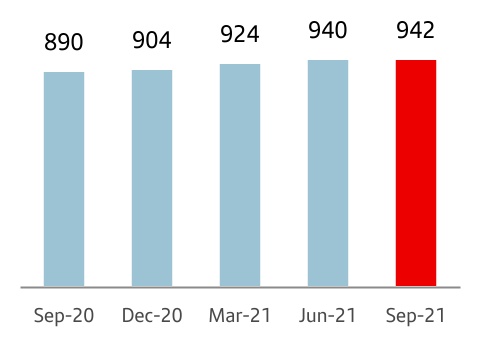

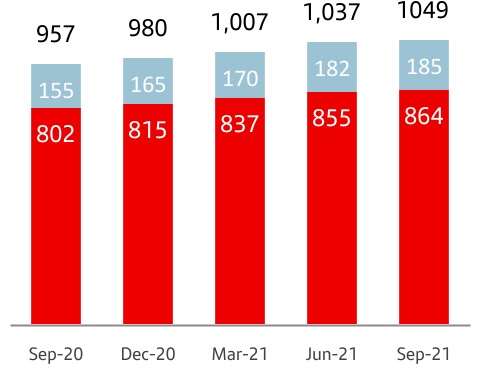

| | | | | 942 | p 1% QoQ | p 4% YoY | | | | | | | 1,049 | p 2% QoQ | p 7% YoY | | |

| | | | | billion | | | | | | | billion | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | è By segment (YoY change): | | | | | | | | | | | | è By product (YoY change): | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | Growth backed by individuals and large corporates | | | | Of note were demand deposits (which account for 66% of customer funds) and mutual funds | | |

| | | | | | |

| | Individuals | SMEs and corporates | CIB and institutions | | | | Demand | Time | Mutual funds | | |

| | +4% | -2% | +9% | | | | +10% | -9% | +17% | | |

| | | | | | | | | | | | |

| | | | | (*) Changes in constant euros | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

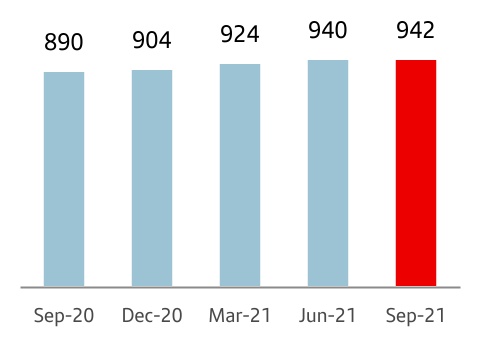

è Loans and advances to customers

Loans and advances to customers stood at EUR 958,311 million in September, virtually unchanged in the quarter and 5% higher year-on-year.

The Group uses gross loans and advances to customers excluding reverse repos (EUR 941,739 million) for the purpose of analyzing traditional commercial banking loans. In addition, in order to facilitate the analysis of the Group's management, the comments below do not include the exchange rate impact.

In the third quarter, gross loans and advances to customers excluding reverse repos and without the exchange rate impact, increased 1%, as follows:

•In Europe Portugal and Poland increased while Spain and the UK had no material change. The region as a whole increased 1%.

•North America volumes remained flat both in the US and Mexico.

•South America growth of 3% with all markets increasing, notably Argentina and Uruguay (+5% each) and Chile (+3%).

•Digital Consumer Bank (DCB) was 1% lower, due to lower new auto lending. Openbank grew 10%.

Compared to September 2020, gross loans and advances to customers (excluding reverse repos and the FX impact) grew 4%, as follows:

•In Europe, 3% growth with all markets increasing except for Spain that remained flat. Rises were recorded in Portugal (+4%), driven by mortgages and SMEs, Poland (+4%) due to mortgages, SMEs and CIB, and the UK (+1%), driven by residential mortgage activity. Growth was also recorded in SCIB branches.

•In North America, Mexico decreased 2% weighed down by the fall in corporates, partly offset by the increase in individuals (mainly mortgages). Balances in the US increased 1%, even with the impact of the Bluestem portfolio disposal (+2% excluding this impact). The region as a whole recorded no material change (+1% excluding the aforementioned disposal).

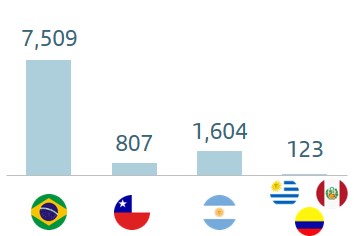

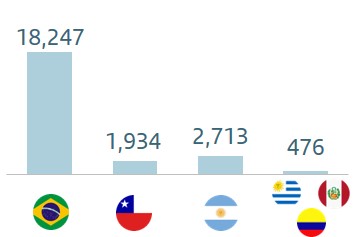

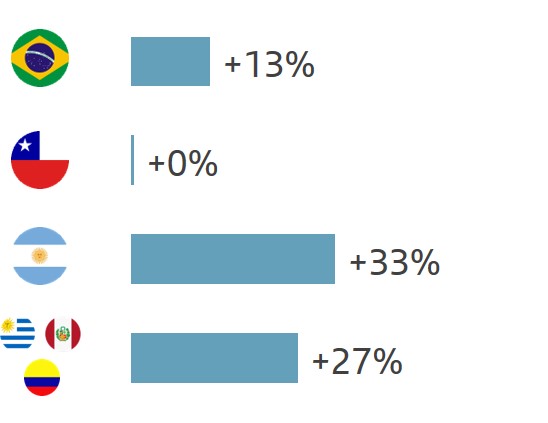

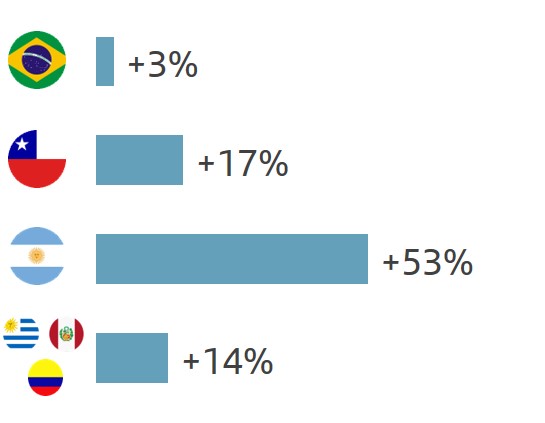

•Growth in South America was 10%. Argentina was up 33% mainly driven by SMEs and cards, Brazil +13% with positive performance in all segments and Uruguay rose 12%. Chile remained largely stable, as growth in mortgages was offset by the fall in corporates and consumer lending.

•Digital Consumer Bank dropped 1% affected by the lower activity at the begining of the year due to the lockdown measures. Mixed performance across countries, with growth recorded in the UK, France and Italy. Openbank increased 41%.

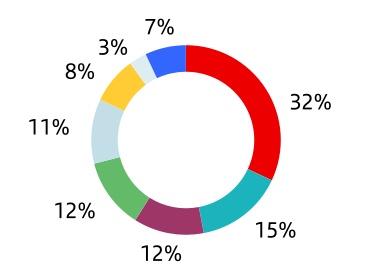

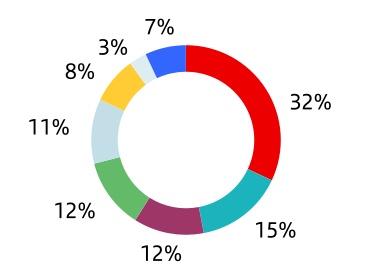

As of September 2021, gross loans and advances to customers excluding reverse repos maintained a balanced structure: individuals (62%), SMEs and corporates (22%) and CIB (15%).

| | | | | |

| Gross loans and advances to customers (excl. reverse repos) |

| EUR billion |

| | |

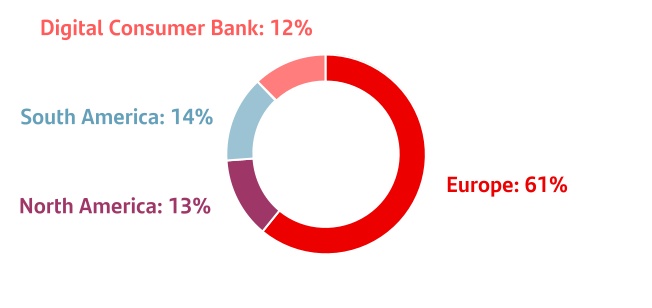

| Gross loans and advances to customers (excl. reverse repos) |

| % operating areas. September 2021 |

(*) In constant EUR: +4%

(*) In constant EUR: +4% | | | | | | | | |

| 14 | | January - September 2021 |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Business model | |

| |

| | | |

|

| | Balance sheet | | | | | | |

è Customer funds

Customer deposits amounted to EUR 909,034 million in September 2021, increasing 2% quarter-on-quarter and 8% year-on-year.

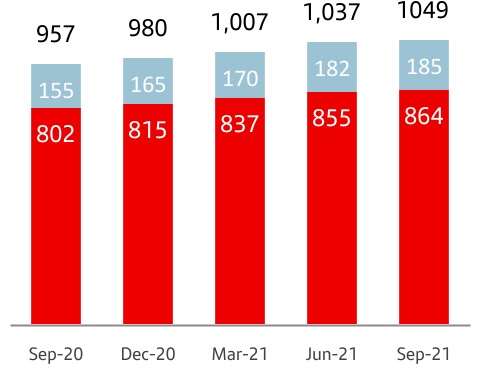

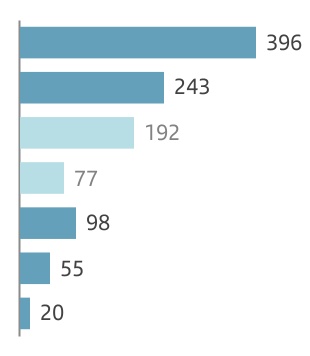

The Group uses customer funds (customer deposits excluding repos, plus mutual funds) for the purpose of analyzing traditional retail banking funds, which amounted to EUR 1,049,188 million.

•In the quarter, customer funds increased 2%, with the following performance excluding exchange rate impacts:

–By product, rises were recorded in demand deposits (+2%), time deposits (+1%) and mutual funds (+3%).

–By primary segment, customer funds increased in all regions and most countries, notably in Argentina (+15%), Chile (+3%) and the US (+2%). Digital Consumer Bank rose 1%.

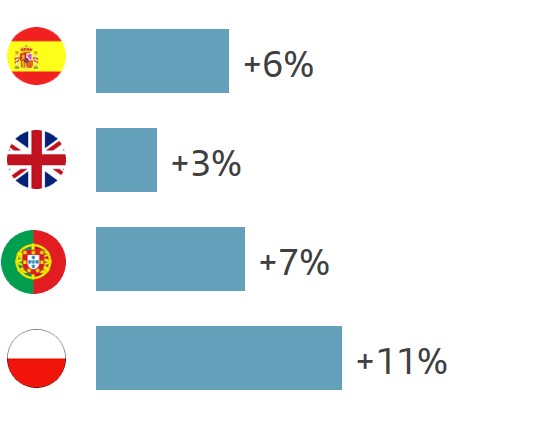

•Compared to September 2020, customer funds were up 7%, excluding the exchange rate impact:

–By product, deposits excluding repos rose 6%. Demand deposits grew 10% with rises in all markets, and time deposits fell 9%, with broad-based declines except Brazil, Chile and Argentina. Mutual funds surged 17% underpinned by net inflows and markets recovery.

–By country, customer funds increased in all regions and countries. Of note was double-digit growth in Argentina (+53%), Chile (+17%), the US and Uruguay (both +13%) and Poland (+11%). More moderate growth was recorded in Portugal (+7%), Spain (+6%), Mexico (+5%), the UK and Brazil (+3% each).

–Positive performance also in DCB, which rose 11%. Openbank increased 27%.

With this performance, the weight of demand deposits as a percentage of total customer funds rose 1 pp in the last 12 months to 66%, which resulted in a better cost of deposits.

In addition to capturing customer deposits, the Group, for strategic reasons, maintains a selective policy of issuing securities in the international fixed income markets and strives to adapt the frequency and volume of its market operations to the structural liquidity needs of each unit, as well as to the receptiveness of each market.

In the first nine months of 2021, the Group issued:

•Medium- and long-term senior debt amounting to EUR 9,369 million and EUR 178 million of covered bonds placed in the market.

•There were EUR 16,433 million of securitizations placed in the market.

•In order to strengthen the Group’s situation, issuances to meet the TLAC requirement amounting to EUR 12,259 million (EUR 9,676 million of senior non-preferred; EUR 2,583 million of preferred).

•Maturities of medium- and long-term debt of EUR 20,516 million.

The net loan-to-deposit ratio was 105% (108% in September 2020). The ratio of deposits plus medium- and long-term funding to the Group’s loans was 117%, underscoring the comfortable funding structure.

The Group's access to wholesale funding markets as well as the cost of issuances depends, in part, on the ratings of the rating agencies.

The ratings of Banco Santander, S.A. by the main rating agencies were: Fitch (long-term senior non-preferred debt at A- and short-term at F2), Moody's (A2 for long term debt and P-1 for short-term), Standard & Poor’s (A for long term debt and A-1 for short term) and DBRS (A high for long term debt and R-1 Middle for short-term), in all cases with a stable outlook. During the year, Moody's and DBRS confirmed their outlook, while Fitch and Standard & Poor's upgraded their outlooks from negative to stable.

While sometimes the methodology applied by the agencies limits a bank's rating to the sovereign rating assigned to the country where it is headquartered. Banco Santander, S.A. is still rated above the sovereign debt rating of the Kingdom of Spain by Moody’s and DBRS and at the same level by Fitch and S&P, which demonstrates our financial strength and diversification.

| | |

| Customer funds |

| EUR billion |

| | |

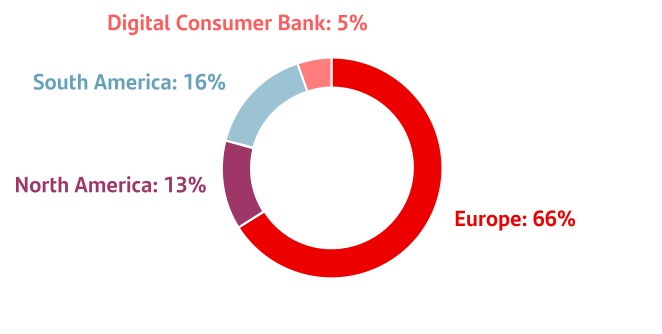

| Customer funds |

| % operating areas. September 2021 |

| | | | | | | | |

| | |

| +10 | % | * | |

| | |

| +19 | % | | |

| | |

| +8 | % | | |

| | |

| | |

•Total |

•Mutual funds |

•Deposits exc. repos |

| | |

| Sep-21 / Sep-20 |

| | |

(*) In constant EUR: +7%

| | | | | | | | |

January - September 2021 | | 15 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Executive summary | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Fully-loaded capital ratio | | | | | | | | Fully-loaded CET1 ratio | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | The fully-loaded CET1 ratio was at the top of our 11-12% target range, following a strong quarterly increase | | | | | In the quarter, strong organic generation driven by profit and RWA management | | |

| | | | | | | | | | Organic generation | +48 bps | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | TNAV per share | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | TNAV per share was EUR 3.99, 1.4% higher quarter-on-quarter and +6.5% year-on-year including dividends | | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

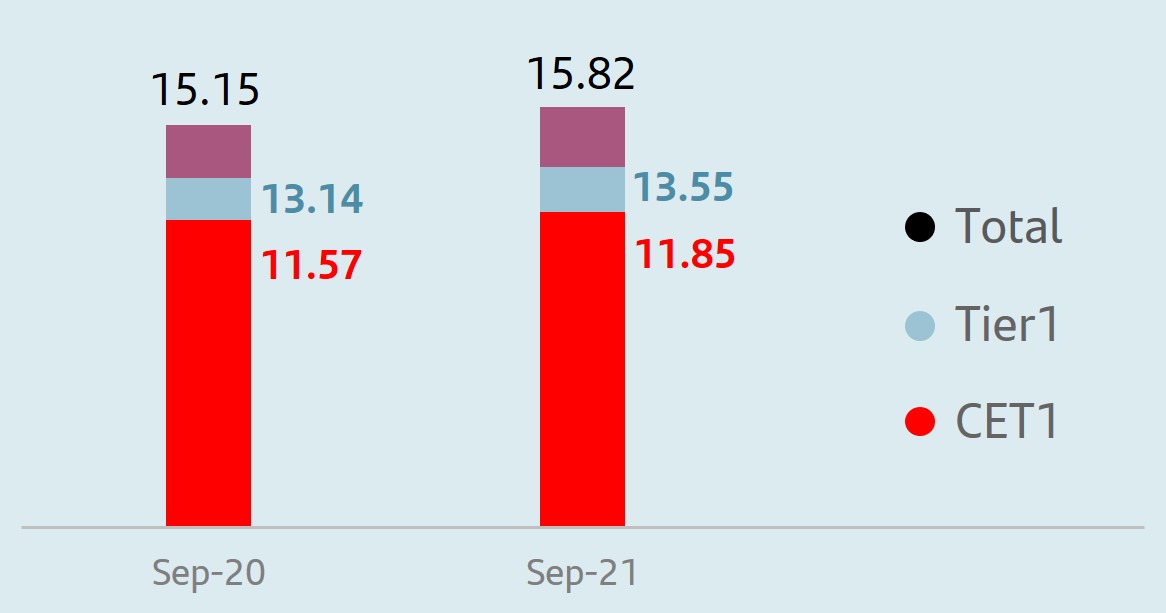

At the end of the quarter, the total fully-loaded capital ratio stood at 15.82% and the fully-loaded CET1 ratio at 11.85%, having increased 15 pp in the quarter.

This growth is driven by strong organic generation (+48 bps), due to the profit in the quarter and a 11 bp uplift from the decrease in risk-weighted assets (increased securitizations and optimization exercises).

Additionally in the quarter there was a 16 bp reduction stemming from regulatory and model impacts (market risk, NPL backstop, New Default Definition anticipation) and -17 bps from other concepts, mainly market performance.

Applying the IFRS 9 transitional arrangements, the phased-in CET1 ratio was 12.26% and the total phased-in capital ratio was 16.20%. We have a strong capital base, comfortably meeting the minimum levels required by the European Central Bank on a consolidated basis (13.01% for the total capital ratio and 8.86% for the CET1 ratio). This results in a CET1 management buffer of 340 bps, compared to the pre-covid-19 buffer of 189 bps.

The fully-loaded leverage ratio stood at 5.05%, and the phased-in at 5.20%.

Finally, the TNAV per share in Q3'21 was EUR 3.99, a 1.4% increase quarter-on-quarter and a 6.5% increase year-on-year. These growth rates include the EUR 4.85 cent dividend to be paid in November, but which has already been deducted from shareholder's equity in September, and the EUR 2.75 cents paid last May.

| | | | | | | | |

| Eligible capital. September 2021 |

| EUR million | | |

| Fully-loaded | Phased-in* |

| CET1 | 68,467 | | 70,787 | |

| Basic capital | 78,264 | | 80,897 | |

| Eligible capital | 91,423 | | 93,537 | |

| Risk-weighted assets | 577,790 | | 577,209 | |

| | |

| CET1 capital ratio | 11.85 | | 12.26 | |

| Tier 1 capital ratio | 13.55 | | 14.02 | |

| Total capital ratio | 15.82 | | 16.20 | |

| | |

| Fully-loaded CET1 ratio performance |

| % |

1.No net impact from shareholder remuneration in Q3 as the dividend accrual in September (corresponding to 20% of 9M’21 underlying profit plus the total amount of the first share buyback already approved) is equivalent to the accrual made in H1'21 (50% of H1’21 underlying profit).

2.Market risk, NPL backstop, New Default Definition anticipation.

3.Mainly HTC&S.

(*) The phased-in ratio includes the transitory treatment of IFRS 9, calculated in accordance with article 473 bis of the Capital Requirements Regulation (CRR) and subsequent modifications introduced by Regulation 2020/873 of the European Union. Total phased-in capital ratios include the transitory treatment according to chapter 2, title 1, part 10 of the CRR.

| | | | | | | | |

| 16 | | January - September 2021 |

u In late July, the European Banking Authority (EBA) published the results of its 2021 EU-wide stress test, which involved the main banks from the EU.

This exercise assesses the resilience of these banks' main balance sheet and income statement items under two different macroeconomic scenarios (baseline and adverse).

To this end, the balance sheets at the end of 2020 were taken as a starting point and the expected behaviour of business models was compared in order to gauge the expected losses and the ability of the balance sheet to withstand such losses without requiring external support.

On this occasion, as with previous exercises, there was no minimum capital threshold to meet. Instead, results will be taken into account when determining the SREP requirements.

The baseline scenario assumes the most likely economic performance according to the models used by the EBA. On the other hand, the very unlikely adverse scenario assumes a severe deterioration in both macroeconomic and global financial market conditions.

This year, the scenarios used to project the evolution of the Group's main businesses were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Gross Domestic Product (GDP) |

| Change (%) | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | Eurozone | | | UK | | | US | | | Brazil |

| 2021 | 2021-23 | | 2021 | 2021-23 | | 2021 | 2021-23 | | 2021 | 2021-23 |

| Baseline scenario | 3.9 | % | 11.0 | % | | 5.9 | % | 11.0 | % | | 3.1 | % | 8.0 | % | | 2.8 | % | 8.0 | % |

| Adverse scenario | -1.5 | % | -4.0 | % | | -3.6 | % | -4.0 | % | | -3.5 | % | -4.0 | % | | -5.2 | % | -5.0 | % |

| | | | | |

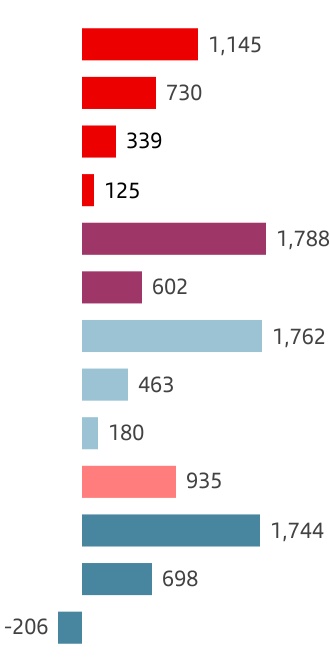

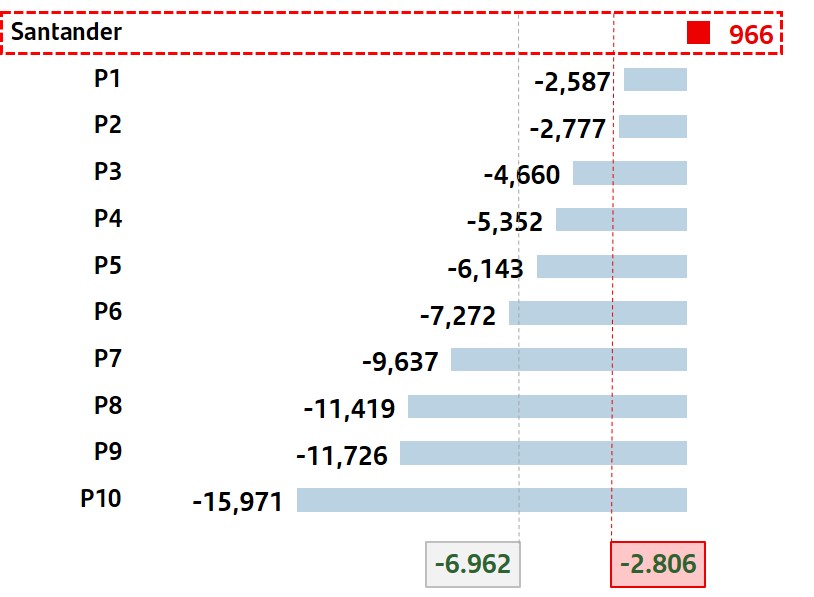

| Santander: resilience of our income statement was reflected in greater capital stability |

In the last thirteen years, the Group has been submitted to eight stress tests, in all of which it has demonstrated the strength of its business model and, consequently, that its solvency levels would be sufficient to face the most severe macroeconomic scenarios.

Our geographic and business diversification enables us to have more stable and non-interrelated sources of income, so that even if the macroeconomic situation were to deteriorate globally, we would be capable of generating profit for our shareholders and thereby ensure an adequate capital position in line with regulatory requirements.

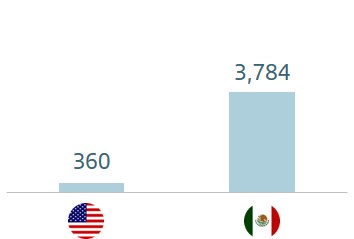

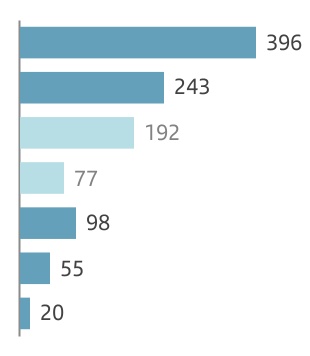

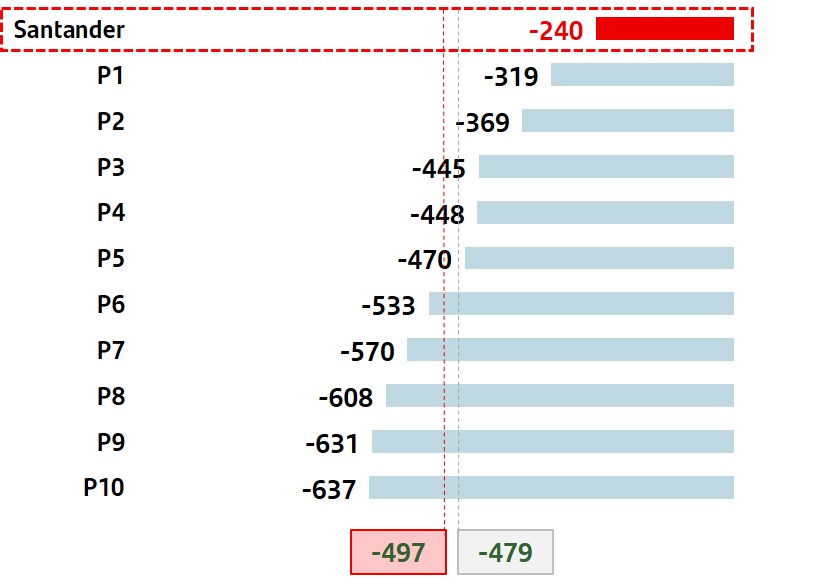

According to the results obtained in this stress test, under the adverse scenario Santander would destroy 240 bps of phased-in

CET1 capital compared to the peer average of almost 480 bps and to the average of European banking system of nearly 500 bps.

This implies that, in terms of legal enforceability, the Group would have a solvency position 30 bps better than the average of its European peers.

It is also worth noting that even in the adverse scenario, the cumulative projections of the Group's income statement show a profit of almost EUR 1 billion. This makes it the only bank among its peers capable of avoiding a negative accumulated result under this scenario.

| | | | | |

| Phased-in CET1 ratio 2020 vs. 2023 |

| Adverse scenario. Basis points |

| | | | | |

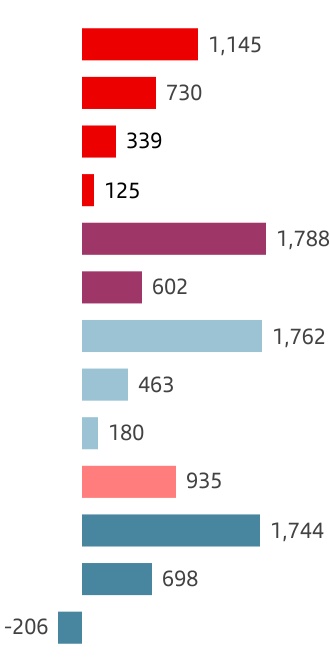

| Profit after tax (accumulated 3 years) |

| Adverse scenario. EUR million |

| | | | | | | | |

January - September 2021 | | 17 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Executive summary | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | Credit risk | | | | | | | Market risk | | |

| | | Credit quality indicators maintained the positive trend of the first half of the year | | Market risk profile remained low, with stable VaR in a context of economic recovery amid increased volatility | | |

| | | Cost of credit2 | NPL ratio | Coverage ratio | | | | | | |

| | | 0.90% | 3.18% | 74% | | Q3'21 | Average

VaR | EUR 10.6 million | | |

| | | q 4 bps vs Q2'21 | q 4 bps vs Q2'21 | p 1 pp vs Q2'21 | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | Structural and liquidity risk | | Operational risk | | |

| | | Robust and diversified liquidity buffer, with ratios well above regulatory limits | | Losses continued to be within expected levels and were lower than Q2'21 in relative terms by Basel categories | | |

| | | LCR 164% 0 pp vs Q2'21 | | | |

| | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

u Credit risk management

As of September 2021, Grupo Santander’s NPL ratio stood at 3.18%, a 4 bp decrease compared to June 2021 and a 3 bp increase year-on-year. The reduction in the quarter was mainly due to the positive performance in Europe with a reduction in its NPL ratio of 16 bps vs. Q2'21. This was partially offset by the increases in North and South America, as their NPL ratio increased by 27 bps and 2 bps, respectively, vs. the previous quarter.

Credit impaired loans amounted to EUR 33,046 million, in line with the previous quarter (in constant euros), while our loan book grew by 1% quarter-on-quarter.

Regarding loan-loss provisions, they amounted to EUR 2,220 million in the third quarter, a 25% increase vs. Q2’21 in constant euros, mainly explained by seasonality and normalization trends after stimulus policies deployed by governments to fight the effects of the pandemic, especially in the US, which are gradually starting to recede.

Considering the first nine months of the year, loan-loss provisions amounted to EUR 5,973 million, a 34% increase in constant euros, on a year-on-year basis, explained by provisions made in 2020 to cover the potential additional losses that could arise as a result of the covid-19 pandemic.

The Group's cost of credit stood at 0.90%, a 4 bp reduction compared to the previous quarter, and -37 bps year-on-year, supported by the good performance of the portfolio and the previously explained additional provisions in 2020.

Total loan-loss reserves in the third quarter stood at EUR 24,462 million, a 2% increase, in constant euros, compared to the previous quarter, with the total coverage of credit impaired loans at 74%, a 1 pp increase compared to the previous quarter.

A significant part of our portfolios in Spain and the UK has real estate collateral, which requires lower coverage levels.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Key metrics performance by geographic area | | | | | | | | | |

| | | | | | | | | | | | | |

| Loan-loss provisions 1 | | Cost of credit (%) 2 | | NPL ratio (%) | | Total coverage ratio (%) |

| 9M'21 | | Chg (%)

/ 9M'20 | | 9M'21 | | Chg (bps)

/ 9M'20 | | 9M'21 | Chg (bps)

/ 9M'20 | | 9M'21 | Chg (pp)

/ 9M'20 |

| Europe | 1,877 | | | (22.5) | | | 0.48 | | | 0 | | | 3.15 | | (14) | | | 51.1 | | 2.4 | |

| Spain | 1,390 | | | 0.0 | | | 1.01 | | | 21 | | | 5.99 | | 1 | | | 48.8 | | 2.8 | |

| United Kingdom | (67) | | | — | | | 0.01 | | | (25) | | | 1.27 | | (6) | | | 36.6 | | (5.1) | |

| Portugal | 95 | | | (37.6) | | | 0.35 | | | (7) | | | 3.44 | | (81) | | | 75.5 | | 11.3 | |

| Poland | 161 | | | (33.7) | | | 0.82 | | | (17) | | | 4.34 | | (24) | | | 74.6 | | 3.8 | |

| | | | | | | | | | | | | |

| North America | 1,095 | | | (63.6) | | | 1.46 | | | (161) | | | 2.56 | | 59 | | | 139.3 | | (62.3) | |

| USA | 450 | | | (79.8) | | | 1.06 | | | (202) | | | 2.36 | | 51 | | | 161.5 | | (67.3) | |

| Mexico | 645 | | | (16.9) | | | 2.69 | | | (28) | | | 3.14 | | 80 | | | 90.1 | | (42.5) | |

| | | | | | | | | | | | | |

| South America | 2,384 | | | (17.8) | | | 2.52 | | | (97) | | | 4.38 | | (2) | | | 98.8 | | 1.5 | |

| Brazil | 1,980 | | | (9.7) | | | 3.60 | | | (98) | | | 4.72 | | 8 | | | 111.8 | | (3.1) | |

| Chile | 266 | | | (48.0) | | | 0.89 | | | (69) | | | 4.36 | | (40) | | | 64.1 | | 4.4 | |

| Argentina | 88 | | | (36.4) | | | 3.51 | | | (203) | | | 3.85 | | 98 | | | 149.3 | | (37.0) | |

| | | | | | | | | | | | | |

| Digital Consumer Bank | 449 | | | (40.7) | | | 0.57 | | | (22) | | | 2.15 | | (14) | | | 112.8 | | 2.3 | |

| | | | | | | | | | | | | |

| TOTAL GROUP | 5,973 | | | (34.5) | | | 0.90 | | | (37) | | | 3.18 | | 3 | | | 74.0 | | (1.9) | |

| (1) EUR million and % change in constant euros |

| (2) Allowances for loan-loss provisions over the last 12 months / Average loans and advances to customers over the last 12 months |

| | | | | | | | |

| 18 | | January - September 2021 |

Regarding moratoria programmes, which were put in place to tackle the effects of covid-19, 99% of the total amount granted had already expired by the end of the third quarter, showing a payment performance aligned with expectations, with 6% classified in stage 3 (IFRS 9).

The outstanding moratoria at the end of the quarter amounted to EUR 1.3 billion (mainly Spain), the majority of which will expire next quarter, following the expiration of a significant volume of operations in Portugal in Q3.

Regarding IFRS 9 stages evolution:

•Stage 1 exposures increased by 1% vs. the previous quarter, mainly due to new loan originations in Europe and South America.

•Exposures in stage 2 decreased by 3% in the quarter, in line with the normalization trend observed after the increase recorded last year, which was mostly driven by macroeconomic deterioration caused by the pandemic.

•Stage 3 remained stable in the quarter.

| | | | | | | | | | | | | | | | | | | | | | | |

| Coverage ratio by stage | |

| EUR billion |

| Exposure1 | | Coverage |

| Sep-21 | Jun-21 | Sep-20 | | Sep-21 | Jun-21 | Sep-20 |

| Stage 1 | 912 | 904 | 862 | | 0.5 | % | 0.5 | % | 0.6 | % |

| Stage 2 | 67 | 70 | 60 | | 8.6 | % | 8.2 | % | 8.8 | % |

| Stage 3 | 33 | 33 | 31 | | 43.0 | % | 42.2 | % | 43.3 | % |

(1) Exposure subject to impairment. Additionally, in September 2021 there are EUR 27 billion in loans and advances to customers not subject to impairment recorded at mark to market with changes through P&L (EUR 26 billion in June 2021 and EUR 29 in September 2020).

Stage 1: financial instruments for which no significant increase in credit risk is identified since its initial recognition.

Stage 2: if there has been a significant increase in credit risk since the date of initial recognition but the impairment event has not materialized, the financial instrument is classified in Stage 2.

Stage 3: a financial instrument is catalogued in this stage when it shows effective signs of impairment as a result of one or more events that have already occurred resulting in a loss.

| | | | | | | | | | | |

| Credit impaired loans and loan-loss allowances |

| EUR million | | |

| | Change (%) |

| Q3'21 | QoQ | YoY |

| Balance at beginning of period | 33,266 | | 2.4 | | 1.5 | |

| Net additions | 2,188 | | (14.6) | | 37.2 | |

| Increase in scope of consolidation | — | | — | | (100.0) | |

| Exchange rate differences and other | (368) | | — | | (78.0) | |

| Write-offs | (2,040) | | (3.7) | | 15.5 | |

| Balance at period-end | 33,046 | | (0.7) | | 7.0 | |

| | | |

| Loan-loss allowances | 24,462 | | 0.9 | | 4.2 | |

| For impaired assets | 14,205 | | 1.25 | | 6.12 | |

| For other assets | 10,257 | | 0.47 | | 1.77 | |

u Market risk

The global corporate banking trading activity risk is mainly interest rate driven, focused on servicing our customer's needs and measured in daily VaR terms at 99%.

In the third quarter, VaR fluctuated around an average value of EUR 10.6 million, increasing slightly at the end of September after market volatility increased over concerns around a potential slowdown in global growth in H2’21, mainly due to supply chain disruptions and the surge in energy prices. The quarter’s closing VaR was EUR 14.9 million. These figures remain low compared to the size of the Group’s balance sheet and activity.

| | | | | | | | | | | | | | |

Trading portfolios (1). VaR by geographic region |

| EUR million | | | | |

| 2021 | | 2020 |

| Third quarter | Average | Latest | | Average |

| | | | |

| Total | 10.6 | | 14.9 | | | 10.2 | |

| Europe | 9.9 | | 13.7 | | | 9.0 | |

| North America | 2.6 | | 2.0 | | | 6.9 | |

| South America | 5.9 | | 6.1 | | | 4.8 | |

(1) Activity performance in Santander Corporate & Investment Banking markets.

| | | | | | | | | | | | | | |

Trading portfolios (1). VaR by market factor |

| EUR million | | | | |

| Third quarter | Min. | Avg. | Max. | Last |

| VaR total | 7.8 | | 10.6 | | 15.2 | | 14.9 | |

| Diversification effect | (10.1) | | (13.8) | | (17.3) | | (13.8) | |

| Interest rate VaR | 7.1 | | 9.9 | | 14.1 | | 12.6 | |

| Equity VaR | 2.2 | | 3.3 | | 6.5 | | 3.3 | |

| FX VaR | 2.4 | | 3.3 | | 6.2 | | 4.5 | |

| Credit spreads VaR | 2.9 | | 6.0 | | 7.9 | | 7.2 | |

| Commodities VaR | 1.1 | | 1.9 | | 3.5 | | 1.1 | |

(1) Activity performance in Santander Corporate & Investment Banking markets.

NOTE: In the North America, South America and Asia portfolios, VaR corresponding to the credit spreads factor other than sovereign risk is not relevant and is included in the interest rate factor.

| | | | | | | | |

January - September 2021 | | 19 |

| | |

Trading portfolios1. VaR performance

|

| EUR million |

(1) Corporate & Investment Banking performance in financial markets.

(1) Corporate & Investment Banking performance in financial markets.

u Structural and liquidity risk

•Regarding structural exchange rate risk, it is mainly driven by transactions in foreign currencies related to permanent financial investments, their results and related hedges. Our dynamic management of this risk seeks to limit the impact on the core capital ratio of foreign exchange rate movements. In the quarter, the ratio’s hedging stayed close to 100%.

•In terms of structural interest rate risk, inflation pressures continued globally, leading to expectations of earlier interest rate hikes than previously thought. This, coupled with continued political instability in Latin America, added volatility to the markets, although no material events were detected and risk levels remained at comfortable levels.

•In liquidity risk during the third quarter, the Group maintained a comfortable position, supported by a robust and diversified liquidity buffer, with ratios well above regulatory limits.

u Operational risk

•Overall, our operational risk profile continued to be stable during the third quarter of 2021. The following aspects were closely monitored during this period:

–Fraud and cyber risk threats across the financial industry, that lead to the reinforcement of the control environment (i.e., patching, browsing control, data protection controls, etc.), as well as reinforcing monitoring as a preventive measure. Development of the external fraud plans in our different country units.

–Third party risk exposure, maintaining close oversight on critical providers, with focus on business continuity capabilities and compliance with service level agreements.

–IT risk, mainly related to transformation plans, new system releases, as well as challenges related to IT services outsourcing.

–People risk, due to our employees returning to offices and/or work from home situations. Measures have been implemented to ensure a suitable and safe working environment across our subsidiaries.

–Regulatory compliance, due to increasing regulatory requirements (such as ESG, operational resilience, crypto-assets and others) across the Group.

•As the situation continues to evolve, we are also monitoring the changes in the environment as well as the transition to digital banking in order to identify potential risk exposures and anticipate actions to reduce their impact.

•In terms of the third quarter performance, level of losses in relative terms by Basel categories were lower than in the previous quarter.

| | | | | | | | |

| 20 | | January - September 2021 |

Grupo Santander conducted its business in the third quarter of 2021 in an environment marked by significant economic dynamism and progress in vaccination, but at the same time by a pronounced impact from the Delta variant and higher-than-expected inflation. The trend in pricing was the most relevant risk factor. The most likely scenario is a temporary rise that, in general, will not call for a tightening of monetary policy, although countries such as Mexico and especially Brazil and Chile have raised interest rates. The general tone of economic policy continued to be expansionary although uneven - more so in the mature economies - which, together with the adjustments the Chinese economy is going through, could lead to a more differentiated economic performance in the coming quarters.

| | | | | | | | | | | |

| Country | GDP Change1 | Economic performance |

| Eurozone | +6.0% | The reopening of economic activities restricted by the pandemic continued to boost GDP growth, which could return to pre-crisis levels by the end of 2021. The unemployment rate fell to 7.5% in August. Inflation rose to 3.4% in September due to temporary factors. The ECB insists that it will maintain loose funding conditions to consolidate the economic recovery. |

| Spain | +5.6% | Restrictions to economic activity continued to ease, driving GDP growth. Inflation (4% in September) picked up due to the impact of energy prices and the normalization of some prices that had fallen due to the pandemic. Employment rose, bringing back to work a significant amount of employees who had been on the temporary workforce reduction scheme (ERTE) and reducing the unemployment rate (to 15.3% in Q2'21). |

| United Kingdom | +7.3% | UK economic recovery stalled in July amid worker shortages and bottlenecks. The labour market continued to improve (unemployment was 4.5% in August). Inflation (3.1% in September) exceeded the BoE's target, which kept interest rates stable (0.1%) and maintained the bond-buying target, although it expressed its willingness to bring forward monetary policy normalization. |

| Portugal | +4.3% | The reopening of the economy, supported by a high vaccination rate (83% of the population) has enabled economic growth to progress towards pre-pandemic levels (still 5.8% below Q4'19), with private consumption as the main driver. The labour market improved (unemployment rate at 6.7% in Q2'21) and inflation picked up (1.5% in September), but without showing a clear acceleration pattern. |

| Poland | +5.1% | The economy started to return to normal in Q2'21, with rapid GDP growth supported by domestic demand, especially consumption, but accompanied by high inflation (5.9% in September). The labour market remained solid (unemployment rate at 3.5%). In this context, the central bank raised Poland's official interest rate by 40 bps to 0.50% in early October. |

| United States | +6.1% | GDP continued to grow strongly in Q2'21, thanks to the fiscal impulse and the reopening of the economy. Inflation rebounded (5.4% in September) due to higher prices in the areas most affected by the pandemic and supply-side problems. The spike in covid-19 cases in the summer somewhat delayed the recovery of the labour market, but the Fed considers this improvement to be sufficient and will start to tighten monetary policy with the announcement of tapering this year. |

| Mexico | +6.9% | Economic growth gained momentum in Q2'21, driven by the reopening of the services sector and exports, but with some weakness in industry. Inflation rebounded sharply (6.0% in September), with widespread pressure on the prices of goods and services, leading the central bank to continue raising Mexico's official interest rate (+50 bps in Q3'21 to 4.75%). |

| Brazil | +6.4% | Economic recovery continued to be driven by the reopening of the services sector, thanks to progress in vaccination and improved mobility, but international supply problems dampened growth in the industry. Inflation continued to pick up (10.25% in August) and the central bank continued to raise Brazil's interest rate, by 200 bps in Q3'21 (6.25%), and indicated that the hikes will continue. |

| Chile | +8.8% | Strong GDP growth in H1'21 driven by progress in vaccination and high fiscal impulses and liquidity (via partial withdrawals of savings from pension plans). Inflation picked up (5.3% in September) and the central bank started to raise the official interest rate in Q3'21, increasing it by 100 bps to 1.5%, and in October by 125 bps to 2.75%. |

| Argentina | +10.3% | After starting Q2'21 with a slight relapse due to the tighter restrictions imposed in the second wave of covid-19, economic growth resumed its recovery in the last few months, boosted by progress in vaccination and increased mobility. Inflation remains high (3.5% in September). |

(1) Year-on-year change H1'21

| | | | | | | | |

January - September 2021 | | 21 |